New opportunities in e ciency rebates

There’s a new class of rebates for industrial motor users — and users may pay you to help apply for them

By John Malinowski, EA Contributing Editor

Electric utilities collect around $8 billion annually from electrical bills that are used for energy e ciency incentive programs. Most industrial companies have used these rebates to upgrade their lighting and possibly the HVAC systems that are simple prescriptive programs.

These funds can be used for other upgrades, such as adjustable-speed drives, but they require measurement and veri cation (M&V) to show the sav-

ings. These M&Vs compare the energy used before and after the installation.

Carrying out these measurements can be complicated and costly, and the process requires purchase and installation of the equipment. The National Electrical Manufacturers Association and a coalition of energy advocates have been working to develop a prescriptive system for adding motors and drives to applications.

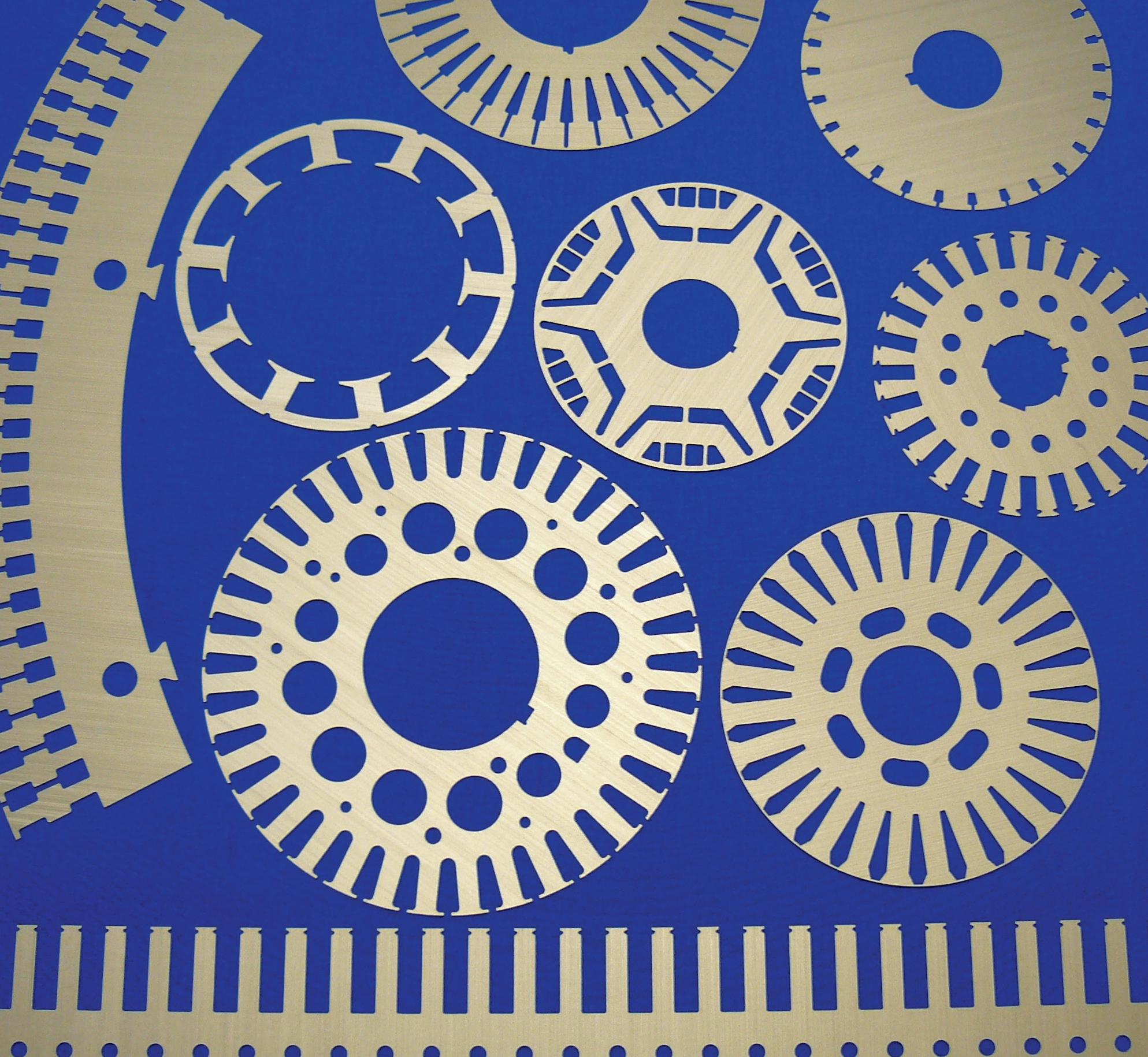

In this context, we’ll refer to the motor and drive system as a power drive system, or PDS. It includes the motor, adjustable-speed drive, and any lters in the system. The PDS does not include the driven load.

First, some background

Over the course of several years, the U.S. Dept. of Energy conducted a motor assessment and issued a series of three reports called the U.S. Industrial and Commercial Motor System Market Assessment Report that looked at the installed base of motors and drives. It was found that energy savings of at least 30% can be seen by adding an adjustable-speed drive to a variable-torque load such as a pump, fan, or centrifugal compressor. A similar study done by Cadeo and funded by the Northwest Energy E ciency Alliance and NEMA indicated similar potential savings of 30% to 40%.

a the ergy E ciency Alliance and NEMA indicated similar talk are provided at the point of sale. In our had An

centive

PDS. focusing

The program administrators who manage the rebates for the utilities talk about upstream and downstream rebates. We are familiar with downstream rebates and incentives that are provided at the point of sale. In our industry, we had a downstream rebate to encourage adoption of Premium Efcient motors before the regulations made them mandatory. An upstream incentive would be given to the OEM manufacturer for using a PDS. We will be focusing here on downstream incentives.

NEMA’s calculation procedure

NEMA has developed a new standard, MG 10011-2024, Power Index Calculation Procedure Standard Rating Methodology for Power Drive Systems and Complete Drive Modules. This standard

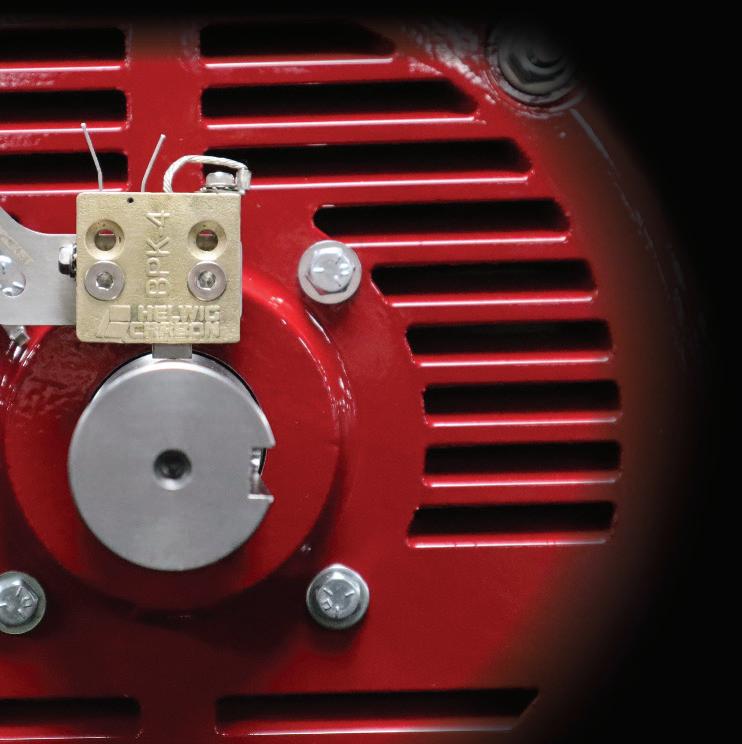

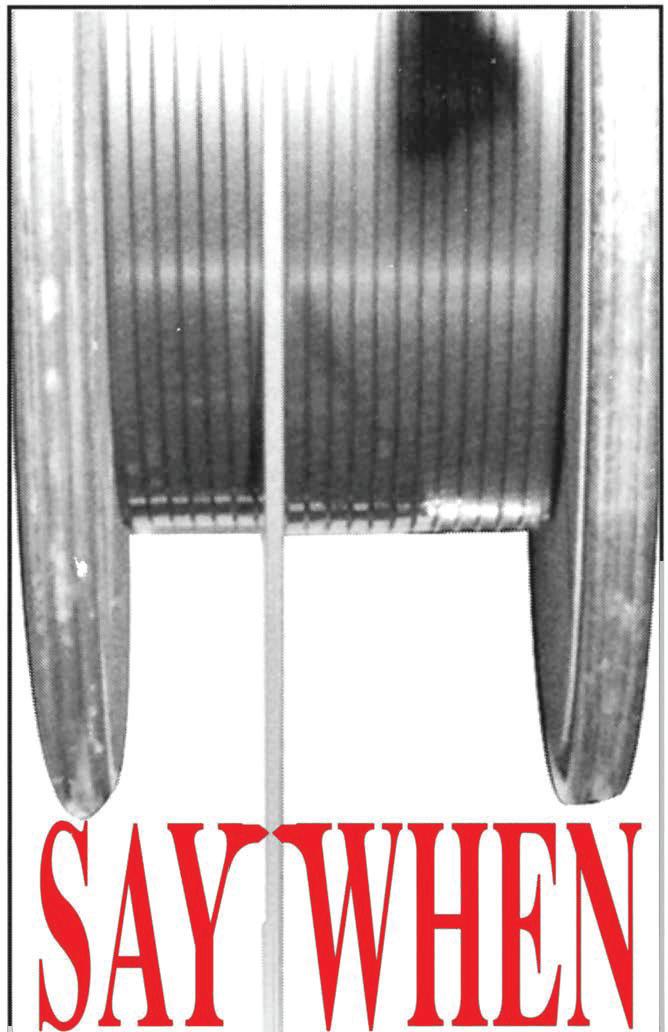

NEMA Super Premium efficient induction motors (IE4) can be drop-in replacements or operated with a drive for additional savings.

EFFICIENCY REBATES continued from previous page

establishes the calculation procedure for the Motor Coalition Metric. It provides a means to compare the relative energy savings of motors (both fixed and variable speed) to a standard baseline motor.

Note that we are comparing energy usage and not system efficiency. For polyphase equipment, this is a premium efficient direct-on-line motor (i.e., an IE3 equivalent). This metric represents weighted-average power consumption relative to a fixed-speed motor like NEMA’s Power Index, which is based on IEC 61800-9-2 Ed. 2.

The IEC standard’s full title is Adjustable-peed Electrical Power Drive Systems — Part 9-2: Ecodesign for Power Drive Systems, Motor Starters, Power Electronics, and Their Driven Applications — Energy Efficiency In-

Purpose and benefits of the new NEMA standard

NEMA MG 10011:2024, titled “Power Index Calculation Procedure — Standard Rating Methodology for Power Drive Systems and Complete Drive Modules,” provides a methodology for calculating the Power Index for power drive systems and complete drive modules.

The Power Index is a metric used to compare the relative energy savings of motors, both fixed and variable-speed, to a standard baseline motor. For polyphase equipment, the baseline is a premium-efficient direct-on-line motor, equivalent to IE3 efficiency standards. This index represents the weighted-average power consumption relative to a fixed-speed motor, providing a conservative estimate of energy savings.

