ProfessionalECHELON SOUTHERN CALIFORNIA EDITION Q3.22 About and By Echelon Professionals CLICK WITH CAUTION! Contracts That Lie In Wait! LOVE ACTUARY! Feeling Fab in Dodger Blue SPECIAL NEEDS TRUSTS: An Important Assurance Just Go For It! Family Law Attorney Kendra Thomas Takes Big Leaps

BIOGRAPHIES 10 It’s Actually Love Actuary How Mark Fishman has turned a passion for hard work and customer service into a top actuarial firm. 20 A Rush of Variety Boring is not a word to describe family law attorney Kendra Thomas FEATURES 16 Click With Caution! One quick “click click” and you might be bound to a not-so-great contract 24 Special Needs Trusts: An Important Kid of Assurance When is a special needs trust necessary? 28 The IRS Says I Owe How Much? Tax law plays a very important role in a divorce settlement, especially when your ex-spouse had a business you didn’t know about 32 SEO Simplified Demystifying what SEO is, how to do it, and why it is critical for professional service business survival COLUMNS 38 LAW: Terminating Employees Answers to common questions CONVERSATIONS 40 ONE-ON-ONE with Jaime Davison My Finance Resource 42 ONE-ON-ONE with Matt Coletta M&A Business Advisor CONTENTS Q3.22 20 10 24 28 16 DEPARTMENTS 4 FROM THE CHAIR 6 CHECK IT OUT: QUICK BITS 36 Membership Has It’s Benefits Cover Photo: Brian Hemsworth

I’ve always been fascinated by what makes someone choose the profession they do. Everyone has a story. Everyone likes to do something other than work. When I ask about a person’s hobby or passion outside of the office, I almost always get something unexpected.

Take Kendra Thomas, our cover bio. Family law attorney who handles some pretty gnarly cases. Her practice has morphed into a bit of a concierge practice. But ask her what she loves to do? Check out page 20.

Then there is Mark Fishman. Great guy to chat with and extremely knowledgeable with pension plans and actuarial tables. But you would never guess him to be an actuary.

He bucks the stereotype. Die-hard Dodgers fan as well as that mop-top foursome from Abbey Road, Mark’s passion is rooted in his family and travel. Read his story on page 10.

Attorney David Schneider has an estate planning practice, and his passion (even though it’s part of his work) is helping families who have children with special needs. He writes about how important Special Needs Trusts are on page 24.

There’s so much more in this issue. A passion of mine to produce. While this issue took longer than planned, it’s one I’m very proud to give you to read. Enjoy.

Echelon Professional Magazine is a publication written exclusively by and about the members of Echelon Business Development Network.

ECHELON BUSINESS DEVELOPMENT NETWORK

Jerri Hemsworth, Newman Grace Inc.

Members

Jim Cagle, Allegent Group Matt Coletta, M&A Business Advisors

Echelon Advisory Board

Davis Blaine, The Mentor Group

Mark Fishman, Actuaries Unlimited

Adam Grant, Alpert, Barr & Grant

Brian Hemsworth, Newman Grace

De Ivett, 5D Spectrum

Renee Jacobs, Echelon Business Development

Robert Klein, The Law Offices of Robert M. Klein

Brian Rabinovitz, Citrin Cooperman

Robert Sniderman, HR Focus

Terry Sternberg, Law Offices of Terence M. Sternberg Steve Weber, HW Premier

Publisher

Newman Grace Inc.

Brian Hemsworth

Editor/Social Media Taryn Gray-Delahunty

Jerri Hemsworth

Herbst

Mason Bissada William Colinas Taryn Gray-Delahunty

Newman Grace Inc. 6133 Fallbrook Avenue, Woodland Hills, CA 91367 P: 818.713.1678

Volume Q3 2022. Copyright ©2022 by Newman Grace Inc. and Echelon Business Development Network LLC. All rights reserved. Reproduction in whole or in part without

Jerri Hemsworth Chair, Echelon Business Development

Chair

Managing

Editor

Assistant

Design Direction/Production

Brian

Editorial Contributors

Editorial/Advertising Offices

written permission is prohibited. Advertising rates and information sent upon request. Acceptance of advertising in Echelon Professional in no way con stitutes approval or endorsement by Newman Grace or Echelon Business Development Network of products or services adver tised. Echelon Professional Magazine, Newman Grace or Echelon Business Development Network reserve the right to reject any advertising. Opinions expressed by authors are their own and not necessarily those of Newman Grace or Echelon Business Develop ment Network. Echelon Professional Magazine reserves the right to edit all contributions for clarity and length, as well as to reject any material submitted. Not responsible for unsolicited manuscripts. This periodical’s name and logo along with the various titles and headings therein, are trademarks of Echelon Business Develop ment Network LLC. PRODUCED IN U.S.A. FROM THE CHAIR Professional service providers are so much more than their professions. 4 ECHELONPROFESSIONAL.COM THE ECHELON PROFESSIONAL: Expect the Unexpected I ProfessionalECHELON

Are your clients faced with big estate taxes?

wealth transfer strategies allow for the transfer of qualified and non-qualified assets in a cost efficient way with fair market values discounts of up to 60%. No controversy or need for a legal opinion.

us to see how we can help your clients navigate the high cost of transferring assets.

IN OUR EVER-CHANGING WORLD Our

Contact

818–222–2300 • hwpremier.com

Quick Bits

Beyond “Entrepreneur”

Changing from Entrepreneur to CEO can certainly be a struggle. But there is a way to succeed.

BY RANDY MILLER, RMM Accounting

BY RANDY MILLER, RMM Accounting

either add-ons to someone’s regular workload or the entrepreneur adds them to his/her list. The result is that the entrepreneur spends more and more time in administrative work instead of building the business.

Investopedia defines an entrepreneur as “an individual who creates a new business, bearing most of the risks and enjoying most of the rewards.” And certainly, beginning with the Great Financial Meltdown in 2008 and through the pandemic, there have been millions of people who have, from one motivation or another, become entrepreneurs.

But there is a significant difference between being an entrepreneur and being an Owner/CEO. One is the business, the other runs a business. Many “entrepreneurs” struggle to navigate the transition to CEO and as a result their business plateaus.

HOW TO TRANSITION SUCCESSFULLY

The first and hardest step is making the conscious decision to develop the organization of the business. This includes building trust with your staff and bringing in professionals.

Almost every business starts out small; an idea, (maybe a vision), a few employees (often only 1), and a little bit of money to launch. Then it begins to grow. For a period of time, the entrepreneur can manage this as they do everything or rely on 1-2 people (often family or friends) to help. But they still retain control over every facet of the business.

As the business grows, employees are added, roles are created. In many cases, the structure still revolves around the entrepreneur’s need for control. Organizationally, the company structure is still flat. Supervisors or managers may be in place, but their authority is limited to overseeing daily activities without much thought about goals beyond month-end.

Often areas of neglect include the Accounting, Human Resources and Legal functions. As these are not revenue producing departments, entrepreneurs are often reluctant to spend on staffing these areas. Many of these duties are

At this point the entrepreneur is faced with a decision: Delegate control or stagnate. This is a harder decision than most will admit. Many will deflect by insisting that they already delegate, and on a task level they do, but often only the smallest of decisions do not require the entrepreneur’s approval.

Bringing in professionals or outsourcing certain functions not only frees the entrepreneur to focus on continuing to build, but also brings in viewpoints and expertise to accelerate that success.

When you move beyond “Entrepreneur” you have created a business where managers who know the vision, daily operations run without your input, and you are focused on strategic growth.

CHECK IT OUT 6 ECHELONPROFESSIONAL.COM

Who Reads Blogs?

Read marketing blogs, and you will likely see the question posed, “Is blogging losing steam?” It’s like the obligatory business reporter’s question while the stock market rages, “How long can the market keep rising?” or the sport reporter’s prodding of a coach, “How long will you be able to keep the win streak?”

The fact is, blogging is BOOMING! According to a recent study by Data Box titled “The Shift in Your Content Marketing Mix: 25 Marketers On What’s Changed in 2 Years,” 68% of business professionals surveyed said they find blogging is more effective than it was 2 years ago!

Roughly 409 million internet users read some 20 billion blog pages monthly! This is a good indication why 50%+ of marketers use blogging as a primary content marketing strategy. Furthermore, blogging continues to flourish with a 12% increase in the last five years.

Worldwide, more than 75% of all internet users read blogs. Internet users in the U.S. read blogs at triple the rate of emails!

And speaking of blogs, have you seen the Echelon blog lately? Check it out: https://echelonbizdev.com/ echelon-member-blog/

Rams Purchase And Plan New HQ

IN ECHELON’S BACKYARD

It’s official—Los Angeles Rams owner

Stan Kroenke has been named as the buyer of the defunct Westfield Promenade mall in Woodland Hills, Calif. The purchase comes as Westfield only recently completed their own plans for the property, including years of predevelopment getting city officials to approve their said plan.

The Westfield plan called for $1.5 billion investment into making it a 3.2 million mixed-use project. It would have included 1,400 apartments, a hotel, restaurants, retail space, an office building, and a 10-15k seat sports facility, which was rumored to double as a concert venue.

While Rams’ plans are still vague, it is believed they will build their team office and headquarters on the site, along with a practice facility. There is also speculation they team may build some mixed-use facilities in the way that we now see at SoFi Stadium, the home playing field of both the Rams and the Chargers.

