Global Renewables Market Update | Q1 2024

Dear readers,

Edison Energy, and affiliated companies Altenex Energy and Alfa Energy, recently unified under one global name and brand: Trio. We look forward to continuing our work of helping large commercial, industrial, and institutional organizations navigate the clean energy transition.

Beginning this quarter, the focus region for Trio’s Global Renewables Market Update will alternate between the U.S. and Europe. Each quarterly report will continue to include PPA pricing trends and project availability from both regions.

Please enjoy this quarter’s report focusing on the U.S. and join us in Q2 for our Europe-focused report.

Contents 6 Introduction 8-9 U.S. and European Environmental Attribute Marketplace 6 Current Events 8 EAC Market Update 9 Voluntary Carbon Offset Market Update 10-19 U.S. Renewable Energy Marketplace 11 Project Availability 12 PPA Pricing Trends 13 Renewables Market Trends 20-23 European Renewable Energy Marketplace 19 Project Availability 20 PPA Pricing Trends 22 Renewables Market Trends 24 Perspectives Roundup 26 Get in Touch Trio | Global Renewables Market Update 3

Meet the Contributors

Adam Cherry

Portland, OR

As the Senior Director of the Clean Energy Origination team, Adam helps clients negotiate and execute commercial transactions, including power purchase agreements for renewable energy supply.

Avery Hammond Boston, MA

As a Senior Analyst on the Clean Energy Sourcing team, Avery focuses on following key policy and market drivers impacting PPA and REC procurement in North America.

Caldwell Brooklyn, NY

As a Senior Analyst on the Clean Energy Sourcing team at Trio, Charlotte advises clients on renewable energy strategy and economics. She leads the design and development of project economic models and communicates regularly with renewable energy suppliers.

Bucharest, RO

As a Senior Clean Energy Advisor on our European team, Corina manages client relationships by bringing insights to life across our customer’s decarbonization journey. Corina’s role is to understand the implications and interdependencies (risk, collateral, etc) that lie in a PPA acquisition.

As Manager, Content and Communications, Elana is responsible for leading content development, creating thought leadership pieces with Trio team members and industry experts, and crafting client engagement & communications strategies.

As a Senior Clean Energy Analyst on our European team, Kristi is responsible for analyzing renewable energy market risks and opportunities, including policy and regulation, and administration of the project database for market evaluation and diligence.

MA

As a Senior Clean Energy Advisor, Chris supports clients in developing their emissions reductions strategy against the backdrop of a complex global environment.

CO

As a Senior Sustainability Analyst, Liam works with clients to develop decarbonization strategies to help organizations meet their corporate and sustainability goals, specifically focusing on EAC strategy development and execution.

Corina Melchor

Elana Knopp New York, NY

Charlotte

Kristi Ghosh Utrecht, NLD

Chris Rader Boston,

Liam Garvey Denver,

Trio | Global Renewables Market Update 4

Megan DeWitt Boston, MA

As a Senior Distributed Clean Energy Manager, Megan manages client relationships, advising clients in the procurement of onsite and nearsite solar.

Patrick Mingey Boston, MA

As a Clean Energy Associate, Patrick analyzes renewable energy strategy and communicates forecasted project economics to clients. He interacts with renewable energy suppliers regularly and evaluates prospective projects throughout North America.

As a Senior Brand and Communications Designer, Anesa leads and supports various design projects and collaborates with Trio team members on creative initiatives.

Shannon Holzer Chicago, IL

As the Head of Policy, Shannon tracks regulatory, legislative and administrative proceedings in North America and uses this information to help our clients make better energy procurement decisions.

MA

As a Marketing Coordinator, Krista assists with the execution of various marketing tasks while also leading content management initiatives.

Krista Donelly Boston,

Anesa Muzurovic Sarajevo, BIH

Trio | Global Renewables Market Update 5

Introduction

With the recent release of the U.S. Securities and Exchange Commission’s final climate-related financial risk rules, transparency in carbon accounting and reporting took center stage for U.S. businesses in Q1 2024. Corporations with renewable procurement goals can plan for disclosure across multiple jurisdictions in several ways, including the adoption of accounting frameworks to measure and report scopes 1, 2 and 3 emissions, and the compilation of renewable procurement data, among other measures.

In the U.S., Q1 saw major shifts in guaranteed commercial operation dates, with the largest number of projects now set to come online in 2027. This contributes to an ongoing trend of developers offering projects roughly 3 years from their operation dates, although many projects with 2026 CODs are still available. For buyers looking to transact on a near-term project, ERCOT has the highest number of offered projects expected to come online between 2024 and 2026.

Following the U.S. trend in Q4, high-voltage equipment continues to be the most cited bottleneck in the development process. Long lead times for transformers and breakers and the need to procure this equipment much further ahead of time than previously necessary has increased upfront capital from developers.

Although U.S. National RECs remain inexpensive, the outlook for the voluntary REC market remains bullish, with 2024 and later vintages forecasted to increase. Corporate buyers continue to turn to unbundled RECs to meet sustainability goals or true-up

against load, while interest in multi-year, specified-source REC transactions has significantly increased in correlation with volatility in the vPPA market.

In Europe, GO pricing for the 2024 vintage year continued its decline that began in Q4 2023, with the prolonged price drop driven by a large surplus of GOs that built up in the market. Some industry stakeholders expect these conditions to hold for the remainder of 2024.

In the U.S., the Q1 median solar PPA price was 6% higher than Q1 last year, compared to the 36% increase between Q1 2022 and Q1 2023. U.S. median solar prices continue to moderate, with slight increases seen in most markets. MISO solar accounted for the largest increase in both P25 and median PPA prices this quarter, while ERCOT solar P25 and median PPA prices continue to trend downward, marking the third consecutive quarter of price decreases in ERCOT - the only market to show consistent price deflation.

In Europe, PPA pricing saw declines continue across most markets. The quarter also saw an increase in non-standard PPA price structures across markets. Additionally, developers showed more interest in contracting smaller PPAs, as delays in interconnection and permitting disrupted larger projects. Hybrid solutions such as combinations of solar, wind, and batteries appeared in several European markets. The addition of storage, in particular, may decrease renewables oversupply risk and present market arbitrage opportunities.

Trio | Global Renewables Market Update 6

Impact. Together.

Trio | Global Renewables Market Update 7

U.S. and Europe Environmental Attribute Marketplace

U.S. Market Update

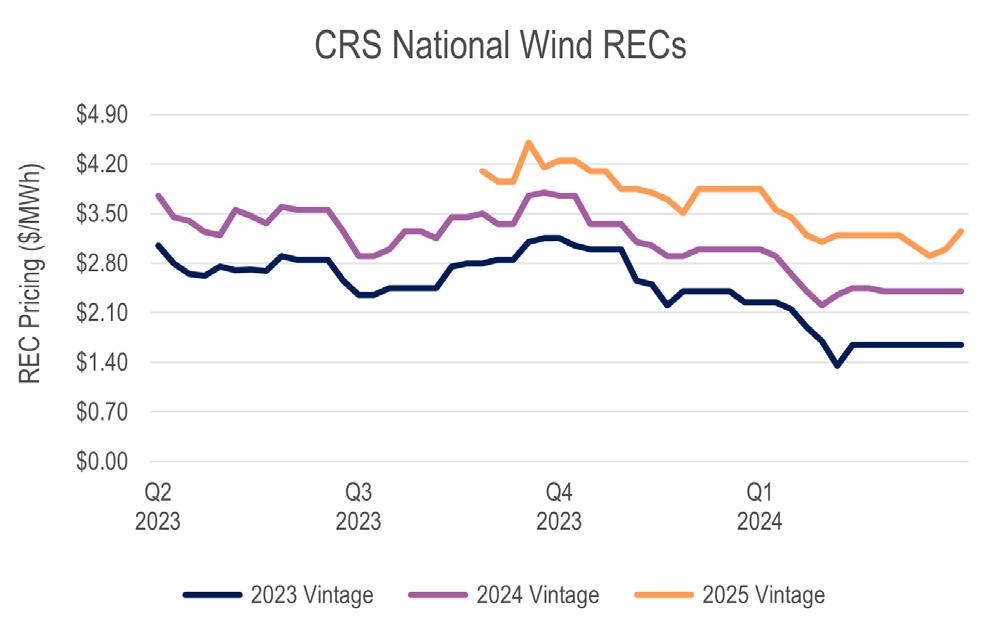

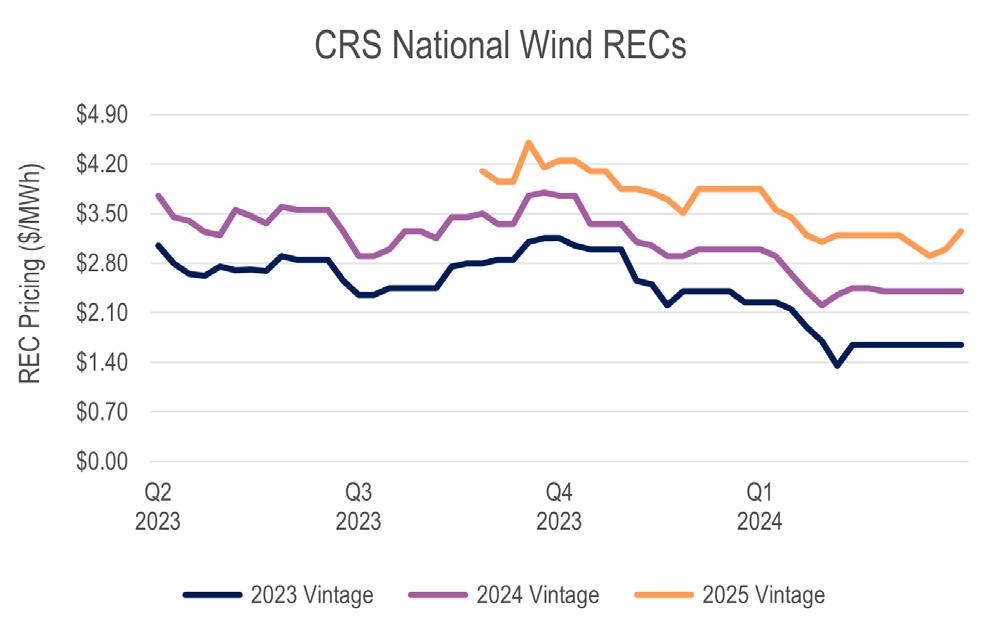

National RECs remain inexpensive as PJM RECs continue to command a premium

National CRS Listed REC prices have declined slightly since the end of Q4 2023, with 2024 vintages currently valued at ~$2.40. This continues a trend seen since the end of Q3 2023, with 2024 vintages continuing to fall from the six-month high of $3.80 in September 2023. January 2024 saw most vintage prices drop steeply over several weeks, before leveling off throughout February and March.

During the last several weeks of the quarter, 2025 and later-year vintage pricing began to sharply increase, in contrast with 2024 vintages, which continued to stay largely flat. Compared to the last 12 months, REC prices remain relatively low, with the last month and a half characterized by a notable lack of significant movement for 2023 and 2024 vintages.

Despite the relatively low prices for RECs, the outlook for the voluntary REC market remains bullish, with 2024 and later vintages forecasted to increase. Corporate buyers continue to turn to unbundled RECs to meet sustainability goals or true-up against load, while interest in multi-year, specified-source REC transactions has significantly increased in correlation with volatility in the virtual power purchase agreement (vPPA) market.

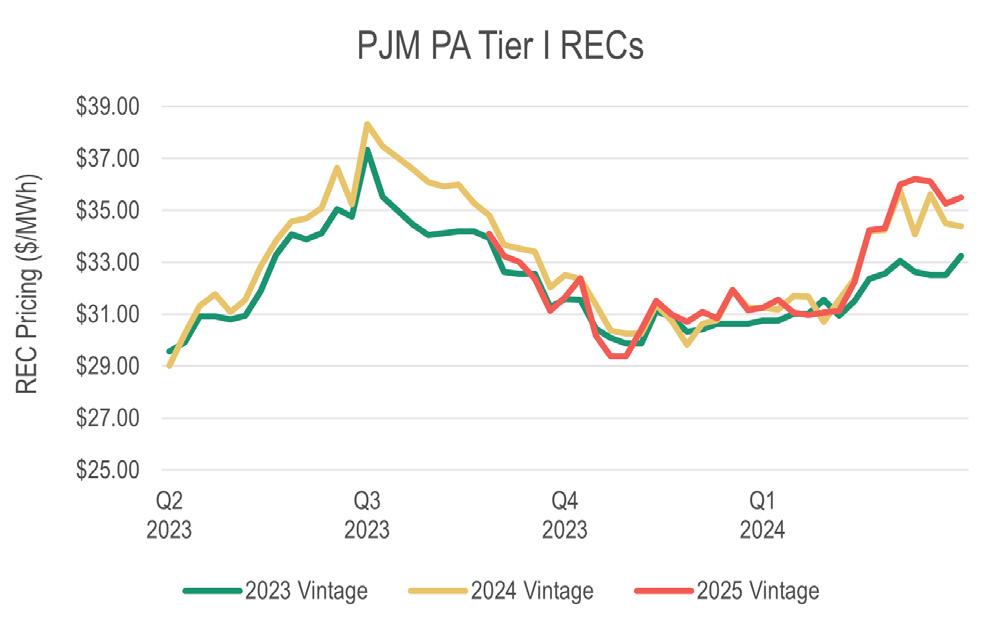

PJM PA Tier I REC prices have gradually increased since hitting six-month low levels in October and November 2023, with many prices for vintages rising sharply only recently. Some PJM Tier

II vintages are still outpacing Tier I pricing, which was relatively uncommon until this past year. After PJM RECs backed off the all-time high prices seen in mid-2023, some vintages are approaching those levels again.

