The California Podiatric Physician

The holidays are fast approaching as I write this message. This time of year we are reminded to “count our blessings” and “give thanks”. I am certain that one of the things for which we are all so very grateful is that we belong to CPMA. During this time of sweeping change in the healthcare environment we need, now more than ever, to come together and help each other navigate the challenging course that we all face.

I am grateful that there are those among us who are dedicated to making sure that we have the resources we need to successfully practice our specialty. Having just returned from the APMA CAC-PIAC (Carrier Advisory Committee-Private Insurance Advisory Committee) meeting in Washington DC, I am inspired by the DPMs from around the country who came together to help members respond to Medicare policy issues and private insurance concerns. As our patients begin to buy insurance on the Covered California exchange and we prepare to implement ICD-10, I am grateful that CPMA is vigilant in alerting us all to the hazards ahead and providing a road map with which to navigate.

I am grateful that CPMA supports our students. As the home of two schools of podiatric medicine, we have a unique responsibility to the future of our specialty. Dr. Karen Wrubel, our immediate past president, has generously funded a scholarship at both of our schools this year that was matched by the CPMA. CPMA board members have traveled to both schools to welcome our students and share with them what it means to be a CPMA member. I paid my first visit to the College of Podiatric Medicine at Western University where I had the privilege of bringing your welcome to the class of 2017 at their white coat ceremony. I was also honored to represent you at the recognition of the 40 years of leadership by Samuel Merritt University President Sharon Diaz.

California Podiatric Medical Association

Legislative Leadership Conference: A Day at the Legislature

The California Podiatric Medical Association (CPMA) will host the 2014 Legislative Leadership Conference: A Day at the Legislature on Wednesday, March 5 at The Citizen Hotel in Sacramento.

The morning breakfast briefing will be followed by a luncheon, after which attendees will meet with their legislators at the Capitol on important health care issues.

After their legislative visits attendees will meet back at The Citizen Hotel for refreshments and to share their experiences.

This is an outstanding opportunity for California’s doctors of podiatric medicine, and is free of charge to all CPMA members and podiatric medical residents and students. Mark your calendar and plan to join your friends, colleagues and podiatric medical faculty and students in Sacramento to speak with legislative leaders as champions for the patients and practice of podiatric medicine.

2014 Western Foot and Ankle Conference

Disneyland Hotel & Convention Center

Anaheim, CA

June 19 – 22, 2014 thewestern.org

Register Online Today and Save - Members Pay Only $7.65/CECH!

Earn all the continuing medical education contact hours you need, including radiology for your california state license at The 2014 Western!

The Western Foot and Ankle Conference is the must-attend continuing medical education meeting of the year. Regarded as a national-level event, The Western has made a name for itself in the podiatric medical community as the premier continuing education and exhibition meeting for foot and ankle specialists from all over the United States and abroad.

The Western provides countless opportunities to be inspired! Discover the most up-to-date clinical and technological advancements. Prepare for the upcoming ICD-10 changes. Stroll the dynamic exhibit hall featuring over 150 vendors showing the latest tools for your practice. Stimulate your mind with a myriad of fresh new CE opportunities. Network with colleagues. Enjoy healthy refreshments to keep you on your toes throughout the meeting. Visit with friends, and take the family to the “Happiest Place on Earth”, Disneyland with discounted theme park tickets through CPMA.

The Western provides the required CECH including radiology contact hours for Doctors of Podiatric Medicine as well as radiology contact hours for Podiatric Medical Assistants in the 3-day Assistants program.

Support CPma and Get Great Registration, hotel, and Ticket Prices for You and Your Staff. you Simply Can’t Beat the Value of The Western.

CPMA Members pay only $199! • Members’ PMAs pay only $99!

Early Bird discount ends Sunday, March 23, 2014. Reserve your seat at the premier continuing podiatric medical meeting today.

Get your vital ICD-10 checkup at the 2014 Western Foot and Ankle Conference (The Western), June 19 - 22 at the Disneyland Hotel in Anaheim, CA.

Western coding experts will help you find out where you are, learn where you should be, and give you the necessary information you need to be prepared for the critical October 1, 2014 ICD -10 Implementation date.

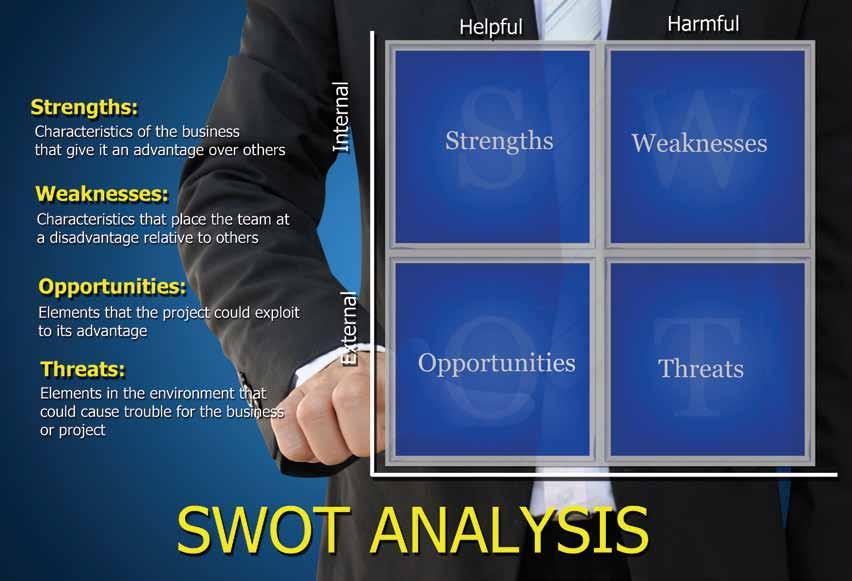

A 2012 Biennial Physicians Survey reported that 77% of doctors were pessimistic about the future of the practice of medicine. There is no question that significant change is coming, the future is currently very uncertain, and doctors are facing difficulty in attempting to determine the type of practice model that will best work for them in addressing this future. Some are making decisions from a position of fear rather than logic, with many DPMs in smaller practices telling me that they are simply hoping to “survive.” It is important to understand that “hope” is not a strategy, and as Will Smith’s character in the movie After Earth said, “Danger is real, fear is a choice.” I am here to say that we do not need to fear the future, and we can do a lot more than “hope to survive.” While we may not know all the details that will define the future healthcare environment in which we will be practicing, we know more than enough to make smart, logical choices regarding the practice models that we should adopt in order to thrive in the new environment.

I am frequently asked, “What is the best practice model to employ for addressing the future?” This is like being asked which model

ship is best for sea travel – a luxury liner, a sail boat, a submarine, or a destroyer? The answer to these questions will always be, “It depends.” “It” depends on (1) the environment to be faced and (2) the goals those employing the model desire to accomplish. Goals are uniquely individual and each practitioner should already know his/her answer to number (2). If you have not already established your goals for the future, I refer you to Yogi Berra, who once said, “If you don’t know what you want, you’re never going to get it.” The first thing to do is to determine what you want.

This leaves a single question to be answered: what environment will we be facing? It turns out that we actually do know enough about the future environment to enable us to determine the models best suited to it – ones which will also be capable of meeting our specific goals. Thankfully, there are a number of options available to us that will meet these needs. Let us examine the six most important environmental factors that our chosen practice models must address in the future.

(1) Price Competition. Similar to those working in every other mature industry, we are facing price competition that is here to

stay. We all recognize that the growing cost of the healthcare system is unsustainable and that the lever available to payers for controlling these costs is their control of the fees which they pay to physicians and hospitals. In the case of practitioners, for whom raising fees to increase the profitability of a medical practice is no longer an option, the primary levers available to them for increasing profitability are (1) the opportunity to control or lower their costs through efficiency, and (2) the utilization of evidence based medicine for proving high quality and value so that they can compete for “pay for quality” contracts.

(2) High Volume. Podiatric practitioners have always treated high patient volume. If we look at podiatric revenue, we see that it is linked with volume in a linear fashion – the greater the volume of patients seen and services provided, the greater the revenue. Because of demand factors, such as (1) aging “baby boomers” who want to stay active, (2) the promotion of activity for maintaining “wellness,” (3) a focus on the prevention of the complications of chronic disease, (4) a predicted physician shortage, and (5) health delivery changes aimed at reducing the number of uninsured patients, it is logical to expect that volume will only continue to increase. Both payers and patients consider timely access to a physician an important indicator of quality, and the primary lever available to physicians for providing timely access in the face of this anticipated increase in volume is efficiency.

