July/August 2023 | Issue

July/August 2023 | Issue

It is ironic that the same week that the IMO requested seafarers’ feedback on the effectiveness of the International Safety Management (ISM) Code which became mandatory 25 years ago, the Fremantle Highway car carrier turned into a blazing inferno off the coast of the Netherlands, burning uncontrollably for several days and resulting in the tragic death of one seafarer.

The investigation into the cause of the accident is still ongoing but an intercepted radio message from a crew member identified the battery of one of some 500 new Electric Vehicles (EVs) being carried onboard as the location where the fire started.

SMI had already co-hosted a webinar

with Stream Marine Training a few weeks before, highlighting the dangers of lithium-ion batteries - an edited transcript of which is included within these pages.

Industry concern over the issue of battery fires onboard ships is steadily mounting, another recent seminar having heard one panellist speak of a matter of seconds between the first sparks being noticed to a full-scale conflagration. Are seafarers being made fully aware of the risks posed by the carriage of batteries, queried another. Others, such as the International Union of Marine Insurance (IUMI), say that EVs may pose “different” hazards to other internal combustion engine vehicles but feel research to

date “suggests that the risks are not heightened or more dangerous”.

Transport insurer the TT Club has waded into the debate, warning that EV manufacturers’ ambitions “for more powerful, lighter and diverse battery cells must not be allowed to outstrip prioritising safety concerns surrounding their future transportation around the globe.”

And the Paris and Tokyo MoUs on Port State Control have just declared the subject of this year’s joint Concentrated Inspection Campaign (September to November inclusive) to be ‘Fire Safety’, illustrating their announcement with a picture of burning car carrier – a sure sign the issue is now firmly in the spotlight.

Is the EU-ETS workable in its present format?

The European Commission faces legal challenges unless pitfalls are addressed before the scheme comes into force next year, writes InterManager Secretary General Capt. Kuba Szymanski.

InterManager has been continuing its examination into the European Union’s Emissions Trading Scheme (EU-ETS) which is scheduled to come into force in 2024. As you will have seen in the previous edition of SMI, InterManager is convinced that the current wording of the scheme will not be workable in practice and places too much reliance on Member States to draft appropriate national legislation. Working on behalf of its members, InterManager, has now sought legal opinion on the draft legislation in its current format and has identified key issues which we believe must be remedied in order for the scheme to be workable in reality.

Now we are warning that the European Commission faces litigation if it targets the one party without effective

influence on vessel emissions, while those with influence go unpunished.

A particular concern for ship managers is the proposal to fine the party responsible for administering the scheme, rather than the owner of the polluting vessel. We are already on record with our point of view that this goes against the concept of ‘polluter pays’ and will fail to encourage ship owners and charterers to adhere to the scheme, which aims to reduce pollution from ships in EU waters.

We are concerned that a legal obligation to surrender allowances is lacking in the legislation. Under the current draft, the obligation to surrender allowances adheres to the obligation to report emissions. The effect of this is that the company named in the ship’s Safety Management Certificate as at 31 December in any calendar year will be

responsible for reporting the greenhouse gas emissions of that ship throughout the entire calendar year, up to and including 31 December, and for surrendering allowances in respect of those emissions. However, what measures can ship managers take against an owner who fails to surrender an allowance for a ship under third-party management?

In drafting national legislation in relation to the operation of the EU-ETS, The EC has advised Member States that, when drafting national legislation in relation to the operation of the EU-ETS, they should make provision for transfer of the costs of the scheme from the shipping company to another entity, stating “Member States shall take the necessary measures to ensure that when the ultimate responsibility for the purchase of the fuel, or the operation

of the ship, or both, is assumed by an entity other than the shipping company pursuant to a contractual arrangement, the shipping company is entitled to reimbursement from that entity for the costs arising from the surrender of allowances.”

InterManager believes the EU Commission is hoping that EU Member States manage to come up with a mechanism under which the Shipping Company can claim the certificates from the charterers, the ones operating the ship in terms of speed, purchase of fuel etc. Unfortunately, the party responsible for surrendering the certificates to the EU Register is still (unchanged to earlier versions) the “Shipping Company”, defined as “the shipowner or any other organisation or person, such as the manager or the bareboat charterer, that has assumed the responsibility for the operation of the ship from the shipowner and that, on assuming such responsibility, has agreed to take over all the duties and responsibilities imposed by the International Management Code for the Safe Operation of Ships and for Pollution Prevention.”

That’s where we need the improvement. Charterers/Owners /Managers must be free to decide who the “Shipping Company” is and register same with the EU Register. The freedom of contract principle applies.

The current draft also endangers shipowners – their vessels could be banned from EU waters due to default of another shipowner on a ship manager’s DOC and the subsequent default of the ship manager itself. A reason why shipowners too should opt for having the right to decide who the responsible party is, not have the EU impose this.

We would consider it materially wrong to hold the ship manager responsible by default. Depending on the local law implementation we would consider the likelihood of litigation

against such a scenario high. InterManager also believes there is a lack of clarity as to how enforceable the scheme will be if both the owner and manager are not based in the EU.

There are some clear pitfalls in the EU-ETS at present and these need to be addressed before the scheme comes into force in 2024. We are hopeful that with further discussions and judicious use of revised contracts the scheme can be made workable and form an important element of shipping’s drive to decarbonisation.

Under current proposals the EU would levy a fine on vessels which breach the EU-ETS. InterManager’s concern is that the fine should be issued to the owner of the polluting vessel. Vessels breaching the EU-ETS face being banned from EU waters and potentially all vessels managed by that shipmanagement company could be impacted by any restrictions resulting from a breach, regardless of who owns them.

Ship managers have highlighted that we have no influence over key aspects of ship operations such as the speed and fuel and the specification of the vessel, which all lie in the hands of owners and charterers and the terms of their contract together.

The European Commission issued a FAQ at the end of July and we have been unable to identify anything particularly different in it. There is still nothing specifically addressing the issue of who will be the regulated entity when there is an ‘ISM Company Distinct From The Shipowner’, i.e. a third party ship manager, involved.

InterManager is seeking to identify workable solutions for its members in order to guide them as to how to effectively operate the EU-ETS once it comes into force.

This is a discussion which will continue in earnest over the coming months! l

InterManager event – Raising the Standard of Shipmanagement

Join InterManager on Thursday September 14th, during London International Shipping Week, as it launches brand new General Principles and a Code of Conduct to raise the standard of ship management across the whole sector.

InterManager welcomes ship owners, ship operators, fellow ship managers, ship suppliers and members of the maritime community to join us at 10.30am to 12 noon for coffee and pastries at Dockside Vaults, London E1W 1BP

If you wish to attend this event, please email: kuba.szymanski@intermanager.org

The maritime industry has a clear path to follow after MEPC 80 – the 80th session of the IMO’s Marine Environment Protection Committee held in early July. International milestones were also established subsequent to the European definition of the regulatory framework and environmental targets.

With a significantly more ambitious target of achieving Net-Zero by 2050 and introducing intermediary targets, including a 20% reduction of all GHG emissions by 2030 and a 70% reduction by 2040, it is evident that not only Europe but also the UN/IMO are deeply committed to environmental protection and that decarbonization is a top priority.

Despite the differing targets set by the EU and IMO, there is generally a common approach. Europe has implemented economic and technical measures by incorporating the Maritime Industry into the EU ETS and establishing FuelEU. This initiative sets the mandatory requirements necessary for adopting alternative fuels while also assessing the emissions profile of fuels on a well-towake basis.

On the other hand, the IMO has also addressed technical measures by establishing LCA (Life Cycle Assessment) guidelines and presenting the emissions profile of fuels on the same basis. However, discussions regarding economic measures still remain to be determined, despite rumors suggesting the implementation of an EU-like system. It's clearer than ever that the Maritime Industry ecosystem has much to digest and address to achieve compliance, which is of grave importance to retain competitiveness and ensure not only survival but also future success. The new reality dictates that change must be adopted.

At Baseblue, we firmly believe that during times of change, planning and proactivity are paramount. This is why we stay constantly updated on both local and international regulations, all while evolving and embracing new solutions and work methodologies from within. We aim to move away from the traditional and segmented model of trading towards a more proactive and holistic approach.

