SUSTAINABILITY REPORT 2024

As CEO of Seaborn, I am proud to present our 2024 VSME Report a vital milestone in our commitment to transparent, goal-oriented, and responsible sustainability development.

At Seaborn, sustainability is more than compliance it is a strategic imperative that defines how we operate and grow. In 2024, we intensified our focus on preparing for the upcoming Corporate Sustainability Reporting Directive (CSRD) by conducting a comprehensive double materiality assessment and developing corresponding IRO (Impacts, Risks, and Opportunities) tables. While the evolving regulatory landscape, including the ongoing Omnibus decision and the “Stop the Clock” provision, led us to adopt the VSME framework for this year’s reporting, we have voluntarily chosen to report at the extended level of disclosure. This approach allows us to build capacity, strengthen our internal governance, and share our sustainability efforts transparently with stakeholders.

The leadership team recognizes the value of the insights gained through the double materiality assessment and IRO process. These learnings will directly inform our strategic planning for 2025, helping to embed sustainability more deeply into our core business decisions and long-term objectives. This report offers an honest account of where we stand, the challenges we face, and the ambitions we have set for the future. Our key focus areas include reducing greenhouse gas emissions, increasing the share of value-added products (VAP), and ensuring that both our organization and supply chain partners uphold high standards for working conditions, ethics, and resource efficiency.

We are proud to announce that we in 2024 set targets aligned with the SBTi standard. Finally, I want to thank all our employees, suppliers, and partners. Your dedication and collaboration make it possible for Seaborn to deliver outstanding seafood with care for both people and planet.

Sincerely,

Dag Aksnes CEO, Seaborn AS

Alex Vassbotten Chairman of the board

Sissel Christin Øren Board member

Knut Roald Holmøy Deputy chairman of the board

Ulf Christian Ellingsen Board member

Geir Erik Karstensen Board member

Birthe Drageset Board member

Seaborn is a total integrated company engaged in production and export of farmed salmon and fjord trout. Our fish farmers are pioneers who have extensive experience, expertise and tradition in farming during generations. Our shareholders own 54 licenses for farming of salmon and fjord trout in Norway along the Norwegian coastline, from Hardanger Fjord to Sognefjord and Lofoten Islands.

Seaborn’s aim is to continue to expand. In cooperation wth some of the best fish farmers in Iceland, and other producers on sea and land, we are in position to export salmon produced in the icelandic fjords. We firmly believe that knowledge is the prerequisite of quality.

Seaborn will continue to be the supplier customers choose because of our high service level and consumer focus, and the bridge between farmers and the market. Thus, good supplier relations through long term and continued cooperation is one key element ensuring our goals.

Our markets are worldwide, in all the continents, and we are currently exporting to over 60 countries. All global markets are served from our head office in Bergen, Norway, and from regional offices in Sweden, Iceland and USA.

Our core values are our DNA.

Being the best: in meeting requirements and exceeding epectations.

Earning trust: from everyone we interact with.

Creating energy: leading to effective action and innovation.

Revenue Growth

% of Certified Sustainable Fish growth

22.4% % of whole fish processed to VAP 0.56 GHG intensity kg CO₂e per EUR

A vital step in identifying the sustainability aspects affecting companies is the execution of a Double Materiality Assessment (DMA). Seaborn initiated its DMA process in 2023, as part of a broader effort to align with the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards. While Seaborn is not currently subject to mandatory sustainability reporting under the CSRD, the company has proactively chosen to align its practices with the Voluntary Sustainability Reporting Standard for SMEs (VSME). This decision demonstrates Seaborn’s strategic ambition to be a frontrunner in sustainability and climate action within the seafood sector.

The double materiality assessment process was structured around four stages:

1. Understand

2. Identify

3. Stakeholder engagement

4. Mapping materiality

In 2023, Seaborn began the first phase, focusing on understanding the company’s sustainability context and the regulatory framework. The remaining phases were completed in 2024 and are continually revised for changes as we now use this as a strategic document for our business.

Impact materiality: Assessment of Seaborn’s impact on climate, ocean health, social conditions, and governance.

Example: Reducing Scope 3 emissions from fish transport.

Financial Materiality:

How sustainability issues affect Seaborn’s financial performance – as risks (e.g. extreme weather) or opportunities (e.g. demand for low-carbon seafood).

