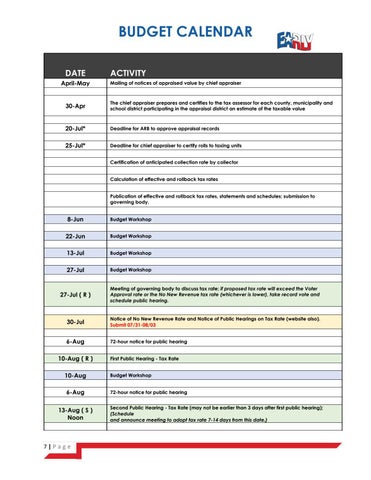

BUDGET CALENDAR DATE April-May

ACTIVITY Mailing of notices of appraised value by chief appraiser

30-Apr

The chief appraiser prepares and certifies to the tax assessor for each county, municipality and school district participating in the appraisal district an estimate of the taxable value

20-Jul*

Deadline for ARB to approve appraisal records

25-Jul*

Deadline for chief appraiser to certify rolls to taxing units Certification of anticipated collection rate by collector Calculation of effective and rollback tax rates Publication of effective and rollback tax rates, statements and schedules; submission to governing body.

8-Jun

Budget Workshop

22-Jun

Budget Workshop

13-Jul

Budget Workshop

27-Jul

Budget Workshop

27-Jul ( R )

Meeting of governing body to discuss tax rate; if proposed tax rate will exceed the Voter Approval rate or the No New Revenue tax rate (whichever is lower), take record vote and schedule public hearing.

30-Jul

Notice of No New Revenue Rate and Notice of Public Hearings on Tax Rate (website also). Submit 07/31-08/03

6-Aug

72-hour notice for public hearing

10-Aug ( R ) 10-Aug 6-Aug 13-Aug ( S ) Noon

7 | P a g e

First Public Hearing - Tax Rate Budget Workshop 72-hour notice for public hearing Second Public Hearing - Tax Rate (may not be earlier than 3 days after first public hearing); (Schedule and announce meeting to adopt tax rate 7-14 days from this date.)