(3) Complexity. The practice of medicine is complex, and it is clear that it will become even more so. The process of simply “getting paid” is already incredibly complicated, and the next layer of complexity soon to be added is ICD-10. Maintaining compliance with HIPPA, OSHA, employment law, X-ray equipment, PQRS, Meaningful Use, and a host of other rules and regulations can be daunting, as can being prepared for the growing number of audits in every aspect of practice. Electronic health records add another layer of complexity, and going to Meaningful Use II, incorporating evidence based medicine, and coordinating care are going to offer additional challenges. If this weren’t enough to be concerned with, predictions are that two-thirds of current software programs are not expected to become Meaningful Use II certified, and who knows how many will be ready for ICD-10? Increased complexity compounds the challenge of managing greater volume – making efficiency all the more essential for success.

(4) Obstacles to Achieving Quality. Cost and quality are the primary forces driving healthcare change. Improving quality has been the biggest challenge for every other mature industry. As much as 50% of total healthcare costs are related to “bad quality,” which includes: medical errors, unnecessary care (i.e. additional care that does not improve a patient’s outcome), necessary care not received, duplication of tests, inefficient bureaucracies, wide variation amongst protocols for treating the same condition, inability to track care, and “perverse” reimbursement incentives. Even though fees are not increasing, something that every payer is willing to pay more for is quality

because it has been estimated that the potential savings from doing so could add up to as much as 50% of the total cost of healthcare

Major industries have figured out how to provide higher quality, at lower cost, with much of this advancement coming from the field of industrial engineering. A well known example is the work that W. Edwards Deming performed for Toyota. Together, they focused on “efficient workflow” and statistical process controls for reducing variation as the most important factors for achieving quality. Toyota achieved widely recognized success through these techniques which were eventually adopted by other industries – including service industries – that were facing similar cost and quality demands. This same strategy can be adapted to medical practices.

(5) Access to Contracts. The primary strategy for efficiently accessing many contracts has been the formation of large group practices (such as Kaiser) and independent physician associations (IPA’s). There is simply too much inefficiency involved when payers contract with doctors “one at a time.” The primary shortfalls of IPAs are that they are (1) unable to control quality at the doctor or practice level and (2) unable to improve efficiency amongst their “member” practices because those practices are not integrated operationally, financially, or clinically.

(6) HIgh Fixed Costs. All medical practice models fit into the category of high fixed cost businesses. They tend also to be high volume, and as such, they have an opportunity available to them – the fact that volume can be used as a positive leverage on profit. The higher the volume of patients and services that can be spread over costs that remain constant, the higher will be the profit margin for care provided at the same fee schedule. Conversely, a disadvantage exists in the fact that negative leverage occurs when volume is low or declining. The high fixed cost structure of a medical practice can be compared with that of the airline industry. The cost of a scheduled flight is the same (fixed) whether the plane takes off with one passenger or is full. Each additional passenger increases revenue with very little additional cost – a formula which offers significant leverage for increasing the profit margin.

Further leverage for keeping costs under control can be created by efficient “throughput,” which, in the case of an airline, is the speed of passenger turnover when it is parked at the gate. The quicker the passenger turnover, the sooner the plane takes off for its next destination. Efficiency at the gate reduces the number of additional planes needed to accommodate a growing number of customers. The faster the turnover, the more flights each plane can fly, which increases

I am grateful that our membership has increased this year to a new recent high. The more of us that participate, the more we can achieve as we all benefit from the experience, innovation, passion, and skill that each member contributes. This increased membership also strengthens the size of our delegation to the APMA House of Delegates where our concerns are effectively brought to the national stage.

I am grateful for the cosponsors of our HELLPP Act, which is our federal legislation to be recognized as physicians in Medi-Cal as we are in Medicare. We must obtain the support of California’s congress members in order to ensure passage. To that end, a letter has been sent to every California congress member along with the letter of support (see page 12) from our friends at the California Medical Association. Now is the time to ask your elected representative to sign on as a cosponsor. Please call and use e-advocacy to contact your congress member today to ask for their support. Nothing is more powerful than hearing from a constituent.

I am grateful for our volunteer board of directors, local society component presidents, committee chairs and members who lead us and do the work of our association every day. We are supported in these efforts by our dedicated CPMA staff Andrea, Althea, and Jeannette and our executive director, Jon Hultman, DPM, MBA. Please visit the CPMA website, www.calpma.org, to take advantage of the legal and practice resources that have been posted there.

I am grateful for our corporate sponsors who support our schools, our students, our practices, our association, and our specialty. Please remember to support those who support us.

I am grateful that we have a podiatrist from California running for Congress. Dr. Lee Rogers will be our champion and he needs our support to send him to Washington DC.

I am grateful for our ongoing collaboration with the California Medical Association. In his presidential remarks at their House of Delegates, Paul Phinney, MD recognized our efforts in working with our colleagues at the California Orthopaedic Association on the Physician’s and Surgeon’s Joint Task Force. It was truly an honor to represent you at the CMA HOD. Having the privilege of being the first CPMA president invited to attend and being received as a welcomed guest will surely prove to be a highlight of my term.

I am grateful for my family allowing me the time away from home and my colleagues at Bay Area Foot Care covering for me at the office so that I may serve. As I travel around the state, I am grateful for your care and concern as so many of you ask how I am holding up. Serving you, the California podiatric physician, is both exhilarating and exhausting as CPMA is as committed as ever to advance our specialty and protect the patients we serve. Thank you for your trust, confidence, and support which truly is a blessing.

Northern and Southern California joined forces to strengthen the voice of podiatric medicine with “One Voice” events in September and October.

The Los Angeles County Podiatric Medical Society (LACPMS) held its sixth annual “One Voice” event at the Peninsula Hotel in Beverly Hills, California.

The Santa Clara Valley Podiatric Medical Association held its second annual “One Voice” at the 4th Street Summit Center in San Jose, California

Attendees of both events enjoyed an elegant evening of dining, entertainment and fun. The two events raised over $19K for the California Podiatric Political Action Committee (CalPPAC).

capacity with the same number of planes (or seats). Comparing this to a medical practice, the “seats” are the number of treatment rooms available, and throughput is the length of time each patient spends in the office. Medical practice throughput is dependent on staffing ratios, efficacy of staff training, available technology, office policies and procedures, and the way in which all of these elements are integrated and utilized to create workflow efficiency in both the clinical and business areas of a practice.

(7) Competition. Doctors who can offer the following have a competitive advantage: (1) high quality treatment, (2) quick access to their practices with short wait times after arrival, and (3) a wide array of services and locations, making their practices conveniently located and “one stop shops” for patients seeking foot or ankle care. This competitive advantage can be further expanded by offering supplies or ancillary services requested by patients. Keep in mind that many of these opportunities are themselves high fixed cost businesses and dependent on high volume for profitability.

Going back to our original question, “What is the best practice model to employ for addressing the future?”, we see that we must evaluate models that make the most sense in an environment in which a practitioner needs to (1) manage a large volume of patients while (2) delivering a wide array of high quality services (3) in a complex, price competitive environment (4) in which doctors need a vehicle to access third party contracts. Since all practice models are high fixed cost businesses, practice mergers make considerable sense because they enable the doctors to utilize a lever on profitability – the “pooling” of costs. Mergers immediately enable more volume to be spread over fixed costs – making them lower for the combined practices than they had been for all the individual practices combined, before the merger. To capture the potential value to be achieved through increased efficiency and the advantages of being able to compete on quality and volume, it makes sense for practices involved in a merger to be integrated

operationally, financially, and clinically. “Size” is not critical at the beginning because combining as few as two or three practices can offer significant return with little downside. Adding more practices to a group over time will increase these advantages – especially the ability to access contracts by offering third parties the multiple location advantages of an IPA as well as the quality and service advantages inherent in an integrated group.

