Planning Your Legacy

SECURING THE FUTURE OF ELKHORN SLOUGH

Photo by Yashwanth Kuruganti

Why Invest in Elkhorn Slough?

Elkhorn Slough touches our hearts. From its timeless oak forests to its rare coastal grasslands and the quiet cycles of its marshes, these protected landscapes shelter a wellspring of biological diversity in the heart of Monterey Bay.

Everyone’s story is uniquely their own, but those who experience the magic of this place know and understand its importance. While the last 50 years have seen major investments in preserving Elkhorn Slough, this work is ongoing. Development pressures and other environmental stressors still threaten the health of the slough and its habitats.

Making a legacy gift to the Elkhorn Slough Foundation (ESF) in your will, trust, or by beneficiary designation enables you to make this magnificent watershed a part of your own story, too. Your future gift is a testament to your commitment to conservation, establishing your enduring legacy for future generations.

WHAT IS THE LEGACY CIRCLE?

The Legacy Circle is a group of people who have made an enduring commitment to conserving Elkhorn Slough by including it in their estate plans. They understand the importance of land conservation and want to do something that makes a real, lasting difference for California’s central coast. As a member of this group, you will have made an important decision to include ESF in your plans. For generations to come, your legacy gift will power continued stewardship and conservation efforts.

Photo by Edmund Lowe Photography

Wills and Trusts

One of the most popular ways to make Elkhorn Slough a part of your legacy is by naming the Elkhorn Slough Foundation in your will or trust.

A gift in your will is an expression of your values. Many people like to leave a gift to the Elkhorn Slough Foundation because they care about protecting keystone species, revitalizing habitat, and addressing climate change long after they’re gone. As someone who cares about the lands, waters, and wildlife of Elkhorn Slough, you can help ensure they are protected and thriving for generations to come.

Best of all, you can support ESF and our beloved estuary while still providing for your family and loved ones. Many supporters choose this option by naming ESF as a small percentage and contingent beneficiary of their plans.

NEXT STEPS

To include the Elkhorn Slough Foundation in your will or trust, or to name us as a beneficiary of your retirement account or life insurance policy, please provide your advisor or financial account administrator with the following language:

“I give and bequeath ___ (dollar amount, percentage of residuary estate, specific asset, etc.) to Elkhorn Slough Foundation (Federal Tax I.D. 94-2823247), PO Box 267, Moss Landing, CA 95039.”

Photo by Paul Zaretsky

Life Insurance

You may have a life insurance policy that has outlasted its original purpose, and this could be an opportunity to support slough conservation.

You can support ESF through your life insurance in two ways:

Beneficiary Designation

Request a change of beneficiary form from your life insurance company and make ESF a beneficiary. Like other beneficiary designations, you can always change this at any time.

Be sure to include ESF’s legal name and tax I.D. when making this selection (Elkhorn Slough Foundation, Federal Tax I.D. 94-2823247).

Transfer of Ownership

Transfer ownership of a fully paid policy to ESF. This is an irrevocable gift and cannot be undone. ESF would become the new legal owner of the policy, but you may receive a tax deduction for your generosity.

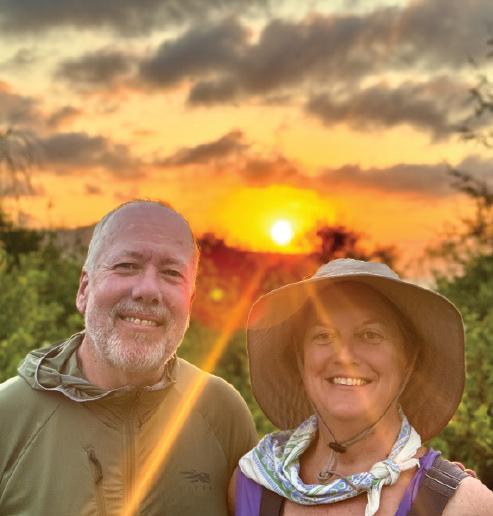

“Elkhorn Slough has been part of my life for 45 years, dating back to my time as a graduate student at Moss Landing Marine Labs. When I became a wildlife photographer in 2017, I saw the slough in a new way. I witnessed how vital these habitats are, thanks to the improved water quality that comes from protecting surrounding lands. My wife and I want to help preserve this rare and beautiful environment for future generations, so we’ve included the Elkhorn Slough Foundation in our estate plans.”

Kevin Lohman

Retirement Assets

Retirement assets are among the most heavily taxed, making them an ideal resource to consider for charitable giving. They are also a simple way to make protecting Elkhorn Slough a part of your life story and legacy.

For most plans, you can add or update the beneficiary designations on your IRA, 401(k), 403(b), or 457(b) in less time than it takes to read this brochure. Visit your plan’s website and look for “beneficiary designations” or speak with your plan provider (or your employer’s HR department) to obtain the necessary forms. You will likely only need ESF’s name and Federal Tax I.D. to name us as a beneficiary in your plans.

