As 2022 rolled in, it heralded the reopening of economies and the pandemic’s gradual transition to an endemic stage. This period also introduced us to other realities previously obscured by the health crisis, such as geopolitical tensions, rising fuel costs, food shortages, and inflation.

This phase presented us with the opportunity to reassess our priorities so that we could further broaden our impact on the community while accelerating genuine progress among all our stakeholders and the industries we serve.

To achieve our goal of promoting inclusive growth while ensuring profitability, we recalibrated gears and restructured operations. We boldly re-examined how we did business, proactively engaged stakeholders to foster stronger collaborations, and identified the need for better alignment so that the Group could cohesively drive business results and, at the same time, motivate our colleagues in the industry to do the same.

We recognized the weight that interdependence had in transforming and stabilizing ecosystems. These interconnections led to unified and tangible benchmarks, transparency, and enhanced organizational efficiency and productivity. More importantly, it strengthened our culture of integrity and social responsibility and renewed EEI’s commitment to nation-building.

To attain this synergy, we established stronger ties with our vendors, suppliers, subcontractors, workers, clients, and industry partners. Through these closer linkages, we were able reinforce stakeholder relations, optimize workflows, push better collaborations, and inspire the development and adoption of innovations and

new technologies. It also emboldened us to challenge our perception of the industry by motivating members of the Group to help steer EEI as it leads transformational change within the industry.

Our collective efforts have been fruitful as EEI completed 25 projects in 2022. These include two buildings for Torre Lorenzo Development Corporation, five infrastructure projects such as the Metro Manila Skyway Stage 3 Project Sections 3 & 4, and eight electromechanical projects, which include the Compostela Inc. Foundation Works and SMNCI Line A. While the Al Rushaid Construction Company, Ltd. (ARCC) delivered another ten projects, among which include the Shuqaiq 3 IWPP - Sea Water Reverse Osmosis Plant (SWRO) - Civil Work Package and the NEOM Advanced Health Center (ARPIC).

The Group has 38 projects in the pipeline. These include 16 buildings, 11 infrastructures, two electromechanical jobs, and nine projects spearheaded by ARCC.

We also obtained 41 new projects in 2022. These undertakings include Megaworld’s Arcovia Palazzo 3 Towers Residential, the DOTR South Commuter Railway JV, electromechanical works for Capitol Steel Rolling Mill, and manpower and equipment supply for the KJO South Area Safety Facilities.

Although it has been quite a challenging year, we remain hopeful that our efforts toward continuous improvement, coupled with our focus on excellence and shared growth, will continue to usher in more prospects for the Group and, at the same time, become a springboard for all our stakeholders to experience success as well.

The disruptive atmosphere brought about by the pandemic continued in 2022, resulting in economic slowdowns in both domestic and international markets. Although economies slowly reopened and businesses attempted to regain their footing, the first steps toward recovery were arduous.

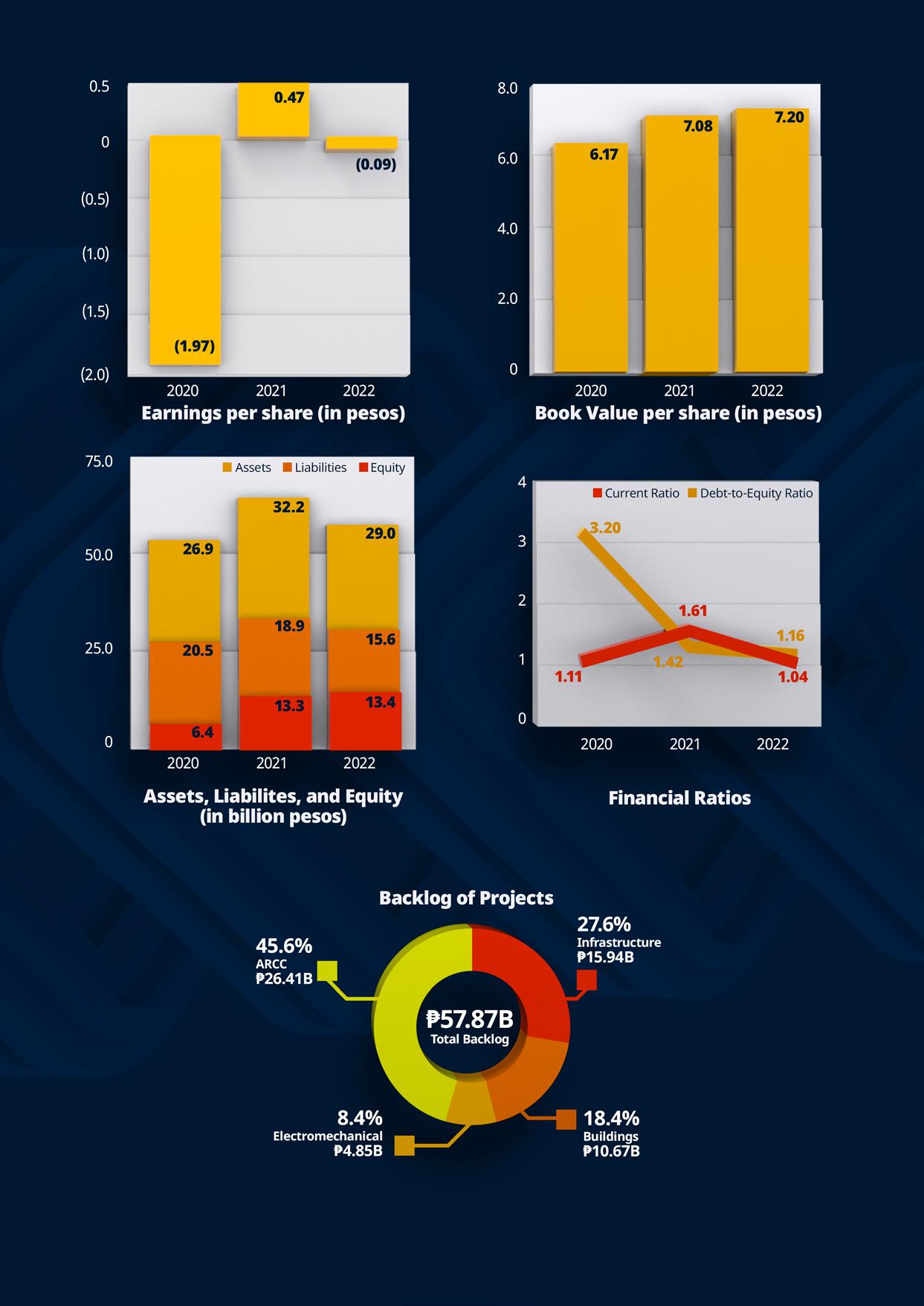

EEI Corporation achieved consolidated revenues of ₱14.7 billion in 2022, 9% lower than the ₱16.1 billion generated the previous year. The Group registered a net income of ₱200 million, lower compared to the ₱479 million posted in 2021.

We had robust construction operations and projects during the year that were supported by strict health protocols and guidelines, and led by an experienced team. However, despite our concerted efforts to stem the lingering effect of the pandemic, our performance continued to be challenged.

EEI Corporation successfully completed 25 projects. Our operations were affected by various delays in executing backlog works which adversely affected revenues. This challenge was further compounded by other factors including a sluggish economy, higher inflation and fuel costs, increasing borrowings, as well as global supply chain issues.

Our subsidiary segment performed well and contributed a noteworthy ₱2.5 billion to the consolidated revenues primarily due to EEI Power’s Retail Electricity Supply Business growth.

To address these deficiencies and help set the Group back on track, we evaluated our operations, identified and addressed weak points, restructured and continued upskilling our workforce, and strengthened our stakeholder relations.

We also brought in new leadership to help the Group gain a fresh and broader perspective of EEI’s competitive advantage and market position. In doing so, we hope to propel EEI to new heights forged in supporting the new economy brought about by changes during the pandemic.

We re-oriented our team on the values, standards, methodologies, targets, and business objectives we uphold. We aligned all employees on the behaviors that are essential for our success: working as a team, leading by example, respecting one another, being open to new ideas, being transparent in our communication, and above all acting with integrity.

More importantly, we instilled in each member of the Group the importance of inclusive growth and our collective duty to uplift the lives of our laborers.

With renewed spirit, we look forward to the completion of the 41 newly-awarded projects we obtained in 2022 and the finalization and delivery of our 38 ongoing projects in the coming months.

As we move forward towards a stronger EEI, we would like to thank our shareholders, clients, business partners, and staff for the unwavering support and confidence they have extended for 91 years and continue to impart to us.HENRY D. ANTONIO Incumbent President and Chief Executive Officer

Despite the formidable headwinds brought about by the industry’s sluggish recovery caused by the pandemic, international geopolitical tensions, and inflation, EEI successfully delivered 25 projects.