We believe that there are three pillars upon which every company in the shipping ecosystem must focus. First, optimizing vessel efficiency is of the utmost importance to reduce consumption and consequently minimize GHG emissions. Through our premier software and platform, we assist our clients in fleet monitoring, offering top-tier weather routing services and voyage calculation tools. Additionally, our post-fixing department closely tracks all deliveries in coordination with agents, physical suppliers, and surveyors to ensure seamless operations and comprehensive documentation of sampling and surveying.

Secondly, the integration of alternative fuels, along with the corresponding regulatory guidelines for decarbonization (EU, IMO), highlights the essential need for compliance support. We maintain an extensive global network of alternative fuel suppliers and have already initiated supplies for our clients, bolstered by our ISCC certification. On a daily basis, we guide our clients in transitioning to the new regulatory landscape and offer comprehensive consultation on their global alternative fuel requirements.

Third, as the EU emissions trading scheme (EU ETS) puts a price on CO2 emissions, reporting and paying for these will become essential. European companies are called to report their emissions and “pay” for them by returning allowance titles called EUAs or European Allowances. We have created a specialised emissions module within our software ecosystem that will allow companies to perform easy calculations and save time in their reporting process whilst also being able to budget voyages considering calculations on the EUA costs. Additionally, through our paper trading desk, a regulated entity that can trade in the European Energy Exchange, we can provide both consultation and actual EUAs to our clients.

The waves of the future are moving, and so are we. The real question is, are you ready? l

Ship managers who agree to manage a ship with a fixed premium P&I insurer that may trade to Russia or Ukraine must do so with great caution.By Robert Hodge, Director & General Manager, ITIC

It is a condition of ITIC’s insurance that all ship managers are named as fully co-assured on the owner’s insurance, including Protection and Indemnity (P&I) policies. It is also a condition that such insurance is with a P&I Club who are members of the International Group (IG).

ITIC does accept some fixed premium P&I providers on a case-by-case basis. However, caution is required as the insurance market now require that most insurances contain an exclusion for claims arising out of Russia, Ukraine or Belarus - also known as the RUB exclusion. This will exclude any claim arising from the RussiaUkraine war and in any territory or area where the conflict is ongoing.

RUB exclusion is now included within all fixed premium covers, but not in the cover provided by IG P&I Clubs on a mutual basis.

The wording of the RUB exclusion is wide. The drafting of the exclusion was presumably worded to exclude war-related incidents. However, could it be used to exclude a claim which has nothing to do with the war? If a ship has a P&I claim (such as pollution) that has nothing to do with the war but is simply within Russian territorial waters, an unscrupulous insurer could exclude the claim based merely on its location.

A prudent ship manager managing a ship trading to Russia or Ukraine should insist on cover with an IG Club on a mutual basis. Some fixed premium insurers even exclude Russia trading in full. One manager accepted a ship into their management, which, unbeknownst to them, had such a trading restriction. There was cargo

damage in Russian waters, and the P&I insurer denied cover. This left the manager potentially exposed to an uninsured claim if they were sued along with the owner (which is not uncommon).

The above instance highlights the importance of managers asking for and checking the insurance cover for every ship they manage to ensure that: firstly, the P&I is with an IG Club; secondly, they are fully coassured; and finally, to consider the impact of the exclusions under those insurance.

If the manager is arranging the insurances on behalf of the owner, they must consider the potential impact the exclusions have. An ITIC ship manager member failed to recall that the hull policy excluded Cuba. The cover was placed when the ship had been trading under the terms of a charter party that excluded Cuba from the acceptable range. The ship entered a new charter party and was not only trading to Cuba but also sustained a fire in Cuban waters. The ship manager faced a claim for the owner’s uninsured losses of US$ 500,000.

The professional indemnity insurance ITIC offers members does not contain a RUB exclusion. So, for example, if a ship you are managing is detained in Russian territorial waters due to deficiencies and a claim is brought against you by the owner for negligent management of the ship, this claim will not be excluded simply due to the fact of the ship’s location at the time. If ITIC does not insure you, we suggest you check with your insurer on their position. l

The Mission to Seafarers has published the latest Seafarers Happiness Index (SHI) report for Quarter 2, 2023, revealing a notable decline in overall happiness. The survey, conducted in association with NorthStandard and Idwal, supported by Inmarsat, measures the wellbeing of seafarers worldwide through ten key questions about their work and life. The latest report shows an overall fall in seafarer happiness from 7.1/10 to 6.77/10, compared to Q1 2023.

In Q2 2023 (April to June), happiness levels declined across all question areas, with the most significant drops observed in general crew happiness, shore leave, and workload, showing an approximate 8% decrease. Average seafarer happiness levels have now declined from a high of 7.69/10 in Q4 2022 to 7.1/10 in Q1 2023, and now 6.77/10 in Q2. In another marked contrast to previous years, happiness levels have not risen over the course of the calendar year.

In this reporting period, seafarers expressed their struggles at not yet seeing working and living conditions fully return to pre -pandemic standards, particularly in areas such as crew changes, time spent on board, wages, and shore leave. Other key issues raised by respondents included unmanageable workloads, limited internet access, and inadequate gym facilities.

A major concern was the

shortage of available drinking water. This requires immediate attention, as it was a common problem from those responding to the survey, despite this being explicitly covered by the Maritime Labour Convention (MLC). Rising global food prices have also impacted seafarers, with low company meal budgets and expense cuts leading to insufficient food supplies, sometimes for periods of up to 2-3 weeks.

The Rev’d Canon Andrew Wright, Secretary General of The Mission to Seafarers, said: “It is extremely disappointing to read of contracts being altered or disregarded, leading to payment issues, salary cuts, rising taxes, and increased living costs, as well as such fundamental requirements such as good quality meals, access to shore leave and manageable workloads. All seafarers are fully entitled to expect fair compensation for their hard work, dedication and commitment to keeping international shipping moving.

“It is incumbent upon all of us to address these issues and make the improvements required to enhance

seafarers' working conditions, wellbeing and job satisfaction."

Thom Herbert, Idwal Senior Marine Surveyor and Crew Welfare Advocate, commented: "We at Idwal are deeply concerned by the findings of The Mission to Seafarers' Q2 2023 Seafarers Happiness Index report, which… underscore the urgent need for industry-wide efforts to improve the wellbeing of seafarers.”

The Mission to Seafarers, together with industry partners, is committed to using the Seafarers Happiness Index as a crucial tool to highlight seafarers' challenges and improve their welfare. A recent Executive Roundtable on Crew Welfare, held during Singapore Maritime Week 2023, brought together industry leaders, ship owners, managers, and charterers to identify effective solutions for seafarers' challenges and well-being.

The next phase of the initiative will take place during London International Shipping Week in September 2023, where further progress will be made in transforming feedback into concrete action. l

The IMO Council has voted to appoint Arsenio Antonio Dominguez Velasco of the Republic of Panama, for an initial four-year term, as next SecretaryGeneral. He will succeed Mr. Kitack Lim as of 1 January 2024, subject to the IMO Assembly’s approval.

Naval architect Arsenio Antonio Dominguez Velasco, the first Panamanian and Latin American candidate for this position, has more than 25 years of professional experience in the international maritime world, in addition to his contributions as Ambassador and Permanent Representative of Panama to the IMO. He is currently Director of the Marine Environment Protection Division of the IMO, after serving as director of the Administrative Division and head of

Cabinet and of the Organization, giving him the trajectory and experience required for his new position in London.

“It is a historic day that fills us with great pride,” said the President of the Republic of Panama, Laurentino Cortizo Cohen, who had formally proposed the candidacy of the country for the top post at the IMO under the slogan: “Taking the initiative for a united and better future”.

Guy Platten, Secretary General of the International Chamber of Shipping (ICS), commented: “It has been a great pleasure and privilege to work with Kitack Lim over the past eight years.

Kitack steered the IMO successfully through challenging times, calmly and with direction, and everyone at the ICS wishes Kitack every success in his future endeavours. We look forward to working with Mr. Arsenio Dominguez and know that [he] will lead with equal measures of authority, purpose and compassion.”

