APRIL 2024 DRUGSTORENEWS.COM

APRIL 2024 DRUGSTORENEWS.COM INSIDE Industry in Transition Page 42 INDUSTRY IN TRANSITION

Join the growing list of drug and grocery retailers satisfying their customer’s demand for problem solving hair care products David Horwitz, Vital’s International Group 818-421-8739 | davidh@vitalsintl.com Problem solving hair care products Made with natural, organic ingredients

Demand less. Expect more. Rethink everything.

LESS COMPLEXITY

KNAPP is on a mission to transform pharmacy by automating virtually every aspect of prescription filling and pickup.

Automated putaway, DSCSA scanning, stock bottle management, and Will Call order packing enable low-touch, high-throughput dispensing — with no additional staff. Automatic indoor kiosks and 24/7 outdoor terminals facilitate low-touch “Fast Lane” pick up.

MORE TIME

1 Pharmacies can reduce operating costs while increasing revenue streams and freeing space for new services

2 Pharmacists and technicians can spend more time with patients and improve care outcomes

3 Patients can conveniently pick up prescriptions when, where and how they want

Making complexity simple

INDUSTRY IN TRANSITION

COLUMNS

Facebook.com/DrugStoreNews linkedin.com/company/drug-store-news/ instagram.com/dsn_media

FEATURES

These products set themselves apart in

What do shoppers really think about self checkout kiosks?

66

We have a sneak peek at some new products and services you can expect to see at NACDS Annual 74

A blue-chip panel of beauty experts discusses how the mass market can carve out a bigger slice of sales and keep up with the blistering pace of new products

Cosnova founder Christina Oster-Daum and Jill Krakowski, chief marketing officer, USA, talk to us about the company’s growth, plans for the year and the importance of social media

Locking up products in the sensitive sexual wellness category can deter sales and hinder consumer education

DSN (ISSN 0191-7587) is published monthly 12 times a year by EnsembleIQ, 8550 W. Bryn Mawr Ave, Suite 200, Chicago, IL 60631. Subscription rate in the United States: $150 one year; $276 two year; $17 single issue copy; Canada and Mexico: $204 one year; $390 two year; $20.40 single issue copy; Foreign: $204 one year; $390 two year; $20.40 single issue copy. Periodicals postage paid at Chicago, IL, and additional mailing offices. POSTMASTER: Please send address changes to DSN, 8550 W. Bryn Mawr Ave, Suite 200, Chicago, IL 60631. Vol. 46 No 1, January 2024. Copyright © 2024 by EnsembleIQ. All rights reserved. 6 April 2024 DRUGSTORENEWS.COM 04.24 DEPARTMENTS 8 EDITOR’S NOTE 11 INDUSTRY NEWS 26 WOMEN IN THE NEWS 28 PRODUCTS TO WATCH 86 PHARMACY NEWS

FUTURE 50

30

54 SELF CHECKOUT RESEARCH

2023

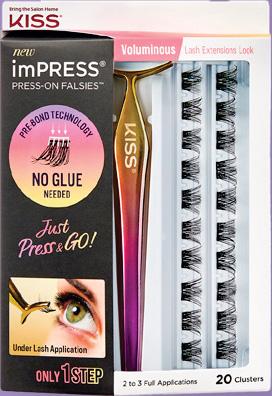

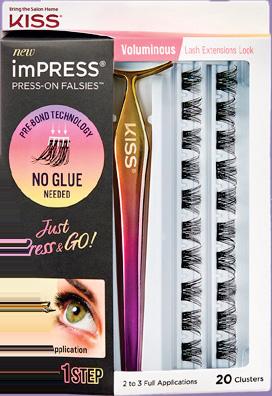

PRODUCT SHOWCASE

INSIDE BEAUTY ROUNDTABLE

BEAUTY TALK

84

92 HEALTH: SEXUAL WELLNESS

Vol. 46 No. 4 42 38 ONE-ON-ONE WITH Hello Bello’s Will Righeimer 40 ONE-ON-ONE WITH OmniSYS’ David Pope 23 GUEST COLUMN by Miranda Rocholl 24 GUEST COLUMN by Brian Nightengale 98 LAST WORD by Danny Sanchez

We are connecting the digital ecosystem and empowering the pharmacist patient relationship. Scan or visit outcomes.com to see how our solutions optimize pharmacy productivity and profitability creating better outcomes for all.

Improve Productivity Improve Profitability Improve Outcomes

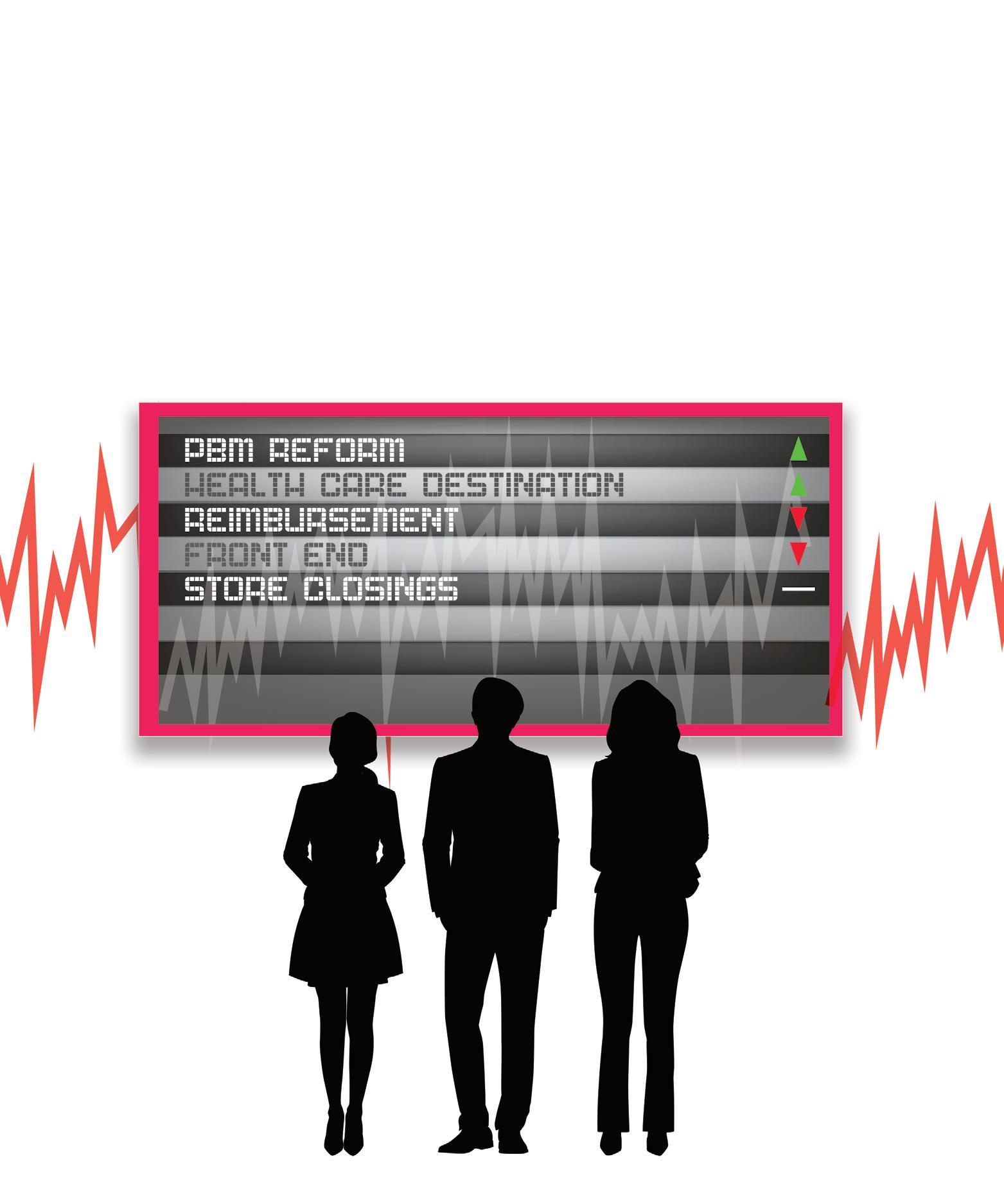

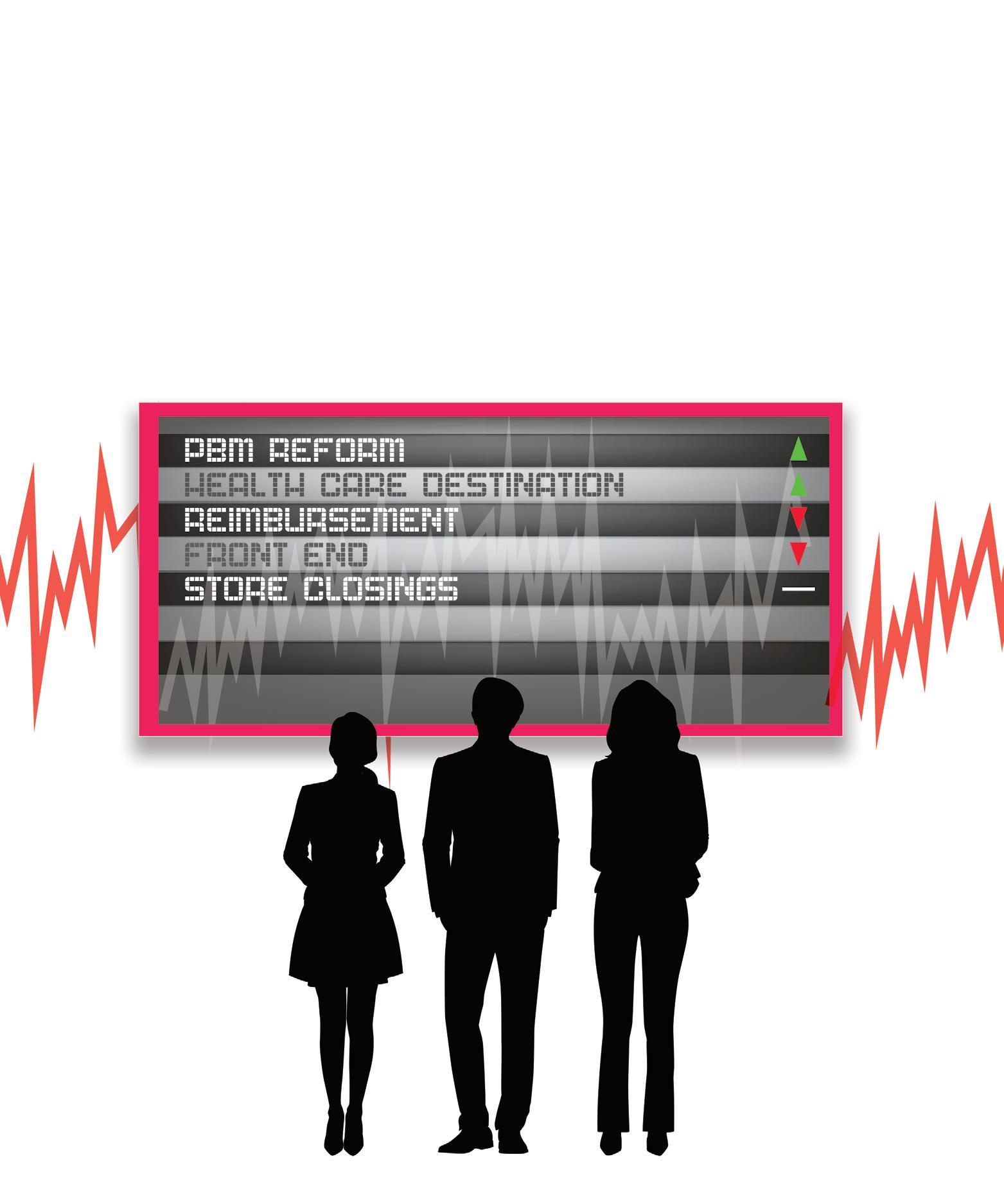

Industry, Check

What

will retail pharmacy be when it grows up?

