FIVE STRATEGIC AVENUES ARE REDEFINING CONVENIENCE RETAIL TODAY

THE YEAR’S TOP NEW PRODUCTS

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT).

AVT reduces the likelihood of selling tobacco products to underage individuals. It’s simpler for associates to execute rather than manually entering in date of birth.

EXECUTE

The AVT system saves on transaction times.

AVT protects the future/viability of innovative products and harm reduction.

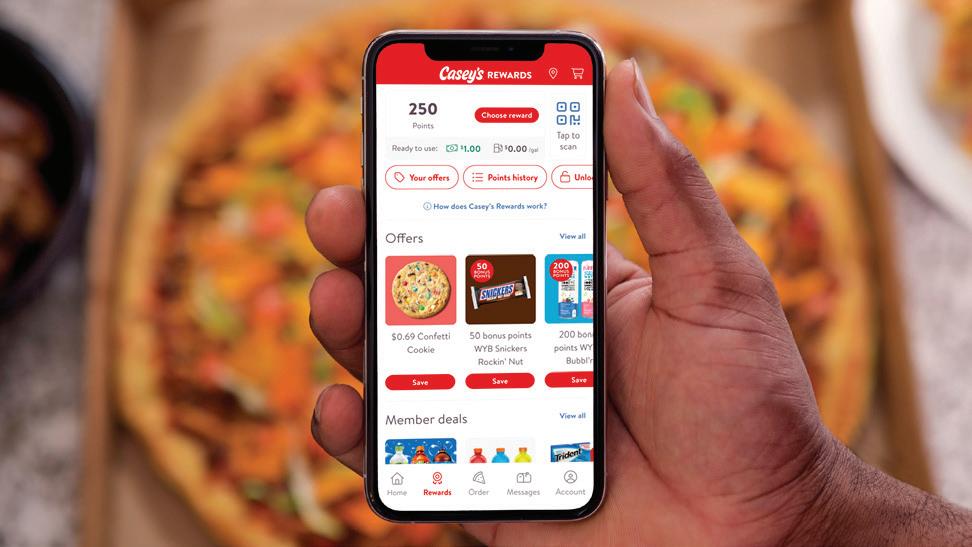

Personalization+ provides personalized value offers on PMUSA, USSTC, and Helix products to Retailers’ select loyalty IDs

Allows select loyalty IDs to receive ATOC offers right through your retailer app

Altria Tobacco P+ offers are based on ID

Altria Tobacco Operating Companies’ (ATOCs’) P+ offers are based on loyalty ID purchase history

Stackable offers with ATOC Price and offers

Stackable offers with existing ATOC Price Promotions, including multipack and loyalty offers

Personalization+ gives Digital Trade Program Tier 3 participants the ability to provide additional value on ATOC products to select loyalty IDs through your retailer app by using personalized value offerings and content.

Contact your AGDC Representative to learn how Personalization+ can help enhance the digital experience of your ATCs 21+.

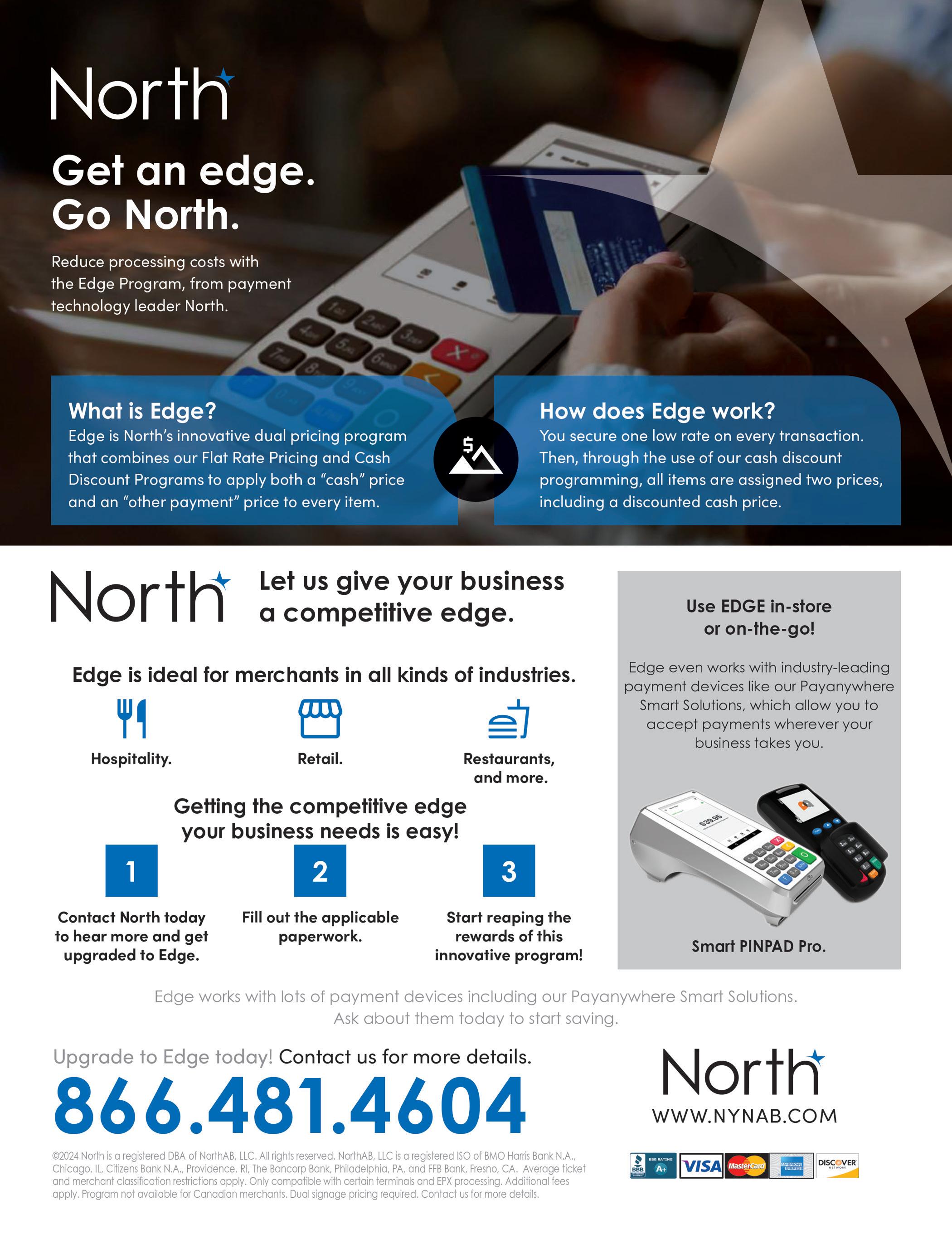

Don’t fear innovation; it’s really just a fancy word for improvement

Each year, Convenience Store News sets aside one issue as our “Innovation Issue” to spotlight the transformation and advancement taking place throughout the convenience store industry. Truth be told, though, there’s so much innovation happening right now that my fellow editors and I had a tough time narrowing down and deciding what we should focus on this year.

Eventually, we settled on this month’s special report entitled “The Innovation Roadmap,” which explores five strategic avenues that are redefining convenience retail today and poised to continue driving the industry in the years ahead:

1. The Store Experience Creating an inviting and memorable store experience for customers is top of mind for today’s convenience retailers, who are using store design, branding, products, amenities and services to captivate customers and keep them coming back.

2. Foodservice Innovation While the stigma of “gas station food” still affects the industry, there are many convenience store operators who are putting in the work to change that stereotype once and for all. The best retailers find ways to make their offerings stand out.

3. Customer Engagement — Today’s c-store shoppers expect and want retailers to build a relationship with them. Technology is at the center of delivering a

EDITORIAL EXCELLENCE AWARDS (2016-2024)

2021 Jesse H. Neal National Business Journalism Award

Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards

Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards

Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

personalized guest experience by scaling hospitality to every customer, every day, at every touchpoint.

4. Data-Driven Decision Making — There are so many sources of data available to c-store operators these days, both internal and external. Savvy retailers are using this information to do much more than see what is selling in their stores; they are forecasting for the future.

5. Workforce Optimization A happy and engaged workforce is key to delivering outstanding results. However, workers today are not afraid to change jobs, and they put a lot more value on their time and experiences, so employers must provide worth.

Where the Innovation Roadmap leads — its destination — is a better convenience store industry for both operators and customers. Changing the status quo certainly can be intimidating but, in its simplest form, innovation is really just a fancy word for improvement.

Perhaps your team is not ready to tackle the entire roadmap today, and that’s OK. Start small — think of one change you could make to improve the experience of your employees or a change you could make to improve the experience of your customers. As they say, a journey of a thousand miles begins with a single step.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Richard Cashion Curby’s Express Market

Billy Colemire Stinker Stores

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s

AS THE CONVENIENCE STORE industry converges on Las Vegas for the annual NACS Show this month, the hottest topic on the convention floor is likely going to be Alimentation Couche-Tard Inc.’s bid to acquire 7-Eleven Inc.’s Japan-based parent company, Seven & i Holdings Co.

Although the Seven & i board of directors last month rejected the Canadianbased retailer’s “friendly” offer, I don’t think we’ve heard the last of this potential blockbuster deal, which would combine the No. 1 c-store chain in the United States — 7-Eleven (12,000-plus U.S. stores) — with No. 2 Couche-Tard (5,851 U.S. locations).

If the merger doesn’t happen, watch for Couche-Tard to turn its attention to any number of other large, modern c-store chains.

