The Smart Planning Handbook: AComplete Guide to Organizing What’s Important in Your Life (andAfter)

By Chris E. Stout

Thanks for reading my book! This is a free companion set of the tables presented in the book, suitable for screen shots, printing, completing, and safely filing away.

They are available in for a limited time as a Word version file for a $5.00 charitable, tax-deductible donation to our non-profit Center for Global Initiatives, where 100% of it goes to the work. To learn more, please visit: http://www.centerforglobalinitiatives.org/ and email me at DrChrisStout@gmail.com with a screen shot of your donation conformation from PayPal: https://www.paypal.com/fundraiser/charity/218379 for your file. Thanks!

First Things First

As noted in the Introduction, optimizing for being organized can go a long way in making a lot of hassles easy-button fixable. I created this Vital Documents Inventory and Contact List to keep track of what’s critical in my life.

Vital Documents Inventory and Contact List

IMPORTANT PROPERT NOTES:

INDIVIDUALS

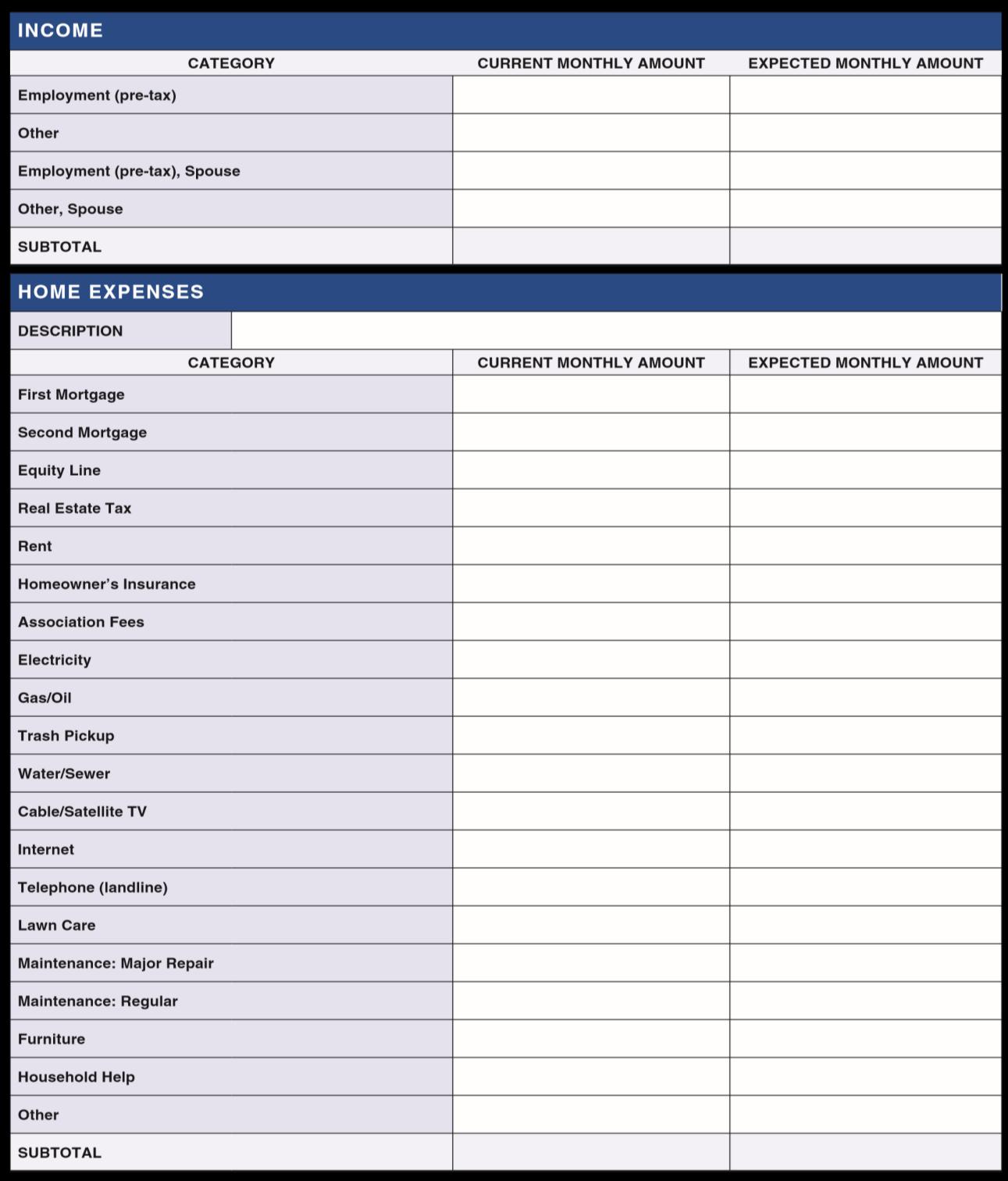

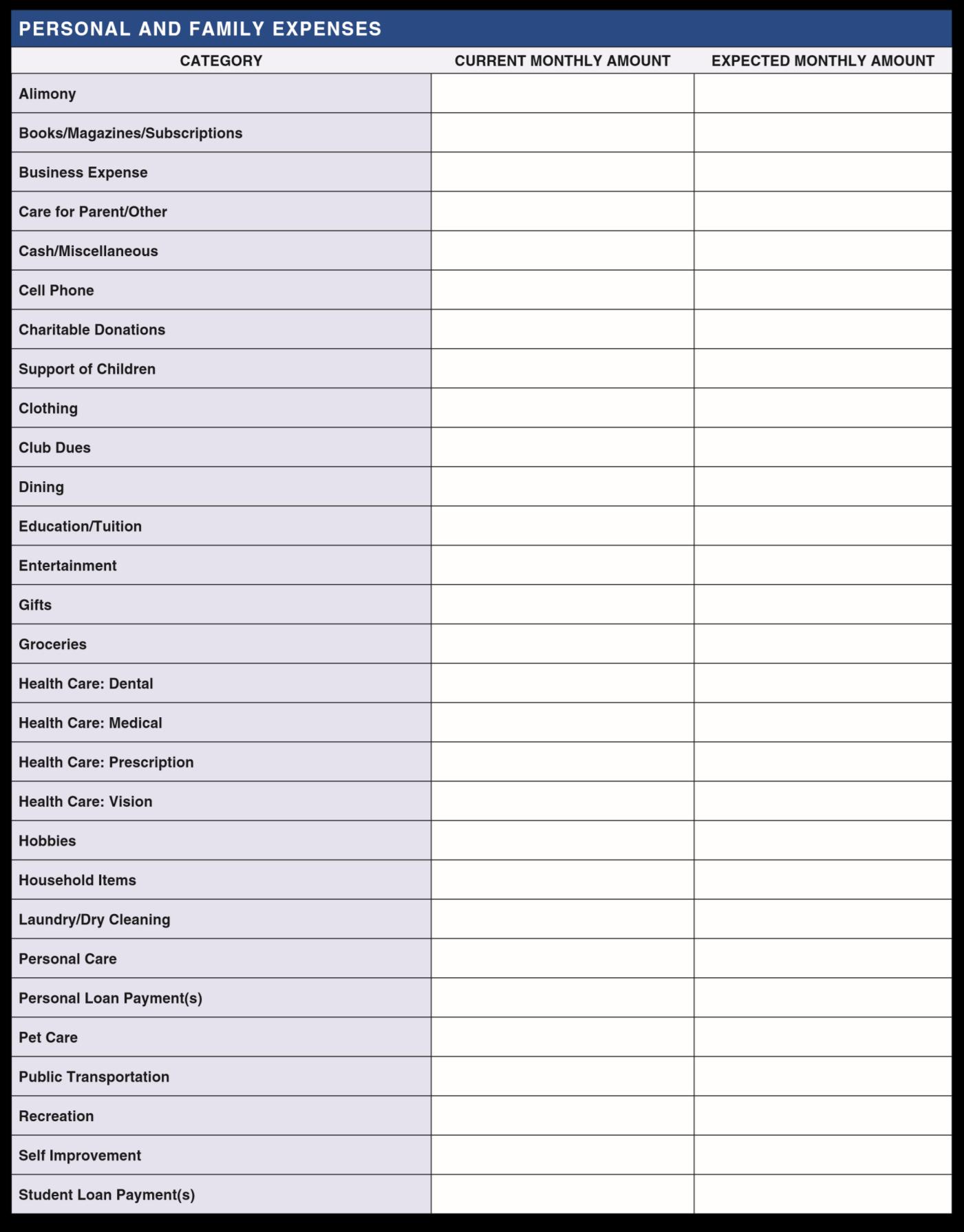

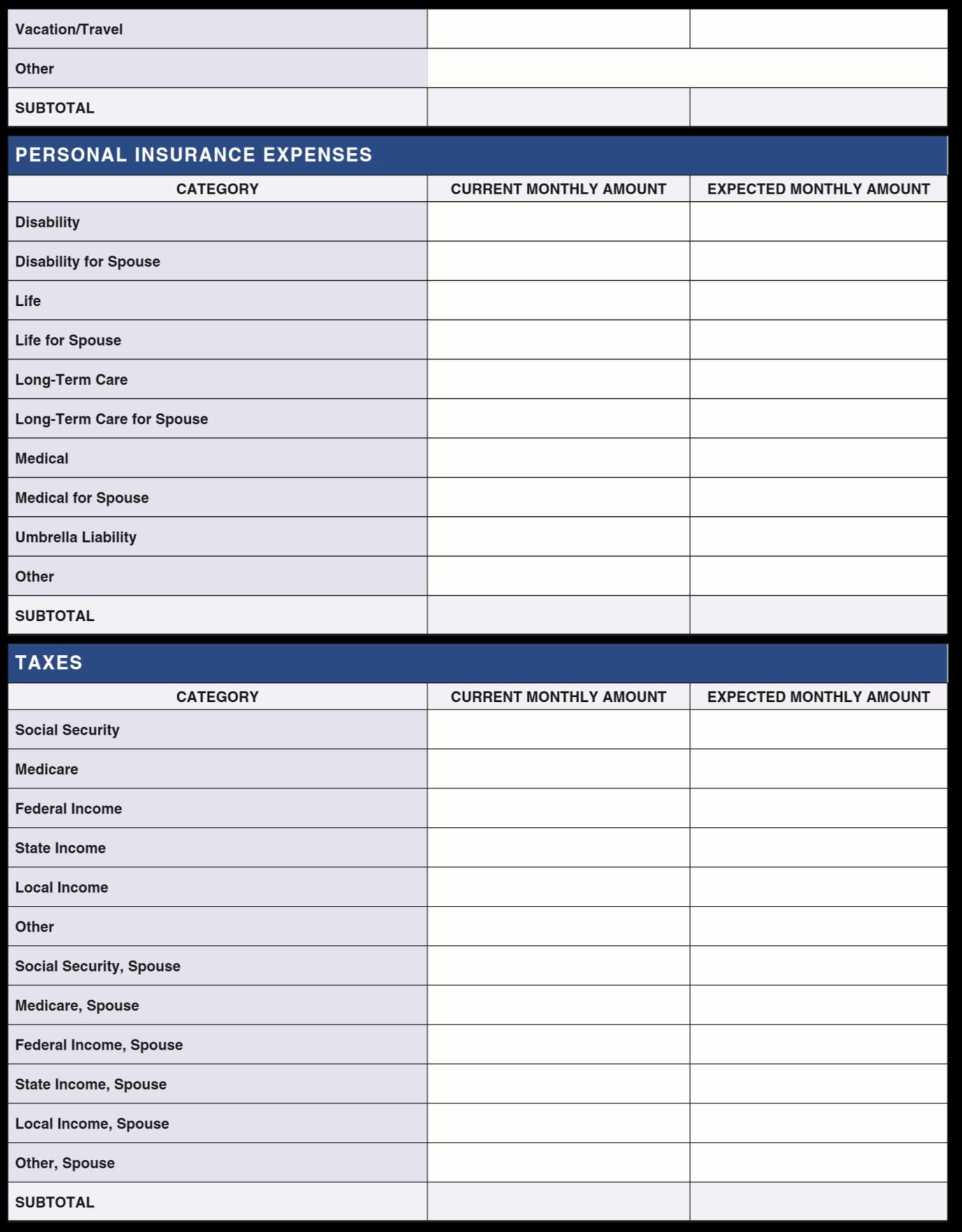

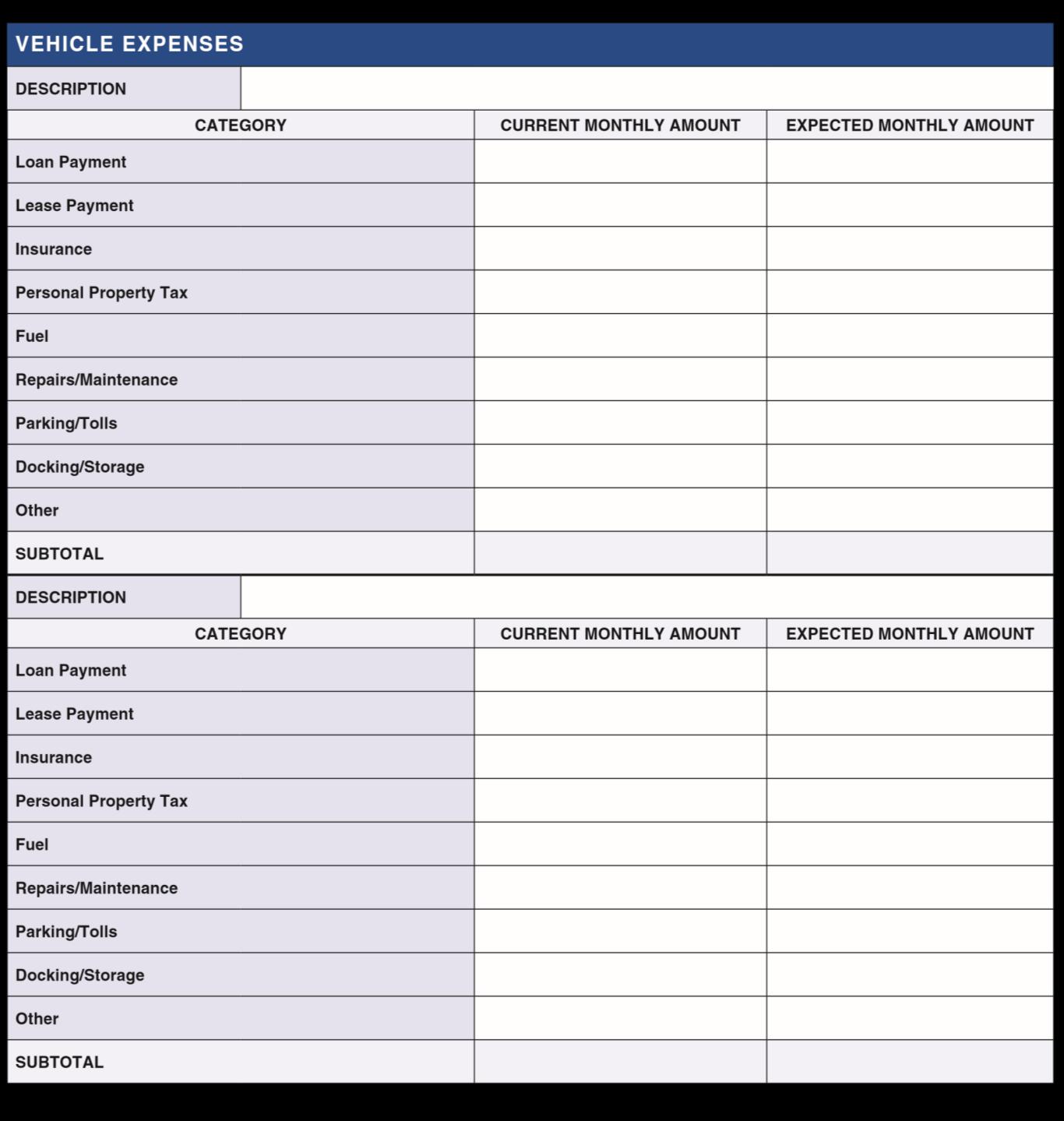

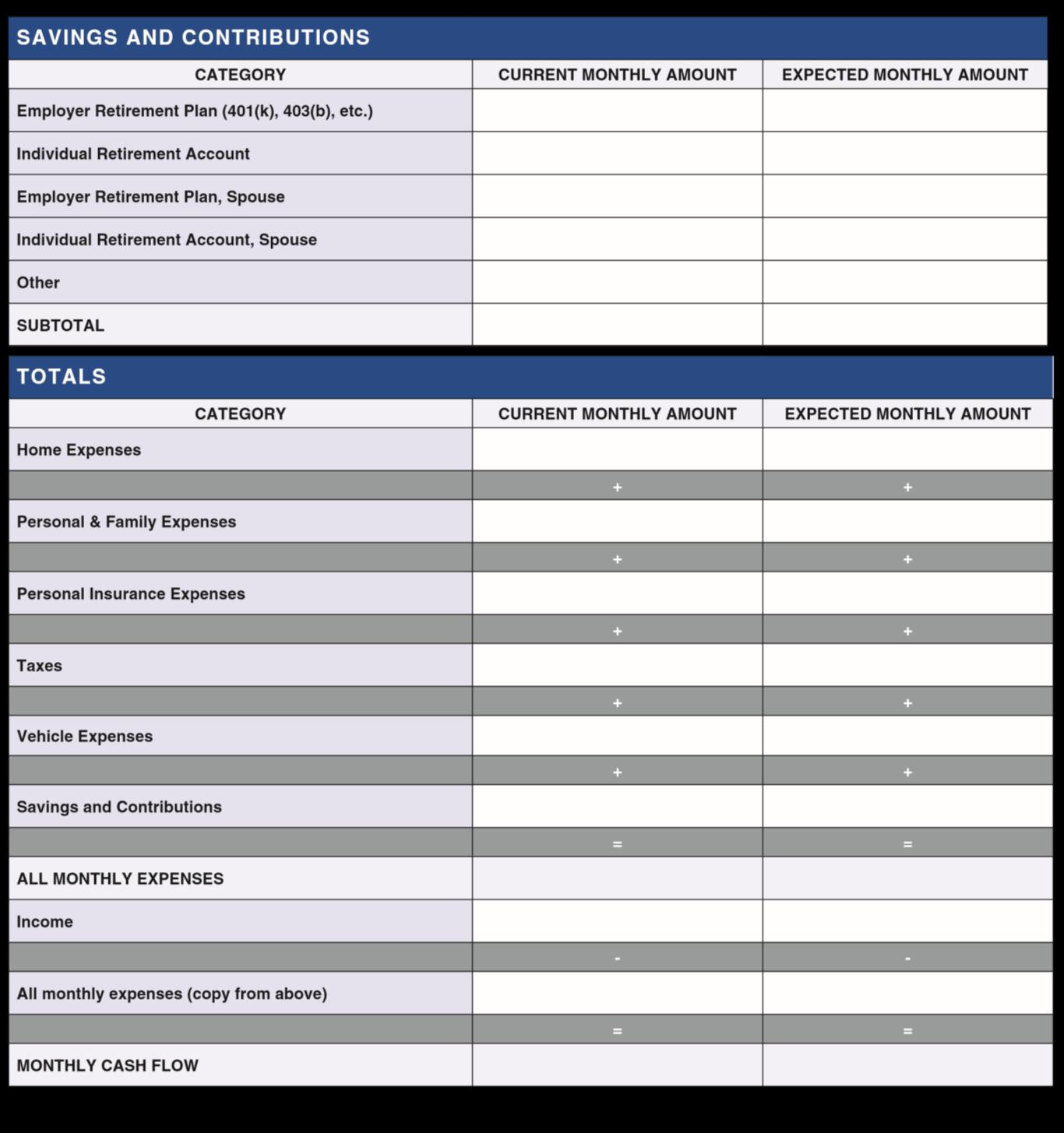

Budget Worksheet

Use this worksheet to track your monthly expenses and income to get a picture of your savings, spending and overall cash flow. You can use the Expected Monthly Amount column to budget for upcoming life events (like the birth of a child or retirement) or to compare how changes in spending impact your bottom line.