This future environment does not rule out the viability of solo practice. Niche solo practices are viable in any environment because doctors in these practices are typically known well beyond their immediate geographical areas. Similarly, concierge or cash practices are viable in any market. If a doctor is in “traditional” solo practice and offers comprehensive services, it would make sense to convert that practice to a low fixed cost business, making it less dependent on volume. A low fixed cost, solo model is known as a “micro-practice” – a practice in which the doctor prefers seeing fewer patients, spending more time with each one, and is able to accomplish this goal by “downsizing” to a smaller facility that is “ultra-high tech,” has only one employee (some have none), and is highly efficient. The office policies and procedures in place are similar to those seen in “mom and pop” businesses in which staff and the doctor do whatever is needed at any given moment to keep the office running smoothly; they are all cross-trained, empowered, trusted, and committed. It is these policies and procedures, combined with appropriate use of technology, that enables “ultra” efficiency. An appealing aspect of this model is that it does not eliminate the option of a future merger. In fact, a merger of multiple micro-practices could create a highly efficient group model well suited to the future environment.

Remember, whatever course of action you decide to take, make sure that your decision makes sense in the future environment we are facing and that it meets your long-term goals. One size does not fit all; you need to adapt the model that you choose to fit both your personal goals and the future environment in which you will be practicing.

CPMA staff continues their tradition of personally donating to provide food and toys to needy families during the holiday season.

Western University of Health Sciences’ annual gala fundraiser highlighted the power and importance of caring.

WesternU’s “A Tribute to Caring” gala on Nov. 9, 2013 brought more than 550 guests to the Disneyland Hotel in Anaheim to raise money for student scholarships.

The theme of “Fire and Ice” was reflected in everything from the table centerpieces to the raffle prizes to the dessert, but the word that resonated through the evening was “caring.”

Second-year College of Podiatric Medicine student Bryon McKenna said he put himself through school, so scholarships have been lifesaving.

“They’re the only way I got through school at this point,” he said. “It helps build your confidence when someone else has confidence in you. It helps push you to be a better student.”

McKenna said he appreciates WesternU putting on an event like ATC.

“It speaks volumes for what the university stands for and how they value their students,” he said.

(Source: Western University of Health Sciences) We SPECIALIZE in Podiatry Billing Over 18 years experience! Low % commission rates

SPECIAL: 1st month free* Our Services Include:

• Billing & Collections

• Daily Billing

• Paper & Electronic

• Complete insurance Follow-up

• Extensive collection

• Posting all charges & payments

• Aging & Financial Reports

• Patient statements mailed daily and monthly

• Lighting fast turnaround Don’t Skip a Beat! For more information call 1.866.324.7003 *New clients only

September 30, 2013

The Honorable Lee Terry

U.S. House of Representatives

2266 Rayburn House Office Building

Washington, D.C. 20515

Dear Representatives Lee and DeGette:

The Honorable Diana DeGette

U.S. House of Representatives

2368 Rayburn House Office Building

Washington, D.C. 20515

On behalf of the California Medical Association, I am writing to express our support for H.R. 1761, “Helping Ensure Life- and Limb-Saving Access to Podiatric Physicians (HELLPP) Act.”

H.R. 1761 would define podiatrists as physicians for purposes of the Medicaid program to ensure that podiatric services provided by a podiatrist is a Medicaid covered benefit. For years, foot and ankle services provided by a podiatrist was an optional Medicaid benefit in California. However, because of recent state budget cutbacks, all optional benefits were eliminated. We are concerned that Medicaid patients (Medi-Cal in California) are already experiencing access to care problems because of California’s low Medi-Cal provider reimbursement rates and with the implementation of the Affordable Care Act, millions more will have a difficult time finding a provider to care for them. This legislation would help to relieve the shortage of providers and improve access to these important services.

We also support the Medicare provisions which could improve the process for obtaining therapeutic shoes for diabetic Medicare patients.

CMA is proud to work with our colleagues in Podiatric medicine to improve access to essential medical foot and ankle care, particularly for those patients at risk for diabetes and related lower limb complications. We support the legislation as drafted to define podiatrists as physicians for purposes of Medicaid as it is within the scope of their training and education as outlined in state law.

Thank you for introducing H.R. 1761. We look forward to working with you. The CMA contact is Elizabeth McNeil, Vice President, Federal Government Relations, emcneil@cmanet.org.

Sincerely,

Paul R. Phinney, MD President

Cc: Glenn Gastwirth, Executive Director & CEO, American Podiatric Medical Association

CPMA and CMA have been working together the last few years to clarify an ambiguity in existing law regarding the employment of licensed physical therapists by medical corporations and podiatric medical corporations. On October 7, 2013 Governor Brown signed AB 1000 into law which expressly adds licensed physical therapists to the list of healing arts professionals who may be professional employees, shareholders, officers, or directors of a California medical corporation or a podiatric medical corporation. The law goes into effect January 1, 2014. Of particular interest to you is that the new law permits the physical therapist employed by the podiatric medical corporation to practice within the full scope of the physical therapist’s practice, without being limited by the podiatric scope of practice. Thus the physical therapist may perform physical therapy services outside of the podiatric scope of practice, as this article will discuss. This article will also discuss the law’s authorization of the employment of other healthcare professionals not expressly listed in the legislation, which is intended to provide the professional corporation flexibility to practice in the future without needing to go back to the legislature for authorization. Additionally this article will discuss the patient’s new direct access to physical therapy services which is a significant change to current law.

Although many medical corporations and some podiatric medical corporations have employed physical therapists for years, in 2010 the Physical Therapy Board reinterpreted the professional corporation regulatory scheme which made it unclear whether these professional corporations could employ physical therapists. The ambiguity lies in the omission of “physical therapists” from the list of health care professionals that may be employed by a medical corporation and a podiatric medical corporation under the Moscone-Knox Professional Corporations Act (Corporations Code Section 13401.5).

Prior to the enactment of AB 1000, Corporations Code Section 13401.5 provided:

“… the following licensed persons may be shareholders, officers, directors, or professional employees of the professional corporations designated in this section so long as the sum of all shares owned by those licensed persons does not exceed 49 percent of the total number of shares of the professional corporation so designated herein. . . .

(b) Podiatric medical corporation.

(1) Licensed physicians and surgeons.

(2) Licensed psychologists.

(3) Registered nurses.

(4) Licensed optometrists.

(5) Licensed chiropractors.

(6) Licensed acupuncturists.

(7) Naturopathic doctors.”

The ambiguity arose because “physical therapists” are not included in the list. Nor are “physical therapists” included in the list for medical corporations. AB 1000 fixes the omission and adds “licensed physical therapists” to the list. Now physical therapists may be employees, shareholders (up to certain percentage and numeric limitations), directors, and officers of a podiatric medical corporation or a medical corporation. The referring physician or podiatric physician must provide the patient oral and written disclosure of such physician’s financial interest in the professional corporation, and explain the patient’s right to be treated by a physical therapy provider who is not employed by the practice. There’s more. Recognizing the changing nature of healthcare, the legislation provides flexibility to allow medical corporations and podiatric medical corporations to employ other licensees who may not be specifically listed in the statute. To accomplish this flexibility, AB 1000 adds the following:

“This section [13401.5] does not limit employment by a professional corporation designated in this section of only those licensed professionals listed under each subdivision. Any person duly licensed under Division 2 (commencing with Section 500) of the Business and Professions Code, the Chiropractic Act, or the Osteopathic Act may be employed to render professional services by a professional corporation designated in this section.”

Therefore podiatry corporations may now employ licensed occupational therapists, licensed speech-language pathologists, and certain other healthcare professionals to provide professional healthcare services within the scope of their respective profession. These healthcare professionals still may not be shareholders, officers or directors of the podiatric medical corporation. Under current practice you might not see the benefit to your podiatry practice to add these practitioners. However, to keep pace with the evergrowing trend of consolidation and affiliation within the healthcare industry, it’s in the professional corporation’s best interest to have legislative flexibility to grow the practice in all ways.

Physical Therapist Employees Not Limited to Podiatric Scope of Practice.

