POWERING INDUSTRY TOWARDS NET ZERO

Our vision on anchoring industry in Europe

| POWERING INDUSTRY TOWARDS NET ZERO | 2 | ANCHORING EUROPEAN INDUSTRY THROUGH ELECTRIFICATION AND LOW-CARBON ELECTRONS

Dear reader,

European industry is undergoing an immense transfor mation. Over the past few years, industry’s approach to the climate crisis has become a combative urge to invest in sustainable practices and processes. Electricity will play a key role in this transformation, as confirmed in the present study. By 2030, industrial electricity consump tion is expected to grow by 40% and 50% in the 50Hertz area and Belgium respectively.

Interestingly, as we discovered over the course of our research, this transformation will not only be good for the climate: companies that have made the most progress on their transition to carbon-free processes have been the least affected by the energy crisis. Together, electrification and access to renewable energy through long-term commitments (via power purchase agreements or their own renewable energy production) offer companies long-term price stability and protection against price inflation in the gas and electricity markets.

The current crisis has further highlighted how society could benefit from accelerating the energy transition. The energy transition will not only reduce our dependence on fossil fuels, it will also ensure more stable and affordable prices. It will grant industry an opportunity to make its business processes more sustainable and will anchor important businesses in Europe, directly contributing to employment and prosperity.

Industry will apply different methods to decarbonise, such as electrification, carbon capture, utilisation and storage (CCUS) and hydrogen. Its demand for electricity will increase significantly. What’s more, its production processes are also changing and many opportunities for more flexible consumption are emerging.

Today, most industries have a rather straightforward rela tionship with our grids: we provide them with a stable source of supply. However, that relationship will rapidly change and become increasingly complex. Compa nies will start to use our network in a more intense and dynamic way. Therefore, it is important to better under stand what changes will happen as a consequence of this industrial transformation. How much electricity will industry need and by when? To what extent are the load profiles of companies that are connected to our grids changing? What potential is held in more flexible consumption?

We have been able to produce this study by relying on the cooperation with over 50 large industrial consumers and federations from Belgium and Germany (50Hertz area). We modelled in detail the most energy- and emissions-intensive industrial sectors. These sectors represent 70% of the total industrial energy consumption. The conclusion we came to is clear: electrification combined with the accelerated expansion of low-carbon electrons will be the main lever for industry’s decarbonisation over the next 10 to 20 years, and will contribute to both climate objectives and the anchoring of industry in Europe.

While the conclusion might sound straightforward, its implementation will be a Herculean task.

It will mean putting in maximum effort at a time of rising interest rates and inflation. In addition to major investments in industrial electrification and renewable generation, important ‘leading’ investments in grid infrastructure and digitalisation will be needed to make this industrial transformation a success. More coopera tion between industry, the electricity sector and public authorities will therefore be needed, including with regulators and local authorities.

If, together, we succeed in addressing both the climate crisis and the competitive pressures felt by European industry which are being caused by high fossil fuel prices, we will be helping to anchor sustainable indus tries in Europe and will be contributing to the formation of a prosperous society.

I believe this is both a challenging and hopeful message. Enjoy the read!

Chris Peeters, CEO of Elia Group

→ If, together, we succeed in addressing both the climate crisis and the competitive pressures felt by European industry which are being caused by high fossil fuel prices, we will be helping to anchor sustainable industries in Europe and will be contributing to the formation of a prosperous society.

CHRIS PEETERS, CEO OF ELIA GROUP

| POWERING INDUSTRY TOWARDS NET ZERO | 1 |

“

IN SHORT

The results obtained as part of this study rely on a bottom-up model of the most energy-intensive indus tries in Belgium and the 50Hertz area (north and east of Germany). Over the past year, Elia Group has worked very closely with over 50 industrial stakeholders to sketch out possible pathways to net zero.

In all considered scenarios, access to affordable low-carbon electrons is crucial for accelerating the elec trification of industry, since this makes it more resilient and sustainable. The rapid expansion of renewable energy therefore occupies a crucial position in industrial decision-making.

Industrial electrification is at risk of slowing down or even coming to a halt if electricity prices continue to follow the marginal cost of gas production units in the longer run. Access to low-carbon electrons at stable and affordable prices is a prerequisite for long-term electrifi cation investments.

A strong electricity grid is key for facilitating the electri fication of industry with renewables. Proactive planning and the accelerated construction of this infrastructure will therefore be crucial for the successful decarbonisa tion of industry.

Industrial flexibility optimises future energy costs and benefits the power system in multiple ways. It will there fore become an inherent part of future business cases.

In addition to ramping up electrification, the full decar bonisation of industry will only happen through carbon capture, utilisation and storage (CCUS) and access to low-carbon molecules such as green hydrogen and ammonia.

| POWERING INDUSTRY TOWARDS NET ZERO | 2 |

Industrial electricity consumption will increase by 40-50% in the run-up to 2030. Electrification and the accelerated development of renewables is our main tool for reducing our exposure to fossil fuels over the next two decades.

In all investigated scenarios, electrification will play a major role in industry’s journey to net zero. Building out leading grid infrastructure is therefore critical for keeping pace with industry’s electrification ambitions, attracting new innovation projects and anchoring industry in Europe.

Carbon capture, utilisation and storage will be essential for dealing with unavoidable process emissions and will have an important effect on power consumption.

Favourable policy and regulatory frameworks to kick-start electrification.

There will be a gradual shift towards low-carbon (green) molecules in heavy industry with an increase in volume demand beyond 2030. A vast amount of green molecules will need to be imported.

Speeding up the development of RES to drive prices down for society and industry.

Industrial flexibility optimises future energy costs and benefits the power system in multiple ways, meaning that it will become an inherent part of future business cases.

Accelerating the build-out of the grid as an enabler for the industrial transition.

Fostering flexibility as a double accelerator for industrial electrification.

| POWERING INDUSTRY TOWARDS NET ZERO | 3 |

1 2 3 4

1 2 3 4 5 CO2 H2

The results of this study can be grouped together under 5 key findings:

Four key levers for enabling industrial decarbonisation and anchoring industry in Europe

| POWERING INDUSTRY TOWARDS NET ZERO | 4 | INTRODUCTION

The current energy crisis, following the war in Ukraine, has switched our economy to survival mode. Short-term measures are being taken to protect households and businesses. However, structural changes are needed to anchor our industry in Europe by making it less dependent on fossil fuels.

This study explores the changing needs of industry and its relationship with the electricity grid. Based on close work undertaken with over 50 companies and associa tions in Belgium and Germany (from the 50Hertz control area, located in the north and east of the country), it outlines different pathways for industry as it moves towards net zero.

ONE ENDURING DEMAND FROM INDUSTRY: ELECTRIFICATION COMBINED WITH ACCESS TO AFFORDABLE, LOW-CARBON ELECTRONS ENERGY POLICY

The one enduring demand from industry that our study notes is electrification combined with access to low-carbon electrons at stable and affordable prices. The rapid expansion of renewable energy therefore occupies a crucial position in industrial decision-making. In addition to ramped-up electrification, the full decarbonisation of industry will only happen through carbon capture, utilisation and storage (CCUS) and access to low carbon molecules such as green hydrogen and ammonia.

THE IMPORTANCE OF INDUSTRY IN 2021

In 2021, industry represented 15% and 24% of Belgium and Germany’s gross domestic product (GDP) respectively and employed 21% and 18% of each country’s working age population [NBB-1, SBA-1, SBA-2].

AFFORDABILITY: soaring natural gas prices, which have a direct impact on electricity prices, have plunged Europe’s economy into crisis.

RELIABILITY: possible gas scarcity, low hydropower availability across Europe and low nuclear availability (particularly in France) are putting pressure on the energy system.

SUSTAINABILITY: whilst the climate crisis requires unprecedented investments for Europe to reach net zero, gas scarcity is pushing some industries to switch to oil and coal.

| POWERING INDUSTRY TOWARDS NET ZERO | 5 |

ALL THREE PILLARS OF THE ENERGY TRILEMMA ARE UNDER PRESSURE

THE ENERGY TRANSITION HAS BECOME A MATTER OF SOCIOECONOMIC PROTECTION

Accelerating the energy transition has never been more relevant than today. In May 2022, the European Commis sion published its REPowerEU Plan [EC-1], which aims to rapidly reduce the Union’s dependence on Russian fossil fuels. Besides energy savings, the plan covers measures relating to the diversification of energy sources and an accelerated rollout of renewable energy. These measures cannot be carried out overnight.

The current situation is strongly affecting industries throughout Europe. Some industries are reducing their output, temporarily halting their production or consid ering turning to offshore production outside of Europe. Industries with a high share of energy costs in their cost of goods sold (COGS) and those that cannot pass price increases onto their consumers have been most affected.

The current energy crisis has made it clear that the role that natural gas has to play as a transition fuel may be more limited than originally anticipated (in terms of energy volumes). The accelerated development of low-carbon generation in the form of renewable energy will be the main tool for reducing Europe’s exposure to fossil fuels over the next 10 to 20 years. This will increase Europe’s energy independence and make European economies more resilient and sustainable.

“→ Net zero in 2045 is only 22 years from now. This equals about one investment cycle for many industrial plants. So net zero in 2045 has an immediate impact on companies’ decisions today as these investments have to be in line with climate neutrality.

JULIA METZ, LEAD INDUSTRY POLICY AT AGORA INDUSTRY (DE)

CRISIS MEASURES TO PROTECT OUR ECONOMIES

To ease the impact of high energy prices on European industry, crisis measures are being rolled out and ideas to support industry are being discussed.

These include revenue caps on infra-marginal electricity production, a dynamic price corridor for natural gas and schemes for (partial) joint gas procurement, as well as targeted support for end consumers and industry.

