Electrical Apparatus

More than Motors

Annual Energy Issue

Ill winds could bode well for one renewables industry

Spying on polluters

History of motor efficiency

Mid-year employee reviews Alternative vehicle fuels

Post-closing M&A disputes

A BARKS PUBLICATION APRIL 2024 / $10

Electrical Manager

10 The mid-year review

Understanding the benefits for both the underperformer and the overachiever

By Bill O’Leary, EA

Contributing Writer

Electric Avenue

18 Going beyond EVs

In light of the shortcomings of electric vehicles, alternative fuel sources are being considered

By Maura Keller, EA

EA Reader Profile

Contributing Writer

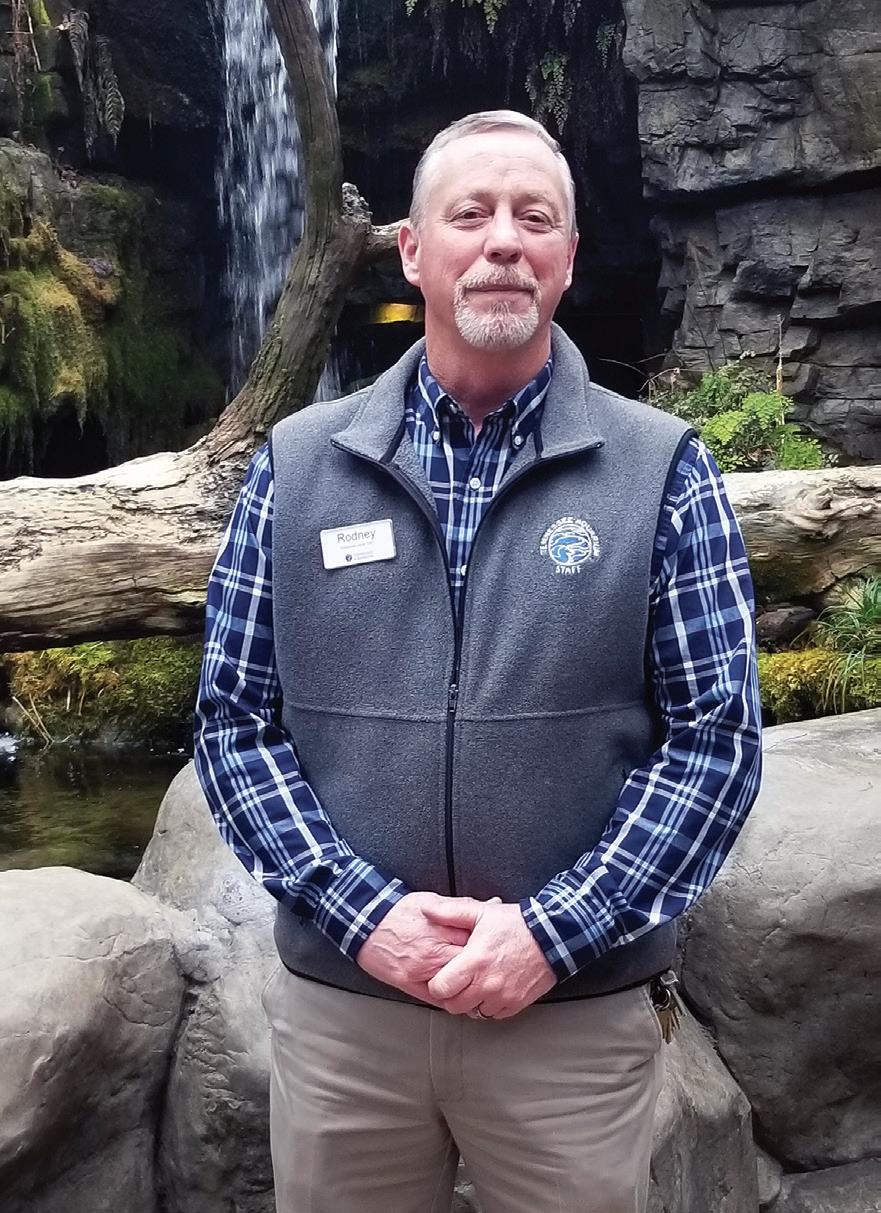

22 The hand of providence

For Rodney Fuller, good things have a way of following hard work

By Colin Gregory-Moores, EA

Contributing Writer

Energy

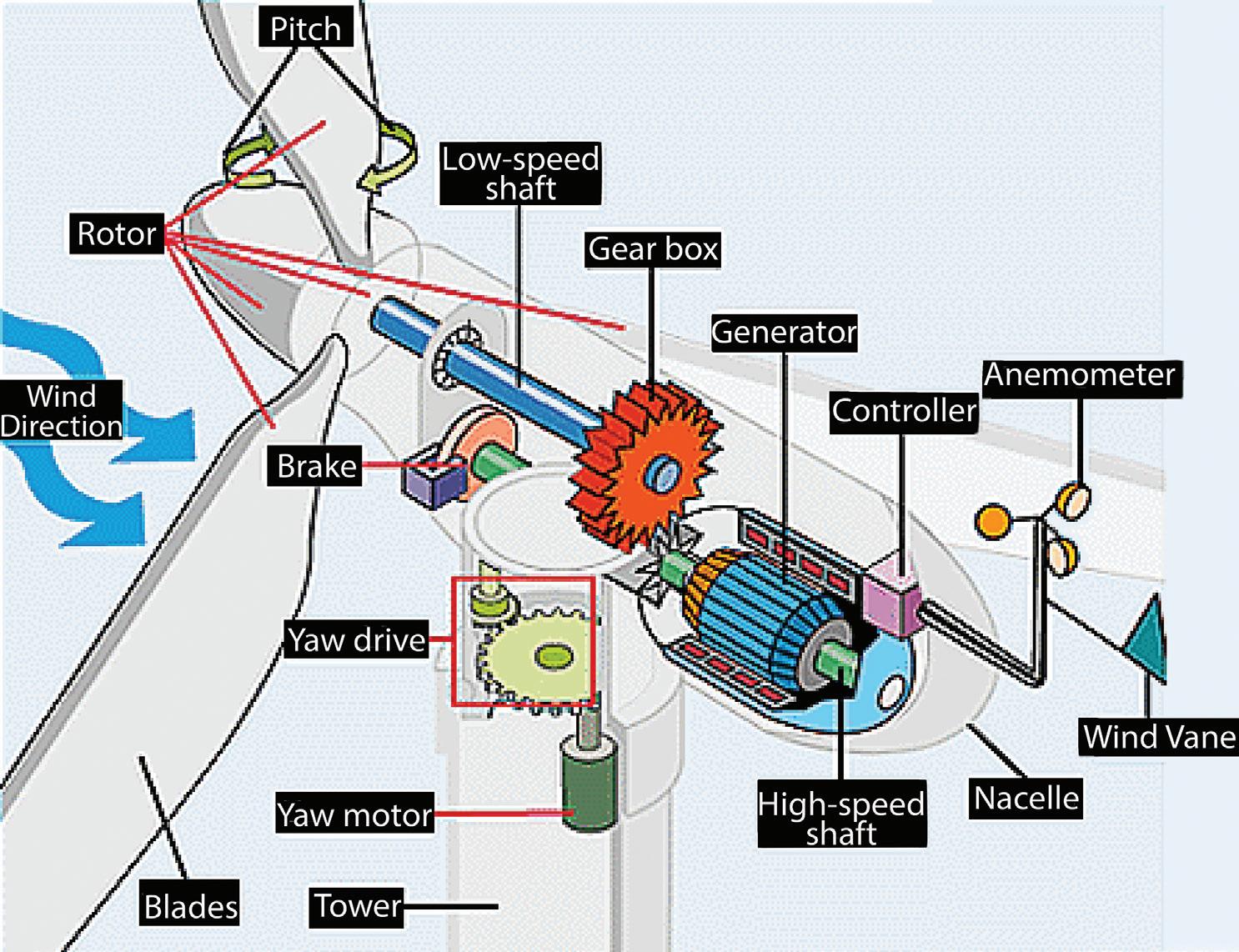

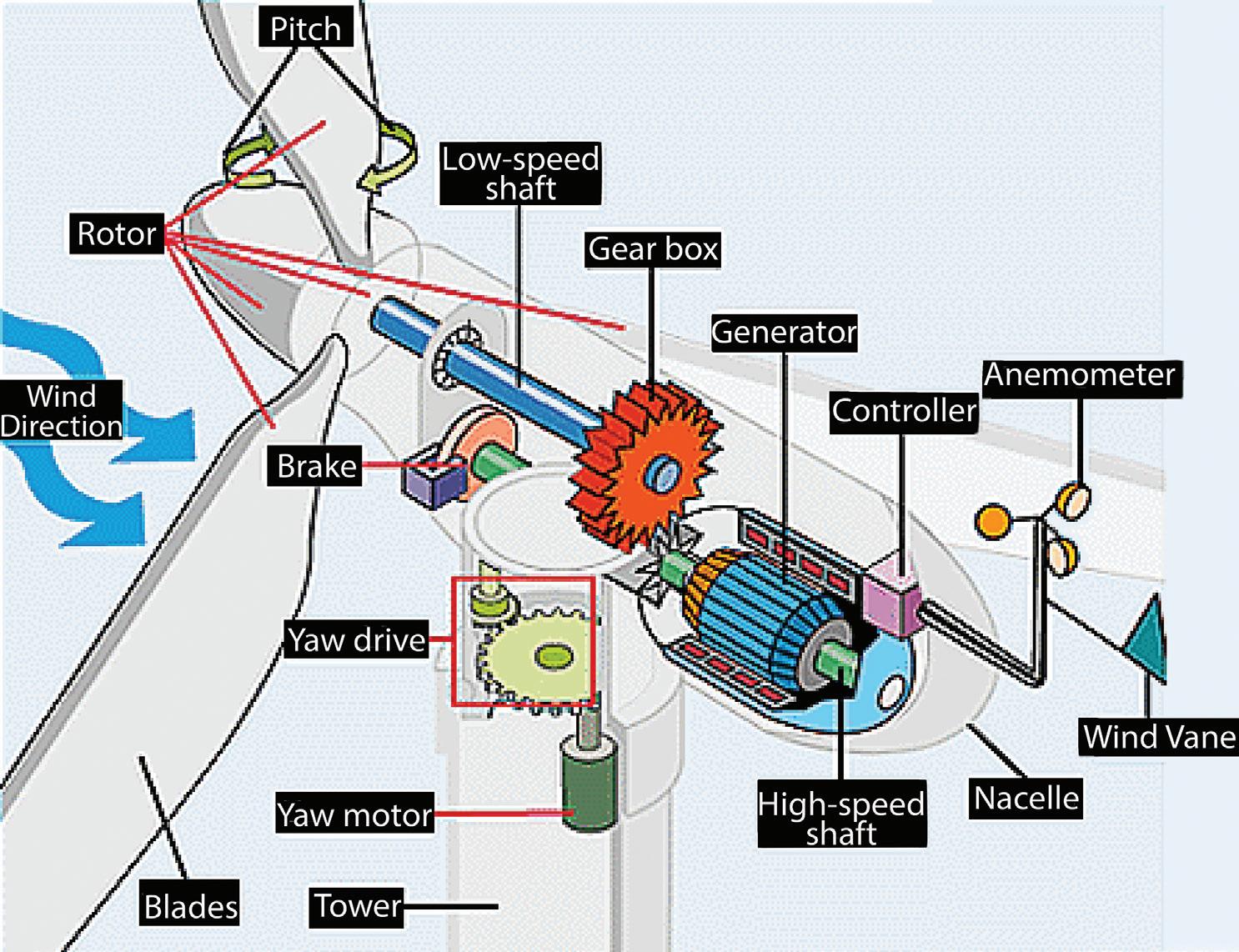

27 Ill blows the wind

The wind industry is weathering storms — financial, engineering, and geographic — that in the end will likely make the industry stronger

