Report on page

Report on page

President Massimo Trebar of Lawtons (Criminal Lawyer)

Vice President

Michael Scutt

Crane & Staples, Employment and Dispute Resolution

Hon Secretary and Treasurer Judith Gower

Immediate Past President

Kirsty Richards of National Legal Service (Family Lawyer)

Members

Steve Hamilton Taylor Walton LLP (Harpenden) Private Client

Marilyn Bell SA Law (St Albans) Family

Paul Davies Hamilton Davies (Stevenage) Employment, Family and Litigation

Sylvia Goulding Perrin Myddleton Commercial Property

Claire Sharp Debenhams Ottaway (St Albans) Private Client

Penny Carey (University of Hertfordshire)

Neil Johnson Gisby Harrison

Suna Duzgan Fish & Co

Alexander McDowall Hertfordshire County Council

Nicola Smyrl of Taylor Walton (Luton and an Employment Lawyer)

(From January 2025 until 31 December 2025)

Laura Woolard of Taylor Walton (St Albans and a Family Lawyer)

Amanda Thurston University of Hertfordshire

Jane-Louise Burrows Fullers Family law

Amy Hodgson Whiskas LLP

National Council Member

Josephine Duchenne National Council Member for Hertfordshire and Bedfordshire (from 15th October 2021)

To begin with the Annual Dinner, it was a great night and all seemed in the end to go very smoothly. It was a great speech from Richard Atkinson, and there were many positives to draw from the evening. We raised over £600 for the New trust. The awards went very well, and there were some very worthy winners.

In terms of sponsorship; it would appear that we were able to cover the vast majority of the costs. In particular Xpress legal, and the generosity of all of the all the sponsors, from review solicitors, Bell Howley Perrotton, University of Hertfordshire, Sworders, national legal service, and crane and staples and Taylor Walton; was all gratefully received.

Most positively both Review Solicitors and Xpress legal have indicated that they would be both very much interested in sponsoring next year, and of course I will be passing their details to Michael in due course.

The photographs were quite superb this year, and included below, is a photograph of myself and Richard Atkinson, National President. Again, as in previous years the music was great, magician utterly dumbfounding; and the caricaturist incredibly accurate!

Whilst of course the vast majority of my time since the last committee meeting in April has being largely preoccupied with the preparation for the annual dinner in June, there have been further very good events that I have participated in.

St Albans Social - The mermaid Tavern –2nd May 2025

It ended up being a lovely evening, and a great turn out, and the opportunity to try some very very nice ales, and indeed there were a number of guest ales available in the beer garden. It was the great opportunity to have an informal catch up, particularly in such pleasant surroundings, and in person

given the disembodied nature of most of our remote meetings.

We could certainly consider another summertime event, and there are certainly many more fantastic public house establishments in Saint Albans!

Hertfordshire Local Family Justice Board, Meeting 1st July 2025

I attended this remote meeting, which was also attended by Tia Hussain of National Legal Service, And Marilyn bell of this committee; and they would probably be able to provide a much better summary than myself, but I was able to discuss a number of matters and maintain Hertfordshire Law Society’s presence in this important resource. There was a very useful presentation by Trisha Cave in relation to the families first partnership programme; there was an update from Tia Hussain in relation to the family courts duty Solicitor scheme and the triage involvement by students from university of Hertfordshire. A further meeting has been scheduled for the 6th of October 2025.

Isle of Wight annual dinner & SAALS meeting 11th July 2025

I was very much hoping to be able to attend and had planned to do so, but unfortunately a particular professional commitment has fallen onto that day, and I'm now unable to attend very regretfully. I do understand that Paul Davis and Josephine Duchene will be in attendance and I trust will be able to represent Hertfordshire.

Local Law Societies Autumn Lunch –Birmingham 2nd October 2025

I'm very much looking forward to attending this event in October, which involves many local law societies, and offers a great opportunity to meet people face to face, and again is so much more useful and interactive than equivalent remote meetings by teams.

Massimo Trebar

President,

Hertfordshire Law Society

My favourite butler took unapproved leave to go to France. My second butler did stay home to look after me so that was acceptable. He apparently went to something called the Le Mans Classic and he camped. I only have one question why?

My second butler did not always do what I ask so I had to sit there and stare at her until she did! Don’t I look beautiful?

I don’t know what is going on in the house but everything is being moved out of certain parts of the house into boxes and two canvas wardrobes have been added. They are slowly being filled with clothes but they make a wonderful cool place to sleep as you can see from the second photo. I keep hearing Gigi won’t like it when the work starts. What work? No-one asked my permission.

I will be 8 on July 22nd. I do hope I get a present this year!

This year, the Law Society of England and Wales marks its 200th anniversary with a year-long programme of activities and events celebrating 200 years of supporting solicitors on a regional, national and international level.

In the past seven months, the Law Society has met with hundreds of its members but also aspiring lawyers, students, judges, local law societies, journalists and members of the public as part of a flagship regional tour across England and Wales. The locations of the bicentenary evening celebrations were led by research for a history road map, which uncovered local solicitor stories past and present. This focus on history can also be found in the Society’s digital exhibition, which tells the stories of the solicitor profession across 200 years on a wider scale.

The tour has encompassed a wide range of cities - from London to Cardiff, Newcastle to Liverpool, Birmingham to Norwich and down to Bristol – reflecting the Law Society’s commitment to engaging with the legal profession across the country. Beyond celebrating the profession’s rich collective history, the Society has actively connected with members to understand

http://www.hertslawsoc.org.uk/

the issues that matter most in their local communities. Discussions with leading legal figures have also explored the future of the profession, touching on key themes such as economic growth, talent and technology, the rule of the law, the importance of a well-functioning and funded justice system, regulation, and equality, diversity and inclusion.

