THE BUSINESS CASE FOR IMPACT

Introduction

An Evolving Approach for Our Evolving Impact Thesis

Formally launched in 2019, the Education Impact Fund (EIF) is still nascent, and as investors in the education sphere, we know that with youth comes a lot of learning. These learnings continue to evolve every aspect of our fund, including our impact thesis and our approach to what we call Impact Acceleration.

A central tenet of our impact thesis is the importance of clarity—clearly defined impact outcomes enable clear articulation of these outcomes, which demonstrate clear ROI for customers. We want to mirror that clarity in our own reporting.

This year, instead of a lengthy, composite impact report, we have split it into more focused modules. Our first module centers on our impact thesis— delivering on the business case for impact. As we mark our fifth year of impact reporting for EIF, our goal is to clarify our thesis, explain how it informs

our impact acceleration strategy and encourage companies and investors to adopt a similar approach.

We believe our emerging thesis is compelling, and we have conviction that it ultimately will move the needle for our portfolio companies. However, it is still unproven that clearly and consistently measured impact outcomes will lead to better financial results for companies. The evidence for this today is inadequate, and the premise remains questioned by the broader markets, companies and even other impact investors. Still, we are excited by the initial evidence we have seen in the market and our impact acceleration work with portfolio companies. Subsequent reporting modules will follow later this summer, detailing outcomes from our EIF portfolio and fund of funds portfolio.

Thank you for joining us on this journey, and we look forward to learning and sharing with all of you.

–The EIF Team

Our Vision

To accelerate the transformation of America’s postsecondary and workforce ecosystem by investing in innovative companies and collaborating with institutions, employers and communities toward a shared vision of improving education access and outcomes for underserved learners.

Our Commitment

Launched by ECMC Group, EIF is an evergreen portfolio of mission-aligned investments to accelerate the transformation of America’s postsecondary and workforce ecosystem. Our EIF double bottom line impact and return-driven investment strategy sits alongside ECMC Foundation’s strategic grantmaking and program-related investments, collectively enabling ECMC Group to deploy funds across the full spectrum of impact capital toward its mission.

Newly Launched Entrepreneurship Fellowship (2025)

Our Team

Our team was purposefully built with diverse skillsets and backgrounds— early- and later-stage investors, former teachers, investment bankers, nonprofit leaders, venture builders and operators. Collectively, we share a passion for improving outcomes for learners and workers. We are excited to continue testing our hypotheses, and proactively collaborate with our portfolio companies and partners to accelerate the transformation of higher education toward better outcomes for learners.

