WHAT’S

FUELLING COFFEE SALES? THE LEADERS - LESSONS FROM

FOOD PRICE REPORT FOUR THINGS TO KNOW

Our passion for exceptional Cheese & Deli is at the heart of everything we do. With a discerning eye for quality and a deep love for the craft, we curate the world’s finest offerings to inspire elevated food experiences. As dedicated category specialists, we don’t just follow trends - we help shape them.

taste of home Meet the Brazilian duo bringing frozen coxinhas, churros and cheese bread to Canadians

Up, up and away New report forecasts food prices will climb up to 6% in 2026

15 The big question Grocery leaders share the biggest opportunities for 2026

17 The meeting point At Canadian Grocer’s GroceryConnex conference, a panel of retailers underscored a simple truth: every decision starts with the consumer

22 In a polycrisis era, tradition becomes a retail strategy As multiple crises converge, nostalgic food offers Canadians a sense of control, explains Mintel’s Joel Gregoire FRESH

49 The fresh formula Whole Foods Market’s Nathan Alvarez offers tips for running a winning produce department

AISLES

51 Coffee’s hottest (and coolest) trends Canadians are finding new ways to fuel their love of this most popular beverage

55 Secret’s in the sauce Flavour forward, globally inspired—and yes, healthier— sauces and condiments are having a moment

18 Leaders connect See photos from this year’s sold-out GroceryConnex COLUMNS

20 Values versus value Patriotism and price drive Canadians’ grocery choices, says NielsenIQ

57 The new sentiment boom A look at the trends shaping the greeting card category

58 Creatine: Four things to know Hint. It’s not just for bodybuilding

EXPRESS LANE

59 Shelf life Professor Sylvain Charlebois on what 2026 holds for the grocery industry

2300 Yonge Street, Suite 2900, Toronto, ON M4P 1E4

(877) 687-7321 Fax (888) 889-9522 www.canadiangrocer.com

BRAND MANAGEMENT

GROUP PUBLISHER/SVP,

GROCERY & CONVENIENCE, CANADA Sandra Parente (416) 271-4706 - sparente@ensembleiq.com

PUBLISHER Vanessa Peters vpeters@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Shellee Fitzgerald sfitzgerald@ensembleiq.com

MANAGING EDITOR Kristin Laird klaird@ensembleiq.com

DIGITAL EDITOR Kaitlin Secord ksecord@ensembleiq.com

ADVERTISING SALES & BUSINESS

NATIONAL ACCOUNT MANAGER Karishma Rajani (437) 225-1385 - krajani@ensembleiq.com

NATIONAL ACCOUNT MANAGER Julia Sokolova (647) 407-8236 - jsokolova@ensembleiq.com

NATIONAL ACCOUNT MANAGER Roberta Thomson (416) 843-5534 - rthomson@ensembleiq.com

ACCOUNT MANAGER Juan Chacon jchacon@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

CREATIVE DIRECTOR Nancy Peterman npeterman@ensembleiq.com

ART DIRECTOR Jackie Shipley jshipley@ensembleiq.com

SENIOR PRODUCTION DIRECTOR Michael Kimpton mkimpton@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

EDITORIAL ADVISORY BOARD

RAY HEPWORTH , METRO

BRENDA KIRK , PATTISON FOOD GROUP

CHRISTY MCMULLEN , SUMMERHILL MARKET

GIANCARLO TRIMARCHI VINCE’S MARKET

SUBSCRIPTION SERVICES

Subscriptions: $102.00 per year, 2 year $163.20, Outside Canada $163.20 per year, 2 year $259.20 Single Copy $14.40, Groups $73.20, Outside Canada Single Copy $19.20.

Digital Subscriptions: $60.00 per year, 2 year $95.00

Category Captain: Single Copy $20.00, Outside Canada Single Copy $30.00

Fresh Report: Single Copy $20.00, Outside Canada Single Copy $30.00

Subscription Questions: contactus@canadiangrocer.com

Phone: 1-877-687-7321 between 9 a.m. to 5 p.m. EST weekdays Fax: 1-888-520-3608 Online: canadiangrocer.com/subscription-centre

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

MAIL PREFERENCES: From time to time other organizations may ask Canadian Grocer if they may send information about a product or service to some Canadian Grocer subscribers, by mail or email. If you do not wish to receive these messages, contact us in any of the ways listed above.

Contents Copyright © 2025 by EnsembleIQ, may not be reprinted without permission. Canadian Grocer receives unsolicited materials (including letters to the editor, press releases, promotional items and images) from time to time. Canadian Grocer, its affiliates and assignees may use, reproduce, publish, republish, distribute, store and archive such submissions in whole or in part in any form or medium whatsoever, without compensation of any sort. ISSN# 0008-3704 PM 42940023 Canadian Grocer is Published by Stagnito Partners Canada Inc., 2300 Yonge Street, Suite 2900, Toronto, ON M4P 1E4. Printed in Canada

“There were a lo T of surprises this year; I think the biggest surprise was how they kept coming,” quipped Pattison Food Group president Jamie Nelson at Canadian Grocer’s recent GroceryConnex conference in Toronto.

Nelson was speaking on the retail leadership panel alongside Metro’s Marc Giroux, Longo’s Deb Craven and Walmart Canada’s Venessa Yates ( more on page 17 ). He said the year started off with the threat of tariffs followed quickly by the whiplash of those threats becoming reality. “It reminded me of the early COVID days,” said Nelson recalling swirling uncertainty and lack of control over many moving pieces. But the way forward, he said, “is to make sure we’re focused on the things we have control over, and that’s running good stores and pulling people together.”

After a tough year marked by a trade war with our U.S. neighbour, rising costs and Canadians feeling financially strained, some optimism is welcome. Encouragingly, all retailers on the panel expressed confidence about the year ahead. Economic signals are also showing signs of improvement. At the conference, BMO’s Douglas Porter told attendees Canada’s economy should see a modest lift in 2026—still below

average but better than 2025 amid ongoing trade uncertainty. Meanwhile, NielsenIQ’s Carman Allison highlighted emerging growth opportunities tied to consumer shifts, including GLP-1s, generation X (“the forgotten generation”) and the Buy Canadian movement. ( Find full GroceryConnex coverage on canadiangrocer.com).

And for this, our final issue of the year, we asked industry leaders for their perspective on what lies ahead. In The Big Question, grocers share the biggest opportunities they see in 2026 (page 15). We also speak with Dalhousie University’s Sylvain Charlebois ( page 59 ) about the road forward.

While grocery has never been an easy business, the sector is fortunate to have a robust pipeline of talent equipped with the skills and drive to face whatever challenges come next. Proof? Check out our 2025 Generation Next winners on page 26 and prepare to be inspired.

Wishing you a happy holiday season! See you next year! CG

Keep up to date on the latest news by signing up for our daily e-newsletter. It’s free and

Bimbo Canada, part of Grupo Bimbo’s snack division, is proud to announce our bold expansion into the food carrier category with Mi Tierra Tortilla Strips.

We’ve taken our deep expertise in cornbased products and authentic Mexican ingredients to create a distinctive stripshaped tortilla chip, a versatile, modern take on a classic. Designed to pair effortlessly with any cuisine, Mi Tierra brings the vibrant spirit of Mexico to tables everywhere.

“The food carrier category is growing, and we see a unique opportunity to lead with a product that stands out in both format and flavor,” says Cristina Slovacek, Brand Lead for Mi Tierra.

Our portfolio delivers what today’s consumers crave: versatility, convenience, and global taste experiences, all while staying true to our Mexican heritage. Our Promise:

Mi Tierra is a Value Plus brand offering high-quality products at an accessible price point, while delivering a rich cultural and culinary experience that celebrates authenticity and makes it approachable for Canadian consumers.

Available in Three Bold Varieties:

Salt –

Classic taste that lets your toppings shine

Hint of Lime –A zesty twist for a refreshing lift

Pico de Gallo –Inspired by the vibrant notes of fresh salsa

More than a snack, it’s a bold, modern twist on traditional corn-based goodness. Rooted in authentic heritage and crafted for every occasion, Mi Tierra brings everyone to the table. Mi Tierra is now available exclusively at LCL Market and RCSS banners across Canada and on January 8th, 2026, will be launched at retailers nationally offered in sharing sizes”.

LONGO’S has opened its 43rd store at 1055 The Queensway in Etobicoke, Ont. Highlights include stone-oven pizza, gourmet sandwiches, a hot buffet, salad bar, ready-to-go meals, fresh-daily sushi and a curated beer and wine assortment. The store houses an in-store Starbucks, and The Loft Cooking School offers classes and events.

FARM BOY has relocated its store in Kanata, Ont., one of Ottawa’s fastest-growing suburbs. Situated in a prime retail district, the new store offers an expanded assortment, including farm fresh produce, Ontario-sourced fresh dairy and meat, grab-and-go items and, of course, Farm Boy’s private-label products.

CF Toronto Eaton Centre is now home to EATALY ’s fourth Toronto location—a two-level, 25,000-sq.-ft. space featuring two restaurants—La Pizza & La Pasta and La Piazza—along with quick-service counters, a wine shop and a retail market offering hundreds of Italian products, fresh pasta, produce and cut-to-order salumi and formaggi.

