TURN UP THE HEAT ON SUMMER SALES SILVER LININGS FOR FOODSERVICE TOBACCO & VAPING REPORT C-STORE iQ Insights into the wants, needs, perspectives and habits of today’s c-store shoppers IT’S TIME FOR YOUR ANNUAL RENEWAL Scan the QR code to confirm your subscription National Shopper Study

4

6

9 Tobacco & Vaping Report

Down, but not out: Amid regulatory challenges and declining sales, innovation sparks tepid optimism for a category in transition

12 Foodservice Fundamentals

Silver linings: Costs, inflation and the opportunity for c-store foodservice to thrive

15

What's

Comprised of leading retail executives and convenience operators, this volunteer group of industry champions offer advice, key insights and on-the-ground perspectives that serve as an invaluable resource to ensure content is relevant and meets the needs of the industry.

Robbie Broda, Little Short Stop

Marc Goodman, 7-Eleven Canada

Leslie Gordon, Circle K

Laurie

Summer

15

Great expectations: Insights into the wants, needs, perspectives and habits of today’s convenience customers

25 Feature

Making the most of summer: Convenience store operators and suppliers coast to coast share tips and timing for getting your c-store ready for the lucrative summer months

ALL CONVENIENCE E-NEWSLETTER

Delivered to your in-box Monday and Wednesday

The

CCentral.ca Convenience Store News Canada March | April 2024 3 SMOKING ILLUSTRATION, SHUTTERSTOCK/FLASH VECTOR; C-STORE SHOPPER ILLUSTRATION, JESSICA SMITH

out! Sign up today at CCentral.ca/signup Simply hover your phone’s camera over this code:

latest industry news and information, plus resources, foodservice insights, store solutions, tobacco/vaping updates and more. Don’t miss

CSNC EDITORIAL ADVISORY BOARD

CONTENTS MARCH | APRIL 2024 VOLUME 7 | NUMBER 2

& Randy Ure, Ure’s Country Kitchen

Editor’s Message Making connections

The Buzz People, places, news and events

2024 C-store IQ National Shopper Study

ready: Matt and Brandi Bialek own Manitoba-based Blast-Off Fireworks

top of mind for c-store shoppers across Canada? 25

Making connections

Welcome to the Consumer Insights issue, which features all new data from the fourth annual C-store IQ National Shopper Study

The 2024 edition features valuable insights about convenience shoppers across Canada. Working with the research team at our parent company, EnsembleIQ, we included several new questions that reflect the changing times (with the pandemic largely behind us, find out how consumer habits have changed p. 15) and evolving categories (recent announcements in B.C. notwithstanding, find out where c-store shoppers says they are buying smoking cessation products p. 11).

C-store IQ debuted in January 2020—just before the pandemic upended everything— as the first convenience and gas specific study delving into the wants, needs, perspectives and habits of your customers. Since then, we’ve doubled the number of participants to provide a comprehensive snapshot of Canada—with coverage of shoppers by age, gender, region and more.

This issue includes a topline report (p. 15); tobacco and vaping data to accompany the 2024 Tobacco + Vaping Report (p. 9); and insights about the forecourt and attitudes towards EVs (OCTANE, p.11).

In the coming months, we will dig deep into the data and share with you detailed reports about your customers’ purchasing habits and thoughts on everything from sustainability to healthy snacking, loyalty, technology, foodservice and more. Please reach out and let me know if you’re interested in a particular topic.

I love hearing from our readers and those across the convenience, gas and car wash space. It’s one of the reasons I enjoy attending The Convenience U CARWACS Show it’s a fun and informative way to meet retailers, suppliers and key players from across Canada. Please stop by our booth and say hello or share your thoughts about what’s important to you and your business. It helps inform our digital and print content, as well as the conference agenda for the show. Once again, our editorial team has curated two exciting mornings of fantastic speakers and engaging discussions. Plus, we are thrilled to present the first annual Future Leaders in Convenience + Car Wash Awards Ceremony, which takes place on Day 2 (March 6) of the conference. We plan to make this in-person celebration an annual event.

Speaking of industry celebrations, nominations are now open for the Star Women in Convenience Awards. We want to hear about the Star Women in your network! The deadline is March 29th. Winners will be announced in the All Convenience e-newsletter, profiled in the July/August issue and celebrated at an event October 1—save the date!

20 Eglinton Ave. West, Suite 1800, Toronto, ON M4R 1K8

(416) 256-9908 | (877) 687-7321 | Fax (888) 889-9522 www.CCentral.ca

BRAND MANAGEMENT

SENIOR VICE PRESIDENT, GROCERY AND CONVENIENCE, CANADA

Sandra Parente (416) 271-4706 sparente@ensembleiq.com

EDITORIAL

EDITOR & ASSOCIATE PUBLISHER

Michelle Warren mwarren@ensembleiq.com

ASSOCIATE EDITOR

Tom Venetis tvenetis@ensembleiq.com

ADVERTISING SALES AND BUSINESS

SALES DIRECTOR

Julia Sokolova (647) 407-8236 jsokolova@ensembleiq.com

ACCOUNT MANAGER

Holly Power

416-910-1085 hpower@ensembleiq.com

SALES COORDINATOR

Juan Chacon jchacon@ensembleiq.com

DESIGN | PRODUCTION | MARKETING

CREATIVE DIRECTOR

Nancy Peterman npeterman@ensembleiq.com

ART DIRECTOR

Jackie Shipley jshipley@ensembleiq.com

SENIOR PRODUCTION DIRECTOR

Michael Kimpton mkimpton@ensembleiq.com

MARKETING MANAGER

Jakob Wodnicki jwodnicki@ensembleiq.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

SUBSCRIPTION SERVICES

Subscription Questions contactus@ccentral.ca

Subscriptions: Print $78.00 per year, 2 year $144.00, Digital $45.00 per year, 2 year $84.00, Outside Canada $120.00 per year, Single copy $14.40, Groups $55.20, Outside Canada Single copy $19.20.

Email: csnc@ccentral.ca

Phone: 1-877-687-7321, between 9 a.m. to 5 p.m. EST weekdays

p.s. If the cold weather has you beat, we’re looking ahead to summer with tips for making the most of the season (p. 25). CSNC

MICHELLE WARREN Editor & associate publisher

Fax: 1-888-520-3608 | Online: www.ccentral.ca/subscribe

Convenience Store News Canada | Octane is published 6 times a year by Ensembleiq. Convenience Store News Canada | Octane is circulated to managers, buyers and professionals working in Canada’s convenience, gas and wash channel. Please direct inquiries to the editorial offices. Contributions of articles, photographs and industry information are welcome, but cannot be acknowledged or returned. ©2024 All rights reserved. No part of this publication may be reproduced in any form, including photocopying and electronic retrieval/retransmission, without the permission of the publisher. Printed in Canada by Transcontinental Printing | PM42940023

CHANNEL ALLIANCES:

4 March | April 2024 Convenience Store News Canada

CCENTRAL.CA E-NEWSLETTER CSNCOCTANE @CSNC_OCTANE standard no gradients watermark stacked logo (for sharing only) CONVENIENCESTORENEWSCANADA BE A PART OF OUR COMMUNITY! ED ITOR’S MESSAGE

New Name. New Possibilities.

NATIONAL SMOKELESS TOBACCO IS NOW NUVONA

At Nuvona, we strive to meet the needs of adult tobacco consumers who are increasingly seeking new options. This reflects our commitment to leading change, and how we lead in every part of our business.

out to your Nuvona sales representative today for more information.

THE BUZZ

CROSS-CANADA ROUND-UP / PEOPLE / PLACES / NEWS & EVENTS

READER POLL

Are you planning to sell beer, wine, cider and ready-to-drink cocktails once the Ontario government extends the program to convenience stores?

74 % Yes

22%

Maybe, I will see how other retailers do before committing

4 % No

0% I already sell beer, wine etc.

ONLINE EXCLUSIVES

10 HEADLINES YOU DON’T WANT TO MISS!

1. B.C. moves flavoured nicotine pouches behind pharmacy counters

2. Special Report: C-store customers crave sugar-free snacks and beverages

3. Groupe Beaudry acquires Distribution Régitan

4. Ipsos Canada: 5 trends to inspire and elevate your foodservice game in 2024

5. Conagra Brands Canada announces two additions to leadership team

6. Product of the Year Canada announces 2024 winners

7. Dover Fueling Solutions acquires POS provider Bulloch Technologies

8. Quebec's minimum wage going up May 1

9. 5 ways convenience retailers can use AI now

10. OPW acquires Transchem Group

Don’t miss the latest news and trends, get the All Convenience e-newsletter delivered to your in-box Monday + Wednesday. Sign up at CCentral.ca/newsletter

23_011342_Convenience_Store_News_CN_MAR_CN Mod: January 19, 2024 9:55 AM Print: 01/25/24 page 1 v2.5

π FACILITY FUNDAMENTALS SHIPS TODAY ORDER BY 6 PM FOR SAME DAY SHIPPING 1-800-295-5510 uline.ca

SAVOR THE EXPERIENCE SweetsAndSnacks.com Our future looks bright in Indianapolis. This vibrant city will add a fresh new flavor to the world’s premier candy and snacks event. You won’t just experience the industry’s hottest innovations and coolest trends, but you can also sample the surprising treats that Indy has to offer. MAY 13-16, 2024 | INDIANAPOLIS, INDIANA, USA We’re on the move.