In addition to the evening celebrations, the Law Society’s Office Holders have undertaken an extensive regional engagement programme, travelling across England and Wales to connect with members and local legal communities through a variety of engagements. This nationwide tour included visits to key towns and cities such as Exeter, Truro, Falmouth and Plymouth in the Southwest; Nottingham, Derby and Leicester in the Midlands; Leeds, Sheffield and York in Yorkshire; Cambridge, Ipswich and Norwich in the East; Manchester in the Northwest; and Llandudno in North Wales. The programme concluded with visits to Brighton, Southampton, Bournemouth and the Isle of Wight in the South.

The Society has also travelled beyond national borders, meeting with our

international members and holding roundtables and receptions in Singapore, Brussels, Hong Kong, Dubai and New York to celebrate the profession’s global standing and foster cross-border collaboration.

Closer to home, the Society has launched a snapshot report examining the current state of the legal profession, highlighting its role as a force for good and a driver of economic growth. Engagement with policymakers has also been a priority, with the Society hosting a parliamentary reception in March attended by the Lord Chancellor and Secretary of State for Justice and welcoming the Solicitor General to its London celebration in June. Across these initiatives, the Society continues to champion critical issues such as strengthening access to justice, upholding the rule of law, and supporting the profession’s future.

Looking ahead, there’s still plenty of opportunity for members to join in on the celebrations. In September, the Law Society will be opening its doors at 113 Chancery Lane to the public as part of Open House Festival, showcasing the history of the profession and it’s building in the heart of legal London. We invite members to come along with their families and colleagues.

The Law Society, will also be holding a hybrid in-conversation event with the renowned journalist and presenter, Emily Maitlis, exploring with a panel of experts in light of global events, why the rule of law matters to us all. It’s possible to attend in person or watch live online.

Celebrations continue until the end of 2025. You can book events, access content, and read about the activities that have been happening across the year within the Law Society’s bicentenary webpages.

Dr Amy Murat

Bicentennial Programme Manger

The Law Society of England and Wales

Wedding season is here, and the air is redolent with romance and confetti. Whilst love is very much the driving force for most couples’ decision to wed, governments have often built in tax benefits to marriage in order to encourage couples to tie the knot, so let us lift the skirts of matrimony, to examine the garter of sound tax planning beneath.

Throughout this article, references to marriage include Civil Partnership, which receives exactly the same tax treatment as traditional marriage.

All gifts made between spouses are taxfree. They neither count towards your £3,000 annual exempt amount, nor fall into account for inheritance tax (“IHT”) if you die within seven years of making the gift.

Any gifts – either made in your lifetime or on death – also pass to your spouse free of capital gains tax (“CGT”). However, lifetime gifts between spouses are not rebased, so an eventual disposal by the recipient will be subject to CGT on the difference between the value at the date of disposal and the value on the date the original spouse first acquired the asset.

On death, anything you leave to your spouse, whether in your Will or by right of survivorship (for jointly-owned assets), is free of IHT. But if unmarried couples wish to provide for one another on death, the inheritance over £325,000 will be subject to IHT at 40% (and lifetime gifts would utilise the donor’s nil rate band).

Gifts on death are rebased, and thus leaving assets to a spouse by Will is an excellent way of washing out any gains. The recipient spouse can dispose of the asset soon after inheriting it, with no (or very minimal) CGT and completely free from IHT.

Transferrable nil-rate band and residence nil-rate band

Each person, whether married or not, can leave £325,000 to persons other than their spouse free of IHT. Where the estate is valued at under £2million and the deceased’s residence passes to direct descendants on death, there is an additional residence nil-rate band of £175,000. A person who has children and owns property can therefore leave a maximum of £500,000 free of IHT.

Where a married person leaves all their assets to their widow, the nil-rate bands will be unused and instead can be transferred to the second spouse’s estate. A spouse who inherits everything on the first death can therefore leave up to £1million tax free on their own subsequent death.

(The residence nil rate band is tapered for estates over £2million but the precise way in which that works is beyond the scope of this article).

Maximise allowances

Gifts between spouses can enable CGT savings to be maximised through the annual allowance and lower rates. Each person is able to realise tax free capital gains of up to £3,000 per year. As lifetime gifts between spouses are tax-neutral, a spouse owning an asset pregnant with gain can transfer part of the asset to his or her spouse so that on disposal, each party’s annual allowance is utilised. If one spouse is a basic rate taxpayer, they will pay CGT at a lower rate (18% as opposed to 24% on most assets).

Inherit the ISA allowance

Many people accumulate a substantial ISA allowance over their lifetime, saving up

to £20,000 per year in these tax-efficient plans. On death, the ISA assets continue to benefit from their income tax-free and CGT-free treatment within a limited time frame. However, a spouse inherits their deceased partner’s ISA allowance (whether or not the ISA itself passes to the spouse on death). A widower may therefore invest up to the amount his deceased wife left in ISAs at her death, and continue to enjoy tax free income and gains from those savings and investments for the remainder of his life.

Marriage is not without its downsides, and if you choose to marry on the strength of this note (such is my persuasive force) please be aware that marriage automatically invalidates any Will you might already have made. It is always better to have a well-drafted and up to date Will in place, and Taylor Walton’s experienced team can assist with this.

When a person dies without a Will, the intestacy rules govern who should inherit the estate. Spouses are included in the line of succession for an intestate estate (although may have to share with children, depending on the values involved), but unmarried partners are not included and would not benefit at all without recourse to the Courts.