By Bill O’Leary, EA Contributing Writer

42 Eye in the sky

A satellite is intended to monitor and ‘call out’ the world’s worst polluters

By Charlie Barks, EA

Managing Editor

Motors & Generators

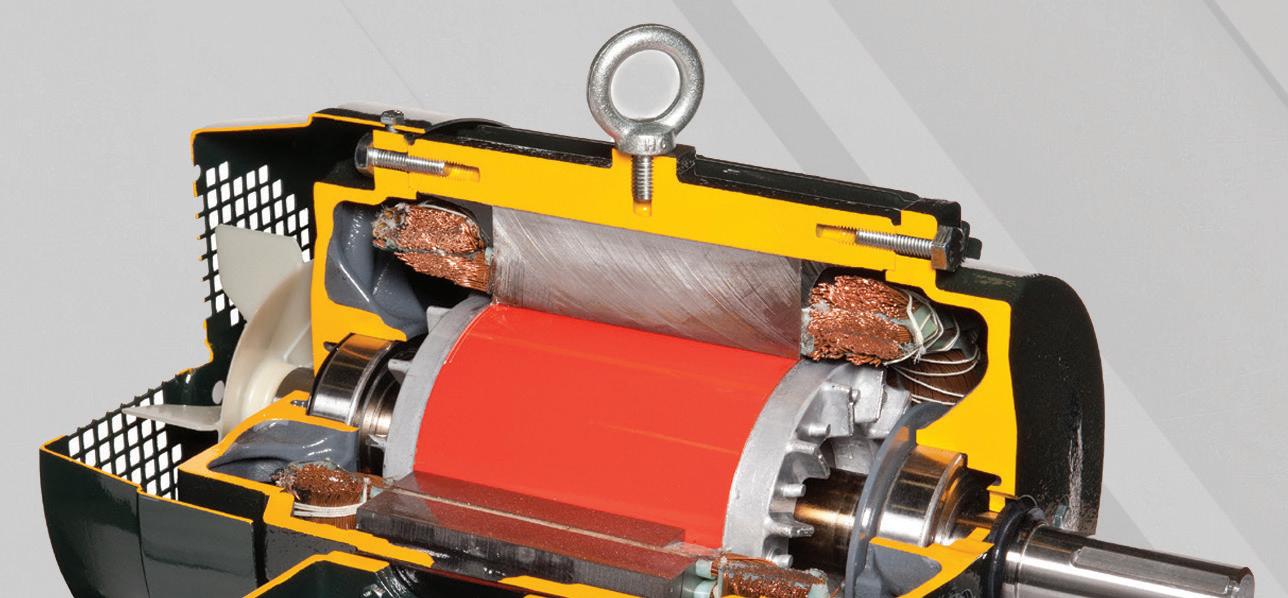

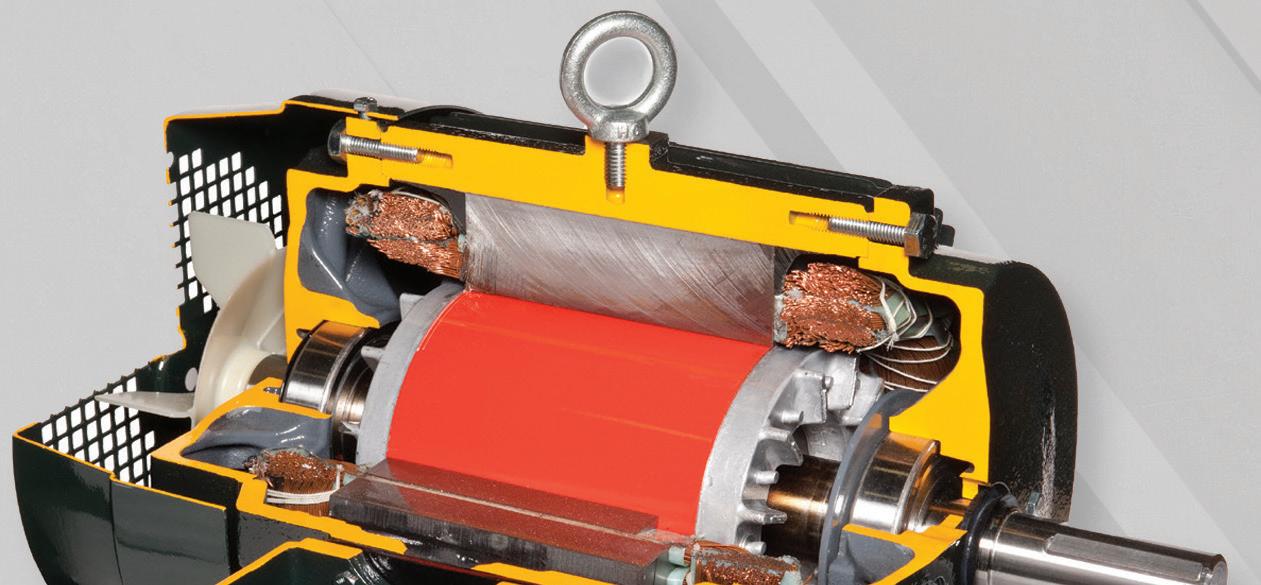

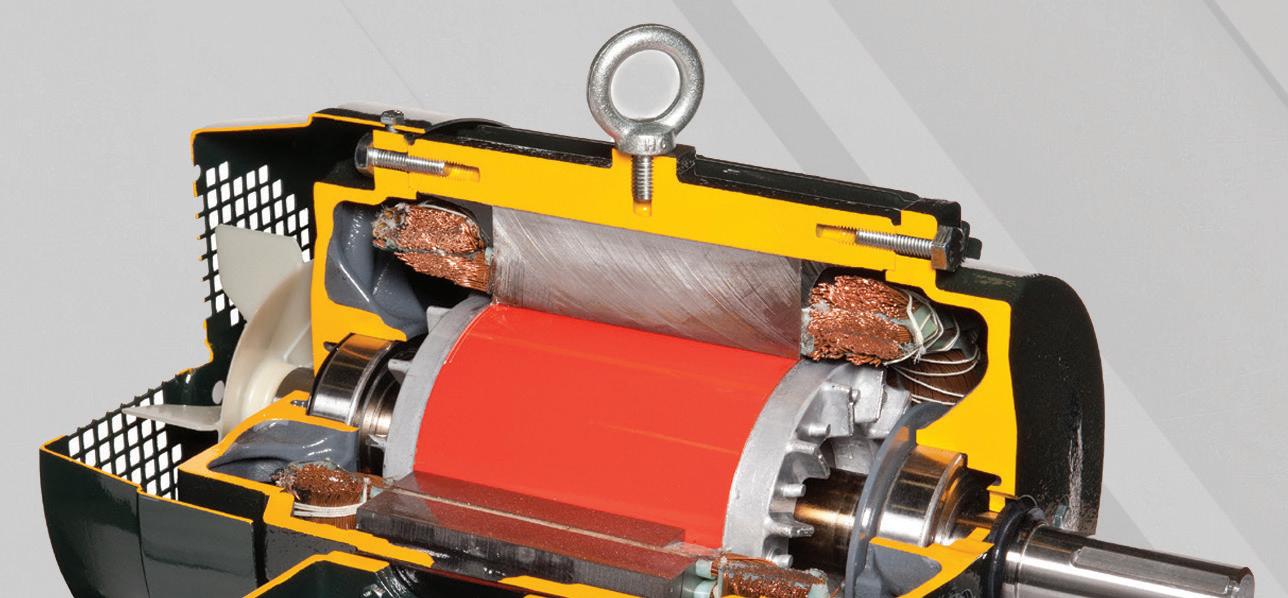

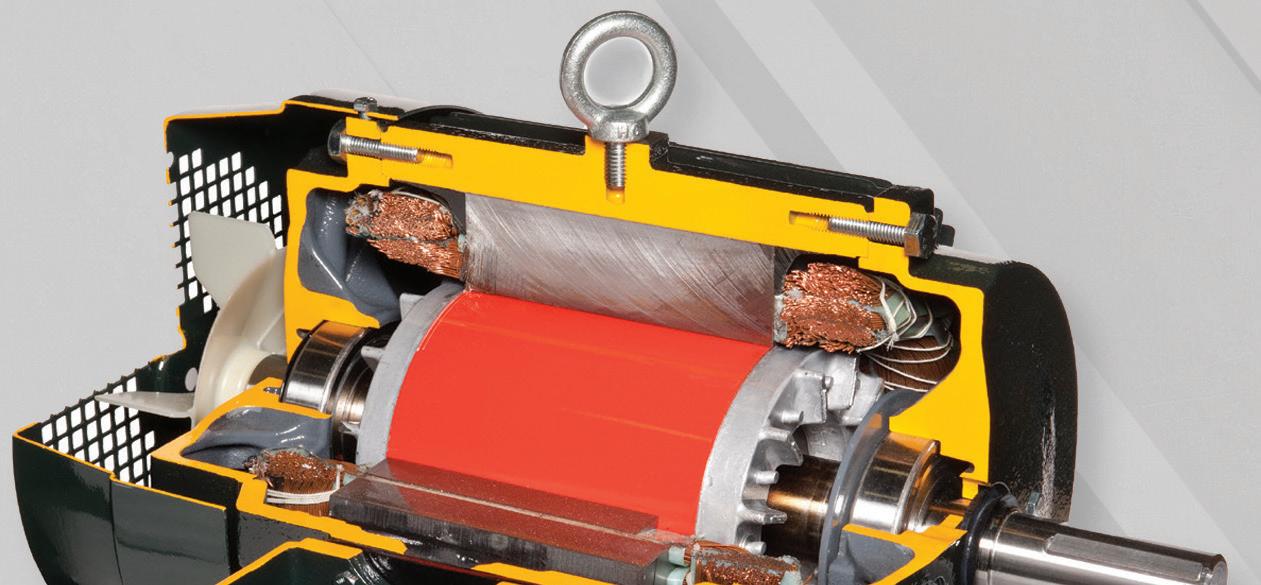

33 The road to improved motor efficiency

A brief look at the history and current status of the U.S. Dept. of Energy’s motor efficiency regulations

By John Malinowski, EA Contributing Editor

Finance

37 Post-closing M&A disputes

The best way to deal with conflicts between business buyer and seller is by preventing conflicts in the first place

By William H. Wiersema, CPA, EA Contributing Editor

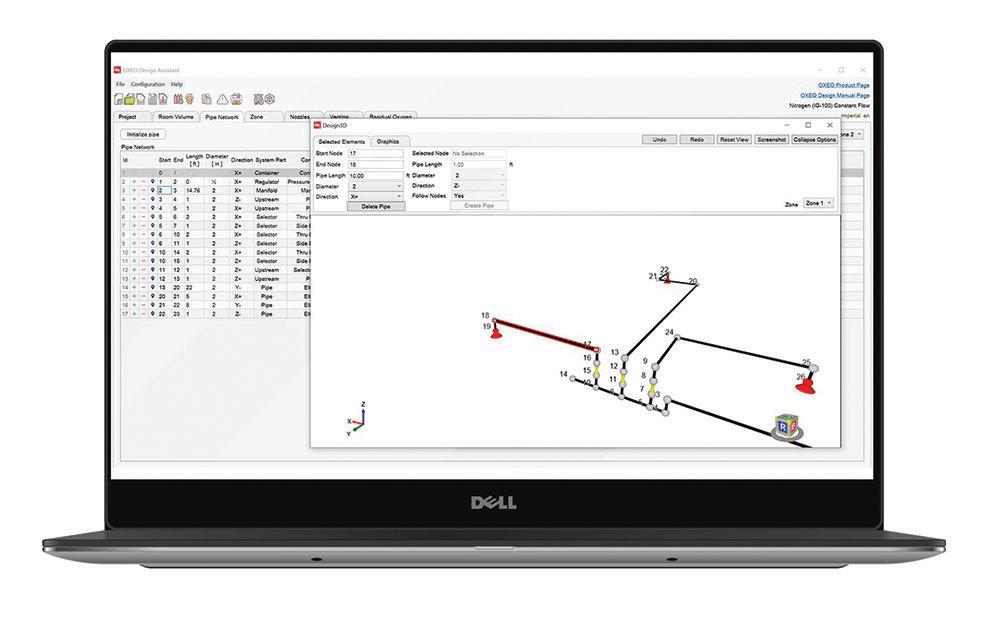

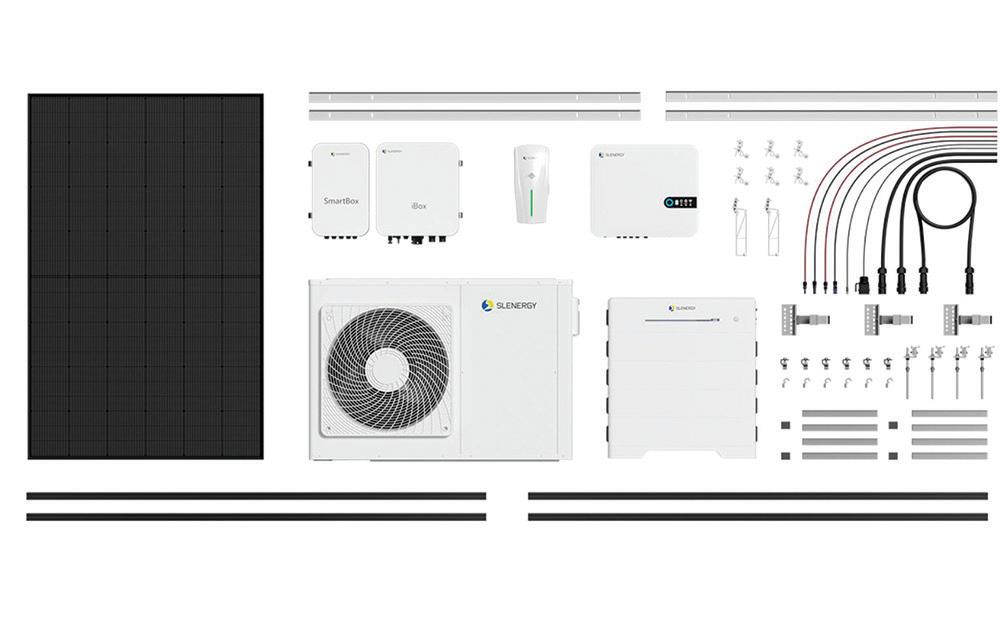

Training & Education

43 Embracing rotational training

A pattern of promotion that can help an individual gain a ‘big picture’ understanding of a business