The historic highs for PJM REC prices can be attributed in part to renewable energy project delays alongside an increase in energy demand in the region, driven to some extent by the increase in data center development as well as electrification initiatives in the PJM region. Given that state RPS programs are structured as a percentage of total delivered power, energy suppliers who are subject to compliance obligations must purchase more RECs in response to this increased energy demand.

Additionally, Trio and others have observed that corporate buyers who have signed PPAs in the region have increasingly retired those project RECs on their own behalf. In the past, REC arbitrage transactions in PJM were more prevalent, in which corporate PPA offtakers would buy lower-priced RECs elsewhere in the country and sell their project RECs, allowing compliance buyers to access a larger pool of PJM RECs. This practice has become less common in recent years, with more corporate buyers opting to retire higher-value PJM project RECs on their own behalf, limiting the number of RECs available in compliance markets. These demand dynamics, coupled with significant delays in PJM for bringing new renewable energy projects to the grid, have contributed to the elevated pricing that is currently observed in the market.

Trio | Global Renewables Market Update 8

Figure 1: U.S. REC Prices (Q2 2023 – Q1 2024)

U.S. and Europe Environmental Attribute Marketplace

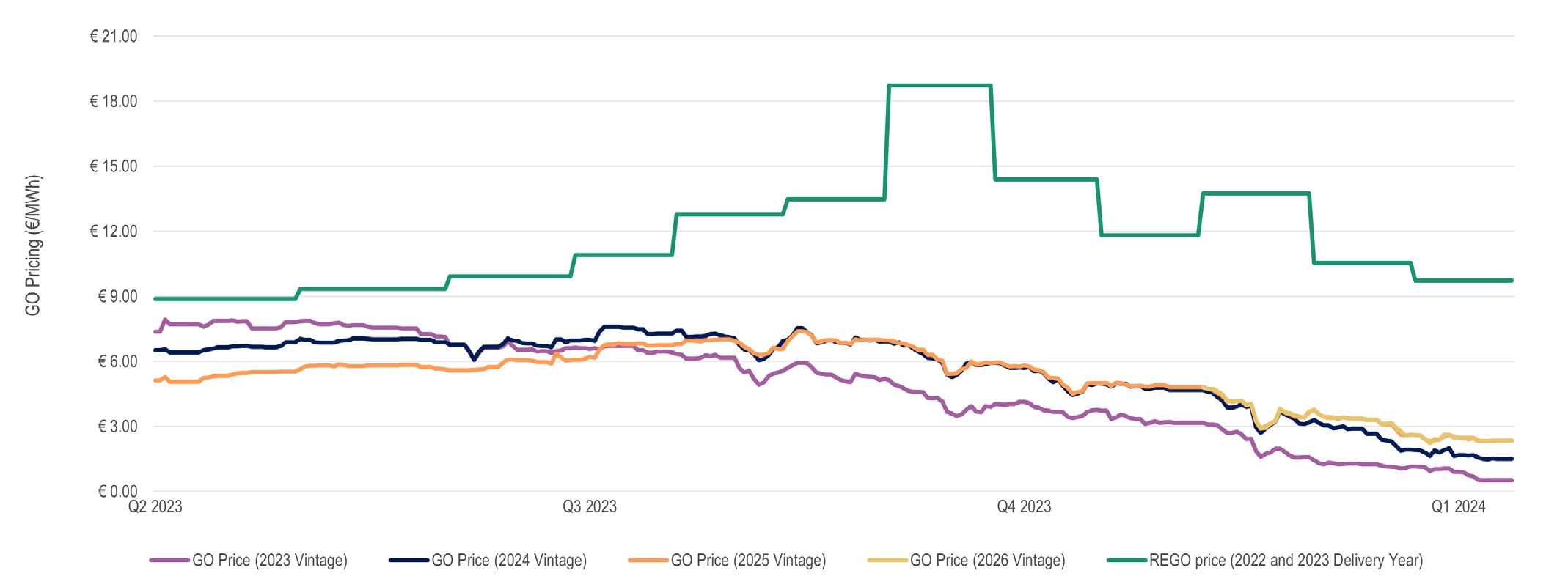

European Market Update

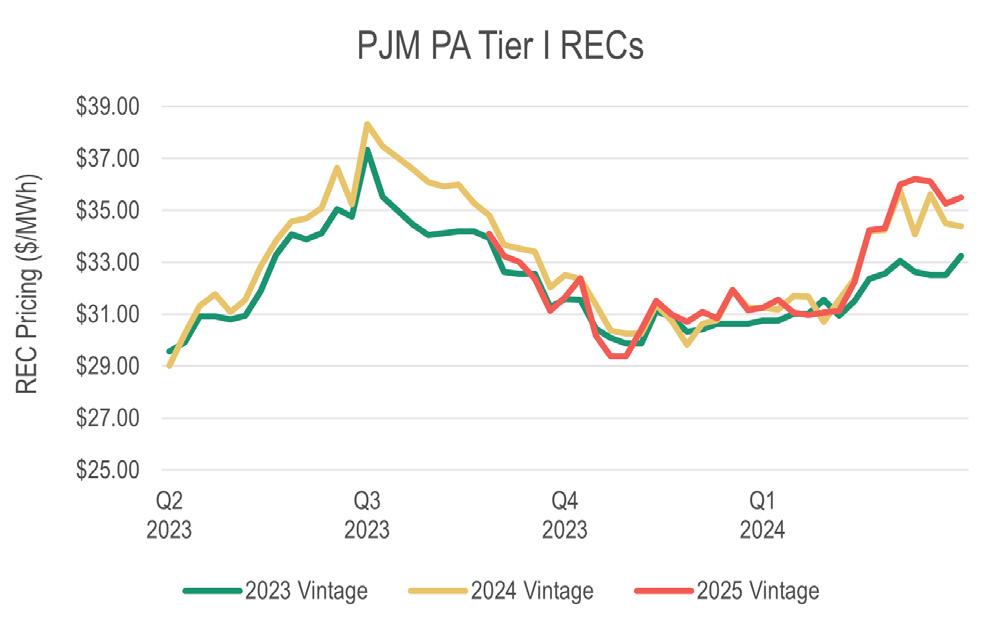

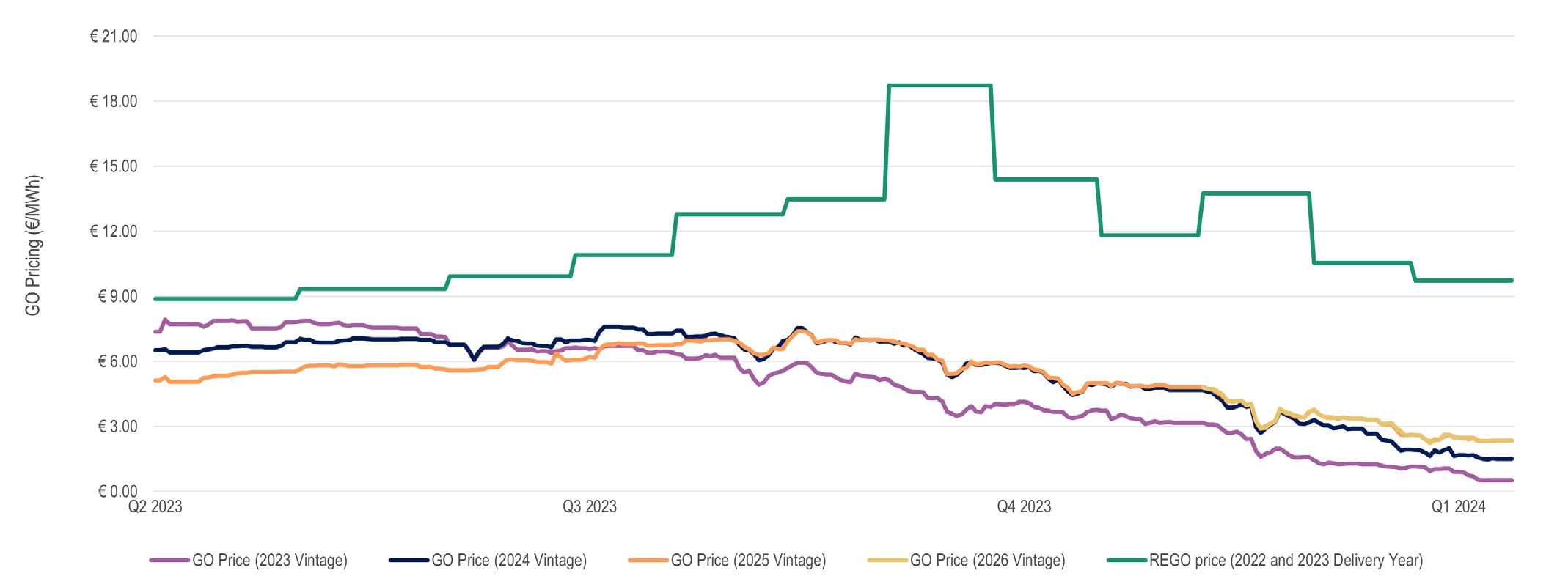

Significant price downturn of European GOs continued in Q1 amid a stubborn supply surplus

GO pricing for the 2024 vintage year continued the decline that began in Q4 2023 and throughout Q1 2024, with a downturn of € 4.5/MWh since the beginning of the year and closing at under € 1.5/MWh by end of quarter. This prolonged price drop is being driven by a large surplus of GOs that built up in the market –largely due to undersubscribed government auctions in an active season. Some in the industry expect these conditions to hold for the remainder of 2024.

GOs for future years have experienced similar decreases but continue to maintain a small premium compared to the 2024 vintage. As covered in our previous reports, this premium on the

GO price in future years may be driven in part by changes to RE100 guidance and EU sustainability reporting mandates placed on corporations. High levels of renewable deployment in the future may maintain this environment, barring any significant changes in GO legislation or shifts in what constitutes a credible renewable procurement.

In the UK, REGO green certificates saw a similar price decrease after record highs in late 2023, closing at ~£ 10/MWh for the 2023 vintage year.

The GO prices tracked in Figure 2 reflect 2023 - 2026 vintage GOs. REGO pricing reflects 2022 CP22 (April 23 - March 24) and 2023 CP23 (April 24 - March 25) vintage.

Source: Veyt

Note: REGO pricing is averaged for the month, using an exchange rate of 1 £ = 1.17 €, as of April 2024.

Figure 2: EU GO Prices (Q2 2023-Q1 2024)