“Physician Partnerships” submitted by Jim Rathlesberger, M.P.A., Executive Officer, California Board of Podiatric Medicine (BPM) and posted on the BPM website at http://www.bpm.ca.gov/forms_pubs/ phys_partner.pdf clarifies that MDs who are employed by podiatric medical corporations may work within their full MD scope of practice. The BPM’s Department of Consumer Affairs attorney interpreted Corporations Code Section 13401.5(b) to permit the healthcare professional employee to practice his or her full scope of practice. Otherwise, the inclusion of “optometrists” on the list of healthcare licensees who may be employed by podiatric medical corporations

See l EGA l UPDATE on Page 15

would make no sense. Interpreting AB 1000 to allow the physical therapist employee to practice within the full PT scope of practice is consistent with this interpretation. The author confirmed this interpretation with Jim Rathlesberger, and Mr. Rathlesberger confirmed that BPM concurs with this interpretation.

Patient’s Direct Access to Physical Therapist Without a Doctor’s Order.

Physical therapists have been lobbying for years to win the right to practice independently without a doctor’s order. AB 1000 stops short of granting PTs full independent practice. However, a big win for physical therapists is that the new law allows health care consumers to seek treatment from a physical therapist without a physicians’ or podiatrist’s order for a limited period of time. Physical therapists may now treat patients for 45 calendar business days, or 12 visits, whichever comes first, without first seeing a physician or a podiatric physician. The law does not expand or modify the scope of practice for physical therapists. The law requires physical therapists to refer patients to a physician or podiatrist for an in-person patient examination and evaluation to ensure there is no underlying medical condition if the therapy extends beyond 45 calendar days or 12 visits, whichever comes first.

Interestingly, it appears that under the new law a patient may seek PT treatment from a physical therapist employee for the limited period of time without a physician’s order. If the therapy extends for more than 45 calendar days or 12 visits, whichever comes first, the physical therapist must refer the patient to a physician. You can foresee the potential for some pretty knotty referral patterns emerging under this scenario which could require regulatory analysis for compliance with the self-referral (i.e., Stark law) and anti-kickback laws.

Additional requirements for the PT are included in the new legislation. Among these, the PT must provide oral and written

notice to the patient of the limitations of the Direct Physical Therapy Treatment Services, as specified in the legislation. The new law specifies that nothing in the legislation requires a health care service plan, insurer, worker’s compensation plan, employer or state program to provide coverage for direct access to treatment by a physical therapist.

If you decide to employ a physical therapist or any other licensed professional authorized by the legislation, you must take care to structure the arrangement to comply with other applicable laws, such as self-referral, anti-kickback, and fictitious name permit laws and requirements. * * * * * *

CMA and CPMA had previously opposed the Physical Therapy Association’s attempts to authorize “direct access” to PTs, but they came to the conclusion that allowing AB 1000’s limited direct access was an acceptable compromise. The bill does not expand the PT’s scope of practice, and the existing prohibition on a PT’s diagnosing disease remains. Some physical therapists are unhappy with the law because they want more independence. If a sign of a good compromise is that both sides feel they had to give more than they wanted to, then AB 1000 has the markings of a good compromise, and offers the prospect of enhanced access to physical therapy care for patients in both the medical and podiatry practice settings and the independent physical therapist’s practice.

The full text of AB 1000 may be found at: http://www.leginfo.ca.gov/pub/13-14/bill/asm/ab_0951-1000/ ab_1000_bill_20130918_enrolled.htm

Legislative history has been made.

Beth A. Kase, Esq. is a partner at Fenton Nelson LLP in Los Angeles, California, and represents healthcare providers in a variety of healthcare legal matters.

ATTRACTIVE OPPORTUNITY IN NORTHERN CALIFORNIA:

30 year old practice for sale, furnished office, hospital and physician referrals. Seeking conscientious, well trained DPM with wound care experience. Submit CV to dr.jeanturner@yahoo.com

PRACTICE FOR SALE

Two office, 20 year-old Bay Area practice for sale located in Livermore and Pleasanton. To inquire, contact: jfm.dpm@sbcglobal.net.

FOR SALE:

Laser MLS model Mix 5-07 year 2010

Excellent condition, like new minimal use - $15K Foothill Podiatry Clinic 530-477-7200

Patients are the lifeblood of your medical practice, so it is crucial to maximize patient satisfaction. Some degree of patient turnover is expected, but successful practices will retain repeat patients.

The cost is higher for a practice if they have to continually bring in new patients because there are no, or very little, repeat visits from patients who have been seen.

Repeat patients not only keep our schedules full, but they usually are very satisfied with their treatment and service and will be more likely to refer their friends and family to the practice, which has zero external marketing cost.

Do you know that patient turnover is a minimum in your practice? Have you taken the time to check to see if first time patients are returning? Do you know if your current patients are referring other patients to your practice?

Here are a few questions to help you evaluate your success in keeping your patients satisfied.

• Do you realize the value of your current patients? Can they tell that you value them?

• Do you make sure that all communication is clear to them before they leave the office?

• Do they understand why their treatment plan is important to their recovery?

• Do you make it easy for your patients to talk to you if they have a question once they leave the practice?

• Do you tailor services or products to your patients’ needs, or do they have to go hunt them down somewhere else?

• Do you provide exceptional patient service that would be difficult to find from other practices in your area?

• Do your patients feel that you are concerned about their condition and wellbeing?

• Do you attempt to learn as much as possible about who your patients are?

• Do you make sure that services, authorizations and benefit verifications are done quickly and accurately?

• Do you follow-up on complaints to make sure the resolution was satisfactory to your patient?

If you answered “yes” to nine or more questions, your medical practice is doing better than average. Below six is poor; between six and nine is mediocre.

Surveys show that a patient who has an unpleasant experience in your practice will tell ten or more people about it.

Building a successful, positive image for your practice with your patients enhances your overall credibility. Living up to that image creates valuable word-of-mouth advertising. People will listen to their friends’ and families’ recommendations of physicians, and they will also tell others of the good things they hear about you and your practice.

It is important to listen carefully to patient complaints. Work with your office team on how to handle situations when patients are unhappy and dissatisfied. Your staff should always inform you when any dissatisfaction is told to them regarding services or care. Here are a few suggestions of protocol you can implement into your practice:

• Listen carefully when a patient has a complaint. Acknowledge the complaint and take appropriate action to resolve it.

• Be empathetic and show concern to the patient.

• Ask appropriate questions to get all the details and listen to see if the patient has a solution in mind.

• When a complaint cannot be resolved immediately, keep the patient informed to the progress.

• Make sure complaints and resolutions don’t fall through the cracks.

• Record complaints and have staff meetings on how to keep them from happening again.

Complaints are bound to happen; it is how you handle them, and how quickly, that will make a difference to your patients.

By developing and implementing positive strategies, like the ones below, you will be doing your best at letting your patients know how much you care about them and how important they are to your practice.

Like it or not, politics have a major impact on the podiatric medical profession. All licenses to practice podiatric medicine in California are issued by the State of California. The statutes and regulations which govern your practice are ultimately determined by our state legislators in Sacramento. These one hundred and twenty elected representatives are routinely called upon to approve or reject legislation that has a direct bearing on the nature and practice of all health professions - including podiatry.

The California Podiatric Political Action Committee (CalPPAC) is a non-profit, non-politically aligned organization run by DPMs for the betterment of DPMs . CalPPAC educates elected and appointed government officials about the critical role podiatric medicine plays in California’s healthcare delivery system. It also assists those legislators and candidates for public office who appreciate and support the podiatric medical profession.

CalPPAC opens doors for dealing with an array of legislative and regulatory issues of interest or concern to California’s DPMs, including: licensure, hospital privileges, scope of practice, insurance, professional discipline, and practice regulations … to name just a few.

Your contribution will help to ensure that the voice of podiatric medicine is heard in Sacramento, where the important decisions are made that affect your patients, practices and profession as a whole.

Remember, a single stroke of the pen can write podiatry into - or out of -the law.

Please send your $250 contribution (less than 70¢ a day) today to: CalPPAC, 2430 K Street, Suite 200 Sacramento, California 95816.

To use your VISA , MasterCard or American Express call toll free (800) 794-8988

Ask yourselfIf CPMA/CalPPAC doesn’t do it, who will?

• Develop good people skills. Not only should you have great people skills, but your staff that spends more time with your patients than you do also needs to have excellent people skills. It is a known fact from surveys that patients will leave a practice because of unfriendly staff members even if they like the physician.