These undertakings, which were a mix of building, infrastructure, and electromechanical projects, and commitments by the Al Rushaid Construction Co., Ltd. (ARCC) demonstrated the Group’s resilience and strength to stand firm in the face of the industry’s volatile and competitive landscape.

These are the projects we completed in 2022.

Buildings

• Torre Lorenzo Development Corporation’s 3 Torre Lorenzo General Construction Works

• Torre Lorenzo Development Corporation’s Torre Lorenzo Malate

Infrastructure

• Metro Manila Skyway Stage 3 Project Sections 3 & 4

• Erection and Construction of the Relocation Works for the Affected Transmission Facilities by the MMSS3 Project Sections 3 & 4

• Balintawak Flyover NLEX-SLEX Connection (Section 5) Project

• Sucat-Alabang Viaduct Improvement

• PAG 3 PEC – Installation of Waterwall Panel Opening for Water Cannons and Sootblowers including Heatflux Sensors

Electromechanical

• Natura Aeropack Corporation Four Units Reactors, Drop and Hold Tanks

• SMNCI Line A

• RSFFB Phase 3 Electrical Connection and Installation of Spare LPG Pump for Tank Truck Loading Project

• Compostela Inc. Foundation Works

• Temporary Works for Atimonan Power Plant Project

• Analog B3 South

• Site Preparation Works Atimonan

• Prony Resources New Caledonia – Project Lucy / Supply of Prefabricated Spooling

ARCC

• Fire Protection for Sulfur & Storage Facilities

• Shuqaiq 3 IWPP - Sea Water Reverse Osmosis Plant (SWRO) - Civil Work Package

• NEOM Advanced Health Center (ARPIC)

• Yansab Olefins Plant - Furnace 8 (F-1180)

• Remaining Works Activities for Upgrade Onshore Flare System (BI-10-00184)

• Safaniyah Upgrade Desalinated Water Treatment (SMR#185)

• Furnace 7 Maintenance Services for Saudi

Kayan Plant

• Waste Water Disposal System

Refurbishment Safaniyah (SMR#135)

• Skilled Manpower and Equipment Services for Rabigh II IWSPP Project Chimeny

Repair Works

• Manpower Supply for Air Base Project

One of our primary objectives as a Group is to become a channel of inclusive growth. To ensure that we carve pathways to progress for our clients, shareholders, subsidiaries, employees, subcontractors, and laborers and, essentially, stimulate nation-building, we have acquired 41 newly-awarded projects.

These undertakings will support EEI’s profitability and, at the same time, expand its reach and capabilities to new markets. These new partnerships will enable EEI to create more employment opportunities for Filipinos while establishing meaningful and transformative collaborations within and beyond the construction industry.

Here are the new projects we obtained in 2022.

Buildings

• Megaworld’s Arcovia Palazzo 3 Towers Residential

• The Yuchengco Centre Phase 2

• STRC The Estate Makati

• Megaworld’s 18 Ave De Triomphe

Infrastructure

• DOTR South Commuter Railway JV Package 7

• Malolos Clark-Railway Project CP N-02 Combined Offer for San Fernando (Concreting and Structural Steel Works)

• Metro Manila Subway Project CP-101 North Avenue Station (NAS) Structure Works Launching Shaft Sections

• Malolos-Clark Railway Project CPN 05: Construction of the GRS Retaining/ Perimeter Wall, Integral Bridge Structural

• Strengthening of Thirteen Link Slabs Along the Candaba Viaduct and Improvement of San Matias Bridge

• Additional Works for Subic Freeport Expressway

• Suez International – Painting Repair of Filters – Calawis WTP

• Shimizu-Fujita-Takenaka Joint Venture; MMSP-CP 101 – Supply and Fabrication of Thrust Frame and Cradle

• Suez International - Painting Repair of Filters - Calawis WTP

• NLEX-SLEX Connector Road Sec. 1 (Fabrication & Delivery of Steel Box Girder)

• Upper Wawa Pumping Station (UWPS) Structural Steel Rib Support

Electromechanical

• Construction of Trenches, Equipment/ Pipe Foundation, Slab on Grade, & Crane Foundation Part 1, Implementation of Site Development & MEPF Work for the Rolling Mill Building

• Capitol Steel Rolling Mill

• Black & Veatch Combined Cycle Power Plant

• Dyson Project Alkaline

• 13.2MW Nabas Phase 2 Wind Farm Project

• Dyson Electronics PTE LTD - Project Alkaline Mechanical Works

ARCC

• Furnace 1391A-B Repair T-A Jobs at Petrokemya South

• KJO South Area Safety Facilities (SMR#258) - Manpower & Equipment Supply

• Expand Vacuum Distillation Unit (VDU) Heater – Riyadh Refinery

• Furnace 5 Partial Retubing at United Plant

• YANSAB LLDPE Shutdown –Manpower Supply

• Furnace 9 Partial Retubing at Saudi Kayan

• Furnace 3 Revamp Shutdown at Saudi Kayan

• Furnace 1 Retubing Services at Yansab

• Oil Water Separation Improvement

• APOC PDH & Complex U&O (HVAC Works)

• Furnace U210 Retubing Services at Yanpet

• SATORP – Manpower Supply

• GCC Electrical Laboratory Project Short Circuit Generator Installation

• Furnace Coil Repair and Recoil Services (Furnace F-1220)

• Jafurah Gas Processing Facilities (JFGPI)

• Zuluf Hydrocardbon Processing Facilities & Utilities and Water Injection (Building BD1 + BD2 and Civil CV2 Package)

• Skilled Manpower & Equipment Services for Rabigh II IWSPP Project

• Furnace #5 Emergency Shutdown at Saudi Kayan

• GCC Electrical Laboratory Project Short Circuit Generator Installation – Manpower Supply

• Furnace #4 Revamp Shutdown at Saudi Kayan

The quality of our work is a reflection of how we operate as an organization. To fulfill our commitments, we ensure that all our undertakings have a highly-skilled team, utilize innovative technologies and systems, and adhere to cost-effective processes. This approach demonstrates EEI’s sincerity and enthusiasm to contribute to nation-building. It also proves that we value our clients.

To date, we have 38 ongoing projects. Of these, 16 are buildings, 11 are infrastructures, two are electromechanical, and nine are spearheaded by ARCC.

Here is a compilation of the projects under development for 2022.

• Federal Land’s Four Seasons Riviera

• Federal Land’s Seasons Residences

• Federal Land’s Big Apple

• Federal Land’s Grand Hyatt Manila Gold Residences Tower 2 - Superstructure

• Federal Land’s IMET BPO Towers 2, 3, and 4

• Federal Land’s Grand Midori Ortigas

• SMDC’s Air Residences

• SMDC’s Glam Residences

• SMDC’s Light Residences Phase 1, Phase 2, and Architectural

• SMDC’s Sands Residences

• SMDC’s Ice Tower

• Cebu Landmasters’ The Masters Tower Project

• Torre Lorenzo Development Corporation’s Torre Lorenzo Loyola

• Cyberzone Properties’ Cebu Cyberzone

• Filinvest Land’s Clark Mimosa Lifestyle Mall Phase 1 and 2

• The Yuchengco Centre Phase 1 Demolition and Excavation

Malolos-Clark Railway ProjectInfrastructure

• Metro Manila Subway Project JV

• Metro Manila Subway Project – Demolition Works for North Avenue Station, Quirino Highway, Tandang Sora Depot

• Metro Manila Subway Project Temporary Yard Development and Piling Works for Depot LS

• Malolos Clark Railway Project CPN 04 (JV Portion with ACCIONA)

• Malolos-Clark Railway Project CPN 05 (Site Clearing and Earthworks Package #1)

• Malolos-Clark Railway Project RC Works

Viaduct and Underground Structures

• Malolos-Clark Railway Project CPN-04 –Structural BR 107 Steel Through Girder

• The Metro Manila Skyway Stage 3, Section

4 – C3-A. Bonifacio Interchange

• The Metro Manila Skyway Stage 3, Section

5 – Balintawak Flyover

• Freyfil – Supply and Fabrication of Structural for Mindanao Bridge

• MRT-7

Electromechanical

• Southern Star Project – SSP Industrial CP01 General Construction Works

• FGen Multipurpose Jetty and Onshore Gas Receiving Facility

ARCC

• APOC PDH/UTOS Project

• Shuaiba Desalination Plant Technology and Expired Assets Replacement Project (Civil Works)

• Shuaiba Desalination Plant Technology and Expired Assets Replacement Project (Supply and Installation of EOT Cranes)

• Abqaiq Plants Restoration

• Abqaiq Plants Restoration (Various CRPOs)

• Debottleneck Onshore Plant – Safaniyah

• Hawiyah Unayzah Gas Reservoir Storage (HUGRS) Project

• Dewatering System & Oily Water Sump Pits – Abqaiq

• Installation of New Seal Leg at DR Module C -Hadeed Plant

The year began on a hopeful note as mobility restrictions associated with the pandemic were finally lifted, and more businesses and institutions actively began hybrid or face-toface operations. However, other significant events, such as the Russia and Ukraine war, geopolitical tensions, supply chain and food shortages, and rising inflation rates in the Philippines and foreign shores, made business more challenging in 2022.