What will this mean for local firms and businesses?

Hard to say. Some see it as a much-needed kick for restaurants and hospitality in the area. One partner at a local law firm, who has offices overlooking the site, weighed in, “The real estate market will probably be affected, more than it is already. And commercial real estate may get a boost, especially for firms who have super fans as owners and partners. It would be pretty cool to look down onto the stadium from our office at lunch and just watch practice.”

Photo by Brevin Townsell, courtesy L.A. Rams

Humanize Your Marketing

Economic growth is projected to continue in the second half of 2022, but the combination of high inflation, monetary policy tightening, and the slowing of housing market, a modest recession is likely for next year. This is according to a new report from the Fannie Mae (FNMA/ OTCQB) Economic and Strategic Research (ESR) Group.

Steve Morris is an author, brand and culture advisor, and speaker based in San Diego, Calif. He works with business leaders to mine, articulate, and activate their driving belief system to create organizational integrity, evolved leaders, connected cultures, and unignorable brands.

His book The Evolved Brand—Why and How to Build a Brand with Soul and Humanize Your Marketing, explores how evolved brands are born from awakened leaders who realize that their business can do more than simply make a profit.

The book is written to give business leaders. regardless of company size or industry, the inspiration, insights, and tools needed to evolve their brand, business, and marketing to its full potential.

Steve is a successful serial entrepreneur and currently leads his brand, culture, and business consultancy Matter Consulting.

The Evolved Brand is available at Amazon.com.

The ESR Group is forecasting 0.0 percent real GDP growth on a full-year basis through 2022, but it revised downward its expectations for fullyear 2023 growth by one-tenth of a percentage point to negative 0.5 percent. The slowing real estate market along with rising interest rates are certainly among the drivers of this.

“In our view, the recent interest rate surge is due

to the market’s recognition of two critical factors: that inflation is indeed not transitory, and that, to tame it, the Federal Reserve will need to be resolute, even at the risk of possible recession,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “Inflation’s entrenchment—and the policy action likely required of the Fed—confirms the expectation in our

Top Blog Posts on EchelonBizDev.com for

BY JENNIFER FELTEN, ESQ, RELAW

BY JENNIFER FELTEN, ESQ, RELAW

BY ABEER SWEIS , SWEISKLOSS

BY ABEER SWEIS , SWEISKLOSS

CHECK IT OUT

Q2 8 ECHELONPROFESSIONAL.COM

IS RECESSION INEVITABLE? Beware of New Requirements for California Transfer Upon Death Deeds in 2022

5 Ways to Increase Your Cash Flow BY RANDY MILLER, RMM Accounting 5 Vital Questions to Ask an Architect Before You Hire Them

Marketing doesn’t need to be an uphill battle.

impact advertising online marketing sales collateral corporate branding brand maximization audits newmangrace.com | 818-713-1678 NEWMANGRACE.COM

10 ECHELONPROFESSIONAL.COM

loveactuary it’sactually

BY MASON BISSADA

How

Mark Fishman has turned a passion for

hard work and customer service

into

a top actuarial firm.

Mark Fishman was surprised to see his former boss in the lobby of the medical practice he was hoping to secure as a client. At that time, Mark had been an actuary for about 10 years, and was even more surprised to find out that he would be competing with said former boss for the medical practice’s business. As a third party administrator (TPA), Mark is used to assessing risk and avoiding sur prises, but this had him a bit unnerved.

Surprises continued to fly at Mark, as the doctors representing the practice asked both Mark and his former boss to sit down and have lunch with them at the same time. The doctors began to ask Mark questions in front of his former boss while they were all eating, and it quickly became clear that he was being interviewed for the position right then and there. What’s worse, his former boss was taking notes. When the questioning shifted to the other candidate, Mark began to take notes as well, but his former boss quickly requested that Mark leave the room. The doctors thanked Mark for his time and asked him to leave. Not exactly ideal interview conditions.

“I was astonished, embarrassed, and upset that I let myself be played like that,” Mark recalls years later. “I couldn’t get this out of my head for days.”

Losing the Battle, Winning the War Time pass and Mark assumed he’d lost the client. But then, yet another surprise came Mark’s way, and it was finally a positive one. He got a call from the medical practice, and they let him know that his firm got the case.

“I asked the reason for this decision and they told me that the other TPA had a huge ego and spoke down to these doctors who were very promi nent,” he said.

Anyone can attest to the difficulty of doing business with someone who’s full of themselves. But what Mark didn’t realize is that he must’ve been somewhat of an opposite of the ego

tistical man that sat next to him that day during lunch. The doctors must’ve seen something in him that made them want to do business with him— some innate quality that made him the opposite of egotistical: humble, relatable, and personable.

The medical practice meeting took place back in 1994. Now, more than 25 years later, Mark uses this humil ity and relatability to connect with numerous other clients. As a partner at Actuaries Unlimited Inc. (AUI), Mark helps determine liability, risk, cash reserve requirements, and premium levels for insurance companies. As a third-party administration and actu arial consulting company, Mark’s firm also designs and administers retire ment plans such as Defined Benefit Plans, Cash Balance Plans, 401(k) Plans, and Profit Sharing Plans. They certify and make sure that these plans

are in compliance with all of the gov ernmental laws and regulations.

All of that sounds pretty compli cated, right? Well, Mark understands that it can get a bit confusing for someone unfamiliar with the job.

“This is a very complicated and complex profession,” Mark says.

“Many times the TPA’s explanations are confusing and unclear using our profession’s jargon, acronyms, and not being sophisticated enough to under stand a client’s overall situation and what the objective is.”

That’s what makes Mark good at what he does, and it’s probably what swayed those doctors to hire his firm all those years ago. He wants to help clients thoroughly understand what he does, so he can better meet their needs and build a long-lasting busi ness relationship. Being personable and likable can go a long way in any

12 ECHELONPROFESSIONAL.COM

“Over the years, I have received the gift of knowing that our firm provides for so many families to help them enjoy their lives and provide for their children.”

business transaction, let alone one as con fusing and unexciting as one involving actuaries. Mark runs a successful firm that is federally licensed with employees prac ticing in nine differ ent states. He is not only good at what he does, he is also good at relating to those with whom he works.

Relatable Beginnings

While these qual ities are innate in Mark, there are several moments and people in his life that helped shape him into the person he is today. He credits his parents for his unwavering optimism, work ethic, and sympathy. Both his mother and father came to the U.S. as holocaust survivors—his father spent five years in a concentra tion camp, losing all but one of his 10 siblings in the process. His par ents didn’t allow these painful trag edies to stop them from providing a better life for Mark.

“My dad and mom worked very hard to live a modest but good life in order to provide me with everything they could,” he says. “I developed their strong work ethic, dedication, and integrity to be successful and live a good life. They always looked toward the future and made family their priority since they lost their entire family in WWII. Everything was taken from them at early ages and they were still able to look to the future and be thankful for what they earned and for their freedom and opportunities they had here in the United States.”

Because of the values his parents instilled in him, Mark was able to turn his own work ethic into produc tivity, and a determination to get the answers he needed career-wise. He graduated from UCLA with a degree

in mathematics, and started working in the aerospace industry as an electri cal engineer. However, while attend ing graduate school in the evenings, he stumbled upon a flyer that peaked his interest.

“Use Your Math Skills. Become an Actuary,” it read.

A simple suggestion, but that was enough for Mark. He pulled out a phone book (no Google back then) and turned to the “A’s” in search of “Actuary.” Sure enough, he found Actuaries Unlimited, Inc., and gave them a ring. He had a straight-for ward question: what does an actuary actually do? The receptionist told Mark there was no one available at the moment to answer his question, but he wasn’t ready to take no for an answer. He begged and pleaded with the receptionist, asking for just a minute of anyone’s time. She finally caved, and passed the phone off. A man (who would turn out to be the owner of AUI) picked up the phone, and Mark asked his question. They proceeded to talk for twenty minutes, and by the end of the call, the owner was urging Mark to apply for their entry level position at the firm. Look ing back, once again, something about Mark resonated with his conversation partner. Whether it be over the phone

or in person, Mark is able to relate, connect, and win over those he speaks to. He cares, and people realize it’s true.

Mark went in for the inter view, and AUI offered him the position, though they could only offer half the salary he was making in the aerospace industry. But something about the actuary trade excited him, and he wanted a career shift, so he went with it. He stayed with AUI for a few years and then moved on to work at other firms, honing his skills and advancing his career. Seven years later, AUI called him up and asked him to come back. By this time, Mark was in his mid-thirties and wasn’t interested in just another position. So AUI offered him a partner ship. He’s been with AUI ever since.

“My takeaways from all of this is: Don’t be afraid to make changes,” Mark reflects. “Take calculated risks, go with your heart, be persistent, have integrity, and impress your co-workers and those in positions above you.”

Getting Personal, Being Personable

If there is a downside to being so personable, it’s that lines tend to blur between work and home. When you make everything about personal rela tionships, where does work stop and life begin? That is the line that Mark has been attempting to walk through out his career, navigating through more difficulties and tragedies. Mark has two adult sons, Evan and Cam eron, who were forced to deal with the loss of their mother when they were just ages 13 and 11. Beyond grieving his ex-wife (they’d divorced five years prior), Mark had to learn how to be a single parent and support his sons through the unimaginable.

