M ARKET U PDATE

Mark Sprague

Mark Sprague State Director of Information Capital

What do you think?

Will the market in 2024 be Better? Same? Worse?

•When do we get back to normal? Economy / jobs / savings / rates.

•Supply-chain disruptions – are they gone?

•Inflation - what is healthy inflation?

•Where are rates headed?

•What is the possibility of a recession?

•2020 / 2021 / 2022 was an outlier, not a benchmark. Ditto on 2023….

•FOMO vs FOBATT

•What inning are we in?

Mark Sprague State Director of Information Capital

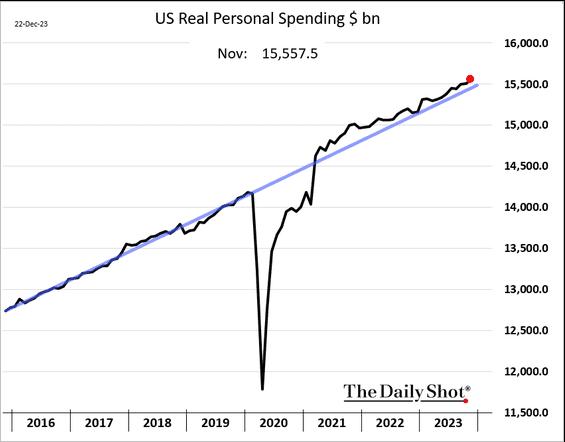

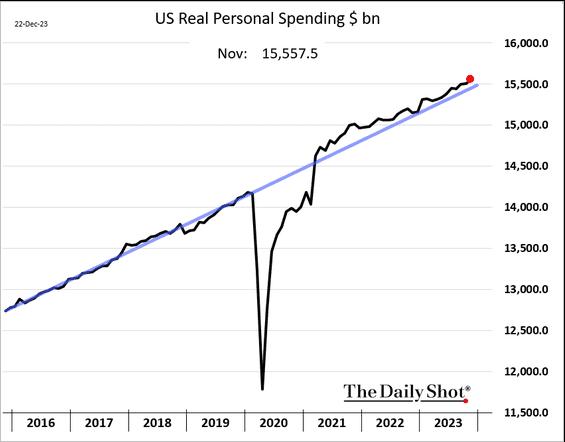

Real Personal Consumption Expenditures

It remains on trend keeping the economy growing and frustrating the Fed

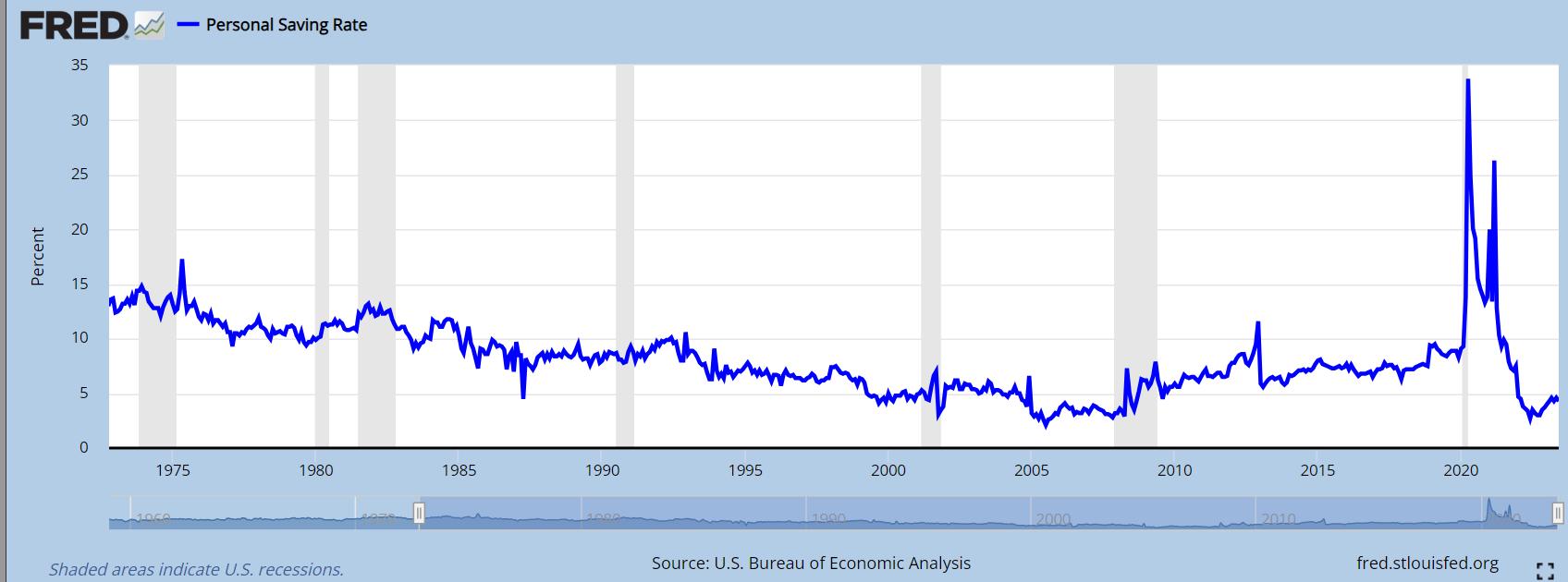

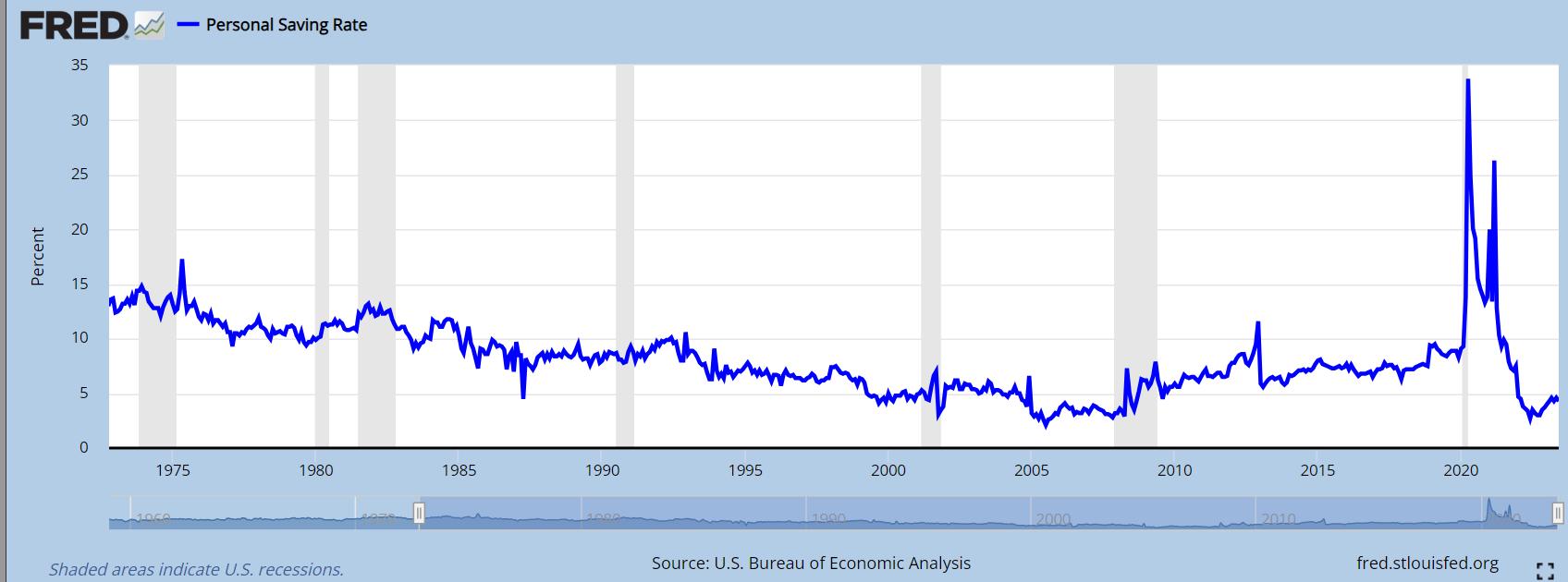

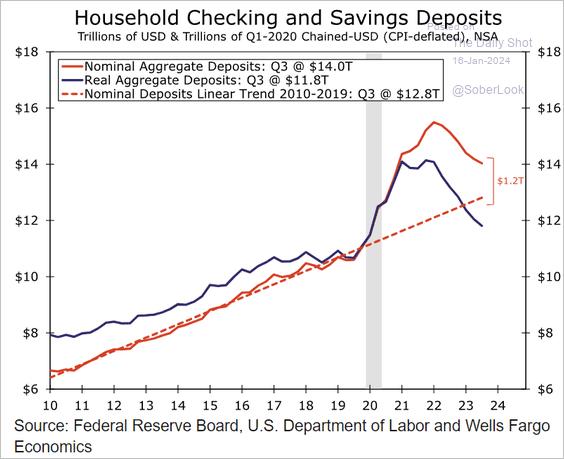

Household Savings Rate Down

Household Savings Rate Down

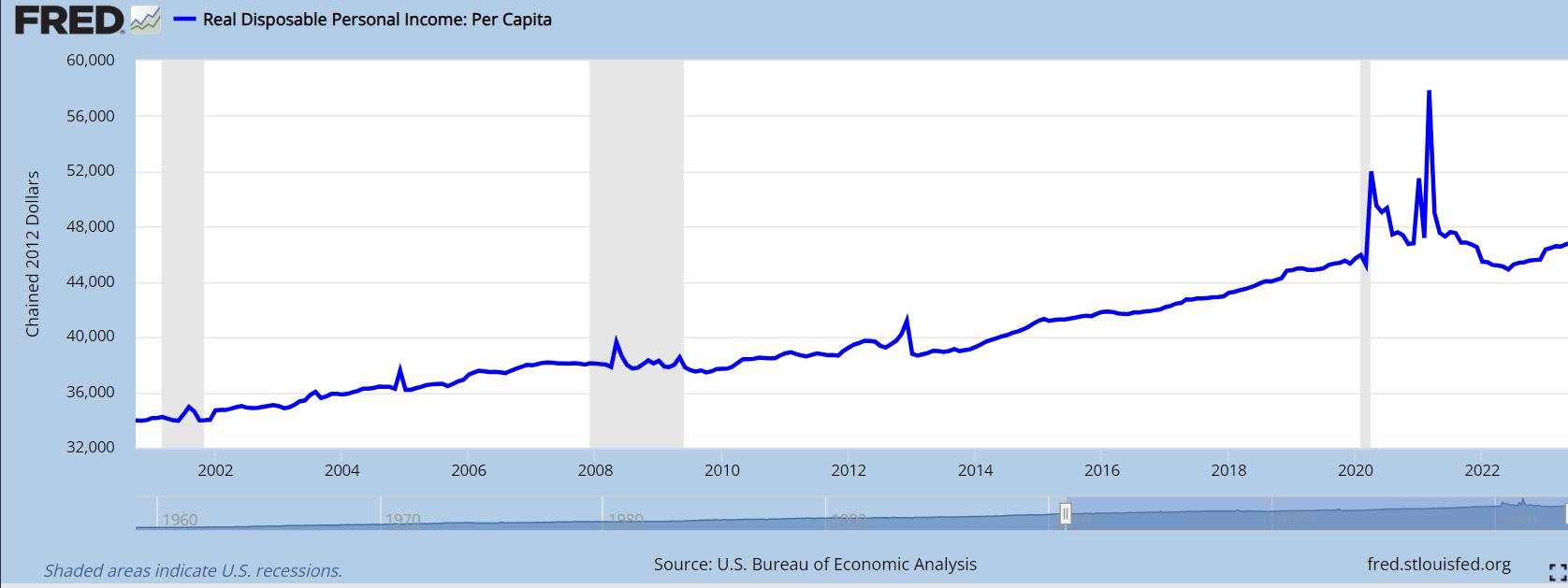

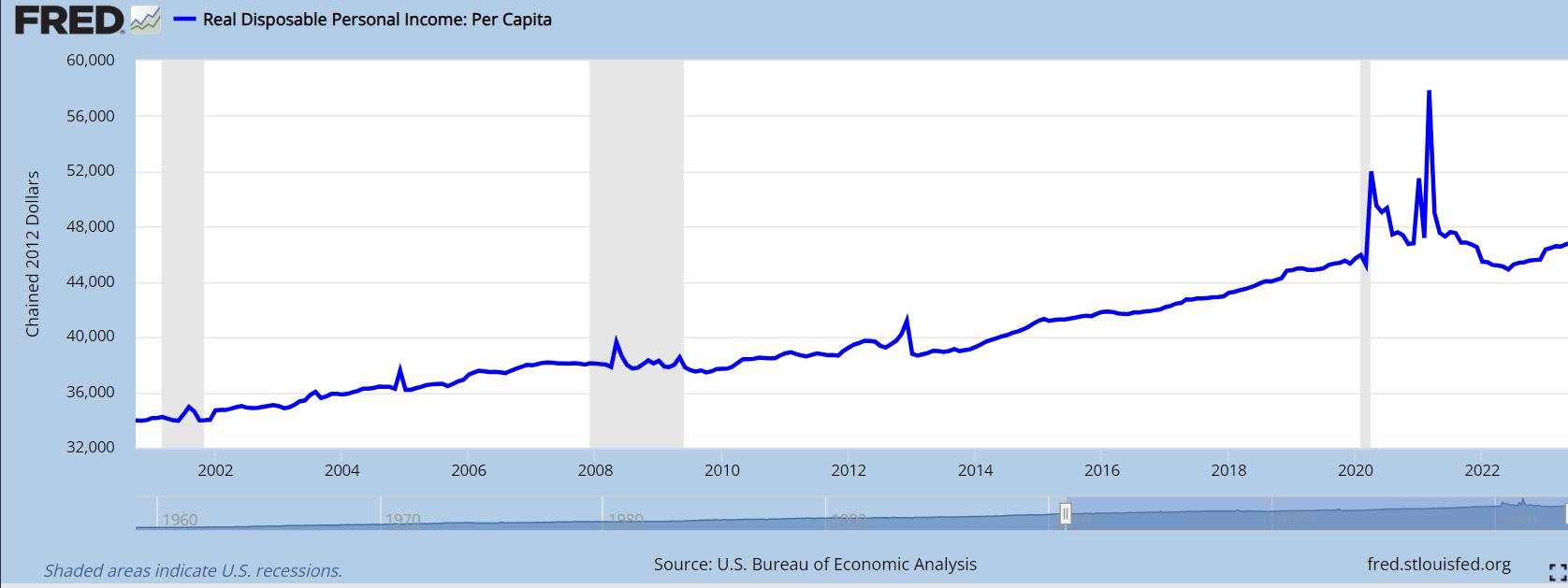

Per Capital Disposable Income

Better than before COVID, but not much…

Mark Sprague State Director of Information Capital

Where have we been (2020)?

• Federal funds rate cut to near 0%The COVID-19 pandemic shut down the globe economy and caused the largest dip and rise in GDP in history.

• Supply chain disruptions and retail shortages affected all industries.

• Still an issue.

• Energy prices surged due to oil wars. Values remain high because of wars and OPEC.

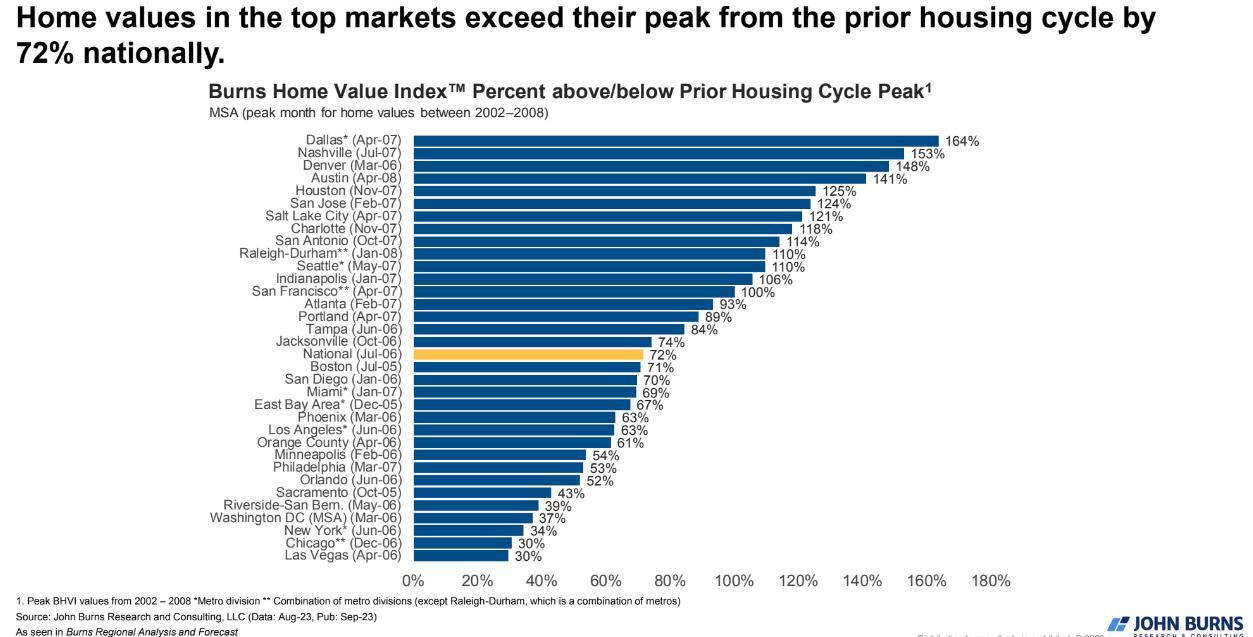

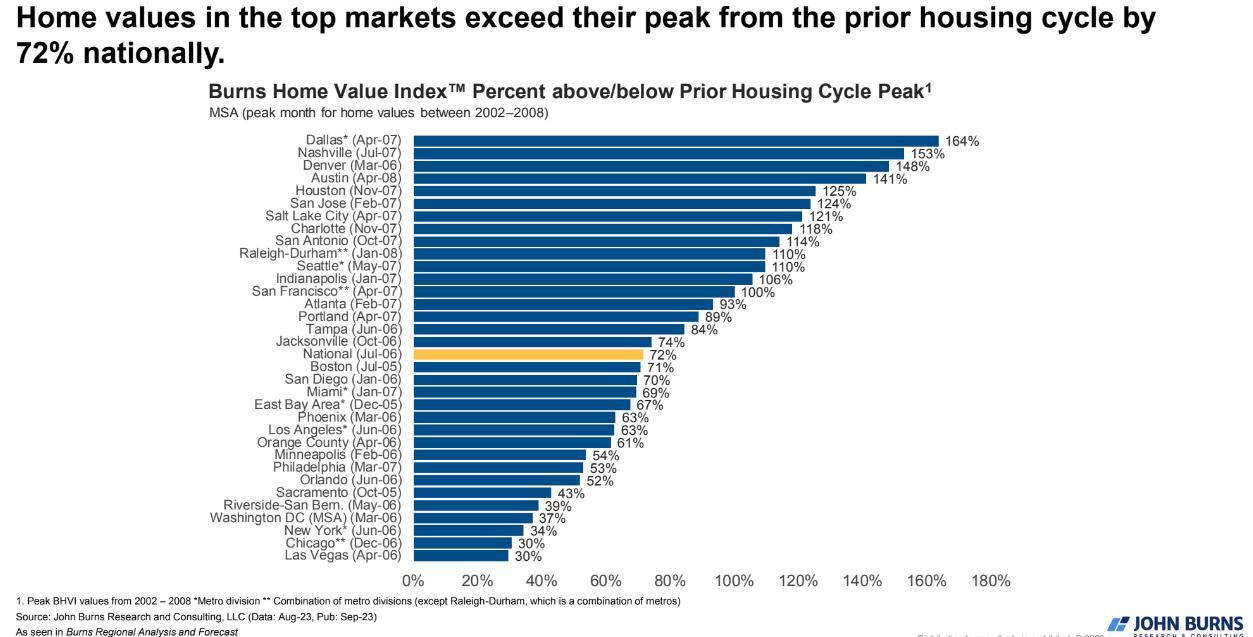

• Unexpected real estate boom. Real estate values increased significantly, The market saw a shortage of inventory and bidding wars.

• Values are expected to return to single digit appreciation in 2024.

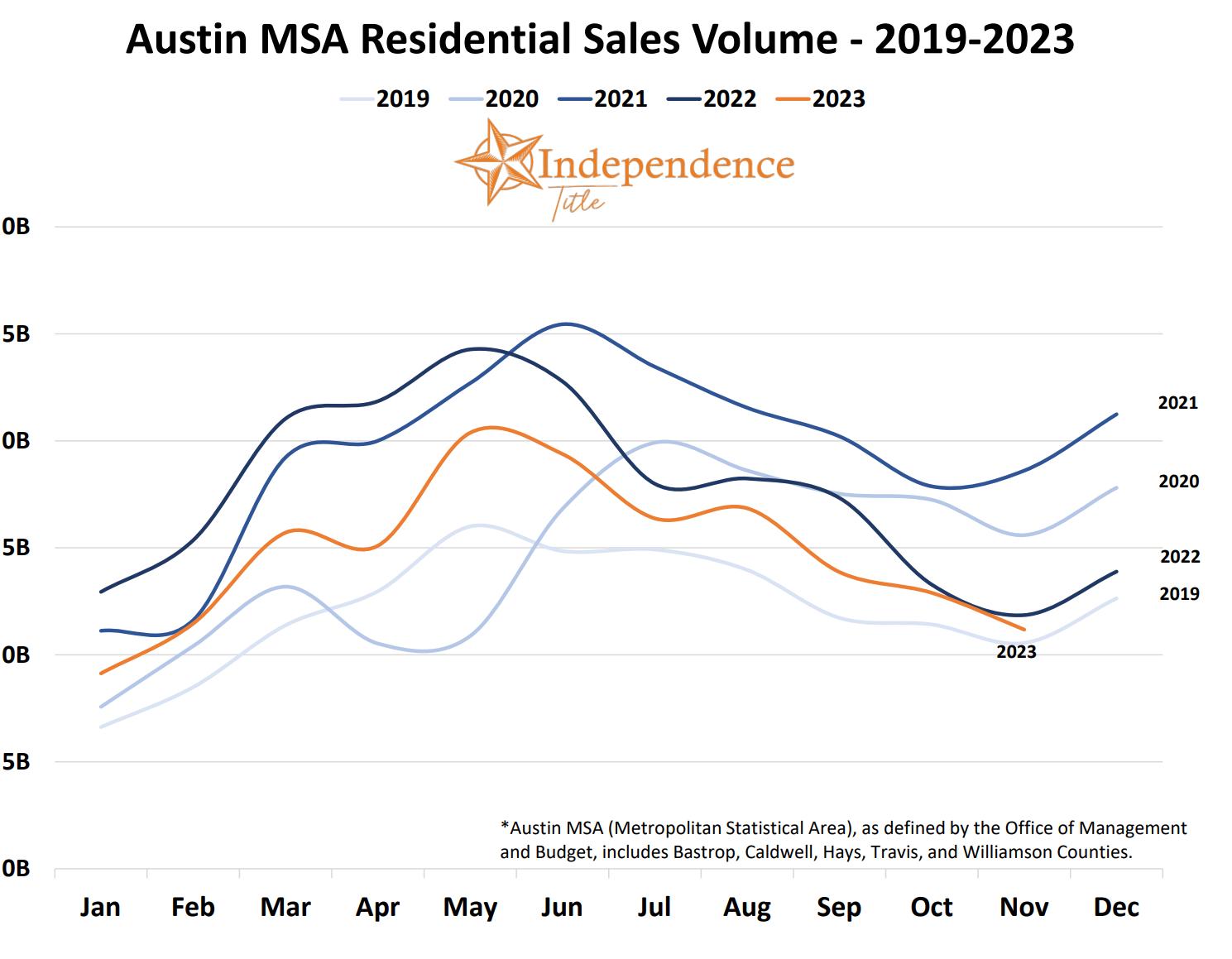

• In 2022, supply chain issues, rising rates caused residential sales to decrease and refis to drop by 70+%.