It is understood that the Panamanian candidate won the final round of the IMO Council election with more than half of the total votes cast, ahead of runner-up candidates from Turkey and Finland. l

Artificial Intelligence (AI) has caught the headlines in the past weeks and months. No longer reserved for sci-fi films or computing professionals, AI entered the world’s mainstream vocabulary at light speed at the end of 2022 with the advent of Chat GPT.

And in shipping, it remains a major talking point, as Nor-Shipping proved back in June. But has it now become a misnomer and catch-all term for many specific and complex topics when usually it’s nothing more than sped-up computational logic with a few elements of AI at its core?

So, should we be afraid of this future dominated by ground-breaking technology? Or are we facing a golden age of shipping where human and digital technology walk hand in hand?

AI is undeniably critical to shipping’s most vital of challenges - decarbonisation. We can use it to support data analysis as the new and incoming scope regulations bite, with more on the horizon.

The best example of this is the Carbon Intensity Index (CII) model - a good concept with the challenge of blunt implementation. The requirement for ship owners and operators to identify their CII rating for the previous year enables the idea to be skewed and taken advantage of depending on the stakeholder.

However, by combining advanced analytics with AI you can use the same IMO equation to calculate CII but include additional available industry data for a vessel – e.g. energy, emissions at different speeds, and weather on route amongst others - to measure carbon emissions every five minutes.

This ability to bring additional transparency to the CII will enable the cheapest direction of travel for carbon taxes, and also lays the foundation for stakeholders to openly promote these voyages. However, this analysis is only possible with the industry’s more nuanced and human interpretation of data for each vessel, which will ultimately enable our sector to take greater strides towards decarbonised shipping, faster.

Speed is of the essence whilst we’re in the midst of a digital transformation. And, while there are leaps and bounds being made by ground-breaking solutions, the level of human intelligence required to manage and analyse multiple functions in our industry cannot be replicated by AI alone. It’s this partnership of human and artificial intelligence that will be the key to making successful and efficient progress in the face of our industry’s multiple challenges.

Ultimately, AI gives everyone the opportunity to deliver far more productive and higher-quality tasks within the limited time that we have when it comes to analysing the vast volume of data that’s now become the daily norm for shipping. l

‘The future is human. The future is us!’

Melina N. Travlos, President of the Union of Greek Shipowners

Melina N. Travlos, President of the Union of Greek Shipowners

Speaking at the Delphi Economic Forum earlier this year, Union of Greek Shipowners (UGS) President Melina Travlos was unequivocal. “This new era has a new challenge, a new philosophy,” she said. “The one where ‘business’ and ‘well-being’ coexist. The one where the human is in the epicentre. The one where the ‘I’ recedes and the ‘we’ retakes its place. Sustainable growth requires sustainable people.

“So, let’s put the parameter of well-being at the heart of development in this new era. The challenge, but also the solution, is to protect the human value and coexistence. Our future, the future of humanity, is the human himself. The future is us!”

Elected UGS President last year, Ms. Travlos is the Chair of the Board of Neptune Lines Shipping and Managing Enterprises SA, which has

been active in Greece for more than four decades in the field of maritime transport, as well as of Neptune Dry Management Company, which operates in the field of dry cargo. She also sits on the Board of numerous maritime-related societies as well as serving as the Honorary Consul of Denmark in Piraeus. Born in Athens, she holds a Business Administration Degree from Northeastern University, Boston, USA.

People always were and will always be my priority and hence at the centre of what we do

Melina N. Travlos

Notably, Ms. Travlos is also a founding member as well as President of the Greek Shipowners’ Social Welfare Company SYN-ENOSIS, developed by the UGS to embody the collective social responsibility of the Greek shipping community, as well as a founding member of Axion Hellas, targeting vulnerable groups in the outermost regions of Greece. In addition, she participated in the foundation of the nonprofit organization that supports entrepreneurs in emerging markets, Endeavor Greece.

Founded in 1916, the UGS represents Greek-owned vessels over 3,000 gt under Greek and other European and third country flags.

Today Greek shipping represents nearly 60% of the EU-controlled fleet and over 20% of the world deadweight capacity.

“Greek shipping is Europe’s superweapon,” Ms.Travlos said at the Delphi Economic Forum. “It is a national economic partner, providing billions of euros in maritime foreign exchange and hundreds of thousands of direct and indirect jobs, steadily investing in various sectors of our national economy. It is a national asset; it is our national pride. The national beneficence and social solidarity towards the motherland and the Greeks are consistent, silent, and broad.”

In a recent interview in the International Chamber of Shipping’s ‘Leadership Insights’, the UGS President expanded on these views. “I

am a strong advocate of teamwork,” she said. “Our mission in the UGS is to serve and protect the common interest of our members to the best of our ability and we succeed in this through collective efforts. People always were and will always be my priority and hence at the centre of what we do.

“At the same time, promoting and further advancing the maritime profession by attracting young talented people and offering them high quality training – is also a strategic priority intrinsically linked with the sector’s longevity and success. Maritime know-how is key both at national and at EU level. In Greece we are particularly proud of our seamanship. Our seamanship is our history, it is our culture, and we must safeguard it.

“Overall, my vision and prime concern is to highlight in every way the vital role of shipping to every citizen in Greece, the EU and around the world. Since politicians and the wider public do not have a clear perception of its indispensability, it is our duty to educate them accordingly.”

The collective spirit of shipping and its indispensable workforce has also been key to how the industry has continued working despite the recent turmoil of first Covid and then the Russia-Ukraine war, she went on to point out. “Despite this turbulent landscape, our people, our seafarers, worked tirelessly to keep the supply chains open. Thanks to their professionalism, persistence, and dedication our ships always reach their

destination and every citizen in the world has access to food, medicines, energy and all other essential goods.

“Our sector is a pillar of stability in a state of flux and has proven its resilience throughout history. We need to make sure the strategic role of our sector is acknowledged. It is our duty to ensure that. Through collaborative thinking and shared effort among all players within our industry we can successfully overcome whatever hardship the future brings.”

As regards decarbonisation, Ms. Travlos has stated that the UGS fully supports the IMO’s new GHG strategy of achieving net zero by or around 2050, as well as its ambitious indicative checkpoints for 2030 and 2040, slipping in the vital proviso that future fuels must be safe for the seafarers that will have to handle and sail with them.

“It is imperative that IMO ensures that the transition to alternative fuels and technologies is safe for the ships and their seafarers,” she said, “and also that it urgently adopts a levybased economic measure regarding GHG emissions, alongside the simple, goal-based fuel standard as proposed by the industry. This will be a practical method which is necessary in order to help reduce the cost gap between conventional and alternative low-carbon fuels and without which their availability and utilisation will not be satisfactory.”

In short, the UGS President has her eyes firmly fixed on a future that is kinder to the planet, in keeping with her strong humanist vision of shipping as a key enabler of human well-being. l

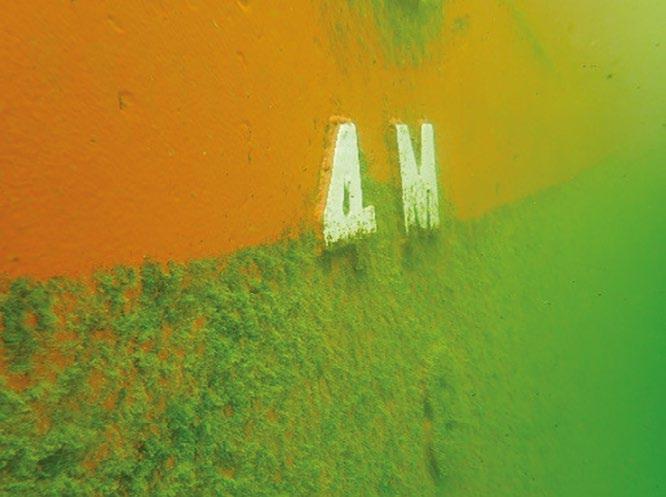

An inferno engulfed the Fremantle Highway car carrier, operated by “K” Line, in the North Sea off the Netherlands in late July, tragically resulting in the death of one Indian seafarer. The fire reportedly started in one of around 500 Electric Vehicles (EVs) of the 3,800 new automobiles being carried onboard, once again focusing industry concern on the danger of lithium-ion batteries spontaneously combusting. This vital topic had been the subject of a Ship Management International webinar, held in association with Stream Marine Training, just a few weeks before.

