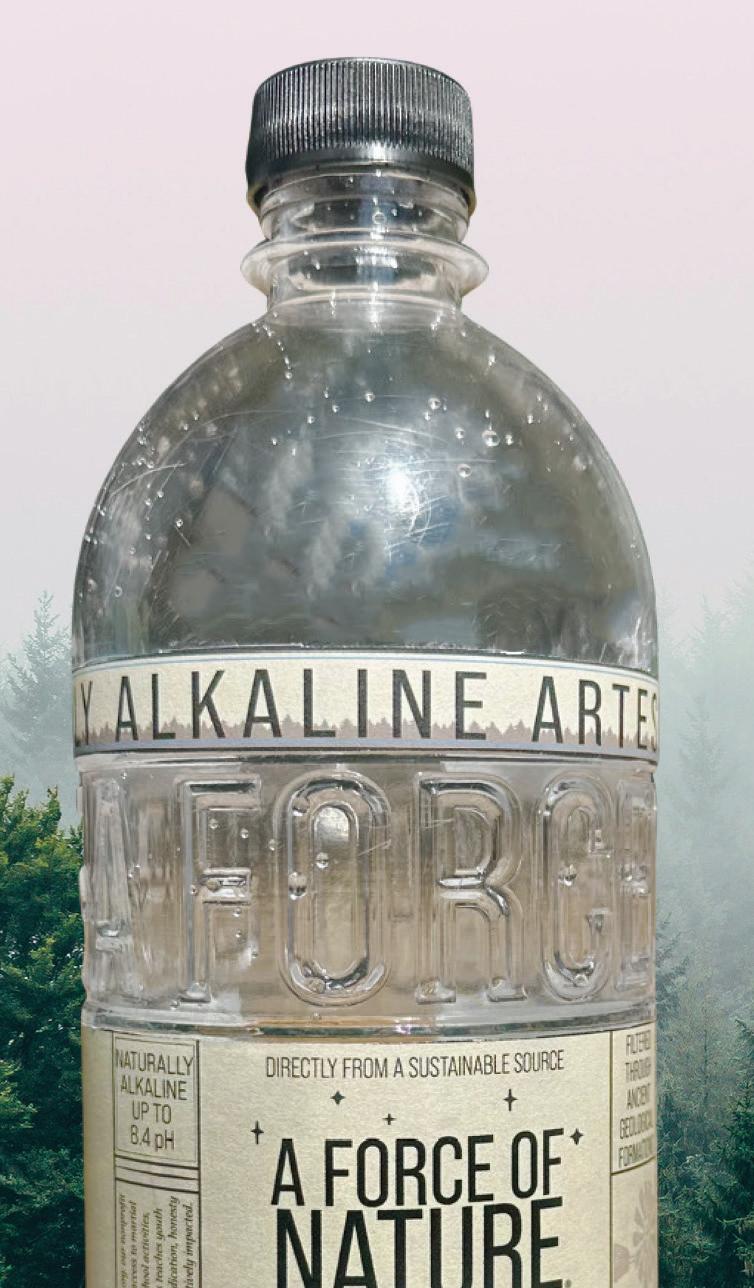

Introducing a naturally alkaline artesian water, sourced deep from the earth and bottled with pride in America. Rich in natural minerals and committed to giving back, it’s water that refreshes you and restores the world around you.

LEARN MORE

LEARN MORE

LEARN MORE

MILLIONS OF YEARS AGO, VOLCANIC ERUPTIONS IN THE UNITED STATES SLOWLY LEAD TO THE CREATION OF A UNIQUE, ANCIENT, AND DEEP AQUIFER. THIS WATER FLOWS THROUGH A GEOLOGICAL FILTERING, MADE UP OF VOLCANIC ROCK, PICKING UP ESSENTIAL MINERALS. THIS NATURAL ARTESIAN PROCESS GIVES THIS WATER AN EXCLUSIVE MINERAL MAKEUP AND SMOOTH TASTE.

MILLIONS OF YEARS AGO, VOLCANIC ERUPTIONS IN THE UNITED STATES SLOWLY LEAD TO THE CREATION OF A UNIQUE, ANCIENT, AND DEEP AQUIFER. THIS WATER FLOWS THROUGH A GEOLOGICAL FILTERING, MADE UP OF VOLCANIC ROCK, PICKING UP ESSENTIAL MINERALS. THIS NATURAL ARTESIAN PROCESS GIVES THIS WATER AN EXCLUSIVE MINERAL MAKEUP AND SMOOTH TASTE.

MILLIONS OF YEARS AGO, VOLCANIC ERUPTIONS IN THE UNITED STATES SLOWLY LEAD TO THE CREATION OF A UNIQUE, ANCIENT, AND DEEP AQUIFER. THIS WATER FLOWS THROUGH A GEOLOGICAL FILTERING, MADE UP OF VOLCANIC ROCK, PICKING UP ESSENTIAL MINERALS. THIS NATURAL ARTESIAN PROCESS GIVES THIS WATER AN EXCLUSIVE MINERAL MAKEUP AND SMOOTH TASTE.

BOTTLED ABOVE AT A SINGLE SOURCE, THIS WATER IS BOLD, REFRESHING AND COMES TO THE SURFACE ON ITS OWN - NATURALLY ALKALINE -

BOTTLED ABOVE AT A SINGLE SOURCE, THIS WATER IS BOLD, REFRESHING AND COMES TO THE SURFACE ON ITS OWN - NATURALLY ALKALINE -

BOTTLED ABOVE AT A SINGLE SOURCE, THIS WATER IS BOLD, REFRESHING AND COMES TO THE SURFACE ON ITS OWN - NATURALLY ALKALINE -

IT HAS WHAT OTHER WATERS MANUFACTURE ARTIFICIALLY, BUT CREATED BY EARTH.

IT HAS WHAT OTHER WATERS MANUFACTURE ARTIFICIALLY, BUT CREATED BY EARTH.

IT HAS WHAT OTHER WATERS MANUFACTURE ARTIFICIALLY, BUT CREATED BY EARTH.

THIS WATER IS MORE THAN WATER, THIS IS

THIS WATER IS MORE THAN WATER, THIS IS

THIS WATER IS MORE THAN WATER, THIS IS

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

AS KWIK TRIP CELEBRATES SIX DECADES IN BUSINESS, THE RETAILER REFLECTS ON HOW IT GOT TO WHERE IT IS TODAY — AND WHERE IT’S GOING NEXT

Boost your business with a responsible digital platform that enhances customer engagement and loyalty. The AGDC Digital Trade Program helps retailers connect with Adult Tobacco Consumers 21+ while driving business growth through incentives.

Receive a Scan Data Base Incentive payment for each eligible Scan Data transaction timely submitted to AGDC.

Earn incremental per-transaction incentive funds for each identified Consistent LID appearing 5 or more weeks in Scan Data.

Submit weekly Scan Data files for 13 out of 13 weeks to receive additional incentive payments.

Without question, technology is a vital part of convenience and fuel retailing today

IN A FEW WEEKS, the convenience store industry will assemble in the Windy City for this year’s NACS Show. Against the backdrop of the conference and expo, Convenience Store News will host its annual Technology Leadership Roundtable & Awards Dinner.

Each year, this event brings together an intimate group of leading c-store technology executives to discuss the critical role of tech in convenience and fuel retailing, and examine the current and emerging technologies required for the future-focused c-store retailer.

When this event was launched in 2016, the conversation focused on EMV updates, touchscreen ordering, the rise of mobile and the threat of Amazon. There was also much discussion around the growing convergence of technology and marketing. As one retailer in attendance questioned, “Is it more IT or marketing? And who is going to win?”

Today, we know the answer is: It’s both.

