A PROMISING CASE FOR IMPACT

Sharing Our First Fund of Funds Impact Report

The Education Impact Fund (EIF) is an evergreen impact investment fund, backed by ECMC Group, that invests patiently and flexibly toward two objectives:

Capitalize impactful companies delivering outcomes aligned with our mission and deliver market-rate returns that can be reinvested to perpetuate that impact.

Since inception, we have invested directly into companies across stages— we have partnered with more than 30 companies to date, ranging from seed to growth stage. We also have a Fund of Funds (FoF) portfolio through which we invest in other mission-aligned fund managers.

In addition to scaling and diversifying our capital’s reach, our FoF portfolio provides a unique, data-driven view across an underlying portfolio of hundreds of companies. Leveraging this dataset, we are interested in understanding how rigorous impact measurement—the process used to measure and quantify the impact of an investment—correlates with better outcomes for learners and workers as well as with financial performance.

While we’ve historically analyzed fund managers’ self-reported impact metrics, 2025 marks the first year we collected comprehensive company-level impact data across our FoF investments, and we look forward to continuing this analysis in forthcoming years.

Education Impact Fund Portfolio

Portfolio-Wide Highlights

EIF direct and FoF portfolios underserved learners and workers served —10.3% growth YoY1 total learners and workers served across all companies in our FoF portfolio

18M

142M

1 This is based on each company’s definition of “underserved”

2 Active portfolio, as of 12/1/2025

Fund of Funds

9 GPs managing 17 funds, comprised of 196 companies

EIF Direct Portfolio2

Using Our Impact Framework to Assess the FoF and Direct Portfolios

Reach

Reach

The size of the impact opportunity that a company is targeting, along with a company’s current and potential impact on underrepresented or marginalized populations.

Portfolio-Wide Metrics

65% FoF Companies Aligned to ECMC Group’s Mission

6.9M K-12 Learners Reached

5.4M Higher Ed Learners Reached

1.3M Pell Grant Recipients

4.1M Underserved Workers

• Apprentices from low-income zip codes

• Non-traditional job applicants

• Working students

3.1M Frontline Workers

• CNAs, home health aides

• Restaurant staff

• Cashiers/sales associates

• Childcare providers

Using Our Impact Framework to Assess the FoF and Direct Portfolios

The research and data points that evidence a company’s ability to deliver long-term outcomes aligned with its impact vision.

Learn more about the Tiers of Evidence, our approach and methodology on page 8.

Using Our Impact Framework to Assess the FoF and Direct Portfolios

Scalability

Scalability

A company’s ability to grow delivery of impact outcomes aligned to its vision, while also demonstrating an economically sustainable and scalable business model over time.

Scalability

Company-Specific Highlights

Portfolio-Wide Metrics

Reporting provided by our general partners (GPs) historically does not provide the level of detail to be able to aggregate scalability metrics across the portfolio. Our data collection this year has established a baseline for both the outcomes as well as the financial metrics needed to be able to assess portfolio-wide scalability, which we will report on in future reports.

Program for high school graduates to spend their first year of college studying abroad, earning college credits while engaging in experiential learning

69%

Growth in top line while scaling percent of students who are college-ready

Online educational platform that provides vocational training in Spanish in areas like entrepreneurship, healthcare and trades

17%

Improvement in EBITDA margin, while growing weekly active users (WAU) by 5% from 2023-2024

A tool for university students to plan their classes and track their academic progress toward graduation

