REPORT 2024/25

REPORT 2024/25

ACTIONS

A focus on Meat Standards

Australia (MSA) - data for analysis

Improved accuracies in BREEDPLAN

Field days and information sessions for members in conjunction with BIN & Repronomics Projects

Support and facilitate the inclusion of additional data and information in sale catalogues

Commercial CompetitionsFeedlot & Carcass

Economic data to validate costs of production comparative to other breeds.

OPERATING OUTCOMES

MSA data to improve meat quality, enhance consumer

confidence, market access and di erentiation, higher producer returns and strengthen breed reputation

Grow BREEDPLAN participation across the membership

Continuation of both BIN & Repronomics Projects

Utilisation of data to improve confidence for stud & commercial buyers.

ACTIONS

Promote Droughtmaster beef/ca le using data and analysis from MSA and Feedlots

Promote the Droughtmaster female as the cornerstone in any beef producer's herd

Promote the natural and sustainable characteristics of the breed

Create further strategic partnerships

Expand our marketing with a greater geographical footprint

Testimonials and case studies

Create new concepts to promote bull and female sales.

OPERATING OUTCOMES

Growth in female registrations

Membership growth

Droughtmaster ca le occupying a larger geographical footprint

Increased demand for Droughtmaster Bulls and Females

Greater awareness of the quality and demand for Droughtmaster beef.

ACTIONS

Increased commitment to school agricultural programs and provide content for their curriculums

Creation of learning modules for new members relating to sale preparation, showing, and general animal husbandry

Educational content available for members and support younger members participating in workshops, conferences and field days.

OPERATING OUTCOMES

Greater involvement by schools using Droughtmaster ca le in their curriculum and at the Futurity

Members equipped with educational content to assist with improvements to their businesses

Growth in Next Gen.

ACTIONS

Commission a study to analyse the unit costs of production for Droughtmaster ca le comparative to other breeds

Create stronger relationships with countries using Droughtmaster genetics to help grow the breed internationally

Sta training & development

Source R&D funding

Alternative income streams

Business model improvements.

OPERATING OUTCOMES

A be er understanding of the economics relating to Droughtmaster beef production comparative to other breeds

Skilled sta

Additional Income Streams

Growth and awareness of Droughtmaster genetics internationally

E iciency in operations.

ACTIONS

Celebrate our people

Heighten the appeal of being a member

Regular and e icient communication

Adopt Modern Communication Strategies.

OPERATING OUTCOMES

Member retention and improvements in value to members

Member satisfaction.

IT IS AN HONOUR to present the President’s Report for the 2024–25 financial year. This period has been both constructive and energising for Droughtmaster Australia, with many milestones reached and fresh foundations laid for the years ahead. While we acknowledge the challenges faced, our progress reflects the strength of our membership, the dedication of our team, and the enduring value of the Droughtmaster breed.

Few moments this year captured our collective passion better than our presence at BEEF 2024. The enthusiasm around

our breed was evident in every aspect of our participation – from the excellent showing in the stud and commercial rings, to the vibrant activity in our dedicated precinct. This event underscored our breed’s relevance and reinforced our commitment to elevating Droughtmaster’s profile both nationally and abroad.

Throughout the year, our Society supported a comprehensive program of events and initiatives, each aligned with our values and strategic goals. From high-performing sales to meaningful educational gatherings, these efforts reflect our community’s dedication to both innovation and tradition.

While this year presented some financial headwinds, our overall position remains stable. A modest operating shortfall of $22,645 was recorded – driven primarily by the decision to host the Toowoomba Feature Show, which, although unbudgeted, was pursued as a worthwhile opportunity to support the breed.

Despite these pressures, revenue held firm at $1.81 million – just slightly below last year’s record and well above pre-2022 levels. Importantly, our financial reserves remain sound, and total liabilities have been reduced to their lowest level in five years.

We remain prudent in our financial management and focused on longterm outcomes. Notably, the BIN and Repronomics programs – while affected by seasonal and market variability – continue to deliver valuable data and have recently been renewed through MLA for another four years.

As we close this chapter, we do so with optimism and purpose. Our updated strategic framework, Data. Growth. Legacy. , sets a clear course for the coming years. It is a forward-thinking plan that balances operational excellence with a vision for sustainable breed advancement.

• Data will sharpen our breeding tools and inform better decisions.

• Growth will ensure our membership, herdbook and market reach continue to expand.

• Legacy reminds us to honour our breed’s past while preparing it for future generations.

These three pillars will guide our collective efforts as we deepen member value, improve genetic insight, and broaden the impact of the Droughtmaster breed.

This year’s achievements would not have been possible without the guidance and hard work of many. I offer sincere thanks to our CEO, Simon Gleeson, whose leadership has been instrumental in delivering another ambitious and successful year. Simon’s commitment to transparency, innovation, and engagement continues to strengthen the Society’s foundation.

To our office team – Leigh, Carley, Jacinta, and Korrina – thank you for your professionalism, dedication, and support of our members throughout a very active year.

(CONTINUED)

(CONTINUED)

I also wish to acknowledge the efforts of our Company Secretary, Michele Galagher, whose integrity and expertise help ensure we remain well-governed and forward-facing.

And finally, to you – our members – thank you. Your trust, involvement, and enduring passion for the breed are what make Droughtmaster Australia such a vibrant and respected organisation. Every sale entered, meeting attended, or insight shared contributes to the strength of our community and the future of our breed.