Despite this predicament, EEI posted consolidated revenues of ₱14.7 billion in 2022, 9% lower than the ₱16.1 billion it recorded in 2021. The Group gained a net income of ₱200.3 million, which is lower from the previous year’s ₱479 million.

The Group has a healthy level of backlog projects that will help ensure profitability in the coming year. EEI’s unworked portion of existing contracts amounts to ₱57.87 billion. Of which, ₱15.94 billion are infrastructure, ₱10.67 billion are buildings, ₱4.85 billion are electromechanical, and ₱26.41 billion are ARCC backlog projects.

Here are the highlights of our financial performance and backlog of projects for 2022.

in the full year of 2022 fastest

in the q4 of 2022

by an emerging asian economy

The Kingdom of Saudi Arabia’s (KSA) economy grew by 8.7 percent in 2022 and 5.4 percent in the fourth quarter of 2022. This performance indicated that the Kingdom has successfully bounced back from the global downturn accompanying the COVID-19 pandemic. Its economy also left behind the period of slower growth that it witnessed before the health crisis following the 2014 downturn in global oil prices.

According to the Oxford Business Group’s “The Report: Saudi Arabia 2022,” the changes in KSA’s domestic structure and policy frameworks, which

based on q4 2022

Real Gross DOmestic Product (GDP) followed by Vietnam at 5.9 percent and China at 2.9 percent

are part of its Vision 2030 socio-economic development plan has benefited the Kingdom. These efforts have helped the country steadily advance its economic diversification and privatization goals since its launch in 2016.

However, continuing uncertainties over the pandemic’s future course and its negative impact on global supply chains continue to impede global recovery. In addition, the effects of Russia’s invasion of Ukraine and the ongoing ramifications of climate change continue to disrupt the way many companies do business. Even so, with Saudi Arabia’s robust economy and ability to capitalize on global market trends such as higher hydrocarbon prices and significant geopolitical influence, the Kingdom stands well placed to continue its socioeconomic progress.

The Philippine economy grew by 7.2 percent in the fourth quarter of 2022, exceeding the median analyst forecast of 6.8 percent. This positive fourth-quarter result led to a 7.6 percent full-year growth in 2022 that exceeded the government’s 6.5 to 7.5 percent target. It also defied the 8.1 percent inflation rate seen last December 2022 and the average inflation rate of 5.8 percent reported by the Philippine Statistics Authority.

The country’s growth was the fastest in the region, followed by Vietnam at 5.9 percent and China at 2.9 percent, based on Q4 2022 real gross domestic product (GDP) reports posted by emerging Asian economies. On a seasonally adjusted quarter-onquarter basis, the Philippine economy expanded by 2.4 percent, driven by increased economic activity mainly from pent-up demand as the economy fully reopened in the last three months of 2022.

8.7%

The government remains optimistic about this continuous growth. A statement from the National Economic Development Authority (NEDA) last January 2023 said that the country’s growth will stay robust as the government continuously intensifies its efforts to revive its high-growth trajectory.

In addition, improved COVID-19 risk management protocols and the removal of mobility restrictions have created a positive economic outlook. These factors boosted economic activity and created more jobs despite external headwinds.

The NEDA further stated that the country’s participation in the recent World Economic Forum (WEF) showcased the Philippines as a prime investment destination in the ASEAN region. This positioning demonstrated that the country is now more open to businesses in various industries such as energy, water, logistics, transportation, agribusiness, infrastructure, manufacturing, tourism, health, education, and digital connectivity.

Meanwhile, through the Philippine Development Plan (PDP) 2023-2028, the government will ensure inclusive growth, creating more green or resilient jobs to enable Filipinos to improve their quality of life.

5.4%

Economic Growth in the full year of 2022

Economic Growth in the q4 of 2022

JP Systems Asia, Inc. (JPSAI) continues to improve its performance year-on-year, amassing a ₱23.5 million net income from an annual revenue of ₱149 million in 2022. This performance is a remarkable 70% increase in both net income and revenue compared to 2021 figures.

JPSAI’s revenues were primarily generated from the formworks, shoring, and scaffolding rental for 40 projects under EEI Corp., scaffolding and accessories rental of the MG EXEO Network, Inc. project in La Union, power plant maintenance projects of Powerhaus Industrial Sales & Services, and others.

The main drivers of the company’s 2022 accomplishment came from scaffolding rental at ₱68.41 million, formwork & shoring at ₱49.60 Million, and inventory management services providing ₱23.36 million.

The company also hopes to increase its presence in the rental market and acquire additional rental assets to achieve this.

objectives. JPSAI will also expand its services to include erection and dismantling to offer more value to clients.

The GAIC Group posted a notable consolidated net income of ₱48.1 million in 2022, 66% higher than the 2021 net income of ₱25.94 million.

GAIC: Gulf Asia International Corporation (GAIC) registered a net income of ₱48.9 million in 2022 from a net loss of ₱8.43 million in 2021. This performance was driven by revenues from its inhouse account or the EEI overseas project, which increased substantially by 104% from ₱15.24 million in 2021 with 2,479 men deployed to ₱31.08 million in 2022 with 4,739 men deployed.

₱3.85 million of GAIC’s total revenues were generated from its traditional accounts in Saudi Arabia, Guam, Equatorial Guinea, Japan, and Ascension Island. At the same time, new accounts in Japan, Zambia, and Papua New Guinea contributed P0.76 million in revenues.

In the coming months, JPSAI will continue to provide innovative solutions to its clients by banking on its specialty and expertise in Scaffolding & Formworks Shoring Systems. The company has also launched initiatives to improve asset utilization to support its revenue growth

With the significant improvement in global health and the high vaccination rate in most destination countries, the market for Overseas Filipino Workers (OFWs) is slowly returning to pre-pandemic levels as most international borders have now opened.

Some labor markets, particularly in Canada, New Zealand, Australia, and the Middle East, need to fill their skill shortages. OFWs affected by the pandemic are now gradually returning to their jobs abroad. With these developments, GAIC will focus its marketing efforts in New Zealand, Australia, GUAM, Europe, Malaysia, Japan, and the Middle East for the supply of construction workers, healthcare personnel, agricultural workers, and IT staff.

For broader market coverage, the company will also initiate tie-ups with more foreign recruitment or placement agencies in the Middle East, Europe, and Asia. Of these, priority searches will be given to the Kingdom of Saudi Arabia, where there are ongoing Giga Projects. The company will also continue to maximize its referrals from satisfied customers and participate in marketing missions organized by PASEI and JEPPCA.

GAIC will proactively advertise its business in international newspapers and magazines to expand its reach. It will also continue to explore establishing an office in destination countries with a large demand for OFWs.

GAMSI: GAIC Manpower Services, Inc.’s (GAMSI) net income increased from ₱34.41 million in 2021 to ₱39.1 million in 2022. The company’s newly-acquired janitorial, office, and building maintenance service contracts in 2022, such as AEB, Inc., Manila Memorial Park Cemetery, Inc., La Funeraria Paz-Sucat, Inc. EEI Power, IASA, Inc., and Radio Wealth Finance, Inc. contributed ₱1.26 million in total revenue with 58 men. The

Yuchengco Group of Companies (YGC) continues to be the primary client of GAMSI. On the other hand, GAMSI’s one-time cleaning (OTC) / subscription and disinfection services generated ₱7.18 million in total revenue.

The company is optimistic that the coming year could see the diminishing effects of the pandemic on the labor market as restrictions continually ease and the country’s economy gradually recovers. This situation could lead to greater opportunities and increase the demand for local manpower outsourcing services to pre-pandemic levels.

GAMSI will intensify its marketing efforts in Clark Development Corporation to cover the following industries: factory, manufacturing sector, textile and garment, industrial park, and PEZA areas. The company will also work out its accreditation as a service provider at Subic Bay Metropolitan Authority (SBMA) to offer its services to locators and other business establishments inside and nearby provinces. It will continuously expand its One-Time Cleaning Services (OTC) and disinfection and sanitation services in Cebu, Cagayan De Oro, and Davao. These services are expected to generate ₱1.2 million in revenues for 2023. GAMSI will also explore new business opportunities such as printing and enveloping and related services, facility management, and the manufacturing and sales of cleaning chemicals.

With all these in the pipeline, the GAIC Group looks forward to another bright and gainful year 2023.

For the past three years, EEI Power’s revenue stream was led by its power solutions business, or the sale of electrical equipment and services, reaching ₱251.4 million in revenue in 2022 but was lower than its ₱269.27 million in 2021. On the other hand, combined equity earnings from EEI Power’s investments in PetroSolar Power Corporation and PetroWind Energy Inc. reached ₱244 million during the year, higher than the ₱241 million equity earnings in 2021. The company’s overall consolidated net income for 2022 registered at ₱254.0 million.