As reported by CSNews.com, Couche-Tard, parent company of the Circle K brand of convenience stores, said it remains “highly focused on consummating a transaction with Seven & i that is in the best interests of all constituencies … and ensuring that the combined entity continues to be the leader and provider of premier offerings in the markets we both serve.”

Couche-Tard can be persistent. I remember back in 2010, Couche-Tard’s effort to purchase Casey’s General Stores Inc. — which at the time would have resulted in the merger of two of the largest c-store chains in the country — turned into a hostile takeover that was only thwarted when Casey’s enacted a series of poison pill defenses.

Analysts interviewed by Convenience Store News appear to suggest that even if the deal doesn’t go down now, there’s a good possibility of the merger being consummated sometime over the next 12 months. There’s even some sentiment among merger and acquisition experts that this union would be good for the industry overall. They opine that a combined 7-Eleven/Circle K national chain would bring consistency to the highly fragmented convenience channel that is comprised mostly of independents and single-store owners.

“It’s going to help the consumer because they’ll have some consistency,” Terry Monroe of American Business Brokers & Advisors, told CSNews, adding that if Couche-Tard pulls off the deal, it will bring consistency with a national offer.

I’m not convinced of that. Almost every market in the country already has a superior c-store brand at which to shop, whether it’s Wawa, Sheetz, Rutter’s, Parker’s, Kwik Trip, QT, ampm or RaceTrac, among many others. By those analysts’ line of thinking, Walmart’s growth was a boon to the mom-and-pop retail segment and Walgreens’ expansion was good for the neighborhood drugstore business.

I can’t pretend to know how this deal will shake out. There are, of course, huge antitrust hurdles in the U.S. to be overcome. One thing I can predict is that if the merger doesn’t happen, watch for Couche-Tard to turn its attention to any number of other large, modern c-store chains. After all, it has the cash and if history is any indication, the retailer embarked on a series of acquisitions following its failed takeover attempt of Casey’s 14 years ago.

Whatever happens, Couche-Tard will be an aggressive industry consolidator.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

FEATURES

COVER STORY

26 The Innovation Roadmap Five strategic avenues are redefining convenience retail today.

FEATURE

50 No Compromise

This year’s Best New Products Awards winners focus on providing value without sacrificing taste.

E DITOR’S NOTE

4 Destination: A Better C-store Industry Don’t fear innovation; it’s really just a fancy word for improvement.

VIEWPOINT

6 Couche-Tard: The Ultimate Industry Consolidator Seven & i takeover attempt likely to have long-term impact on the industry.

12 CSNews Online

22 New Products

TWIC TALK

93 Climbing Past the ‘Broken Rung’ Women should focus on four key areas to advocate for themselves in the workplace.

INSIDE THE CONSUMER MIND

114 The Health of CBD Increasing awareness and appeal could improve the category’s wellbeing.

74 Opportunity in Oral Nicotine

The category is growing fast, but still faces a perception issue with adult consumers.

80 Raising the Bar Wawa headlines the largest-ever class of Foodservice Innovators Awards winners.

86 Optimizing the Customer Experience C-stores are prioritizing consumer-facing technology to boost the quality of every visit.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455

BRAND MANAGEMENT

SENIOR VICE PRESIDENT/GROUP PUBLISHER, CONVENIENCE NORTH AMERICA Sandra Parente sparente@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

MARKETING COORDINATOR Mateo Rosas mrosas@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER

CHIEF FINANCIAL OFFICER

CHIEF PEOPLE OFFICER

CHIEF OPERATING OFFICER

A prototype store designed to serve both professional drivers and regular travelers is under construction in Hope Mills, N.C. The 8,400-square-foot store is expected to open by mid-2025 and will feature both indoor and outdoor seating areas.

Fortune and Great Place to Work’s annual list ranked Sheetz Inc. as No. 2 and The Spinx Co. as No. 9 in the large business category. The Wills Group, parent company of Dash In convenience stores, ranked No. 9 in the small/medium business category.

The rule raises the minimum age for certain restrictions on tobacco product sales to 21, in line with previously passed federal legislation. As of Sept. 30, retailers must verify with photo identification the age of anyone under the age of 30 who tries to purchase certain products, such as e-cigarettes.

The retailer’s new Jalapeño Popper Pizza turns a favorite gameday appetizer into a full entrée. The subtly spicy specialty pie features Philadelphia Whipped Cream Cheese, cheddar and mozzarella cheeses, smoky bacon, mild pickled jalapeños and a drizzle of Mike’s Hot Honey.

1 3 4 5 2

The annual McLane Engage tradeshow and conference featured a two-part education session focused on real-world application of artificial intelligence and the trends shaping next-generation convenience stores. Culinary expert and “Top Chef” personality Padma Lakshmi served as the event’s keynote speaker.

How C-stores Can Innovate Their Menus

To stay competitive with traditional restaurants and drive foot traffic, c-stores must develop unique and enticing menus that offer more than just convenience, writes Rich Products Corp.’s Amy Shipshock, culinary manager and team leader, and Tim Wiesner, culinary manager. Standing out with distinctive food choices is crucial, while adding innovative twists on core foods already available in their kitchens can create offerings that are unfamiliar yet approachable. Other key strategies include customization and limited-time offers.

How consumers perceive convenience is a major area of change, according to Intouch Insight’s “2024 Convenience Store Trends Report.” Perception of new technologies is a notable shift retailers should pay attention to, according to Intouch Insight President and CEO Cameron Watt, who discussed key insights of the report with Convenience Store News. The rising view of convenience stores as quality meal destinations is another key shift, he said, and demonstrates the need for retailers to elevate both offerings and environment.

For more exclusive stories, visit the Special Features section of CSNews.com.

Coca-Cola and Oreo, two “bestie” brands, team up to offer fans a pair of limited-time products. The Oreo Coca-Cola Sandwich Cookie includes two signature chocolate base cakes paired with a Coca-Cola taste, embossed with Coca-Cola designs, and featuring a smooth white-colored creme studded with red edible glitter. Coca-Cola Oreo Zero Sugar features a refreshing Coca-Cola taste with flavorful, Oreo cookie-inspired hints. A frozen variation of Coca-Cola Oreo Zero Sugar will be available at participating 7-Eleven Inc. locations in select markets.

By Amanda Koprowski

NEARLY FIVE MONTHS after unexpectedly closing all its locations this spring, Foxtrot Café & Market made a return to the convenience channel in September.

Its comeback began with the Sept. 5 reopening of a store at 23 West Maple on Chicago’s Gold Coast, followed by a Sept. 19 reopening at 1562 North Wells in Chicago’s Old Town.

Foxtrot shuttered its 33 locations on April 23 under former parent company Outfox Hospitality, shocking the industry, its employees and its customers. Just a few months earlier, the company had looked like it was solidifying its place in the retail sector. Foxtrot completed an acquisition of Dom’s Kitchen & Market in late 2023, creating a new umbrella entity to operate both sides of the business. Placer.ai subsequently named Foxtrot one of its top 10 brands to watch in 2024.

Behind the scenes, however, things were not quite so rosy. Foxtrot/Outfox went through two CEOs in less than a year, with Liz Williams serving in the position for eight months before leaving shortly after the Dom’s merger, and Rob Twyman only coming onboard in the last two months before the abrupt closures.

According to Mike LaVitola, Foxtrot cofounder and chairman, an investor was able to enter in the wake of the bankruptcy and pick up several of

the retailer’s assets, including intellectual property and physical locations.

“[The investor] wanted to reboot it, but there was a lot of thinking to be done, such as conversations with former employees and vendors to gauge how they were feeling about everything and their … appetite for coming back,” he told Convenience Store News. “And despite how things ended … Foxtrot was a company that was willing to take risks on new brands and give them a shot. And I think that reputation ultimately gave us the opportunity to have a second chance.”

Given this opportunity, LaVitola wanted to bring the company back to its roots. Additionally, both its cofounder and the company’s former head of operations came onboard to usher in the new Foxtrot alongside numerous other company veterans.

New offerings at the reopened stores include a ramped-up café experience with an expanded, full-day menu featuring breakfast, lunch and afternoon offerings. Foxtrot’s original breakfast tacos will remain a staple, while new foodservice options include made-fresh-daily panini sandwiches, salads and bowls for lunch, as well as an assortment of freshly baked cookies.

The reopened stores will also reintroduce customer favorites, along with a highly curated market featuring products from small and local makers, alongside innovative brands specializing in consumer packaged goods. The company is also working on a back-to-basics approach when it comes to grocery offerings and a return to storytelling as a key selling point.

Foxtrot plans to reopen more locations in Chicago and Dallas through 2025.

81% of evening meals are sourced from the comfort of home and consumed with others.

— Circana

Popular weekly snack choices include chips (39%), confectionery items such candy and chocolate (38%), and crackers (38%).

— YouGov

Nearly 80% of electric vehicle drivers report that they would go out of their way to use a public charger located in a safe environment.

— Vontier

Maverik — Adventure’s First Stop broke ground on its first two stores in Kansas. Upon the stores’ expected opening date of mid-2025, the chain will operate in 14 states.

Royal Farms marked a major milestone with the grand opening of its 300th store. Located in Millersville, Md., the new site offers the chain’s popular fried chicken and fresh, made-to-order meals, and features a modern car wash.

Fischer’s Neighborhood Markets is acquiring all Mini Mart locations in Texas. The sale is expected to be finalized by the end of October. No announcement has been made yet on rebranding post-merger.