By Maura Keller, EA

Contributing Writer

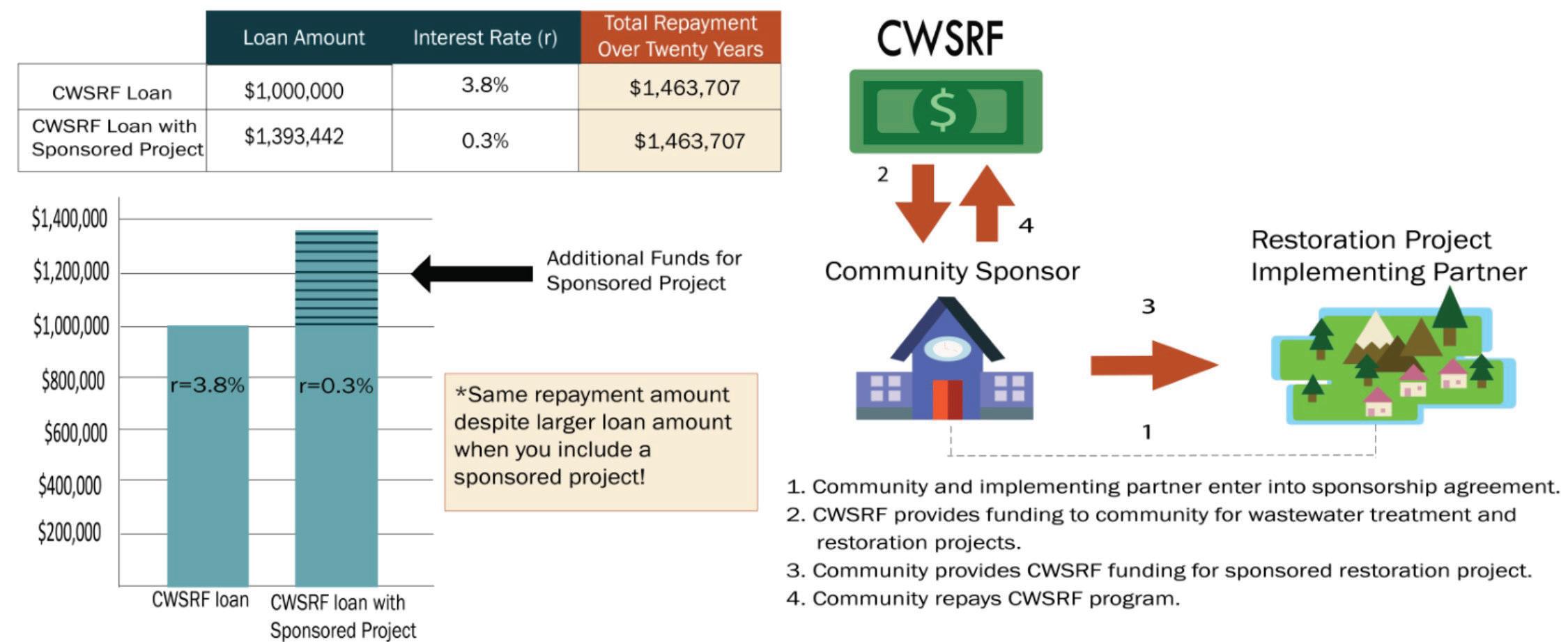

Pump It Up

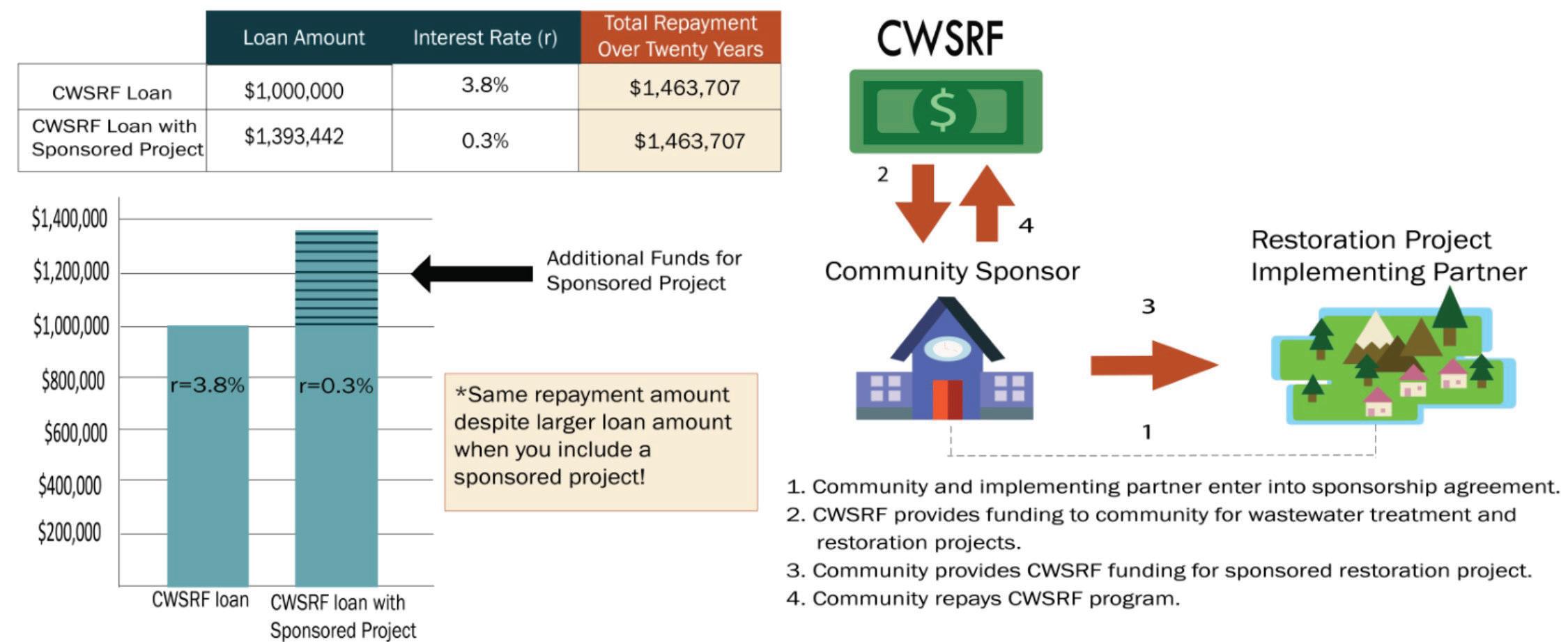

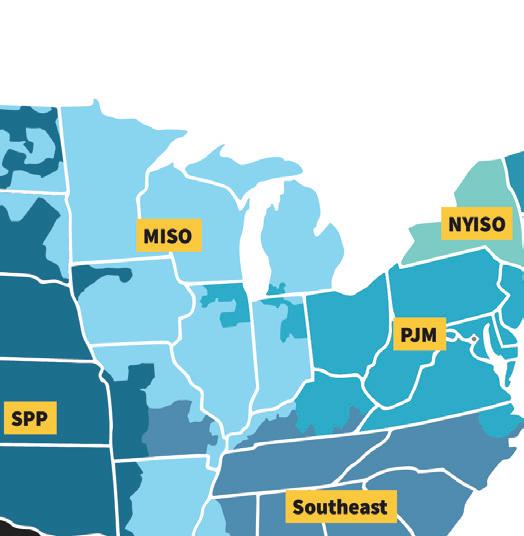

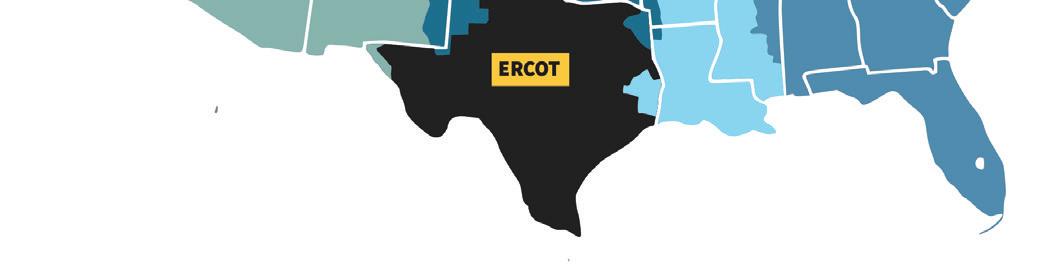

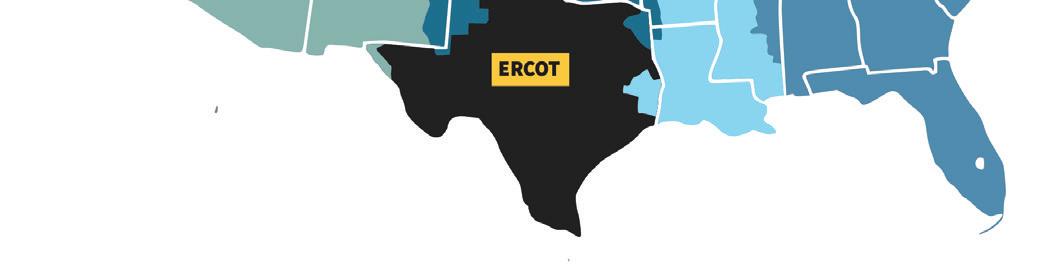

44 Feds open the money spigot for water infrastructure spending

An unprecedented quantity of money is being unleashed for spending on U.S. water infrastructure — but there’s a catch

By Kevin Jones, EA Senior

Editor

22

A BARKS PUBLICATION VOLUME 77 / NUMBER 04 WWW.BARKS.COM 04/24 — Tennessee Aquarium photo —

Energy Corp. photo — Adobe generative AI image ELECTRICAL APPARATUS | APRIL 2024 1

27 33 Contents

Duke

04 The editor’s comment Energy in limbo 06 Speaking of . . . Clean power company Exro Technologies expands again 07 Let’s solve your problem Questions and answers about electric motor efficiency 08 Associations Associations point the way toward AI in machine maintenance 14 Know your industry Edison Electric Institute is not your average institute 16 Calendar Events on electrical maintenance and facility management 25 Business Recent mergers and acquisitions

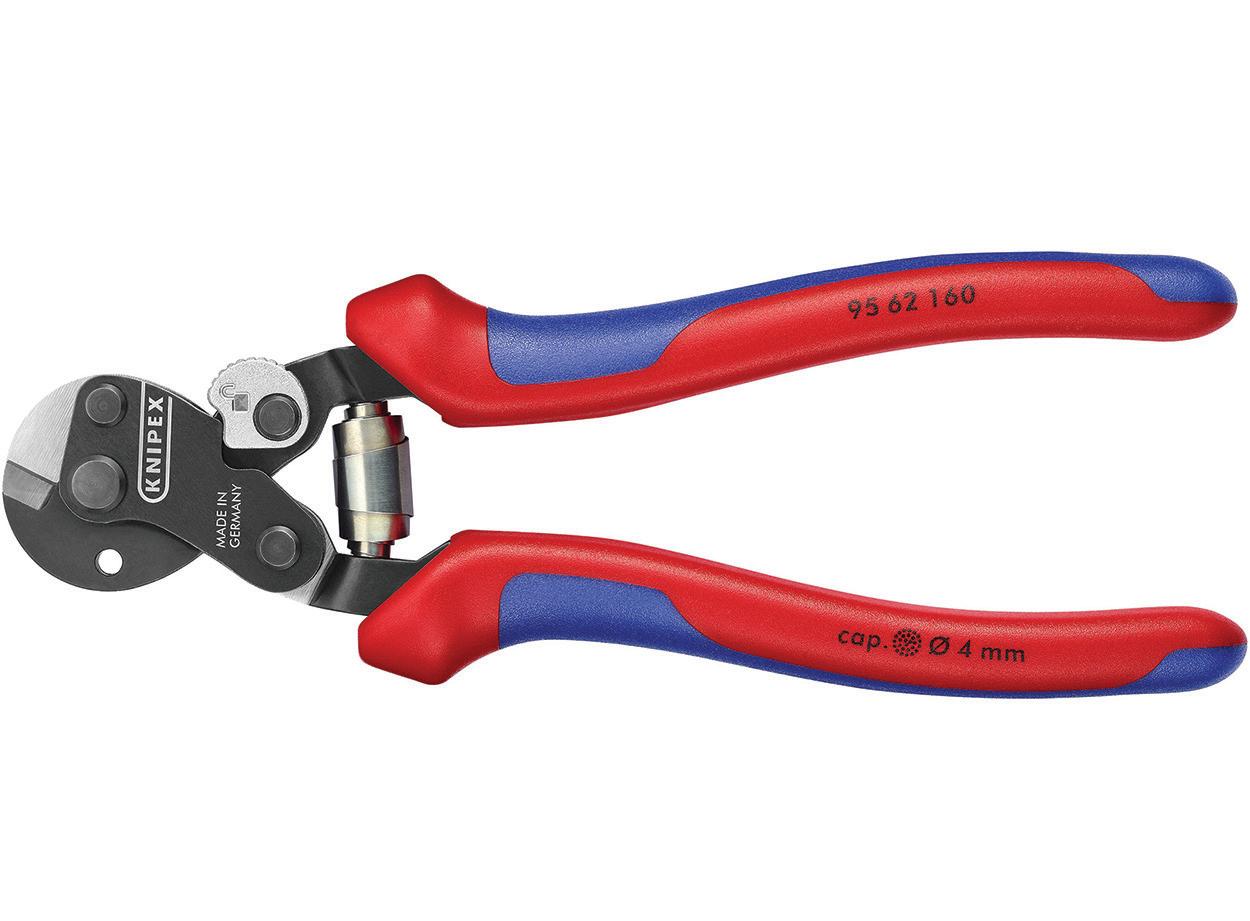

Say it right Making technical writing less verbose 39 Names & faces Personnel changes at Helwig, Origami Solar, and NAED 40 Product showcase What’s new in tools, clean energy, and fire protection 46 Utilities New handbook explains U.S. wholesale energy markets 47 Plant happenings Plants in Tennessee, Pennsylvania, and Alabama to expand 48 Classified advertising Your monthly marketplace for equipment, businesses, and more COVER PHOTO: By Natascha Kaukorat / Shutterstock. An offshore wind installation under construction. 25 26 40 Departments 48 Cy’s Super Service The electrical service industry’s most prominent curmudgeon 49 EA puzzle A word search puzzle based on this month’s “EA reader profile” 51 Moe, Genny & friends The surreal world of an anthropomorphized motor and generator 52 Direct & current Schneider fends off a hacking attempt, and Apple ditches an EV 52 Advertising index Who’s who—and who’s where—in this issue of Electrical Apparatus — Precision Coil and Rotor photo — Illustration by Bing generative AI — Mill Industries photo 2 ELECTRICAL APPARATUS | APRIL 2024

26

Quality

BEARINGS

VIBRATION

DUTY CONSTRUCTION •100% QUALITY TEST •INSULATION WITH WIDE THERMAL CAPABILITY

INTER-LAMINATION MATERIAL •HIGH TORQUE OUTPUT

QUALITY CONSTRUCTION WWW.TOSHIBA.COM/TIC (US) 1-800-231-1412 EQP Global SD, 840, 841 Low Voltage Motors Performance and

•OVERSIZED

•LOW

•HEAVY

•C5-RATED

•HIGH

The Editor’s Comment

Coming next month in Electrical Apparatus:

EASA Convention venue preview; adjustable-speed drives in industrial systems; the economics of direct labor and inventory; UL’s “healthy building” designation

Read Electrical Apparatus online

The entire contents of this issue are available online. Scan the QR code below:

Energy in limbo

The highly impactful energy sector has never been more in uential. In some ways, it’s never been more lucrative. Its popularity and visibility have increased — energy is talked about more in the news than ever before due to climate implications and the surrounding debate.

However, despite progress being constantly touted in areas such as renewables, the world of energy could also be looked at as being at a standstill. Things appear to get done, such as progress on emissions reduction and decarbonization, only to witness oil and gas companies record one of their best years ever in 2023 in terms of production. Energy in 2023 appears to be in the midst of a game of tug-o-war.

In this issue, we’ll take a look at what that means for those of you on the ground, in terms of OEMs and repair services, HVACR companies, and anyone energy-adjacent. In particular, our cover story by EA Contributing Writer Bill O’Leary (“Ill blows the wind,” page 27) focuses on the advancements and pitfalls of the wind power industry, one of the methods at the forefront of the renewables movement. One expert, Douglas Hines, president and CEO of O shore Wind Power Systems of Texas LLC in Grapevine, Tex. — who describes his experience as having come on “both sides of the ght” — sums up the challenges this way: “There has been a great deal of in ghting between renewable communities and the oil and gas companies too, as each has staked their own rights in the marketplace. Technically you have the experience on the O&G side and the political and capital support with the renewable group, and they are still ghting.”

On the regulatory side of things, the jockeying continues, as nonpro ts begin to assert more force in their e orts to monitor emissions and detect corruption.

For example, in early March, a controversial satellite labeled “MethaneSAT” lifted o with intentions some consider righteous but many others are calling dubious. The satellite’s stated design mission is “to help protect the Earth’s climate by accelerating reductions of a powerful greenhouse pollutant, focusing rst on oil and gas operators, the world’s largest industrial source of methane emissions,” according to its developers. Yikes. Oil and gas operators have long been a target of climate activists’ ire, but never before have they had to consider an all-seeing eye in the sky watching everything they do with the intention of relaying it to the public. You can read all about it in “Eye in the sky,” page 42.

Electrical Apparatus

17 N. State St., Suite 435 Chicago, Illinois 60602-3598

(312)321-9440; fax (866) 228-7274

E-mail: EAMagazine@barks.com

www.barks.com

Founded 1948 as Volt/Age

Horace B. Barks, Founding Publisher

Elsie Dickson, Founding Publisher

STAFF

Elizabeth Van Ness, Publisher

Kevin N. Jones, Senior Editor

Richard L. Nailen, Engineering Editor

Charlie Barks, Managing Editor

Contributing Editors

William H. Wiersema

John Malinowski

Special Correspondents

Jane Powell Campbell

Christopher Wachter

Cartoonists

John D’Acunto

Tim Oliphant

ElectroMechanical Bench Reference

Supplement mailed with the December issue

Elizabeth Van Ness, Editor & Publisher

ADVERTISING

Barbara Wachter, Advertising Director

CIRCULATION

Circulation@barks.com

Electrical Apparatus (ISSN 0190-1370), Vol. 77, No. 4, is published monthly by Barks Publications, Inc., 17 N. State St., Chicago, Ill. 60602; (312) 321-9440; fax (866) 2287274. www.barks.com. Periodicals postage paid at Chicago, Ill., and at additional mailing o ces. Postmaster: Send address changes to Electrical Apparatus, c/o Barks Publications, Inc., 17 N. State St., Suite 435, Chicago, Ill. 60602. PM #40830553

U.S. subscriptions: 2 years—$100; 1 year— $60. Foreign airmail: 2 years—$250; 1 year—$140. Subscriptions also include an annual directory supplement, the ElectroMechanical Bench Reference. Single copies: $11 each plus postage; December issue, $30 with the supplement ElectroMechanical Bench Reference.

Copyright 2024 Barks Publications, Inc.

Reproduction of any part, by any means, including photocopy machines and computer networks, without the written permission of Barks Publications, Inc., is prohibited. Electrical Apparatus and ElectroMechanical Bench Reference are trademarks registered with the U.S. Patent O ce.

Or enter the URL directly:

https://bit.ly/ APR24WIND

See page 50 for links to upcoming issues that you can bookmark.

Copies of articles in print or PDF format may be ordered from our Marketing Department (312)321-9440. Prices available on request. Libraries and companies registered with Copyright Clearance Center, 222 Rosewood Dr., Danvers, Mass. 01923, should send 75¢ per page copied direct to CCC.