• If you offer products in your practice make sure they are of the highest quality and that they work. Try the products yourself and also have your staff try them out before you dispense them in the office so that you have personal experience with them to share with your patients.

• Get to know your patients. Tell them that you appreciate their business. Call them by their names and inquire about their families. People feel valued when someone takes an interest in them and are more likely to refer those they care about to those who appreciate them.

• Make sure your office is neat, clean, and a pleasant place to visit. Walk in your front door and take a seat in your waiting room. How does it look and feel? Walk around the office and treatment rooms and really take the time to notice the details that your patients are seeing when they are there. Would you want to come back or refer others to your practice just by the way it looks? People are attracted by the visual appeal of the office environment.

Finally, be willing to change what needs to be changed to give your patients the best care in the best practice in your town. Talk with your staff and make a list of all of the things that you and they want when they visit a doctor’s office, and then make sure that you give the same to your patients. They not only will appreciate all that you do for them, they will want to tell their friends and family whom they need to visit when they have foot problems.

Hello fellow California Podiatric Medical Association members. We have had an interesting six months regarding health policy including the fact that Gabriel Halperin, DPM; Jon Hultman, DPM; Carolyn McAloon, DPM and I attended the annual APMA CAC-PIAC meeting in Washington, D.C. in early November. That meeting was extremely informative and as part of this report I will explain some of the issues that were discussed at that meeting. Gabriel Halperin, DPM will go in to greater detail in the next California Podiatric Physician newsletter after the first of the year.

In the next several paragraphs I will discuss some of the more significant issues regarding health policy which affects California podiatric physicians

As I have previously discussed in other Health Policy Reports, over the past several years, Multiplan continues to be the only PPO plan in the state of California that clearly discriminates against podiatric physicians. By that I mean, Multiplan places podiatric physicians in a category called “mid-level providers” which pays a reimbursement to podiatric physicians for performing the same foot and ankle services as an MD or DO physician, 85% of that received by an MD or a DO. This is clearly a discriminatory action by Multiplan and unfortunately they are gaining a greater share of the insurance marketplace.

The potential good news on this front, however, is that I have developed a collegial and very cordial, respectful relationship with the Medical Director of Multiplan who resides in Waltham, Massachusetts and appears to be very receptive to the idea of changing podiatric physicians status from that of mid-level provider to a status similar to MD’s and DO’s. If this were to happen, then DPM’s would receive the same reimbursement as any MD or DO providing the same foot and ankle service.

The sticking point here is that although we have the understanding and agreement from the Medical Director of Multiplan, the corporate and network executives have not yet seen the wisdom of placing podiatric physicians in that proper categorization. According to the Medical Director, he has advocated for us to the corporate and network directors and is hopeful that in the near future this condition will be rectified. Until that time, I have indicated to the Medical Director that I personally will not join any plan in which Multiplan is a party. At such time when Multiplan recognizes the proper categorization of podiatric physicians, I advised him that I would be more than happy to participate in the Multiplan network. He does understand this and appreciates the sensitivity of this issue. Stay tuned for further discussion about this very important issue.

We continue to have a very cordial and respectful dialogue with the Medical Directors at Blue Shield. Unfortunately, Blue Shield has changed its software programming and has once again sent out a number of notices to podiatric physicians and consumer members of Blue Shield, indicating that when certain services are performed by podiatric physicians, they may be “out of the scope” of the podiatric physicians providing that service and therefore will not be reimbursed by Blue Shield. I have discussed this issue at length with the Medical Directors at Blue Shield and they claim that this is a software problem and they are actively engaging to remedy it. Again, stay tuned for further progress on this issue. In every discussion that I have had with them, they agreed that they are clearly in the wrong and will repair this unfortunate recurrent situation. Just for your information, for many years we enjoyed proper payment from Blue Shield for almost all foot and ankle services that were provided to Blue Shield members, and it is only within the past year that this has once again become a resurgent problem. However, persistence and “right” will prevail.

As I indicated in a previous Health Policy Report, I have recently been audited by Blue Cross for the proper utilization of the -25 modifier and use of consultation coding. I had sent a letter to Blue Cross indicating that I reviewed all of my coding and medical records with appropriate legal counsel, and felt that I was absolutely coding and billing properly. Since that time, I have not heard anything from Blue Cross and as it has been over a year, I have to believe this issue has been put to rest. I do want to emphasize the importance of seeking legal counsel in the event that you receive a similar audit request from Blue Cross. Although we are well versed in providing podiatric medical, foot and ankle services, we may not be as versed in documenting all that we have done appropriately. Therefore it is advised to seek assistance should an audit occur.

Blue Cross has also emphasized to me the importance of explaining to our members that when using newer technologies when treating various foot and ankle conditions, including wound care, that members go to the Blue Cross policy website and determine whether or not such materials will be covered or considered experimental and investigational. For your information, Blue Cross considers the use of APLIGRAF and DERMIGRAFT the only suitable “skin substitutes” to be applied to a diabetic wound. All other advanced technologies in the skin substitute and wound care arena are consider experimental and investigational and will be denied reimbursement by Blue Cross. This may effect your

DerMatOlOgiCal SOlutiOnS fOr PODiatriC CliniCianS

Bako Pathology Services is proud to announce the emergence of an entirely new model for the management of conditions related to the integument and peripheral nervous system. for the betterment of patient care, we now offer a complete solution, which integrates the therapeutic suggestions that are offered by our unique pathology reports, with a full portfolio of correlating office dispensed medical products. By bringing Clinical Therapeutic Solutions beneath the Bako umbrella, we’ve created the Nation’s only such model, and we believe that it will change the way podiatric medicine is practiced!

ambulatory surgical center’s or hospital center’s reimbursement as well so please be aware of Blue Cross’ policy.

As many of you know, I am the Podiatric Medical Advisor to the Medical Evidence Evaluation Advisory Committee for the Department of Workers’ Compensation in California and am responsible for developing proper evaluation and treatment guidelines for foot and ankle injuries sustained by injured workers. I am presently in the process of reviewing those guidelines and we will be using, as instructed by the Department of Workers’ Compensation, the ACOEM guidelines as well as the Official Disability Guidelines (ODG). This is mandated by the Department of Workers’ Compensation and I have found the majority of these guidelines to be clearly compatible with current treatment standards. Previously, ACOEM and ODG guidelines were very sparse in their evaluation and treatment guidelines for foot and ankle injuries and disorders. That has clearly been upgraded and improved and much of which will be adopted in the new Medical Treatment Utilization Schedule (MTUS), as required by state law, as it pertains to the evaluation and treatment of the injured worker.

The other issue that I do want to address regarding workers’ compensation is the request by review companies of workers’ compensation claims to obtain invoices for durable medical equipment, such as removable cast boots.

According to the labor code 8 CCR-9789.11(a)(1) it is clear that if there is a fee amount in the CMS DMERC fee schedule, then the workers’ compensation carrier must pay a similar fee which may not exceed 120% of that CMS DMERC rate. There is no need to submit an invoice for items that have a clearly delineated fee schedule under CMS DMERC fee schedule. You can use that section of the labor code in sending it to your insurance carrier when they request such an invoice. That should clearly get you paid. If there is not a clearly indicated fee for that product which you are using, then the maximum reasonable fee is the purchase price plus sales tax plus 50% up to a maximum of cost plus $25. That is also clearly indicated in the labor code cited above.

CAP-PIAC MEETING IN WASHINGTON D.C. ON NOVEMBER 8-10, 2013

I will discuss some of the highlights of the CAC-PIAC meeting that took place in Washington D.C. in early November of this year. As indicated above, Gabriel Halperin, DPM, will discuss other issues discussed at that meeting in the next California Podiatric Physicians newsletter.