As an example, in Germany, at the time of writing, the Federal Govern ment is finalising a legislative proposal to introduce a price freeze on gas and electricity for all categories of consumers. For industry, this proposal sets a fixed gas/electricity price that applies to 70% of historical consump tion. These support measures, which are due to be applied between January 2023 and April 2024, are to be partly financed by the introduc tion of a technology-specific cap on market revenues, as prescribed by the EU regulation on an emergency intervention to address high energy prices [EC-2].

| POWERING INDUSTRY TOWARDS NET ZERO | 6 |

DR.

CREATING THE RIGHT CONDITIONS FOR STRUCTURAL CHANGES TO ANCHOR INDUSTRY IN EUROPE

While short-term measures are essential for getting industry through the next few winters, the anchoring of industrial players in Europe will only be secured if the right conditions are created for longer-term, structural changes to occur, such as:

▶ creating favourable economic conditions to reduce the use of fossil fuels;

▶ scaling up the development of renewable energy sources (RES);

▶ developing infrastructure to bring clean energy to industry; and

▶ creating the supply chain for a sustainable economy.

These measures need current political and regulatory frameworks to be urgently adapted.

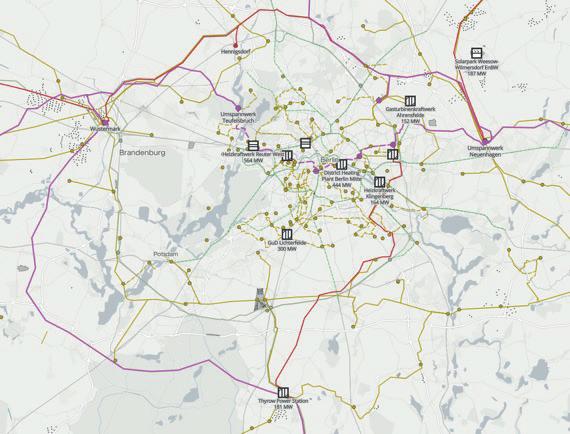

For industrial players to meet the net zero targets in Germany (2045) and Belgium (2050), companies need access to stable and affordable climate-neutral energy supplies and feedstock. The right infrastructure will need to be realised accordingly. A strong electricity grid infrastructure is key for facilitating the electrification of industry on the basis of low-carbon electrons (like renewables), which is one of the main levers for industry to reach net zero. Proactive planning and the accelerated construction of this infrastructure will therefore be crucial for the successful transition of industry towards net zero.

“

→ Due to the long lead times for infrastructure projects, the further development of the power grid must be planned in a timely manner. We have to take developments into account that you cannot fully assess today. A year ago, there was no mention of the REPowerEU Plan to decouple Europe from Russian fossil fuels. However, the continued scaling up of renewable energy targets and rampant electrification are creating urgencies that are requiring fast and additional investments.

FREDERIC DUNON, DEPUTY CEO OF ELIA TRANSMISSION BELGIUM

“

→ There is a growing understanding that integrating more renewables into the system and connecting markets are flattening price curves.

Given that Europe still is dependent on energy imports, each interconnector that is built and every common project that is completed - like the energy islands that have been planned - are important steps forward in strengthening European energy sovereignty.

STEFAN KAPFERER, CEO OF 50HERTZ TRANSMISSION

| POWERING INDUSTRY TOWARDS NET ZERO | 7 |

THIS STUDY EXPLORES INDUSTRIAL PROCESSES THAT MAKE UP 70% OF INDUSTRIAL ENERGY CONSUMPTION IN

BELGIUM AND GERMANY (50HERTZ AREA)

Over the past year, Elia Group has been in discussions with over 50 industrial companies, associations and think tanks in Belgium and Germany to sketch out the possible pathways to net zero for industrial players in their control areas. The insights gathered have been verified against decarbonisation options outlined in European research and macroeconomic developments.

| POWERING INDUSTRY TOWARDS NET ZERO | 8 |

TotalEnergies Raffinerie Mitteldeutschland GmbH

This study covers in-depth industrial processes that are responsible for over 70% of Belgium’s and Germany’s (50Hertz area) industrial energy consumption and CO2 emissions.

In addition to heavy industry, other sectors like data centres and other companies (such as those belonging to the food and drink industry) were modelled. Some industrial sectors are not covered in detail. For these sectors, high-level analyses were performed and the results were included in the industrial energy demand projections. The impact of logistic services companies on electricity consumption was considered for some of the cluster analyses (Annex B). Information on the assumptions taken for the different sectors can be found in Annex A.

The results obtained were cross-checked against macro economic statistical datasets like those provided by Eurostat [EUR-1], Statbel [STA-1], Destatis [DES-1], the European Environment Agency [EEA-1], and Bref [BRE1]. They were also discussed with industrial stakeholders, associations and research centres.

The results obtained in this study rely on a bottom-up model of most of the energy-intensive industries in Belgium and in the 50Hertz area. The production processes for each of these industries were modelled: for each product and each variant of the production process (business as usual, climate-neutral variants...), the model determined the required feedstock (such as fossil fuels, molecules (H2 and derivatives) and biofuels) and energy carriers needs (electricity, fossil fuels and molecules) based on the volumes of final products.

Cement

Petro chemical final products (80%)

High-Value Chemicals (80%)

Steel Machinery

Food and Drink (80%)

Paper Glass

Transport equipment

Wood and wood products Construction Textile and Leather Mining and quarrying Others

Non-ferrous metals (50%)

Data centres Non-metallic minerals (60%)

Fossil Fuels Electricity

Molecules (H2 and derivatives)

Figure 1 outlines the industry model that was developed for this study. Three different scenarios were investigated; these scenarios are based on information received from industry on the options they identified to move towards net zero (complemented with options identified in the literature where relevant). Hence, each scenario involves different process variants that industrial players might employ as they work towards net zero (for example, more or less business as usual, different decarbonisation options such as electrification or carbon capture, utilisa tion and storage, etc.). These scenarios are explained in more detail below (see Figure 2 under “Pathways to net zero”).

This study is not a one-shot exercise. Close collabora tion with industry is needed to update these bottom-up scenarios regularly, as they will be subject to change.

Molecules (H2 and derivatives)

Fossil fuels Biofuels

| POWERING INDUSTRY TOWARDS NET ZERO | 9 |

30% 70% of energy consumption not modelled in detail of energy consumption modelled in industry model FEEDSTOCK PRODUCTION VOLUMES ENERGY CARRIERS

FIGURE 1 – SCHEMATIC REPRESENTATION OF THE INDUSTRY MODEL DEVELOPED FOR THE STUDY

FOUR FOCUS AREAS

The investigations in this study focus on four main areas:

1. Pathways to net zero, 2. System impact and flexibility, 3. Grid impact, and

4. Elia’s and 50Hertz’s commitments as facilitators of the energy and industrial transition.

1. Pathways to net zero

The pathways to net zero, or scenarios, are models of the different options being considered by industry to move towards net zero. The pathways provide a holistic view of the industrial transition by considering aspects such as energy efficiency, products, process variants, energy carriers and feedstock.

A CLEAR VIEW ON 2030, MORE UNCERTAINTY REGARDING LONGER TIME HORIZONS

The geographical scope of this study comprises Belgium and the north and east of Germany (the 50Hertz control area). The study also explores several industrial clusters in more detail (see Annex B).

Industry’s transition to net zero is explored in line with three different time frames: 2030, 2040 and 2045/2050 (climate neutrality target dates in Germany/Belgium).

For 2030, one central scenario was established based on input from industrial players on their - in most cases concrete - short- to mid-term plans to reduce emissions.

After 2030, the pathways leading industry to net zero are more uncertain. Based on interviews with industry, academic research, exchanges with Bloomberg New Energy Finance (BNEF) and more in-depth investiga tions of the (petro)chemical sector undertaken with Accenture, three different scenarios were established for 2040 and 2045/2050. The scenarios differ in assumptions for sectors where uncertainty remains on the pathways to net zero.

Except for some specific sectors, the model assumed in both Belgium and the 50Hertz area a slight increase in production volumes (0.05% to 1%). The study considers that all existing industry will remain in Belgium and Germany. The results must therefore be interpreted in terms of what needs to be done in order to maintain industry in Belgium and Germany. This also means that regular updates are needed to keep track of the latest evolutions (e.g. industries leaving, new industries arriving etc.). Some exceptions apply to this principle, as outlined in the next paragraphs.

→ Having worked with the main chemical players throughout Europe, we were able to provide insights to Elia Group covering twenty of the most energyintensive processes in refineries and (petro)chemical industries. With Accenture’s insights into industry players’ decarbonisation roadmaps and detailed understanding of the production processes, we focused on developing plausible pathways for these industries towards net zero. As an example, we observed a strong electrification potential for low temperature heat and steam in these processes.

| POWERING INDUSTRY TOWARDS NET ZERO | 10 |

“ 2019 2030 2040 and 2045/2050 Baseline Central scenario Scenario based on input from industrial players on their short- to mid-term plans Scenario FOS+CCUS A scenario which includes the tendency to use more fossil fuel (FOS) and carbon capture, utilisation and storage (CCUS) Scenario ELEC An electrification scenario in which more industrial processes are electrified Scenario MOL A low-carbon molecule scenario with a tendency for more (green) molecules as an energy carrier H2 Input from industry, academic research, BNEF and Accenture FIGURE 2 – PATHWAYS TO NET ZERO

TINA PIGA, MANAGING DIRECTOR UTILITIES & ENERGY BELUX AT ACCENTURE

Exceptions applicable in Belgium:

▶ a reduction of oil refining capacity by 2050 in line with [CON-1];

▶ a growth ambition for the food and drink industry focused on exports [STT-1];

▶ a yearly growth rate of 11% is expected in the digital sector in the lead-up to 2040. This increase is based on historical observed growth and includes effi ciency improvements. Uncertainty surrounding the exact evolution of this sector remains high.