Material also available in microform and CD-ROM from Pro Quest information service, (800) 521-0600 ext. 2888 (US) or 01734-761-4700 (International); https://www. proquest.com/.

Printed in the U.S.A.

CHARLIE BARKS WWW.BARKS.COM CHARLIE@BARKS.COM

4 ELECTRICAL APPARATUS | APRIL 2024

D-flange

C-face

D-flange

Official website Certified Class I Division 2 IEEE841 Premium Efficiency TEFC 3Ph, AC Motors 1HP~900HP VFD Rated - NEMA MG1 Part 31 · · · · · Severe Duty and IEEE841 Motors ■ C-Face and Flange Mount Motors ■ Please contact here ■ +1-678-789-1885 LVmotor@heamerica.com HYUNDAI Always ready State of the Art Modern Manufacturing facilities · · Cutting Edge Design Engineering Explosion Proof Motors ■ IEC Metric Motors ■ Certified Class I Division 1

proof Premium Efficiency

3Ph, AC Motors 1HP~250HP VFD Rated - NEMA MG1 Part 31 · · · · · · Cast Iron Construction Certified Class I Division 2 Premium Efficiency

3Ph, AC Motors 1HP~250HP VFD Rated - NEMA MG1 Part 31 · · · · · Foot mounting

with Foot mounting

Explosion

TEFC

TEFC

C-face

with Foot mounting

without Foot mounting

without Foot mounting · · · HYUNDAI Always with you Large Inventory supplied by multiple warehouses · World Class Quality, Performance and Reliability ·

Speaking of . . .

Exro expands again

Calgary manufacturer Exro Technologies and California EV company SEA Electric, Inc., announced Feb. 16 that they have entered into an agreement providing for the acquisition of SEA by Exro.

This business combination is expected to strengthen Exro’s technology o erings while accelerating revenue growth and Exro’s path to pro tability. Following completion of the transaction, the combined company will continue to operate under the name Exro Technologies, Inc., and trade on the Toronto Stock Exchange (the “TSX”) under the ticker symbol EXRO.

“We are pleased to announce the merger between Exro and SEA Electric, which unites our complementary EV technology platforms and unlocks substantial opportunities for growth and a path to pro tability. Our merger with SEA not only creates signi cant revenue and cost synergies but positions Exro to amplify its growth with new partners while continuing to develop our existing relationships,” said Sue Ozdemir, CEO of Exro.

“Having come to know SEA and its management team from doing business with them over the past several

years,” Ozdemir went on to say, “I have great con dence that this acquisition will bolster our competitive positioning in the EV technology space while providing signi cant value potential for our shareholders.”

In related developments for the clean technology company, which hangs its hat on “new generation power electronics,” Exro also announced the closing of a previously announced private placement o ering of subscription receipts. Pursuant to the o ering, Exro issued a total of 31,600,000 subscription receipts at an o ering price of $0.95 per receipt for total gross proceeds of approximately $30 million.

Exro and SEA have both been featured in the pages of Electrical Apparatus multiple times over the past few years since their separate foundings in 2014. — Charlie Barks EA

The Exro Technologies U.S. headquarters in Mesa, Ariz.

The Exro Technologies U.S. headquarters in Mesa, Ariz.

6 ELECTRICAL APPARATUS | APRIL 2024

— Exro photo

Some e ciency motor claims di cult to verify

In dealing with commercial refrigeration equipment, we are always looking for chances to promote energy e ciency if it can be done cost-e ectively.

Now we’re seeing claims that premium motors in this equipment can be several times more e cient than ordinary motors. What does this really mean? How can savings be gured?

Phrases such as “twice as e cient” are meaningless.

Inasmuch as e ciency of these small commercial motors is typically below 50%, “twice” the e ciency ought to mean 100%, which of course is impossible.

We expect that what is meant is that losses in the newer design motor are half the losses of the other version. This may be possible, but it’s not what the claim says. And available test procedures make it di cult to verify.

Newer HVACR systems are using variablespeed compressors that can lead to energy savings of 30% or more over a xed speed system.

Additionally, Dept. of Energy regulations on HVACR motors have mandated higher system e ciencies over older machinery.

E ciency can go by many names

The terms nominal and minimum for motor e ciency are de ned by NEMA and are used in the Energy Policy Act. What has bothered me is the use of various other names for motor e ciency applied to ratings that the law and the standards don’t cover — for example, a 600 hp motor. Terms like “design e ciency” and “calculated e ciency” are sometimes used. How should we interpret these terms?

Motor manufacturers show a nominal efciency value for the motor based on rated horsepower and load at nameplate voltage and frequency as required by NEMA and the U.S. Dept. of Energy. NEMA de nes e ciency levels in MG 1, Part 12. Most three-phase motors today comply with Table 12-12 showing nominal e ciency values for Premium Eciency motors.

These are the same levels used by the Dept. of Energy as well as by regulatory agencies in Canada and Mexico. Imported motors also must comply with these levels. Table 12-10 shows the minimum e ciency for each eciency level. NEMA MG 1, “Standards for Motors and Generators,” is available as a free download at www.NEMA.org.

Motor Tester & Winding Analyzer

Electrom Instruments is proud to introduce the new iTIG IV Series motor tester and winding analyzer. Smaller, faster, and lighter than ever! Now with faster automatic testing and a lightweight construction, the iTIG IV offers accurate and reliable testing in a rugged and compact case. See

Should motor e ciency ever be above average?

In costing out motor purchases, we have a problem interpreting nominal e ciency. After calling for some tests to verify the claims of suppliers, we found that all the samples met the so-called minimum efciency, with every test ranging between that value and the nominal. But none exceeded the nominal. If nominal is an average, as the NEMA standard says, shouldn’t we expect some units to test above as well as below that value?

The NEMA standards o er no precise detail on how “nominal” is arrived at other than to call it an average applicable to a “large population” of motors. In theory, any average must fall between extremes both above and below. However, no industry standard de nes either of these extremes or the nature of the distribution.

Thus, no basis exists for saying that any percentage of all individual motors should test above the nominal value, or by how much. NEMA Table 12-10 identi es the standardized NEMA Nominal e ciencies for motors as well as the related guaranteed minimum e ciency. EA

Edited by the EA sta

Let’s Solve Your Problem

what makes the iTIG IV more portable

previous generation. Scan the

to

the

complete details. New miniaturized design!

| +1 720.491.3580 ELECTRICAL APPARATUS | APRIL 2024 7

than any

QR code

visit

iTIG IV Product Page for

www.electrominst.com

Associations

Associations point the way toward AI in rotating machine maintenance

We’ve heard a lot of talk over the past couple of years about artificial intelligence. Now, instead of just talking about it, a few associations are beginning to show how AI might be used in machine maintenance.

The significance of AI in electromechanical machine application and maintenance was laid out by Electrical Apparatus Service Association pump and vibration

specialist Gene Vogel in a presentation at the association’s annual convention in Las Vegas in 2019.

Working in conjunction with digitally enabled machine components, microprocessors running AI algorithms can enhance the effectiveness of various types of machine monitoring, such as preventive and predictive maintenance, condition monitoring, and reliability-centered maintenance, Vogel explained. These methods have existed for years. “Big Data” and “the Cloud” have enhanced these approaches to machine monitoring and maintenance, but the need for human judgment to evaluate conditions has not been eliminated.

There’s a widespread belief, Vogel said, that “sophisticated AI algorithms with machine learning could be turned loose on disparate data and correlations could be established.” At the time of his presentation, however, there was “little evidence that this Big Data strategy will produce accurate actionable information about machine condition.” AI might be used in narrow applications to produce such information, “but as a broad-based strategy, it is uncertain what the future may hold,” he said.

And yet, for some, this uncertainty may be good. “From a business perspective, IIoT-based machine condition monitoring is a wide-open field,” Vogel said, and the convergence of technologies “has created new opportunities.” The diverse technologies needed to make AI work in machine monitoring and maintenance already exist. They merely need to be brought together.

A couple of trade associations in the U.K. have recently turned their attention to helping member companies do just that.

This past January, Britain’s Association of Electrical and Mechanical Trades reported that it’s working with the British Standards Institute to develop an AI-powered tool to help electromechanical specialists repair hazardous-area motors to the correct standard. The two organizations have been working with Innovate UK, Britain’s national innovation agency, which plans to deliver the product through its Driving the Electric Revolution Challenge, probably during the second quarter of this year.

The tool, according to AEMT, “aims to vastly simplify interpreting and complying with these complex standards while reducing the potential for error.” It will enable engineers repairing rotating electrical equipment to clarify technical requirements through a chatbot-style interface. The tool will be based on the BS EN and IEC 60079 series of standards that cover the design, repair, overhaul, reclamation, installation, maintenance, inspection, testing, and marking of equipment intended for use in explosive atmospheres — what the British call “Ex equipment.”

EASA pump and vibration specialist Gene Vogel gives a presentation at the association’s annual convention last year in National Harbor, Md. Four years previously, at the convention in St. Louis, he had described the promise that artificial intelligence holds for rotating machine maintenance. EASA and other associations have since continued to offer guidance on how to make the promise of AI a reality.

EASA pump and vibration specialist Gene Vogel gives a presentation at the association’s annual convention last year in National Harbor, Md. Four years previously, at the convention in St. Louis, he had described the promise that artificial intelligence holds for rotating machine maintenance. EASA and other associations have since continued to offer guidance on how to make the promise of AI a reality.

Your Universal Servo Motor Test Station! NEW Developments in Technology, Training, and Support! Mitchell Electronics, Inc. Athens, OH 740-594-8532 sales@mitchell-electronics.com www.mitchell-electronics.com Manufacturer Support List Continues to Grow... Allen Bradley. B+R. Baumuller. Berger Lahr. Bosch/Rexroth/lndramat. Elau. Fanuc, Heidenhain, Kawasaki, Matsushita, MFE, Mitsubishi, Nachi, Sanyo Denki, Sick Stegmann, Siemens, Sumtak, Tamagawa, Yaskawa, and many more .. 8 ELECTRICAL APPARATUS | APRIL 2024

— Electrical Apparatus photo by Kevin Jones

Implementing these standards is challenging under the best of circumstances. “Navigating and interpreting this complex range of standards can be timeconsuming and open to error,” the AEMT notes. “In addition, these standards are reviewed and updated periodically; however, it can be a challenge to ensure the right standard is used in conjunction with the age of the equipment being repaired.”

Only the most recent editions of standards will be used by the new tool, because repair procedures improve over time. “For example,” the AEMT explains, “a go-no-go test, which helps to check for damaged threads, was introduced in the latest edition, 2019, but this is not referenced in the 2015 version of the same standard [IEC 60079-19].”

Another U.K. organization, the British Pump Manufacturers Association, has taken an equally pragmatic look at the use of arti cial intelligence in rotating electrical machine maintenance. In an article rst published in the association’s Flow magazine in 2022, Trenton Roncato Juraszek, an application engineer at motor and drive manufacturer WEG, explained how machine learning and arti cial intelligence can support better maintenance as well as overall equipment e ectiveness.

In response to an urgent need to reduce machine downtime, manufacturers that previously concentrated only on machine hardware, such as motors and starters, are moving into the development of software that can be used by the people who actually operate the machines, not just by IT professionals. According to Juraszek, 53% of all machinery downtime is caused by hidden internal faults that human engineers can’t see — a shortcoming that IIoT tools such as software and sensors can make up for.

If it DOESN’T include ’s

Red, White & Blue Seal CERTIFYING COMPLIANCE, YOU DON’T WANT IT!

Another perfect example: Procedural shortcuts with modern high-performance v-ring type commutators, like relying on compression to absolute minimum diameter, merely banking on a click of a torque wrench and/or listening (subjectively) for “ding” when striking with a hammer (to “determine tightness”) versus proven (OEM specified) testing procedures too often results in reliability/ longevity issues. ADDITIONAL TESTING procedures (required by most OEMs) FOLLOWING COMPLETION of multiple cycles of static seasoning (heating/compression/torquing/cooling /retorquing) processing PROVES STABILITY. Quantitative TESTING RESULTS ALWAYS BEATS Subjective Guessing!™ BACKED By SCIENCE! ™

Using software and sensors like ones made by WEG and other manufacturers, 3D vibrational analysis can be used to estimate the energy use and the load a motor is carrying. “Both historical and real-time data are gathered by the sensors and software and relayed to the plant’s supervisory control and data acquisition and manufacturing execution systems,” Juraszek writes. “Through AI and [machine learning], this data can be used to automatically adjust and optimize the performance of the motor.”

These may be baby steps, but they’re the steps the industry needs to take in order to see full implementation of articial intelligence. — Kevin Jones EA

Because IT MATTERS!

Circumventing typical OEM testing requirements might still enable inferior finished products to outwardly resemble any COMPLIANT modern high-performance v-ring type commutator to the untrained eye, but it’s a fact they’re NON-COMPLIANT due to lack of QUANTITATIVE TESTING RESULTS & therefore VASTLY MORE likely to experience expensive issues in the field. This is merely one of many perfect examples of the NEED to be ACTually CERTIFIED COMPLIANT! ™

Like ACT AKARD COMMUTATOR of TENNESSEE ACTion@commutator.expert • 1-800-889-ACTion! (2284) • FAX: 1.800.891. ACTion! WHEN YOU KNOW THE DIFFERENCE! TM See ACT’s latest video! Copyright © 1993 - 2024 ACT MANAGEMENT, Inc. Dba AKARD COMMUTATOR of TENNESSEE ( ACT ) ALL RIGHTS RESERVED

ELECTRICAL APPARATUS | APRIL 2024 9

The mid-year review

Understanding the benefits for both the underperformer and the overachiever

By Bill O’Leary, EA Contributing Writer

Ah, spring. Rejuvenation. Rebirth. Renewal. Flowers blooming and animals ascending from their gentle hibernation. Spring cleaning and allergy season. It’s a season of transformation.

Which is why spring also provides the idyllic setting for the mid-year review - the penultimate performance evaluation process to the year-end review. The midyear review is often viewed as the neglected sibling to its year-end brother, and many companies don’t even indulge in this particular structured, manager-led conversation. The reason for its paltry popularity makes sense, at least on its face.

Quite simply, the mid-year review isn’t directly tied to compensation, so there is less pressure to have a clear line drawn between ratings and monetary rewards. Budget planning, raises, and bonuses are the essential long-tail tasks from the year-end review. The other reason is psychological. The end of the year brings a specific weight and feeling of conclusion that begs for reflection.

More important than the end-of-year review?

But I’d hazard to say that the mid-year review is just as important, perhaps even more important than

the year-end review. Hear me out. The mid-year has optimal placement between goal-setting at the beginning of the year and final evaluation with all of its green-backed gifts at the end. It serves as a crucial checkin point with employees to reinforce goals. Which is much needed. According to a 2022 study from Betterworks, a Menlo Park, Calif.-based performance management software provider, 21% of employees said their goals are of the “set it and forget it” variety. They’re created and never looked at again.

A mid-year review as an immovable milestone reinforces your goals and sustains them across the year. Employees will be aware that they’ll be evaluated against these targets and ensure their contributions match the framework established by their managers. It’s easy for goals to get lost in the day-to-day shuffle if managers don’t hold themselves

Please turn to page 12

Feature | Electrical Manager — Illustration by denayunebgt/Shutterstock 10 ELECTRICAL APPARATUS | APRIL 2024

Bartlett Bearing’s on-the-shelf inventory is unsurpassed and consistently stocked with a wide variety of quality products. With 6 fully stocked locations, our competitive pricing and 24/7/365 availability mean we are dedicated to being your go-to bearing distributor no matter your locale. We are proud to be an Authorized Distributor for major manufacturers including SKF, JTEKT, NTN, SLF, The Schaeffler Group, Timken, and many more.