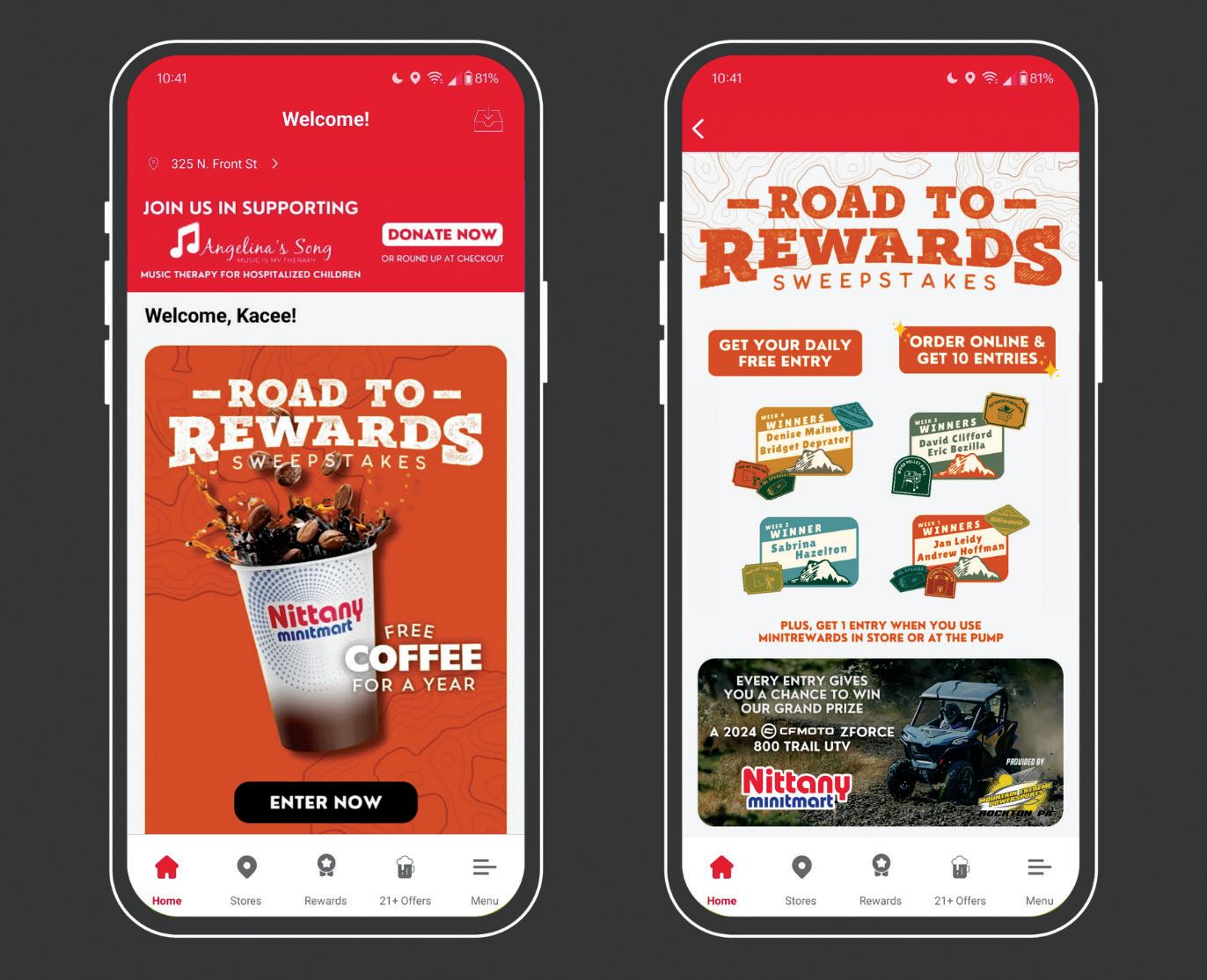

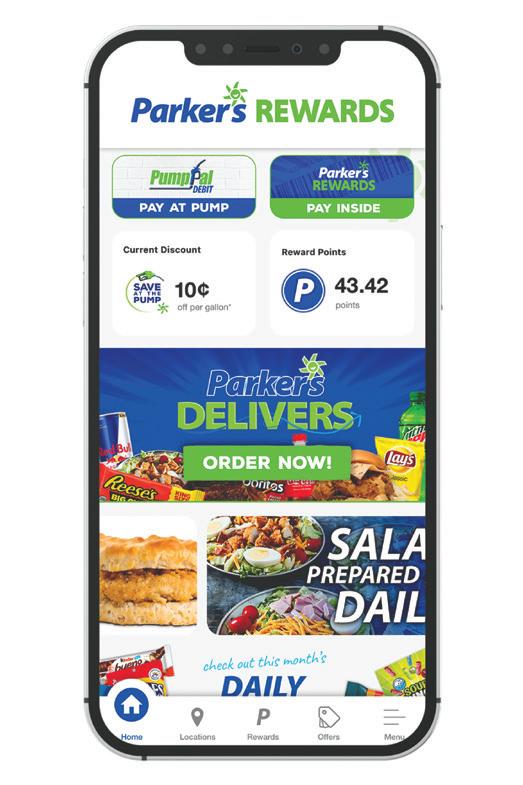

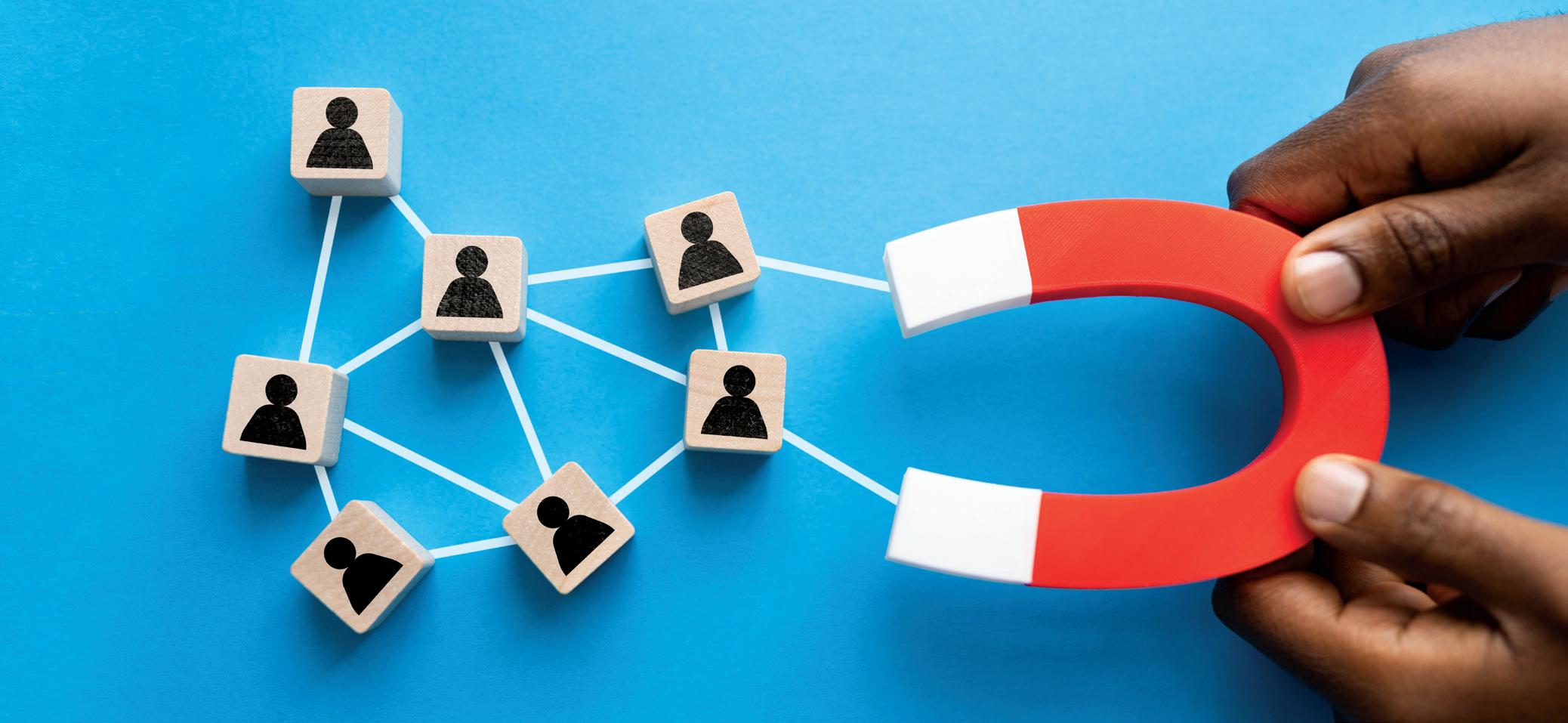

Loyalty programs are one of the best examples of how technology and marketing unite to drive strong growth for convenience store operators. In this issue, we spotlight how c-store retailers of all sizes are reevaluating and elevating their loyalty programs. Leveraging tech (AI, predictive analytics, automation, etc.), they are moving beyond onesize-fits-all offers to give customers a dynamic and

EDITORIAL EXCELLENCE AWARDS (2016-2025)

2021 Jesse H. Neal National Business Journalism Award

Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business

Journalism Award

Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015 Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards

Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications

Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

personalized experience that keeps them loyal to their brand.

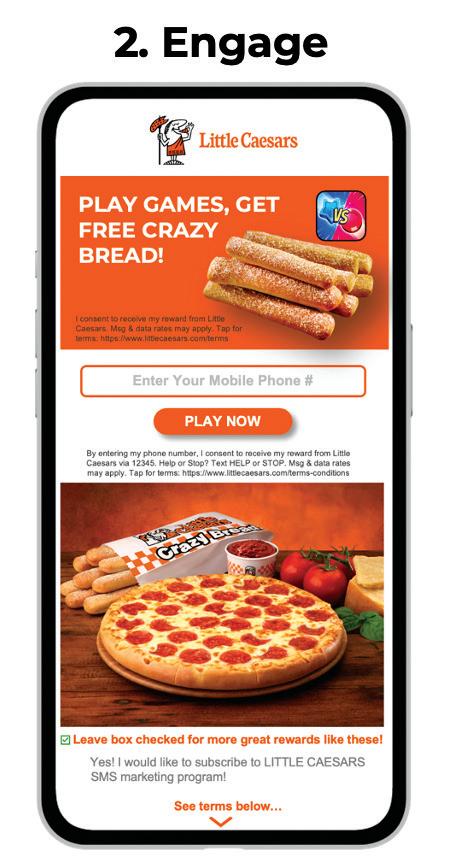

In this issue, you’ll also find an insightful report on the many ways c-store retailers can connect with and engage customers apart from loyalty programs. Think email, text, geofencing, gamification, social media and more. These days, it’s all about “the customer journey” and making that journey seamless across channels — powered by the collection of data.

