Office: 913.345.0700

Office: 913.345.0700

Our goal is to provide such an extensive, high level of service - from assisting with your home search, to placing an offer, to placing the key in your hand - that you will feel compelled to tell your friends, family and co-workers about us.

Our greatest compliments are referrals & 5 star reviews

With over three decades of dedicated experience in real estate, we bring a wealth of knowledge and expertise to the table. As seasoned professionals, we have assisted hundreds of families in successfully purchasing homes at all price points. We ourselves have revitalized homes and owned a portfolio of 15 residential income properties. As a former teacher, Anne provides perspective on the ever changing housing market and what to expect during the buying process. As a former nationally certified home/mold inspector, Mark provides valuable insight to buyers while viewing homes and placing offers. Your experience with us is our top priority, aiming for a smooth and seamless journey.

Rob began in real estate in 1995, with an early success that helped him realize due to the rapid growth, he needed to form a team that would help him serve his client’s needs. In 2023, we reached a new level of service with over $730.8 million in sales and helped 1,820 families with their real estate needs. RET is the #1 team in Kansas and Missouri and the #3 team in the nation! We are one of the fastest-growing real estate teams (currently 200+ agents) as we never stop looking for new and innovative ways to serve our clients, builders, and our team members.

Assist in locating and evaluating properties

Negotiate the best price and terms for you, NOT the seller

Evaluate loans and finance options

Recommend home inspectors, insurance agents, & home warranty

Access to any new listing that meets your search criteria

Disclosures (when provided by sellers) for those listings you choose to view

Comparables on properties you wish to place an offer

Step by step communication of all processes from signing agency to closing

Consult and write offer to purchase with terms YOU approve

There can be over a dozen parties involved in a real estate transaction and we work as a team to ensure everyone is doing their job. Above all, we offer undivided loyalty and work to protect you as the Buyer and your interests throughout the transaction.

No matter where you find homes, whether it be on the internet, on the road, from a friend, FSBO, new build, we can help with all of them! We can negotiate any offer. If you review a property with a different agent, we can NOT represent you If you see a yard sign, an open house, or even hear about a property call us FIRST! We will work to provide you with all the property information and make the necessary arrangements for getting you in to see the property.

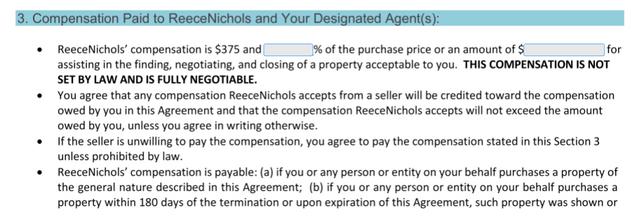

That’s a great question! Our minimum commission is 3% or $5000, whichever is greater. Should the chosen property generate a commission that is less, the Buyer will pay the difference at closing. Due to the amount of administrative time/work involved, once under contract, should the Buyer decide to cancel the contract, an additional $225 administrative fee per canceled contract will be assessed at time of final closing or ending of agency agreement

The seller of a property may choose to offer a buyer’s agent compensation upon the sale of the property. The compensation amount is decided upon by the seller(s). Should a buyer’s agent compensation be offered by the seller, that amount will be taken from the seller’s proceeds at closing and applied towards the buyer’s agent commission spelled out in the paragraph above.

We discuss your needs, wants, and your timeline for buying a home.

Custom tailored to your wants and needs, this search gives you daily updates on what hits the market.

We can put you in touch with a great Loan Officer for a free Pre-Approval. Must have Proof of Funds or be Pre-Approved prior to viewing homes.

If you see a home you love, we’ll schedule a showing on a property you intend to write an offer on.

Ready to make an offer? We’ll negotiate and get the contract drawn up

Your lender will guide you through the process and order the appraisal, generally after the Inspection Notice has been signed and delivered.

04 03 02 01 07 08

06

Depending on the terms of your contract, this is typically 7-10 days. If necessary, collect bids and negotiate repairs

Buyer(s) to Secure Homeowners Insurance

Title will research & clear any title issues to ensure you have a clean title and set your closing appointment either in person or with a Mobile Notary if needed.