Our Impact Thesis

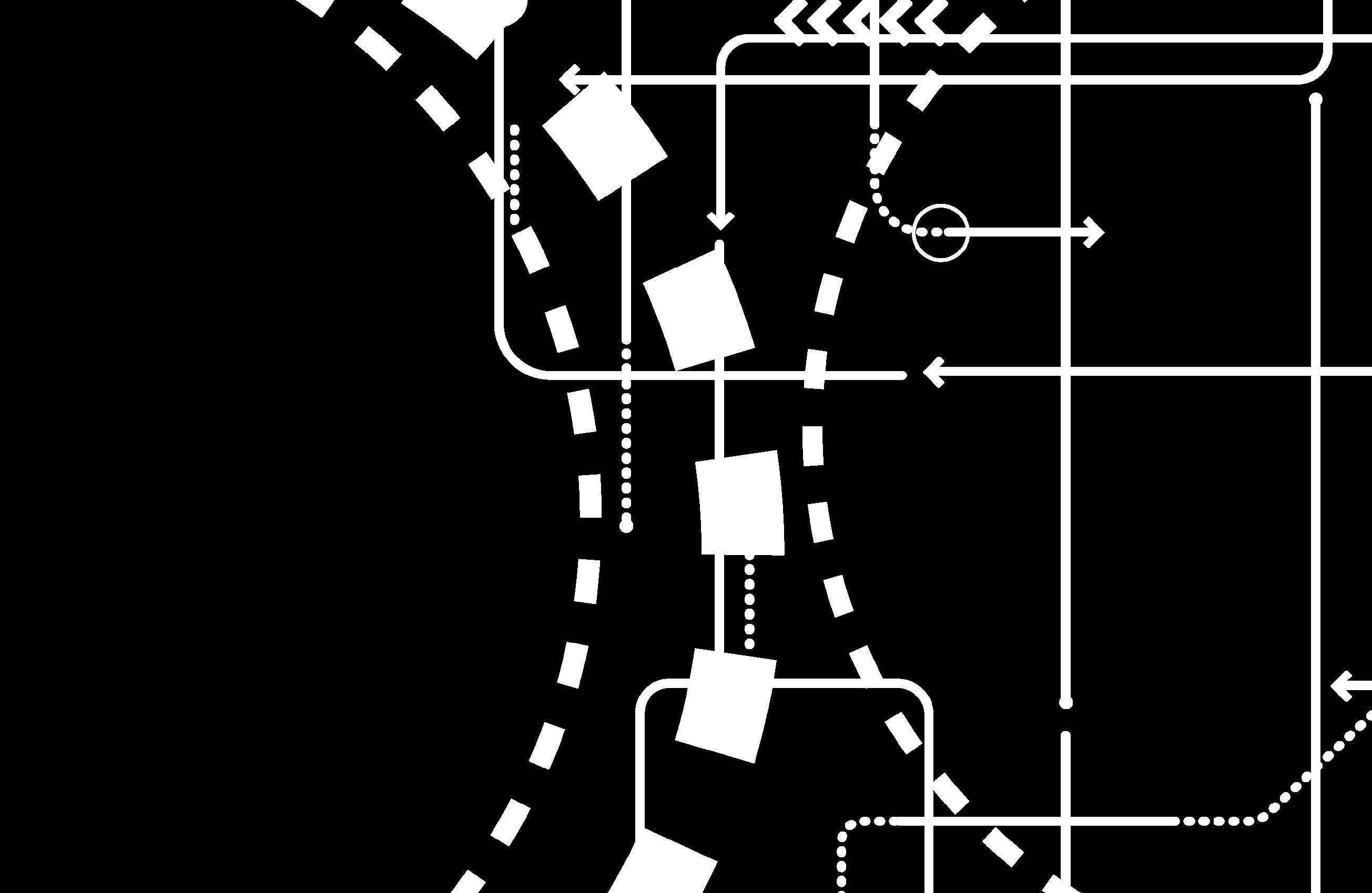

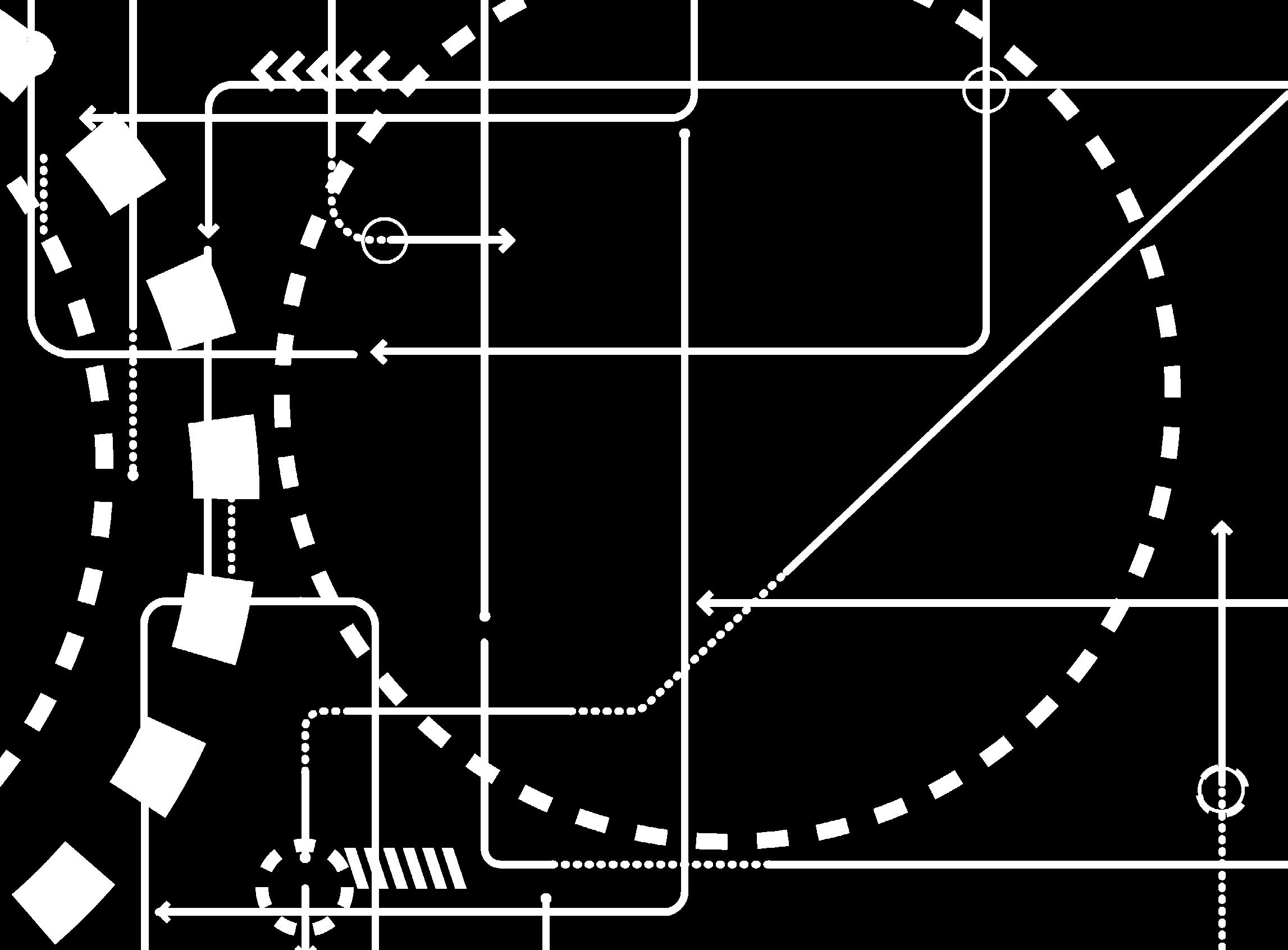

Steps to Identify Metrics That Matter

The idea that investing for impact can drive returns, or “doing well by doing good,” is not new. Additionally, in the education and workforce sectors, it’s even more salient— businesses delivering good outcomes for their learners should result in happy customers. Happy customers lead to growing businesses, which deliver attractive financial returns for investors. In theory, this relationship sets forth the business case for impact.

Our impact thesis aims to clarify this idea a step further—when a company can clearly measure, report and market outcomes that tie directly to the metrics that its customers care most about, or the Metrics That Matter, it can deliver on the business case for impact to its customers.

The Metrics That Matter cannot be vanity metrics. We must focus more on communicating ROI (outcome) and less on learners served (output). While a company’s impact investors may prioritize specific impact metrics, the metrics that ultimately matter most are the ones a company’s customers care about (i.e., drive enterprise value). There is good news in education: if a company is genuinely oriented toward long-term success (i.e., not using shortcuts to spur growth), those metrics are either synonymous or positively correlated with positive learner outcomes.

Learn more on page 9

Demonstrate relevant positive impact and ROI outcomes to customers

Have a high degree of influence on customer renewal/expansion decisions

Both (1) and (2) have been validated by key customer stakeholders

The Business Case for Impact Is Overlooked

Despite the logical case for measuring and communicating impactful education outcomes leading to better business outcomes, education companies (and their investors) continue to overlook, underinvest and underdeliver on the premise.

Overlooked

