FROM THE CEO MESSAGE

Empowering Communities through Financial Support and Community Development

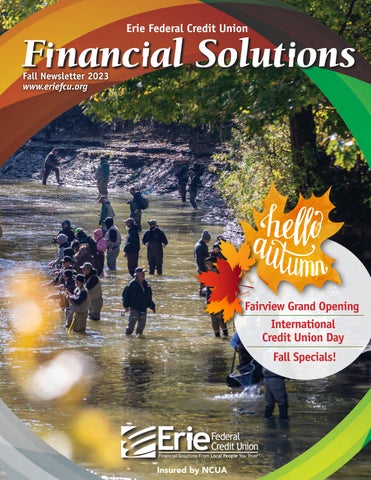

The leaves are falling, the mornings are cooler, and the beautiful colors of Fall are upon us. What is also here is our new branch in Fairview! We held a ribbon cutting ceremony on Wednesday, September 6 to celebrate the new branch and had an awesome time. Like the change of seasons, the new office is beautiful, and I encourage all members to stop by and say hi! Please check out the Grand Opening photos later in this issue.

Not only is Fall a great time to unwind and make lasting memories, it is also an opportune time to reflect on the financial choices we make and explore the unique advantages of credit union membership. Let’s take a closer look at how Erie FCU is working to enhance members’ financial well-being and the community that supports each of us.

Erie FCU has long been a champion of community development, playing a vital role in fostering economic growth and improving the lives of individuals and families. As a member-owned financial institution, Erie FCU prioritizes the needs of the local communities we serve, offering not only financial services but also actively engaging in many community outreach and development initiatives. Erie FCU is focused on supporting community development and creating a more positive impact in the communities we serve.

Local Focus and Member Ownership

Unlike traditional banks, Erie FCU is deeply rooted in the communities we serve. Our primary mission is to promote the financial well-being of our members, who live, work, worship, and have strong ties to our local area. By operating at the community level, Erie FCU gains firsthand knowledge of the unique challenges and opportunities that exist, allowing us to tailor our services to meet the specific needs of our community.

Access to Affordable Financial Services

One of the key ways Erie FCU contributes to community development is by providing access to affordable financial services, especially in underserved areas. We offer a wide range of products, including savings accounts, low-interest loans, mortgages, and small business financing. Erie FCU often provides a more favorable lending experience, making it easier for individuals with limited credit history or lower incomes to obtain loans and build their financial stability.

Supporting Small Businesses and Entrepreneurship

Erie FCU understands the vital role that small business plays in our local economy. We actively support small business and entrepreneurship by offering business loans, lines of credit, and business advisory services. By providing financial assistance and guidance to small businesses, Erie FCU strives to foster economic growth, job creation, and sustainability here at home.

Financial Education and Empowerment

Empowering individuals with financial knowledge and skills is a cornerstone of community development. Erie FCU takes great pride in providing free financial education and resources to our members and the community. We offer workshops, seminars, and one-on-one counseling sessions that cover topics such as budgeting, debt management, homeownership, and retirement planning. The aim of our financial literacy efforts is to equip individuals with the knowledge and understanding needed to assist members to make informed decisions, improve their financial well-being, and break the cycle of poverty.

Collaborations and Partnerships

Erie FCU recognizes the power of collaboration and actively seeks partnership with local organizations, nonprofits, and community development agencies. By pooling resources and expertise, we can amplify our impact and address community needs more effectively. Past partnerships involve initiatives supporting affordable home ownership, community revitalization, financial literacy, and support for various communitybased organizations.

Philanthropy and Volunteerism

Erie FCU, and #TeamAOK, demonstrate our commitment to community development through philanthropic efforts and continued volunteerism. Over the past 87 years, Erie FCU has consistently supported local charities, scholarships, youth programs, and community events. Moreover, Erie FCU employees often volunteer their time and expertise to serve on boards, mentor individuals, and actively participate in community service projects, strengthening the social fabric of the communities we serve.

(Continued on page 3)

“Life starts all over again when it gets crisp in the fall.”

~F. Scott Fitzgerald

Community Development Financial Institution (CDFI)

In addition to the above efforts, the U.S. Treasury recently certified Erie FCU as a Community Development Financial Institution or CDFI. This designation is only available to organizations that have proven they provide financial services and products in communities that have historically lacked access to traditional banking services. CDFI Certification is granted with the purpose of generating economic growth and opportunity within the areas served by CDFI certified organizations.

Receiving CDFI certification means Erie FCU is furthering its mission to responsibly deliver financial solutions that meet the needs of our community.

CDFI certification enhances Erie FCU’s ability to further extend critical credit union financial services to underserved communities lacking access to traditional financing, thereby, deepening the impacts our credit union can have in the communities we live, work, serve and call home.

CDFI certification qualifies Erie FCU to apply for and receive federal money in the form of financial and technical assistance grant dollars. Working with our partner, CU Strategic Planning, Erie FCU is scheduled to submit our first grant application the last quarter of 2023. Access to these funds will allow Erie FCU to deepen relationships by allowing us to develop and promote expanded lending and service programs meeting the needs of underserved populations within our community, and if approved, we will be looking to expand our ability to assist those within the local small business community that do not currently have access, or have limited access, to traditional capital investment.