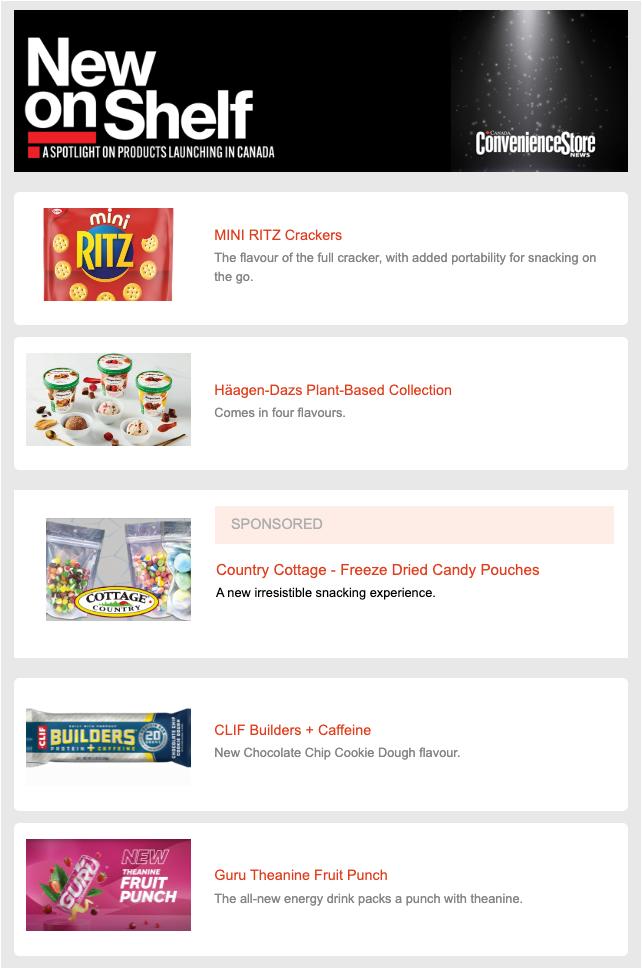

LET THE INDUSTRY KNOW ABOUT YOUR NEW PRODUCT LAUNCH Sandra Parente Senior Vice-President, Grocery and Convenience, Canada 416.271.4706 sparente@ensembleiq.com Julia Sokolova Sales Director, Convenience Store News Canada 647.407.8236 jsokolova@ensembleiq.com Holly Power Business Development, Convenience Store News Canada + OCTANE 416.910.1085 hpower@ensembleiq.com Contact your sales consultant to spotlight your product! Sign up today! The monthly New on Shelf e-newsletter features products carefully selected by our editors, as well as sponsored product placement. From confection to snacks, beverages and more, we’re spotlighting product innovation. Sponsored products will:

be featured in our New on Shelf enewsletter – you choose the date • live on ccentral.ca- so retailers have access 24/7

be promoted through brand social channels Specifications

1 product shot (655 x 368, 1MB, JPG file)

1 product write-up (50-75 words)

Click-through URL featuring the product www.CCentral.ca First Thursday, monthly A SPOTLIGHT ON PRODUCTS LAUNCHING IN CANADA

•

•

•

•

•

DOWN, BUT NOT OUT

Amid regulatory challenges and declining sales, innovation sparks tepid optimism for a category in transition

When adult customers step into Family Variety in Bolton, Ont., a town northwest of Toronto with about 27,000 residents, they can walk straight ahead into the c-store to purchase lottery, cigarettes, snacks, drinks and the other usual items.

Or they can open the sliding door to their left, where Family Variety operates a small vape shop.

Prominent signage on the door indicates entry is restricted to adults 19 and over. Wide enough to accommodate about two adults at a time, the shop’s side and back walls feature floor-to-ceiling shelves of vaping devices (pens, pod systems, disposables), as well as e-liquids/juice, pods and cartridges in flavours like “super spearmint,” “explosion orange,” “tropical breeze” and “bussin’ banana.” Brands include Flavour Beast, STLTH, Allo, Fruitbae, Vuse, Level X, Pop Vapor, Veeba, Ghost and Salt Nix.

The only evidence of the vape shop to passersby at Family Variety—located in a busy shopping plaza alongside other retailers like Chatime, Hakim Optical, Dollarama and Bulk Barn—is a large white window covered with the words in big black lettering, “Bolton Vapes.” In adhering to provincial regulations, the covering blocks vaping products and promotions from being visible to minors.

Opened in June 2022, “it’s doing well,” says Family Variety owner Christopher Reyhani, a 2023 Future Leaders in Convenience + Car Wash winner.

The shop is connected from behind the counter to the convenience store, allowing the cashier to slide between serving c-store and vape customers—no extra staffing required. Bolton Vapes has 35 5-star Google reviews praising the wide selection and prices.

Customers seek alternative products

“The c-store industry is evolving, and consumers are looking for smokeless alternatives,” says Reyhani. “Vapour products have become popular over the past few years. With increased demand for vapour products, companies have grown in selection and value for the consumers.” Products with the best value, he notes, “last longer and cost less” than competitors.

That includes market leaders like Pacific Smoke International headquartered in Markham, Ont., a wholesale distributor of electronic vapes and e-liquids, including Flavour Beast and Allo. “We have established

BY CHRIS DANIELS

a strong foothold in the independent c-store market,” notes Gero Petrolito, who leads the convenience and gas channel at Pacific Smoke. (See full Q&A at CCentral.ca or follow the QR code at the end of the article.)

As for Reyhani’s advice for c-store owners and managers? “With alternatives to nicotine-delivery, retailers should keep up to date with products that consumers are interested in.”

Delivering results in all sorts of ways

According to the Convenience Industry Council of Canada (CICC), cigarettes, e-cigs, other tobacco and pipe/cig tobacco are the top four declining categories at convenience. One of the big reasons for this is the rise in contraband, with bad characters brazenly taking to online marketplaces to move illicit product (see “Contraband battle moves online” p. 10.)

Still, these categories deliver a whopping $3.9 billion in annual sales for the channel nationwide—roughly $175,000 per store—and account for 7% of total c-store sales and 45% of in-store sales.

“The nicotine category is still the number one nonfuel contributor to Parkland’s On the Run convenience store sales,” says James Rolph, Parkland’s director, Canada convenience retail. “Not only do they help generate traffic, our nicotine customers gravitate towards other in-store offers like coffee, sandwiches, beverages and snacks.”

The rise of reduced risk products

Rolph is also optimistic about the evolution in the category brought on by product innovation. Think vapes, nicotine pouches and heated tobacco sticks.

“As our customers move toward risk-reduced products, we see solid growth in these areas and aren’t forecasting a slowdown anytime soon,” says Rolph. “The exception to this would be in markets where flavour bans have been implemented or are coming into effect. For example, we are now into the third month post-flavour ban in Quebec, and to date have not seen the category rebound.”

One example of a newer product is Zonnic, nicotine pouches from Imperial Tobacco Canada (ITCAN) that Health Canada approved for sale as a nicotine-replacement therapy. First launched on Oct. 31. 2023 in pharmacies in Quebec, Zonnic is now carried in about 5,800

CCentral.ca Convenience Store News Canada March | April 2024 9

Gero Petrolito

Chris Reyhani

2024 Tobacco + Vaping Report

James Rolph

outlets nationally, the majority—about 4,800 stores— being in the c-gas channel. (Note, at press time, the B.C. government had just announced it was moving nicotine pouches behind the pharmacy counter and the CICC said it would urge the province to reconsider. Visit CCentral.ca for updates). By comparison, ITCAN cigarettes and its vaping brand, Vuse, are carried in 23,000 convenience outlets across the country.

“Our rollout of Zonnic will continue to expand further into the c-store footprint, as we want to make sure these products are available where smokers buy cigarettes and can switch to less harmful options,” says Michael Bonelli, vice-president, commercial marketing and sales, at ITCAN, which has been undergoing a transformation into a smoking cessation solutions manufacturer.

“We still sell cigarettes, but vaping and cessation products are what we talk about 90% of the time,” says Bonelli. “Our whole business is now centered around providing less harmful products to the market, including through our partners in convenience. It’s paramount that we work with them.”

Japan Tobacco International (JTI) has numerous reduced risk products, but has yet to launch them in Canada.

“We are currently monitoring the business environment and assessing the impacts of potential regulatory changes in the future, in so far as products that have the potential to reduce risk are concerned,” says Elaine McKay, head of corporate affairs and comms, JTI Macdonald Canada.