Next fall, T&T SUPERMARKET plans to open its largest Ontario location at the Riocan Empress Walk in Toronto’s North York district. At 66,000 square feet, the store, previously occupied by a Loblaws, will feature a self-serve hot food bar, a bakery section with more than 150 varieties of baked goods, an Asian beauty section and more than 500 T&T private-label items.

NATIONS FRESH FOODS is expanding its Nations Experience concept, first piloted eight years ago at Toronto’s Stockyards Village at St. Clair Avenue West. The next-generation, 120,000-sq.-ft. flagship, is taking over the former Hudson’s Bay space at Oakville Place in Oakville, Ont. It will open in 2027 with an international

T&T Supermarket will open its largest Ontario store (66,000 square feet) in Toronto’s North York district in fall 2026, replacing a former Loblaws location

grocery shopping, global cuisine and multi-generational entertainment including diverse prepared foods, birthday parties and immersive games.

COSTCO WHOLESALE CANADA has opened a 167,000-sq.-ft. warehouse in West Winnipeg at 4077 Portage Ave., replacing the longtime St. James Street location, which is being converted into a Costco Business Centre opening in 2026. The new site features wider aisles, expanded food offering and specialty departments.

In mid-November, COMMUNITY NATURAL FOODS cut the ribbon on a 11,500-sq.-ft. store in Seton—a new residential community in Southeast Calgary. The store, the banner’s fourth in the city, offers grab-and-go meals, more than 3,000 organic products, 2,500 local Alberta items, a robust bulk department, a wide range of gluten-free, vegan, lowand-no sugar options.

Empire has appointed 34-year company veteran Pierre St-Laurent as president and CEO of Empire and Sobeys Inc. He succeeds Michael Medline, who announced his retirement in April. St-Laurent has held senior roles across finance, distribution, logistics, retail operations and merchandising, and has served as executive vice-president and COO since 2019, overseeing merchandising, operations and supply chain, nationally.

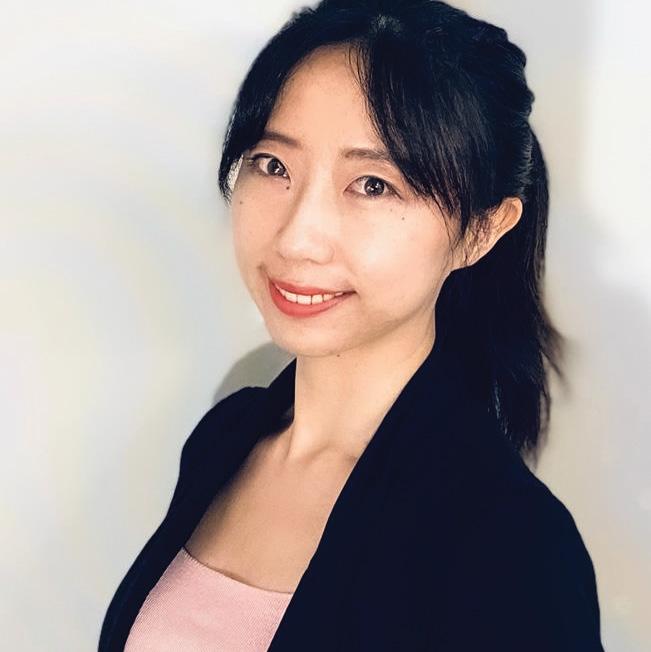

Yoplait Liberté Canada has named Claire Bara as its new CEO. Bara previously spent more than six years at A. Lassonde, most recently as president, and has also held leadership roles at Molson Coors Canada and Sobeys. Bara will oversee teams in Montreal, Saint-Hyacinthe, Que., Mississauga, Ont. and Vancouver.

Maison Riviera has appointed Michael Norman as general manager (CEO). He has more than 30 years of experience in the agri-food industry, including senior management roles at Argopur and Exceldor. Most recently, Norman served as general manager of Nutrinor.

Bryan McCourt has joined Mother Parkers Tea & Coffee as chief commercial officer, bringing more than 25 years of CPG experience to the company. McCourt has held roles at Grupo Bimbo, Nestlé, PepsiCo and McCain Foods.

The Canadian Federation of Independent Grocers handed out its 2025 CANADIAN INDEPENDENT GROCER OF THE YEAR AWARDS at a gala in Toronto in late October. The National Gold Award winners are: 1. Freson Bros. Fresh Market Glenora, Edmonton, Alta. (medium surface category); 2. Greco’s Fresh Markets, Thornhill, Ont. (small surface); and 3. Save-On-Foods Park & Tilford, North Vancouver, B.C. (large surface). The awards recognize retail excellence in areas such as customer service, store layout, merchandising, creativity and community involvement.

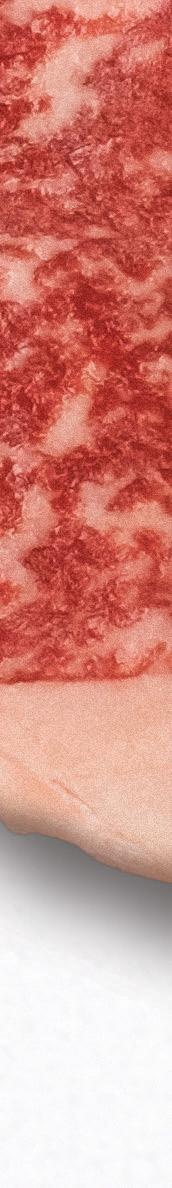

By Andrea Yu • Photography by Jaime Hogge

ALTHOUGH BOTH WALLACE Franca and Marcelo Braga hail from Brazil, they didn’t cross paths until after they immigrated to Canada—arriving six months apart in 2019 and settling in London, Ont. Introduced through the local Brazilian community, they quickly discovered a connection: Franca’s father-in-law, an obstetrician, delivered Braga’s daughter back in Brazil. That coincidence sparked an instant connection between their families. “We became very close and spent Christmases together,” Franca explains.

Franca had previously been working at a bank in Brazil but yearned to start his own business in Canada. After meeting Braga, who had opened and operated sushi, hot dog and burger restaurants in Brazil, the two came up with an idea for a food business. Called Frittos & Co., the venture was inspired by their love of Brazilian food and featured a lineup of frozen foods that pair classic Brazilian snacks with Canadian flavours.

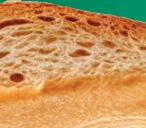

Braga was responsible for recipe development. Their signature product would be variations of the coxinha, a Brazilian bite-sized croquette with a meat filling (chicken is the most traditional). “It’s very crispy on the outside and soft on the inside,” Braga explains. “It’s very flavourful.”

Frittos & Co. officially launched in 2022. The initial lineup consisted of four flavours of croquettes (cheese, chicken, bacon and cheese, and pizza bites), along with a dulce de leche-flavoured churro. They began selling in small grocers, focusing on Latin, Brazilian and Portuguese stores in Ontario. Braga and Franca initially made their products in a food incubator and a ghost kitchen in London. Then, in 2023, they moved to The Grove, an agri-business incubator in the city. By the end of that year, they were selling their products in about 100 stores across Ontario.

As the company grew, Braga and Franca faced their fair share of hiccups. When their Brazilian-made manufacturing equipment broke down, Braga had to problem-solve by calling the manufacturer in Brazil. “The machines always break, so now I’m a technician as well,” Braga jokes. One memorably tough day, they were in the middle of an important order when a machine broke down and couldn’t be easily fixed. “We were like,

‘Oh my goodness, how are we going to deliver the order?’” Franca explains. “We did one week of production manually. It was crazy.” After that, they ordered an additional machine as a backup.

Braga and Franca made their foray into major grocery stores in 2024, thanks to a Loblaws’ buyer who discovered Frittos & Co. products in an independent grocer. The buyer trialled the products in four Real Canadian Superstore locations in Ontario before expanding into 37 Superstore locations across Canada. “When we see our products in big grocery stores, it’s so emotional,” Franca explains. “Our company is kind of like a baby to us.”

Frittos & Co.’s presence in major grocery stores expanded in 2025 with launches in 10 Sobeys stores and 24 Fortinos locations across Ontario. The company’s products are now available in more than 800 locations across Canada. Over the years, the company’s product lineup has also grown, adding another Brazilian snack staple—cheese bread— as well as more flavours of their existing lineup such as chocolate churros and barbecue pulled pork croquettes.

The company is now busy enough that both Braga and Franca’s spouses help out with the business—Franca’s wife works on the company’s finances while Braga’s wife assists with product development. “It’s nice to spend time together,” Franca says. “But, we have a rule at home—don’t talk about the business when we’re with the kids.”

In 2026, Braga and Franca hope to increase their presence in Loblaw and Sobeys stores across Canada, and launch into even more major grocers in the country. They’re also planning to expand south into the United States, Mexico and Panama next year. “One of our goals is to be in 2,000 stores by the end of 2026,” Franca states.