The standard applies to low-voltage (600 V and less) power drive systems and complete drive modules ranging from 1 to 500 hp. It establishes a rating methodology for power drive systems and complete drive modules; the idea is to ensure consistency and comparability across different products from different manufacturers. The standard also includes the Motor Coalition Metric, which helps in comparing the energy efficiency of different motors.

NEMA MG 10011:2024 offers several benefits. By providing a standardized method for calculating energy savings, it helps manufacturers and users identify more efficient motor systems. The Power Index allows for a rank ordering of products based on their energy efficiency, making the comparison of different systems easier. And the methodology provides conservative estimates of energy savings, ensuring that the reported savings are reliable and achievable.

The standard, published last March 26, is available in both electronic (PDF) and hard-copy formats. For more information, visit the NEMA website at http://bit.ly/3OA2pQF. — Kevin Jones

dicators for Power Drive Systems and Motor Starters. [Brevity is obviously not the IEC’s strong suit. — Editor.]

The NEMA PI metric provides a rank ordering and a conservative estimate of energy savings relative to a single-speed baseline product. In the PI scenario, a lower PI number uses more energy than one with a higher number. This PI measurement will allow comparisons between systems so that the M&V can be eliminated, and we are allowed an easier path to prescriptive rebates.

Variable-torque applications with centrifugal loads, such as fans, pumps, and compressors, offer the most energy savings when used with adjustable-speed drives instead of a fixed-speed motor with a method of throttling the load (valve, damper, etc.). Constant-torque loads may offer not a direct energy saving but one related to productivity improvements that are difficult to benchmark. Thus, the prescriptive incentive programs we are discussing are first being directed to variable-torque applications.

The Dept. of Energy recently conducted an incentive program for PDS installations on variabletorque loads. These incentives provided $25 per horsepower for the motor and $25 per horsepower for the drive. This covered systems that were installed in 2022-2023. Unfortunately, this program was not well publicized, and its details were released in 2023 after many of the qualifying systems had been installed.

Installation classifications

Consider the following classes of installations. The base Class 1 is a direct-on-line (DoL) premium efficient motor as may be already installed. Class 2 is a drop-in replacement of a Super-Premium (IE4) level motor that has a similar mechanical footprint. In some cases, its inrush current may be higher than the original motor, and the starter sizing may need to be upgraded.

In a recent Electrical Apparatus article (“NEMA adds new Design BE and CE motors,” October 2024 EA, page 37), we discussed the new NEMA Design BE that was developed to address motors that had higher locked rotor currents than a NEMA Design B. Design BA locked rotors may be up to 1200% of full-load current compared to 800% on Design B. A study of having correctly sized motor protection is a simple task that the user should be able to accomplish. If he can’t, he should be able to reach out to his electrical contractor for assistance.

— WEG Electric Corp. photo

‘Upstream’ vs, ‘downstream’ rebates

Electric utility rebates for the installation of more efficient motors and drives are generally categorized as either “upstream” or “downstream” rebate programs. Both types of rebate are intended to promote energy efficiency, but they differ in their approach and implementation, coming at the objective from opposite directions.

Upstream rebates are incentives provided directly to manufacturers, distributors, and retailers of energy-efficient equipment. Their purpose is to reduce the initial cost of these products before they reach the end user. By lowering the purchase price, upstream rebates encourage the adoption of energy-efficient technologies at the point of sale. This approach simplifies the process for end users, as user benefit from the reduced cost without the need to apply for rebates themselves.

Several steps go into the implementation of upstream rebates. Utilities partner with manufacturers, distributors, and retailers to offer rebates on qualifying products. The rebate is applied at the point of

When we look at the Class 3 and Class 4 upgrades that offer the most energy savings, a drive must be installed and integrated into the application.

Where the opportunity lies

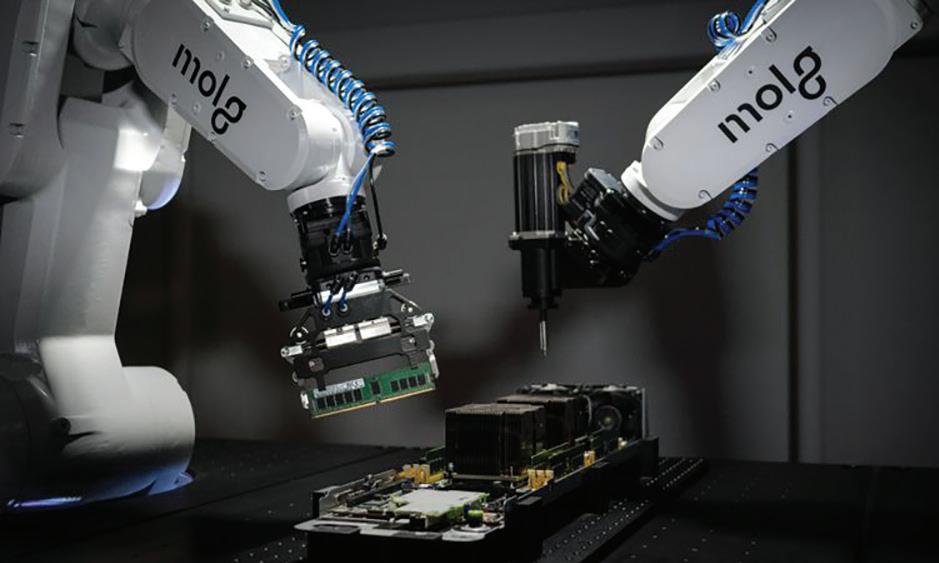

Skills to successfully transition from a fixed-speed motor with mechanical variable speed may be beyond the ability of most users, and this is where the opportunity arises for skilled motor system technicians. Industry will require people trained to do this job. Many applications are repetitive, so the installations do not need the advanced skills of a system integrator. The drive manufacturer can provide training so that the shop or contractor can sell the drive, the motor, and the installation and integration.

sale, reducing the cost for the end consumer. Utilities verify that the products sold meet the efficiency criteria and that the rebates are correctly applied. For the user, the process is simple.

Downstream rebates, by contrast, are incentives provided directly to end users, such as businesses or homeowners, after they purchase and install qualifying energy-efficient equipment. These rebates are typically applied for after the installation is complete, and they require the end user to submit documentation proving the purchase and installation of qualifying products.

There are several steps in the implementation of downstream rebates. First the end user purchases and installs energy-efficient motors and drives. The end user submits a rebate application to the utility; this application includes proof of purchase and installation. Then the utility reviews the applications, verifies the eligibility of the equipment, and — assuming everything is in order — approves the rebate. Once approved, the rebate is issued to the end user, either as a check or as a credit on the end user’s utility bill.

Both upstream and downstream rebates have come to play a significant role in promoting energy efficiency.

Because downstream rebates require that the user gather information about an installation and submit an application, there’s a service — and revenue — opportunity here for contractors and service companies to apply their expertise to the process. — Kevin Jones

With the Class 3 product class using a Premium Efficient motor, the existing motor may be used if it is a Premium Efficient design that is compatible for use with a drive (inverter-capable). Since this is meant to be a variable-torque application, a NEMA Part 31 inverter-only motor is not necessarily required and may be overkill, as these motors are primarily used in constant-torque or constant-horsepower applications.

The drive will be integrated to adjust the motor speed, driving the load to the system needs rather than using a valve or damper to control the flow. In most applications, a pressure or flow transducer to be used as a set point needs to be installed and programmed into the drive. Most of these installations will be the same, so installation technicians won’t need to engineer each new application.

Class 4 products will require installation of the new Super Premium IE4 induction motor along with the drive. Class 4 also includes motors

Please turn to next page

Class 1, NEMA 10011:2024,

(IE2)

NEMA 10011:2024 OR IEC 61800-9-2, IEC 60034-30-2, IEC 60034-2-3 ≥ Inverter-Fed (NEMA Super Premium or IEC 30-2 IE4) or ≥IE4 synchronous motor + PWM VFD (IE2)

above the IE4 level such as any of the synchronous motor systems that manufacturers have introduced. These IE5 motors are the highest-efficiency systems available for sale today and are being sought after by many utility programs. As we discussed with Class 3 above, the drive will adjust motor speed to control the output and use a transducer as a set point for desired performance. Class levels for a proposed voluntary incentive program are listed in the table on the previous page.

Several electric utilities are interested in a Max Tech solution, which means the highest efficiency PDS possible. Today this means some type of synchronous motor design that needs a drive for operation. Lower horsepower ratings may be a motor with an integral drive, but they become separate components. Synchronous motors of these types are available to almost 1000 hp and with the usual mounting configurations as an induction motor. With a higher power density, synchronous motors could be built in a smaller frame size. Both NEMA and IEC designs are available from many manufacturers.

Actual rebate amounts are still under study by the energy advocates and utilities, so we do not know

Several electric utilities are interested in a Max Tech solution, which means the highest efficiency PDS possible. Today this means some type of synchronous motor design that needs a drive for operation.

those amounts at the time of this writing. We anticipate that consideration will be made for the additional costs incurred installing the PDS system on downstream applications. The utility programs either have their own department that administers the rebate program, or they contract with a program administrator.

The future of motor-driven systems lies in using the PDS, so there will be more drives installed on new equipment. Some of this is driven by Dept. of Energy regulations, but companies are becoming more energy-conscious, and the opportunity to save 30% or more on electrical use can’t be ignored.

Opportunities for increased sales, as well as the installation and service of PDS products, could produce significant revenue and job opportunities for contractors and service providers. EA

Assessing the market for efficient drive systems

Between January 2021 and July 2022, the Energy Technologies Area of the Lawrence Berkeley National Laboratory released three volumes of a report titled U.S. Industrial and Commercial Motor System Market Assessment Report, which served as a foundation for NEMA standard MG 10011-2024, which is discussed in the accompanying article.

The report contains numerous facts and insights that can provide a better understanding of how the U.S. market for more efficient drive systems is evolving. This background is helpful in understanding why rebates are being offered to spur industry toward more efficient use of electrical power.

The report points out that reducing the amount of carbon dioxide emitted in the U.S. industrial and commercial sectors has become a priority in domestic energy policy. Reducing energy use through energy efficiency and productivity improvements is seen by many as crucial for achieving a “decarbonized” economy cost-effectively.

In 2019, a quarter of all U.S. CO2 emissions could be traced back to the generation, transmission, and distribution of electricity. The report says that 29% of U.S. electric grid demand in 2018 came from polyphase motors of 1 hp or greater in these sectors. This accounted for 15% of all U.S. energy-related CO2 emissions, 27% of industrial sector emissions, and 42% of commercial sector emissions.

Even with a fully renewable electric grid, improving energy efficiency in motor systems would significantly reduce the required renewable energy generation capacity, lowering decarbonization costs, according to the report’s authors. One study they cite estimates that achieving a 95% renewable electric grid in the U.S. by 2050 would cost about $3 trillion, with costs rising nonlinearly to reach 100% renewable generation.