“WITH

HEALTHCARE COSTS SURGING AND THE DEARTH OF PHARMACISTS CONTINUING, AN EVOLUTION IN CONVENIENT, AFFORDABLE HEALTHCARE SERVICES IS THE NEED OF THE HOUR IN THE U.S.”

-ADITYA KAUSHIK, CORESIGHT RESEARCH

As retail pharmacy executives prepare to gather in Palm Beach, Fla., for the National Association of Chain Drug Stores Annual Meeting, the industry is in a pivotal moment. As one analyst told our reporter, in some ways, it is deciding what it wants to be when it grows up.

Pharmacies large and small are rethinking how they do business, and there is a lot to think about—from the products they offer to the design and locations of their brick-and-mortar stores, competition from e-commerce giants, PBM reform, a reimbursement payment framework and much more.

In this month’s cover story (page 42), our reporter interviewed analysts, pharmacy executives, industry observers and others to get a clear picture of where the industry stands at the moment and where it’s headed. The outlook might be positive.

“With U.S. healthcare costs surging and the dearth of pharmacists continuing, an evolution in convenient, affordable healthcare services is the need of the hour in the U.S.,” Aditya Kaushik, analyst at Coresight Research, said in a recent Market Navigator report on the retail drug store industry. As drugstores increasingly expand the services they offer, they have an opportunity to become “the next generation of primary care providers, treating patients with acute illnesses and chronic conditions, such as asthma, diabetes, and hypertension.”

Our second feature (page 54) takes a look at something that all shoppers in the United States have to face at some point—self checkout kiosks. Billed as a revolution in retail, self checkout is as American as apple pie but not as enjoyable.

We wanted to see what consumers really think of self checkout, so we reached out to TruRating, a customer experience and insights company that recently conducted a study of perceptions about selfcheckout. Based on verified customer feedback, the study gives an accurate snapshot of why shoppers use self checkout and when.

“There has been a move in more and more retailers to implement self-checkout options to try to increase throughput at the point of payment and also to reduce labor costs and shortages,” said Gareth Johns, chief data officer at TruRating. “The preferences and experiences of customers hasn’t been the main driver for this move and there has been little research into how customers feel about this major shift in their shopping experience.” Hopefully, this study changes that. dsn

www.drugstorenews.com

jkenlon@ensembleiq.com

EDITORIAL Editor-in-Chief, Editorial

Nigel F. Maynard nigelmaynard@ensembleiq.com

Managing Editor Julianne Mobilian jmobilian @ensembleiq.com

Senior Editor

slevy@ensembleiq.com

Online Editor Gisselle Gaitan ggaitan@ensembleiq.com ADVERTISING

212.756.5155 atomas@ensembleiq.com Regional

swerner@ensembleiq.com DESIGN/PRODUCTION/MARKETING

Art Director Catalina Gutierrez cgutierrez@ensembleiq.com

Production

jbatson@ensembleiq.com

Marketing

kabrahamsen@ensembleiq.com SUBSCRIPTION

Subscription

contact@drugstorenews.com

EDITOR’S NOTE 8550

W. Bryn Mawr Ave., Ste. 200 Chicago, IL 60631 773.992.4450 Fax 773.992.4455

BRAND MANAGEMENT

Senior Vice President & Publisher John Kenlon 516.650.2064

Director

Sandra Levy

SALES & BUSINESS Northeast Manager Alex Tomas

Manager Steven

Werner 312.961.7162

Manager Jackie Batson

Manager

SERVICES

Kathryn Abrahamsen

List Rental mbriganti@anteriad.com

Questions

CORPORATE OFFICERS Chief Executive Officer Jennifer Litterick Chief Financial Officer Jane Volland Chief People Officer Ann Jadown Chief Strategy Officer Joe Territo Chief Operating Officer Derek Estey EDITORIAL ADVISORY BOARD John Beckner, NCPA Becky Dant, Costco J. Jeremy Faulks, Thrifty White Pharmacy Doug M. Long, IQVIA Nancy Lyons, Health Mart Pharmacy Katie Scanlon, Publix Super Markets Heidi Snyder, Drug World Pharmacies 8 April 2024 DRUGSTORENEWS.COM

U.S.

Join us in Chicago to celebrate the honorees! The DSN Top Women in Health, Wellness & B eauty program applauds and recognizes women for their exceptional contributions to both their companies and communities. Help us recognize and celebrate the women in your industr y. Visit www.dsntopwomen.com for more information. Nominate Now M ARR I O T T M A R Q UI S CHIC A G O THE NOMINATION WINDOW IS NOW OPEN! DEADLINE: JUNE 20

Dollar General makes personal care donations to address period poverty

Because a reported 16.9 million women in the United States are living in poverty, two-thirds of which could not afford personal care products in the past year, seven Dollar General distribution centers and their employees across the nation donated more than 36,000 feminine hygiene products in 2023. They are donating in their local communities again this year.

After talking with her younger sister last fall, Elizabeth T., an inbound-outbound manager at DG’s Scottsville DC, discovered that the local high school was not always able to provide resources for feminine hygiene. Working with the DG Diversity and Inclusion team, the Scottsville DC launched a voluntary initiative surrounding the cause, collecting sanitary napkins and tampon donations for Allen County-Scottsville High School. In March 2023, the Scottsville DC donated more than 3,500 pads, 1,000 tampons and 330 panty liners for students. “I felt like it was an important thing to have for our younger generation of females in the community,” said Elizabeth.

In addition, the Scottsville DC recently donated personal care products to the International Center of Kentucky, helping to provide hygiene essentials to incoming refugees.

In Northern Kentucky, Dollar General’s Walton DC collaborated with employees for a feminine hygiene product drive. The collective donations benefited Sunrise Children’s Services, a nonprofit providing therapeutic foster care and community-based services statewide.

“Often, our children arrive with little notice and few possessions, sometimes only the clothes they are wearing,” said Jake Pelfrey, vice president of advancement at Sunrise Children’s Services. “Dollar General’s support in caring specifically for the young ladies in our program is invaluable. It enables us to offer healing and hope, showing these girls that they are surrounded by a community that loves, cares and roots for them.”

DG’s Alachua DC selected the nonprofit organization Blossoming Butterfly as the recipient of its feminine hygiene product drive—collecting and donating an estimated $3,700 worth of assorted items. Blossoming Butterfly provides encouragement, education and support for individuals battling cancer. The organization’s focus is on preparing for the battle, providing financial assistance and maintaining a pantry of needed items that align with the organization’s values and goals for community impact.

At Ardmore High School and Madill Middle School in Oklahoma, school officials noticed several girls were absent once a month because their families could not afford menstrual products.

Joi B., director of diversity and inclusion at DG, worked with the Ardmore DC to establish a feminine product collection drive for the 2023-2024 school year.

In addition to supporting each distribution center’s personal care product drive, Joi B. has made it a personal

INDUSTRY NEWS 10 April 2024 DRUGSTORENEWS.COM

mission to support the hygiene needs in her local community of Indianola. She independently established “Keep It Cute” shelves at local schools, which serve as repositories of feminine hygiene and other basic clothing products where students can privately access what they need at no cost.

Dollar General has supported Joi’s efforts through product donations, the DG Kindness employee recognition program including a $1,000 donation and the annual Women’s History Month drives—and Joi’s efforts were recently

spotlighted through partner content with Reader’s Digest.

In addition to the collective efforts of the DCs and their employees, DG has implemented feminine care produce drives at the company’s distribution centers and the Store Support Center throughout the month to continue to support women and raise awareness of period poverty.

Kroger to sell specialty pharmacy business

Kroger has entered into a definitive agreement to sell its specialty pharmacy business to CarelonRx, a subsidiary of Elevance Health.

“Kroger Specialty Pharmacy has been part of our company since 2012, and we want to thank our management team and associates for their enduring commitment to their patients,” said Colleen Lindholz, president of Kroger Health. “As part of our regular review of assets, it became clear that our strong specialty pharmacy business unit will better meet its full potential outside of our business. One of the most important considerations was continued operations to ensure minimal disruption to our associates and patients. We are confident this transaction will help the business to grow and deliver better results for patients. We look forward to working toward a smooth transition for associates and patients.”

The retailer’s specialty pharmacy serves patients with chronic illness and require complex care. Skilled clinicians and therapy programs allow patients and prescribers to benefit from education and resources, counseling, side effect management, financial assistance, personalized care and administrative expertise. The specialty pharmacy business supports patients facing diseases including rheumatoid arthritis, growth hormone deficiencies, multiple sclerosis and bleeding disorders.

Kroger Specialty Pharmacy is separate from other Kroger Family of Pharmacies, so in-store retail pharmacies and The Little Clinics are not included in this transaction.

This transaction is subject to customary closing conditions, including regulatory approvals and is expected to close in the second half of 2024; it is not expected to have an impact on Kroger’s 2024 guidance.

INDUSTRY NEWS 12 April 2024 DRUGSTORENEWS.COM

et al. BMJ Open, 2021

80% of Americans Aren’t Getting Enough Omega-3s Get ultimate support for heart, brain, immune health, and more.*

*These statements have not been evaluated by the Food and Drug Administration. This product is not intended to diagnose, treat, cure or prevent any disease.

Murphy RA,

Target enhances checkout experience

Target is making several enhancements to its checkout experience.

The retailer said checking out is one of the most important moments of the Target run, so a fast, easy experience is critical to getting guests on their way quickly. During the pandemic, many guests preferred using self-checkout for all their purchases because it offered them a contactless option, the retailer said.

“Today, ease and convenience are top of mind, so, to learn more about guests’ self-checkout preferences, we piloted the concept of Express Self-Checkout with limits of 10 items or fewer at about 200 stores last fall,” Target said. “The result: self-checkout was twice as fast at our pilot stores. By having the option to pick self-checkout for a

ACTIONABLE INSIGHTS & CONNECTIONS POWERING BUSINESS GROWTH

EnsembleIQ is the premier resource of actionable insights and connections powering business growth throughout the path to purchase. We help retail, technology, consumer goods, healthcare and hospitality professionals make informed decisions and gain a competitive advantage.

EnsembleIQ delivers the most trusted business intelligence from leading industry experts, creative marketing solutions and impactful event experiences that connect best-in-class suppliers and service providers with our vibrant business-building communities.