Exceptions applicable in the 50Hertz area:

▶ a decrease in the oil refining capacity is envisaged by 2045 in line with [CON-1];

▶ a strong increase is expected in the digital sector: with more than 2 GW of connection requests for data centres by 2030, the yearly growth of this sector’s power demand is estimated to be around 7% (but uncertainty remains high);

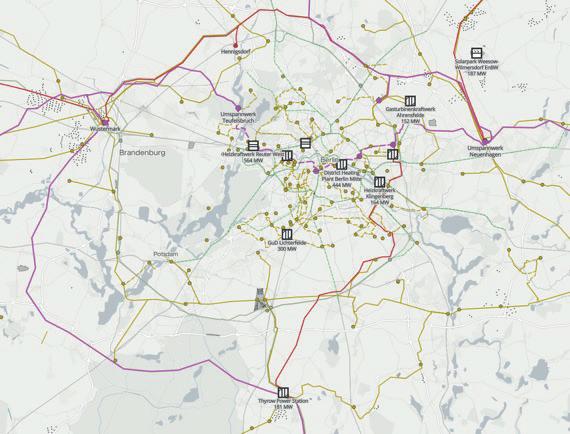

▶ due to its high levels of green electricity supply and the availability of land for new industrial sites, the 50Hertz area (the Berlin-Brandenburg region in particular) is attracting new industrial settlements, mainly in the manufacturing and digital sectors.

A VAST AMOUNT OF GREEN MOLECULES TO BE IMPORTED

Results regarding the demand for low-carbon molecules were reported separately by the model. The reason for this is that the production locations of low-carbon mole cules (e.g. hydrogen, ammonia or methanol) are not yet fully clear. The hydrogen strategy of Belgium and Germany focuses on importing a large share of the needs for green hydrogen and derivatives. If part of the green molecules are produced locally using the electrolysis process, Belgium and Germany will need additional amounts of renewable electrons. These volumes then need to be added to the volumes reported in Key Finding 1 (next chapter). This approach allows an easy calculation of the effect of different shares of domestic production of low-carbon molecules. To illustrate the possible impacts on the grid, the cluster analyses do take into account projects considered by industry to produce low-carbon molecules or e-fuels (see Annex B).

TRANSITION PATHWAYS ALSO CONSIDER A SWITCH IN FEEDSTOCK

Next to switching to a carbon-neutral energy supply, a switch in feedstock is part of the transition pathway. For example, primary steelmaking processes will reduce their use of coal to cut their greenhouse gas (GHG) emis sions. This can be achieved e.g. by using innovative direct reduced iron (DRI) technology alongside an electric arc furnace (EAF). In an initial phase, this technology will be powered by natural gas (as it is already in place in a steel plant in Hamburg and will be in Ghent); a later shift towards low-carbon hydrogen can be considered (once available at affordable prices).

Different examples of industrial symbiosis exist to decarbonise raw materials: waste wood and plastics can replace a part of fossil carbon in blast furnaces for iron production, and waste materials and by-products from other industries can be substitutes for limestone in cement kilns. Other examples can be found in the chemical recycling of plastics, which is a rather ener

gy-intensive process as plastics are broken down into their initial components (like naphtha,…), which are then used as feedstock for rebuilding these plastics. The Flan ders ‘VLAIO’ study emphasises this process of plastic recycling as a potential solution that allows fossil feed stock to be reduced whilst at the same time securing the future of the high-value (petro)chemical sector in Belgium [VLA-1].

“

→ Indaver’s Plastics-to-Chemicals (P2C) depolymerisation technology allows the recycling of end-of-life plastics such as polyolefins and polystyrene by converting them into a petrochemical feedstock that can be used for the production of high-demand packaging materials. With P2C, we are significantly expanding the possibilities for recycling of endof-life plastics waste that could previously not be recycled or only be used for conversion into low-value applications.

| POWERING INDUSTRY TOWARDS NET ZERO | 11 |

ERIK MOERMAN, DIRECTOR SALES AND DEVELOPMENT AT INDAVER PLASTICS2CHEMICALS (BE)

2. System impact and flexibility

In order to model the impact of future industrial processes on the power system, it is important to under stand their power consumption profiles. These profiles can differ from historic profiles. Therefore, new power profiles were elaborated for some processes based on different inputs like type of process (batch or continuous), working schedules, available flexibility, etc. This is shown in Figure 3. The learning gained from these profiles can be integrated into future exercises e.g. to calculate the required grid infrastructure.

Flexibility plays a significant role both in the integration of renewables and in optimising the use of the existing grid infrastructure. Following the analyses performed for the ‘Roadmap to Net Zero’ study [ELI1], this study highlights the value that can come from optimising industrial flexibility on day-ahead market prices via several use cases. In addition, an illustrative case was developed to show the impact of flexibility on the grid infrastructure (see Key Finding 5).

3. Grid impact

Based on findings from the first two focus areas, this section identifies some of the actions needed to prepare the power grid to accommodate industry’s transition to net zero. It confirms the findings of the Federal Develop ment plan (FDP) in Belgium and Netzentwicklungsplan (NEP) in Germany, which approach the planning of the electricity grid in a holistic manner.

The electrification of industry requires the accel erated development of grid infrastructure. Several clusters were investigated in more detail in order to get a better understanding of the infrastructurerelated challenges and needs to enable the industrial transition (see Annex B).

→ In our challenge to achieve a climate-neutral Belgian economy by 2050, all sectors will have to make the necessary efforts to reduce their CO 2 emissions. A future-proof infrastructure is key to allow access to cost-competitive renewable energy. A first step has been taken by carrying out this study. That is why the reinforcement of our power grids is a first priority in the transition towards a robust energy system, hand in hand with pipelines and port facilities for green molecules and carbon capture and storage.

JACQUES VANDERMEIREN, CEO PORT OF ANTWERP-BRUGES (BE)

| POWERING INDUSTRY TOWARDS NET ZERO | 12 |

BOX 1 Load profile synthesis Industrial sectors Main Input Production processes Load profile [MW p.u] Flexibility assessment Scan for effects of… …temporal load modulation +/…load shift (incl. rebound of energy) …temporal shut down Electrolysis Mechanical energy Modulation of work shifts Low/Mid/ High temp heat Energy intensity Annual production output [quantity of units] Flexibilisation options with cost and availability Energy share of key activities Technologies to enable activities

FIGURE 3 – SCHEMATIC REPRESENTATION OF THE INDUSTRY MODEL DEVELOPED FOR THE STUDY

“

PER SECTOR PER PROCESS PER ACTIVITY

4. Elia’s and Hertz’s commitment as facilitators of the energy and industrial transitions

Elia and 50Hertz want to facilitate industry’s journey to net zero by providing industrial stakeholders with infor mation and services.

This includes:

▶ providing them with insights into their real-time offtake;

▶ better information about the origin of the energy they consume;

▶ insights into the impact of flexibility;

▶ and enabling industrial players to move (excess) solar energy produced in one of their sites to another.

A successful industrial transformation involves more than simply switching to low-carbon energy sources. The transition must be approached in a holistic way, including adopting measures and practices such as: climate-neutral feedstock; new processes and products, circularity, energy efficiency, and offsetting/ capturing remaining emissions. The current study combines these different elements and then focuses on their impact on the power system.

| POWERING INDUSTRY TOWARDS NET ZERO | 13 |

| POWERING INDUSTRY TOWARDS NET ZERO | 14 |

FIVE KEY FINDINGS

THE RESULTS OF THIS STUDY CAN BE GROUPED UNDER

FIVE KEY FINDINGS

Industrial electricity consumption will increase by 40-50% in the run-up to 2030. Electrification and the accelerated development of renewables is our main tool for reducing our exposure to fossil fuels over the next two decades.

These key findings are based on extensive data analyses and interviews with different industrial players. Elia and 50Hertz always handle connection requests and bilateral discussions with the utmost discretion and confidenti ality. Our priviliged position allows us to share some key, aggregated insights into how industry is expected to evolve in the coming decades.

In all investigated scenarios, electrification will play a major role in industry’s journey to net zero. Building out leading grid infrastructure is therefore critical for keeping pace with industry’s electrification ambitions, attracting new innovation projects and anchoring industry in Europe.

More information on the assumptions and performed analyses for the different sectors can be found in Annex A. The results for the investigated industrial clusters in the Elia and 50Hertz area are provided in Annex B.

Carbon capture, utilisation and storage (CCUS) will be essential for dealing with unavoidable process emissions and will have an important effect on power consumption.

There will be a gradual shift towards low-carbon (green) molecules in heavy industry with an increase in volume demand beyond 2030. A vast amount of green molecules will need to be imported.

Industrial flexibility optimises future energy costs and benefits the power system in multiple ways, meaning that it will become an inherent part of future business cases.

| POWERING INDUSTRY TOWARDS NET ZERO | 15 |

1 2 3 4 5 CO2 H2

INDUSTRIAL ELECTRICITY CONSUMPTION WILL INCREASE BY 40-50% IN THE RUN-UP TO 2030. ELECTRIFICATION AND THE ACCELERATED DEVELOPMENT OF RENEWABLES IS OUR MAIN OPTION FOR REDUCING OUR EXPOSURE TO FOSSIL FUELS OVER THE NEXT TWO DECADES.

Elia Group is convinced that industry’s transition to net zero is about to accelerate, given the increase in connec tion requests in recent year(s). Elia and 50Hertz began collaborating more closely with industrial companies in their control areas to better capture their changing needs. This resulted in a thorough comprehension of the industrial processes and their technology readiness. These insights are important for a proactive and holistic grid and system development.