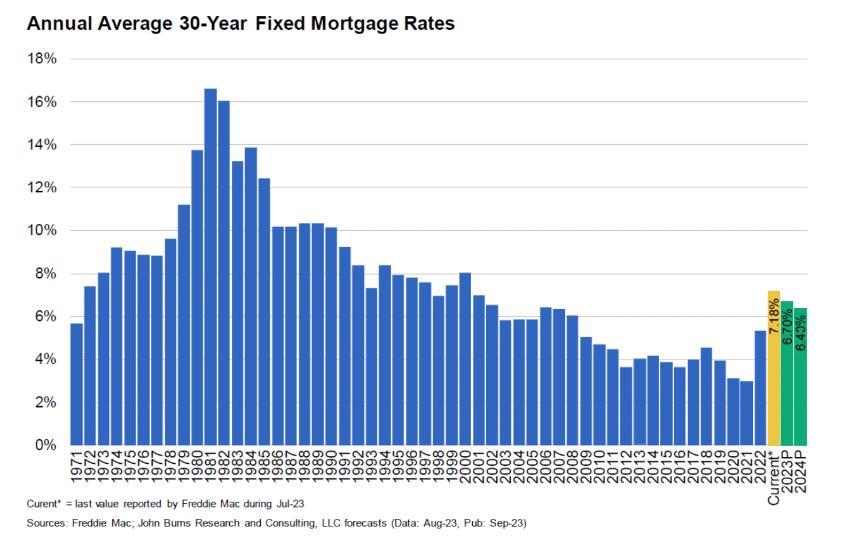

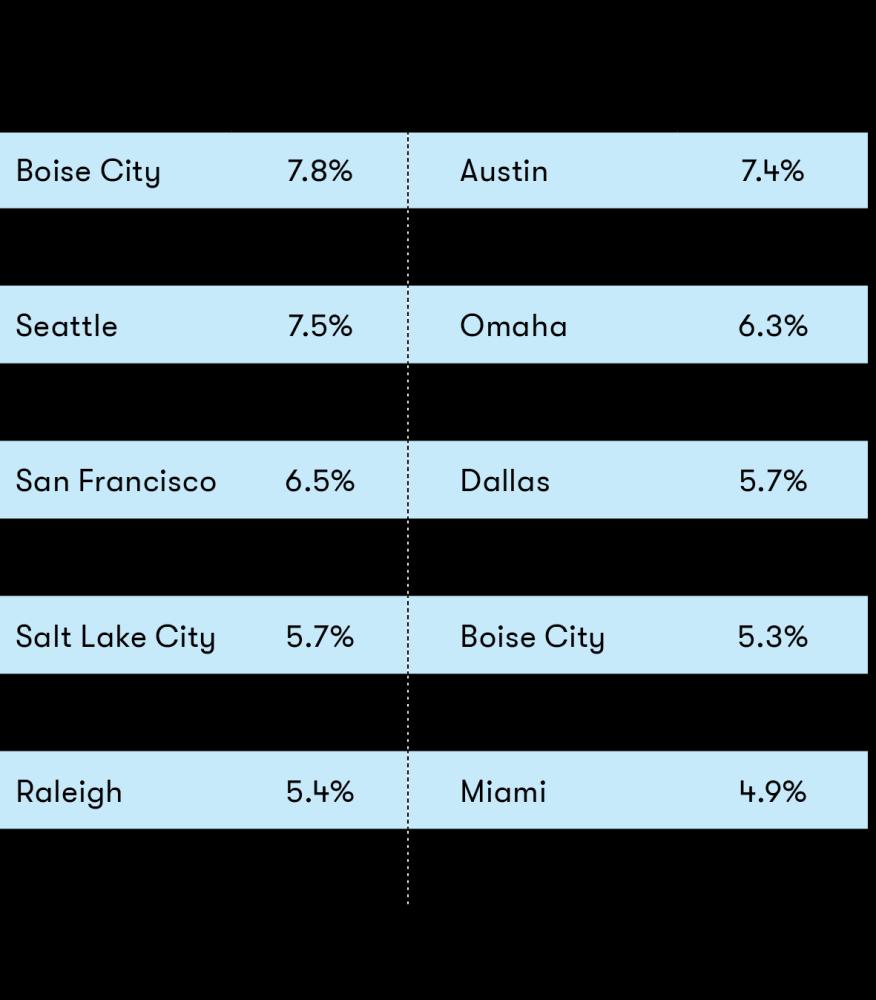

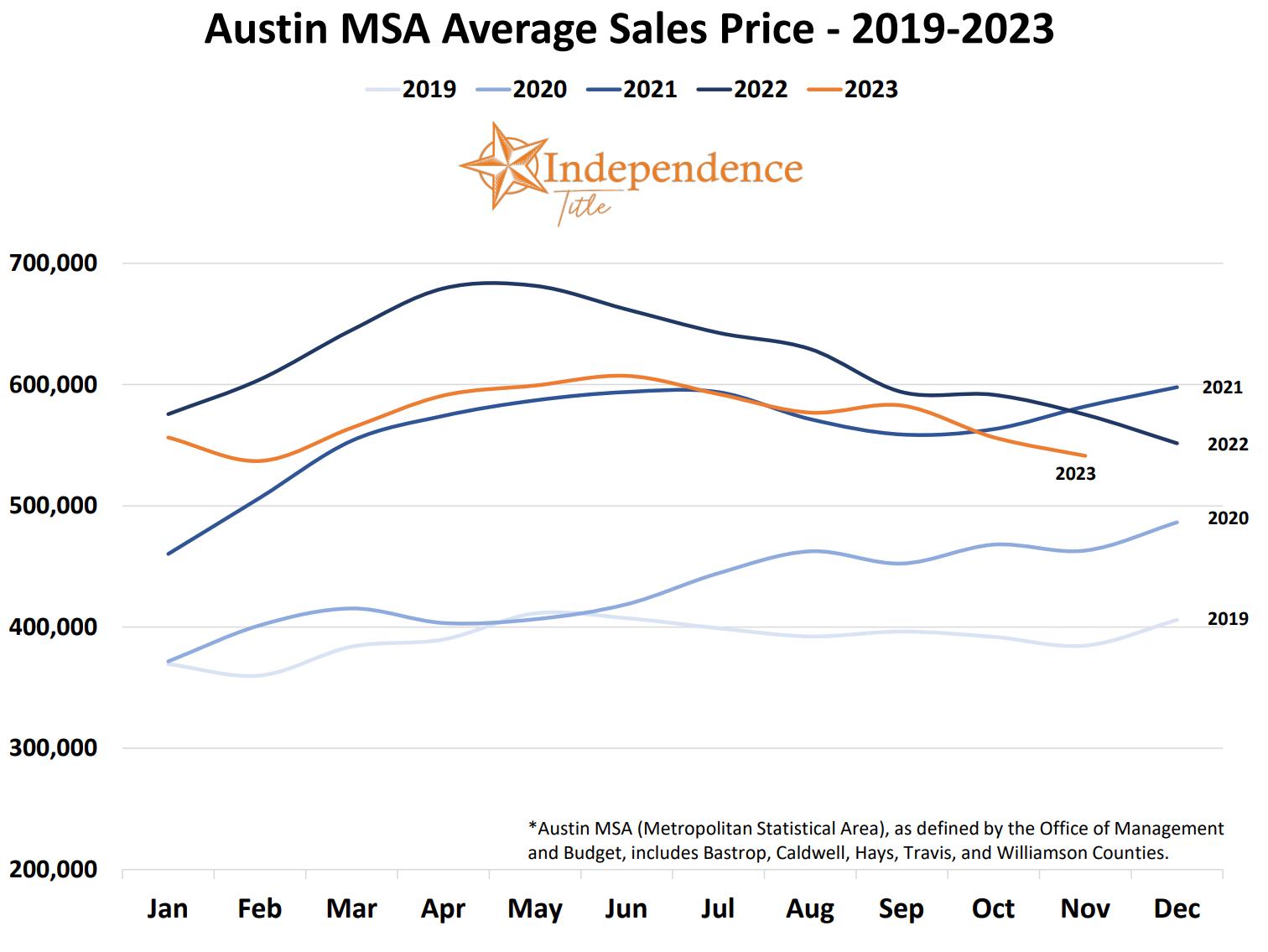

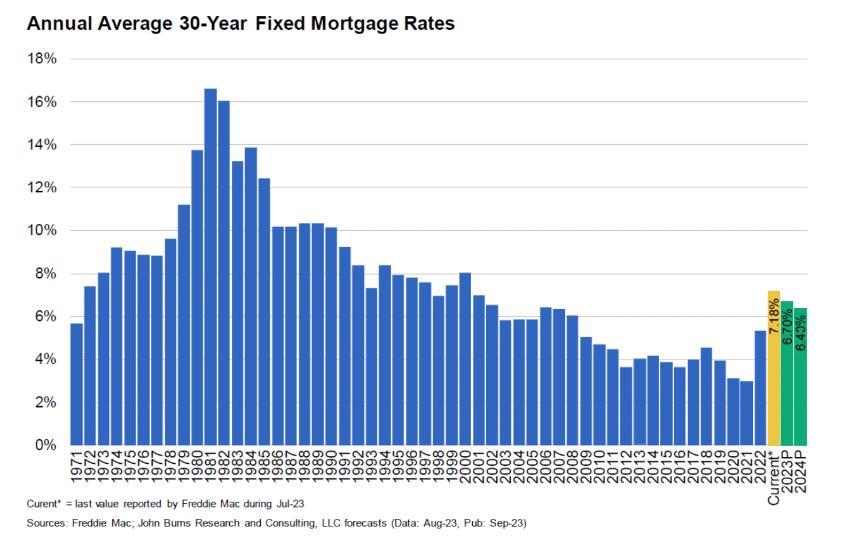

• The market paused in 2022 due to mid-year rate hikes and mortgage rates reaching 6% to 7%. 2023 should end up somewhere between 7.5% and 8.5%. 2024 rates have slowed, potentially stabilizing.

• Values will remain strong and continue to grow in 2024 /2025.

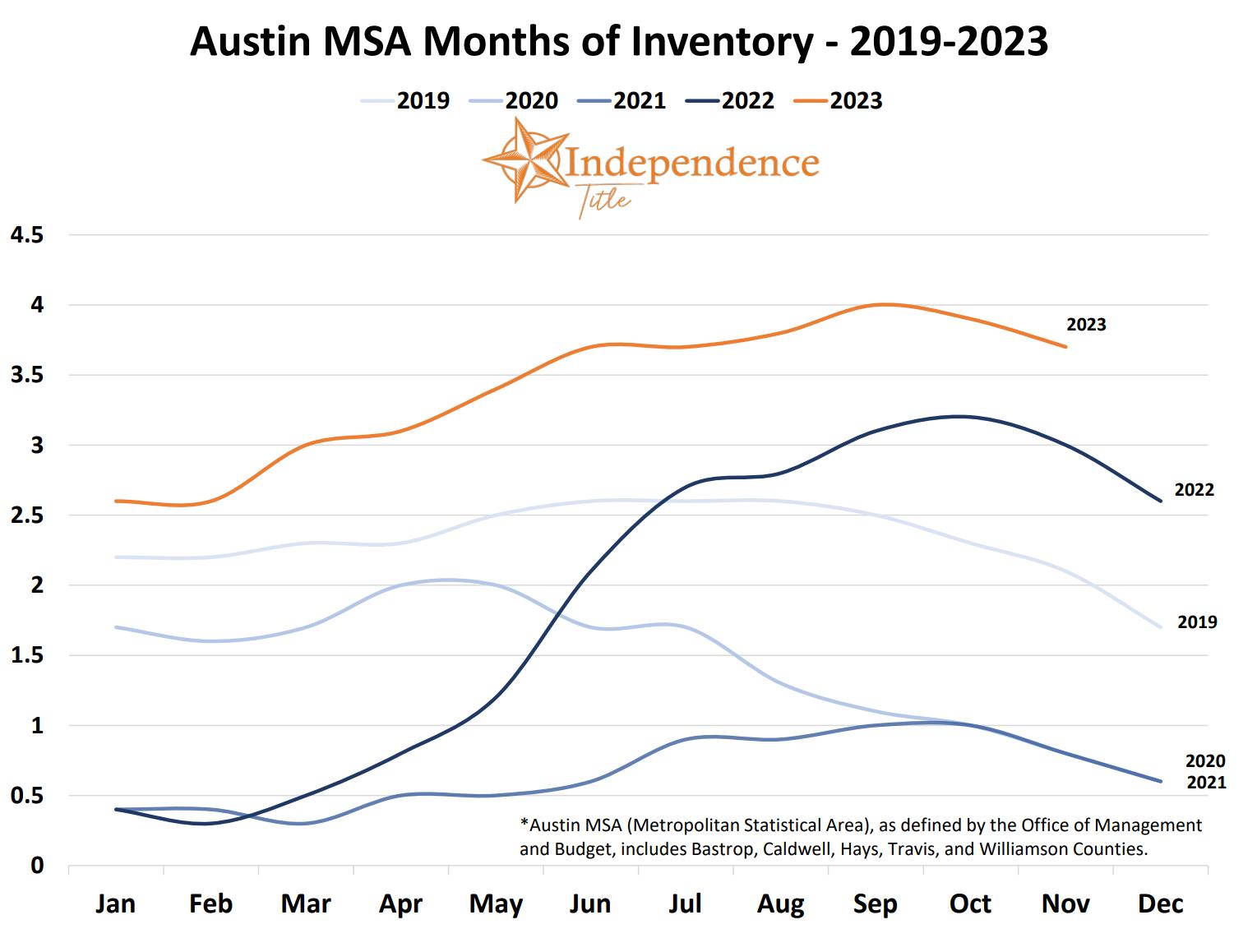

• Inventory will continue to be challenging for the next 3 to 5 years.

• Trillions of dollars flooding the economy (quantitative easing).

• Federal funds rate cut to near 0.

• Dow at record high – 18,591.

Mark Sprague State Director of Information Capital

COVID Economic Impact 2024

• Unusual economic downturn caused by the pandemic initially than economic upturn with govt. stimulus and continuing low rates.

• Rising incomes and surging demand for goods and housing.

• Collapse; than surge in demand for services and a labor shortage.

• Trends were prevalent before the pandemic, but 2020 compressed and accelerated them.

• Low-educated, low-skill, and direct contact service workers hit the hardest by COVID.

• Those with less formal education hit particularly hard.

• High-touch and face-to-face services severely impacted. Recovering in 2023.

• Small towns affected by mill and factory closures.

• Retail hit hard with over 30,000+ storefront closures.

• Rise of online purchases changing brick and mortar retail.

• Automation and digitalization of the economy contributing factors.

• Housing inventory remains below equilibrium.

• Quantitative tightening.

• Dow – 38,630+/-

• Rates rise, housing demand slows.

• Recovery ongoing.

Mark Sprague State Director of Information Capital

COVID Economic Impact

Reasons for the boom in the housing market during the pandemic:

• Increased need for larger homes with separate spaces for virtual meetings, as well as everyone's home……

• Caused greater than normal demand for homes, with some taking advantage of shutdowns to purchase secondary or tertiary homes for vacation properties..

• Preference for purchasing homes resulting in a record amount of home formations

• Ability to work from home and low mortgage rates due to Federal Reserve's monetary policy.

• Fiscal stimulus preventing economic collapse.

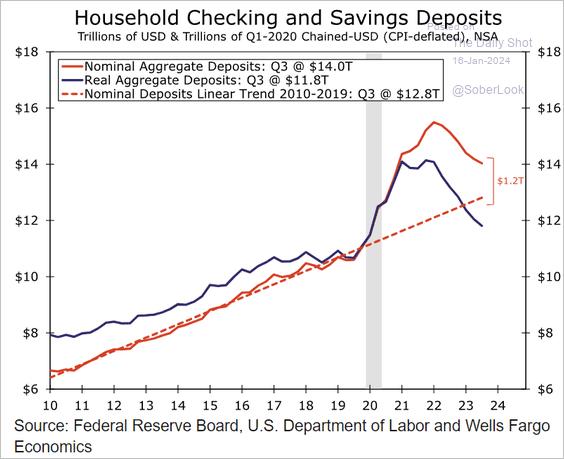

• Increase in savings, net worth, and earnings for many individuals. 2024 will see savings return to pre 2020 levels.

• Historical difficulties in finishing homes and labor/materials shortages contributing to shortage of homes available. Not enough inventory to meet demand.

• Accelerated trends such as hybrid work from home and relocation decisions.

• Need for a thriving business community with strong tax base, culture, and infrastructure to support residential real estate market.

• Demographic trends such as desire for larger homes, access to outdoors, walkability, and affordability, with millennials embracing home ownership more than ever before.

Mark Sprague State Director of Information Capital

Global Economic Outlook

The rest of the world was in recovery until the invasion of Ukraine…….

Mark Sprague State Director of Information Capital

Global Recovery Slow

Mark Sprague State Director of Information Capital

US Economic Outlook

Mark Sprague State Director of Information Capital

Lowest since 1969

Mark Sprague State Director of Information Capital

Comparison

Unemployment

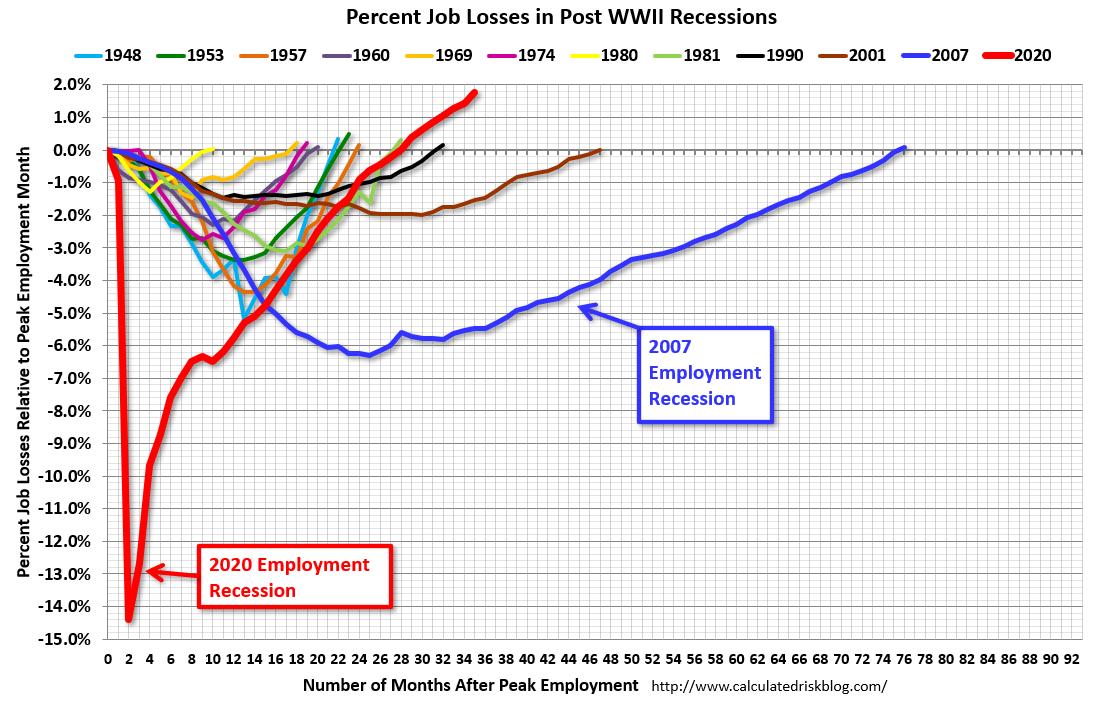

COVID Economic Comparison

Mark Sprague State Director of Information Capital

U.S. Economic Concerns in 2023 / 2024

There are concerns about a potential recession in the US due to:

• The conflict in Ukraine / Mid East.

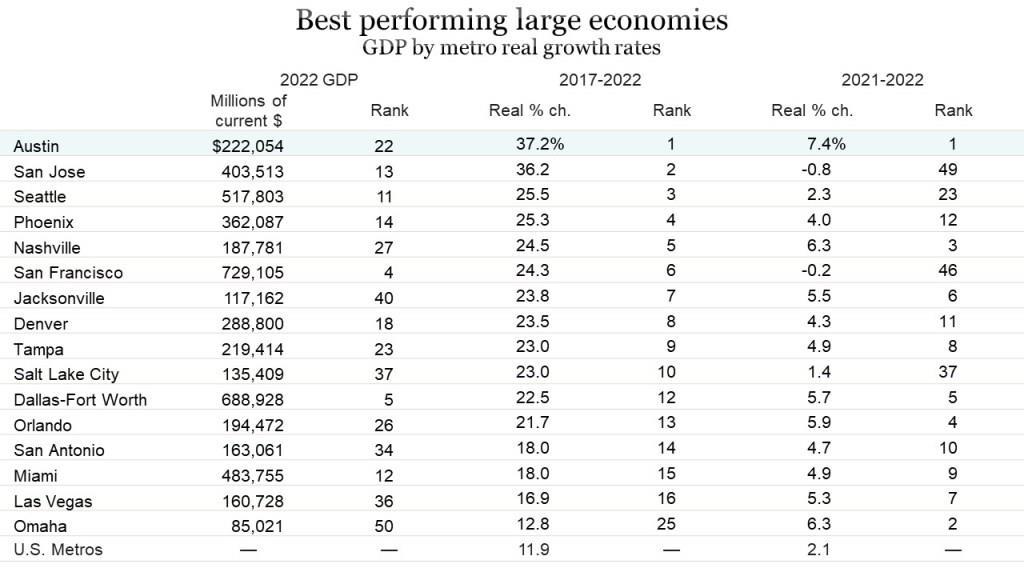

• GDP growth has decreased significantly, from 7% to 2.3%

• Inflation is slowing, ranging from 3.1+% presently from over 9% a year ago.

• Europe's reliance on Russian gas and restructuring contributes to higher inflation and a potential recession. Wars don’t help.

• China's COVID policy caused an economic lockdown, affecting the global supply chain and causing inflation, which increases the likelihood of a national recession particularly in China which would have global consequences.

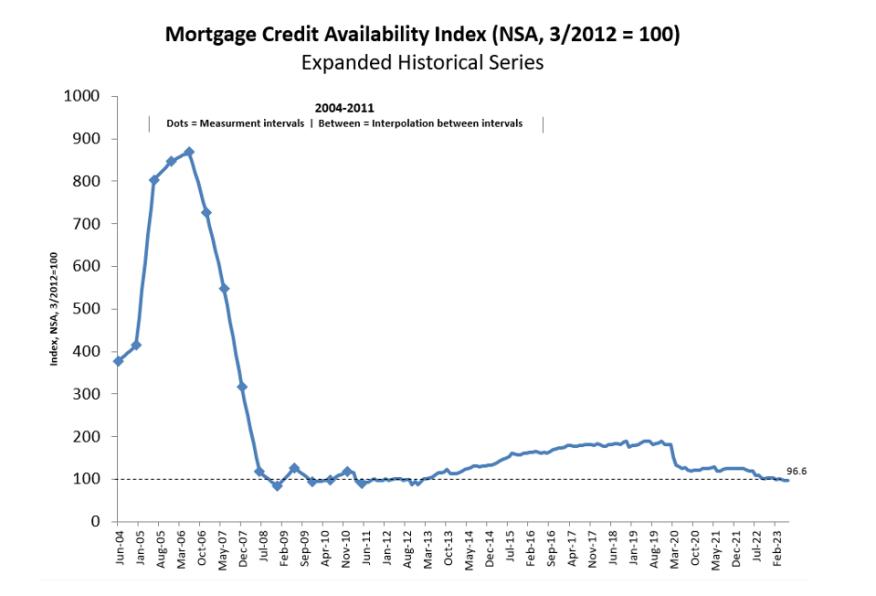

• Despite these challenges, consumers' credit scores, savings, and income are in much better shape than in previous rate increases, credit tightening, potential recessions.

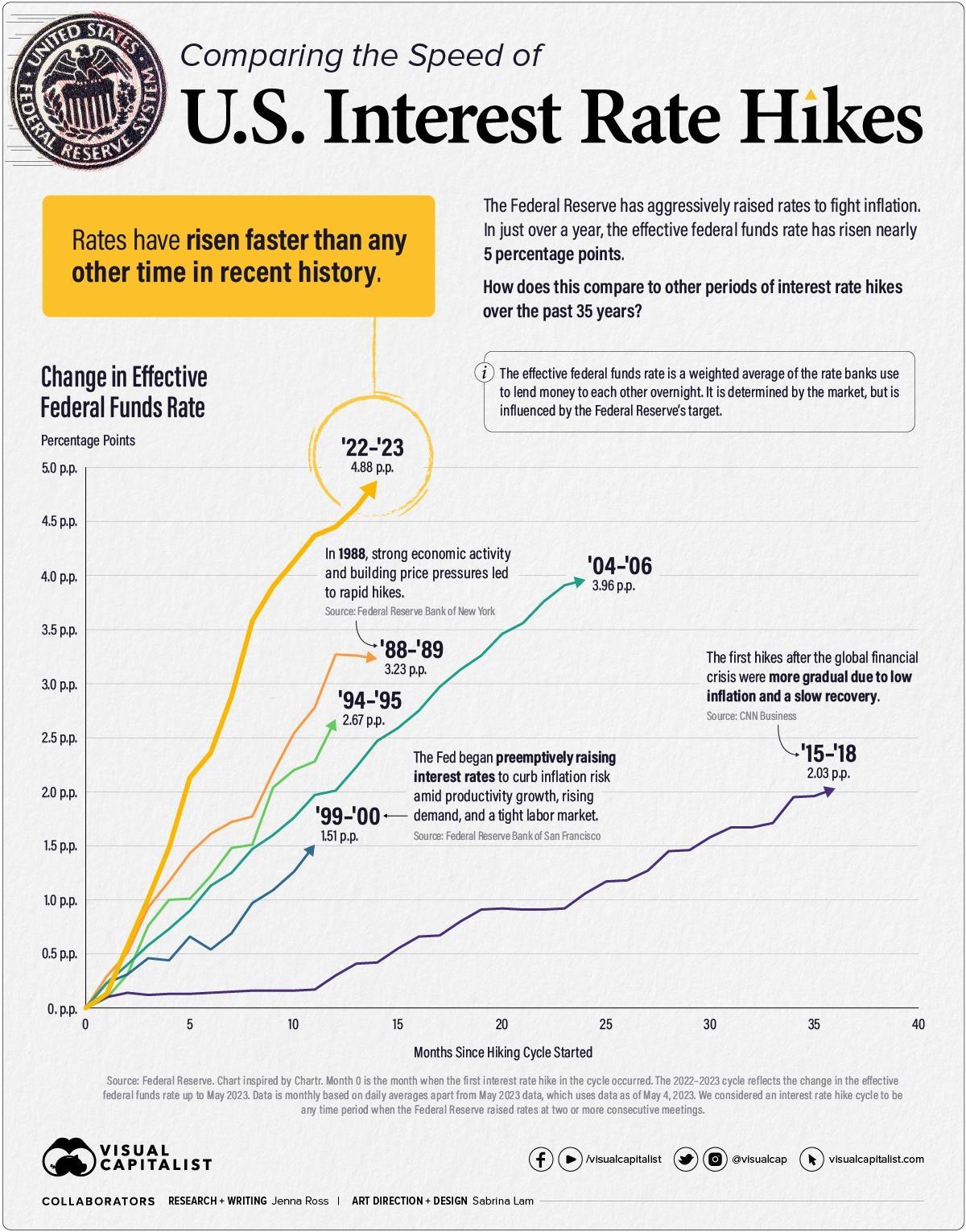

• The Fed is expected to continue to raise rates in response to the current economic climate, but there are signs of improvement in certain areas.

• Expectations on real estate, mortgages, stocks, etc. changed with rate expansion.

Mark Sprague State Director of Information Capital

U.S. Economic Concerns in 2024

Headwinds facing the US economy:

• US economy facing challenges with slow recovery from 2009 recession.