Our seasoned team provides unmatched customer service and same-day shipping for every customer, every time.

Experience excellence with Bartlett Bearing.

INDEPENDENT AUTHORIZED BEARING DISTRIBUTOR bartlettbearing.com | 800-523-3382 | sales@bartlettbearing.com

EXACTLY

YOUR ORDER,

WHEN YOU NEED IT

ON-THE-SHELF INVENTORY UNBEATABLE SERVICE

Tips for conducting a mid-year review

Having a mid-year review is half the battle. How you conduct yourself in this setting should have equal focus. A rushed, disorganized, or antagonistic mid-year can backfire in spectacular fashion. Mid-years can be incredibly effective when done well, and here are a few tips to get there:

> Clearly tie the content of the review to the company’s goals and any individual goals you and the employee had established at the beginning of the year.

> Provide the written review to the employee the day before the scheduled meeting as a pre-read document. This allows the employee to absorb your feedback and not have the meeting be a dry walkthrough of the text.

> Along with sending the review in advance, encourage employees to come to the conversation with any questions and also express that you are looking forward to the discussion. This should establish a positive vibe up front and dispel any fear or anxiety the employee might be feeling.

> In the meeting, if your company provides ratings, cover those first and provide thoughtful justification, because that is often what the employee zeros in on. You want your employee engaging in the discussion, not feeling antsy because you haven’t addressed the “elephant in the room.”

> Always start with the positive. It creates a collaborative and encouraging dialogue and can help set the tone for the rest of the meeting.

> Provide specific examples of success. Saying “you really took ownership of this project” is a nice sentiment, but adding “. . . by setting up weekly meetings with the procurement team and establishing targeted improvement metrics” adds clarity for the employee to emulate that success later on.

That specificity is even more important if you are providing critical feedback. Many employees become defensive when receiving a negative message. With specific details like dates, events, and behavior at the ready, you can provide a convincing case that eliminates any confusion and hopefully softens those rigid edges of anger.

> Take a breather! This is supposed to be a conversation and you’re providing the framework and the material but always pause to get reactions, comments, or feedback from the employee. The performance review can feel like an intimidating environment, but you can punch through the power dynamic by making the employee feel like their voice is being heard.

> Ask them if they disagree with anything in the review. Often, employees can accept the general message but disagree with the specific wording or tone. Also, there might have been feedback from other business partners that was incorrect or mischaracterized. If their defense is convincing and has substance, you can remove or alter pieces of the review.

> On the subject of business partners, include direct quotes from work colleagues that you’ve gathered when soliciting feedback. It adds color to the review, a personal touch that emphasizes the importance of collaboration and partnership. It also provides insight on how others perceive that employee. Also, they are often very positive and encouraging, which can help elevate team culture. My direct reports often enjoy these parts of the review the most and have expressed how they appreciate their inclusion.

> Ask what you can do better. In a sense this is also a mid-year review for you! A team member’s performance, positive or negative, can be a reflection of your leadership, and it’s important to acknowledge this interdependent relationship by turning the bright lights on yourself.

> Set a roadmap for the rest of the year. Be clear about how a high performer can sustain this level of success and encourage them to reach even higher with specific examples of what they can do. Conversely, for employees who need to improve, provide clear recommendations and communicate the need to see progress in certain areas by year’s end.

> End on a positive note by circling back on accomplishments and progress and thanking them for their time. — BOL

MID-YEAR REVIEWS continued from page 10

accountable for promoting their importance. Midyear reviews ensure that every employee gets that meaningful reminder of what their company values and what they want to accomplish in the remaining months.

If the company is undergoing change, the midyear performance review can help steer everyone in that new direction. “Having clear and consistent goals with rewards to support them provides unambiguous support for the desired change,” said Donald L. Anderson in his book Organization Development: The Process of Leading Organizational Change. “Documenting these goals and expected results in the performance helps organizational members to focus on the activities that matter most in the support of change.”

Mid-years can also help managers dodge the scary surprised reaction from employees at year’s end. A performance review filled with shock, confusion, anger, and invective is a failed one. Employees should never be caught off guard, and the mid-year establishes that pipeline of communication for managers to send ringing encouragement but also “hard” messages if necessary. If an employee is starting to veer from the path, by failing to meet the bar on the “what” of their work — i.e., general performance in accomplishing their tasks — or the “how,” their soft skills, attitude, and communication, this performance conversation can help set them on the right path with much time to spare.

The benefits of mid-year reviews

That goal and role clarity can have long-term benefits for you and your team. A study from the American Management Association conducted at Ford Motor Co. found 25% of managers and their bosses disagreeing on the definitions of the managers’ jobs. After specific goal-setting activities, that lack of agreement was reduced to approximately 5%.

With the mid-year serving as the “tough love” conversation, the year-end is often viewed as the celebration of a year of growth and improvement. Essentially, the mid-year makes the year-end easier. At year’s end you can revisit what was covered in the mid-year and trace those specific action items to the present, determining whether the employee “got the message” and made the necessary course corrections. There should be no confusion or defensiveness because you’ve clearly outlined the areas of improvement in the mid-year. If done well, the midyear is the climax of a worker’s story, and the yearend is the falling action and conclusion that fits with the established narrative.

And for those high-potential high performers, the mid-year is equally as important. Here, managers can provide the encouragement to sustain that el-

12 ELECTRICAL APPARATUS | APRIL 2024

elevated bar and even try to move it further. Many employees are galvanized by positive reinforcement, and the mid-year allows managers to make those top employees feel valued and supported. It provides that energy to continue delivering for the remainder of the year.

Managers can also use this meeting as an opportunity to structure development opportunities and discuss what other roles or responsibilities the employee might be interested in. Instead of waiting six long months to deliver this vote of con dence, you can use that time to set up stretch work and make connections across the business. And from that, the outputs of a successful mid-year make a whole lot of sense — improved morale, increased engagement, and higher retention to name a few. But how do you go about conducting a mid-year review? Some suggestions are listed in the accompanying sidebar.

Following up afterward

Use your daily, weekly, or monthly conversations with employees who have gone through a mid-year review to follow up and ensure that they’re continuing on the right track. Performance reviews should not be viewed as isolated events but larger, focused conversations that are built up over time. The days in between are just as important, because they provide the content for these conversations.

There is nothing middling about mid-year reviews. Managers should view them as a time to celebrate strong work and behaviors and address substandard work and negative attitudes. It’s a halftime speech to encourage your team, no matter if it’s a blowout or a close game. Mid-year and yearend reviews should be viewed like parts of the same game. And with that attention and guidance, as the coach you can lead everyone to positive results — the team wins but also each team member feels like a valued contributor. EA

GLOBAL SOURCING UL CERTIFIED TO SLIT 3M TAPES

MANUFACTURING

RES-I-LAM - NMN, DMD 180, NKN LAMINATES | RES-I-GLAS & POLYGLAS BANDING TAPE | RES-I-STRAINT EDGING

TAPE | RES-I-FLEX ARMOR TAPE | B-STAGE SURGE ROPE & FELT | RES-I-BAND BANDING FILM CONVERTING THERMAVOLT / TUFQUIN / CEQUIN INSULATING PAPERS | ELANTAS HT180 FILM | DIAMONDDOT& PRE-PREG PAPERS |ARAMID, POLYESTER,POLYIMIDE, POLYAMIDE,& PEEK PRODUCTS BYDUPONT, 3M, & ST. GOBAIN DISTRIBUTING LENNI, VARFLEX, 3M, KANEKA, IPG, IDP, ATKINS & PIERCE, KREMPEL, ISOVOLTA, HESGON, ST. GOBAIN, DUNBAR, DELFINGEN MANUFACTURING lCONVERTING l DISTRIBUTING THE RIGHT SOURCE, RIGHT ON TIME. SALES@PEIPITTSBURGH.COM ESPANOL@PEIPITTSBURGH.COM (412)462-6300 (EN) | (956) 554-3690 (ES) WWW.PEIPITTSBURGH.COM CALL US FOR A QUOTE TODAY. 800.462.4734 A mid-year review can help steer an employee toward better future productivity as well as evaluate the employee’s past performance. It can also help prevent unpleasant end-of-year surprises for both the employee and the employer. — Image by storyset on Freepik ELECTRICAL APPARATUS | APRIL 2024 13

Know Your Industry

Not your average institute

Edison Electric Institute

Founded: 1933

Headquarters: 701 Pennsylvania Ave. NW, Washington, D.C. 20004

Annual dues: dependent on membership type

Phone: (202) 508-5000

Website: www.eei.org

Electricity is such a natural part of modern homes, life, and work that it is easy to take it for granted or forget how dependent on it everyone is. Sometimes it takes a power outage to remember that electricity is needed for internet connections, most media consumption, and often cooking appliances. These functions are so much a part of everyday life that they are not thought about until you are roaming around the house looking for a ashlight during a thunderstorm. Luckily, before anyone believes they need to invest in messenger pigeons or a hamster on a wheel to power their home, the Edison Electric Institute (EEI) is here to support electricity providers.

Named after one of America’s most famous inventors and proponents of electric power generation, Thomas Edison, the EEI is a trade association consisting of all U.S. investor-led electric companies, 70 international electric organizations, and 250 associate members.

Calling a trade organization an “institute” might be con-

of an organization. As an institute, it o ers a level of sustainability, advocacy, and a crucial role in society, especially as electricity became a prominent power source. Its vision, according to EEI, is to contribute “to the long-term success of the electric power industry in its vital mission to provide electricity to foster economic progress and improve the quality of life.”

The Edison Electric Institute was established in 1933 to unite e orts to advocate for the electric power industry and encourage reliable and affordable energy. The Institute is smartly situated in Washington, D.C., which keeps it near the heart of decisive energy policy development. This advocacy work includes member involvement through committees and publications..

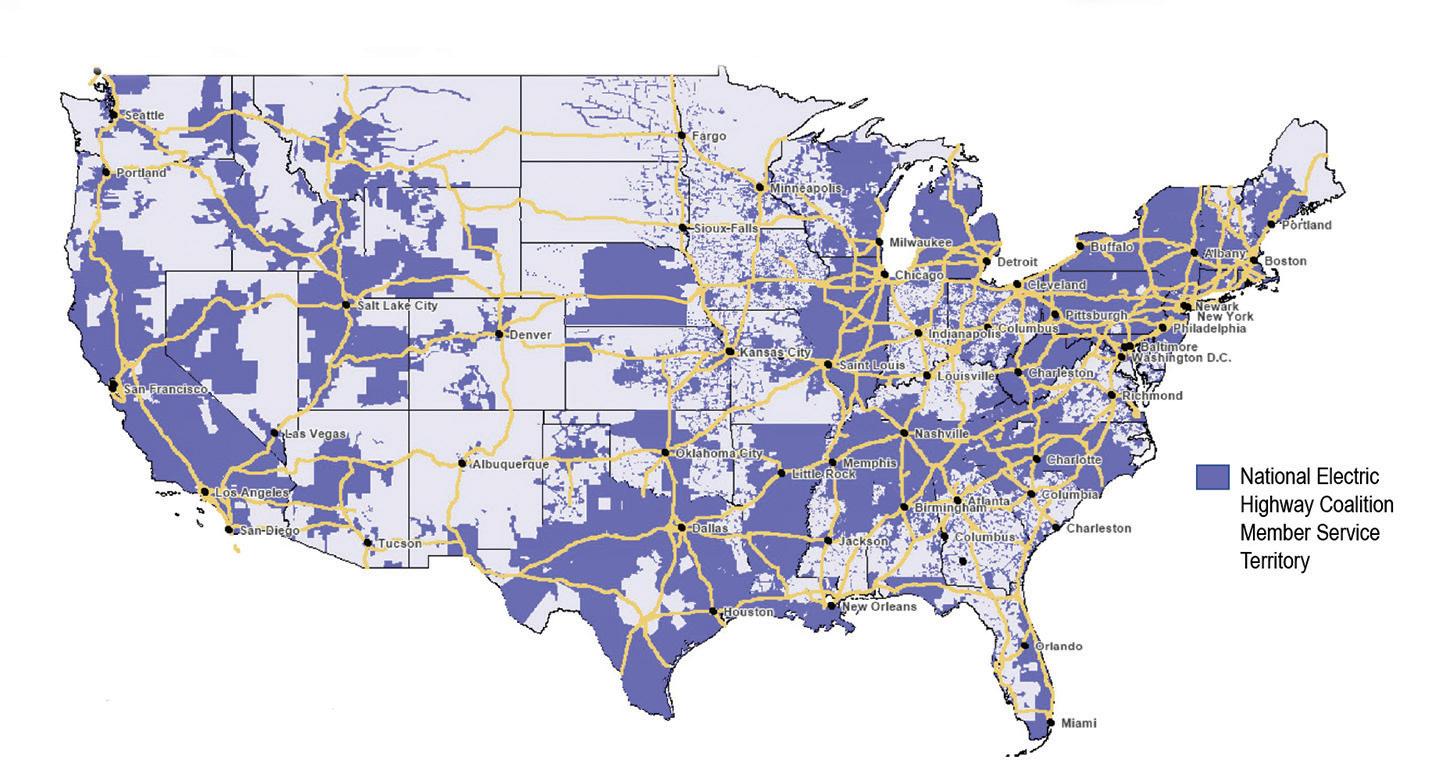

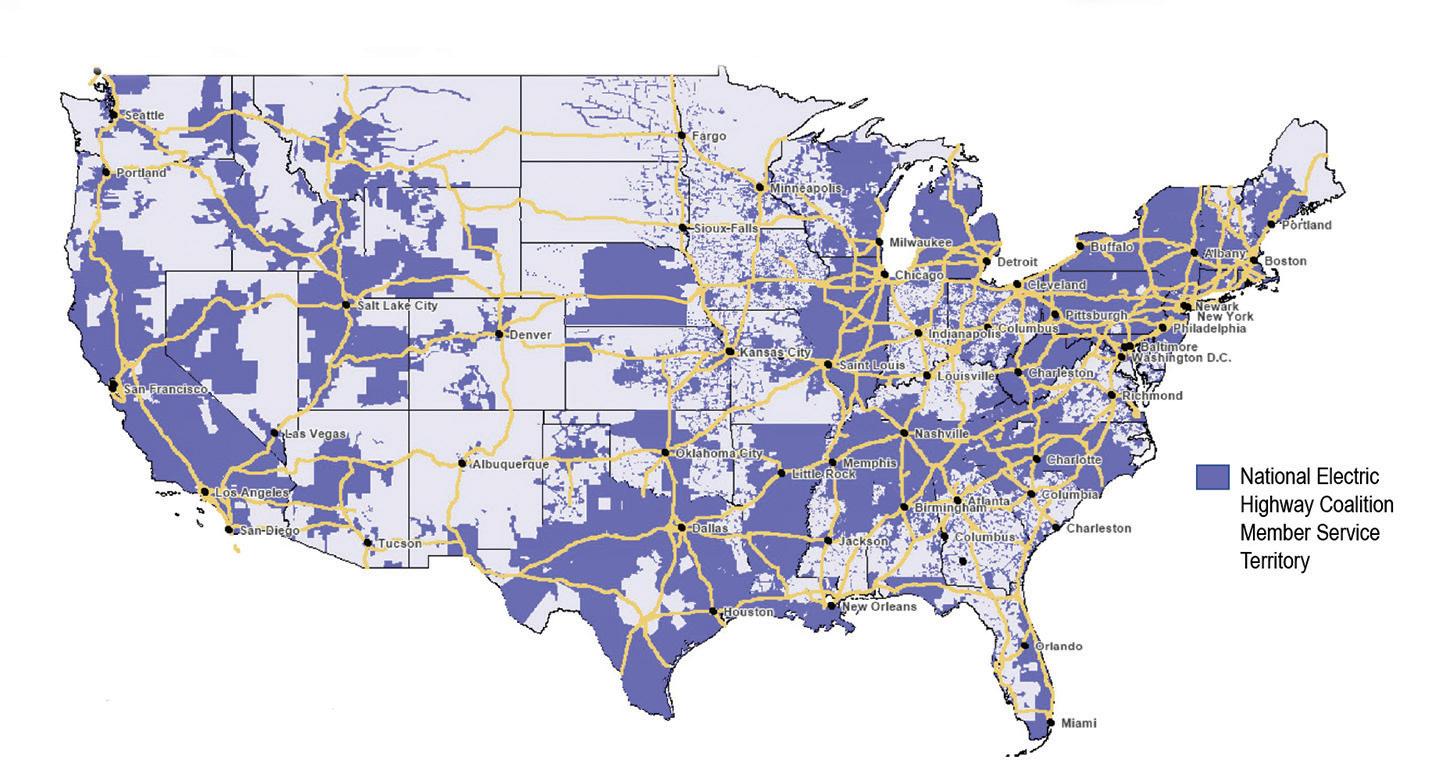

One such initiative was formed in December 2021 when EEI announced the formation of the National Electric Highway Coalition, which brought together the rst fourteen member companies joining forces to bring fastcharging electric vehicle charging stations to major roadways across the nation. The (now sixty) members of the coalition have invested more than $4 billion since its formation. The commitments of the coalition members ultimately link back to the EEI advocacy for clean energy, and according to an article in EEI’s Electric Perspective magazine, “continue to reduce their carbon emissions and invest in the clean transportation system of the future.”