Utility set up, Mail forwarding, Final Walk-through & obtaining a Cashier’s Check. Your lender will give you final loan approval and provide closing figures. Then, we close!

There are certain “do’s and don’ts” which may affect the outcome of your loan request. These remain in effect before, during, and after the loan approval, up to the time of settlement when your loan is funded and recorded. Credit, income and assets are usually verified the day if not the hour before you have signed your final loan documents.

Keep all accounts current, including mortgages, car loans, credit cards, etc.

Contact both your lender and The Fraser Team anytime you have a question. Make all payments on or before due dates on all accounts, even if the account is being paid off with your new loan.

Have any lender-required money/funds to your loan officer within 72 hours after the home inspection is complete.

Return phone calls from your agent, lender, settlement company, or anyone else involved in your transaction within one hour of a message. Time is of the essence!

Quit your job or change jobs. If this is likely or happens unexpectedly, consult your loan officer and call us as soon as possible.

Allow anyone to make an inquiry on your credit report except your lender

Apply for credit anywhere else. This causes more “hits” on your credit rating which can reduce your credit score.

Change bank accounts or transfer money within your existing accounts.

Co-sign for anyone, for any reason, for anything.

Purchase or attempt to purchase anything on credit, such as a car, truck, boat, furniture, or other real estate

Charge any abnormal amounts to your current credit cards or credit lines.

Send in late payments or incur late fees for anything. Wait longer than the time frame given per your contract to provide all necessary paperwork and information to your lender when requested.

Down Payment: 5%-20%

Loan Amount: $726,200+

Down Payment: 3%-20%

Loan Amount: Up to $726,200

No PMI if there’s at least a 20% down payment

Custom Home Build

Construction - To - Permanent Remodel

Costs covered: Land, Building Materials, Contractor

Labor, Permits

Typically require a minimum of 20% down

VA Fee (Possible VA Fee Waiver)

VA Fee can be financed into the loan Strict Appraisal guidelines

Down Payment: 3.5% (can be gifted)

Monthly MIP is required

Upfront MIP may be an option

Strict Appraisal guidelines

Loan amount up to $472,030

Down Payment: 3.5% minimum

Loan Amount: Depends on Loan

No down payment for VA

0% down with strict income and location requirements

The part of the mortgage that remains unpaid (your balance owed)

The fee charged by the lender

Property taxes

Homeowners Insurance

*Mortgage Insurance Premium (MIP) on Freddie Mac and Fannie Mae loans

*Premium Mortgage Insurance (PMI) on lender loans with less than 20% down payment

If you go into a new housing office without one of us, please let them know you are represented and share our information. Agents in the office represent the builder, NOT the buyer!

Warranties on the home

Builders may have different incentives

Can customize features

Generally more energy efficient

Sold AS-IS (repairs typically NOT done)

Banks control timing and process

Condition of the property is unknown

Home conditions unknown till inspections

Finishes/features are set

Seller motivation is generally unknown

Sense of established neighborhood

Bank must agree to purchase price

Timeline is dictated by bank’s response

If time is a factor, short sales may not be the best option as they can linger up to 2 years

Also known as REO

Pre-MLS - Coming soon

Active - Active listing on the market

Show For Backup - Currently under contract however still allowing showings and accepting back up offers until the end of the Inspection Period

Contingent - Under contract with a buyer that must sell their home first Pending - Under contract and not allowing any more showings

We encourage you to do your due diligence when selecting an area and a home, including conducting any and all inspections by qualified experts to help you determine the condition of your property.

School District - Be sure to ask about any upcoming school boundary changes

Review HOA ByLaws, Covenants, Conditions & Restrictions

C.L.U.E. report www.forbes.com/advisor/homeownersinsurance/clue-report

Check Builder references and reputation (for new home purchase)

Check with the Engineering firm that developed the area and review building site info (excessive fill, built over pond site, etc)

Talk to neighbors

Review Structural Engineer’s Report

Proximity to toxic areas www epa gov

Proximity to Sexual Offenders www nsopw gov

Zoning and City / County Master Plans

Consumer Housing Advocates www.consumeradvocates.org/forconsumers/mortgage-real-estate-housing

Once you choose a home, we will write a purchase agreement. While much of the agreement is standard, there are a few areas that we can negotiate:

Based on current market value

Single items such as refrigerator or washer/dryer set can generally be included in the offer. Multiple items will need to be negotiated between buyer and seller and written on a separate Bill of Sale. A lender/underwriter will not allow personal property included in the loan.