Trio | Global Renewables Market Update 9

U.S. Renewable Energy Marketplace

Trio | Global Renewables Market Update 10

Project Availability

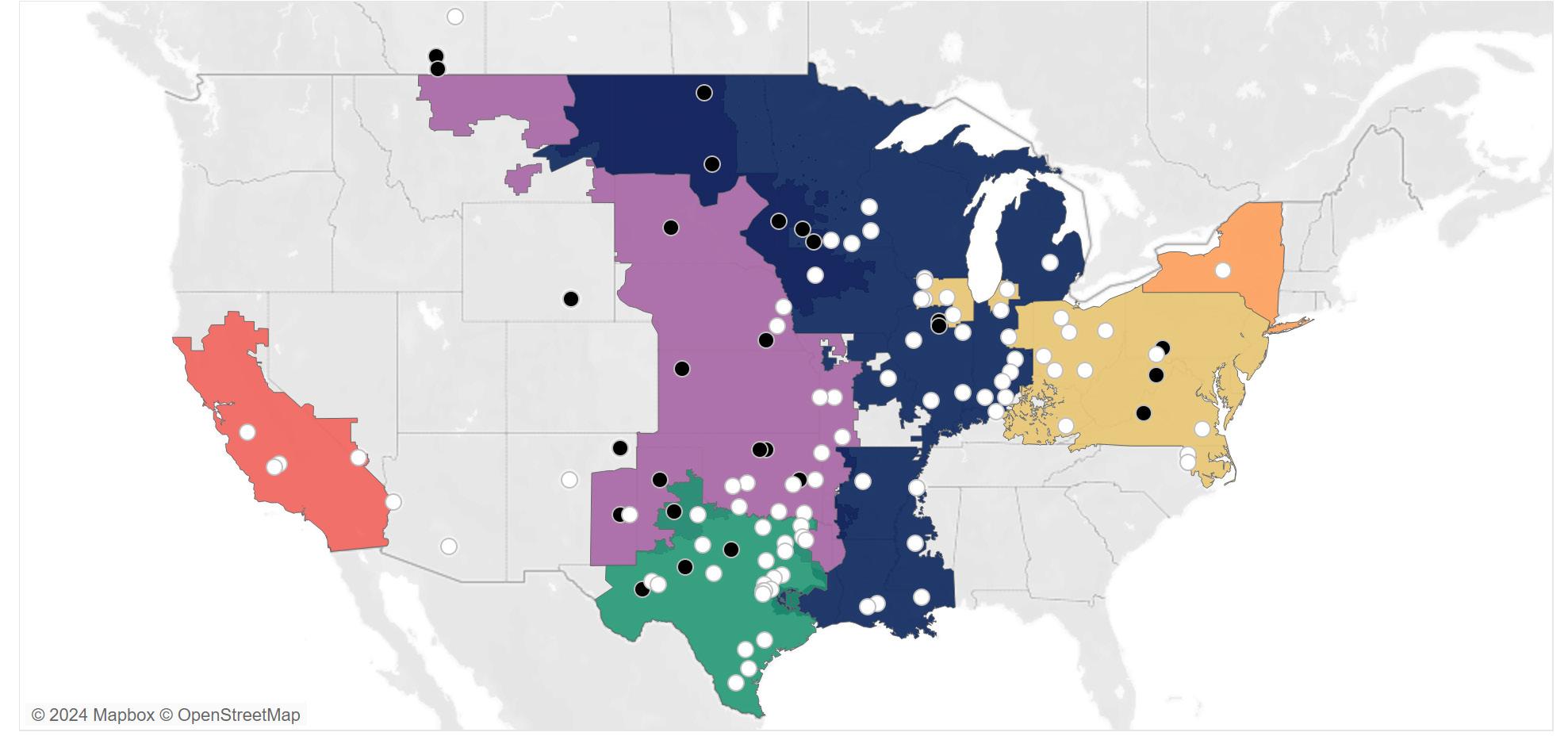

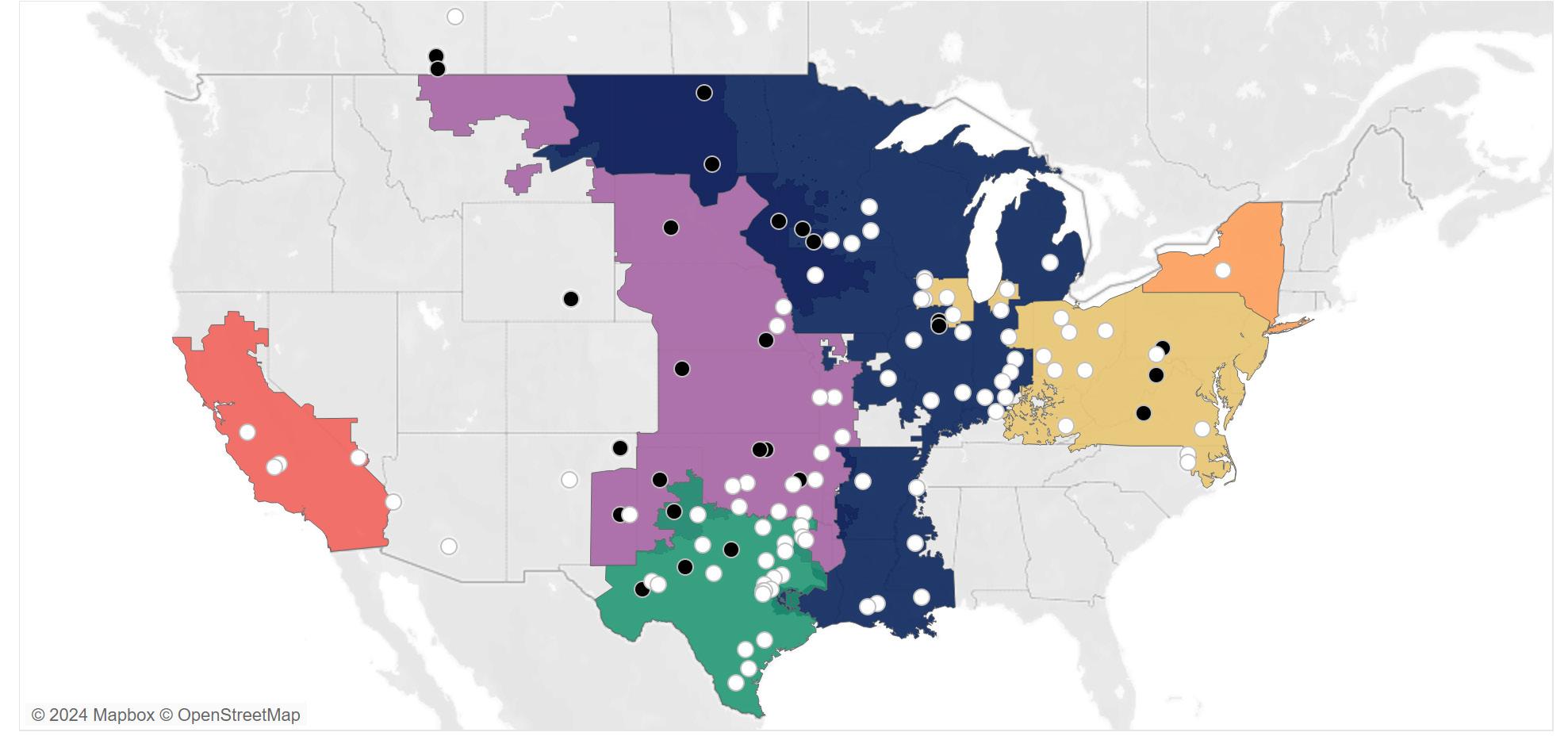

3. Trio’s North American Renewable Energy Marketplace –Utility-Scale Projects Marketed to Voluntary Buyers, Q1 2024

Guaranteed Commercial Operation Dates

U.S.

Energy

Renewable

Marketplace

Figure

Technology Solar Wind Market CAISO ERCOT MISO NYISO PJM SPP Wind Solar Wind Solar Wind Solar Wind Solar Wind Solar 2024 2025 2026 2027 2028 or later 3 Projects 8 Projects 32 Projects 45 Projects 28 Projects Trio | Global Renewables Market Update 11