Of the 100 most used EdTech products across K-12, only 25% have a defined logic model and less than 10% demonstrate any level of evidence of impact.1

Underinvested

According to the EdTech Evidence Exchange, educators estimate that “85% of EdTech tools are poor fits or poorly implemented.”

Underdelivered

65% of EdTech licenses in K-12 go unused.3 A survey across a diverse set of nine institutions showed that 56% of college faculty agree that it is difficult to know whether an EdTech product will work effectively.4 College faculty that agree that it is difficult to know whether an EdTech product will work effectively

Case?

Barriers to Investing in Outcomes

It’s difficult, expensive and time consuming

• Early-stage companies must be extremely efficient, optimizing their burn across several functional priorities, particularly in the current fundraising environment. This leaves little opportunity to proactively invest in data systems and impact evidence that can demonstrate key outcomes that will lead to customer expansion and growth.

• Impact measurement is often not a core competency/skillset of the founding team.

• Truly rigorous impact measurement is time consuming; designing and executing quasi-experimental, correlational or control trials can take a long time and can be expensive if led by a third party.

It’s hard to distinguish the signal from the noise

• Impact investors often ask for metrics intended to satisfy their own or their Limited Partners’ (LPs) demands for impact data. Companies in the education sector often have multiple impact investors on their cap table. This often leads to onerous reporting and collecting metrics that do not directly inform business decisions.

• While educators and administrators have clear conviction around their impact, their institutions do not often have inherently data-driven processes for education technology or service provider evaluation, making it difficult for companies to ascertain the data/metrics their school customers genuinely care most about.