“I learned a lot about myself at that time,” Mark recalled. “I had to step up as a father, make my boys my priority over everything else and learn how to

13ECHELON PROFESSIONAL Q3 2022

Raised in Los Angeles, Mark’s an avid Lakers and Dodgers fan and his office is full of L.A sports memorabilia to prove it!

loveactuary

be organized as a parent and partner at my firm. I am grateful for my part ners at AUI who allowed me to take care of my boys and be there for them when I needed to be.”

Today, Mark is still finding that balance. He’s been with his partner

als in my firm who can. I feel that our high level of service and expertise is what separates us from our other competitors, so I continue this level of service even when I am traveling in other countries.”

A Day in The L.A. Life

Outside of traveling, Mark finds time for interests closer to home. Raised in L.A., he’s an avid Lakers and Dodgers

stadium where he had the pleasure of meeting a certain Liverpudlian.

“About 10 minutes before the con cert started, they let in the VIPs and who had seats immediately behind me, but Ringo Starr and his wife Bar bara Bach. As Ringo was about to sit down, I introduced myself to him, shook his hand and had a small con versation with him. Then later in the concert, Ringo left, went backstage and came out to play two of Paul’s encore Beatles songs. So in one night, I got to meet Ringo AND see him play with Paul McCartney on stage. That was a night I’ll never forget and was one of the highlights of my life.”

While striking the work/life equi librium has been challenging, Mark ultimately finds the work rewarding. As a partner at his firm, he takes pride in his employees, and his personable nature allows him to build genera tional connections with folks.

Carrie for more than 16 years—he met her on Match.com, after a bit of nudging and encouragement from his sons, and they love nothing more than to travel the world together. Mark has been all over: Israel, Greece, Italy, Germany, Poland, Czech-Republic, Turkey, and France to name a few. But even when he’s on vacation, he finds himself responding to emails from work. He finds it crucial to maintain those same personal connections that have helped build up his clientele in the first place.

“It’s very difficult when I have strong relationships with clients and referral sources that depend on hav ing their retirement plan concerns answered and dealt with,” Mark says. “So I either respond as soon as I can or pass it on to other profession

fan. He’s been a season ticket holder for more than twenty years, and his office is full of L.A sports mem orabilia (he has an original Sandy Koufax bobblehead!). While it pains him that he wasn’t able to witness it in person because of the pandemic, he was overjoyed to see both of his teams win championships in 2020.

He also prides himself on his passion for The Beatles, and deems “A Day in the Life” to be one of the greatest songs ever made. He knows every Beatles song, plays them for his kids, and whatever space in his office that isn’t taken up by L.A. sports memorabilia is covered in Beatles memorabilia. Ask him to tell you about one of the most memorable nights of his life, and he’ll recall a Paul McCartney concert at Dodger

“Over the years, I have received the gift of knowing that our firm provides for so many families to help them enjoy their lives and provide for their children,” Mark says. “We have seen so many employees going from being single, to married life, and then having children who grow up, go to college, and start their pro fessional careers.”

The joy that Mark finds in seeing his employees flourish falls perfectly in line with what helped him succeed in this business in the first place: he cares about people, and more than that, he understands them. He’s seen hardship and tragedy throughout his life, and this has helped him under stand that other people are all we’ve got. Talking down to others and plac ing yourself above them will you get you nowhere. Mark places himself on level ground with his family, clients and employees, and it’s worked out pretty well for him.

“Always be yourself,” he concludes. “Be real, do not oversell, keep it sim ple and speak in terms that are basic and understandable. Lucky for me, that comes easily and naturally.

14 ECHELONPROFESSIONAL.COM

Click with

BY MADISON B. OBERG, ESQ.

A s you browse a website, be cautious before you click on the user agreement. Not all online agreements are favorable for users. They are considered “contracts,” and it’s always best to fully understand the terms of any contract before you sign on the dotted line. This issue was recently addressed by a California appellate court in B.D., a Minor, etc., et. al. v. Blizzard Entertainment, Inc.

In Blizzard, a dispute arose between the owner (“Owner”) of an online gam ing website and a user (“User”). User filed a lawsuit in state court, and Owner moved to compel arbitration. That means that User had to submit the dispute to arbitration. Owner argued that arbitration was required per the dispute resolu tion provision incorporated into its online licensing agreement.

The court held in favor of Owner and concluded that the arbitration provi sion was enforceable because User had sufficient notice. In reaching this conclu sion, the court identified and analyzed four different forms of online agreements of which consumers should be aware.

One quick “click click” and you might be bound to a not-so-great contract.

CAUTION! 16 ECHELONPROFESSIONAL.COM

FOUR ONLINE AGREEMENTS TO BE AWARE OF

1. Clickwrap

A “clickwrap” agreement, as the name suggests, requires the website user to click a button to accept the terms of use of the website. For example, when signing up for an account with Total Wine, you will see (left) that you must expressly click a box acknowledging that you are 21 and that you agree to its Terms and Conditions.