Stakeholder engagement:

Input from fish farmers, customers, employees, and investors.

Goal: Understand expectations and risks.

Mapping materiality:

Key findings from the first three steps identified topics like GHG emissions, food safety, and ethical governance.

Seaborn views the DMA as a strategic tool to guide sustainability efforts and reinforce transparency, trust, and continuous improvement. The outcome of this process supports more targeted action across ESG dimensions and enhances the company’s readiness for future reporting obligations.

Furthermore, Seaborn’s long-term collaboration with suppliers strengthens supply chain resilience and availability. By promoting mutual sustainability goals, Seaborn ensures stable access to responsibly sourced seafood, reinforcing both operational continuity and shared environmental responsibility.

The double materiality analysis has therefore become an essential mechanism for Seaborn to remain at the forefront of sustainability leadership in the global seafood industry, and to meet growing expectations from regulators, investors, and customers alike.

Climate change

Circular economy and packaging

Own workforce – working conditions and balance

Supply chain working conditions and safety

Animal welfare in aquaculture

Business conduct and supplier management

WE ARE PART OF THE ECOSYSTEM

That’s why we protect it.

We work closely with Norwegian and Icelandic fish farmers to promote sustainability across the value chain. Protecting nature is not a goal – it’s how we operate.

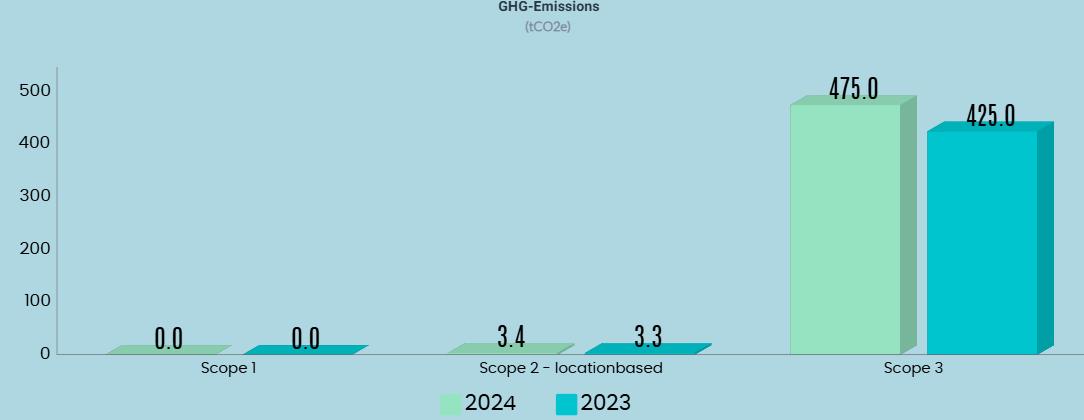

This section provides an overview of Seaborn’s greenhouse gas (GHG) emissions in 2024, with a comparison to 2023.

Emissions are reported according to the GHG-Protocol, divided into three categories:

• Scope 1 covers direct emissions from owned vehicles or facilities. As Seaborn does not operate any such assets, this category is not applicable.

• Scope 2 includes indirect emissions from purchased electricity – specifically, electricity used at our office premises.

• Scope 3 accounts for all other indirect emissions in our value chain. This includes, emissions from fish farming, processing, packaging, and transport. The majority of Seaborn’s emissions fall under Scope 3.

Purchased energy

2024: 3.38 tCO2e

2023: 3.27 tCO2e

There was a slight increase in emissions due to increased energy usage.

01. Purchased Goods and Services

2024: 325,119.642 tCO2e

2023: 306,514.472 tCO2e

Increased emissions due to increased business activity.

03. Fuel- and Energy-related Activities

2024: 0.745 tCO2e

2023: 0.579 tCO2e

Emissions have remained relatively stable.

04. Transportation and Distribution

2024: 149,804.452 tCO2e

2023: 117,953.499 tCO2e

Emissions have increased by about 27% due to a rise in transport caused by increased sales.

05. Waste Generated in Operations

2024: 0.012 tCO2e

2023: 0.019 tCO2e

Emissions remains relatively stable, with a slight decrease.

06. Business Travel

2024: 151.884 tCO2e

2023: 135.209 tCO2e

Emissions increased in 2024, mainly due to our participation in The Global Seafood Marketplace in Barcelona.