Henry Desmarais, MD, MPA partner in Health Policy Alternatives discussed Medicare policy issues applicable for DPM’s and all physicians. As many of you may know, the Medicare fee schedule for 2014 has been proposed. The projected net impact on podiatric physicians is zero. This is actually a very positive outcome for us. The major losers, however, in this proposed fee schedule are pathologists, imaging centers, and laboratories. Winners

include anesthesiologists, emergency room physicians, clinical psychologists, nurse anesthetists and social workers. The real issue, however, is that as of January 1, 2014 if the sustainable growth rate (SGR), which is the aggregate of all health care costs incurred by all Medicare beneficiaries, is not fixed or delayed as it has been numerous times over the past several years, all physicians and health care providers will sustain an estimated 24.4% pay cut in all of the fees that are generated to Medicare patients. What this actually means is that right now we have Medicare conversion factor of 34.023. If the 24.4% pay cut goes in to effect, then the 2014 conversion factor adjusts to 25.71. This is very substantial and remember, so goes Medicare fee decreases does go private insurance carrier fee decreases as well as workers’ compensation which after 2014 is going to be based on Medicare fee schedules. Therefore, it is extremely important that Congress once again either fixes the SGR problem or delay it as they have in the past.

The other large issues that I want to make you aware of are the fact that we are moving toward the evaluation of all medical practices based on quality measures and outcomes. This means that there will be new measures that are applied to physician fee reimbursements by Medicare based on quality measures which are not clearly defined at this time but will subject Medicare payment to a risk of increase or decrease of 1% or 2% in calendar year 2016. This initially will apply to groups of physicians with 10 or more eligible professionals but eventually it is expected that it will apply to all physicians. It is important to keep abreast of what those measures are and what we can do to improve the quality of care that we provide to our patients as well as demonstrating positive outcomes. This is extremely nebulous at this time but it is gaining traction in the halls of congress.

Another large issue that is developing in Washington health policy is payment in aggregate or what we call “Bundled Payments”. That means that rather than getting a fee for service payment for the services you provide, there will be a large bundled payment dependent on the diagnosis of the patient that is receiving care. The payment will be received by either the hospital, the outpatient surgery center, or the physicians delivering care and will have to be divided up appropriately. Who is actually going to be responsible for dividing these payments up is not clear at this time but I can only emphasize the importance of developing very strong, positive relationships with your hospitals and fellow physicians and demonstrating the great value that a podiatric physician brings to the medical care and treatment of patients so that you will receive proper compensation for your services. The development of relationships is going to play a much greater role in fee reimbursement as the years go on. There is much more on this to come in the future.

Everybody knows that out of the Affordable Care Act came this new concept of state exchanges. An exchange is a new program

which provides people in the individual insurance market or small business insurance market a way to obtain health insurance. Many of the cost savings associated with the exchanges, beside enrolling as many people as possible across all age categories, is creating what is called a narrow network of providers as well as getting providers to accept discounted fee for service. It is important to understand that when you sign up for the exchanges, you have agreed in most cases to accept a discount from the insurance carrier, which may be substantial for the services you provide. It is again extremely important to look at any contracts that come across your desk to determine whether or not it is worthwhile and a good business decision to sign up for such programs. In California our exchange is presently enrolling many members across all age categories and this will create a new volume of patients for our practices. However, when a patient comes to you through the exchange, remember you are seeing them at a discounted rate and an increase in volume of patients does not always compensate for losses associated with seeing those patients. This is a determination that you need to make based on your particular circumstances and whether or not it makes sense for you to participate in the exchange. There will be more to come on this in future Annual Health Policy Reports.

Kelly Back, esquire made a presentation about issues arising out of the ACA involving private insurance companies that will effect all physicians including podiatric physicians. One such extremely important issue is the fact that under the Affordable Care Act, a health plan can no longer discriminate against any provider with respect to participation under the plan as long as that provider is acting within the scope of his license and certification under state law. Unfortunately, however, that does not prevent the plan from establishing varying reimbursement rates based on quality or performance measure or some other unspecified determination. This is an example of how Multiplan operates in the state of California. While they allow you to see patients and do not discriminate against podiatrists as a class with regard to their ability to access patients, they clearly pay less to a podiatric physicians than they do to an MD or DO providing a similar service. This is a very large problem more so in other states than in California but nonetheless as indicated in my above discussion about Multiplan, it does affect us with regard to Multiplan.

Another very important issue that did come out of the Affordable Care Act which will impact you receiving reimbursement from insurance carriers, is the fact that if you are non-contracted with an insurance plan, and you have the patient sign a form indicating that you are an AGENT for that patient, the insurance company is obligated to send any communications and/or payment regarding that patient directly to you. Prior to this, if you were not contracted with an insurance company such as Blue Cross or United Healthcare, and you did have an assignment of benefits on file

signed by the patient, the insurance company would nonetheless send payment and communication about their insurance policy directly to the patient and it would be your responsibility to procure that reimbursement from the patient, which many times would provide to be difficult, tedious and costly. However, now with the new law and regulation, if you have the patient sign a form indicating that you are acting in the capacity of their Agent, in addition to having an assignment of benefits on file, the insurance company is then obligated to pay your directly the money should not go to the patient. This obviates the need to develop collection services and labor intensive activities to procure such payments from patients. This is a great improvement for providers and will affect many non-contracted providers. If you are contracted with insurance plans, then this is not going to have any substantial affect on your collection patterns.

Accountable Care Organizations (ACO’s), have gained much greater prevalence in today’s marketplace. As I have indicated before in previous discussion about health policy, as specialist physicians, we are entitled to join as many ACO’s as we would like. The primary care physicians, however, is limited to joining one ACO at a given time. This actually is a major advantage to us as we may see ACO patients and gain whatever financial and referral benefit is to be derived from joining such an ACO. The reason to join ACO’s, is that you again develop relationships with your primary care physicians as well as other specialty physicians and doctors in those networks are more inclined to refer to you. As again I indicated in previous reports, Medicare ACO’s are comprised of fee-for-service Medicare patients. The do not include Medicare Advantage plan patients. Therefore, whether or not you join the ACO, the Medicare fee-for-service patient is still allowed to see you. However, if there is an ACO in your area, it is certainly recommended that if you are able, try to participate in that ACO. In addition, it is my personal recommendation that if you do participate in the ACO try to seek a leadership position in the ACO related to quality issues, governance, or financial concerns. Distribution of any profits that may be obtained by the ACO has to meet certain governmental criteria but there is some range of flexibility enjoyed by the leaderships of the ACO. It is my recommendation that if you choose to join such a group, that you get involved so that you have some control over financial and policy decisions made by the ACO.

As part of this meeting, we did discuss the movement from ICD-9 to ICD-10 beginning on October 1, 2014. For those of you who may not know what ICD-10 is, ICD-10 is diagnostic coding which goes from 14,000 codes that we presently use in ICD-9 to 68,000 codes that we will now use in ICD-10. This also takes us from 3-digit to 5-digit characters for diagnoses in ICD-9 to 7-digit characters used in ICD-10. It is extremely important, that if you have already done so, that you purchase an electronic medical record system that

P RESIDENT

Carolyn E. McAloon, DPM Castro Valley, CA 94546

P: (510) 581-1484 drmcaloon@bayareafootcare.com

P RESIDENT-ELECT

Thomas J. Elardo, DPM Los Gatos, CA 95032

P: (408) 358-6234 painfulfeet1@gmail.com

V ICE P RESIDENT

Ami A. Sheth, DPM Los Gatos, CA 95032 P: (408) 358-6234 amishethdpm@gmail.com

I MMEDIATE PAST P RESIDENT

Karen L. Wrubel, DPM Hawthorne, CA 90205 P: (310) 675-0900 drkw@cox.net

S ECRETARY-TREASURER

Rebecca A. Moellmer, DPM San Bernardino, CA 92404 P: (909) 886-3668 rebeccamoellmer@hotmail.com

D IRECTORS

John A. Chisholm, DPM 345 F Street, Suite 100 Chula Vista, CA. 91910

P: (619) 427-3481

F: (619) 420-7807 dr_triguy@yahoo.com

Devon Glazer, DPM Newport Beach, CA 92660 P: (949) 272-0007 drdev01@yahoo.com

Thomas J. Tanaka, DPM Ontario, CA 91761 P: (909) 724-5052 drtanaka@doctor.com

Jonathan J. Uy, DPM Hercules, CA 94547 P: (510) 724-4674 flipdpm@sbcglobal.net

Mark A. Warford, DPM Fair Oaks, CA 95628 P: (916) 548-0218 markwarforddpm@att.net

S TUDENT R EPRESENTATIVES Kevin Grenier (CSPM) Oakland CA 94601 Kevin.grenier@samuelmerritt.edu