44%

Growth in revenue while scaling number of student decisions supported by 2x

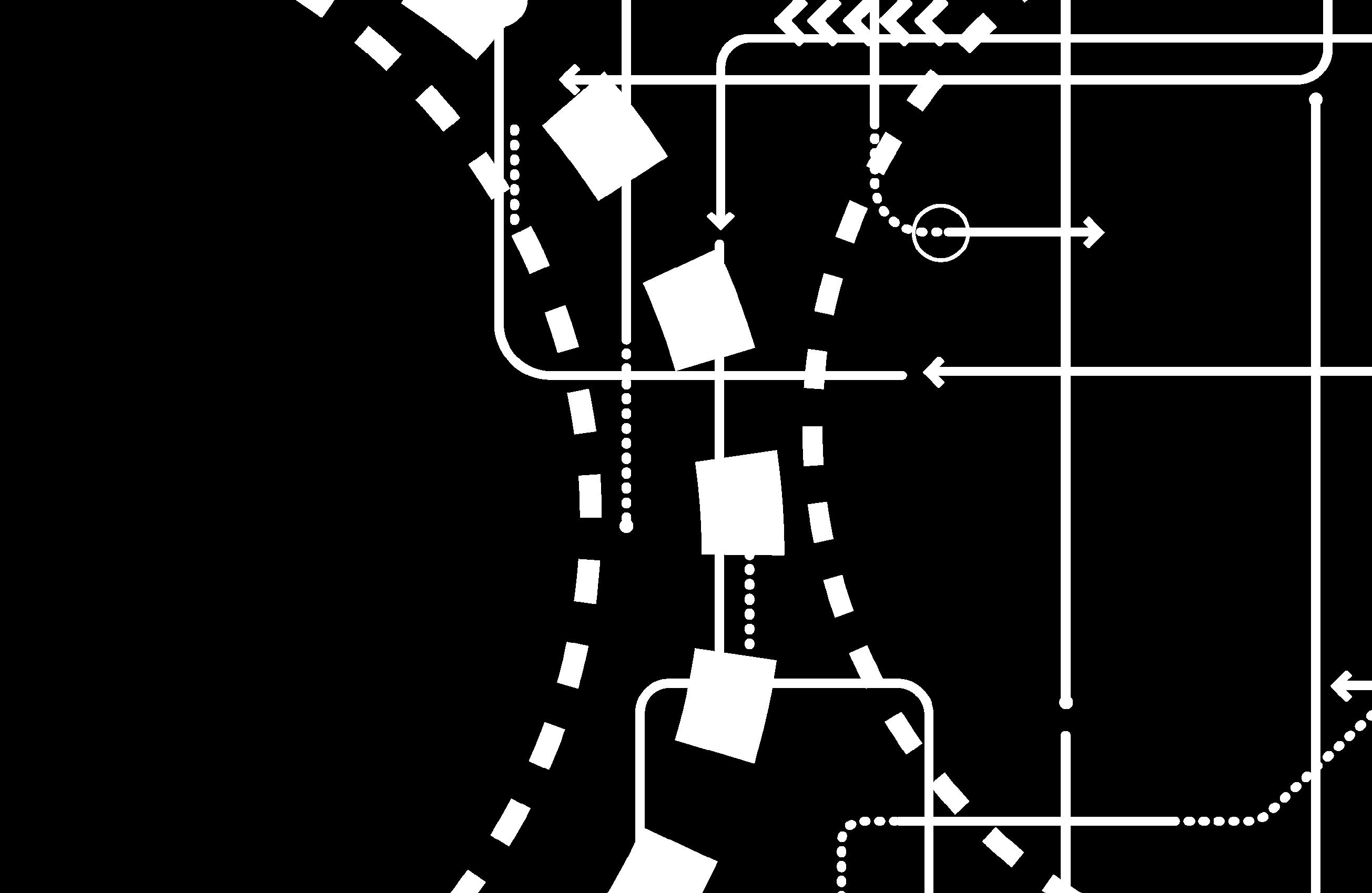

Early Signs That Impact Rigor Drives Financial Returns

The company-level impact data from our FoF and Direct portfolios gives us a unique and proprietary dataset to understand further how more robust, rigorous impact data connects with stronger financial outcomes.

We examined four critical questions: And found compelling signals in the data:

1 2

Does evidence show that impact rigor correlates with stronger financial returns?

3

How do our GPs’ impact measurement practices compare to industry standards and our internal framework?

4

What concrete evidence demonstrates mission-aligned impact within each GP’s portfolio?1

How can we leverage these insights to enhance collaboration and deepen impact across both our FoF and Direct investments?