07. Employee Commuting

2024: 26.304 tCO2e

2023: 26.199 tCO2e

Emissions from employee commuting remain relatively stable.

08. Upstream Leased Assets

2024: 39.360 tCO2e

2023: 40.79 tCO2e

Emissions have decreased by approximately 3.5% from 2023 to 2024.

09. Downstream transportation and distribution

2024: 208.632 tCO2e

Data were first registered in 2024.

10. Processing of sold products

2024: 61.361 tCO2e

2023: 74,97 tCO2e

Emissions decreased with 18,2% from 2023 to 2024, primarily due to lower energy emission factors by NVE.

12. End-of-life Treatment of Sold Products

2024: 2.164 tCO2e

2023: 3.914 tCO2e

Emissions decreased by 44.7% in 2024 due to lower emission factors by DEFRA.

Seaborn’s methodology for measuring and tracking greenhouse gas emissions.

Scope 3, Category 1

Purchase of fish is our largest source of emissions. To improve data quality, we assessed nearly 100 suppliers and categorized them. Instead of using generic emissions factors, we collected supplier-specific CO₂e data, particularly from Salmon Group members to better reflect actual production practices and emission differences.

Scope 3, Category 4

We calculate transport emissions using Maritech, a software solution that integrates with our trading systems and captures real logistics data – including country, distance, vehicle type and route. This enables highaccuracy, activity-based emissions, replacing assumptions with real data and strengthening decision-making.

All other remaining greenhouse gas calculations are from Emisoft’s GHG123:

• Emissions factors for market-based method and location-based method Scope 2 are taken from NVE (National Product Declaration).

• Emissions factors for calculating Scope 3 are based collected from DEFRA (Government conversion factors for company reporting of greenhouse gas emissions)

• Industry-specific emission factors for the seafood industry are taken from SINTEF (2022). Calculations and factors for transport are provided by Maritech.

References

DEFRA, «Greenhouse gas reporting: conversion factors»

NVE "Strømdeklarasjoner"

SINTEF (2022), «Greenhouse gas emissions of Norwegian salmon products»

Scope 1 - Direct emissions

Scope 2 - Purchased energy Scope 3 01. Purchase goods and services 02. Capital goods 03. Fuel- and energy-related activities 04. Upstream transportation and distribution 05. Waste generated in operations

06. Business travel 07. Employee commuting 08. Upstream leased assets 09. Downstream transportation and distribution 10. Processing of sold products 11. Use of sold products 12. End-of-life treatment of sold products

13. Downstream leased assets

14. Franchises

15. Investments

Includes

Not relevant - no own vehicles or processes

Included - electricity from office premises

Included - purchased fish from all suppliers and IT equipment

Not relevant – no investments in capital goods

Included - calculated from energy consumption

Included - transport from all suppliers

Included - waste from office operations

Included - flights performed by all employees and hotel stay

Included - travel habits survey conducted and reported

Included - energy from storage

Included - transportation by customers' vehicles of sold products

Included - energy from our fish processing partner

Relevant - Not included this year

Included - packaging from products are included

Not relevant – does not lease out any assets

Not relevant – does not have any franchises

Not relevant – does not have any investments

OUR PEOPLE DRIVE OUR SUCCESS

That’s why we put them first.

At Seaborn, we foster a supportive, inclusive and flexible work environment. We invest in well-being, development and resilience – because thriving employees build a stronger company.

At Seaborn, we recognize that our people are our greatest asset, and their well-being is fundamental to our long-term success. Operating in the high-paced seafood industry, we acknowledge that the nature of our business can be demanding and fast-moving. While this environment drives innovation and competitiveness, it also brings potential risks related to stress, workload, and work-life balance. Through structured measures and strong internal culture, Seaborn takes these challenges seriously and invests continuously in creating a safe, inclusive and supportive workplace for all employees.

We have implemented a set of initiatives designed to promote employee well-being and prevent burnout. These include access to health and wellness benefits such as gym memberships, external training support and the use of a company apartment in Myrkdalen. Flexible work arrangements, including the possibility to work from home, further support a healthy balance between work and personal life.

Regular employee performance reviews, annual workplace surveys, and follow-up by our internal Working Environment Committee (AMU) ensure that feedback is captured and acted upon effectively. These efforts are backed by our dedicated HR department and social committee, who work proactively to foster engagement and a positive work environment.