As we move forward, we do so with clear intent and shared enthusiasm. The work of the past year has positioned us well to deliver on our new strategic priorities. I am confident that, together, we will continue to build a strong, enduring legacy for the Droughtmaster breed.

Thank you for the privilege of serving as your President.

Steve Farmer, President on behalf of the Board of Directors

Simon Gleeson | Chief Executive Officer

THE 2024–25 FINANCIAL YEAR has been a remarkably busy and productive period for Droughtmaster Australia. With a full calendar of sales and events, increased member engagement, and continued investment in data capture, breed development, and national footprint expansion, we’ve built strongly on the momentum of recent years.

Our presence within the Australian beef industry – both domestically and internationally – continues to grow. Throughout the year, we’ve remained focused on supporting our members and upholding the Society’s core values. As with previous years, our progress is a direct result of the passion, commitment, and generosity of our members, volunteers, staff, and partners. I extend my sincere thanks to all who have contributed to what has been a dynamic and rewarding year.

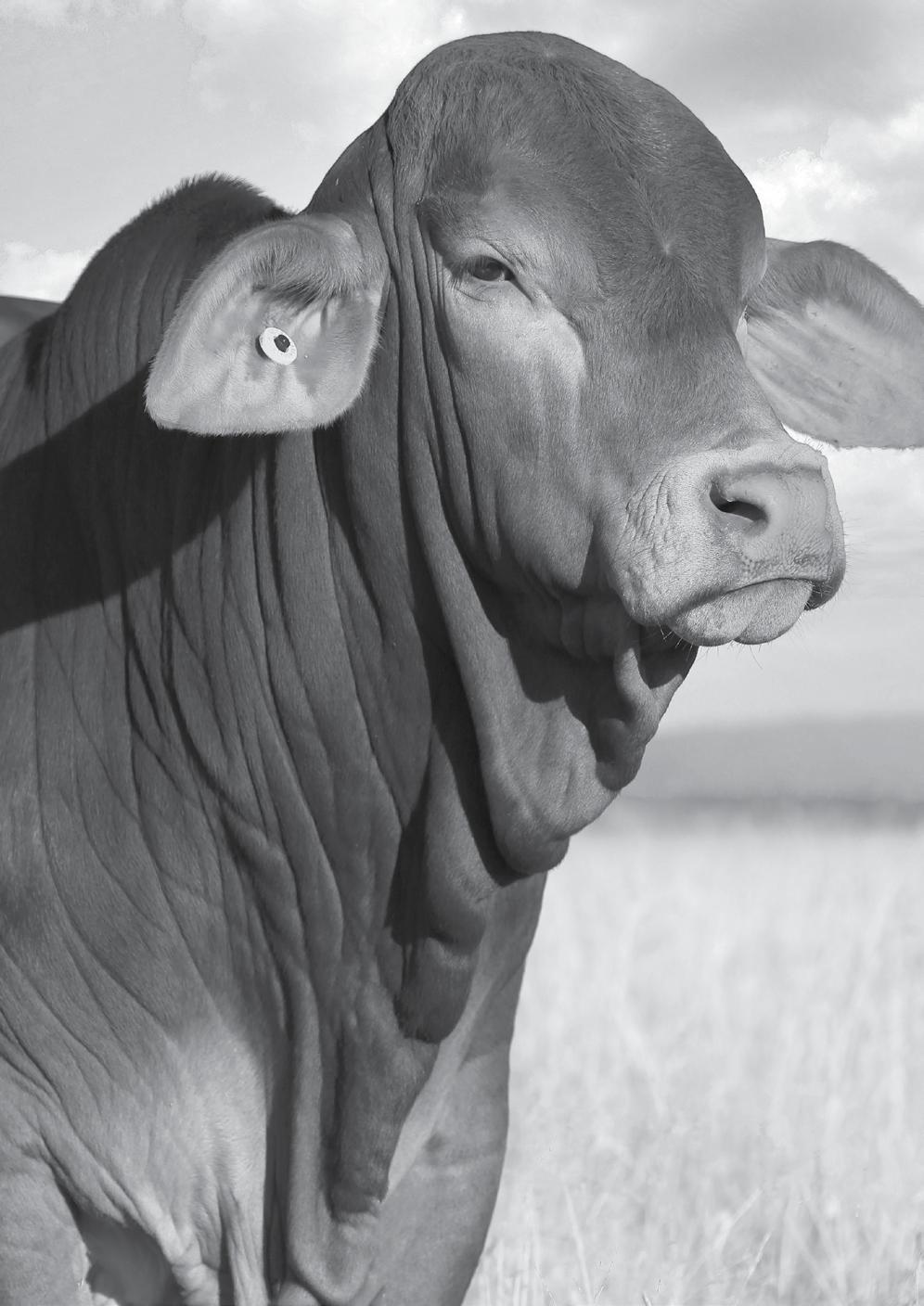

The standout moment of the year was undoubtedly BEEF 2024, where the Droughtmaster breed took centre stage. With more than 200 head exhibited in the stud ring and Grand Champion honours in the commercial section, the event was a powerful showcase of the breed’s adaptability, performance, and standing in the broader beef industry.

Our marquee precinct was a true highlight – a bold and welcoming space for members, stakeholders, and partners to connect. My thanks go to the Beef Committee, the staff at Droughtmaster Australia, and everyone involved in delivering such a strong presence for the breed and the Society.