It may seem like an ambitious goal, but the duo is determined. And their prior experience of aiming high and taking big risks has paid off, so far. “When we started the business, we put all the money we had into it,” Franca explains. “I sold everything I had in Brazil and Marcelo did the same. It’s a lot of risk. It was a bit scary, but we trusted the process and trusted our products. We’re still small, but we’re proud of what we’ve done.” CG

30 seconds with …

CO.

What do you like best about your job?

MARCELO: I love the relationships I’m developing with people, especially when doing events and demos. It makes me very, very happy to see people’s reactions when they eat our food.

WALLACE: I love solving problems. In our business, there are always problems, but I like figuring them out.

What’s the best career advice you’ve received?

WALLACE: Someone told me a few years ago, “Put your soul in it and your business will grow.” This business is an extension of our lives and we’ve really put our souls and passion into it.

What’s the hardest decision you’ve had to make?

MARCELO: To say “no” to a customer. Early on, we got a very huge order, but we weren’t in a position to fulfil it, so we had to say no.

What’s your favourite product from your lineup?

MARCELO: The dulce de leche churros, dusted in cinnamon sugar; it’s a winner.

WALLACE: Mine is the cheese bread. I eat them as a snack almost every day with my kids.

What do you like to do when you’re not working?

WALLACE: I’m spending all of my free time with my kids. I have a two-yearold son and a four-year-old daughter. We like reading books and watching movies together.

MARCELO: It’s the same for me. My son is three years old and my daughter is eight. We like cooking together. They like to help me in the kitchen and we like watching movies.

Canadians should braCe for even higher grocery bills next year, with food prices forecast to increase 4% to 6%, according to the 2026 Canada’s Food Price Report. For a family of four, that will add up to $17,571.79—a $994.63 increase from 2025. Compared to five years ago, food prices are 27% higher.

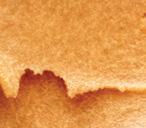

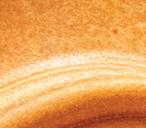

Now in its 16th year, the report also looks at expected price hikes across major categories. Meat is expected to see the steepest increase, rising 5% to 7%. Vegetable prices are projected to climb 3% to 5% and fruit comes in at 1% to 3%. Prices in bakery, along with dairy and eggs, are expected to increase 2% to 4% while seafood will rise 1% to 2%. Food prices at restaurants are forecast to rise 4% to 6%, as will packaged goods (categorized as “other” in the report).

THE MEAT OF THE MATTER

Among all categories, meat is the big story. In 2025, prices increased 7.2%—the highest rate of any food category. This was largely driven by the soaring retail price of beef, which jumped 19% in the first quarter alone, according to the report. While spring and summer brought more stability, beef prices were still up 9% year over year and up 23% from the five-year average.

Several factors are behind the surge, including low cattle herd numbers, a drought in Western Canada and rising input costs. Production, processing and packaging costs have all climbed, with these added costs passed on to consumers.

“We predict meat prices are going to continue to be a nightmare for consumers,” says Sylvain Charlebois, director of AgriFood Analytics Lab at Dalhousie University, which produced the

report in collaboration with other universities across Canada. To keep up with Canadians’ appetite for beef, the country is turning to import markets such as Mexico and Australia. However, Canada limits the volume of imported beef that can enter the country at low tariff rates. “We don’t see how beef prices will get normalized before mid-year 2027 unless something is done,” Charlebois says.

Beyond category-specific pressures, a mix of economic and geopolitical factors are contributing to the projected 4% to 6% increase in food prices. These include trade disputes with the United States, labour markets, policy changes and an uncertain Canadian dollar.

With grocery bills climbing, Canadians will continue to shift their dollars to the discount channel. But, with big chains owning most of the discount banners, the report warns that pricing negotiations remain concentrated among a few companies.

The grocery code of conduct, which becomes fully operational in January 2026, is designed to create a more level playing field. In theory, it gives manufacturers and smaller grocers more sway and, therefore, more choice for consumers at the grocery store.

“I’m hoping this will work and I do believe it will, but only time will tell … my expectation is the code of conduct, its functionality, will stabilize prices over time,” says Charlebois. “And that’s the whole idea.”—Rebecca Harris

Gino DiGioacchino President and CEO GIANT TIGER STORES LIMITED

“For Giant Tiger, the biggest opportunity in 2026 is staying true to who we are—a proudly Canadian hard discount retailer—while continuing to evolve how we deliver value and convenience to our customers. Our distinctive franchise model allows us to continue growing from the strong local foundations that define our business. Our owner/operators know their communities best, and that connection gives us a unique advantage. As customers’ needs around low prices and convenience continue to change, that local insight will help us move faster, stay more agile and remain deeply connected to the people we serve.”

President

“At the Italian Centre Shop, we don’t just sell Europe’s bestknown products, we bring people together through food. Our goal is to create spaces for Italian cooking demos, olive oil tastings, wine and charcuterie nights, and artisan meet-and-greets that turn shopping into a cultural experience. While we offer online shopping, we truly want customers to ‘Come, Step into Italy’—our tag line—and explore our curated private label and exclusive imports, experiencing the story behind every product, from field and factory to our shelves and, finally, to the table.”

“2026 is a milestone year for Longo’s. Our focus is always on trust with our team members, guests and the community. We build it by delivering remarkable service, unbeatable quality, value and unmatched local freshness. With a foundation built on 70 years of family standards and partnerships with Canadian farmers and vendors, we see tremendous potential to enhance innovation, assortment and deepen community connections. Our 44th store opens this spring in Welland, marking the next chapter in fuelling happier, healthier lives across Ontario.”

“In 2026, our biggest opportunity is continuing to deliver value to consumers. We are doing so by expanding discount banners in Quebec and Ontario with the opening of 12 discount stores. Second, reinforcing value in conventional stores through strong private-label and fresh offerings, and tailoring pricing and promotions locally. Building loyalty is one of our priorities, and the launch of Moi [rewards] in Ontario last year provides a way to connect with customers and deliver more value in our omnichannel strategy—creating seamless, personalized experiences across platforms. These efforts will strengthen customer relationships and drive growth.”

“In 2026, the biggest opportunity will be elevating the customer experience as discount grocers continue gaining market share. While price will always matter, customers are increasingly seeking quality, service and a sense of connection in their shopping routine. For independent grocers, this creates room to differentiate through locally curated products, knowledgeable staff and an inviting in-store atmosphere. By focusing on freshness, convenience and personalized service, we can strengthen loyalty and offer a value proposition that goes beyond simply competing on price.”

Shaped like dinosaurs and ready in minutes, these new Organic Gluten-Free Chicken Dino Nuggets are certified organic, certified gluten free, and certified FUN! Made using 100% Canadian raised organic chicken, with no soy or artificial ingredients, these delicious and nutritious dinos are sure to delight even the fussiest eaters.

Yorkshire Valley Farms is committed to producing poultry products that are both good for Canadians and kind to the environment with chickens raised on family-run farms in Ontario, without the use of antibiotics and in barns that are open to sunlight and fresh air.

For more than 25 years, Tampico customers have been served irresistible products chocked-full of smiles. They constantly strive to create moments of joy for consumers through their products.

With just a sip, Canadians are transported to a frutopia, filled to the brim with a mesmerizing medley of fruit flavours that leave their taste buds tickled and laughing for more.

Tampico is a global favourite, known for affordability and wide appeal. New for 2026, ZERO Sugar offerings.

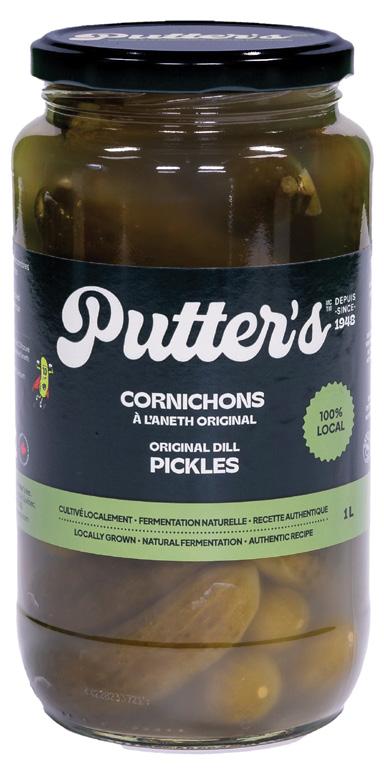

Discover the bold, clean taste of Putter’s Original Brine Pickles, naturally fermented for a crisp bite and balanced, refreshing flavour. With a stronger dill aroma than traditional kosher dills, these pickles deliver pure freshness in every crunch. Preservative-free, vegan, gluten-free, lactosefree, vegetarian, and made with no artificial colours, they’re a wholesome, authentic staple for every pickle lover.

Kupiec Coated Rice Cakes bring a modern twist to the snacking category. New to the Canadian market, perfect for a work break, a quick snack, or a moment of indulgence anytime. Glutenfree, nuts-free, and free from artificial colours or preservatives, these rice cakes offer a light alternative to traditional sweets. Each 60g pack includes four cakes, available in Milk or Dark Chocolate, Mango, Forest Fruits, and Plain Yoghurt flavours.

conference, a panel of retailers underscored a simple truth: every decision starts with the consumer

ACROSS STORE DESIGN, flyers and even the adoption of self-checkout, one thing guides every major decision in Canadian grocery: the customer. And as expectations evolve, grocers are adapting every touchpoint to meet shoppers where they are.