Coupled with scientific research, these exchanges resulted in a projected increase in electricity consump tion of up to 50% and 40% in the Elia and 50Hertz control areas respectively by 2030. In Belgium, more than two thirds of this projected increase is underway or in study phase today. For 50Hertz, an increase of 3.5 GW (of which 2 GW will come from data centres) in industrial connec tion capacity is due over the coming decade.

Electrification will take place both in energy-intensive sectors, often located in industrial clusters, and other more decentralised companies (such as food and drinks). A large share of the latter uses natural gas for the supply of low- to mid-temperature heat. The majority of these processes will be electrified over the coming decades. Investments in electrification are clearly advantageous: even if gas prices return to lower levels, electrification will make our industry more resilient in face of future crises, and will constitute a major step forward in terms of industry reaching climate neutrality on top of the associated efficiency gains.

In all considered scenarios, access to affordable low-carbon electrons is crucial for accelerating the electrification of industry, making it more resilient and sustainable. Industrial electrification is at risk of slowing down or even coming to a halt if electricity prices continue to structurally follow the marginal cost of gas production units on the longer run. In order to avoid this, we need to go all out on the development of infra-marginal (i.e. cheaper) low-carbon electrons. An accelerated build-out of RES capacity will be the main lever for doing so in the coming 10 to 20 years. A larger share of RES generation will reduce the amount of hours where gas (or other fossil fuels) set the electricity price, leading to lower power prices. Accelerating renewable development not only reduces emissions, but also makes Europe more energy independent and resilient.

“→ As ArcelorMittal in Belgium, we are a very energy-intensive company. By investing €1.1 billion by 2026, we will triple the use of electrical energy between now and 2026. The availability and the stability of the grid is of utmost importance for us to realise our ‘Decarb’ roadmap, and it has even been a criterion used to invest here in Belgium.

“→ The transition from “grey to green” power sourcing, the direct electrification of rotating equipment, “power to steam” via e-boilers and carbon capture technologies will lead to a significant increase in our power demand by 2030. Therefore, we need the implementation of offshore wind and onshore high-voltage grid projects in Belgium to be accelerated.

“→ Agoria is deeply convinced that digital technologies can offer an answer to the climate challenge. The digital and green transitions (“twin transition”) can reinforce each other, support sustainable growth and maintain our economic and social welfare.

PIERRE MARTENS, SENIOR BUSINESS GROUP LEADER AT AGORIA (BE)

“→ The electricity demand of the chemical park in Leuna is expected to grow by 1 GW in the next 10 years, mainly driven by electrolyser projects. The sustainability of the chemical park will strongly depend on the grid connection and the availability of green electricity. This is why we need a 380 kV line as soon as possible.

MARC PECQUET, BUSINESS DEVELOPER SUSTAINABILITY PROJECTS AT TOTALENERGIES RAFFINERIE MITTELDEUTSCHLAND GMBH (DE)

| POWERING INDUSTRY TOWARDS NET ZERO | 16 |

KEY

1

FINDING

MARC VAN BREDA, VICE PRESIDENT SENIOR PROJECT CCS, ENERGY & CLIMATE POLICY AT BASF (BE)

MANFRED VAN VLIERBERGHE, CEO AT ARCELORMITTAL BELGIUM (BE)

2030 PROJECTION: ALL SECTORS ARE PREPARING FOR ELECTRIFICATION ON A LARGE SCALE.

The highest increases in electricity consumption by 2030 will occur in the following sectors: steel, (petro)chemical, paper and pulp, food and drink, and digital (see Figure 4).

▶

In the steel sector, some initial projects have been launched to replace traditional blast furnaces with a combination of direct reduction (DR) and electric arc furnaces EAF (+2.5 TWh and +1.2 TWh in the Belgian and 50Hertz areas respectively).

▶

In the (petro)chemical sector, electric drives, carbon capture techniques, electric boilers and heat pumps are driving these significant increases (+5.3 TWh and +3.4 TWh in the Belgian and 50Hertz areas respec tively).

▶

The electricity consumption will more than double in the cement industry when carbon capture techniques are employed (+1 TWh and +0.6 TWh in the Belgian and 50Hertz areas respectively).

▶

In the paper and pulp industry (+0.8 TWh and +2.4 TWh in the Belgian and 50Hertz areas respectively) as well as in the food and drink sector (+4 TWh and +1.7 TWh in the Belgian and 50Hertz areas respectively), both heat pumps and electric boilers are replacing conventional gas boilers.

▶

The continued digitalisation of society will have a major impact on the usage of data, thereby exponen tially increasing electricity consumption. Based on connection requests and input from sector experts, Elia Group assumes there will be significant growth in this area in the coming decade, with a power consumption increase of 2.7 TWh and 3.6 TWh by 2030 in the Belgian and 50Hertz control areas respectively. However, the growth of the digital sector remains difficult to predict as limited information is available. Additional efforts to improve power usage effectiveness could lower the overall impact on the energy demand. Heat recuper ation to other sectors is another important lever for further optimisation, providing that sufficient demand for low-grade heat is present in the close vicinity. Finally, the movement of remote servers to clouds in data centres increases the efficiency as hyperscale clouds are more efficient.

The annual power consumption volumes in Figure 4 focus on gross power consumption. In Belgium, approxi mately 2.4 GW of local production in the form of combined heat and power installations (CHPs) are installed behind industrial access points. With a higher penetration of renewables in the system, the running hours of these units will gradually decrease over time, adding up to their net offtake from the grid. An increase in on-site renew able production would result in an opposite effect.

As noted from the interviews that we undertook for this study, it is clear that industry is ready to shift to the electrification of its processes. The technology needed for this is mature in most cases and if certain barriers are removed (see Lever 1), electrification will be the most impactful method for reducing Belgium’s and Germany’s CO2 emissions and their dependence on fossil fuels.

→ Currently we use natural gas to melt glass. We have the vision to become carbon net zero by 2050. On the roadmap to get there, we have an objective for 2030 to reduce carbon emissions by 30%. Therefore, we need to do electrification.

NIELS SCHREUDER, DIRECTOR PUBLIC AFFAIRS & COMMUNICATION, AGC GLASS EUROPE (BE)

| POWERING INDUSTRY TOWARDS NET ZERO | 17 |

*Machinery, transport equipment ** Wood

Industrial electricity consumption [TWh] 2019 2030 2019 2030 Central scenario Central scenario +50% +40% Others** Manufacturing* Glass Data centres Cement Food and drink Non-ferrous metals Paper and pulp Iron and steel Chemical and petrochemical 60 50 40 30 20 10 0 FIGURE

–

and wood products, textile and leather, mining and quarrying, other non-metallic minerals, other industrial sectors

4

EVOLUTION OF THE ANNUAL ELECTRICITY CONSUMPTION IN BELGIUM AND THE 50HERTZ AREA IN THE LEAD-UP TO 2030

“

→ Reducing net carbon emissions in industry will require a substantial increase in carbonneutral electricity generation in the coming decades. Therefore, all technological options need to be kept open, including renewable energy (in combination with storage and energy conversion), carbon capture and storage/usage and nuclear. Energy policy must be technology neutral and strive for the best balance between system costs (including grid infrastructure), security of supply and environmental impact.

PETER CLAES, DIRECTOR AT FEDERATION OF INDUSTRIAL ENERGY CONSUMERS FEBELIEC (BE)

2045/2050 PROJECTION

Figure 5 shows the projected industrial electricity consumption in the run-up to 2045/2050 (excluding power consumption for the production of green mole cules). It will increase by a factor of 2.4-2.5 compared with today’s values under the FOS & CCUS and the MOL scenario and by a factor of 2.8-3 in the ELEC scenario.

This increase will be driven by the same sectors as mentioned in the 2030 projection, with additional increases noted in the non-metallic minerals (cement, glass, lime…), non-ferrous metals and the paper and pulp sectors. This clear trend has been confirmed by other studies, including Febeliec-Energyville [FEB], DENA Leit studie [DENA], and the study commissioned by BMWK on the energy transition in industry [BMWK].

In addition, new industrial processes like waste plastic pyrolysis and e-cracking, if implemented on large scale, will also be important drivers behind the increase in electricity consumption.

Finally, the further increase for data storage and compu tation power across society will have a major impact, exponentially increasing electricity consumption by +15 TWh (Belgium) and +15.6 TWh (50Hertz area) by 2045/2050. Further efforts to optimise effective power usage and heat recuperation methods to other sectors (greenhouses, district heating, etc.) could lower the impact on the overall energy demand.

FIGURE 5 – EVOLUTION OF THE ANNUAL INDUSTRIAL CONSUMPTION IN BELGIUM AND THE 50HERTZ AREA IN THE LEAD-UP TO 2045/2050

→ Different, independent research shows converging projected transition paths for industry to reach net zero by 2050. The electrification of processes and having access to reliable electricity supply will be crucial to reach this target.