A

Of course, despite the above benefits, we would always counsel against marrying only for the financial incentives built into our tax system. In addition, the pooling of marital assets which allows couples to take advantage of the various tax benefits should only occur within secure and trusting marriages (without coercion or abuse). Money makes the world go round but, in the words of Elizabeth Barrett Browning, love is what makes the ride worthwhile.

Rachel Giles Partner, Taylor Walton LLP

As for so many years, the event was held at the Old Palace, Hatfield house, but following on from the precedent set last year, the event was again held on a Friday.

We saw over 130 guests; and as ever; the room was laid out with wonderful flowers to compliment the magnificent ancient tapestries adorning the walls.

The format stuck to the tried and tested formula of drinks in the magnificent and picturesque the gardens outside the Old Palace, From 6:15 PM. As can be seen from the wonderful photographs taken by the official photographer Simon Wright, which are available to view in full on our website.

Guests were called to take their seats before 7:00 PM, and myself and my top table guests were then asked to make their way to the top table. We were privileged to have the following guests on the top table, including myself and my wife Sarah Jane, Richard Atkinson (President of the national Law Society, and keynote speaker); Michael Scutt (Vice President); Mark Proctor (President Bournemouth Law Society); Josephine Pilling (Bucks, Berks and Oxon Law Society); Josephine Duchene (Herts Member for National Law Society Committee, and Past President); Charles Duchene (Past President); Adam Hall of Review Solicitors; Steven Kay KC (Head of Chambers of 9 Bedford Row) and Rebecca Palmer of the New Hope Trust.

It was wonderful to be able to welcome the guests, and after initial toasts and a welcome speech from myself; the guests were served with their starters, which was a choice between torched mackerel or leek stracciatella.

After starters were cleared, I commenced with my main speech. I discussed my personal background and links to Hertfordshire, having grown up in

Croxley near Watford. I also referred to my memories of Hertfordshire life, and referred to the wonderful history of Watford FC particularly in the 1980s. I inquired as to the current status of their great rivals Luton FC, and wondered how their fortunes had faired this season.

I touched upon my practise as a criminal solicitor, and also referred to the anniversary of the Legal Aid and Advice act 1949, enacted by Clement Attlee’s landmark post war government; and observed of the loose connection between Hertfordshire, and that act, given that Clement Attlee had attended Haileybury school in Hertford.

I referred to the current state of criminal legal aid provision; and highlighted worrying trends in respect to the ageing of duty solicitors; reduction in their numbers and the current state of appalling delay and backlog in all court proceedings but particularly those in the Crown Court. I highlighted my own firm, Lawtons, and their commitment to the training of new trainee solicitors; and their commitment to publicly funded work.

Finally I made observations generally in relation to the unique, and uniquely intimate position we hold in respect of our clients; and made the differentiation

between ourselves; and members of the bar, who were very well represented on that evening; particularly from 9 Bedford Row; who very generously attended.

The Keynote speaker Richard Atkinson, president of the national Law Society; and himself also a criminal practitioner; gave a superb speech, highlighting the many campaigns the national law SoC have been conducting, especially under his presidency. In particular he was able to refer to the first increase in criminal and civil legal aid rates in over 30 years; the significant reviews being undertaken in relation to sentencing; and the Leveson review due in respective court backlogs; and potential reconstitution of the Crown Court and Right to a jury trial. He also referred to the dreadful current status of affairs in respect of the hacking of the legal aid portal; which would be having a profound effect on legal aid practitioners entirely dependent on that as a source of income.

Further toasts took place and our guests were then served with their main courses which included Roast Lamb rump or Roasted Cauliflower. A huge thank you must go to the chef, Kitchen teams and waiting staff for their work to make the evening go so smoothly.

After the main course, Keira O’Connor assisted in selling the raffle tickets; the

proceeds of which went entirely to my chosen charity, New Hope Trust, homeless charity based in Watford. Rebecca Palmer of the New Hope Trust, also gave a short speech setting out the magnificent work that they undertake for the homeless, which had followed my observations of the inextricable link between homelessness and commission of offences.

Desert, tea and coffee were then served ahead of the Law Society excellence awards, And again a huge thank you must be given to the headline sponsors, Adam of review solicitors; and Xpress Legal, together with Judith Gower, Honorary secretary and treasurer of Hertfordshire law Society, who all sat on the judging panel.

The Winners of the 2025 awards were as follows;

Community engagement award - Taylor Walton

There were also prizes for the following trainees and students, presented by the Vice President Michael Scutt;

Orlagh Willis

HRJ Foreman Laws (highest SQE)

Emily Foster

Taylor Walton (highest LPC)

And we were also able to congratulate the following newly qualified solicitors:

Alisha Afzal - Taylor Walton

Nia Miller-Jones - Debenhams Ottaway

Brittaney Gleed - Debenhams Ottaway

Juliette Fletcher - C&S

Amy Tapping - C&S

The raffle was a tremendous success and over £600 was raised for the New Hope trust.

The evening continued with music from time flies, who have supported this event for many years, and feature His Honour Judge Perusko. There was further wonderful entertainment with the incredible magician Ben wolf, caricaturist Dan Pilkington; and also a photo booth.

I must thank again all of the sponsors; review solicitors, Xpress Legal, Bell Howley Perroton; University of Hertfordshire, sworders fine art auctioneers; national legal service (sponsors of the photo booth), Crane &

Staples and Taylor Walton (Sponsors of PreDinner Drinks).

It was a wonderful evening and I hope that everyone who attended enjoyed the evening as much as I did. It will now be for my vice president, Michael Scutt, of Crane and Staples to begin organising next year's event.