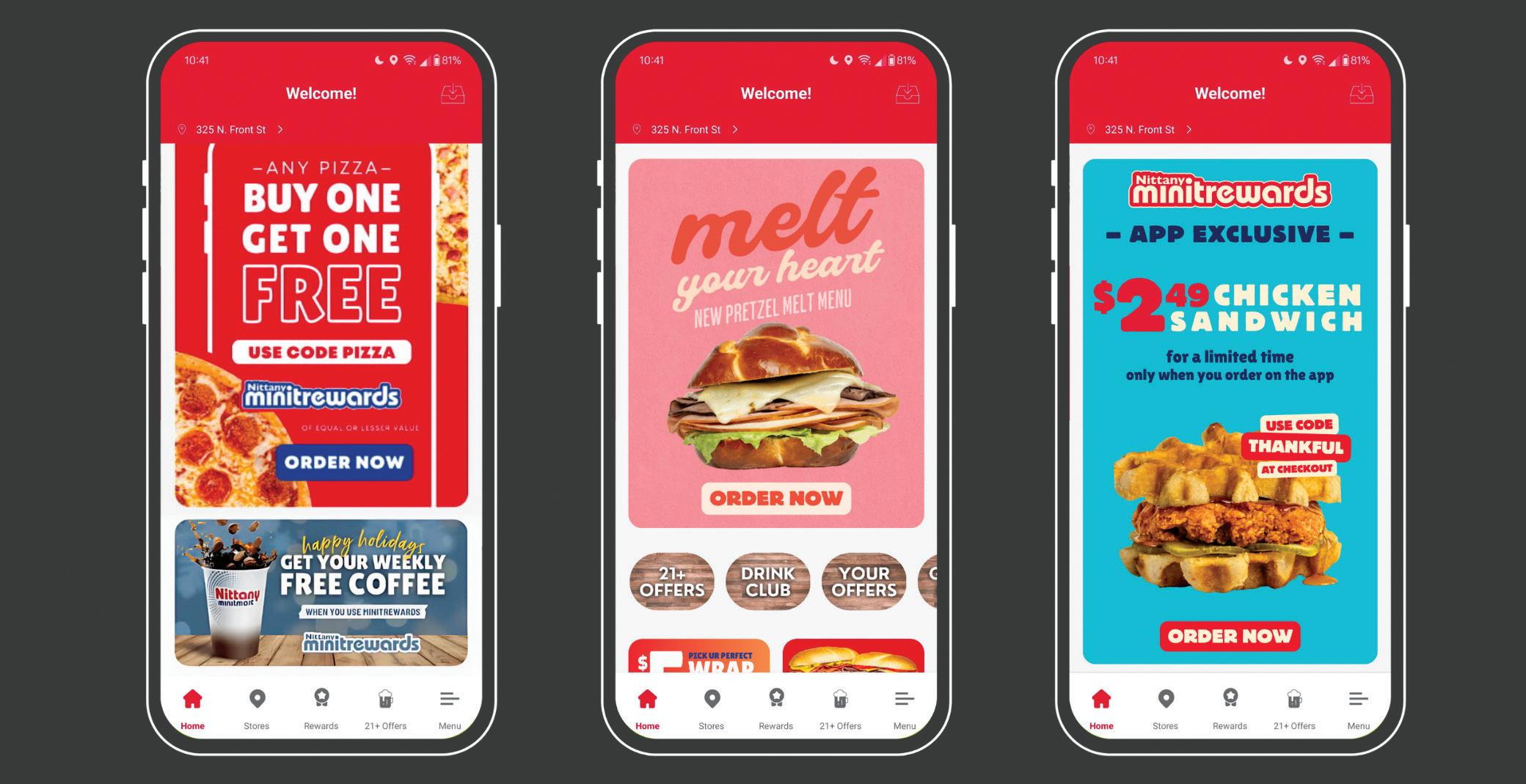

Four convenience retailers that have demonstrated exceptional vision and innovation in the development and utilization of tech solutions are this year’s Technology Leader of the Year honorees: Parker’s Kitchen, RaceTrac Inc., Nittany MinitMart and Taylor Wilson of Golden Oil Co. You can read about each one’s achievements in this issue. They will be presented with their awards at our Technology Leadership Roundtable & Awards Dinner on Oct. 14.

I’m eager to hear what topics dominate the conversation at this year’s event. Technology is undeniably an essential part of convenience and fuel retailing today. Going well beyond just marketing, tech touches nearly every aspect of the business now.

If you’re not investing in your tech stack, you may very well find yourself left behind.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2024 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, May 2024

Honorable Mention, Business to Business, Magazine Section, October 2024

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Richard Cashion Curby’s Express Market

Billy Colemire Majors Management

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s

Faheem Jamal CPD Energy Corp./ Chestnut Markets

Vito Maurici McLane Co. Inc.

Jonathan Polonsky Plaid Pantries Inc.

Greg Scriver Kwik Trip Inc.

Roy Strasburger StrasGlobal

Today, we’re witnessing the culmination of three major trends.

AS THE CONVENIENCE STORE INDUSTRY gathers in Chicago next month for the 2025 NACS Show, I thought it would be a good time to review the current state of an industry that has been transforming over the better part of the last decade.

Today, we’re witnessing the culmination of three major trends. Foodservice excellence, digital innovation and loyalty engagement have converged into a single force that is reshaping what it means to be “convenient.”

Let’s start with foodservice. According to the latest consumer data, nearly 72% of shoppers now see c-stores as a viable alternative to quick-service restaurants. That’s up sharply from 56% last year, according to NACS research. This is a huge shift in perception, being driven by bold investments in made-to-order kitchens, fresh prep and chef-inspired menus.

Retailers such as Casey’s, Wawa and Sheetz, as well as the giants like 7-Eleven and Circle K aren’t dabbling in food — they’re going all in. And consumers are responding. In fact, 35% of shoppers say they’ve purchased a hot meal at a convenience store in the past month, up from just 29% a year ago.

Then, there’s technology. AI-driven inventory systems, ceiling-mounted sensors that capture behavioral data and even autonomous checkout are no longer futuristic. Pair that with retail media networks that not only engage customers, but also create a new revenue stream for retailers and you’ve got a digital frontier that’s as profitable as it is customer-friendly.

And let’s not forget loyalty. Today’s shoppers are digitally savvy, mobileconnected and hungry for personalized experiences. Nearly three-quarters are enrolled in some kind of loyalty program, and 85% of nonmembers say they’d be more likely to join if the perks were tailored to their behavior and preferences. This is where c-stores can shine — by leveraging data to connect the dots between what shoppers want and what retailers can offer.

So, what should c-store leaders be doing right now to capitalize on these intersecting trends?

First, think like a restaurant. That means committing to quality ingredients, craveable menu items and speed of service. You’re not just competing with other c-stores anymore. You’re in the same arena as Chick-fil-A, Starbucks and Taco Bell. If you want share of stomach, your food must be great, not just good enough.

Second, invest in your tech stack. Your store should be just as savvy as your shopper. That means mobile ordering, digital signage, intuitive loyalty apps and operational tech that cuts labor costs and boosts efficiency. In today’s market, technology isn’t a bonus, it’s the price of entry.

And third, get personal. Use your loyalty data to understand who your customers are and what they want. Then, show them you’re paying attention. From fuel rewards to free coffee, real-time offers based on their buying behavior is how you build long-term, high-value relationships.

As we are nearing the end of 2025, it’s clear that the retailers to beat in 2026 will be those that treat every store visit not just as a transaction, but as an opportunity to surprise, delight and deliver.

For comments, please contact Don Longo,

Editorial Director Emeritus

, at dlongo@ensembleiq.com.

FIJI Water is committed to sustainability and is proud to have launched its 330mL and 500mL bottles made from 100% recycled plastic* in 2022. This change replaces nearly 70% of FIJI Water’s plastic bottles in the U.S.**

FIJI Water is available direct. Contact your FIJI Water representative at 888.426.3454 or at FIJIWater.com .

DEPARTMENTS

Convenience retailers have a responsibility to their customers and their community. LEARNING

have significant potential to develop their better-for-you offerings.

FEATURES COVER STORY

No Less Than Best

As Kwik Trip celebrates six decades in business, the retailer reflects on how it got to where it is today — and where it’s going next.

106 Redefining the Loyalty Experience

Convenience retailers of all sizes are reevaluating and elevating their loyalty programs.

113 Engagement Outside the Loyalty Box

There are many ways for c-store retailers to digitally capture the attention of customers apart from loyalty programs.

116 The Pulse of D&I Slows

Diversity and inclusion programs in the convenience store industry are under pressure.

TOBACCO

46 Good News, Bad News

The FDA recently authorized more products, but illicit vapes remain a big problem.

FOODSERVICE

56 Firing Up Your Foodservice Business Highlights from the 2025 Convenience Foodservice Exchange event in Denver.

ALCOHOLIC BEVERAGES

90 Embracing Innovation Convenience Store News recognizes the 2025 Technology Leader of the Year honorees. TECHNOLOGY

70 The Explosive Growth of RTDs Ready-to-drink cocktails have become a primary growth driver in the category.

HEALTH & BEAUTY CARE

78 Deviating From Tradition

While pain relief is still important, vitamins and family planning products are fueling growth.

LOTTERY

84 Game On!

Go beyond luck to make your c-store the destination for lottery enthusiasts.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT/GROUP PUBLISHER, CONVENIENCE NORTH AMERICA Sandra Parente sparente@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Cristian Bejarano Rojas crojas@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CHIEF EXECUTIVE

CHIEF

CHIEF

CHIEF OPERATING OFFICER

The Hope Mills, N.C., location opened its doors on Aug. 28. Wawa’s first travel center offers its signature fresh food and beverages, plus fuel for passenger vehicles and a high-speed diesel fuel court for the needs of professional tractor-trailer drivers.

Seven & i Holdings Co. Ltd. expects to add 1,300 new convenience stores in North America and around 1,000 new locations in Japan through the year ending February 2030. This expansion will boost revenue by an estimated $76.5 billion, according to the company.

With a score of 92.78, Buc-ee’s landed at No. 4 on the annual list compiled by Newsweek and Statista. The rankings were based on an independent survey of participants who have either made purchases, used services or gathered information about products or services in the past three years.

The adventure-themed convenience store chain will consolidate its headquarters operations in Salt Lake City to improve efficiency. A limited presence will remain in Des Moines, Iowa, the former headquarters of the Kum & Go brand, which Maverik acquired.

5

2 EXPERT VIEWPOINT

Zuber Issa called for the sale of EG Group’s entire U.S. business, valued at more than $5 billion, as an alternative to an initial public offering. The plan is backed by private equity firm TDR Capital, which owns 50% of EG Group.

Today, there are a growing number of new nicotine alternatives on store shelves, and more innovations on the way for America’s approximately 30 million legal-age adult smokers. Smokefree products aren’t just better for the legal-age adult smoker; they’re better for retailers as well, writes Dan Mulvaney, director of industry engagement for Philip Morris International Inc. U.S. The U.S. Food and Drug Administration should work with retailers to ensure they have clear, timely and accurate information about and access to authorized products to meet consumer demand.

Foodservice is an essential driver of growth, differentiation and customer loyalty for today’s convenience store retailers. This dynamic category is only becoming more important as c-store retailers work to establish themselves as top-of-mind dining destinations and expand their competitive landscape. In a recent webinar, Convenience Store News’ Foodservice Editor Angela Hanson and Vice President of Research Beth Brickel explored the findings of the brand’s 2025 Foodservice Study and highlighted cutting-edge examples of the insights in action.

For more webinars, visit the CSNews Webinars section of CSNews.com.

Oreo Cookies & Cream Muddy Buddies

General Mills Convenience elevates its Cookies & Cream Muddy Buddies variety with the introduction of Oreo Cookies & Cream Muddy Buddies. The snack features crispy corn Chex pieces coated with a topping of real Oreo cookie wafers. Oreo Cookies & Cream Muddy Buddies are available nationwide in a 4.25-ounce bag for $4.29. The new variety joins other Muddy Buddies flavors available in convenience stores, including Cinnamon Toast Crunch, Funfetti, Peanut Butter & Chocolate, Brownie Supreme and Girl Scout Thin Mint.