Dayna Chang (Western U) Walnut CA, 91789 changd@westernued.org

ExECUTIVE D IRECTOR

Jon A. Hultman, DPM 2430 K St Ste 200 Sacramento, CA 95816

P: (916) 448-0248 (800) 794-8988 jhultman@calpma.org jonhultman@gmail.com

G ENERAL COUNSEL

C. Keith Greer, Esq. San Diego, CA 92128 P: (858) 613-6677 greerkeith@aol.com

G OVERNMENTAL R EPRESENTATIVE Jodi Hicks Sacramento, CA 95814

PARLIAMENTARIAN/ R ECORDING S ECRETARY Roderick Farley, DPM/ Nedra L. Farley Albuquerque, NM 87122 drrodfarley@gmail.com

aL ame Da/CONTR a COSTa COUNTY

Timothy Dutra, DPM P: (510) 869-6511 x7564 tdutra@samuelmerritt.edu docpod85@yahoo.com

Ce NTR a L Va LL eY

Matthew Takeuchi, DPM Stockton, CA 95204 P: (209) 948-3333 mjtakeuchi@gmail.com

COaC heLL a Va LL eY

Harvey Danciger, DPM Palm Desert, CA 92260 P: (760) 568-0108 docofeet@gmail.com

INL a ND

Diane Koshimune, DPM Pomona, CA 91766 P: (909) 706-3778 ISCPMA@gmail.com

LOS a NG eLe S COUNTY

Gabriel Halperin, DPM Los Angeles, CA 90063 P: (323) 264-6157 ghalp@earthlink.net

m ID-STaTe

Richard Motos, DPM Visalia, CA 93291 P: (559) 734-1171 moetoes@hotmail.com

m ONT eRe Y B aY aR ea Vittorio Lagana, DPM Monterey, CA 93940 P: (831) 375-5634 vlagana@gmail.com

NORThe RN C a LIFORNI a K a IS eR

Thomas DaSilva, DPM Walnut Creek, CA 94596 P: (925) 295-7099 thomasdasilva@hotmail.com

OR a NG e COUNTY

Gregory Eirich, DPM Tustin, CA 9 92780 P: (714) 669-1780 eirichdpm@sbcglobal.net

Re DWOOD emPIR e Paul Weiner, DPM Vallejo, CA 94590 P: (707) 643-3687 mdweiner@scrserv.com

SaCR ame NTO Va LL eY

Mark Warford, DPM (liaison) Fair Oaks, CA 95825 P: (916) 488-8750 markwarforddpm@att.net

Sa N DI e GO/I mPe RI aL Nicholas DeSantis, DPM San Diego, CA 92101 P: (619) 239-3286 footdoc5@pacbell.net

Sa N FR a NCISCO/S a N maTeO

Bill Metaxas, DPM San Francisco, CA 94108

P: (415) 433-3668 bjm@faisf.com

Sa N LUIS OBISPO/S a NTa Ba RB aRa

David Sterling, DPM Santa Maria, CA 93455 P: (805) 928-5645 sterlingfamily4@gmail.com

Sa NTa CL aRa Va LL eY Adam Howard, DPM Cupertino, CA 95014 P: (408) 446-5811 footdoc4u@gmail.com

S haSTa R e GION

Gordon Shumate, DPM Redding, CA 96001 P: (530) 246-4800 g.shumate.dpm@frontiernet.net

SOUThe RN C a LIFORNI a hm O Anthony Cannizzaro, DPM South Pasadena, CA 91031 P: (323) 857-2000) anthony.x.cannizzaro@kp.org doctoracann@aol.com

Ve NTUR a COUNTY

Heather McGuire, DPM Ventura, CA 93003

P: (805) 648-2016 drhmcguire@me.com

The California Podiatric Physician is the official publication of the California Podiatric Medical Association. CPMA and the California Podiatric Physician assume no responsibility for the statements, opinions and/ or treatments appearing in the articles under an authors’s name. For editorial or business information and advertising, contact California Podiatric Medical Association, 2430 K Street, Suite 200, Sacramento, California 95816; telephone, (916) 448-0248; facsimile; (916) 448-0258; e-mail; calpma.org.

18,

19-22,

will allow you to convert to such a burdensome, labor intensive and technologically intensive program. This changing of programs will not be for the faint of heart and will unfortunately take a great deal of labor, cost and consulting in order to be done properly. It is extremely important that you check with your electronic medical record vendor to see that they are upgrading their system to allow you to diagnose conditions utilizing the ICD-10 format. What is also important to note is that on September 30, 2014 you will be using the ICD-9 format and the next day, October 1, 2014 you will be moving to the ICD-10 format. So your EMR system has to be able to accommodate both formats in order to be able to bill and be reimbursed properly.

APMA has done a great webinar on this and I know they will be continuing to do webinars as to how to move in to this new future of medicine. Also, for those of you who do not have it already, the APMA coding resource guide is probably your best vehicle

for understanding this transition to this new coding and Dr. Harry Goldsmith and staff will be developing a crosswalk from ICD-9 to ICD-10 for the most common diagnosis codes that we us in podiatric medicine and all of foot and ankle medicine and surgery.

As this article has gotten quite lengthy, and although there is much to discuss, I will leave it to Dr. Haleprin in the next issue of the California Podiatric Physician to discuss other issues presented at the CAC-PIAC meeting in Washington. We have a lot to look forward to with the coming changes in health care policy as it relates to us and All physicians in the coming years. It is extremely important that we stay abreast of all such changes in health policy so that we are able to provide the most effective, cost-efficient, high quality care to all of our patients, and remain viable in practice.

Again it has been my pleasure to serve as your Health Policy Committee Chair for the California Podiatric Medical Association.

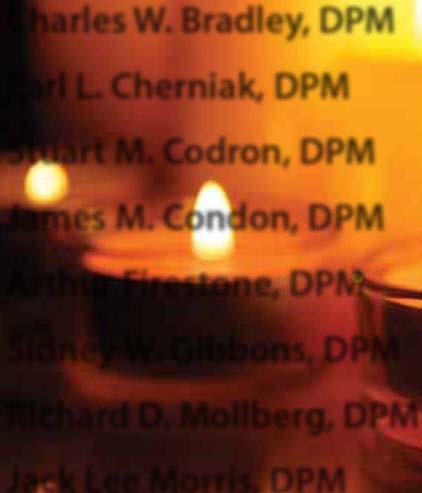

Charles W. Bradley, DPM

Earl L. Cherniak, DPM

Stuart M. Codron, DPM

James M. Condon, DPM

Arthur Firestone, DPM

Sidney W. Gibbons, DPM

Richard D. Mollberg, DPM

Jack Lee Morris, DPM

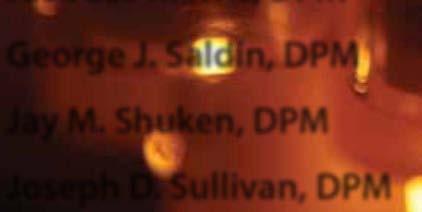

George J. Saldin, DPM

Jay M. Shuken, DPM

CPMA Member Dr. Timothy Dutra, President of the Alameda/Contra Costa Podiatric Medical Society has been elected to the Board of Directors of the Joint Commission on Sports Medicine and Sciences.

The JCSMS consists of leaders from various sports related organizations that get together annually to form and develop their own network and liaison strategies. The JCSMS is committed to advancing the sports medicine profession. As long as the spirit of cooperation exists between the associations the JCSMS will thrive! Dr. Dutra is the first podiatric physician elected to the board.

Joseph D. Sullivan, DPM

(Source: American Academy of Podiatric Sports Medicine)

Tax planning is always a good idea, but in 2013, tax planning is vital. Due to the passing of the American Taxpayer Relief Act (ATRA) at the beginning of 2013, there are many new changes on the horizon.

Included in these changes were many significant tax incentives (known as tax extenders) that will be expiring at the end of 2013. These tax incentives may be extended again when Congress takes up tax reform at the end of 2013. However, with the uncertainty of Washington politics, we have no guarantee that these incentives will extend beyond their sunset date of January 1, 2014.

Businesses and individuals should also be aware of those tax rules that are new-for-2013. In particular, increased tax rates on higherincome individuals effective for 2013, will impact both business and individual tax planning. Also important for 2013, are the recently passed final “repair” regulations; these regulations provide many tax strategies that should be addressed before the end of 2013.