PIETER LODEWIJKS, PROGRAM MANAGER AT VITO/ENERGYVILLE (BE)

* Machinery, transport equipment ** Wood and wood products, textile and leather, mining and quarrying, other non-metallic minerals, other industrial sectors

| POWERING INDUSTRY TOWARDS NET ZERO | 18 |

“

“

2019 2019 Scenario FOS+CCUS Scenario FOS+CCUS Scenario MOL Scenario MOL Scenario ELEC Scenario ELEC Scenario ELEC Scenario ELEC Scenario FOS+CCUS Scenario FOS+CCUS Scenario MOL Scenario MOL

Industrial electricity consumption [TWh] 120 100 80 60 40 20 0 2040 2040 2050 2045

x1.9 x1.9 x1.8 x2.1 x1.9 x2.4 x2.4 x2.8 x2.2 x3 x2.5 x2.5

Others** Manufacturing* Glass Data centres Cement Food and drink Non-ferrous metals Paper and pulp Iron and steel Chemical and petrochemical

CO2 REDUCTION TARGETS FOR INDUSTRY ON TRACK IN RUN-UP TO 2030

As shown in Figure 6, there is a clear correlation between the increasing industrial decarbonisation efforts and the decreasing emissions. Projected industrial GHG emis sions in 2030 for the modelled sectors are compared with the ambition of -55% reduction of the EU Fit for 55 package for Belgium and the -58% reduction target for Germany (as defined in the German Climate Change Act [BMU-1]). Beyond 2030, further measures are needed to reach net zero targets by 2045/2050, such as the use of direct air capture technologies or negative emissions via bio-energy combined with CCS (BECCS).

| POWERING INDUSTRY TOWARDS NET ZERO | 19 |

Industrial GHG emissions [MtCO 2eq ] 30 25 20 15 10 5 0 Glass Cement Food and drink Non-ferrous metals Paper and pulp Iron and steel Chemical and petrochemical Cap set by national/ EU regulation 2019 2019 Scenario FOS+CCUS Scenario FOS+CCUS Central scenario Central scenario Scenario MOL Scenario MOL Scenario ELEC Scenario ELEC Scenario ELEC Scenario ELEC Scenario FOS+CCUS Scenario FOS+CCUS Scenario MOL Scenario MOL 2040 2040 2030 2030 2050 2045 FIGURE 6 – EVOLUTION OF INDUSTRIAL GHG EMISSIONS (MODELLED SECTORS ONLY) IN BELGIUM AND THE 50HERTZ AREA IN THE LEAD-UP TO 2045/2050

IN ALL INVESTIGATED SCENARIOS, ELECTRIFICATION WILL PLAY A MAJOR ROLE IN INDUSTRY’S JOURNEY TO NET ZERO. BUILDING OUT LEADING GRID INFRASTRUCTURE IS THEREFORE CRITICAL FOR KEEPING PACE WITH INDUSTRY’S ELECTRIFICATION AMBITIONS, ATTRACTING NEW INNOVATION PROJECTS AND ANCHORING INDUSTRY IN EUROPE

Many industrial players in the Elia and 50Hertz control areas are front-runners in terms of electrification and have been carrying out pilots and investments as part of their decarbonisation strategies:

▶ ArcelorMittal is already operating a direct reduction (DR) plant in Hamburg and is in the process of setting up a direct reduction - electric arc furnace (DR-EAF) project in Belgium.

▶ The Antwerp site of BASF has been identified as the first entity in the BASF group to reach net zero in the future.

▶ Holcim (cement) is considering an oxyfuel kiln to perform CCUS.

▶ Other examples are Nyrstar (virtual battery), PSA (elec trification of horizontal transport), Indaver (plastics recycling), HH2E (H2 electrolysis), along with many other examples mentioned in this study.

In addition to the transition of industries located in the Elia and 50Hertz control areas, this study also focuses on particular industrial clusters. In Belgium, the study looks at the Antwerp and Hainaut industrial clusters in more detail. In the 50Hertz area, the considered clusters are Leuna, Berlin, Hamburg and Lubmin. Other clusters in the Elia and 50Hertz control areas will be investigated in more detail in 2023. Detailed results can be found in Annex B.

Industrial clusters are typically prime locations for existing and new industries to settle in. They have access to diversified infrastructure (electricity, CO2 infrastruc ture, molecules). Additionally, industries within a cluster can implement synergies and in some cases make use of each other’s waste streams (circularity).

Our analysis confirms that most of the increase (up to 70%) in industrial power consumption by 2030 will take place in industrial clusters. Supporting this strong increase will require a switch from infrastruc ture being built following industrial electrification to leading infrastructure to keep pace with the electri fication of industry.

The precise speed of industrial decarbonisation and the exact multiplication factor of electricity consump tion as we approach 2045/2050 differ across each scenario. However, it is clear that electrification will play a major role under all investigated scenarios and that infrastructure build-out is necessary. Access to sufficient resources (in terms of financing, workforce and supply chains) is essential for building a robust and reinforced grid, anchoring industry in Europe and ensuring the energy transition is a success.

“→ There are three blocking points that need to be addressed. The first one is providing industry with planning security to make long-term investments. The second one is to provide them with a leading market to produce green products. The third one is to facilitate permitting procedures.

DIETMAR GRÜNDIG, DIRECTOR INDUSTRY AND TRADE AT DENA (DE)

“→ North Sea Port has expressed in its strategic plan ‘Connect 2025’ the intention, together with the companies based in the port, to reduce CO 2 emissions in the port area and to be a carbon-neutral port in 2050. The electrification of industry and mobility is one of the actions to achieve these goals. The availability of an extensive (high-voltage) transport network is of crucial importance.

DAAN SCHALCK, CEO OF NORTH SEA PORT (BE)

| POWERING INDUSTRY TOWARDS NET ZERO | 20 |

KEY FINDING 2

CARBON CAPTURE, UTILISATION AND STORAGE WILL BE ESSENTIAL FOR UNAVOIDABLE PROCESS EMISSIONS AND WILL HAVE AN IMPORTANT EFFECT ON POWER CONSUMPTION