This topic came to life during a panel discussion at Canadian Grocer ’s GroceryConnex conference, featuring industry leaders Jamie Nelson (Pattison Food Group), Venessa Yates (Walmart Canada), Marc Giroux (Metro) and Deb Craven (Longo’s). Each discussed how they’re using technology, marketing, store layouts and product assortment to make shopping easier— and even a little delightful.

“Shopping is a bit of a chore, it’s a bit of a pain point I think for most customers,” said Yates. “So, you need to make it a bit of a delightful experience, make it easy, make it seamless, get customers whatever they’re looking for when they’re looking for it and meet them where they are versus them meeting us where we are.”

Nelson agreed. “We’re in business to fulfil the demands of the consumer,” he said, emphasizing that while shoppers seek value in a challenging economy, it’s quality—not price—that leaves a lasting impression.

“The key to the experience is ensuring you’re running a good store—it’s full, it’s fresh, it’s friendly and when the consumer comes in, they’re getting what they’re looking for,” he said. “Because they’re shopping around lots and if you disappoint them, next time—when it comes to making a decision—they’ll maybe turn right instead of left.”

For many grocers, part of that experience now involves technologies such as self-checkout systems that can improve customer satisfaction by eliminating wait times and streamlining the checkout process, among other benefits.

“Shoppers are looking for convenience— they’re money starved, but they’re also time starved,” said Metro’s Giroux. “So, our self-checkout process is a way to deliver them convenience.”

Giroux also pointed out that “not all customers are created equal” and finding the balance between self-checkout and the human touch of traditional cashier lanes can be a challenge. But, again, it all comes down to the customer.

“We have a lot of debate internally, have we gone too far in the deployment of self-checkout and how many hours [do] we put at regular till?” he said. “A lot of the work done in our business is to understand store by store the customer satisfaction [of the checkout experience].”

Craven echoed this sentiment, noting there would be a revolt if self-checkout lanes weren’t an option at urban locations such as Longo’s Maple Leaf Square in downtown Toronto; customers want to be in and out of the store as quickly as possible. In other markets, however, the idea of a self-checkout would be exhausting to some customers.

“The North Star we mould ourselves to is, again, I’m going to sound like a broken record, but meeting the guests where they are,” she said.

Equally critical to a smooth checkout is the shopping journey that precedes it—guided by effective store design, the panel agreed.

“Sometimes customers just want to get in and get out and find what they’re looking for in a really easy way,” said Yates. “So, the role of navigation signage is really important, the role of really clean aisles and making sure we’ve thought out the flow is really, really important.”

Costs are rising across the board, but real estate—taxes, cost of square footage, etc. —is the biggest spike, said Nelson, which is why maximizing space and assortment is so important.

“We need to ensure we’re getting the most of that and sweating that as much as we can,” he explained. “So, that’s why assortment is so important and that’s where innovation is so important … You need to design your store for the convenience of the consumer, but you need to have the products in the time they’re looking for.”

Despite a rise in digital technology, one traditional marketing vehicle endures: the paper flyer. It has weathered everything from Canada Post disruptions to COVID blackout periods and proves there’s an audience for everything.

When it comes to digital versus paper flayers, no two stores, regions or customers are the same, said Giroux. “The paper [flyer] is still important, especially in rural areas,” he explained. “In more urban areas, digital is more penetrated, so you have an opportunity to reach your customer then and you can do the personalization, the relative content, et cetera, et cetera, but not all customers are equal, not all regions are equal.”

Kristin Laird

TORONTO’S FAIRMONT ROYAL YORK Hotel was buzzing on Nov. 24 as grocery execs from across the country came together for GroceryConnex—a day packed with ideas, conversations, connections and well-earned awards.

The sold-out event brought together leaders from Empire, BMO Financial Group, Walmart Canada, Pattison Food Group, Longo’s, Metro and NielsenIQ to tackle hot topics from internal trade and tariffs to artificial intelligence and evolving consumer habits.

Canadian Grocer also recognized 37 of the industry’s rising stars with the 2025 Generation Next Awards ( read more on page 26), and the day wrapped with the Food Industry Association of Canada’s Golden Pencil Awards. CG

d espi T e ongoing e C onomi C uncertainty, Canadian consumers are demonstrating remarkable resilience. NielsenIQ’s Consumer Outlook: Guide to 2026 reveals that while financial pressures persist—rising debt-to-income ratios, increasing unemployment and inflation fatigue—many Canadians are adapting their behaviours rather than pulling back.

Canadians report avoiding U.S. brands, but this sentiment has dropped by seven points as more consumers shop for the brand that meets their needs.

While many still prefer Canadian-made goods, they’re increasingly willing to choose U.S. or international products if they offer better value. This shift is evident in performance data: while “Made in Canada” and “Product of Canada” items continue to outperform “Made in U.S.A.” products, the gap is narrowing as price sensitivity grows.

Retailers are responding by expanding assortments that balance national origin with affordability. Promotions, private-label offerings and discount formats are gaining traction, reflecting a consumer base that is loyal to value above all else.

One of the most striking trends in the fast-moving consumer goods (FMCG) landscape is the rise of smaller brands. These nimble players are fuelling growth across categories, contributing to 38% of absolute dollar gains. In contrast, larger brands are struggling to maintain momentum in a market where differentiation and agility matter more than legacy.

While many still prefer Canadian-made goods, they’re increasingly willing to choose U.S. or international products if they offer better value

In September 2025, consumer confidence rose slightly to 60.3 points, while 36% of Canadians reported feeling financially worse off. Rather than halting spending altogether, consumers are recalibrating how and where they spend. This shift is not just about survival—it’s about strategic adaptation.

Food inflation remains a top concern for Canadians. In September, the cost of essentials such as meat (+6.8%), baby care (+6.3%) and dry grocery items (+4.5%) continued to climb, outpacing overall CPI. Producer price data shows dramatic increases in commodities such as coffee (+33.2%), cocoa (+22.9%) and finfish (+33.2%), signalling that elevated prices may persist into 2026.

Inflation fatigue is reshaping consumer habits. Nearly half of Canadians (49%) now stock up when items go on sale, and 42% report only having money for essentials. Shoppers are increasingly planning purchases to avoid impulse buys, with 41% actively managing their baskets to control spending.

While patriotic purchasing surged in recent months, the “Buy Canadian” movement is moderating. In mid-2025, 14% of Canadians identified as “Canadian loyalists,” committed to only buying Canadian-made products. However, this figure is down three points, suggesting a shift in priorities. Thirty per cent of

Retailers are adapting by curating assortments that go beyond price. Smaller brands often bring innovation, niche appeal and authenticity—qualities that resonate with today’s value-conscious but experience-driven shopper. Whether it’s unique flavours, sustainable sourcing or local production, these brands offer something distinct. This shift also reflects a broader evolution in strategy. Assortment is no longer just about breadth—it’s about relevance.

Another key dimension of value is time. More Canadians are turning to online channels to optimize their lives. Online now accounts for more than 10% of FMCG spend, with penetration reaching 68%—a five-point increase in just two years.

Middle-aged, higher-income households with children are leading this shift. These consumers are not just buying online; they’re integrating digital shopping into their routines. From bulk purchases to subscription models, online platforms offer time-saving solutions that align with busy lifestyles.

Forecasts suggest this trend will accelerate, with online share expected to hit 15% by 2030. Retailers are investing accordingly, enhancing digital experiences and expanding fulfilment options to meet growing demand. CG

Mike Ljubicic is managing director at NielsenIQ (NIQ), where he leads the company’s business operations across the Canadian market. Mike has spent his entire career in the fast-moving consumer goods (FMCG) and retail industries, beginning with early experience working in grocery stores. At NIQ, Mike is responsible for driving market execution for new initiatives and acquisitions, while aligning the Canadian business with NIQ’s broader innovation strategy across omni-panel, technology and e-commerce.

Fresh produce from the European Union, including apples, leeks, shallots and persimmons (also known as kakis), are a profitable option for Canadian retailers during winter and spring, delivering the quality, transparency and sustainability that consumers demand.

When the weather gets colder and locally grown produce becomes more scarce, Canadian consumers look for imported fruit and vegetables they know are safe and tasty alternatives. Increasingly they’re looking to fruit and vegetables from the European Union to fill that gap.

For retailers, produce from Europe offers a consistent and transparent supply, a rich variety of choice, and strong consumer appeal, making them best sellers during the winter months. Now Freshfel Europe, Interfel, and protected designation of origin (PDO) Kaki Ribera del Xúquer are proud to offer apples, leeks, shallots from France, and kakis from Spain.