EEI Power Corporation EEI Power will continue to execute its strategy of actively deploying and utilizing sustainable and renewable energy sources, including expanding its power generation portfolio and growing its presence in the solar rooftop business.

Starting in 2023, EEI Power has begun to see a significant increase in its power sales revenue, attributable to the completion of several solar rooftop projects that are expected to reach megawatt scale. The company’s solar rooftop business, which primarily targets commercial and industrial customers, and to some extent, retail installations in the residential sector, is expected to grow along with the maturation of the market’s awareness of the volatility of electricity prices and the interest in environmental sustainability.

Along the lines of sustainable development, EEI Power is likewise looking at establishing its presence in the area of energy efficiency and conservation (EE & C) by pursuing its certification as an accredited Energy Service Company (ESCO). With the passage of Republic Act No. 11285 or the EE & C Act of 2019, the compliance of establishments on institutionalizing efforts geared toward the judicious use of energy has already been mandated.

from its existing interests in solar and wind. As a solutions provider, EEI Power will continuously expand its menu of electrical products and service offerings to best address the needs of its clients. This includes the addition of innovative products and new service approaches that the company is developing in-house. Additionally, EEI Power will continue to provide turn-key solutions by being an accredited electro-mechanical contractor of the Philippine Contractors Accreditation Board.

2022 was an outstanding year for EEI Energy as it achieved ₱882.8 million in revenue, 810% higher than the ₱97 million revenue it earned in 2021. Gains from energy trading efforts in the Wholesale Electricity Spot Market (WESM) significantly complemented EEI Energy’s revenues from retail contracts. EEI Energy’s net income for 2022 reached ₱53.5 million, exponentially higher than its ₱4.14 million net income in 2021.

As a power generation company, EEI Power sets its sight on increasing its presence in the renewable energy (RE) space by expanding its portfolio to include hydropower generation, aside

During this period, EEI Energy served its existing six (6) contestable customers with an aggregate demand of 12MW. These customers include Grobest Feeds Philippines, Limcoma MultiPurpose Cooperative, Wesselton Inc., Genstar

Manufacturing Inc., Liwayway Marketing Corporation, and Cathay Steel Pacific Corporation (CAPASCO).

EEI Energy Solutions Corporation continues to gear up for new milestones as the threshold for contestability is expected to go down in the coming years. At the same time, EEI Energy will likewise take an active role in providing clean, renewable energy to qualified customers, having been granted a Green Energy Option Program (GEOP) operating permit by the Department of Energy. In the highly competitive retail electricity market, EEI Energy sets itself apart from the other industry players by positioning itself as one of the most innovative renewable energy services (RES) companies that deliver competitive rates and relevant value-added services to its customers.

EEI Construction & Marine, Inc. (ECMI) improved its numbers and surpassed targets in 2022 by generating ₱568.3 million in revenue and ₱90 million in consolidated net income. Major contributors came from its petroleum sectors and railway projects.

While the company is currently performing well in the petroleum market, it is also preparing for several business developments and projects, including shipbuilding and repair, modular structure production using cold-formed steels, and fabrication. ECMI will also upgrade its automation of processes by investing in new equipment that will expedite fabrication and repair jobs. Since

the country is entering the post-pandemic period, the company is optimistic that it will have more opportunities to spearhead projects without compromising safety and quality.

ECMI expects to continue its recovery to prepandemic growth levels in the coming months. The company has a healthy backlog from the previous year to sustain operations and continues to secure more projects from petroleum companies and food and beverage businesses.

Transformation became the company’s byword in 2022 as it underwent several significant changes in branding and structure. The shift began with its rebranding from Equipment Engineers Inc. (EE Inc.) to EEI Business Solutions, Inc. (EBSI) to better reflect its services and products. EBSI then rationalized its products trading operations, restructured its organization, and acquired new vendor-partners to add to its product portfolio while maintaining its flagship partners like CETCO & Franklin Fueling Systems. The company also created a Channel Management Group to improve its market coverage outside the National Capital Region.

EBSI renewed focus proved fruitful as it registered ₱300.7 million in revenue with a gross profit of ₱42.5 million in 2022, notably 16% and 4% higher than the previous year, respectively. Major contributors to this growth came from CETCO,

with an annual revenue of ₱88 million, followed by ₱68 million from FFS, ₱26 million from SIKA, and ₱25 million from Lightstrong.

For 2022, gross revenue for EEI Realty Corporation (ERC) was ₱3.9 million, a 71% decline from the previous year’s ₱14.0 million. The gross contribution, derived from only one revenue source, amounted to ₱0.85 million or 21%.

Net income after tax amounted to (₱1.4 million), 161% lower than the previous year’s ₱2.3 million. With limited inventories to sell out of the three primary revenue sources, ERC shifted its focus to provide additional rental areas for EEI Corporation during the middle of 2022 while building up its inventories for sale in Suburbia Marikina, RoyalParks @ Grosvenor Place in Tanza, and Puting Lupa, Calamba for the coming years.

Moving forward, EEI Realty continues to monitor the economic landscape and is poised to benefit from any appreciation due to its sizeable landholdings. The most significant holdings are approximately 54 hectares of vacant land in Cavite. This, alongside EEI Realty’s plans for joint ventures with property developers for its other land holdings, ensures EEI Realty’s source of growth in the future.

EBSI’s mother company, EEI Corp., topped the list as its highest source of revenue with ₱141 million in sales of products and services, while Pilipinas Shell, with ₱21 million, came in second. Other outstanding sources of revenue include its Channel Dealer in Visayas & Mindanao at ₱19 million, NW Steel Technologies with ₱14 million, and Unioil with ₱13 million, among others.

EBSI intends to grow revenues by capitalizing on the demand from its parent company EEI’s construction contracts. The reorganization of its parent company and strengthened commercial strategy will create more opportunities for EBSI to cross-sell its products and services. At the same time, EBSI will continue to expand its revenue streams from non-EEI projects. EBSI’s Petroleum Group has also revamped its offering to petroleum clients by providing total solutions for gasoline station projects. This new strategy of supplying design and value engineering services on top of product sales and support is expected to generate more interest from new and existing clients.

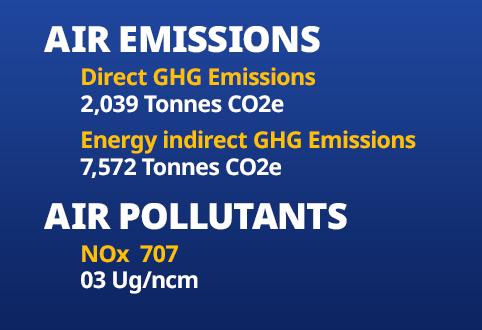

The Construction Industry is an energy-intensive and fuel-intensive industry. As the business grows, consumption of energy and fuel consequently increases. There is a huge disparity between the usage of fuel for transport vehicles as compared to all other categories. The transport vehicles category comprises service vehicles that ferry employees and equipment and materials to and from the project sites or permanent sites such as the Headquarters, Equipment Yard or the Fabrication Shop.

Generator sets are a far second in terms of fuel usage. While permanent sites use electricity from both the grid and solar panels, new projects use generator sets to provide electricity while their applications for electricity connection are pending. Likewise, all project and permanent sites maintain generator sets for backup power in the event of power interruptions.

Although the other categories pale in comparison to transport vehicles, their impact on the business cannot be understated. In the case of mobile cranes and backhoes, these are essential equipment at most, if not all, projects. Without any viable alternative, the Company cannot do away with the use of diesel-powered heavy equipment.

With its heavy reliance on fossil fuel, the Company is greatly exposed to fluctuations in fuel prices. This was evident in the reportable year, as fuel companies tried to capitalize on the world slowly returning to its pre-pandemic norm of traveling to and fro for work or leisure. Fuel prices were further aggravated as the supply chains were affected by the advent of the Russia-Ukraine war. The Company’s finances took the brunt of the increases. This is without even considering the

obvious and adverse effects of the use of fossil fuels on the environment.

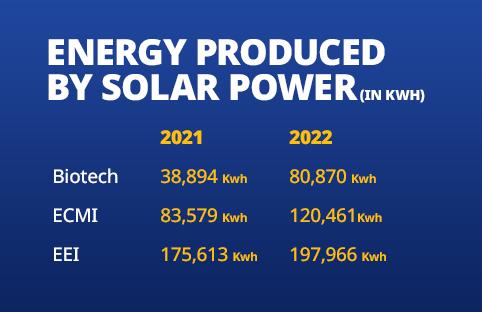

In an effort to offset its reliance on fossil fuel, EEI installed solar panels in its permanent sites to complement power sourced from the grid. The increase of energy generated from the solar panels is an indication of lesser consumption or demand for grid-sourced power.