INDUSTRY NEWS 14 April 2024 DRUGSTORENEWS.COM

ENSEMBLEIQ.COM Untitled-3 1 3/26/24 12:15 PM

quick trip, or a traditional, staffed lane when their cart is full, guests who were surveyed told us the overall checkout experience was better, too.”

Target said the following updates—which went live on March 17—will make its checkout experience more enjoyable:

♦ Express Self-Checkout with limits of 10 items or fewer at nearly 2,000 stores nationwide;

♦ Opening more traditional lanes staffed by team members across for guests who have more in their Target carts, need a helping hand or just enjoy connecting with team members;

♦ Store leaders have the flexibility to open more lanes staffed by team members and set self-checkout hours that are right for their store.

DRUGSTORENEWS.COM April 2024 15 ®

♦ While the hours of operation may vary based on store needs, Express Self-Checkout will be available during the busiest shopping times;

♦ Investing in additional training to ensure that teams can continue to provide great guest service during the checkout;

Walmart offering on-demand early morning delivery

Walmart is debuting Express On-Demand Early Morning Delivery, offering the convenience of delivery starting at 6 a.m.

“This expanded timing offers them peace of mind knowing they can get things they need at their doorstep to kickstart the day,” the retailer said.

With hundreds of thousands of items available in-store and hundreds of millions more online, customers can easily get what they need during the early morning hours from fashion to furniture and beyond in as soon as 30 minutes, Walmart noted.

“Our commitment to convenience extends beyond just the early hours. It’s about making shopping seamless for the customer,” the company said. “With features like LateNight Express Delivery, Live Shopper for real-time communication with Shoppers and On-Demand Delivery for sameday convenience, Walmart prioritizes putting the power in the customers’ hands. It’s a superpower that’s simple—all customers need to do is open the Walmart app or Walmart. com and begin selecting their items. And for Walmart+ members, standard delivery is always free.”

“As we continue to innovate and accelerate, the message is clear: Shopping should be personal and as tailored to fit your lifestyle as those freshly-delivered work shirts. With Walmart’s On-Demand Early Morning Delivery and a suite of other convenient options, we’re making sure you have what you need, when you need it so you can reclaim your time no matter what the clock says,” the company added.

♦ Continue evolving to match guests with the right checkout options—alongside same-day fulfillment services like Drive Up, Order Pick Up and Target’s same-day delivery.

BJ’s Wholesale Club plans Southeast,

Midwest expansions

BJ’s Wholesale Club continues to expand its footprint into markets beyond the East Coast.

The Massachusetts-based membership warehouse club, which previously announced plans to open 12 news clubs and 15 gas stations this fiscal year, has revealed the newest locations coming to its footprint. The locations, in the Southeast and Midwest, include two new major markets.

BJ’s did not disclose the opening dates of the five locations, which are listed below.

♦ Maryville, Tenn. (BJ’s fourth location in the state and first in the Knoxville market);

♦ Myrtle Beach, S.C. (BJ’s second club in the state and first in Myrtle Beach);

♦ Palm Coast and West Palm Beach, Fla. (BJ’s 38th and 39th clubs in the state); and

♦ Carmel, Ind. (BJ’s second location in the state).

♦ Earlier this month, BJ’s announced plans to enter its 21st state—Kentucky—with the opening of a club near the Jefferson Mall in Louisville, in early 2025.

INDUSTRY NEWS 16 April 2024 DRUGSTORENEWS.COM

“BJ’s combination of unbeatable value and convenience continues to resonate with members, and we’re pleased with the performance of our new clubs,” said Bill Werner, executive VP, strategy and development, BJ’s Wholesale Club. “Our real estate pipeline is the strongest it’s been in 20 years, and we look forward to helping even more families save up to 25% off grocery store prices as we add clubs to both new and existing markets.”

Each new BJ’s location is expected to create approximately 150 jobs for its respective community. Clubs feature an assortment of fresh foods, produce, full-service deli offerings, bakery goods, grocery staples and household essentials, in addition to home décor items, toys, tech products and pet supplies.

For the 14-week period ended Feb. 3, BJ’s revenue rose 8.7% to $5.357 billion, compared with $4.93 billion for the 13-week period in the year-ago quarter. Membership fee income increased by 6.5% year-over-year to $108.4 million. Total comparable club sales decreased by 0.4%.

“We ended fiscal 2023 on a strong note,” said BJ’s chairman and CEO Bob Eddy in the most recent earnings release. “Our membership grew in robust fashion and we continue to retain members at all-time high rates. We delivered impressive market share gains in our clubs and at our gas pumps, driven by acceleration in traffic and growth in units sold.”

This story originally appeared on Chain Store Age.

CVS touts prescription delivery offerings

CVS Pharmacy is reminding customers that it offers several delivery options for patients with eligible prescriptions, including one- to two-day delivery and on-demand delivery (within three hours), at more than 9,000 pharmacy locations nationwide.

Additionally, CVS offers free one- to two-day delivery and on-demand (same-day) delivery on eligible prescriptions through its ExtraCare+ membership program. All options can be easily managed through the CVS Pharmacy app, SMS text messaging, CVS.com or by speaking with the local CVS Pharmacy team.

CVS Pharmacy began offering one- to two-day prescription delivery nationwide in 2018 and launched on-demand prescription delivery nationwide in April 2019.

Walmart’s beauty sector glows up

Spring has sprung and Walmart is building up its beauty assortment, following the recent expansion of its virtual try-on feature.

To kick things off, the company said that its brand accelerator program—Walmart Start—would be making a return, with a class that includes a diverse group of hair, skin and body care brands from women and diverse-owned founders.

♦ The newest Walmart Start class includes:

♦ Current State: Co-founded by Emily Parr and Majeed Hemmat, the brand creates nutritiously balanced and clinically responsive products to help care for the skin;

INDUSTRY NEWS 18 April 2024 DRUGSTORENEWS.COM

♦ LatinUS: Created for Latinas, its mission is to help all women feel empowered, confident and beautiful. Lu products are powered by a proprietary technology that aims to give consumers healthier strands after use;

♦ Kazmaleje: A hair care tool and accessory brand that was founded by sisters LaToya, LaTasha and LaTrice Stirrup and includes KurlsPlus Detanglers; and

♦ Sundae Body: Founded by Lizzie Waley, the brand creates body care products that aim to transform shower routines.

Walmart’s beauty savings event would be returning through April 28, and will include such brands as Olive & June, Bubble, Evo & Avo, Schwarzkopf and Cantu, among others.

Lastly, the company shared a few trends currently on the rise, which include skincare’s influence on the beauty sector, bold cosmetics colors for the spring and the continuing popularity of skin care.

Target reportedly doubling salaried employees’ bonuses

Target is reportedly doubling bonuses for salaried employees, per a Bloomberg report, which cited people familiar with the matter.

The report noted that Target will pay 100% of employees’ eligible 2023 bonuses, up from 50% the year prior.

The hike in bonuses follows three consecutive quarters of sales declines.

Target’s profits increased higher than it was expecting last year, providing $2 billion in operating income from which to give out bonuses. Bonuses at Target typically max out at 175% of eligible amounts, per the report.

The increased payouts don’t apply to hourly employees, and senior executives have a separate bonus structure, according to the report. Cash bonuses will be payable at the end of March.

Target did not disclose its potential bonus ranges or how many of its roughly 415,000 employees are eligible, the report noted. Most Target workers are hourly store and

distribution-center employees. “The bonus structure is informed by goals set at the beginning of the fiscal year and includes sales performance and profit outcomes,” Target spokesman Brian Harper-Tibaldo said, per the report.

The report also noted that in recent weeks, Target’s shares rose 12% after the company disclosed better-than-expected earnings attributable to lower inventory levels and supply-chain costs. The retailer also announced plans to launch a paid membership program as well as plans to open and renovate hundreds of stores. Additionally, store and digital traffic are improving, though still in the red. Target now expects comparable sales to return to growth in the second quarter, per the report.

Ulta Beauty, Pact partner on sustainability efforts

Ulta Beauty is teaming up with packaging waste solution provider Pact to divert beauty product empties from landfills.

The beauty retailer is providing collection bins from Pact’s The Beauty Dropoff recycling program at all of its more than 1,350 U.S. stores. Customers can discard clean, empty, unbagged small cosmetics containers in the bins for recycling. Eligible items include plastic bottles and jars smaller than a fist, as well as pumps and dispensers, droppers and applicators, and pouches.

Empties for recycling via The Beauty Dropoff can be any brand, not just brands available at Ulta Beauty. Pact will then upcycle packaging material into another product or downcycle it into a lower-value item by breaking down packaging material to its most basic molecular component so it can be used as raw material in future products.

Packaging that cannot be used in any other way is incinerated to generate electricity or fuel. Ulta will promote its participation in The Beauty Dropoff program by social media, email and in-store displays.

Pact is a non-profit beauty collective founded by cosmetic brand MOB Beauty and clean beauty retailer Credo that now has more than 150 members from the beauty and wellness industries.

Participating in The Beauty Dropoff is Ulta’s latest step in an ongoing effort to become a more environmentally responsible company. Other actions the company has taken in the past few years include joining The Sustainability

INDUSTRY NEWS 20 April 2024 DRUGSTORENEWS.COM

Part D Pen Needle Block?

Unifine® SafeControl® has you covered.

Unifine® SafeControl® gives you and your patients a choice when faced with a Part D Pen Needle Block. ffered at a great price, with upgraded features for improved grip and enhanced comfort, Unifine® SafeControl® is the pen needle that benefits both your patients and your bottom line.

Make Unifine® SafeControl® your 1st Choice for your Medicare Part D Patients.

NOW AVAILABLE IN 4MMX32G! SCAN HERE TO LEARN MORE! Product Range: *Reimbursement Code Covered by most Medicare Part D Plans. ITEM NO: AN 7955 RC*: 08470-7955-01 mm x 30G 5 ITEM NO: AN 7940 RC*: 08470-7940-01 mm x 32G 4 ITEM NO: AN 7950 RC*: 08470-7950-01 mm x 31G 5 ITEM NO: AN 7990 RC*: 08470-7990-01 mm x 31G 6 ITEM NO: AN 7935 RC*: 08470-7935-01 mm x 30G 8 ITEM NO: AN 7930 RC*: 08470-7930-01 mm x 31G 8 has you cove . For more information, visit owenmumford.com/us. PARTDBLOCK/OMI/0124/1/US

Consortium, a global non-profit organization dedicated to creating more sustainable consumer products.

As a member of TSC, Ulta Beauty engages in consumer goods industry environmental impact efforts and leverages TSC’s science-based resources and tools. Ulta Beauty joins more than 100 TSC members working together on projects spanning topics such as plastic packaging and circularity.

In addition, the retailer operates the Conscious Beauty at Ulta Beauty initiative, which is designed to help consumers identify clean ingredients; as well as locate cruelty-free, vegan, and sustainably packaged brands and products.

According to Ulta, its sustainability efforts have included diverting more than 14,800 tons of waste from landfill and, in 2021, investing $1.6 million in energy management system retrofits while working toward greater sustainable packaging across its full product assortment.

This story originally appeared on Chain Store Age

Meijer makes $2M donation to Midwest food bank partners

Meijer announced a surprise $2 million donation to 30 key food bank partners to help battle hunger in its local communities. These focused donations will create a larger impact helping the food banks to better meet the needs of those they serve, resulting in a positive ripple effect in communities across the Midwest.