Depending on the market, this will more than likely need to be included with the offer. Box 1,2, or 3.

Used when you anticipate a gap between the contract price and the appraised value.

Typically 3% of the purchase price, which includes the lender and title fees, as well as taxes (7 months) and insurance (14 months). May vary according to loan product used.

Typically within 3-5 calendar days, you will need to provide the title company with your Earnest Money Deposit (EMD). They WILL deposit in an escrow account and the funds will go towards your closing costs/down payment. 1% of the purchase price is the standard amount.

This will depend upon what has been agreed upon within the sales contract. If the property is vacant, possession is generally given upon funding. If the property is occupied, it has become somewhat standard to allow the seller(s) a couple of days after closing to move out. Cleanliness of the property is never a given. Some sellers will leave the home spotless while others may not have time to clean. Cleaning prior to move out is not a requirement, but rather a courtesy by the seller(s). Depending upon market climate, it may be written into the contract or resolution.

1. Accept the offer 2. Counter the offer with changes 3. Reject the offer When a Counter Offer is presented, we will work together to review each detail, making sure we move forward with your goals in mind and ensure we negotiate the best possible price and terms on your behalf.

These new additions were brought about due to the NAR Settlement in August of 2024.

Gone are the days of sellers and listing agents negotiating Buyer Agency Compensation. The Buyer Agency Compensation is now part of the terms negotiation as a line item in the contract. This allows the buyer(s) to include or exclude it from their offer and allows the seller(s) to focus on the estimated net proceeds along with other terms & conditions.

We will conduct all inspections within the first 7-10 days unless otherwise specified. The Seller will make the property available for any inspections

Whole Home (~$350-$450)

Termite (~$125)

Radon (~$125)

Sewer (~$200)

Roof (FREE)

Structural (~$400)

Plumbing Fireplace Windows Electrical Foundation Furnace Attic Basement

After we have conducted all inspections, we may be able to negotiate larger ticket and safety items as unacceptable conditions. Once submitted, the Seller typically has 5 days to do the following:

Accept the request

Counter the request with changes

Reject the request

After the unacceptable conditions are agreed upon by all parties, the Seller will begin making the repairs/treatments, which are to be completed prior to closing Receipts will be provided to Buyer’s Agent, generally 5 days prior to close of escrow.

Today, homes are moving faster than ever. You need an agent who can be both responsive to your needs and proactive with ideas to help you find and acquire the home of your dreams. What can you expect? Timely access to homes, the best counsel to get your offer selected, and availability of needed resources to see you through to a successful closing and possession of your new home. With 100+ experienced agents on our team and a full support staff, we’ll always have you covered!

The Rob Ellerman Team closes more transactions than any other team in the Kansas City Metro. In 2023, we sold 1820 homes totaling over $730 8 million in volume And over the course of our history, we’ve sold over $3.1 billion in career sales. That’s the experience you can rely on!

Our world is about making your world easier. With 4 moving trucks available for our clients to use (First come, first served - 1 truck per client - 1 day only), we’ll help to make your home buying process easier from start to finish! Additionally, ReeceNichols’ partnership with Nebraska Furniture Mart provides you access to a year-long discount on multiple items/services after closing.

As you can see, there are many factors to be considered when successfully purchasing a home That is why, as your Buyer’s Agent, our job is much more than just to help you find the right home and purchase it at the best possible price and terms. We’ll educate you about market values, home construction, equity potential and more, so you can make the most informed decision possible. In addition, you will have the benefit of our extensive professional network - everyone from electricians, plumbers, and contractors to estate planners, insurance agents, bankers, carpet cleaners tax accountants/bookkeepers and many more! In short, we’ll provide you with an extensive, high quality buyer’s service, from assisting with the home search, to placing an offer, to ensuring all documents are signed, sealed and delivered on closing day. We are your realtors for life! This is our commitment and we, as The Fraser Team, look forward to being of service to you now and in the future.