In recent years, clean energy and climate action have been a focal point of the Institute’s policy engagement, but EEI hasn’t limited itself to meeting with state and federal legislators. EEI leaders and key member company representatives attended co-located events for COP28, the United Nations’ climate conference. Its delegation attended six events discussing electric transportation, energy storage, and reaching “net zero.” Clean energy is also a crucial topic for the annual EEI conference, which brings together electric industry leaders, government o cials, and innovative business guests for three days.

The EEI conference also hosts the Edison Awards, which date back before the formation of the Edison Electric Institute. The Edison Awards are given

14 ELECTRICAL APPARATUS | APRIL 2024

to electric companies that have demonstrated “distinguished leadership, innovation, and contributions to the advancement of the electric industry for the bene t of all,” according to an article in the May/June 2023 issue of EEI’s Electric Perspective magazine.

While the EEI website is home to member-exclusive bene ts like industry data and a resource center, one of its most interesting pages is available to anyone visiting the site. The a liate page “Get into Energy” provides information on careers in various energy sectors and starting on a new career path. It even features a quiz for those uncertain of what energy career would suit them. The page is run by the Center for Energy Workforce

Development, or CEWD, created for career changers, teachers, students, and military veterans. CEWD is a collaborative venture between EEI and nine other energy associations, including the International Brotherhood of Electrical Workers and the American Gas Association.

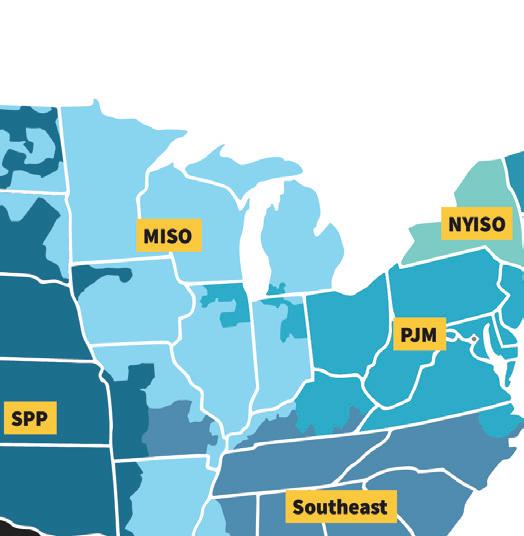

Another aspect of the EEI website that stands out is the rising energy costs section, which is aimed at consumers with an interactive map providing information on available energy bill assistance in each state. When a state is clicked, the various electricity providers in the state are listed at the bottom of the section. Each is linked to the providers’ web pages detailing energy bill assistance. It works as a helpful tool to consumers and a guide for members to see what each is o ering its customers.

So how does the EEI connect to Electrical Apparatus readers? Whether you repair motors or manufacture carbon brushes, the e orts of the Edison Electric Institute shape much of the country’s electricity policies and use. Much like its namesake, the Edison Electric Institute’s in uence on electric vehicles and energy access and costs is a big part of everyday activities. Now if only we didn’t forget to turn o the lights when the shop closes. — Kristine Weller EA

ELECTRICAL APPARATUS | APRIL 2024 15

—

This map from the National Electric Highway Coalition shows the network of roadways across the U.S. that are served by charging stations for electric vehicles.

EEI illustration

Calendar

Update your calendar with these upcoming trade shows, conferences, and other events.

• April 7-9, 2024 — EGSA Spring Conference, Hyatt Regency Miami, Miami, Fla. Electrical Generating Systems Association, https://egsa.org/Events/Future-Con ferences.

• April 7-10, 2024 — EERA 2024 Annual Meeting, Ritz-Carlton Laguna Niguel, Dana Point, Calif. Electrical Equipment Representatives Association, https://web. eera.org/events.

• April 15-17, 2024 — NECA Emerge 2024, MGM Grand, Las Vegas, Nev. National Electrical Contractors Association, www.necanet.org/events.

• April 19-20, 2024 — PEARL Annual Conference and Exhibition, Westin Denver Downtown, Denver, Colo. The Professional Electrical Apparatus Reconditioning League, https://pearl1.org/2024-confer ence.

• April 22-26, 2024 — Hannover Messe 2024, Hannover Fairgrounds, Hannover, Germany. Deutsche Messe AG, www.han novermesse.de/en.

• May 5-7, 2024 — Facility Fusion 2024, The Westin at Boston Seaport District, Boston, Mass. International Facility

Adjustable Motor Base keeps improving!

Our Adjustable Motor Base is continuously improving to be the most durable and longlasting motor base on the market. With the latest patent pending advancement, Overly Hautz motor bases now last 5 to 9.5 times longer than the competition. Decrease downtime and save money with extended motor base life cycles. Read the verified factory test report at: www.overlyhautz.com

Management Association, https://facility fusion.ifma.org.

• May 6-9, 2024 — CleanPower 2024, Minneapolis Convention Center, Minneapolis, Minn. American Clean Power Association, https://cleanpower.org/events/ cleanpower-2024-conference-exhibition.

• May 14-16, 2024 — CWIEME Berlin, Messe Berlin, Berlin, Germany. Coil Winding, Insulation & Electrical Manufacturing Exhibition, https://berlin.cwiemeevents. com/Home.

• May 21-23, 2024 — National Association of Electrical Distributors 2024 National Meeting, JW Marriott Austin, Austin, Tex. National Association of Electrical Distributors, www.naed.org/nationalmeeting.

• May 22-24, 2024 — Europump Annual Meeting, De Vere Beaumont Estate, Windsor, U.K. Europump and the British Pump Manufacturers Association, www.europump2024.com.

• June 22-24, 2024 — 2024 ASHRAE Annual Conference, JW Marriott Indianapolis, Indianapolis, Ind. American Society of Heating, Refrigerating and AirConditioning Engineers, www.ashrae.org/ conferences/2024-annual-conference-indi anapolis.

• June 23-26, 2024 — EASA Convention 2024, Caesars Forum and Harrah’s Casino Hotel, Las Vegas, Nev. Electrical Apparatus Service Association, https:// easa.com/convention.

• June 24, 2024 — Hydraulic Institute 2024 Technical Conference, Portland Marriott Downtown Waterfront, Portland, Ore. The Hydraulic Institute, www.pumps. org/event/2024-technical-meeting.

• August 7-9, 2024 — Safety 2024 Conference & Expo, Henry B. Gonzalez

Convention Center, Denver, Colo. American Society of Safety Professionals, https:// safety.assp.org.

• September 9-14, 2024 — IMTS 2024, McCormick Place, Chicago. International Manufacturing Technology Show, www. imts.com.

• September 15-17, 2024 — EGSA Fall Conference, Hyatt Regency Bellevue, Bellevue, Wash. Electrical Generating Systems Association, https://egsa.org/Events/ Future-Conferences.

• September 15-18, 2024 — Power 2024, Washington, D.C. [venue to be announced]. American Society of Mechanical Engineers, https://event.asme.org/power.

• September 19, 2024 — Golf Day 2024, Portal Golf & Spa Resort, Tarporley, Cheshire, U.K. British Pump Industry Association, www.bpma.org.uk/home.

• September 25-27, 2024 — AEE World Energy Conference & Expo, Music City Center, Nashville, Tenn. Association of Energy Engineers, https://aeeworld.org.

• October 7-10, 2024 — The Battery Show North America, Huntington Place, Detroit, Mich. The Battery Show, www.the batteryshow.com/en/home.html.

• October 15-17, 2024 — Fabtech 2024, Orange County Convention Center, Orlando, Fla. Fabtech Event Partners, www. fabtechexpo.com.

• November 12-14, 2024 — NEMA Annual Meeting, Kiawah Island, S.C. National Electrical Manufacturers Association, www.nema.org/about/events.

• January 22-24, 2025 — AHR Expo, Orange County Convention Center, Orlando, Fla. The Air-Conditioning, Heating, and Refrigeration Institute, www.ahrexpo. com. EA

Edited by Kevin Jones

What’s said to be the world’s largest international trade fair and conference dedicated to the coil winding and electrical manufacturing industry will return to Berlin, Germany, next month when CWIEME Berlin is held May 14-16. The annual event brings together manufacturers, suppliers, and industry professionals from all over the world; last year, more than 5,000 visitors from 88 countries came to see over 600 exhibitors. Once again, the popular Connect @ CWIEME will serve as a nexus through which potential buyers will be matched with sellers. — CWIEME photo

16 ELECTRICAL APPARATUS | APRIL 2024

“CONTINUALLY IMPROVING THE BEST MOTOR BASE” TM

TM

Codi- ·1 D ,.. , _ ic ... 1, ,,.., .. ::__ ------· ) .., , ;.co,� Ce- ·e�.r/ �) .Ji •. -=--- __J ---=-__J Founded in 1973, by Bob Ross, Jasper Electric has provided quality motor and rotor repair by being on the cutting edge of technology and using high-quality materials, such as Ml 9 electrical steel. Handling large and small motors alike, we are the future. We have almost every tool needed to repair or rebuild your rotor and stator. Most motors we repair will run as efficiently if not better than when they were new from factory. Our personnel allow us to work smoothly while giving our customers a peace of mind. JASPER ELECTRIC MOTORS INC. The Electro,Mechonlcol Authority & Armature Cores• Fiber Optic Laser Cutting• Large Machine Shop• Water Jet• Loose Lams Core Loss & 15' VPI , 300 KVA 20 HP to 10,000 HP • Computer printout sent with eidl .klb , Water stripping for fmn v.ound stators , Full rewindwith 15ftVPI available , 1 HP to 10,000 HP • Infrared hot spot check on each job • Quality core loss report with each job , Loop testing for 10,000 HP+ stator cores Motor Load Testing Laminations , Full 4-Hour load test available or until • Punch or laser cut temperature stabilizes • Pole pieces (laser cut) , Load test up to 1500 HP A(. 925 HP DC • Any size or thickness , Voltage test up to 7200 volts A(, 600 volts DC •Emergency pick-ups , Run test as long as necessary, 7500 HP , Emergency deliveries , Government and utility approved , Segment or whole • Synchronous motor testing • Estimate over the phone , Computer print-out with efficiency rating I TWO SERVICE LOCATIONS! Box 1494 • 175 Curry Hwy•Jasper AL 35502 205-384-6071 • Fax 205-384-6073 jemi@bellsouth.net 0 22673 Hand Rd • Harlingen • Texas 78552 /-, 1 956-421-2446 • Fax956-421-3616 �m/ info@newcoreinc.com , R.D.T. Available • On-site quotes and repairs • Stacked in your housing, spider/shaft or shipped loose New Rotors • All copper alloys to match conductivity , Normal turnaround 15-24 Days • In house aluminum and copper extrusion , R.O.T. Available NEW CORE INC. newcoreinc.com G FACEBDDK.CDM/ NEICDREINC Gt IN STAG RAM.COM/ NEICDREINC Majority woman-owned busines

Going beyond EVs

In light of the shortcomings of electric vehicles, alternative fuel sources are being considered

By Maura Keller, EA Contributing Writer

In recent years, advancements in alternative fuels and technologies, including EV and hydrogen fuel cell technologies, have taken the transportation industry by storm. With ongoing efforts, commercial fleets and individual consumers are vetting these alternative fuels and technologies and determining their use and viability for transportation. And as vehicle manufacturers make statements concerning how soon they will be eliminating internal combustion engine (ICE) technology and embracing these alternative energy options, what the future of the alternative energy vehicle industry will look like is anyone’s guess.

Faced with high-energy costs, environmental concerns by consumers, and government regulatory measures, the world’s leading automakers are embracing new technological advancements to make today’s vehicles more fuel-efficient and environmentally friendly than ever before. One alternative vehicle technology, electric vehicles, is making inroads in the minds of consumers who are eager to “go green” and leave a smaller carbon footprint. But are EVs truly the way of the future or are other alternative energy sources going to emerge as the key method by which vehicles operate?

In the West, EVs not a priority

that many of the Western EVs are being placed on the backburner.

“GM last year invested nearly $4 billion for ICE vehicles despite previously pledging to ‘go all in’ on EVs, whereas BMW, Toyota, and other manufacturers have switched over to hydrogenbased cars. And Tesla, despite slashing prices, has been radically underperforming on the market for the past year. So, while the number of EVs produced has risen, the expectations for the percentage as well as absolute numbers of Western-made EVs and even EVs in general have not been met,” Tsukerman said.

The U.S. continues to experience a very slow rise in EVs due to the fact that most people in the country simply do not have the charging equipment that could meet the demand. Rental companies like Hertz are increasingly burdened with EVs that are seen as a liability for long-distance travel.

Irina Tsukerman, business and geopolitical analyst, president of Scarab Rising, Inc., a media and security strategic advisory, and program vice chair of the American Bar Association’s Oil and Gas Committee, said

“On the other hand, the rise of EV vehicles in government fleets like buses is linked to specific subsidies and other policies encouraging reliance on EVs,” Tsukerman said. Moreover, technical issues in places like New York City have caused significant security concerns. These issues included 13 deaths by fires from the EVs in the first seven months of 2023 in New York City alone, aside from injuries, as well as two recalls and production-related strikes, which have likewise caused delays.

