Instructions.You are encouraged to work in groups, but everybody must write their own solution to the problem that is for grade. Good Luck! 1. (For Grade) There are Önitely many states s 2 S. The set of outcomes is [0; 1), the amount of consumption. Consider an expected utility maximizer with utility function u (c) = p c. Suppose that for each state s 2 S, there is an asset As that pays 1 unit of consumption if the state is s and 0 otherwise (these are called ArrowDebreu securities). Suppose also that we know the preference of the decision maker among these assets and the constant consumtion levels; e.g., we know how he compares an asset As to consuming c at every state.

(a) Derive the decision makerís preference relation among all acts from the above information.

(b) Assume that the decision maker has a Öxed amount of money M,

which he cannot consume unless he invests in the Arrow-Debreu secuirites above, assuming that these secrities are perfectly divisible, and the price of a unit of As is some ps > 0. Derive the demand of the decision maker for these securities as a function of the price vector p = (ps) s2S :

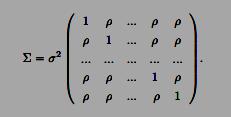

Question 1 Part (a) We know that the DM is an expected utility maximizer. Therefore her preferences Á over acts are completely described by her utility function u : : r0, 8q Ñ R and probability P P U(f) := _ P(s)u(f(s))> > P(s)u(g(s)) =: U(g) We already know what is u: u(c) = vc for ce [0, co). So we only need to find P. Write f, for the Arrow-Debreu security corresponding to state s: for all state s' 1 its = s f . (s') 10 else. Observe that U(fs) = P(s), so to find P(s) it is enough to measure U(f,).We know how the DM ranks fs against any ce [0, co), that is, we can say whether the DM prefers f, to a constant act.

economicshomeworkhelper.com

This means in particular that for every s we have enough data to find c, e [0, co) such that is ~ Cs. But fs ~ Cs implies that P(s) = U(f.) = U(cs) = Vcs. So we have found P, and we can conclude that for an arbitrary act f U() = EVcaf(s).

BES

Remark. This exercise has a "Anscombe-Aumann flavour." In the Savage approach, to elicit and P, first we estimate the probability (chopping the state space using P6), and then we use the probability to measure utility (applying mixture space theorem). The Anscombe-Aumann

economicshomeworkhelper.com

methodology goes the other way round. First utility is measured using obejctive lotteries (applying mixture space theorem). Then certainty equivalents are used to measure the probability, which is what we do here. Even if objective lotteries are slightly misterious objects, the Anscombe-Aumann method is way more flexible than Savage's, and nowadays most of the works in decision theory adopts it (e.g., ambiguity).

Part (b)

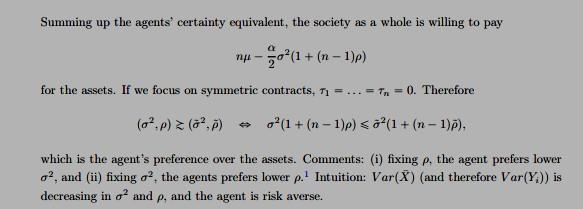

Note that any act can be written as a non-negative linear combination of ArrowDebreu securities, and any non-negative linear combination of Arrow-Debreu securities is an act. Therefore the portfolio problem for the DM is: maximize U(f) over f E F subject to _ f(s)p. < M. The solution to this problem is: for all

economicshomeworkhelper.com