Retailer groups cheer the decision even as part of the order is on hold pending appeals

RETAIL INDUSTRY ADVOCACY groups applauded a federal judge’s recent ruling that overturns the Federal Reserve’s 2011 cap on debit card swipe fees.

In the case of Corner Post v. Board of Governors of the Federal Reserve in the U.S. District Court for the District of North Dakota, Judge Daniel Traynor vacated regulations setting the debit card swipe fee rate, but put implementation on hold pending appeals “to prevent interchange transactions from becoming a completely unregulated market.” He noted that the order does not prevent the Fed’s proposed cap reduction — pending since 2023 — from taking effect if the Fed chooses to move forward with it.

Prior to the ruling, regulations allowed banks that have at least $10 billion in assets and follow rates set centrally by Visa and Mastercard to charge up to 21 cents per debit card transaction, as well as 1 cent for fraud prevention and 0.05% of the transaction amount for fraud loss recovery.

The federal lawsuit filed in 2021 by Corner Post, a truck stop and convenience store in Watford City, N.D., argued that the 2011 rate was set too high due to a 2010 law requiring that the rate be “reasonable” and “proportional” to the banks’ costs.

The North Dakota Retail Association and the North Dakota Petroleum Marketers Association joined Corner Post in the lawsuit,

which the U.S. Supreme Court ruled last year could move forward. The 6-3 decision found that the lawsuit filed by Corner Post was not blocked by the statute of limitations because the time limit did not begin for the business until it began accepting debit cards upon opening for business in 2018.

“As merchants have argued for 14 years, the Fed’s broad attempt to allow big banks to essentially charge rent-seeking fees for debit card transactions is illegal. That question is now settled,” Stephanie Martz, chief administrative officer and general counsel for the National Retail Federation, said after the ruling. “If the Durbin Amendment is to mean anything, it’s that there are specific costs that banks can recover from merchants and costs that they categorically cannot recover from merchants.”

The Retail Industry Leaders Association (RILA) also welcomed the ruling. “RILA is pleased to see the court’s decision in Corner Post, which squarely rejects the board’s flawed Reg II, which has — for far too long — imposed excessive costs on merchants and their customers,” said Deborah White, RILA’s senior executive vice president and general counsel, and president of the Retail Litigation Center.

The Merchants Payments Coalition urged the Fed to take quick action. “We are glad to see this well-reasoned decision,” said Doug Kantor, Merchants Payments Coalition executive committee member and NACS general counsel. “This case shows that banks have swiped a windfall of billions of dollars per year in debit fees from Main Street that go far beyond normal, competitive profit margins. The Federal Reserve should quickly rewrite its rules to cure this problem and reduce the inflationary pressure these fees impose on the entire U.S. economy.”

85%

of U.S. shoppers have tried made-to-order food at a convenience store.

— Intouch Insight

-3%

Hard seltzer category growth was down 3% year over year in the second quarter.

— Goldman Sachs

27.5%

of electric vehicle drivers favor loyalty perks or reward schemes.

— Konect

we blend performance and convenience!

Delicious. Convenient. Packed with 25g Protein. Meet the future of frozen beverages, where high-quality protein by Optimum Nutrition® meets the advanced, automated blend technology from Fresh Blends®!

Bring your shoppers the ultimate grab-and-go upgrade: From protein shakes to fruit smoothies and energy refreshers, our self-serve machine delivers delicious, high-quality drinks with zero prep and automatic cleaning. More variety, more sales, less hassle.

Applegreen plc is expanding its U.S. presence through a $70 million investment in new highway service plazas in Colorado. The company’s plans call for four service plazas along the E-470 highway in Denver.

Wawa Inc. began construction on its first convenience stores in Middle Tennessee. The Murfreesboro and Clarksville locations are slated to open during the second half of 2026.

Blarney Castle Oil acquired Pri Mar Petroleum’s convenience and gas business, while Merle Boes took Pri Mar’s delivered fuels and lubricants business. Pri Mar operated 13 Pri Mart branded stores and supplied 12 wholesale dealers in southwest Michigan.

LV Petroleum secured a $20.11 million construction bridge loan from Forman Capital for the redevelopment of a travel plaza located between Mobile, Ala., and Pensacola, Fla. The 51-acre site has already been converted into a TA Travel Center.

Love’s Travel Stops opened a new compressed natural gas (CNG) station in Fresno, Calif. The site, which features six CNG fuel dispensers, is the first to open under the new Love’s Alternative Energy brand.

The Pala Band of Mission Indians broke ground on a new Pala Super Mart & Fuel Station between inland San Diego and the coast. The facility will include a grocery market, specialty coffee bar, full-service deli and electric vehicle charging stations.

Female executives from Weigel’s Stores Inc. and 7-Eleven Inc. were honored with 2025 Retail’s Top Women Awards from Chain Store Age, a sister publication of Convenience Store News. Weigel’s Director of Loyalty Jessica Starnes and 7-Eleven’s Senior Director of Electric Vehicle Charging and Utilities Ann Scott were among the 20 recognized.

Dash In debuted a refreshed look at two pilot stores. The retailer worked with GSP’s Retail Environments Team to create and deliver an enhanced shopping experience, refined brand aesthetics and brand consistency.

Curby’s Express Market closed its original location at 1903 Milwaukee Ave. in Lubbock, Texas, on July 22, bringing its store count down to just one location in Amarillo, Texas. A company statement hinted at future new locations.

Jacksons Food Stores celebrated its golden anniversary in August. The chain got its start in August 1975 with one Texaco service station and has grown to more than 1,400 Jacksons and ExtraMile stores across 10 states.

Casey’s General Stores Inc. joined NCR Atleos’ Allpoint Network to provide surcharge-free access to cash through Atleos managed ATMs. Access will be available in Casey’s stores across seven states: Wisconsin, Ohio, Tennessee, Arkansas, Nebraska, Kentucky and Oklahoma.

Jet Food Stores unveiled family-friendly restrooms at more of its locations. Nine of the retailer’s stores now feature Step ‘n Wash, a built-in retractable step stool that allows children to reach the sink safely and independently.

McLane Co. Inc. unveiled a new chicken program, HiBird. Part of the McLane Fresh family of brands, the HiBird program provides comprehensive support — from implementation and training to merchandising and equipment.

Keurig Dr Pepper (KDP) will acquire JDE Peet’s in an all-cash transaction, creating a global coffee champion. Post closing, KDP plans to separate into two independent, U.S. listed, publicly traded companies: Global Coffee Co. and Beverage Co.

Core-Mark International, a Performance Food Group company, entered into a distribution agreement with Onvo. Under the terms of the pact, Core-Mark will serve as regional supplier for the retailer’s stores in Pennsylvania and New York markets.

PMI U.S. introduced its IQOS heated tobacco system in the greater Fort Lauderdale, Fla., area. The announcement came after more than 5,000 adults aged 21 and over participated in the “Be the First” pilot program in Austin, Texas.

American Car Wash Solutions signed a distribution agreement with Complete Car Wash Solutions to be the company’s lead distributor in the Southeast. This milestone marks the first major move under the leadership of CEO John Olert, who acquired American Car Wash Solutions in August 2024.

Johnson Brothers, a distributor of wine, spirits and beer, entered the Texas market by acquiring Maverick Beverage Co.’s operations in Texas, Arizona, Colorado and Florida. Approximately 400 Maverick team members will join the Johnson Brothers family.

We are not a franchise. We do not have franchise fees, royalty fees or marketing fees.

Partner with Hunt Brothers® Pizza and unlock your pizza profits of 50% or more. Our turnkey branded pizza program fits into your existing space and operates with your current employees. Our simple program is designed specifically for c-stores and delivers maximum profitability.

Inspired by the classic cinnamon-sugar snickerdoodle cookie, TWIX Snickerdoodle features the iconic crunchy cookie, gooey caramel and smooth milk chocolate of TWIX with the addition of a cinnamon-sugar swirl of snickerdoodle-flavored caramel. The product taps into the deep well of nostalgia while embracing the current tastes and trends that fans crave, according to its maker. TWIX Snickerdoodle is available nationwide in a single 1.4-ounce size and 2.8-ounce share size. It is the third cookie-inspired flavor to join the TWIX lineup, following TWIX Cookie Dough and TWIX Cookies & Crème.

MARS INC. • NEWARK, N.J. • TWIX.COM

Seagram’s Escapes Spiked WWE Series

Seagram’s Escapes, known for great-tasting flavored malt beverages, and WWE, a global leader in sports entertainment, announce a new multiyear partnership. The collaboration is highlighted by the launch of a cobranded product, the Seagram’s Escapes Spiked WWE Series, which marks WWE’s first-ever licensed ready-todrink product. Now available nationwide, the line features flavors such as Rumble Punch, Pineapple Powerhouse and Slammin’ Blueberry. As an official partner of WWE, Seagram’s Escapes also will receive prominent integrations within live events, a custom digital content series featuring WWE Superstars, and more. THE SEAGRAM BEVERAGE CO. • ROCHESTER, N.Y. • SEAGRAMSESCAPES.COM

Wip Energy Pouches are designed to be a category-defining product that reimagines how caffeine is consumed. The pouches are available in both 100-milligram and 200-milligram caffeine strengths in four bold flavors — Orange Tangerine, Mint, Sour Cherry and Strawberry Kiwi. Wip pouches are zero sugar and zero calories, and formulated with natural caffeine sourced from non-GMO green coffee beans, B vitamins to support energy metabolism and healthy cognitive functions, and chromium to support stable blood sugar levels. Wip is available nationwide with a suggested retail price of $5.99 per can, containing 10 pouches. WIP • NEW YORK • WIP.COM

Throne Sport Coffee Premium Charged Lattes

Throne Sport Coffee seeks to outperform the “sugar-loaded coffee milkshakes” that have long dominated the ready-to-drink coffee landscape with the launch of Premium Charged Lattes, a better-for-you alternative. Made with no artificial flavors or sweeteners, each 11-ounce can contains 150 milligrams of natural caffeine for clean energy and focus; 10 grams of protein from ultra-filtered, lactose-free milk to support muscle recovery; electrolytes; and 100% daily value of vitamins B2, B3, B6 and B12. Four flavors are available: Mocha Java, French Vanilla, Salted Caramel and Coffee Latte. THRONE SPORT COFFEE • STAMFORD, CONN. • SPORTCOFFEE.COM

Three new pre-sliced, pre-cooked sausage varieties from Johnsonville Foodservice aim to help foodservice operators reduce prep time, save labor and deliver the bold, on-trend flavors customers crave. Available in Ultimate Italian, Jalapeño Cheddar and Southwestern, the sausages are fully cooked and frozen with a 270-day shelf life. They are also clean label, with no gluten, MSG, high-fructose corn syrup or artificial flavors. Each sausage is packed with visible, authentic ingredients such as bold herbs, real jalapeños and creamy cheddar. With five slices per ounce, they provide excellent coverage on pizzas, burritos, wraps, bowls and more.