True North Energy LLC picked up 15 feeowned convenience retailing and petroleum

The transaction, which does not include Wagner’s wholesale fuel business, closed in September.

marketing assets from Wagner Shell Co. and its affiliates in the Green Bay, Wis., market.

7-Eleven Inc. opened four new stores and two rebranded locations in July. The stores are located in California, Connecticut, Florida, North Carolina, Pennsylvania and Texas.

TravelCenters of America added four new sites to its 300-plus network: two travel centers under the TA banner, a TA Express and a Petro Travel Center. Two of the sites are in Nevada, while the others are in Cowpe, S.C., and Coburg, Ore.

Oneida Nation broke ground on a $3 million Oneida One Stop gas station and convenience store in Oneida, Wis. The store will replace the existing Oneida One Stop at the same intersection, and construction will take approximately one year.

24_009061_Convenience_Store_News_OCT Mod: September 9, 2024 10:53 AM Print: 09/16/24 page 1 v2.5

Parkland Corp. plans to divest its retail and commercial businesses in Florida. The operation includes roughly 100 retail sites, nine cardlock facilities, and four bulk storage plants and warehouses.

Rutter’s partnered with Uber Technologies Inc. to launch an on-demand delivery service for its Rutter’s Rewards customers. The service allows members to order food and products for delivery through the chain’s mobile app.

Dash In rolled out a connected retail strategy across its network. SymphonyAI will assist the retailer with optimizing shelf management and providing a consistent shopping experience.

7-Eleven Hawaii went live with a new mobile app, which offers mobile checkout, 7Rewards and 7NOW delivery. 7Rewards is available at all the chain’s 67 stores across O’ahu, Maui, Kaua’i and Hawai’i Island.

Love’s Travel Stops is offering a 10% discount to road-tripping customers at all its RV locations through Feb. 9, 2025. Love’s currently operates 70 RV locations with more than 1,300 reservable spaces across the country.

7-Eleven Inc. strengthened its commitment to bringing sustainably grown produce to its California stores. A venture with Plenty Unlimited Inc. includes high-quality, locally grown produce.

JT Group entered into a definitive agreement to acquire Vector Group Ltd., the fourth largest tobacco company in the United States. The agreement has a total equity value of approximately $2.4 billion.

This year’s program will award $200,000 in grants to 20 women entrepreneurs.

PepsiCo Inc. kicked off year three of its signature Jefa-Owned (owned by a Latina boss) program, which aims to provide business-building resources, enhance business visibility and build community for Latina entrepreneurs.

Altria Group Inc. and its operating company NJOY will dispute the initial findings of the U.S. International Trade Commission

EnsembleIQ is the premier resource of actionable insights and connections powering business growth throughout the path to purchase. We help retail, technology, consumer goods, healthcare and hospitality professionals make informed decisions and gain a competitive advantage.

EnsembleIQ delivers the most trusted business intelligence from leading industry experts, creative marketing solutions and impactful event experiences that connect best-in-class suppliers and service providers with our vibrant business-building communities.

ENSEMBLEIQ.COM

in a case that centers on a patent infringement complaint JUUL Labs Inc. filed against NJOY.

Conagra Brands Inc. is adding to its betterfor-you snacking portfolio with the acquisition of Sweetwood Smoke & Co., maker of FATTY Smoked Meat Sticks. The deal was announced Aug. 9. Financial terms were not disclosed.

Swisher International Inc. rebranded its smokeless tobacco portfolio under the historic Helme Tobacco Co. name. The smokeless division previously fell under the Fat Lip Brands umbrella and included 24 individual brands.

McLane Co. Inc. received the Service Provider of the Year award from the National Coalition of Associations of 7-Eleven Franchisees for the second consecutive year. The distributor completes almost 800,000 deliveries to 7-Eleven locations each year.

La Colombe Draft Latte Cans

Chobani continues its partnership with La Colombe Coffee Roasters with the national launch of 11-ounce Draft Latte cans.

Billed by the company as the “World’s Frothiest Draft Latte,” the new offering comes in Double, Triple, Mocha, Vanilla and Caramel flavors, and has the same creamy texture and smooth taste as the Draft Lattes on tap in La Colombe cafés. Made with highquality ingredients such as single-origin Colombian bean coffee that has been carefully selected, roasted and cold brewed, plus locally sourced, fresh milk, the product boasts 50% less sugar than typical ready-to-drink flavored coffee beverages and has a suggested retail price of $3.29. CHOBANI LLC • PHILADELPHIA • LACOLOMBE.COM

Building on the legacy of its popular Honey Stung Bone-In Chicken products, Tyson Foodservice introduces boneless tenderloins in two new flavor profiles: Original Honey and Hot Honey. Made with real honey, crispy breading and whole muscle chicken, the new offerings allow operators to serve customers without creating a sticky mess in the kitchen or on the plate. Tyson Foodservice is also introducing a new Fully Cooked Chicken Breakfast Sausage under its Jimmy Dean brand, as well as Red Label Fully Cooked Authentically Crispy Bone-In Chicken Wing Sections, both of which are designed to save cooking time.

TYSON FOODSERVICE • SPRINGDALE, ARK. • TYSONFOODSERVICE.COM

Ferrara Candy Co.’s SweeTARTS brand offers a new take on its soft and chewy SweeTARTS Rope with the launch of SweeTARTS Mega Rope. Filled with “mega” amounts of tart filling surrounded by a sweet and smooth licorice, the candy rope comes in Twisted Rainbow Punch flavor and features unique packaging. The new product is a permanent addition to SweeTARTS’ existing line of candies and is now available nationwide. SweeTARTS Mega Rope comes in a 1.32-ounce pack for a suggested retail price of between $1.49 and $1.99.

FERRARA CANDY CO. • CHICAGO • SWEETARTSCANDY.COM

Jack Daniels Country Cocktails Hard Tea

Jack Daniel Beverage Co. adds to its line of malt beverages with Country Cocktails Hard Tea. A nod to the company’s southern heritage, the hard teas debut in 12-ounce cans in four flavors: Original, Peach, Raspberry and Blackberry. Twelve-packs of all four flavors launched this spring in 13 test markets and are rolling out nationwide this fall. Additionally, the Original and Peach varieties are being offered in 16-ounce and 23.5-ounce single-serve cans nationwide.

JACK DANIEL BEVERAGE CO. • LOUISVILLE, KY. • COUNTRYCOCKTAILS.COM

New from Interface Systems, its enhanced Intelligent Voice-Down Solution is intended to integrate with its Interactive Security Operations Center (iSOC). The new solution can proactively detect individuals and vehicles loitering or behaving suspiciously by leveraging artificial intelligence enabled cameras. It then uses customizable audio messages, auxiliary lighting and sirens to alert potential troublemakers to the security presence. Should the threat persist, the system will escalate the issue to remote intervention specialists at iSOC, who can then use live video and audio feeds to assess the situation and take appropriate action.

INTERFACE SYSTEMS • ST. LOUIS • INTERFACESYSTEMS.COM

ONE Brands Reese’s Peanut Butter Protein Bar

ONE Brands, a part of The Hershey Co., is bringing “everyone’s favorite peanut butter” to the protein bar aisle with the debut of its Reese’s Peanut Butter Lovers flavor inspired protein bar. The better-for-you offering has 18 grams of protein and just 3 grams of sugar. ONE Brands is also introducing a Hershey’s Cookies ‘n’ Crème flavor inspired protein bar made with “the delightful crunch” of real Hershey’s Cookies ‘n’ Crème bits. Both new bars are now available at retailers nationwide. ONE Brands is part of Hershey’s Better-For-You strategy, which aims to ensure that consumers are met wherever they are in their journey, every single day.

THE HERSHEY CO. • HERSHEY, PA. • ONE1BRANDS.COM

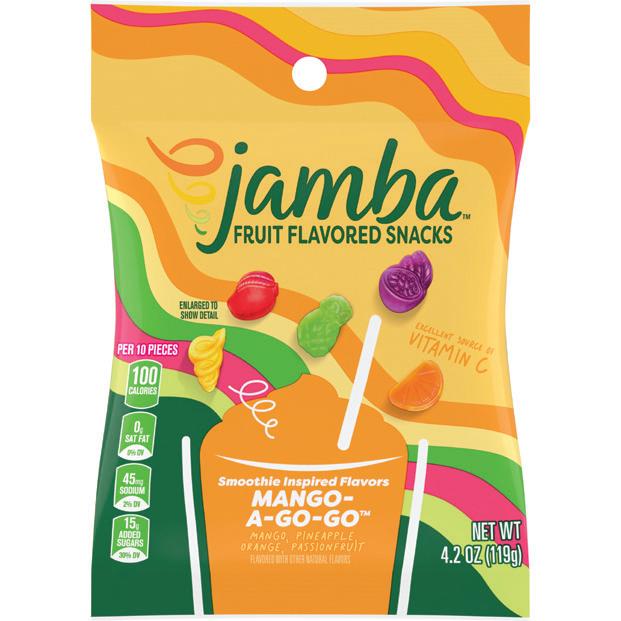

Inspired by the namesake brand’s signature smoothies, Jamba Fruit Flavored Snacks were created to appeal to convenience store shoppers looking for a fun and flavorful snack to eat on the go, according to the maker. Available in two varieties, Strawberry Surf Rider and Mango A Go-Go, each 4.2-ounce bag is 100 calories and includes five different fruit flavored snacks that can be mixed and matched. The pieces are made from real juice and provide a source of vitamin C. The offering ships in three sleeves of 12 units per case and comes with a suggested retail price of $2.89.