Stream Marine training group offers bespoke training consultancy in the use and handling of new and alternative fuels under the name Stream Marine Technical. It has already provided training and advice to some of the world’s largest shipbuilders, ferry companies and cruise lines, and its safety courses include the prevention and management of shipboard battery fireswhich result in the release of toxic gases (such as carbon monoxide and hydrogen cyanide), very high temperatures and can spread very rapidly.

Tim Springett, Policy Director at the UK Chamber of Shipping, kicked off the webinar by outlining the nature and potential scope of the problem that will gradually

affect other types of vessels besides specialised car carriers for new vehicles.

“Well, it seems like stating the obvious,” he began, “but the proportion of vehicles carried on ro-ro ferries that are powered by lithium-ion batteries, which I shall call LIBs, is increasing, and this is likely to continue. Hence there is a high probability that over time, ageing electric vehicles with deteriorating LIBs will be brought on board by passengers wishing to carry them or have them carried by sea.

“In addition to that, there is of course a wide range of products containing LIBs that are being brought onto ships, including electric scooters and bikes, plus of course

Jan Polderman, Kelly Malynn, Tim Springett and Tony Int’ Hout Scan QR code to watch Webinar

laptops and mobile phones. Now, barely a day goes by without a news story somewhere about an e-scooter fire. LIBs are also carried as cargo in containers, and if one of those were to overheat and to go into thermal runaway [i.e. an uncontrolled chain reaction of increasing temperature] what chance would anyone have of preventing a spread to other contents. Even though we’d be talking about newly manufactured LIBs, it’s a danger that has to be considered.”

Mr Springett noted that there had been 387 ‘verified’ LIB fires between 2010 which may not sound a lot but there had been a lot more ‘suspected’ ones, he added. “This is the challenge that we face. It’s really a case of obtaining reliable information on which ship operators and their advisors, whether they’re regulators, surveyors, classification societies and so forth, and of course insurers, can base their risk assessments.”

He went on to detail how a LIB’s state of health is crucial. Most LIB fires have involved batteries that have been damaged in some way, he pointed out, adding: “It’s often said that a fully charged LIB has a higher ignition risk than one with a low state of charge, but what is less clear is by how much

protection suits, he added, and whether bespoke LIB fire suppression systems are in in existence.

Mr Springett concluded by saying that it’s possible that the UK Chamber of Shipping will lobby for legally enforceable standards for LIBs, specifically those that are used to power electric vehicles that are accepted for sale and use in the UK.

the risk increases, how significant it is in reality. One thing that we found out is that the risk of a toxic vapour cloud explosion is greater in a battery with a low state of charge. Rapid charging is said to increase the fire risk.”

As regards people wishing to take their EVs on ferries and charge them on board, he cautioned that “some companies allow it, but by complete contrast, there’s one Norwegian company operating domestic ferries that has completely banned the carriage of electric vehicles.”

Then there is the nature of the fires that batteries can cause, which are particularly quick to ignite and fierce burning. IMO STCW (Standards of Training, Certification and Watchkeeping) firefighting requirements are based on entirely different types of fire and burning materials, Mr Springett noted, and “whilst they probably don’t predate LIBs themselves, they certainly do predate current levels of usage, so this is another thing that needs to be addressed, what are the appropriate requirements for training going forward.”

The same problem applies to identifying what standards and specifications are needed for fire

“We want to get some work out, some recommendations, some guidance, and a proposal that can be turned into regulation really by the end of this summer,” he said. The Chamber has formed an ad hoc working group and set up two subgroups that are looking at developing guidance for crews and guidance on fire suppression. Any proposal for UK regulation that results may then be shared with the EU, he said, and later more widely with IMO.

Tony Int’ Hout, Director of Stream Marine and Technical, then gave an in-depth presentation on the different types of batteries – i.e. lead acid, alkaline based batteries and lithium ion batteries - and their perceived fire risk. He explained that fires normally result from various initiating causes, such as damage to the battery following a collision, incorrect charging regime or wrong charging, incorrect installation, a battery being incorrectly stored, or a malfunction of the battery.

Addressing the current training requirements for crews, Mr Int’ Hout, said: “The regulations are not really robust enough yet. Even if you have 85 firefighters onboard, similar to a standard cruise ship, they can respond to the fire very quickly, but the challenge lies with dealing with a battery fire, they are very hard to put out. We do not have enough training in fire safety with any of the alternative fuels that are coming into the industry.”

Next webinar speaker was Jan

Polderman, a founder member of BlueTack, an emergency response cooperative. He pointed out some of the differences in handling battery fires and the toxic vapours they produce. For example, “a normal reaction with a fire is try to keep as low as possible,” he explained, “because the fumes are high in the compartments, so you stay below the smoke level. But that doesn’t apply, for example, with battery fires. Going low, there, the toxic vapours are heavier than air. There’s also an added risk for electrocution if you approach an electric fire with normal methods, like spraying with a fire nozzle, water over the fire.

Mr Polderman detailed how the experience with electrical fires in vehicles onshore is to create an exclusion zone around the fire, special fire blankets have been introduced as a solution, he informed, “but explain to me how to get a fire blanket around cars in [tight] stowage.”

Polderman concluded by pointing out that little research had been carried out to date on how to handle onboard – as opposed to shore-

based - battery fires. ‘So what we propose from the salvage industry is that we do a structured approach with collecting all the data on incidents, collecting it, analysing it. We develop new systems and redevelop existing systems, test new ideas, and think that is very important, test it, and again, in situations that are really similar to what you can expect at sea. Develop systems based on all this data and analysing information, training for the responders, and build further on the experience.”

Kelly Malynn, ESG Strategy Lead for Marine at insurers Beazleys, detailed how already there’s been a 70% increase in fires on superyachts in the last few years, “and around a third of those we believe are due to thermal runaway of ‘water toys’ {i.e. jet skis etc.) stored on board. So, we’re bringing in underwriting assessment questions and wordings where we’ve seen that claims trend, and this will continue into the cargo space. This will continue into the passenger ferries and the ro-ros.

“We will be looking for best practice above and beyond the regulations, because as it’s been said,

the regulations tend to follow large incidents. What we’re looking to do is trying to mitigate the likelihood of those incidents before they happen. Nobody wants to have a claim of that nature, and so we will be bringing in additional questions around, “Have you got thermal monitoring of your cars that are stored? Are you allowing charging onboard?” And if you’re transporting lithium batteries as a cargo, the questions will be about how those are being stored, how many firefighters you have on board. All of the key points that we’ve heard today will start to become underwriting insurance considerations.”

Moderator Sean Moloney, Publisher of SMI, ended by thanking all the panellists for what he said had been a very enlightening discussion on a most important topic where future developments would be followed with great interest. l

A full recording of the SMI/ Smart Marine Training webinar is available on the SMI website: https:// shipmanagementinternational.com/ webinar_video/deadly-dangers-ofbattery-fires/

VIKING Life-Saving Equipment has just launched an offer of dual equipment that it recommends be carried on each deck of a vessel carrying EVs. First is a special Bridgehill fire blanket, used to isolate the fire and prevent it spreading, and the second a portable Rosenbauer BEST system, which it claims is “purpose-developed to extinguish high-voltage lithium-ion batteries in EVs, with the firefighter using a piercing stinger attached to a hose to penetrate the battery housing and flood the cells, rather than the deck. Direct cooling stops the chemical reaction in the cells and consequent thermal runaway.”

Biofuels have rapidly emerged as one of the most popular alternative marine energy choices over the past few years as the shipping industry bears down on its greenhouse gas emissions, with IMO and EU regulatory drivers incentivising their further uptake over the short term (see infographic right).