JOHNSONVILLE LLC • SHEBOYGAN FALLS, WIS. • FOODSERVICE.JOHNSONVILLE.COM

For three decades, We Card has set the national standard in helping retailers prevent underage access to age-restricted products. Through employee training, in-store signage, and education programs, they’ve strengthened ID-checking practices across the country—helping retailers build trust and improve age verification at the counter.

At PMI U.S., we’re proud to support We Card’s mission as an Advisory Council member. Their commitment to responsible retailing helps ensure that tobacco and nicotine products are sold only to adults 21 and over.

Here’s to 30 years of leadership, impact, and doing what’s right— with many more to come.

Scan to see the actions we’re taking to control access and work with others.

Convenience retailers have a responsibility to their customers and their community

By Roy Strasburger, CEO, StrasGlobal

“WHO ARE YOU? Who, who, who, who?”

With all due respect to Pete Townsend, this is not an existential question, but rather a practical one. In today’s world of digital transactions, AI-generated personalities and relentless scammers, it is becoming more and more important to be able to verify that the person you are dealing with is, in fact, a real person and that they are who they say they are.

Convenience retailers have a responsibility to their customers and their community to make sure age-appropriate products are sold according to the law. Our industry, more than any other (with the exception of pharmacies), deals the most in restricted products, whether it be cigarettes, alcohol, lottery tickets or vape products. We are the gatekeepers, making sure restricted products get into the right hands.

There is a level of trust that must be earned by a retailer, and that trust reflects the operator’s integrity and professionalism, whether it be in handling money, preparing food, creating a safe environment for people to visit, enforcing legal requirements or protecting minors.

How can store operators accurately and

consistently know that the person they are facing is not a minor? Let’s review what you should do — and train your employees to do — to ensure you are legally selling restricted products.

First, and most important, is to identify the products that are age restricted. The customer service representative needs to know what they can, and cannot, sell to minors.

The second step is to check the identification of everyone who could be underage when they attempt to buy a restricted product. NACS recommends that employees check customer IDs if the buyer looks under 40 years old.

Third, when you’re handed an ID, look at it closely. Whether it is plastic, paper or digital, the burden is upon the retailer to make sure it is legitimate and that the ID matches the person presenting it. You must study the identification and the person in front of you very carefully. If there is any doubt that the person presenting the ID is not the same person in the photo, you should decline the sale.

A corollary to these three steps is that the cashier should use reasonable efforts to make sure that even if the person is the

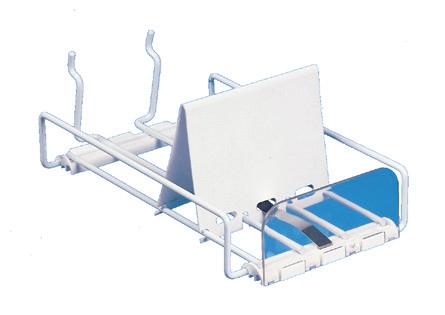

With the WonderBar® Tray & Bar Merchandising System, now you can bring related products neatly together in ways not previously possible. Fit many more items, sell families of products in different sizes, and increase impulse buying with cross-sells and adjacencies.

■ Dual Lane Tray accepts two narrow items for side-by-side merchandising.

■ Unique design features separate paddles to push each lane forward individually.

■ Asymmetrical lanes sell different-width products. Each lane adjusts to fit products as small as 1¾" wide. Mini and Standard width trays available.

■ WonderBar offers a full range of bars, trays, hook styles, pushers, spring tensions, label holders and signs adapt to any product, any size, storewide.

■ Consistently better product presentation with less labor time spent facing.

■ Trays lift out for rear restocking and proper rotation.

■ Increases product facings and rows, lifts sales as much as 20%.

■ Maximizes visibility and shopability and billboards package design. Auto-feed trays and hooks assure a continuously well-faced display.

■ Simple design allows one-man installation in as little as one-tenth the time of traditional systems. Reset 48 facings in as little as 15 minutes. Replanogramming any product is a snap.

■ Easy tray dismount and rear-loading reduce labor, speed restocking, ensure product rotation, and reduce shrinkage.

■ Designed for center store, perimeter, general merchandise, soft goods, cooler and freezer use. Tool-free universal mount adapts to all major gondola and upright configurations.

■ Choice of 3 bar profiles in 30," 3' and 4' lengths accommodate trays and baskets, bar-mount and plug-in hooks, pouch hooks, auto-feed and security hooks, and horizontal and vertical sign and label holder systems.

■ System design allows 1" vertical adjustment and increased usable tray and hook depth for even greater display capacity.

■ As many as 7 standard tray depths ranging from 13" to 24" are available. Trays adapt to fit the width of virtually all products and package styles with Oversize, Standard, Dual and Mini Trays accommodating lane widths from 13/4" to 17 1/2".

■ A store tested solution with more than 16 million trays sold and in use across retail.

■ Scan Lock® Hook Locks are an easy-to-use, inexpensive key-lock system, securing most common scan hooks, and even retrofits existing hooks right in place! Secure all items or display some unlocked.

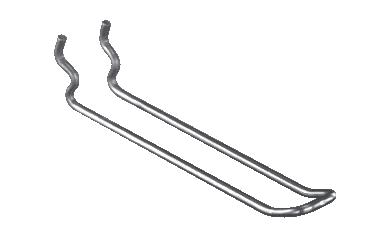

■ Anti-Sweep™ Hooks are a simple solution to multiple item theft and mass “sweeping” losses. Grants direct access by customers but deters high-volume shoplifting allowing only one product to be removed easily at a time.

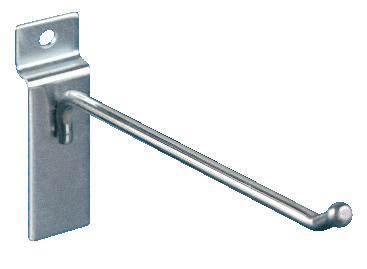

■ Your single source for a full offering of hooks for every purpose. Trion fields a complete line of Display, Scan and Specialty Hooks for any surface including: Pegboard, Slatwall, Grid, Cross Bar, Corrugated, Plastic Panel, Perforated Metal, Slatwire, Uniweb, and Flat and Rectangular Bar.

Hooks for Every Purpose

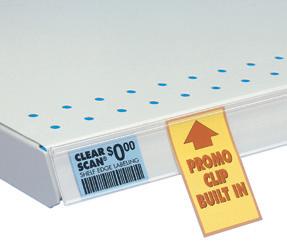

■ Easy-to-use design flexes open at a touch for fast, drop-in plain paper labeling, then automatically springs shut to secure the label in place.

■ See-through front with protective roof overhang shields your labels from dirt, spills, moisture and wear so they last longer, read easier and scan more accurately.

■ Flip-up Label Holders with flexible living hinge allows the holder to swing up, out of the way for easier product access, then fall back to vertical.

■ Built-in Promo Clips eliminate the need for separate clips. Insert your sales message instantly for a quick, cost-effective signage program.

■ Clear Scan mounts directly to all popular makes of metal, wire, glass and wood shelving. Choose from magnetic, adhesive or clip-on mounting systems.

■ Unsurpassed range of sizes, styles and lengths.

■ Clear Scan Label Holders can be ordered cooler-capable for harsh environments and freezer use.

Trion Headquarters, main plant & off-site warehouse offers a 500,000 square-foot, state-of-the-art, computerized production facility, featuring the greatest number of automated wire forming machines of any factory complex in the industry.

Trion ® revolutionized merchandising with the introduction of the first straight-entry display hook in 1965, and the first scanning hook in 1978. It has since earned over 120 United States and international patents for innovations.

Today, Trion is rated among the Top-50 North American Retail and Point-of-Purchase fixture makers and is the world’s leading manufacturer of display and scanning hooks.

An award winning website, TrionOnline offers a complete collection of product lines, including cooler and freezer merchandising systems, case studies, product test drives and more.

President Doug Anderson vows to continue the focus on the fundamentals of preventing underage access.

This year marks the 30th anniversary of the We Card Program, an initiative to equip retailers with the education, training and tools to prevent the sale of tobacco products to underage customers.

Over the past three decades, We Card — together with its retail partners — has made significant strides in reducing youth access to tobacco and vapor products, helping to build a culture of responsibility across the industry.

Convenience Store News sat down with We Card President Doug Anderson to discuss the organization’s milestone anniversary, its ongoing mission and what’s in store for September’s We Card Awareness Month.

Convenience Store News: Thirty years is a significant milestone—what does it mean to you?

Doug Anderson: We’ve seen a lot of changes in the past 30 years, but the fundamentals of responsible retailing of age-restricted products remain constant.

This 30-year commitment is a true testament to the dedication of our stakeholders — including retailers, wholesalers, manufacturers and our many supporters. Few corporate social responsibility programs can claim such longevity, and even fewer can match its sustained relevance, utility and impact on the retail industry. It’s not just been around a long time; it’s been used by both single store operators and retail chains.

CSN: Can you share the progress that has been achieved through the We Card program?

DA: More than 1.2 million We Card kits have been sent to our retail partners—90% of retail locations selling tobacco post We Card signage.

We’ve provided retailers with 4.5 million calculation tools, 7.2 million training tools and 6.1 million in-store signage materials. And we have 27,000plus monthly website users seeking tools, job , law summaries and other key information they can use to train and educate their employees and prevent underage sales.