For 90 years, feeding people has been at the heart of Meijer, with hunger relief being one of the retailer’s longest-standing philanthropic commitments. Meijer works with all parts of the hunger relief system including both food banks and food pantries. Food banks are large-scale operations that service dozens of smaller-scale food pantries that, in turn, service a smaller geographic region. This cooperative system is designed to efficiently get food to those who need it the most.

The food banks receiving the donation are:

♦ Akron-Canton Regional Foodbank

♦ Central Illinois Foodbank

♦ Community Harvest Food Bank of Northeast Indiana

♦ Dare to Care Food Bank (Louisville, Ky.)

♦ Eastern Illinois Foodbank

♦ Feeding America Eastern Wisconsin

♦ Feeding America West Michigan

♦ Feeding America Kentucky’s Heartland

♦ Food Bank of Eastern Michigan

♦ Food Bank of Northern Indiana

♦ Food Bank of Northwest Indiana

♦ Food Finders Food Bank (Springfield, Ill.)

♦ Food Gatherers (Ann Arbor, Mich.)

♦ Forgotten Harvest (Detroit, Mich.)

♦ Freestore Foodbank (Cincinnati, Ohio)

♦ Gleaners Community Food Bank of Southeast Michigan

♦ Gleaners Food Bank of Indiana

♦ God’s Pantry Food Bank (Lexington, Ky.)

♦ Greater Chicago Food Depository

♦ Greater Cleveland Foodbank

♦ Greater Lansing Food Bank

♦ Mid-Ohio Food Collective

♦ Northern Illinois Food Bank

♦ Second Harvest Food Bank of East Central Indiana

♦ Second Harvest Food Bank of Mahoning Valley

♦ Second Harvest Food Bank of North Central Ohio

♦ Second Harvest Food Bank of Clark, Champaign & Logan Counties

♦ South Michigan Food Bank

♦ Terre Haute Catholic Charities Foodbank

♦ The Foodbank (Dayton, Ohio)

INDUSTRY NEWS 22 April 2024 DRUGSTORENEWS.COM

The Future of AI in Pharmacy

What can we learn from Kerrville Drug Co., who is using AI technology to drive more profitability in their cash business?

By Miranda Rochol

With so much in the news about artificial intelligence, it’s hard to imagine all the ways the emerging technology will have an impact. But what if I told you the future of AI in pharmacy was already here—in rural Kerrville, Texas?

Case study: Increasing

profitability

for

cash

pricing in 30 days

Kerrville Drug Co., a single independent pharmacy nestled in rural Kerrville, Texas, exemplifies the challenge pharmacies face to balance competitive pricing and profitability.

Margie Hocker, pharmacy manager and certified pharmacy technician, recalled the days when they had to turn away cash-paying customers who wanted to use a popular drug discount card. The pharmacy couldn’t accept the card due to high, unsustainable fees charged back to the pharmacy.

“At one point, we had no choice but to turn customers away,” said Hocker. “But now we are able to offer our cash-paying customers something even better to help patients save on their medications.”

What changed? Kerrville Drug Co. implemented a unique cash pricing program from Prescryptive, a healthcare technology company.

AI: Balancing profitability with patient savings

At Prescryptive, we’ve harnessed AI to help pharmacists with their cash pricing through an AI pricing engine that analyzes opportunities based on many factors. Kerrville Drug Co. saw the difference:

Miranda Rochol

SVP of Provider Solutions at Prescryptive Health.

In 30 days, Kerrville Drug Co. saw a 96% increase in average per prescription profitability for cash pricing

6% increase in total cash claims processed in the same 30-day period

88% average per prescription savings for patients for cash pricing

Hocker at Kerrville said: “We have confidence that the patient is getting a good price, and our pharmacy improves its profitability. It’s very transparent. Very affordable. And customers’ information will not be shared. It’s just a win-win on both sides.”

When a patient advocate from a nearby hospital called Kerrville Drug Co. on behalf of a patient who was newly diagnosed with diabetes, “we were able to save the patient more money on his prescriptions than other popular discount cards. He has now become a regular customer—and his wife, too,” said Hocker.

A wider lens: What can AI do for pharmacies nationwide?

America’s pharmacies face major headwinds, battling reimbursement challenges, increasing fees and more. But there is an opportunity: a solution for cash-paying customers at the counter.

And pharmacies need a solution now, as the use of high-deductible health plans continues to grow. A 2023 study from Kaiser Family Foundation found enrollment in these plans increased over the past decade, from 20% of covered workers in 2012 to 29% in 2023.

With more cash customers at the counter, pharmacies can use AI to help increase profitability in one lane of their business. New profitability data from Prescryptive Health underscores the powerful potential that AI can bring to cash pricing: In a recent analysis, the gross profit margin in 2023 for Prescryptive AI Pricing was nearly 54%. NCPA’s recent findings for total gross profit margin in 2022 found that independent pharmacies averaged 21%.

But using AI for a cash pricing system isn’t just about numbers—it’s about empowering pharmacies like Kerrville Drug Co. to stay profitable while doing what they do best: patient care in their communities.

Miranda Rochol is the SVP of Provider Solutions at Prescryptive Health. dsn

GUEST COLUMN DRUGSTORENEWS.COM April 2024 23

Challenges for Pharmacy in 2024

Pressures mount for the industry in wake of financial, operational and regulatory pressures

By Brian Nightengale

Last fall I joined Inmar Intelligence because of the great opportunity to work with an organization that is a healthcare, technology and media company uniquely positioned to help stakeholders successfully navigate the healthcare ecosystem. With the NACDS Annual Meeting drawing near, I’m compelled to share the key market forces that are informing Inmar’s strategy going forward. Our priorities will continue to evolve and I am excited to gain more insights from our customers and partners during NACDS Annual.

Financial and operational pressures are mounting

The financial pressures faced by the industry are seriously affecting the viability of the traditional retail pharmacy business model and pressuring the ability of pharmacies to meet the expanding healthcare needs of those in the communities they serve so effectively. The geography of pharmacy deserts is expanding during a time when consumer access to treatment has never been more crucial.

Primary among these financial pressures is reimbursement. Inmar data from January of this year shows overall reimbursement rates for all lines of business down measurably from January 2023 as DIR fees are now reflected in the adjudicated rate.

On top of reimbursement challenges, pharmacies are also dealing with inflationary pressures, operational complexities and workforce challenges, while also needing to plan for an evolving business and care model that must accommodate and leverage

expanded scope of practice, automation and the influence of artificial intelligence in healthcare.

Regulatory obligations are expanding

Pharmacies are also challenged with increasingly complex and burdensome regulations impacting the supply chain, most notably USP <800>, the enactment of the Inflation Reduction Act and full enforcement of DSCSA.

For the latter, final implementation of the Act will hopefully bring value beyond compliance by increasing efficiency throughout the supply chain. However, turning this from an administrative burden to an efficiency gain will require a collaborative mindset across all stakeholders throughout the supply chain.

Consumer expectations and behaviors are changing

Today, consumers are thinking more holistically about their health and are playing a more active and informed role in their wellness journey. Their increasing engagement with outlets such as omnichannel pharmacies, telemedicine and social media is changing how they learn, what they expect from the retail experience and how they pay for care.

With evolving payer models that blend pharmacy, medical, wellness and even food programs into holistic health and wellness programs, it is incumbent upon all of us in the pharmacy industry to listen to consumers and find innovative and collaborative ways to meet them where they are so that we can stay true to our mission of enabling higher quality care, lowering costs and expanding access.

Brian Nightengale

Executive Vice President of Healthcare at Inmar Intelligence.

Brian Nightengale

Executive Vice President of Healthcare at Inmar Intelligence.

Our industry’s challenges will not go unanswered

It is well known that community pharmacies are highly accessible and affordable sites of care. With the predicted increase in primary care physician shortages and other access challenges in many parts of this country, the pharmacy profession is well suited to meet these needs. However, we must work collaboratively as an industry to address the reimbursement and scope of practice barriers.

We are inspired by the impact our customers have on improving the lives of health and wellness consumers that they serve. I am excited to be part of an organization that supports this mission by being laser focused on bringing our unique expertise, products and insights to help solve the complex problems that our customers are facing. dsn

GUEST COLUMN 24 April 2024 DRUGSTORENEWS.COM

Controlling diabetes means controlling blood sugar, and for many people, that means regular testing and injections. Our diabetes products have been created to provide exceptional product quality and comfort while addressing the ever-changing needs of both patients and allied health professionals worldwide. Our wide range of insulin syringes, are designed for comfort and ease of use. Our pen needles and lancets feature a universal ISO standard fit and can be used with standard insulin pens and lancing devices.

SureComfort insulin syringes and pen needles are manufactured in a MDSAP certified facility. MDSAP is the newest and most stringent quality program for medical devices. Achieving this quality standard provides independent verification of Allison Medical’s commitment to providing exceptionally high quality insulin syringes and pen needles. Our SureComfort product lines offer a large variety of options for all specific needs and comes in tri-lingual packaging.

allison medical inspiredinnovation SCAN HERE TO LEARN MORE AOUT OUR SURECOMFORT PRODUCT LINE Trust and comfort. Every single customer. Every single time. Toll Free: 1-800-886-1618 For questions regarding the SureComfort product line, contact our Allison Medical Customer Service at: ...its time to take a New Look! Coming Soon, the Clean New BOLD Look of SureComfort Quality & Profitability so exceptional... PRIORITIES 3RITIES SAME GREAT 1 Patient Care • MDSAP certified facility • Exceeds quality standards set forth by Six Sigma 2 Product Quality • Stringent manufacturing process • Ownership in the manufacturing facility 3 Profitability • Potential enhanced profits for each Insulin Syringe and Pen Needle dispensed

TM Sure Delivering Quality and Comfort

Making Her Mark

Crystal Lennartz spoke with DSN about her new role as president of Health Mart and Health Mart Atlas and the pivotal advice she offers to young women starting off in the pharmacy field

By Julianne Mobilian

Crystal Lennartz, Pharm.D., MBA, recently made history as the first female president of Health Mart and Health Mart Atlas in the franchise’s 26-year history. She previously served as vice president and general manager for Health Mart Atlas, leading McKesson’s Pharmacy Services Administrative Organization to be the largest, top-performing PSAO in the market. As community pharmacies expand their clinical services offerings, Lennartz is dedicated to helping pharmacies get fairly reimbursed for the care they provide to patients.

DSN caught up with Lennartz about her monumental new role, career background and the pivotal advice she offers to young women starting off in the pharmacy field.

“I would encourage women looking to take on elevated pharmacy roles to express interest to their leader and sponsors. Raise your hand as being willing to take on stretch projects or handle tough customer issues.”

-

Crystal Lennartz, Pharm.D, MBA

Drug Store News: How has your background prepared you to lead Health Mart and Health Mart Atlas?