When comparing the highest rigor companies against those showing no rigor (i.e., companies that haven’t yet established a logic model), we find a clear pattern of outperformance.

Data shows companies demonstrating high-impact rigor outperform on financial outcomes across each category we examined.2

This data provides compelling signals that investing in impact rigor could translate to better returns. While we recognize this isn’t causal evidence, and the underlying portfolio is still maturing, these early signals portend a compelling case for deeper investment in impact outcomes measurement.

We’ll continue tracking these metrics as our dataset grows and the portfolio matures, but this data supports our working hypothesis that seasoned investments with stronger impact rigor will deliver more definitive impact outcomes and financial returns, further demonstrating the business case for impact. Read more about our business case for impact in Module 1 here.

Our Approach and Methodology

To evaluate the impact measurement rigor of our underlying portfolio, we developed a framework that was inspired by principles included in the Every Student Succeeds Act’s (ESSA) Tiers of Evidence. While typically applied within a K-12 context, the ESSA tiered evidence framework is simply a tiered assessment of measurement approach, rigor and evidence base, and can also be utilized more broadly—including within higher education and workforce development contexts.

TIER 4

Provides Rationale for Expecting Impact:

Well-defined logic model based on rigorous research

TIER 3

Promising Evidence of Impact:

Well-designed and implemented correlational study, statistically controls for selection bias

TIER 2

Moderate Evidence of Impact:

Well-designed and implemented quasiexperimental study

TIER 1

Strong Evidence of Impact:

Well-designed and implemented experimental study

It is important to note that we are using these tiers as a heuristic for assessing impact rigor in a relatively standard and efficiency way across our portfolio. We are not suggesting that every company can or should aspire to conduct a randomized control trial (RCT). Ultimately, our thesis is that companies need to measure the impact of the Metrics That Matter, but do so with rigor. This can be accomplished in multiple ways and may or may not involve something like an RCT.

Working with our GPs to apply this framework to their underlying portfolio companies, as well as our own, we created a portfolio-wide database that allow us to use a standardized methodology for comparing impact measurement rigor across different business models and sectors.

Our analysis examines companies with higher-impact measurement rigor (Tiers 1-3) across three key dimensions:

Hold period and average Multiple on Invested Capital (MOIC)

Hold period and change in revenue growth

Company stage and average MOIC

TIER 4

Provides Rationale for Expecting Impact:

Well-defined logic model based on rigorous research

TIER 3

Promising Evidence of Impact:

Well-designed and implemented correlational study, statistically controls for selection bias

TIER 2

Moderate Evidence of Impact:

Well-designed and implemented quasiexperimental study

TIER 1

Strong Evidence of Impact:

Well-designed and implemented experimental study

Impact x Financial Returns: A Deeper Dive on the Data

For companies with high levels of rigor (Tiers 1-3 in our framework), we see promising patterns—companies that have generated evidence and are rigorous in their impact measurement have higher Multiple on Invested Capital (MOIC) ratios and higher average revenue growth.

We analyzed this data in multiple ways, accounting for hold period and found that companies with longer hold periods demonstrated a stronger relationship, with

Impact Rigor By

MOIC x Hold Period

Avg +68% higher MOIC for high-rigor companies

Avg +37% higher MOIC for high-rigor companies

MOIC x Company Stage

a higher average MOIC. We also analyzed revenue growth across cohorts and found that companies that have generated evidence and maintain rigorous impact measurement have higher average revenue growth.

When examining the data by company stage, we again found similar trends— companies with higher rigor have higher average MOIC than those with no rigor. This pattern was across every stage with Series B essentially flat.

Does evidence show that impact rigor correlates with stronger financial returns?

Revenue Growth x Hold Period

Avg +50% higher revenue growth for high-rigor companies

Impact Measurement Assessment

Alongside our analysis of our GPs’ impact and returns data, we also evaluated their Impact Measurement and Management (IMM) practices. We believe that rigorous IMM holds organizations accountable to their stated impact goals and provides a transparent way to verify their claims. Our assessment focused on six categories; see page 14 for additional details on our rubric.