Grown with care, European produce meets strict standards and certifications, with an emphasis on premium quality, scientifically-based health and nutrition benchmarks, sustainability through the European Green Deal, and farm-to-fork traceability. Consumers also recognize that European growers follow a number of environmental initiatives, including biocontrol and biological protection techniques to reduce chemical inputs, and improved water, soil and resource management techniques in order to meet High Environmental Value farm certifications.

Apples, leeks and shallots from France are available throughout the winter, offering an assortment of fresh, in-season selections. Thanks to its unique climate and soil, France offers more than 100 apple varieties, with a range of flavours and uses to satisfy every consumer. French apples also carry the Eco-friendly Orchards label, meaning consumers can count on their premiumquality, nutrition and unsurpassed taste.

European leeks are another seasonal choice known for their versatility and flavour, with more white, edible stalk compared to other leeks. Packed with antioxidants, vitamins and fibre, leeks add a subtle, sweet-savoury taste to winter stocks, soups and casseroles.

Shallots are a variety of onion, and feature a coppery outer skin and white to pink flesh that is firm and savoury. Because they peel easily and blend perfectly with other ingredients, shallots are a convenient option chopped for use in salads, sauces and vinaigrettes, or cooked in main dishes, adding a delicate yet distinct flavour and aroma. Shallots also offer anti-inflammatory properties, so are an excellent choice during Canadian winters.

From October to January, consumers can enjoy colourful kaki varieties from Spain, including Rojo Brillante, grown under the protected designation of origin (PDO) Kaki Ribera del Xúquer. Although the traditional astringent varieties found on the market must ripen until soft and red before eating, these kakis offer a firm, crunchy flesh that can be enjoyed like an apple. This ready-to-eat texture is unique and helps avoid the common misconception that firm kakis are unripe. Rich in vitamins, calcium, and minerals, they make an ideal winter dessert or snack.

This winter look for fruit and vegetables from Europe – your customers will thank you!

Learn more at www.persimon.eu/en (PDO Kaki Ribera del Xúquer) and www.interfel.com (French fruit and vegetables). Follow us on Instagram @fruitvegfromfr and on LinkedIn at Fruit And Veg From France – Interfel

As Canadians navigate overlapping crises, nostalgia-driven food and traditions are giving consumers a sense of control

s o far, T he 2020s have been defined by a “polycrisis”—a series of interconnected shocks that have shaped the consumer landscape. From the COVID19 pandemic to geopolitical conflict, generationally high inflation, supply chain disruptions and the ever-present climate crisis, Canadians have faced a barrage of challenges. If all that wasn’t enough, the Toronto Blue Jays lost game seven of the World Series in 2025. Indeed, Canadians have been through a lot. OK, good things have happened in the 2020s, too, but individuals could be forgiven for thinking the world is in a worse place than it used to be. For

brands, the challenges experienced can inform how they look to connect with consumers. This doesn’t mean leaning into doom and gloom, but rather being authentic and empathetic; it’s important to not be tone deaf to the realities people are facing and how they’re feeling.

In its 2026 Global Food and Drink Predictions, Mintel identified “Retro Rejuvenation” as something to watch. Retro Rejuvenation highlights how brands can foster connection by focusing on tradition. In a world where generative artificial intelligence is rapidly changing daily life—and the pace of innovation can feel overwhelming—many consumers are seeking a sense of control and balance in their lives.

This desire is manifesting in a renewed interest in “grandma hobbies” such as knitting, quilting, gardening and reading. These activities, along with baking and cooking, offer a return to simplicity and mindfulness, qualities that grocers and food manufacturers are well-positioned to support.

Even younger generations, including millennials—often considered the last non-digitally native cohort—are drawn to nostalgia and tradition. In fact, about two-thirds of Canadian millennials say they enjoy products that remind them of the past.

This nostalgia is a powerful lever for brands across categories, particularly in food. For example, Fishwife Tinned Seafood Co. uses bold flavours and vibrant, retro-inspired packaging to evoke another era, standing out on the shelf while tapping into consumers’ longing for authenticity.

Tradition can also serve as a springboard for innovation. Modern twists on classic products, such as canned pears in salted caramel syrup or cod with a Japanese miso glaze, demonstrate that provenance and authenticity need not come at the expense of convenience. There is also growing interest in ancestral food practices, including fermentation and natural preservation, which can inspire product launches and innovative offerings.

Hopefully, the second half of the 2020s will bring a period of relative calmness compared to the first half. Who knows?

In the meantime, consumers are seeking ways to alleviate vulnerability and regain a sense of personal control. For retailers and manufacturers, leaning into tradition can provide consumers with simplicity and stability CG

“BE GENUINE! WHEN YOU STAY AUTHENTIC AND TRUE TO YOURSELF, IT ENCOURAGES OTHERS TO DO THE SAME, HELPING EVERYONE TO BRING OUT THEIR BEST” – ANNEMARIE HEIKENWÄLDER

What is your leadership story? I was born in Austria but moved to Quebec when I was eight. My parents were pioneers in organic farming in Austria and later bought a farm close to Montreal, so I grew up with this mentality of being close to nature. My parents would have liked me to follow in their footsteps, but I wasn’t interested in farming and was determined to follow my own path. After completing an honours bachelor of commerce degree from the University of Ottawa, I was recruited for a full-time job in aviation, working for a fixed based operator (FBO) in Saint-Hubert, Que. There, I quickly made a name for myself, moving on to lead aircraft sales and becoming head of sales and marketing for Diamond Aircraft. (Heikenwälder was recruited to aircraft sales after being named among the “Top 20 under 40” in Wings Magazine in 2017 for raising the FBO’s occupancy from 40% to 100%.) Professional development is important to me, too. I earned an IATA Aviation Management certificate from Stanford University.

In a predominately male environment, I worked with associations and boards to raise the profile of women in aviation. We encouraged university programs to attract more females to the industry, and I’ve always supported female pilots. I certainly broke some glass ceilings during my 15 years in aviation, but I was also lucky to be surrounded by mentors and others who supported me along the way.

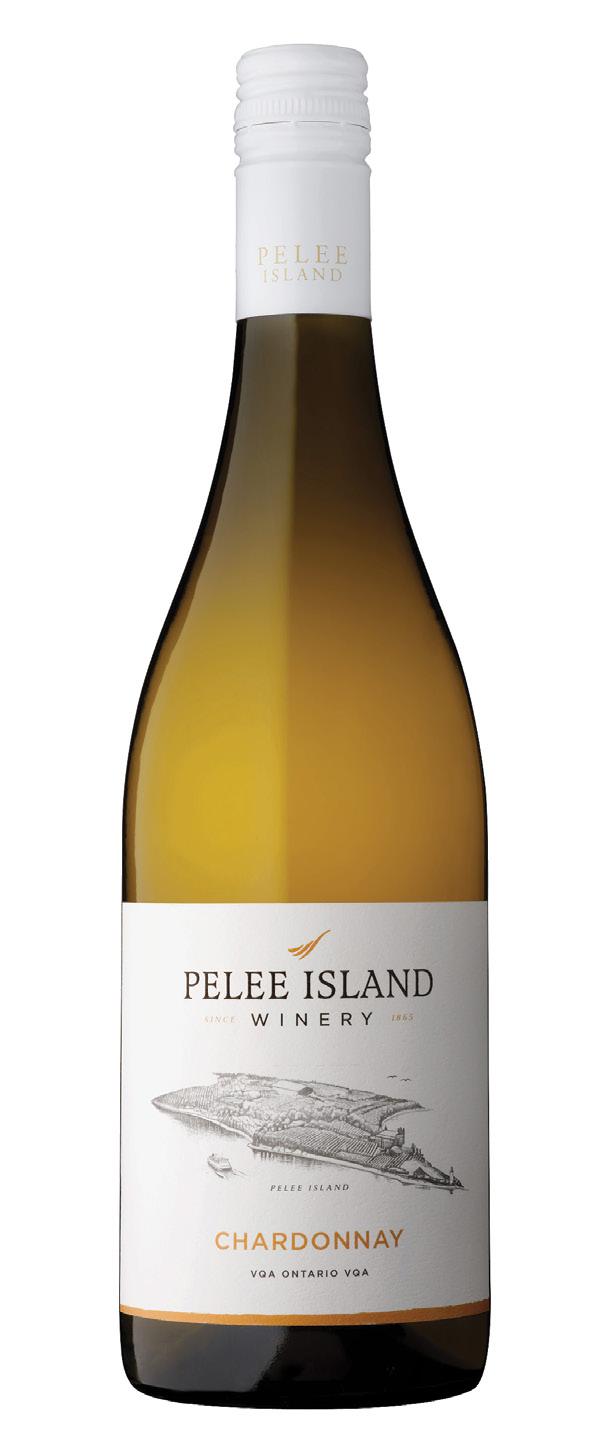

By Rosalind Stefanac • Photography by Jaime Hogge

How did you get your start in the wine business? In my previous role, I was travelling a lot and home only one week a month, if that. My territory was pretty much the world for some aircraft models. I decided it was time for something that could ground me a little more and the opportunity came up at Pelee Island Winery. I took away a lot of discipline working in a highly regulated environment

like aviation, which translates well to the regulated world of winemaking where I’ve now been for two-and-a-half years.