During our recent double materiality assessment, conducted in collaboration with Emisoft, employee feedback identified work-life balance and stress management as topics of significance under the social dimension. Therefore, we are committed to continuously improving policies and programs that promote resilience, engagement, and job satisfaction across the organization.

We also place a strong emphasis on skill development. Seaborn invests heavily in both internal and external training programs, in example all our members of the sustainability team have taken courses in sustainability reporting.

Our training initiatives enhance compliance with evolving regulatory requirements, strengthen operational capabilities, and support employee development across all levels of the company. By empowering employees with the right tools and knowledge, we build a more agile and forward-looking organization that can respond effectively to industry demands.

Seaborn’s office facilities are designed to accommodate individuals with physical disabilities, with elevators and wide doorways ensuring universal access. Through transparent dialogue, workplace safety reviews, whistleblower channels, we ensure that all employees can raise concerns and that any issues are resolved in collaboration between HR, management and AMU.

Beyond our direct workforce, Seaborn is committed to upholding social responsibility throughout our value chain. All suppliers are required to sign our Supplier Code of Conduct (SOC) before any transaction begin, covering principles as fair labor practices, decent working conditions, and human rights. We monitor supplier compliance through annual risk assessments, including on-site audits and contract reviews – especially with transporters where risk is higher due to transnational labor practices.

For example, recent media scrutiny of subcontracted transport services in Europe has underscored the importance of consistent oversight. In Seaborn’s case, Norwegian regulations such as Allmenngjøringsforskriften ensure that drivers operating in Norway receive proper wages and rest time, and we perform spot checks to confirm compliance.

We are members of Future Proof, an initiative that helps reinforce ethical practices across the full length of our supply chain. While most of our suppliers are based in Norway and Iceland and thus subject to strict labor laws, we remain vigilant about potential risks further upstream. Our certified suppliers and adherence to standards like ASC, Global G.A.P., and BRC help mitigate these risks. In Norway, the presence of trade unions and flat organizational structures also contribute to transparency and worker representation.

Seaborn proudly supports the Dale Oen Experience Foundation through annual donations. Our contribution provides adolescents who struggle with the traditional school path an opportunity to experience personal growth, build character, and find direction through nature-based learning and physical challenges.

Founded in 2012 in memory of World Champion swimmer Alexander Dale Oen, the foundation offers a unique “experience year” through the Dale Oen Academy a program for youth aged 15–20.

Through activities like hiking, sailing, diving, and teamwork challenges, participants develop confidence, resilience, and life skills that go far beyond the classroom. Since its founding, over 115,000 children and youth have taken part in the foundation’s programs. More than 90% of academy participants complete the year, and over 95% move on to education or employment a strong testimony to the impact Seaborn is proud to support.

That’s why we lead with transparency and integrity.

At Seaborn, governance means acting responsibly across borders, partnerships and processes guided by strong principles and high ethical standards.

Seaborn is committed to conducting its operations with integrity, transparency, and accountability. Robust governance structures are essential to safeguarding the company’s reputation and ensuring compliance with national and international regulations.

Governance responsibilities are embedded in Seaborn’s leadership, finance, HR, and quality management functions, which collaborate on evolving laws, sanctions, and trade regulations. Internal procedures are continually evaluated and refined to ensure compliance. All employees are required to read and understand the company’s Code of Conduct, which is regularly updated and includes clear guidance on anti-corruption, whistleblower protection, and ethical business behavior. Specific departments also undergo annual anti-corruption training (nano-learning) to maintain awareness and readiness

Seaborn performs due diligence and integrity checks on all customers and suppliers before onboarding and reassesses them on an ongoing basis. These checks include evaluation of corruption risk based on country of operation using the Transparency International Corruption Perceptions Index (CPI) and recommendations from the Norwegian Ministry of Foreign Affairs.

Seaborn conducts business with customers in countries where jurisdictions differ from the Nordic countries, where corruption risks are higher – therefore, the company maintains stringent compliance routines to mitigate reputational and financial exposure. If suspicions of corruption arise, customer relationships are immediately terminated.

The governance framework is supported by a broader quality management system that includes routines for anti-corruption, anti-money laundering, and responsible supplier conduct.

Seaborn’s supplier governance is based on its Supplier Code of Conduct, which all suppliers must sign prior to cooperation. Supplier surveys include questions regarding any known incidents of corruption further down the supply chain. If regulatory breaches are discovered, the company initiates corrective action and may suspend the supplier relationship.