2. Scrollwrap

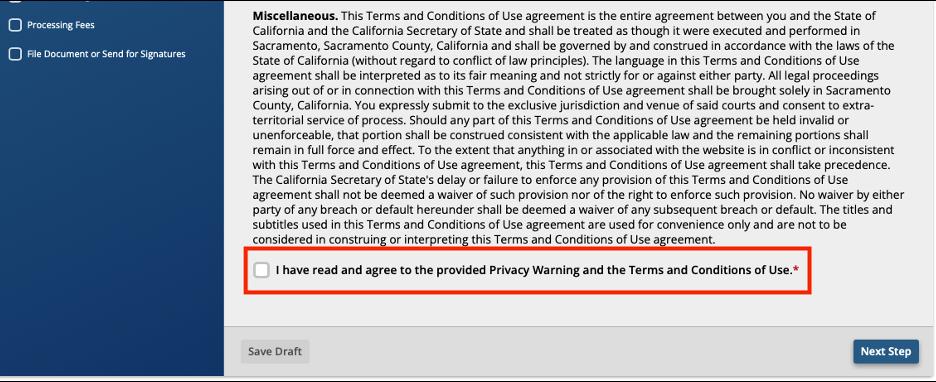

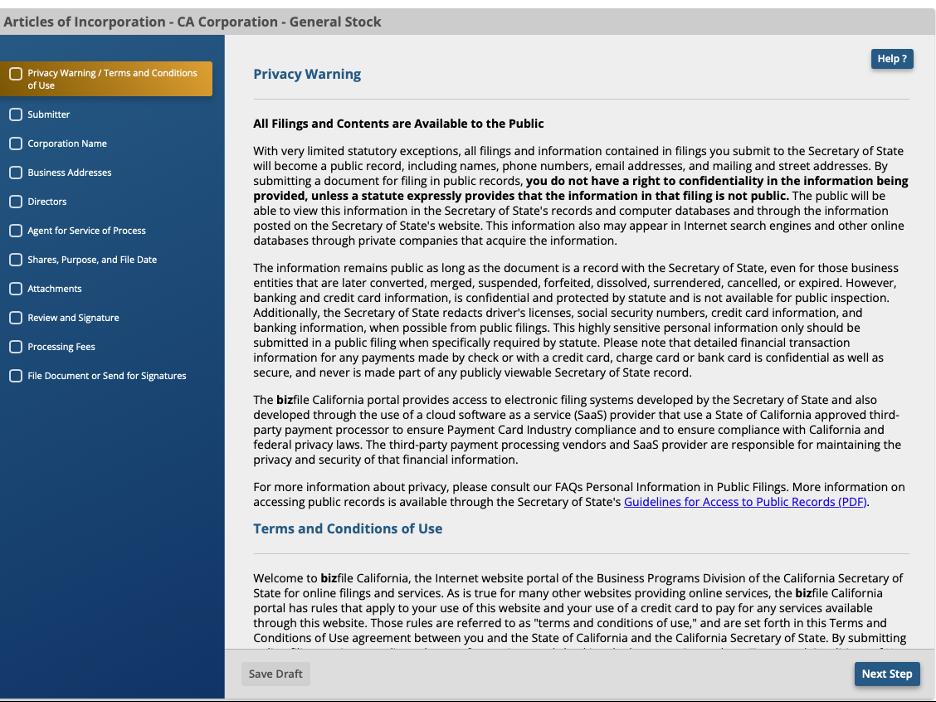

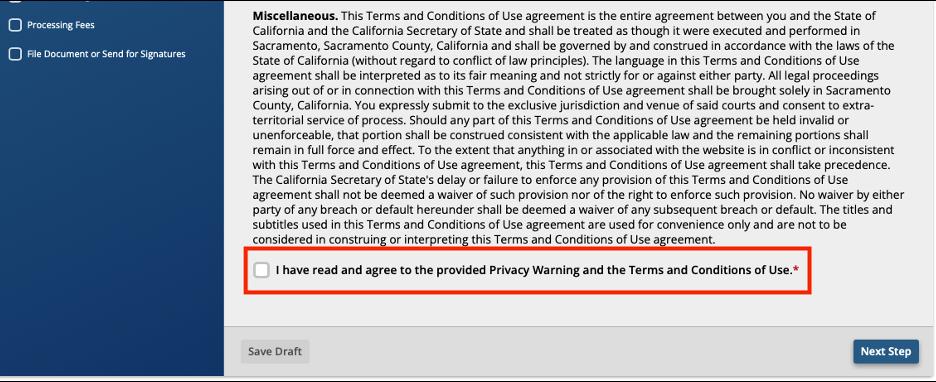

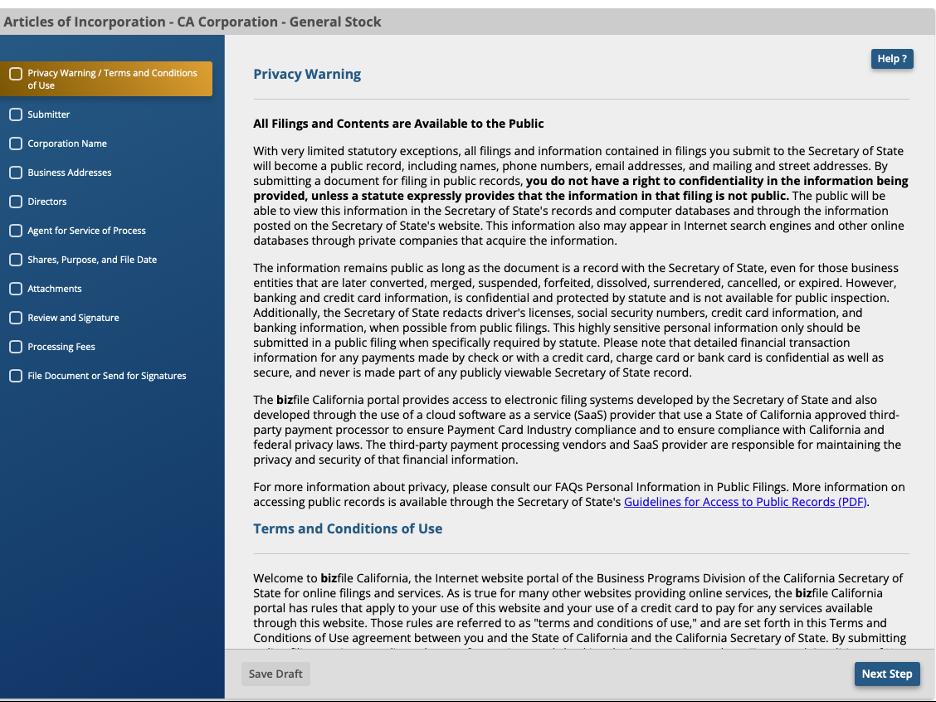

A “scrollwrap” agreement is similar to a clickwrap agree ment, but the user must physically scroll through the entire agreement before it can reach the button by which they accept terms. For example, in order to file a form online with the California Secretary of State, you will now see (right) the agreement pop up. After scrolling through the entire agreement, at the bottom you can click a button by which you agree to the terms.

Putting Protection Into Practice

California Courts have generally found that clickwrap and scrollwrap agreements are enforceable because they provide sufficient notice to the user. In other words, the agreement is clear and obvious enough that a reasonable user would understand they are entering into a contract. In contrast, browsewrap agreements are traditionally unenforceable

because they do not provide sufficient notice. Sign-in wraps vary by court, depending on the facts—when signing up for a single use/one-time purchase, courts have found that con sumers would not reasonably expect to be bound to some agreement. In contrast, when a consumer signs up for an ongoing relationship with the website, a court will tradition ally find that agreement enforceable. As such, when the pur

18 ECHELONPROFESSIONAL.COM

3. Browsewrap

A “browsewrap” agreement binds the user simply by browsing or using the site. The terms of use are likely hyperlinked to another page, but the user need not affirmatively accept the terms. For example, the below image is a screenshot from Wikipedia’s website—as you will see, the final line of the Privacy Policy provides: “By using our services, you consent to any such transfer of information outside your country.” So by enjoying the knowledge Wikipedia has to offer, you are automatically agreeing to its terms and conditions.

4. Sign-in Wrap

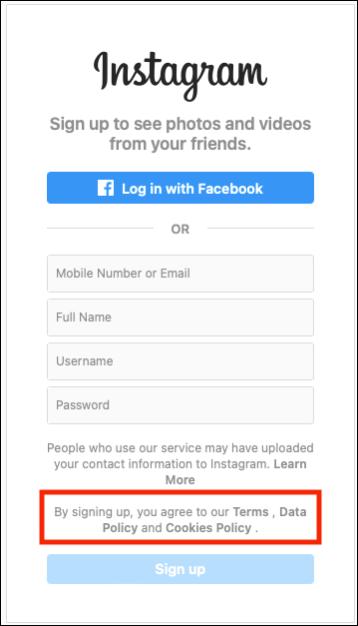

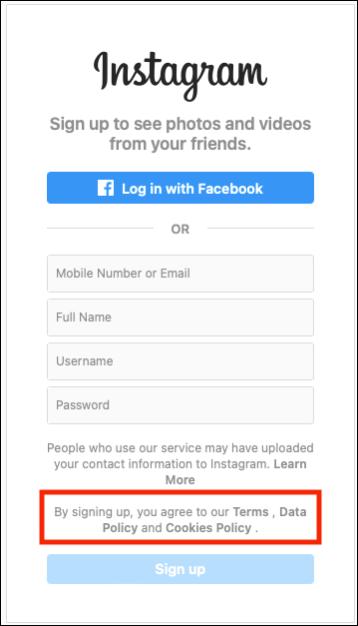

A “sign-in wrap” agreement requires the user to agree to the terms and conditions in order to sign up for the website. For example, when creating an account through Instagram, you will see by signing up you must agree to be bound by the Terms. This combines the clickwrap and browsewrap agreements, because you cannot use the site without checking a box and acknowledging the terms and conditions.

pose of the site is to create a “forward-looking,” more “long term” relationship with the user, a sign-in wrap agreement will most likely be deemed valid.

In the Blizzard case, in order to sign up to use the website, the user had to accept the terms of use, including the dispute resolution provision, in the form of a pop-up. The dispute resolution provision was hyperlinked in bold, blue font, and the court determined that the format of the pop-up gave the user sufficient notice that they were agreeing to be bound by a contract. Further, this was a website in which one signed up in order to continuously use it; it was not a one-time purchase. As such, the court found that the arbitration agree ment was enforceable, and ruled in favor of website Owner.

So, think twice before you “click,” and make sure to review the online agreement before you give your consent.

Madison B. Oberg is a partner at Oberg Law Group, a law firm that represents high net worth individuals and privately held small-to-mid-sized companies. They focus on commercial transactions and business matters including issues resulting from formation, governance, acquisitions, and real estate.

Madison is a passionate animal lover and volunteers at local animal care centers. When she is not working as an attorney, you can likely find Madison playing with her rescues, Mia and Sophie. Madison can be reached at (818) 212-2991, madison@oberglawapc.com.

19ECHELON PROFESSIONAL Q3 2022

A Rush of Variety

BY MASON BISSADA

One of the most cathartic exercises for any human being as of late has been visualizing a post-COVID world. So, let’s indulge: Picture yourself in a crowded bar on a Friday night in the middle of Hollywood (namely, the Hotel Cafe on Cahuenga, just off of Hollywood Boulevard). It’s karaoke night, and a walk-on steps up to the stage and blows the roof off the venue. Would you ever guess that she’s a family law attorney?

Her name is Kendra Thomas, and karaoke is one of her many forms of catharsis. For Kendra, not only does she find release in stage performance (whether it be a Karaoke bar or community theater), but she also believes it makes her a better lawyer.

“I love entertaining, and I love music, which I think helps in law,” says Kendra, who founded her own firm in 2007. “In order to entertain an audience, you need to be able to engage. In order to be persuasive in a courtroom, you need to keep your trier of fact engaged and connected to what you are saying.”

Kendra’s Calling Kendra always knew that her brain processes information differently than most people. Learning new things was not a challenge for her. In fact, she embraced it. Kendra found law with the same “Why not? Just go for it” motivation that gets people up on that karaoke stage. She originally had aspirations of being a doctor but came to realize that she wanted to help people in another way. Having a near pho tographic memory, she took the LSAT on a whim and scored extremely well. Years later, she’s a family law attor ney at Thomas Law Offices, based out of Woodland Hills, California. Kendra and her firm specialize in divorce, child custody and support matters. They also have a Concierge Program for higher net worth individuals that oversees all of the client’s legal tasks, beyond just family law.

Family Law Keeps Her On Her Toes

While family law can be a bit dramatic and confrontational at times, Kendra welcomes the challenge. Divorce and cus tody battles are by no means pleasant, but she has her cli ents’ best interest, and the idea of helping them fuels her.

20 ECHELONPROFESSIONAL.COM

Boring is not a word to describe family law attorney Kendra Thomas. In fact, her “just go for it” attitude has given her quite the array of life experiences.

A Rush of Variety

“I do dysfunction really well,” she says, “and I liked the business model. Once I started to get really immersed in the Family Law world, I realized how rewarding it was to impact someone’s life through a positive outcome.”

Just as karaoke gives her a rush of variety, Kendra has to be ready for anything when it comes to her profession. Complex family law encompasses many other forms of law, and her work shifts depending on the client. Some days, she’s in a courtroom, but she’s also certified in Alternative Dispute Resolution, meaning her firm will often attempt to resolve matters outside of court. Sometimes, she’ll even be appointed by the courts to act as Minor’s counsel, which means she gets to represent children.