• Only 45% of country has recovered over past decade.

• Only 3 of top 50 US metropolitan areas fully recovered in terms of GDP, real estate values, and employment as of 2024.

• Industrial and manufacturing sectors have weak productivity growth.

• Sectors like hospitality, leisure, and retail improving, but still struggling.

• Lack of qualified applicants, and immigration policies not helping situation.

• Declining population and falling labor force participation also contributing factors.

• Wage growth improving.

• US housing and real estate market saw dramatic improvement in 2020 but unclear what normal market looks like.

• Trade wars, tariffs, and higher costs preventing expansion.

• Increasing polarization in income distribution making it challenging to restart and maintain economy over long term.

Mark Sprague State Director of Information Capital

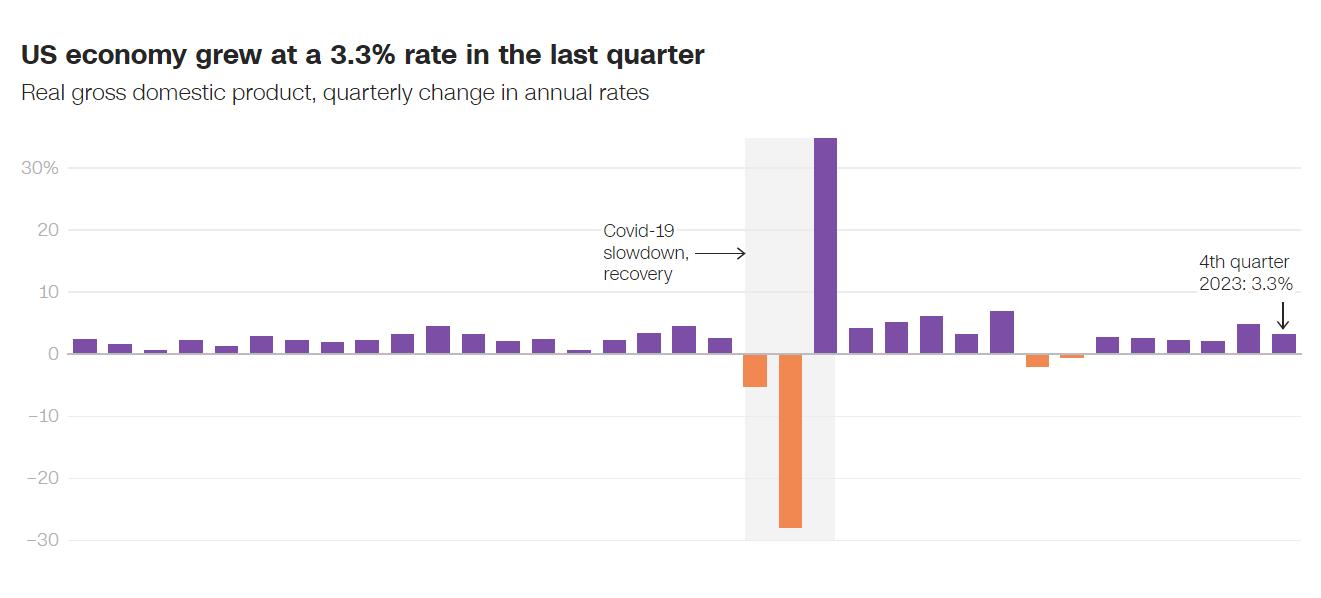

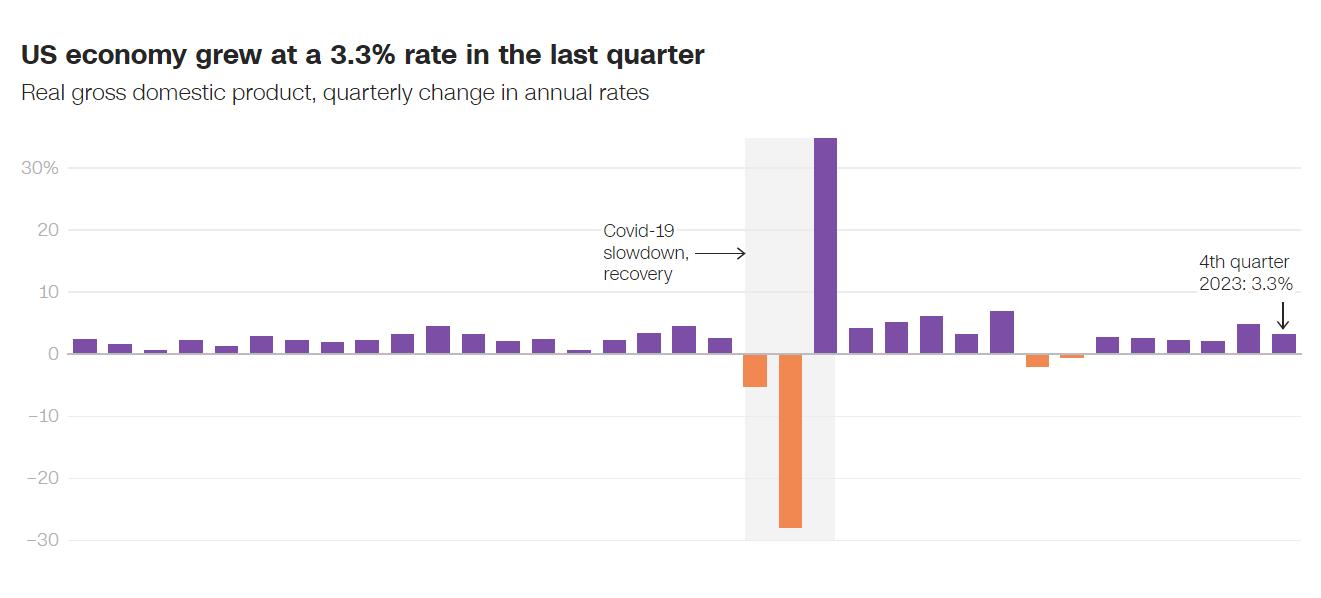

4Q23 Surprisingly Robust

Source: BEA

2024 U.S. Economic Outlook

• Rate hikes have already delivered their biggest hits to GDP growth.

• Central banks, meanwhile, will have room to reduce interest rates if they’re concerned about the economy slowing.

• Don’t expect the low rates of the previous 10+ years.

• The global and our national economy fared better than many economists expected in 2023 and will continue to improve in 2024.

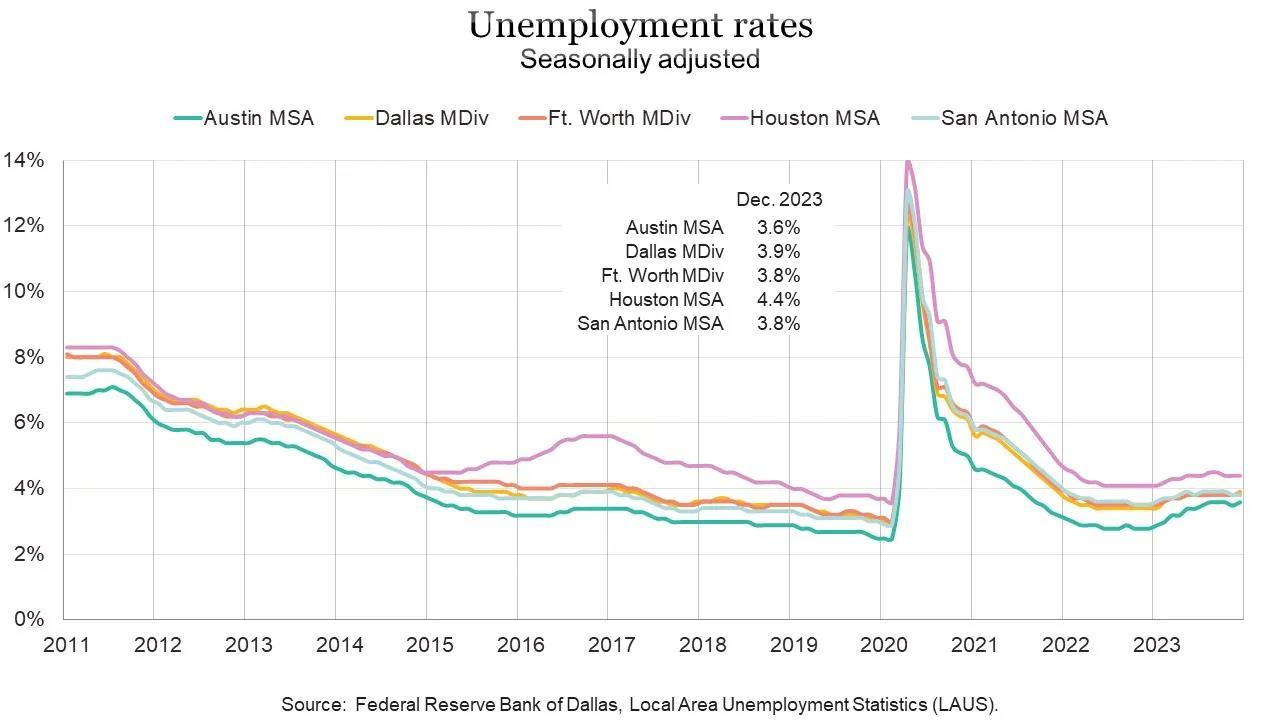

• Unemployment rates have improved since March 2020, only about 1.1 million people are still jobless. The number of hiring still out number the number of quits.

• Unemployment is historically low.

• Will inflation continue to cool?

• Inflation rates had been low for the past 20 years, but they increased to 9.1+% in 2022, which was a concern. Still higher than wanted in 2023, but moving in the right direction.

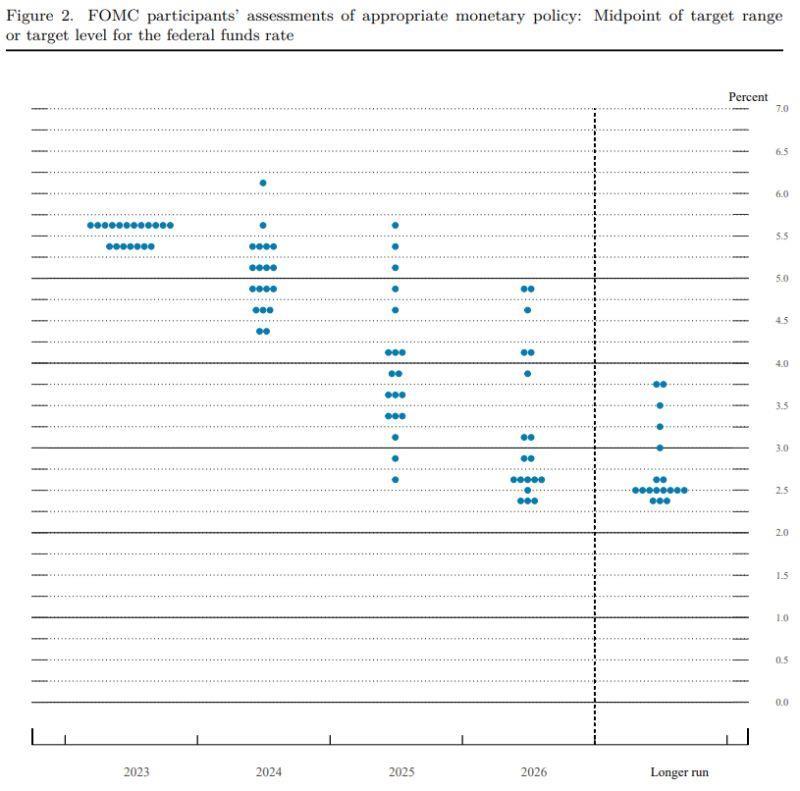

• The Federal Reserve has increased interest rates in response to the economy and they are projected to stabilize with possible rate decreases in 2024.

• Oil and gas prices have been impacted by war and a decline in consumption since 2020, and prices at the pump should continue to rise.