A significant barrier to attaining these objectives has been a lack of sufficient data. Prior to this report, there was no comprehensive information on the current state of motor-driven systems in the U.S. This dearth of data limited the ability to analyze potential energy savings, develop technologies to address energy and productivity gaps, and create programs to promote energy efficiency.

Often overlooked in this process is the role played by motor systems. Since electric motors are already electrically driven, it’s commonly

thought — erroneously — that decarbonizing motor system energy use will follow the decarbonization of the electric grid without further intervention.

This belief, however, overlooks the role motor systems could play in “decarbonizing” the economy. Given the magnitude of grid electricity used for motor systems, increasing the energy efficiency and power management of existing motor systems could substantially reduce the costs associated with expanding the capacity of renewable electricity generation, according to the report.

It’s generally agreed that from a facility’s perspective, energy savings through efficiency improvements also reduce operating costs. According to this report, U.S. industrial and commercial motor systems use 1,078 TWh of electricity annually, costing $116 billion per year. A 5% reduction in electricity use could save nearly $6 billion annually for business owners. While there’s room for improvement in motor efficiency, greater energy savings can be achieved by considering the broader system, including the electric drive, motor, power transmission, driven equipment, and fluid distribution system.

Supply chains for the raw materials used in motor manufacturing are another wild card. Not to be overlooked are the increasing demand and supply risks for permanent magnets, weak relationships between motor manufacturers and steel suppliers for electrical steel, and challenges in the supply chain for wide-bandgap semiconductors used in variablefrequency drives.

Yet another factor influencing the demand for more efficient drive systems is the shifting federal attitude toward the reduction of carbon dioxide emissions. Whether or not the incoming presidential administration will fully back efficiency rebate initiatives is an open question. — Kevin Jones

Index of Articles: 2020-2024

Back issues, or photocopies of articles when back issues are out of stock, are available from:

Circulation Department

Barks Publications, Inc.,

17 N. State St., Suite 435, Chicago, Ill. 60602-3570

(312) 321-9440

Fax (866) 228-7274

www.barks.com

See page 4 for prices

Automation

Welcome, our new robot coworkers. Selena Cotte. January 2020, p. 46. Becoming a cyborg. Selena Cotte. September 2020, p. 10.

Thinking small. Susan Follett. December 2021, p. 30.

Robots and renewable energy. Charlie Barks. January 2022, p. 8.

A quicker path from virtual to actual. Susan Follett. January 2022, p. 20. Robots in the shop. Charlie Barks. January 2022, p. 24.

Not your standard-issue robot. Selena Cotte. January 2022, p. 29. Fasten your robotic exoskeleton and get to work. Selena Cotte. January 2022, p. 32.

Robot workers for rent. Leah Zitter. May 2022, p. 10.

How 3D printing transforms manufacturing. Anna Claire Howard. June 2022, p. 24.

Tomorrow comes today at Hannover Messe. Charlie Barks. July 2022, p. 18.

Detroit welcomes Automate show. Selena Cotte. July 2022, p. 30. “Dark” manufacturing plants. Anna Claire Howard. August 2022, p. 52. The International Manufacturing Technology Show. Kevin Jones. October 2022, p. 16. Learning the AI ropes. Charlie Barks. December 2022, p. 12. What’s new in electromechanical and automation control technology. David Miller. December 2022, p. 25. University degrees in “human-robot collaboration.” Charlie Barks. January 2023, p. 16.

SME certi cation in manufacturing robotics. The Electrical Apparatus sta . January 2023, p. 20.

All Control of Elgin, Ill., meshes automation and service. Charlie Barks. January 2023, p. 21.

The 2023 Cleanpower and Automate trade shows. Charlie Barks. July 2023, p. 20.

Automation and robotics in training. Charlie Barks. September 2023, p. 37. Fabulous-tech. Kevin Jones. November 2023, p. 14.

Truths and myths about AI. Bill O’Leary. November 2023, p. 24. Robots in critical medical procedures.

Kristine Weller. January 2024, p. 24.

The emerging role of robotic process automation. Maura Keller. January 2024, p. 25.

A fresh look at IoT. Bill O’Leary. February 2024, p. 24.

At the pinnacle of service with Apex Industrial Automation of Romeoville, Ill.

Charlie Barks. June 2024, p. 41.

Automate 2024: Guard your Job. Charlie Barks. July 2024, p. 32.

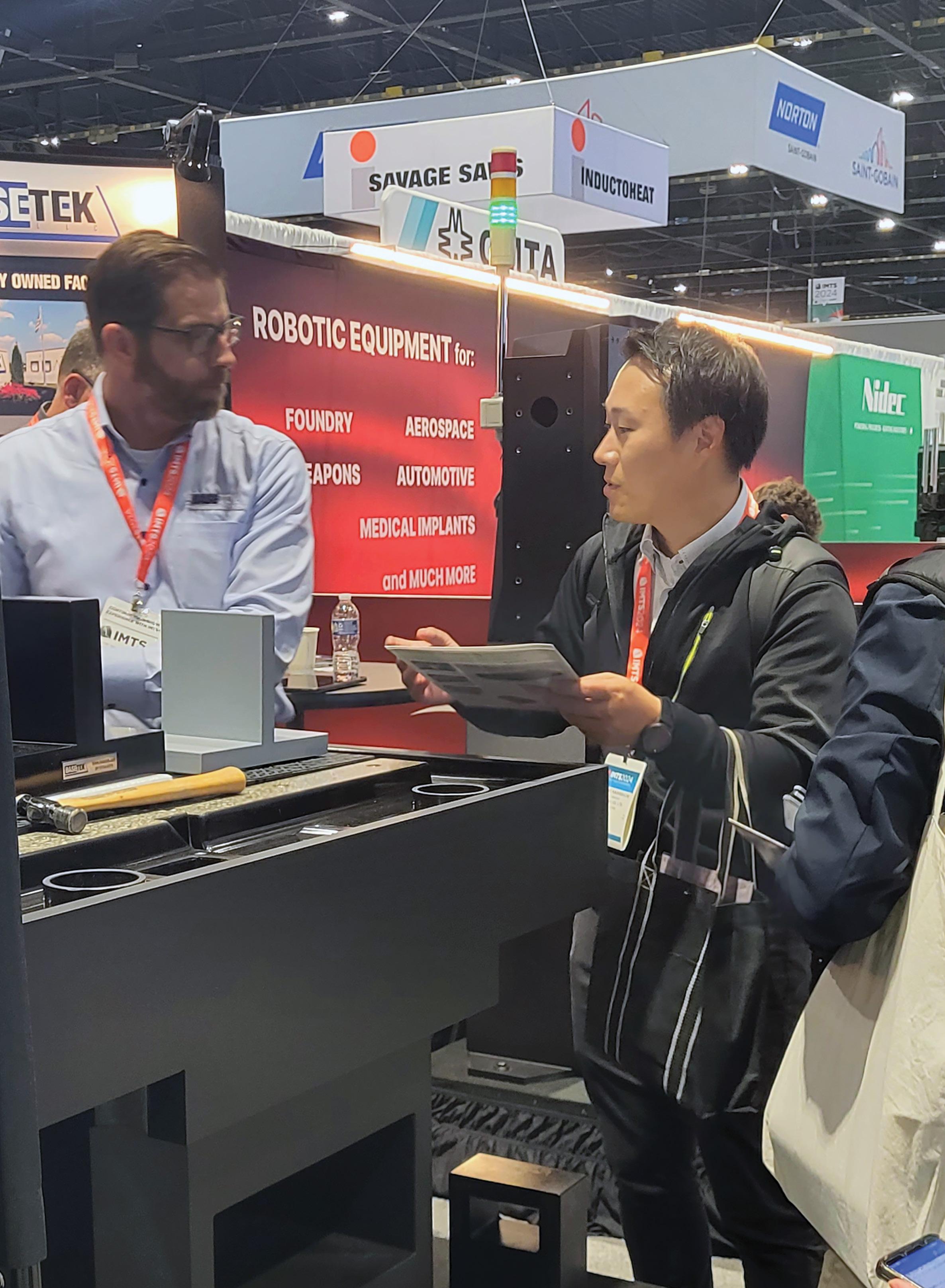

Automation to be everywhere at the International Manufacturing Technology Show. Kevin Jones. September 2024, p. 30.

Installing new digital machines. Bill O’Leary. October 2024, page 20.

Batteries

Utility batteries not driven by price alone. David Miller. May 2020, p. 44.

EV batteries power up. Charlie Barks. July 2020, p. 14.

Tesla’s Battery Day proves to be a mixed bag. David Miller. December 2020, p. 10.

Batteries cheaper than ever; wind power prevalent abroad. Charlie Barks. February 2021, p. 39.

Another boost for utility-scale batteries. Kevin Jones. April 2021, p. 32.

“These batteries are making me nervous.” Susan Follett. July 2021, p. 12.

Recharge at the Battery Show in September. Susan Follett. July 2021, p. 24.

Nurturing innovation globally. Charlie Barks. September 2021, p. 9.

More money, more problems. Charlie Barks. November 2021, p. 12.

More than just lithium. Carol Brzozowski. February 2022, p. 18.

A new dawn for battery production in the U.S. Carol Brzozowski. March 2022, p. 20.

Electric battery recycling. Carol Brzozowski. April 2022, p. 16.

Battery Show preview. Charlie Barks. September 2022, p. 24.

The best in batteries. Kevin Jones. November 2022, p. 16.

The risks of lithium-ion batteries. Carol Brzozowski. November 2022, p. 22.

Countering the risk of lithium-ion batteries. Carol Brzozowski. January 2023, p. 36.

Battery Show preview. Charlie Barks. September 2023, p. 18.

Battery Show 2023. Charlie Barks. November 2023, p. 19.

EV battery replacements & warranties. Maura Keller. January 2024, p. 20.

The Battery Show moves to downtown Detroit as EVs gain traction. Charlie Barks. September 2024, p. 29.

Revving up for the Battery Show. Charlie Barks. October 2024, page 30.

The twists & turns of EV and AV technology. Maura Keller. November 2024, p. 18.

Battery Show report. Chelsea Fisher and Charlie Barks. December 2024, p. 17.

The dynamics of EV eet charging and storing. Maura Keller. December 2024, p. 26.

Sodium-ion batteries making waves with new developments. Charlie Barks. December 2024, p. 48.

Business Management

When employees become owners. Selena Cotte. January 2020, p. 14.

Field customer service for manufacturers. Selena Cotte. February 2020, p. 20.

The show must go on. Selena Cotte. April 2020, p. 38.

Executive incentives today. William

Wiersema. June 2020, p. 47.

Product, product everywhere. Selena Cotte. August 2020, p. 42.

The value of giving back. Selena Cotte. November 2020, p. 13.

Remote management for plants. Selena Cotte. November 2020, p. 40.

Ransomware and other threats against manufacturing. Selena Cotte. December 2020, p. 10.

Are your virtual meetings secure? Selena Cotte. December 2020, p. 38.

Smarter construction with Robots. Selena Cotte. January 2021, p. 8.

Hiring through a pandemic. Selena Cotte. January 2021, p.19.

Success in the year of Covid-19. William Wiersema. January 2021, p. 35.

On-the-job monitoring: are there no limits? Elizabeth Van Ness. January 2021, p. 41.

The bene ts and costs of the new stimulus. William Wiersema. February 2021, p. 31.