Thank you everyone for a truly wonderful

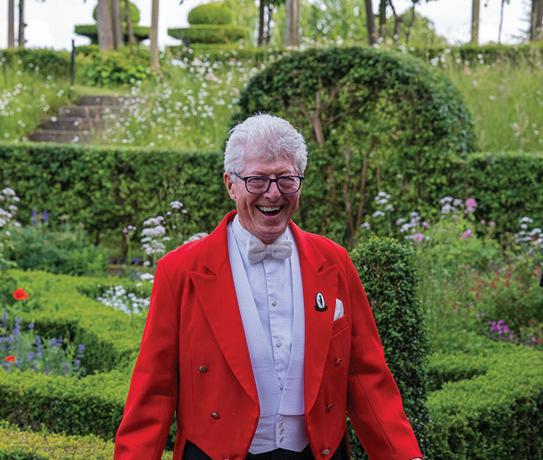

evening, and a final special thank you to master of ceremonies Reg Parsons, who effortlessly made the whole evening go so smoothly.

July 2025 http://www.hertslawsoc.org.uk/

Elite Law Solicitors have uncovered £270,000 held in a previously unknown account while managing an estate administration case. The discovery was made following a Financial Profile Search carried out through the legal technology group Estatesearch, which provides a range of estate administration services to help legal teams save time and mitigate risk during probate and deputyship cases.

Meg Wilton CILEX Lawyer and TEP, Elite Law Solicitors explains: “We pride ourselves on offering comprehensive advice to clients. This often means asking the right questions and checking the wider picture to see if there is a recommendation we can make beyond our services which is in the best interests of our client.

“We have used Estatesearch’s services for several years and it is not uncommon to discover the odd account or asset but

no one was prepared for what transpired on this occasion. The search yielded a positive match, and further enquiries revealed an account containing over £270,000 which no one was aware of.

“This represented a huge windfall for our clients. Although funds and the estate was now subject to IHT, both beneficiaries will both still receive a substantial sum once the HMRC account and legal fees are settled. By contrast, if the asset had been discovered after the estate had been distributed, it would have been likely they would have needed to pay interest and penalties to HMRC, so they were pleased and relieved this bank account was discovered thanks to the Estatesearch’s Financial Profile Search we recommended. It was rewarding to work on a case which had such a positive impact on our clients.”

Estatesearch’s Financial Profile Search makes enquiries of more than 150 organisations, searching over 450 companies and brands including banks, building societies, investment managers, share registrars, pension providers and insurers to help identify accounts.

Private client solicitors then make further enquiries if a financial institution confirms the subject holds, for example, an account or a pension of which they were previously unaware.

Meg Wilton continues: “This case has also been a useful example to share with clients to explain about the importance of an asset search. It’s not just about the potential of finding ‘buried treasure’ but also avoiding any penalties or fines relating to IHT or potential additional legal fees should assets become known, even years later and the estate needs to be re-distributed.”

Ben Furlong , Managing Director, Estatesearch confirms: “While it is unusual for our Financial Profile Search to contribute to the discovery of an account containing such a significant sum of money, identifying unknown assets is not. Feedback from the 2,000 legal firms we work with regularly shows that 70% of private client firms have identified assets their clients were previously unaware of, thanks to our Financial Profile Search. The report also acts as a due diligence record, a liability bridge should anything surface later. If an asset is found after estate distribution, we can help firms seek to recover re-administration costs from the financial institution involved, supporting clients and helping to protect legal firms.”

For more information about Estatesearch’s Financial Profile Searches or Will Searches or to read Elite Law Solicitors’ full case study please see: https://www.estatesearch.co.uk/

For more information about Elite Law Solicitors please see: https://www. elitelawsolicitors.co.uk/

• 92% of professional advisers say that estate and tax planning will become even more important following the Inheritance Tax (IHT) changes announced in the 2024 Autumn Statement;

• 60% say they are already receiving more requests for advice;

• 65% say charitable tax incentives will become even more important to their client base; and

• 62% think more people will consider leaving a gift to charity.

Upcoming Inheritance Tax (IHT) changes are already beginning to influence the charitable Will-writing and estates market, with professional advisers reporting an increase in demand for estate planning advice and predicting a rise in charitable legacy giving, according to new research from Remember A Charity.

The changing IHT landscape

In the Autumn Budget 2024, the Chancellor announced that IHT thresholds would remain frozen until 2030, with pension wealth no longer exempt from IHT from April 2027. As such, it’s estimated that the proportion of estates facing an IHT bill will almost double by 2030.

Remember A Charity’s Professional Adviser Tracking Study* – carried out by Savanta – reveals that 60% of professional advisers (solicitors, Will-writers and financial advisers) are reporting an increase in requests for advice about estate or inheritance planning since the IHT changes were announced. 9 in 10 advisers expect estate and tax planning to become more important under the IHT changes (92%), and that more people will need to consider how to mitigate the tax due (91%). Only 15% think there will be no discernible impact from the changes.

As more estates fall within the scope of IHT, two thirds of advisers believe that the charitable tax incentives will become an even more important consideration for their clients (65%), and that a greater number of people will consider leaving a gift to charity from their estate (62%). Charitable gifts are exempt from IHT and estates that donate 10% or more of the net value can qualify for the reduced IHT rate of 36%.

Tanya Watson, Chartered Tax Adviser and Senior Director at Alvarez & Marsal Tax LLP, says:

“The changes to IHT are prompting a fundamental reassessment of estate planning strategies, particularly among clients who may not have previously been impacted. What we’re seeing is a growing need for tailored advice that balances financial objectives with personal values. Charitable giving can be a highly effective planning tool, and these changes provide a timely reason for advisers to revisit legacy plans with clients who may not have considered this route before.”

Eleanor Evans TEP, Partner, Trusts and Estates Administration at Hugh James, says:

“We’re already seeing an increase in clients seeking early advice on estate planning. Many people choose to leave legacies to benefit a cause they care about, and the tax breaks for gifts to charity provide an added incentive. As more estates will become liable for IHT once the changes take effect, charitable giving is becoming an increasingly important part of the estate planning conversation.”

Advisers communicating charitable giving more actively

When it comes to Will-writing, over two thirds (77%) of solicitors and Will-writers now say they always or sometimes proactively raise the charitable option with clients (up from 72% in 2023). Charitable

gifts are becoming more prevalent over time, with an average of 21% of Wills written through a solicitor or Will-writer now including a donation. This rises to 24% amongst those who always reference charitable legacies with clients and falls to 14% of those who never do.

Tax incentives are the most prevalent reason advisers give for raising the topic of legacy giving with clients. 92% of solicitors and Will-writers and 86% of financial advisers in the study say they always or sometimes advise their Will-writing clients of the charitable tax incentives.

Lucinda Frostick, Director of Remember A Charity – the consortium of UK charities working to grow the legacy giving market, explains:

“Across the advisory spectrum, we’re seeing more advisers referencing the option of charitable giving when talking to clients about their estate and inheritance planning. While the reasons for giving extend far beyond tax incentives, the fiscal framework forms a natural starting point and these IHT changes make the legacy conversation even more relevant to a wider group. This is helping to build understanding of legacy giving and to inspire more people to support the good causes they care about – alongside their loved ones – from their estate.”

Remember A Charity works with professional advisers, legal partners, regulators, trade bodies and government to build awareness about legacy giving. Find out more at www.rememberacharity.org.uk/ advisers

* A summary report of the findings is available here: https://www.rememberacharity.org.uk/media/ seflc0aj/savanta-summary-report-2025-publicjune-2025.pdf

The Charity Commission has published its annual public and trustee research, revealing a stark long-term rise in people seeking charitable support amid continued high levels of public trust in charities.

The Commission’s annual survey of public attitudes to charities reveals that in the last year 9% of people received food, medical or financial support from charitable organisations, compared to just 3% five years ago.

While demand for such services has risen dramatically, the Commission’s research shows that charities themselves are feeling increased financial pressure.

Over the same five-year period, the proportion of people who said they’d donated to, or raised funds for charity in the past year, fell from 62% to 48% as households have felt the pinch.

Nearly half of charity trustees said their charity had been forced to make changes as a result of cost-of-living pressures in the past year (46%). This included stopping some services (11%) and using more of their reserves than expected (17%).

Against the backdrop of these challenges, public trust in charities remains high, with almost 60% of people reporting high trust in charities – placing them second only to doctors among trusted institutions.

The research indicated that public confidence in charitable spending has improved, with over 6 in 10 people believing donations are reaching the intended cause. This confidence has risen by 7 percentage points in 12 months.

In other findings, the research suggested that charities’ campaigning activities are unlikely to diminish public support in their work – and for nearly half, may increase it. Fewer than 1 in 20 said they would be less likely to support a charity that campaigned, suggesting continued public support for charities that advocate for their beneficiaries.

In the Commission’s annual survey of trustees, also released

today, there are signs of slight improvement in banking services, after the regulator and its partners highlighted persistent issues for many charities.

The research found that 38% of trustees reported problems with their charity’s bank, which is down from 42% in 2024, but remains an issue for many.

Charity Commission Chief Executive, David Holdsworth, said: “These findings highlight the central role of the charitable sector at a time of significant pressures in wider society.

“Charities are providing a vital lifeline to ever more people, while simultaneously navigating their own financial challenges as donors feel the pinch.

“It’s encouraging to see improved public confidence in charitable spending, though there is no room for complacency. Charities must continue to keep their charitable purposes central to everything they do because this remains a key driver in maintaining public trust.

“The data paints both a challenging picture and a hopeful one – showing a sector that continues to be a bedrock of support and community for people across the country as well as overseas, despite navigating unprecedented demand in an increasingly unstable global landscape.”

The full findings can be found on gov.uk

Recently, the solicitors’ professional indemnity market has seen an increase in the number of insurers offering firms primary insurance. With more choice available, how should firms best present their risk — and why should they choose HDI?

At HDI, how do we assess you as a firm?

As your insurer, we are there for you when the worst happens. However, insurance is just one tool in your armoury against risk. We look for firms that invest in a clear and robust risk management strategy. We want to hear about how you identify and manage risk in your firm. This can include how you structure your firm, risk management planning, business continuity plans, file review and supervision policies, and external audits.

When reviewing a firm’s proposal form, I like to pay particular attention to the answers that provide insight into the workings and values of your firm. Your submission can be really enhanced, for example, by sharing your firm’s history, any particular specialisms, your future goals, the type of work you like to do and the type of work that you would turn away. These details allow me to take a more holistic view of your firm.

Getting your submission in early and in full order is vital. Work with your

broker to ensure you have up-to-date claims summaries. It is also very helpful to include a narrative around any open and closed claims — for example, what the allegation was and what lessons were learned. The fact that you may have experienced a claim is not necessarily an issue — at HDI, we recognise that there is often a story behind every claim, and we are openminded and willing to listen.

What are the key concerns for Insurers currently?

Whilst the frequency of claims appears stable, the severity of claims has notably increased in recent years. Contributing factors include rising asset values, more complex transactions and defence cost inflation. Worryingly, the market has begun to see more claims exceeding the compulsory primary limit. Firms should have heightened risk management measures in place when taking on matters of high value, or when acting for clients of considerable net worth.

Conveyancing remains the main source of claims, both in frequency and overall cost. Conveyancing firms continue to be prime targets for property fraud. Being aware of key red flags and undertaking rigorous due diligence is vital to protect your firm from such claims.

Additionally, there has been a notable rise in claims from wills, trust and probate work. The drivers for this are a combination of more complex family structures, increases in overall estate values and the challenges that can arise with people living longer. Our advice is that this would be a good time to conduct a review of policies and procedures and implement targeted refresher training for staff.

Beyond this, insurers will be taking into account the economic environment,

technological development and other similar contextual factors as drivers for claims, such as the impact of AI, and the continued cyber threat we all face. Sharing your firm’s policies and risk management strategy for these areas helps provide insurers with reassurance that your firm is well equipped to navigate such challenges.

Why choose HDI as your insurer?

In the past, we have seen volatility created by insurers entering and exiting the solicitors’ professional indemnity market. At HDI, we have the experience, strength and stability to support you now and into the future. Our recent credit rating upgrade by international rating agency S&P Global Ratings to AA- (Very Strong) is a testament to our financial resilience, enabling us to be your trusted insurance partner.

We look to provide law firms with a high-quality, long-term solution. That’s why many of the practices we cover have been with us for the 15+ years as we have been a primary insurer for law firms. We use our specialist experience to ensure that we are the experts for your needs today – and help prepare you for what might happen tomorrow.

If you are a firm with a turnover of under £20 million and would like to obtain a quotation from HDI, please contact Lockton Insurance Brokers.

Sarah White, Underwriting Manager, HDI Global SE.

Business valuations in shareholder disputes and matrimonial cases often highlight undisclosed cash takings and personal expenditure hidden in company accounts. It can also be relevant when considering the valuation of a company for strategic planning or a business sale.

When dealing with disputes, including divorces, it is not uncommon for one party to raise concerns about undisclosed cash or personal expenditure and the impact they have on the valuation. At the same time, the other party may dispute the existence, extent or relevance of the transactions.

Undisclosed cash takings

Historically, cash-based industries provided an opportunity to not record all takings and to either spend the cash personally or bank it in a private account. The move to a cashless economy has made it more difficult to divert cash income in this way. However, we do come across situations where certain types of business sales are omitted completely from the records and the sales receipts are diverted to a private bank account.

Quantifying undisclosed cash takings is difficult unless the parties are willing to provide an estimate that we can use in our calculations. In some industries, we may be able to estimate a figure based on, for example, diary entries or bookings. Clearly if the undisclosed takings are banked in a private account, we can use statements from those accounts to quantify the amount omitted from the accounts.

We have had cases where both parties are fully aware of a long-term practice of undisclosed sales and it only becomes an issue at the time of the divorce. We also need to consider the implications

in respect of underpaid tax, VAT and penalties.

In terms of the impact on valuation, it depends on valuation basis in our instructions. If instructed to provide an “open market valuation” , we may decide not to include undisclosed takings in the valuation calculation. This may be because, in our view, the undisclosed takings cannot be reliably estimated or because an external buyer will not be prepared to pay for profits that are not recorded in the accounts. An external buyer may in fact discount the valuation due to the potential tax issue.

Alternatively, if instructed to provide an “equitable basis” valuation, we may decide to include the undisclosed income to arrive at a fairer outcome where one party is going to retain the company and future undisclosed profits.

In a divorce case, undisclosed takings may also be relevant in assessing future sustainable income if it is expected the undisclosed takings will continue.

In family companies it is common for personal or discretionary expenses to be paid through the company. In the first instance the valuer needs to ascertain if the expenditure has been charged to a director’s loan account or whether it is charged within the profit and loss account.

If expenditure is charged to a director’s loan account, then there is no impact on the valuation of the business. In effect a cash balance is replaced by a debt in the company. It may be an adjustment if the directors is unable to repay an overdrawn loan.

The expert may be instructed to investigate the level of private expenditure in the accounts or it may be identified through analysing the profit and loss variances. However, it can be difficult to identify, particularly if hidden in the “cost of sales” heading.

If the expenditure is in the profit and loss account and can be quantified, there is likely to be an impact on valuation –potentially significant. For example, let’s assume that the personal expenditure in the profit and loss is £100,000 annually. A value based on future maintainable earnings/EBITDA and a multiplier will increase: if we adopt a multiple of, say, 5X, then the valuation in this case increases by £500,000.

Again, in divorce cases, personal expenditure within the profit and loss account will impact the assessment of future sustainable income as well as valuation.

Personal expenditure within the profit and loss account may also raise potential issues in terms of potential future tax liabilities.

In commercial valuations for a potential sale of the business, the seller will provide an estimate of personal and discretionary expenses which a buyer is unlikely to continue paying. They will seek to add these back in the assessment of the company’s market value. Such adjustments typically include family wages and other benefits to directors which exceed an assessment of the commercial salary for the role.

Undisclosed takings and personal expenditure are typically sensitive issues but can have a significant impact on a business valuation. If instructing an expert, it is helpful to engage early with the expert and to provide clear instructions on how the issue is to be dealt with. Valuations can be prepared based on alternative assumptions.

A

review by

Phillip Taylor MBE, Richmond Green Chambers

Alegal highlight each year for those involved in expert evidence is to visit the EWI’s Online Conference It is well established as a virtual event working to update us on the work of experts with panel discussions including, this year, ADR. The Conference was again excellently chaired by Kitty St Aubyn with panel chairs.