The advantages of using biofuels are clear: they work as a drop-in alternative to conventional bunkers, with little or no changes needed to ships’ engines or delivery infrastructure to use them, and result in net reductions in GHG emissions based on their full lifecycle assessment when produced from second or third generation (sustainable) feedstocks.

Biofuels already help buyers today meet their ESG targets and will soon be one of the solutions to meet the mandatory blend-in requirements as set out in the FuelEU Maritime Regulation, starting in 2025.

Bunker buyers can take on these fuels immediately, without significant up-front investment or any long-term commitment to them.

Biofuel volumes

Demand for these fuels has grown rapidly during the past months.

Rotterdam saw 791,000 mt of sales for biofuel/marine fuel blends last year, up by 163% from 2021, while Singapore

kicked off biofuel sales in 2022 with 140,000 mt of blended product sold in total. The main products in ARA are B30 and in Singapore B24, which means 30% respectively 24% of biofuel blended with conventional marine fuel. The fuels are already available at a wide range in other ports, and volumes can be expected only to climb in the coming years.

These sales initially came in the course of trials from shipping companies looking to try out the fuels in their engines on a one-off basis, but regular sales are now increasingly being seen.

The first thing to note about biofuels in the marine fuel space is that when we talk about them, it’s almost always blends being referred to, typically with up to about 30% biofuel content mixed with VLSFO, HSFO or MGO. Higher ratios of biofuel content, even up to 100%, have been shown to work in conventional engines but are as yet rarely used.

Which biofuel?

Beyond choosing the appropriate conventional fuel grade for the blend, the provenance of the biofuel

component is a key consideration.

Biofuels such as Biodiesel or HVO are produced from a range of biomass feedstocks, with varying degrees of environmental credentials.

The feedstock types are divided into generations: first-generation biofuels are produced from food crops on arable land, the second generation come from waste products from industries like fish processing, while the third are sourced from more advanced sources like algae.

Products produced from firstgeneration are increasingly frowned upon by various groups both for taking away arable land and for not delivering sufficient net reductions in GHG emissions, particularly when sourced from palm oil, and may increasingly face legal restrictions in the coming years.

For that reason, first-generation biofuels are considered as ‘fossil’ under IMO regulations and will not play a role in decarbonizing the shipping sector. Production of biofuels from secondgeneration is currently being expanded significantly, but output levels cannot rise indefinitely without sufficient waste

feedstock, and a range of industries including aviation will soon be competing aggressively for access to these fuels. And production of the third generation has yet to take off in a significant way.

Guaranteeing the origins of the biofuels is another important consideration, to ensure that the emissions savings are genuine and have not been double-counted.

Even though biofuels are an excellent low-carbon solution and drop-in fuel, there are parameters to look out for that may be less familiar to buyers used only to conventional fuels. The ISO 8217 tests used for conventional bunkers work as an initial check of relevant quality parameters of the blends, however fuel quality firm VPS also recommends carrying out tests looking out for the following parameters:

• Renewable content

• Oxidation stability

• Energy content

• Cold flow properties

• Corrosivity Considering costs, this can vary significantly around the world according to local regulations, availability and last mile delivery. In Europe biofuels

In drawing up their guidelines for biofuel bunkering, Singapore’s authorities as an example have recommended that buyers only take on biofuel blends that have been certified by the ISCC (International Sustainability and Carbon Certification). The ISCC certification ensures that biofuels meet internationally recognized sustainability and traceability standards. Assessing the sustainability credentials of biofuel producers, verifying the compliance of their production processes, and ensuring transparency throughout the supply chain is key when purchasing biofuels. IMO has also just adopted a guideline on biofuels defining the criteria for a sustainable biofuel and how it should be reported into the IMO Data Collection System.

demand will be driven by FuelEU Maritime regulation, mandating for GHG reduction in shipping as of 2025, which will have an effect on biofuels prices. Though today bunkering for example in the Netherlands can benefit from subsidies that can apply to biofuel bunker sales and reduce their net costs significantly. In the US the lack of similar measures has meant the marine biofuel market has yet to emerge in a significant way.

In Singapore, recent market analysis has put the cost of a B30VLSFO blend at a premium of 20-30% over VLSFO prices.

Ultimately, most of the pitfalls around buying biofuel bunkers can be avoided in the selection of an experienced marine fuels firm to help with the purchase. An ISCC certified and well-established company will be able to guide shipping companies through every stage of decision-making, from quality assurance to emissions planning and reporting, delivering peace of mind to the buyer. l

In late July the UK government launched a new Seafarers’ Charter in conjunction with the French government. This Charter is the next step in the fight to protect domestic seafarers in the UK and builds on the Seafarers’ Wages Act which was made law in March 2023. Both documents are part of the UK Government’s Seafarer Protections Nine Point Plan which was published in July 2022.

The aim of the Charter is to ensure proper employment protection for all seafarers including being paid and treated fairly, irrespective of the flag of the vessel or the nationality of the seafarer. In general, the requirements of the Charter build on the protections already laid out in the Maritime Labour Convention 2006 (MLC) and it is specifically stated that nothing within the Charter is intended to change the minimum requirements of the MLC.

The Charter already has the support of a large proportion of the cross-channel ferry operators with all UK ship operators being encouraged to sign up to the voluntary agreement. Operators can apply to the scheme by submitting evidence of their compliance with the standards of the Charter to the Department for Transport, noting that it is only required to demonstrate compliance for routes that have a UK call. The Department for Transport will then review the provided evidence against the standards and, if successful, the operator will be awarded Verified Seafarers’ Charter status. This status is then reviewed on an annual basis.

To meet the standards of the Charter, UK ship operators must be able to show:

• They are paying at least the National Minimum Wage equivalent to all eligible seafarers i.e. those covered by the Seafarers’ Wages Act

• They are paying overtime at a rate of at least 1.25 times the basic hourly rate in the seafarers’ employment agreement. Basic hours are not to exceed 48 with any work over 48 hours being overtime.

• Adequate training and development is being provided to all seafarers, including cadets and trainee ratings.

• The seafarers’ contracts of employment are not voyage contracts (except in exceptional circumstances), provide for

adequate rest between engagements and do not contain any charges for seafarers with respect to their accommodation.

• They have in place provisions to provide seafarers with the minimum standard in the MLC for an array of benefits including sickness, pension and maternity. There should also be provisions for paternity and adoption within the policies.

• All roster patterns take into account the intensity of the route, fatigue, mental health, safety, welfare and operational manning. Risk assessments must be submitted with the rosters. Seafarers must be provided with shore leave between their roster patterns or when the vessel is in port and the seafarer is off duty.

• Adequate rest is being provided between shifts.

• All crew have received adequate familiarisation training on the vessel they are working on.

• Drug and alcohol testing is being done at intervals of no longer than 12 months, on both a regular and random basis.

• There is nothing new or surprising in the Charter for operators who are working in compliance with the MLC to be startled by.

Reputable operators should not be afraid of signing up to the Charter and it should help to weed out rogue operators who are not providing proper protections to seafarers - looking for the verified status will provide an easy way for seafarers to check they are working for an operator that will treat them fairly.

It is well overdue that seafarers are receiving the same employment protections as other UK workers, it is very easy to adopt an out of sight out of mind approach to the shipping industry and those working in it. Whilst currently this only applies to vessels operating with calls to UK ports, there is possible scope for the rules to be extended to UK flagged vessels in the future which would greatly enhance the protections for seafarers. The UK government has plans to further expand the protections including the development of a statutory code of practice which will make it explicitly clear to operators/employers that they must not use threats of dismissal to pressure employees into accepting changes to their terms and conditions.

It remains to be seen how many operators will sign up for the Charter but it is certainly a hopeful sign that so many Channel operators have signed up for the initial launch. l

Q) How has the perception and nature of maritime training changed in recent times?

Raal Harris: From a perception point of view, guess a lot of changes stem from how the technology and tools available have evolved. When I came into the business in 2004 there were always people who thought training was important, but it was almost separate from work. It was all about compliance and evidence about what you’ve done, rather than something crucial to underpinning performance. And I think that is the journey we’ve been on.