Beyond BEEF, Droughtmaster Australia successfully delivered or supported a wide range of initiatives throughout the year, including:

• The National Bull Sale, Roma Bull Sale, National Female Sale, Commercial Female Sale, Toowoomba Feature Show, Ekka, and Droughtmaster Futurity

• A member field day in Taroom, focused on BIN and Repronomics data collection and insights

• A feedlot and carcass competition with Mort & Co and JBS, offering breeders meaningful performance feedback

• Launch of the King of the Ring selling concept at the National Bull Sale

• A successful business lunch in Rockhampton at the Allenstown Hotel, featuring Droughtmaster beef

• The lively Battle of the Breeds steakeating competition at Brisbane’s Norman Hotel

(CONTINUED)

• Collaboration with Meat & Livestock Australia to collate and analyse MSA eating quality data

• Infrastructure investments, including office upgrades and joint acquisition of a BBQ promotional trailer

Together, these initiatives reflect the Society’s operational strength, brand presence, and shared commitment.

Membership and female inventory have continued their upward trajectory throughout the year. We remain firmly committed to achieving our strategic targets of 750 members and 40,000 registered females, and we are actively working toward these important milestones. Encouragingly, this growth is driving stronger demand at sales and expanding the breed’s presence in commercial herds across Australia.

A standout highlight was the National Bull Sale being recognised as the second most successful multi-vendor sale in Australia, based on clearance rate and average price – a powerful endorsement of the Droughtmaster breed’s performance, value, and market appeal.

On the international front, the breed’s global reach also strengthened. Droughtmaster is now officially registered as a breed in South Africa, and we were pleased to welcome South African buyers investing in genetic material during the BEEF 2024 heifer auction. This represents a significant step forward in our international market development and a promising pathway for future breed expansion.

The Beef Information Nucleus (BIN) and Repronomics projects continue to form the backbone of our long-term breed improvement strategy. Droughtmaster has proudly participated in these collaborative initiatives – alongside two other tropical breeds – since 2013.

The primary goal remains the collection of high-quality performance and reproductive data to inform future genetic decisionmaking. However, in recent years, the projects have also delivered meaningful financial returns. This was particularly apparent during a period where cattle were acquired in softer markets and sold during stronger ones, supported by favourable seasonal conditions that helped contain operational costs.

In contrast, the 2023–24 and 2024–25 financial years saw these dynamics reverse. Cattle were purchased at higher market values and sold into a softer pricing environment. Compounding this, drier seasonal conditions led to increased feed and operational expenses. As a result, the financial performance of the projects in the past two years has not matched previous outcomes.

Nevertheless, the program remains in a strong overall net-positive position. We remain fully committed to the BIN and Repronomics initiatives and are pleased to confirm that Meat & Livestock Australia (MLA) has recently approved a four-year extension, with the full support of all participating breed societies.

(CONTINUED)

• Total income remained strong at $1.81 million, slightly down from the previous year’s record of $1.87 million, but still representing a 40% increase over 2021/22.

• Operating expenses rose slightly to $1.83 million, resulting in a small operating loss of $22,645. This increase was largely due to the unbudgeted delivery of the Toowoomba Feature Show, which cost $24,576. The event was seen as a valuable and timely opportunity to promote the breed and engage members – one the Society chose to pursue despite not being part of the original budget.

• Extraordinary income of $22,573 helped reduce the overall loss, resulting in a near break-even gross loss of just $72, compared to a gross profit of $3,640 in the previous year.

• Had the Toowoomba Feature Show not been undertaken, the Society would have recorded both an operating profit and a gross profit.

• The Society recorded a net loss of $119,187, primarily driven by a significant reduction in non-operating income, particularly from the BIN Research Project, which posted a net loss of $119,115.

• This compares to a net loss of $81,674 in 2023/24 and a net profit of $72,160 in 2021/22 – highlighting the combined effects of market cycles, seasonal conditions, and targeted project investments.

• Cash at bank decreased to $273,237, a reflection of operating and project-related outflows.

• The BIN Steer Inventory and property values remained stable, ensuring a strong asset base.

• Total liabilities decreased significantly to $270,314, the lowest in the past five years, improving the organisation’s financial position despite operating challenges.

Building on the foundation set by The Next Phase 2023–25, we have now launched our updated strategic plan: Data. Growth. Legacy. This new strategy will guide our efforts in the years ahead, and we look forward to delivering on the actions and priorities it outlines.

I would like to thank our staff – Leigh, Carley, Jacinta and Korrina – for their commitment and professionalism throughout what has been an incredibly active and highperforming year. I also thank our Board, led by Chair, Steven Farmer, and our Company Secretary, Michele Galagher for their ongoing governance and support.

Finally, to our members, volunteers, sponsors and partners – thank you for your continued belief in the Society and the breed. Your passion and dedication are the heart of this organisation, and the reason Droughtmaster continues to grow and thrive. I look forward to what we can achieve together in the year ahead.

Simon Gleeson Chief Executive Officer

THE 2024-25 FINANCIAL YEAR has seen continued growth and advancements in both the herdbook and the breed’s development. Our commitment to maintaining the integrity and high standards of the Droughtmaster breed remains unwavering.

In the 2023-24 financial year, Droughtmaster Australia negotiated a Corporate BREEDPLAN Membership and cost model that significantly reduced the cost of participating in BREEDPLAN. Furthermore, a new BREEDPLAN Model was created, greatly reducing the cost by incorporating this levy across all Stud and Junior Members.

This saw increased BREEDPLAN membership and performance data being entered which further benefits the Droughtmaster breed. The performance data collected through BREEDPLAN has been integral in shaping the future of the breed. The continued collection and analysis of submitted traits drive genetic improvements within the Droughtmaster population.