The IoT transition gets a boost. Charlie Barks. February 2021, p. 35.

“This will only hurt a little bit. . . .” Susan Follett. June 2021, p. 26.

People come rst at the family business. Susan Follett. August 2021, p. 14.

Labor compliance in a remote world. William Wiersema. January 2022, p. 45.

A third option for those on the “shorefront” fence. Charlie Barks. August 2021, p. 34.

HELP WANTED. Susan Follett & Selena Cotte. August 2021, p. 35.

The new business normal. William Wiersema. August 2021, p. 45.

Unraveling digital threads. Susan Follett. September 2021, p. 22.

Insights into private equity. William Wiersema. September 2021, p. 42.

Nurturing the development of facility managers. Charlie Barks. October 2021, p. 13.

The myriad opportunities of crypto. Susan Follett. October 2021, p. 14. Global service disruptions. Kevin Jones. October 2021, p. 25.

Why nancial reporting rules matter. William Wiersema. October 2021, p. 34.

Pre-to-what? Susan Follett. November 2021, p. 16.

Help needed. Selena Cotte. December 2021, p. 8.

There’s never a bad time for a party. Selena Cotte. December 2021, p. 18

A better way to modernize equipment. William Wiersema. December 2021, p. 43.

Robots in the shop. Charlie Barks. January 2022, p. 24.

This company wants to update your facility. Selena Cotte. February 2022, p. 8.

Steps to a bonus plan. William Wiersema. February 2022, p. 38.

Can relocating save taxes? William Wiersema. March 2022, p. 40.

A better way to sell “S” corporations. William Wiersema. April 2022, p. 39.

Virtual training is here to stay. Emily Halnon. June 2022, p. 19.

Financial planning for a business exit. William Wiersema. June 2022, p. 50. Unlikely manufacturing partnerships. Anna Claire Howard. July 2022, p. 52.

Accounting for business growth. William Wiersema. August 2022, p. 47. A path to rehabilitation. Emily Halnon. August 2022, p. 50.

Cybersecurity: more important now than ever. Anna Claire Howard. September 2022, p. 33.

Inventory in disruptive times. William Wiersema. September 2022, p. 41. Do your company’s earnings show quality? William Wiersema. October 2022, p. 44.

The post-Covid workforce. The Electrical Apparatus sta . November 2022, p. 27.

Flat-rate pay for technicians. William Wiersema. November 2022, p. 37. In search of sustainable talent. Charlie Barks. November 2022, p. 40.

New accounting rules for leasing. William Wiersema. December 2022, p. 34.

Machine shops come in all shapes and sizes. Charlie Barks. January 2023, p. 25.

New rules covering bad debts. William Wiersema. February 2023, p. 33.

Exercise caution when buying or selling a business. William Wiersema. March 2023, p. 35.

Does more inventory lead to higher prices? William Wiersema. April 2023, p. 35.

Mergers and acquisitions in the pump sector. Kevin Jones. April 2023, p. 40.

A business planning agenda. William Wiersema. May 2023, p. 43.

The new nancial fraud. William Wiersema. June 2023, p. 48.

Bringing electric vehicles into the workforce. William Wiersema. July 2023, p. 36.

Taking control through accounting. William Wiersema. September 2023, p. 35.

Innovation on the factory oor. The Electrical Apparatus sta . September 2023, p. 42.

Getting started with cost accounting. William Wiersema. November 2023, p. 32.

Get smart about setting goals. Bill O’Leary. December 2023, p. 22.

New products, from concept to customer. Bill O’Leary. December 2023, p. 29.

China’s economic standing post-pandemic. William Wiersema. December 2023, p. 36.

Training Gen Z. Chelsea Fisher. December 2023, p. 44.

Operational metrics. Bill O’Leary. January 2024, p. 22.

New federal reporting requirements for business owners. William Wiersema. January 2024, p. 43.

Saving taxes at business sale. William Wiersema. February 2024, p. 37.

The ve types of plant maintenance. Bill O’Leary. March 2024, p. 20.

Creating a new hybrid workplace. William Wiersema. March 2024, p. 37.

The mid-year employee review. Bill O’Leary. April 2024, p. 10.

Post-closing M&A nancial disputes. William Wiersema. April 2024, p. 37.

Embracing rotational training. Maura Please turn to next page

INDEX continued Keller. April 2024, p. 43.

Management’s quest for the best. William Wiersema. May 2024, page 44.

The elements of lifecycle. Bill O’Leary. May 2024, page 46.

The manager as coach. Bill O’Leary. June 2024, p. 62.

The EV’s place in the plant. Bill O’Leary. July 2024, p. 16.

Electric trucks for commercial eets. William Wiersema. July 2024, p. 38. Improving customer and employee relations with contests. Bill O’Leary. August 2024, p. 14.

Using the working load limit to reduce workplace injuries. Bill O’Leary. August 2024, p. 18.

Upgrade your project accounting. William Wiersema. August 2024, p. 48. Securing funding for innovation. William Wiersema. September 2024, p. 41.

Preparing for health crises. Bill O’Leary. October 2024, page 22. Will the deal work? William Wiersema. October 2024, page 41.

Better employee retention. Bill O’Leary. November 2024, p. 12.

What’s new in payroll compliance. William Wiersema. November 2024, p. 36.

Building a competitively sustainable service shop. Michael Mitten. December 2024, p. 12.

Year-end product purchasing. Bill O’Leary. December 2024, p. 29. Financial payback for new equipment. William Wiersema. December 2024, p. 41.

Codes & Standards

How well do we understand ambient? Richard Nailen. June 2020, p. 41. What’s become of IEEE 1415? Richard Nailen. July 2020, p. 19.

Harmonization: still a ways to go. Richard Nailen. October 2020, p. 19. Beyond Motor E ciency. John Malinowski. March 2021, p. 14. The subjective language of standards. Richard Nailen. March 2021, p. 31. IEEE 841: designed and built for severe duty. John Malinowski. May 2022, p. 48.

The hands-on approach of TÜV North America. Charlie Barks. May 2022, p. 54.

Taking a blue pencil to IEEE documents. Richard Nailen. June 2022, p. 22. When “standard” motor features are anything but. Richard Nailen. July 2022, p. 39. No standard covering “standard.” Richard Nailen. August 2022, p. 22. A matter of motor size. Richard Nailen. August 2022, p. 41.

Navigating the standards maze. Richard Nailen. September 2022, p. 35. New rule on the e ciency of circulator pumps. Kevin Jones. November 2022, p. 24.

Updated DOE regulations cover more small motors. John Malinowski. March 2023, p. 31.

Cite your sources! Richard Nailen. April 2023, p. 24. Why get involved with standards? John Malinowski. December 2023, p. 33. Hydraulic Institute pump ratings adopted by federal and California agencies. Kevin Jones. February 2024, p. 18. HVACR motor testing standards. John Malinowski. March 2024, p. 33. The road to improved motor e ciency. John Malinowski. April 2024, p. 33. What s new in ANSI/NEMA MG 1. John Malinowski. July 2024, p. 33. NEMA adds new Design BE and CE mo-

tors. John Malinowski. October 2024, page 37.

Conventions & Trade Shows

What’s cool in HVACR. The Electrical Apparatus sta . January 2020, p. 18.

EV batteries power up. Charlie Barks. July 2020, p. 14.

“See you at the Zoom meeting.” The Electrical Apparatus sta . August 2020, p. 18.

Back in the saddle. Kevin Jones. May 2021, p. 24.

Welcome to Fort Worth. Susan Follett. May 2021, p. 26.

Together again: revisiting in-person trade shows. Charlie Barks. May 2021, p. 56.

Show stoppers. The Electrical Apparatus sta . June 2021, p. 30.

EASA Convention exhibitors. The Electrical Apparatus sta . June 2021, p. 52.

EASA’s over . . . Now what? The Electrical Apparatus sta . July 2021, p. 22. The business and technology of water. Charlie Barks. August 2021, p. 18.

Together again. Selena Cotte, Richard Nailen, and Kevin Jones. August 2021, p. 20.

Fabulous fabricators. Kevin Jones. August 2021, p. 26.

More money, more problems. Charlie Barks. November 2021, p. 12.

Weftec 2021: Dampened moods. Charlie Barks and Selena Cotte. December 2021, p. 49.

The newest — and safest — in HVACR. Susan Follett. January 2022, p. 16.

Setting the stage for CWIEME Berlin. Kevin Jones. February 2022, p. 24.

The 2022 AHR Expo. Selena Cotte. March 2022, p. 27.

EASA Convention a Midwestern homecoming. Kevin Jones. May 2022, p. 16.

EASA to meet in a revitalized St. Louis. Charlie Barks. May 2022, p. 20.

EASA Convention preview: The latest in apparatus service and repair. The Electrical Apparatus sta . June 2022, p. 28.

Tomorrow comes today at Hannover Messe. Charlie Barks. July 2022, p. 18.

Detroit welcomes Automate show. Selena Cotte. July 2022, p. 30.

Weftec show preview. Charlie Barks. August 2022, p. 18.

EASA 2022 Convention report. Kevin Jones and Charlie Barks. August 2022, p. 23.

The 2022 EASA Convention in photos. Kevin Jones and Charlie Barks. August 2022, p. 32.

Manufacturing show returns to the Windy City. Kevin Jones. September 2022, p. 20.

Battery Show preview. Charlie Barks. September 2022, p. 24.

The International Manufacturing Technology Show. Kevin Jones. October 2022, p. 16.

The best in batteries. Kevin Jones. November 2022, p. 16.

Weftec 2022 report. Kevin Jones. November 2022, p. 20.

Report from Pack Expo 2022. Charlie Barks. December 2022, p. 14.

Buyers and sellers to meet at CWIEME Berlin. Kevin Jones. February 2023, p. 22.

The AHR Expo and the HVACR industry today. Charlie Barks. March 2023, p. 27.

EASA Convention preview. Kevin Jones. May 2023, p. 20.

EASA Convention venue. Charlie Barks.

May 2023, p. 28.

EASA Convention exhibitor preview. The Electrical Apparatus sta . June 2023, p. 28.

The 2023 Cleanpower and Automate trade shows. Charlie Barks. July 2023, p. 20.

Together in National Harbor: EASA Convention report. Charlie Barks. August 2023, p. 20.

The EASA Convention in photos. The Electrical Apparatus sta . August 2023, p. 28.

Highlights from the EASA Convention technical sessions. Kevin Jones. August 2023, p. 35.

Battery Show preview. Charlie Barks. September 2023, p. 18.

Fabulous-tech. Kevin Jones. November 2023, p. 14.

Battery Show 2023. Charlie Barks. November 2023, p. 19.

Photos from Weftec 2023. The Electrical Apparatus sta . December 2023, p. 24.

Welcome to AHR Expo 2024. Charlie Barks. March 2024, p. 22.

The AHR Expo in photos. Charlie Barks. March 2024, p. 24.

How Sabine Lehmann reached the pinnacle of trade expo management. Colin Gregory-Moores. May 2024, page 16.

Las Vegas for the EASA conventioneer. Charlie Barks. May 2024, page 26.

On display at the 2024 EASA Solutions Expo in Las Vegas. The LightItalic>Electrical Apparatus sta . June 2024, p. 28.