Crystal Lennartz: My experience in pharmacy has prepared me for this role in many ways. Fundamentally, I’m a trained pharmacist, and I have worked in or on behalf of pharmacies for 20 years. Since joining McKesson 11 years ago, I’ve taken on roles of increasing responsibilities with Health Mart and our payer solutions. Most recently, I served as vice president of Health Mart Atlas and Atlas Specialty, where I helped grow Health Mart Atlas to be one of the largest top performing pharmacy services administrative organizations on the market.

I’m enthusiastically committed to the advancement of pharmacy services and the impact pharmacists can have on public health, from vaccinations and screenings to medication therapy management and health equity measures. Throughout my career, I’ve worked in large chains, for the National Association of Chain

WOMEN IN THE NEWS 26 April 2024 DRUGSTORENEWS.COM

Drug Stores, and even as director of continuing education for Drug Store News, so I understand retail pharmacy and what pharmacies need to thrive and grow. Now, as president of Health Mart and Health Mart Atlas, I can focus exclusively on enabling and scaling solutions that support pharmacists so they can focus on what matters most taking care of patients.

DSN: What part of pharmacy are you most passionate about?

CL: I’m passionate about the pharmacy profession as well as advancing patient care. Advocating for people and issues I believe in fuels my passion in a genuine way. Throughout the past five years, I’ve focused on pharmacy performance and reimbursement for prescriptions as well as pharmacist services. By serving on the boards of McKesson’s employee Political Action Committee and Pharmacy Quality Alliance, I’m committed to helping advance healthcare policy as well as establishing quality standards that drive performance-based reimbursement. With continued support from McKesson, National Community Pharmacy Association, NACDS and continued industry collaboration, I’m hopeful we’ll see legislation at both the state and federal level to achieve provider status and pharmacy access goals.

DSN: What motivates you to go to work every day?

CL: It’s a privilege to work on behalf of our independent pharmacy customers because of everything they do for their community. But it starts with having a great team that is dedicated to staying connected to customers to truly listen to their needs so we can provide the solutions that help strengthen their pharmacy businesses and elevate the role they play in people’s lives.

DSN: What advice do you have for female pharmacy students or those who are just beginning their career? How can we get more women into elevated pharmacy roles?

CL: I would recommend they think outside the box. Most pharmacy schools prepare pharmacists very well for traditional careers in retail or hospital pharmacy, for example. Yet, as my career suggests, pharmacists can have an impact more broadly across healthcare and the business, whether it’s association work, with wholesalers or generally in the pharmaceutical industry. I would encourage students and young pharmacists to look for opportunities to get exposed to leaders and mentors in some of the non-traditional pharmacy areas to broaden their mindset. I’m thankful that my time at Drake and different mentors since have given me that opportunity.

Having terrific mentors has played a very big role in my success. So, I work hard to pay that forward, whether it’s building teams or giving back through McKesson’s Women Empowered employee resource group. I honestly feel like now as a mentor and sponsor I get just as much out of it as the mentee.

Building on this, I would encourage women looking to take on elevated pharmacy roles to express interest to their leader and sponsors. Raise your hand as being willing to take on stretch projects or handle tough customer issues. Sometimes as women, we think it’s

“I

would encourage students and young pharmacists to look for opportunities to get exposed to leaders and mentors in some of the non-traditional pharmacy areas to broaden their mindset.”

- Crystal Lennartz, Pharm.D, MBA

necessary to check 100% of the boxes when applying for new roles and that’s not always the case.

DSN: You spearheaded the development of Health Mart Atlas DIR Assist last year. Can you provide an in-depth framework of the processes, challenges and successes from these efforts?

CL: To help pharmacies manage the financial pressures of the DIR fee collection changes that started in January, Health Mart Atlas developed DIR Assist, a voluntary, opt-in program designed to help pharmacies with cash flow challenges associated with the change. Pharmacies that signed up for DIR Assist last year are now receiving escrow funds they put aside through DIR Assist to help offset the “double dip” as some call it.

We started bringing awareness to the anticipated DIR changes back in 2022. Through conversations with Health Mart Atlas members, we found there was a need for a tangible method to help pharmacies weather through these changes. That’s what inspired the development of DIR Assist as one of the first proactive solutions on the market. With the rule now in effect, we remain committed to supporting our member pharmacies through this transition through financial planning as well as tools to help diversify and expand revenue.

DSN: Where do you hope to see the pharmacy profession in the next 10 years?

CL: As pharmacists continue to elevate their role in protecting the health and wellness of their communities, I hope they are fully recognized as vital and equal members of patients’ overall care team. Empowered with provider status, current and future pharmacists can focus not just on filling prescriptions for patients but being part of their total care team and responsible in part for the patients’ outcomes. dsn

DRUGSTORENEWS.COM April 2024 27

New and Noteworthy

4 1 3

HRG’s five notable products from March 2

5

After seeing a slight dip in February, product introductions spiked for the month of March, continuing the strong start for the year so far.

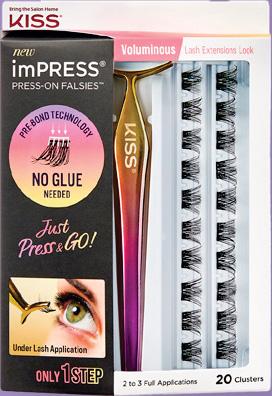

For the month of March, suppliers introduced 272 new products, which is 62 more than the 210 they introduced in February and very close to the 278 products suppliers released in January. Waukesha, Wis.-based HRG reviewed 28 products in the health category, 213 items in the wellness sector and 31 items in the beauty aisle to see which ones stood out as Products to Watch.

Here are the ones to watch:

1. Advil Targeted Pain Relief Cream

Haleon said it has introduced the first topical pain reliever from Advil and claims it works on contact, at the source, for up to eight hours. Utilizing four pain fighting ingredients—menthol, capsaicin, camphor and methyl salicylate—Advil Targeted Relief Pain Relieving Cream is formulated to target fast relief of arthritis and joint pain, back and body aches, sprains and strains, and sore muscles with a specially designed massage applicator. It comes in a 2.5-oz. bottle.

2. Refresh Tears PF Lubricant Eye Drop

Refresh Tears PF eye drops from AbbVie is a preservativefree version of the original Refresh Tears. The drops are formulated to instantly moisturize and lubricate eyes to relieve mild symptoms of dry eyes in a multi-dose bottle. Designed for dry, sensitive eyes, the HydroCell technology is a NaClfree glycerin-based solution that enables rehydration while maintaining the volume of cells on the ocular surface. The drops come in a .33-oz. bottle.

3. Pepto Bismol Fast Melts Soft Chews

Procter & Gamble’s Pepto Bismol Fast Melts Soft Chew Tablets provide the same fast and effective relief as Pepto Bismol liquid with a soothing mint flavor, the brand said. The chews are formulated to coat the digestive tract to quickly provide relief from nausea, heartburn, indigestion, upset stomach and diarrhea in a new form. It comes in a 24-ct. bottle.

4. Vitafusion Wellness MultiSoft Chews

Church & Dwight claimed that its Vitafusion Daily Wellness Multi Soft Chew provides nine key daily nutrients per serving in a chew that offers more flavor and satisfaction. Each chew is individually wrapped for easy portability and convenience. The chews come in a 30-ct. bottle.

5. Bioré Aqua Rich UV Moisturizer SPF 30

Bioré Aqua Rich UV Weightless Moisturizer SPF 30 from KAO Brands is formulated to provide protection from the harsh effects of UV exposure, such as wrinkles, pigmentation, pore degradation and dehydration. Developed without oxybenzone and octinoxate, this lightweight hyaluronic acidbased moisturizer is designed to work well under makeup without clogging pores. It provides all day hydration with no white cast on all skin types. It comes in a 1.7-oz. tube. dsn

PRODUCTS TO WATCH 28 April 2024 DRUGSTORENEWS.COM

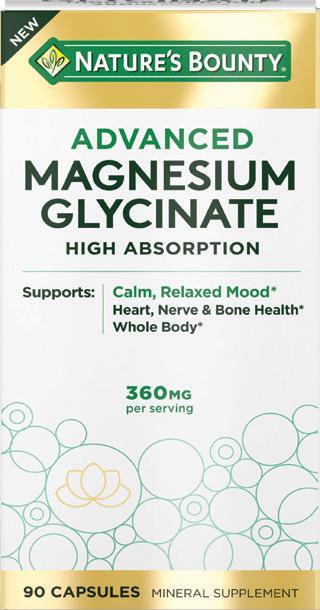

HRG Future 50

These

products set themselves apart in 2023

Coming off of a relatively strong 2022, supplier-introduced new products slowed a little bit in 2023. The Waukesha, Wis.-based data and analytics company HRG reviewed 1,634 new health, beauty and wellness items in 2023, and came up with its list of the top 50 that stand a good chance of being successful on store shelves in the coming years.

“This is a decrease of 12.8% from the 1,875 products reviewed in 2022,” HRG said in a February release. “Of the newly introduced items in 2023, 18, or 1% of new items, never made it to the retail shelf as their launches were canceled by manufacturers sometime after their initial HRG review. The decrease in new product introductions is the fourth consecutive year that HBW launches have declined. It can be directly attributed to manufacturers focusing on managing continued supply chain irregularities and rationalizing the ranges for their current brand portfolios.”

HRG compiled the list using an unbiased, weighted review of promotional support, product innovation, importance to community pharmacy, earning and category growth potential to determine future performance. HRG’s category research and analysis team also reviewed key sales indicators and distribution within community pharmacies to select the new items trending to be the top 50 performers.

Several trends emerge in HRG’s analysis. Here are some of the highlights:

◊ Within the top five categories in independent pharmacy (cold & allergy, pain relief, diabetes management, vitamins & dietary supplements and digestive health), 425 new items were reviewed, with 70 of those products receiving a Star, or roughly 16.5%.

◊ The wellness classification, for the second consecutive year, had more product launches (776), than the beauty segment (626). Wellness products also earned the second highest quantity of Stars for 2023 introductions at 11.25%. Two of these wellness products received the sought-after threestar rating, one in the first aid category, the other in feminine care.

◊ The health classification had the largest percent of Stars awarded at 18%.

◊ The beauty classification experienced a continued three-year decline in overall product launches from 2022, with 3% of products being awarded HRG Stars.