The value of it has historically been questioned

• “It’s an open secret in the EdTech industry that the success of a company is often unrelated to the quantifiable learning outcomes of their product.”1

• We have heard directly from EdTech companies that dismiss the potential value of quality/efficacy certifications, noting that no one they speak to in their go-to-market process cares about these certifications.

• EdTech certifications face a similar problem that micro-credentials grapple with—the sheer volume of them is exploding, and unless they are broadly recognized and transacted upon, they are relatively low-value for those pursuing them.

None of this is intended to say third-party studies, certifications or metrics requested by impact investors are without merit and impactoriented companies should completely disregard them. Rather, our thesis is that the only impact Metrics That Matter are those that a company’s customers care about enough to drive their renewal decision on. Everything else is secondary.

Validating the Metrics That Matter: From Vendor to Strategic Partner

Identifying, measuring and marketing the Metrics That Matter may sound like an obvious concept, but as described in the previous pages, it is easier said than done.

Influencing stakeholders in complex, matrixed organizations, i.e., schools, universities, large-scale enterprises, is a notoriously slow and unclear process. Genuinely validating (not presuming or projecting) which metrics matter to stakeholders is difficult and requires intentionality and persistence. Clearly reporting and demonstrating ROI within real-life use cases outside of a controlled experimental environment is hard.

But it can be done. And education businesses’ customers are demanding it more and more—both implicitly (i.e., churn!) or explicitly (e.g., evidence requirements in RFPs). Companies need to show that investing in their product/solution impact outcomes can be quantified as an economically efficient, high-ROI way to solve operational challenges and evolve from vendor to strategic partner.

Delivering on the Business Case for Impact

Because of its centrality to our impact thesis and our belief that zeroing in on the Metrics That Matter can move the needle for companies, we have built an Impact Acceleration platform hyper-focused on supporting our portfolio companies’ execution. In each step of the Metrics That Matter framework, we have scoped projects and identified opportunities that position our portfolio companies to deliver on their business case for impact.

Metrics That Matter (MTM) Strategy

Identifying and validating the right metrics

Business Case for Impact: Strategies for Success

• Identify MTM—these are metrics that matter to both learners and customers

Potential Pitfalls

Measuring them rigorously Communicating them clearly to customers to drive growth and expansion

• Direct questions, posed to key stakeholders, lead to key insights on which outcomes influence value/ decision making

• Take a walk-crawl-run approach; outcomes often take a long time to gather the requisite data, so identify quick-win metrics that can provide leading indicators and serve as a bridge to more longitudinal outcomes data

EIF Approach

Analyzing the data to inform product enhancements

• Not validating data with customers (e.g., presumptuous metrics reporting)

• Focusing on metrics that only matter to external stakeholders, like impact investors

• Data lacks rigor (i.e., foundational and formative vs. summative outcomes data)1

• The way to validate data with customers is to learn directly from customers; our Impact Acceleration team supports our portfolio companies by:

• Conducting voice of the customer work, including synthesizing and sizing customer feedback and needs

• Stakeholder mapping to tailor data to customer segments

• Net Promoter Score (NPS) and Customer Satisfaction (CSAT) support (baseline data required for customers)

Metrics That Matter (MTM) Strategy

Business Case for Impact: Strategies for Success

• Invest time, talent and resources early on to ensure ability to collect data that will be necessary to convert early pilot customers into expansion

• Proactively develop systems and processes to measure MTM across key customer subgroups (i.e., MTM can vary across customer personas)

• Refine collection processes to have meaningful data ready for key renewal/ expansion decision points

Potential Pitfalls

• Measuring only outputs vs. outcomes, i.e., descriptive statistics (learners reached, active students) vs. outcomes (A/B testing of learner engagement, persistence, wage uplift)

• Segmenting customers based on descriptive variables (size, demographics, etc.) vs. desired values and outcomes

• Measuring the same data across all customers

• The goal is to measure MTM at the level of rigor customers require to land and expand partnerships. We help each portfolio company progress its approach through:

• Customer segmentation work to identify and build MTM-based reporting around key customers

• Supporting product efficacy research to drive commercial outcomes

Metrics That Matter (MTM) Strategy

Business Case for Impact: Strategies for Success

• Segmenting communication and marketing strategies to use MTM to the right customers is essential

• If decision makers don’t have the MTM to engage in renewal/expansion decisions, changes to internal processes and/or product need to be sized and scoped