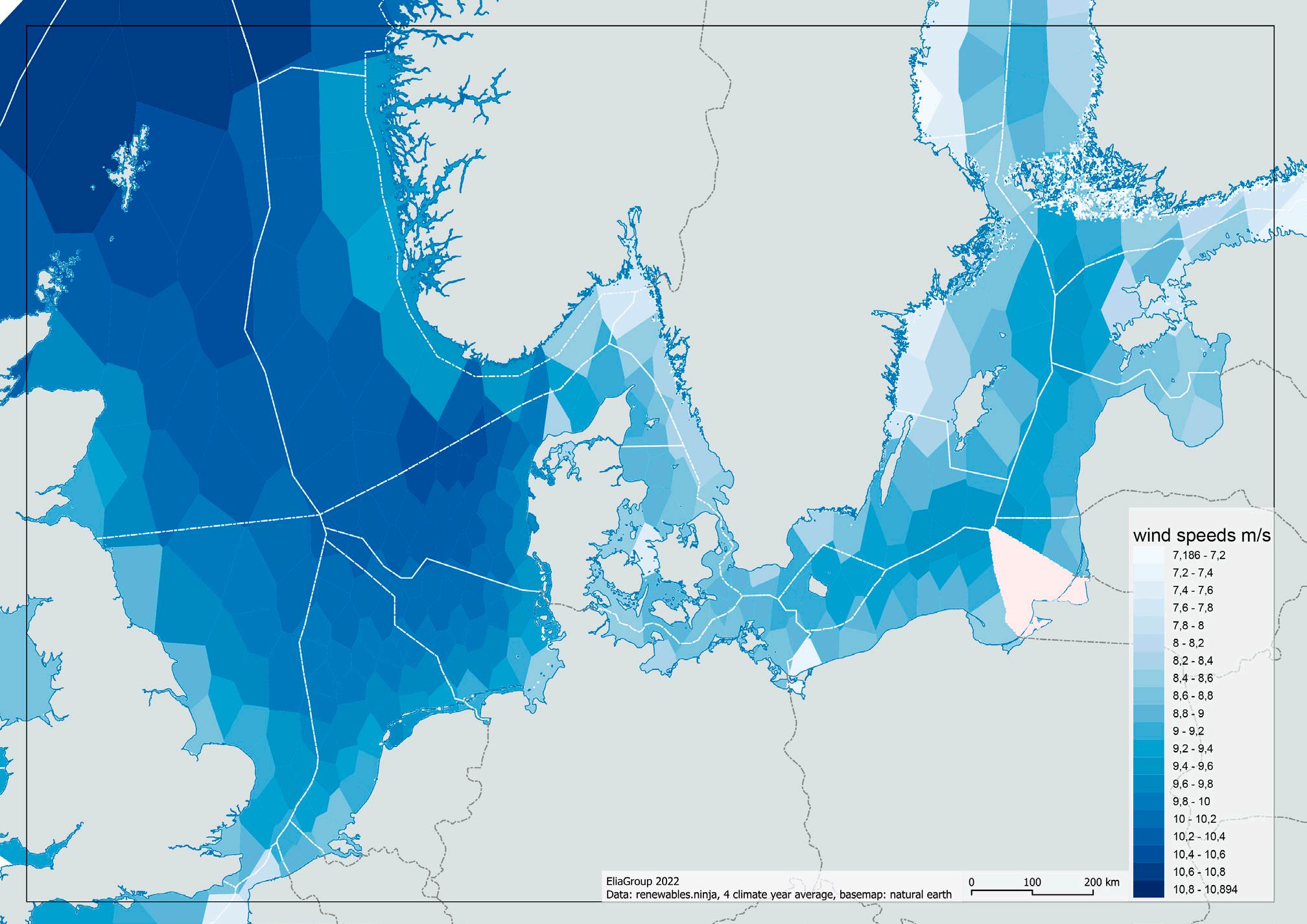

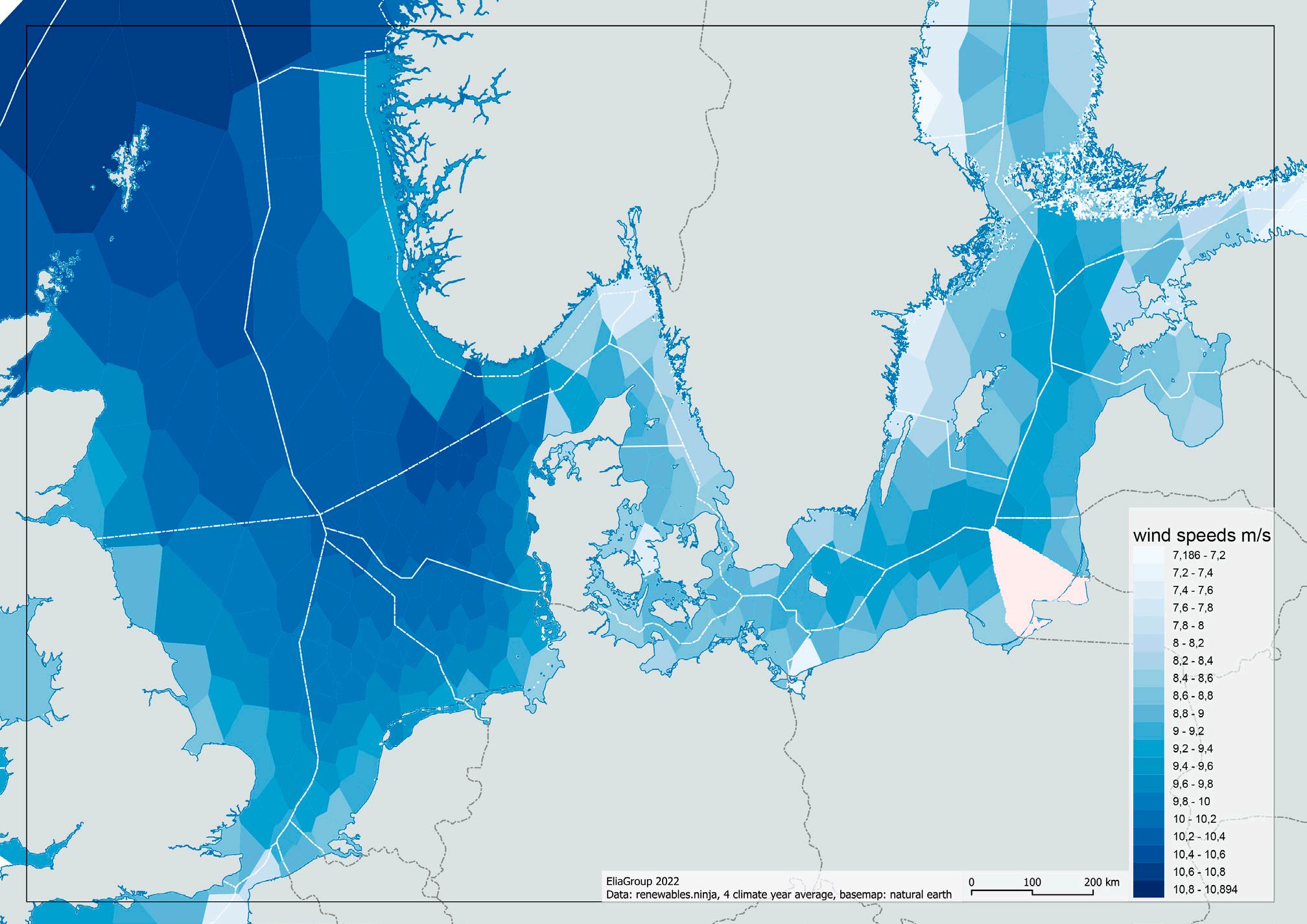

The North Sea coastlines of Belgium and Germany will provide both countries with access to CO2 storage. The necessary infrastructure (such as CO2 pipelines and liquefaction infrastructure) must be developed within the current decade.

Based on input received from industry, CCUS will mostly take place in refineries and the high-value chemicals (HVC), cement, steel (potentially in transition phase) and lime sectors. CCUS will mostly deal with process emis sions: based on the input received, industries will not widely develop CCUS for capturing combustion emis sions.

By 2045/2050, our findings identify a range of carbon capture potential of 8 Mt (ELEC & MOL) to 17 Mt (FOS+CCUS) of CO2 in Belgium and 7 Mt (ELEC & MOL) to 11 Mt (FOS+CCUS) of CO2 in the 50Hertz area. The evolu tion is shown in Figure 7.

Several industrial pilot projects are focusing on the usage of captured CO2 (e.g. for production of synfuels). This has a positive effect on overall emissions, but requires correct carbon accounting. In order to reach net zero, the CO2 used for the production of synfuels needs to origi nate from direct air capture (DAC) or the combustion of biomass. Alternatively, the carbon needs to be captured again upon combustion of the synfuel.

CCUS has an important effect on power consumption, given the heat required for the capture process and the compression / liquefaction of CO2 for its trans portation. Our findings predict that there will be an offtake of 4 to 9 TWh (Belgium) and 4 to 6 TWh (50Hertz area) for CCUS by 2045/2050.

→ The decarbonisation of the cement industry is extremely challenging because of our process’ inevitable CO 2 emissions, which put us firmly in the hard-to-abate sector. CCUS is vital for Obourg to become the first net carbon neutral clinker plant in NorthWest Europe. We are working with several partners to accelerate the development of these CCUS solutions for GO4ZERO. By joining the first movers, we want to set the standards for future clinker manufacturing plants.

BART DANEELS, CEO OF HOLCIM BELGIUM (BE)

| POWERING INDUSTRY TOWARDS NET ZERO | 21 |

KEY FINDING 3

“

–

Industrial CO 2 abatement [MtCO 2 ] 18 16 14 12 10 8 6 4 2 0 2019 2019 Scenario FOS+CCUS Scenario FOS+CCUS Central scenario Central scenario Scenario MOL Scenario MOL Scenario ELEC Scenario ELEC Scenario ELEC Scenario ELEC Scenario FOS+CCUS Scenario FOS+CCUS Scenario MOL Scenario MOL 2040 2040 2030 2030 2050 2045

FIGURE 7

ANNUAL CARBON CAPTURE VOLUMES IN BELGIUM AND IN THE 50HERTZ AREA IN THE LEAD-UP TO 2045/2050

→ With Project ONE, INEOS

Olefins Belgium is building one of the most innovative, efficient steam crackers in the port of Antwerp: our ethane cracker will emit less than half as much CO 2 compared to the top ten percent cleanest plants in Europe. By fueling our cracking furnaces and steam boilers with hydrogen as a byproduct from the steam cracking process, we can already meet 60% of our heat consumption from day 1. Due to its flexible design it will be possible to fuel our installation with 100% hydrogen in the future when sufficient climate-friendly hydrogen becomes available.

JOHN MCNALLY, CEO OF INEOS PROJECT ONE (BE)

KEY FINDING

THERE WILL BE A GRADUAL SHIFT TOWARDS LOW-CARBON (GREEN) MOLECULES IN HEAVY INDUSTRY WITH AN INCREASE IN VOLUME DEMAND BEYOND 2030. A VAST AMOUNT OF GREEN MOLECULES WILL NEED TO BE IMPORTED.

Molecules (hydrogen and its derivatives) are used for two different purposes in heavy industry: as feedstock and as an energy carrier.

In 2019, almost all of the hydrogen was produced using the conventional steam methane reforming process (SMR) or came from the waste streams of other processes. The total volume is shown in Figure 8.

Over time, a gradual shift will take place to low-carbon hydrogen (and derivatives). The main routes for this are via CCUS of existing processes to produce hydrogen, or via electrolysis on the basis of green electricity (green H2). Towards 2045/2050, the Belgian and German hydrogen strategies are fully centered on a shift to green H2 (and derivatives).

FEEDSTOCK – With increasing shares of renewable energy in the system, a gradual switch will take place from grey to green hydrogen (and derivatives).

ENERGY – The projected use of low-carbon molecules as energy for industrial processes will remain limited until 2030. From that point onwards, processes like steam cracking using low-carbon molecules (for heating purposes) will start emerging. Additionally, molecules could start to play a more prominent role in the DR-EAF process, decreasing the use of natural gas. Finally, in some petrochemical production processes, hydrogen will play a role in heating under the molecule scenario (MOL).

| POWERING INDUSTRY TOWARDS NET ZERO | 22 |

4

“ Industrial hydrogen demand [TWh] 60 50 40 30 20 10 0 Central scenario Scenario ELEC Scenario ELEC Scenario ELEC Scenario FOS+CCUS Scenario FOS+CCUS Scenario MOL Scenario MOL 2050 FIGURE 8 – EVOLUTION OF INDUSTRIAL HYDROGEN DEMAND FOR ENERGY AND FEEDSTOCK USE IN BELGIUM AND THE 50HERTZ AREA IN THE LEAD-UP TO 2045/2050 Scenario FOS+CCUS 2019 2030 2040 2045 2040 2030 2019 Central scenario Scenario FOS+CCUS Scenario MOL Scenario ELEC Scenario MOL

All of our scenarios show that low-carbon molecules will have an important role to play in heavy industry by 2045/2050, mostly driven by their use as feedstock in hard-to-abate sectors and as an energy carrier in sectors where full electrification is not possible.

Approximately 33 to 62 TWh (Belgium by 2050) and 24 to 37 TWh (50Hertz area by 2045) of hydrogen (derivatives) will be needed to cover industrial needs for energy and feedstock.

The numbers reported for Belgium do not account for H2 needs for the potential production of synthetic fuels (feedstock for synthetic fuels for international aviation, shipping and long-distance trucking, amounting to 115 TWh in Belgium in 2020). The numbers for 50Hertz include one synthetic fuel project (production of e-fuels by TotalEnergies in Leuna). If more projects are realised, corresponding hydrogen (derivatives) need will have to be added to the above numbers.

Given the scarcity of domestic RES in both countries, a vast amount of green molecules will need to be imported. Nevertheless, an electrolysis capacity of 4.3 GW is being explored in the 50Hertz area to be installed by 2030 and approx. 1.8 GW of electrolysis capacity is currently being explored in Belgium.