CSN: What impact has We Card had on reducing sales to minors?

DA: In 1997, in federal government required compliance checks conducted by the states using underage decoys, the violation rate was 40%, meaning that four out of ten times, retailers were illegally selling to minors. Today, it hovers around 10%. That’s a significant achievement and well below the federal government’s 20% target violation rate.

In 2024, FDA enforcement data of 116,000 store inspections using underage purchase attempts showed retailers achieved an 85% compliance rate.

We Card helped shape a culture of responsible retailing, from establishing “carding” best practices to establishing training on how to handle a variety of customer-sales associate scenarios. Our tools, job aids, in-store signage and mystery shopping program help, but the real credit goes to retailers who have embraced our services over the past 30 years.

We offer our in-store signage and training a la carte to fit retailers’ needs — you can select a Renewal Kit or just what tools and training you need. We have our 2026 materials available by Labor Day so retailers can be ready for January 1.

CSN: Can you elaborate on the training program?

DA: September is We Card Awareness Month and we like to remind everyone about our training programs. One of the features of We Card is that we deliver more than just a decal in the store. We offer comprehensive training, including three training courses: an employee course, a refresher course and a manager course. We get constant feedback from retailer surveys so that we can stay current and make sure we offer valuable tools and what retailers need. Over 93% of We Card-trained employees rate our training as “good” or “great.”

Over 700,000 retail employees have been directly trained with our online training program. What’s interesting is that retailers tell us their trained employees go on to train an average of 11 co-workers, amplifying the reach and impact of our program. We want managers to impart their knowledge.

Retailers value our training. Ninety-nine percent of respondents report feeling more confident in enforcing age restrictions. Seventy-seven percent say they have increased confidence in denying underage sales.

That’s important because we want trained and confident employees. You have to be confident standing behind the counter and assured you know what to do when selling age-restricted products — you know what to say, how to calculate age and handle a potential social sourcing situation.

CSN: What are you doing to address social sourcing?

DA: The CDC reports in surveys of high schoolers that 79% of the time minors are getting vaping products via social sourcing as opposed to saying they bought directly in the store. While commercial access to tobacco and vaping products has declined, this social sourcing avenue of bumming, borrowing or getting someone of age to buy or give it to them remains as a big youth access problem.

We have two campaigns that address the issue of minors asking adults to purchase for them. Retailers choose one of the campaigns to run in their store, with each getting the message across that if they’re under 21, there is no bumming, no borrowing and no buying for them. We want to reinforce that buying tobacco, vaping products, or other alternatives like nicotine pouches for minors is not a responsible thing to do and that retailers will deny those third party purchase attempts.

Our signage and training job aids have been updated to include emerging forms of alternative tobacco. We have several that talk about nicotine pouches and that serves to both alert customers and reinforce the training that it is an age-restricted product.

As We Card enters its fourth decade, the mission remains clear: help retailers stay compliant, support responsible retail practices, and prevent underage access to age-restricted products — one training, one toolkit, one retailer at a time.

correct age, they are not buying restricted product on behalf of a minor. Are there underage people standing outside waiting to be given cigarettes or alcohol after the adult has purchased it and left the store? If a clerk could reasonably assume that a third-party was buying restricted products for a minor, it is possible they could be charged with underage selling, and your business could lose its license.

The challenge of age verification is becoming increasingly complicated with the sophistication of fake IDs and as society relies more heavily on smartphones to store personal information. Gen Z and millennials would much rather have all their data stored on their phone, so they do not have to carry wallets, bags or pieces of plastic to navigate the real world.

While convenience retailers don’t generally have to worry about deepfake videos, they do have a big issue regarding the verification of who is actually standing in front of them. Help may be on the way with the introduction of digital IDs that can be used on a phone.

In a recent Convenience Technology Vision Group (CTVG) meeting, we discussed the complexities of creating a digital ID. Christina Hulka, executive director of the Secure Technology Alliance (STA), gave the group an overview of what they are doing to create a national digital ID program. Without

Help may be on the way with the introduction of digital IDs that can be used on a phone.

getting too much into the details, the STA is creating a way to tokenize a person’s identity so that it is verified with a centralized registry and embedded in the phone on which it is kept. The token is unique to the phone and the person.

There would be a reader in the store that would scan the token, compare it against the database and verify whether it is legitimate. It would still be up to the retailer to determine whether the photo on the phone matches the person who’s holding it — in the same way the retailer has always had to with a physical ID — but this new technology provides an opportunity to develop more extensive loyalty programs, payment options and customer interactions. You may also have heard of TruAge, an initiative that was launched by NACS several years ago. It works the same way as the STA program does and has been adopted in several states.

The CTVG Vision Report on the meeting (available at vgnsharing.com) provides valuable insight into how digital IDs can address fraud concerns, such as credit card misuse. With a verified identification system, credit card fraud can be reduced because the payment system will reconcile whether the buyer’s ID matches the one they have for the card. If the two don’t match, the sale won’t go through.

The report also addresses the challenges that rolling out a national digital ID program face. First of all, since the United States does not have a national ID system (other than the Social Security number, which does not currently have a photo attached to it), each state has developed its own requirements for accepting and authorizing the verification of their identification cards or driver’s licenses. As you can imagine, getting approval in each state is a laborious process.

The second big challenge is getting the digital ID readers into stores. As we discovered with the EMV conversion, retailers are reluctant to make hardware upgrades unless there is a proven benefit for doing so.

One way to encourage the investment in equipment would be for state authorities to say that when a retailer uses a digital ID verification system, they are not held liable for underage selling. The benefit of not having to worry about a law enforcement sting operation or underage selling violations would be a real positive.

The other way to provide a retailer benefit is to make sure the hardware and software have an open API that integrates into legacy point-of-sale systems and other platforms. This would really unlock the value by linking digital IDs to loyalty programs, retail media networks and government benefit programs.

The effort to reduce the cost of implementing digital IDs and integrating them into other platforms has an advantage in that its application could impact multiple industries. There are all types of businesses that would benefit from a verified digital ID: pharmacies, restaurants, bars, casinos, airlines and cannabis-related retail stores. The economies of scale that go with implementing a program at so many locations should drive down the cost of hardware and encourage software companies to open up their platforms for easy integration.

At the end of the day, it is up to you to make sure that your store is operating responsibly and legally protect the interests of our underage neighbors. It is a responsibility we have to our community, and it is one that needs to be taken seriously 24/7/365. CSN

Roy Strasburger is CEO of StrasGlobal, a privately held retail consulting, operations and management provider serving the small-format retail industry nationwide. StrasGlobal operates retail locations for companies that don’t have the desire, expertise or infrastructure to operate them. Learn more at strasglobal.com. Strasburger is also cofounder of Vision Group Network, whose members discuss future trends, challenges and opportunities, and then share with all retailers and suppliers, regardless of the size of their business.

Editor’s note: The opinions expressed in this article are the author’s and do not necessarily reflect the views of Convenience Store News

“We don’t intend to be the biggest, but we do intend to be the best.”

—

Scott Zietlow, CEO, Kwik Trip Inc.

their locations and put money back into them. That, I think, is a poor strategy,” Zietlow said.

These efforts all contribute to Kwik Trip’s primary long-term goal, which is less about raising its store count than it is about raising the quality of the chain’s reputation.

“We don’t intend to be the biggest, but we do intend to be the best,” the chief executive said. “That is definitely, always a goal.”

Much of Kwik Trip’s success comes from founder Don Zietlow’s strong vision for the company and his decision to make major investments in initiatives such as the centralized dairy, kitchens and bakeries, as well as the shift to focus on foodservice in the early 2000s, long before it was common wisdom that the category was the future of convenience retail.

As chairman of the board since 2000, Scott Zietlow was “involved in every major decision in this company this century,” he said, but prior to succeeding his father, he served as a professor of surgery in the trauma, critical care and general surgery division of the Mayo Clinic in Rochester, Minn. In his post-retirement career as Kwik Trip’s CEO, Zietlow uses many of the same skills to pursue his goal of servant leadership and live up to the responsibility of leaving things better than one inherited them.

“My goal is to make everybody better and to help them in their leadership skills and development, so that everybody wins,” he said. “One of the most rewarding things I did in my prior life was train the next generation of surgeons … to become competent and caring for others.”

Pursuing a similar goal at Kwik Trip benefits the company and the people who make it what it is.

“It’s not about me, it’s about how we make

things better for the institution or the company, develop the next generation of leaders, and how we best serve our customers,” Zietlow said, recalling a familiar saying of his father. “The family needs to take care of our coworkers, and our coworkers need to take care of our guests — except do it 12 million times.”

The development of Kwik Trip’s present-day culture began around 21 years ago, according to John McHugh, vice president of external affairs, who was recruited as

a trainer around the time that the company’s “cultural revolution” began.

Inspired by a convention presentation by former Southwest Airlines Vice President of People Ann Rhoades and the airline’s highly regarded customer service, Don Zietlow became determined to create a customer service culture that was the pinnacle of the convenience store industry. At the time, Kwik Trip had a training program, but no real leadership development.

“I said, ‘Well, I’ll give you one year,’” McHugh recalled. “I was here three months and said I’m never leaving because the higher up you went in the company, the nicer the people got. I feel like it’s usually the opposite.”

Today, Kwik Trip’s hiring process looks beyond retail

“I challenge you to go to any one of our employees and say, What’s Kwik Trip’s mission statement? They’ll all be able to tell you.”

— John McHugh, Vice President of External Affairs, Kwik Trip Inc.

experience to focus on character. Three key interview questions are:

• What was the last random act of kindness you did?

• How have you made a difference in someone’s life in the last six weeks?

• Have you treated others as you’d like to be treated?

“I challenge you to go to any one of our employees and say, What’s Kwik Trip’s mission statement? They’ll all be able to tell you — it’s to treat others as you’d like to be treated, to make a difference in someone’s life,” McHugh said. “It’s the golden rule applied to business.”

The company’s modern-day leadership development includes more than three weeks of training at the Kwik Trip Support Center in La Crosse, covering “every topic under the sun in terms of leadership,” along with ongoing leadership development at the store and district levels. Executive coaching and 360-degree leadership assessments at higher levels are also routine.