PPA Pricing Trends

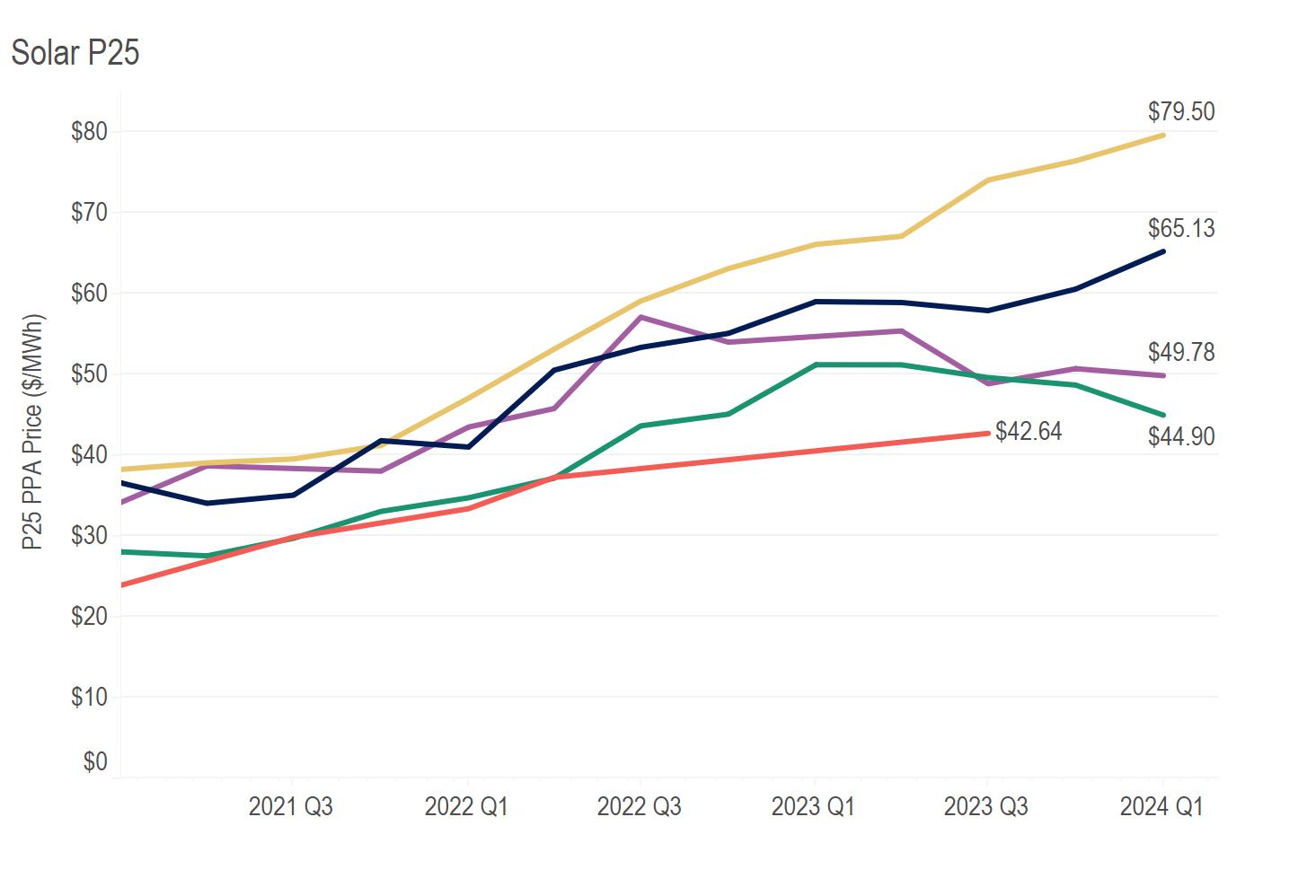

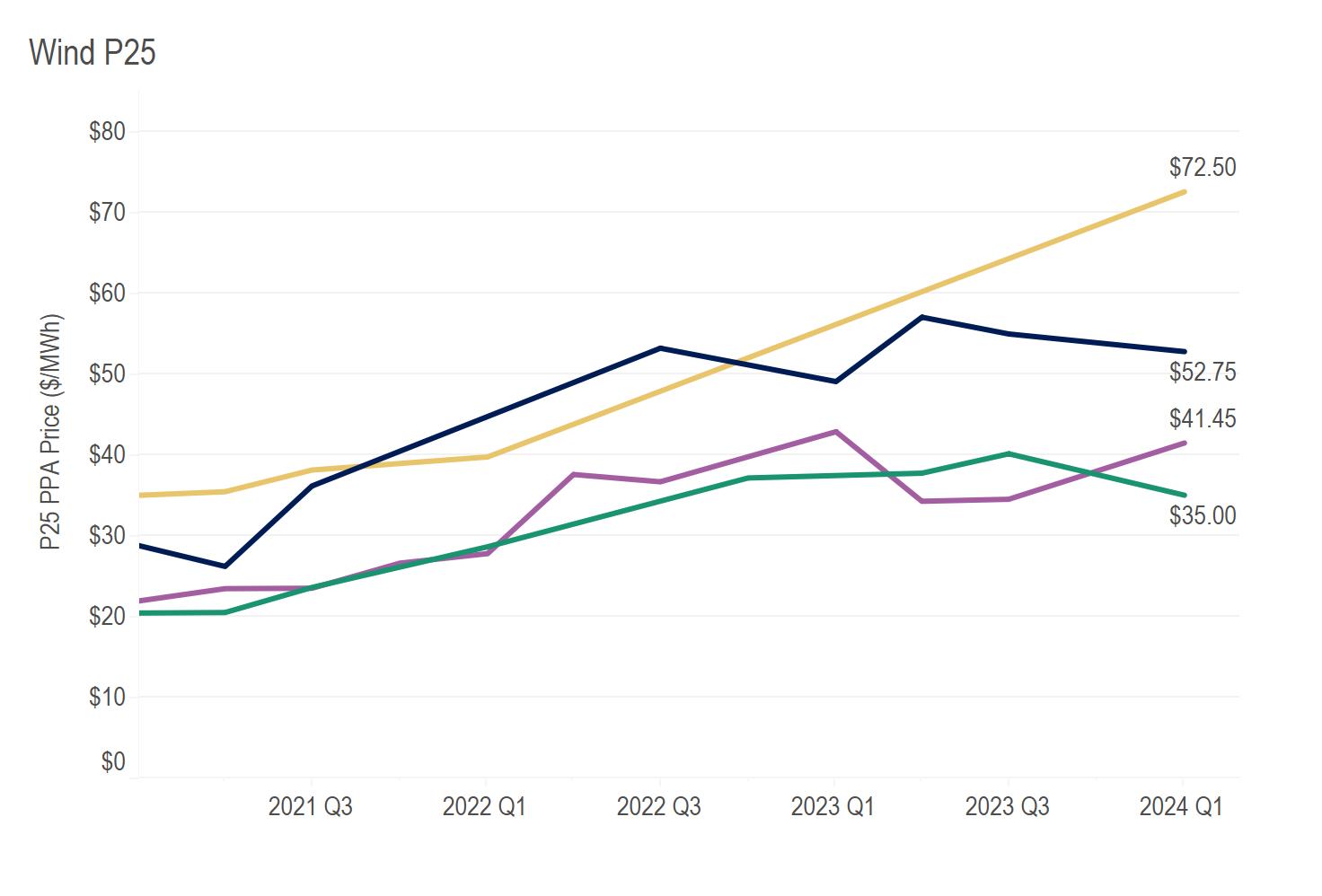

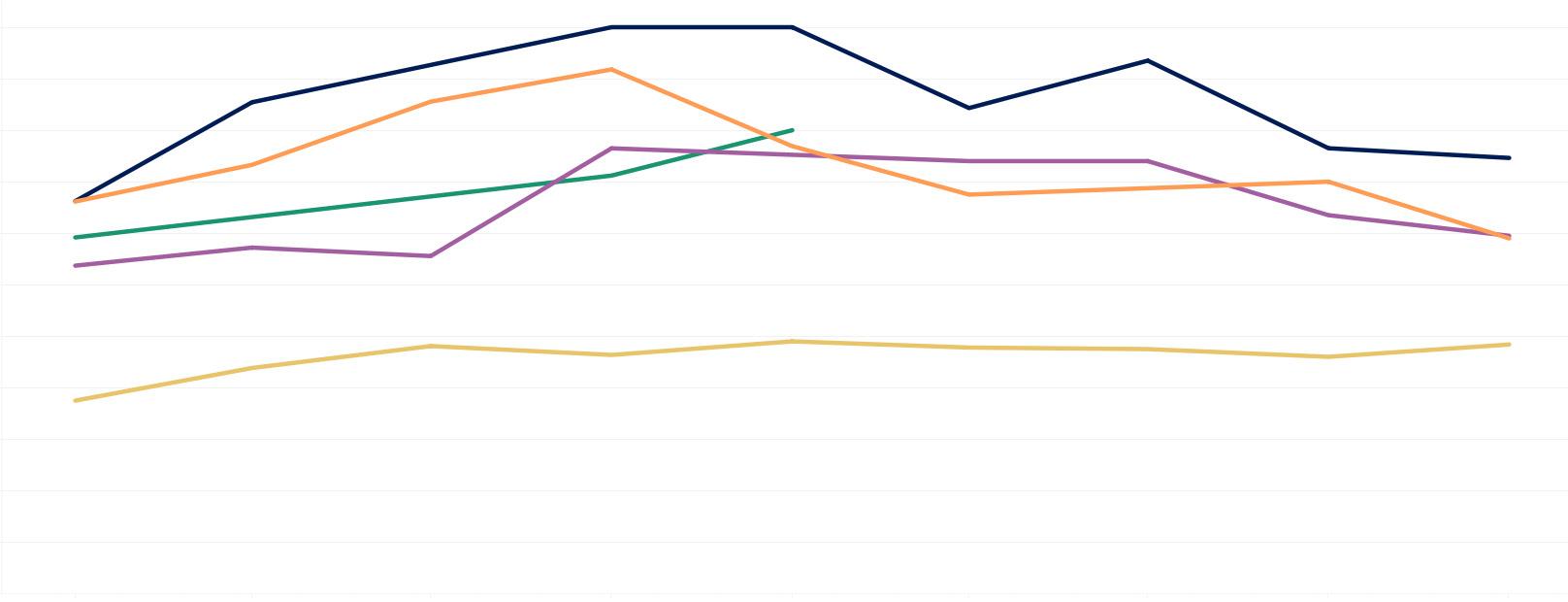

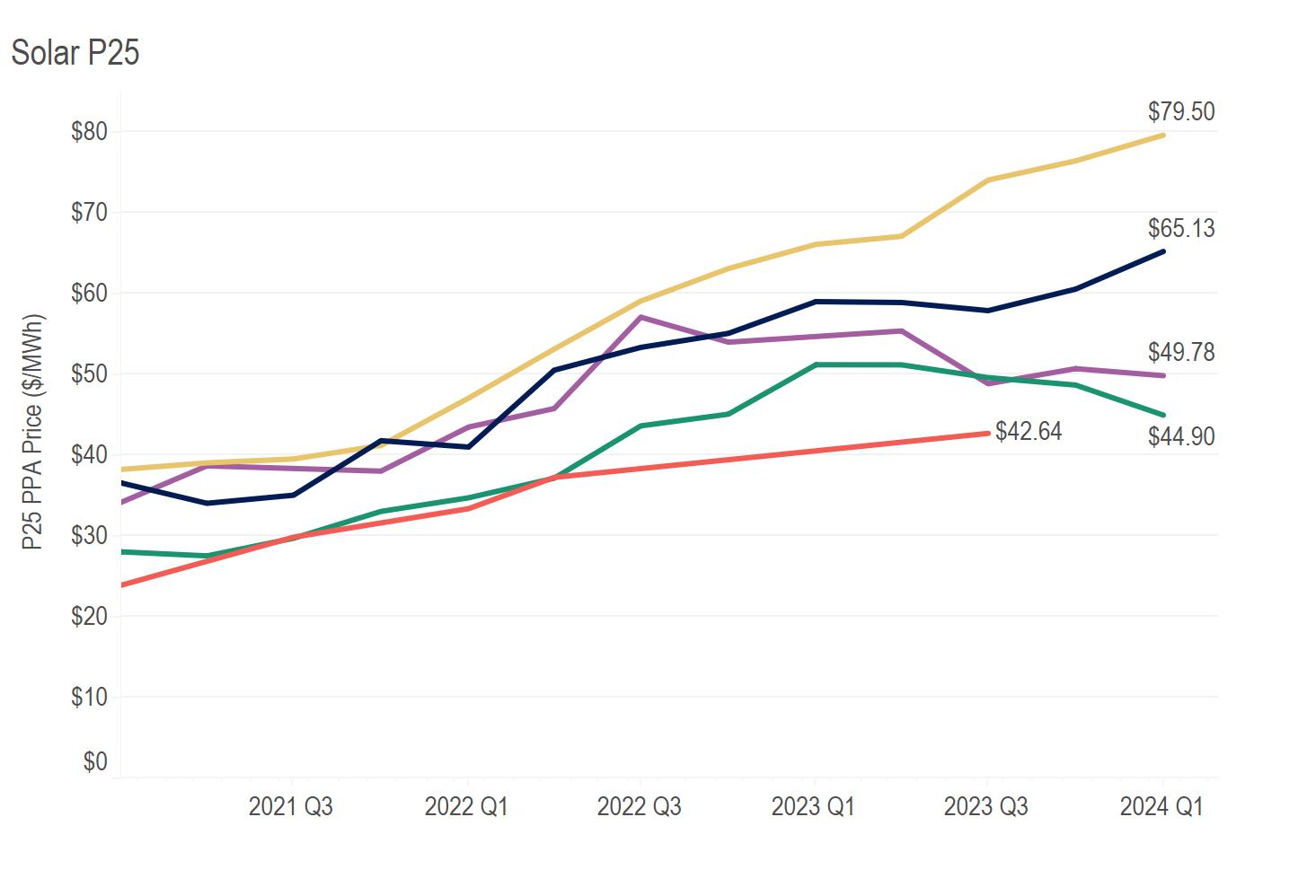

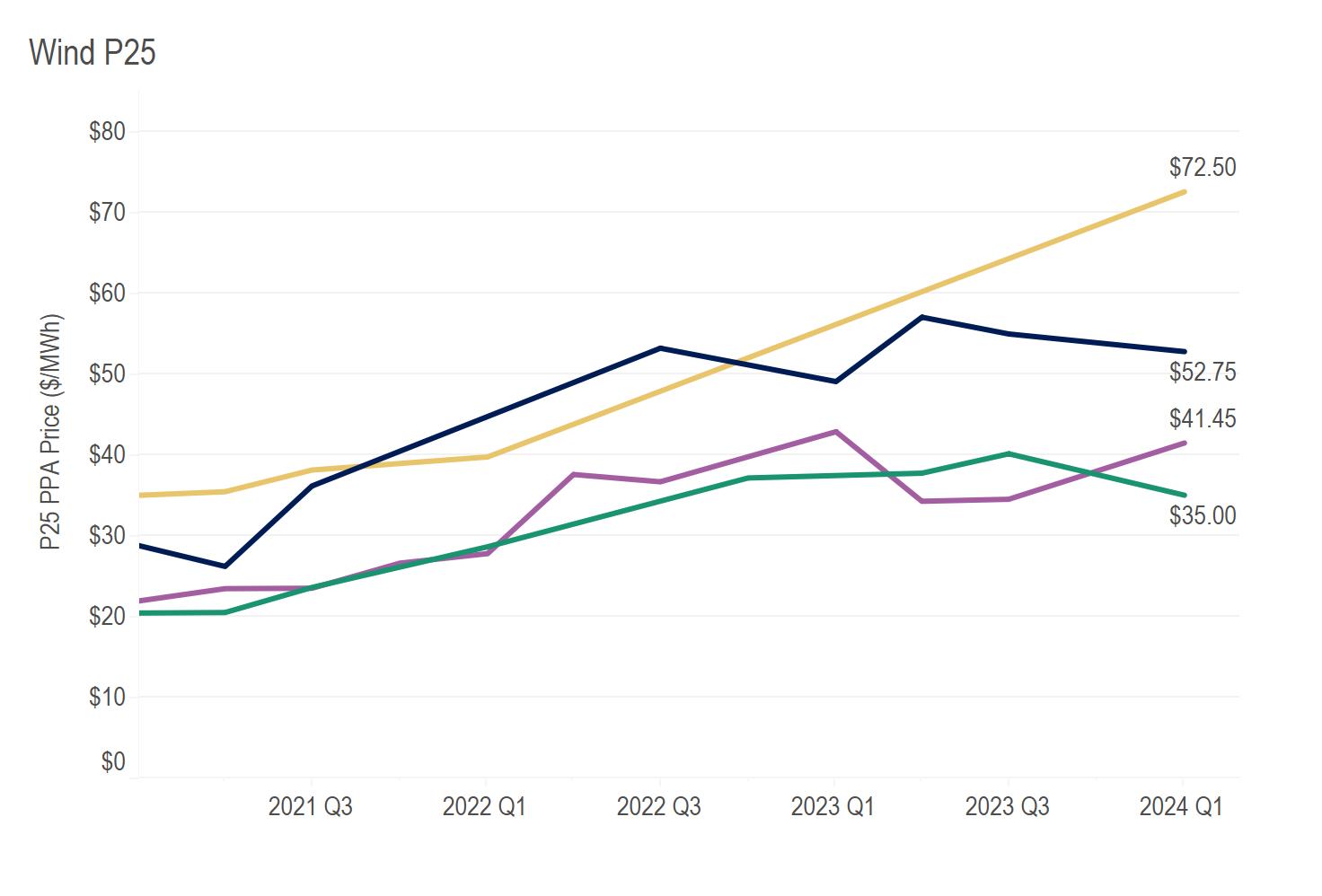

Figures 4 & 5. Trends in PPA Prices

Prices shown reflect the P25 prices received over time of flat, hub- and zone-settled, unit-contingent offers, inclusive of project RECs. Markets and technologies with fewer than four distinct projects in a given quarter are not shown. Please note that Trio has transitioned from publishing median pricing to P25 pricing, which refers to the 25th percentile of relevant bids offered in the quarter.