“I appreciate that challenge and enjoy that no two days are the same,” she says.

Kendra’s firm also drafts, negotiates and reviews pre- and post-marital agreements, to keep things as orderly as possi ble for the people she serves.

“We understand your best life is a life where I am in it, in a professional sense, sparingly,” she says of her clients.

The Concierge Program

Kendra’s services were so good that one client out of Newport Beach decided he wanted her firm to handle all of his legal matters—not just family law. In classic Kendra fashion, she said ‘sure,’ with the caveat that she would have to assemble a team of lawyers that could assist with the matters outside her purview.

Thus, the Concierge Program was born. Now, she offers this elite service to many of her clients, giving them the peace of mind knowing that all of their legal matters will be dealt with in one place by lawyers they can trust.

Licensed In Colorado Because...Why Not? While the majority of her legal presence is in Los Angeles and Orange County, she is also licensed in Colorado— another byproduct of her “just say yes” attitude. A few years ago, Kendra was visiting family in the Centennial State, and they asked for some help with legal affairs. Not only did Kendra offer her Californian legal knowledge, she also vowed (with some alcohol-based encouragement) to learn ALL of Colorado’s laws as well.

“I then drunkenly committed to taking the bar exam,” Kendra recalls. “It was all fun and games, until word (and video) of my commitment spread and I got signed up for

the exam. Although I did not have the time to prep as I would have hoped, as a woman of my word, I took the exam and our Colorado office was born.”

The Jump

Kendra takes these sorts of leaps in her profession quite often, so it’s all too fitting that she loves to take literal leaps as well. She’s been known to jump out of a plane or two, given the proper equipment. Kendra has completed more than 160 skydiving jumps dating back to her teenage days. Most of these jumps have been in European skies, though she loves to jump above American soil as well, namely in Perris, California.

Her father helped her find this passion, around the time she and her family immigrated from Calgary, Alberta, Canada. Jumping out of a plane together can be quite the bonding experience.

“I love the rush and the release that comes from skydiving,” Kendra says. “My work is very controlled with deadlines and structure, so I like that there is an element of being able to ‘let go.’”

Kendra admits that she has trouble finding a work/life balance, despite her many daring hobbies. It seems that, when she commits to something, she commits the entirety of her will to it. There is no way to “attempt” to skydive or “partially” perform in front of a huge crowd, and she applies this same mentality to her work and to her clients. There is a rush in this sort of commitment—jumping into something with everything you have.

“From preparation to landing, no two jumps are the same,” she says comparing law to skydiving. No two cases are alike. No two people are alike. No two firms are alike. And Kendra Thomas has no problem finding pouring everything she has into her life.

22 ECHELONPROFESSIONAL.COM

Results Oriented. Relationship

Miller Law Partners provides the service you would expect from a boutique employment law firm as well as the experience and expertise usually only found in larger firms.

At MLP, we are committed to helping our clients achieve their goals while exceeding their expectations. Experience, integrity, results are not empty promises. They are the attributes that are put to work for each of our clients.

Keeping the client’s end-result in mind at all times is how we approach every matter. We don’t get stuck in “process” like many lawyers do. We remain flexible, and in so doing achieve the results our clients desire.

Driven. Employment and Business Litigation Wage and Hour Disputes Class and Collective Action Litigation Workplace Advice and Solutions Employee Policies and Procedures Workplace Investigations and Audits p: 818-279-6600 | millerlawpartners.com 21600 Oxnard Street, Suite 380 | Woodland Hills, California 91367

An Important Kind of Assurance Special Needs

If a family has a child who has developmental disabilities, how can that child inherit from the parents? How can the parents be assured that their money will be there to help take care of their child? How can the parents feel assured that their child will not be taken advantage of? How can the parents know that the money will not be taken by the state? How can their needs-based government benefits be preserved?

These are just some of the many questions’ par ents ask themselves when they have a child who has special needs, whether from birth or devel oped later in life through accident or illness.

These issues are addressed with a Special Needs Trust (SNT)—an irrevocable trust as the bene ficiary for the incapacitated child instead of an inheritance directly given to the child. If the fam ily does not take the time to make a strong and

24

Trusts

BY DAVID R. SCHNEIDER, ESQ.

the trust assets for the beneficiary as needed. By directing the inheritance away from the beneficiary with capacity issues, keeping the assets in trust with a trusted manager, called a trustee, the funds can be used to help offset additional costs not covered under the child’s current benefit plan. This not only maintains the beneficiary’s eligibility in their gov ernment benefits, but also protects the beneficiary by using a trusted manager (trustee) who has the beneficiary’s best interests in mind.

Persons with special needs will qualify for one or more governmental benefits. These include— but are not limited to—supplemental disability income, housing assistance, training programs, and state-provided health insurance when they have very limited funds (at the poverty level). If the child is under the age of 18, he or she already qualifies for some of these benefits because they are below the poverty level. Their parent’s assets do not count against them.

The big issue is when the parent or grandparent dies and leaves an inheritance for the child under the belief that he or she will need these assets for their future after the parent/grandparent is gone. Qualification for such government benefits is not just the child’s incapacity, but the inability to pay for these resources. When the child inherits, the government now considers that said child can afford the services as they are no longer at the pov erty level. This will lead to being removed from the programs that the child depends on.

definitive plan, it is most likely the said child’s inheritance will be lost or squandered.

WHAT DOES A SPECIAL NEEDS TRUST DO?

A SNT is an irrevocable trust funded from the parent’s or grandparent’s trust at their death. With a SNT irrevocable trust, the person with special needs does not take ownership or control over the assets. A trustee is selected by the parents who uses

This is particularly troubling for those individu als who are on the autism spectrum. Those persons with autism are often best served with a more static regimen. The discontinuing of services can have a debilitating affect by interruption of their routine. This result has been demonstrated over the past couple of years after many programs were unable to continue due to the pandemic. Not only were staffing and safety issues at play, but parents also feared jeopardizing their child’s health. Many indi viduals suffered significant setbacks by this inter ruption. An inheritance is most likely to have the same effect, with the added burden of not having the parents here to deal with the situation.

However, if the assets were delivered to a Spe cial Needs Trust, where the child beneficiary has no control over the assets, no power to amend or

25

Caring for children with special needs comes with a certain set of concerns. So when is a special needs trust necessary?

ECHELON PROFESSIONAL Q3 2022

Special Needs Trusts

revoke the trust, those assets are not counted as the child’s assets and therefore do not disqualify the child from the current government benefits they are receiving or may come due to them. Use of the Special Need Trust will help keep the services and routine in place that the child depends upon, with out interruption.

Trustee Matters

Too many families will make the mistake of choos ing a trusted family member to give their assets to. They have the belief that this trusted person will take care of the child with special needs. This can be a particularly bad idea. To begin with, there is nothing that forces the designated beneficiary to use the funds for the child and not themselves.

Even assuming that the designated beneficiary is honest and has the best interests of the individual in mind, they, too, could die or become incapaci tated, leaving the assets to their spouse/heirs who may not have the same goals or allegiances. Other areas of concern are that the designated beneficiary could be sued for divorce. This could jeopardize the assets. The designated beneficiary could be sued for a variety of matters, and the assets would be part of the defendant’s estate. There could even be probate proceeding issues. All these issues can be addressed with a Special Needs Trust.

Case-In-Point

Not long ago, a case came to our office. There were two sisters who were roughly 5 years apart

26

“Too many families will make the mistake of choosing a trusted family member to give their assets to.”

in age. The younger sister was born with develop mental disabilities and had significant limitations. When their father passed away, their mother had continued to care for her adult incapacitated child. The mother transferred all of her assets to her typically-abled daughter prior to her death. The mom believed that her older daughter would be around to take care of the younger one. When the mother died, the older sister rightfully filed for Conservatorship of the Person for her younger sister and was granted such conservatorship. But then the older sister died prematurely—without an estate plan—leaving an estate of a little more than one million dollars.

The sister with special needs became heir of her sister and the inheritance has to pass through a traditional probate proceeding. There were result ing in fees, costs, and statutory commissions in excess of $50,000. At the same time a Successor Conservator of the Person had to be appointed by the court. But since the inheritance passed directly to the sister with special needs, a Conservator of the Estate had to be added with additional costs in excess of $10,000.

When the young sister passes away, a second probate proceeding will now be required since she cannot execute the appropriate estate planning documents. This will result in another loss likely to exceed $50,000.

Further still, it is a requirement to provide notice to the state Department of Health Services (DHS), wherein DHS will make a significant claim for reimbursement of benefits. As part of the agreement to accept such government services, the parent/conservator for the incapacitated person pledges that if the beneficiary’s financial status changes, those assets would be used to reimburse the governmental agencies who previously pro vided the services.

If the mother had simply used a revocable liv ing trust designating a Special Needs Trust for her daughter’s benefit, there would likely be a savings in excess of $100,000 and no place for DHS to sub mit a claim. There would be no probate proceeding and unused monies would be preserved for other family members and not the state.