“Electric vehicles are facing multiple setbacks in the early weeks of 2024, including slowed demand and unreliable charging networks,” Tsukerman said. “On the other hand, developing economies and booming states like India find manufacturing relatively cheaper EVs (with raw materials easy to access), an easy source of quick income.”

Feature | Electric Avenue

Rental car companies like Hertz are at the forefront of implementing EVs, but they’re starting to feel the weight of the associated costs and drawbacks, such as charging infrastructure and range concerns.

— Hertz photo

18 ELECTRICAL APPARATUS | APRIL 2024

Irina Tsukerman

EVs versus other options

Tsukerman says that hydrogen-based cars and EVs with alternate batteries such as the sodium-ion batteries currently breaking into Japanese manufacturing are the future of “going green,” despite cost-related barriers to R&D at the moment.

“And a return to the hybrid model, which combines the best features of EVs and ICE vehicles without the expense and the raw material limitations, may be forthcoming,” Tsukerman said. In terms of the immediate benefits of EVs, these include smaller carbon footprint, lower operating costs (excluding the costs of dealing with fires and weatherrelated issues), lower maintenance needs and costs, high performance/energy efficiency, convenience of charging at home (which explains the popularity of EVs among short-distance Uber drivers and other car-sharing drivers), and EV-only parking spots. The cons include EV charging station shortages and general inefficiency, the limitations on driving range at full charge, higher initial purchase cost, high battery replacement costs, low endurance at low temperatures, and the propensity towards fire hazards.

mass expansion of EV use can contribute to blackouts like the ones becoming more frequent in California, and electric grids, if not managed properly, are an easy target for cyber-attacks. Moreover, the process of electrification is not necessarily any more environmentally friendly than natural gas, which is considered a ‘clean’ energy option in Europe.”

Skepticism about EVs

John Berman is founder and chief investment officer of Berman Capital Group, an investment management company that employs multiple strategies focused on global opportunities in traditional energy, renewable energy, minerals, infrastructure, and carbon credits.

Tsukerman further stressed that EVs are arguably a potential future contributor to an energy crisis. This is due to the reliance on expensive raw materials that are difficult to procure and which the U.S. and other Western countries are not likely to be able to manufacture independently in sufficient quantities and break through the market due to assorted geopolitical and commercial limitations.

“The process of electrification is costly, inefficient, linked to assorted secondary concerns, and is a huge strain on power grids,” Tsukerman said. “Without investing into building up relevant infrastructure,

Berman said EVs are not better for the environment than ICE vehicles; the pollution is just outsourced to other parts of the world.

“All the additional mining required to get the battery metals requires diesel-powered mining equipment, and the mining is often done by Chinese companies in places like the Congo, not known for their rigorous environmental standards,” Berman said. “Additionally, most EVs are charged by electricity that was generated from the burning of coal or natural gas, so they are not nearly as ‘green’ as the marketing material would lead one to believe. If we build out our grid with cleaner energy sources like nuclear for base load power generation, then EVs will become the ‘greenest’ option, but I think that is a story that will be told in decades, not years.”

However, as Phil Dunne, U.K. managing director at the global strategy consulting firm Stax, explained, the general population is still wary of EVs, with concerns around range, charging infrastructure, second-hand values, etc.

“Huge improvements are going to come over the next five years as new battery technologies evolve. Lithium-ion batteries are the current standard, but there are already a number of different technologies, including lithium iron phosphate and lithium nickel manganese cobalt, which each refer to different materials used in the cathodes and anodes

THE WIDEST PRODUCT PORTFOLIO FOR THE ELECTRICAL INSULATION INDUSTRY We Enable Energy POTTING COMPOUNDS RESINS & VARNISHES FLEXIBLE LAMINATES MICA TAPES CORONA PROTECTION TAPES COATED PRODUCTS COMPOSITES CONTACT US sales.us@vonroll.com

Please turn to next page ELECTRICAL APPARATUS | APRIL 2024 19

John Berman

linked by a liquid electrolyte,” Dunne said. Changing the chemistry using different cathode and anode materials operating within a liquid electrolyte can change the efficiency impact.

Dunne said the next big improvement will come with solid-state batteries that replace the liquid electrolyte with a solid. The emergence of production-ready solid-state batteries is currently being developed by Toyota and Volkswagen for anticipated scale production by 2027.

“We are also going to see huge changes in charging infrastructure and recycling EV batteries through secondary use as stationary storage units to recovery of the constituent materials for reuse in next-generation batteries,” Dunne said.

The long-term promise of hydrogen

So what role is hydrogen expected to play in the future of vehicle development? As Tsukerman explained, hydrogen cars, if the development cost barrier is overcome, seem more promising in terms of suffering from fewer of these shortcomings – being less dependent on raw materials, having longer driving range, better function at low temperatures, and better safety. “The charging issue is also less likely to be a burden as are overall costs to consumers,” she said.

However, due to the impact of lobbying, the U.S. has almost completely oriented its markets towards electrification in absolute numbers despite recent government efforts to push for hydrocarbons.

“Hydrogen will take a long time due to costs of R&D and the fact that there are only five leading countries, and none have invested sufficiently to make hydrogen into an immediately available reality,” Tsukerman said. Countries like Morocco need huge amounts of direct investments to develop the infrastructure for hydrocarbon manufacturing. And while Saudi Arabia has the means to push this issue heavily, it lacks the know-how to move hydrocarbons to the forefront of R&D in the foreseeable future. Tsukerman added that this means hydrogen leaders will need to work closely together and coordinate their efforts to turn hydrogen into reality.

“Japan is leading on the hydrogen-based vehicular breakthroughs but lacks the lobbying clout to sell the product and to attract sufficient investments that would make ROI worthwhile in the short term,” Tsukerman said. “Moreover, it is heavily reliant on imports of hydrocarbons for its R&D, and those are expensive due to the lack of overall global investments.”

However, at least as it relates to ground transportation, Berman believes EVs are here to stay.

One case for hydrogen that he sees is using it for aircraft, as lithium-ion batteries are too heavy to supply all the energy an airplane needs for a flight, but he thinks that reality is also decades away before that becomes the industry norm.

“I think in the near term (next 10 years), hybrid vehicles will gain more traction, especially in commercial vehicles (freight trucks, mining equipment, etc.), as current battery technology can’t provide the range that these kinds of trucks need,” Berman said.

Overall, Berman does not think that there are other viable options as far as decarbonization is concerned (other than more fuel-efficient ICE vehicles), but we are seeing that EVs currently still have real limitations that make it hard to compete with ICE vehicles.

“Hydrogen fuel cell-powered cars have not really been able to compete with EVs because of the hydrogen infrastructure that would be required, which is much more complicated (transportation of compressed hydrogen) than the charging infrastructure required of EVs,” Berman said. “In the long term, nuclear is the only viable low-emissions power source; the public perception of nuclear has been badly damaged but it really is an extremely safe technology.”

Public perception of nuclear seems to be coming around a bit, but only time will tell. As Berman explained, other than hydroelectric, nuclear is the only technology that can produce emissions-free base load power generation.

“The energy transition is going to take decades longer than many people want to believe. In the meantime, there should be additional investment in natural gas to replace coal-powered plants,” Berman said. “While natural gas does produce emissions, it produces far less than thermal coal, and natural gas is the least bad option. There are a lot of limitations to renewable energy (limited battery storage capacity, and intermittency), which may be solved with time, but the perfect is the enemy of the good in the effort to decarbonize.” EA

Phil Dunne

BEYOND EVs continued from previous page 20 ELECTRICAL APPARATUS | APRIL 2024

A fuel-cell hydrogen-powered bus operating in London. Hydrogen-powered vehicles are more feasible in fleets and situations that involve tax credits. — Energy Hydrogen Alliance photo

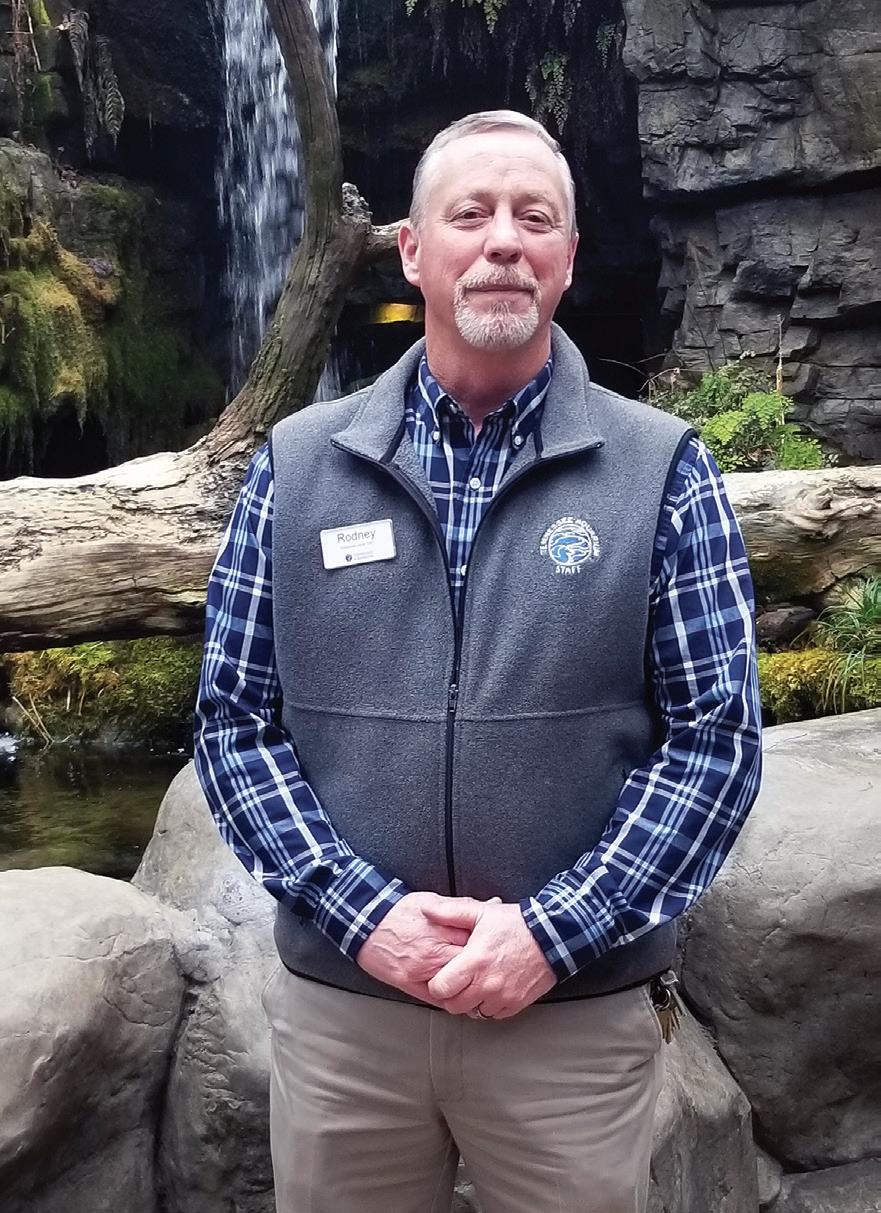

The hand of providence

For Rodney Fuller, good things have a way of following hard work

By Colin Gregory-Moores, EA Contributing Writer

Rodney Fuller has lived and worked most of his life in southern Tennessee. His parents were part of that Greatest Generation and closer in age to that of his friends’ grandparents. He describes them as being very responsible, fairly conservative, and hardworking.

“I don’t know if it was just from growing up in that era, but you never heard them complain. Didn’t matter how hard things got, they kept on going.” Rodney says in a southern voice reverberating with warmth. His father was a Baptist preacher, who ministered and whose faith guided him through life. It was kind of a natural progression that Rodney would follow in his father’s footsteps as an electrician, just like his older brother some sixteen years before him, and just like his youngest son would do.

“My Dad was always doing work on the side to help people, not even getting paid. . . . I was the one who crawled under the house pulling wires and sticking them through the hole,” he infectiously laughs. Rodney’s father set him an example in everything he did, just like Rodney would do later for his two sons. “He was a very gifted craftsman; he

could do anything. So just being around him growing up, I picked up a lot of his skills. I’m a lot like him.”

Lessons in responsibility

Rodney nished Sequoyah Vocational School in 1979 and Soddy Daisy High School in 1980 before enrolling at the IBEW/NECA Joint Apprenticeship Training Center – Local 175 Chattanooga, where he graduated in 1985. At 16, he got his driver’s license and an evening job at an Ace Hardware store. The money he earned went towards his car. “My dad taught me early on that when I got my car, I’d have to pay half on the purchase, and all of the cost for gas, upkeep, and insurance. It didn’t move if I didn’t.”

As an apprentice, Rodney worked 40 hours per week with an electrical contractor, while two nights a week he attended school for three hours. When he

Feature | EA Reader Profile 22 ELECTRICAL APPARATUS | APRIL 2024 ♦ Build relationships with leading manufacturers and suppliers of electric motors, predictive and preventative maintenance equipment, bearings, pumps and pump supplies and more during the EASA 2024 Solutions Expo. ♦ Get in tune with expert-led training on topics ranging from technical skills to sales management and marketing. ♦ Solidify and develop relationships with electromechanical professionals from around the world! ATTEND THE HIGHLIGHT EVENT OF THE YEAR FOR ROTATING EQUIPMENT! SOLUTIONS EXPO ♦ JUNE 24-26 CONVENTION ♦ JUNE 23-26 Caesars Forum & Harrah’s Las Vegas Register today at easa.com/convention! 1331 Baur Blvd. • St. Louis, MO 63132 USA +1 314 993 2220 • easainfo@easa.com •easa.com easa.com/convention

graduated, there was no work to be had in Chattanooga. At the age of 23, he went down to Augusta, Ga., showed them his union ticket with his electrician license, and his journeyman inside wireman classi cation, and they referred him to the Vogle Nuclear Plant in Waynesboro.

In 1981, when he was 19, Rodney married his sweetheart Kelly, and together they built their rst home. They did all the inside work, from the insulating to the electrical work and drying the walls. Rodney even got a plumber to show him how to solder pipes so that he could do the plumbing too.

“It took about nine months before we could move in, but it was ours. It was a little 1,000-square-foot home. We lived there for 16 years.” Towards the end of nishing the house, they ran out of money for the septic tank and had to sell his wife’s car to pay for it. In 1985, just before they went down to Waynesboro, where they rented property, their rst son was born.

“We had the little one with us. The whole bit,” Rodney proudly smiles. Just like Rodney’s parents, he and his wife were making their own conditions and taking responsibility for their actions.

Rodney’s path from 1985 to 1991 took him from nuclear and fossil plants to working for an electrical contractor, where he was soon running jobs from the ground up by himself. He enthusiastically recalls doing the electrical controls for a water plant, high-voltage work for the local hospital, as well as lots of other commercial and industrial wiring construction and trouble-shooting projects. Rodney abounded in work.

“The more of these projects that I did, the more I just got better at them. My goal was to never have the architect or electrical engineer looking over my work nd things that were not quite nished.”

Besides being a perfectionist, Rodney is a universalist. He always wants to know the whole kit and caboodle. “I loved to observe the other trades. I’d always corner somebody and say, ‘Hey, show me how

Please turn to next page

WORLD. LEADING. INDUSTRYSHOW. HANNOVER MESSE 2024 ENERGIZINGA SUSTAINABLE INDUSTRY Products and solutions at #HM24 22–26 April 2024 Hannover, Germany hannovermesse.com

ELECTRICAL APPARATUS | APRIL 2024 23

Rodney Fuller in the River Journey Aquarium Appalachian Cove Forest Exhibit. — Tennessee Aquarium photo

to do that.’ And I just kind of self-taught myself.”