The event was no different to previous occasions and highly informative! The webinar brings together expert witnesses, solicitors, barristers and eminent judges, including, this year, Lady Rose and Birss LJ. Discussions reviewed key issues facing our expert community, giving legal updates, and delivering “an enlightening day of insight, advice and discussion”. And all online, too, from the comfort of your home or office.

Lady Rose “How to be a witness as well as an expert”

The day’s highlight was the leading keynote address from a Supreme Court Justice, Lady Rose of Colmworth. In her recorded address, Rose reflected on the vital role of the expert witnesses across all aspects of modern litigation and dispute resolution.

Drawing on memorable cases from her time in the Chancery Division and on the Competition Appeal Tribunal, Rose highlighted the powerful impact that expert evidence can have on the outcome of a case. She cited two trends shaping expert testimony involving the nature of an experts’ work for the future.

The first trend identified the growing importance of “collective actions”, where a representative brings a claim on behalf of many individuals. These are sometimes known as “class actions”, being “the presentation of individualised evidence from

numerous claimants” which can often be impractical as sole proceedings. “Such cases”, Rose said, “increasingly rely on expert witnesses to provide an aggregate analysis”.

To avoid expert analyses duplication, Rose discussed use of ‘hot tubbing’ - always a favourite issue with the conference in recent years because of the imagery of the title! It’s a process where experts collaboratively present and discuss findings before the judge early in the process. It’s also an approach that does narrow the issues, promoting collaboration between experts, and it saves time.

The second trend covered the increased technical nature of expert evidence. “Such evidence is becoming more technical”, she said, observing that “it makes it harder to communicate clearly to barristers and judges, who must in turn explain the evidence in their judgments”.

To help experts navigate these challenges, four points emerged:

1. Remember that your duty is to the court and not to the party instructing you. Rose stated that “it’s the judge’s trust and respect that ultimately will prove the most important factor in your evidence being accepted by the court.”

2. Be clear and precise. “Quantity does not guarantee the quality”, Rose explained. “Sometimes the sheer weight of analysis obscures the royal the real point of issue.”

3. Do not underestimate the tribunal’s expertise. Rose made this observation: “You may find that your most searching questions come not from opposing counsel, but from the bench.” Too true!

4. Judges don’t want to trip you up or catch you out. Rose explained here that “We want you to help us understand what for many will be on familiar territory, and if you do that with honesty and clarity, you will find yourselves indispensable to the process.”

Lord Justice Birss “Expert witnesses: vital participants in civil justice”

Colin Birss is a judge of the Court of Appeal, Deputy Head of Civil Justice, and an advisory editor to “Civil Procedure: The White Book 2025” A self-confessed “computer wonk”, Birss offered a most useful picture of current issues in civil justice as the most experienced judge in both IP and IT matters today. We were very lucky to hear from him.

Conference aims for 2025 were to assist new experts looking to develop their understanding of key issues; experienced experts looking to develop their practice; and those who work with or instruct experts, so there was much variety again this year.

Expert witnesses come under continual scrutiny in the courts, so the conference provided essential insight and practical advice to help experts further develop their knowledge and skills, obtain instructions, and win repeat business.

Hearing from the senior judiciary, solicitors, and experienced experts, participants could reflect on important legal updates and ethical issues when considering what instructing parties are looking for. As usual, latest case law decisions introduced by Sean Mosby were particularly helpful.

There was a useful participation in a range of practical interactive sessions and discussions which are easy to use once one gets the hang of it in the virtual environment. For those who missed any sessions, recordings from the Conference are available, so thank you again, EWI, for a most successful virtual day. See you next year.

An appreciation by Elizabeth Robson Taylor MA of Richmond Green Chambers and Phillip Taylor MBE, Head of Chambers, Reviews Editor, “The Barrister”, and Mediator

The 2024 Standard Civil Contract and The 2025 Standard Crime Contract

Edited by: Vicky Ling, Sue James and Simon Mullings

ISBN: 978-1-913648-68-8

Legal Action Group

Supported by The Law Society www.lag.org.uk

This Is The Only Comprehensive Guide To The Legal Aid Scheme -- Now In Its New Annual Edition For 2025

“Without legal aid, there is no access to justice.” In their terse and to the point introduction to this latest edition of the celebrated ‘Legal Aid Handbook’ (published annually), editors Vicky Ling, Sue James and Simon Mullings have certainly set out to remind everyone involved in the justice system of this painfully obvious and uncomfortable truth for the 2020s.

Legal aid and advice, as they rightly insist, is a public service, critical, indeed, to ensure the fairness of the justice system. One might add, in tandem with the editors, that legal aid is chronically and consistently underfunded, while at the same time, its complexity increases. All the more reason why dedicated practitioners in this challenging and vital area of law should acquire this latest edition of the ‘Legal Aid Handbook 2024/25’ published annually by the Legal Action Group (LAG).

The statement has been made -- and who could disagree -- that all busy practitioners involved with legal aid cases should have a copy of this Handbook permanently on their desks -- and so many do. Always have the most recent edition because the rules do change quite often. As the publishers point out, this is ‘the only comprehensive guide to the legal aid scheme.’ Within almost 800 pages the handbook provides all pertinent and specific advice on the conduct of cases, as well as advocacy and the practicalities if financial and contract management, plus advice on getting paid.

As the subtitle indicates, this new and updated edition provides advice on ‘The Standard Civil Contract 2024’ and ‘The Standard Crime Contract 2025’ -- and there’s a new chapter on “what you need to know at a glance” which we found most helpful. Other new sections of the text include key resources and key points to note.