What is your leadership philosophy? I approach everything collaboratively, but also give my crew the rope they need to get things done. When issues pop up, I make sure the right people are in the room to discuss the solution together. It’s never a one-man show. When I have an important decision to make, I also listen to my gut always—it has never veered me in the wrong direction.

How did you handle a difficult decision as a leader? When the world shut down during COVID-19, we had to make some very challenging decisions in aviation, particularly around staffing. I needed to let people go but also bring back teams in a safe way during the recovery period. In that time, I learned that it’s very possible to scale down your teams to operate more effectively, but you have to continue to grow and build them up again when volumes resume. When I got to the winery, there was a lack of structure and accountability in certain roles, which required me to restructure certain departments. But, it also allowed me to put the right people in the right places, which has set the business up for future success. I really believe with the right people in place, a business will run like a well-oiled machine and that is key to a company’s long-term success.

What is the biggest challenge facing leaders today? I think a major challenge today is the uncertainty of changing market conditions, which creates a real test in agility and navigating these changes. Tariffs are the most recent example, but there have been countless other [events] in the last five to 10 years where markets have changed nearly overnight and leaders have had to make tough decisions on redirecting their businesses to remain resilient.

Being in an industry that’s quite culturally diverse, how do you lead across global markets? My background on the international sales and marketing side has been an asset for us here at the winery. When you speak a common language, it enables you to relate to one another and build relationships. I am fluent in four languages and speak seven conversationally—and I’m now learning Arabic, too. Not only was I forced to learn

a new language when I came to Montreal, but growing up, I also went on a lot of trips to learn languages. At 13, I presented a business plan to my parents, convincing them to let me study in Mexico City and stay with a host family, which I did the following year. You gain such a deep understanding of a culture when you’re immersed in it like that. To this day, Mexico is very close to my heart.

How do you handle conflict or differing perspectives among your team members? Having different perspectives is always good. We wouldn’t be able to improve and grow if everyone did everything the same. When there is a conflict, I bring everyone involved together, really listen to all their perspectives and, collaboratively, we devise the best path forward. Sometimes you walk in expecting one direction but leave heading 180 degrees the other way—and it’s an even better route. There’s obviously some compromise involved, but we ensure it’s a win-win situation for everybody. I think people are more at ease when they’re able to voice their opinions. We also try to do things differently next time we face a similar situation so we’re not dealing with the same issue 16 times over.

What lessons would you share with other aspiring leaders? Be genuine! When you stay authentic and true to yourself, it encourages others to do the same, helping everyone to bring out their best. (Heikenwälder walks the talk, having received the Women of Inspiration Authentic Leader Award in 2022.)

What are some key traits leaders today should possess? Adaptability is more important than ever. Whether that’s adaptability to the market volatility or to changes in workforce expectations. We live in unpredictable times and leaders need to learn to roll with the punches and adapt quickly. Also, information is power. The more data and information leaders have, the better they can steer companies in the right direction and make appropriate decisions for the future.

What’s a piece of advice you’re glad you ignored in your career? Being told I wasn’t old enough to go for certain roles. My age has come up several times in my career as a hindrance to pursuing new opportunities, even though the experience and competence was there. So, I’m glad I kept pushing forward.

How do you stay inspired in your current role? What’s exciting about this job is that I’m learning every day as I get to sit down and talk to the winemakers about what they do. For all leaders, I think it’s important to take a moment to do something that makes you happy, at least once a day. In my case, I may take a trip to the island to disconnect and stroll through the vineyards to soak in what we’re doing here. Or I’ll ask the winemakers to take me around to try the latest vintage or pressed juice. If you follow this recipe, you’ll look back at your week and find it was awesome in many ways, no matter what happened.

What do you hope to accomplish in your current role? I hope to set this awardwinning winery up for lasting success! Putting the right people in the right positions and empowering my team to challenge the status quo is key. I hope to inspire, empower and positively impact my team to be game changers in this industry. CG

This interview has been edited for length and clarity.

1 YOUR FIRST JOB? I loved horseback riding, so I got my first job mucking stalls for $5 cash an hour.

2 BIGGEST INDULGENCE? Binge-watching TV shows.

3 FAVOURITE DESTINATION? Mexico and, more recently, Turkey.

4

FAVOURITE HOBBIES? I’m a private pilot, so nothing beats the feeling of sitting in the airplane by myself and just cruising. I’m also a runner and planning a half-marathon soon.

Bold thinkers, innovators, problem solvers and future leaders—this year’s Generation Next winners have it all. These 37 standout young professionals are making waves in roles spanning sales, technology, marketing, product development and operations, and are proving that the grocery industry is in very capable hands. For 15 years, Canadian Grocer has celebrated the industry’s brightest rising stars under age 40; we can’t wait for you to meet the class of 2025.

By Chris Daniels, Rebecca Harris, Jessica Huras, Danny Kucharsky and Carol Neshevich

ASSOCIATE

DIRECTOR, CUSTOMER SALES PLANNING KRAFT HEINZ CANADA

Brett Arbique has never been afraid to aim high. “My vision is to take my potential as far as it can go—whether that’s head of a region, head of sales or president of the company,” he says.

He backs that ambition with results. In 2024, Arbique delivered 8% year-overyear net sales growth

across Kraft Heinz’s six core brands and is on track for 5% growth this year. He’s especially proud of the turnaround on Kraft Peanut Butter, bringing back lapsed buyers to the brand.

At Kraft Heinz since 2019—and two years at Ferrero before that—Arbique emphasizes that success is a team effort.

“I’ve had strong, capable teams, and I love empowering them and leveraging their strengths to

drive results,” he says. “I try to stay hands-off, focusing on the bigger picture and senior stakeholders while keeping the noise out of their way and letting them learn. We’re big on ownership and meritocracy, so I let teams run the business as if it were their own, stepping in only when needed.”

He also organizes rec hockey, fantasy leagues, golf outings and other activities that help colleagues connect.

Sarah Atteck brings clear vision and genuine passion to her role at General Mills Canada, where she oversees several highprofile portfolios, including cereals and Costco, which are central to the company’s growth.

She says working on the Costco portfolio has been particularly transformative for her career, pushing her

DIRECTOR, STRATEGIC MARKETING PARTNERSHIPS SOBEYS INC.

With experience on the agency side and at Maple Leaf Sports and Entertainment (MLSE), Zak Bannerman brought a well-rounded mix of brand sponsorship and leadership skills to Empire in 2018. He played a key role in launching Empire’s landmark partnership with the Canadian Olympic and Paralympic teams, including the creation of the Feed the Dream platform. Bannerman also pioneered the NHL My Team Picks gamification program, a first-of-its kind

to reimagine conventional retail thinking. Atteck says she’s had to overcome new barriers and find alternative ways to appeal to buyers.

“Making significant headway in growing our Costco business over our last two fiscal years is one of my proudest accomplishments.”

Her collaborative approach shines through in her recent distribution and shelf-optimization work. Working closely with the insights and sales teams,

platform that blended fan passion with digital engagement. Another highlight was launching corporate-led shopper marketing initiatives that connect CPG suppliers with sports properties across Empire’s banners.

What inspires Bannerman is facilitating experiences that connect people with sports—and each other. “Giving people experiences that are highly sought after and that create connections and memories is truly special,” he says.

Bannerman is a passionate advocate for youth empowerment, grassroots sports and food security. At the National Bank Open, he led the Tennis Canada Kids Community Clinic, giving underprivileged children their first experience with tennis. In Halifax, Bannerman spearheaded Sobeys’ investment in a refurbished basketball court in partnership with Giants of Africa. He also supported Sobeys’ partnership with MLSE LaunchPad’s Nutrition Hub, which provides nutritious snacks to kids in afterschool programs.

she created customized strategies for different retail banners that balance product launches with strategic portfolio management.

Atteck’s genuine love of food continues to inspire her work. “Being in the food industry is a dream,” she says.

Known for uniting people around shared goals, Atteck prioritizes developing her team. As co-lead of the Asian Leaders Network, she also strengthens her

LOBLAW COMPANIES LTD.

community through cultural celebrations and inclusion initiatives.

With a degree in aerospace engineering and a master’s in operations research, Georges Baydoun worked for global technology companies before joining Loblaw in 2021. At Loblaw, he is transforming how the company uses AI and analytics to drive results across supply chain, store operations and merchandising.

A standout accomplishment is pioneering an agentic AI framework through Loblaw’s AI Store Manager Assistant project. The framework is now becoming the blueprint for developing intelligent systems across the business, creating efficiencies and unlocking new capabilities.

Another highlight is Baydoun’s work in space planning optimization. The project integrated complex models into an interactive web tool, delivering a network-wide sales lift. He also led the development of a tool that identifies Canadianmade products from images and descriptions.

His long-term career goal is to continue to combine technical and AI expertise with deep industry knowledge. “That’s where you can deliver the most value,” he says. “You can be the best technical expert, but if you don’t understand the challenges facing the industry, you might not be solving the right thing.”