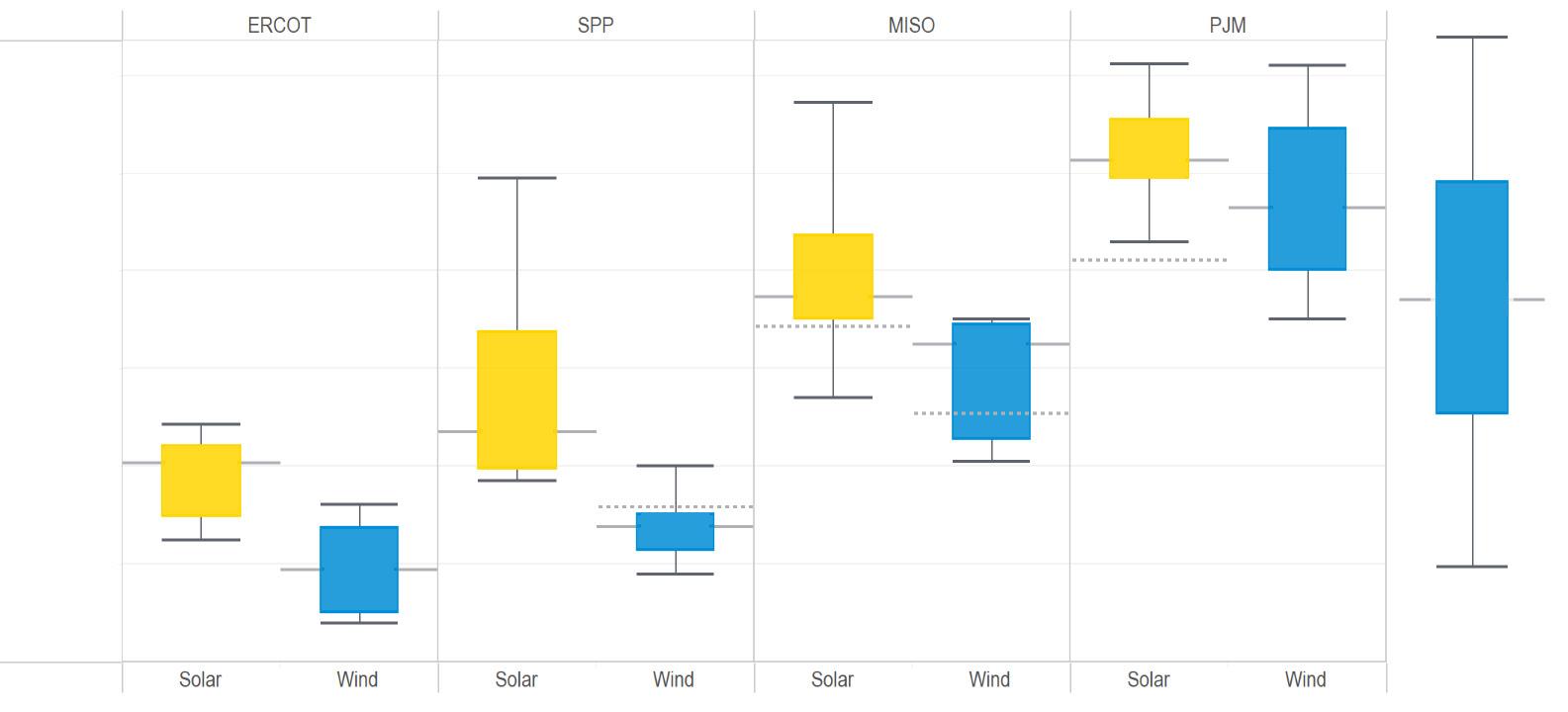

The Q1 U.S. median solar PPA price was 6% higher than Q1 last year compared to the 36% increase between Q1 2022 and Q1 2023. Median solar prices continue to moderate, with slight increases seen in most markets. P25 solar price changes have been more pronounced for most markets, but none have shifted more than 8% since last quarter.

MISO solar accounted for the largest increase in both P25 and median PPA prices this quarter at 8% and 4%, respectively. The increase is primarily due to more expensive projects entering the market, although a few projects were also offered at higher price points than in Q4.

ERCOT solar P25 and median PPA prices continued their downward trend. ERCOT solar’s P25 price dropped 8% in Q1, while the median PPA price fell 1%. This marks the third consecutive quarter of price decreases in ERCOT - the only market to show consistent price deflation.

PJM’s P25 solar PPA price rose 4% in Q1, while its median increased 1% - its smallest change since late 2020. PJM still struggles with pervasive upward pricing pressures, but the market appears to have had a slight reprieve in the first quarter of 2024.

U.S. Renewable Energy

Marketplace

Solar P25 $80 $70 $60 $50 $40 $30 $20 $10 $0 P25 PPA Price ($/MWh) 2021 Q3 2022 Q1 2022 Q3 2023 Q1 2023 Q3 2024 Q1 $42.64 $44.90 $48.78 $65.13 $79.50 2021 Q3 2022 Q1 2022 Q3 2023 Q1 2023 Q3 2024 Q1 Wind P25 $80 $70 $60 $50 $40 $30 $20 $10 $0 P25 PPA Price ($/MWh) $35.00 $72.50 $52.75 $41.45 Market CAISO ERCOT MISO PJM SPP Trio | Global Renewables Market Update 12

PPA Pricing Trends

Project inventory continues shift towards 2027 CODs, but earlier options remain

Following a dip in Q4 of last year, project inventory provided by developers to Trio’s RFI (Request for Information) increased by 36% in Q1. Inventory growth occurred for both wind and solar projects and was dispersed across most markets. The exception to this trend was PJM, whose inventory volume has been stagnant for three consecutive quarters. SPP saw the largest jump at 75%, while ERCOT and MISO inventories both increased by approximately 45%. These movements aligned with buyer demand, which is focused heavily on ERCOT, SPP, and MISO.

Q1 also saw major shifts in guaranteed commercial operation dates, with the largest number of projects now set to come online in 2027. This contributes to an ongoing trend of developers offering projects roughly 3 years from their operation dates, although many projects with 2026 CODs are still available. For

buyers looking to transact on a near-term project, ERCOT has the highest number of offered projects expected to come online between 2024 and 2026.

The number of offers for projects with a planned COD of 2028 or later has also increased, with approximately 90% of these projects located in PJM, SPP, and MISO. Notably, PJM and MISO suffer from major interconnection queue delays, which have already pushed out CODs for many projects. This increase in later CODs may indicate a more conservative approach from developers as they consider the impact that these delays may have on project commissioning.

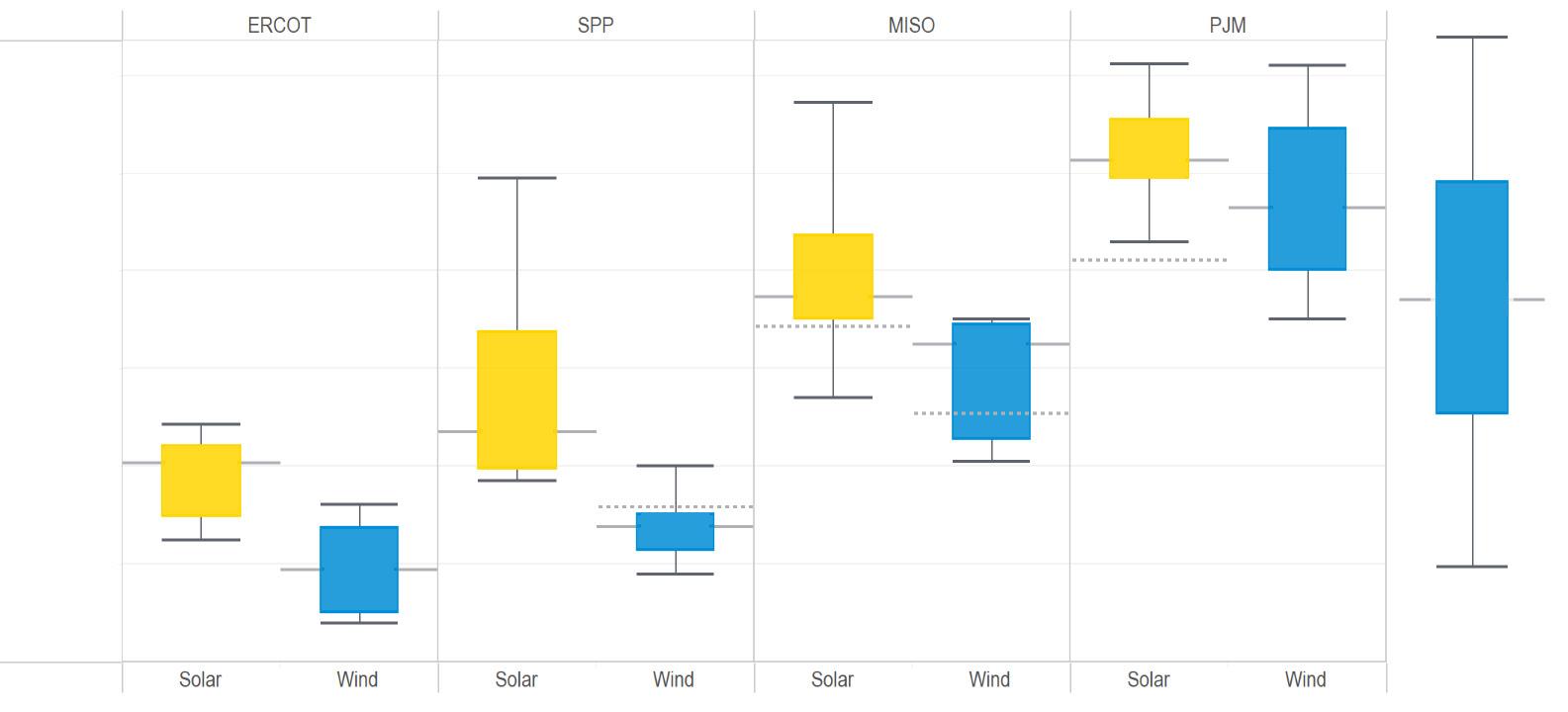

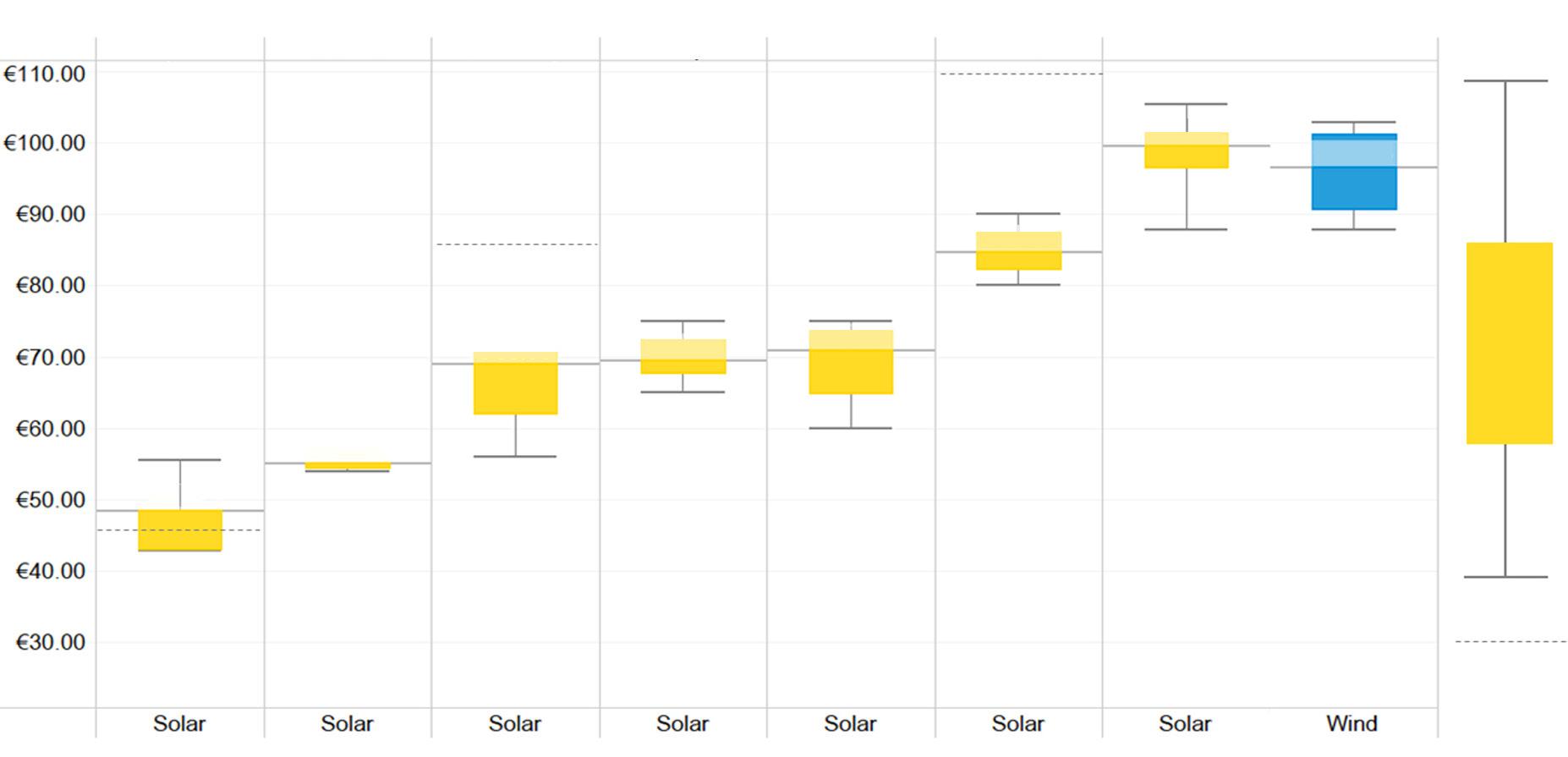

PPA prices shown above reflect flat, hub- and zone-settled, unit-contingent offers, inclusive of project RECs received in Q1 2024. Markets and technologies with offers from fewer than four distinct projects are not shown. Some offers shown may no longer be on the market. The dotted line indicates where the median PPA price was one year ago.