As a work of reference, including key chapters written by a total of thirteen expert contributors, including the editors -- this is a handbook that is more than useful, as it includes tables of cases, statutes, statutory instruments -- and a table of EU and international legislation. Straightforward to navigate, it also provides a list of abbreviations (very useful, that), a glossary, an index of seventy-five pages -- plus five appendices, which include advice on what you can claim for in civil, as well as criminal costs.

For all practitioners who handle legal aid cases, this newly published up to date and information-rich handbook should be regarded as an absolutely essential purchase.

The date of publication is cited as November 2024.

Many legal organisations are working hard to improve inclusion and wellbeing - but knowing what really makes a difference can be difficult.

Reverse mentoring is one approach that offers a fresh, people-focused way to drive change. It helps senior staff hear directly from others, build trust, and better understand what it’s like to work in their organisation.

What is reverse mentoring?

In reverse mentoring, junior staff or people from underrepresented backgrounds mentor more senior colleagues. It’s a way to have honest conversations, share experiences, and make sure everyone’s voice is heard - especially those often left out of important conversations and decisions.

This type of mentoring recognises personal experience as valuable knowledge. It helps leaders better understand their people and how the workplace affects them. It’s not always easy - but when done well, it’s powerful.

Top tips for running a reverse mentoring scheme

If your legal organisation is thinking about reverse mentoring, here are six key things to keep in mind:

1. Take your time

Don’t rush into it. Involve a mix of voices when planning your scheme so it reflects a range of experiences.

2. Seek diverse views

Go beyond the usual perspectives. Make space for underrepresented

groups to help shape the programme from the start.

3. Build trust first Relationships matter. Everyone involved needs to feel safe, respected, and supported before they share personal experiences.

4. Support your mentors and mentees Offer practical help - time, quiet spaces, and guidance on how to structure meetings - to ensure the project supports mentors to feel confident and heard and mentees to listen.

5. Focus on action Don’t let good conversations go to waste. Make sure there’s a clear process to turn insight into meaningful change.

6. Celebrate and share Mark progress, reflect on what’s been learned, and show this is just the beginning of longer-term culture change.

Need support? Try the new Reverse Mentoring Toolkit

To help legal workplaces run impactful and thoughtful reverse mentoring schemes, LawCare and the University of Leeds have created a free, practical Reverse Mentoring Toolkit.

The toolkit is packed with practical resources to help you design, launch, and sustain an impactful reverse mentoring programme. It will help you:

• Understand what reverse mentoring is - and what it isn’t

• Create a safe, respectful space for

honest conversations

• Support mentors and mentees throughout the process

• Turn insights into meaningful action

• Avoid common mistakes

Read more and download the toolkit today: www.lawcare.org.uk/reverse

Explore more resources on the University of Leeds reverse mentoring project page: https://essl.leeds.ac.uk/ directory-record/1234/partnerships-forcultural-change-reverse-mentoring-in-highereducation-and-the-legal-profession

Who is the toolkit for?

The toolkit is for any legal organisationwhether a large law firm, small practice, in-house team, barristers’ chambers, or legal education provider. You don’t need a big HR team or budget to start a reverse mentoring programme. What you do need is a commitment to inclusion, an openness to listening, and a willingness to act on what you learn.

Whether you’re just starting out or looking to refresh an existing initiative, the toolkit can help you build a programme that is thoughtful, sustainable, and genuinely inclusive.

“This toolkit is such a valuable resource, especially for HR, EDI teams, and senior leaders looking to build more inclusive, supportive workplaces. It provides clear, practical advice on how to set up and get the most out of reverse mentoring. By taking part, you’re not only investing in your own growth, but you’re also helping to shape a more inclusive, dynamic, and forwardthinking legal sector for the future.”

Trish McLellan (Director of Engagement at LawCare)

Ready to get started?

Reverse mentoring isn’t a tick-box or a quick fix - but it can be a powerful way to build trust, highlight what needs to change, and make your workplace fairer for everyone.

The UK government is announcing its industrial strategy Invest 2035 soon recognising that the legal sector, as part of Professional and Business Services (PBS), is a key component of the country’s economy and growth.

Acknowledging that the services sector is one of the country’s strengths signifies a fundamental shift from previous strategies. The UK is the world’s second biggest services exporter after the US, valued at £1.9 trillion supporting regional development and innovation.

The legal sector is a key growth enabler bringing all other sectors together. It is the second largest in the world and the biggest in Europe*. It generated £44 billion in 2022 and grew by 45% between 2013 and 2022. Investing in legal services is an opportunity that cannot be missed. The Law Society is asking the government to:

• invest in the courts infrastructure that are facing a £1.3 billion repairs backlog threatening the legal sector’s global position and reputation

• open global markets for UK lawyers and law firms by promoting the sector and business mobility

• provide a LawTech grant, loan or tax incentive scheme. The £1.5m LawTech funding that the government has committed to for startups is a welcome start but more ambition is needed

• expand the starting age of the Level 7 Apprenticeship to those over 21 and introduce a similar apprenticeship scheme in Wales. It is essential for people who cannot afford university fees but want to pursue a career in law

• support Wales by providing cybersecurity upskilling schemes, better mapping of the economic value of the Welsh legal sector and

ensuring that there is better and more reliable data about the legal sector

Richard Atkinson, president of the Law Society of England and Wales, said: “Invest 2035 can be a game-changer for the UK economy and the legal sector. The Law Society is looking forward to the unveiling of the new industrial strategy later this week and working with the government to deliver its long-term ambitions.

“Putting legal and professional services at the heart of the country’s economic engine is key to making sure we live up to our potential. The government needs to invest in our courts’ infrastructure, open global markets and upskill English and Welsh lawyers.”