Of heated tobacco sticks (HTS), McKay says the category remains small in Canada “mainly because of the unfavourable format and taxation,” but that it’s showing “continuous growth driven by increases in immigration post-COVID.” HTS are popular in parts of Asia and Europe.

Nicotine pouches is another relatively small product category, but “has growth potential if you benchmark Canada against the U.S. market.” For now, though, she says “there remains an uncertainty around how regulation will develop in Canada.”

Still, despite the regulatory challenges, it’s clear the tobacco and vaping category isn’t without opportunity and potential.

CONTRABAND BATTLE MOVES ONLINE

Illicit tobacco used to be sold largely out of the trunk of a vehicle, with some even set up in c-store parking lots.

“Now that transaction is being replaced by the click of a mouse,” says Jeff Brownlee, VP, communications and stakeholder relations, the Convenience Industry Council of Canada (CICC).

At press time, CSNC did a quick Google search and came across more than half a dozen websites selling contraband cigarettes and vaping products to Canadians. Some sites even feature customer ratings on products and expedited delivery though Canada Post’s Xpresspost. “That consumers can get their product delivered to their door by a Crown corporation legitimizes these websites to consumers,” says Brownlee. “The illegal activity is very blatant.”

Contraband is also being sold on online marketplaces.

Danny Fournier, manager, illicit trade prevention at RBH Canada—who spent more than 25 years in law enforcement specializing in organized crime investigations, including with the Quebec Provincial Police where he oversaw drug and contraband tobacco enforcement operations—says illicit trade of tobacco online has “not been very prevalent” until recently.

Contraband tobacco is estimated to represent 69% of the market in Ontario, 45% in British Columbia and 44% in Newfoundland, according to an EY Canada study in 2023 commissioned by the CICC.

According to RBH’s estimates, 25% of illegal cigarette sales are now online transactions.

“But if you include the next generation of products that are not combustible cigarettes, such as vapours, the percentage is higher than 25%, because some provinces have implemented bans on vaping flavour products,” says Fournier.

For example, there is little stopping people in Quebec, where vape flavours are banned, from making an illegal online order in Ontario. “There is no national coordination on this,” notes Fournier.

Highlighting the role the private sector can play, RBH Canada is working with the likes of Kijiji and Craigslist to remove ads hawking contraband.

“Kijiji alone was getting 100,000 new posts every day last fall for tobacco—I knew it would be large numbers, but I was expecting 10,000 or 20,000 per day—and so a combination of their technology and human intervention on our part helps identify and prevent those posts from going or staying up.”

One online marketplace where it doesn’t have cooperation: Facebook Marketplace. Fournier says they can’t get through to a real person to discuss the issue.

As for websites, RBH has had the most success working with the likes of Visa, MasterCard, Moneris and PayPal in curbing illicit sales, by shutting down their payment vehicles. Another option is to contact their ISPs, but some of them reside outside Canada.

Robust commercial operations of contraband tobacco online are reported to law enforcement.

“Online sale of tobacco and nicotine products is growing exponentially given the ease and convenience of ordering online and delivery,” agrees Elaine McKay, head of corporate affairs and comms, JTI Macdonald Canada. “When we are able to identify these sites, we conduct research and gather actionable information that is then provided to law enforcement and regulatory bodies.”

CCentral.ca 10 March | April 2024 Convenience Store News Canada

Access the full 2024 Tobacco + Vaping Report online, including regulatory updates and a Q&A with Gero Petrolito 2024 Tobacco + Vaping Report

Elaine McKay

VECTOR

SHUTTERSTOCK, FLASH

NEW HABITS, NEW OPPORTUNITIES

BY MICHELLE WARREN

In 2024, there’s a notable drop in convenience shoppers who regularly use cigarettes, while new data reveals smoking cessation products are gaining market share.

Three-in-four smokers say they purchase from c-stores and that decision is influenced by convenient location, brand and price, according to the 2024 C-store IQ National Shopper Study

• Males more than females are influenced by price (38% vs. 28%).

• Younger—millennials and generation Z—shoppers are more influenced by special promotions than older shoppers—generation X and boomers—(12% vs. 6%) and packaging (8% vs. 3%).

• Shoppers in the Atlantic region are most influenced by location (61%), compared to

Quebec (44%), Ontario (42%) and B.C. (39%).

People purchase from multiple locations and this year those reporting they purchase from a reserve dropped to 23% from 26% in 2023 (but still higher than 19% in 2022). It’s worth noting that these numbers fluctuate greatly by province, with 35% of smokers in Ontario saying they purchase from a reserve, compared to Alberta (19%), B.C. (17%) and Quebec (10%). In Quebec, 78% of smokers say they purchase from a c-store vs. 66% in Ontario.

There is a notable generation divide when it comes to preferred habits.

Younger shoppers are more likely than older shoppers to use vaping devices (18% vs. 10%) and smoking cessation products (8% vs. 3%). In turn, the older cohort is more

likely to use cigarettes (28% vs. 21%).

Two-in-three shoppers that use vaping or e-cigarette products say they purchase from vape shops, with a growing share choosing other channels, most notably online. One bright spot for the channel, males are more likely to purchase vapes and e-cigarettes at c-stores than females (52% vs. 39%), however younger shoppers are more likely to purchase at vape shops (70% vs. 55%).

New in 2024, we asked c-store shoppers about their use of smoking cessation products. More than one-third (35%) of shoppers who buy smoking cessation products say they do so at a convenience store, signalling opportunity for a rapidly evolving category (unless new regulations roll out beyond British Columbia). CSNC

% of shoppers regularly using Cigarettes

Smoking cessation products

CCentral.ca Convenience Store News Canada April 2024 SHUTTERSTOCK, FLASH VECTOR

Influence on recent cigarette purchase Where cigarettes purchased Where vaping/e-cigarette products purchased Where cessation products purchased 34% 33% 10% 9% 5% 4% Convenient location Always purchase same brand Good price/value Other stores don't carry Special promotion Packaging Other Significant increase/decrease vs. 2023 27% C-store 36% Drug store 29% Grocery 21% Mass 20% C-store 74% Reserve 23% Other 9% 6% Vape shop 66% C-store 44% 2% C-STORE iQ

Vaping devices/e-cigarettes 6 % 24 % 14 % 13%

Silver linings

FOODSERVICE FUNDAMENTALS

BY JEFF DOVER

Costs, inflation and the opportunity for c-store foodservice to thrive

Times are tough in the restaurant industry. In January 2024, Restaurants Canada released the results of a survey of members that reported: “53% of restaurants are operating at a loss or barely breaking even, compared to 10% pre-pandemic.” Restaurants are challenging to operate at the best of times, with an average pre-tax profit for foodservice operations in Canada of 3.7% (from Restaurants Canada Foodservice Operations Report 2023).

The Canadian restaurant industry’s challenges are likely to continue through 2024, as the two biggest expenses (cost of sales and labour) continue to increase. While overall inflation is decreasing (3.4% year-over-year December 2023), food inflation was 4.4% in the same period, indicating the price of food is still increasing greater than all items. Also, restaurants are challenged in recruiting and retaining labour, more so than other service industries, and, as a result, are paying more for labour than they have in the past.

Coming out of the pandemic, consumers’ pent-up demand for entertainment and “revenge spending” benefitted restaurants, with people willing to pay more when dining out and accepting menu price increases. The most significant indicator of foodservice spending is consumer confidence and, unfortunately, Canadian consumer confidence recorded its second-lowest score in history in November 2023, the most recently released data. People are cutting back on their spending on away-from-home food, which is adding to restaurants’ challenges.

What’s worse, these restaurant operating pressures are not expected to improve in the short- to mid-term by even the most optimistic prognosticators. Tough times will continue for a while.

Consumers are dining out less and, when they do, are spending less. People are seeking value when patronizing foodservice operations.

Cost advantages

As discussed in my previous columns, there’s a significant cost advantage that convenience store operators have with respect to foodservice. In most cases, foodservice can be provided using little, if any, incremental labour. One of the two biggest expenses in a foodservice operation is labour, the other is cost of sales, which is (almost) 100% variable. The next biggest cost in a typical foodservice operation relates to occupancy expenses, which, in most cases, are not significantly incremental for convenience store operators. All other expenses are minimal. There are several ways to take advantage of these benefits.

• Maximize the labour cost advantage. Ensure that menu items are not labour intensive, but rather purchased ready-toserve or ready-to-heat-and-serve.

• Products should hold well (to minimize waste) without compromising quality.

• Foodservice should be located close to the cashier so that any service required can be done by existing employees.

• Cleaning and closing the foodservice area at the end of the day should be considered: Choose less labour-intensive menu items.

• Limit foodservice space to maximize the occupancy cost advantage: i.e. No seats (in many jurisdictions having seats requires offering public washroom facilities).

• Select menu items that are portable and easy to consume while walking or driving.