Water is an important part of our daily lives. For EEI, water has a wide variety of applications and is a valuable resource for several activities in its project sites depending on the stages of the construction. Some of the activities that use water are compression of the landfill, manufacturing of concrete, curing of concrete, testing for waterproofing, and cleaning.

Air pollutants are a risk to both human health and the environment. For employees working regularly in construction sites, there is an increased risk of developing health complications as a result of repeated or prolonged exposure to air pollution. Poor air quality is proven to cause various health problems such as coughs, wheezing, shortness of breath, and other respiratory diseases.

To reduce air pollution contribution, EEI committed to:

EEI is focused on conserving energy and water, and committed to efficient use of power against the established power consuming devices. This was clearly defined in the Occupational Safety, Health, and Environment (OSHE) Objective and Program for the year 2022 resulting in at least a 5% increase in efficiency as compared to the previous reportable year.

Among the activities EEI implemented during the year were:

• Inventory of energy-consuming machines and equipment

• Monitoring of actual fuel consumption and operating hours of machine and equipment

• Inventory of ICT equipment and monitoring of actual operating hours

• Phase-out of all mercury-added lighting products i.e., compact/linear/ cold cathode / external electrode fluorescent lamps, high pressure Hg vapor lamps etc.

• Regular conduct of energy audit in all project sites and offices

• Installation of automatic sensor for switches in toilets and hallways

• Gradual conversion to inverter-type Air Conditioning Units

• Use of power from electricity from grid and solar panels instead of diesel generators

• Use of appropriate capacity of equipment instead of over-rated capacity

• Never burning waste materials, as the smoke emitted releases carbon dioxide and other potentially toxic gases such as methane and carbon monoxide into the atmosphere.

• Using low-sulphur diesel to power heavy equipment and vehicles.

• Improving existing equipment by using particulate filters and catalytic converters.

• Using water sprays or sprinklers to control or minimize dust particles to be carried off in the air and spread to nearby areas, particularly during tasks such as the filling of skips or breaking down of concrete.

• Use of an on-tool extraction to control some types of dust. This is a type of exhaust that fits onto some tools and equipment which captures particulates as they are emitted.

In addition, EEI mandates the use of appropriate personal protective equipment, particularly respiratory protective equipment (RPE) depending on the activity undertaken.

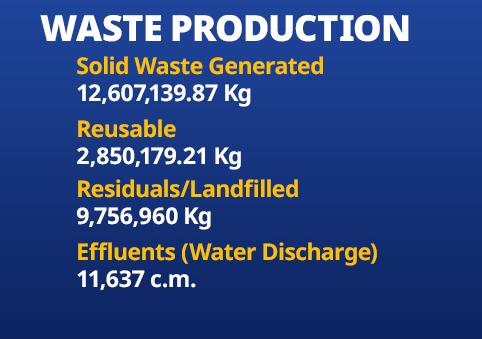

EEI established procedures in generating, storing, transporting, or disposing of its waste. Alongside such efforts, the Company also aims to continuously reduce the amount of waste generated by its activities by reusing, repurposing, exchanging, or recycling, where applicable opportunities exist, such as:

• Reuse of scrap materials such as phenolic board, plywood, lumber, metal, GI sheets and rebars

• Donation/Sale of other wastes to cement plants which can be used as alternative fuel/ co-processing

• Issuance of Memo banning the use of plastics

• Donation of shredded paper to LGU

• Donation of collected PET bottles to LGU

• EEI established a “Return to Supplier Agreement” for all Hazardous Wastes such as paint cans to ensure proper disposal of wastes generated by sites by region. There is also an enormous effort to keep the hazardous components of the waste generated out of landfills, conserve natural resources, and protect human health and the environment. In addition, EEI acquired the services of Hazardous Waste Contractors, accredited by DENR and other government agencies, to ensure that hazardous waste is properly disposed to avoid fines or environmental liability. These contractors are evaluated annually to guarantee efficient Waste Disposal management.

Occupational safety and health incidents cause human suffering and financial loss. With some 17,000 workers, EEI is continuously promoting a culture of safety and health and brings OSH services to those that need them the most.

For 2022, the following activities were implemented to promote safety awareness in the organization:

• Safety Culture Talk by EEI President & CEO, Roberto Jose L. Castillo

• Safety Leadership Training by Tony Small

• Safety Training Observation Program

• Implementation of Stop Work (Red Card)

• Toolbox meetings every morning to remind workers of the importance of safe workplace

• Incident debriefing wherein incidents are discussed during SHES Meeting

EEI employs fully staffed and competent OSHE personnel that ensure safe working practices in all of its projects. Moreover, safety violations are closely monitored and met with appropriate disciplinary actions to mitigate this risk.

Aside from the policy and procedure on Workplace Conditions, labor standards, and Human Rights, employees are given appropriate OSH Training.

The Company remains compliant with the guidelines set by the Department of Health and the Inter-Agency Task Force, among others.

Despite the obvious difficulties of the industry, EEI does not have any standing policy that limits hiring on the basis of gender. Regardless of the nature of the employment opportunity, EEI adheres to the principle of non-discrimination and bases its hiring solely on the qualifications of the applicants. This is evident in job opportunities where manual labor is not the main job description.

EEI is very optimistic about growth and opportunities to improve its operations in terms of gender diversity. As technology and other innovations continue to develop that will decrease reliance on brute strength, this will in turn open more opportunities for diversity.

to women to pursue work in other aspects of the construction industry such as engineering, design, information technology, accounting, and management.

With the increased demand and access to resources and information, more women are now joining the construction industry and possess relevant competencies. This is reflected in the increase in the number of female employees with 2,674 female workers for the reportable period for EEI Corporation and its subsidiaries.

EEI’s hiring policy adheres to the equal opportunities and does not discriminate against any applicant on the basis of gender. EEI encourages more women to join the Company and empower women’s participation through the following:

• Training and development are given with equal opportunity for all.

• Selection and Recruitment of EEI prohibit discrimination on the basis of gender

• Implementation of Laws protecting women such as the 105-Day Expanded Maternity Leave Law, Magna Carta of Women, Solo Parents Act, Anti-Sexual Harassment Law, Safe Spaces Act, to name a few.

EEI Corporation supports the advancement of employees’ skills, career growth and treats training as an important investment in making a clear path for employees. Throughout the pandemic, EEI’s Learning and Development Department (L&D) was able to adopt alternative modalities of training and keeping employees motivated in attending face-to-face and online training. To ensure that EEI has sufficient skilled manpower, the Company maintains government-accredited training facilities and certifies workers for highly technical skills like welding and pipefitting. These trainees are sourced from the provinces and provided with the necessary knowledge and skills to allow them to acquire good employment opportunities.

Addressing the problems with gender diversity in the construction industry is a huge undertaking rooted in the primary need of the Company for manual labor often associated with male workers. However, EEI is helping to create a pathway to gender diversity by giving more opportunities

EEI’s OSHE also conducts regular or continuous training on occupational safety to equip its employees with the right knowledge and practices such as (1) Loss Control Management and (2) Course on Effective EHSMS Internal Auditing. Based on Iso 45001:2018. Iso 14001: 2015 Standards.

EEI recognizes the constitutionally guaranteed right of every person to selforganization which includes the right to form, join or assist labor organizations for the purpose of collective bargaining through representatives of their own choosing and to engage in lawful concerted activities for the same purpose for their mutual aid and protection.

Industrial peace is a shared responsibility of

Management and the Unions. Any imbalance or disruption to industrial peace eventually results in not only delays in project completions but possibly temporary cessation of operations and thereby loss of profit to the Company and to the employees affected.

In 2022, EEI generated a consolidated Php 14,957,173,420 direct economic value, of which 49% was distributed to operating costs, 44% to employee wages and benefits, 5% as dividends and financing cost, 2% as taxes given to the government and the remainder as investments to the community.

erupted, affecting global commodity and oil costs. The construction industry’s challenge in this period of hyperinflation is the rise in fuel prices, driving the construction cost of operation higher and giving the industry a much lower margin of income. Despite all the challenges, the Company makes sure to keep up with these changes. New Projects continue to be awarded in 2022, some of which are part of the national government’s plan to promote and ensure sustainable development within Metro Manila and the nearby cities, municipalities and provinces.

The on-going development and construction of railways and highways will improve accessibility to and from the major cities, boosting development and distributing wealth and opportunities to the various nearby cities, municipalities and provinces. The infrastructure developments likewise aid in the modernization of mass transportation, decongesting of roads and reducing time spent in traffic, all of which greatly improve the quality of life of every Filipino. At the forefront of all these developments is EEI.