As a result, Kwik Trip tends to promote internally, giving coworkers the chance to build a career, not just have a job. “It’s not

INTRODUCING A PORTFOLIO BUILT FOR THE SEASON. AND SALES.

This fall, stock the products your shoppers know and love. From the iconic depth of Guinness to the famous flavors of Smirnoff Ice, Diageo’s portfolio delivers: high-velocity performers for high-value register ring. Perfect for tailgates, football weekends, and all fall celebrations, this lineup keeps shoppers coming back —and your sales moving up. Contact your Diageo distributor for details.

REMEMBER TO ENJOY RESPONSIBLY.

very often that we hire a high-level leader from outside the organization, and partly it’s because the culture is so unique here,” McHugh said.

Beyond payment and benefits, company leadership believes that what any coworker wants — whether they work for Kwik Trip or an entirely different business — is “to know that there was a purpose to your job, that it was more important than just selling stuff to people,” he said.

“When you know at the end of the day that because of the quality guest service you provided that you made a difference in someone’s life, that gives you job satisfaction deeper than the paycheck,” McHugh continued. “When you have that kind of deep satisfaction, it inspires you to do the same thing tomorrow.”

Because Kwik Trip asks much of its coworkers, it also takes steps to give them the support they deserve. Procedures are in place to escalate the more challenging guest encounters to the proper departments rather than push everything to be handled at the store level.

“Our coworkers put up with a lot, but there’s some things that they should not have to put up with,” McHugh said. “So, when our coworkers know that we’ll support them in those difficult situations and protect them, I think that’s important in a culture like ours.”

The company always tries to resolve customer incidents calmly but at the end of the day, the customer does not always come first if they are being inappropriate or threatening. “We believe that our coworkers come first because if we don’t treat them with compassion internally, I can’t expect them to work an eight-hour shift and be compassionate to the public,” he explained.

Additional ways Kwik Trip shows appreciation are regular public recognition of coworkers and customer success stories, a more recently implemented coworker appreciation week that includes a drawing for a $5,000 bonus check plus the associated taxes, and a one-month paid sabbatical for company veterans who reach 20 years. There’s also an employee stock ownership plan (ESOP), which gives 40% of pretax profits back to Kwik Trip coworkers each year.

“I’m not aware of any other company in this country, probably the world, where that exists,” Zietlow said. “That has not changed, and we don’t intend to do that. I think it’s given everyone a sense of family ownership that’s important for our culture.”

It’s possible that Kwik Trip could grow faster without the ESOP, he admitted. “But maybe you wouldn’t, because you wouldn’t have the same quality of people and the same culture.”

The Next 60 Change is a necessary part of success, Zietlow acknowledged.

“We’re in the business of convenience. What is it you can continue to provide the customer that they want or need? And so, we’ll continue to morph,” he told CSNews

He pointed to Kwik Trip’s use of no-fee

Excellence

Honesty & Integrity

Humility

Respect

Work Ethic

ATMs as a small example of an amenity that may be leaving money on the table but cultivates loyalty because it is better for customers.

At the same time, certain aspects of Kwik Trip have not changed since the company’s founding, nor will they, according to Zietlow.

“Our goals, our values, none of that has changed. That’s kind of our true north, if you will, and that helps ground you at times with decisions about what you could or should do,” he said. “Other things that haven’t changed are the long-term strategy and vision because we intend to continue to be family owned, privately held, and that is a very good anchor.”

During CSNews’ visit to Kwik Trip’s headquarters, Zietlow highlighted one statistic in particular that makes the company stand out and makes him proud.

“Only about 13% of family-owned businesses make it to 60 years in this country,” he noted. “The goal is: How do you get to the next 60? That’s what we’re doing.”

Kwik Trip’s success is rooted in vertical integration and the determination to be the best

KWIK TRIP IS A GOLD STANDARD for quality control of its food and beverage products and their fresh distribution due to its vertical integration, which enables the retailer to operate its own bakery, dairy, kitchens, food safety lab, distribution center and more.

Today, an astonishing 80% of in-store products are Kwik Trip branded products that it makes, ships and sells.

However, in the early 2000s when the company began pursuing foodservice in earnest, it was far from a guarantee that it would become a core part of its success.

The pivot to foodservice came directly from longtime CEO and company cofounder Don Zietlow, who recognized that tobacco products were facing longterm decline.

“If Don said we were going to do something, you didn’t question it, so you didn’t doubt it,” said Paul Servais, retail foodservice director at Kwik Trip, who was a district leader at the time. “My approach was, ‘OK, what do I gotta do to make this work?’”

By around 2002, Kwik Trip had launched a high-end sandwich program. The next year, most locations had simple breakfast programs. The expansion didn’t automatically bring success, though.

“We were selling more, but we weren’t selling the numbers we felt we could,” Servais recalled. “Our waste was atrocious. Our execution at store level was mediocre at best. We still had a lot of people in the company that didn’t believe we should do it.”

80% of in-store

are

branded products that it makes, ships and sells.

So then, how did Kwik Trip go from a fledgling foodservice purveyor to its current status as the winner of multiple Convenience Store News Foodservice Innovators Awards?

“Relentless execution,” Servais shared.

Development of the foodservice district leader role was also key. Then and now, the sole responsibility of foodservice district leaders is to sell more food safely with less waste.

The role has become so important, in

in the company. Every current district leader was once a foodservice district leader, which ingrains Kwik Trip’s food culture in everybody, according to Servais.

By the mid-2010s, Kwik Trip’s prepared food offering was “really exploding,” he said. Then in 2019, it launched a proprietary fried chicken program, made fresh from raw, unfrozen chicken.

“That took our whole food program to another level,” Servais recounted. “We had a great program before, but it legitimized it to all the customers that hadn’t tried it yet

because they’re like, ‘OK, they’re frying fresh food. We know their food’s got to be quality. We know it’s fresh. It’s not just a rehydrated burger.’”

Kwik Trip’s vertical integration gave it more control over the chicken program, but it also presented the company with some challenges. “We had to basically rewrite all our policies and it wasn’t just at store level, it was at warehouse level since we self-distribute,” he explained.

Changes had to be made at the distribution center for raw product and inside semi-trucks, which include compartments for ambient temperatures, coolers and freezers. Store kitchens also had to have designated sections for working with raw chicken.

“I would not have the success in our food program that we have if we didn’t have vertical integration. There is no way.”

— Paul Servais, Retail Foodservice Director, Kwik Trip Inc.

“At that point, we were well established and we had a food safety team; we had a store engineering design team that would pretty much take anything that myself and the chef drew up and make it into a kitchen for us,” Servais said. “We had the resources to do this ourselves and that’s why it works so well for us.”

Three years into the fried chicken program, sales were “on fire,” he recalled. The introduction of fryers in every store also started “a whole new ballgame in foodservice” for Kwik Trip.

“Fry everything!” he said. “Our next best-selling group of foods has become appetizers. Cheese curds, the mini tacos, all that fried stuff. It’s comfort food. Anything cheesy is a homerun.”

Thanks to vertical integration, Servais and his team work hand-in-hand with Kwik Trip’s research and development team and production team to come up with new items.

“When we do LTOs [limited-time offers], we throw out ideas of flavors of ice cream and milks that sound nuts. ... We can do that because it’s all here,” he said. “We’re not going to an outside company saying, ‘Hey, do you want to try and take a risk and make that for us?’ We’re taking our own risk and making our own products.”

The benefits of vertical integration apply as well to production and other operations that keep things running smoothly. The retailer is vertically integrated through real estate, as well through store engineering and repairs with its own service technicians that go to the stores.

“I would not have the success in our food program that we have if we didn’t have vertical integration. There is no way,” Servais asserted. CSN

The FDA recently authorized more products, but illicit vapes remain a big problem

By Renée M. Covino

E-CIGARETTES AND VAPES are lighting up the nicotine news feed once again.

Most recently, the list of approved e-cigarettes expanded by five items in July, when the U.S. Food and Drug Administration (FDA) authorized the sale of Juul Labs Inc.'s e-cigarette device and refill cartridges in tobacco and menthol flavors.

An FDA spokesperson said the agency authorized the handful of JUUL products after additional evidence provided by the company demonstrated that the benefits to public health outweighed the risks. The FDA noted that Juul Labs “submitted robust data — including a two-year longitudinal cohort study — demonstrating high rates of adults completely switching from cigarettes to either the tobacco- or menthol-flavored JUUL products.”

After a federal ban of its products in 2022

and then a subsequent court challenge/appeal, Juul Labs said it views the recent authorizations as “a significant milestone.” The company plans to launch additional FDA applications soon.

“Over the past decade, our product design team in Silicon Valley has been working on the next generation of JUUL products to provide adults who smoke with preferred alternatives to cigarettes,” a company spokesperson stated. “[The FDA authorization] enables us to submit applications with updates to the device and pod hardware with the goal of improving the user experience.”

The company is touting its new JUUL2 platform as incorporating “a suite of innovative technology for an enhanced, more consistent vapor experience for adults moving away from cigarettes, and built-in access control capabilities to prevent underage use.” Juul Labs also said it’s developed a portfolio of adult-oriented flavors beyond Virginia tobacco and menthol to provide adults who smoke with an increasing variety of options.

“The end of smoking in America is within our grasp,” the

company spokesperson said. “Our team remains committed to our mission to make the cigarette obsolete.”

Meanwhile, it’s no secret that illicit disposable vapor products continue to flood store shelves across the country, typically targeting underage consumers with inappropriate flavors — some even identified as Bubble Gum and Rainbow Candy.

Manufacturers of illicit vape products routinely engage with customs brokers who facilitate the importation of the illicit disposable vapor products by misdeclaring shipments, according to Matt Domingo, senior director of trade external relations for Reynolds American Inc., maker of Vuse products. He also explained to Convenience Store News that illicit product manufacturers routinely under-declare the value of the package contents, thereby avoiding taxes.

Retailers remain concerned about illicit market activity around disposable vape products. While it is difficult to quantify the direct sales or volume impact, 63% of retailers surveyed this April by Goldman Sachs Global Investment Research said illicit activity has grown worse, compared to 57% who said the same in January.