Mark Sprague State Director of Information Capital

4Q23 Surprisingly Robust

Source: BEA

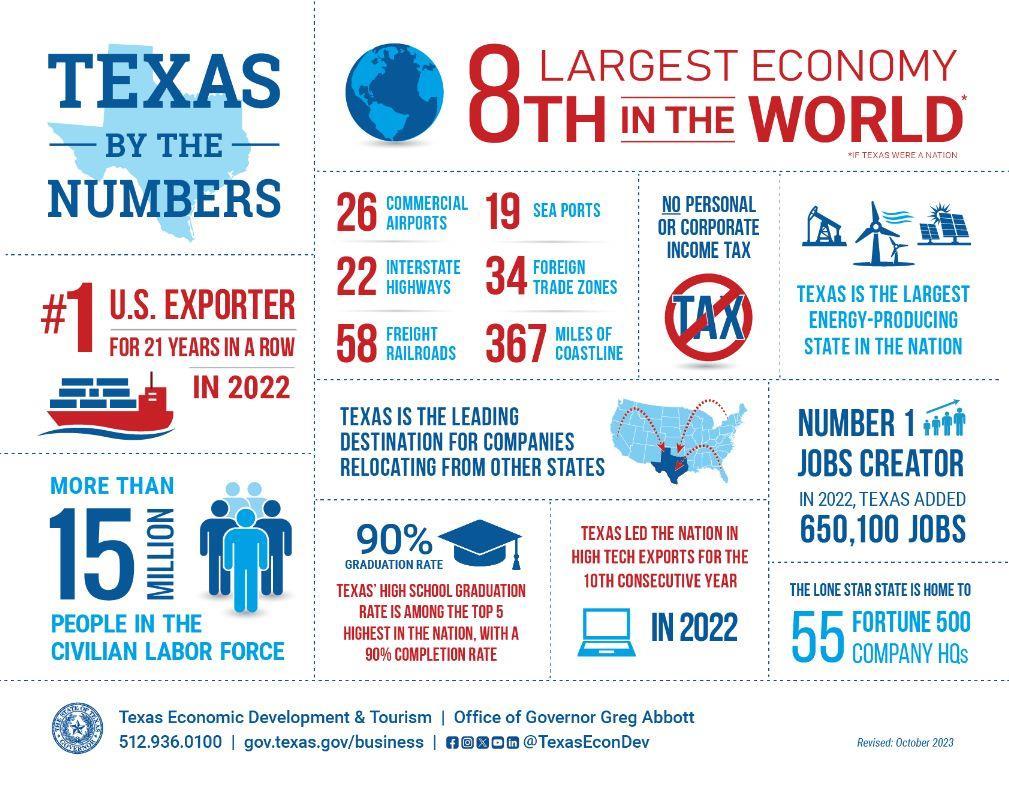

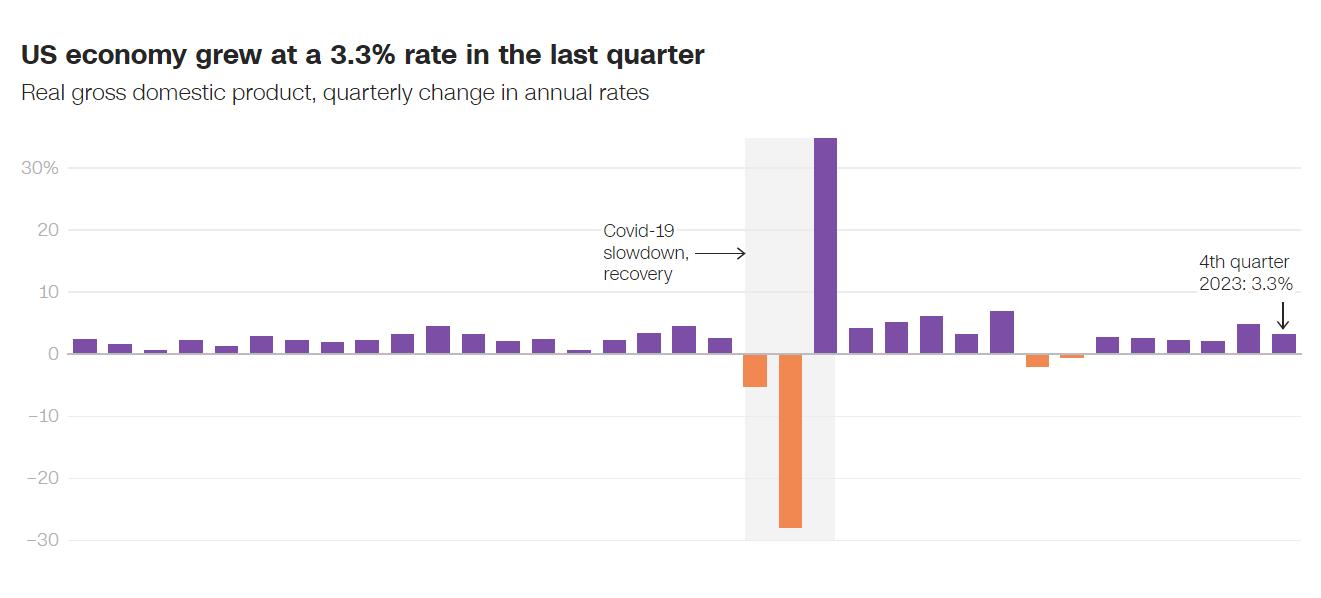

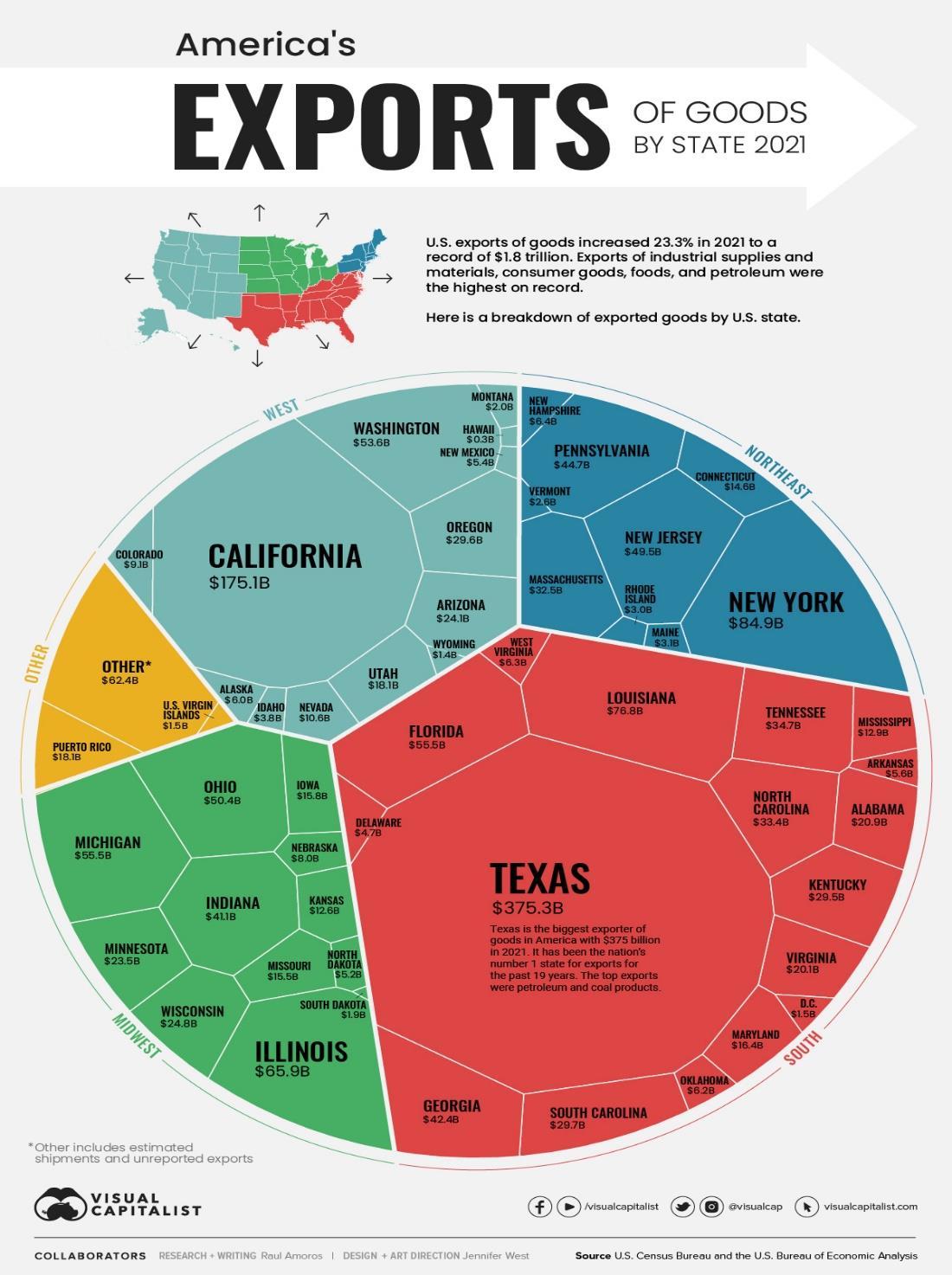

Texas Economic Outlook

Mark Sprague State Director of Information Capital

Mark Sprague State Director of Information Capital

Mark Sprague State Director of Information Capital

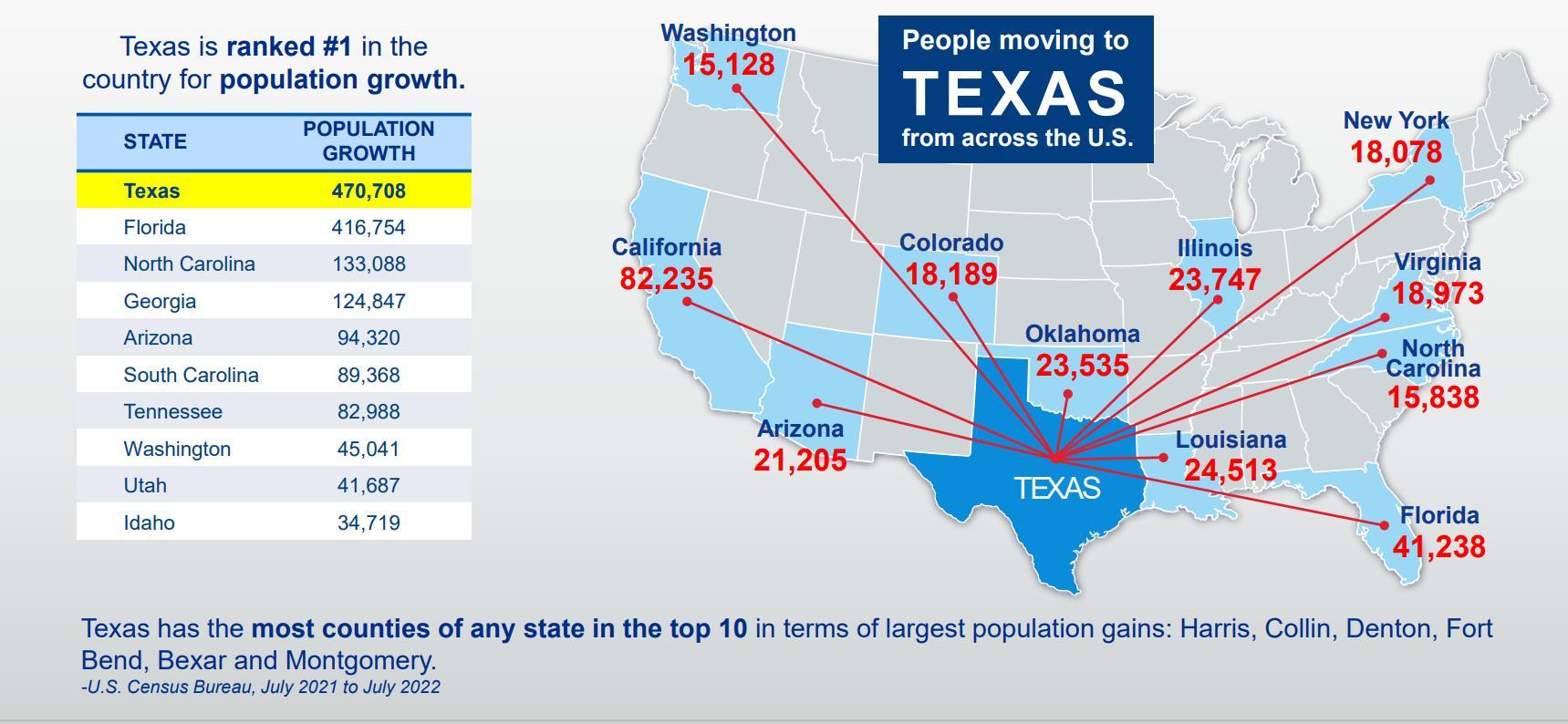

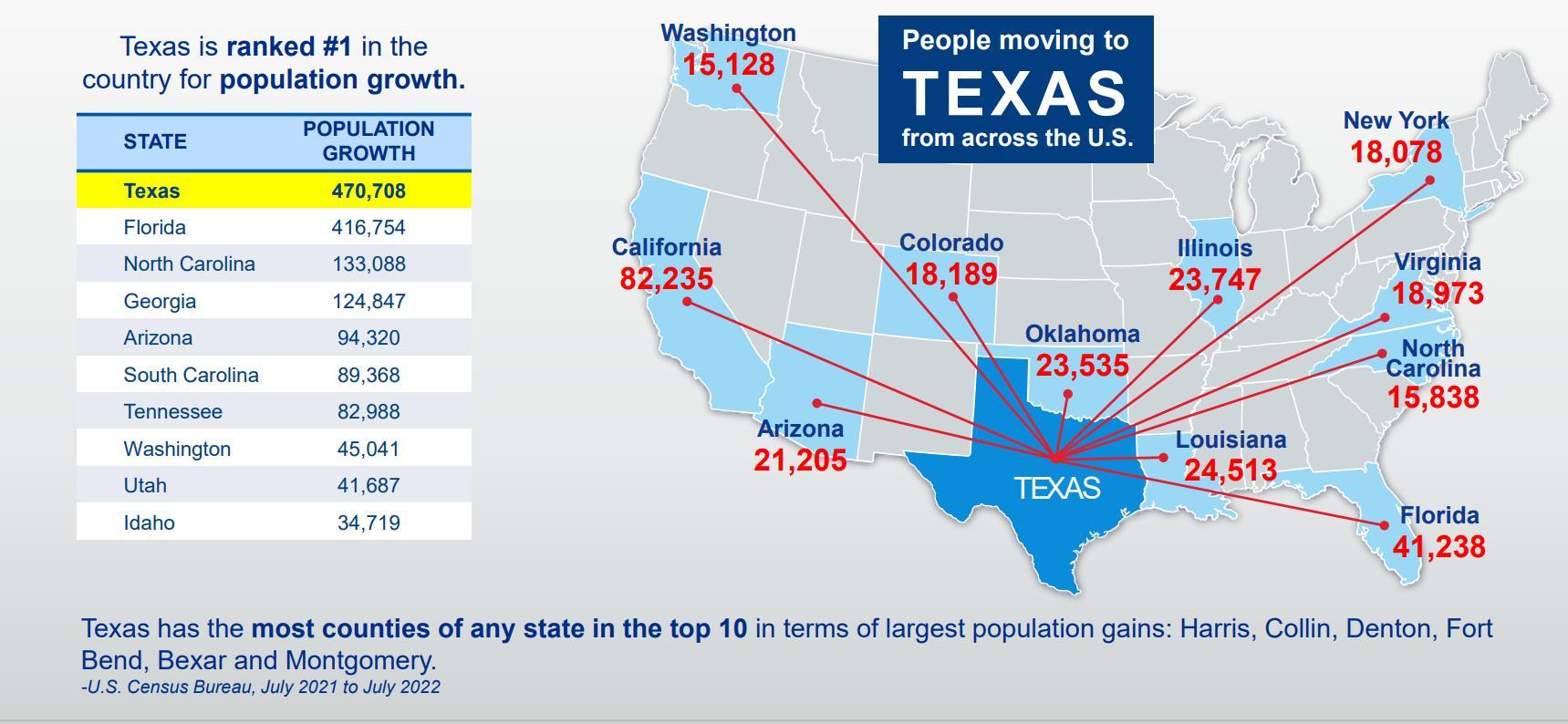

Population Growth

Mark Sprague State Director of Information Capital

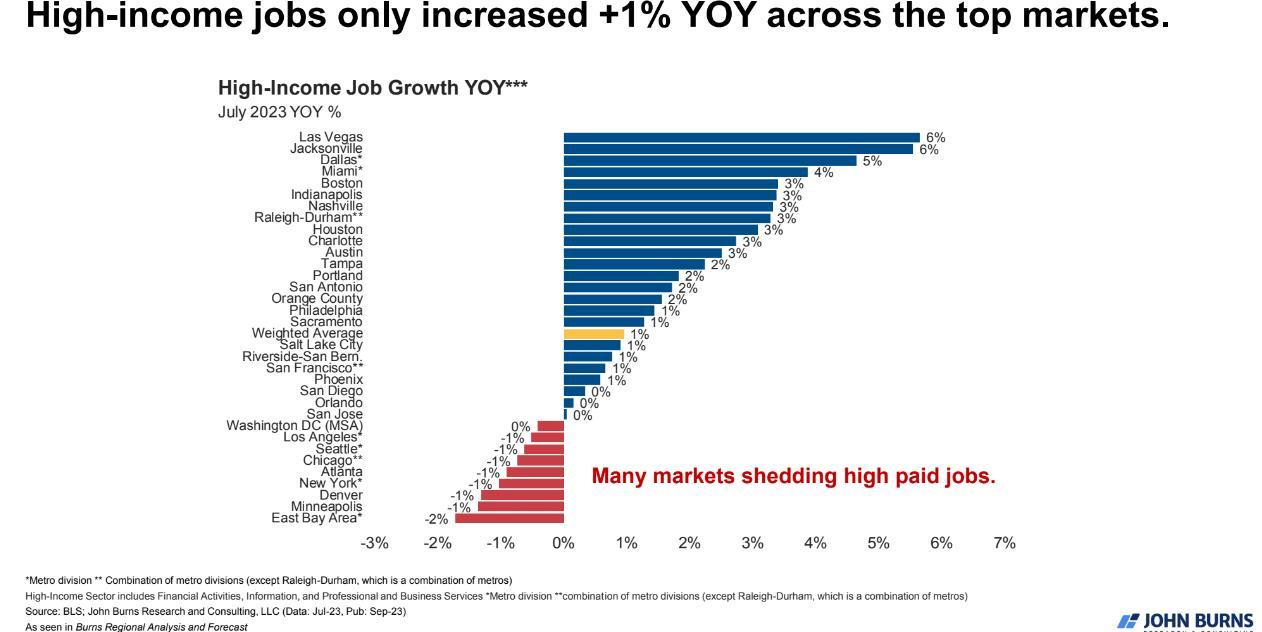

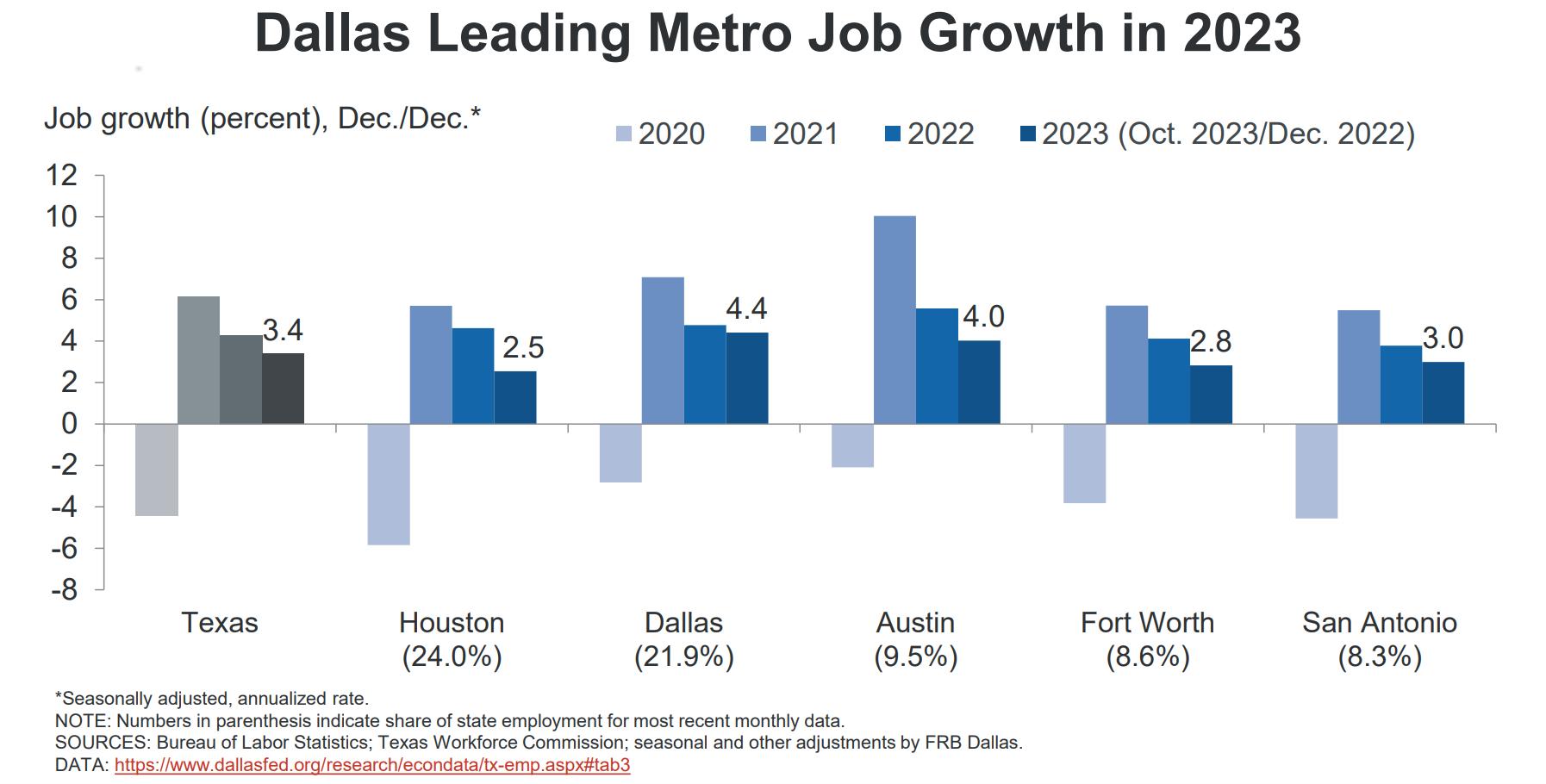

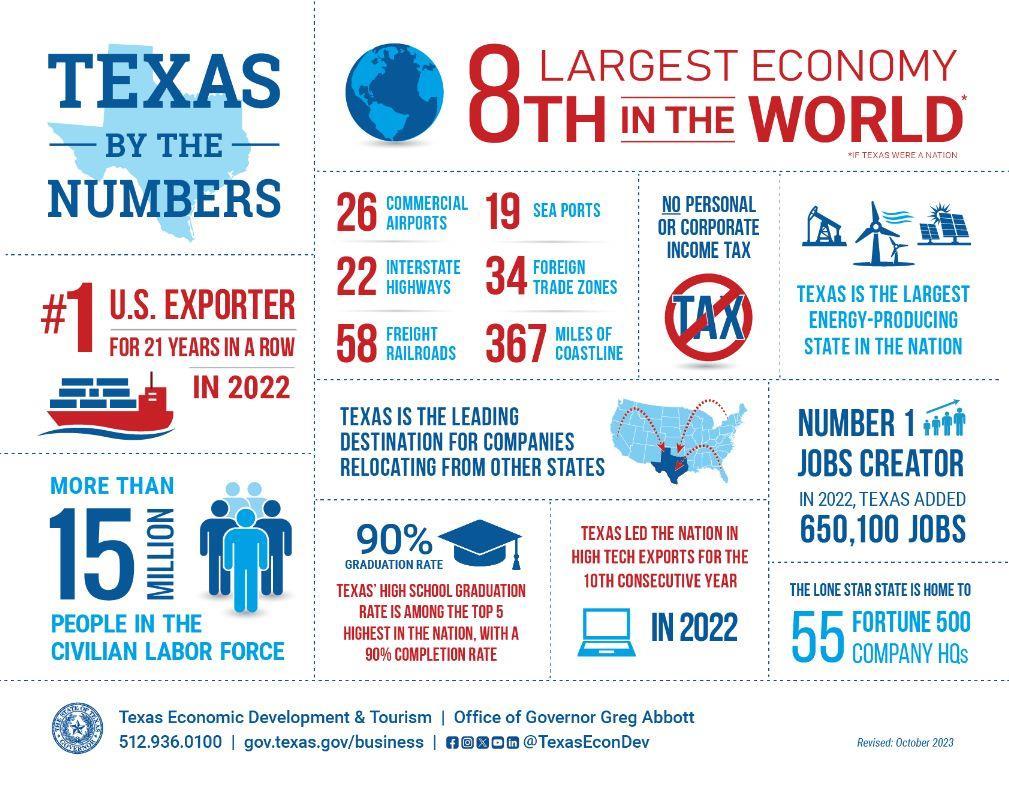

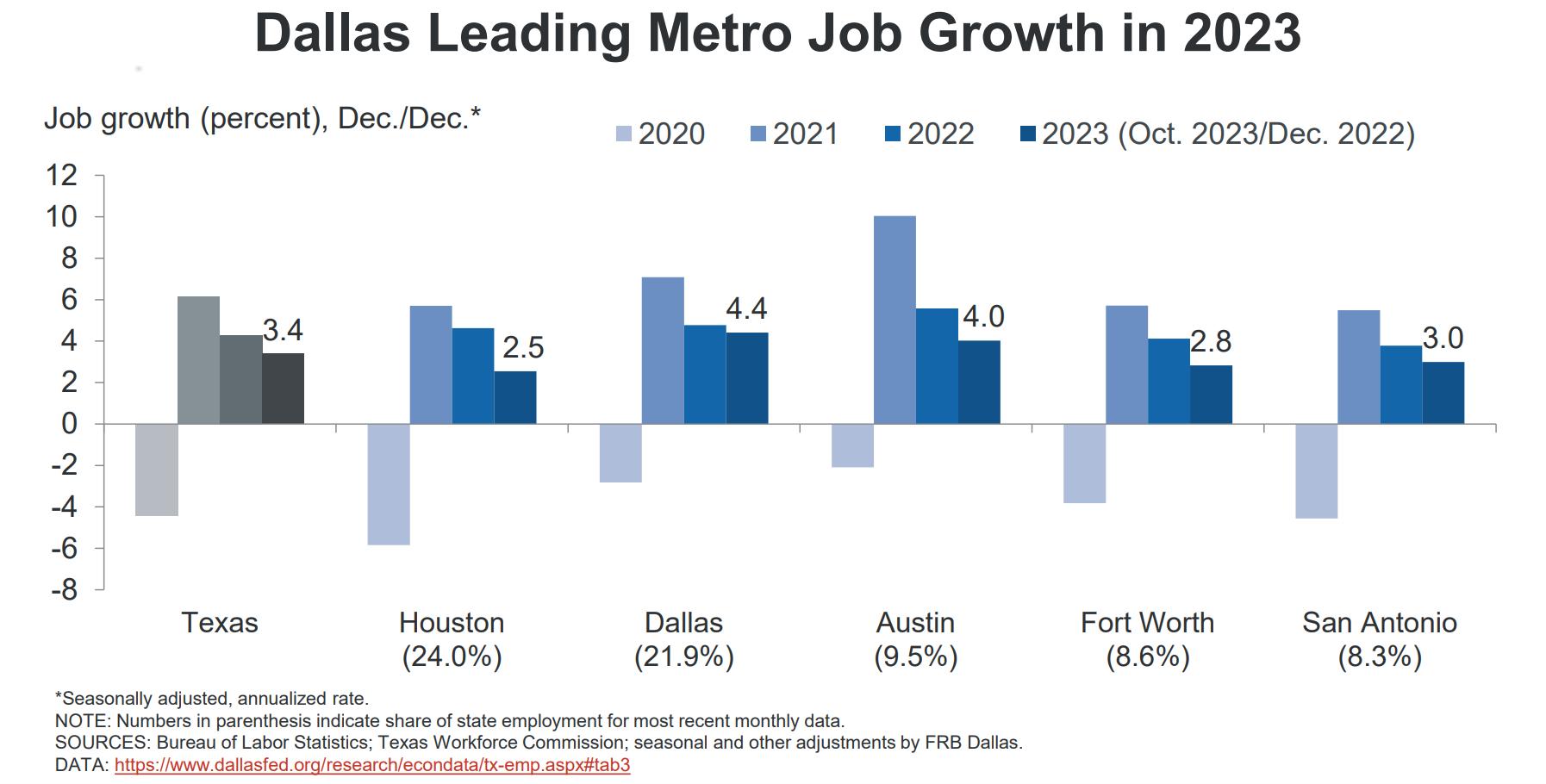

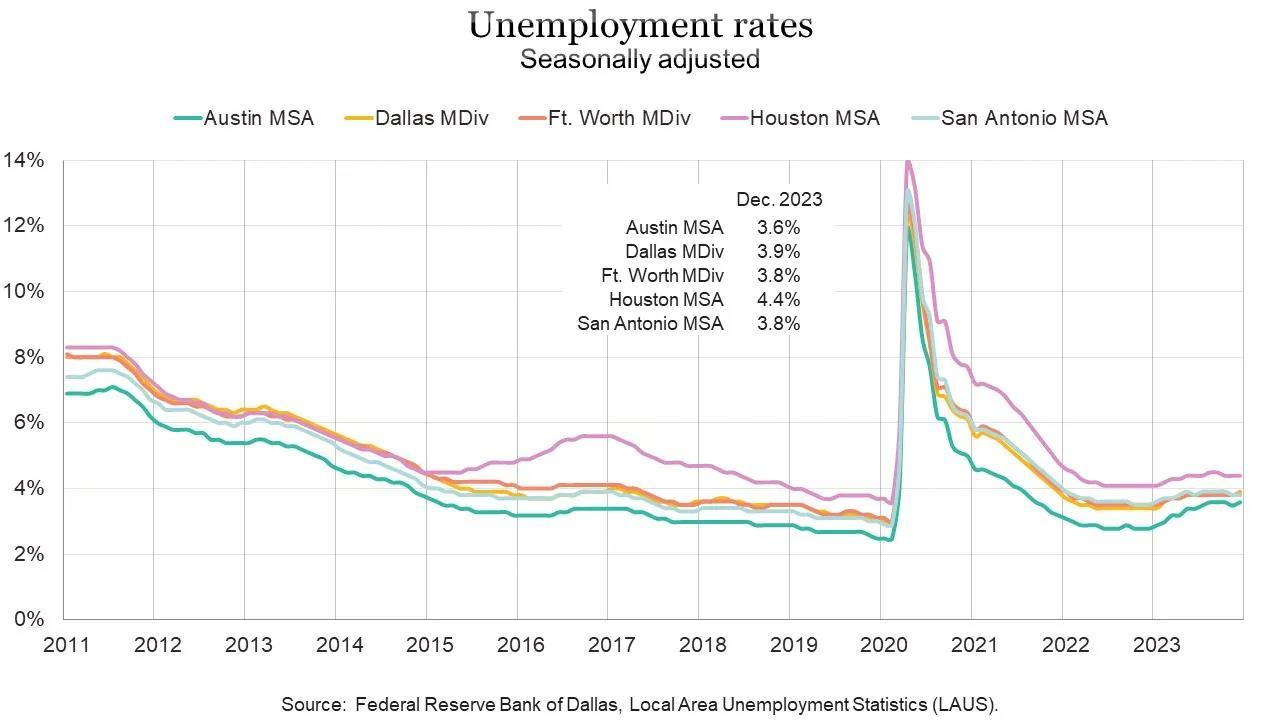

Texas jobs have recovered faster.

Mark Sprague State Director of Information Capital

Texas Job Growth

Mark Sprague State Director of Information Capital

Mark Sprague State Director of Information Capital

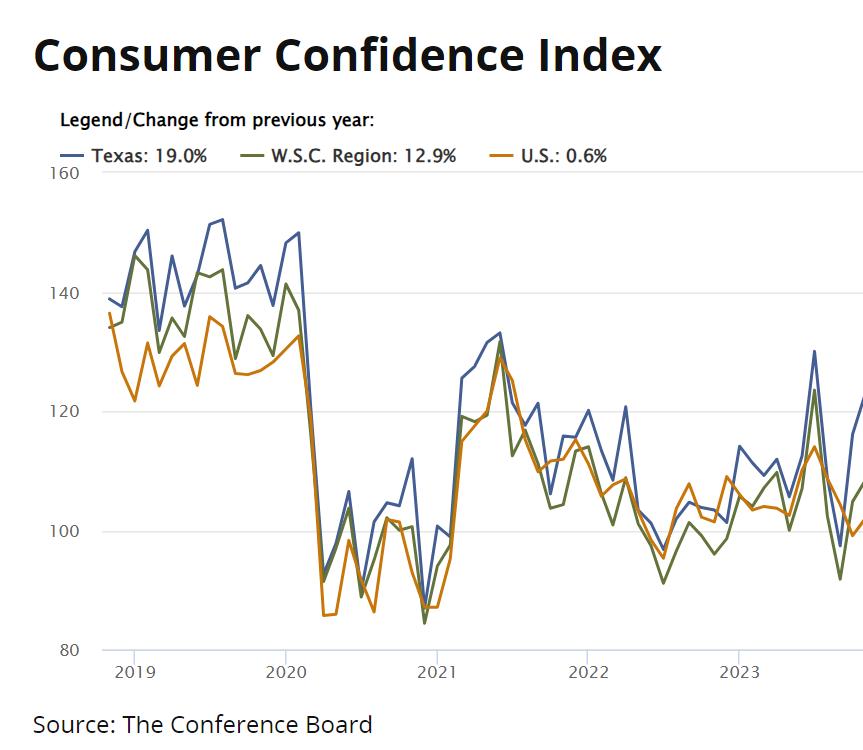

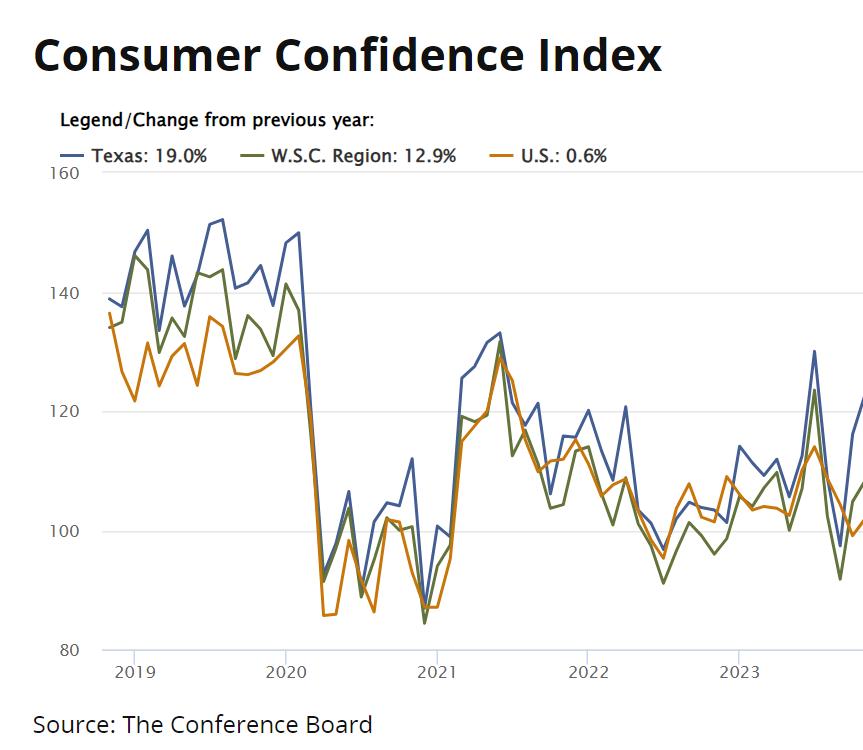

Mark Sprague State Director of Information Capital November 2023 Texas 123.00 US 102.00

Texas Unemployment Growth

Mark Sprague State Director of Information Capital

2024 Texas Economic Outlook

• Texas economy has recovered from COVID-19 setbacks, Texas lost over 1 million jobs in two months during the early pandemic days in 2020. The state has not only recovered those jobs but added about 1,000,000+ more.

• Service sector growth has been moderate to improving, while manufacturing sector has experienced a slowdown.

• Unemployment rate has declined since its peak in April 2020 but has shown recent increase, currently at 4.1% as of Nov. 2023.

• Real estate sales have slowed comparatively, with residential real estate rebounding in 2021 after initial COVID shock. Slower as market adjusts to rate increase.

• Construction sector has expanded, but activity has slowed down due to labor, supply chain and rate increase issues.

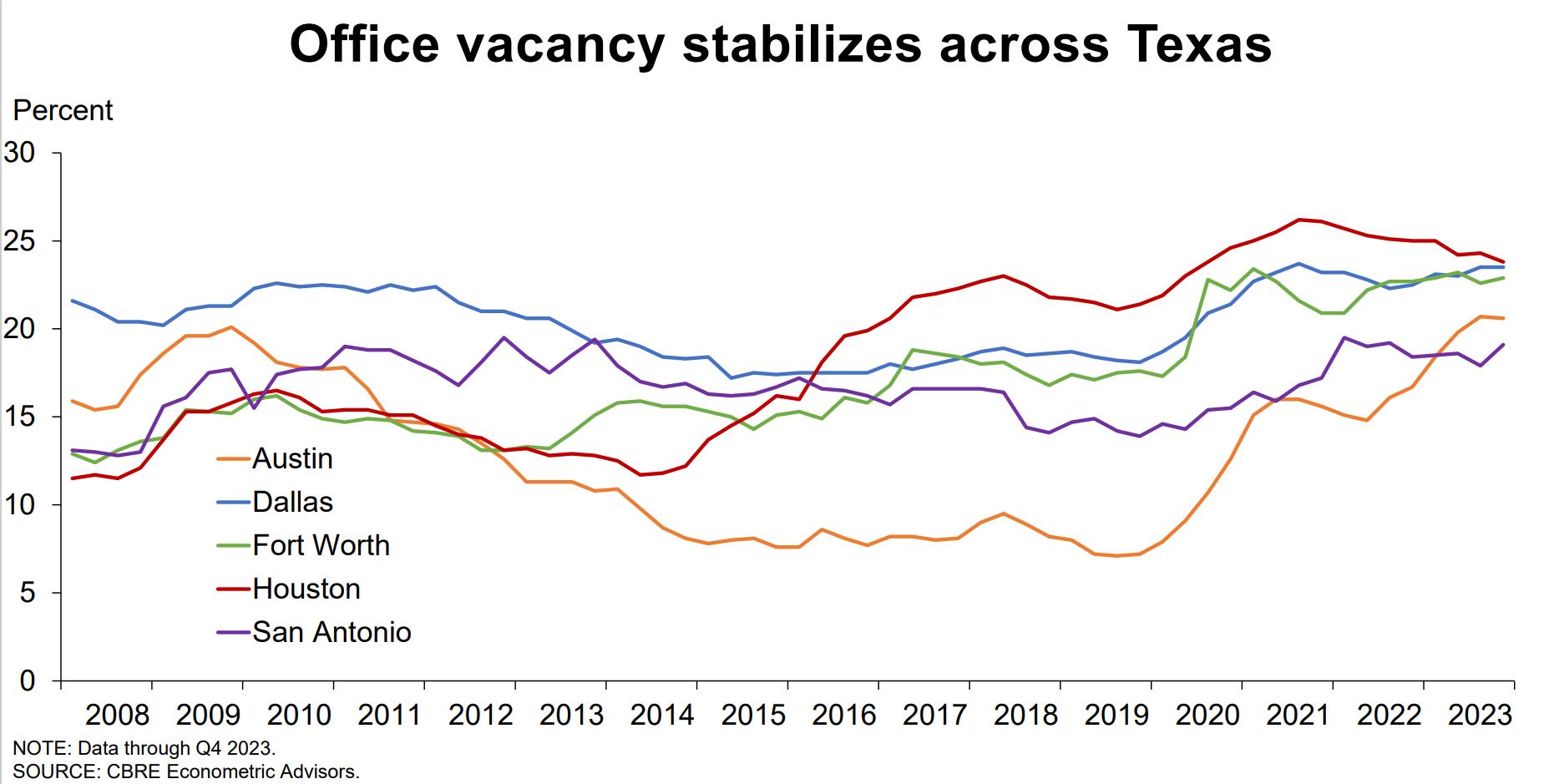

• Office and warehouse construction remain strong, but office construction and rent growth have slowed down. Warehouse will slow.