Not Leaving Things To Chance… Or To Probate

The Special Needs Trust can deal with all of these issues by taking the money out of the hands of the child who has special needs. It places the assets and/or money with a trustee who can be

held accountable. Since the assets are held in trust, the trustee owes a fiduciary duty to the incapacitated beneficiary. Other family members may make reasonable inquiries on behalf of the beneficiary to ensure that the money is being held and used correctly for the sole benefit of said beneficiary. The Special Needs Trust will include back-up choices for trustees, ensuring the par ent’s choice of trusted individuals and not left to chance by a probate court.

Keep Extended Family in the Loop

Extended family must be in the loop. When we work with a family facing these types of issues, it is important to consider what else can be costly mis takes by extended family. For example, grandparents may leave their assets to their daughter who has three children. One is a child with special needs. If the daughter fails to survive her parents, her share would then be divided by her three children in equal share. The grandparents trust most likely was written before the child with special needs was born. Or the grandparents may not recognize the difficulties and believe that the grandchild will “need the money.” Therefore, any share that was designated for their daughter will now pass in some measure to the child. This starts all of the problems discussed above. Proper communication with the extended family advising those members to either avoid the distributions altogether, or send the assets to a Special Needs Trust. This planning is important on a multi-generational level.

Proper planning can save years of grief working through the court system. It can save hundreds of thousands of dollars for the beneficiary and their family. Speak with your estate planning profes sional to discuss the personal circumstances of your family. Develop a plan that meet the ultimate goal of providing the best future for the child with special needs.

David R. Schneider of DRS Law is a member of Echelon Business Develop ment. He is an estate plan ning attorney and trusted advisor in Thousand Oaks, Calif., with more than two decades of experience help ing families with their estate planning needs, probate proceeding avoidance, conservatorship issues and use of Special Needs Trusts. He can be reached at 805374-8777, dschneider@drs-law.com.

27

ECHELON PROFESSIONAL Q3 2022

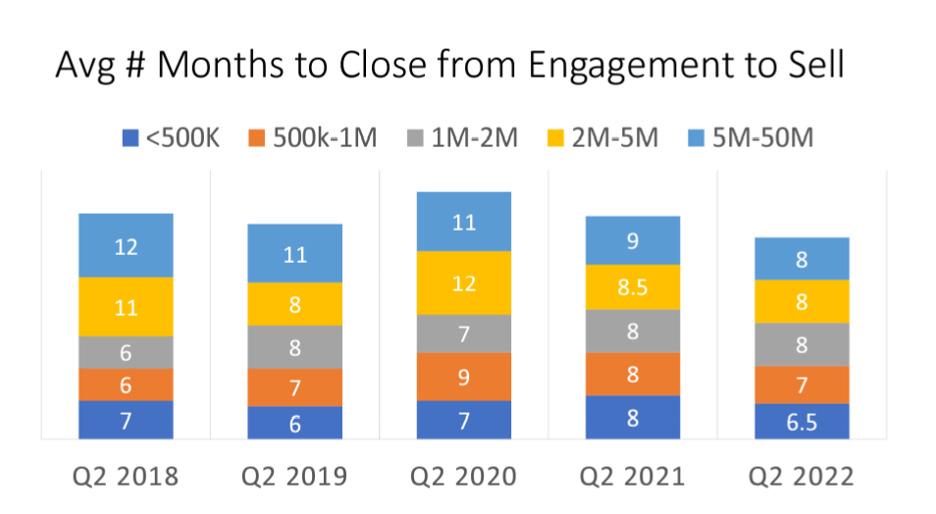

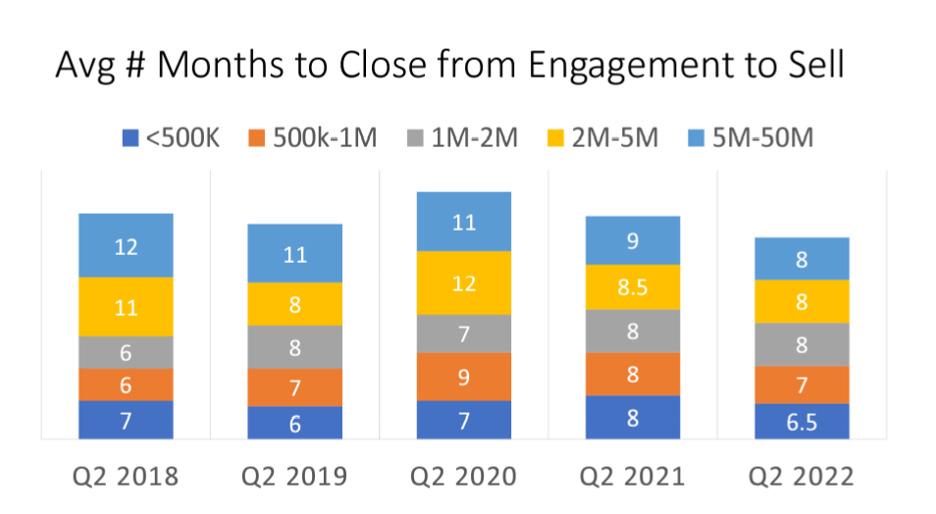

The IRS Says I Owe HOW MUCH?

Tax law plays a very important role in a divorce settlement, especially when your ex-spouse had a business you didn’t know about. And if payroll taxes weren’t paid, watch out! Your divorce papers won’t save you.

BY GARY WEISS, CPA WEISS, CPA

BY GARY WEISS, CPA WEISS, CPA

THIS MAY COME TO SOME OF YOU AS A REAL “SHOCKER BOB,” but not all marriages survive the test of time and even fewer end in an amicable, cordial, courteous, polite or even civil manner (yes, I did use a thesaurus). As I have written about many times, marital tax matters do not always end when the marriage is finalized, and a family court judge drops the hammer—I mean gavel Since this is an article about taxes and

tax topics, I will focus strictly on how matters of tax law play a very import ant role in a divorce settlement.

A Common Case-In-Point

You and your spouse file a joint return for tax years 2000 thru 2005. In 2006 you file for divorce which is granted. Great, now the two you can go your own separate merry ways and live happily ever after. Dream on. Then the friendly folk at the IRS decide to audit your joint return

for 2004 (those meanies). Because your ex-spouse was the first name on the return, the Taxpayer, and Spouse is the second name, he/she received one of those nasty notices from the IRS stating that your return has been selected for review. Since the two of you are not on—let’s just say—friendly speaking terms, the ex-spouse goes ahead and has his/ her CPA handle the audit. There may be hidden reasons for not informing you of the audit, as you will see.

28 ECHELONPROFESSIONAL.COM

During this, what I would assume, is a friendly exchange of information and dialogue, it is discovered that there are some significant irregu larities. The IRS discovers that your ex-spouse has under-reported a few million dollars in income and failed to remit to the government a large sum of payroll taxes. This is hap pening all whilst you are sleeping blissfully and completely unaware of the freight train headed directly toward you.

It Doesn’t Matter What Your Divorce Papers Say

Since you are really smart, and you had a real good family law attorney who—in an effort to protect you from just such a situation—included a clause in the martial separation agreement that indemnifies (that means you are not responsible) you against all future community prop erty tax assessments (both federal and state). Great, you keep on sleeping sound as a baby.

Finally, Friday night has arrived. You’ve had a long day at the coal mines toiling away and come home drop dead exhausted. You are ready for a quiet dinner and a great bot tle of vintage wine all to yourself. As you open your front door, you pause to pick up the mail and set it down next to your keys on that incredible antique table so skillfully rescued from the evil clutches of your ex-spouse. You let out a sigh of relief. Peace at last. Great, now it’s Miller

29

ECHELON PROFESSIONAL Q3 2022

The IRS Says

Owe HOW MUCH?

Time! You change, slip into some thing warm and comfortable, poor yourself that large glass of wine and pick up the mail. To your amazement, there, just after the sweepstakes letter guaranteeing you are a million-dollar winner, is a certified letter from the Internal Revenue Service. Your heart starts to race, you quickly—but care fully—put down the glass of wine and begin to open that certified envelope. Your palms grow sweaty as you begin to read the first page, and then true unadulterated panic begins to set in.

On the first page of the letter, it says that as a result of an audit, you owe the government $377,845.15. First thought, HOW MUCH and what audit are they talking about? The second thought is of various ways to harm your ex-spouse.

Now the question is, where do you go from here. First you scream. Wait, first you finish the wine then scream (watch Netflix, everybody is always drinking during a crisis.) Next you call your ex, and finally you call your attorney. They all tell you the same thing. Talk to your CPA. Come Mon day morning, you are on the horn first thing looking for answers and a plan.

A Plan with Possible Solutions

A plan is nothing but a series of solu tions. If you do them carefully and in the correct order, you most likely will end up with a positive outcome. One possible solution for you, the surprised spouse, is to file for Innocent Spouse Relief. After all, you are com pletely innocent and definitely need some relief.

But First, A History Lesson

A brief but important tax lesson about 26 U.S. Code § 6015—Relief from joint and several liability on joint return. In less technical jargon, here how this works. Believe it or not, between 1913 and 1918, couples were not permitted to file jointly. There was no such concept of a marriage as an single economic unit. It all changed in 1948 when Congress finally rec ognized that married couples should be treated as a single unit. In 1971, Congress decided that under certain circumstances, there are times when you must ignore the economic unit of marriage and unwind the joint lia bility of the tax return. That provision was improved (I mean modified) in 1984 and then again in 1998 (it is

Congress, nothing happens quickly.)