U.S. Renewable Energy

Marketplace

Figure 6. Current PPA Prices Q1 2024

PPA Price ($/MWh) $90.00 $80.00 $70.00 $60.00 $50.00 $40.00 $30.00 ERCOT SPP MISO PJM Upper WhiskerMaximum Price Inter-Quartile Range of PPA Prices Lower Whisker - Minimum PPA Price Q1 2023 Median PPA Price Solar Wind Solar Wind Solar Wind Solar Wind $50.39 $39.35 $53.50 $43.80 $67.28 $62.47 $81.23 $76.50 Median Trio | Global Renewables Market Update 13

Factors Driving the PPA Market

Buy-side finance: uptick in green and sustainabilitylinked bond issuance expected as economic headwinds ease

Green bond issuance is poised to accelerate over the next two years if interest rates fall, according to S&P Global Market Intelligence. As economic headwinds hit the broader debt market in 2022 and 2023, what had been an upward trend in the volume of global green bond issuances reversed course after peaking in 2021. However, there remains long-term appetite for these products, as well as an expectation that softer monetary policies in many developed economies will continue to spur the green bond market forward. The changing economics of clean energy procurement may drive additional corporate interest in these structures as buyers seek out new tools to reduce net costs.

Green bonds and sustainability-linked bonds collectively fall under a subset of the overall bond market known as green, social, and sustainability-linked bonds (GSSSB). While many entity types issue green and sustainability-linked bonds to finance a variety of “green” activities, corporations and others seeking to purchase clean energy have found that this debt market offers advantages in terms of both structure and cost versus traditional debt options. However, there are nuances to these offerings that a potential

issuer would need to consider when selecting a financing structure that makes sense to them.

For example, green bonds have specific requirements around how investor funds will be used, such as the financing of renewable energy purchases. Investors view this structure most favorably when metrics and guidelines for use of funds are clear and show a real impact on emissions reduction targets. Sustainability-linked bonds, in contrast, allow the issuer to use the funds as they see fit, but may incorporate an interest rate adjustment based on whether the company hits a specific emissions reduction or sustainability target in the future. In either structure, there is a delicate balance between the flexibility provided to the corporation, and managing investor sentiment around the impact of bond issuance on the company meeting its sustainability goals.

Upcoming Webinar

For more on buy-side finance, listen in to Trio’s upcoming quarterly webinar, where we’ll be joined by an expert panel from the commercial/industrial and finance sectors to discuss their experiences with green and sustainability-linked bonds.

U.S. Renewable Energy Marketplace

Sign up → 1 https://www.spglobal.com/_assets/documents/ratings/research/101593071.pdf Trio | Global Renewables Market Update 14

U.S. Renewable Energy Marketplace

Onsite Solar Spotlight

In the face of increasing costs and uncertainty in the vPPA market for buyers, onsite solar continues to be a valuable tool in the decarbonization toolbox. More corporations are pursuing onsite solar to help reduce their Scope 2 emissions targets. These assets are on display at business locations as a tangible commitment to sustainability for employees, customers, and other stakeholders. In many states, onsite solar projects offer relief from high electricity prices, providing cost savings throughout the life of the asset.

• Smaller projects do not necessarily mean a simple procurement process, particularly for companies seeking to add solar to a large portfolio of properties. Firms must categorize and prioritize sites, and design a procurement strategy that will balance quality, speed, and cost. Key considerations with respect to site ownership, site size and design parameters, and local utility rules must be assessed. For example:

• Is the site owned or leased?

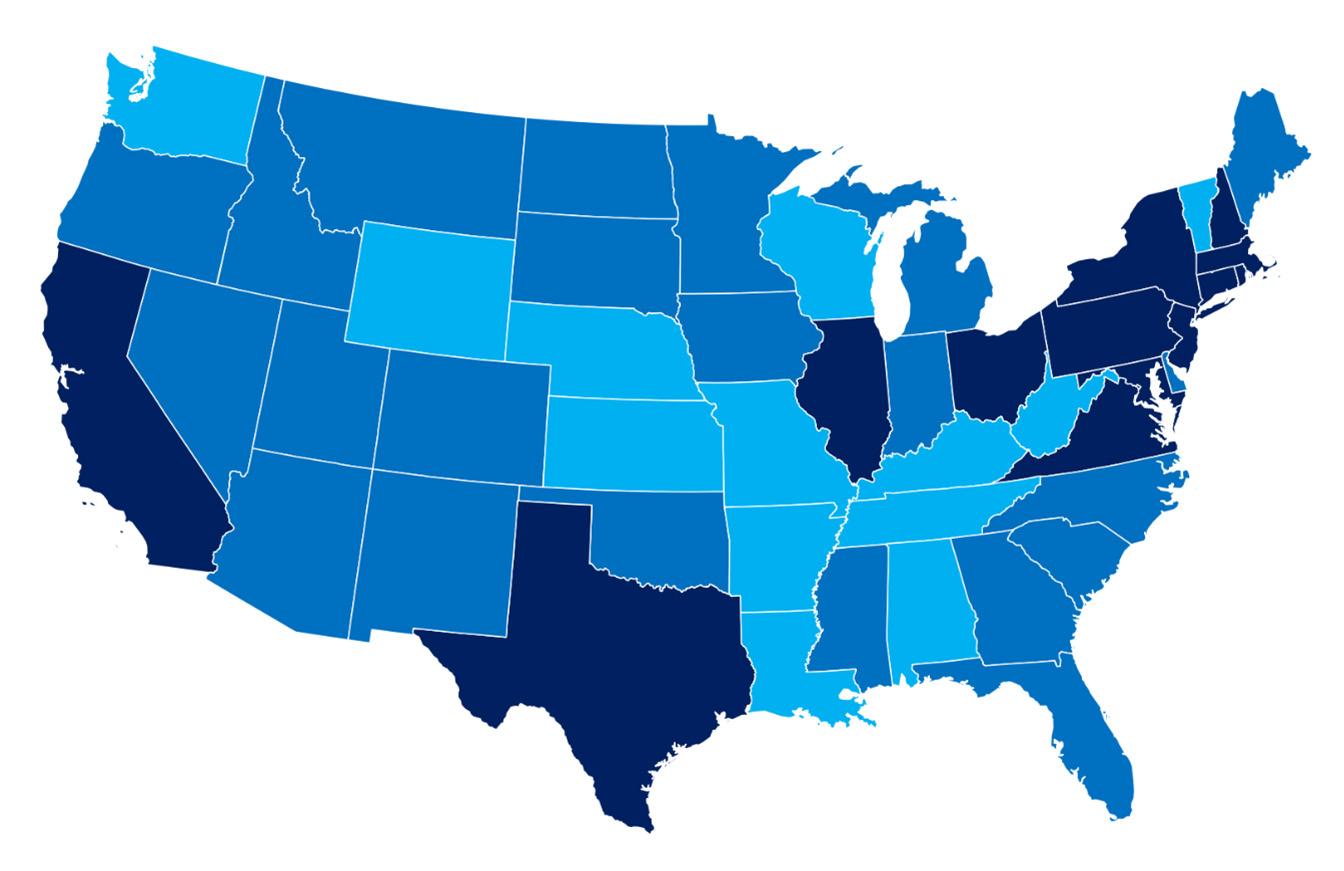

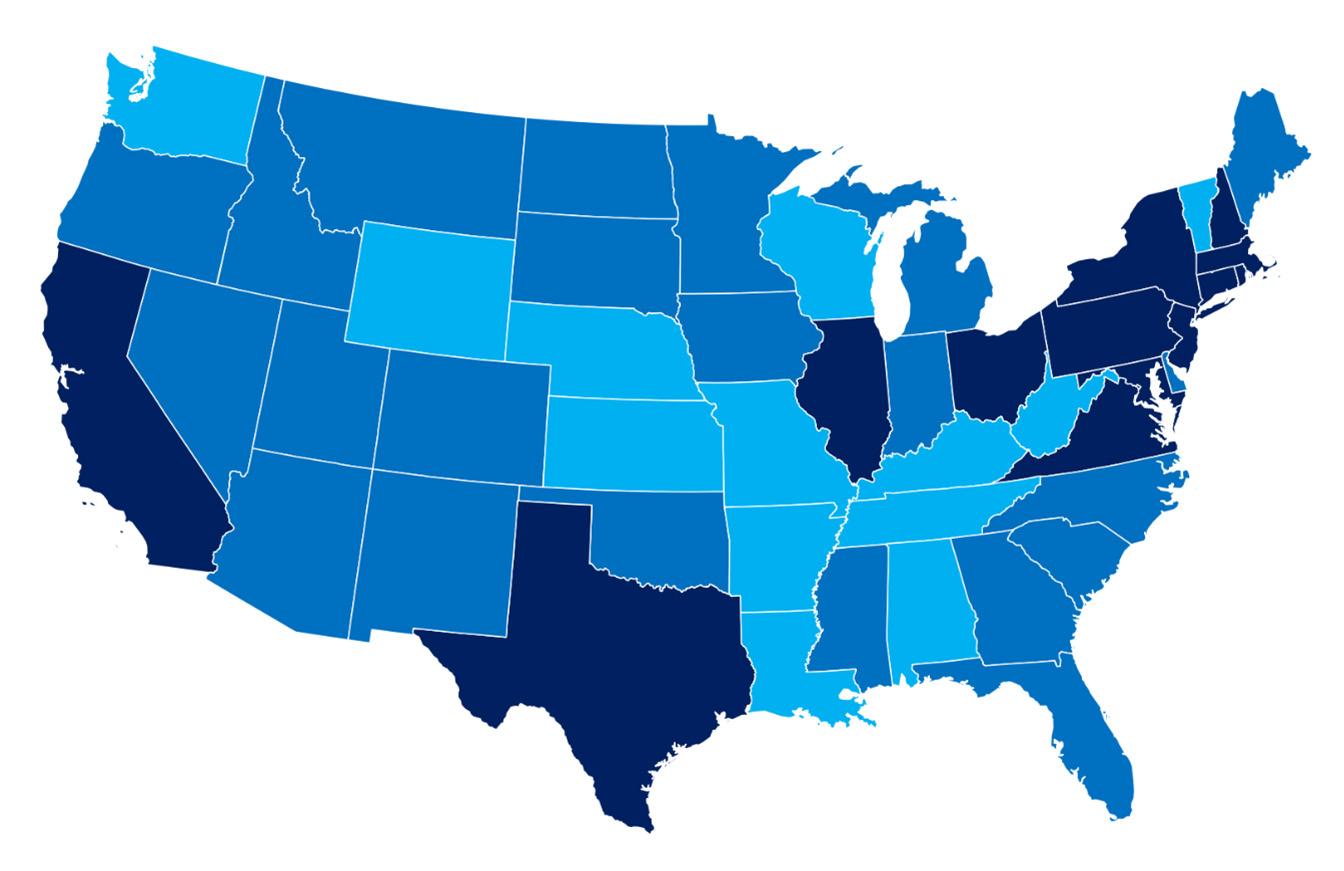

Potential Value of Onsite Solar Opportunities by State

• Does the site have space for rooftop, ground mount, or carport solar?

• What is the utility’s net metering policy?

• How much economic value will a facility provide in terms of energy and RECs?

While high-level statewide data can provide buyers with a rough idea of the attractiveness of a particular region, local nuances can have a significant impact. For example, a buyer in New York may expect strong cost savings due to the state’s favorable policies and generally high energy costs; however, parts of the state, particularly in the Western region, have extremely low energy costs due to inexpensive hydropower. These sites rarely obtain PPA prices that can provide savings against their low electricity prices. Key:

Trio’s Onsite Solar Advisory practice leverages real-world experience and market knowledge to help clients design a comprehensive strategy, gain management approval, access the market, and close transactions. With its broad database of local-level information, ranging from policy characteristics such as PPA availability and net metering policies, to economic data, such as electricity and state REC prices, Trio provides a robust assessment of opportunities in a client’s site portfolio. Metrics are weighted and potential sites ranked in accordance with each buyer's unique goals. Once a client is prepared to implement a strategy, Trio provides comprehensive support in RFP design and management, offer analysis, and commercial negotiation support. Contact Joey Lange, (+1-859-445-3132, Joey.Lange@ trioadvisory.com) for an introductory discussion.

Potential economic value Trio | Global Renewables Market Update 15

Factors Driving the PPA Market

Battery storage development widespread as developers digest IRA changes to tax credits

As project developers continue to digest the incentives provided by the Inflation Reduction Act (IRA), utility-scale energy storage development — both as standalone projects and co-located projects with wind and solar — has increased substantially.

While co-located solar+storage was eligible for the investment tax credit (ITC) prior to the passage of the IRA, it was subject to significant restrictions. Specifically, ITC penalties and recapture would apply if charging was not predominantly from the associated solar, rather than the grid. Co-located solar+storage facilities were also subject to the ITC phaseout schedule that stepped down to 10% for 2024 and later projects.

With the passage of the IRA, the ITC percentage was increased to 30% and the phaseout schedule extended, ITC eligibility was extended to standalone storage and the solar charging requirement was eliminated. While the new law has had a

significant impact on standalone storage, storage paired with clean energy came out ahead as well in terms of the raw tax credit value, ability to pair with wind, and operational flexibility to capture price arbitrage opportunities.

As storage assets increasingly penetrate the grid, market prices will be less volatile as generators optimize the deployment of energy onto the grid; they'll dispatch storage when prices are high and store energy when prices are low. In the near term, sellers may find that storage is an important tool for remaining competitive in energy markets. As more storage facilities come online, energy market price trends will respond as well. In the long term when storage is taken to scale, flattening market prices may decrease the value of co-located battery storage for clean energy projects.