There are still pockets where people think about training as something separate and primarily to do with compliance. Perhaps ‘crew learning’ is a better term. And I think there’s more to do in terms of seeing training as part of a personal development culture.

As regards to how maritime training itself has changed, it’s become multimodal – now we’re able to deliver training in all sorts of ways. These can either be ‘asynchronous’ where people are learning individually in their own time, or ‘synchronous’ where they’re learning together in real-time. I think a blend of these is important as it gives a chance for people to all come up to the same level and produces a richer learning experience.

A mixture of remote and in-person learning also means you don’t have to worry about geography and can bring together people with different experiences and perspectives. You can do virtually everything this way now. Take cloud-based simulation, for example, where today you have the software for this to be done on virtually any decent PC. You have simulators for navigation, ECDIS, cargo control, ship handling etc. Then there’s VR (Virtual Reality) as well, where you can connect two or more people remotely and you can familiarise and work through a common task in the bridge or engine room.

And the speed with which you can deploy such learning tools after an incident is another big advantage, sharing the lessons learned quickly rather than having to bring everyone together in one place.

Also, what we’re seeing is a move from seafarer training being almost entirely prescriptive. Now we’re moving to a learner-led situation where we can identify the knowledge gaps to be closed and provide them with the materials they need. So we’re moving to a ‘just in time’ model and away from a ‘just in case’ one.

Raal Harris: The maritime e-learning journey probably started in an analogue form with videos in the 1970s, moving to DVDs and then e-learning itself. All that was an evolution of video or film in one way or another – taking physical material and putting it on ships.

Once you move to digital you can start recording activities, and the challenge is then getting that material to where you want it to be. Digital delivery is obviously what you want, but we are still a long way from having universal coverage – it depends where you are and what the available connectivity is. But as more and more ships light up and bandwidth increases, it becomes easier. If you want to learn lessons quickly you don’t want to wait to get a USB stick in the post.

But getting material to where you want it to be remains a ‘pain point’, it is still an evolving space. There’s a whole lot of bandwidth used for operations and crew communications, but the amount assigned for training is still limited. When I started out you had to keep attachments to under 1MB. Now you’re collecting much more material and transmitting much more data, the exact limit depending on what individual package the ship is signed up to. And why that matters is when you’re trying to keep data really small, you only keep minimum data records; now that’s opened up you have a much fuller picture to analyse.

Q) How do seafarers choose to access training courses?

Raal Harris: When people are home from ship their time is very precious. So they value being able to do training without having to travel to shore-based centres. We also have an online shop where we have pay-as-you-go courses – to get extra training, for continual professional development for example. Sometimes seafarers pay for this, sometimes companies. There are certainly a cohort of seafarers that are savvy about managing their own careers and certification. And this process is likely to increase with future fuels. The more multi-access we make the material, the more people use it, like in every facet of our lives. The latest iteration of our learning app allows you to download material online, and then work offline where there’s

no connection – on buses, trains etc. We expect to see a big uptake on account of this.

Of course, the more material you want to access, the more it costs. But as always for the shipowner it’s a cost-to-value thing, an investment. Better trained seafarers lead to less incidents, accidents and detentions. Having multiple methods of accessing material also makes your operations more robust to disruption, we saw during the pandemic for example that people who had already had access to online training were massively advantaged.

Q) How are the concepts of personalised learning and adaptive assessment being applied in today’s maritime training?

Raal Harris: We’re trying to move towards self-directed learning and away from the ‘cookie-cutter’ approach of ‘people at such and such a rank need to learn such and such things’. In my experience, a one size fits all approach is rarely the answer. You have to start by assessing people’s needs and piecing together what they require. It’s all about making training as efficient and effective as possible and relevant to the user, avoiding them being demoralised by thinking ‘I already know this, or ‘how is this going to help me?’.

Q) What ‘soft’ skills are included in maritime training today?

Raal Harris: The importance of ‘soft’ or non-technical skills content, such as communication, leadership and other ‘human’ rather than technical skills, is increasing all the time. This is in line with the realisation that people make decisions for different reasons. It’s about addressing behavioural competencies. And concerns with mental health issues and how to support them are one area in particular that’s really growing.

Q) What do you see as the future challenges for maritime training?

Raal Harris: I would like us all to think about how people are readying themselves for all these big changes that are coming such as decarbonisation and future fuels, and how you address that skills gap. And then there’s everything that goes into ESG, including the ‘S’ factor, that companies need to think about and start building a learning and development strategy for. Put that in place now and you’ll be in a better position for the future. l

Raal Harris, Chief Creative Officer of OCEAN Technologies Group (OTG).

Raal Harris, Chief Creative Officer of OCEAN Technologies Group (OTG).

The maritime sector must embrace a new culture of transparency and accountability to not only comply with growing reporting and regulatory requirements, but to also unlock new avenues for greener, smarter and more efficient sailing, writes Esa Henttinen, EVP for Safety Solutions, NAPA.

For an industry that’s about 5,000 years old and moves approximately 90% of the world’s goods while navigating some of the most challenging environments on international waters, shipping is bound by numerous regulations, and seafarers are inherently accustomed to processes and paperwork.

But while there has always been a culture of strict recordkeeping onboard vessels, the data revolution has suddenly moved the goalpost beyond just storing information, to putting that information to good use. In other words, data is the new oil, and everyone is eager to extract value from this newfound resource and improve operational efficiency.

Underpinning this transformation is the question ‘What more can my ship data do for me?’

Shipping’s digitalization has already introduced opportunities for greater transparency and accountability, permeating all levels of operation across departments, both onboard and onshore, and opening new frontiers for reporting and optimisation. And with more data than ever at our fingertips, we are witnessing a complete paradigm shift in the way maritime does business. Everything, from strategic decisions to daily vessel operations, is profoundly affected by new capacities to turn data into insights.

That said, there is also a growing gap between the ginormous amounts of data being captured and the capacity to generate actionable insights from it.

There’s a vast amount of data that shipping companies are already storing but not using. To overcome this, there are

two primary challenges we need to first address: the underutilisation of existing data and fragmented data capturing. It’s well known that 90% of data collected onboard typically stays onboard. This is a missed opportunity, significantly limiting the scope for teams to analyze the data already captured by onboard systems and sensors, as well as noon reports, weather, and more. Thus, the first frontier is digitalization and automation of information collection.

Finding ways to manage and analyze this massive amount of information will be the next critical step for the industry. This is tied to building a more structured and systemic way of compiling, managing and interpreting data, but we don’t need to start from zero. Digital solutions are already making a difference in streamlining and standardizing a lot of these information management processes, from data-gathering to integration and sharing.