Pitfalls

• Use metrics in marketing collateral but with no real tie to sales lift given little/ no proof of product efficacy

• Focusing on stats/features vs. ROI/outcomes

• Designing customer success dashboards and processes around the “average” customer

• The lessons learned from customers are tied directly to product roadmap prioritization. Our team supports:

• Identifying gaps in marketing MTM and refining sales and customer success collateral to align the story and metrics to each customer

• Right-sizing lessons from customer discovery and updating outbound sales efforts

Metrics That Matter (MTM) Strategy

Business Case for Impact: Strategies for Success Potential Pitfalls

• Having tight feedback loops between customer success and product orgs

• Sizing customer feedback consistently–weighing financial impact (likelihood of renewal/signing), reputation risk and competitive positioning

• Without clear understanding of MTM to customers, product roadmap and prioritization does not reflect what active customers need to renew or expand

• Clear, timely and consistent feedback (from in-app-surveys, QBRs, even exit interviews for churned/lost customers are key to surfacing insights that can map to necessary product updates

• Our team supports deep data analysis for current/prospective portfolio company customers to:

• Size customer impact of action (or inaction)

• Analyze product and operational updates by customer segment

• Support the development of a business case

• Gather the right stakeholders to land decisions and game plan communication back to customers

Promising Early Evidence

Evidence in the Broader Ecosystem

We are doubling down on having our portfolio companies validate the Metrics That Matter. In doing so, we believe our fund can help accelerate their impact and growth, while further proving the business case for impact. Our team has seen early promising results within our portfolio and in the broader ecosystem.

Our team is impressed with encouraging data from the Jacobs Foundation, which conducted an analysis of its fund of funds portfolio to assess the relationship between evidence and the multiple on invested capital (MOIC).1 Specifically, the Jacobs team analyzed the underlying portfolios of two funds and found that average MOIC for companies with evidence was 50% higher than those without evidence in that fund.

The second fund results were even more impressive with average MOIC 70% higher for companies with evidence vs. those without.

What makes this initial assessment especially compelling is that the definition for “evidence” was inclusive of early-stage work (such as logic models), in addition to large-scale product efficacy research. As the foundation acknowledges, the relationship it is observing between impact outcomes and MOIC is not necessarily causal, and certainly the overall dataset remains relatively small, but we applaud the Jacobs Foundation’s leadership in this work. We are excited about the potential to expand the evidence base going forward, leveraging data from EIF’s fund of funds portfolio.

50% Higher

70% Higher for companies with evidence for companies with evidence

The average multiple on invested capital for companies with evidence was 50% higher than those without evidence in that fund.

The second fund results were even more impressive with average MOIC 70% higher for companies with evidence.

Evidence in Our Portfolio

We are doubling down on having our portfolio companies validate the Metrics That Matter. In doing so, we believe our fund can help accelerate their impact and growth, while further proving the business case for impact. Our team has seen early promising results with Project Cosmos and Project Freestyle.

Develop New Sales Materials to Drive Customer Expansion

Project Goal

Scale a pilot with a leading U.S. healthcare provider to create a reference customer and drive repeatable sales.

Getting to the Metrics That Matter

Targeted conversations with the pilot champion surfaced key metrics for expansion, including data on reduced turnover and vacancy rates.

Early Results

We partnered with the company to create a case study highlighting early pilot results—showcasing improved patient care perceptions and validated metrics like reduced turnover and vacancy rates. By focusing on decision-relevant outcomes and crafting targeted collateral, we’re paving the way for expansion and broader product adoption.

Customer Discovery to Refine

Value Proposition

Project Goal

Validate product impact on retention and graduation to demonstrate business value— leading to increased customer utilization.

Getting to the Metrics That Matter

To assess the need for efficacy studies, we began with voice of the customer research. Customers prioritized implementation and operational feedback, prompting a shift in focus—efficacy remains on the roadmap but is currently delayed.

Early Results

The company is evaluating how widespread similar customer feedback is, its impact on utilization and required product updates. Insights from this work will shape customer success playbooks and the product roadmap to better align with customer priorities and drive growth.

Are you building a solution in education or workforce development that makes a strong business case for impact? Reach out to our team! educationimpactfund.org

What’s Next?

This summer, our team will be reporting on impact outcomes across our full portfolio. This fall, we will be conducting a meta-analysis on our fund of funds portfolio. Our goal is that each of these modules will add to the evidence base and continue to prove the business case for impact.