In the meantime, developers continue to find value in it - thanks in part to the ITC - while the value proposition to corporate offtakers in conjunction with a vPPA is still unclear.

U.S. Renewable Energy Marketplace Trio | Global Renewables Market Update 16

Factors Driving the PPA Market

High-voltage equipment lead times, EPC availability are the new project construction schedule disruptors; panel crunch eases, though concerns linger

Following the trend in Q4, high-voltage equipment has been the most cited bottleneck in the development process throughout Q1 of this year. Many developers have stressed the long lead times for transformers and breakers and the need to procure this equipment much further ahead of time than previously necessary.

A comprehensive study conducted by the National Renewable Energy Laboratory (NREL) revealed that lead times for transformers are now up to 2 years - four times what was typical pre-2022 - and prices have increased by as much as 4-9 times over the past 3 years. Additionally, the need to procure equipment well in advance not only demands increased upfront capital from developers but also incurs additional costs associated with storing equipment.

The scarcity of high-voltage equipment has been attributed to labor shortages, supply chain disruptions, and raw material shortages. It's not likely that the strong demand for transformers will ease, given the accelerated electrification of the grid, renewable energy buildout, the need to replace aging electric infrastructure, utility-driven investment in local grid reliability, and the escalating frequency of extreme weather events necessitating more repairs and replacements. In response to this supply and demand imbalance, seven trade groups within the energy sector have called for $1.2 billion in federal funding to boost US manufacturing of high-voltage equipment.

The extension of tax credits for renewable energy projects through the IRA is expected to drive a significant increase in solar and wind

installations. However, a McKinsey study highlights a potential challenge in the form of a substantial shortfall in Engineering, Procurement, and Construction (EPC) capacity, particularly for utility-scale solar projects.

To meet the projected demand of ~50 GW installed in 2027, the study suggests that EPC capacity would need to nearly triple. Factors contributing to this challenge include an already limited workforce in rural project locations, the surge in renewable projects, and heightened competition for skilled labor from more profitable sectors like transportation, semiconductors, broadband, and public infrastructure, all benefiting from federal funding. Addressing this capacity gap becomes crucial for the successful implementation of the increased renewable energy installations envisioned under the IRA, requiring strategic collaboration and investment in workforce development.

Developers have expressed relief over panel supply and pricing, as an 82% surge in imports to a record 54 GW in 2023 - primarily from Southeast Asian countries - helped meet demand, according to S&P Global Market Intelligence . However, concerns linger about the potential negative impact on planned domestic panel manufacturing. As President Biden's safe harbor period on panels imported from Cambodia, Malaysia, Thailand, and Vietnam ends in June 2024, there is apprehension about a shortage of panels meeting tariff requirements, as only those using non-Chinese wafers with polysilicon cleared by U.S. Customs and Border Protection are deemed compliant. Moreover, despite a softening in module pricing, the savings are often offset by detention costs at the border.

2 Major Drivers of Long-Term Distribution Transformer Demand (nrel.gov)

3 Utility trade groups call for $1.2 billion to boost transformer manufacturing – pv magazine USA (pv-magazine-usa.com)

4 Build together: Rethinking solar project delivery | McKinsey

5 'Extreme dependence': US solar panel imports boom to record 54 GW in 2023 | S&P Global Market Intelligence (spglobal.com)

U.S. Renewable Energy Marketplace

Trio | Global Renewables Market Update 17

U.S. Renewable Energy Marketplace

Factors Driving the PPA Market

U.S. climate reporting takes center stage: how can corporations with renewable procurement goals plan for forthcoming compliance?

With the much-anticipated release of the U.S. Securities and Exchange Commission’s (SEC) final climate-related financial risk rules in early March, transparency in carbon accounting and reporting took center stage for U.S. businesses in Q1 2024. The adoption of rules requiring publicly traded U.S. companies to disclose their climate-related risks represents a pivotal moment in corporate climate reporting, bridging the gap between financial performance and environmental impact.

The SEC’s final rules build on similar regulations already adopted by the European Union and California. For publicly traded U.S. companies with a footprint in either the EU or California, most – if not all – of the SEC disclosure requirements may already be included under the more stringent EU Corporate Sustainability Reporting Directive (CSRD) and/or California’s forthcoming suite of disclosure requirements (SB253, SB261, and AB1305). Companies with reporting obligations across multiple jurisdictions will need to plan to meet the most stringent of those standards.

U.S. climate disclosure rules: the role of RECs

Under the SEC’s final climate-related disclosure rules, a public company must disclose any climate-related target or goal if the target or goal has materially affected or is likely to materially

affect the company's business, results of operations, or financial condition. If carbon offsets or RECs are used as a material component of a company’s plan to achieve their climate targets and/or goals, each fiscal year the company must also disclose the following: expenditures related to carbon offsets and RECs, the source of the offsets or RECs, description and project location, registration or authentication of the offsets or RECs, and the cost of the offsets or RECs. Companies with established renewable procurement practices will have this data readily available, facilitating compliance.

The other U.S. climate disclosure rule, California’s Climate Corporate Data Accountability Act (SB 253), requires public and private companies with annual revenues exceeding $1 billion globally to conform to the GHG Protocol’s Standards to measure and report emissions beginning in 2026. There is no reference in the law regarding the reporting of PPAs, RECs, or offsets beyond conforming to the GHG Protocol. The California Air Resources Board (CARB) will adopt regulations to implement the law by January 1, 2025 - assuming no forthcoming legislative changes or legal challenges delay CARB’s implementation.

Therefore, as of this publication, RECs are claimable to offset Scope 2 emissions under the SEC and California climate disclosure rules, with no additional limiting factors at this time beyond compliance with the GHG Protocol Standards.

Trio | Global Renewables Market Update 18

Factors Driving the PPA Market

How to prepare for upcoming climate reporting

Corporations with renewable procurement goals can plan for disclosure across multiple jurisdictions in several ways:

1. Standardize greenhouse gas (GHG) metrics: Adopt accounting frameworks like the GHG Protocol to measure and report scopes 1, 2 and 3 emissions, as this ensures transparency and comparability of data for investors and regulators. California’s Climate Corporate Data Accountability Act requires conformance to the GHG Protocol Standards.

2. Compile renewable procurement data: Companies subject to climate disclosure rules may be required to report their renewable procurement goals and plans to achieve them. If using RECs to meet renewable goals, adequately document your procurement process and REC portfolio for disclosure. For client advisory on REC strategy and support procurement, we offer a detailed dashboard capturing a suite of characteristics for their REC portfolio (e.g., vintage, volume, retirement date, registry, location of generation, and generator info) – information that may need to be disclosed under the SEC’s rules. Companies can obtain authentication or registration from the seller or in public registries. Similar information is also provided for carbon offset retirements, including project and registry information.

3. Assess your reporting needs: Begin evaluating any data or reporting gaps across your company to ensure compliance with these regulations. First, identify in-house staff for data collection and the metrics you will need to report. Then, consider partnerships with credible providers for assurance.

4. Revisit your renewable goals and strategy: Review your existing renewable procurement goals and ensure your

strategy aligns with the level of detail and impact required by the disclosure regulations. Disclosure may result in greater stakeholder scrutiny of a company’s strategy that relies heavily on purchasing unbundled RECs without directly investing in new renewable energy. Companies may need to adjust their procurement strategies to prioritize high-impact renewable energy sources or set more ambitious targets for emissions reduction in the future. Clear and demonstrably impactful renewable goals can strengthen a company's sustainability credentials with investors, consumers, and regulators. This can translate to better access to capital and improved brand reputation.

5. Stay updated on evolving climate disclosure regulations and best practices: Ensure your approach is adaptable to regulatory changes, such as new requirements that will result from CARB’s implementation of California’s climate disclosure law. Consult with sustainability and policy experts like Trio to ensure that your renewable procurement strategy, accounting, and reporting complies with climate disclosure requirements and industry best practices.

By implementing these steps, corporations with renewable procurement goals will be well-positioned to comply with forthcoming climate disclosure regulations. Trio is here to support our clients in navigating the evolving and complex realm of climate disclosures and can serve as a trusted advisor throughout your sustainability journey.

Learn more about the SEC’s final climate-related disclosure rules.

U.S. Renewable Energy Marketplace

Learn

Trio | Global Renewables Market Update 19

more →

European Renewable Energy Market

Trio | Global Renewables Market Update 20

Project Availability

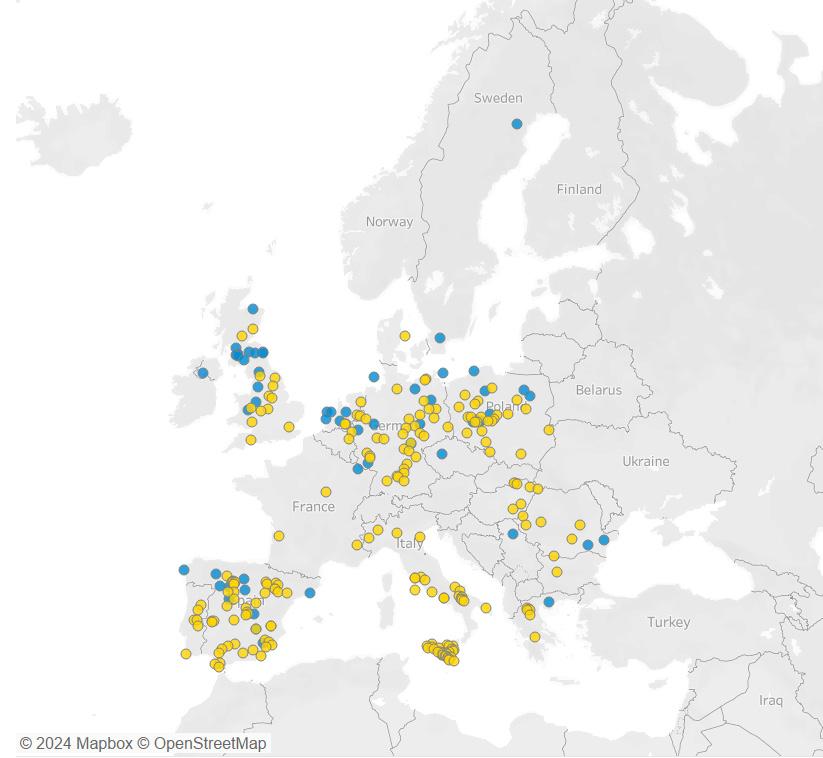

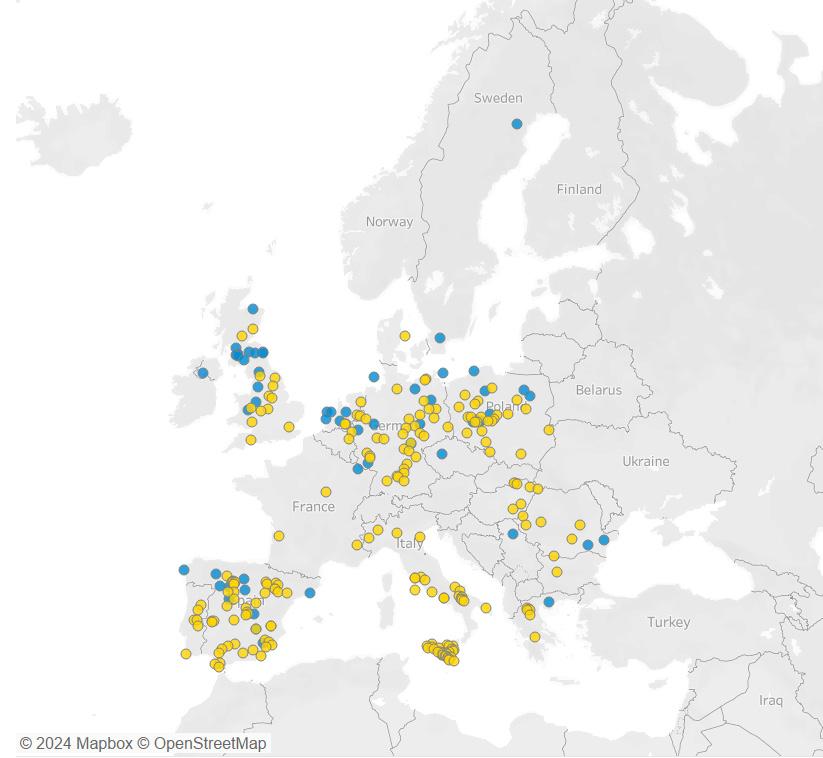

Figure 7. Trio’s European Renewable Energy Marketplace –Utility-Scale Projects

Marketed to Voluntary Buyers, Q1 2024

Guaranteed Online Dates

European Renewable Energy Market

Technology Solar Wind Wind Solar Wind Solar Wind Solar Wind Solar 2024 2025 2026 2027 or later 101 Projects 125 Projects 53 Projects 6 Projects Trio | Global Renewables Market Update 21

European Renewable Energy Market

PPA Price Trends

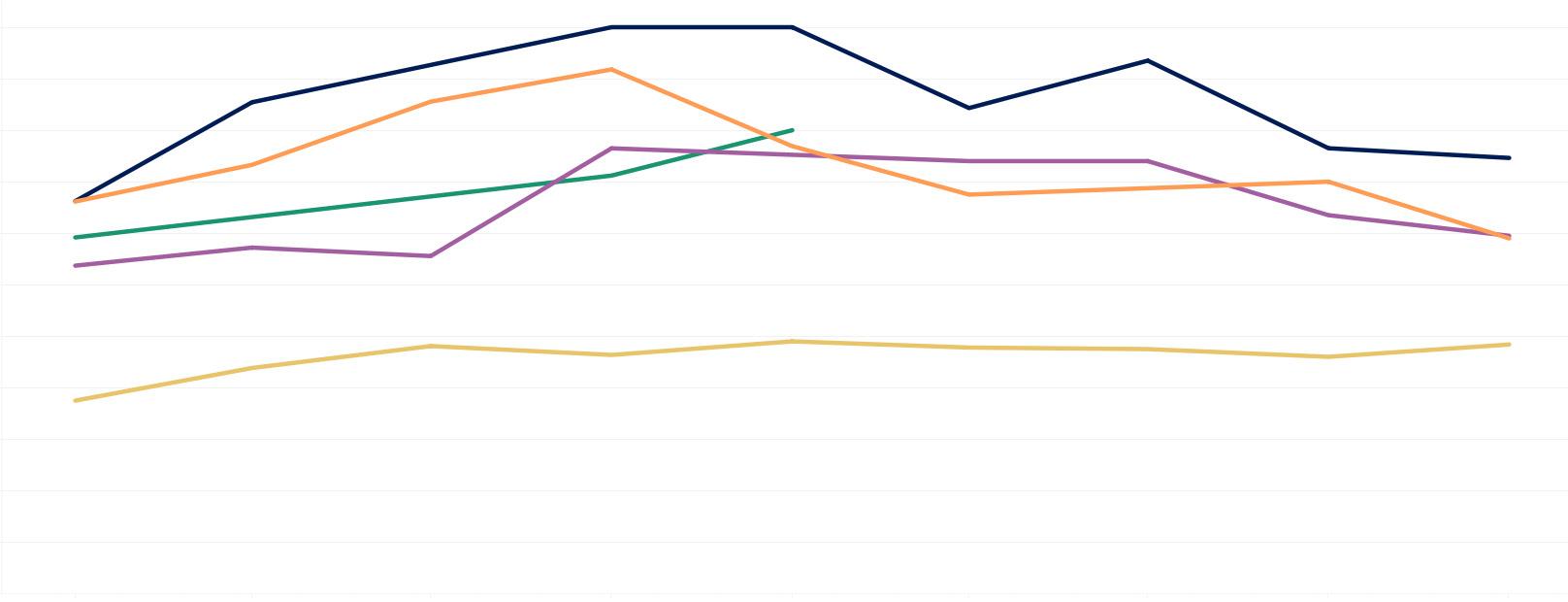

Figure 8. Trends in PPA Prices

PPA prices for the five markets shown reflect the median of flat, unit-contingent offers inclusive of project GOs received over time. Markets and technologies with offers from fewer than three distinct projects in a given quarter are not shown. Wind PPA price trends are not shown this quarter due to fewer than three wind projects seeking offtake in each market.

European PPA price declines continued through Q1 2024 across most markets. Compared to Q4 2023, Polish, German, and Italian median price levels fell by 2%, 16%, and 6%, respectively, following a drop in commodities and power prices. In Spain, Q1 2024 PPA prices are quoted at similar levels to the previous quarter, with a shift of just € 2/MWh upwards. As expected, median prices in Poland, Germany, and Italy fell when compared to Q1 2023, as European markets saw much less volatility in 2023. Spanish PPA prices year-to-year saw the least significant decrease of € 1/MWh due to strong demand and sufficient supply.

PPA markets across Europe are responding to emerging challenges by offering new products. Q1 2024 saw an increase in nonstandard PPA price structures, such as discount-to-market with floor, with availability across European markets. This has been partially driven by declining power prices, which have led to an increase in lender confidence in a guaranteed floor structure. More shorter-tenured PPAs were offered, primarily for existing assets. Additionally, developers showed more interest in contracting smaller PPAs, as delays in interconnection and permitting disrupted larger projects.

€ 90 € 80 € 70 € 60 € 50 € 40 € 30 € 100 € 110 € 20 € 10 € 0 2022 Q1 2022 Q2 2022 Q3 2023 Q1 2023 Q3 2024 Q1 Solar Median Trends Median PPA Price (€/MWh) 2022 Q4 2023 Q2 2023 Q4 Country Germany Italy Netherlands Poland Spain Trio | Global Renewables Market Update 22

European Renewable Energy Market

PPA Price Trends

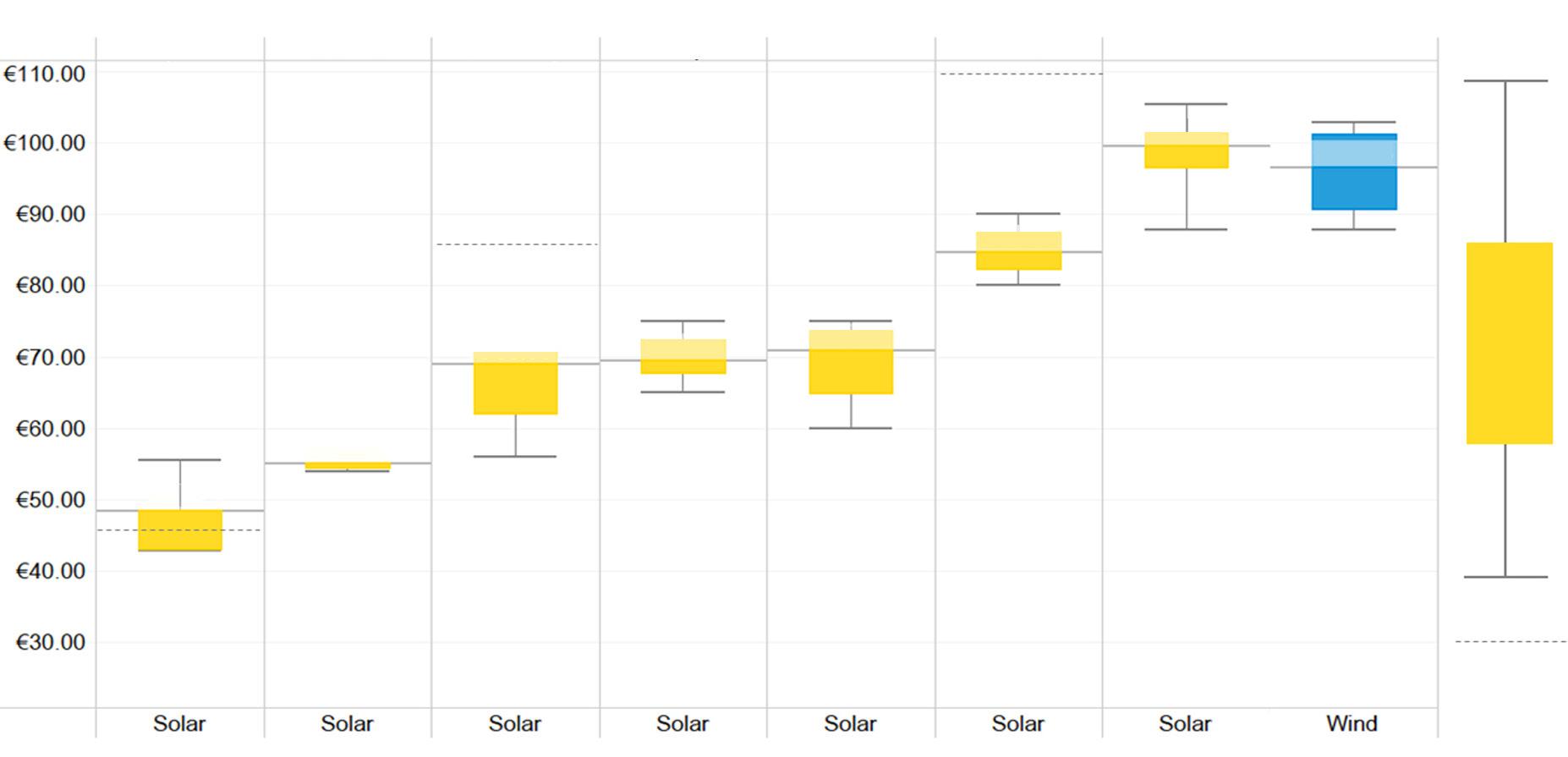

PPA prices shown above reflect flat, unit-contingent offers received in Q1 2024. Markets and technologies with offers from fewer than three distinct projects are not shown. Some offers shown may no longer be on the market.

Increase in hybrid projects may help optimize generation profiles. Hybrid solutions such as combinations of solar, wind, and batteries were seen in several European markets. In particular, the addition of storage may decrease cannibalization risk and present market arbitrage opportunities. Despite the lack of regulatory frameworks for storage in many markets, we expect a solution to become available for corporates. However, the relative economic benefit of these solutions remains unclear.

Figure 9. Current PPA Prices Q1 2024

PPA Price ($/MWh) € 90.00 € 80.00 € 70.00 € 60.00 € 50.00 € 40.00 € 30.00 € 100.00 € 110.00 Spain Greece Germany Italy Romania Poland UK Solar Solar Solar Solar Solar Solar Solar Wind € 55.00 € 69.00 € 69.50 € 70.94 € 84.62 € 99.47 € 96.53 Upper WhiskerMaximum PPA Price Inter-Quartile Range of PPA Prices Lower Whisker - Minimum PPA Price Q1 2023 Median PPA Price € 48.39 Median Trio | Global Renewables Market Update 23

Perspectives Roundup

Trio | Global Renewables Market Update 24

You don’t want to miss this from our team

→ Powering the future: How Trio charges up transportation electrification with clean energy solutions

By Sage McLaughlin, Director, Business Development

→ Pop-Up Power: How Temporary Solutions Can Solve Your EV Charging Dilemmas

By Galen Kent, Program Manager, Electric Vehicle PMO; Simon Horton, Director, EV Design & Delivery; and Sandra Baker, Senior Project Manager, EV Infrastructure

→ Insurance costs for clean energy projects are rising. Here’s what buyers need to know

By

Evan Dell’Olio, Clean Energy Originator

→ Decoding the clean energy horizon: Insights from Merck KGaA, Darmstadt, Germany’s recent PPA deal

A webinar providing a market overview and engaging fireside chat delving into the intricacies of securing a PPA agreement in the ever-changing European renewable energy landscape.

→ The EPA's new standards set the U.S. on path towards electric future: What fleet owners and operators need to know

By

Matt Donath, Policy Manager, and Iman Nordin, Transportation Electrification Manager

→ The SEC's final rules on climate disclosures: A paradigm shift for corporate transparency

By Kiwa Anisman, Policy Analyst, and Marc Steele, Manager, Energy

& Sustainability Strategy

→ Low natural gas prices spur a different producer strategy

By Jeff Bolyard, Principal, Energy Supply Advisory

→ What will a post-ARENH energy market look like for French power consumers?

By Elisa Blanco, Senior Analyst Regulatory Intelligence

→ Retail renewable PPAs 101: Here's what you need to know

By By Patrick Mingey, Sr. Analyst, Clean Energy Advisory

Perspectives Roundup

Electrification Clean Energy Advisory Policy

Trio | Global Renewables Market Update 25

Joey Lange

Senior Managing Director, Energy Supply Advisory +1-617-663-8240

Joey.Lange@TrioAdvisory.com

Corina Melchor

Senior Advisor, European Energy Advisory +40-73-399-8964

Corina.Melchor@TrioAdvisory.com

About Trio

Impact. Together. Trio is a global sustainability and energy advisory company that helps large commercial, industrial, and institutional organizations navigate the clean energy transition. A subsidiary of Edison International, Trio provides integrated strategy and implementation services – in sustainability, renewables,

50

Fortune 500 and Fortune Global 500 clients

Did you know

30+ Countries

Our global team has locations across Bosnia and Herzegovina, Germany, The Netherlands, Romania, Spain, and the UK. We specialize in delivering integrated strategies that best meet the needs, goals, and objectives of our global clients in an evolving energy market.

Shannon Holzer

Head of Policy +1-708-638-8209

Shannon.Holzer@EdisonEnergy.com

Emily Williams

Vice President, Strategy & Sustainability +1-815-847-9135

Emily.Williams@TrioAdvisory.com

energy procurement, energy optimization, and transportation electrification – to help the world’s largest organizations meet their strategic, financial and sustainability goals.

For more information visit trioadvisory.com

20+ Languages spoken $11.4BN+ Energy spend

Exchange Place, 53 State Street, Suite 3802 Boston, MA 02109

Central Park, Stadsplateau 19-40, 3521 AZ Utrecht, NL

Global presence in: North & South America, Europe and Asia-Pacific

Get in touch

Trio | Global Renewables Market Update 26

trioadvisory.com