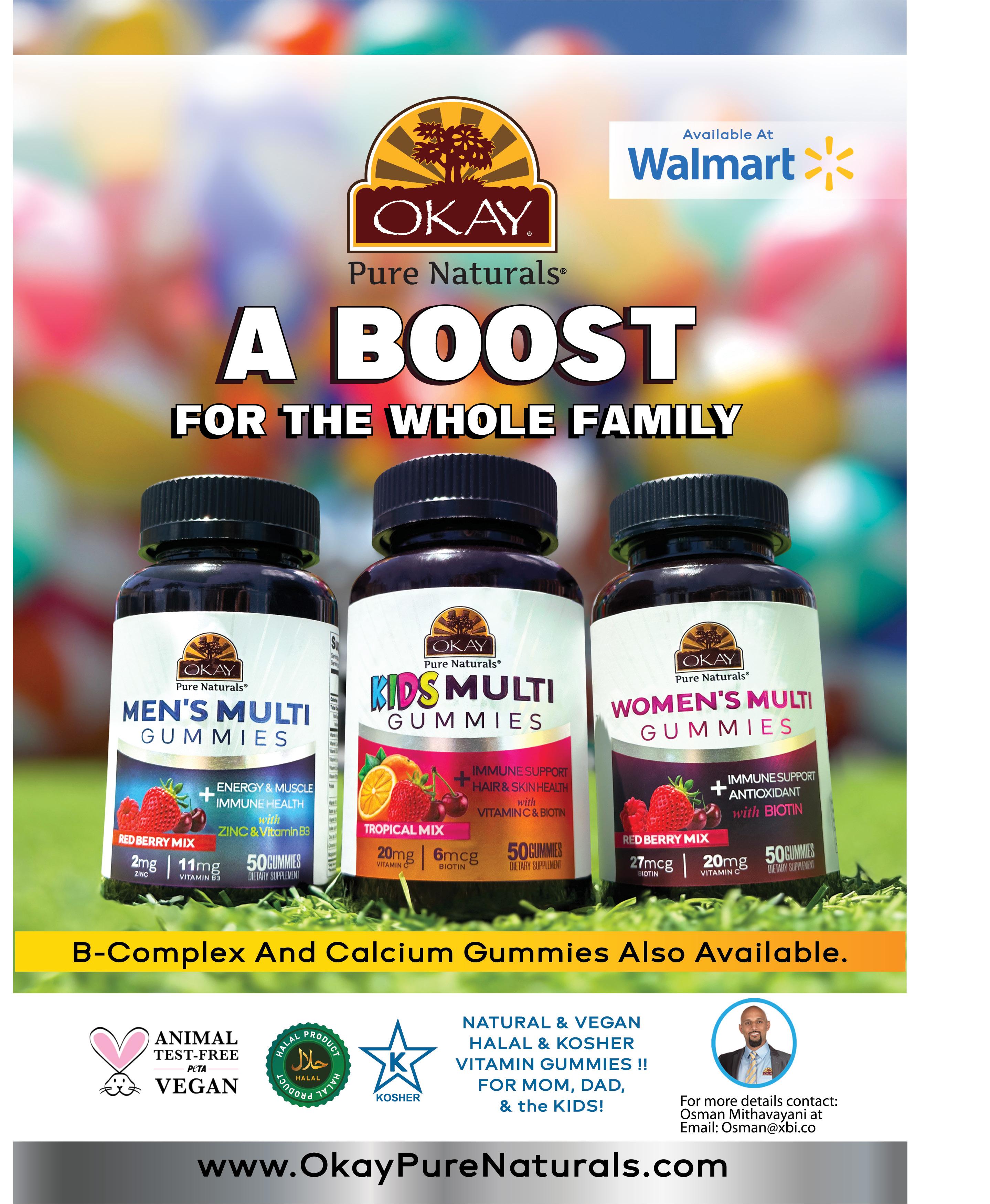

◊ The gummy form is trending for a third year—when comparing the gummy form to the total new items for 2023, nearly 7% were in this popular form, spanning six categories. Some of the key treatment targets for these products are sleep, immunity, pre- and probiotics, and popular supplements such as magnesium and ashwagandha.

◊ Manufacturers continue to focus on the self-care trend by introducing products that focus on immune support and products that include elderberry. Another popular ingredient for 2023 was hemp, utilized as an aid in reducing pain, and it was popular in beauty regimen lines.

◊ Whitening products also increased in 2023, with consumers looking for personal treatment options. This subcategory increased in performance over 2022.

◊ The popular scent, lavender, was not only found in beauty products in 2023, it was utilized in health and wellness products as well, in categories such as foot care and cold & allergy.

FUTURE 50 30 April 2024 DRUGSTORENEWS.COM

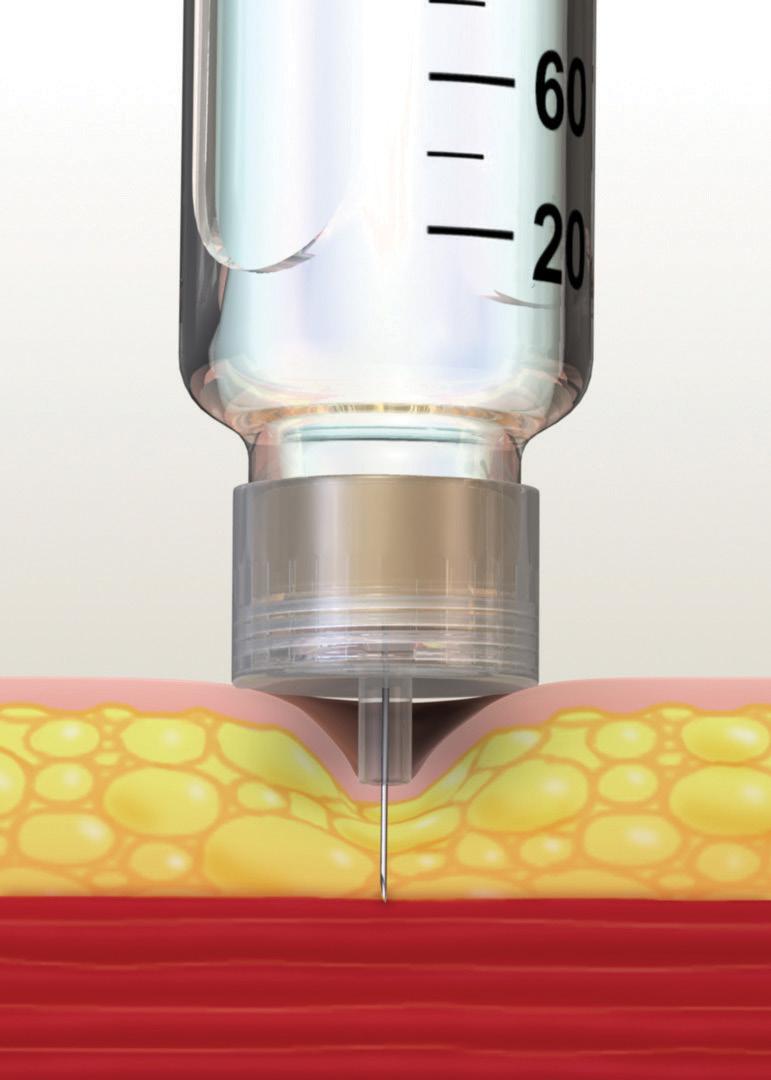

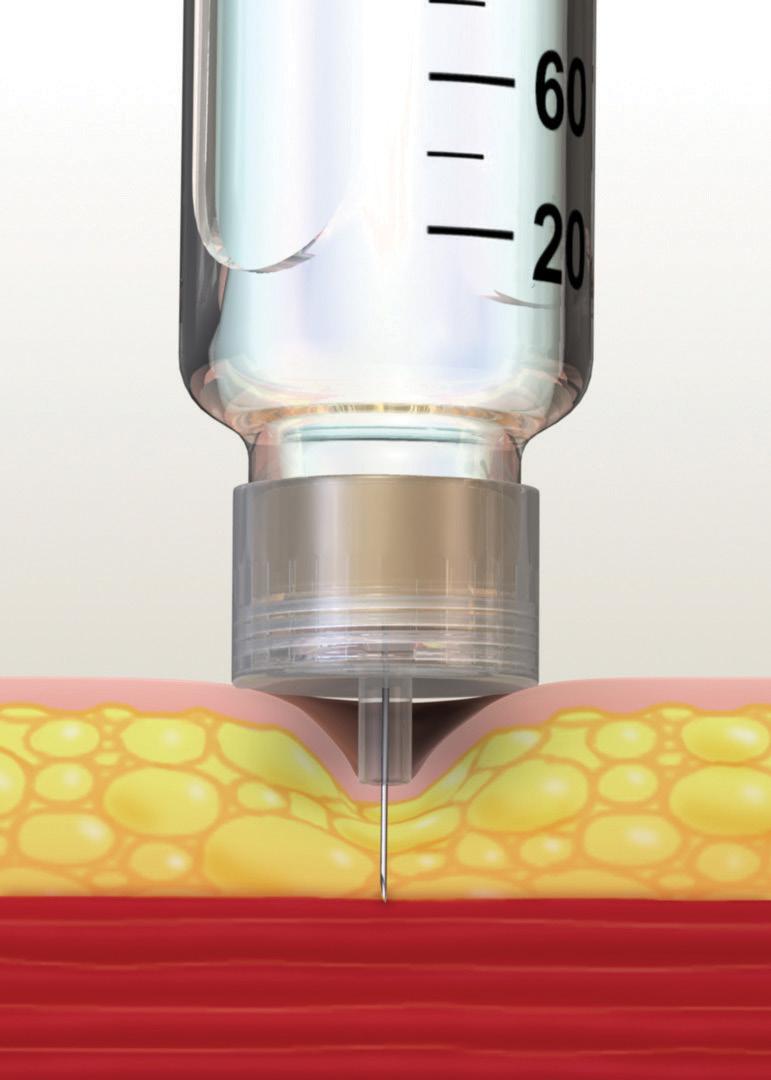

BD N noTM 2n Gen Pen Nee les

s el ver he r nsul n orre

BD NanoTM 2nd Gen Pen Needles have a unique ontoured ase to help compensate for too much injection force, a common challenge for patients injecting insulin.1*

zone)

REFERENCES

BD NanoTM 2nd Gen Pen Needles are estimated to educe nt muscul nject n sk y 8x vs 4mm posted base pen needles.2†

Intramuscular injections have been shown to lead to nc e sed p n nd e te sk yp lycem . 3

*N=230 patients with diabetes across Canada. Participants answered a survey as part of the cross-sectional observational behavioral study. BD helped fund this study. † The study used in-silico probability model of needle penetration depth for posted-hub 4mm pen needles and average human tissue thickness measurements across a range of injection forces and recommended sites, pooled across gender and BMI.

1. Bari B, Corbeil MA, Farooqui H, et al. Insulin injection practices in a population of Canadians with diabetes: an observational study. Diabetes Ther. 2020;11(11):2595-2609. . Rini C, Roberts BC, Morel D, et al. Evaluating the impact of human factors and pen needle design on insulin pen injection. J Diabetes Sci Technol. 2019;13(3):533-545. 3. Frid AH, Kreugel G, Grassi G, et al. New insulin delivery recommendations. Mayo Clin Proc. 2016;91(9):1231-1255. embecta, formerly part of BD. BD is the manufacturer of the advertised products. embecta and the embecta logo are trademarks of Embecta Corp. BD and the BD Logo are trademarks of Becton, Dickinson and Company. All other trademarks are the property of their respective owners. © 2023 Embecta Corp. All rights reserved. BD-85393

ly VS

hel en

go.embecta.com/pharmacypartner Cons er s ens ng BD N noTM 2n Gen Pen Nee les. Experience the difference of a contoured needle base.