Scenes from the 2024 CWIEME coil winding expo in Berlin. Charlie Barks. July 2024, p. 20.

Manufacturing summit at Hannover Messe 2024. Charlie Barks. July 2024, p. 22.

EASA Convention reveals an industry in ux. Charlie Barks and Kevin Jones. August 2024, p. 22.

The Battery Show moves to downtown Detroit as EVs gain traction. Charlie Barks. September 2024, p. 29.

Automation to be everywhere at the International Manufacturing Technology Show. Kevin Jones. September 2024, p. 30.

Revving up for the Battery Show. Charlie Barks. October 2024, page 30.

IMTS 2024: International Manufacturing Technology Show report. Charlie Barks and Kevin Jones. November 2024, p. 20.

Battery Show report. Chelsea Fisher and Charlie Barks. December 2024, p. 17.

Fabtech report. Kevin Jones. December 2024, p. 20.

Sodium-ion batteries making waves with new developments. Charlie Barks. December 2024, p. 48.

Electric Vehicles

Code check: ICC projects an EV- lled future. Charlie Barks. March 2020, p. 37.

The future of EV charging. Selena Cotte. July 2020, p. 16.

Electric vehicle roundup. The Electric Apparatus sta . July 2020, p. 23.

Electri cation of buses hits a speed bump. Kevin Jones. July 2020, p. 24.

“Not for the faint of heart.” Selena Cotte. July 2020, p. 26.

Amidst pandemic, governments play outsized role in EV prospects. David Miller. October 2020, p. 16.

The trans-Paci c EV competition is heating up. Kevin Jones. January 2021, p. 39.

Right to repair: e-mobility edition. Char-

lie Barks. April 2021, p. 48.

“These batteries are making me nervous.” Susan Follett. July 2021, p. 12.

Advocates for the development of EV infrastructure. Charlie Barks. July 2021, p. 26.

The present and future of EV charging station maintenance and repair. Matt Cousineau. July 2021, p. 33.

A patchwork of energy rebates for EV owners. Kevin Jones. July 2021, p. 48.

Mineral de ciency? Charlie Barks. July 2021, p. 52.

“Electromodding.” Charlie Barks. October 2021, p. 42.

“Gentlemen, choose your engines.” Kevin Jones. January 2022, p. 22.

More than just lithium. Carol Brzozowski. February 2022, p. 18.

A new dawn for battery production in the U.S. Carol Brzozowski. March 2022, p. 20.

All aboard the green bus! Emily Halnon. April 2022, p. 10.

Electric battery recycling. Carol Brzozowski. April 2022, p. 16.

EV tech continues to innovate. Carol Brzozowski. May 2022, p. 32.

The promise of marine electri cation. Carol Brzozowski. June 2022, p. 66.

Portugal leading the charge on EVs. Charlie Barks. July 2022, p. 16.

EV charging unit maintenance repair. Carol Brzozowski. July 2022, p. 28.

Take me home, (electri ed) country roads. Kevin Jones. July 2022, p. 35.

Preparing the workforce for work on electric vehicles. Emily Halnon. July 2022, p. 45.

Electri ed aircraft. Carol Brzozowski. August 2022, p. 34.

Battery Show preview. Charlie Barks. September 2022, p. 24.

The electric-grade steel shortage. Carol Brzozowski. September 2022, p. 42.

EV charging access. Carol Brzozowski. October 2022, p. 20.

The best in batteries. Kevin Jones. November 2022, p. 16.

The risks of lithium-ion batteries. Carol Brzozowski. November 2022, p. 22.

New models of electric vehicles. Charlie Barks. December 2022, p. 20.

Countering the risk of lithium-ion batteries. Carol Brzozowski. January 2023, p. 36.

These EVs do the heavy lifting. Carol Brzozowski. February 2023, p. 36.

From diesel to electri ed rail. Carol Brzozowski. March 2023, p. 15.

Electri ed construction equipment. Carol Brzozowski. April 2023, p. 19.

Speed bumps in the EV road. Carol Brzozowski. May 2023, p. 31.

Learning by doing with Switch Lab. Carol Brzozowski. June 2023, p. 22.

EVs and the grid. Charlie Barks. July 2023, p. 14.

Training the EV techs of the future. Carol

Adjustable-speed drives and power quality

Brzozowski. July 2023, p. 22. West Virginia high schoolers build an EV charging system. Charlie Barks. July 2023, p. 27.

The promising world of EV service. Carol Brzozowski. July 2023 EA, p. 28. Bringing electric vehicles into the workforce. William Wiersema. July 2023, p. 36.

Large-scale EV charging projects. Carol Brzozowski. August 2023, p. 16. Battery Show preview. Charlie Barks. September 2023, p. 18. New solar EVs on the horizon. Carol Brzozowski. September 2023, p. 21. Battery Show 2023. Charlie Barks. November 2023, p. 19.

Connecting with customers with EV charging stations. Maura Keller. November 2023, p. 34.

Where in the U.S. electric vehicle manufacturing is concentrated. Maura Keller. December 2023, p. 26. EV battery replacements & warranties. Maura Keller. January 2024, p. 20. Adding noise to electric vehicles as a safety measure. Maura Keller. February 2024, p. 42.

The state of EV charging infrastructure. Maura Keller. March 2024, p. 40. Alternative fuel sources for EVs. Maura Keller. April 2024, p. 18.

Inductive charging and the adoption of EVs. Maura Keller. May 2024, page 51.

Improving EV accessibility. Maura Keller. June 2024, p. 25. The EV’s place in the plant. Bill O’Leary. July 2024, p. 16.

Obtaining raw materials for EVs. Charlie Barks. July 2024, p. 27. Electric trucks for commercial eets. William Wiersema. July 2024, p. 38. We drive, drive, drive on the autobahn. Colin Gregory-Moores. July 2024, p. 42.

The pumped-up EV pump market. Kevin Jones. July 2024, p. 44.

Design and implementation challenges of larger electric vehicles. Maura Keller. August 2024, p. 52.

The Battery Show moves to downtown Detroit as EVs gain traction. Charlie Barks. September 2024, p. 29. Innovations in electric vehicles. Maura Keller. September 2024, p. 46. EV initiatives on a global scale. Maura Keller. October 2024, page 27. The twists & turns of EV and AV technology. Maura Keller. November 2024, p. 18.

Battery Show report. Chelsea Fisher and Charlie Barks. December 2024, p. 17. The dynamics of EV eet charging and storing. Maura Keller. December 2024, p. 26.

Sodium-ion batteries making waves with new developments. Charlie Barks. December 2024, p. 48.

Energy

Decentralized generation with geothermal HVACR. David Miller. March 2020, p. 18.

The many sources of clean energy. Selena Cotte. August 2020, p. 10. Hydrogen pipe dreams. David Miller. August 2020, p. 13.

Batteries cheaper than ever; wind power prevalent abroad. Charlie Barks. February 2021, p. 39.

Solar-powered transportation. Selena Cotte. April 2021, p. 29. Oil & gas — not down for the count. Selena Cotte. April 2021, p. 34.

Block chain renewables projects becoming a reality. Charlie Barks. June 2021, p. 63.

Putting the blue in green. Charlie Barks. June 2021, p. 66.

Big Oil’s terrible, horrible, no good, very bad day. Charlie Barks. July 2021, p. 26.

Carbon measurement: How do we know what’s what? Charlie Barks. August 2021, p. 58.

Climate report contains unprecedented urgency. Charlie Barks. September 2021, p. 26.

The element in the room. Charlie Barks. September 2021, p. 29.

Blockchain technology in the energy sector. Charlie Barks. November 2021, p. 21.

Equipping the planet. Charlie Barks. December 2021, p. 16.

Energy rating labels expanded to cover circulator pumps. Kevin Jones. December 2021, p. 45.

Robots and renewable energy. Charlie Barks. January 2022, p. 8.

Energy, rede ned. Charlie Barks. February 2022, p. 20.

A new dawn for battery production in the U.S. Carol Brzozowski. March 2022, p. 20.

Beating the (oil) drums of war. Charlie Barks. March 2022, p. 38.

All aboard the green bus! Emily Halnon. April 2022, p. 10.

Renewable energy called up from the minor leagues. Charlie Barks. April 2022, p. 22.

Toward a more perfect grid. Selena Cotte. April 2022, p. 29.

Niagara rises. Charlie Barks. April 2022, p. 40.

An “energy transition for all.” Charlie Barks. May 2022, p. 34.

Old vs. new equipment repair. Charlie Barks. June 2022, p. 36.

Environmental e orts during a drought. Charlie Barks. August 2022, p. 48.

It’s a coal world after all. Charlie Barks. September 2022, p. 14.

Are we in a “global energy crisis”? Charlie Barks. October 2022, p. 25.

Updates on nuclear energy hotspots around the world. Anna Claire Howard. October 2022, p. 49.

In search of sustainable talent. Charlie Barks. November 2022, p. 40.

Recycled plastic a failed experiment?

Charlie Barks. December 2022, p. 10.

Pieces of the energy pie. Charlie Barks. January 2023, p. 14.

Fusion breakthrough. Charlie Barks. February 2023, page 20.

From diesel to electri ed rail. Carol Brzozowski. March 2023, p. 15.

The top 10 states for sustainable buildings. Charlie Barks. March 2023, p. 22.

Training for jobs in the oil and gas sector. Charlie Barks. April 2023, p. 16.

Traditional versus alternative energy. Charlie Barks. April 2023, p. 22.

Coal- red power plants, a vanishing breed. Chase Fell. April 2023, p. 31.

Battle for the climate. Charlie Barks. May 2023, p. 16.

A Master’s degree in Applied Energy and Electromechanical Engineering. Charlie Barks. June 2023, p. 50.

EVs and the grid. Charlie Barks. July 2023, p. 14.

The 2023 Cleanpower and Automate trade shows. Charlie Barks. July 2023, p. 20.

A roundup of energy news from the U.S. Charlie Barks. August 2023, p. 46.

New solar EVs on the horizon. Carol Brzozowski. September 2023, p. 21. Innovation in agrivoltaics. Charlie Barks. September 2023, p. 33.

A new wind-powered transmission project in the southwestern U.S. Charlie Barks. November 2023, p. 38.

Three new interregional U.S. transmission lines. Charlie Barks. December 2023, p. 20.

Virgin Atlantic uses waste as fuel. Charlie Barks. January 2024, p. 45. Are heat recovery and thermal transfer becoming practical? Charlie Barks. March 2024, p. 35.

Oil and gas companies seek to in uence carbon-capture projects. Charlie Barks. March 2024, p. 47.

Alternative fuel sources for EVs. Maura Keller. April 2024, p. 18.

Storms on the horizon for the wind industry. Bill O’Leary. April 2024, p. 27.

An “eye in the sky” to call out polluters. Charlie Barks. April 2024, p. 42.

U.S. Dept. of Energy pledges $6 billion towards decarbonization. Charlie Barks. May 2024, page 38.

Inductive charging and the adoption of EVs. Maura Keller. May 2024, page 51.

The place of pumps in the hydrogen economy. Kevin Jones. May 2024, page 54.

Updates on the U.S. energy workforce. Charlie Barks. June 2024, p. 57.