GENERAL MILLS CONVENIENCE • MINNEAPOLIS • GENERALMILLSCONVENIENCE.COM

BIC refreshes the Special Edition Countryside Pop Series of its Maxi Pocket Lighters. Featuring a wide variety of designs inspired by a rural lifestyle, this series is perfect for consumers who enjoy a touch of relaxing countryside simplicity in their everyday routine, according to the company. The refreshed designs are available now with a suggested retail price of $2.39 per lighter.

BIC Maxi Pocket Lighters are long-lasting, reliable and 100% quality inspected. BIC USA INC. • SHELTON, CONN. • US.BIC.COM

Baby Bottle Pop Twisters

Bazooka Candy Brands debuts Baby Bottle Pop Twisters, a new offering in its Baby Bottle Pop portfolio. Available in four flavors — Strawberry, Watermelon, Blue Raspberry and Berry Blast — consumers can enjoy the experience of twisting, flipping and shaking out the candy from the refillable and reusable bottles. The multitextured candy comes with a crunchy outer shell that surrounds sweet, chewy candy and a pop of sour powder at the core. Baby Bottle Pop Twisters will be available for retail in spring 2025.

BAZOOKA CANDY BRANDS • INDIANAPOLIS • BAZOOKACANDYBRANDS.COM

Dencar Technology presents the Right-Height Pay Station, a car wash pay station that uses face-identification technology to read the driver’s location and automatically adjust up or down for a comfortable transaction. Whether customers are in a high truck or a low-to-the-ground sports car, the pay station will adjust to ensure drivers of pickups, vans and large SUVs won’t need to stretch halfway out the window to reach low buttons, while drivers of lower-profile vehicles won’t need to reach over their heads, according to the company. The Right-Height Pay Station also includes a middle “standard” setting for drivers not at either extreme.

DENCAR TECHNOLOGY • AKRON, OHIO • DENCARTECHNOLOGY.COM

The latest everyday flavor from Game Leaf is made from tobacco that’s aged a minimum of twelve months, to create the darkest leaves on Earth.

BY MELISSA KRESS, DANIELLE ROMANO & TAMMY MASTROBERTE

THE COVID-19 PANDEMIC set off an innovation race in the U.S. convenience store industry, and the pace of innovation has not hit the brakes yet. The speed of change in the industry continues to accelerate as c-stores must keep up with evolving customer needs and wants.

Falling behind can be especially detrimental in the convenience channel because c-store shoppers make a habit of visiting their preferred store. One of the findings of the 2024 Convenience Store News Realities of the Aisle Study, which surveyed 1,500 consumers who shop a c-store at least once a month, is that 84% typically shop at the same location for every c-store visit.

While the innovation roadmap may be slightly different for each convenience store operator depending on their resources, customer base, operating area and competition, there are common mileposts along the journey to becoming a preferred destination for c-store shoppers.

In this special report, Convenience Store News explores five strategic avenues that are redefining convenience retail today and poised to continue driving the industry in the years ahead:

The customer journey begins from the minute a shopper pulls into the parking lot.

Captivate and keep customers coming back with engaging environments

CREATING AN INVITING and memorable store experience for customers is top of mind for today’s convenience retailers, who are competing not just with each another, but also against quick-service restaurants, coffeehouses, drugstores, big-box locations and more. C-store retailers are using store design, branding, products, amenities and services to captivate customers and keep them coming back.

At Global Partners LP, which operates nearly 300 company-owned convenience stores, including the Alltown and Alltown Fresh brands, building a new location, or renovating or refreshing a store, starts with understanding the customer’s journey through the store from the minute they pull into the parking lot, according to Laura Derba, senior vice president of retail operations at the Waltham, Mass.-based company.

“The retail landscape has become so competitive these days that customer expectations have reached new highs when it comes to in-store experiences,” said Joseph Bona, president of Bona Design Lab Inc., based in New York. “This has created opportunities for retailers to add personality and storytelling to the store environments to personalize their brands and connect with consumers on a more emotional level.”

Depending on what a retailer wants to highlight or focus on, they can use branding and design to tell that story and differentiate themselves from their competition. While most operators compete on price and speed of service, design can separate them from others, according to Bona.

“We look at what they see, what it says to them and what they can be excited about,” she said. “We want it to feel comfortable and easy to navigate, and when they walk into the store, it’s about what they see, what the look is, how they will feel and if

the flow makes sense.”

Joseph Bona, president of Bona Design Lab Inc., based on, they can use branding and design to tell that story

The store experience will differ depending on the location and the customers who frequent it. A site with a lot of commuters who want to get in and out requires a different experience than a suburban site with a lot of dinner traffic where customers tend to have more time. Knowing this allows Global

the location and the customers who frequent it. A out requires a different experience than a suburban

“A running shoe is a running shoe until you add a swoosh or three stripes and then it becomes a Nike or Adidas,” he explained. “Such is the same in retail. A set of cooler doors are a set of cooler doors, but once you cross the threshold and enter the store, storytelling through design is how great retailers change the focus from impulse behavior to becoming a mission-driven destination.”

“A running shoe is a running shoe until you add a swoosh behavior to becoming a mission-driven destination.”

Partners to draw out footprints and design each store experience to meet the customer’s expectations, noted Derba.

“It’s never only about what fixtures are used, what color the walls are painted or the style of graphics that deliver the marketing messages,” echoed Bona. “It’s how the store environment comes together in a seamless experience that feels authentic and relevant to the target audience.”

No matter the location, Global Partners makes sure there are easily identifiable brand elements, coupled with things that reflect the different customer and community. “There are elements that show up as familiar even if the interior layout is different,” said Derba. “You get the same look, feel and welcoming when you walk in the door.”

For example, there will be the same fixturing and small touches such as signage, color palettes and “soft touches” that convey the brand no matter what size the store is or where it’s located, according to Joanna Linder, vice president of marketing at Global Partners.

“Also, the role of technology and how we incorporate

that lends to the brand and store experience, including digital menuboards, kiosks and self-checkout,” Linder said.

The products, services and amenities a convenience store offers also lend to the overall experience and can be used to convey the overarching message of a brand.

“Our offerings vary not only by the type of store — whether commuter, suburban or urban — but also the size of the store,” Derba pointed out. “The highest category customers look for is fresh, so we have made-to-order food, and the bigger stores have seasonal components, supplies from local farmers, and the foodservice concept is focused on local.”

The bigger the store, the more Global Partners is able to highlight fresh and local, including perishables and small service bakery where team members bake fresh products in the morning. In fact, the retailer plans to venture more into perishables in 2025, including dairy, produce and even flowers — with the goal of supporting local businesses in the community.

Revitalize displays and boost sales with Pole Star® Spinner Displays

Retailers can create numerous revenue-generating impulse buy stations in high-traffic areas that can accommodate a variety of merchandise. The Pole Star® Spinner Display features a streamlined design to reduce setup and install timeswith various merchandising options available to hold different product packaging types and sizes.

The Pole Star® Spinner Displays are perfect for boosting category sales inimpulse areas near checkout lanes and throughout convenience stores, withproducts such as gift apparel, snacks, candy, toys, and more.

“We will ground ourselves with local, artisan products and small producers in the communities we serve,” Derba said. “Hospitality is another big piece of our stores because we want customers to feel engaged and excited about the opportunities through customer service. That could be suggesting new items that are in season or something they have not seen.”

Global Partners has four pillars they operate on — hospitality, local, fresh and community — and the retailer uses branding, design and offerings to convey these pillars throughout each store. Customers have come to expect these pillars from the brand, but the goal is to also surprise and delight them, according to Derba.

“A running shoe is a running shoe until you add a swoosh or three stripes and then it becomes a Nike or Adidas. Such is the same in retail.”

— Joseph Bona, Bona Design Lab Inc.

“Leaning into 2025, the goal is to make our stores a place that is fun,” she said. “The stores often look the same 365 days a year and don’t have a lot of seasonality. We want to bring our stores to life with a personality that is fun and brings people a smile when they see something unexpected to enjoy.”

Foodservice and beverages continue to dominate the c-store space and design is often used to elevate expectations, Bona noted. These areas of the store are becoming even more prominent, whether through enhanced visibility with open kitchens or adding drive-thrus.

“When trying to emphasize foodservice, it starts with layout and design, and knowing the customer journey to see where to place it in the store and elevate it,” he said. “If you are focused on fresh ingredients and prepared onsite, you might have an open kitchen. If you are more about efficiency, you might have digital menuboards or touchscreen ordering.”

While some customers make a habit of stopping at their local c-store often, there are many who stop unexpectedly because they need or forgot something. While it’s important to get them in and out quickly, it’s also important to provide an experience that brings them joy so they return, said Linder, Global Partners’ marketing lead.

“We want to put a smile on their face and give them something different and memorable where they think, ‘I would go back there if I need something next time,’” she said.

Successful foodservice programs are not exclusive to larger chains

WHILE THE STIGMA of “gas station food” still affects the industry, there are many convenience store operators who are putting in the work to change that stereotype once and for all.

The best retailers are focused on quality ingredients and made-to-order options that always give the customer just what they want, according to Jessica Williams, founder and CEO of Food Forward Thinking LLC, who previously led fresh food product development at Thorntons Inc.

When thinking about those in the convenience channel that do foodservice well, images of Media, Pa.-based Wawa Inc.’s hoagies, Ankeny, Iowa-based Casey’s General Stores Inc.’s pizza, and Irving, Texas-based 7-Eleven Inc.’s dispensed beverage program spring to mind. However, successful foodservice programs are not exclusive to larger chains.