CUSTOMER TEAM LEAD

In his 11 years at Unilever, Richard Bertrand has earned six promotions—momentum he credits to stepping outside his comfort zone.

He began in Unilever’s Montreal office as a business analyst and key account manager before relocating to Toronto to run the Sobeys account nationally. Later, he moved into the lead customer and brand strategy role for the hair care portfolio. “Moving

TYLRE BROWN DIRECTOR, STRATEGIC COMMERCIAL DEVELOPMENT

I-D FOODS CORPORATION

During his 14-year career at I-D Foods, Tylre Brown has worked in both sales and marketing roles, gathering key insights into what retailers and brands are seeking.

“I like to challenge the norm by trying to understand both what

from Montreal to Toronto was a big risk—leaving family, leaving everything,” he says. “But, it gave me a real understanding of the Canadian market.”

Back in Montreal as team lead for Club-Dollar—which includes Costco, Dollarama and Giant Tiger—Bertrand pushes his team to think beyond the day-to-day.

“Curiosity is everything. When someone asks not just about their role, but how a launch works across channels—that’s when I know they’re ready for more.”

“My job is to understand where people want to go, identify gaps and give them projects that get them there,” he adds.

He’s also advanced sustainability in the club channel, shifting products away from shrink-wrapped plastic—“a huge focus over the past five years,” he says.

Looking ahead, Bertrand is drawn to strategy and transformation roles that leverage technology to make systems smarter and improve work efficiency. brands want to do and what retailers are looking to accomplish,” Brown says.

Along the way, he’s made significant contributions to the company. Brown spearheaded the development of I-D Foods’ e-commerce channel, which “has grown to be pretty significant” and now represents about 6% of the company’s business.

Taking on Nando’s Peri Peri Sauce brand, Brown increased sales eightfold,

DIRECTOR OF OPERATIONS AND TRANSFORMATION PROJECTS

SOBEYS INC.

In his 23 years at Sobeys, Maxime Bourget has gone from working part time in a grocery store in high school to managing IGA and IGA Extra corporate stores and, ultimately, transforming entire systems for the grocer.

Bourget says he made his name at the grocer as “the go-to guy when they need someone in the different regions to put the store back on the rails.”

He’s done everything from managing customer experience to changing the payroll system.

His latest achievement was managing the Quebec deployment of electronic shelf labels in stores. He’s now assisting with the national deployment.

“I’m really proud of everything I’ve done so far,” says Bourget. He adds that what he enjoys most about his role is having an impact on processes, people and in-store operations. There is a need for grocers to constantly innovate, he says, “and obviously I have the trust from my company to try new things.”

Bourget would like to be a vice-president one day, but “I’m open to every opportunity,” he says. “I would really like to have even more of an impact on the banners.”

making it the No. 3 hot sauce brand in Canada.

“I’m very proud of the work I did on that from a marketing front,” he says.

Beyond those successes, Brown takes pride in mentoring others and seeing people he supported succeed. “My goal is to essentially get to a position where I can support other people to do the same thing I’ve done and grow in the industry,” he says. “That’s where I find such joy in what I do.”

STORE TEAM LEADER, WHOLE FOODS MARKET

KITSILANO

WHOLE FOODS MARKET

Starting as a produce clerk while studying business at the University of British Columbia, Kelvin Cheng didn’t initially envision a career in grocery. Influential mentors and exposure to different parts of the business inspired him to stay, eventually resulting in a leadership role at Whole Foods Market. “I’m a strong

SENIOR MANAGER, SALES STRATEGY AND INSIGHTS

RESTAURANT BRANDS INTERNATIONAL

Like many business graduates—Choy earned a bachelor of management and organizational studies with a finance specialization at Western University in London, Ont.—he expected to follow the well-travelled path toward investment banking or consulting. But, an unexpected opportunity in the CPG sector changed everything. “I fell in love with it—building bold brands,

advocate of mentorship and training up the next generation because, without that, I don’t think I would be where I am today,” says Cheng.

Throughout his 16-year grocery career, Cheng has consistently demonstrated innovation and leadership. He implemented a crossfunctional approach to store operations, breaking down departmental silos and improving overall store efficiencies. He played a key role on the planning committee for Whole Foods’ 2024

launching exciting innovation and the amazing people who work in this industry.”

During his time at General Mills (almost five years) and Danone (one year), Choy helped unlock more than $100 million in incremental revenue and $30 million in profit. In January 2025, he joined Restaurant Brands International, the parent company of Tim Hortons, Burger King, Popeyes and other QSR brands.

Choy has been pivotal in transitioning Tim Hortons to operate like a CPG—growing not only through new restaurants, but data-led strategy, pricing, channel development and portfolio management.

Previously, he served as president of the Canadian Asian International Student Association (CAISA) at Western and continues to mentor students today. “Seeing young people discover their strengths, find their direction and realize there’s a place for them in this industry is incredibly rewarding,” says Choy.

North International Area Leadership, contributing to event organization and logistics planning. A key highlight for Cheng was being recognized as a Rising Star store team

leader in his region, which includes 70 Whole Foods stores in three countries. Cheng is deeply committed to giving back. He’s led volunteer events for a senior luncheon program at Kitsilano Neighbourhood House and mobilized teams to support Quest Outreach Society, a non-profit food exchange program. “As I progress through my career, I’m looking to contribute beyond the four walls, whether it’s celebrating team members or serving the community.”

MATT DILL DIRECTOR OF CATEGORY MANAGEMENT, FRESH FARM BOY

Matt Dill says luck brought him to the grocery industry—20 years ago, Farm Boy opened near his Ottawa home and he landed a job in the meat department. He later moved to Farm Boy’s manufacturing facility and then into the role of category manager for meat, where he consistently delivered double-digit growth. Today, Dill oversees the meat, seafood, bakery, deli, cheese and chef categories.

In meat and seafood, he led the expansion of Farm Boy’s value-added program, tripling SKUs and turning it into one of the fastest-growing areas of the business. He also drove the launch of several chef-led grab-and-go programs, collaborating across culinary, supply chain, marketing and store operations. Another career highlight is scaling the business outside Ottawa into the Greater Toronto Area and Southwestern Ontario.

For Dill, a standout achievement has been playing a role in Farm Boy’s evolution. “It went from a mom-and-pop grocery store to a huge company, and it’s been fun to be a part of it,” he says. Another proud moment? Playing an instrumental role in shaping Farm Boy’s commissary and manufacturing business. “It was so innovative and disruptive and a lot of hard work,” Dill says. “But, it’s the soul of Farm Boy now—the products are made by us and are unique to Farm Boy.”

At Kruger Products, our mission is to make everyday life more comfortable — and that begins with a culture that fosters strong sense of belonging for colleagues. Our inclusive work environment is rooted in Canadian pride, where everyone can bring their best selves to work. Our team members play an important role in driving innovation and leadership behind Canada’s most popular tissue brands – Cashmere®, Purex®, SpongeTowels®, Scotties®, and Bonterra®. That’s why we’re committed to providing opportunities to take on exciting new challenges, make a meaningful impact in their communities and grow their careers.

With ten manufacturing facilities across North America as well as our corporate headquarters and regional field sales, our strong Canadian roots service coast to coast. Whether your passion lies in Supply Chain, Operations, Finance, HR or Sales and Marketing, something great awaits you at Kruger Products.

Visit krugerproducts.ca/careers for more information.

MARLEEN DIMESKI SENIOR MARKETING MANAGER, EMERGING BRANDS (SNACKING) BIMBO CANADA

Marleen Dimeski, who began her career at Bimbo Canada as a leadership trainee, was instrumental in launching what became the top-selling product in the hot dog and hamburger bun category.

Leaning on consumer insight, she introduced Dempster’s Signature Gold Buns in only 20 weeks in 2018. The innovation came “just by learning about consumer behaviour and providing a solution,” she says. That success led to the revamping of Dempster’s entire Signature lineup.

Dimeski has twice won the Bimbo Canada President’s Award, once for the Gold Buns launch and also for the introduction—during the pandemic—of the Sobeys Gift Card Program, a first-of-its-kind shopper marketing program for the grocer.

Since January 2025, she’s been managing emerging snacking brands such as Big Daddy and Mexico’s Marinela cookies, identifying opportunities and building brand awareness in a space where the company lacks market share. “It’s been a steep learning curve, but it’s been fun,” she says.

Passionate about building brands, Dimeski aims to continue driving innovation in the snacking space and mentoring emerging talents.

MANAGER, SUPER C MONT TREMBLANT METRO INC.

Since joining Super C Saint-Canut in Quebec at age 16 as a part-time clerk in the produce department, Koralie Dupont has risen through the ranks and now, at only 24, supervises more than 80 employees as store manager of the retailer’s Mont Tremblant store.

Rose Donatelli has built her career in the food industry by challenging conventions and driving category growth. Overseeing national fluid sales at Lactalis Canada, she has helped reverse years of decline in premium milk by rethinking the category.

“We shifted away from a price-led narrative and focused instead on the true drivers of purchase: quality, freshness, shelf life and the tangible benefits that justify a premium [milk],” she says. By simplifying promotional structures and emphasizing product integrity, she made milk exciting again while driving sustainable growth.