Several retailers in that same survey indicated that more nicotine trips are shifting to vapor shops and/or retailers willing to sell illicit vapor products. In terms of the 2025 yearend outlook, less than 27% of retailers are optimistic about the illicit market pressures easing up. Many cite slow progress on enforcement by the FDA.

The Goldman Sachs survey, however, came out just before the FDA and U.S. Customs Border Protection (CBP) in May seized illegal e-cigarettes valued at nearly $34 million. The joint operation took place in Chicago and targeted shipments of e-cigarettes that violated the Federal Food, Drug and Cosmetic Act and intellectual property rights for unauthorized use of protected trademarks. The seized e-cigarettes were primarily imported from China and intended for distribution across the United States. All the products lacked premarket authorization from the FDA.

While there have been other CBP vape seizures, what’s unique about this one is that customs is calling out the illegal practice of misidentifying the e-cigarettes as innocuous goods, such as flashlights, according to Bryan Haynes, a partner with the national law firm of Troutman Pepper.

For the first time, the FDA sent letters to 24 tobacco importers and entry filers responsible for importing these illegal e-cigarettes, advising them that it is a federal crime to make false statements or entries to the U.S. government. The FDA is seeking information on the steps they’ve taken to ensure compliance with applicable federal tobacco laws and regulations.

“You’re continuing to see the supply of illicit products being constricted, so fewer and fewer will be available for sale in the U.S.,” Haynes said. “There’s pretty robust enforcement at the border, but what’s still missing in my mind is the enforcement efforts once products get into the country among retailers and distributors. You’re seeing warning letters, several money penalties and injunction actions, but not comprehensive actions.”

In recent public comments, both U.S. Health and Human Services Secretary Robert F. Kennedy Jr. and FDA Commissioner Dr. Martin Adel Makary provided insight into the Trump Administration crackdown on illicit disposable vapor products from China.

“We are going to wipe out the illicit vapes off the market,” Kennedy said.

“Chinese smugglers are laughing at us, and we are going to stop it,” Makary vowed.

David Spross, executive director of the

National Association of Tobacco Outlets, told CSNews that “based on these comments and recent enforcement actions, I would expect a further crackdown on illicit disposable vapor products from China.”

Retailers’ Responsibility

With the overflow of different illicit vapor products entering U.S. borders, enforcement is still struggling to keep up in real time, but that doesn’t ease up retailer responsibility.

So, what can, and should, convenience store retailers do right now?

63% of retailers surveyed this April said illicit activity has grown worse, compared to 57% who said the same in

January.

Source: Goldman Sachs Global Investment Research

As of press time, the FDA had authorized just 39 vapor products. Numerous applications remain under review, years after filing.

“It’s important for c-stores to not only be knowledgeable about the products, but also about which products can be sold, as opposed to illicit disposable vapor products which are openly marketed to youth and could be subjected to costly fines and other penalties,” Reynolds’ Domingo stated, adding that the company engages closely with retailers, wholesalers and their respective state associations on these issues.

“I would be more diligent, for sure, if I were a retailer,” Haynes advised. “While the government, principally the FDA, has not been aggressive about enforcement once these products get into the country, that could change at any time and it is reasonable to assume that given the administration’s known stance on imported goods, including imported goods from China, it would not be surprising if it directed additional resources to [this effort].”

Retailers also should be aware that in midJune, the U.S. Supreme Court ruled that marketing denial orders (MDOs) issued by the FDA can be challenged not only by the manufacturer or importer of the products, but also now by retailers who would sell such products.

“As a result, more challenges to MDOs are likely to be brought before the U.S. Court of Appeals for the Fifth Circuit, where litigants have generally had greater success to date in challenging MDOs relative to other appellate courts,” said Haynes.

This is a good thing for retailers looking to stock legitimate products on their shelves.

As of press time, the FDA had authorized just 39 vapor products (see “What’s Legal?” sidebar on page 54). Numerous applications remain under review, years after filing.

Mississippi recently joined 13 other states trying to curb illicit e-cigarettes and vapes through vapor product directory laws, also known as e-cigarette registry laws. The introduction of these bills is in response to the uncertainty around the Premarket Tobacco Product Application (PMTA) process and the proliferation of flavored disposable e-cigs on the market.

While the U.S. Food and Drug Administration (FDA) has authorized the marketing of only a few dozen products, there are still thousands awaiting responses, noted David Spross, executive director of the National Association of Tobacco Outlets (NATO).

“As a result, retailers and the public lack clarity as to the regulatory status of many products, including those for which a PMTA was never filed, those for which a PMTA was timely filed and is awaiting an order, and those for which a PMTA was denied but the application remains pending for legal reasons,” he detailed.

The new state-level legislation creates a state-based directory/registry that requires e-cigarette and vape manufacturers to submit information to state tobacco regulators regarding the FDA regulatory status of their products.

“Ultimately, for states that have passed directory legislation, state enforcement will be critical to cleaning up the marketplace,” Spross said. “Retailers need to be aware of these laws and need to be in compliance to avoid enforcement action.”

With many states actively enforcing these vapor directory laws, Reynolds American Inc. expects some positive impact. “However, not every state will have the same outcomes, and many still do not have a directory in place,” said Matt Domingo, the company’s senior director of trade external relations. “Therefore, compliant retailers must continue to take the initiative to inform local/state and federal authorities on these issues.”

Spross noted that NATO has been monitoring the state laws. “Some of our membership has been supportive of this kind of legislation to rid the market of illegal vapor products, while others believe that this legislation is unnecessary as it is the FDA’s role to review products and enforce against illicit tobacco and nicotine products,” he said.

“Providing transparency around where those products stand in the review process would be very helpful for retailers,” Spross maintained. “Additionally, FDA needs to authorize more vapor products to provide adult tobacco and nicotine consumers wider access to choices that help them successfully move down the risk continuum.”

Haynes agrees that while more rigorous enforcement is part of the solution, the other piece is to authorize more scientifically backed products.

The model for tobacco harm reduction is Sweden, according to Spross, where smoking rates are low and as a result, so is tobacco-related disease.

“This is attributable to the use of snus, a tobacco product that does not require combustion,” he explained. “While not risk-free, vapor products are also noncombustible and therefore should be used as part of a tobacco harm reduction strategy.”

Haynes is hopeful that more FDA authorizations will come before year’s end, including products in the vape and pouch space that have followed a science-based approach. CSN

As of July 2025, these are the only e-cigarette/ vape products authorized by the FDA to be sold in the United States, listed in alphabetical order by manufacturer:

Juul Labs Inc.

• JUULpods (Menthol 3.0%)

• JUULpods (Menthol 5.0%)

• JUULpods (Virginia Tobacco 3.0%)

• JUULpods (Virginia Tobacco 5.0%)

• JUUL Device

Logic Technology Development LLC

• Logic Regular Cartridge/Capsule Package

• Logic Pro Capsule Tank System (1)

• Logic Vapeleaf Cartridge/Capsule Package

• Logic Pro Capsule Tank System (2)

• Logic Vapeleaf Tobacco Vapor System

• Logic Power Tobacco e-Liquid Package

• Logic Pro Tobacco e-Liquid Package

• Logic Power Rechargeable Kit

NJOY LLC

• NJOY DAILY Rich Tobacco 4.5%

• NJOY ACE POD Classic Tobacco 2.4%

• NJOY DAILY EXTRA Rich Tobacco 6%

• NJOY ACE POD Classic Tobacco 5%

• NJOY DAILY EXTRA Menthol 6%

• NJOY ACE POD Rich Tobacco 5%

• NJOY DAILY Menthol 4.5%

• NJOY ACE POD Menthol 2.4%

• NJOY ACE Device

• NJOY ACE POD Menthol 5%

“FDA needs to authorize more vapor products to provide adult tobacco and nicotine consumers wider access to choices that help them successfully move down the risk continuum.”

— David Spross, National Association of Tobacco Outlets

R.J. Reynolds Vapor Co.

• Vuse Vibe Power Unit (1)

• Vuse Replacement Cartridge Original 4.8% G2

• Vuse Vibe Tank Original 3.0%

• Vuse Alto Power Unit

• Vuse Vibe Power Unit (2)

• Vuse Alto Pod Golden Tobacco 5%

• Vuse Ciro Power Unit (1)

• Vuse Alto Pod Rich Tobacco 5%

• Vuse Ciro Cartridge Original 1.5%

• Vuse Alto Pod Golden Tobacco 2.4%

• Vuse Ciro Power Unit (2)

• Vuse Alto Pod Rich

Highlights from the 2025 Convenience Foodservice Exchange event in Denver

A Convenience Store News Staff Report

FOODSERVICE EXECUTIVES from across the convenience store industry enjoyed food tours, store visits, top-notch speakers, one-on-one networking and more at the 2025 Convenience Foodservice Exchange (CFX), presented by Convenience Store News

Held in Denver, the 10th annual CFX event was an exclusive networking and experience-focused conference that left attendees with innovative ideas, best practices and new connections to take back to their organizations and strengthen their foodservice business.

Multiple executives from leading food-forward convenience store chains spoke at the event, as well as prominent category experts. Among the highlights were the keynote presentation on Kwik Trip Inc.’s holistic approach to culture; a powerhouse panel that delved into the generational shifts driving marketplace changes; and the presentation of new and insightful research conducted among both convenience store shoppers and retail operators.

The agenda also included the 2025 Foodservice Innovators Awards ceremony; a local history and food tour of downtown Denver; and store tour visits to c-store foodservice market leader Maverik Inc. and innovative community market Leevers Locavore.

Read on for highlights from the event.

WHAT IS THE FOUNDATION of an outstanding foodservice culture?

At Kwik Trip, it's more than what's on the menu. The La Crosse, Wis.-based operator of nearly 900 convenience stores often symbolizes its culture as a triangle, with the three sides consisting of food, the company's vertical integration and — perhaps most importantly — people.

During the keynote presentation of this year’s Convenience Foodservice Exchange, two of Kwik Trip’s directors of foodservice, Selia Kleine and Ben Wilson, discussed how the company defines a food-forward culture and how that culture has empowered the retailer to be the best it can be.

According to Wilson, foodservice has been the baseline of Kwik Trip's culture for many years — since cofounder and former CEO Don Zietlow looked at the convenience landscape and predicted that c-stores would not survive long-term focusing on gasoline and cigarettes.