Derek Thurston, director of foodservice operations, told Convenience Store News, explaining that the category breaks out into three main segments. “Our beverage bar offers a variety of fresh brewed coffees, teas, lemonades, cold brew and slushies. We also offer our full-service deli, which has made-to-order subs, wraps and melts, and we have our pizza areas where we do pizza slices as well as whole pies.”

“Strong foodservice is perhaps more attainable for a chain with fewer stores than larger chains, actually. My advice is to pick one thing — whether it’s burritos, pizza, chicken, pies, cookies, a local favorite — but just one. And do it very, very well,” Williams said.

Case in point is Marcy, N.Y.-based Clifford Fuel Co. and the company’s Cliff’s Local Market chain. With 22 convenience stores, the small operator thinks big when it comes to its food offer.

“We have a robust, full-scale foodservice program,”

Cliff’s Local Market traces its roots back to Nice N Easy Grocery Shoppes, which went through a series of changes when it was acquired by San Antoniobased CST Brands Inc. in 2014 and again when Laval, Quebec-based Alimentation Couche-Tard Inc. acquired CST three years later.

“When I joined the company nine years ago, we branched out to become Cliff’s Local Market,” Thurston recalled. “I feel like we still have some of that Nice N Easy DNA in our brand. We’re doing our own thing now, but Nice N Easy had such a great program to build off. We’ve established such a strong brand on our own, but occasionally you’ll hear someone go, ‘Oh, my God, they’ve got Nice N Easy food.’”

Not only is foodservice part of the chain’s roots, but it also plays a key role in its future.

“When we build a new store, it is very food-focused. Our design is to really have a strong foodservice presence, so we build out our pizza area, our deli area and our beverage bar,” Thurston added. “I work closely with the design team, and we set it up to be operationally efficient. Everything flows perfectly through right up to the front register where customers get cashed out.”

Innovation in foodservice comes in many forms, from dayparts to flavors to limited-time items.

Limited-time offers (LTOs) are proving to be a big hit with customers at Cliff’s Local Market stores in upstate New York. Currently, the c-store chain is embracing all things pumpkin with pumpkin parfait, pumpkin muffins, pumpkin coffee and pumpkin cappuccino among its seasonal offers.

“We’re very LTO-focused, and we do them once a quarter,” Thurston said. “Most of them work, but at times you have things that fall flat. … You’re going to have misses if you try it.”

For instance, the retailer paired a stuffed churro with a chorizo burrito with mixed results. The chorizo burrito did great, but the stuffed churro did “just OK,” he said.

On the other hand, its Three-Meat French Stack, which consisted of two slices of French toast, American cheese and ham, bacon and sausage, performed extremely well. “We did awesome. … That was one of my best LTOs,” Thurston reported.

Cliff’s Local Market brings back LTOs that resonate with its customers. For example, the chain last year tested a summer salad with spinach, goat cheese,

candied walnuts, blueberries and strawberries that did well. This year, it performed great, so it will return next year.

In 2025, Thurston plans to bring brisket-style smoked turkey to the menu — a product he is very excited about given the popularity of turkey in the chain’s operating area.

“We’re in the Northeast and probably 30% of every sandwich that goes out the door has turkey in it,” he shared. “Turkey is very, very popular in our region and this was probably the first time I’ve seen some kind of innovation in turkey.”

With the rise of made-to-order food, made-to-order beverages are also coming along at the same time, Williams pointed out. This is a new platform for many convenience retailers.

“Beverages, in fact, primarily drive the decision to purchase food in many cases, so wherever there is made-to-order food, watch for made-to-order espresso and energy beverages,” she said.

Additionally, when made-to-order is not the best fit for a retailer, self-service beverage areas can offer some of the same customizable ingredients and upsell opportunities, such as cold brew, flavored syrups and creamers, she advised.

Some other foodservice innovation recommendations from Williams are:

• Brainstorm ways to make your unique platform stand apart.

• Look for cooking and holding equipment that results in the very best version of your unique item.

• Be sure to consider how to make the packaging work well for your product and for the customer carrying it away.

• As the majority of dispensed beverages are now sold cold, look for iced and frozen options to dominate when it comes to beverages.

Rutter’s aims to deliver a quality and consistent experience across its network of 80-plus stores.

Technology has created multiple paths to build a relationship with customers

IN THE CONVENIENCE CHANNEL, everything begins and ends with the customer experience.

Elements of a shopping experience that might have once been considered “nice-to-haves” have evolved into “must-haves.” This means a quality and consistent shopping experience through both physical and digital touchpoints.

“Convenience retail leaders have advanced their engagement capabilities significantly in recent years,” remarked Mike Templeton, vice president of digital strategy for NexChapter Inc., an Iowa-based convenience store strategic advisory firm. “Loyalty programs have opened up customer understanding, customer data has enabled targeted messaging, and mobile apps have wrapped all these capabilities into a package that customers prefer. The path to building a relationship with customers has never been more clear.”

Today’s c-store shoppers are not only open to interacting with retailers digitally but, in many cases, they expect it. Technology continues to be at the center of delivering a personalized guest experience by scaling hospitality to every customer, every day, at every touchpoint.

served as head of digital at Casey’s General Stores. “Years ago, few retailers were investing in rewarding their customers, so consumers took advantage of the value they could find. Today, there are many choices to consider with compelling value propositions, leading to a much more discerning shopper.”

York, Pa.-based Rutter’s, which operates convenience stores in Pennsylvania, Maryland and West Virginia, always wants to know the customers it is trying to reach. Shoppers in many different need states visit Rutter’s more than 80 c-stores at any given time, so the necessity to understand those consumers and tailor communication accordingly is paramount.

“Based on the prevalence of loyalty programs at retail and the resulting information being shared by participants, customers are demanding relevance from the value exchange,” said Templeton, who previously

“Utilizing loyalty data is a great way to improve interactions and have the best chance for success, which is something we’ve focused on in recent years,” said Chris Hartman, vice president of fuels, advertising and development at Rutter’s. “For example, trying to sell a coffee drinker a noncaffeinated drink in the morning will likely fall flat, but a deal that pairs that coffee with a breakfast item gives us the opportunity for growing the basket in the short- and long-term through trial and habit adoption.”

s rch indic t s th t 75% of consum rs h ri d s lf-s r ic b r g s li off n int n to o s g in hil % b li h t con ni nc tor off tch s th u lity of c f off . P opl ly on con ni nc tor s for coff n sp ci lty rin s, m in r t s lf-s r ic off rogr m cruci s ch nn ls blu n consum rs xp ct high-qu lity coff h r r th y go. Do s your coff rogr m m t consum xp ct tions? Th 1000 FLEX off rs th st of bot orl s, pro i ing tr ition lly br coff n spr sso b r g s, hot or ic ll in on chin . ith f tur s li ol - t r Byp ss for ic rin n t nt Br Unit sign for both coff n spr sso nsur s p rf ct b r g s ith customi tion, consist ncy n qu lity in s con s—m tin ll your consum rs’ n s!

Better personalized interactions have become a customer expectation, and technology has become a huge part of providing a personalized guest experience. Loyalty programs have given retailers the data needed to provide that personal touch.

“We’re now able to direct specific offers to specific consumers, which improves the redemption rate significantly,” Hartman pointed out.

Successful customer engagement also means engaging customers on their terms. Last spring, Rutter’s heeded the call for online ordering, rolling out the service to Rutter’s VIP Rewards members, who can now order food online or through the updated Rutter’s mobile app, and then skip the line in-store.

Last month, the convenience retailer amplified the Rutter’s VIP Rewards program by launching ondemand delivery through a partnership with Uber Technologies Inc. The program enables members to order food and products for delivery via Rutter’s app.

“Our business is convenience, and what’s more convenient than having your favorite Rutter’s items delivered right to your front door or office?” Hartman

posed. “We believe in giving customers the best options to get the products they need to get throughout their day. Partnering with Uber is another way for them to enjoy our wide variety of options by ordering directly through our mobile app.”

The way Hartman sees it, innovation is the ability to think differently and challenge the status quo with the intention of creating new opportunities for sustained growth. He said Rutter’s embraces the challenge to innovate and diversify outside of traditional c-store categories.

“Utilizing loyalty data is a great way to improve interactions and have the best chance for success, which is something we’ve focused on in recent years.”

— Chris Hartman, Rutter’s

“Whether it’s through alcohol, gaming or food, we’re always trying to be at the forefront,” he commented. “I believe there is a desire throughout the industry to innovate, too. The biggest mistake I see is fear of failure. However, those who embrace trial and error in the right way will continue to lead the pack.”

The convenience store industry has been built on the back of innovation, according to Templeton, who points to innovation keeping customers engaged and keeping retailers relevant.

“What I’m excited to see today is the nearly limitless ability to bring new and creative ideas to life. Some of my favorite innovations are when someone borrows a concept from another industry and then applies it to their own business in a way that’s unique to their customers,” he said. “If a retailer can dream it, the tools are now available to enable them to do it.”

The NexChapter executive sees artificial intelligence (AI) playing an important role in advancing the automation necessary for scaling digital customer engagement.

“AI should help marketers do the things they’ve always done — present compelling messaging and relevant offers — but do it much faster, with greater accuracy and fewer interventions required,” Templeton said.

WARNING: Cigar smoking can cause lung cancer and heart disease.