The construction industry continues to recover after pandemic-related restrictions have slowly eased. Yet even as the country recovers from the effects of COVID-19, the Russia-Ukraine war

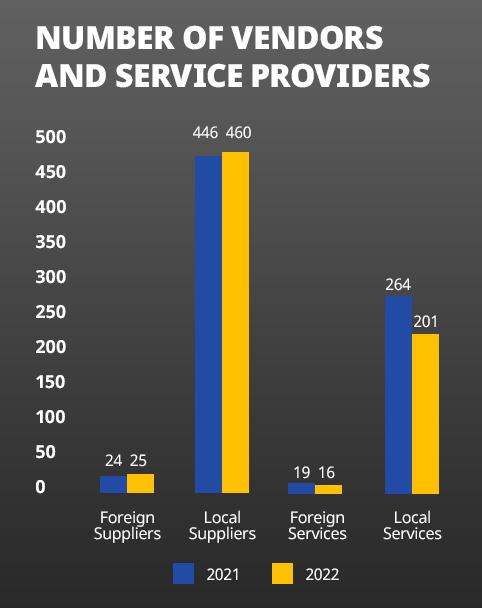

Knowing the local landscape of vendors and service providers in the country can be a big advantage to both ongoing projects and preparation of bid proposals for new projects. Buying from local vendors speeds up the procurement process

and results in cost savings, especially for remote projects where supplies and services are sourced locally rather than from Metro Manila. By sourcing locally, EEI also contributes to the local economy by generating more business, which in turn results in more taxes for the local government and more jobs for the local communities.

As the country eases back to the “old normal”, the Supply Chain Management Department is resuming its initiative of mapping the entire country so that it knows ‘what can be bought from which supplier’ anywhere in the Philippines, which was temporarily placed on hold due to the Covid-19 pandemic.

EEI recognizes that corruption not only damages the good reputation of the Company, which it worked hard to build for many years, but also leads to an increase in project cost. As used herein, corruption is understood in its general sense, a type of misconduct affecting the integrity in the workplace, rather than referring solely to the crime of corruption as defined under penal laws.

Corruption can occur among the various departments of the Company and impacts the Company’s overall performance, especially in the following aspects:

• Increased operating cost

• Loss of trust on and reputation of the Company

• Delay in project delivery

• Reduced work efficiency

EEI’s campaign in 2022 focused on the value of “MALASAKIT”, which places the responsibility of looking after the welfare and interest of everyone working for the Company on each and every employee’s shoulders. The Company continued its anti-corruption trainings while also strengthening anti-corruption campaigns through the whistleblowing hotlines that employees may use to communicate concerns or complaints without fear of negative consequences.

EEI has a Board Risk Oversight Committee (BROC) that meets regularly to oversee the Company’s enterprise-wide risk management (ERM) program, including Management’s ability to assess and manage its risks, and to provide an open communication between Management and the Board for effective risk management. The BROC meets regularly to discuss the Company’s major risks and opportunities, including those related to the climate.

EEI has a Risk Management Council chaired by the President and CEO, and comprising the Company’s various department heads. The Council oversees the implementation of the enterprise-wide risk management program and is responsible for providing timely, relevant and comprehensive risk information to the Board through the BROC. Part of what the Council oversees is the assessment, treatment and reporting of climate-related risks. Moreover, the Company also has a Risk Management Department that provides technical expertise and assistance to the risk owners for the implementation, monitoring and reporting of the ERM activities.

Saudi Arabia remains the largest economy in the Middle East and North Africa (MENA) region and a hub connecting the three continents of Asia, Africa, and Europe. A number of pioneering and pivotal sectors have greatly benefited from Saudi Arabia’s Vision 2030 economic and development framework. The most notable is Saudi Aramco which gained a 46.5% increase in net income or $161.1 billion in 2022, compared to $110.0 billion in 2021.

Even though some Saudi Arabia businesses and markets in 2022 have experienced ups and downs, Al Rushaid Construction Co., Ltd (ARCC) continues to grow and has achieved a revenue of SR 1.09 billion in 2022. ARCC also acquired SR 1.009 billion worth of awarded projects in 2022, increasing its backlog to SR 1.7 billion, of which SR 853 million is workable in 2023.

In 2022, ARCC continuously acquired a stream of projects because of its previous accomplishments, stable business relationships with major Engineering Procurement and Construction (EPC) companies, and reputation from previously completed projects for Saudi Aramco. ARCC again acquired a new contract through the EPC company Samsung Saudi Arabia Co., Ltd. for the construction of the Saudi Aramco Jafurah Gas Processing Facility (JGPF1) Project on November 13, 2022. The JGPF1 is one of the three major work packages in the Jafurah Unconventional Gas Plant Project of the Jafurah Gas Field Development,

considered the world’s biggest shale gas field outside the United States. The other two packages are the Gas Compression Plant and the Utilities and Interconnecting Facilities. The gas field lies southeast of the Ghawar oil field, 190 kilometers from Jubail, Eastern Region, Saudi Arabia.

ARCC also entered a contract with JGC Arabia at the end of 2022 to construct the Saudi Aramco Zuluf Hydrocarbon Processing Facilities & Utilities and Water Injection Project. ARCC will carry out the construction of thirty-seven (37) building structures which covers the procurement of construction materials and installation works involving civil, structural, and architectural segments for a period of 24 months.

Apart from ARCC’s concurrent mega-projects this year, the company was also awarded and signed a contract with Mitsubishi Power Saudi Arabia Ltd. Co. for the GCC Lab, an Electrical Testing Laboratory. This project is expected to become a world-class Electrical Product Testing and Services Hub in the GCC and MENA region, an independent authority for testing and certifying high-voltage, medium-voltage, and low-voltage electrical equipment, and a third party for failure investigations and arbitration that provides low voltage calibration services for electrical equipment and testing tools, and certification courses for engineers and technicians. The Lab is jointly owned by the Saudi Electricity Company 25%), Saudi Aramco (20%), Saudi Government (20%), and King Fahad University (15%).

ARCC continues to impress its clients, particularly Saudi Aramco, SABIC, and Sadara, with its highquality output and early completion of shutdown works. The company is also continuously receiving work orders for plant maintenance, especially heaters and furnaces. ARCC is the preferred Contractor in Kingdom for emergency and shutdown works because of its expertise and capable team with extensive experience on these types of projects.

Top row, from left to right: Director Paolo Y. Abaya (Resigned effective May 17, 2023) Director Wilfrido E. Sanchez, Independent Director Gregorio T. Yu, Independent Director Roberto F. de Ocampo, Director Juan Kevin G. Belmonte, Director Renato C. Valencia

Bottom row, from left to right: Director Roberto Jose L. Castillo (Retired effective Apr 30, 2023) Chairperson Helen Y. Dee (Resigned effective May 02, 2023) Director Lorenzo V. Tan (Appointed Chairperson effective May 02, 2023) Director Medel T. Nera

*Designations reflected in this Annual Report are applicable for year 2022. Designations of some officers have changed in year 2023.

Top row, from left to right: JOSE TION TAN JR. Senior Vice President - Internal Audit

ROBERTO JOSE LARIEGO CASTILLO, President & Chief Executive Officer (Retired effective April 30, 2023)

Bottom row, from left to right: EARL JASON REYES VISTRO, Senior Vice President - Scm And Logistics

HENRY DIZON ANTONIO Chief Operations Officer (President and CEO effective May 1, 2023)

Top row, from left to right: JOSE TION TAN JR. Senior Vice President - Internal Audit

ROBERTO JOSE LARIEGO CASTILLO, President & Chief Executive Officer (Retired effective April 30, 2023)

Bottom row, from left to right: EARL JASON REYES VISTRO, Senior Vice President - Scm And Logistics

HENRY DIZON ANTONIO Chief Operations Officer (President and CEO effective May 1, 2023)

*Designations reflected in this Annual Report are applicable for year 2022. Designations of some officers have changed in year 2023.