• Houston has experienced slower job growth than previous five years.

• COVID surge threatens to slow down local, state, and national economy further.

Mark Sprague State Director of Information Capital

2024 Texas Economic Outlook

• Possible recession in Texas in 2024. Somewhat mitigated in the last month.

• Texas economy showing mixed signals and slowdown.

• Job growth higher than national average.

• Texas Business Outlook Surveys mixed.

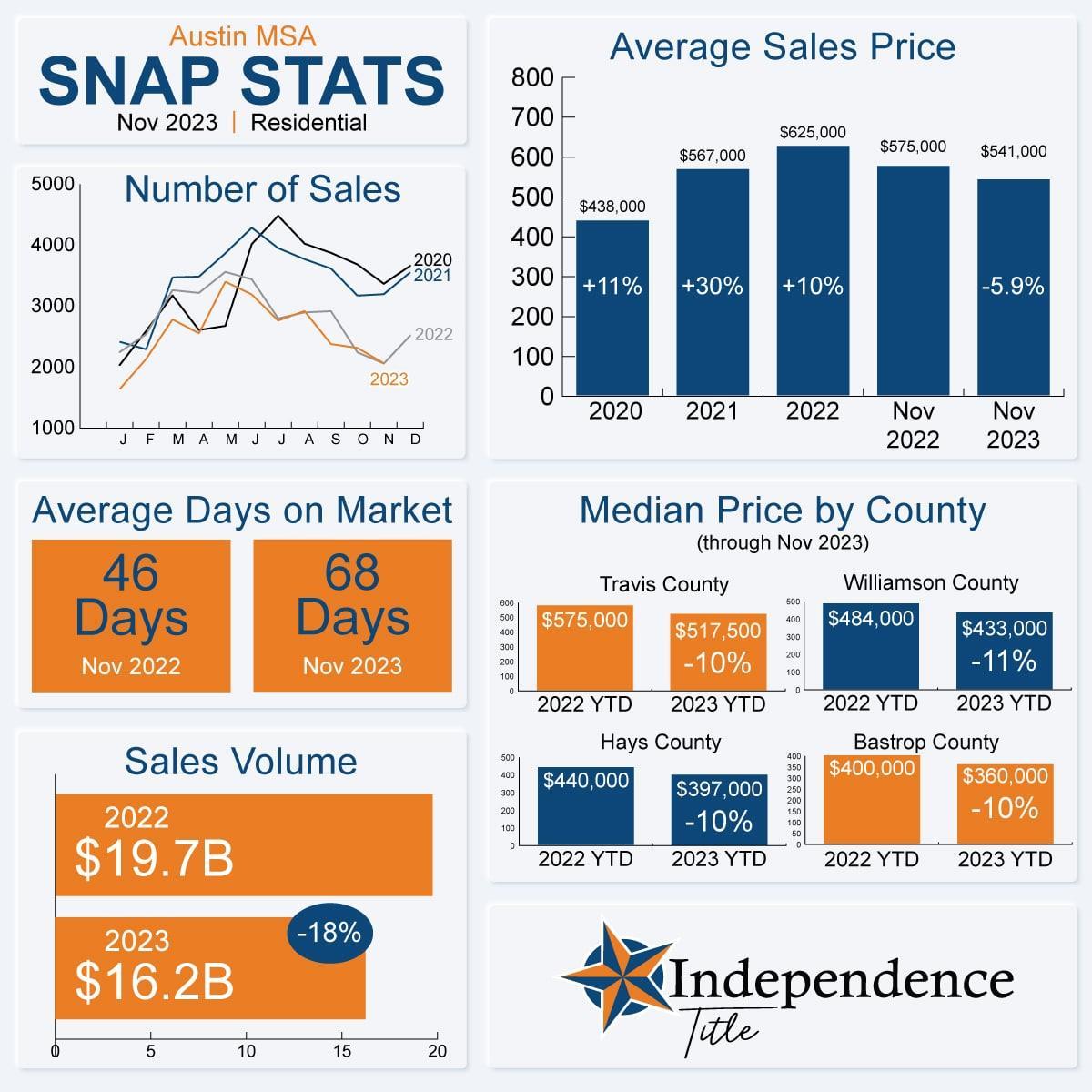

• Residential home values sales slowed due to lack of inventory and rate increase. Residential values improve.

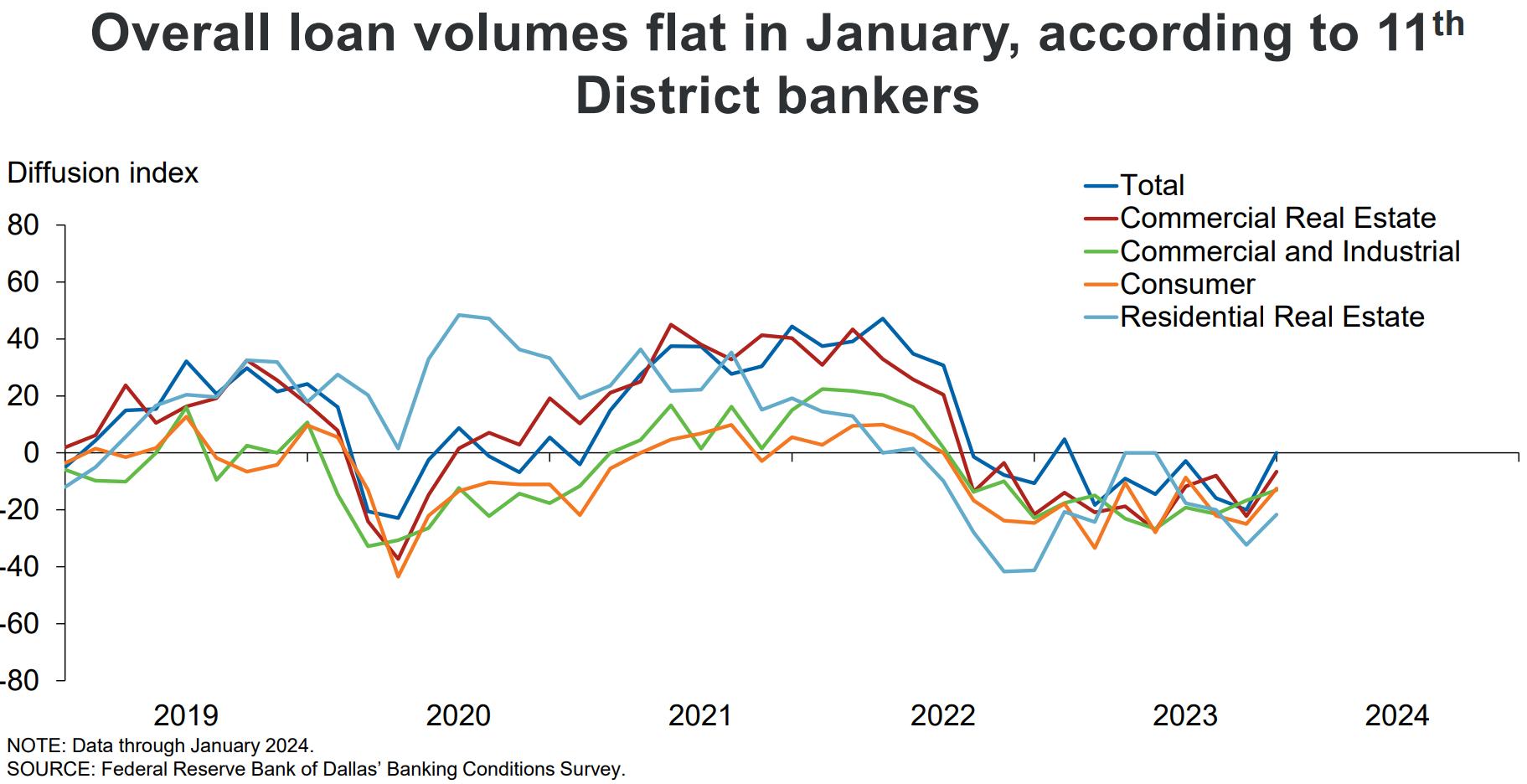

• Commercial sales channels have slowed with rate increase and lending changes.

• Rent growth plateaued.

• Restaurant bookings and sales tax receipts positive.

• Stronger labor market and net migration contributing to overall stronger regional growth.

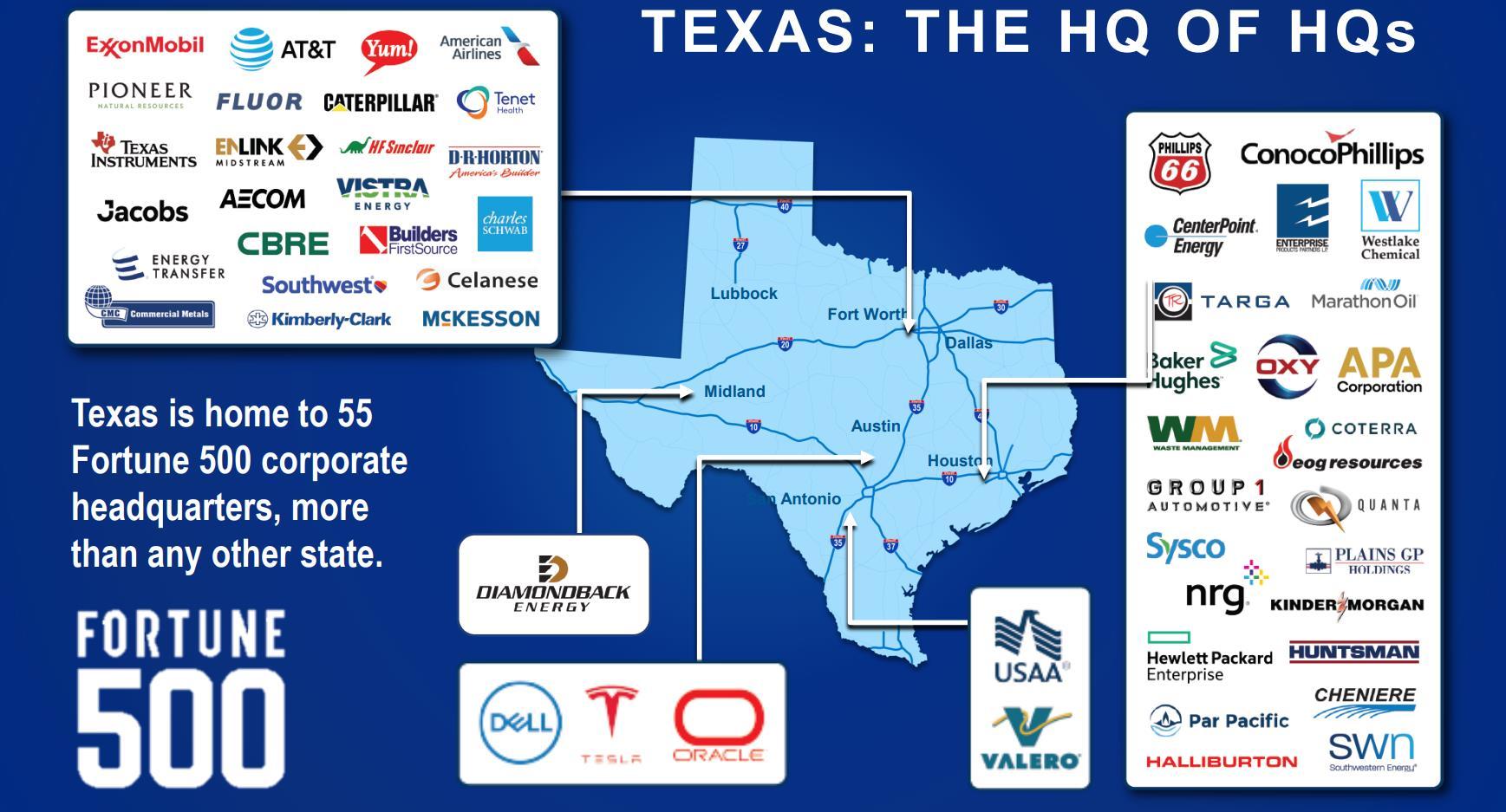

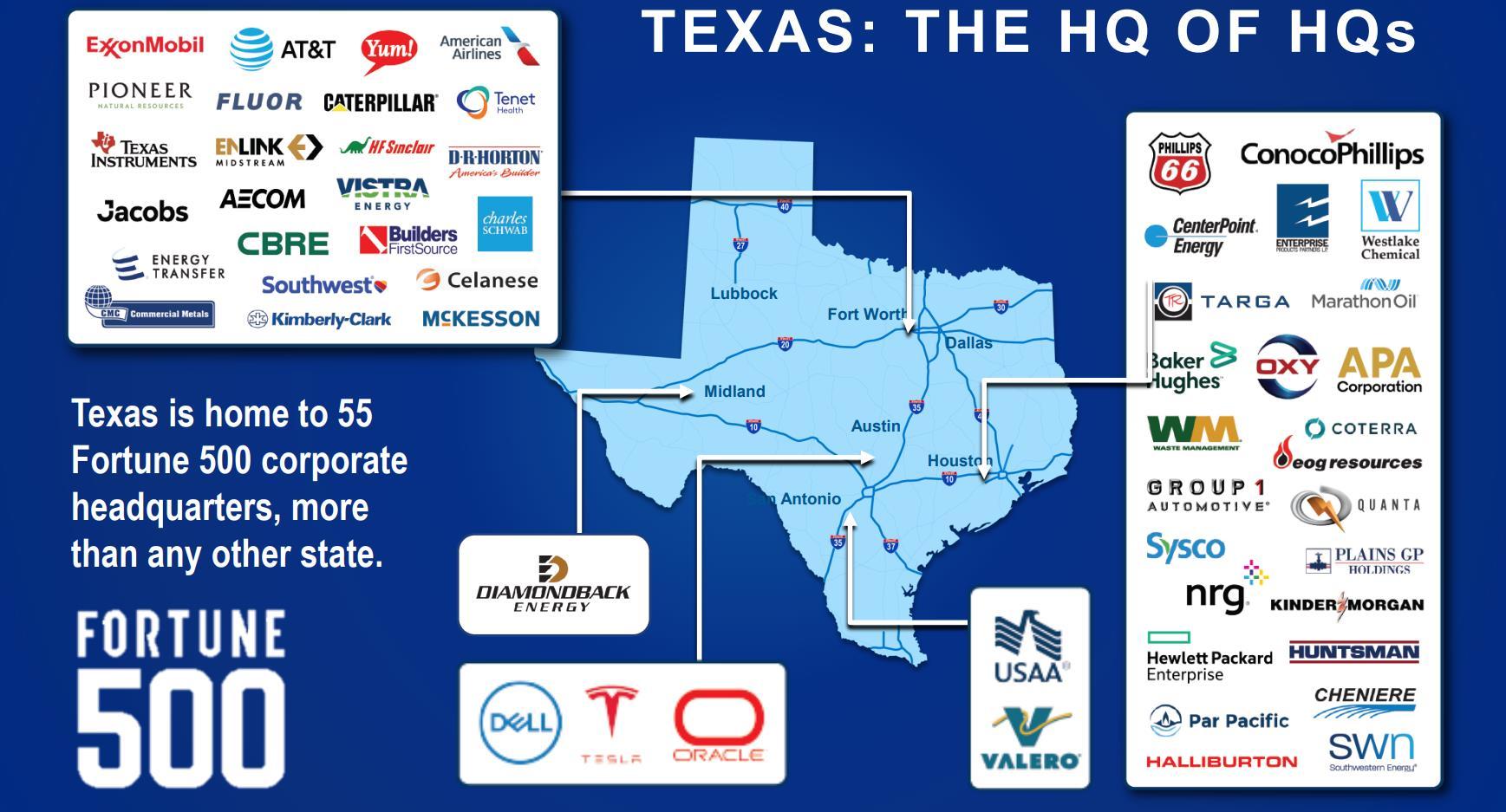

• More businesses and people relocate to Texas if recession occurs.

• Recovery expected to begin in early 2024.

Mark Sprague State Director of Information Capital

2024 Texas Economic Outlook

• Possible recession in Texas in 2024. Somewhat mitigated in the last month.

• Texas economy showing mixed signals and improvement / slowdown…?

• Continues job growth higher than national average.

• Texas Business Outlook Surveys mixed.

• Residential home values sales slowed due to lack of inventory and rate increases. Will improve as rates stabilize and values continue to improve.

• Commercial sales channels will be challenged.

• Rent growth plateaued. (but will improve in 2025.)

• Restaurant bookings and sales tax receipts positive.

• Stronger labor market and net migration contributing to overall stronger regional growth.

• More businesses and people may relocate to Texas if recession occurs.

• Recovery expected to begin in 2024.

• Texas has attracted the most HQ relocations (209), 2018 – 2024.