Erie FCU, with our cooperative structure, personalized service, community involvement, and focus on financial education, offers a refreshing approach to traditional banking. We are more than just a financial institution; we are a catalyst for community development. Through our localized focus, affordable financial services, support for small businesses, financial education programs, collaborations, and philanthropy, Erie FCU makes a tangible and positive impact in the communities we serve. By choosing Erie FCU, individuals not only gain access to reliable financial services but also contribute to the sustainable development of their local neighborhoods. Together, Erie FCU and our members can build stronger, more resilient communities enabling a brighter future for all.

In closing, I hope you and your family enjoy a very Safe & Happy Fall Season,

Brian J. Waugaman, CEO

Brian J. Waugaman, CEO

#TeamAOK Walks for a Cause

Join Us As We Celebrate YOU!

This year Member Appreciation Week will be celebrated October 9 – 13. Keep an eye on our website and social media for more information about give-a-ways and fun surprises. We will CU soon!!!

75 Years of International Credit Union Day®

On October 19, 2023, Erie FCU will join over 56,000 credit unions around the world to celebrate International Credit Union (ICU) Day®. This year marks the 75th anniversary of International Credit Union Day®. Credit unions were built on the principle of “people helping people.” We’ve seen that philosophy in action for more than 100 years, with credit unions providing access to affordable financial products and striving to meet the needs of underserved communities. Erie FCU is honored to be a part of this proud tradition. We invite both members and nonmembers to visit any of our branches and celebrate this day. More to come on our social media about ICU Day!

Community Impact Report

Erie FCU is proud to share its Community Impact Report, telling the story of our community investments and engagement initiatives in Erie County and beyond.

You can view the Impact Report and our Annual Report here:

Your Credit Union: Intentionally Different

The movement is afoot! For the month of October, Erie FCU is again reaching out to the community asking for donations of new, warm and practical, adult sized socks which will be donated to local homeless shelters. Along with collecting warm, winter, adult size socks to give to those in need, this year, we are asking members to kindly donate new winter hats, scarves & mittens. (Men’s and women’s). We will be collecting these items at any one of our nine branch locations (during business hours) beginning October 1st through October 31st

Erie Otters Member BOGO Nights are back!

MEMBERSHIP HAS ITS ADVANTAGES!

Erie FCU hockey fans, good news! Erie FCU – Erie Otters “Member BOGO Nights” are back! Find info and complete BOGO schedule here: www.eriefcu.org/bogonights

Go Otters!

The time to get spooky is right around the corner!!

The Haunted Hayride at Sparrow Pond Family Campground kicks off October 6 at 7:30 pm and runs every Friday and Saturday through October 28th! Enjoy a good ole fashioned scary Haunted Hayride!

All your frightening friends will be there! Our members get 20% off tickets too! We saving our members money! Erie FCU is as proud sponsor.

Sparrow Pond Family Campground is located at 11103 Route 19 North, Waterford, PA.

Credit unions are different from banks in significant ways. Those differences were made intentionally, with you as the focus.

For one thing, credit unions are not-for-profit cooperatives owned by their members. Therefore, credit unions try to avoid doing anything that might harm their members. In contrast, for-profit institutions, like banks, focus on generating income for their shareholders.

To generate that income, banks sometimes engage in lucrative, but risky practices that most credit unions avoid. A case in point: credit unions did not engage in practices that caused the deposit insurance bank failures in March 2023

Credit unions are also better able to weather tough economic periods. They do this by staying well-capitalized. What that means is that they have a lot of wiggle room to absorb mistakes or bad behavior on the part of people who have borrowed from them. When members suffer financially and are unable to pay their loan payments, credit unions have less money to loan to other members. But that’s the beauty of the credit union model—the capital buffer protects the credit union from going under. Credit unions can live with those conditions without suffering dire consequences. In the for-profit sector, it’s more difficult. If their stockholders see earnings go down or they don’t continue getting high rates of return, the bank could collapse. Credit unions, on the other hand, can continue to serve their members even if they’ll make a little less money in the process.

In addition, your hard-earned money is protected. As to how your money is insured, the National Credit Union Administration (NCUA) insures all deposits up to $250,000. In addition, Erie FCU offers Excess Share Insurance (ESI), which provides additional coverage beyond primary NCUA coverage up to an additional $250,000 essentially extending combined coverage up to $500,000 per individual\joint depositor. Federal insurance protects your money in credit union share savings,share draft/checking, money market, share certificate, trust, and retirement accounts.

REMEMBER: Members of federally-insured credit unions have never lost a penny of insured savings.

The philosophy of the credit union movement is “People Helping People.” Your credit union was established for You. We’re here to provide you, your family, and your community with a secure place to keep and grow your money.

We’ll Be With You Every Step of the Way.

Chuck Molloy LPL Financial AdvisorWhether you’re saving for your children’s education, planning for your retirement or securing your family’s financial future, you can depend on Erie Advisors to help you find strategies to address your long-term financial objectives. Unlike some financial companies, our focus is on investment strategies and service. You can feel confident that you’ll receive the same level of personal service together with the knowledge you need to make sound financial decisions.

Dave Garres LPL Financial Advisor

Through LPL Financial, Erie Advisors offers a vast array of exceptional wealth management products and services including:

• Comprehensive financial guidance

• Retirement planning and income strategies

• 401(K) transition assistance

• Investment management

• Insurance needs analysis

To learn more, call 814-897-2500 or contact Erie Advisors online at https://www.eriefcu.org/invest/appointment-request to schedule a complimentary consultation.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Erie Federal Credit Union and Erie Advisors are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Erie Advisors, and may also be employees of Erie Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Erie Federal Credit Union or Erie Advisors. Securities and insurance offered through LPL or its affiliates are:

Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value

In Memoriam

We are saddened to share the passing of long-time board member, Dan Nawrocki. Dan passed away on Saturday, August 12, 2023. He attended St. Stanislaus and Holy Rosary Grade Schools and was a proud graduate of Cathedral Prep, Class of 1958. Dan earned B.A. and M. Ed. degrees from Gannon College and became a science teacher and counselor in the Erie School District, winning the district’s Teacher of the Year award in 1996.

Dan’s leadership and commitment left an indelible mark on Erie Federal Credit Union. His strategic insights, dedication, and tireless advocacy have propelled Erie Federal Credit Union toward greater heights and enriched the lives of all us serving our membership and community today. In Dan’s role as a Board Member and as Board Chair, Dan demonstrated unparalleled wisdom, providing guidance and direction through challenging times and celebrating our many triumphs. Dan’s legacy will forever inspire us to uphold the values he held dear and to continue striving for excellence in all that we do.

As we are grieving the loss of Dan, we are appreciative of the dedication he had for his family, friends, community and career.

Erie Federal Credit Union Announces New Director of Community Outreach

Erie Federal Credit Union is proud to announce the recent appointment of Katey Cross as Director of Community Outreach. In her new role, Cross will be responsible for ensuring successful financial wellness and community programs to support the areas Erie FCU serves, including Erie and Crawford counties. Cross will also lead Erie FCU’s team in developing strong relationships with local nonprofits and community leaders. Cross will also be actively involved in employee volunteerism through the credit union’s Team AOK (Acts of Kindness) and business development. Her appointment emphasizes the credit union’s commitment to continuously serving the local community, supporting financial wellness and financial diversity and inclusion.

Cross, a graduate of Gannon University, has been with Erie FCU since 2015 formerly serving as the Support Center Manager. Her experience includes over 20 years of customer service, specifically with financial institutions.

1% Rate Reduction NOW

1% Cash Bonus LATER No Payments for 60 Days

Annual Percentage Rate = APR. Loans subject to credit approval. Rates, terms, and conditions vary based on credit worthiness, qualifications and collateral conditions and are subject to change. 1% auto loan rate reduction is applied to qualifying interest rate and interest will accrue on the loan during the first 60 days. 1% cash back amount is based on amount refinanced and cannot exceed $500. 1% cash back amount will be paid one year after loan closing date and will be forfeited if loan is closed before one year term. Existing Erie FCU auto loans are excluded. Membership eligibility required. Insured by NCUA

*An additional .25% discount is available. To qualify for the additional .25% discount, member must have an Erie FCU checking account with direct deposit and enroll in auto pay/ payroll deduction. Certain restrictions apply. Promotion subject to change and could end without notice. Promotion runs through 11/30/23.

Office Locations & Hours of Operation

Important Information

Routing Number: 243380927

Website: eriefcu.org

E-mail: memberservices@eriefcu.org

E-Z Phone: 814.825.2436, Option 9

Toll Free: 800.480.0494

Lost/Stolen Debt & Credit Cards

Debit Mastercard® or ATM Card: 1.866.820.2868 (After Hours)

Mastercard® Credit Card:

1.866.611.4864 (After Hours)

Erie FCU NMLS #414454

Privacy Policy Notice - The Erie FCU privacy policy has not changed. You may obtain a copy at www.eriefcu.org/pp or contact us at (814)-825-2436 or (800)-480-0494.

Holiday Hours & Closings

Columbus Day

Monday, October 9, 2023

All branches will be closed

Veterans Day

Saturday, November 11, 2023

All branches will be closed

Thanksgiving Day

Thursday, November 23, 2023

All branches will be closed

Financial Statistics

Financial Data as of August 31, 2023 Assets...................... $786,417,290

Erie FCU No Surcharge & No Fee ATMs

As an Erie FCU member, you can make withdrawals and deposits at our ATMs or Fast Branch/ATMs using your Erie FCU Debit Mastercard® and you will not be charged a surcharge or Out-of-Network Fee.

For a current listing of all ERIE FCU ATMs, visit www.eriefcu.org/atms