ANDRES PARAS TUMBOKON III, Senior Vice President - Building Operations

NORMAN KU MACAPAGAL, Executive Vice President & General Manager / President-EEI Limited

DANTE GAGAN DESEMBRANA, Senior Vice President - Infrastructure Operationshenry Dizon Antonio

GLENN FAJARDO VILLASENOR Senior Vice President - Business Transformation

FERDINAND MONIS DEL PRADO, Senior Vice President - Sales And Marketing

SAN MIGUEL, SIMON ELMER DECENA

Vice President-Electromechanical / General Manager - Al Rushaid Construction Company Limited

PENUMAJJI, RAMA MOHANA RAO Finance Controller

MANRIQUE, REYNALDO SALVATIERRA Assistant Vice President - Staffing, Talent Acquisition And Recruitment Services Department

IGNACIO, ALBERTO ARIOLA Managing Director

VISAYA, PAUL CALMA Vice President - Buildings

STA. MARIA, EDWIN RAZON

Assistant Vice President - Buildings

SARSOZA, PERMO RESPITO Assistant Vice President - Light Industries

SANTOS, CHRISTOPHER ABILON General Manager, LearnJP & GAMSI Express

SAMSON, KENNETH BADUA Vice President - Sales And Marketing

REYES, JESUS TEODORO CAMACHO Assistant Vice President - Corporate Development

RECIO, VAL JOSEPH ALINSAO Assistant Vice President - HRM Total Rewards And Analytics

PUNZALAN JR, HIPOLITO PAGDANGANAN Vice President - Electromech

PEREZ, VICTOR GONZALES Vice President - Treasury

MONDRAGON, IANNOEL VERZOSA Vice President - Corporate Secretary / Data Protection Officer / Corporate Compliance Officer

MENDOZA, JOSE LUCIO ROQUE Vice President - Light Industries

MEDIAVILLO, MEDVIL TUSCANO ASSISTANT VICE PRESIDENT - SUBCON PROCUREMENT

MATIAS, LAURO FELICISIMO CATRAL Vice President - Information Technology

MASA, ROSELYN MENDOZA Vice President - Finance Controller

MACALINO, GLENN CALARA Manager - Commercial

LAVALLE JR, CORNELIO ARROZA

Assistant Vice President - Engineering I And II

LAPUZ, ROMAN MANALASTAS Vice President - Project Control

GREGORIO, CHARLIE PACIS

Assistant Vice President - Logistics Support

GESULGA, CYRIL CABAYA

Assistant Vice President - Legal

GAYYA, VICENTE ADORNA

Vice President - Electromech

GALICIA, LOUIE IRAL

Assistant Vice President - Organizational Development

FIGUERA, ANNA SHEILA PAYAWA Director - Commercial And Contracts

EVIDENTE, VICTOR CABALLES Assistant Vice President - Welding

ESGUERRA, CHRISTOPHER FIGUEROA Vice President - Sales And Marketing

DIZON, REYNALDO JACINTO Vice President - Human Resources Management

DELA CRUZ, RAUL GILBERTO JABERINA Assistant Vice President - Fabrication Operation

DE GUZMAN, JUSTINO BULAWIT Assistant Vice President - Infrastructures

DADO, LUIS HORA Assistant Vice President - Labor & Employee Relation and Field Administration

CRISTI JR, ERNESTO ERAZO Assistant Vice President - Quality Control

CANLAS, ROMUALDO DE LEON Vice President - Engineering

BRUTAS, CRISANTO BROFAS Vice President - Buildings

BRUGE, LEONARDO Assistant Vice President - International Marketing

BATERINA, STEPHEN FLORENTIN Assistant Vice President - Project Planning

BARTOLOME, RYAN TANADA Assistant Vice President - Forensic Audit

ARGUELLES, MICHAEL DEGANOS Assistant Vice President - Safety, Health, Environment & Security

APOLONIO, FERDINAND DUSUHAN Assistant Vice President - Infrastructures

AMBAT, MARIA CRISTINA RAMIREZ Assistant Vice President - Quality Assurance

ALUA, MA. FATIMA BRAZA Assistant Vice President - Quality Control

ACEVEDO, VIOLY BASILIO Assistant Vice President - Finance

CRUZ, GARIZALDY FLORES President & General Manager, EEI, BSI, JP Systems Asia, Inc.

REYES , RICARDO CACDAC President, GAIC

SALIRE, SALVADOR JR. MORALES General Manager, EEI Power Corp. And EEI Energy Solutions Corp./ CEMO, EEI Corporation, EEI Power Corporation

REYES, JEROME MACTAL Assistant Vice President, EEI Construction & Marine, Inc.

NG, JOSEPHINE CECILLE BENITEZ Avp, Human Resources, EEI Business Solutions, Inc.

BAUZA, CESAR ARANDA Head, Customer Relations / Procurement EEI Business Solutions, Inc.

JUNGOY, EFREN JR. COLALJO Head, Vismin Operations EEI Power Corporation

The streets of Del Carmen and General Luna in Surigao Del Norte are now lit up with solar-powered streetlights donated by EEI Corporation through AY Foundation. EEI turned over 40 solar-powered streetlights to help residents of the two areas in their

rebuilding process from the devastation caused by Typhoon Odette.

According to EEI Senior Vice President and Chief Financial Officer Cris Noel Torres, the donation is part of the company’s continuing community engagement activities through AY Foundation. He added that “it aligns with YGC’s vision of helping Filipinos be future-ready through our commitment to quality, safe and environmentally sound construction and engineering services.”

Photo shows previous Del Carmen Mayor Proserfina Matugas-Coro with EEI Senior Vice President and Chief Financial Officer Cris Noel Torres during turnover ceremonies held in May 2022. They were joined by representatives from EEI, LGU, and Del Carmen.

Corporate Office

12 Manggahan Street, Bagumbayan, Quezon City

1110, Philippines

Tel. No.: (+632) 8-334-2677 (EEI-CORP)

Fax No.: (+632) 8-635-0861

Email: eeicenter@eei.com.ph

Website: https://www.eei.com.ph

Mailing Address

P.O. Box 287 ACPO, Cubao, Quezon City, Philippines

Steel Fabrication Division

Barangay Santa Maria, Bauan Batangas Philippines 4201

CBW M-27

E-mail: rgjdelacruz@eei.com.ph

Tel. No.: (+6343) 727-1602

Al Rushaid Construction Co., Ltd.

3rd Floor Tower A, Petroleum Center Building 3927, Prince Sultan Road

Al Jawharah District Unit No.333 Al Khobar 34431-9618, Saudi Arabia

Tel. No.: (00966) 3 801-0000

Fax No.: (00966) 3 801-0177

Website: www.arccksa.com

ARCC Business Development & Marketing Department

Tel. Nos.: (00966) 13-801-0000 ext. 1412, 1200, 1380 & 1188

Emails:

mabodrees@arccksa.com

fgparaisojr@arccksa.com

malek.hemadneh@arccksa.com

jdmanglicmot@arccksa.com mktghq@arccksa.com

EEI Business Solutions, Inc

12 Manggahan Street, Bagumbayan, Quezon City 1110, Philippines

Tel. Nos.: (+632) 8-334-2677 loc 3057 and 3064

E-mail: ebsi@eei.com.ph

EEI Power Corporation

12 Manggahan Street, Bagumbayan, Quezon City

1110, Philippines

Tel. Nos.: (+632) 8-635-0843 to 49 loc 3074

Tel. No.: (+632) 8-297-4776

E-mail: power@eei.com.ph

EEI Energy Solutions Corp.

12 Manggahan Street, Bagumbayan, Quezon City 1110, Philippines

Tel. No.: (+632) 8-634-2677 loc 3150

E-mail: eeienergysolutions@eei.com.ph

EEI Realty Corporation

12 Manggahan Street, Bagumbayan, Quezon City 1110, Philippines

Tel. Nos.: (+632) 8-334-2677, (+632) 8-880-1956

E-mail: eeirealty@eei.com.ph

EEI Construction and Marine, Inc.

12 Manggahan Street, Bagumbayan, Quezon City

1110, Philippines

Tel. No.: (+632) 8-880-1936

Email: eeimc@eei.com.ph

Website: www.eeicmi.com

ECMI Fabrication Shop

Lot 5A Maguyam Road, Brgy. Maguyam, Silang, Cavite, 4118

GAIC MANPOWER SERVICES, INC.

Ground Floor Topy Building, 3 Economia Street, Bagumbayan, Quezon City 1110, Philippines

Tel. Nos.: (+632) 8-633-7910, (+632) 8-534-4100, (+632) 8-635-7419

Fax Nos.: N/A

Emails:

jqalivarvar@eei.com.ph

aomcardenas@eei.com.ph

rcreyes@eei.com.ph

GAIC CAGAYAN DE ORO

Tan’s Apartment Door#5 Captain Vicente St., Cagayan de Oro, Philippines

Tel. Nos.: (+63) 928-665-8226

Email: rlgomos@eei.com.ph

G/F JL & Sons Building

No. 92 Landon Junquera Street., Cebu City

Philippines

Tel. No.: (+6332) 253-4190

E-mails: jjgcabreros@eei.com.ph rcreyes@eei.com.ph

JP Systems Asia, Incorporated

12 Manggahan Street, Bagumbayan, Quezon City 1110, Philippines

Tel. No.: (+632) 8-635-0974

Email: gfcruz@eei.com.ph / gfcruz@jpsai.net

BiotechJP

Central Technopark, Brgy. Lourdes, Tarlac City, Tarlac

Mobile No.: (+639) 917-706-0923

E-mail: info@biotechjp.com.ph

LearnJP Corp.