Skin Fat (target

Fat (target zone) Muscle Skin Muscle POSTED Conventional 4mm pen needle CONTOURED BD Nano TM 2nd Gen Pen Needle NDC: 08290-3205-50

FUTURE 50 32 April 2024 DRUGSTORENEWS.COM Rank Product Manufacturer Category Subcategory Launch 1 NARCAN Emergency Treatment of Opiod Overdose 2pk Emergent Devices Inc. First Aid Kits & Supplies Mixed/Miscellaneous First Aid Kits & Supplies Nov. 2 Colgate Optic White Stain Fighter Toothpaste with Baking Soda 4.2oz Colgate-Palmolive Compnay Toothpaste & Treatments Whitening Toothpaste April 3 Dr. Scholl's Freeze Away Skin Tag Remover 8 treatments Scholl's Wellness Company Wound Treatments & Skin Relief Wound, Burn & Skin Treatments May 4 CONTOUR NEXT GEN Blood Glucose Monitoring System 1ct Ascencia Diabetes Care Holdings Blood Glucose Testing Blood Glucose Testing Devices Nov. 5 Clearblue Early Digital Pregnancy Test 3ct Procter & Gamble Pregnancy & Ovulation/Fertility Tests & Support Pregnancy Tests June 6 Pampers Baby Wipe Sensitive Pop-Top 168ct Procter & Gamble Disposable Diapers & Wipes Wipes & Flushables June 7 Neutrogena Clear Face Serum Fragrance Free SPF 60+ 1.7oz Kenvue Inc. Therapeutic/Beauty Sun Protection Therapeutic/Beauty Face Sun Protection Jan. 8 Compound W Total Care Kit 1ct Medtech Products Wart Removers Wart Removers Feb. 9 Cortizone-10 Intensive Moisture Cream 2pk Sanofi Itch Treatments General Itch Treatments Jan. 10 Neosporin+ Lidocaine Maximum Strength Ointment .5oz Kenvue Inc. Wound Treatments & Skin Relief Topical Antibiotics & Antimicrobials Feb. 11 Dr Scholl's Heel And Arch Pain Relief Orthotics Men's 1pr Scholl's Wellness Company Shoe Insoles & Inserts Heel & Arch April 11 Dr Scholl's Heel And Arch Pain Relief Orthotics Women's 1pr Scholl's Wellness Company Shoe Insoles & Inserts Heel & Arch April 12 La Roche-Posay Anthelios Melt-In Milk Sunscreen SPF 60 5oz La Roche-Posay Therapeutic/Beauty Sun Protection Therapeutic/Beauty Body Sun Protection Aug. 13 Tylenol Precise Cooling Pain Relieving Cream 4oz Kenvue Inc. External Pain Relief External Muscle/Joint Pain Relief Creams, Ointments & Gels Nov. 13 Tylenol Precise Pain Relieving Cream 4oz Kenvue Inc. External Pain Relief External Muscle/Joint Pain Relief Creams, Ointments & Gels Nov. 14 Ricola Throat Drop Cherry 45ct Ricola Inc. Cough Drops, Sore Throat Relief Throat & Cough Drops June 15 Biofreeze Overnight Pain Relief Roll-On 2.5oz Reckitt External Pain Relief External Muscle/Joint Pain Relief Lotions, Liquids, Roll-Ons & Sprays Aug. 16 Nizoral Anti-Dandruff Shampoo 14oz Arcadia Consumer Healthcare Therapeutic Shampoos, Conditioners, Hair & Scalp Treatments Therapeutic Shampoos July 17 Nasonex 24 Hour Allergy Spray 60 sprays Perrigo Company Allergy Allergy Nasal Sprays, Drops & Inhalers March HRG Future 50 These products set themselves apart in 2023

FUTURE 50 34 April 2024 DRUGSTORENEWS.COM Rank Product Manufacturer Category Subcategory Launch 17 Nasonex 24 Hour Allergy Spray 120 sprays Perrigo Company Allergy Allergy Nasal Sprays, Drops & Inhalers March 18 Trojan Magnum Raw Condom 3ct Church & Dwight Co., Inc. Condoms & Barrier Contraceptives Male Condoms June 18 Trojan Magnum Raw Condom 10ct Church & Dwight Co., Inc. Condoms & Barrier Contraceptives Male Condoms June 19 Motrin Dual Action with Tylenol Tablet 80ct Kenvue Inc. Internal Pain Relief Ibuprofen & Other Anti-Inflammatories July 19 Motrin Dual Action with Tylenol Tablet 20ct Kenvue Inc. Internal Pain Relief Ibuprofen & Other Anti-Inflammatories July 20 Mucinex Fast-Max Kickstart Severe Cold & Flu 6oz Reckitt Cough, Cold, Flu & Sinus Cough, Cold, Flu & Sinus Liquids June 21 Neutrogena Purescreen+ Mineral UV Tint Face Liquid SPF 30 Medium 1.1oz Kenvue Inc. Mineral/Natural Sun Protection Mineral/Natural Body Sun Protection Jan. 21 Neutrogena Purescreen+ Mineral UV Tint Face Liquid SPF 30 Light 1.1oz Kenvue Inc. Mineral/Natural Sun Protection Mineral/Natural Body Sun Protection Jan. 22 Dove Baby Wash Sensitive Skin 13oz Unilever Baby Health, Beauty & Wellness Baby Bath & Hair Care Aug. 22 Dove Baby Cream Sensitive Skin 8oz Unilever Baby Health, Beauty & Wellness Baby Lotions, Creams, Oils & Powders Aug. 23 Natrol MelatoninMax 10mg Gummy Blueberry 50ct Natrol Specialty Supplements Sleep, Stress & Anxiety June 24 Secret Deodorant Aluminum Free Clear Solid Lavender 2.4oz Procter & Gamble Women's Deodorants Women's Solids & Gels Feb. 25 BAND-AID Bandages Disney Princess Assorted 20ct Kenvue Inc. Children's First Aid Children's First Aid Dressings Feb. 25 BAND-AID Bandages Mickey Mouse Assorted 20ct Kenvue Inc. Children's First Aid Children's First Aid Dressings Feb. 26 Hawaiian Tropic Weightless Hyrdration Clear Sunscreen Spray SPF 70 6oz Edgewell Personal Care General Sun Protection General Body Sun Protection Jan. 27 Dr. Scholl's Odor-X Foot Odor Probiotic Spray 4oz Scholl's Wellness Company Odor & Wetness Treatments Odor & Wetness Sprays May 28 Fungi-Nail Anti-Fungal Spray 1oz Arcadia Consumer Healthcare Antifungal Treatments Nail Fungus & Repair Treatments July 29 Cortizone-10 Fast Itch Relief Massaging Rollerball 1.5oz Sanofi Itch Treatments General Itch Treatments Jan. 30 Systane Ultra PF Dry Eye Relief .34oz Alcon Eye Preparations Eye Relief Products Jan. 31 U By Kotex Balance Ultra Thin Pads with Wings Extra Heavy Overnight 22ct Kimberly-Clark Corporation Feminine Protection Feminine Pads March HRG Future 50 These products set themselves apart in 2023

FUTURE 50 36 April 2024 DRUGSTORENEWS.COM Rank Product Manufacturer Category Subcategory Launch 31 U By Kotex Balance Ultra Thin Pads with Wings Overnight 26ct Kimberly-Clark Corporation Feminine Protection Feminine Pads March 32 Old Spice Champion Deodorant Fresh Air 3.0oz Procter & Gamble Men's Deodorants Men's Solids & Gels Feb. 33 Zzzquil Pure Zzzs Triple Action Gummy 60ct Procter & Gamble Specialty Supplements Sleep, Stress & Anxiety Sept. 34 Bausch + Lomb Biotrue Hydration Boost for Contacts Drops .33oz Bausch Health Companies Contact Lens Care Soft Lens Multi-Purpose Solutions June 35 Dr. Scholl's Plantar Wart Remover Fast-Acting Liquid Kit 1ct Scholl's Wellness Company Wart Removers Wart Removers May 36 Crest Pro-Health Gum Detoxify & Restore Toothpaste Deep Clean 4.6oz Procter & Gamble Toothpaste & Treatments Regular Toothpaste & Tooth Powder March 37 Vicks VapoRub Advanced Plus Cough Suppressent Topical Analgesic Ointment 2.82oz Procter & Gamble Respiratory Treatments Vapor Products Sept. 38 DayQuil Cold & Flu Ultra Concentrated Liquicap 48ct Procter & Gamble Cough, Cold, Flu & Sinus Cough, Cold, Flu & Sinus Tabs & Caps July 39 Old Spice Swagger Body Wash Cedarwood 24oz Procter & Gamble Hand & Body Cleansing Body Cleansing Liquids March 40 Bactine Max Lidocaine Dry Spray 4oz Wellspring Pharmaceutical Company Wound Washes & Cleansers Mixed/Miscellaneous Wound Washes & Cleansers April 41 Abreva Cold Sore Rapid Pain Relief Cream .10oz Haleon Lip Care Medicated Lip Treatments Sep. 42 Clearblue Menopause Stage Indicator Test 5ct Procter & Gamble Pregnancy & Ovulation/Fertility Tests & Support Mixed/Miscellaneous Pregnancy & Ovulation/Fertility Tests & Support Oct. 43 Hyland's Naturals Dry Ear Relief Oil .5oz Hyland's Naturals Ear Care Mixed/Miscellaneous Ear Care Jan. 44 NyQuil Cold & Flu Ultra Concentrated Liquicap 48ct Procter & Gamble Cough, Cold, Flu & Sinus Cough, Cold, Flu & Sinus Tabs & Caps July 45 Olay Super Serum Night Repair 1oz Procter & Gamble Facial Moisturizers & Treatments Facial Moisturizers Oct. 46 O'Keeffe's Working Hands Pain Relief Cream 3oz O'Keeffe's Company Hand & Body Moisturizers & Treatments Therapeutic Hand & Body Moisturizers Aug. 47 Neutrogena Reusable Gentle Foaming Facial Cleanser Fragrance Free 1 Kit Kenvue Inc. Facial Cleansers Facial Cleansers & Scrubs Dec. 48 Zarbee's Children's Gentle Bedtime Gummy with Chamomile Raspberry Lemon 30ct Zarbee's Inc. Children's Pain & Fever Relief Children's Sleeping & Calming Aids Dec. 49 Icy Hot PRO Pain Relief Patch 5ct Sanofi External Pain Relief External Muscle/Joint Pain Relief Patches & Pads Jan. 50 MiraFIBER Gummies 72ct Bayer Inc. Laxatives Fiber Products Aug. HRG

50 These products set themselves apart in 2023

Future

Bringing brand synergy to new heights

Will Righeimer, CEO of Hello Bello, discusses the strategic goals and the partnership opportunities the brand brings to Hyland’s Naturals

Will Righeimer is the CEO of Hyland’s Naturals and Hello Bello.

Will Righeimer, the newly appointed CEO of Hello Bello and CEO of Hyland’s Naturals, discusses the strategic goals and priorities ahead for Hello Bello and the new opportunities the partnership brings to Hyland’s Naturals. Check out what’s ahead for the brands in 2024.

Drug Store News: Thanks for speaking with us, Will. Congratulations on your appointment as CEO of Hello Bello. We understand you’ll continue to serve as CEO of Hyland’s as well. Do you mind answering some questions about these exciting brands? Will Righeimer: Absolutely! It’s an honor to have this opportunity and we’re excited to share what this means for our customers.

DSN: What are you most excited about becoming the new CEO of Hello Bello?