Source: Wealth Advisor Investments

foundation, and consult with your financial advisor and estate planning attorney to tailor a plan that fits your unique needs.

DOCUMENTS THAT MAKE A DIFFERENCE

Essentials

These critical documents can make certain your assets are distributed as you intended.

Original Document of Will

Letter of Instruction

Original Trust Documents

Health Care Information (Advance Directives)

Authorization to Release Information

Do-Not-Resuscitate Order

Durable Power of Attorney

Living Will

The most important item to keep on file. Determines who inherits your assets and guardianship of underage children. Without the original document, family members can challenge a copy of the will in court.

Provides specific instruction on personal preferences for medical care as well as contact information for attorneys, accountants and financial advisers. Communicates your preferences to your executor for setting your estate. Holds no legal weight, but it is a useful complement to your will.

Estate planners increasingly recommend the use of revocable trusts in addition to wills, since they are private and more difficult to contest in court. Can be changed at any time during your life.

Having these pieces in place in the event of your incapacitation is just as important as preparing for what happens after your death.

Defines the medical history and insurance information that you allow to be shared with specified recipients.

Separate document completed with your physician asking medical personnel to refrain from administering CPR or cardiac life-support should you wish it.

Legal authorization for a trusted person to act as your agent in legal or financial affairs after incapacitation and remaining in force until death.

Outlines wishes for medical care if you’re incapacitated and can’t advocate for yourself. Keep a copy for yourself and give copies to your doctor, a family member and a health-care proxy.

List of Medications Dosages, prescribing physician and pharmacies.

Personal and Family Medical History

Insurance and Retirement Accounts

401(k) and IRA Accounts

Annuity Contracts

Life Insurance Policies

Pension Documents

Personal Records

Create a document detailing your own and all known medical conditions of parents and siblings.

If you have many sources of income, a financial adviser can help you get organized and create distribution and spending plans for your surviving family.