Donatelli’s leadership philosophy centres on empowerment and clarity. “Great results come when people understand the ‘why’ behind what we’re doing and feel trusted to make decisions,” she says.

Her experience coaching youth soccer informs her

What’s even more impressive is that Dupont has managed this accomplishment

approach. “Leadership isn’t about having all the answers,” she says. “It’s about creating an environment where people can perform their best and feel supported through both wins and losses.”

Looking ahead, Donatelli aims to expand into segments that connect health, sustainability and innovation, and to help reinvent dairy for the next generation.

while continuing her studies. She has already obtained a certificate in administration from the Université du Québec en Outaouais and is now pursuing a bachelor’s degree in social work.

“Academic knowledge plays a fundamental role in both professional and personal development,” Dupont says. “Therefore, continuing my education was a basic necessity.”

She is aiming to integrate social science

principles such as social justice, open-mindedness and empowerment as she leads her Super C team, and to “create a work environment based on respect, collaboration and inclusion.”

As for the future, Dupont’s goal is to “assert my presence in a predominantly male environment as a competent, committed and passionate professional within a field that deeply stimulates me.”

C o n g r a t u l a t i o n s

t o o u r i n s p i r i n g

G e n N e x t W i n n e r s !

SENIOR KEY ACCOUNT MANAGER

THE CLOROX COMPANY OF CANADA

Although she’s been at The Clorox Company for less than two years, Margarita Duque has already delivered impressive results for the company, managing its full portfolio for major customers such as Pattison Food Group and Federated

SENIOR SALES LEADER

MARS WRIGLEY CANADA

Daria Garlicki discovered her passion for business operations and sales as a teen working part time at her parents’ Gino’s Pizza franchise. After studying international business relations and economics at university, a summer stint in the mail room at Energizer led to a full-time retail representative job.

In 2012, Garlicki joined Mars as a retail operations co-ordinator and has since moved through roles in customer marketing, supply

Co-operatives Limited.

Duque completed three in-depth category reviews for Clorox, all without sales analyst support. One of the reviews for water filtration led to increased share of shelf for Brita water filters.

Another review provided insights on trends in the post-consumer recycled (PCR) plastic garbage bag category. She went on to ensure the 2024 launch of Glad’s first-in-market white PCR garbage bags in

chain, customer experience and sales.

Now, as senior sales leader, Garlicki partners with customers nationwide to deliver Mars brands to consumers across Canada— and she does it all with efficiency, strategic focus and an innovative outlook.

“My favourite part of the job is collaborating with our customers to bring our brands and products to life at retail and to Canadian consumers from coast to coast,” she says.

Garlicki also champions mentorship and inclusion through her leadership in Mars’ Women & Allies Associate Resource Group and involvement in initiatives such as Girls E-Mentorship.

“I take pride in creating environments where people feel empowered to learn, take risks and bring their strengths forward,” she says.

Canada was a resounding success, securing highly visible in-store and online promotions at all SaveOn-Foods stores.

She also increased the profitability of some low-ROI promotions after finding Clorox was providing deeper discounts than necessary.

Seeing the impact of her work is something Duque most enjoys. “Working in this industry is tangible. It has very measurable outcomes,” she notes.

In the future, Duque

would like to accelerate her e-commerce experience and have more strategic roles “doing things I haven’t done before.”

BRAND MANAGER, MARKETING, OIKOS DANONE CANADA

Aurelie Goffinet was handed some major challenges only six weeks after she joined Danone Canada in 2022, following a seven-year stint at Pernod Ricard and Corby’s Spirit and Wine in Belgium and Canada.

She was tasked with reinvigorating the Danone Go and Danino brands in the kids’ portfolio and launching the high-protein, low-sugar Two Good brand. “That was a big transition because I was coming from a totally different world from the spirit and wine industry. It demonstrated my ability to transfer skills from one company to another,” she says.

So successful was Goffinet that she was named Marketer of the Year for Danone in 2023.

More recently, Goffinet and her team spearheaded the Canadian launch of Oikos PRO, which has gained significant market share in the yogurt protein category. “We exceeded all our benchmarks when it comes to trial, awareness and, ultimately, sales. We’re extremely happy,” she says.

A passion for brand-building and brand strategy “drives me and excites me the most,” says Goffinet, adding that her dream goal would be to lead the global strategy of a multinational brand.

proud to recognize

Their leadership, innovation, and unwavering commitment in the grocery industry have earned them the well-deserved Canadian Grocer’s Generation Next Award.

SENIOR NATIONAL ACCOUNT MANAGER

PEPSICO CANADA

One of Tyler Gubb’s greatest strengths lies in his ability to lead people effectively while consistently driving business results. From his early days as a district manager through his current role leading PepsiCo Beverages development at Costco Canada, Gubb has focused on helping teams prepare, reflect and grow beyond what they thought possible. His partnership work with Costco has created

strong momentum for both organizations, with Gubb successfully commercializing multiple unique offerings across carbonated soft drinks and ready-to-drink tea in 2025.

Committed to his own development, Gubb has completed two major PepsiCo leadership programs and spent four years mentoring others through PepsiCo Canada’s Mentorship Program.

“I try to lead by example and show vulnerability within a team environment,” he explains. “Having held several roles in a short period, I recognize that I may not always be a subject matter expert at the outset, so I’ve found that showing vulnerability builds trust, empowers my team and creates space for collaboration and growth.”

A father of three, Gubb contributes more than 300 hours annually coaching youth hockey and lacrosse in Durham region, which he says has strengthened his ability to communicate and motivate diverse teams.

Alexandre Jacques has transformed operations at Agropur by doing everything from overhauling its ordering practices to revamping its payment system.

Jacques implemented an automation roadmap that changed the way clients order. In just six months, orders went from 50% calls to 90% automation, dramatically improving efficiency without compromising sales.

He modernized transactions by having clients switch from manual to digital payments. Thousands of grocery and conveniencestore clients now make pre-authorized or e-transfer payments, instead of paying by cash or cheque. The initiative dramatically cut operational costs and eliminated 60,000 cheques per year.

Jacques also convinced clients across Canada to submit orders 48 hours instead of 12 hours in advance— an initiative that has greatly improved planning and on-time delivery. “It changed habits that were established for 25 years,” he says. “It was really a change of culture internally and externally.”

The changes are working “and being part of this for me is just phenomenal,” says Jacques, whose goal is to continue to lead projects that redefine the industry.

SENIOR DIRECTOR, RETAIL SALES

SOFINA FOODS

Rory Johnston has achieved some of Sofina Foods’ largest business successes over the last several years.

He is currently responsible for sales at Loblaw, Sofina’s largest retail customer, after similar stints on the Metro

and Sobeys accounts.

At Sobeys, Johnston inherited a declining account and was able to completely turn around the numbers. Among other successes, he was also instrumental in the launch of a portfolio of Lilydale sliced meat products.

But, he maintains his greatest achievement, so far, has been watching the development and career success of those he has

mentored, coached and supported.

“I want to continue to develop and improve myself as a leader so I can be part of the growth and change and development of this organization,” Johnston says. “I see a long runway for myself here and just want to ensure that I absorb as much as I can in each role so I can lean on that experience in future roles as well.”

R&D GROUP LEADER (CHOCOLATE), NORTH AMERICA

MONDELĒZ CANADA

Jessica Kok translates consumer insights into award-winning confections that redefine categories. Since joining Mondelēz Canada as an engineering intern in 2012, she’s become a driving force in innovation, leading a team developing seasonal products while championing sustainability at the company across

SAVE-ON-FOODS

GRANDE PRAIRIE, ALTA. SAVE-ON-FOODS

ingredients and packaging. Her recent launches tell the story of her impact: Caramilk Salted Caramel won Product of the Year in 2023, and Cadbury Dairy Milk Micro Mini Egg achieved breakthrough success, ranking among the brand’s top performers.

“Combining two iconic products—Cadbury Dairy Milk chocolate bars and Mini Eggs—into a single product that offered a new and exciting experience for consumers was a complex yet satisfying challenge,” she says.

After earning his business degree, James Lam was working for a painting company; and while painting an impressive oceanfront house, a lunch break chat became a turning point. “My co-workers were talking about how nice it must be to live in a home like that,” he recalls. “At that moment, I decided I wanted more.”

Deciding grocery would be his path to success, Lam quit his job and started as a clerk at Pattison Food Group’s Save-On-Foods banner in Tsawwassen, B.C. Within three months, he was promoted to supervisor and, a year later, assistant store manager. In 2023, he became a store manager in Yorkton, Sask., where his innovative approach to reducing shrink transformed his store’s performance and earned him a spot presenting at the 2025 Pattison Food Group Summit. Named a Rising Star at the company’s Leadership Excellence Awards, he’s also proud of building a high-performing team and mentoring two assistant managers who are now store managers themselves.

He’s now store manager in Grand Prairie, Alta., and the ambitious Lam hopes to continue achieving great things with his company: “The Pattison Food Group has so many amazing leaders that hold their teams and themselves to the highest standard, and that inspires me.”