As an electrician doing a lot of control work, Rodney was also curious about the processes and the sequence of events behind the controls. All this know-how would serve him well at the Tennessee Aquarium in Chattanooga. “An aquarium is a lot of things in just one building,” he says.

Life at the new aquarium

The year 1990 finds Rodney working on the installation of the building automation, and aquatic life support control systems for the new Aquarium that was being built. When he got there, the builders were already pouring the third floor of the building.

“I had this superintendent who was just riding my case pretty hard.” One day, he came by and started hollering at Rodney, “Where are the controls?” Rodney showed him all the wire that was waiting for devices to be delivered. From that point on, they got along so well that the superintendent later went to the Aquarium officials: “When you get ready to hire somebody to take care of this place, you need to go and see that young man.” Since he had a family, Rodney had been hoping that he’d find permanent work in town. His prayers were answered.

Starting there as construction and maintenance manager and having been awarded numerous promotions, Rodney has been director of facilities and safety since 2017. During his time at the Aquarium, he has been given the task of overseeing construction projects, assembling a maintenance team for the complex, and handling installations; he has been

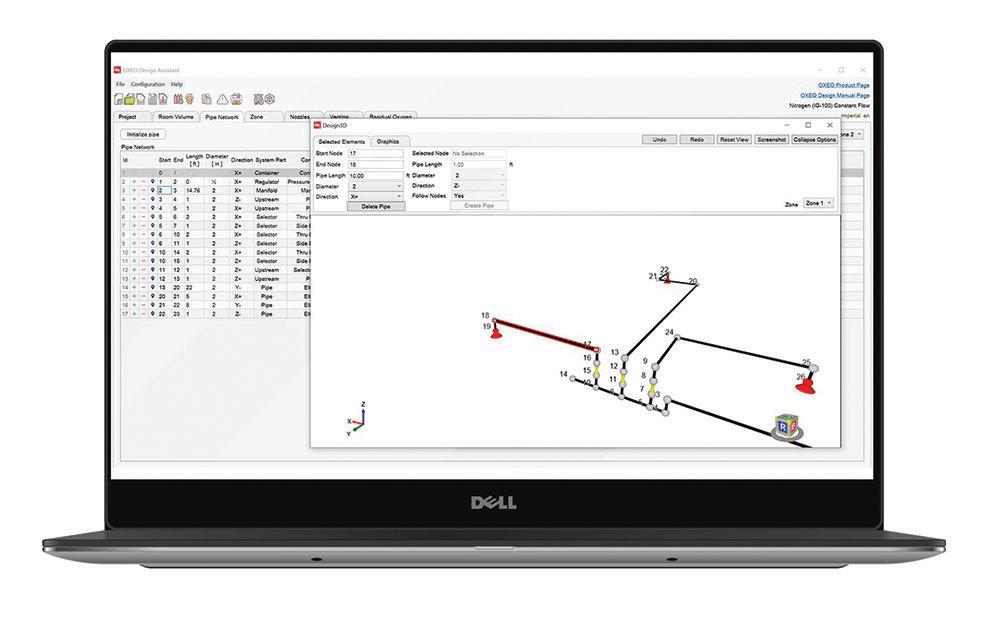

involved in various large capital projects (the Aquarium buildings now cover an area of 317,497 square feet), has introduced a computerized maintenance management system, and has developed organizationwide health and safety regulations and procedures that helped to reduce the facility’s EMR to an astounding 0.64.

One recent project, he recalls, was the replacement in 2020 of the thirty-year-old standby diesel engine situated between two large glass peaks on the sixth floor of the Aquarium with a CAT D350 GC (60 Hz) generator. The crane company belongs to Rodney’s old Ace Hardware buddy of 44 years ago. “I always have a back story,” Rodney laughs. “It’s almost spooky.”

Reflecting on his good fortune

After some 32 years, he still immensely loves his work, mostly due to the people: “They are really what make this organization the success that it has become. I am so blessed to work and have worked with such talented people who enjoy what they do.” Rodney subscribes to Electrical Apparatus magazine and passes it around to his electricians to read. “All things that are covered in the magazine, we’ve got them. The articles are very informative.”

Whether walking through the echoing halls of the Aquarium after closing or trekking on nature trails, Rodney never ceases to wonder at the fair raiment of nature. There is the sea, vast and spacious, teeming with creatures beyond number, and there are the mountains and forests where he loves to spend his time with Kelly, his wife of 42 years, their six grandchildren and dog Marley.

Rodney is fortunate that he and Kelly, their two sons and families live in the same community and get to enjoy a lot of time with each other. “And to top it off, we are able to attend church together as well,” he adds. Like his father, Rodney has always worked hard for his family, his coworkers, and his community. He feels blessed to have the life he leads and the talents to serve others. You might say that the hand of providence watches over him.

EA EA READER PROFILE continued from previous page 24 ELECTRICAL APPARATUS | APRIL 2024

The Aquarium’s River Journey basement pump room houses equipment to manage water circulation, filtration, aeration, and specialized tasks. — Tennessee Aquarium photo

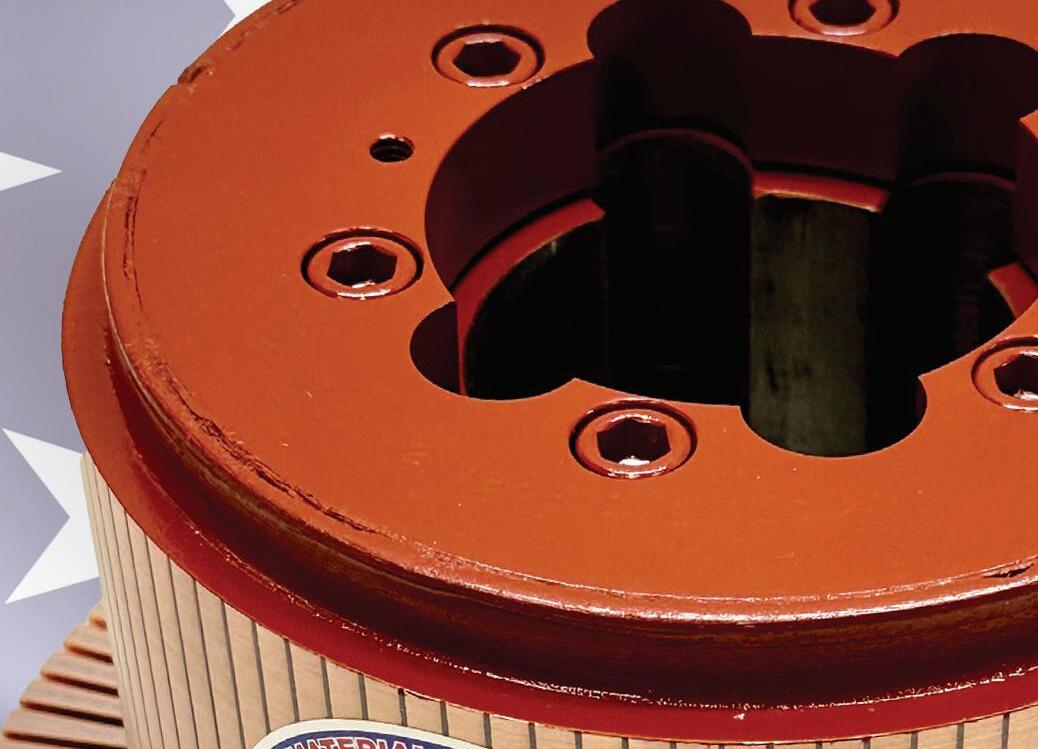

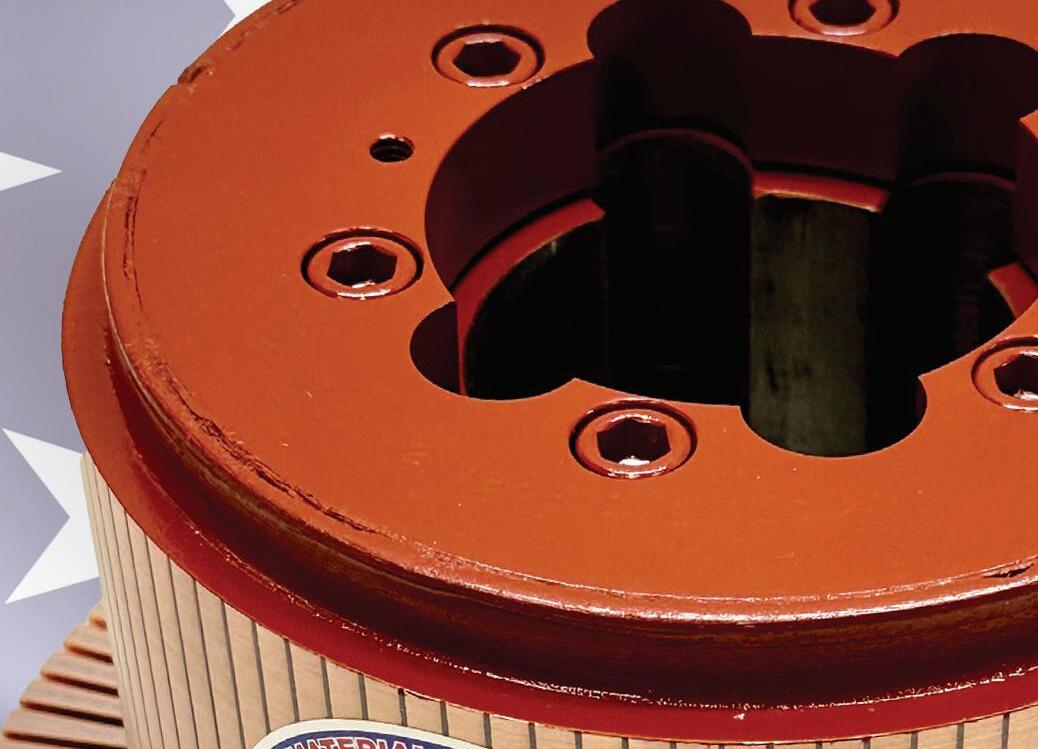

Precision Coil and Rotor buys an Oklahoma City coil company

Precision Coil and Rotor of Birmingham, Ala., a division of Jay Industrial Repair, has purchased Industrial Coil, Inc., of Oklahoma City, a family-owned and -operated electric coil wholesaler that manufactures electric motor, stator, generator, d-c field, armature, and rotor coils. The company also offers coil customization and special wrapping and turn taping. Industrial Coil was founded in 1982 by Paul Kemp, Doug Kemp, and Ron Pittman.

Joel McMahon, owner and CEO of Jay Industrial Repair and Precision Coil and Rotor, said the acquisition will help sustain Precision’s growth and will aid in serving partners in the western U.S. “more effectively and efficiently.” The acquisition will also further Precision Coil’s objective “to safely provide customers with the highest quality of products and services on time while continually improving processes is aligned with their mission.”

Precision Coil and Rotor manufactures electric motor, stator, generator, d-c field, armature, and rotor coils using “the latest equipment and techniques to manufacture our products,” the company says. Precision Coil and Rotor’s specialty is manufacturing and rebuilding of component products for rotating electric machines up to 13.8 kV.

Siemens buys a machine vision software maker

German electrical and electronics manufacturing giant Siemens recently upped its automation game by acquiring Inspekto, an AI-enabled machine vision software company headquartered in Heilbronn, Germany. The products manufactured by Inspekto enable manufacturers to automate visual inspection without vision experts and intensive production data.

Inspekto will become part of Siemens’ Digital Industries Factory Automation unit, with headquarters in Nuremberg, Germany. Siemens calls Inspekto’s innovative AI technology “a valuable addition to the Siemens industrial AI software portfolio.” The stock of Inspekto is to continue being traded independently of that of Siemens.

Inspekto’s flagship product, the S70, is described by its manufacturer as “a fully equipped out-of-the-box industrial visual inspection product with unprecedented simplicity and immediacy that can be operationally deployed in less than a day.” The S70 can be used in a variety of applications, such as connector verification, robotic inspection of electronic components, verification of oil pump pin integrity, PCB soldering, electrical wiring, and piston coating. The company also markets a mobile version of the system, along with various inspection services.

Siemens is no stranger to the use of Inspekto’s products. In a 2022 interview, Siemens test engineer Lukas Hoffmann described his use of the S70 inspection system at a plant in Karlsruhe, Germany. Using the system, he said, “it was very easy to set up the inspection task in order to detect all components which needed to be

checked, even the SIM-Tray detection. It was even possible to check for label damage.”

ABB acquires asset management provider

Swiss electrical and electronics manufacturer ABB announced in February that it has entered into an agreement to acquire SEAM Group, a provider of energized asset management and advisory services across the industrial and commercial building markets. SEAM Group is the result of a 2018 merger between Lewellyn Technology, an electrical training company founded in 1993, and Predictive Service, an infrared services company founded in 2002. The business’s U.S. operations are based in Beachwood, Ohio, and Indianapolis.

ABB’s acquisition of the SEAM Group is expected to complement ABB’s electrification services by bringing additional expertise to customers in the areas of predictive, preventive, and corrective maintenance, as well as electrical safety, renewables, and asset management. The transaction is subject to regulatory approvals and expected to close during the third quarter of this year.

SEAM Group has nearly 250 employees and supports more than a million energized assets for more than 800 clients in all 50 U.S. states as well as in the rest of the Americas and in Europe, Africa, the Middle East, and Asia. SEAM Group has a presence at about 3,000 customer sites and a foothold in such segments as commercial buildings, data centers, healthcare, manufacturing, and renewable energy.

Regional service provider buys North Carolina shop

Motion & Control Enterprises of Zelienople, Pa., a distributor and service provider with 47 facilities in 15 U.S. states throughout the Midwest, Northeast, and South, has acquired Piedmont Electric Motor Repair, Inc., of Asheboro, N.C., a provider of industrial products and services including electric motors, cranes, material handling, fabrication, welding, and machinery services.

Piedmont will continue operating as Piedmont Electric Motor Repair under the leadership of current vice president Scott Saunders.

Motion & Control Enterprises chairman and CEO Charles Hale said that “maintenance and repair capabilities are critically important for today’s customers and are consistent with our strategy of being a full-lifecycle provider of highly engineered products and services.” Piedmont Electric Motor Repair, he said, is highly regarded as a provider of electric motor and crane repair services.

Motion & Control Enterprises is a portfolio company of Frontenac, a Chicago-based private equity firm that invests in lower middle-market buyout transactions in the consumer, industrial, and services industries.

— Kevin Jones EA

Business

ELECTRICAL APPARATUS | APRIL 2024 25

Industrial Coil, Inc., of Oklahoma City, an electric coil wholesaler and manufacturer, was recently bought by Precision Coil and Rotor of Birmingham, Ala. — Precision Coil and Rotor photo

Hear the wind blow

Technical writing that’s verbose serves neither the author nor the reader well

By Richard L. Nailen, EA Engineering Editor

We’ve commented before about the windy prose in so much technical writing. But a few needless words cut from a sentence here or there are only a beginning. What happens if the same treatment is applied to larger sections of text?

Here’s one example. First the original, from a passage about motor lubrication: