On behalf of Erie FCU’s dedicated staff and leadership, we hope each of you enjoyed a very relaxing holiday season. We are sincerely looking forward to the new year and the wonderful opportunities ahead. While excited for 2023, this is also the time to reflect on the concerns from 2022 that impacted you, the credit union, and our community. With this said, I am very proud to report that with your continued loyalty and trust, Erie FCU remains financially sound

positioned to move our organization to new heights.

As we look in the rear-view mirror, we find ourselves hoping that life in general, going forward, will provide more clarity and stability…back to the pre-pandemic, ‘good old days” if you will. It has been some time since we had the confidence in knowing what lies ahead. We are all facing pressures as a result of inflation and the slow to recover economy, and in the case of the credit union, increasing regulation and external competition that has forced us to take pause and reflect as we plan our future in effectively and efficiently serving our member-owners. It is our goal to remain the primary and preferred choice for all your financial needs.

As to the current economy, it certainly has been a challenge for all of us. As your credit union, we are here to provide knowledgeable assistance to help you navigate this changing environment. It is our steadfast pledge to continue offering low interest rate loans as well as competitive savings, checking and certificate rates to our membership. Within this newsletter, we hope to provide some examples of these benefits. We have rolled out a number of new promotions designed with your financial well-being in mind. Please have a look and be sure to contact our team if you have any interest or additional questions. We are here to serve you.

• In January 2022, we welcomed many new members from the Erie Times Federal Credit Union after a successful merger with Erie FCU. By year’s end, we were excited to have exceeded 70,000 credit union members! A ‘BIG’ thank you to all of those who made this milestone possible.

• We announced plans to build a new full-service branch location in Fairview, PA. Our Fairview crew is looking forward to serving the Fairview community this upcoming summer commencing with a Grand Opening celebration! Feel free to follow the progress of this project and view our groundbreaking ceremony at https://www.eriefcu.org/news/erie-fcu-fairview-branch

• Erie FCU was once again named “Erie’s Choice in Credit Unions” for the 10th year in a row by readers of the Erie Times-News/GoErie.com, as well as, “Erie’s Choice in Mortgage Lender” and “Erie’s Choice in Financial Advisory” for services provided by the Erie Advisors group located at Erie FCU. And most recently, we are very honored to share that Erie FCU, competing against both banks and credit unions, was again voted “Best Bank” for the 9th consecutive year in Erie Reader’s Best of Erie 2022! All we can say is, THANK YOU!!!!!

• Our Online Account Opening platform received a much-needed upgrade in 2022. One of the most important aspects of the member experience is an efficient and streamlined account opening process, and especially true in relation to online account opening. Our goal is to create a safe and secure member experience across all channels when it comes to opening a new product or account with Erie FCU. Give it a try…we think you are going to like it.

• We enhanced our Business Services offerings by introducing three new business checking account options—most businesses need a checking account, but not every business needs the same type of account. A new Business Bill Pay platform was also rolled out providing additional capabilities and features specific to business, and reception has been amazing! As a local, not-for-profit financial cooperative, we are going the extra mile to ensure our business members are given the tools they need to succeed.

• As a local employer approaching 200 total employees, Erie FCU invests heavily in continued Staff and Leadership Development initiatives while enhancing our talent and recruitment efforts to provide continued professional and knowledgeable service to our members and our community.

• We want to thank everyone who participated in our annual Member Satisfaction Survey this past fall. We received an amazing response and were provided constructive feedback to help us better serve you.

“Kindness is like snow. It beautifies everything it covers.”

and is

• Along with Erie FCU team members, your credit union remains supportive of our communities through our #Team AOK (Acts of Kindness) efforts. As an example, over the holidays, and for the second consecutive year, Erie Federal Credit Union donated $30,000 to 10 local nonprofit and food agencies to fight hunger through our “Give Hope – Feed the Need” campaign. This campaign was established in response to the increased demand for food assistance and hardships in our community. Please see some of the happy recipients of this gift later in this newsletter!

• Finally, our first ever Member & Community Impact Report was published to illustrate the many good things Erie FCU as an organization is doing to improve the lives and well-being of our members, neighbors and community. Look for an updated Impact Report soon!

By the way, have you noticed the new signage at our East 38th, Edinboro and Zuck Road branches? New, consistent look on the outside, same friendly faces and outstanding member service on the inside.

In conclusion, it is our goal to remain the primary and preferred choice for all your financial needs. We are committed to building strong relationships with you and our local partners based on trust. We want you to feel so confident in your credit union that you will refer Erie FCU to your friends and family members when they are searching for a member and community-centric financial services provider. We are here to serve you!

Stay safe and hopes for a wonderful new year, and as always, thank you for your continued trust and patronage.

Happy new year, everyone,

Brian J. Waugaman, CEO

Erie FCU was again recognized by the Erie Reader as “Erie’s Best Bank” for the 9th consecutive year!

(We think our members are the BEST too!)

Thank you , it’s truly an honor.

Even though the temperatures have dipped, don’t let the hunt for your next home cool off! Whether you are in the market to purchase or refinance your first home or dream home, we’re here to help!

We have the tools you’ll need to help you get settled sooner!

Learn more: www.eriefcu.org/mortgage-center

Erie FCU officially broke ground for their newest branch in Fairview, PA. The groundbreaking ceremony took place on Thursday, November 17, 2022 at 7141 West Ridge Rd Fairview, Pa 16415 (east of Coach USA across from Holy Cross Church). Attending the groundbreaking ceremony were Erie FCU leadership and staff, the credit union’s Board of Directors along with other officials. The new one-story, 1,500 square foot branch will be open for business in the summer of 2023.

“We are thrilled to break ground in Fairview,” said Erie FCU CEO, Brian Waugaman. “It is truly exciting to see this project being put into motion and for us to continue to strive to make a difference in our community and in the lives of our members.”

For more updates on the new branch, visit www.eriefcu. org/news/erie-fcu-fairview-branch

Erie FCU is proud to once again support Erie FREE Taxes, a no-fee program that helps anyone with low to moderate income to file their Federal, State, and Local taxes for free. This free service is available to members with household incomes of $60,000 or less.

*Drop-Off service will be available at the Erie FCU

Glenwood Office 3503 Peach Street Erie, PA 16508

Here’s what you need to do:

4 Please pick up your “VITA”/Erie Free Taxes packet at any of our branches and complete at homePackets are now available.

4 Place all tax documents in envelope with your completed paperwork. Packets must be complete prior to drop off.

4 Drop off at Glenwood Branch at the Peach Street / West Entrance only. There will be a drop off box. Location pictured above.

4 The drop off box will be available January 30, 2023

4 Drop off hours will coincide with Branch hours –www.eriefcu.org/atms

For more information -- www.eriefcu.org/taxes

Online Filing - Log onto www.unitedwayerie.org/learn/ eriefreetaxes/ to file your taxes.

For appointment information at other tax sites call 1-888-829-5680

Have your Federal, State, and Local taxes prepared for one low price. Call our friends at Tax Strategies to schedule your appointment.

Tax Strategies - 4420 Peach Street 814-866-5494

*Tax Strategies cannot prepare or file your tax returns without copies of your W-2 form(s).

Erie FCU has always been a huge supporter of local food agencies and the work they do here in our community. In appreciation of their generosity, Erie FCU proudly donated $30,000 to ten (10) local food agencies and nonprofits. Erie FCU’s “Give Hope - Feed the Need” campaign was created to provide monetary relief to various local agencies and non-profit organizations who offer food assistance to struggling individuals and families affected during the winter months.

“It gives me great joy to be able to represent Erie FCU in such a wonderful community endeavor” said Kim Latimer Davis, Erie FCU’s Director of Community Outreach. “Assisting these amazing non-profit organizations, who provide so much to so many in need during the holiday season, goes hand in hand with the credit union’s motto of ‘People Helping People’.”

Through this initiative, Erie FCU provided a $3,000 check to fund these ten (10) well deserving agencies. Metro-Erie Meals on Wheels, Salvation Army, Emmaus Ministries, Community of Caring, St. Martin Center, Erie Martin Luther King Center, Sister of St. Joseph’s, Home House of Erie, Kind Pantry by CAP, and Bethany Outreach Center. Money will be used for programs affiliated with supplying meals, nourishment and warm companionship to families and individuals in the Erie area to help alleviate hunger.

Our new signage at Zuck Road looks pretty cool, but even cooler when lit!

If you’re in the area, stop in and visit branch manager Carrie and her team!

Check out a list of all our locations and Surcharge Free ATMs here: https://www.eriefcu.org/bank/bankingservices/atm-branch-locations

Whether you’re saving for your children’s education, planning for your retirement or securing your family’s financial future, you can depend on Erie Advisors to help you find strategies to address your long-term financial objectives. Unlike some financial companies, our focus is on investment strategies and service. You can feel confident that you’ll receive the same level of personal service together with the knowledge you need to make sound financial decisions.

Garres LPL Financial AdvisorThrough LPL Financial, Erie Advisors offers a vast array of exceptional wealth management products and services including:

• Comprehensive financial guidance

• Retirement planning and income strategies

• Investment management • Insurance needs analysis

• 401(K) transition assistance To learn more, call 814-897-2500 or contact Erie Advisors online at https://www.eriefcu.org/invest/appointment-request to schedule a complimentary consultation.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Erie Federal Credit Union and Erie Advisors are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Erie Advisors, and may also be employees of Erie Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Erie Federal Credit Union or Erie Advisors. Securities and insurance offered through LPL or its affiliates are: Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value

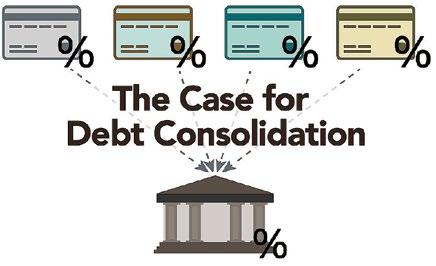

The most common arrangements for consolidation include:

• A low-rate card. You could transfer accumulated high-interest credit card balances to one card with a lower rate. Drawbacks: Attractive “teaser” rates often increase soon after activation. Read the fine print and beware of fees.

• A home equity loan. For homeowners, this may be the best way to reduce interest costs. Rates on a second mortgage are lower. Also, mortgage interest can be tax deductible. Drawbacks: Lenders can seize your house if you default.

Consolidating your credit card bills into a single loan can be a wise financial move. Debt consolidation can lower your overall interest costs, reduce your monthly payoff, eliminate late fees and over-thelimit charges, and allow for one, convenient monthly payment.

On paper, it’s a no-brainer.

But that doesn’t account for your behavior. Ask any financial counselor and they’ll say that if you’re planning on using a loan to help you get out debt, you must first change your spending habits.

Many Americans spend unconsciously, using money and credit to distract themselves from their lives. Some people get a loan to pay off old debts yet continue buying more than they can afford. The inability to control their spending only makes their financial troubles worse. However, if you’re ready to straighten out your credit snarls and be very mindful about your spending, then consolidation can work for you.

For instance, taking four $3,000 card balances at 19%, 18%, 17%, and 16% and putting them into one loan at 10% would save about $43 a month in interest payments. If you save that $43 instead of spending it, you’d have $1,500 in three years.

• A counseling agency. Pay an agency to arrange lower rates and longer paybacks with your creditors and then manage the repayments for you. The best services try to teach you how to live within your means. Drawbacks: Paying off your debt on your own looks better on your credit report. Also, there are some shady operators in this field, so know whom you’re dealing with.

The first step toward clearing your credit card clutter is to assess how bad off you are. Get a copy of your credit report and figure out how you got so deep into debt.

Next, call your card issuers and ask how much they’d be willing to lower your current interest rates.

If you’ve reached the limit on your cards, are struggling to pay the monthly minimum, or if a job loss or emergency bill would wipe you out, then look into consolidating.

But don’t try to start tackling the problem until you come to grips with its cause. You must find out why you spend unconsciously and then address those issues.

Managing your finances effectively requires that you be diligent and organized about paying your debts. If this is too difficult for you to do alone, then get some professional help. Take advantage of your credit union membership and use the services available to you. We can even recommend credit counselors who can help you.

The Erie FCU Board of Directors consists of seven directors who each serve a three-year term. The duties of a Director include: setting operational policies for personnel; reviewing investments; and ensuring guidelines for asset–liability management and federal regulatory compliance. A director must also be committed to the Credit Union Philosophy, understand Federal NCUA Regulations, and make competent policy decisions. Members in good standing who are interested in learning more about how the credit union operates may request to serve in the Associate Volunteer Program.

Requirements to hold the Office of Director:

1. Attend a full-day orientation session and meetings scheduled by the Chairperson.

2. Attend state, national and local meetings as required.

3. Attend specialized training sessions on Asset-Liability Management, Investment Polices, and other training as required by NCUA.

4. Complete all required board training provided by the credit union.

Nominated by Committee: Norbert Kaczmarek, Richard Macer, Dr. Pablo Reyes

Norb Kaczmarek, Board of Directors, has served the credit union for 50 years. He also served on the boards of the Pennsylvania Credit Union Association, PCUA Foundation, and the Credit Union Shared Service Center.

Rick Macer, Board of Directors, joined the board in 2019 after serving for 14 years as a member of the Supervisory Committee.

Dr. Pablo Reyes, Board of Directors, joined the board in 2021after serving on the Supervisory Committee and in the Associate Volunteer Program.

Members interested in becoming a candidate for the Office of Director must be at least 18 years of age and a member in good standing. The petition process requires a candidate to obtain signatures from 1% of the primary Erie FCU membership and submit them by March 10, 2023. If there are nominations by petition*, an election will be held by email or paper ballot.

Petition and additional information can be obtained by contacting Susan King at 814-825-2436, opt.1, Ext 1037.

*Erie FCU will not conduct the election by ballot and there will be no nominations from the floor when the number of nominees equals the number of open positions.

3503 Peach Street • Erie, PA 16508-2741

38th Street Office 1109 East 38th St. Erie, PA 16504

Lobby Hours

Drive Thru Hours:

Monday-Wednesday: 9AM-5PM

Thursday-Friday: 9AM-6PM Saturday: 9AM-3PM

Monday-Thursday: 9AM-5PM Friday: 9AM-6PM Saturday: 9AM-1PM

Bayfront Office 1005 Greengarden Rd. Erie, PA 16501

Lobby Hours

Monday-Thursday: 9AM-5PM Friday: 9AM-6PM

Drive Thru Hours:

Monday-Wednesday: 9AM-5PM

Thursday-Friday: 9AM-6PM Saturday: 9AM-3PM

Buffalo Road Office 2436 Buffalo Rd. Erie, PA 16510

Lobby Hours Monday-Thursday: 9AM-5PM Friday: 9AM-6PM

Drive Thru Hours:

Monday-Wednesday: 9AM-5PM Thursday-Friday: 9AM-6PM Saturday: 9AM-3PM

Zuck Road Office 5500 Zuck Rd. Erie, PA 16506

Lobby Hours

Drive Thru Hours:

Monday-Wednesday: 9AM-5PM

Thursday-Friday: 9AM-6PM Saturday: 9AM-3PM

Monday-Thursday: 9AM-5PM Friday: 9AM-6PM Saturday: 9AM-1PM

Drive Thru Hours:

Monday-Wednesday: 9AM-5PM

Thursday-Friday: 9AM-6PM Saturday: 9AM-3PM

Drive Thru Hours:

Monday-Wednesday: 9AM-5PM Thursday-Friday: 9AM-6PM Saturday: 9AM-3PM

Lobby Hours Monday-Thursday: 9AM-5PM Friday: 9AM-6PM Lobby Hours Monday-Tuesday: 9AM-5PM Wednesday-Thursday: 9AM-6PM Friday: 9AM-7PM Saturday: 9AM-3PM Lobby Hours Fastbranch ATM access only

State Street Office 518 State St. Erie, PA 16501 Walmart Office (Walmart Supercenter) 1825 Downs Drive Erie, PA 16509 32nd Street Office 1220 West 32nd Street Erie, PA 16508 Edinboro Office 101 Washington Towne Blvd. Edinboro, PA 16412

Lobby Hours

Monday-Thursday: 9AM-5PM Friday: 9AM-6PM

Routing Number: 243380927 Website: eriefcu.org

E-mail: memberservices@eriefcu.org

E-Z Phone: 814.825.2436, Option 9 Toll Free: 800.480.0494

Debit Mastercard® or STAR Card®: 800.523.4175 (After Hours)

Mastercard® Credit Card Lost/Stolen: 866.604.0381 (After Hours)

Erie FCU NMLS #414454

Privacy Policy Notice - The Erie FCU privacy policy has not changed. You may obtain a copy at www.eriefcu.org/pp or contact us at (814)-825-2436 or (800)-480-0494.

Martin Luther King, Jr. Day Monday, January 16, 2023

ALL offices will be closed

Presidents’ Day Monday, February 20, 2023

ALL offices will be closed

Glenwood Office 3503 Peach St. Erie, PA 16508

Lobby Hours

Monday-Thursday: 9AM-5PM Friday: 9AM-6PM Saturday: 9AM-1PM

As an Erie FCU member, you can make withdrawals and deposits at our ATMs or Fast Branch/ATMs using your Erie FCU Debit Mastercard® or STAR® Card and you will not be charged a surcharge or Out-of-Network Fee. For a current listing of all ERIE FCU ATMs, visit www.eriefcu.org/atms