The electricity needed for their production is not accounted for in the changes in electricity consump tion under Key Finding 1. The domestic production of some of these green molecules to kick-start the market and gain knowledge is a logical first step, but this will strongly influence the electricity demand in Belgium and Germany. Assuming that the electrolysis process has an efficiency of 70%, the required volume of elec tricity to produce the total amount of required green molecules would amount to 55 TWh (ELEC scenario) and 82 TWh (MOL scenario) in Belgium in 2050 and to 34 TWh and 53 TWh in the 50Hertz area in 2045. This is equiva lent to an annual production yield of around 13 – 19 GW of

offshore wind capacity (with a capacity factor of 50%) for Belgium and 8-12 GW for the 50Hertz area.

Given the scarcity of domestic RES in both Belgium and Germany, a large share of these green molecules will be imported. This is reflected in the hydrogen strategies of both countries. Investments in import infrastructure and pipelines leading to industrial clusters are needed under all investigated scenarios. One remaining question is the type of molecules that industry will use. As the long-dis tance transport of hydrogen is difficult, given that it only liquefies at very low temperatures and has a low energy density, other molecules like green ammonia or meth anol are also considered.

The location of domestic projects matters: if positioned close to renewable production sources (e.g. the Baltic coast in the 50Hertz area), electrolysers have positive effects on the grid and can contribute to facilitating RES integration, in particular if operated flexibly (see the Lubmin use case in Annex B). The use of synergies (waste heat, oxygen…) should also be considered, which provides some arguments for the on-site production of green molecules.

“→ As an energy-intensive sector at the base of the value chain of many sectors, the chemical sector and life sciences are a crucial link in the energy transition. With an open mind, the sector works on new processes, efficiency improvements and solutions for companies and citizens in the climate problem, driven by new energy carriers and raw materials. Without taboos and with a focus on CO2 reduction and cost efficiency, committing to the production and import of all sustainable, competitive and supply-secure energy sources is necessary for basic industry to realise the climate neutral future in Europe.

ELS BROUWERS, DIRECTOR ENERGY, CLIMATE AND ECONOMIC AFFAIRS AT ESSENSCIA (BE)

| POWERING INDUSTRY TOWARDS NET ZERO | 23 |

INDUSTRIAL FLEXIBILITY OPTIMISES FUTURE ENERGY COSTS AND BENEFITS

THE POWER SYSTEM IN MULTIPLE WAYS. IT WILL THEREFORE BECOME AN INHERENT PART OF FUTURE BUSINESS CASES.

Today, the business case for flexibility is mostly focused on supplying ancillary services to the power system. By supplying these services, grid users become actively involved in managing and helping to ensure the effi cient operation of the transmission grid. However, whilst the volume of ancillary services is rather limited, the flexibility needs for integrating higher shares of RES will significantly increase. In the future, the majority of flexibility needs to be optimised directly in wholesale markets (DA, intraday and more real-time markets).

Flexibility should therefore be placed in a wider context and will be an inherent part of future (industrial) busi ness cases. Sufficient flexibility is required in the power system to cope with the high volatility of RES infeed e.g. daily, weekly or seasonal fluctuations. Flexibility in industry will facilitate industry’s transition to net zero in two ways. Firstly, it will facilitate the integration of renew ables and lower the total energy cost of flexible processes. Additionally, by reducing the peak load during specific periods, industry can contribute to security of supply (moments with low RES infeed and high demand).

As we interviewed industrial stakeholders, it became clear that some of the pathways to net zero will enable new and innovative ways of flexible power consumption. These types of flexibility can be divided into four categories, which are outlined in Figure 9.

1. Additional production capacity

By carrying out additional investments in extending the production capacity of certain energy-intensive process steps, an overcapacity can be created. This capacity - combined with an intermediary storage - creates flex ibility in the process, without having an impact on the output itself. In the framework of this study, Elia Group

has worked on use cases proposed by Nyrstar and Trimet (see use cases 1 and 2).

2. Switching between energy carriers

A second form of flexibility comes from maintaining two parallel heating systems. When investing in heat pumps or electric boilers, they can be used in parallel with the current (typically gas boiler) heating system.

By switching between electric heating and fossil fuel based heating, flexibility can be provided to the power system during this transition phase. In the framework of this study, Elia Group worked on a use case proposed by BASF (see use case 3).

3. Geographical location shifting

In addition to shifting loads in time as done in the case of overcapacity, large companies – that have operations in different locations – can shift part of their load between production sites. In this case, the consumption will temporarily be shifted from a location with low renew able infeed or unfavorable grid conditions to a location where the conditions are more favorable. This type of flexibility is investigated in the data centre sector [DATA1], but can potentially be more widely implemented.

4. Battery storage, green molecule storage and heat storage

The final types of flexibility can be grouped together under the umbrella of energy storage. This energy storage can be provided in the form of electricity (batteries), molecules (H2, NH3,…) or heat. A large share of companies are considering these options in order to support their energy consuming processes or to make the most of their RES supply portfolio. In the frame work of this study, Elia Group has worked on a use case proposed by Microsoft (see use case 4).

FIGURE 9 – FLEXIBILITY OPTIONS IN INDUSTRIAL PROCESSES

PROCESS FLEXIBILITY

Fuel switch

Overcapacity

H2

Storage (H2 NH3,…)

Location shifting Heat storage

Location and/or time

Batteries (Li-ion, flow)

| POWERING INDUSTRY TOWARDS NET ZERO | 24 |

KEY FINDING 5

FLEXIBILITY DEVELOPED IN PARALLEL CAPEX investment and storage of intermediate products (virtual battery)

FIGURE 10 – MONOTONE CURVE OF THE LOADING OF A LINE WITH AND WITHOUT THE ACTIVATION OF INDUSTRIAL FLEXIBILITY TO REDUCE PEAK

LOAD

Figure 10 shows how industrial flexibility can help to solve congestions by reducing peak load over a limited number of hours or after the occurrence of a grid inci dent. The monotone curve on the left shows the loading of a line between production and consumption centres. In this illustrative example, there is high loading during approximately 400 hours, which defines the overall capacity of the line.

By activating industrial flexibility (in addition to other measures for solving overloads), and thus avoiding consumption during these specific hours, the average peak capacity is reduced, as shown in Figure 10. This will free up additional capacity, allowing (for example) addi tional industrial capacity to connect. Hence, flexibility has – where available – a beneficial impact. It is clear, though, that this is only possible for specific industrial processes and needs to be discussed with the industrial stakeholders in question. The right incentives must be created to unlock this industrial flexibility.

Industrial load profiles were developed as part of this study for some existing and new (carbon-neutral) production processes. The reason for doing so was that power profiles for future industrial processes can differ significantly from historic ones. These power profiles take into account available flexibility (that can be opti mised against power prices, renewable infeed, etc.).

An example of such a load profile – and the effect of flexibility - is shown in Figure 11, which depicts the load profile for a generic ‘grinding’ step in cement production. This process has the potential to temporarily increase its power consumption by 30% and can decrease it by up to 20%. Taking into account other constraints on the process, the flexibility can (for example) be opti mised against electricity prices, increasing the energy consumption at times when prices are low and lowering it when prices are high.

(ILLUSTRATIVE PURPOSES).

140 120 100 80 60 40 20 0

% loading % loading

Hourly load (MWh)

Flex activation 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

140 120 100 80 60 40 20 0

Real example Frequency of occurance Frequency of occurance

FIGURE 11 – ACTIVATION OF FLEXIBILITY IN THE CEMENT SECTOR TO AVOID HIGH PRICES (ILLUSTRATIVE PURPOSES)

Load including flexibility for the two first months of 2021

7.5 7.0 6.5 6.0 5.5 5.0 4.5 2021-01-01 2021-01-08 2021-01-15 2021-01-22 2021-02-01 2021-02-08 2021-02-15 2021-02-22 2021-03-01

| POWERING INDUSTRY TOWARDS NET ZERO | 25 |

ZINC SMELTER VIRTUAL BATTERY

FLEXIBILITY POTENTIAL IN THE ALUMINIUM ELECTROLYSIS PROCESS

As for many non-ferrous metals, zinc production is an elec tro-intensive industry and one of the largest industrial consumers in Belgium. The main energy consuming process in Nyrstar’s zinc production plant in Balen (BE) is the electrolysis section (ca. 80% of energy use), which has the incredible advantage of operating flexibly at very short notice. By investing in additional electrolysis capacity and intermediate storage, utilising this flexibility has no impact on the production capacity. This flexibility enables the operator of the production plant to reduce their electricity costs by using the volatility of day-ahead market prices and reacting to imbal ance prices.

Aluminium is obtained from alumina via the Hall-Héroult electrolysis (or smelting) process. This process is very electro-intensive (14 MWh of electricity is needed to produce 1 tonne of aluminium) and is carried out in continuous operation with process parameters kept as stable as possible.

In their production site in Hamburg as well as on other sites, TRIMET has upgraded their smelters to ensure thermal and electromagnetic compensation in case of flexible operation: energy balance can be kept within the electrolysis cells even with a variating power input. With this upgrade, 10% of the electrical load can be shifted within seconds and balanced out within a week while short activations can go up to 25% of the installed capacity.

CASE

The operation of this virtual battery requires a significant investment in expanding the capacity of the zinc operations in order to enable a flexibility of approximately 140 MW and a storage capacity of 7 GWh. This is comparable with the storage capacity of a larger pumped-storage power plant (e.g. Coo). When optimising these characteristics using historical day-ahead market prices with perfect foresight, this virtual battery reduces the overall electricity cost by an average of 22%.

Next to price arbitrage, operating the production plant in a flexible way can also resolve congestion issues in the adjacent transmission grid and could therefore offer the possibility of enabling a faster connection of additional customers.