3rd Floor Topy’s Place, 6 Calle Industria Street, Bagumbayan, Quezon City

Tel. Nos.: (+632) 8-880-1864 loc. 3320

Mobile Nos.: (+63) 997-514-5863, (+63) 966-154-0424

Laguna Office: #39 3rd FlooR RPR Commercial Bldg., 57 Pacita Ave., San Pedro, Laguna

Tel. No.: (+632) 8-880-1865

Mobile Nos.: (+63) 920-810-8746, (+63) 916-630-4069

E-mail: learnjpcorp@eei.com.ph

eCarga

12 Manggahan Street, Bagumbayan, Quezon City 1110, Philippines

Mobile No.: (+63) 917-316-2643

E-mail: support@ecarga.com.ph

Website: www.ecarga.com.ph

ShinBayanihan

12 Manggahan Street, Bagumbayan, Quezon City

1110, Philippines

Tel. No.: (+632) 8-334-2677

E-mails: cabauza@eei.com.ph , jmresmade@eei. com.ph

Tetsuichiro Komatsu

Mobile No.: (+63) 995-365-1156

E-mail: ktetsuichirou@shec.com.ph

Cagayan De Oro Satellite Office

3rd floor Marel Bldg., Pabayo Hayes St., Cagayan De Oro City

Tel. Nos.: (088) 855 0894

(+63) 926-568-7146

(+63) 926-835-1457

(+63) 965-815-5637

E-mail: sblumactod@eei.com.ph

Cebu Satellite Office

AVJ Building 3rd floor Purok Kalubihan Central Poblacion, City of Naga, Cebu

Mobile Nos: (+63) 950-221-0166 , (+63) 981-5680012

E-mailS: jarecla@eei.com.ph cblibrea@eei.com.ph

Davao Satellite Office

Room 208 Goldwin Building

E. Quirino Ave., Davao City, Philippines

Tel. Nos.: (+6382) 224-1332

(+639) 30-880-5635 (+639) 26-111-4921

E-mails: rsvillafuerte@eei.com.ph, llma@eei.com.ph

Stock Transfer Agent

Rizal Commercial Banking Corporation

Auditors

Sycip Gorres Velayo & Co. Certified Public Accountants

The Board of Directors and the Stockholders

EEI Corporation

No. 12 Manggahan Street

Bagumbayan, Quezon City

We have audited the consolidated financial statements of EEI Corporation and its subsidiaries (the Group), which comprise the consolidated statements of financial position as at December 31, 2022 and 2021, and the consolidated statements of income, consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows for each of the three years in the period ended December 31, 2022 and notes to the consolidated financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as at December 31, 2022 and 2021, and its consolidated financial performance and its consolidated cash flows for each of the three years in the period ended December 31, 2022 in accordance with Philippine Financial Reporting Standards (PFRSs).

We conducted our audits in accordance with Philippine Standards on Auditing (PSAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Group in accordance with the Code of Ethics for Professional Accountants in the Philippines (Code of Ethics) together with the ethical requirements that are relevant to our audit of the consolidated financial statements in the Philippines, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the Code of Ethics. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. For each matter below, our description of how our audit addressed the matter is provided in that context.

We have fulfilled the responsibilities described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report, including in relation to these matters. Accordingly, our audit included the performance of procedures designed to respond to our assessment of the risks of material misstatement of the consolidated financial statements. The results of our audit procedures, including the procedures performed to address the matters below, provide the basis for our audit opinion on the accompanying consolidated financial statements.

The Group’s revenue from construction projects on electro-mechanical works, industrial, buildings and infrastructure accounts for 86% of the total revenue of the Group. Under PFRS 15, Revenue from Contracts with Customers, the Group assessed that there is only one performance obligation for each construction agreement that it has entered and that revenue arising from such agreements qualify for recognition over time. The Group also recognized as part of its construction revenue, the effects of variable considerations arising from various change orders and claims, to the extent that they reflect the amounts the Group expects to be entitled to and to be received from the customers, provided that it is highly probable that a significant reversal of the revenue recognized in connection with these variable considerations will not occur in the future. The Group elected to use the input method to measure the progress of the fulfilment of its performance obligation, which is based on the actual costs incurred to date relative to the total estimated cost to complete the construction projects.

Aside from the significance of the amount involved, we consider this as a key audit matter because this process involves significant judgment and estimates, particularly with respect to the estimation of the variable considerations arising from the change orders and claims and calculation of estimated cost to complete construction projects, which requires the technical expertise of the Group’s engineers.

The Group’s disclosures about construction revenue are included in Notes 5 and 20 to the consolidated financial statements.

We inspected sample contracts and supplemental agreements and reviewed management’s assessment on the identification of performance obligation within the contract and the timing of revenue recognition. For construction revenue which includes significant effects of the variable considerations, we obtained an understanding and tested the relevant controls over the management’s process to estimate the amount of consideration expected to be received from the customers. For change orders and claims of sampled contracts, we compared the amounts recognized as revenue to the change orders and claims approved by the customers and other relevant documentary evidences supporting the management’s estimate of revenue recognized.

For the measurement of progress of the construction projects, we obtained an understanding of the Group’s processes to accumulate actual costs incurred and to estimate the expected cost to complete and tested the relevant controls. We also tested actual costs incurred by examining sample invoices and other supporting third-party correspondences. We also considered the competence, capabilities and objectivity of the Group’s cost engineers by referring to their qualifications, experience and reporting responsibilities. We examined the approved total estimated completion costs, any revisions thereto, and the cost variance analysis with supporting details. We discussed the status of the projects under construction with the Group’s engineers. We also inspected the related project documentation and inquired about the significant deviations from the targeted completion.

The Group owns 49% equity interest in Al-Rushaid Construction Company Ltd. (ARCC), associate accounted for under the equity method. As of December 31, 2022, ARCC recognized deferred tax asset on net operating loss carryover of ₱435.92 million. We consider the accounting for the investment in ARCC as a key audit matter because the Group’s share in ARCC’s net loss and the carrying value of the investment represents 193% of the Group’s consolidated net income and 5% of the Group’s total assets, respectively. The Group’s share in ARCC’s net earnings is significantly affected by ARCC’s revenue recognition from its construction contracts. In addition, management’s assessment process on the recognition of deferred tax asset is based on assumptions, which are affected by expected future market or economic conditions.

The Group’s disclosures about the investment in ARCC are included in Note 11 to the consolidated financial statements.

We sent instructions to statutory auditors of ARCC to perform an audit on the relevant financial information of ARCC for the purpose of the Group’s consolidated financial statements. These audit instructions cover their scope of work, risk assessment procedures, audit strategy and reporting responsibilities. We discussed with ARCC’s statutory auditors about their key audit areas, planning and execution of audit procedures, significant areas of estimation and judgment. We reviewed their working papers, focusing on the procedures performed on ARCC’s revenue recognition, and obtained relevant conclusion statements related to their audit procedures. Furthermore, we evaluated management’s assumptions on the recognition of deferred tax assets and inquired with the Group’s management the basis of the financial forecast. We also compared management’s forecast against historical performance of ARCC.

We also obtained the financial information of ARCC for the year ended December 31, 2022 and recomputed the Group’s share in net earnings for the year ended December 31, 2022.

The Group has unquoted equity investments classified as equity investments at fair value through other comprehensive income (FVOCI) amounting to ₱1.3 billion. The valuation of these investments is significant to our audit because it is inherently subjective as it involves the use of valuation inputs that are not market observable. Management also applied judgment in selecting the valuation technique and the assumptions to be used.

The Group’s disclosures about its unquoted equity investments are included in Notes 12 and 34 to the consolidated financial statements.

We evaluated the competence, capabilities and qualifications of the external valuers by considering their qualifications, experience and reporting responsibilities. For the unquoted equity investment valued using market approach, we inquired from the external appraiser the basis of the adjustments made to the sales price. For the unquoted equity investment valued using earnings-based approach, we involved our internal specialist in the review of the methodology and assumptions used. The key assumptions used are the revenue growth rate and discount rate. We evaluated the revenue growth rate by reference to historical information and relevant market data. We tested the parameters used in the determination of the discount rate against market data. We compared the fair value of the investment against a range of values determined using earnings-based approach. We also reviewed the Group’s disclosures about those assumptions to which the outcome of the valuation is most sensitive; specifically, those that have the most significant effect on the determination of the fair value of the unquoted equity investments.

Management is responsible for the other information. The other information comprises the information included in the SEC Form 20-IS (Definitive Information Statement), SEC Form 17-A and Annual Report for the year ended December 31, 2022, but does not include the consolidated financial statements and our auditor’s report thereon. The SEC Form 20-IS (Definitive Information Statement), SEC Form 17-A and Annual Report for the year ended December 31, 2022 are expected to be made available to us after the date of this auditor’s report.

Our opinion on the consolidated financial statements does not cover the other information and we will not express any form of assurance conclusion thereon.

In connection with our audits of the consolidated financial statements, our responsibility is to read the other information identified above when it becomes available and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audits, or otherwise appears to be materially misstated.

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with PFRSs, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Group’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Group or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Group’s financial reporting process.

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with PSAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with PSAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

• Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Group to cease to continue as a going concern.

• Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

• Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the audit. We remain solely responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.