Mark Sprague State Director of Information Capital

What to Watch

• Job Growth

• Gross Domestic Product

• Population Growth

• Consumer Confidence

• Real Estate

• Interest Rates / Cap Rates

Mark Sprague State Director of Information Capital

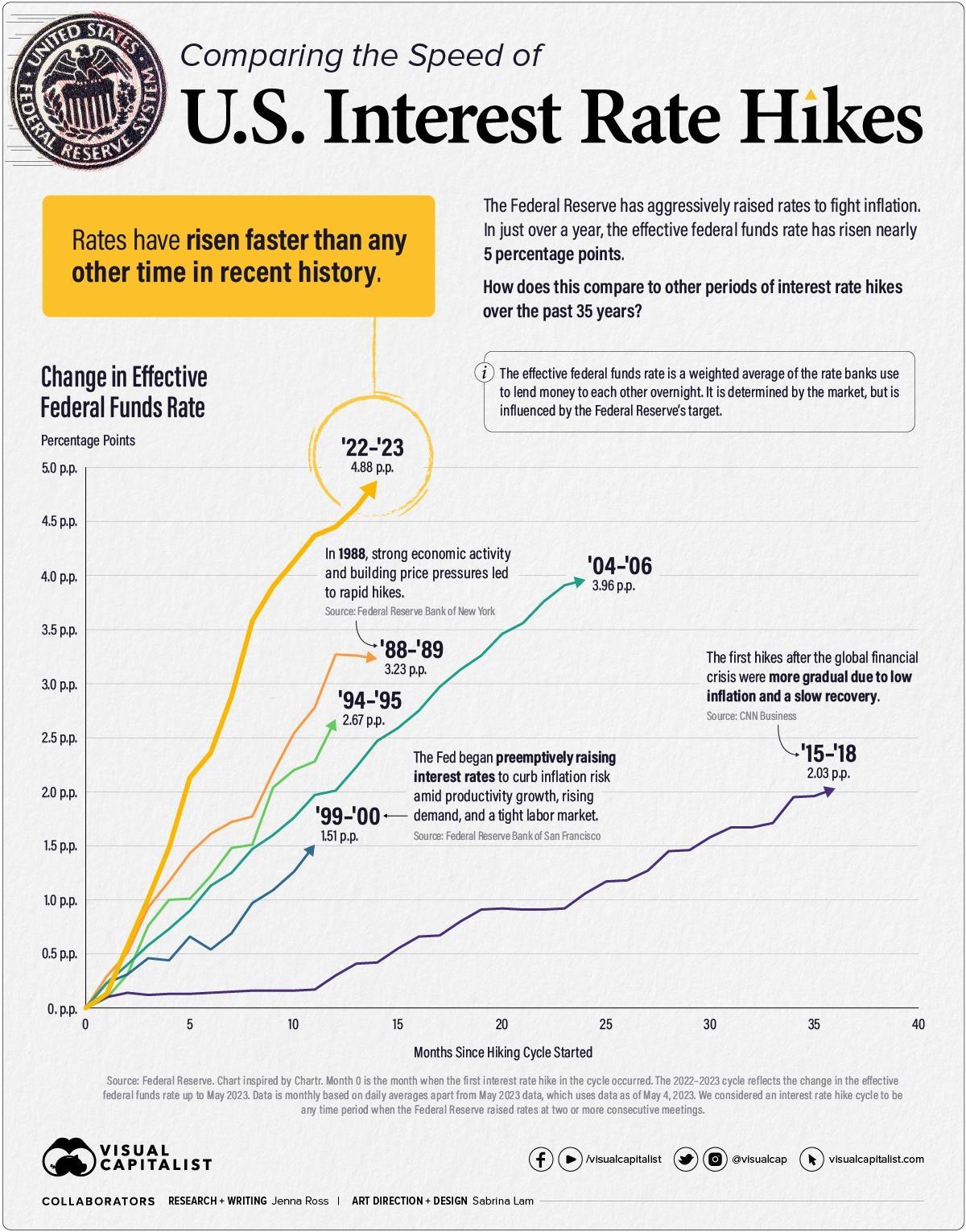

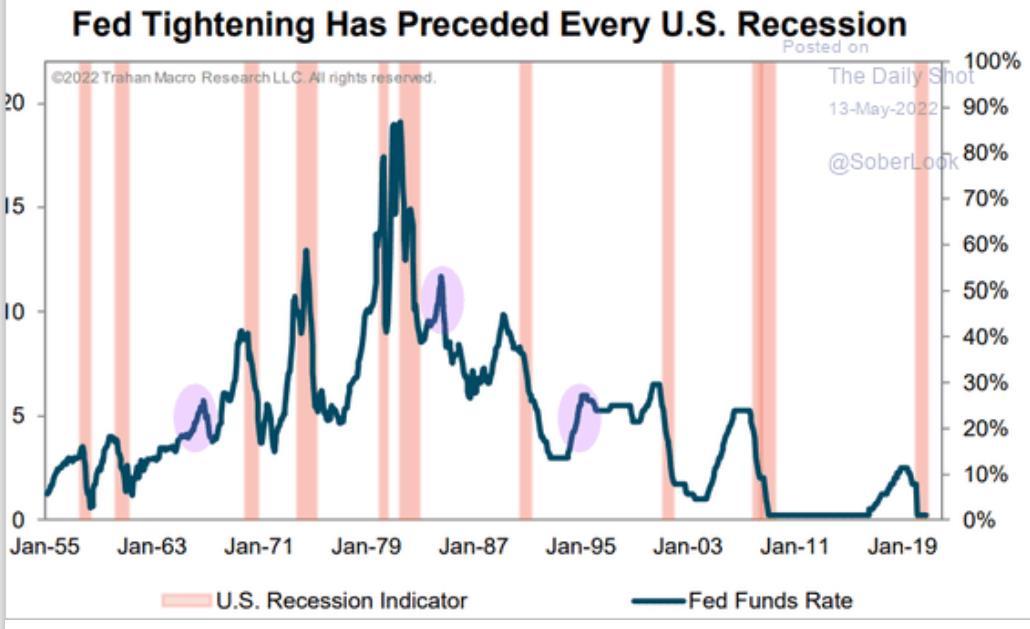

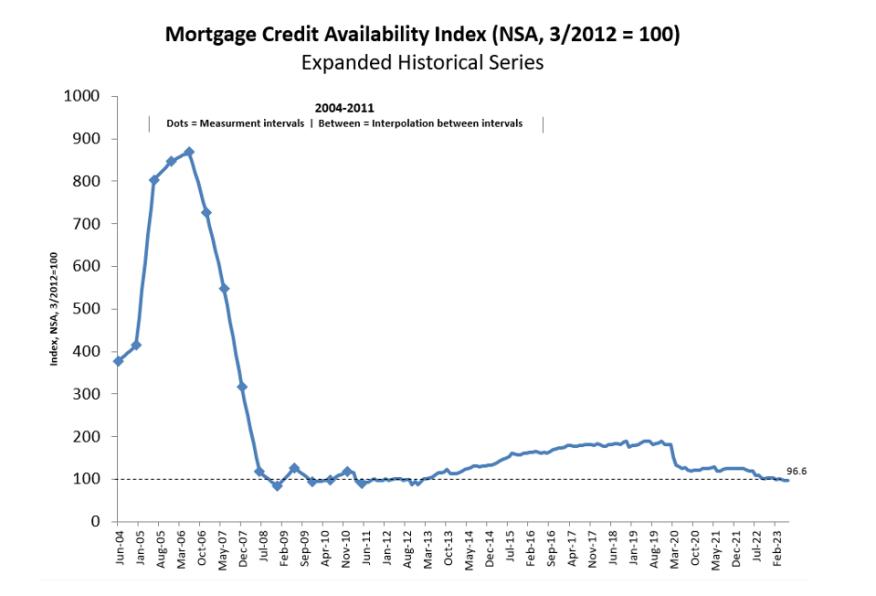

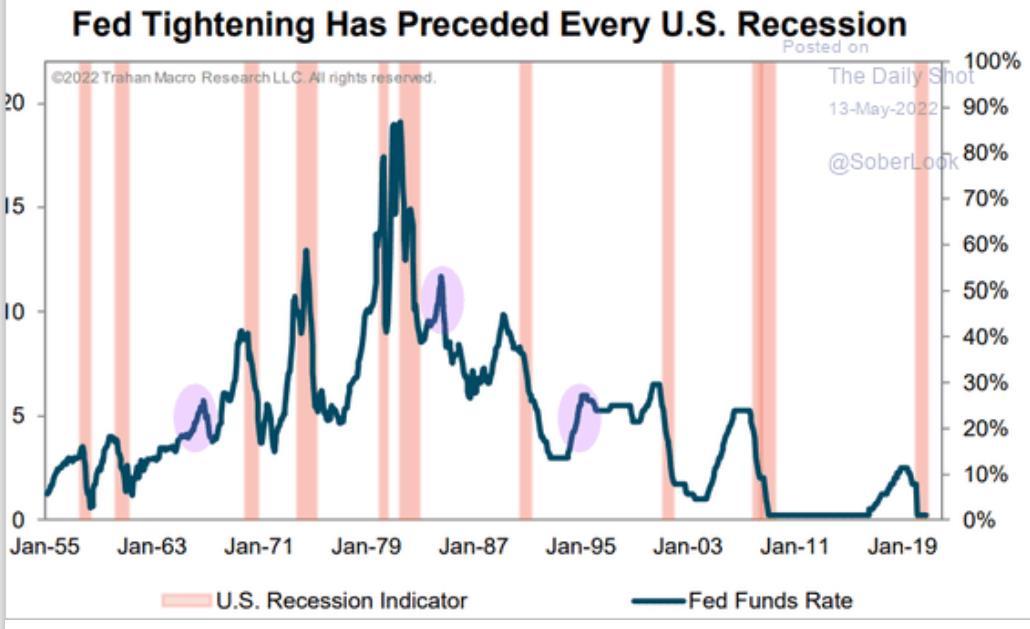

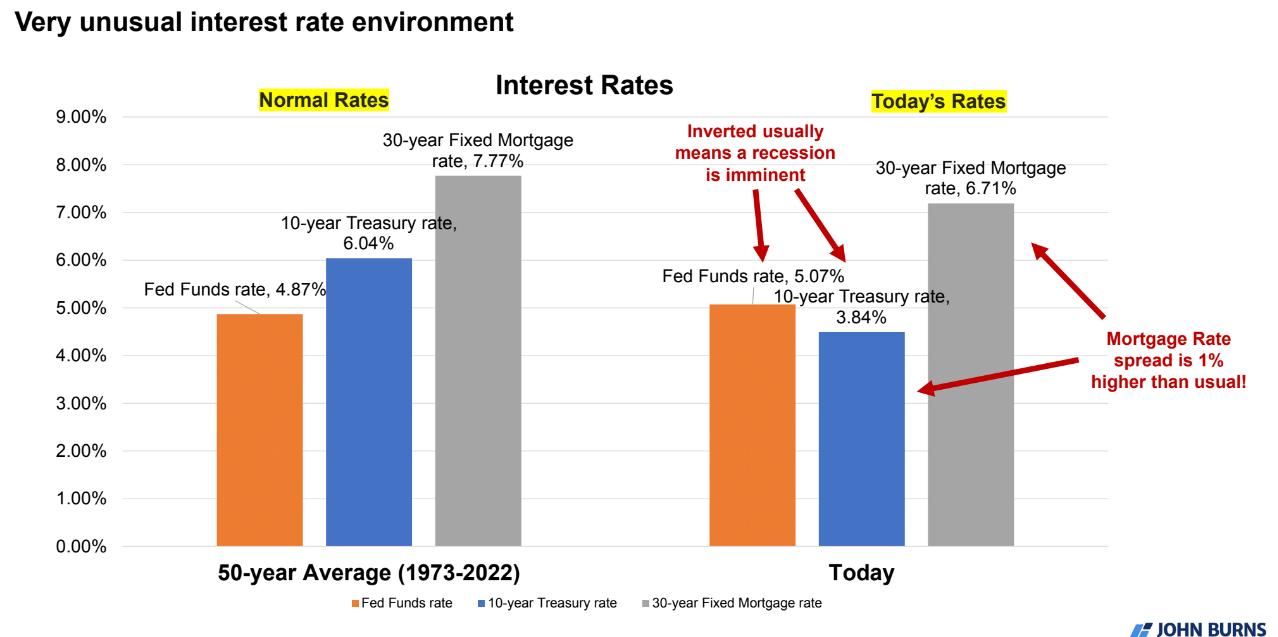

Fed Rate Hikes Precede Every Recession

Rates projected to stay over 6% the next couple of years

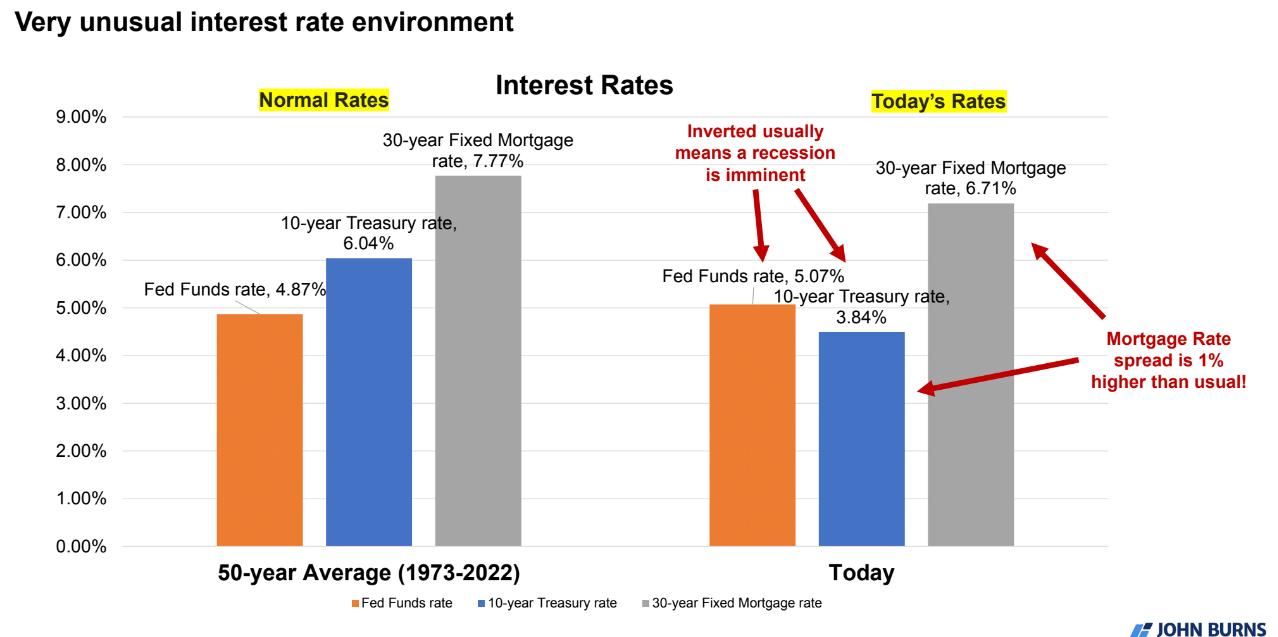

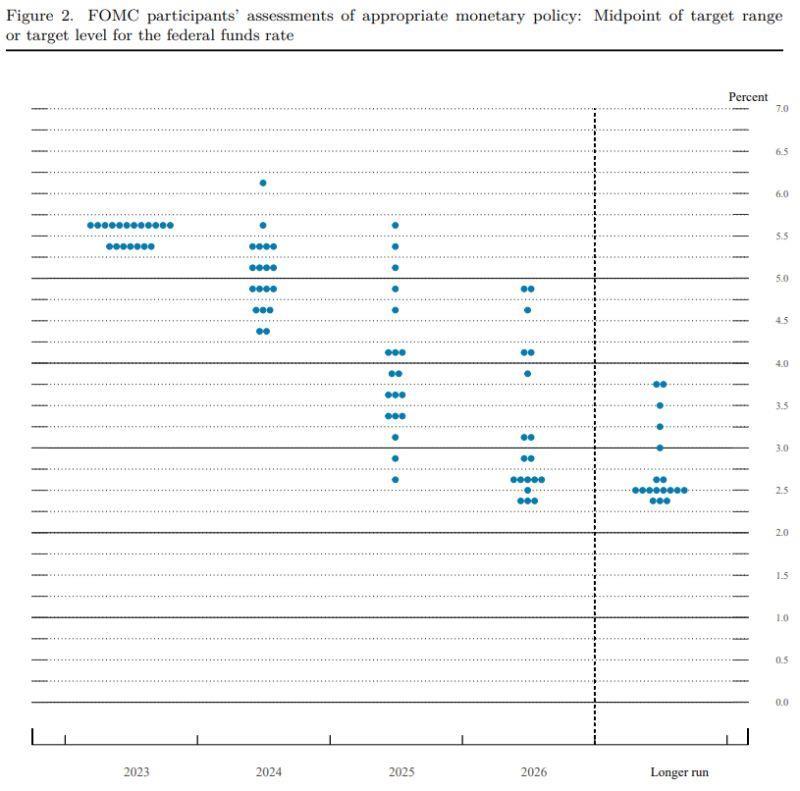

Where are Rates

Federal Reserve Board projections / add 3+ points for lending rates

Mark Sprague State Director of Information Capital

Headed?

Outlook for Rates

• Federal Reserve Policy

– Fed Funds rate 5.5% Year End, 5.25-5.5%. (add 3 points for actual lending rates.) Some Federal Reserve governors are pushing for higher.

– Final (terminal) rate 2023 likely 3nd quarter.

– Won’t lower rates until early 2024, earliest.

– However, may start to signal market in late 2023 especially if we’re in a recession.

– Rate reduction announcement in dec 2024, may be premature.

• Market Rates

– Market rates for mortgages, commercial and corporate bonds will likely peak once Fed starts its “pause” in or around the 2nd or third quarter.

– Market rates may start to “drift” downward towards the middle/end of 2023 in anticipation of Fed lowering rates in 2024.

– It may take years (if ever) for some market rates to return to pre-pandemic levels. (Again, rates lower than 6% are not a sign of a healthy economy.)

– Pandemic levels were anomalous and not likely to occur again unless significant economic stress occurs.

• Municipal Bond Market

– Worst is likely over from an investor perspective (Bloomberg Muni index down 21% on year)

– Muni yields nearly double longer-term treasuries and tax equivalent yields higher than corporates.

Mark Sprague State Director of Information Capital

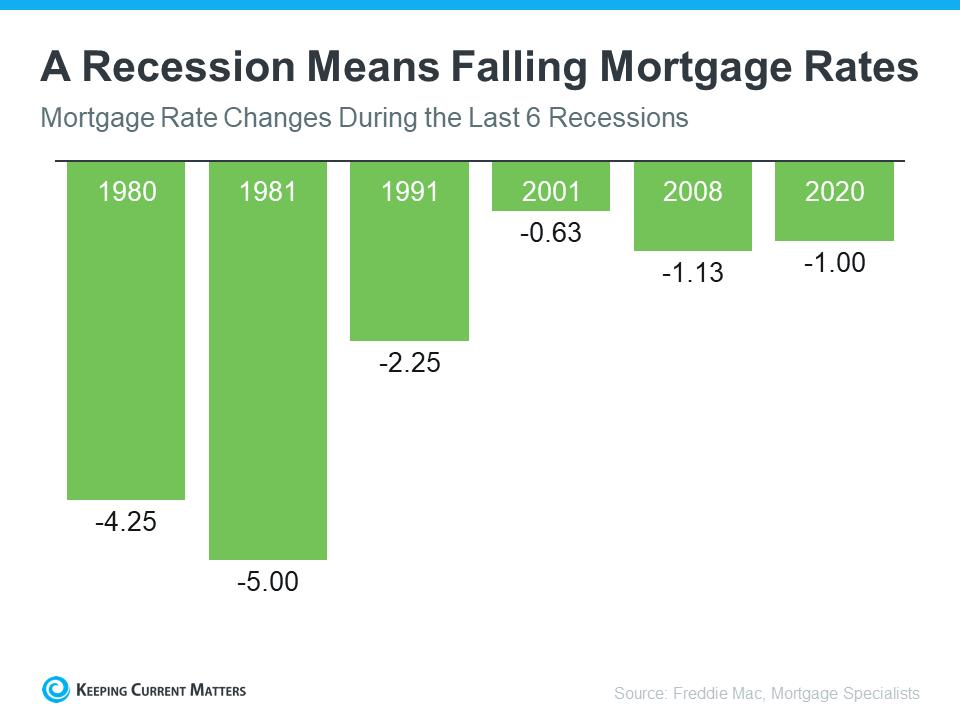

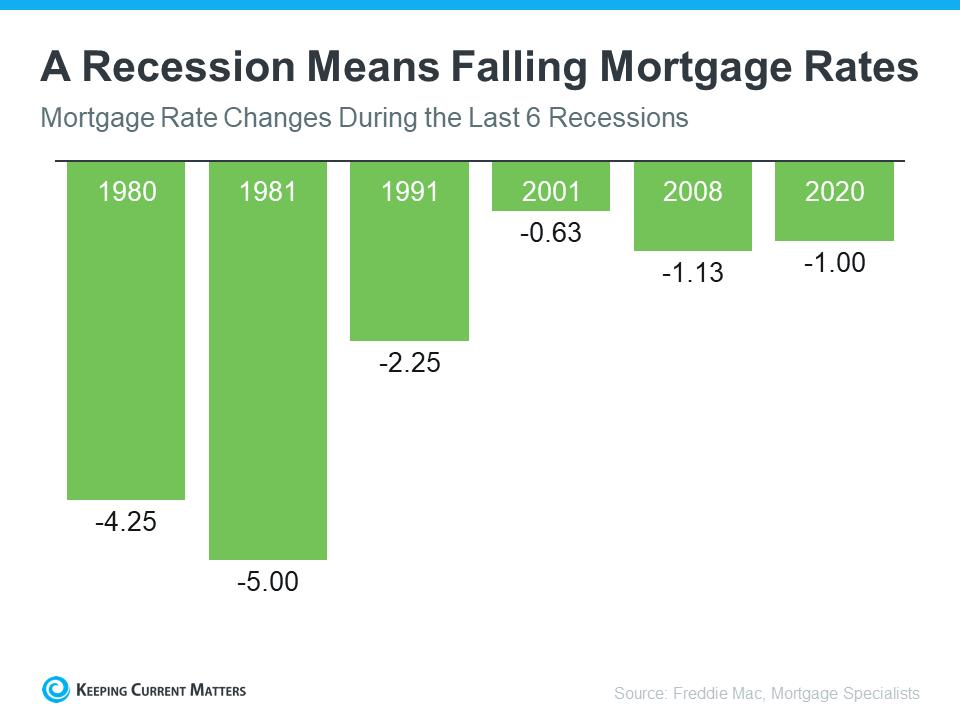

What are the odds of a recession?

Federal Reserve Board projections

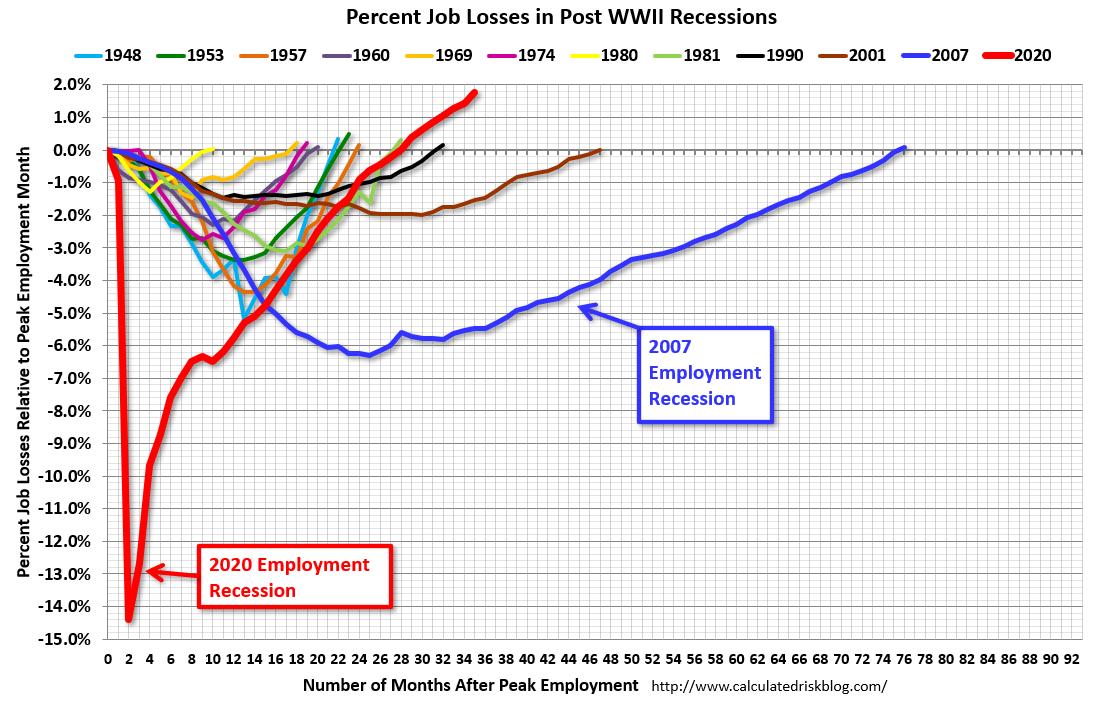

Examining past recessions (excluding 2008 and 2020), unemployment rates hit their lowest point around 6 months before the recession starts, while during the recession, unemployment rates tend to increase by an average of 3.2% over 21 months.

Mark Sprague State Director of Information Capital

It will be a different type of recession?

Mark Sprague State Director of Information Capital

It will be a different type of recession.

Mark Sprague State Director of Information Capital

It will be a different type of recession.

Mark Sprague State Director of Information Capital

It will be a different type of recession.

Mark Sprague State Director of Information Capital

It will be a different type of recession.

Mark Sprague State Director of Information Capital

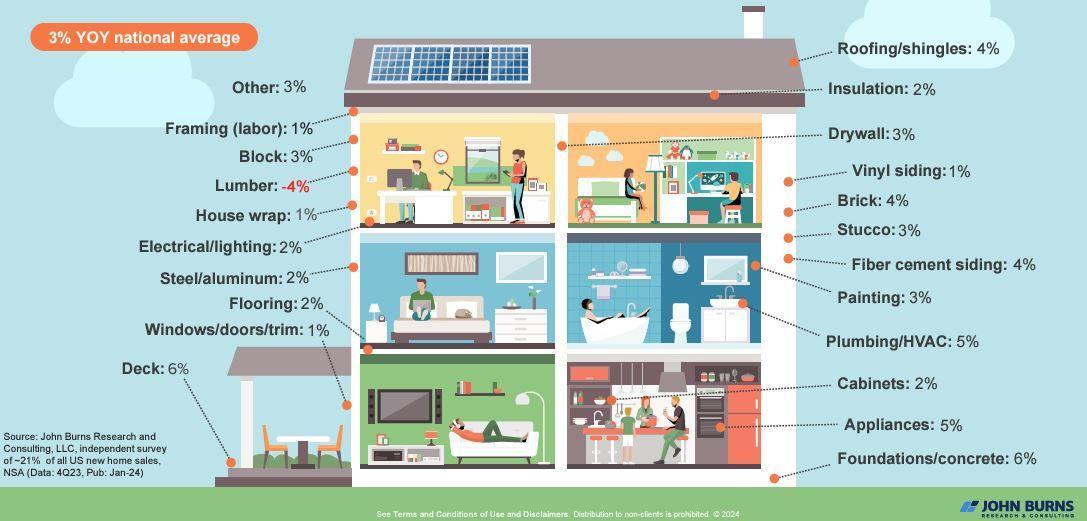

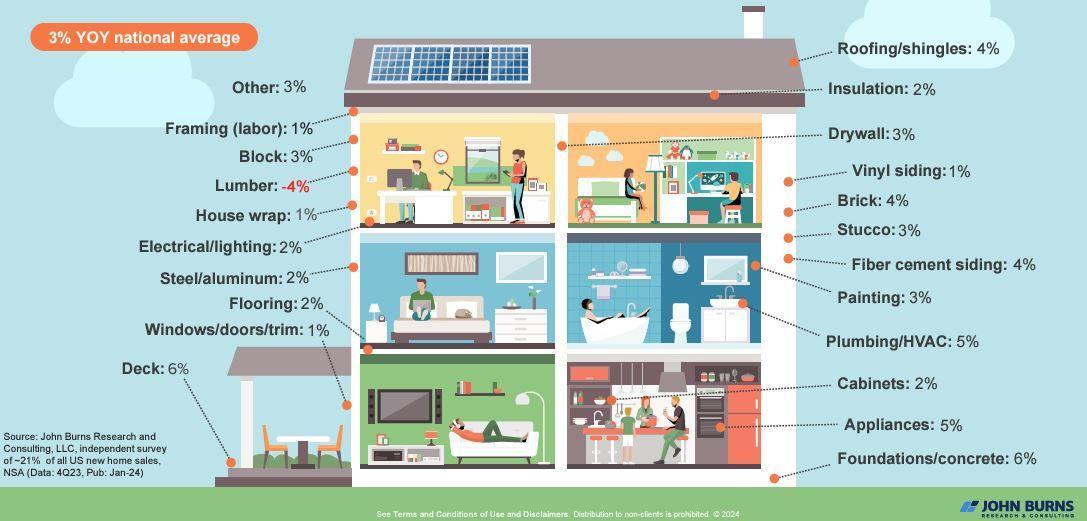

Construction Costs 4Q23

Austin Economic Outlook

Mark Sprague State Director of Information Capital

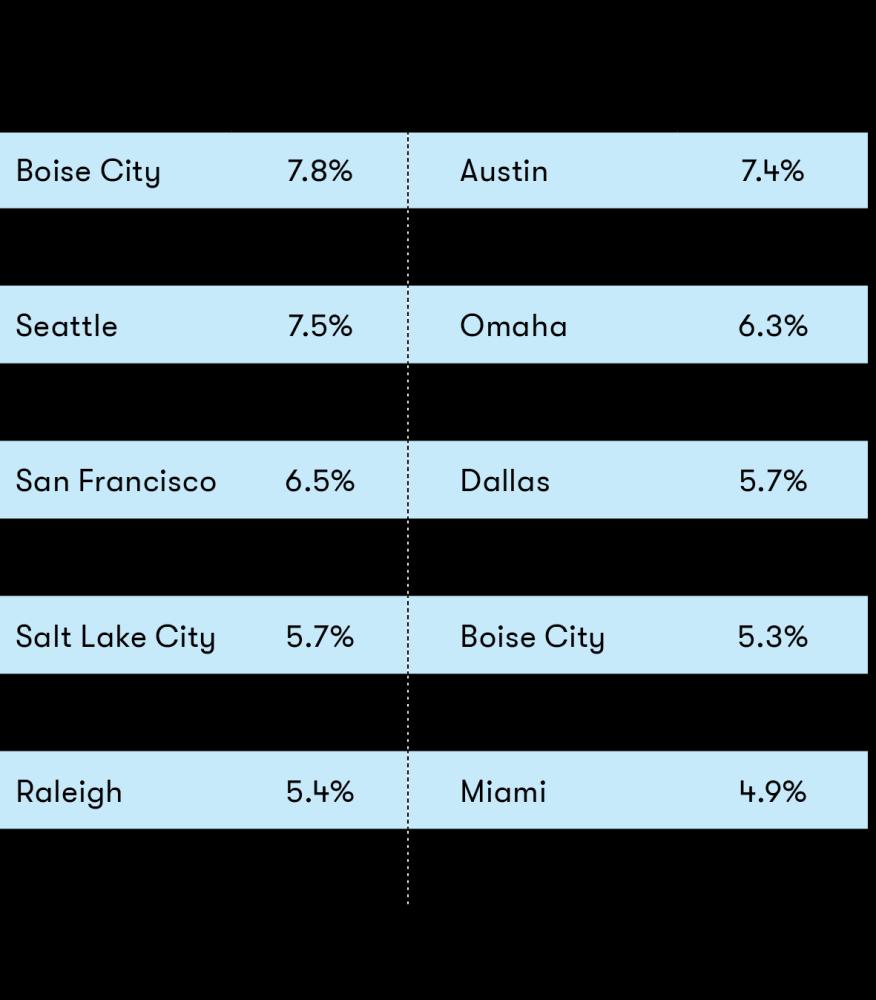

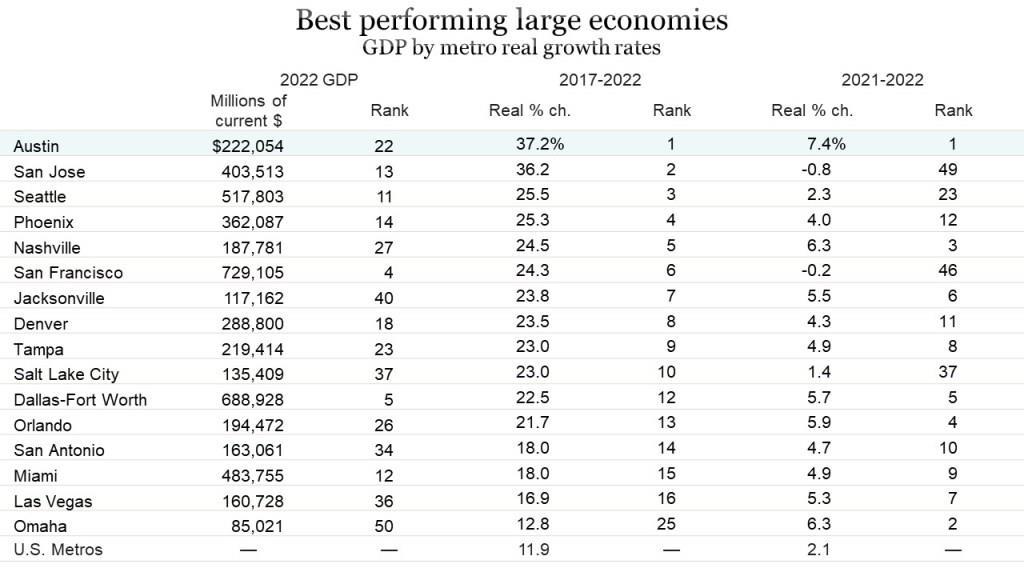

Austin Strengths

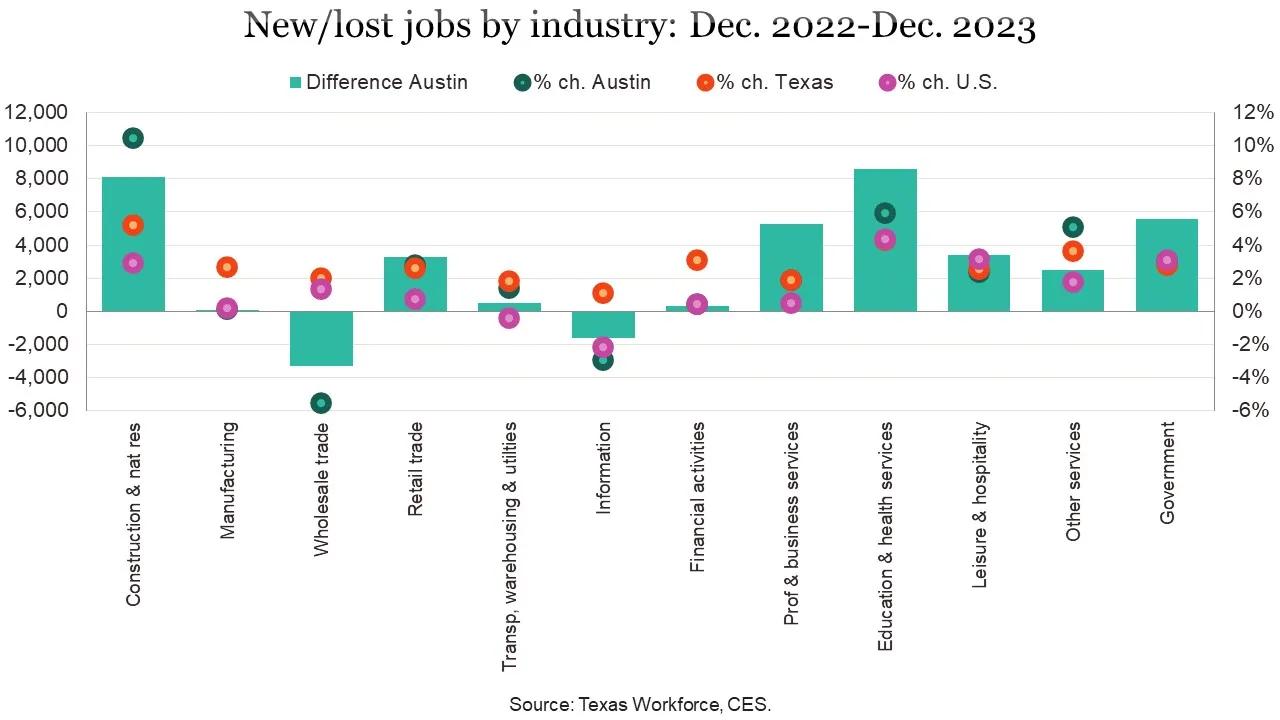

• No. 1 Best Performing City in Milken Institute’s 2024 report, an annual measure of a city’s sustainable and equitable growth.