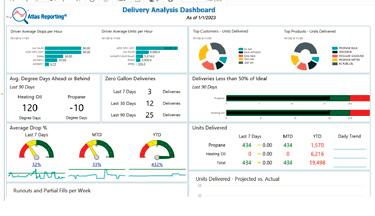

Combining internal and external data helps retailers boost the bottom line

WITH YEARS OF SCAN DATA, coupled with loyalty program data and all the other sources convenience retailers have of collecting and accessing data — including vendors and research companies — making profitable decisions is easier now than ever before. It’s also more necessary than ever before in order to stay competitive in today’s market.

“Today, data is king,” said Ed Burcher, a partner with Business Accelerator Team, a convenience retailing consultancy based in Phoenix. “The availability and use of data is needed today at all levels of retail, including operations, promotions, category management, and support departments such as real estate and finance.”

Gone are the days of making decisions based on “a gut feel and observations,” he said. Those who have embraced data to improve operations continue to thrive and grow faster.

There are so many sources of data for c-store operators today, both internal and external. Pointof-sale (POS) systems, backoffice systems, loyalty programs, fuel pumps and more provide a tremendous amount of data to help retailers make decisions around sales, labor, product assortment, promotions, planogramming, etc. Most retailers combine their internal data with external sources, such as vendor data and research companies like IRI and Nielsen.

Along with gathering data, c-store operators must

decide how they want to use the information and then find ways to interpret what they collect. On a basic level, most companies are using transactional data to understand sales and predict what to reorder, as well as to schedule labor depending on sales, daypart and more, according to Burcher.

“It is important to know what questions you want answered, as this drives how you will organize and use this information,” he explained. “I’ve helped companies design and implement dashboards, scorecards, KPIs and benchmark reporting that not only helps in day-to-day operations, but can also be used at the strategic level, including new markets, new offers and businesses to enter and exit.”

“I don’t think I recall data ever not being important because it’s always been the key before we make a move, but data is a lot more enhanced now than what we were used to in the past,” observed Pervez Pir, president of retail at Loop Neighborhood Market, the Freemont, Calif.based operator of 135 convenience stores.

“Our POS and pumps are collecting data,

so we know every transaction and then, our loyalty program through our app is capturing data, including how long they stay on a page and what they are clicking,” he explained. “The key things are retail dollars — but you are looking at units because that justifies if you are really moving the needle — as well as basket size and frequency.”

Loop also prioritizes loyalty data because it “really lets you look at behavior patterns, and we look at it on a granular level such as frequency, basket size, what customers are buying, when they shop, and to understand the promotions to offer them,” Pir said.

“The availability and use of data is needed today at all levels of retail, including operations, promotions, category management, and support departments such as real estate and finance.”

— Ed Burcher, Business Accelerator Team

Before loyalty data, retailers were basing marketing on POS and pump data, creating generalized offers on energy drinks, soda and other popular items. Now, with the inclusion of loyalty, he said they can drill down into data to see what each person is buying and target products to them.

“We are doing that right now with a campaign where we have five offers available and when a loyalty member punches in their phone number, they get a targeted message for either an energy drink, water or one of the other options based on what they purchased,” he said.

The retailer also looks at data on promotions to measure success, along with “affinity products” to see what items are purchased together, so they can make decisions on new possible promotions. “We look to see what program worked and what didn’t based on units, as well as affinity and frequency,” Pir explained.

Loop, like many other retailers, looks at external data as well. The chain uses IRI, Nielsen and vendor data, especially for merchandising. They look at the portfolio for vendors to see how each category is doing as a whole and how their stores are performing compared to the competition. This data is reviewed at least quarterly, if not every two months.

“This could highlight an opportunity where there are things we are not taking advantage of, [where we]

should be testing things, as well as if an item is not selling with us, but is selling well with others,” Pir added.

Data also can be used for labor scheduling, and in predictive ways for product launches, seasonal events and promotions, according to Burcher. “Data can help with product-test analysis to know what is working and what is not to maximize results across an organization,” he said.

Technology continues to advance when it comes to analyzing the mountains of data convenience store companies are able to collect these days. Proprietary and vendor-based solutions can help to organize and collate the data so that information can be pulled out and implemented to drive profit, whether for new items, promotions, events or restocking.

Savvy c-store retailers are using data to do much more than see what is selling in their stores. They are forecasting for the future and using AI to take learning to the next level.

“There are many ways that using predictive data and analysis can help a company,” said Burcher. “In a tactical way, it can help with scheduling promotions, events, seasonality and other factors. It’s most valuable when the data and the insights gleaned from it can be used to anticipate behavior.”

In addition, predictive data and analysis can be used strategically to understand customer behavior and enhance customer experience. For instance, Loop created a proprietary tool called Right Sense that is based on trends and patterns. The retailer uses it to predict sales at current stores, as well as to predict sales in site selection, according to Pir.

“Right now, we started with food to predict based on sales and waste to see what would happen the following week and how much to order based on trends and patterns,” he explained.

When it comes to AI, the industry is just beginning to scratch the surface of what’s doable.

Loop currently utilizes AI at the operational level. For foodservice, the company might look at which store had the largest waste the day before, or what is the best-performing store for chicken wings. The chain mostly uses internal, proprietary technology, but also leverages tools such as Microsoft Power BI and Tableau business intelligence software.

“How we process the data has changed completely. Before, you used to pull reports by data and parameter and now, there is more live data being streamed so we can see something within two or three minutes of it happening rather than waiting for the day to close,” Pir said. “Now, we can make changes throughout the day if we are not hitting our numbers. We didn’t have that level of data 15 or 20 years ago.”

Nouria’s objective is to have a happy and engaged workforce.

Valuing employees goes a long way in delivering a superior customer experience

WHEN ONE THINKS of workforce optimization, the first thing that comes to mind is likely technology. From self-checkout to artificial intelligence, there are many tech-driven solutions retailers can utilize to operate a convenience store efficiently in a challenging labor market.

“If you never ran a register for five minutes, let alone eight hours, it’s pretty taxing,” said Peter Rasmussen, founder and CEO of Convenience and Energy Advisors, a consulting firm based in St. Petersburg, Fla. For this reason and others, he is a proponent of self-checkout. From a customer perspective and an employee perspective, self-checkout offers a better experience all around — if done correctly, according to Rasmussen.

Giving an employee the ability to help the customers who want to be helped and then do other things instead of standing behind a register saying the same thing over and over all day long “has a measurable impact on turnover,” he pointed out. “I think that’s really huge when you think about workplace experience.”

they want to do and are more empowered.”

Casey’s did a systemwide rollout of AVA (Automated Voice Assistant), a conversational AI voice ordering system powered by SYNQ3 Restaurant Solutions’ SYNQ Voice technology. AVA enhances the ordering experience for customers by answering every call, providing convenient reorder options and processing new orders in a natural conversational interaction.

“I think any investment and innovation where you can just take out jobs that other people don’t want to do can be really magical,” Rasmussen said.

Nouria Energy Corp., the Worcester, Mass.-based operator of approximately 170 convenience stores, also believes in being a company that truly cares for its employees and invests in making their workplace experience the best it can be.

Rasmussen pointed to Casey’s General Stores as a convenience retailer that has done a good job of enhancing its employee experience. The chain has reduced same-store labor hours for eight quarters in a row. “You think it must be taxing for the employees. No, the turnover has gone down and their Gallup engagement scores are going up,” he said. “They attribute it to pulling out jobs from the store that people don’t want to do. Employees can do more things that

“We look at simplifying the jobs at the store level, making sure the task, the project, anything our people do, is well thought out before we implement it in the

stores,” said Chief Operating Officer Joe Hamza. “There are ways to make anything more efficient, whether by using more technology or by just making sure that you thought through whatever program you’re trying to execute.”

Nouria does have self-checkout in its stores, and the objective is to “enhance the convenience of our customers and improve the work conditions for our people,” Hamza said. “With self-checkout, our people now have more slack to do other things that are either customer service-oriented or learning and trainingoriented tasks that could actually lead to higher productivity than transacting with somebody at the register. … Payroll is very expensive these days and it would be nice to cut back on payroll, but that’s really not the objective.”

At Nouria, value is more than just what the retailer can offer its customers; it is a key part of the company’s employee proposition as well.

“Our company really prides itself on being a place where employees feel valued, respected and empowered to do the best job they can. The culture is built around the foundation of mutual respect and open communication with us and with our team members,” Hamza explained. “We have a philosophy — and I’m sure many companies feel the same way — [that] a happy and engaged workforce is really key to delivering outstanding results. Everything that we plan, that we put in place is based on that philosophy and based on those foundations in terms of workforce innovation.”

One avenue for keeping employees engaged is through town hall meetings hosted by Nouria’s Founder and CEO Tony El-Nemr. In addition to addressing new employee programs, these meetings offer team members the opportunity to ask El-Nemr questions on anything from wages to issues and challenges.

“We believe the basis of any good engagement is communication, having that open communication and consistent communication with who we call frontline heroes,” Hamza said.

The convenience retailer also offers its team members discounts and free products through a dedicated employee mobile app, which keeps them updated on new programs and offers.

“There are also things we do on a store-by-store basis. For example, store managers have things like a pizza party or a luncheon in their stores,” Hamza said. “Our people are No. 1. We want people to have fun in what they do, but also we want them to feel that they belong to a company that really cares for them and wants them to succeed.”

Today, people put a lot more value on their time and their experiences, Rasmussen observed, so employers must find ways to provide that worth.

“Our company really prides itself on being a place where employees feel valued, respected and empowered to do the best job they can.”

— Joe Hamza, Nouria Energy Corp.

“Gone are the days when someone works for General Electric for 40 years and gets a gold watch. People change jobs now. That used to be called job jumping, but now it’s the pursuit of happiness, or if I’m not going to get promoted, let me work somewhere else, or maybe I can have more flexibility somewhere else,” he explained.