Membership has continued to grow, with new breeders joining and existing members remaining committed to the breed. While growth has slowed to 1% in the 202425 financial year, compared to 6% last financial year, interest in the breed and its future remains strong. Our dedication to providing exceptional support, educational

opportunities, and resources for members remains a priority. We warmly welcome the new breeders who have joined us and look forward to supporting them in their breeding and business goals.

While DNA testing has decreased compared to the previous financial year, this shift reflects a focus on current animals rather than historical DNA, ensuring a catch-up in testing. With DNA testing now compulsory for most sales and a requirement to register progeny, members are utilising negotiated bundles with Neogen and Zoetis to maintain and strengthen their herds.

The 2024-25 financial year has been a year of growth, innovation, and success for the Droughtmaster breed and Droughtmaster Australia. We are proud of the strides we have made in advancing our registry, improving genetic quality, and supporting breeders across Australia.

As we move into 2025, we remain committed to advancing the Droughtmaster breed and supporting our breeders in line with the new strategic plan. We will also be looking at streamlining processes to ensure a quicker and easier process for members on registration, herd inventory and DNA ordering.

Jacinta Brown Registrar, DNA Coordinator and Member Services

DROUGHTMASTER AUSTRALIA successfully hosted three Society-Sponsored Stud Cattle Sales in 2025, further strengthening the breed’s presence in the market.

The Droughtmaster National Bull Sale introduced the highly anticipated King of the Ring concept, where nine elite bulls competed for the prestigious title of “King.” The event, held on Day One at the CQLX sale complex, attracted a nearcapacity crowd and garnered significant media attention, drawing interest from breeders and rival breed societies alike. Ultimately, Rondel Domino was crowned the inaugural King.

Adding to its success, the National Bull Sale was ranked second in the top 30 multivendor bull sales of 2024 – a remarkable achievement considering the sale hosted 87 vendors, compared to the top-ranked sale’s eight vendors from related genetics. This ranking is a testament to the strength and quality of National Bull Sale vendors offerings.

The Roma Droughtmaster Bull Sale continues to deliver top-quality bulls, earning the loyalty of returning buyers year after year. Dubbed “the friendly sale,” Roma maintains a welcoming atmosphere, embracing new vendors, buyers, and community members. The dedicated sale committee works tirelessly to bring in new sponsors while fostering strong relationships with existing ones. A highlight of the event is the pre-sale function, held the evening

before, where attendees gather to connect and celebrate.

The Droughtmaster Futurity is gaining momentum at its new home in Toogoolawah. It has become a key event for Warwick, Toogoolawah, and Maleny State High Schools, with efforts underway to welcome additional agricultural programs. The expanded two-day format provides young participants with hands-on experience in Junior Judging and Parading, offering many their first opportunity to step into the show ring. It remains a fantastic platform for animals, members, and students to refine their skills and build confidence.

The National Female Sale faced unexpected challenges when cyclonic weather predictions led to its postponement. With much of the southeast corner of the state shut down on the original sale date, rescheduling was a wise decision. The event proceeded two weeks later amid lingering uncertainty, yet buyers were delighted with the exceptional quality of the females on offer – many even wishing they had brought larger trucks.

Overall, 2025 was an outstanding year, marked by successful sales and innovative initiatives. We remain committed to continuous improvement, striving to make each sale and event even more successful in the future.

Leigh Eleison Sales & Events Manager

THE 2024-25 FINANCIAL YEAR was a significant one for Droughtmaster Australia, with our primary marketing focus centred on our presence at BEEF2024. This event represented a substantial investment of time and resources, delivering excellent returns through elevated brand awareness and strengthened industry reputation.

A standout highlight was ‘The Droughtie Precinct’ – a dynamic and engaging activation that attracted strong attention and generated widespread interest in the Droughtmaster breed. Our marquee quickly became a central hub of activity, hosting daily events and seminars featuring guest speakers, award presentations, live music, and the much-anticipated female auction. These events were made possible through the generous support of our sponsors and the invaluable catering services provided by CocoBrew, whose coffee and hospitality helped encourage visitors to stay and engage throughout the day.

We were pleased to collaborate with Harry Clarke from Country Caller, who reported on Droughtmaster’s involvement and created video content for our social media channels. This partnership not only enabled remote engagement for those unable to attend BEEF2024, but also offered fresh and effective exposure for our breed. We also invested in advertising through Country Caller, exploring new promotional avenues beyond our usual approach.

Further marketing efforts included a targeted campaign with Queensland Country Life, which featured a Droughtmaster video on the large screen at the front of their marquee – strategically located on the main thoroughfare – to great effect and positive feedback.

A massive thank you goes to the Droughtmaster team – Simon, Leigh, Leah, and Jacinta, the Board, and the Beef Committee for their dedication, and tireless efforts around BEEF2024.

Beyond BEEF2024, we proudly supported and participated in a range of industry events, including:

• CQ Carcase Classic

• Gympie District Beef Liaison Group Cattle Camp

• West Australian Youth Cattle Camp

• Maleny State High School’s Paddock to Plate

• Business Lunch, Allenstown Hotel

• Steak Eating Competition, Norman Hotel

• FarmFest

• Young Beef Producers Forum

• AgQuip

In collaboration with the AgQuip Droughtmaster Committee, we developed a new promotional asset –the Droughtmaster BBQ Trailer. This fully branded, multifunctional trailer includes a TV, BBQ, and ample storage for signage and promotional materials. It serves as both a practical tool for event engagement and a mobile billboard. Already featured at events such as the Roma Bull Sale and Diamond Genetics Sale, the trailer is also available for member hire.