• Between 2017 /2022, Austin was

• No. 1 in five-year job and wage growth.

• No. 4 among large cities for high-tech diversification.

• No. 8 in five-year high-tech GDP growth.

• Here’s one more staggering stat for you: between 2017 and 2022, wages increased by 73.1% in the Austin metro.

Mark Sprague State Director of Information Capital

Mark Sprague State Director of Information Capital

Austin Job Openings

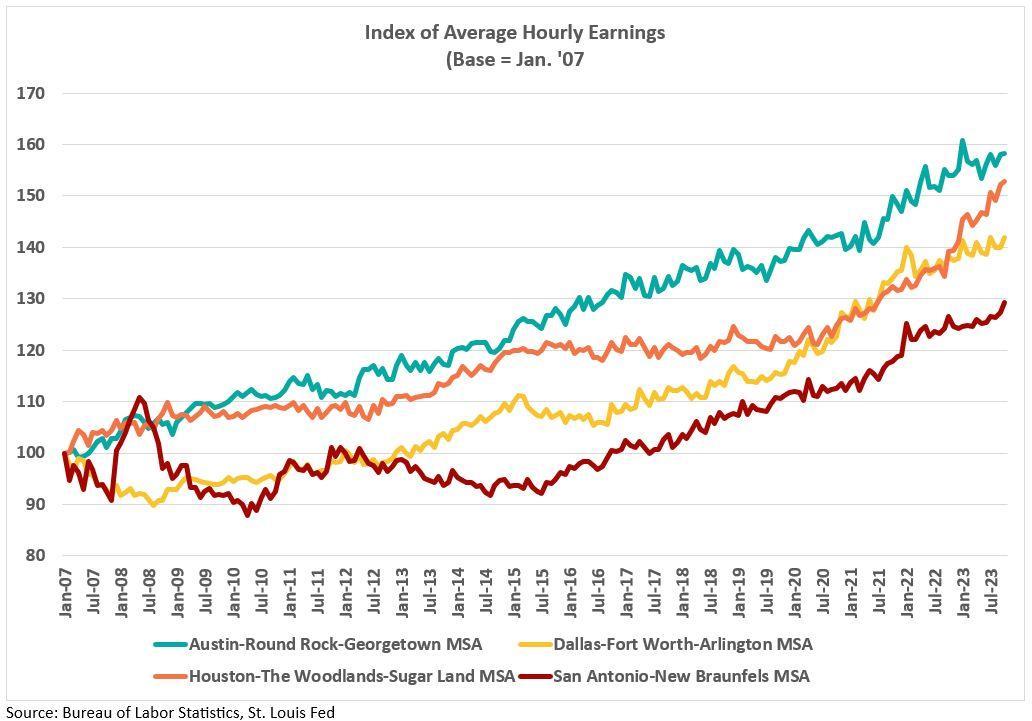

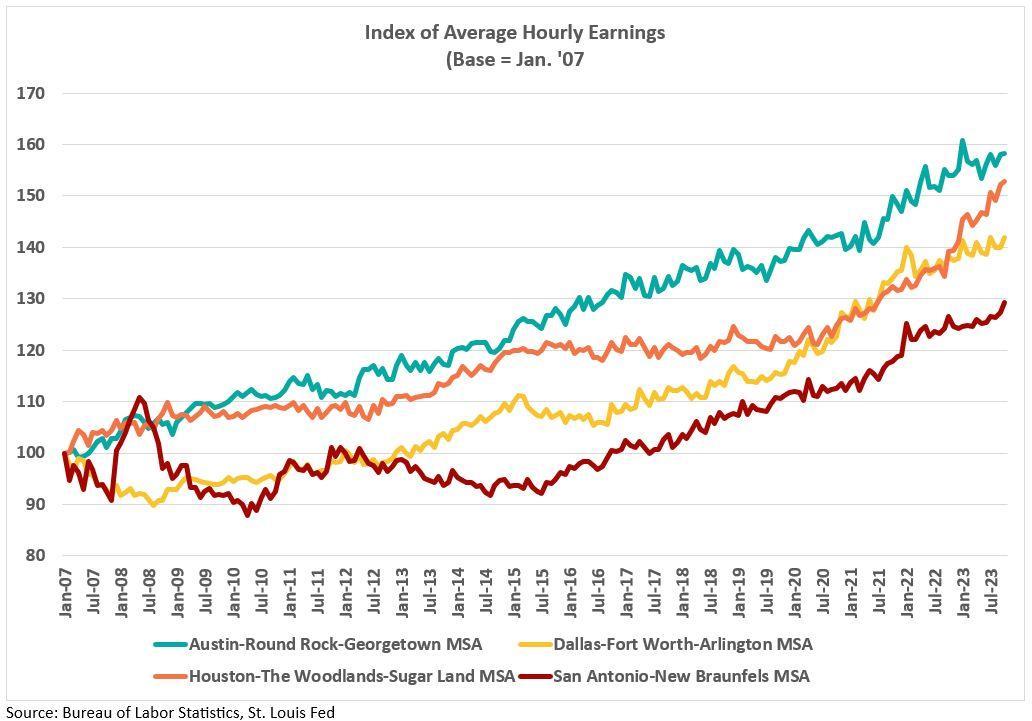

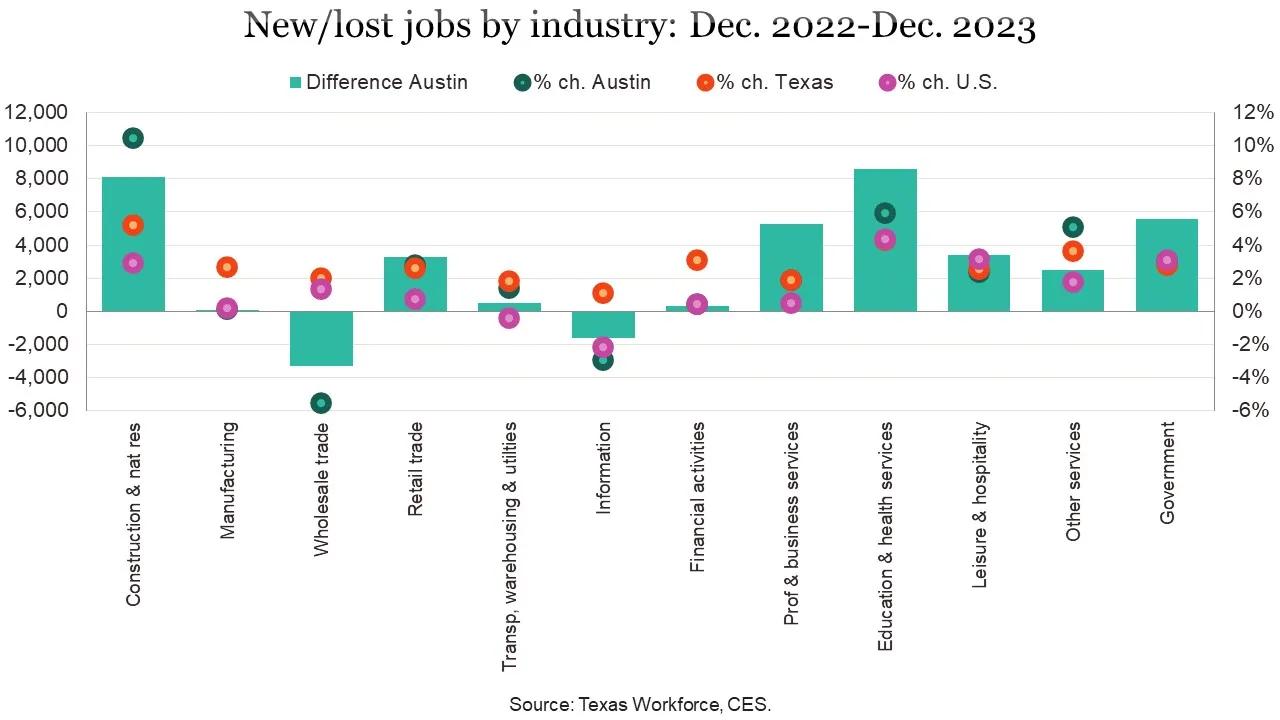

Wage growth in the Austin-Round Rock-Georgetown MSA continues to outpace that of the other three major MSAs in Texas. Wage growth increased 2.8% YoY in the Austin-Round Rock-Georgetown MSA in Oct. '23.

Mark Sprague State Director of Information Capital

Mark Sprague State Director of Information Capital

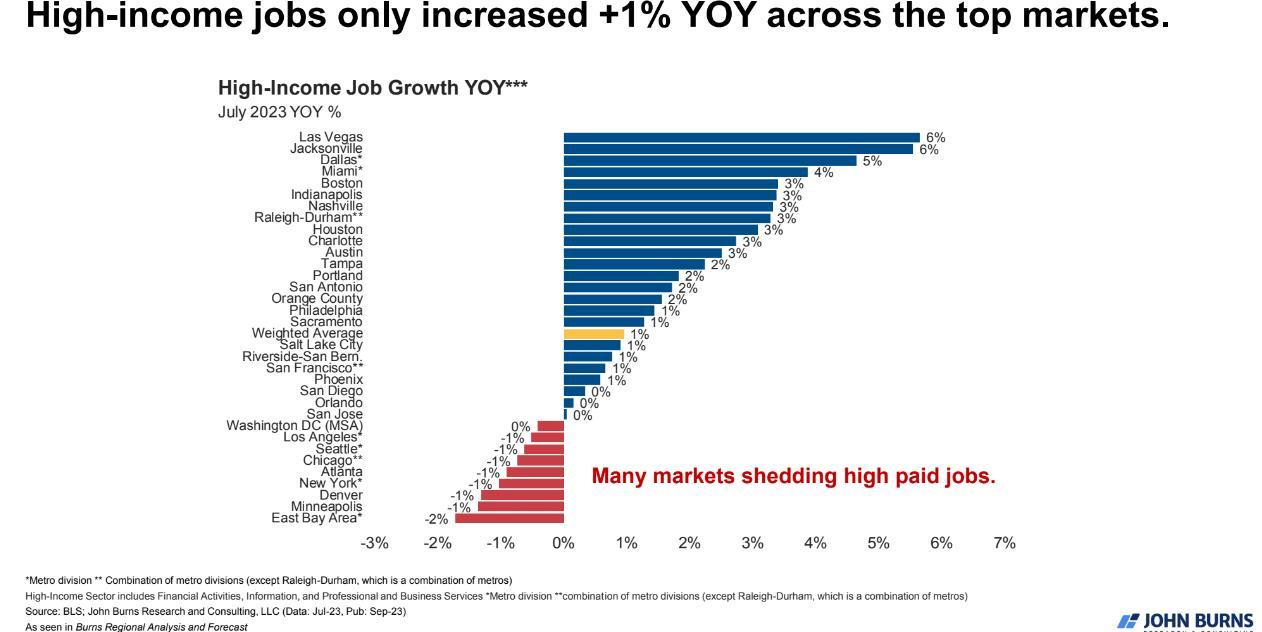

Jobs

Austin

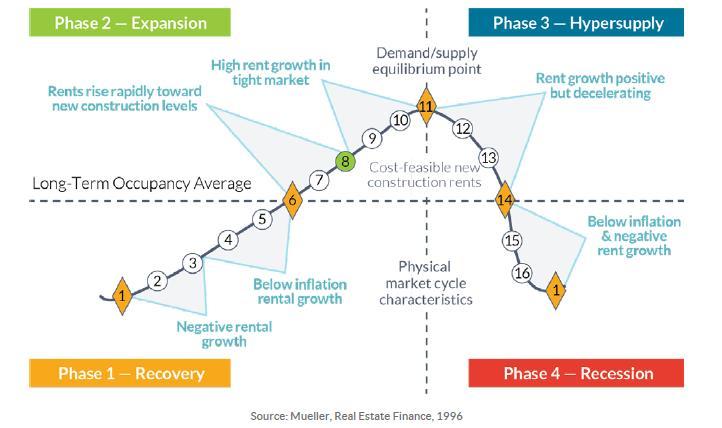

The Real Estate Market Affects the Economy!

• Real estate values have an impact on consumer spending and economic growth.

• Strong economic areas usually have prime real estate.

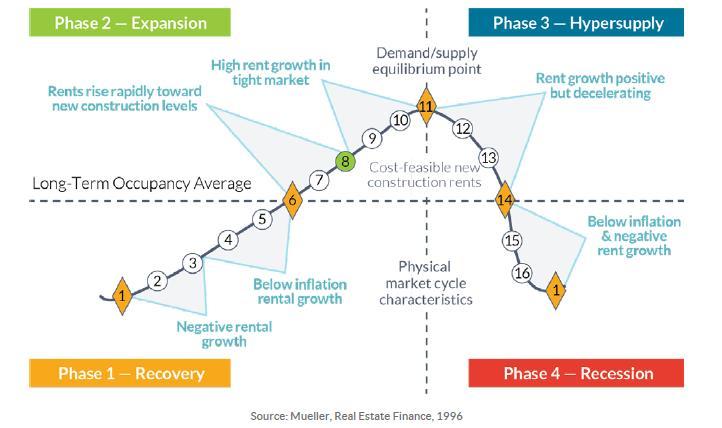

• Real estate goes through cyclical phases, and it's important to identify the current phase.

• Commercial real estate has the potential to succeed in all phases of the cycle.

Mark Sprague State Director of Information Capital

Buyers vs. Sellers

Confidence & affordability are key concerns.

Buyers Concerns

• Buyer's mindset and experiences: FOMO to FOBATT, GFC scars, rate/value trends.

• Buyers ratio of income to home values is greater in Austin.

• Federal Reserve policies: Hawkish stance, restrictive policies, bubble concerns.

• Job security worries: Recession, layoffs, interest rates.

• Homeownership considerations: Lending rates, rents, payment vs. rent analysis, lock-in effect, majority of homeowners with rates below 5% or 4%.

Seller Concerns

• Lock-in effect: Why reset rate? Why sell just to buy less? Never see these rates again.

• Homeownership: 42+/- % homeowners own home free and clear.

• Cost considerations: Cost alternative. Cheaper to remodel?

• Real estate market dynamics: Rental income. Inventory challenge. Cycle of limited neighborhood supply. No urgency, fewer sellers. Builders boom 2022

• Timing and market factors: Trying to time the market. Waiting for spring-summer market. State of the economy. Direction of rates.

• Motivations for selling: Why sell?

Mark Sprague State Director of Information Capital

Mark Sprague State Director of Information Capital 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

- Residential Sales

2022 2023

Austin MSA

2020 2021

Austin MSA - Annual Residential Sales

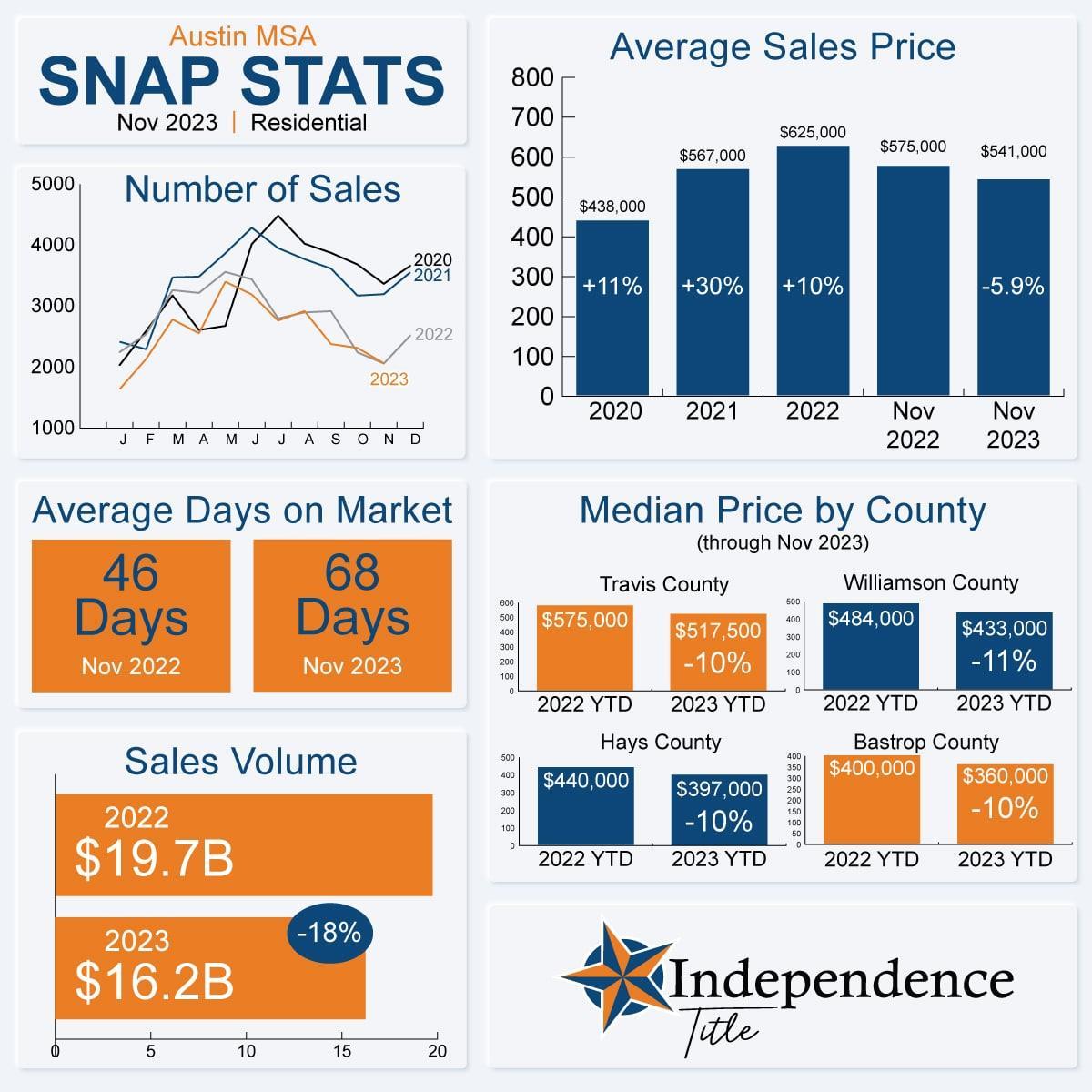

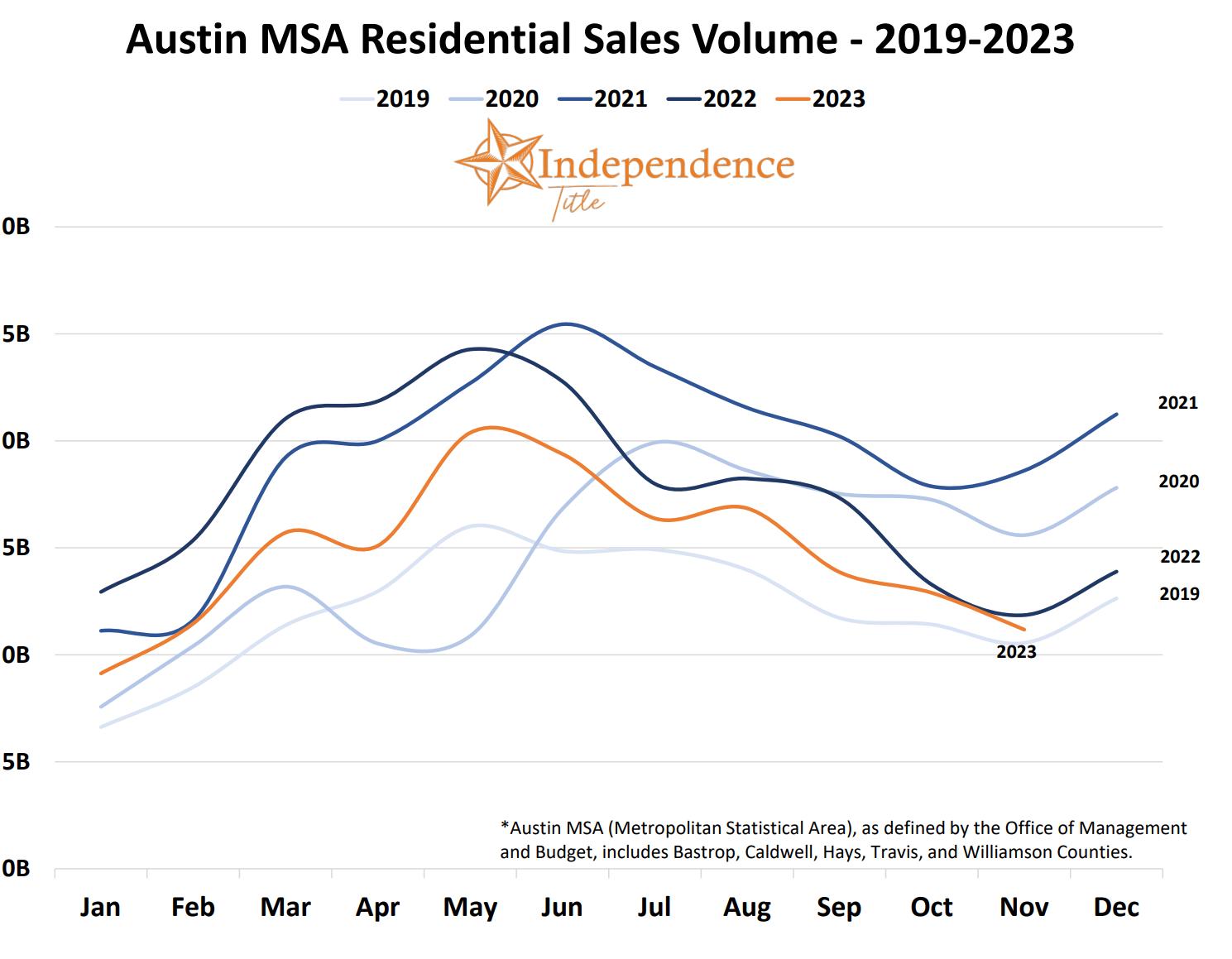

Mark Sprague State Director of Information Capital +1% 29,929 +4% 31,072 +4% 32,323 +4% 33,537 +3% 34,473 +7% 36,889 +9% 40,050 +2% 41,023 -18% 33,625 -10% 30,231 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