Create a list of all accounts for beneficiaries. An IRA is considered inactive and unclaimed if no withdrawal has been made by age 70½.

(Track unclaimed pensions, 401(k)s and IRAs at www. missingmoney.com, a free service to help find forgotten assets.)

Annuity beneficiaries will need to provide the contract in order to claim benefits.

Keep all current and former policies together, especially those from former employers.

Heirs may not be aware of assets from your work history, which can be easy to overlook.

Government- and court-issued documents can be costly in both time and money to track down and replace. Keeping them in a secure place like a safe deposit box can greatly streamline claims by beneficiaries.

Birth Certificates Your own and those of any family members that you possess.

Divorce Papers

Divorce judgement/decree (or, if settled out of court, the stipulation agreement). Prevent disputes about child support, alimony, property settlements and division of investment and retirement accounts.

Logins and Passwords

Marriage Certificate and License

Military Records

Passports

Pet Information

Social Security Cards (or Numbers)

Proof of Ownership

Bank Accounts

Brokerage Accounts

Escrow Mortgage Accounts

Housing/Land/Cemeter y Deeds

Liabilities

Loans

Partnership/Corporate Operating Agreements

Safe Deposit Boxes

Stock

Certificates/Savings Bonds

Tax Returns

Vehicle Titles

Compile passwords and logins for all web-based accounts in a separate, password-protected document. Include logins for computers, phones, tablets and every online account (from banking and investments to streaming or social media, and make note of any paid services or subscriptions with recurring or periodic payments due).

Make sure your spouse knows where to find paperwork. A marriage license often needs to be produced before your surviving spouse can claim any benefits or assets.

Necessary for beneficiaries to receive benefits.

Originals or copies. Number and expiration date acceptable.

Description of each pet, veterinarian contact info and any medical notes.

Provide for yourself as well as any beneficiaries named in will.

If you don’t tell family members about every asset, there is the chance that they will never know about them all.

Provide your family with all accounts and access information so they can inform the bank of your death. Accounts that have no money movement can become property of the state.

If you’ve registered for online access, also include user names and passwords. Share the list of each investment custodian in your Letter of Instruction.

Beneficiaries are responsible for making payments. Any home equity loan must be satisfied or closed.

Original documentation is ideal.

Gather information about all of your debts so loved ones can easily pay bills and know where to send payment. Mortgages, car loans, credit cards, etc.

Money you have lent to other people can be included in an estate.

Highlight sections relevant to beneficiaries if your interest in a partnership is contracted to transfer after your death.

List any that you own and register your spouse or child’s name with the bank so they can have access without needing to petition a court.

Physical copies will save your heirs the hassle of tracking down purchase date and prices.

Providing returns from the last three years can offer a clear guideline to the types of assets you owned and make it easier for the executor to file the final income and estate tax return.

Also helpful to include information about loans and registration fees.

Source: Wealth Advisor Investments

Consideration/Option

Cremation

Burial

Funeral Service Type

Memorial Service

Grave Marker/Headstone

Casket

Burial Clothing

Viewing/Visitation

Music

Flowers

Service Program

Memorial Table

Video/Slideshow

Pallbearers

Details/Choices

Cremation with or without service; choice of urn; scattering, keeping, or burial of ashes

Traditional ground burial; mausoleum; green or natural burial

Religious, secular, or themed; location (funeral home, church, graveside, other)