Whether they are sunsetting in 2013 or new for 2013, these changes provide many opportunities to strategize and plan for your tax liability in 2013.

Bigger Section 179 Deduction. A larger Code Sec. 179 expense deduction is available through 2013 to taxpayers that elect to treat the cost of qualifying property (generally equipment, furniture, and software expense used in the trade or business) as an expense rather than a capital expenditure. The annual dollar limitation on Sec. 179 expensing for tax years beginning in 2012 and 2013 is $500,000. Similarly, for tax years beginning in 2012 and 2013, an annual $2 million overall investment limitation applies before the maximum $500,000 deduction must be reduced, dollar-for-dollar, for amounts above that $2 million amount. For 2014, this maximum 179 deduction is set to plummet to $25,000 (unless the $500,000 is extended Congress to 2014).

Note: Watch out if your business is already expected to have a tax loss for the year before considering any Section 179 deduction. The Section 179 expense cannot create or increase an overall business loss.

Section 179 Deduction for Real Estate. For years 20102013, real property improvements can be expensed in certain circumstances. Real property improvement costs are generally ineligible for the Section 179 deduction. However under the current exception, your business can immediately claim a Section 179 deduction of up to $250,000 of qualified improvement costs for (1) interiors of leased nonresidential buildings, (2) restaurant buildings, and (3) interiors of retail buildings. This $250,000 is part of the $500,000 allowance described above. For 2014, this deduction for real estate improvements will not be allowed (unless congress extends the exception).

Bonus Depreciation. Businesses can also claim first-year bonus depreciation equal to 50% of the cost of qualifying property placed in service by December 31, 2013. Qualified property for bonus depreciation purposes must be depreciable under the Modified

Accelerated Cost Recovery System (MACRS) and have a recovery period of 20 years or less. These requirements can encompass a wide variety of assets. For a new passenger auto or light truck that’s used for business and is subject to the luxury auto depreciation limitations, the 50% bonus depreciation break increases the maximum first-year depreciation deduction by $8,000. Unless congress extends the allowance of bonus depreciation, after January 1, 2014, 50% bonus depreciation will not be allowed.

Note: Bonus depreciation deductions can create or increase a Net Operating Loss (NOL) for your business’s 2013 tax year. You can then carry back the NOL to 2012 and/or 2011 and collect a refund of taxes paid in one or both those years.

15-year Recovery for Leasehold/Retail Improvements, Restaurant Property. For 2013, the 15-year recovery period for

qualified leasehold improvements, qualified retail improvements and qualified restaurant property is still in place. This law is schedule to sunset at the end of 2013. All property must be placed in service before January 1, 2014 to qualify for this treatment.

All of the depreciation changes noted above provide opportunities to limit or reduce your tax liability. A taxpayer may want to consider accelerating any purchases or improvements of tangible property into 2013 to take advantage of these tax benefits.

Final Repair/Capitalization Regulations. The IRS, in September 2013, released the final “repair” regulations that explain when taxpayers must capitalize costs and when they can deduct expenses for acquiring, maintaining, repairing and replacing tangible property.

The final regulations apply to tax years beginning on or after January 1, 2014, but provide taxpayers with the option to apply either the final or temporary regulations to tax years beginning after 2011 and before 2014.

As part of the final regulations there is a new de minimis expensing rule that allows taxpayers to deduct amounts used to purchase and improve tangible property. If the taxpayer has an Applicable Financial Statement (AFS) (this is typically an audited financial statement), written accounting procedures for expensing amounts paid or incurred for such property under certain dollar amounts, and treats such amounts as expenses on its AFS in accordance with its written accounting procedures, the regulations allow up to $5,000 to be deducted per invoice.

To take of this $5,000 de minimis rule, taxpayers must have written accounting procedures in place that specify a per-item dollar amount (up to $5,000) that will be expensed for financial accounting purposes. Therefore, to take advantage of the 2014 de minimis rule, taxpayers should have a policy in place by year-end 2013.

For smaller businesses that do not have an AFS, the final regulations added a safe harbor de minimis amount. The per-item or invoice threshold amount in this case is $500.

Since the final regulations offer an optional retroactive date, some taxpayers may benefit from putting certain procedures into place before the start of 2014. Taxpayers may also consider filing amended returns for 2012 and 2013 to take advantage of certain elections allowed under the final regulations. No matter the circumstances, taxpayers will need to follow the final regulations starting in their tax years beginning in 2014. This means, all taxpayers should work on addressing the final regulations as part of their 2013 year-end planning, and have a plan in place before mandatory rules become effective on January 1, 2014.

Higher Long-Term Capital Gains Rates. For many individuals, the 2013 federal tax rates on long-term capital gains stay the same as last year: either 0% or 15%. However, for higher-income individuals the maximum rate is now 20% (up from 15% last year). This

change applies to taxpayers with taxable income above $400,000 for singles, $450,000 for married joint-filing couples, $425,000 for heads of households, and $225,000 for married individuals who file separate returns.

New Net Investment Income Tax. In addition to the higher longterm capital gains rate of 20%, many individuals are also subject to the new 3.8% Net Investment Income Tax (NIIT). This tax has a lower income threshold, but is also meant to apply to higher income individuals. This rate applies to taxpayers with modified adjusted gross income above $200,000 for singles, $250,000 for married joint-filing couples, $200,000 for heads of households, and $125,000 for married individuals who file separate returns. The introduction of NIIT and the increased capital gains rate for higher income individuals means that some individuals will be subject to a rate of 23.8% federal income tax rate on 2013 long-term gains.

To help combat these higher taxes, carefully evaluate investments held in your taxable brokerage firm accounts and consider the tax impact of selling appreciated securities. Also selling some loser securities before the end of 2013 is a smart idea. The capital losses from these sales will offset capital gains from other sales in 2013, including high-taxed short-term gains (the maximum rate on short-term capital gains can potentially be 43.4% depending on the taxpayer’s taxable income) from securities owned for one year or less.

In addition, if capital losses for this year exceed capital gains, you will be allowed to take a net capital loss against your higher taxed ordinary income of up to $3,000 for 2013 ($1,500 if you’re married filing separately). Any excess net capital loss is carried forward to next year.

Another way to combat these higher taxes is with gifts to relatives. Since the federal income tax rate on long-term capital gains and qualified dividends is still 0% when those gains and dividends fall within the 10% or 15% federal income tax rate brackets, taxpayers have a chance to do some tax planning. This 0% rate applies to extent the taxpayer’s taxable income (including long-term capital gains and qualified dividends) does not exceed $72,500 for married joint-filing couples ($36,250 for singles). Even though your income may be too high, you may have children, grandchildren, or other loved ones who will be in the bottom two brackets. If so, consider giving them some appreciated stock or mutual fund shares that they can then sell and pay 0% tax on the resulting long-term gains. Gains will be long-term as long as your ownership period plus the gift recipient’s ownership period (before he or she sells) equals at least a year and a day. Giving away stocks that pay dividends is another tax-smart idea. As long as the dividends fall within the gift recipient’s 10% or 15% rate bracket, they will be federal-income-tax-free.

Note: If you give securities to someone who is under age 24, the Kiddie Tax rules could apply and potentially cause some of the resulting capital gains and dividends to be taxed at the

parent’s higher rate. Also, if you give away assets worth over $14,000 during 2013 to an individual, you will need to file a gift tax return and this gift it will generally reduce your $5.25 million unified federal gift and estate tax exemption. However, you and your spouse can together give away up to $28,000 without reducing your respective exemptions.

Similar to the gifts to relatives’ strategy, gifts to IRS- approved charities is yet another way to limit the tax on your investment income. A great strategy is to sell loser shares and give the cash proceeds to the charity. You can claim the resulting capital loss on your return and claim the resulting charitable deduction for the cash given to the charity (assuming you itemize deductions). This strategy results in two tax benefits (the capital loss and the charitable deduction). With appreciated shares, give the securities away to charity instead of giving cash. For shares that are publicly traded and you have owned over a year, you can deduct the full current market value at the time of the gift. With this strategy you are not liable for the capital gains tax on the donated securities and you get a charitable deduction, again resulting in two tax benefits.