TIP: If you can, use a Merrychef-style oven to heat your product, as these tend to produce great quality menu items. Before investing in equipment, determine the return on investment (make sure your sales of heated product is significant enough) and,

given the challenges in the traditional foodservice industry, consider used equipment, which is plentiful and priced attractively.

Pricing

Consumers are seeking value, and, with cost advantages, c-stores can set lower prices than traditional foodservice operators. Do a survey of prices at fast-food restaurants in your area and set your prices below, while still ensuring a healthy profit margin. Traditional foodservice operations mark up menu items by 65% to 70%. A convenience store can afford a lesser mark-up—50%—resulting in lower prices and greater value for the consumer, as well as a healthy profit.

TIP: When determining mark-up and pricing, consider the full cost of the menu item, including packaging and condiments. Add more value by offering combos with other products already in your store, such as beverages and potato chips.

Remember, the recommendation is lower prices for menu items of similar quality to your fast-food competitors. In most cases, I would not recommend using low quality products to minimize prices.

The challenges faced by traditional foodservices are significant and ongoing. In the wake of fast-food competitors being forced to take price increases at a time when consumers are seeking value, convenience stores are well-positioned to take advantage. Every cloud has a silver lining. CSNC

Jefff Dover is president of fsSTRATEGY, a consulting firm specializing in strategic advisory services for the hospitality industry, with an emphasis on food and beverage. He is based in Toronto and can be reached at 416-229-2290 ext. 2 or jdover@fsstrategy.com.

CCentral.ca 12 March | April 2024 Convenience Store News Canada SHUTTERSTOCK

CONVENIENCE STORE

Fountain

Walk-In

Custom

Storage

Product

Glass

1,

Ice

Cubers,

Roller

Bun

CANADA’S LEADING DISTRIBUTOR of convenience food service and beverage equipment

Dispensers

Beverage

& FCB Dispensers

Coolers & Freezers

Design

Racks

Glides

Door Coolers & Freezers

2, & 3 Door Options

Machines

Flaker & Nugget

Display Merchandisers

& Horizontal

& End Cap Displays

Food Programs

Open

Multi-Purpose Vertical

Island

Hot

Grills

Merchandisers

Heated

Warmers

Refrigerated Food Reach In’s Condiment Cases Ice Cream Soft Serve/Shakes Dipping Cabinets Miscellaneous Cup & Napkin Dispensers Trash Dispensers Safes Equipment Sales Delivery and Installation Product Training & Warranty Coverage Across Canada PROVIDING CANADIANS WITH THE LATEST SELECTION OF C-STORE EQUIPMENT 1.888.443.1946 WWW.WR.CA TURNKEY EQUIPMENT PACKAGES WESTERN REFRIGERATION & BEVERAGE EQUIMENT LTD. See for yourself how we can help enhance your sales today!

Microwaves

National Shopper Study

Great expectations: Insights into the wants, needs, perspectives and habits of today’s convenience customers

BY MICHELLE WARREN | ILLUSTRATIONS BY JESSICA SMITH

Shoppers across Canada are putting a premium on price, as economic pressures shape overall spending, but confidence and engagement with the convenience channel remains high.

Nearly half of shoppers (47%) visit a convenience store at least weekly. However, data shows many are spending somewhat less than a year ago: Shoppers say they spent an average of $17.13 on their most recent visit (excluding the costs of gasoline), compared to $18.06 last year (but still up from $15.46 the previous year and $13.56 in 2019), accord-

ing to insights from the 2024 C-store IQ: National Shopper Study from Convenience Store News Canada

Now in its fourth year, C-store IQ is the only convenience and gas specific study delving into the wants, needs, perspectives and habits of consumers in Canada.

Led by our sister brand EIQ Research Solutions, we surveyed more than 2,000 convenience shoppers across the country to capture valuable insights into Canada’s ever-evolving convenience and gas landscape.

With comprehensive data by age demographics and geographical locations, the goal is, as always, to give you valuable insights

about your customers that will help inform business decisions and drive success.

Fresh insights

Compared to last year, shoppers reported a significant decrease—5 percentage points— in shopping at what they perceive as an independently-owned (non-branded) c-store on a weekly basis.

This is partly driven by the younger demographic—millennials and generation Z—44% of whom say they shop at chain convenience stores once a week or more, up from 37% last year.

When asked, “What is the name of the

CCentral.ca Convenience Store News Canada March | April 2024 15

C-STORE iQ

2024 NOMINATIONS OPEN

Fresh new look!

Three reasons to nominate a colleague or client for an award

1. She makes a difference

2. She is valuable

3. She deserves recognition

Categories for 2024

Senior-level stars

Shining stars

Store-level stars

DEADLINE TO ENTER March 29, 2024

SAVE THE DATE October 1, 2024

International Centre Toronto

Visit StarWomenConvenience.ca or scan this code OCTANE Presented by

convenience store you shop at most often?” nearly half (47%) of shoppers named two major global players: 7-Eleven (19%) and Couche-Tard/Circle K (28%).

What’s driving store choice? Proximity prevails, with 29% of shoppers defining convenience as a close-by location. With that in mind, it’s unsurprising that most shoppers (69%) visit the same convenience store each time (Albertans are the most loyal—perhaps it’s geographical circumstance—with 75% shopping at the same store).

Overall, shoppers are getting back to basics with location, hours and purchasing gas increasing their influence on convenience store choice. Indeed, the research shows that the COVID-19 pandemic, which defined shopping habits for the past four years, is in the rear-view mirror.

Convenience shoppers are on-the-go, commuting to work and school or travelling more for pleasure and for business.

Data shows close to half of shoppers visit a convenience store to purchase gas, a significant increase over last year. Late night snacking and stops while running errands are the next most common, for nearly onethird of shoppers. Data shows the younger demographics love their late-night run to the convenience store.

New and noteworthy

New this year, we asked shoppers about their social media habits and if they follow c-gas operations. Fewer than one-third say they follow a c-store on social media, but this shifts when we break out data by age: Younger— again, think generation Z and millennials— are more likely to follow on social media versus older shoppers (38% vs. 22%). In addition, females are more likely than males to

follow c-stores on social (33% vs. 28%).

With an eye on c-stores as a source of innovation and inspiration, for the first time we asked: “What types of stores do you like to shop at to discover new products?”

Mass/superstores, online and grocery stores are destinations for finding new products, while convenience appears to be relied on more for routine and quick in-and-out trips. Of note, however, younger shoppers (19% versus 11% of older shoppers), say they rely on convenience stores as a source for new products. There’s an opportunity here to encourage shoppers of all ages to browse and discover. When asked about the types of new products they like to discover at convenience stores, shoppers say they are looking for interesting beverages, confectionery and snacks.

To understand impulse purchases, this year we asked: “When shopping at convenience stores, how often do you purchase items you didn’t plan to buy when you entered the store?”

Impulse at convenience is more of an occasional experience for most shoppers (younger shoppers tend to be more open to impulse buys), but there are opportunities to influence behaviour: Shoppers say spontaneous purchases are most often the result of a desire for a personal treat or to take advantage of a sale or promotion.

Looking ahead

What’s different this year? The importance of the shop “experience” has shifted, with fundamentals like pricing and in-stock items gaining influence, while employee friendliness, trip speed and store organization dropped.

Some notable differences by gender and ages in terms of what creates a positive experience:

Speed of trip:

14% of males vs. 10% of females

Employee helpfulness:

14% of males vs. 11% of females

Loyalty program:

32% of females vs. 26% of males

Quality of foodservice:

20% of younger vs. 14% of older shoppers

Fun to shop:

11% of younger vs. 7% of older shoppers

Contactless shopping:

6% of younger vs. 1% of older shoppers

Delivery:

8% of younger vs. 4% of older shoppers

Price:

74% of older vs. 64% of younger shoppers

Employee friendliness:

16% of older vs. 11% of younger shoppers

Quality of foodservice:

21% of shoppers in Quebec vs. 14% in B.C. and 9% in the Atlantic region.

With affordability top of mind, shoppers say they perceive c-stores as the more expensive option, with 61% saying better pricing is the dominant area where c-stores could improve to motivate more shopping trips, twice as important as second place—product variety.

This is a topline report, and we will continue to share data throughout 2024—in the magazine and online, as well as through special reports—to dig deeper into consumers’ attitudes, habits and expectations regarding key categories, sustainability, healthy snacking, foodservice, technology, fuelling, loyalty and more.

Plus, don't miss EIQ, VP research, Beth Brickel, present exclusive data and analysis at The Convenience U CARWACS Show on March 5, 2024.