Our advertising strategy this year embraced a balanced mix of print and digital platforms, with particular emphasis on New South Wales and Western

Australia. These efforts supported not only Society Sponsored Sales but also broader awareness of the Droughtmaster breed, aligning closely with our Strategic Plan.

A renewed focus was placed on social media content, particularly through branded tiles highlighting the key benefits of the Droughtmaster breed. This initiative delivered significant audience engagement, follower growth, and excellent return on investment given its low cost and high visibility.

A major innovation this year was the launch of the Commercial Cattle Feedlot & Carcass Competition, held alongside the Droughtmaster Toowoomba Feature Show. Created to collect valuable MSA data and demonstrate the breed’s versatility, this competition was made possible through partnerships with Mort & Co and JBS.

(CONTINUED)

A dedicated video captured the event’s success and showcased the paddock to plate journey of Droughtmaster cattle. The accompanying Virbac Drinks with Droughties event at the Moat House at Toowoomba Showgrounds featured industry presentations and award recognitions, further enhancing member engagement and breed promotion.

In summary, 2024-2025 was a dynamic and productive year for Droughtmaster Australia. We significantly broadened our promotional reach, strengthened our presence at key events, and created meaningful engagement across traditional and digital platforms. As we look to the year ahead, we are excited to build on this momentum and continue driving awareness and growth for the Droughtmaster breed.

Carley Stieler Marketing & Events Manager

Droughtmaster Stud Breeders’ Society Limited

ABN 19 010 129 683

For the year ended 31 March 2025

The directors present their report on Droughtmaster Stud Breeders’ Society Limited for the financial year ended 31 March 2025.

The names of each person who has been a director during the year and to the date of this report are:

Angus McCormack

Jenny Underwood (from 9 Aug 2024)

Bronwyn Betts

Dean Allen (from 9 Aug 2024)

Ken McKenzie (ceased 9 Aug 2024)

Hastings Donaldson

Alex Power

Kellie Williams

Steve Farmer

Olivia Wright

Andy Hayes

Todd Heyman

Directors have been in office since the start of the financial year to the date of this report unless otherwise stated.

The principal activity of Droughtmaster Stud Breeders’ Society Limited during the financial year was promotion and recording of Droughtmaster breed of cattle.

No significant changes in the nature of the Company’s activity occurred during the financial year.

The Company’s short term objectives are to:

• Promote, develop and protect the breed and the brand, identify activities that will further increase breed participation; and

• Enhance membership of the Breed Society by delivering more efficient services, benefits and value.

The Company’s long term objectives are:

• To be recognised nationally throughout the entire supply chain (paddock to plate) as a breed that was developed in Australia to suit the Australian environment for its resilience and exceptional meat quality.

To achieve these objectives, the Company has adopted the following strategies:

• The traditional functions of the Droughtmaster Society will always remain core, however we must continue to be relevant and evolve to remain competitive in the beef industry.

How principal activities assisted in achieving the objectives

The principal activities assisted the Company in achieving its objectives by:

• Promotion & marketing;

• Embrace technology;

• Retain & recruit members;

• Cultural reset & unity;

• Sponsors & corporate partners;

• Operational efficiency; and

• Financial management.

The following measures are used within the Company to monitor performance:

• Member retention & growth through improved communications, benefits and value;

• Brand awareness through improved marketing and promotion;

• Improved data capture and utilisation;

• Up weighting in Society activities, events and sponsored sales;

• Genetic improvement and breed excellence, protect breed integrity;

• Increased partnerships and sponsorships;

• Operational efficiency and financial management; and

• Advancement in technology.

Droughtmaster Stud Breeders’ Society Limited is a company limited by guarantee. In the event of, and

for the purpose of winding up of the company, the amount capable of being called up from each member and any person or association who ceased to be a member in the year prior to the winding up, is limited to $20 for members that are corporations and $20 for all other members, subject to the provisions of the company’s constitution.

At 31 March 2025 the collective liability of members was $13,860 (2024: $13,960).

Likely developments in the operations of the Company and the expected results of those operations in future financial years have not been included in this report as the inclusion of such information is likely to result in unreasonable prejudice to the Company.

During the financial year, 7 meetings of directors (including committees of directors) were held. Attendances by each director during the year were as follows:

The lead auditor’s independence declaration in accordance with section 307C of the Corporations Act 2001 , for the year ended 31 March 2025 has been received and can be found on page 4 of the financial report.

Signed in accordance with a resolution of the Board of Directors:

Dated 23 June 2025

I declare that, to the best of my knowledge and belief, during the year ended 31 March 2025, there have been:

(i) no contraventions of the auditor independence requirements as set out in the Corporations Act 2001 in relation to the audit; and

(ii) no contraventions of any applicable code of professional conduct in relation to the audit.

INDEPENDENT AUDIT SERVICES

Chartered Accountants

Jiahui (Jeremiah) Thum Director Brisbane, QLD

Dated this 23rd day of June 2025

Droughtmaster Stud Breeders’ Society Limited For the year ended 31 March 2025

Droughtmaster Stud Breeders’ Society Limited

As at 31 March 2025

Droughtmaster Stud Breeders’ Society

For the year ended 31 March 2025

Droughtmaster Stud Breeders’ Society Limited

The financial report covers Droughtmaster Stud Breeders’ Society Limited as an individual entity. Droughtmaster Stud Breeders’ Society Limited is a notfor-profit Company limited by guarantee, incorporated and domiciled in Australia.