1 USE CASE 2

Its fast response allows the aluminium electrolysis process to provide ancillary services, contributing to stabilising the grid (frequency containment reserve). The load shifting potential across the week offers opportunities for optimisation against electricity market prices, facilitating the integration of intermittent renewable generation, and could provide further services to the grid.

Additionally, TRIMET can quickly interrupt their processes and cut more than 90% of their power consumption for a limited period of time. This flexibility could be used by the TSO to restore system balance or solve grid constraints as part of the German “interruptible load” scheme, which expired in July 2022.

→ Typically, the production of aluminium in smelters worldwide is run as a constant process. At TRIMET, we have adapted our production process in a unique way that allows for variable energy input, which helps to stabilise the grid and to integrate more renewables into our energy system. However, to be able to fully offer our flexibility potential, we need the right regulatory framework.

| POWERING INDUSTRY TOWARDS NET ZERO | 26 | USE

DR. ANDREAS LÜTZERATH, TECHNICAL DIRECTOR AT TRIMET ALUMINIUM SE (DE)

“

FUEL SWITCH – E-BOILER

USE CASE: FLEXIBILITY POTENTIAL IN THE ALUMINIUM ELECTROLYSIS PROCESS

GRID-INTERACTIVE UPS: HOW DATA CENTRES CAN SUPPORT SYSTEM STABILITY AND FACILITATE THE INTEGRATION OF RENEWABLES

Today, steam is typically produced by gas boilers and cogenera tion units in industrial sites. The (partial) electrification of this steam production by e-boilers and heat pumps is an important lever on the pathway to net zero for industry.

Together with BASF, a use case was designed to investigate the financial surplus to switch from gas boilers to electric boilers during hours of excess renewable energy (low prices). The opti misation was done based on day-ahead market prices for gas and electricity and resulted in the following outcomes:

▶

E-boilers have faster ramping rates than gas boilers and have no standby losses, in contrast to gas boilers. This makes them particularly interesting for applications with a dynamic steam demand (also avoiding the blow-off of excess steam).

▶

During hours where the marginal price in the electricity market is set by a gas unit, it is not beneficial to activate the e-boilers as there is no substantial efficiency gain between electric and gas boilers (in contrast with industrial heat pumps which are more efficient).

▶

Access to affordable low-carbon energy is important for the business case for e-boilers.

In addition, some regulatory barriers discourage their current implementation. Due to the rather limited running hours in the first few years, the reservation of the necessary connection capacity is expensive - especially as, during a transition phase, it can be argued that this capacity could be used in a flexible way. An exploration of applicable tariffs is required in the future for such flexible loads.

USE CASE 3 USE CASE 4

The main goal of data centre operators is to provide their customers with highly available computing power. As financial and regulatory incentives for flexible operation have been low so far, data centres show a baseload electricity consumption profile. However, we see potential flexibility for ancillary services.

Aluminium is obtained from aluminium oxide via the Hall-Héroult electrolysis (or smelting) process. This process is very electricity intensive ( (14 MWh of powerelectricity is needed to produce 1 ton of aluminium/tAl)) and is usually carried out in contin uous operation with process parameters kept as stable as possible.

In their plant in Hamburg as well as in other sites, Trimet has upgraded their smelters to ensure thermal and electromagnetic compensation in case of flexible operation: energy balance can be kept within the electrolysis cells, even with a variating power input. With this upgrade, 10% of the electrical load (20 MW) can be shifted within seconds and balanced out within a week while short activations can go up to 25% (50 MW) of the installed capacity.

The uninterruptible power supply (UPS) is a short-term energy storage device which provides back up power and protects computing racks from damage. As UPS have a short response time but a limited storage capacity, they are well suited to providing ancillary services, compensating for shortterm frequency fluctuations.

Microsoft is developing a grid interactive UPS technology and already offers this flexibility, via the aggregator EnelX, on the balancing market in Ireland [MS2022]. The displacement of fossil fuel-fired power plants currently providing balancing services will contribute to a reduction in costs and emissions within the power system (-2 MtCO2eq in Ireland by 2025 [BAR2022]).

The project in Ireland is a blueprint for how data centres can help decar bonise electric power grids and can be rolled out to other areas across Europe.

Its fast response allows the aluminium electrolysis process to provide ancillary services, contributing to the stabilization of the grid (frequency contain ment reserve). The load shifting potential across the week offers opportunities for optimisation against electricity market prices, facilitating the integration of intermittent renewable generation, and could provide further services to the grid.

Additionally, Trimet can quickly interrupt their processes and cut more than 90% of their power consumption for a limited period of time. This flex ibility could be used by the TSO to restore system balance or solve grid constraints as part of the German “interruptible load” scheme, which expired in July 2022.

| POWERING INDUSTRY TOWARDS NET ZERO | 27 |

FOR ANCHORING INDUSTRY IN EUROPE FOUR LEVERS

| POWERING INDUSTRY TOWARDS NET ZERO | 28 |

This chapter reviews the building blocks for anchoring industry in Europe, based on the pillars of the energy trilemma: sustainability, affordability and reliability.

Four key levers have been identified to enable the necessary transformation and anchor industry in Europe.

Favourable policy and regula tory frameworks to kick-start electrification.

TO KICK-START ELECTRIFICATION, INDUSTRY NEEDS FAVOURABLE POLICY AND REGULATORY FRAMEWORKS IN PLACE

The electrification of industry ticks all the right boxes: it reduces GHG emissions and our exposure to fossil fuels. The technology required to facilitate this process is mature and ready to be rolled out at scale. However, not all investments in electrification that anticipate the future have a clear business case from the start. The right policy measures and incentives are needed to ensure that early investments in industrial electrification and flexibility will take off.

Our interactions with stakeholders show that industrial players are ready to invest in the decarbonisation of their processes. Most technologies needed to electrify indus trial processes are mature (low- and mid-temperature heat, DR-EAF for steelmaking, …) and industry is consid ering their implementation in the near future.

On the longer term

Speeding up the development of RES to drive prices down for society and industry.

On the short term

Accelerating the build-out of the grid as an enabler for the industrial transition.

Fostering flexibility as a double accelerator for industrial electrification.

The electrification of low-temperature heating and steam will be deployed in the short term across different sectors. Electric boilers have technical advantages compared to gas boilers: they have fast ramping rates, higher availability and lower standby losses. In addi tion, they bring flexibility to the electricity system. They operate during hours with high renewable energy infeed in conjunction with thermal storage or in parallel with conventional boilers. Industrial heat pumps have the potential to significantly lower energy consumption, given their coefficient of performance (COP) of 3 or more. They can currently provide heat for temperatures of up to 200°C [HP-1] and more. A good example is the implementation of industrial heat pumps in the food and drink sector, but their utilisation is also being consid ered in heavy industry.

Electrification options for other processes, like high-tem perature heating, the (partial) electrification of glass production, shore power for ships, the electrification of trucks, etc. are gradually being tested or are starting to be rolled out. The electrification of heavy transport is expected to pick up in the near future. Electric steam cracking for high-value chemicals or electrolysis tech nologies for steel are expected to develop well beyond 2030. In addition, carbon capture, utilisation and storage processes and the domestic production of green mole cules result in increased power consumption.

→ Either we impose the same rules or similar rules to installations all over the world, or we find ways to help industry to finance these huge investments.

PETER CLAES, DIRECTOR AT FEDERATION OF INDUSTRIAL ENERGY CONSUMERS FEBELIEC (BE)

| POWERING INDUSTRY TOWARDS NET ZERO | 29 |

LEVER 1

“ 1 2 3 4

Most effective methods to reduce our fossil fuel dependence

As society is currently facing both an energy crisis and a climate crisis, we at Elia Group are convinced that solu tions that tackle both crises at the same time must be prioritised and accelerated.

As shown by the sector deep dives (see Annex B) and summarised in Table 1, the electrification of industrial processes combined with access to low-carbon elec trons is the first and most important method that is mature and available at scale for industry to reduce its dependence on fossil fuels.

“

→ Demand response is very important. It needs to be publicised. In fact, right now, if we were to help stabilise the grid with our virtual battery and our peak load were to increase, we would have to pay more than we do now. That shouldn’t be allowed. There should be a system change that provides incentives for demand response.

| POWERING INDUSTRY TOWARDS NET ZERO | 30 |

INGE SCHILDERMANS, GENERAL MANAGER AT NYRSTAR BELGIUM (BE)

TABLE 1 - PATHWAYS TO CLIMATE NEUTRALITY AND THEIR IMPACT ON THE CURRENT CLIMATE AND ENERGY CRISES

Pathway to climate neutrality

Energy efficiency

Impact on climate crisis Impact on energy crisis Maturity Explanation

Energy efficiency is a ‘no-regret’ and a high priority area.

The combination of electrification with low-carbon electrons (mainly stemming from RES development) is the fastest and most efficient lever to reduce industry’s exposure to fossil fuels and its CO2 emissions.

“

Electrification

H2

Low-carbon molecules

Can be scaled up fast as many applications can be electrified with proven technology

Provided sufficient green electrons are available

Electrolyser technology to be scaled up. Blue H2 mature but CO2 infrastructure to be developed first

Electrification is mature for low- and medium temperature heating. However, other technologies (e.g. e-cracking, molten oxide electrolysis) are still in study or pilot phase.

Low-carbon molecules will mainly be used to replace fossil fuels as feedstock but also as an energy carrier for industrial sectors that cannot fully electrify their processes.

As green electrons will be scarce in Belgium and Germany, import infrastructure for green molecules must be developed. Imports will also speed up the reduction of industry’s exposure to fossil fuels, as more green electrons will be available locally for direct electrification.