Elkhorn Slough Foundation (Federal Tax I.D. 94-2823247)

Photo by Sebastian Kennerknecht

Ways to Give a Retirement Asset

Partial Beneficiary

Name your loved ones and ESF as partial beneficiaries. Use this method when you wish to provide for both loved ones and ESF.

Sole Beneficiary

Name ESF as a 100% primary beneficiary of your plans. Use this method when leaving your entire balance to ESF.

Contingent Beneficiary

Use this method when you want to provide for your loved ones but want your assets to make a charitable impact should they predecease you.

TAX TIP: The income your heirs receive from an IRA account is taxable upon transfers at your heirs’ highest tax rate. This is called “Income in Respect of a Decedent.”

Since your heirs will pay tax on this, many ESF supporters choose to designate us as a beneficiary of their IRA accounts and provide for their loved ones through other means that come with a reduced tax burden. 1 2 3

“I had the good fortune to work and live at the Elkhorn Slough Reserve for 20 years, which has left me with a deep appreciation for this unique ecosystem and its inhabitants. Having witnessed firsthand the quality of work that goes into land acquisition, restoration, research, and education here, I am confident that our dollars will be spent wisely. While our legacy gift will be modest compared to some, it is satisfying to know that whatever we can leave for the future will contribute to the health and longevity of the estuary.”

Becky Suarez

Real Estate

Donating a gift of real estate to ESF establishes your philanthropic legacy while avoiding potential capital gains on your appreciated property. Furthermore, some options allow you to receive tax benefits during your lifetime, while still retaining the ability to live in your home for the rest of your life. Here are a few options for donating real estate:

Donate the property outright

You may donate your property to ESF and enjoy a charitable income tax deduction equal to your property’s full fair market value.

Donate the property with a retained life estate

If you already know you want the future sale of your home to support Elkhorn Slough, you may donate your property to ESF and receive a tax deduction while still maintaining your legal right to live in and enjoy your home for the rest of your life.

Include us in your will or trust

You may include a specific bequest in your will or trust to ensure your home is left to ESF so that the proceeds from its sale support the bountiful life of Elkhorn Slough for generations to come.

Receive annual payments for the rest of your life

By using your real estate to fund a charitable gift annuity from ESF, you will receive fixed payments every year for the rest of your life. 1 2 3 4

To learn more about donating a gift of real estate, please contact Taylor Honrath at (831) 728-5939 or taylor@elkhornslough.org.

Charitable Gift Annuities

A charitable gift annuity is a gift that pays you back. By establishing a gift annuity, you will receive payments every single year, for as long as you live, and a tax deduction in the year that you establish the gift. Even better, you will help protect and maintain the long-term future of Elkhorn Slough and the delicate watershed that surrounds it. Here’s how it works:

1 2 3

You make an irrevocable gift using cash or appreciated securities. (The minimum is $25,000.)

You receive an annual, fixed payment (in many cases tax advantaged) for the rest of your life, no matter what happens in the stock market. You can also choose to establish the gift annuity now and receive payments at a deferred time.

You protect and maintain Elkhorn Slough for generations to come.

If you have owned highly appreciated stock for more than one year, using stock to fund your gift annuity is an ideal way to support a charitable cause and mitigate capital gains taxes. Though you must be age 60 or older to receive payments, individuals who are younger can use this as an effective retirement planning tool.

To learn more about how a charitable gift annuity could benefit you, please contact Taylor Honrath at (831) 728-5939 or taylor@elkhornslough.org. We recommend consulting your financial planner to discuss the details specific to your personal circumstances.

Photo by Michael Kenna

Other Assets

Donor Advised Funds

Did you know you can shape the legacy of your donor advised fund? Many financial institutions allow you to direct the remaining balance to causes close to your heart, like ESF. You can even choose to have your fund continue to support the organizations you care about year after year, creating a lasting impact well into the future.

Be sure to include ESF’s legal name and tax I.D. when making this selection (Elkhorn Slough Foundation, Federal Tax I.D. 94-2823247).

Certificates of Deposit and Other Banking Accounts

One of the easiest ways you can protect Elkhorn Slough for generations to come is to designate ESF as the “pay on death” beneficiary of a certificate of deposit, or on your bank or brokerage accounts. Many financial institutions will allow you to do this online.

Be sure to include ESF’s legal name and tax I.D. when making this selection (Elkhorn Slough Foundation, Federal Tax I.D. 94-2823247).

Gifts You Can Give Today

Appreciated Stock

If you own highly appreciated stock, you may be subject to a hefty capital gains tax. By donating that stock to ESF directly, you can fulfill your charitable goals while maximizing your tax benefits.

IRA Mandatory Minimum Distributions

If you own a donor advised fund, you can choose to support ESF through your charitable fund grants. Contact your financial institution to request that a grant be made today. 1 2 3

If you are age 70 ½ or older and have assets in an IRA, you are eligible to withdraw what is called a mandatory minimum distribution each year. These distributions are considered personal income and taxed accordingly. Many ESF supporters who do not wish to be taxed on this income choose to donate all or a portion of it to ESF. Doing so lowers your annual taxable income by the gift amount.

Donor Advised Fund Grants

Photo by Kevin Lohman Photography