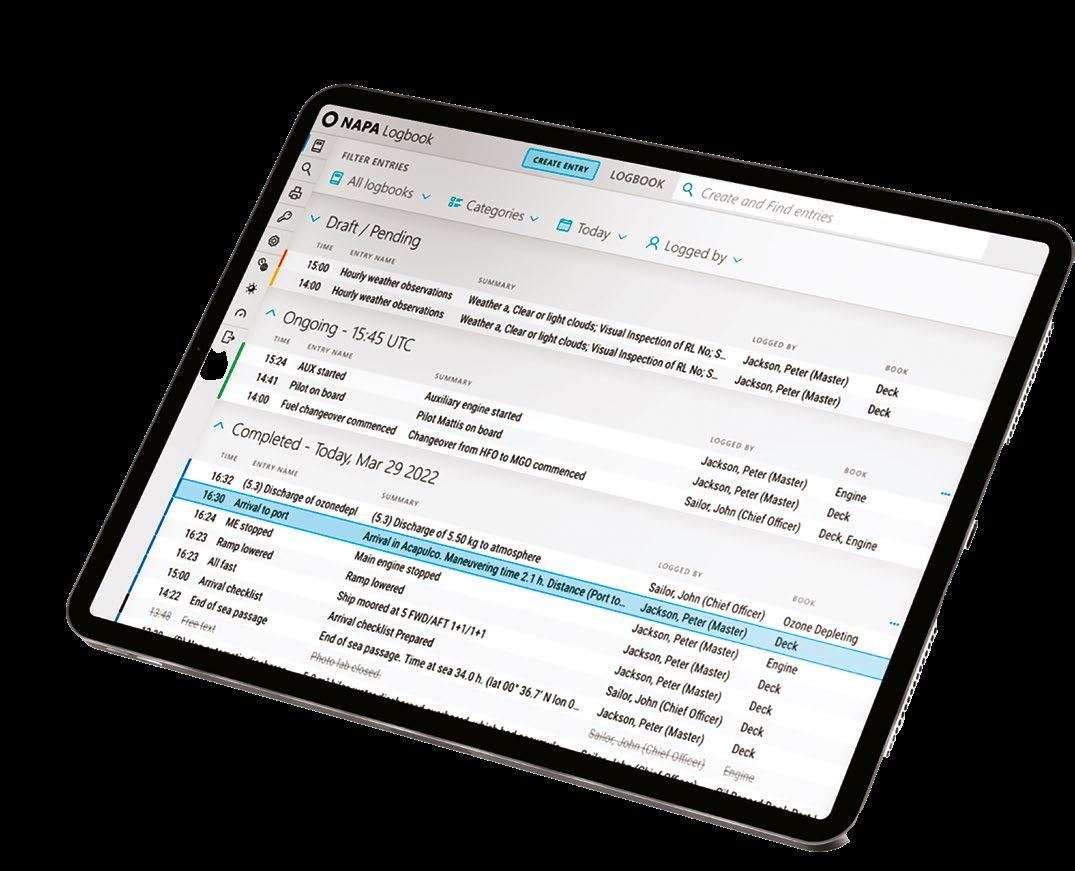

For instance, NAPA Logbook can present captain-verified data on a multitude of function reports and daily logs in an integrated and error-free format. Then, leveraging ship-to-shore connectivity, teams can collaborate more closely and in realtime to make the most of this data on cloud-based solutions like NAPA Fleet Intelligence. This enables teams to uncover new efficiency opportunities and improve safety measures, using insights that previously were hidden in paper logs.

It’s almost a no-brainer that integrated data flows like this can make reporting and data sharing immensely easier. Importantly, it introduces safety as a key checkpoint across

decision-making processes, enabling a proactive and collaborative culture where safety comes first.

Passenger ships are leading this change, in part because they are more ‘visible’ to their end customers. This element of accountability makes compliance and reporting on ESG critical to building trust and winning the confidence of stakeholders, from passengers to potential investors.

Driven by shifting societal expectations around how companies do business and the growing need to fight climate change, the maritime industry too, is under the spotlight to do better. There’s mounting scrutiny around its sustainability credentials and ESG governance.

In fact, the industry is already facing greater reporting requirements, with the European Union’s corporate sustainability reporting directive calling on large companies and listed SMEs to report on sustainability matters such as environmental, social and human rights, and governance factors. Moreover, the EU Monitoring, Reporting and Verification (MRV) requires ships calling at EU ports to report their CO2 emissions. And it’s not just the EU – the IMO Data Collection System (DCS) is also requiring ships to record and report their fuel oil consumption, based on which their Carbon Intensity Indicator (CII) will be calculated at the end of this year. This is just a snapshot. As regulations become more stringent with stricter record-keeping requirements, data and digital data-capturing tools become even more valuable in allowing crews to manage compliance, simplify reporting, and ultimately improve on those operational parameters. This also shows how reporting requirements can become a foundation for new regulations aimed at improving shipping’s safety and environmental performance.

For many publicly listed companies, meeting mandatory ESG reporting requirements and keeping up with increasingly stringent regulatory obligations is a growing priority. Working with Columbia Cruise Services (CCS), a ship management company that adopted NAPA Logbook back in 2019, we helped them automate the collection and analysis of ESG data, to monitor and action their commitment to sustainable and responsible business practices.

Using NAPA Logbook, CCS transformed their data collecting and reporting processes, making them simpler, more

transparent and automated. This also opened new avenues for data analysis, and as a result CCS is now able to capture vessel performance-related data such as water balance, fuel efficiency, ballast conditions, voyage performance, and more. With stricter regulations, the maritime industry is faced with two options: to get by doing the bare minimum or turn obligation into opportunity. And with more ship data than ever at our fingertips, it’s really the second option that shipping should be focusing on.

While voyage optimisation and fuel efficiency are the most talked about areas when it comes to data and digitalisation, this transformation is powering every aspect of operations onboard and onshore – from greenhouse gas emissions, waste and stability management to equipment safety and maintenance, as well as food and beverage consumption, heating ventilation and air conditioning (HVAC) efficiency, people and cargo flow onboard, and resource management.

Here, electronic logbooks are the real unsung heroes of the industry. For example, NAPA Logbook can be used as a framework for data collection, with endless possibilities to tailor it to the specific needs of a company. In addition to regulatory logbooks, data on everything from fridge temperatures to sanitation logs, hygiene logs, and hospital logs, can be included – depending on what the company wants to measure and improve.

Food waste on vessels can be measured to identify trends, improve practices and ultimately reduce waste. Greywater management can be improved by capturing data on the use of different systems and optimizing cleaning practices accordingly. And with data from Permit to Work modules, trends can be identified with seafarer workloads and downtime, which can help improve work processes and identify any issues that may impact their well-being.

At its core, digitalisation is about data supporting decisionmaking. And this trend is only forecast to grow; the industry will continue to gather more data and, crucially, harness its potential for more informed decision-making and better reporting. Regulatory compliance and ESG reporting depend on transparency and accountability. This new cultural shift will allow us to accelerate towards safer, more efficient and sustainable shipping. l

Does London – and the wider UK – still have what it takes to remain a global maritime hub? Felicity Landon reports on traditional strengths, changing pathways and new opportunities.

To the ‘outsider’, shipping means ships. To the industry, shipping encompasses regulation, law, insurance, classification, ship registers, a wide range of industry associations and NGOs – and that’s just for starters.

English law is still the predominant force in shipping contracts

Nick Shaw, CEO, International Group of P&I Clubs

London has it all and, despite much talk of the maritime pendulum swinging eastwards, London remains a hugely important global maritime hub. This comprehensive, complex maritime cluster has the International Maritime Organization at its heart, and historic strengths such as

Lloyd’s and the traditions of English law on its side. But this isn’t all about history. London is also looking forward, with new arrivals and a particular focus on digitalisation and decarbonisation.

Nick Shaw, CEO of the International Group of P&I Clubs, said: “It starts with the IMO – the UN regulatory body for shipping in what is perhaps the most global of industries – being based in London. Secondly, English law is still the predominant force in shipping contracts. So you have the regulatory body based here and the law that is most often in shipping contracts centred around English law – that’s a pretty good starting point for why London will remain important.”

He also points to London’s importance as an arbitration hub. More maritime disputes are referred to arbitration in London than to any other venue worldwide - the LMAA (London Maritime Arbitrators Association) reported 3,193 new appointments under its terms and procedures last year, an increase of almost 15%.

“On the back of that, law firms and experts who get involved in those arbitrations need to be broadly centred here, or at least have offices here,” said Shaw. “From there, you are starting to build out a strong maritime cluster. In marine insurance, Lloyd’s is still very important for all three major marine insurance classes – cargo, P&I and hull, he noted. Seven of the International Group P&I clubs are based in the UK with large London offices, and the other five have a significant presence in the city. Among them, both The Swedish Club and Gard have recently stepped up their presence in London.

“Most of the other international bodies that support the international maritime regulatory framework are also based here – the International Chamber of Shipping (ICS), the International Association of Classification Societies (IACS), INTERTANKO, INTERCARGO, InterManager, the

International Transport Workers’ Federation (ITF) and ITOPF (International Tanker Owners Pollution Federation).

One of the key reasons for this is the IMO – a lot of organisations have NGO status at the IMO and want to make representations, and that makes it important to be in London.”

Shaw concluded: “In terms of the International Group, we place the biggest or second biggest reinsurance contract in the world. Certainly it is the most high-profile, and it is brokered here in London. A large slice of that goes into the London market, including Lloyd’s.”