Frequency of shopping store type

Grocery store Discount supermarket Mass/supercentre Drug Dollar Online stores Local independent stores (e.g., butcher, fishmonger, fruit market) Club Specialty/natural store 2% 2% 2% 3% 8% 9% 19%

Shop at any type of convenience store once/ week or more Shop at a chain convenience store once/week or more Shop at an independently-owned convenience store once/week or more 38% 41% 37% 42% 30% 33% 21% 26% 11% 18% 20% 24% 47% 35% 40% Significant increase/decrease vs. 2023 Shop once/week or more Never shop 40% 18% 13% 31% 25% Convenience Store News Canada March | April 2024 17 CCentral.ca 67% 70% 53% 51% 55%

What ‘convenience’ means to shoppers

Factors influencing convenience store visit

Occasions typically shop at convenience store

Time of day when typically shop at convenience stores

A spike in lunchtime trips in 2023 has dropped back to 2022 levels, while late night visits have increased significantly, driven by younger shoppers. Males are more likely to shop 7-10 p.m. (37% vs. 24% of females) and 10 p.m. or later (23% vs. 10% of females). In addition, shoppers in Ontario (21%) and Alberta (23%) are more likely to shop 10 p.m. or later vs. Quebec (12%), B.C. (15%) and Atlantic (14%) shoppers.

CCentral.ca 18 March | April 2024 Convenience Store News Canada

% Shop same convenience store each time 69 %

29% Close by/ proximity 15% Affordable prices 13% Longer hours 12% Has basic necessities 12% Quick to shop 8% Easy to shop 7% Great variety 4% Friendly staff

Proximity / close by Longer hours To purchase gas Loyalty program Has products I can’t buy anywhere else Coupon Quality of foodservice Gas price app Word of mouth Mobile app offer

media promotion / messaging Private label brands Availability of contactless shopping Drive-thru Email Outdoor ad Mobile ordering Text message Radio or TV advertisement Curbside pickup None of the above 37% 32% 21% 12% 11% 10% 5% 5% 5% 4% 4% 3% 3% 2% 4% 4% 4% 8% 8% 6% 32% 12% 10% 29% 7% 7% 6% 6% 6% 5% 4% 5% 53% 47% Of shoppers shop the same convenience store each time 10% To purchase gas Late night snacking Running errands Special trips from home Travelling for pleasure Afternoon snack/ break Travelling to/ from work or school To purchase lunch While working from home Travelling for business To purchase dinner To purchase hot beverage / breakfast 46% 32% 30% 29% 25% 25% 23% 11% 17% 9% 9% 7% 40% 14 % 6:00 am-8:59 am 35 % 4:00 pm-6:59 pm 15 % 9:00 am-10:59 am 27% 2:00 pm-3:59 pm 31 % 7:00 pm-9:59pm 17% 10:00 pm or later 14% 22 % 11:00 am-1:59 pm 25% C-STORE iQ National shopper study Significant increase/decrease vs. 2023

Social

Types of trips

For the second year, we asked shoppers how long they typically spend in-store and found three-in-four shoppers are relying on quick in-and-out trips to convenience stores, an increase over 2023, while longer browse and hang-out trips decreased. Of note, younger shoppers are more likely to browse (37% vs. 26% of older shoppers) and hang out (6% vs. 2%).

Following convenience stores by social media platform

Aspects that influence purchase decision when shopping in-store

Window signage

Product samples or demos

Wall posters or signage

Cooler stickers

Ceiling banners or signage

Digital display or video

Floor stickers

In-store audio or radio

None of the above

Factors that describe a positive shopping experience

CCentral.ca 20 March | April 2024 Convenience Store News Canada 75 % Quick in-and-out Less than 5 minutes 71% 32 % Browse a bit 5-15 minutes 36% 4 % Hang out, eat & drink at store Over 15 minutes 6%

Shelf signage

counter sign or display

floor or aisle

Checkout

Freestanding

display

Price of products Products I need are in-stock Loyalty/rewards program Variety of products offered Store cleanliness and hygiene General convenience Quality of prepared food Employee friendliness Employee helpfulness Speed of shopping trip Organization of store Fun to shop Offers delivery Look and feel of store Availability of contactless Offers curbside pick up Embraces cutting-edge technology 21% FACEBOOK 12% INSTAGRAM 10% YOUTUBE 7% TIKTOK 5% X Don’t follow any convenience stores on social media but of the 31% who do, Facebook and Instagram are most popular Importance of 'experience' when choosing which store to shop at 41% Very important/Important 31% Moderately important 27% Slightly/Not important 68% 60% 22% 21% 20% 19% 17% 15% 12% 10% 9% 7% 6% 28% 42% 37% 30% 26% 22% 17% 17% 13% 11% 11% 9% 6% 6% 4% 3% 2% 12% 16% 15% 14% 11% 4%

Significant increase/decrease vs. 2023

69 %

46% 27%

Areas where convenience stores must improve to encourage more shopping

Price of products

Variety of products offered

Loyalty/rewards program

Products I need are in-stock

Healthier/better-for-you items

Cleanliness of store

Quality of prepared food

Friendliness of employees

Variety of prepared food and beverages offered

Local or Canadian-made product offering

Look and feel of store

Helpfulness of employees

Speed of shopping trip

Organization of the store Coffee program

Larger package sizes/more bulk items

Fun to shop

Better commitment to sustainability/recycling

Likelihood to visit different store if items unavailable at current store shopped

Most shoppers continue to indicate that out-of-stocks will drive them to another store, with over one-third expressing high likelihood to do so. Alternatively, there is a growing segment of shoppers that is not as driven to shop elsewhere.

38% Extremely/Very Likely

39% Somewhat Likely

23% Not Very / Not At All Likely

Delivery

Embraces cutting-edge technology

Availability of contactless shopping options

61% 30% 28% 27% 22% 21% 19% 18% 17% 15% 15% 14% 13% 13% 12% 12% 10% 8% 8% 6% 6% 57% 25% Significant increase/decrease vs. 2023 19% 11% 10% C-STORE iQ National shopper study

Supercentres

Grocery

Store types shopped to discover new products

Preferred types of new products at c-stores

19% Drinks/beverages (general)

18% Candy/chocolate

16% Snacks (general)

9% Chips

7% New/unique flavours

4% Ice cream/frozen treats

3% Slushies

3% Pop/soda

To

On sale/promotion

To avoid going to another store

To treat someone else

Reason for recent impulse purchase at convenience store

CCentral.ca 22 March | April 2024 Convenience Store News Canada

trip spend=$17.13

of unplanned

convenience stores

Mean

Frequency

purchases at

Payment used

/ mass Online stores

store Club Dollar store Drug store

supermarket Local independent store Convenience stores Specialty / natural store Discovering new products does not influence the stores I shop at 45% 39% 38% 34% 32% 30% 28% 16% 15% 13% 10% 2% 9% 23% 21% 13% 13% 13% Retailer's mobile app 1% Mobile payment 6% Debit card 40% 36% Credit card 32% Some of the time 45% Most of the time 13% All of the time 4% Never 7% Rarely 32% Cash 19% Gift card 2% 3% $18.06

Discount

treat myself

Looked too good to pass up

with

time

Item I wanted

Item I wanted

expensive Recommendation from someone I know Employee recommendation 42% 27% 16% 16% 16% 16% 14% 10% 10% 7% 6% 6% 6% C-STORE

Less than $2 $2.00$4.99 $5.00$9.99 $10.00$14.99 $15.00$19.99 $20.00$29.99 $30.00 or more Significant increase/decrease vs. 2023

New item I want to try New flavour/variety Child

me asked to purchase Limited

offer/seasonal

was not available

was too

iQ National shopper study

Demographics

Researchers noted the overall sample shift slightly more female and a minor shift towards rural (vs. urban and suburban) shoppers. The effort that retailers have been making to appeal to female shoppers appears to be having an impact. In terms of the rural bump, perhaps this can be attributed to population movement spurred by the pandemic and a rise in working from home.

Age & generation mean age 42.9 20% Gen Z 19% Gen X 35% Millennials 24% Baby boomers 3% Mature/Silent Living arrangements 58% With partner/ spouse and/or children 13% With parents 18% Alone 6% With friends 4% Other Residence type Rural 26% Urban 47% Suburban 28% Other 1% Male 42% Female 57% Gender QC 25% AB 10% ON 32% BC 11% MB 5% ATLANTIC 13% SK 3% Province/ Territory Ready-to-Eat Meat Category Survey of 4,000 people by Kantar Now Available! GrimmsFineFoods.com Jalapeño & Cheddar Pepperoni Bites WINNER! Get your free Small Business WORKPLACE SAFETY ROADMAP SAFETY, SIMPLIFIED SCAN QR NOW! WSPS.CA/SmallBusiness

® /TM BA Sports Nutrition LLC, used under license.

SUMMER MAKE THE MOST OF

Convenience store operators and suppliers coast to coast share tips and timing for getting your c-store ready for the lucrative summer months

BY MARK CARDWELL

Peggy’s Cove is a must-see attraction for visitors to Nova Scotia.

In summer, tourists flock to the picturesque fishing village an hour’s drive southwest of Halifax to see its famous lighthouse and walk on barren rocks that jut out into the Atlantic Ocean.

Almost everyone passes by The Whale’s Back, a country store in neighbouring Indian Harbour.

Located on scenic Route 333—the only road to Peggy’s Cove—it is also the closest convenience store to the provincially-protected inlet.

Open daily year-round, it sells everything from groceries, baked goods, tobacco and alcohol to suntan lotion, ice cream, fireworks and souvenirs.

“We cater to everyone—locals and tourists alike,” says store manager Marcy Graves. “But from late May to early October we serve mostly tourists. And we can get awfully busy.”

Convenience Store News Canada March | April 2024 25

From top right: Summer treats; Whale's Bay Country Store near Peggy's Cove, N.S.; Fireworks set the tone for summer; Local gift items appeal to Nova Scotia tourists; A stroll through the forest inspired the murals painted by artist Tom Hutchings on the wall outside of Honeymoon Bay General Store on Vancouver Island (store front above); summer accessories; Duggers Variety in Midland, Ont. stocks visitors' preferred cigarettes

Winter is prep time

For Graves, success at the store in summer both starts with and depends on the plans and actions she and her team take during the quieter winter months.

They include visits to gift shows in search of merchandise for The Whale’s Back and its sister property—the Sou’Wester Restaurant and Gift Shop next to the lighthouse in Peggy’s Cove—and doing annual spring maintenance.

“We put out some picnic tables and spruce things up by cleaning and painting,” says Graves, who has been with the business 25 years. “Then we start looking at orders for things like fireworks, ice cream and saltwater toffee. Fortunately, we have a great list of suppliers, most of them local—and people love local products. The trick is to be ready when you see the uptick in business in late May.”

That’s a common refrain among c-store owners, operators and suppliers of all sizes and stripes in a country as cold as Canada. For many, the food, gas and supplies that cottagers, campers and road trippers buy in their stores during the summer months is crucial to their bottom line.

“Things are dead here until the May 24th weekend then—boom!— they go crazy until Labour Day,” says Laura Fevez, who owns and runs the Honeymoon Bay Food & General Store in Honeymoon Bay on Vancouver Island, an hour’s drive north of Victoria.

It is the only c-store in the village, which is nestled in pristine wilderness on Lake Cowichan, a popular summertime destination for campers, hikers, cyclists, boaters and anglers.

Since buying the business in the early summer of 2022 and going through what she calls “my baptism of fire” in the c-store trade, Fevez said she spends the slow winter months making physical changes to the store and expanding its product lines to make the most of the summer rush.

“You have to put in a lot of time and effort to think about things and to shop and order items you hope will find favour with your customers,” says Fevez. “It takes a lot of schlepping.”

In addition to expanding her store’s kitchen to make more food items, like breakfast sandwiches, pizza and samosas, which the previous owner introduced, she rearranged aisles and displays to improve the flow of traffic and give the business what she calls “more of a general store look where people can breathe and relax.”

Boost curb appeal

Fevez also cleaned up outside the store and added planter boxes, picnic tables and a bike rack “to make it more inviting for people, both locals and tourists, to come and sit and enjoy themselves.”

She also commissioned a local artist to create four nature-themed murals that were installed on the outside walls of the store on the Victoria Day weekend in 2023.

“It’s easy to drive by a place that has nothing of interest,” says Fevez. “But if you add atmosphere to it, like these four murals do, people will drop in. Like the old saying goes, you gotta make hay when the sun shines.”

Ensure the right product mix

“We call it the ‘Hundred Days of Summer,'” says Leena Halim, director of marketing for SRP Companies Canada, which supplies some 20,000 Canadian retail stores—including major gas stations, c-store chains and independents—with affordable eyewear, mobile electronic devices, travel comfort accessories and toys. “It’s a key season

“As of January 2, we have been officially taking orders for Victoria Day and Canada Day,” says Matt Bialek, the secondgeneration owner of Manitoba-based BlastOff Fireworks

for many of our clients.”

According to Halim, orders start to arrive in March, as winter gives way to spring and c-store operators in touristy areas take advantage of the many promotions her company offers for summertime merchandise. “It’s big business for us and them,” she says. “On beautiful summer days people don’t want to wait in line for 20 minutes at a box store when they can get what they want in a convenience store in two.”

Ray Leviste agrees. As the owner of Sunrayzz Imports, one of the biggest online B2B wholesalers of imported eyewear in Canada, he says sales of sunglasses pop in May, when his company registers its biggest monthly volume in sales.

“We start getting orders in February, but things really pick up when it starts getting nice outside and people are on the move,” says Leviste, who sells directly online to c-stores and other retailers like pharmacies and gift shops across Canada. “It takes us about a week to ship and we go hard from May until September when sales go down along with the temperature.”

Though fireworks are less weather dependent—thanks to personal and public celebrations like birthdays, anniversaries, New Year’s Eve and the Indian festival of Diwali—they too are a must-have item for many c-stores during the summer months.

“As of January 2, we have been officially taking orders for Victoria Day and Canada Day,” says Matt Bialek, the second-generation owner of Manitoba-based Blast-Off Fireworks, a fireworks importer, distributer and educator that supplies more than 4,500 retailers across Canada’s with everything from Roman candles and sound shells to fountains and family packs.

According to Bialek, demand for fireworks is “steady and broad” in both urban areas and cottage country in summer, when large public events and family gatherings generate the lion’s share of industry sales.

“Our collection of family packs, which are almost fireworks displays in a box, are by far our most popular items,” he says. “They are big ticket items with good margins and low risk of theft.”

Anticipate customers’ needs

For his part, Claude Beausoleil, who owns and operates Duggers Variety, a small c-store near the waterfront in the Ontario port town of Midland, 150 kms north of Toronto on Georgian Bay and a major gateway to the world-famous 30,000 Islands, summer begins in March when he starts placing orders for cigarettes and pop.

“I add a few brands like Belmont and Benson & Hedges that people from Toronto smoke, but the locals here don’t,” says Beausoleil, who has run the store, which he is now trying to sell, for 27 years. “And I’ll add a third Crush product and maybe some Brisk or other drinks that I see the tourists like. It's all about experience, knowing what your customers want and planning ahead so you have those items when they come into your store.” CSNC

CCentral.ca 26 March | April 2024 Convenience Store News Canada

Matt and Brandi Bialek

EXHIBITOR SPOTLIGHT

NEW PRODUCTS & EQUIPMENT FEATURED AT THE SHOW SUPPLIERS,

WHAT’S NEW IN YOUR PRODUCT LINE?

CONTACT: JULIA SOKOLOVA, 647.407.8236, JSOKOLOVA@ENSEMBLEIQ.COM | HOLLY POWER, 416.910.1085, HPOWER@ENSEMBLEIQ.COM

HONEYINNOVATIVE INC.

Pioneers the vaping experience, offering a diverse range of top-notch vaping devices and smoke shop essentials. Our curated selection extends beyond just accessories, delving into convenience store items that elevate your lifestyle. With a commitment to quality and innovation, we redefine the standards of vaping, providing enthusiasts with unmatched products. Join us in embracing a seamless fusion of technology and style for a unique journey into the world of vaping. Honeyinnovative.com

MURRAY MARKET NATIONAL

is your one-stop-shop for sales and logistics services in Canada. We help fast-moving consumer goods companies get their products onto retailer’s shelves and into the hands of consumers.

Our team is dedicated to ensuring our partners see continued growth in the Canadian market. This allows you to focus on manufacturing products that delight consumers, and letting consumers know about the compelling story behind your brand. Leave the rest to us

604.952.6025

murraymarketnational.com

BOOTH #548

GUAYAKI YERBA MATE

is thrilled to unveil Peach and Berry Lemonade, available in Canada March 1, 2024.

Guayaki invites you to elevate your state with their meticulously curated blend of flavours, providing an unparalleled taste experience. From the first sip to the last drop, Peach and Berry Lemonade are a symphony of indulgence. With less than 3g of sugar, 20 calories, and 150mg of caffeine, these new flavours invites consumers to explore their low cal, high energy beverages.

canada@guayaki.com guayaki.com

WITH

OVER 40 YEARS OF HERITAGE, RUBICON EXOTIC is the No. 1 Exotic Juice Brand in Canada and the UK! Our unique range of exotic juice drinks and organic coconut water are made using only the finest and authentic ingredients from across the world. Visit Booth #478 today for a free sample and talk to our Sales Reps to see how Rubicon Exotic can help increase your sales today!