The functional and presentation currency of Droughtmaster Stud Breeders’ Society Limited is Australian dollars. Comparatives are consistent with prior years, unless otherwise stated.

The financial statements are general purpose financial statements that have been prepared in accordance with the Australian Accounting Standards - Simplified Disclosures and the Corporations Act 2001

The financial statements have been prepared on an accruals basis and are based on historical costs modified, where applicable, by the measurement at fair value of selected non-current assets, financial assets and financial liabilities.

Significant accounting policies adopted in the preparation of these financial statements are presented below and are consistent with prior reporting periods unless otherwise stated.

Revenue from contracts with customers

The core principle of AASB 15 is that revenue is recognised on a basis that reflects the transfer of promised goods or services to customers at an amount that reflects the consideration the Company expects to receive in exchange for those goods or services.

Generally the timing of the payment for sale of goods and rendering of services corresponds closely to the timing of satisfaction of the performance obligations, however where there is a difference, it will result in the recognition of a receivable, contract asset or contract liability.

None of the revenue streams of the Company have any significant financing terms as there is less than 12 months between receipt of funds and satisfaction of performance obligations.

The revenue recognition policies for the principal revenue streams of the Company are:

This is a charge for registering females and forms part of annual membership fees. Revenue is recognised at the beginning of the financial year.

This is a charge for DNA testing done on cattle for members. Revenue is recognised when testing is performed.

This is breed promotion levy charge and forms part of annual membership fees. Revenue is recognised at the beginning of the financial year.

This forms part of annual membership fees. Revenue is recognised at the beginning of the financial year.

Nomination fees are charged in two parts for Society Sponsored Sales. Number nomination fees (1/2 full nomination fee) are charged out at close of number nominations and the remainder of the fee, Pedigree nomination fee, are charged out at the close of pedigree nominations.

This is sale of research livestock. Revenue is recognised when a livestock is sold.

Where the amounts billed to customers are based on the achievement of various milestones established in the contract, the amounts recognised as revenue in a given period do not necessarily coincide with the amounts billed to or certified by the customer.

When a performance obligation is satisfied by transferring a promised good or service to the customer before the customer pays consideration or the before payment is due, the Company presents the contract as a contract asset, unless the Company’s rights to that amount of consideration are unconditional, in which case the Company recognises a receivable.

When an amount of consideration is received from a customer prior to the entity transferring a good or service to the customer, the Company presents the contract as a contract liability.

The Company recognises assets relating to the costs of obtaining a contract and the costs incurred to fulfil a contract or set up / mobilisation costs that are directly related to the contract provided they will be recovered through performance of the contract.

Costs to obtain a contract

Costs to obtain a contract are only capitalised when they are directly related to a contract and it is probable that they will be recovered in the future. Costs incurred that would have been incurred regardless of whether the contract was won are expensed, unless those costs are explicitly chargeable to the customer in any case (whether or not the contract is won).

The capitalised costs are amortised on a straight line basis over the expected life of the contract.

Set up / mobilisation costs

Costs required to set up the contract, including mobilisation costs, are capitalised provided that it is probable that they will be recovered in the future and that they do not include expenses that would normally have been incurred by the Company if the contract had not been obtained. They are recognised as an expense on the basis of the proportion of actual output to estimated output under each contract. If the above conditions are not met, these costs are taken directly to profit or loss as incurred.

Costs to fulfil a contract

Where costs are incurred to fulfil a contract, they are accounted for under the relevant accounting standard (if appropriate), otherwise if the costs relate directly to a contract, the costs generate or enhance resources of the Company that will be used to satisfy performance obligations in the future and the costs are expected to be recovered then they are capitalised as contract costs assets and released to the profit or loss on an systematic basis consistent with the transfer to the customer of the goods or services to which the asset relates.

Provisions relating to contracts with customers

There are no provisions relating to contracts with customers identified during the year.

Financing component of contracts with customers

There are no significant financing component of contracts with customers identified during the year.

Other income

Other income is recognised on an accruals basis when the Company is entitled to it.

The Company is exempt from income tax under Division 50 of the Income Tax Assessment Act 1997

Revenue, expenses and assets are recognised net of the amount of goods and services tax (GST), except where the amount of GST incurred is not recoverable from the Australian Taxation Office (ATO).

Receivables and payable are stated inclusive of GST. Cash flows in the statement of cash flows are included on a gross basis and the GST component of cash flows arising from investing and financing activities which is recoverable from, or payable to, the taxation authority is classified as operating cash flows.

Inventories are measured at the lower of cost and net realisable value.

Inventories acquired at no cost, or for nominal consideration are valued at the current replacement cost as at the date of acquisition, which is the deemed cost.

Each class of property, plant and equipment is carried at cost or fair value less, where applicable, any accumulated depreciation and impairment.

Items of property, plant and equipment acquired for significantly less than fair value have been recorded at the acquisition date fair value.

Land and buildings

Land and buildings are measured using the cost model.

Plant and equipment

Plant and equipment are measured using the cost model.

Property, plant and equipment, excluding freehold land, is depreciated on a straight-line and reducingbalance basis over the asset’s useful life to the Company, commencing when the asset is ready for use.

The depreciation rates used for each class of depreciable asset are shown below:

At the end of each annual reporting period, the depreciation method, useful life and residual value of each asset is reviewed. Any revisions are accounted for prospectively as a change in estimate.