Service held after burial/cremation; flexible timing and format

Material (granite, bronze, etc.); style; inscription

Material (wood, metal, ecofriendly); open or closed

Personal clothing; traditional attire; religious garments

Open or closed casket; private or public

Hymns, favorite songs, live or recorded music

Type, color, arrangement style; donation in lieu of flowers

Order of service; photos; readings; acknowledgments

Display photos, mementos, awards, meaningful objects

Photo/video montage; music accompaniment

Family, friends, honorary pallbearers

Notes/Recommendations

Discuss preferences with family; check local regulations for ashes scattering

Consider cemetery policies, religious customs, and prepurchased plots

Reflect beliefs and wishes; consider accessibility for guests

Allows for more planning time and wider participation

Check cemetery guidelines for size and design; personalize inscription

Consider budget and personal preferences; ask for price list

Select items meaningful to the deceased or family

Consider cultural traditions and family wishes

Choose pieces meaningful to the individual and guests

Coordinate with florist; share preferences in obituary

Helps guide attendees; keepsake for family and friends

Personalizes the service; invite contributions from family

Share memories visually; check venue’s technical setup

Choose people meaningful to the deceased; communicate roles in advance

Post-Service Event

Obituary Information

Estate Document Locator

Notifications

Options for Veterans

Reception, meal, or gathering at home or venue

Biographical details, survivors, service details, donation requests

Will, insurance policies, advance directives, contact lists

Inform family, friends, employers, organizations, social media

Military honors, burial in national cemetery, service flag

Opportunity for sharing memories and support; plan refreshments

Proofread carefully; consider publishing in print and online

Ensure documents are accessible to executor or next of kin

Assign a point person for notifications; use checklists

Contact Veterans Affairs; gather discharge papers

Funeral and memorial planning is a deeply personal process. Taking time to consider and communicate these preferences ensures that arrangements reflect the wishes and values of the individual and provide comfort to loved ones. Review options thoughtfully, involve family in discussions, and document decisions for clarity and peace of mind.

Death Certificate Information

Full Name:

Maiden Name:

Date of Birth: Place:

Sex: Race:

Full Name of Father:

Birthplace of Father:

Full Maiden Name of Mother: Birthplace of Mother:

Social Security Number:

Marital Status: Spouse’s Name:

Occupation: Employer:

Type of Business: Years at Occupation: Education (years completed)

Residence Address:

City, State, Zip:

County:

Military Service (year) to (year)

Served Where?

Years in County:

Branch of Service:

Death Certificate information varies from state to state. Additional information may be required to complete the Death Certificate. Veterans be aware of benefits that may be available to you and the information that may be required.

Viewing the Body

Whether or not to have your body on view before or during the funeral service, and by whom, is a very personal decision. Your family’s level of comfort with the decision is a real consideration. Some choose not to have a viewing while others feel it can help the family accept death and say “goodbye.” For some, a viewing provides time to reflect on memories and private thoughts. Children may have a difficult time when there is a viewing because they don’t know what to expect. While funeral homes can do an excellent job of making the deceased look natural, children may be disturbed by the stillness and coldness of the body. If they will be attending the viewing, try to prepare them for the experience. Even young adults may need preparation. There are other ways young people can say “goodbye” without participating in the viewing. They can color a picture, write a letter, choose a photograph or have one taken or create a special story or poem about the deceased. I would like to have:

___ A public viewing

A private viewing (family or invitation only)

___ A fully open casket

___ A partially open casket (usually from the waste up)

___ No viewing

Special Instructions:

Funeral or Memorial Service

Today’s services often depart from past traditions. A more personal touch is preferred, creating a relaxed and comfortable atmosphere for everyone involved. Personalizing the service may require more planning and decisions, but the impact on the people special to you can make it well worth the effort.

You can decide the type of service to have or to not have a service.

Your options include:

Location of service: (address, contact person, phone)

Services to be conducted by (name, address, phone):

Eulogy or memorial statements by (name. address, phone):

Readings

Select favorite scriptures, poems or literary passages

List name, address and phone of who will read them:

Music

Choose your favorite types of music and songs. Be creative rather than an organ or vocalist, you might choose a string quartet, guitar or barbershop quartet, worship band or any combination of instruments and vocals you like. Play recordings of your favorite artists or have friends, family or other artists sing or play.

Favorite Songs:

Musicians: (Name, address, phone):

Vocalists: (Name, address, phone):

Flowers and Donations

Flowers can create a warm atmosphere at a service. Some people prefer to send donations in lieu of flowers, and you can ask mourners to send donations instead of flowers.

Flower and Arrangements Preferences:

Preferred Florist: (Name, address, phone)

Church and/or Charities to Receive Memorial Donations: (Name, address, phone):

Service Program

The program for a funeral or memorial service typically presents the order of events, speakers and music for the service. It can provide a lovely keepsake for family and guests. The program should reflect the personality and style of the deceased in a meaningful way.

Personalize the program with your favorite pictures, art, graphics, quotations, Bible verses, poems or special readings. Include drawings by children or grandchildren on the cover. Consider including lyrics for the songs sung during the service, or the text of the readings. The whole family can contribute to the design and content.

Program Preferences:

Memorial Table

A memorial table creates a personal touch and invites conversation and reminiscences. You and friends and family can choose photos, crafts, stories, newspaper clippings and other memorabilia for the table. Guests can be asked to bring mementoes to leave on the table or to share with the family and guests. The table can be set up at a funeral service, memorial, postservice event or at a family member’s home.

Memorial Table Preferences:

Video

In place of, or in addition to the memorial table, families might create a commemorative video. The video is played at the service and provides a special keepsake for family. Copies may be presented to special friends or guests.