Assessment Category FoF

How do our GPs’ impact measurement practices compare to industry standards and our internal framework?

Driving Closer Collaboration and Meaningful Outcomes

Looking across the FoF portfolio, outcomes measurement is inconsistent. Even Series A+ companies are still early in tracking outcomes that rigorously demonstrate efficacy of a product. While leading metrics like Net Promoter Score and usage data are instructive, they are lacking in their ability to evidence both ROI and impact to companies, customers and investors. While difficult, collecting and measuring these metrics is possible and we believe this analysis signals compelling financial ROI to doing so as well.

There is real upside in building the systems to capture them and communicating progress to customers. Advancing outcomes-level measurement is a 2026 priority for our team and direct portfolio.

Why This Matters

Clear outcomes build trust with customers, sharpen product focus and shorten sales cycles. We can help standardize definitions, reduce friction and support companies to identify and measure what matters.

How can we leverage these insights to enhance collaboration and deepen impact across both our FoF and Direct investments?

Our Next Steps

Q2 2026

Publish standardized target outcome recommendations and co-create measurement roadmaps with Tier 1 and 2 companies in the EIF portfolio to guide 2026 reporting.

2026

In 2025, we joined EdFirst, an evidence-focused organization comprising of mission-aligned investors, to accelerate our learning and approach to IMM. In 2026, we plan to benchmark outcomes across our portfolio, as well as evaluate a third-party partner to support our IMM approach.

2027 and Beyond

Operate as a field leader in outcomes measurement and reporting, sharing playbooks and benchmarks with our GPs and the broader ecosystem.

Commitment

We will report progress against these goals in our impact reporting to hold us accountable to our own IMM approach.

APPENDIX

Impact Measurement Assessment Rubric

Criteria Description Foundational (0) Structured (1)

Impact Framework Does the fund clearly explain how its investments lead to impact (e.g., theory of change or structured pillars)?

Data Collection Methodology

External Impact Metrics

Does the fund share how it collects, verifies and tracks impact data across its portfolio?

No public articulation of an impact strategy or logic model.

No information on how impact data is collected or validated.

High-level impact goals shared (e.g., themes, pillars) but lacks structured theory of change.

Fund collects company-level data, but limited public transparency on consistency or validation of data.

Clearly defined impact strategy and measurement framework theory that maps investments to learner/worker outcomes.

Fund publishes its defined methodology or tool (e.g., surveys, dashboards, lifecycle tracking) with clear publicly available cadence and validation.

Does the fund report quantifiable, outcome-based metrics, and benchmark them against external standards?

Portfolio Input Do portfolio companies have a role in shaping or informing what gets measured and reported?

Cadence of Reporting

Does the fund publish impact reports consistently (e.g., annually) with comparable data over time?

Partnerships Does the fund engage with thirdparty experts to strengthen its measurement practices?

Reports metrics (e.g., number of learners served), but not benchmarked against standards.

No evidence of portfolio companies shaping metrics or reporting.

Reports both outputs and outcomes across companies. Partial or no benchmarking for company metrics and outcomes.

Investee input is implied or informal (e.g., strong founder relationships).

Includes outcome-level metrics benchmarked against external references for all companies with relevant outcomes.

Portfolio companies co-create or validate impact metrics or influence fund’s IMM strategy.

No regular impact updates; no public reporting.

At least one impact report exists but no multi-year cadence.

No external partnerships for impact validation or learning.

Collaborates with ecosystem actors (e.g., impact advisory councils, Impact Capital Managers).

Demonstrates consistent cadence (e.g., annual impact reporting with trends over time).

Partners with recognized evaluators, researchers or third parties for impact validation or learning infrastructure (e.g., BlueMark).

Our team would love to discuss your insights and your solutions.

educationimpactfund.org

Stay in Touch

Our portfolio is impacting millions of learners who face barriers to success across the postsecondary and workforce landscape. Our investment thesis is driven by the opportunity to remove these barriers by supporting innovative, impact-oriented solutions to improve educational access and outcomes.