Financial instruments are recognised initially on the date that the Company becomes party to the contractual provisions of the instrument.

On initial recognition, all financial instruments are measured at fair value plus transaction costs (except for instruments measured at fair value through profit or loss where transaction costs are expensed as incurred).

All recognised financial assets are subsequently measured in their entirety at either amortised cost or fair value, depending on the classification of the financial assets.

On initial recognition, the Company classifies its financial assets into the following categories, those measured at:

• amortised cost

Financial assets are not reclassified subsequent to their initial recognition unless the Company changes its business model for managing financial assets.

Amortised cost

The Company’s financial assets measured at amortised cost comprise trade and other receivables and cash and cash equivalents in the statement of financial position.

Subsequent to initial recognition, these assets are carried at amortised cost using the effective interest rate method less provision for impairment.

Interest income, foreign exchange gains or losses and impairment are recognised in profit or loss. Gain or loss on derecognition is recognised in profit or loss.

Impairment of financial assets is recognised on an expected credit loss (ECL) basis for the following assets:

• financial assets measured at amortised cost

When determining whether the credit risk of a financial assets has increased significant since initial recognition and when estimating ECL, the Company considers reasonable and supportable information that is relevant and available without undue cost or effort. This includes both quantitative and qualitative information and analysis based on the Company’s historical experience and informed credit assessment and including forward looking information.

The Company uses the presumption that an asset which is more than 30 days past due has seen a significant increase in credit risk.

The Company uses the presumption that a financial asset is in default when:

• the other party is unlikely to pay its credit obligations to the Company in full, without recourse to the Company to actions such as realising security (if any is held); or

• the financial assets is more than 90 days past due.

Credit losses are measured as the present value of the difference between the cash flows due to the Company in accordance with the contract and the cash flows expected to be received. This is applied using a probability weighted approach.

Impairment of trade receivables have been determined using the simplified approach in AASB 9 which uses an estimation of lifetime expected credit losses. The Company has determined the probability of non-

payment of the receivable and multiplied this by the amount of the expected loss arising from default.

The amount of the impairment is recorded in a separate allowance account with the loss being recognised in finance expense. Once the receivable is determined to be uncollectable then the gross carrying amount is written off against the associated allowance.

Where the Company renegotiates the terms of trade receivables due from certain customers, the new expected cash flows are discounted at the original effective interest rate and any resulting difference to the carrying value is recognised in profit or loss.

Impairment of other financial assets measured at amortised cost are determined using the expected credit loss model in AASB 9. On initial recognition of the asset, an estimate of the expected credit losses for the next 12 months is recognised. Where the asset has experienced significant increase in credit risk then the lifetime losses are estimated and recognised.

The Company measures all financial liabilities initially at fair value less transaction costs, subsequently financial liabilities are measured at amortised cost using the effective interest rate method.

The financial liabilities of the Company comprise trade payables only.

At the end of each reporting period the Company determines whether there is evidence of an impairment indicator for non-financial assets.

Where an indicator exists and regardless for indefinite life intangible assets and intangible assets not yet available for use, the recoverable amount of the asset is estimated.

Where assets do not operate independently of other assets, the recoverable amount of the relevant cashgenerating unit (CGU) is estimated.

The recoverable amount of an asset or CGU is the higher of the fair value less costs of disposal and the value in use. Value in use is the present value of the future cash flows expected to be derived from an asset or cash- generating unit.

Where the recoverable amount is less than the carrying amount, an impairment loss is recognised in profit or loss.

Reversal indicators are considered in subsequent periods for all assets which have suffered an impairment loss.

Cash and cash equivalents comprises cash on hand, demand deposits and short-term investments which are readily convertible to known amounts of cash and which are subject to an insignificant risk of change in value.

Provision is made for the Company’s liability for employee benefits, those benefits that are expected to be wholly settled within one year have been measured at the amounts expected to be paid when the liability is settled.

Employee benefits expected to be settled more than one year after the end of the reporting period have been measured at the present value of the estimated future cash outflows to be made for those benefits. In determining the liability, consideration is given to employee wage increases and the probability that the employee may satisfy vesting requirements. Cashflows are discounted using market yields on high quality corporate bond rates incorporating bonds rated AAA or AA by credit agencies, with terms to maturity that match the expected timing of cashflows. Changes in the measurement of the liability are recognised in profit or loss.

Obligations for contributions to defined contribution superannuation plans are recognised as an employee benefit expense in profit or loss in the periods in which services are provided by employees.

Provisions are recognised when the Company has a legal or constructive obligation, as a result of past events, for which it is probable that an outflow of economic benefits will result and that outflow can be reliably measured.

Provisions are measured at the present value of management’s best estimate of the outflow required to settle the obligation at the end of the reporting period. The discount rate used is a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the liability. The increase in the provision due to the unwinding of the discount is taken to finance costs in the statement of profit or loss and other comprehensive income.

The directors make estimates and judgements during the preparation of these financial statements regarding assumptions about current and future events affecting transactions and balances.

These estimates and judgements are based on the best information available at the time of preparing the financial statements, however as additional information is known then the actual results may differ from the estimates.

The significant estimates and judgements made have been described below.

The Company assesses impairment at the end of each reporting period by evaluating conditions specific to the Company that may be indicative of impairment triggers. Recoverable amounts of relevant assets are reassessed using value-in-use calculations which incorporate various key assumptions.

There are no indicators of impairment during the year.