Animal welfare is also a significant topic for Seaborn. In recent years, average mortality rates in Norwegian aquaculture have reached around 16%, caused by factors such as salmon lice, disease, and gill problems. Seaborn recognizes the importance of supporting industry-wide efforts to improve welfare and reduce mortality. A growing number of customers are monitoring these issues closely, and some have introduced upper limits for acceptable mortality rates in their sourcing policies.

Seaborn’s strong supplier relationships, not only enhance compliance but also contribute positively to trust and transparency. The company pays suppliers promptly and, in some cases, ahead of due dates to support liquidity – effectively acting as a financial buffer for its partners. Although this generates higher financing costs for Seaborn, it helps sustain ethical and stable supply chains.

By maintaining high standards for ethical conduct, engaging in active monitoring, and embedding accountability throughout its value chain, Seaborn ensures its governance practices remain both resilient and responsive in a complex and evolving global landscape.

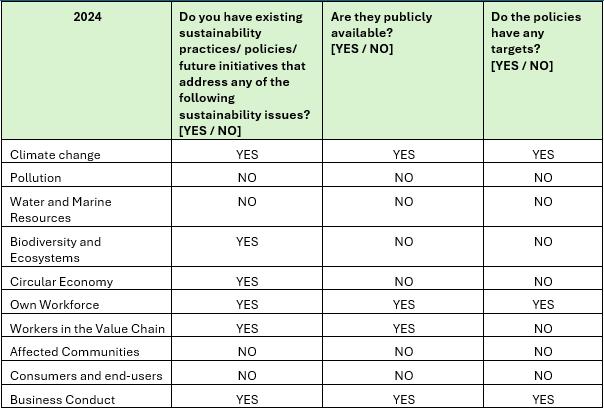

Seaborn’s sustainability report has chosen to report on the VSME standard with both the B (impact-focused) and C (financial materiality-focused) sections of the VSME standard. This decision reflects Seaborn’s strategic belief that sustainability is not just about environmental and social responsibility, but a key driver of long-term value creation and risk management.

Seaborn operates from its headquarters in Bergen, Norway, strategically located in proximity to some of the world’s most advanced aquaculture regions. The company’s core logistics and export activities are supported through a network of partners and terminals along the Norwegian coast. Seaborn’s global reach spans key markets across Europe, Asia, and North America, enabling efficient distribution of Norwegian seafood to a diverse international customer base. This geographic positioning supports both operational agility and a resilient supply chain. Seaborn collaborates with certified suppliers (GlobalG.A.P., ASC, DEBIO) and follows the GHG Protocol and CSRD/ESRS frameworks.

i. The undertaking’s legal form: Private limited liability undertaking (AS)

ii. NACE sector classification code(s): NACE 46.381 Engroshandel med fisk, skalldyr og bløtdyr

iii. Size of the balance sheet (in Euro): 124 229 560

iv. Turnover (in Euro): 864 960 260

v. Number of employees in headcount or full-time equivalents: 72.7

vi. Country of primary operations and location of significant asset(s): See Table 1.

vii. Geolocation of sites owned, leased, or managed: See Table 1.

Individual or consolidated: The report is prepared on a consolidated basis and includes the full value chain. Certifications: Seaborn collaborates with certified suppliers (GlobalG.A.P., ASC, DEBIO) and follows the GHG Protocol and CSRD/ESRS frameworks.

Procedures:

• Regular supplier audits.

• Supplier Code of Conduct and ethical business practices.

• Training in sustainability and risk management.

Policies: Internal policies on climate, social responsibility, and business conduct. Aligned with the UN Global Compact.

Future initiatives:

• Increase the share of Value-Added Products (VAP) to 30% by 2030.

• Reduce Scope 3 emissions by 9.8% by 2030.

• Increase the number of frozen products sold, allowing for transport by boat.

Seaborn is committed to enhancing the accuracy of upstream and downstream value chain data. Our plan involves close collaboration with our suppliers to improve reporting accuracy and standardise data quality. We aim to alleviate reliance on indirect sources by encouraging direct emissions reporting from our suppliers and utilizing robust data management tools like Maritech. For data not directly accessible, we plan to refine our estimation methodologies based on industry standards whilst acknowledging inherent uncertainties. We're also exploring third-party verifications of our data to ensure reliability.