There is good evidence that the London maritime cluster is growing, said Jos Standerwick, CEO of Maritime London

“We have seen new shipping entities build their commercial management in the UK – some because of the UK Shipping Concierge [which helps maritime businesses interact with government departments] set up two years ago. We have seen a significant entry into the UK tonnage tax over the past year or so. We continue to see law firms, both UK-based and international, build their presence in the UK. There is evidence that the established P&I Clubs in the UK are bolstering their presence and with the NorthStandard merger we have one of the biggest P&I Clubs globally in the UK. We have also seen the likes of Taylor Maritime issue IPOs in London.

“There is a real opportunity for asset management operations in the UK; as new capital comes into the market that will be required to decarbonise, and we see the enhanced importance of ESG coupled with transparency in the shipping industry, the sorts of structures that will come out of that are well suited to jurisdiction within the UK. We have seen a growth of asset management in the UK and, if we get the offer right, this is a potential area of significant growth.”

Standerwick also highlighted English law: “It is still

nearly ubiquitous in shipping contracts and charter parties and, as a consequence, London maintains a significant proportion of marine insurance and shipbroking globally. More than 30% of global marine insurance premiums are put through the London market. London is still the leading hub for ship brokering, especially for the tanker and dry bulk markets.”

Chris Shirling-Rooke, CEO of Maritime UK, said: “The success of London International Shipping Week continues to prove we are the world’s natural home for maritime. But it’s not just about London. The popularity of LISW in recent years has been driven by a maritime renaissance across the UK. Our infrastructure, services, people and heritage set us apart and ensure we’ll remain a maritime hub for decades to come.”

There are numerous reasons for the UK’s attractiveness, he noted, “but ultimately it comes down to one crucial factor – our people. As an island nation with a deep-rooted maritime and trade heritage, we embrace diversity and cultivate a welcoming environment. It’s this aspect that makes our country an attractive destination for conducting business.”

The Baltic Exchange has a physical presence in Singapore, Athens, Shanghai and the United States, but remains London headquartered. Mark Jackson, CEO of the Baltic Exchange said: “Our origins can be found in an 18th century London coffee house, where shipowners and merchants would meet to discuss trade. Whilst our trading floor days are behind us, we still think that London is the perfect location for an organisation which represents a global community of shipping interests.

“Being based in London puts us at the heart of the international shipping markets. We are in close proximity to large and small shipbroking firms, charterers and traders, as well as shipowners. Also important to us is the presence of the financial markets. Innovations in futures and options trading have enabled the development of a thriving freight derivatives market. As an audited benchmark producer, we employ people with a range of skills. Being based in London gives us access to a deep pool of talent, especially people with niche shipping, financial and IT experience.”

The UK’s main strength as a global maritime hub is the presence of so many interconnected service providers and the network effect this delivers, said Jackson.

“From shipbroking to insurance through to legal and finance-related businesses, shipowners benefit from the presence of so many experts in one city. It’s a place where shipping, tech and finance converge. Language, time zone and the ease of international connections are also critical.”

The International Association of Classification Societies is in London “because that is where the IMO is,” according to IACS Secretary General Robert Ashdown.

“Our meeting structure is built around the IMO’s meeting structure and our involvement with the IMO is our primary focus,” he said. “IACS had a permanent representative at the IMO long before it had a secretary general; that’s because to deliver at/serve the IMO was the primary motivation when IACS came into being in 1968.

Our IMO work makes up 90% of what we do.”

The IMO also pulls in many other associations and organisations, he added – “including our primary

interlocutors, such as ICS, INTERTANKO and INTERCARGO and the International Group of P&I Clubs, which is very convenient. For us, London doesn’t really have any negative factors – it is very easy to recruit staff, it is a good city and attractive destination for members to travel to for meetings, etc. Perhaps the downside is that it is not cheap – but where is these days? Try to do business in Paris or Tokyo and it’s equally expensive.”

The Brexit question has to be asked. Ashdown said: “Brexit has made no difference for us. Most of the employees who come into the IACS office as secondees from outside have been from outside Europe, including India, Korea, China, Japan, etc., so they needed working visas and we have always had to deal with those issues. If anything, obtaining skilled worker visas has become quicker post-Brexit than before.

to long-term strategy, rather than quick wins – and, at the same time, we must maintain a very good relationship with the EU.”

Does the pendulum continue to swing east when it comes to shipping?

Ashdown said: “Shipping always tends to follow the shipowners, who are at the top of the food chain, and services filter down from the owners. An increasing volume of tonnage is owned in Asia and so you see, for example, ship finance moving east, insurance moving east, and the likes of the International Chamber of Shipping, BIMCO and WSC establishing offices in Asia. That trend, a general drift east, is likely to continue.”

Although the IMO’s lease will soon be up for renewal, there are no suggestions it is ready to leave London, said Standerwick. “However, it’s incumbent on everyone in the UK and London maritime markets to ensure that the IMO feels appreciated and knows that we understand how important it is that they are still based here.”

There is widespread optimism about London’s future, visualised by Standerwick as ‘a really great story for London and the UK’.

Our meeting structure is built around the IMO’s meeting structure and our involvement with the IMO is our primary focus

Robert Ashdown, Secretary General, IACS

However, Nick Shaw said: Brexit has made a difference. It hasn’t helped the P&I clubs because a number who are regulated by the PRA have had to expand their office networks in Europe or increase their personnel in the places where they do business in Europe.”

Standerwick said the market has been incredibly resilient around Brexit, but he believes more could be done to take advantage of the UK’s departure from the EU. “The UK could think a little bit more creatively about how it could support the maritime industries in this country, now that we are outside the EU, whether in terms of taxation or the way the government can support capital coming into the market,” he said. “These opportunities would be a medium

“We lean into our heritage as a maritime centre but we are definitely embracing innovation and creating a market fit for the challenges ahead. The level of innovation across the market is genuinely unprecedented. We have more start-ups based in the maritime sector with either a decarbonisation or digitalisation focus in the UK than any other cluster. Look at the ways some of the biggest firms in the market across marine insurance, ship broking, etc., are beginning to embrace technology and the way in which that is changing the service and the way they deliver value to their customers. We have seen a very significant shift in the past couple of years.”

The UK Government ‘gets’ shipping and has been keen to work with the sector in recent years, said Jackson. However, London is an expensive location: “Corporate and personal taxation as well as office rents and the general cost of living are all factors which companies and individuals take into consideration when choosing whether or not to be based in London. London never stands still and to remain a top global maritime hub it will need to continue to be able to attract the best talent, the best ideas and to continue to innovate and evolve.”

Shirling-Rooke said: “We feel that our strongest days as a maritime nation lie in the future. Any impact of Brexit pales in comparison to the pandemic and Russia’s invasion of Ukraine. And yet maritime in the UK continues to survive, and thrive, as it’s done for centuries.” l

This year’s London International Shipping Week (LISW23) will be 10-year anniversary edition and promises to be the ‘must attend’ event of 2023, offering more than 300 industry functions and unique networking opportunities.

Leaders from across all sectors of the international shipping industry come to LISW to exchange views and network – regulators, charterers, ship owners, ship managers, bunker suppliers, maritime lawyers, ship brokers, bankers, insurers, insurance brokers, commodity traders and brokers, ship suppliers, port operators, shipping service providers and many more.

LISW is a cluster event, meaning that rather than being centred around an exhibition hall, the organisations supporting LISW run their own events. These are many and varied, and include seminars, cocktail receptions, conferences and product launches, run by international organisations, marine trade associations and individual companies from all sectors of the shipping industry. The week is actively

supported by the UK Government.

This year’s LISW23 also sees important national delegations attending from overseas countries including Cyprus, France, the Netherlands and Gibraltar amongst others.

Some of the many iconic venues that London has to offer will host events during the week, including the IMO building, the Maritime Museum, Greenwich, Tower Bridge and various vessels moored on the Thames.

Two LISW23 events stand out: The Headline Conference on Wednesday 13 September and the Champagne Reception, Gala Dinner and After Party on Thursday 14 September at the spectacular Evolution London in Battersea Park. Both events have surpassed all previous attendance records and both are expected to be sold out well before the week begins.