As described in the accounting policies, provisions are measured at management’s best estimate of the expenditure required to settle the obligation at the end of the reporting period. These estimates are made taking into account a range of possible outcomes and will vary as further information is obtained.

The receivables at reporting date have been reviewed to determine whether there is any objective evidence that any of the receivables are impaired. An impairment provision is included for any receivable where the entire balance is not considered collectible. The impairment provision is based on the best information at the reporting date.

4 Revenue and Other Income

6 Cash and Cash Equivalents

Trade and Other Receivables

The carrying value of trade receivables is considered a reasonable approximation of fair value due to the short-term nature of the balances.

The maximum exposure to credit risk at the reporting date is the fair value of each class of receivable in the financial statements.

8 Inventories

of

Contract assets and liabilities

The Company has recognised the following contract assets and liabilities from contracts with customers:

(i) Represents members advanced payments received at year end.

BUILDINGS

Movement in the carrying amounts for each class of property, plant and equipment between the beginning and the end of the current financial year:

12 Other non-financial assets

Trade and other payables are unsecured, non-interest bearing and are normally settled within 30 days. The carrying value of trade and other payables is considered a reasonable approximation of fair value due to the short-term nature of the balances.

Provision - Beef Aust Expo 2024

The Company incurred a significant amount for organising the Beef Aust Expo 2021. As a result, the Directors have decided to provide an estimate for Beef Aust Expo 2024. The estimate is based on the actual cost incurred for the 2021 event. During the year, the event was held and amount has been fully utilized. There was an overspent of approximately $47,000 as a result of holding this event in the financial year ended 31 March 2025.

16 Financial Risk Management

The Company is incorporated under the Corporations Act 2001 and is a Company limited by guarantee. If the Company is wound up, the constitution states that each member is required to contribute a maximum of $20 each towards meeting any outstanding obligations of the Company. At 31 March 2025 the number of members was 693 (2024: 698).

The remuneration paid to key management personnel of the Company is $272,703 (2024: $275,750).

20 Contingencies

In the opinion of the Directors, the Company did not have any contingencies at 31 March 2025 (31 March 2024: None).

(a) The Company’s main related parties are as follows: Key management personnel - refer to Note 18.

Other related parties include close family members of key management personnel and entities that are controlled or significantly influenced by those key management personnel or their close family members.

(b) Transactions with related parties

There are no transactions with related parties during the year.

(c) Loans to / from related parties

There are no loans to / from related parties during the year.

No matters or circumstances have arisen since the end of the financial year which significantly affected or may significantly affect the operations of the Company, the results of those operations or the state of affairs of the Company in future financial years.

The registered office and principal place of business of the company is:

The directors of the Company declare that:

1. The financial statements and notes, as set out on pages 5 to 23, are in accordance with the Corporations Act 2001 and:

a. comply with Australian Accounting Standards – Simplified Disclosure Standard; and

b. give a true and fair view of the financial position as at 31 March 2025 and of the performance for the year ended on that date of the Company.

2. In the directors’ opinion, there are reasonable grounds to believe that the Company will be able to pay its debts as and when they become due and payable.

This declaration is made in accordance with a resolution of the Board of Directors.

Angus McCormack, Director

Dated 23 June 2025

We have audited the accompanying financial report, being a general purpose simplified disclosures financial report of Droughtmaster Stud Breeders’ Society Limited (the Company), which comprises the statement of financial position as at 31 March 2025, the statement of profit or loss and other comprehensive income, the statement of changes in equity and the statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies, and the directors’ declaration.

In our opinion, the accompanying financial report of the Company is in accordance with the Corporations Act 2001 , including:

(i) giving a true and fair view of the Company’s financial position as at 31 March 2025 and of its financial performance for the year ended; and

(ii) complying with Australian Accounting Standards to the extent described in Note 1 and the Corporations Regulations 2001

We conducted our audit in accordance with Australian Auditing Standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Report section of our report. We are independent of the Company in accordance with the auditor independence

requirements of the Corporations Act 2001 and the ethical requirements of the Accounting Professional and Ethical Standards Board’s APES 110 Code of Ethics for Professional Accountants (the Code) that are relevant to our audit of the financial report in Australia. We have also fulfilled our other ethical responsibilities in accordance with the Code.

We confirm that the independence declaration required by the Corporations Act 2001 , which has been given to the directors of the Company, would be in the same terms if given to the directors as at the time of this auditor’s report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

The directors of the Company are responsible for the preparation of the financial report that gives a true and fair view and have determined that the basis of preparation described in Note 1 to the financial report is appropriate to meet the requirements of the Corporations Act 2001 and is appropriate to meet the needs of the members.

The directors’ responsibility also includes such internal control as the directors determine necessary to enable the preparation of a financial report that gives a true and fair view and is free from material misstatement, whether due to fraud or error.

In preparing the financial report, the directors are responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the Company or to cease operations, or have no realistic alternative but to do so.

Our objectives are to obtain reasonable assurance about whether the financial report as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Australian Auditing Standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of the financial report.

A further description of our responsibilities for the audit of the financial report is located at the Auditing and Assurance Standards Board website at: https:// www.auasb.gov.au/auditors_responsibilities/ar4.pdf. This description forms part of our auditor’s report.

We also provide the directors with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

Jiahui (Jeremiah) Thum Director

Brisbane, QLD Dated this 23rd day of June 2025

40 Thorn Street, Ipswich QLD 4305

07 3281 0056

office@droughtmaster.com.au droughtmaster.com.au