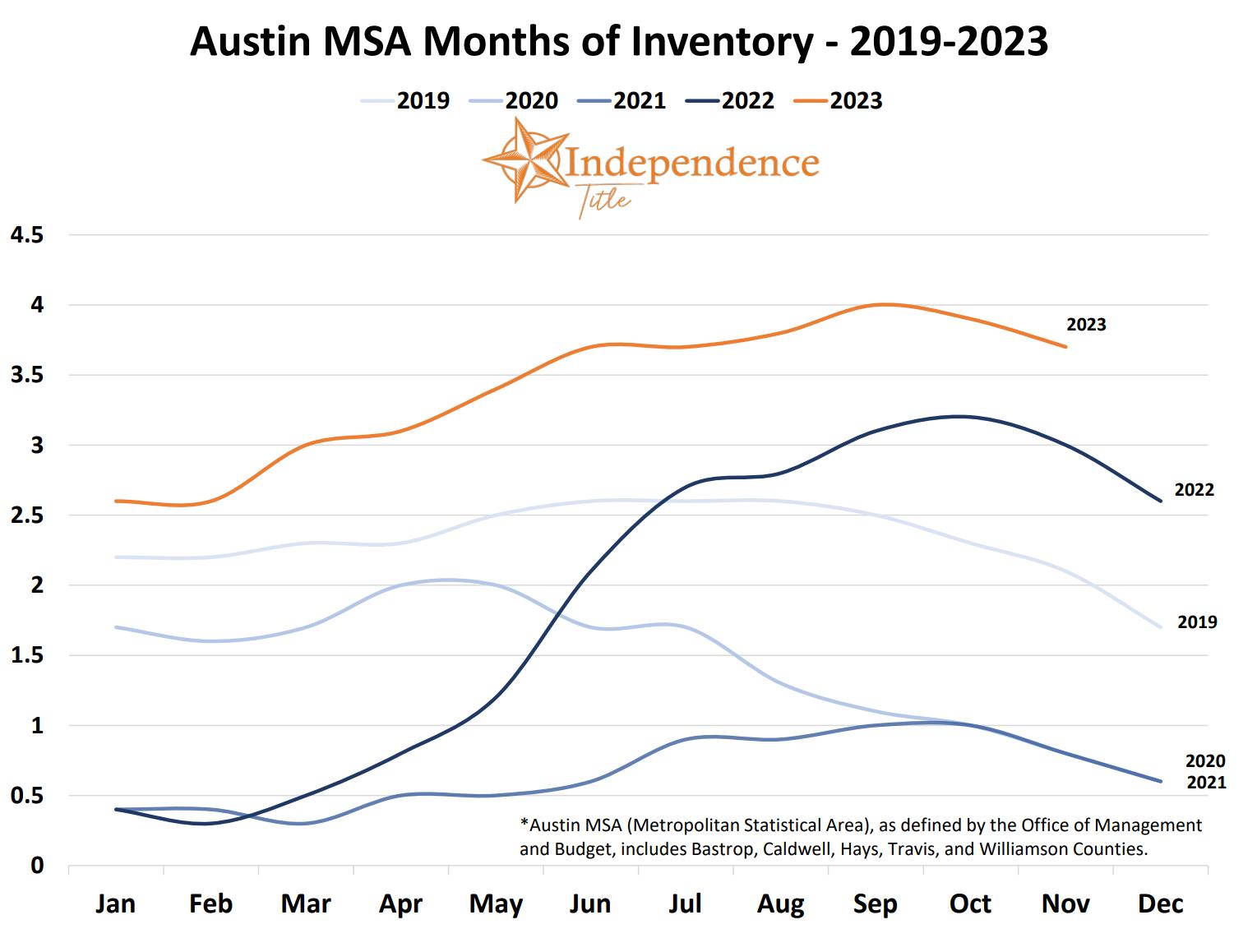

December 2023 Inventory: 3.4 months 2014 - 2023: 1%

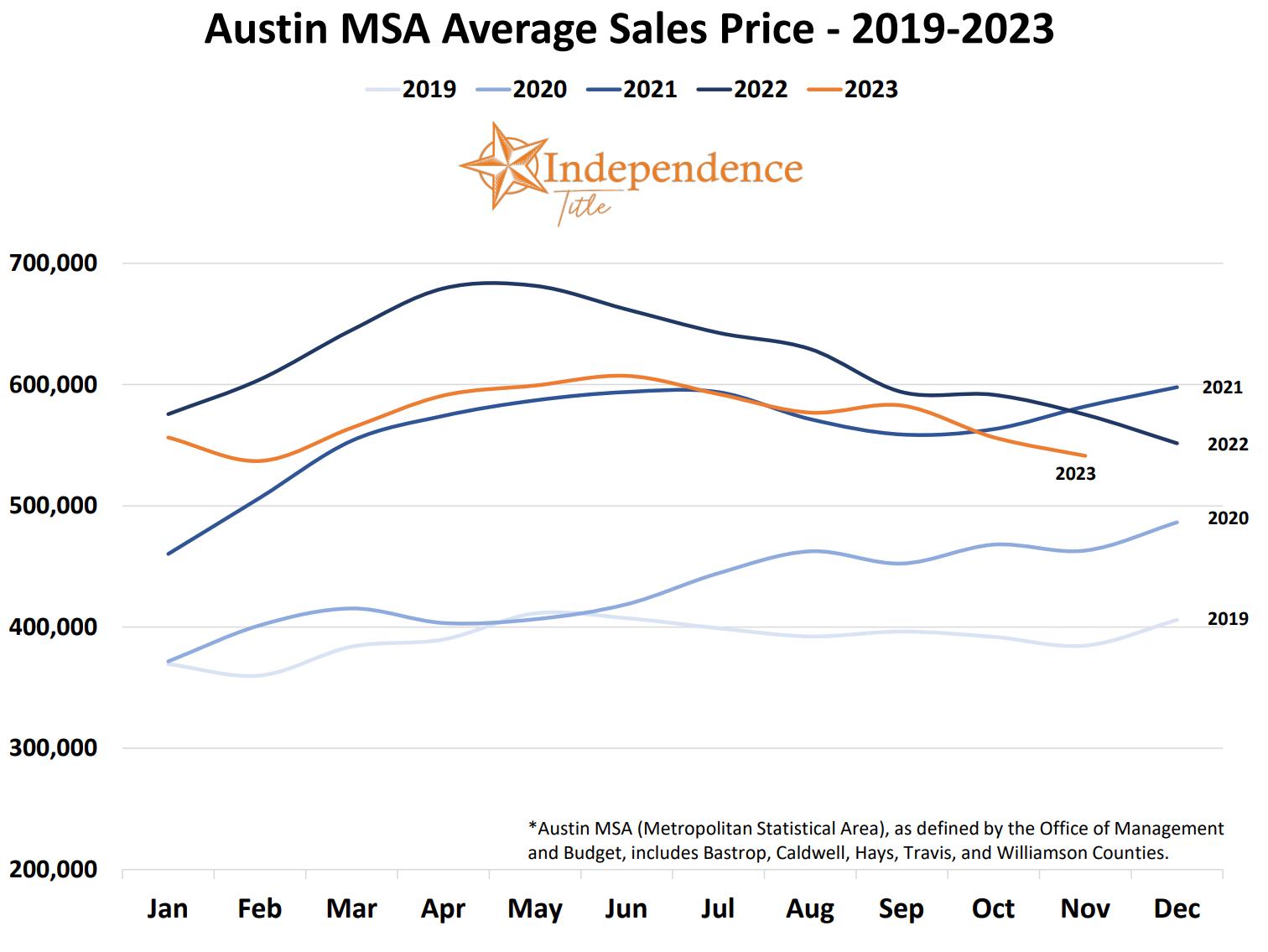

Mark Sprague State Director of Information Capital +9% $240,000 +9% $260,722 +7% $280,000 +5% $295,000 +4% $305,683 +3% $315,000 +10% $345,000 +32% $454,000 +11% $503,000 -11% $450,000 $0 $100,000 $200,000 $300,000 $400,000 $500,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Austin MSA - Median Residential Sale Price 2014 - 2023: 88% December 2023 Median Price: $443,605

$0-250$250-300$300-350$350-400$400-500$500-600$600-700$700-800$800-900

Mark Sprague State Director of Information Capital 3% 6% 13% 15% 21% 13% 8% 6% 4% 3% 5% 2% 2% 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000

Austin MSA - Residential Sales by Price Range - Last 12 Months

$900-1,000$1,000-1,500$1,500-2,000 $2,000+

COVID Effect on Commercial Real Estate

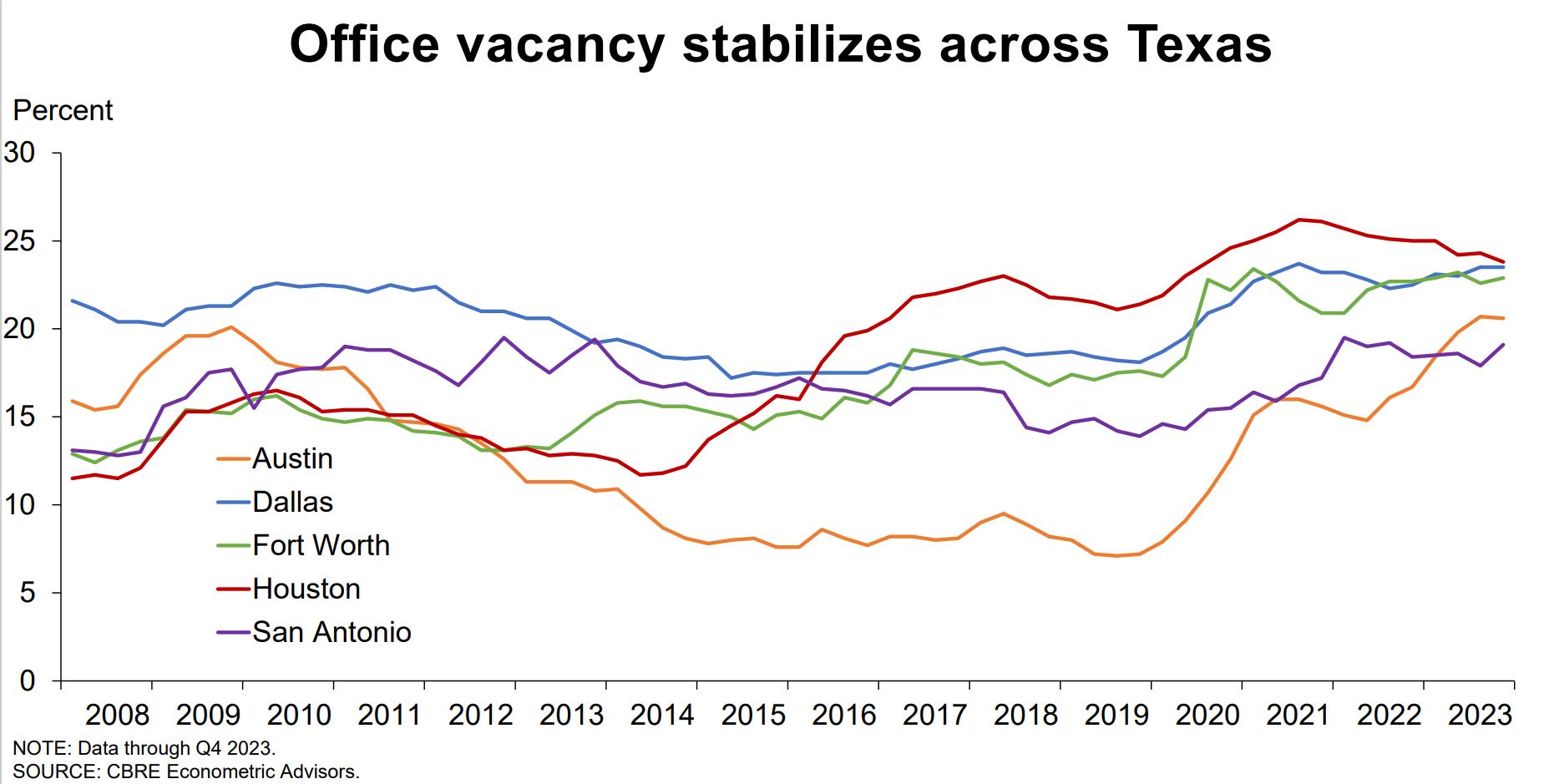

•Office:

• Vacancy rates and rents hit from work from home mandate.

• Rents stabilized in 2022 in Texas markets. 2023 / 24 will have some challenges.

• Hybrid work likely for several years.

• Corporations / Commercial need to earn that commute back!

•Retail:

• Hit the hardest – accelerating the shift to online.

• Potential of over 35,000+ storefronts closing.

• Retail online continues to improve and capture more.

•Industrial:

• Benefitted by the shift to online shopping.

• More warehouses closer to the customer.

• Strong demand has led to overbuilding.

•Hospitality, Leisure and retail:

• Challenged for several years. Improving.

• Potential consolidation, change of venue or purpose.

Mark Sprague State Director of Information Capital

Commercial Economic Forecast for 2024

Economy:

• Slowly improving nationally, but COVID variants continue to cripple economy.

• Real estate values maintain strong appreciation in most channels. However new banking guidelines and COVID challenges an issue.

• Sales continue, with greater velocity on values.

• Inventory challenged in multiple channels.

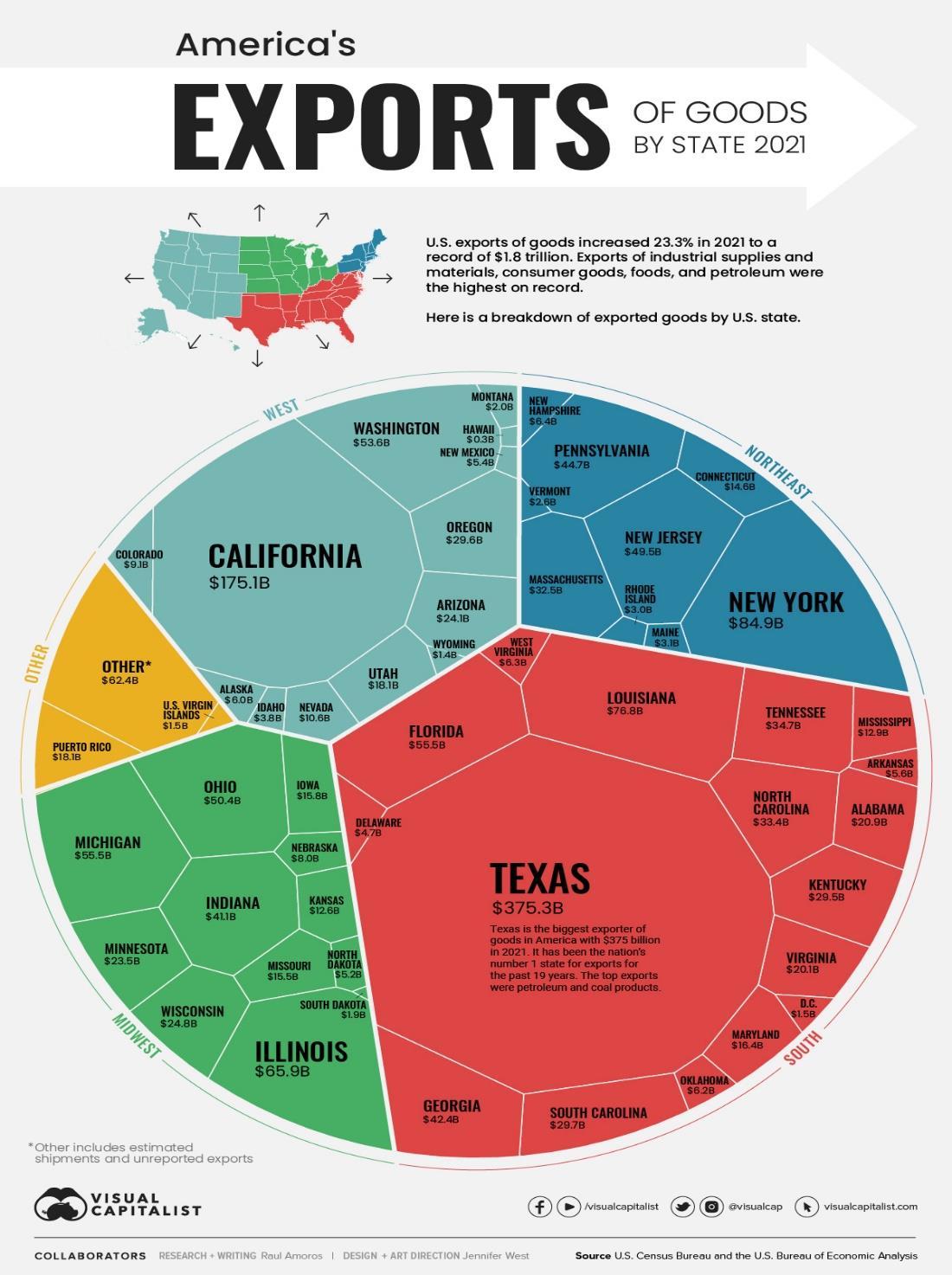

• Oil / Gas prices staying above $75. a barrel. Good for Texas.

• Weaker global demand for consumer goods. Particularly these last 3 quarters.

• Strong employment. Stronger than expected.

• Virus crisis hits hospitality, leisure and retail hard. When market can reopen, one out of five gone.

Mark Sprague State Director of Information Capital

Commercial Economic Forecast for 2024

• Opportunities will emerge for commercial real estate investors in 2024, as higher interest rates and an economic slowdown—perhaps even a mild recession—lead to bargain pricing for certain assets.

• Rent growth is offset by rising operating expenses in all channels.

• Higher than normal vacancies particularly in offices / malls.

• The average time on the market for rentals is growing.

• Build to rent SF / MF building slowing down.

• Rent concessions available, however rent discounts not.

• Short term slower market.

• Land development is costlier than ever. Low investment in land development has kept the supply of developed land sparse.

• Land sales slower.

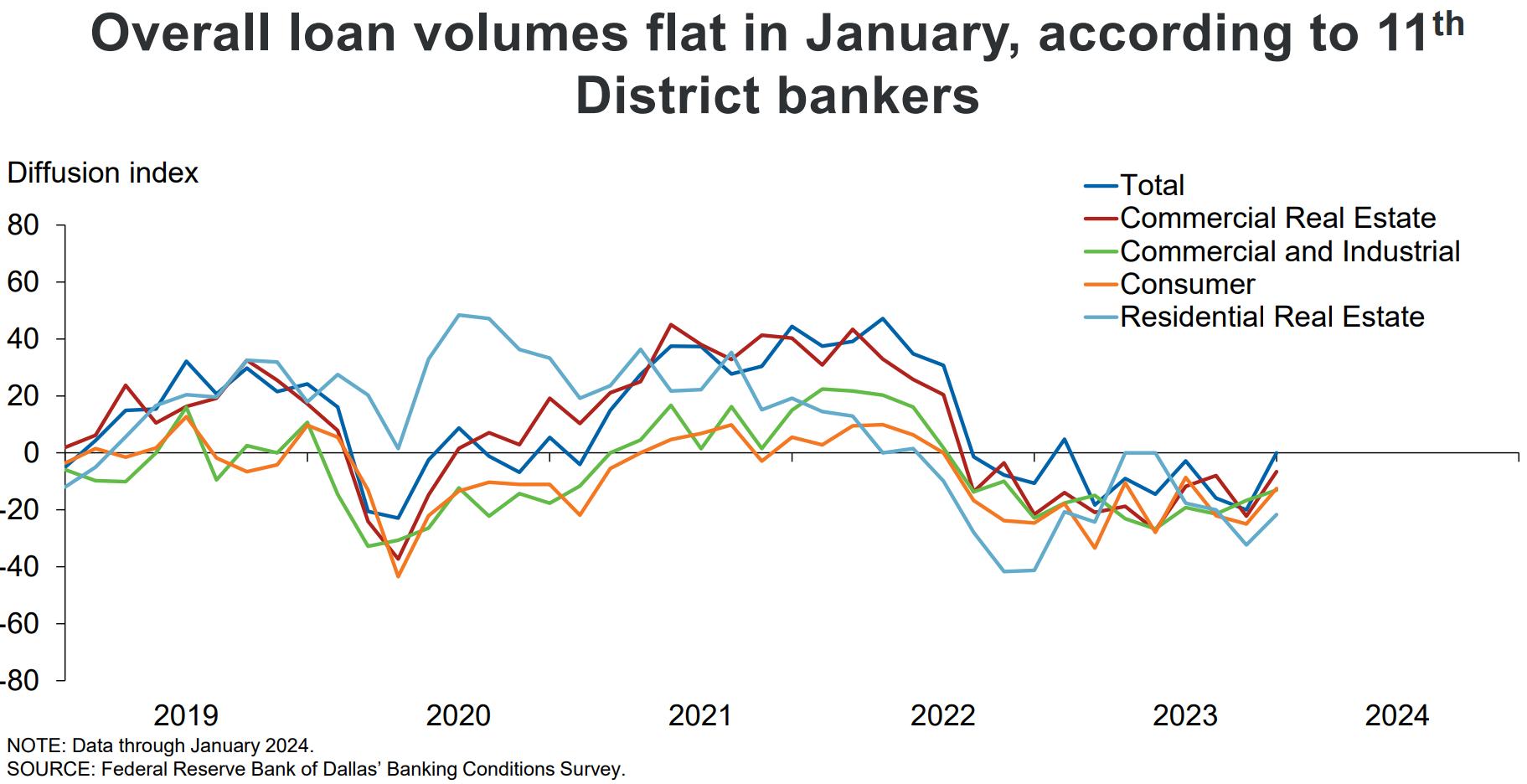

• Commercial lending harsher. 3 to 5 year window challenge.

• Real estate values maintain stronger than avg. appreciation in most channels.

• Oil / Gas prices staying above $75. a barrel. Good for Texas.

• Weaker global demand for consumer goods. Particularly these last 3 quarters.

• Strong employment. Particularly in Texas. Stronger than expected.

• Virus crisis hits hospitality, leisure and retail hard. When market can reopen, one out of five gone.

Mark Sprague State Director of Information Capital

Economic Forecast for 2024

Real estate:

• Sales came out of COVID stronger than expected and market is pressed for inventory.

• It will take 2-3 years to catch up nationally. Texas residentially 5+ years.

• Commercially financing challenged.

• Tight inventory in most real estate channels in 5 largest Texas metros.

• List overpricing is common.

• Still a seller's market for a number pf years.

• Rates are increasing and will continue based on inflation and Feds direction.

• Affordability will continue to be challenged. Drive till you qualify.

• Consumers staying much longer in homes. No reason to sell other than relocation.

Mark Sprague State Director of Information Capital

Final Thoughts- Market Challenges

•Inflation: Inflation has slowed but will stay elevated through 2024.

•Interest rates: Interest rates will slow rest of 2024.

•Recession: A global, national economic recession is less likely put still a possibility in 2024.

•Inventory: Residentially, there is a lack of inventory in the market, which is causing prices to rise.

•Investors: Investors are reevaluating their investments due to higher rates and tax bills.

•Tech layoffs: Tech layoffs are happening, which is reducing demand for housing / offices.

•Rental rates: Rental rate growth is slowing in the short term, but there is not enough inventory to meet demand in the long term.

•Office sublease inventory: The return to office will cause an increase in office sublease inventory. Nationally will continue to be challenged.

•Retail: Retail is stabilizing and there is a resurgence in the market.

•Affordable housing: Affordable housing is becoming more difficult to find. ‘Drive till you qualify’.

•Cost of construction: The cost of construction is rising due to a lack of labor and materials.

•Rural land deals: There will be fewer rural land deals in 2024.

•Land values: Prices for high-quality properties will remain, but prices for lower-quality properties will fall.

1Q24 thoughts

Reasons for Optimism

➢ Peak Fed funds rate? Interest rates back to normal, but higher than pre pandemic.

➢ Consumers have better purchasing power and are spending.

➢ Core CPI continued to drop – disinflation, but energy costs could increase, (war, OPEC, etc.).

➢ Demand for labor is strong.

➢ Housing improving. Not enough inventory (for sale or rent.)

➢ ECB had a dovish rate hike.

➢ Possible improvement in China recovery expectations (stimulus) .

➢ Mexico is the U.S.’ largest trading partner. But many new businesses in Mexico are run by Chinese firms that are looking to avoid US tariffs.

➢ While the American consumer will have student debt payments restarting and they are running out of excess savings and their savings rate has dropped to 3.5% of net.

➢ Avoided 2023 recession.

Bearish Points

✓ 2-yr yield back down below 5% (higher Fed funds rate for longer).

✓ The 2-year Treasury yield is a key benchmark that reflects the market’s expectation of the Federal Reserve’s monetary policy. As of December 15, 2023, the yield on the 2-year Treasury note is 4.37% .

✓ Fear that FOMC meeting will reveal higher estimates and 2024 not cut the Fed funds rate.

✓ Rate adjustment expectations.

✓ Waning disinflation (CPI and PPI higher than expected b/c of energy)

✓ UAW added to economic uncertainty – targeted strikes at all three big US automakers. They done?

✓ The resumption of student loan payments is likely to knock. 25 point off annualized GDP. A government closure another .25 point. UAW strike .10 pt /week.

✓ High valuations – lending adjustments?

Final Thoughts- Market Summary

•Commercial:

• Warehouse and multifamily slower.

• Office, land, multifamily (short term) sector challenged.

• Suburban office will continue to improve.

• Industrial/warehouse continues to have strength in a relatively small industrial market. Will slow in 2024.

• Hospitality, leisure improved. Retail (storefront) will be challenged for years.

•Residential:

• Single-family market is strong with lack of inventory (new and used).

• 2023 home starts off ......not enough inventory replacement.

• Multifamily market is strong with 61,000 units under construction and close to 50% near completion. Rent raising have slowed…..

• Record number completions have led to concessions

• Foreclosures are non-event in most of Texas due to strength of market.

•Job market:

• Tesla, Oracle, and Apple are some of the biggest job creators in the last 10 years.

• Job announcements are likely to continue.

•Overall:

• Austin area continues to show strength in opportunities.

• Knowledge of the submarkets pipelines and fundamentals key in being successful.

Final Thoughts

• Is the Fed Done raising rates?

• Mortgage rates will bounce around between 6-7% for the next 12 months.

• Low inventory will keep housing prices from changing very much. I would expect high single digit annual appreciation

• Homes will likely cost more in the Austin area - up 1-2-3% - each quarter of 2024

• Inflation keeps builders building smaller homes, in the same price ranges, to slightly higher. Because of the lack of inventory builders will capture more market share.

• Buyers already have more leverage - although, it's likely to remain more of a seller's market for a number of years.

• Yes, commercial real estate will be challenged. For a couple of years.

• Quit comparing to the last 3 exceptional years and one down year. The prior were outliers / once in a lifetime events. The latter happens every 7 to 10 years when inflation gets out of control.

There is no better time to buy!

Why would you wait?

Mark Sprague State Director of Information Capital