Norwegian solar energy company NorSun inks an Oklahoma deal. Charlie Barks. August 2024, p. 34.

The latest research on the energy use of electric motors. Charlie Barks. September 2024, p. 28.

U.S. Dept. of Energy’s new projects for training centers. Charlie Barks. October 2024, page 47.

Global nuclear news. Charlie Barks. October 2024, page 50.

Copper’s critical role in the “energy transition.” Charlie Barks. November 2024, p. 42.

Facility Management

Time for a motor survey. John Malinowski. April 2021, p. 14.

This company wants to update your facility. Selena Cotte. February 2022, p. 8.

Updating your plant’s HVACR. Selena Cotte. March 2022, p. 26.

“Dark” manufacturing plants. Anna Claire Howard. August 2022, p. 52.

Cybersecurity: more important now than ever. Anna Claire Howard. September 2022, p. 33.

Remote condition monitoring: more than just hardware and software. Kevin Jones. March 2023, p. 18.

Distributed pumping in HVACR systems. Kevin Jones. March 2023, p. 40.

Maintaining antique motors at a Memphis pumping station. Chase Fell. November 2023, p. 27.

A fresh look at IoT. Bill O’Leary. February 2024, p. 24.

The ve types of plant maintenance. Bill O’Leary. March 2024, p. 20.

Codifying guidelines for verifying the health of buildings. Kristine Weller. May 2024, page 22.

The EV’s place in the plant. Bill O’Leary. July 2024, p. 16.

Please turn to next page

Guarding against overheating in the plant. Bill O’Leary. September 2024, p. 20.

Installing new digital machines. Bill O’Leary. October 2024, page 20. Preparing for health crises. Bill O’Leary. October 2024, page 22.

Finance

Repair or replace? William Wiersema. January 2020, p. 38.

Executive incentives today. William Wiersema. June 2020, p. 47.

Rethinking retirement. William Wiersema. July 2020, p. 33.

The new uncertainty about “revenue” William Wiersema. October 2020, p. 37.

Buying or selling a business post-Covid. William Wiersema. November 2020, p. 35.

Financial reporting in a pandemic. William Wiersema. December 2020, p. 35.

Success in the Year of Covid-19. William Wiersema. January 2021, p. 35. New performance metrics. William Wiersema. April 2021, p. 48.

Financial protections in the pandemic. William Wiersema. May 2021, p. 45.

Better inventory accounting. William Wiersema. June 2021, p. 48.

Benchmarks for success. William Wiersema. July 2021, p. 44.

The new business normal. William Wiersema. August 2021, p. 45.

Insights into private equity. William Wiersema. September 2021, p. 42.

Why nancial reporting rules matter. William Wiersema. October 2021, p. 34.

Better nancial ratios for managers. William Wiersema. November 2021, p.37.

A better way to modernize equipment. William Wiersema. December 2021, p. 43.

Labor compliance in a remote world. William Wiersema. January 2022, p. 45.

Steps to a bonus plan. William Wiersema, February 2022, p. 38. Can relocating save taxes? William Wiersema, March 2022, p. 40.

A better way to sell “S” corporations. William Wiersema. April 2022, p. 39. The economy post-Covid. William Wiersema. May 2022, p. 50. Financial planning for a business exit. William Wiersema. June 2022, p. 50. Finding business funding. William Wiersema. July 2022, p. 26.

Accounting for business growth. William Wiersema. August 2022, p. 47.

Inventory in disruptive times. William Wiersema. September 2022, p. 41. Do your company’s earnings show qual-

ity? William Wiersema. October 2022, p. 44.

New accounting rules for leasing. William Wiersema. December 2022, p. 34.

Predictive maintenance: more essential than ever. William Wiersema. January 2023, p. 33.

New rules covering bad debts. William Wiersema. February 2023, p. 33.

Exercise caution when buying or selling a business. William Wiersema. March 2023, p. 35.

Does more inventory lead to higher prices? William Wiersema. April 2023, p. 35.

A business planning agenda. William Wiersema. May 2023, p. 43.

The new nancial fraud. William Wiersema. June 2023, p. 48.

Bringing electric vehicles into the workforce. William Wiersema. July 2023, p. 36.

Selling to private equity. William Wiersema. August 2023, p. 41.

Taking control through accounting. William Wiersema. September 2023, p. 35.

Getting started with cost accounting. William Wiersema. November 2023, p. 32.

New federal reporting requirements for business owners. William Wiersema. January 2024, p. 43.

Saving taxes at business sale. William Wiersema. February 2024, p. 37.

Creating a new hybrid workplace. William Wiersema. March 2024, p. 37.

Post-closing M&A nancial disputes. William Wiersema. April 2024, p. 37.

Management’s quest for the best. William Wiersema. May 2024, page 44.

Mergers & acquisitions on a roll. William Wiersema. June 2024, p. 55.

Electric trucks for commercial eets.

William Wiersema. July 2024, p. 38.

Upgrade your project accounting. William Wiersema. August 2024, p. 48.

Securing funding for innovation. William Wiersema. September 2024, p. 41.

Will the deal work? William Wiersema. October 2024, page 41.

What’s new in payroll compliance. William Wiersema. November 2024, p. 36.

Year-end product purchasing. Bill O’Leary. December 2024, p. 29. Financial payback for new equipment. William Wiersema. December 2024, p. 41.

HVACR

What’s cool in HVACR. The Electrical Apparatus sta . January 2020, p. 18.

What’s smart in HVACR? Selena Cotte. March 2020, p. 12.

How to get a start in the HVACR trade. Kevin Jones. March 2020, p. 13.

Updating your plant’s HVACR. Selena Cotte. March 2022, p. 26.

The 2022 AHR Expo. Selena Cotte. March 2022, p. 27.

The AHR Expo and the HVACR industry today. Charlie Barks. March 2023, p. 27.

Welcome to AHR Expo 2024. Charlie Barks. March 2024, p. 22.

Flolo Corp.’s HVACR division. Kevin Jones. March 2024, p. 27.

HVACR motor testing standards. John Malinowski. March 2024, p. 33.

The updated Seasonal Energy E ciency

Rating for heat pumps. Bill O’Leary. March 2024, p. 44.

Phased-out products. Bill O’Leary. June 2024, p. 60.

Industry Personalities

Orvin W. Craley, the self-made motor repairman. Colin Gregory-Moores. March 2024, p. 16.

Rodney Fuller and the hand of providence. Colin Gregory-Moores. April 2024, p. 22.

How Sabine Lehmann reached the pinnacle of trade expo management. Colin Gregory-Moores. May 2024, page 16.

Foodie adventurer: Krista DeSocio of ICC International. Colin Gregory-Moores. June 2024, p. 20.

How Brittany Riley established a career as a trade show professional. Colin Gregory-Moores. July 2024, p. 24.

Blake Bailey, the solution nder for people with motors. Colin GregoryMoores. August 2024, p. 35.

Physicist Dr. Oswald Willi’s ve-peak climb. Colin Gregory-Moores. September 2024, p. 18.

Remembering Dick Nailen. Kevin Jones. September 2024, p. 24.

Michael Mitten’s journey from pole to pole. Collin Gregory-Moores. October 2024, page 24.

Travis Conner’s education in accountability. Colin Gregory-Moores. November 2024, p. 40.

Cybersecurity: more important now than ever. Anna Claire Howard. September 2022, p. 33.

Manufacturing

The reshoring revolution. David Miller. January 2020, p. 23.

Just one word: plastics. William Wiersema. February 2020, p. 35.

Coronavirus and the supply chain. Selena Cotte. March 2020, p. 40.

The end of an era for manufacturing? Selena Cotte. June 2020, p. 55.

Beyond Fordism. David Miller. July 2020, p. 40.

Machine, print me a cheeseburger. Selena Cotte. October 2020, p. 12.

Food and beverage manufacturing gets exible. David Miller. October 2020, p. 40.

Smarter construction with robots. Selena Cotte. January 2021, p. 8.

The trans-Paci c EV competition is heating up. Kevin Jones. January 2021, p. 39.

President’s plan for manufacturing. Selena Cotte. February 2021, p. 19. Representing manufacturers for more than a century. Charlie Barks. February 2021, p. 41.

India: the next manufacturing giant? Selena Cotte. March 2021, p. 38.

Time for a motor survey. John Malinowski. April 2021, p. 14.

Meet your “digital twin.” Selena Cotte. May 2021, p. 12.

A complicated manufacturing landscape. Selena Cotte. July 2021, p. 14.

Using metrology in manufacturing. Selena Cotte. August 2021, p. 12.

A third option for those on the “shorefront” fence. Charlie Barks. August 2021, p. 34.

Advanced manufacturing across the globe. Selena Cotte. September 2021, p. 12.

Unraveling digital threads. Susan Follett. September 2021, p. 22.

Recognizing new ideas. Selena Cotte. September 2021, p. 24.

Metals, manufacturing & more. Selena Cotte. October 2021, p. 20.

The broken supply chain. Selena Cotte. October 2021, p. 21.

Bringing back the factory town. Selena Cotte. November 2021, p. 8.

Thinking small. Susan Follett. December 2021, p. 30.

A better way to modernize equipment. William Wiersema. December 2021, p. 43.

Rise of the machine shop. Selena Cotte. February 2022, p. 27.

Rebuilding American manufacturing communities. Leah Zitter. April 2022, p. 8.

Robot workers for rent. Leah Zitter. May 2022, p. 10.

HVACR society o ers information you can use. Kevin Jones. March 2020, p. 24.

HVACR heats up local economy. David Miller. March 2020, p. 25.

E cient pumps, e cient HVACR. Kevin Jones. March 2020, p. 39.

Waste not, want not. Charlie Barks. March 2021, p. 21.

Promoting an economical heating alternative. Charlie Barks. March 2021, p. 23.

Change is in the air. Kevin Jones, Selena Cotte, and Charlie Barks. March 2021, p. 25.

The heat pump’s moment in the sun. Kevin Jones. March 2021, p. 39.

The newest — and safest — in HVACR. Susan Follett. January 2022, p. 16.

Bruce Lyle’s trek from tropical rainforests to prairie winters. Colin GregoryMoores. December 2024, p. 46.

Information Technology

Keeping up with new tech. Selena Cotte. January 2020, p. 43.

Privacy and the Internet of Things. Charlie Barks. July 2020, p. 37.

Ransomware and other threats against manufacturing. Selena Cotte. December 2020, p. 10.

Reality check. Susan Follett. March 2021, p. 18.

Where water meets broadband. Kevin Jones. September 2022, p. 18.

HECO and Relayr: Partners in remote condition monitoring. Charlie Barks. September 2022, p. 27.

How 3D printing transforms manufacturing. Anna Claire Howard. June 2022, p. 24.

Unlikely manufacturing partnerships. Anna Claire Howard. July 2022, p. 52.

“Dark” manufacturing plants. Anna Claire Howard. August 2022, p. 52. Manufacturing show returns to the Windy City. Kevin Jones. September 2022, p. 20.

The International Manufacturing Technology Show. Kevin Jones. October 2022, p. 16.

University degrees in “human-robot collaboration.” Charlie Barks. January 2023, p. 16.