WG: I’m really excited to work with two amazing brands that are trusted by millions of families. Hello Bello is still at the beginning of its journey and has incredible growth potential. Hyland’s is a mature brand with tremendous growth driven primarily through our continued innovation in the pediatric and women’s health categories. Together, our brands offer parents a robust portfolio of products to care for their families with clean and natural product offerings.

DSN: What makes Hello Bello unique?

WR: Hello Bello makes high quality premium products that outperform most brands on the market today. One example is our diapers - not only are they able to absorb well and provide a comfortable fit, they offer parents fun, catchy designs and capture the imagination of their young users. They add a bit of fun to the parenting journey.

DSN: Do you see any commonalities between Hyland’s and Hello Bello? How will customers and consumers benefit from the partnership?

WR: Absolutely! They both offer premium quality products that are accessible, in price and availability, and have loyal consumers who prefer cleaner, more natural products.

We are excited to partner Hyland’s with Hello Bello, because we serve the same customer, which is typically parents looking for the best options for their family’s wellbeing. We believe that together

we provide one of the most significant independent platforms for parents to keep their families healthy with clean and natural options. The synergy between our companies will empower us to provide unparalleled support to parents, from newborns to young children, through a comprehensive range of high-quality pediatric products and consumer healthcare essentials.

DSN: Can you share some of the strategic goals and priorities for the new partnership moving forward?

WR: Our top priority is to always put the customer first. We understand that this past year has been challenging for Hello Bello to ship products timely to some of its customers. At Hyland’s, we have worked hard to make sure we ship 100% on time and in full, everytime. It is our intention to immediately apply that same commitment to our Hello Bello customers just as we do at Hyland’s. With the new operational and financial resources we now have available to Hello Bello, we are certain that we can achieve this goal.

DSN: Can you highlight any specific challenges or opportunities that this partnership presents for the organization?

WR: This partnership with Hello Bello is new for all of us at both organizations. The Hyland’s team is very excited to partner with Hello Bello and its own team of passionate employees. We look forward to collaborating together and optimizing the strength of both companies. Ultimately, we are very excited for our two brands to work together to create a meaningful pediatric and general wellness platform to support the parenting journey.

DSN: What message would you like to convey to the loyal customers of both brands regarding this new partnership?

WR: We’re here for you! Our message to consumers is that between Hyland’s and Hello Bello, we believe we have the best high quality products to serve your family’s needs.

At Hyland’s, we’re excited to offer customers more than 15 new innovative pediatric and women’s health products launching in 2024.

For Hello Bello, we are back on track proudly producing millions of diapers each week in our Waco, Texas facility and we are dedicated to shipping 100% on time and in full. dsn

ONE-ON-ONE SPONSORED 38 April 2024 DRUGSTORENEWS.COM

Raising littles is a big job. We’re here to help. Hello Bello makes premium parent-approved diapers, wipes, and personal care to keep families covered through every age and stage. Learn more at: www.hellobello.com Soft, Secure & Comfy Fit Hypoallergenic Ultra-Absorbent Made Without: Artificial Fragrance, Parabens, Latex*, or Fragrance *Natural Rubber

Examining Medical Billing Opportunities Pharmacies Should Leverage

David Pope PharmD, CDE, Chief Pharmacy Officer, OmniSYS, XiFin Pharmacy Solutions

David Pope PharmD, CDE, Chief Pharmacy Officer, OmniSYS, XiFin Pharmacy Solutions

Pharmacies and their accessibility play an increasingly important role in the US healthcare system. The pharmacy landscape is evolving beyond simply filling prescriptions; it’s transforming into the front door of healthcare. Consumers across the country demand more convenient access to care, healthcare deserts that lack vital primary care resources litter communities nationwide, and advocates for improving community health continuously push for better health outcomes.

The reasons pharmacy teams are needed to shore up healthcare in the US are clear. Offering clinical care services in pharmacies can help fill in healthcare gaps nationwide. Venturing into clinical care gives pharmacies the leeway to drive revenue by tapping into medical billing and reimbursement. Here are the top three opportunities pharmacy teams should consider when exploring medical billing possibilities.

Legislative Changes Support the Expansion of Pharmacy Care

The movement to expand pharmacists’ roles has been underway for several years, and legislation supporting expanding the role of pharmacists as providers has been introduced in many states

As pharmacists play an increasingly important role in delivering healthcare services and helping patients better manage long-term chronic conditions, consumers get more convenient access to clinical care closer to home.

In addition to better serving patients, more clinical services delivered at the pharmacy also play an important financial role for pharmacies, creating new higher-margin revenue streams.

A Looming Physician Shortage Creates a Care Gap that Pharmacists Can Help Fill

An Association of American Medical Colleges report estimates a shortage of more than 100,000 physicians in America by 2032. This includes up to 55,000 primary care physicians and up to 65,000 specialty care providers. There is also an ongoing nurse shortage that is expected to persist and grow. All of these factors make the pharmacist’s role as a provider of clinical services more critical and valuable.

While the looming physician shortage coupled with the accessibility of pharmacies to the vast majority of Americans creates a tremendous opportunity for pharmacies to deliver more clinical services, they need resources and technology solutions to optimize delivery and billing.

The Ability to Improve Efficiencies and Alleviate Administrative Stress

Across the country, pharmacists are dealing with escalating job demands as well as staffing shortages. This creates stress. Pharmacists need technology solutions that help them to improve efficiency, reduce administrative burdens, and alleviate staff stress so they can operate at the fullest extent of their licenses and begin to fill healthcare gaps.

To maximize reimbursement from clinical services, pharmacies need to augment their pharmacy billing systems with supplemental medical billing capabilities that integrate seamlessly into the current workflow and increase operational efficiency, while alleviating administrative workload.

Putting a Medical Billing Strategy into Place

Putting sound strategies, processes, and solutions in place is imperative to manage medical claims for clinical services via the medical benefit pathway. By augmenting the existing workflow and using purpose-built technology, pharmacies can be set up for success today and truly thrive in the future. Adding medical billing capabilities gives pharmacies the most flexibility to exploit new revenue opportunities as pharmacists are granted the ability to deliver a broader array of clinical services.

To fully support clinical service expansion, it’s more important than ever to have a revenue cycle management (RCM) technology or outsourced services solution to ensure maximum allowable reimbursement for the growing number of items covered under the medical benefit. To optimize the likelihood of reimbursement for medical billing, pharmacies must employ technology that offers comprehensive capabilities.

Whether delivered exclusively via technology or through an outsourced billing service, a comprehensive RCM solution will enable pharmacies to manage eligibility and benefits verification, front-end edits, and the end-to-end accounts receivable (AR) process for medical billing within the pharmacy workflow. These capabilities are critical to ensuring pharmacies maximize reimbursement for immunizations, clinical services, durable medical equipment (DME), and specialty drugs.

Explore our medical billing resources at OmniSYS.com/medicalbillingcompass to learn more.

© 2024 OmniSYS, the OmniSYS logo, and XiFin are trademarks of XiFin, Inc. All other trademarks, logos, and brand names are the property of their respective owners. 24-AR-101

Get on the Path to Higher Reimbursement

Finding it difficult to navigate the complexities of medical billing? We can help.

Let us power your medical billing strategy with the solution that enables pharmacies to better manage eligibility and benefits verification, front-end edits, and the end-to-end accounts receivable (AR) process —all within your pharmacy workflow.

Download your guide at OmniSYS.com/medicalbillingcompass © 2024 XiFin, Inc. All rights reserved.

INDUSTRY IN TRANSITION

Integrating adjacent healthcare services businesses tops the agenda for operators

By Mark Hamstra

After several years of acquisitions and store expansion, the retail drugstore industry is now focused on the nuts-and-bolts that will be involved in transforming into a more holistic—and profitable—provider of healthcare services.

42 April 2024 DRUGSTORENEWS.COM COVER STORY: STATE OF THE INDUSTRY

BETTER CARE WHEN WE SHARE

In some ways, the major national chains are “deciding what they want to be when they grow up,” said Elizabeth Anderson, senior managing director and research analyst at Evercore ISI.

As a result, retailers are rethinking everything from the products they offer to the design and locations of their brickand-mortar stores. Importantly, they are seeking to determine how all of the pharmacy-adjacent businesses they have acquired, including clinics, can best work in tandem under each company’s broad umbrella.

“How do they evolve their businesses from the traditional pharmacy model, to ‘pharmacy retail-plus?’” said Anderson. “How do they think about scaling that business? How do they think about the right way for those businesses to link up with the core pharmacy business? Those are things they need to sort out.”

Aditya Kaushik, analyst at Coresight Research, said retail pharmacies are in a prime position to meet the healthcare demands of today’s consumers.

“With U.S. healthcare costs surging and the dearth of pharmacists continuing, an evolution in convenient, affordable healthcare services is the need of the hour in the U.S.,” he said in a recent Market Navigator report on the retail drug store industry.

As drugstores increasingly expand the services they offer, they have an opportunity to become “the next generation of primary care providers, treating patients with acute illnesses and chronic conditions, such as asthma, diabetes and hypertension,” Kaushik said.

He predicted that the U.S. drugstore and pharmacy sector would grow revenues by 4.7% in 2024, reaching $373.9 billion, after an estimated 7.3% rate of growth in 2023, which featured high inflation on some items. The growth in the year ahead will be driven by strong demand for prescriptions, overthe-counter products, and other health and wellness items amid a broad consumer shift toward prioritizing health and wellness, he said.

A Strategic Review at Walgre ens

With a new CEO at the helm and a host of other new executives joining the ranks during the last several months, Walgreens Boots Alliance is perhaps undergoing the biggest transformation among retailers in the industry.

It is still early in the process of figuring out exactly how its business will evolve, following the hiring of Tim Wentworth, the former CEO of pharmacy benefit management company Express Scripts, as its new CEO late last year. A Walgreens board meeting scheduled for April will include a strategic review that will set the stage for more specific plans about how the company will move forward, he recently told investors at the 44th Annual TD Cowen Healthcare Conference.

“There will not be a big bang after that where we announce and unveil some incredibly new Walgreens,” Wentworth said. “What you’ll see is that will be the starting gun for a lot of work that we have to deliver.”

He said the efforts to revive the positive trajectory at

We believe PHARMACY can fill a vital need in the healthcare ecosystem, both for access and delivery of care.”

– Jeremy Faulks, VP of pharmacy operations, Thrifty White

COVER STORY: STATE OF THE INDUSTRY

We need to look at the fleet not based on what it’s doing today, but what we need it to do in five years, given our services aspirations, and then reverse-engineer what that footprint should look like.”

– Tim Wentworth, CEO, Walgreens, at a recent TD Cowen conference

Walgreens—following a fiscal year in which the company posted a net loss of $3.1 billion—was “not a 12-month turnaround story.” Any initiatives the company undertakes, whether to expand or contract certain elements of its business, may take “time and thoughtful planning,” he said.

One of the key components of the strategic review will be the direction of the company’s approach to its physical retail stores, which currently number some 8,600 U.S. locations. It has closed hundreds of stores in the last few years, and last year said it would close another 150 by the end of fiscal 2024 in August.

“We need to get the footprint right,” said Wentworth. “We need to look at the fleet not based on what it’s doing today, but what we need it to do in five years, given our services aspirations and then reverse-engineer what that footprint should look like.”