Target tracking: Indicators and performance reviews aligned with double materiality assessments.

o Renewable: 8,936 MWh

o Non-renewable: 331,769 MWh

o Total: 340,705 MWh

Seaborn does not yet report pollutant information.

The company does not operate in or near biodiversity sensitive areas.

Estimated water consumption in 2024: 1,522,000 liters.

Seaborn applies circular economy principles both in its own operations and downstream through product design. Internally, waste sorting, packaging optimization and reuse are key focus areas.

Additionally, VAP product development contributes to reduced food waste downstream by extending shelf life and improving portion control.

• Number of employees: 78 in Norway and 1 in Iceland, all on permanent contracts.

• Gender distribution: 44 women and 34 men.

• Turnover: 1.38%. The reporting period saw a net increase in personnel, with eleven new hires and one departure. The total number of employees rose from 67 at the beginning to 78 at the end of the period.

• Number of employees: 78 in Norway and 1 in Iceland, all on permanent contracts.

• Gender distribution: 44 women and 34 men.

• Turnover: 1.38%. The reporting period saw a net increase in personnel, with eleven new hires and one departure. The total number of employees rose from 67 at the beginning to 78 at the end of the period.

• Minimum wage: Seaborn follows Norwegian standards.

• Percentage of employees covered by collective bargaining agreements: Data not available. Seaborn determines yearly adjustments based on the results of the frontline sector (Frontfaget) along with an evaluation of the company’s situation.

• Training hours per employee: Employees receive sustainability training; average training hours not specified.

No convictions or fines reported in 2024.

Seaborn is a B2B sales company that purchases salmon and trout from Norway and Iceland and distributes it across the globe, with most customers being in Europe, Asia and North America. Seaborn had 489 active suppliers in 2024, with 72 % of them being in Norway and Iceland, 26 % in Europe and 1 % in America and Asia respectively.

Seaborn has an emission reduction target of 9.8% reduction in Scope 3 emissions by 2030 compared to 2022 levels. Seaborn does not have targets for Scope 1 and 2 as there are no Scope 1 emissions and Scope 2 emissions are very limited.

An important measure to reach the target will be increasing the share of VAP to 30% in 2030.

Seaborn operates in NACE Section G which is considered a high climate impact sector but does not yet have a transition plan for climate change mitigation in place. Such a plan is planned to be adopted by 2026.

High carbon intensity in operations and value chain Seaborn’s operations are carbon-intensive, particularly in air freight, fish feed production, and logistics. Scope 3 emissions dominate, including procurement, transport, travel, and product end-of-life.

High exposure due to reliance on highemission activities; high sensitivity as changes in climate regulation or customer expectations may directly affect cost, reputation, and access to markets.

Short to medium Mapping emissions through GHG inventory and developing an emission reduction strategy to reach SBTi aligned goals.

Transition risk: evolving climate regulation and compliance expectations

Increasing pressure from EU regulations and stakeholder demands for transparency and emission reductions across the value chain poses financial and reputational risks for Seaborn.

Medium to high exposure; low sensitivity due to voluntary reporting increasing preparedness for regulatory changes.

Short to Medium Monitoring regulatory landscape; initiated emissions data integration in procurement systems; assessing material topics for stakeholder communication

In accordance with the voluntary nature of Criterion C5 under the VSME framework, the organization has decided not to disclose additional workforce characteristics for this reporting period.

• Does the undertaking have a code of conduct or human rights policy for its own workforce? (YES)

• If yes, does this cover:

o Child labor (YES)

o Forced labor (YES)

o Human trafficking (YES)

o Discrimination (YES)

o Accident prevention (YES

o Other (NO)

• Does the undertaking have a complaints-handling mechanism for its own workforce? (YES)

• Does the undertaking have confirmed incidents in its own workforce related to:

o Child labor (NO)

o Forced labor (NO)

o Human trafficking (NO)

o Discrimination (NO)

o Other? (NO)

Seaborn is not aware of any confirmed incidents involving workers in the value chain, affected communities, consumers or end-users.

Seaborn has no revenue from weapons, tobacco, or fossil fuels. The company is not excluded from any EU reference benchmarks that are aligned with the Paris Agreement.

The board comprises six members consisting of two women and four men.