SME certi cation in manufacturing robotics. The Electrical Apparatus sta . January 2023, p. 20.

Buyers and sellers to meet at CWIEME

Berlin. Kevin Jones. February 2023, p. 22.

Stern Pinball of Elk Grove Village, Ill.

Charlie Barks. May 2023, p. 35.

Virtual reality goes to work. Chelsea Fisher. May 2023, p. 46.

Innovation at John Deere’s Harvester Works in East Moline, Ill. Charlie Barks. September 2023, p. 24. Innovation on the factory oor. The Electrical Apparatus sta . September 2023, p. 42.

When failure is part of innovation. Charlie Barks. September 2023, p. 44.

Fabulous-tech. Kevin Jones. November 2023, p. 14.

Where in the U.S. electric vehicle manufacturing is concentrated. Maura Keller. December 2023, p. 26. New products, from concept to customer. Bill O’Leary. December 2023, p. 29. A fresh look at IoT. Bill O’Leary. February 2024, p. 24.

Scenes from the 2024 CWIEME coil winding expo in Berlin. Charlie Barks. July 2024, p. 20.

Manufacturing summit at Hannover Messe 2024. Charlie Barks. July 2024, p. 22.

Automation to be everywhere at the International Manufacturing Technology Show. Kevin Jones. September 2024, p. 30.

IMTS 2024: International Manufacturing Technology Show report. Charlie Barks and Kevin Jones. November 2024, p. 20.

Fabtech report. Kevin Jones. December 2024, p. 20.

Motor Performance

Some reminders about motor e ciency. Richard Nailen. July 2020, p. 27. Beyond motor e ciency. John Malinowski. March 2021, p. 14. Motor e ciency then, now, and tomorrow. John Malinowski. May 2021, p. 30.

Verifying motor operating conditions. Richard Nailen. June 2021, p. 41. Motor e ciency: A refresher course. John Malinowski. July 2021, p. 16. A “disruptive” motor backed by a highly regarded manufacturer. Charlie Barks. July 2021, p. 31. What “everyone knows” about motor application. Richard Nailen. July 2021, p. 37. Motor maxims: true or false? Richard Nailen. November 2021, p. 31. Choosing the right motor enclosure. John Malinowski. December 2021, p. 33.

Die-cast copper rotors: Where do we stand? Richard Nailen. December 2021, p. 37. All about performance curves. Richard Nailen. February 2022, p. 31. How hot is that motor? Richard Nailen. April 2022, p. 44. Amortisseur windings in synchronous machines. Chase Fell. February 2023, p. 29.

Remote condition monitoring: more than just hardware and software. Kevin Jones. March 2023, p. 18. Fundamentals of motor condition monitoring. John Malinowski. May 2023, p. 41.

Up-rating a motor’s horsepower. Chase Fell. June 2023, p. 45.

Maintaining antique motors at a Memphis pumping station. Chase Fell. November 2023, p. 27. The road to improved motor e ciency. John Malinowski. April 2024, p. 33. Resistance temperature detectors. Chase Fell. June 2024, p. 51.

Operating a-c motors over and under rated voltage. Chase Fell. September 2024, p. 37.

New horizons in motor e ciency and power density. Chase Fell. December 2024, p. 35.

Motors &

Generators

Good, better, best. Richard Nailen. January 2020, p. 27.

Understanding a motor’s service factor. Richard Nailen. October 2020, p. 21.

From farm to factory: How motors bring food to the table. Selena Cotte. October 2020, p. 25.

A question of motor size. Richard Nailen. November 2020, p. 29.

“Revolutionary motor technology”: marketing or reality? Kevin Jones & Selena Cotte. December 2020, p. 23.

Large, medium, small: What’s the di erence? Richard Nailen. December 2020, p. 29.

What do we mean by “cyclic load”? Richard Nailen. December 2020, p. 42.

Form-wound versus random-wound: Is there a choice? Richard Nailen. January 2021, p. 23.

The great motor e ciency race. Richard Nailen. February 2021, p. 21.

The quest for more-e cient materials. Kevin Jones & Selena Cotte. February 2021, p. 27.

Large, small, or. . . ? Richard Nailen. March 2021, p. 20.

Time for a motor survey. John Malinowski. April 2021, p. 14.

“Is this the motor I ordered?” Richard Nailen. April 2021, p. 35.

Motors old . . . Kevin Jones. May 2021, p. 33. . . . And motors new. Charlie Barks. May 2021, p. 36.

Random winding for high-voltage motors? Richard Nailen. May 2021, p. 39.

A question of environment. Richard Nailen. August 2021, p. 31.

Motor management: What’s it all about? Richard Nailen. August 2021, p. 39.

The meaning of “severe duty.” Richard Nailen. September 2021, p. 35.

Choosing the right motor enclosure. John Malinowski. December 2021, p. 33.

Die-cast copper rotors: Where do we stand? Richard Nailen. December 2021, p. 37.

Guidance for “large” motor repair. Richard Nailen. January 2022, p. 33.

All about performance curves. Richard Nailen. February 2022, p. 31.

A deeper dive into TEFC motors. John Malinowski. February 2022, p. 36.

V-belt e ciency. Richard Nailen. February 2022, p. 39.

Communicating the needs of rotating machines. Richard Nailen. March 2022, p. 22.

Specifying the right motor for the job. Richard Nailen. March 2022, p. 31.

Another look at the “drop-in” motor. Richard Nailen. April 2022, p. 33.

How hot is that motor? Richard Nailen. April 2022, p. 44.

Separating the true motor maxims from the false ones. Richard Nailen. May 2022, p. 43.

IEEE 841: designed and built for severe duty. John Malinowski. May 2022, p. 48.

The meaning of “above NEMA.” Richard Nailen. June 2022, p. 45.

When “standard” motor features are anything but. Richard Nailen. July 2022, p. 39.

No standard covering “standard.” Richard Nailen. August 2022, p. 22.

A matter of motor size. Richard Nailen. August 2022, p. 41.

Navigating the standards maze. Richard Nailen. September 2022, p. 35.

A motor’s global journey. Charlie Barks. October 2022, p. 29.

Relating motor output and input. Richard Nailen. October 2022, p. 33.

Motors for use in hazardous locations. John Malinowski. October 2022, p. 38.

How many starts is a motor capable of?

Richard Nailen. November 2022, p. 31.

A two-way street for motor designers and users. Richard Nailen. December 2022, p. 29.

Laminated-frame motors. John Malinowski. January 2023, p. 25.

Amortisseur windings in synchronous machines. Chase Fell. February 2023, p. 29.

Updated DOE regulations cover more small motors. John Malinowski. March 2023, p. 31.

Fundamentals of motor condition monitoring. John Malinowski. May 2023, p. 41.

Up-rating a motor’s horsepower. Chase Fell. June 2023, p. 45.

When rewinders make house calls. Chase Fell. August 2023, p. 31.

Highlights from the 2023 EASA Convention technical sessions. Kevin Jones. August 2023, p. 35.

When motors fail. John Malinowski. September 2023, p. 29.

Maintaining antique motors at a Memphis pumping station. Chase Fell. November 2023, p. 27.

Compensating windings in d-c machines. Chase Fell. February 2024, p. 33.

HVACR motor testing standards. John Malinowski. March 2024, p. 33.

The road to improved motor e ciency. John Malinowski. April 2024, p. 33.

Adjustable-speed drives and power quality. David Bredhold. May 2024, page 39.

Resistance temperature detectors. Chase Fell. June 2024, p. 51.

What s new in ANSI/NEMA MG 1. John Malinowski. July 2024, p. 33.

Controlling motors with VFDs. David Bredhold. August 2024, p. 43.

The latest research on the energy use of electric motors. Charlie Barks. September 2024, p. 28.

Operating a-c motors over and under rated voltage. Chase Fell. September 2024, p. 37.

NEMA adds new Design BE and CE motors. John Malinowski. October 2024, page 37.

New horizons in motor e ciency and power density. Chase Fell. December 2024, p. 35.

Power Transmission & Distribution

The use and care of electrical and electronic equipment for Class I hazardous locations. David Bredhold. January 2024, p. 31.

Adjustable-speed drives and power quality. David Bredhold. May 2024, page 39.

Controlling motors with VFDs. David Bredhold. August 2024, p. 43.

How Wescom of Duluth, Minn., is “energizing America.” Charlie Barks. November 2024, p. 25.

Pumping Systems

Pump rms lead in workforce development. Kevin Jones. January 2020, p. 44.

New pump e ciency rule now in e ect. Kevin Jones. February 2020, p. 43.

E cient pumps, e cient HVACR. Kevin Jones. March 2020, p. 39.

Improving pump e ciency. Kevin Jones. April 2020, p. 36.

When “ ushables” clog the pumps. Kevin Jones. May 2020, p. 46.

Pool pump season is here. Kevin Jones. June 2020, p. 53.

EVs no place for pumps? Wrong! Kevin Jones. July 2020, p. 39. Pharmaceutical-grade pumps: Just what the doctor ordered. Selena Cotte. August 2020, p. 25.

New guidance for pump e ciency incentives. Kevin Jones. August 2020, p. 40.

Know your food and beverage pumps. David Miller. October 2020, p. 41.

Delivering water responsibly. Kevin Jones. November 2020, p. 41.

Trends in pump design. Kevin Jones. December 2020, p. 39. Intelligent pumps: What’s new in 2021. Kevin Jones. January 2021, p. 38.

“And the award goes to . . .” Kevin Jones. February 2021, p. 37.

Spring training. Kevin Jones. April 2021, p. 46.

Lab work. Kevin Jones. May 2021, p. 55.

Pumps get smarter. Kevin Jones. June 2021, p. 74.

After the storm, clear sailing. Kevin Jones. July 2021, p. 28.

When innovation is about more than hardware. Kevin Jones. September 2021, p. 10.

A world of pump standards. Kevin Jones. October 2021, p. 36.

Best of the best. Kevin Jones. November 2021, p. 46.

Energy rating labels expanded to cover circulator pumps. Kevin Jones. December 2021, p. 45.

Weftec 2021: Dampened moods. Please turn to next page

Charlie Barks and Selena Cotte. December 2021, p. 49.

Virtual community showcases a pump maker’s products. Kevin Jones. January 2022, p. 48.

Fresh nancial foundations. Kevin Jones. February 2022, p. 42.

The Infrastructure Act: What’s in it for pumps? Kevin Jones. March 2022, p. 42.

Pump manufacturers take to the eld. Kevin Jones. April 2022, p. 42.

Pump manufacturers and “sustainability.” Kevin Jones. May 2022, p. 58. Pump training matters. Kevin Jones. June 2022, p. 60.

Pump manufacturers navigate choppy economic waters. Kevin Jones. July 2022, p. 50.

Where water meets broadband. Kevin Jones. September 2022, p. 18.

A roundup of global pump news. Kevin Jones. October 2022, p. 52.

New rule on the e ciency of circulator pumps. Kevin Jones. November 2022, p. 24.

What’s under the Christmas tree for pump users? Kevin Jones. December 2022, p. 38.

2022: The year in pump news. Kevin Jones. January 2023, p. 40.

Pump stories from the eld. Kevin Jones. February 2023, p. 40.

Distributed pumping in HVACR systems. Kevin Jones. March 2023, p. 40.