Ultimately, the code section was final ized with three main parts allowing some form of relief. That means that the surprised spouse has three different ways to obtain partial or complete relief. To avoid the gory details of this provision, I will give a quick and way over-the-top summary of the three sec tions granting relief:

6015(b)—Requesting spouse was both (a) innocent of knowledge of the facts of the omission and (b) innocent of benefit from the income.

6015(c)—On the date the request is filed, the taxpayer is no longer married to the non-request ing spouse, and the request is made within two years of when the IRS first initiates collection action and the requesting spouse had no actual knowledge of the transactions that gave rise to the erroneous items.

6015(f) - provides simply that “if...taking into account all the facts and circumstances, it is inequitable to hold the individual liable for any unpaid tax or any deficiency...and... relief is not available to such individual under subsection (b) or (c).”

To request relief under (b), (c)

30

ECHELONPROFESSIONAL.COM

I

or (f), the surprised spouse must file Form 8857, Request for Innocent Spouse Relief

Back To the Solution Plan

So, off to the CPA’s office you go to get some relief. The two of you fill out the form with all the torrid details of how you were deceived by your ex-spouse. You claim you never signed the return and was basically clueless and so on. For now, I am going to make simple assumptions; that the surprised spouse did not review or sign the tax return, had no knowledge of the business affairs of the ex-spouse and did not benefit in any meaningful way (e.g. ex-spouse bought the surprised spouse a Royals Royce, diamonds or designer clothing.) Remember, for the most part, this is a test of facts and circumstances, and the initial judge and jury is the IRS.

The certified letter is now in the mail on its way to the IRS. You wait and wait for answer. Then, on another Friday night you get the answer you have been waiting for and the IRS grants you relief from the income tax liability on the 2004 tax return. Once again it is “Miller Time” or at least back to the expensive bottle of wine.

But wait, in that stack of letters is another certified letter from the IRS. What could it be? You open in and to your aghast and amazed, you still have a large balance due to the IRS. Not only that, this neatly folded letter goes on with the words “Intent to Levy” and “File a federal tax lien.” What the hell!

The Hits Just Keep on Coming

Earlier in this story, I said that the IRS determined that the ex-spouse failed to remit a large sum of payroll taxes (e.g., trust fund monies.) What is the differ ence you may ask. Well, especially for purposes of Innocent Spouse Relief, payroll taxes are not considered income taxes. Wait a minute, aren’t taxes “taxes”? (Thank you Yogi Berra).

Again, it is off to see the Wizard, I mean the CPA (same thing.) After some simple Google search, the CPA prints out the following for your reading displeasure:

Section 6672 imposes joint and several liability on each responsible person, and each responsible person can be held for the total amount of withholding not paid.” Wait there is more: 6672 also provides that if any “person required to collect, truthfully account for, and pay over any tax imposed by this title...willfully fails to collect such tax, or truthfully account for and pay over such tax” then that person is “liable to a penalty equal to the total amount of the tax evaded, or not collected, or not accounted for and paid over.” This means that for every dollar of tax not collected and remitted to the government, there is a dollar of penalty. Oh yes, don’t forget about the interest.

You all have heard of traffic court, criminal court, family law court and obviously, the Supreme Court. Well guess what—there is a Tax Court. Since the majority of you reading this are not tax nerds, this may come as a surprise, but “Yes, Virginia, there is a Santa Claus.”

Though I changed the names to protect the innocent (sort of), this is an actual case that worked its way up to the Tax Court. Quick note, in order to get to Tax Court, you have to jump through many hoops involving various levels of review by the IRS. In fact, cases like this can take years to adjudicate. It started in 2014 and was finished June 22, 2022.

The Bottom Line

Let’s get right to the bottom line, and this bottom line is very important. It’s important not just for divorced couples, but for anybody that is in a business that has payroll, even if the payroll is just for the owners (no actual employ ees.) If your name is on the payroll bank account—even though you never wrote a check, made a deposit or have anything to do with it—the IRS will just assume you are a responsible party and send the IRS hounds after you. It will be up to you to prove you were not part of your ex-spouses failure to do the right thing. This is the only solution, besides suing your ex-spouse and hope fully getting, at least, a judgment to pro tect you (better than nothing.)

Bottom line here is that the request

ing spouse was denied relief under any section of 6015, Innocent Spouse, because, according to the interpretation of the Tax Court, payroll taxes are not income taxes and only income taxes are on a personal return (that 1040 thing you fill out once a year, maybe.)

And that is the only type of tax that the joint liability 6015 attempts to unwind. Therefore, requesting spouse is out of luck on this one.

The Only Thing To Do

While you cannot easily discover if your spouse has obsconded with com pany payroll taxes, you can take note of your income taxes. If your spouse or partner is involved with any form of business that you know nothing about, it is your responsibility to review your tax return before it is submitted. In today’s world for most of us, we do not sign the actual return but Forms 8879 “IRS e-file Signature Authorization.” Once a jointly filed return is accepted by the IRS, both of you are on the hook for whatever is represented on that return. Remember you are signing under penalty of perjury. So, you better pay attention, because when it come to these type of matters, it is everything, everything, everything that matters.

One final note, I would like to per sonally thank Bryan Camp who is a George H. Mahon professor of law at Texas Tech University School of Law. It is his weekly, and very technical blog that has inspired me to write this article for you. Thank you, Bryan.

Gary Weiss is a graduate of the Marshall School of the University of Southern Cali fornia. He founded and operates a boutique accounting firm dedi cated to bringing high-quality tax prepa ration, tax planning and tax resolution services to individuals, small businesses, small nonprofits, family-owned businesses and start-ups. He can be reached at 805874-2001, gary@garyweisscpa.com.

31

ECHELON PROFESSIONAL Q3 2022

SEO simplified

BY BRIAN HEMSWORTH

The following statements are direct quotes over heard in recent and real conversations:

“We need to do more SEO, whatever that is.”

“We spent thousands of dollars on SEO and have no idea if it’s working.”

“We’ve got a guy doing our SEO, but we can never get a hold of him.”

“I really don’t know what SEO is, or why we need to do it.”

Most people know that SEO has something to do with the internet and websites. Unfortunately, most don’t know much more than that. Even more unfortunate is the fact that compa nies invest small fortunes in SEO services, having been sold SEO “snake oil” by some marketing or website firms. Companies are sold on how SEO will “revolutionize their business,” only to see very little in concrete results after spending thousands of dollars.

What Is SEO?

SEO is the abbreviation for the term “search engine optimization.” Search engines are programs that operate on the internet by using what are called “spi ders” or “bots” to search or “crawl” for words, terms, images, and data on web sites. These spiders can read technical coding and all the text written on a website, including the file names of images or videos embedded

on a website. They also read any new or updated content. They analyze the information they find and put it into giant databases.

When we “search” on a browser such as Google or Yahoo, we are accessing the information the spiders have put in these databases. The results are “links” they have built that lead straight to the information.

The search engine spiders focus on words and terms

32 ECHELONPROFESSIONAL.COM

Demystifying what SEO is, how to do it, and why it is critical for professional service business survival!

that are used repeatedly on your site. These are called “keywords.” In the early days of the internet, search engines looked at only por tions of websites. Today’s search engines are much more sophisticated. They not only count how many times keywords are used on your website, but cross-check and cross-reference those terms with other information found on other websites. They analyze how other

websites are using the same terms. They also see if any other websites reference (or “link”) to your website. This is all an attempt to point you in the right direction when you search for something.

This is where “optimiza tion” comes in. Optimizing a website for search engines is the process of writing and posting the proper keywords and information on a web site that search engine spi ders like and can understand.

SEO vs. SEM = Organic vs. Purchased

When a website is well-op timized, spiders know that content-rich information lives there. They are hungry for that rich information. The more they find, the higher they rank those content-rich websites. For example, when you search for a term like “lawyer,” a search engine like Google searches its database, applies its own logic to the

search, and sends you a list ing of websites it thinks are mostly likely to satisfy your search needs.

The page of results you get is a “SERP,” or search engine results page. These results are also known as “organic search” results, meaning you put in a search query, and Google sent you the best results it could find. You didn’t pay for the results, nor did any companies pay Google to try to reach you.

33

ECHELON PROFESSIONAL Q3 2022

SEM is short for “search engine marketing.” SEM results on Google are typ ically found near the top of your search results page. They are identified with the word “Ad” in front of the listing. These “ads” are pur chased by companies that are trying to reach specific people searching for spe cific things. Yep, these are advertisements.

Putting these concepts together, SEO helps us improve our organic search results (which is the main goal), while SEM lets us pay for advertising that comes up for certain search results. It’s important to know that both SEO and SEM are industries in their own right, and while many companies employ both methods of improving search results, they are both highly com plex matters that take some learning and experience to understand and use.

The Key To Google And SEO

There are many different search engines out there, both public and private. The good news for most of us is that there is only one that we really need to be concerned with, and that’s Google. In the United States, Google accounts for approximately 90% of all search engine usage. (It var ies slightly if you are using a desktop, laptop, or mobile device, but Google domi nates them all, by a lot!)

In the early days of the internet, it often took weeks,

even months, for Google to find your website. Today, it can take as little as a few minutes to be found by search engines. Therefore, it pays to know what kind of content Google is looking for on websites.