905.883.1112

rubiconexotic.ca

BOOTH #478

SLIM JIM, OFFICIAL WWE® MEAT SNACK

• Most desirable meat snack

• Multiple formats (long and short sticks)

• Exciting flavours

• Shelf-ready

• High in Protein

• No Artificial Flavours

Connect with us today!

conagrasnacks.com

ORIGINAL AND BEST

Nick.Abdo@conagra.com

Visit us at booth 644 for a sample

905.940.0889

tfb.ca/brand/irn-bru/

Irn-Bru, the original and best soft drink has been brewed in Scotland since 1901 to a secret recipe of 32 flavours. Its unparalleled taste is a true representation of Scottish heritage making it the number one flavoured soda in Scotland. It’s also known as Scotland’s “other national drink”

Andrea.Fung@conagra.com

BOOTH #644

BROUGHT TO YOU BY MARCH 5 & 6, 2024 | TORONTO | THE INTERNATIONAL CENTRE

BOOTH #482

BOOTH #513

BOOTH #654

OCTANE CANADA’S CAR WASH & PETROLEUM MAGAZINE MARCH / APRIL 2024 CCentral.ca @CSNC_Octane PM42940023 $12.00 Shifting routines and priorities changing consumer habits at the forecourt Forecourt & EV Report + • Fuel management strategies • The uneven road to zero emissions March 5 & 6, 2024 Toronto The International Centre BROUGHT TO YOU BY IT’S TIME FOR YOUR ANNUAL RENEWAL Scan the QR code to confirm your subscription C-STORE iQ

Brands You Know. Service You Trust.

BRAND

SENIOR

Sandra Parente

EDITORIAL

EDITOR & ASSOCIATE PUBLISHER

Michelle Warren mwarren@ensembleiq.com

ASSOCIATE EDITOR

Tom Venetis tvenetis@ensembleiq.com

ADVERTISING SALES AND BUSINESS SALES DIRECTOR

Julia Sokolova

(647) 407-8236 jsokolova@ensembleiq.com

ACCOUNT MANAGER

Holly Power

416-910-1085 hpower@ensembleiq.com

SALES COORDINATOR

Juan Chacon jchacon@ensembleiq.com

DESIGN | PRODUCTION | MARKETING CREATIVE DIRECTOR

Nancy Peterman npeterman@ensembleiq.com

ART DIRECTOR

Jackie Shipley jshipley@ensembleiq.com

SENIOR PRODUCTION DIRECTOR

Michael Kimpton mkimpton@ensembleiq.com

MARKETING MANAGER

Jakob Wodnicki jwodnicki@ensembleiq.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

SUBSCRIPTION SERVICES

Subscription Questions contactus@ccentral.ca

Subscriptions: Print $78.00 per year, 2 year $144.00, Digital $45.00 per year, 2 year $84.00, Outside Canada $120.00 per year, Single copy $14.40, Groups $55.20, Outside Canada Single copy $19.20.

Email: csnc@ccentral.ca

Phone: 1-877-687-7321, between 9 a.m. to 5 p.m. EST weekdays

Fax: 1-888-520-3608 | Online: www.ccentral.ca/subscribe

Convenience Store News Canada | Octane is published 6 times a year by Ensembleiq. Convenience Store News Canada | Octane is circulated to managers, buyers and professionals working in Canada’s convenience, gas and wash channel. Please direct inquiries to the editorial offices. Contributions of articles, photographs and industry information are welcome, but cannot be acknowledged or returned. ©2024 All rights reserved. No part of this publication may be reproduced in any form, including photocopying and electronic retrieval/retransmission, without the permission of the publisher. Printed in Canada by Transcontinental Printing | PM42940023

CHANNEL ALLIANCES:

5

The uneven

to zero emissions: For starters, there aren’t enough high-speed charging stations to meet future demand

6

Get

Today’s innovative technologies make fuel management easier and more accurate, helping drive profits at the pump and

11

SHUTTERSTOCK, CKA

OCTANE March | April 2024 3 CONTENTS MARCH | APRIL 2024 VOLUME 29 | NUMBER 2 STAY CURRENT Don’t miss our e-newsletter! Car wash, petroleum, and convenience news & insights, delivered weekly. Sign up today at www.CCentral.ca/signup Simply hover your phone’s camera over this code: CCENTRAL.CA E-NEWSLETTER CSNCOCTANE @CSNC_OCTANE standard no gradients watermark stacked logo (for sharing only) CONVENIENCESTORENEWSCANADA BE A PART OF OUR COMMUNITY!

The Road Ahead

road

Feature

in-store

a grip:

2024 C-store IQ National Shopper study Forecourt & EV Report: A shift in routine

The Convenience U CARWACS Show

ready to supercharge your business: Show preview and more! 20 Eglinton Ave. West, Suite 1800, Toronto, ON M4R 1K8

256-9908 | (877) 687-7321 | Fax (888) 889-9522 www.CCentral.ca

17

Get

(416)

MANAGEMENT

VICE PRESIDENT, GROCERY AND CONVENIENCE, CANADA

(416) 271-4706 sparente@ensembleiq.com

share tips for fuel management success BROUGHT TO YOU BY 11

6 Experts

Equipment built to last. Tommy Car Wash Systems® offers equipment, systems, detergents, and technology that can take your car wash to the next level. With over 50 years of industry experience, put your trust in us for all of your car wash needs!

more! ©2024 Tommy Car Wash Systems, LLC 373N1 2/24 Scan to view our offerings. Booth #244 at Convenience U CARWACS sales@tommycarwash.com (616) 494-0411 Equipment built to last. Tommy Car Wash Systems® offers equipment, systems, detergents, and technology that can take your car wash to the next level. With over 50 years of industry experience, put your trust in us for all of your car wash needs!

more! ©2024 Tommy Car Wash Systems, LLC 373N1 2/24 Scan to view our offerings. Booth #244 at Convenience U CARWACS sales@tommycarwash.com (616) 494-0411

...and

...and

THE ROAD AHEAD

BY MARK HACKING

The uneven road to zero emissions

For starters, there aren’t enough high-speed charging stations to meet future demand

On December 20, 2023, the Canadian federal government released its long-awaited final draft of the zero-emission vehicle (ZEV) regulations. While there wasn’t much in the regulations that could be considered a surprise, it was an important development because it signalled a definitive direction for the federal Liberals.

The regulations form a sales mandate that effectively requires manufacturers to increase the availability of ZEVs to Canadians or face penalties. For the record, this is one of the most challenging times in the history of the automotive industry. The transition to electrification has required immense investment; it’s also been made more difficult by the supply chain issues that occurred in the wake of the COVID-19 pandemic.

These and other factors have conspired to create turmoil in the industry, forced new car prices for both EVs and more traditional vehicles to reach eye-watering levels, and caused knock-on effects all over the place, including upheaval to rental car fleets and wild fluctuation in used car prices.

Essentially, what we have in North America is increasing government interest in EVs, reduced interest from consumers due to high sticker prices and higher interest rates, and general confusion from carmakers as they consider how to best maintain profit margins. The only thing missing from this combustible mixture is the threat of lower-priced Chinese EVs being allowed to enter the market free of all encumbrances. This is the main issue impacting Elon Musk’s sleep these days, as he struggles to keep Tesla in the green while firing off angry Xs to whomever might be inclined to listen.

Now, to be sure, automakers don’t really deserve our collective pity on this issue. They’re in the business of selling cars at a profit. They would ultimately be happy if everyone replaced his or her fossil fuel pow-

ered vehicle with something shiny, new and electrified. But this is definitely a transition period, and all signs are it’s going to be a rocky one for years to come.

“Look at the situation through the lens of what’s driving the costs; it’s a huge cost to convert entire factories over to electrification—you’re developing a whole new ecosystem,” says David Adams, president and CEO of Global Automakers of Canada (GAC), a not-for-profit that represents 21 different manufacturers operating in this country. “EVs are only about 3% of vehicles on the road today. It’s a new technology with a battery that’s responsible for thirty percent of the cost of the vehicle. Scale of production is the only way to lower the cost, aligned with the cost of the battery.”

‘If the government really wants consumers to adopt zero emissions vehicles in a big way, there would be charging stations exactly where gas stations are today’

While the GAC recognized that the inclusion of certain plug-in hybrid vehicles (PHEVs) in the revised ZEV mandate was somewhat positive, Adams isn’t sure the government listened to all their concerns. That carve out for PHEVs, for example, covers only those vehicles that can travel on electric propulsion alone for 80 kilometres or more. As of right now, the only vehicles that make the grade are a handful of bigticket models such as the Land Rover Range Rover Sport.

“We’ve been supportive of the federal government and other governments putting in rebates,” Adams says, “But the gap is still about $14,000 between a comparable EV and ICE (internal combustion engine) vehicle. We don’t see price parity happening until beyond 2035 for all segments, apart from compact vehicles.”

While the affordability of EVs seems like a manufacturer issue, things aren’t quite that simple. The Ford F-150 Lightning, easily one of the best EV pickup trucks on the market, is a victim of its own success. Ford Motor Company estimates that it loses between $34,000 and $36,000 (all figures in USD) on every Lightning sold. It’s a rough business to be in.

The GAC also pinpoints the lack of charging infrastructure as another key reason why an aggressive EV mandate is premature. “If the government really wants consumers to adopt zero emissions vehicles in a big way, there would be charging stations exactly where gas stations are today,” says Adams. “The assumption is that most charging would be at home, but 40% of the population doesn’t live in a single-family home.”

It’s clear that there aren’t enough highspeed charging stations to meet future demand. But this is another area where companies operating in a free enterprise are asking for government assistance. It’s kind of like the richest man in the world asking for tariffs on Chinese EVs.