At the end of the day, a convenience store’s operating model has become more expensive — wages are higher and costs have increased — making it harder for retailers to make the multiple they need to reach to be successful, according to Rasmussen.

“It’s not about cutting hours, but it’s about having the right people paid their worth, and [they] can do more things they want to do and don’t have to do taxing things that may make them think, ‘Maybe I should just work somewhere else,’” he said. CSN

A 17-year-old hangs outside the local convenience store waiting for an older adult to agree to buy him cigarettes.

When a shopper with an expired ID was denied a purchase, she turned to her 21-yearold friend to buy her oral nicotine pouch.

A 20-year-old pressures his buddy, a cashier at a busy store, to sell him cigars and a sixpack of beer.

These real-world scenarios, where legal-age adults purchase age-restricted items for minors, are all too common in retail stores.

To address this growing concern, The We Card Program launched a campaign in 2022 focusing on the issue of social sourcing. The social sourcing efforts continue to be at the forefront of We Card’s efforts.

“We’ve come a long way since we launched,” says Doug Anderson, president of The We Card Program. “We shipped 30,000 of our free kits to retailers across the country. We’ve reached a good part of the market, but we see even greater potential. One illegal sale is one too many, and the same goes for social sourcing.”

We Card’s Social Sourcing initiative mirrors the signage and educational materials that helped retailers curb the underage sales rate of tobacco products from 40% in 1997 to 10% today.

The social sourcing campaign is not a replacement for the existing We Card program, but rather an add-on to help retailers address the growing issue.

“Our efforts have helped retailers reduce underage commercial access, but social access is a growing problem,” says Anderson. The introduction of new nicotine products like e-cigarettes and pouches makes addressing the social sourcing issue of greater importance.

According to a 2021 Youth Risk Behavior Study, 80% of minors who obtained electronic vapor products did so through social sources—almost 55% from a friend, family member, or someone else.

We Card offers two impactful retail store awareness kits to address this issue. The first campaign, “Be A Real Influencer,” asks young adults aged 21-plus to be “a real influencer” by confidently saying “no” when asked by someone underage to purchase tobacco or vaping products.

The second campaign, “We Card We Care,” emphasizes that retailers care and offers straightforward wording: “If they’re under 21: NO Bumming. NO Borrowing. And NO Buying for Them.”

Both campaigns include a variety of in-store signage with a QR code call-to-action to learn more and demonstrate support for the campaign.

In addition to the kit, We Card provides training on how frontline employees should deny purchase attempts where minors ask those over 21 to buy tobacco or other agerestricted products for them.

Beyond reducing illegal sales to minors, store patrons appreciate retailer efforts to take leadership roles in their communities. “And retailers appreciate our efforts to help them train their employees on how to responsibly sell agerestricted products. We are excited that retailers are stepping up to address social sourcing, and we will continue to provide impactful tools to help,” Anderson adds.

Both Social Sourcing campaigns are available now, and retailers are encouraged to sign up and participate throughout 2024 and beyond.

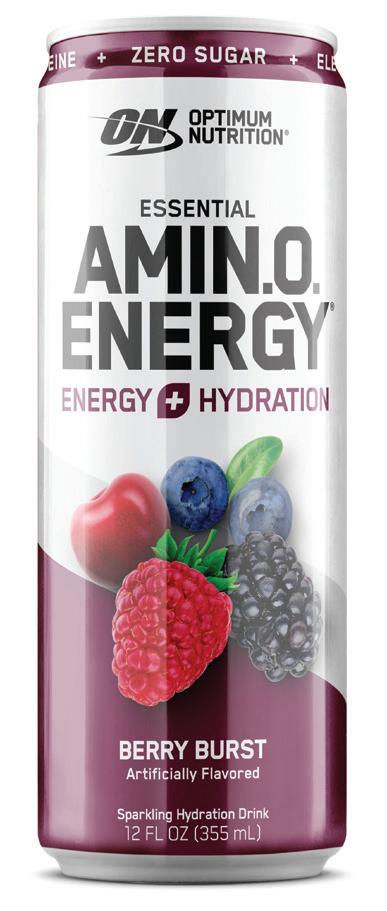

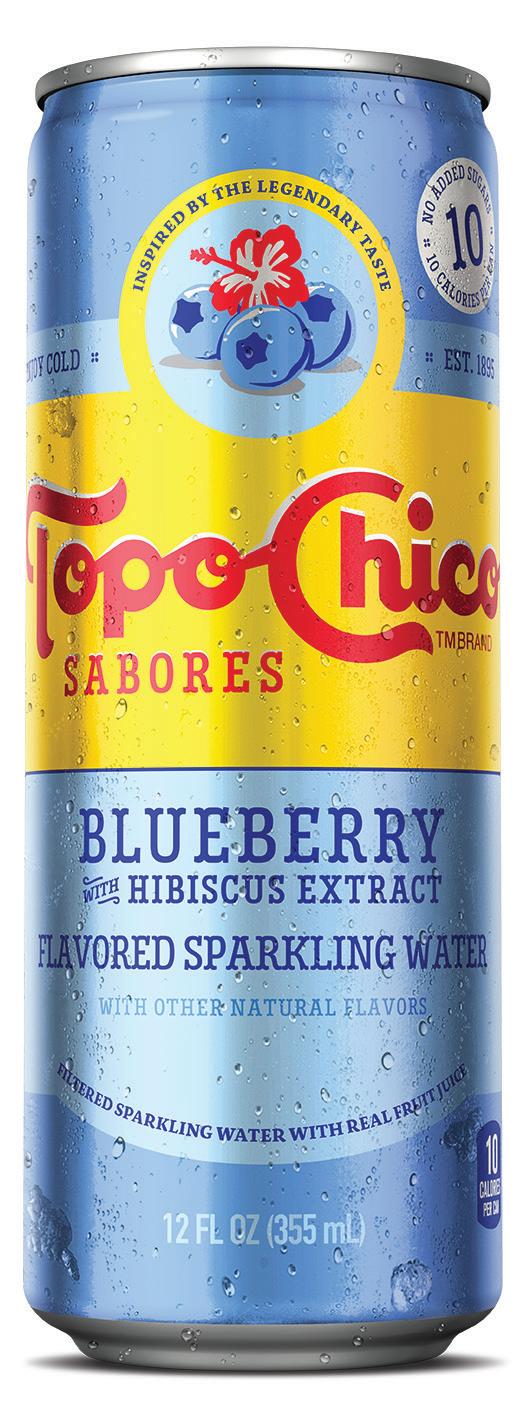

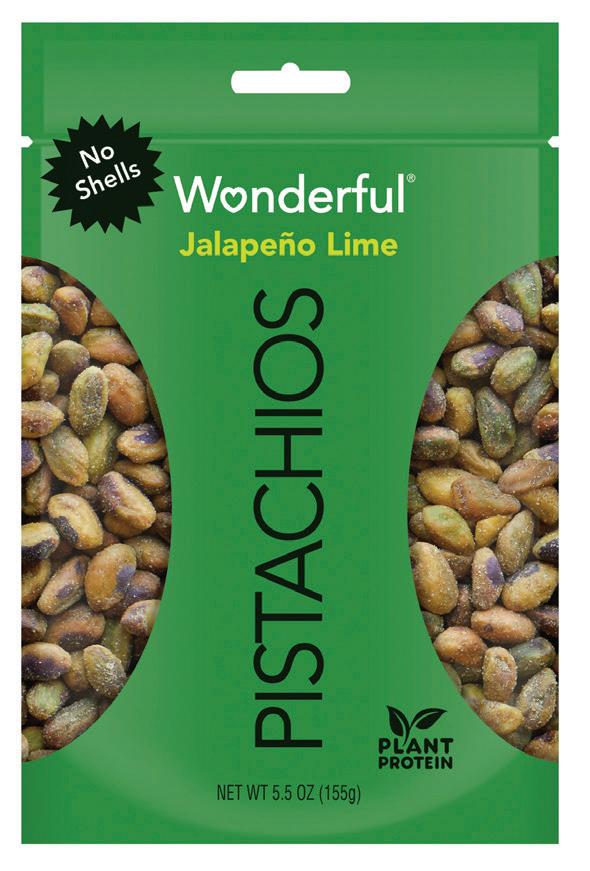

year’s Best New Products Awards winners focus on providing value without sacrificing taste

By Susan Durtschi, Past Times Marketing

THE NUMBER OF ENTRIES in the annual Convenience Store News Best New Products Awards program exploded this year. The categories of foodservice, packaged beverages and packaged sweet snacks had a record number of submissions, so competition was fierce. Foodservice entries tripled, with handheld options dominating the submissions. Functional beverages with multiple benefits, such as hydration, natural energy and new flavors, were also in abundance.

Products brought to the market between June 2, 2023 and June 1, 2024 were eligible for entry. A panel of consumers judged the submitted products on value, convenience, appearance and packaging, along with attributes such as taste and ingredients for edible items. Judging was supervised by Past Times Marketing, a New York-based consumer research and producttesting firm.

It was apparent that food and beverage product innovation in the convenience channel this past year focused on providing value without sacrificing taste. Value pricing was mentioned in many of the entries as inflation has played a part in recent product development. At the same time, flavor is trending, with hot honey, hot pepper/ Cajun spices, caramel and peach being the top profiles.

Calorie-conscious products were down this year in most categories with the exception of packaged beverages, where low-calorie was a prominent feature of the entries, as well as energy and caffeine. A top trend in alcoholic beverages was high alcohol content.