In a nutshell, Google likes:

• Specific information. It’s not really interested in plain old generic content that it can find on tens, if not hundreds, of other sites.

• It likes a site to be well organized and well written.

• It also likes recent infor mation, i.e. websites that update their content often.

• It likes sites that have quality links going out to other websites that per tain to your content. For example, if you have a site about baseball, your con tent should contain links to websites or pages on the MLB website or a museum website that also has con tent about baseball.

• It likes a site to have “internal” links. That means having links on your pages linking to other pages on your website.

• It likes it when other websites with content related to yours have links back into your website.

Other things have changed with Google over time. In the past, websites that used keywords an obscene amount of times often came up high in search rankings. This is called “keyword stuffing.”

That prompted another change to Google: BAN ISHMENT! Google decided if you are trying to trick them, they will punish your site by ranking you

lower, or worse, dropping you entirely.

Ultimately, what Google wants is directly related to what users of Google want. They both want good infor mation, well organized, easy to find, and not tainted by needless terms, tricks, or treachery designed to lure viewers under false pretense.

A Simple 5-Prong SEO Strategy

If you would like to see your website rise up in the search engines and ultimately result in more customers or clients, we have developed a simple 5-pronged approach to SEO. It includes:

Focusing your business messaging

Developing strong key word association

Organize your website information

Building strong, keyword-rich content

Reaching out beyond your own website.

1 Focusing Your Business Message

This is important not only for SEO, but for business growth in general. When you are a generalist, you are not as likely to be perceived

as a leader or valued as a specialist.

One of the best ways to find this is to spend a little time looking at your own business. What services do you provide? Which are the most profitable? Which ones are the type of work your firm is best at, or enjoy the most doing? This is your “strategic sweetspot.”

For example, the world thinks of CPAs as “doing the books,” doing taxes, and that’s pretty much it. But experience tells us that CPAs have areas of special exper tise. It might be things tax resolution, forensic account ing, auditing or accounting for product manufacturers.

2Developing Keywords

We live in a key word-driven world. People associate keywords with everything, from brands to celebrities, from feelings to activities.

What keywords do clients associate with the focus of your business? When they search Google for a service like yours, what words (or phrases) do they use. The best way is NOT to guess, but to actually ask clients and customers.

34

1.

2.

3.

4.

5.

ECHELONPROFESSIONAL.COM SEO simplified

(Tip: Whenever anyone tells you the found you on the internet, ask them what they were searching for!)

Start with a list. We suggest coming up with AT LEAST 20 different keywords and keyword phrases.

Now try to whittle the list down to the FIVE most commonly searched terms or phrases used to search for by your customers or used to describe your business focus. These are words you need to use and repeat on your website.

3Organizing Your Website (using your business focus and short keyword list)

Now, take a look at your website. Are any of the key words in the URL? Are any in the first 25 words found on a page? Are they used in head ings, callouts, or subheads? Are they above-the-fold (top half of a page). If not, they need to be.

The goal is to work those keywords into the important real estate of your website. The important real estate includes page names, headers/headlines, and the first few sentences of every page and section.

If you don’t find those

and customers likely search for. (It is also a “landing page” that you can easily link to from social media, but that’s another article!)

nies from different industries and locations, there is not much likelihood there is SEO value.

words, rewrite your website copy to include those words. Also, try to work those same words onto the page at least 4-5 times. An SEO rule of thumb is to try to work one or two keywords into every 100 words on your website. That creates a keyword den sity of 1-2%.

4Build Strong Keyword-Rich Content

Think about how you can strategically work the key words and your business focus into more pages, more sections, and more content.

For example, if you are a business attorney whose business focus is franchise work, consider adding some additional pages of con tent to your website. These might include pages titled something like, “Franchise Agreements” or “How to Become A Franchise.” If you work on the franchisee side and a lot of your work involves litigation with fran chisors, consider a page that answers a common ques tion like, “What are the top three reasons franchises are involved in lawsuits?”

These are called “hub” pages, and form hubs of key information that your clients

And finally, in terms of working content into your website, consider a news section, a blog, or an easily-changed page where you can add new information frequently. Remember that Google likes to see updated information, so it’s a good idea to update some content quarterly, or even monthly.

5Beyond Your Own Website

In addition to the business-focused, keyword-rich content found on your web site, Google will also reward your rankings when it finds links or references to your web site elsewhere on the internet.

This is where things like directory listings and links from other websites come it. Sometimes called “back links,” they link people from another site back to yours.

Google LOVES these.

One easy way to do this is to do “reciprocal” likes with business alliances, strategic partners, vendors, and others you do business with. Another is simply submitting your website to multiple directories and guides that will publish your company information and website address. A common question is what about “paid” directories. A good rule of thumb is to only pay for well-known, well-re garded directories that are clearly related to your type of business. There are many run-of-the-mill directories that charge small amounts of money to be listed, but if all they list are random compa

Another easy way to gain links is to use social media to post information about your business focus, including a link back to informational hub pages on your website.

If you undertake these five simple steps, you will put yourself ahead of the majority of websites out there. While some websites, typically e-commerce sites or websites that are missioncritical to getting clients such as injury attorneys, need to invest a lot of time and money into SEO, most pro fessionals can accomplish a lot without huge invest ments of time or money. Focused information and messages, well organized on a websites, and updated regularly, are really what Google is looking for from small companies.

Brian Hemsworth is a marketing and brand professional who works with clients on creating powerful marketing strategies at Newman Grace Inc. He has taught business and marketing at numerous universities, and is a frequent author and speaker on marketing topics. He is currently a professor of advertising and marketing at Pepperdine University. He can be reached at bhemsworth@newmangrace. com.

35

ECHELON PROFESSIONAL Q3 2022 HOW ECHELON HELPS YOUR SEO Members of Echelon receive the benefit of powerful “SEO content.” This includes: n Member bios (on two websites!) n Links to your website n Blog posts about your practice area n Magazine articles about members n Videos on the Echelon website and YouTube n Social Media Posts and mentions

There are a lot of professional networks to be found. But few are highly focused on member benefits. Echelon Business Development Network is a member-benefit focused organization that puts its members marketing needs in the forefront. Echelon’s goal is to provide a platform for high-quality business, professional, and personal development. From cultivating quality business referrals and having access to diverse professional resources, to providing events that focus on work-life balance, Echelon Business Development Network keeps member needs at the core of its mission.

Echelon members have access to powerful tools

their

Membership includes a

all designed to help them acquire

that help

business development and marketing.

Marketing Mix

business! • Monthly Meetings • YouTube® Channel with Member Introduction Videos • Echelon Professional Magazine • TopTrustedAdvisors.com Viral Website • Echelon Radio Podcast • Echelon Member Blog • Front-Facing Member Bios that Online Search Engines Can Find BUSINESS DEVELOPMENT AT NEW LEVELS. “More than just networking...WAY MORE!” How? BENEFITS DRIVEN LASTING RELATIONSHIPS HIGHLY TRUSTED ADVISORS MARKETING FOCUS Membership Has Its Benefits

BENEFITS AT-A-GLANCE

Group Membership Meetings

Our meeting groups range from 12–18 members each. This allows for deep business development discussions and participation with everyone in the room.

Searchable Member Website

Member biographies are in a Search Engine-friendly directory. This allows for increased Search Engine Optimization (SEO) of our members with active links back to their businesses.

TopTrustedAdvisors.com

Echelon has a viral website that is designed to enhance a member’s SEO. Every Echelon One member has their biography, video and links to their business on it.

Echelon Professional Magazine

The official publication of Echelon Business Development Network. Written by and about the members. Printed and mailed as well as digital.

Echelon Member Blog

Echelon publishes a blog with submissions from our membership. Members write poignant short-form articles on their areas of expertise which add to their SEO. They link to their own websites and are promoted throughout our membership and via social media.

Echelon Radio Podcast

Echelon members are eligible to be guests on the Echelon Radio Podcast. We go in-depth on member’s professional lives and fun “back of the business card” stories. The Echelon Radio Podcast is available on Apple Music, Spotify, Google Podcasts, Amazon Music, and many others.

INTERESTED? Fill out our Membership Interest Form at the top of our website.

echelonbizdev.com

LAW TERMINATING EMPLOYEES: Answers to Common Questions

BY BLAKE M. WELLS, ESQ., The Small Business Law Firm P.C.

Terminating an employee can often be one of the most dif ficult yet necessary decisions for a small business owner. Business needs change. Issues arise. You, the employer, must do what’s best for your clients, your other employees, and ultimately, your business. How ever, the situational pressure of hav ing to fire someone can cause many employers to overlook some of the legalities associated with termination. This article provides some guidance on how to terminate an employment relationship while avoiding the com mon pitfalls (and big penalties) of California’s Labor Code.

As you may now, California is an “at-will” employment state, meaning employers have the right to terminate an employee, with or without notice, with or without cause, for any reason, so long as that reason is not unlawful. Of course, the list of unlawful rea sons is long—discrimination, retali ation, and implied-in-fact contracts being the most typical (and topics for another article). Regardless, once you’ve come to your decision to ter minate, take heed of some common problems that employers encounter.

MUST Pay Them Immediately Upon Termination

The situation goes like this: an employer decides to fire an employee,