Regardless of the charging infrastructure or the cost of building electrified vehicles, it’s nevertheless up to manufacturers to meet the Electric Vehicle Availability Standard—or risk penalties and fines. The standard targets at least 20% of new vehicle sales by EVs/PHEVs by the year 2026, 60% by the year 2030 and 100% by 2035.

Manufacturers that fail to meet these targets will be in a credit deficit, a situation that must be remedied within three years. If they can’t comply within the time allotted, they will then face government fines. The race is well and truly on. OCTANE

Mark Hacking is an award-winning editor/writer with an affinity for all things automotive. He contributes to leading publications in Canada, Australia, Switzerland and the U.S.

CCentral.ca

OCTANE March | April 2024 5

GET A GRIP

Today’s innovative technologies make fuel management easier and more accurate, helping drive profits at the pump and in-store

BY TOM VENETIS

There are 11,893 retail gasoline stations operating in Canada, according to the 2022 National Retail Petroleum Site Census published by Kalibrate Canada Inc. in June 2023. A recent study from IBIS World finds that among that number of gasoline stations, there are 5,442 gas stations with c-store businesses as of 2023, with Ontario (3,414), Quebec (2,038) and British Columbia (1,520) having the most number of gas stations with c-stores.

So, it should not come as a surprise to most that fuel sales and fuel management are an important part of those operations that sell gasoline and have a c-store component. Now, most may think that fuel management is a simple affair. You make sure you have fuel in your tanks for customers, pumps to dispense the fuel and a way for a customer to pay for that fuel, either at the pump or in the c-store.

The reality is, in fact, more complex, and knowing the various parts of fuel management and how to effectively manage them will add more profits each time someone pumps at your operations.

What is fuel management?

Brent Hamby, senior director of product management with Invenco by GVR, says that at its most basic level, fuel management is “anything that encompasses the ability to procure and to sell fuel to the

CCentral.ca 6 March | April 2024 OCTANE SHUTTERSTOCK

customer.” That includes everything from the tanks, lines and sensors that monitor the fuel in the tanks, to the pumps and payment systems the customer uses, as well as the systems that allow one to monitor and to reconcile fuel sales, payments, taxes and the ordering and delivery of fuel to the operation in a timely manner.

By working together, all those systems can help a gas station operator keep a closer eye on their fuel usage, reduce costs and aid in profitability.

Rob Hoffman, director, government and stakeholder relations with Canadian Fuels Association, says good fuel management begins with inventory management, which is knowing how much fuel is going into and out of your storage tanks. “The key thing for that is the integrity of your storage system,” he continues. “It has to be whole and complete, meaning you want to guard against such things as leaks that can create, over time, huge headaches and challenges for the fuel retailer.”

This is where it is important to have in place accurate fuel measurement systems to help guard against what in the industry calls ‘fuel shrinkage’—when the amount in the tank doesn’t match what’s supposed to be there.

Scott Negley, senior director, product management at Dover Fuel-

Above, the DFS AX12 supports a 12-inch touchscreen display, which allows for promo and ads

Left, Dover Fueling Solutions' ProGauge 3D Laser Scan Automatic Tank Calibration uses stateof-the-art technology to accurately determine the exact volume of liquid in fuel tanks.

ing Solutions, explains, “Fuel shrinkage, where the quantity of the fuel decreases between the point of storage, transportation and point of sales, is typically due to factors such as leakage, theft or measurement inaccuracies.”

What can cause such inaccuracies? There are a variety of reasons, such as, daily deliveries and frequent dispensing activity means the fuel level within the tank is constantly changing; ripples in the tank from deliveries and tank tilt; as well as inaccurate measurements of what fuel was to be delivered. The list can be long.

Combating shrinkage

Some gas station operators continue to use the old manual methods of checking the tanks, which involves taking a dip stick to measure what’s in the tank and trying to reconcile these numbers with hard copy delivery reports or daily sales. While a manual check is certainly inexpensive, manual checks do not provide fully accurate measures of fuel going into and out of the operation, all of which have considerable consequences.

“For retailers striving to remain profitable, losing even a small amount of their most valued product can result in significant repercussions,” says Negley. “Additionally, environmental compliance

CCentral.ca OCTANE March | April 2024 7

requirements have become more stringent in recent years, with agencies conducting inspections and issuing fines for leaks or non-compliant technologies. Each of these factors underscores the necessity for enhanced and effective fuel management tech-

Technology enables up-to-date accurate fuel measuring. For instance, Dover Fueling Solutions has sensors and systems that allow for accurate measuring of what is in the tanks, including its 3D Laser that is made to accurately determine the exact volume of liquid in fuel tanks and to automatically provide a precise strapping table, which can then be sent to an automatic tank gauge (ATG), and thereby provide an accurate reconciliation report of fuel stock. In addition, the Veeder-Root TLS4 or TLS4B ATGs— which can be upgraded to the TLS-450PLUS—eliminates the need for manual dipping, while providing more accurate fuel

The technology also helps with reconciliation, one of the most important parts of running a gas station. Ensuring that it is done consistently and accurately helps to reduce theft; identify if storage tanks or the lines delivering fuel to the pumps are leaking; or, if there is any faulty equipment. Plus, the technology ultimately helps to ensure that margins are calculated correctly.

Accurate measurement = accurate ordering

By having accurate measurements of what goes into and out of the storage tanks, gas stations can then tie those measurements into today's advanced computer-based fuel management systems, which allows for more accurate ordering of fuel. This is critical, as gas stations operate on tight margins and knowing when to order fuel to meet demand, and to price the fuel at a competitive rate, is critical.

Technology has advanced to such a degree that one can collect real-time information on daily fuel consumption by customers, which helps produce accurate historical forecasts of fuel sales. In turn, operators can use this information to adjust fuel orders to meet peaks and troughs in demand.

In all cases, fuel management solution providers build into their systems tools that will automatically order more fuel from the gas station’s fuel provider when it finds fuel stock running low or if, for example, an anticipated sales peak is approaching.

Doing this also helps in reconciliation.

Hamby says that Invenco’s fuel management system brings all that information together, from inventory readings, forecasts, historical sales and consumption data, even weather events impacting fuel sales at the pumps to “accurately see what is going on. This deep understanding then allows you to make decisions as to when it is the best time to buy fuel—is it right now, later; is it best to buy from Terminal A or Terminal B—and by balancing all them together you [can] be more accurate with your reconciliation.”

Hamby adds that accurate reconciliation has a direct impact on customers, by ensuring that fuel is available when they arrive to fill their tanks, and that fuel is priced competitively.

The AI revolution

Reconciliation and fuel management is poised for a major shakeup, with AI systems tied to advanced video monitoring and an ever-growing number of sensors providing real time information about customer behaviour, fuel consumption and fuel stock inventories and usage, according to Jason Chiu, professional services group manager, Canada, with Axis Communications.

“The capability to integrate data from multiple disparate systems and present it in a meaningful way—for example, fuel inven-

CCentral.ca

| THE U CARWACS

SOFT-TOUCH WWW.MARKVII.NET

SHOW BOOTH #318

TOUCH-FREE COMBINATION

ChoiceWash XT

TO

THE POWER

CHOOSE

tory, prices, time spent at the pump, time spent in the c-store, traffic patterns outside and inside the c-store—can yield insights into consumer behaviours,” he adds.

These insights can be used to create targeted advertising to lure fuel customers into the c-store: Coffee for the morning commuter; ready-made meals for tired and hungry travellers; or even real-time weather information that then promotes relevant products, such as windshield washer fluid.

Dover Fueling Solutions’ The Future of Fueling Report: Innovation at the Pump 2023 finds that ads at the pump are catching the attention of younger consumers and helping drive c-store foot traffic.

According to the report, “more that more than half (51%) of consumers ‘always’ or ‘often’ notice advertisements on or around a fuel pump, but consumers have mixed opinions on their effectiveness. Close to one-third (32%) say fuel pump commercials or ads have convinced them to enter a convenience store, with age also playing a factor in that decision. Gen Z and millennial consumers are more likely to be swayed to go into a c-store based on ads at the pump, and nearly half of them (46%) say those ads influenced their purchasing decision.”

Perhaps this is why, in early 2023, Dover launched, as part of its DFS Anthem UX platform, the DFS AX12 enhanced fuel pump that supports a 12-inch touchscreen display, which allows for the display of ads and other promotional content designed to drive people into the c-store.

Fuel management and c-store management go hand in hand. With today’s increasingly advanced technologies, operators and their customers can now expect more from each fuel fill at the pumps.

OCTANE C-Store Commander POS and Back Office Software INTUITIVE AND RELIABLE TECHNOLOGY • Robust promotions • Dynamic reporting • PA-DSS certified • Full cycle inventory management • Loyalty and gift card options • Wayne and Gilbarco Pay @ Pump • Contactless payment options • Fleet card management and control • 24/7 Support • Customized solutions available • And much