Mergers and acquisitions in the pump sector. Kevin Jones. April 2023, p. 40.

The British Pump Industry Awards. Kevin Jones. May 2023, p. 52.

The UN Water Action Agenda. Kevin Jones. June 2023, p. 60.

News from top pump suppliers. Kevin Jones. July 2023, p. 40.

Working with larger pumps. Kevin Jones. August 2023, p. 48.

Update on pump innovations. Kevin Jones. September 2023, p. 40.

Maintaining antique motors at a Memphis pumping station. Chase Fell. November 2023, p. 27.

Atlas Copco pumps up the acquisitions. Kevin Jones. November 2023, p. 40. A tale of two pumping stations. Kevin Jones. December 2023, p. 42.

AI is coming for pumps. Kevin Jones. January 2024, p. 49.

Hydraulic Institute pump ratings adopted by federal and California agencies. Kevin Jones. February 2024, p. 18. The updated Seasonal Energy E ciency Rating for heat pumps. Bill O’Leary. March 2024, p. 44.

Money spigot opens for water infrastructure spending. Kevin Jones. April 2024, p. 44.

The place of pumps in the hydrogen economy. Kevin Jones. May 2024, page 54.

The British pump industry awards. Kevin Jones. June 2024, p. 69. The pumped-up EV pump market. Kevin Jones. July 2024, p. 44.

Maintaining larger pumps. Kevin Jones. August 2024, p. 55. Recent innovations in pump technology. Kevin Jones. September 2024, p. 49.

A snapshot of the European pump market. Kevin Jones. October 2024, page 48.

Investing in pumping knowledge. Kevin Jones. November 2024, p. 44. New composite materials for pumps. Bill O’Leary. December 2024, p. 22.

Repair Operations

Industrial-use drones: a primer. Selena Cotte. February 2020, p. 41.

The future of the small, independent

shop. David Miller. June 2020, p. 33.

Guidance for “large” motor repair. Richard Nailen. January 2022, p. 33.

Rise of the machine shop. Selena Cotte. February 2022, p. 27.

Niagara rises. Charlie Barks. April 2022, p. 40.

Old vs. New equipment repair. Charlie Barks. June 2022, p. 36.

Trends in industrial maintenance. Carol Brzozowski. June 2022, p. 41.

Attracting young people to the eld of CNC machining. Charlie Barks. January 2023, p. 12.

Machine shops come in all shapes and sizes. Charlie Barks. February 2023, p. 25.

Virtual reality goes to work. Chelsea Fisher. May 2023, p. 46.

Energetic growth at EMS Industrial of Madison, Wis. Charlie Barks. June 2023, p. 39.

The promising world of EV service. Carol Brzozowski. July 2023 EA, p. 28.

When rewinders make house calls.

Chase Fell. August 2023, p. 31.

Highlights from the EASA Convention technical sessions. Kevin Jones. August 2023, p. 35.

House calls are their specialty. Charlie Barks. February 2024, p. 27.

Compensating windings in d-c machines. Chase Fell. February 2024, p. 33.

Installing new digital machines. Bill O’Leary. October 2024, page 20.

Building a competitively sustainable service shop. Michael Mitten. December 2024, p. 12.

Robotics

Keeping humans in the loop. Susan Follett. June 2021, p. 70.

Working like a dog. Charlie Barks. April 2021, p. 22.

Robot workers for rent. Leah Zitter. May 2022, p. 10.

The International Manufacturing Technology Show. Kevin Jones. October 2022, p. 16.

Learning the AI ropes. Charlie Barks. December 2022, p. 12.

What’s new in electromechanical and automation control technology. David Miller. December 2022, p. 25.

University degrees in “human-robot collaboration.” Charlie Barks. January 2023, p. 16.

SME certi cation in manufacturing robotics. The Electrical Apparatus sta . January 2023, p. 20.

All Control of Elgin, Ill., meshes automation and service. Charlie Barks. January 2023, p. 21.

Automation and robotics in training. Charlie Barks. September 2023, p. 37. Fabulous-tech. Kevin Jones. November 2023, p. 14.

Truths and myths about AI. Bill O’Leary. November 2023, p. 24.

Robots in critical medical procedures. Kristine Weller. January 2024, p. 24.

The emerging role of robotic process automation. Maura Keller. January 2024, p. 25.

A fresh look at IoT. Bill O’Leary. February 2024, p. 24.

Safety & Health

Field safety 101. Kevin Jones. February 2020, p. 40.

Hydro uorocarbon bill hits a road block. Selena Cotte. April 2020, p. 40. The Security Industry Association. Charlie Barks. May 2020, p. 26.

The Covid-19 stimulus. William Wiersema. May 2020, p. 38.

Clean plant, healthy employees. Kevin Jones. May 2020, p. 41.

Invoking the Defense Production Act. Selena Cotte. May 2020, p. 43.

When “ ushables” clog the pumps. Kevin Jones. May 2020, p. 46.

3D printers: The medical industry’s latest resource. Selena Cotte. May 2020, p. 50.

No rest for the regulators. Kevin Jones. July 2020, p. 43.

Safe manufacturing post-Covid-19. William Wiersema. August 2020, p. 36.

Anti-nuclear meltdown. David Miller. August 2020, p. 43.

Robots boost plant safety post-Covid. David Miller. November 2020, p. 42.

Working with a mask. Selena Cotte. February 2021, p. 34.

Workplace safety updates. Charlie Barks. May 2021, p. 48.

Carbon measurement: How do we know what’s what? Charlie Barks. August 2021, p. 58.

Start ’em early. Charlie Barks. August 2021, p. 59.

Secure the perimeter. . . . Charlie Barks. November 2021, p. 24.

Disputed statistics. Charlie Barks. February 2022, p. 22.

Countering the risk of lithium-ion batteries. Carol Brzozowski. January 2023, p. 36.

Stern talk from OSHA. Charlie Barks. March 2023, p. 20.

Industrial accidents in Pennsylvania. Charlie Barks. May 2023, p. 48.

Adding noise to electric vehicles as a safety measure. Maura Keller. February 2024, p. 42.

Codifying guidelines for verifying the health of buildings. Kristine Weller. May 2024, page 22.

Phased-out products. Bill O’Leary. June 2024, p. 60.

Using the working load limit to reduce workplace injuries. Bill O’Leary. August 2024, p. 18.

Guarding against overheating in the plant. Bill O’Leary. September 2024, p. 20.

Wearable technology in MRO. Bill O’Leary. September 2024, p. 31.

Preparing for health crises. Bill O’Leary. October 2024, page 22.

OSHA is taken to court. Bill O’Leary. November 2024, p. 14.

Sodium-ion batteries making waves with new developments. Charlie Barks. December 2024, p. 48.

Service & Sales Companies

(In alphabetical order by company name, as featured in full-length articles) Advanced Motor Solutions, Hamilton, Ontario. Diverse team, diverse market. Selena Cotte. February 2020, p. 23. Atlas Electric Motor, Walton, Ky. Boone County boom. Charlie Barks. April

2023, p. 25.

Brithinee Electric, Colton, Calif. Wallace Brithinee takes stock of the industry. Colin Gregory-Moores. June 2024, p. 45.

Core Machinery, Phoenix. Keeping the big vehicles rolling. Charlie Barks. August 2024, p. 37.

EMS Industrial, Madison, Wis. Energetic growth. Charlie Barks. June 2023, p. 39.

Etheredge Industrial, Shreveport, La. Work on the Ether-EDGE. Selena Cotte. May 2022, p. 37.

EV Garage Miami. The promising world of EV service. Carol Brzozowski. July 2023 EA, p. 28.

Evans Enterprises, Norman, Okla. ”We want to be the best, not the biggest.”” Selena Cotte. November 2021, p. 25. Flolo Corp., West Chicago, Ill. HVACR plugged in. Kevin Jones. March 2024, p. 27.

HECO, Kalamazoo, Mich. HECO and Relayr: Partners in remote condition monitoring. Charlie Barks. September 2022, p. 27.

Kräutler Elektromotoren, Lustenau, Austria. Sails set for the future Colin Gregory-Moores. October 2024, page 31.

Longo’s machine for generating electricity in natural gas pipelines. Charlie Barks. May 2024, page 33.

Mile Hybrid Automotive, Denver, Colo. The promising world of EV service. Carol Brzozowski. July 2023, p. 28.

Rotating Apparatus Co., Salem, Wis. House calls are their specialty. Charlie Barks. February 2024, p. 27.

How Wescom of Duluth, Minn., is “energizing America.” Charlie Barks. November 2024, p. 25.

Terminology

The how and why of locked-rotor testing. Richard Nailen. February 2020, p. 29.

Call it “engineerese.” Richard Nailen. June 2020, p. 18.

How well do we understand ambient? Richard Nailen. June 2020, p. 41. “Let me be clear . . .” Richard Nailen. September 2021, p. 20.

Communicating the needs of rotating machines. Richard Nailen. March 2022, p. 22.

Taking a blue pencil to IEEE documents. Richard Nailen. June 2022, p. 22. Avoiding redundancy in writing. Richard Nailen. November 2022, p. 18.

Cite your sources! Richard Nailen. April 2023, p. 24.

Be careful when using acronyms. Richard Nailen. December 2023, p. 16.

Training & Education

Pump rms lead in workforce development. Kevin Jones. January 2020, p. 44.

How to get a start in the HVACR trade. Kevin Jones. March 2020, p. 13. HVACR heats up local economy. David Miller. March 2020, p. 25. More ways than ever to “earn while you learn.” Kevin Jones. April 2020, p. 12. Organizations o er free online training. Kevin Jones. May 2020, p. 48.

The spike in distance learning is more than just a temporary anomaly. Kevin Jones. June 2020, p. 22. Still too soon to assume training events are in-person. Kevin Jones. August 2020, p. 23.

Assessing the talent of technicians. Charlie Barks. November 2020, p. 19. Fast-track electrician training is gaining

favor. Kevin Jones. November 2020, p. 46.

Embedding credentials within bachelor’s degrees. Kevin Jones. January 2021, p. 12.

Providing electrical technician certi cation. Charlie Barks. January 2021, p. 15.

Spring training. Kevin Jones. April 2021, p. 46.

Skilled Trades Day spotlights career bene ts. Susan Follett. May 2021, p. 18.

An alternative to “death by PowerPoint.” Susan Follett. June 2021, p. 64. New York State boosts apprenticeship opportunities; Federal funds aimed at improving apprenticeship programs. Susan Follett. August 2021, p. 56. The ABCs of Gens Y and Z. Susan Follett. September 2021, p. 16. Metallica forges a connection to its fan base. Susan Follett. November 2021, p. 10.

IBEW helps earn while you learn. Emily Halnon. May 2022, p. 30. Virtual training is here to stay. Emily Halnon. June 2022, p. 19. Pump training matters. Kevin Jones. June 2022, p. 60. A path to rehabilitation. Emily Halnon. August 2022, p. 50.

School’s in for summer. Charlie Barks. September 2022, p. 46. University degrees in “human-robot collaboration.” Charlie Barks. January 2023, p. 16.

SME certi cation in manufacturing robotics. The Electrical Apparatus sta . January 2023, p. 20.