Overall, the 28th annual Best New Products Awards program recognizes 45 consumer-selected, innovative products introduced into the convenience channel in the past year.

The 2024 Best New Products Awards winners are:

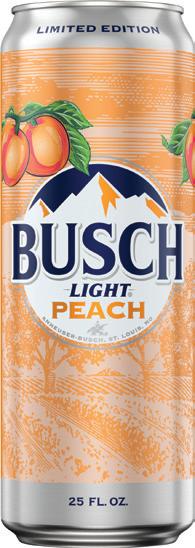

ALCOHOLIC BEVERAGES: BEER Busch Light Peach, Anheuser-Busch

In a year when sales in the value beer segment were forecast to remain relatively even, the June 2023 launch of limited-edition Busch Light Peach brought excitement to the cooler. The crisp, refreshing, peach-flavored lager has a touch of sweet peach on the front end and the clean beer finish of Busch Light on the back end. Flavor is especially important to younger legal drinking age consumers, who cultivated these preferences from their favorite nonalcoholic beverages. The 25-ounce value size of Busch Light Peach speaks to them as well.

ALCOHOLIC BEVERAGES: FLAVORED MALT

el Jimador Spiked Bebidas, Pabst Brewing Co.

This highly recognizable tequila brand from Mexico appeals to the large Generation Z and millennial Hispanic base in America, and delivers a unique, sophisticated and quality cocktail experience in a can with this product. Half of el Jimador’s legal drinking age consumers are under the age of 34. el Jimador Spiked Bebidas are made with 100% blue agave and no artificial sweeteners. The Orange Sunrise variety has a bright, citrusy taste and tangy flavor that our panelists liked.

ALCOHOLIC BEVERAGES: SELTZER

High Noon Vodka Iced Tea, E&J Gallo Winery

E&J Gallo Winery built on the consumer shift to ready-todrink iced tea with High Noon Vodka Iced Tea. Made with only real vodka and real iced tea, these noncarbonated beverages have 90 calories, with no added sugar. Each drink has a small amount of caffeine (approximately 10 milligrams per serving), which is naturally derived

from the tea itself. Four flavors are available: Original, Lemon, Raspberry and Peach. Lemon was the favorite among our testers.

ALCOHOLIC BEVERAGES: HIGH ABV SELTZER

Truly Unruly, The Boston Beer Co.

Truly Unruly breaks the rules of what a high-alcohol seltzer can taste like with four “turned up” flavors: Tropical Twist, Berry Blast, Citrus Crush and Strawberry Smash. The 8% alcohol by volume (ABV) beverages deliver a refreshing, tasty and crisp experience compared to other harsher-tasting high ABV beverages. Citrus Crush crushed it among our panelists. According to a study by The Boston Beer Co., drinkers see the higher alcohol content of Truly Unruly as new and different, and a means to get more bang for their buck.

ALTERNATIVE SNACKS

Double Eagle Beef Jerky, Old Trapper

Smoked Products

Old Trapper is the second-largest beef jerky brand in the nation and the leader in the large bag jerky category. Its

new 21-ounce Double Eagle Beef Jerky comes in the top four flavors of jerky meat snacks and uses premium beef in a value-size option — an excellent value per ounce to compete against the high price of traditional meat snacks. The clear bag packaging is designed to attract jerky users to make an impulse purchase. The Hot n Spicy flavor was the favorite of our panel.

CANDY: CHOCOLATE

Reese’s Big Cup Milk Chocolate Peanut Butter Cups with Caramel, The Hershey Co.

Reese’s is the No. 1 brand in confection and in the convenience channel, and its dedicated base of fans consistently delivers high trial and repeat sales. Reese’s Big Cup Milk Chocolate Peanut Butter Cups with Caramel are a salty and sweet indulgence. The product brings a new textural experience to Reese’s fans with an indulgent caramel layer that perfectly complements the iconic peanut butter and chocolate combination. The caramel inclusion was the most consumer-requested for Reese’s Big Cups, according to The Hershey Co.

CANDY: GUM

Hubba Bubba Mini Gum, Mars Wrigley

Hubba Bubba Mini Gum offers a soft and chewy gum experience that features a mix of fan-favorite Skittles Original flavors, including lemon, strawberry, grape, orange and lime. The product delivers a new Skittles crossover to fans that brings more variety to the brand and aims to inspire moments of everyday happiness for

gum and candy fans alike. According to Mars Wrigley, this innovation is a response to brand fans connecting Hubba Bubba to nostalgia. Panelists especially liked the container, which they said is eye-catching and fun.

CANDY: NONCHOCOLATE

Skittles Littles, Mars Wrigley

Mars Wrigley is expanding its snacking portfolio with new formats and mini product offerings to attract core consumers and new audiences. Its latest innovation, Skittles Littles, puts a tiny twist on the classic chewy candy. Skittles Littles deliver the iconic five fruity flavors of Skittles Original, but now in a smaller, more poppable experience that makes it even easier to enjoy the candy on the go. Skittles Littles come in reusable mini tubes that are less messy for on-the-go treating, as well as resealable graband-go pouches.

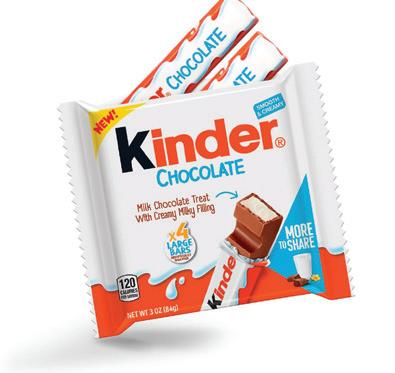

CANDY: OVERALL

Kinder Chocolate Share Pack, Kinder Chocolate Last fall, Kinder Chocolate joined the brand’s existing U.S. portfolio of Kinder Joy, Kinder Bueno

and Kinder Seasonal. The Kinder Chocolate Share Pack is a delicious, sharable treat that contains four small, individually wrapped chocolate bars that are the perfect size for snacking on the go. Kinder Chocolate features an outer layer of smooth milk chocolate with a creamy milky filling. According to the company, the Kinder Chocolate Share Pack is a top five best-selling new item year to date in 2024 in the convenience channel.

CBD

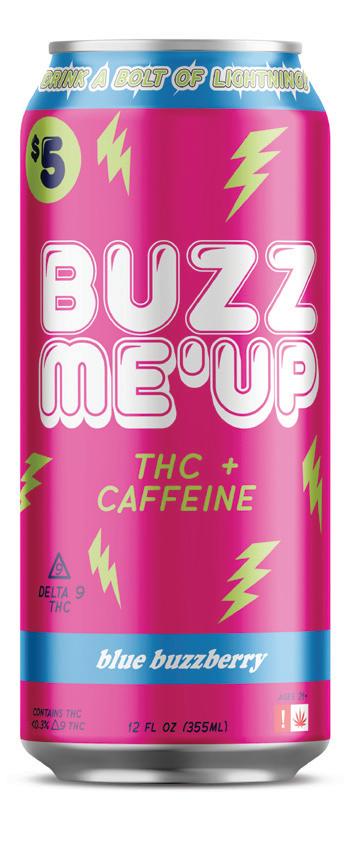

Buzz Me’Up, The Buzz Brands LLC

As cannabis legalization spreads, there is a growing market for THCinfused beverages. The Buzz Brands LLC (formerly J and A Consumable Products) taps into this trend with Buzz Me’Up, which offers a novel way for consumers to enjoy THC. Combining the stimulating effects of caffeine with the potential relaxation and euphoria benefits of 5 milligrams of pure Delta THC, Buzz Me’Up fits into the functional beverage category, which is increasingly popular among health-conscious consumers. Unlike traditional energy drinks that are often high in sugar and artificial ingredients, Buzz Me’Up is marketed as a more natural alternative.

MamaMancini’s Flame Grilled Paninis, Mama’s Creations Inc.

MamaMancini’s Flame Grilled Paninis fill a gap in the market for more differentiated, superior heat-and-eat meals that cater to modern lifestyle needs. The flamegrilled bread provides a distinctive smoky flavor and crispy texture, while premium white meat chicken ensures a juicy, flavorful bite. The variety of flavors available — including Chicken Bacon Ranch and globally inspired options such as Greek Chicken — cater to diverse

taste preferences. Transparent, resealable packaging showcases the quality of the 10-ounce fully cooked paninis, which are ready to enjoy in minutes.

FOODSERVICE: BAKERY

Whole Grain Double Chocolate Filled Donut Bites, Rich Products Corp.

Rich’s Whole Grain Double Chocolate Filled Donut Bites are bite-sized chocolate cake doughnuts made with premium ingredients and stuffed with an indulgent and gooey chocolate filling. This retail-ready menu item arrives frozen, ready to thaw and serve or heat and serve. The product offers endless opportunities for decorating and frosting before presenting to the consumer. According to the company, Rich’s Whole Grain Double Chocolate Filled Donut Bites fulfill three growing trends: doughnuts, grab-and-go and indulgence.

The foodie innovation your customers have been craving. Stuft Tots are patented, first-to-market, crispy flavor-filled hashbrowns:

• Deliciously protein-packed, with 60 calories or less per serving.

• Versatile for any time of day—breakfast, lunch, or snack.

• Quick and effortless preparation that ensures bites stay hot and fresh.

• Proven customer satisfaction and profit performance.

These filled bites can even be customized to offer your shoppers something exclusively yours.

FOODSERVICE: BREAKFAST

Hillshire Farm Stuffed Croissants, Tyson Foodservice