The video can contain sequences from other family videos showing the deceased at home, work or special events. Family or friends may be asked to tell a favorite story, or talk about the deceased’s accomplishments and good qualities. A photo montage of favorite family photos can define the life of the deceased. Sequences made especially for the video might include an arrangement of the person’s awards, medals or favorite collections. Favorite music or visual sets can be added to the background.

Video Preferences:

Post-Service Event

Some families have a reception at their home, a restaurant or some favorite place after the service. Planning in advance with family and friends will help the event run more smoothly.

What type of event is planned?

Where will the event be held? (Name/contact, address, phone):

Who are the event planners? (Names/Contact, address, phone):

Disposition of Your Body

There are many choices to consider when making decisions for final disposition of the body.

1. Embalming is for the temporary preservation of the body and allows viewing of the body for relatives and friends. This may include a full funeral, graveside service, burial without a funeral service, entombment in a mausoleum or cremation.

a. For those choosing cremation following a funeral service, most funeral homes have a rental casket available.

2. Immediate cremation with no services.

3. Immediate cremation followed by a memorial service, with or without the cremated remains being present.

4. Immediate burial, either without services, or followed by a memorial service.

a. These choices may be very difficult for family members when they have no idea what you may have wanted.

Note: Questions concerning state and/or federal laws and regulations of funeral practices may be answered by consulting with your local funeral director. Each choice creates various decisions that will need to be made. These will be covered on the following pages:

Pallbearers

Pallbearers carry or walk next to the casket from the hearse to the gravesite. In a military or dignitary’s funeral, they may carry or walk with it during a processional. If the bearers will carry the casket, they must be physically able to do so. Traditionally there are six to eight pallbearers. Honorary bearers who are not physically able to carry the casket may also be appointed.

Pallbearers: (Name, address, phone):

Honorary Pallbearers: (Name, address, phone):

Disposition of Cremated Remains

Choosing cremation requires decisions about final disposition of cremated remains. Cremated remains are customarily returned to the family in a cardboard or plastic container, unless an urn has been purchased and provided to the crematory or funeral home.

Urns are available in many styles and shapes and sizes. Most funeral homes have a display and/or catalogs of available choices.

Cremated remains can be buried in a cemetery lot, placed in an above ground columbarium niche designed for cremated remains, or the family may take the cremated remains for scattering or they may be kept by the family. (Check state laws regarding scattering). Most cemeteries allow one set of cremated remains and one casket to be buried in one lot, or two cremated remains in one lot. Call or visit cemeteries to make an Informed decision.

Special Instructions: Cemetery

Making a trip to the cemetery and selecting a burial plot is one of the most difficult issues facing a family making funeral arrangements. Choosing your final resting place and having it purchased in advance is another act of love that you can accomplish long before the need arises. Today’s mobile society can make this decision difficult. Your family may be faced with:

• Burial where you are now

• Burial near family members

• Burial in another state

• Burial in your hometown.

This is not an easy decision without your guidance. Most cemeteries give you an option of earth burial or above-ground entombment in a mausoleum. If these are choices you want to consider, you will need to inquire at the cemetery of your choice. Many cemeteries have sections designated for religions, veterans, etc. Be aware that many older or smaller cemeteries may not have a mausoleum.

Cemetery of choice:

Address: Phone:

City, State, Zip:

Earth Burial: Mausoleum:

If pre-purchased, where can the paperwork be found:

Special Instructions

Obituary Information

Newspapers and Notices

List the newspapers in which you, your family and friends would like your obituary to appear. If you do not know the name of the paper, list the city and state. Include places where you lived, worked or were involved in community, business or social activities. You may also want to include places where there are people who should be aware of your death. More and more, newspapers are charging for obituaries and even more if they have to prepare it.

Newspaper Name: City/State:

Photo

Many newspapers include a photo of the deceased with the obituary for a fee; some will charge extra for this service.

Would you like a photograph included? Yes No

Place your selected photograph with this booklet or a note where it is kept.

Preparing your obituary in advance is a good idea for several reasons. It gives you a chance to reflect on your favorite events and memories. You can tell your story your way, taking another burden off your family. And it helps evoke positive memories for your favorite people during their grief.

Either attach a copy of the obituary text you have written to this booklet or outline your thoughts below:

Obituary Text or Outline:

Special Accomplishments:

Career Overview:

Community Service:

Military Service and Citations:

Special Events, People and Places:

Survivors:

Include names of survivors and city/state where they reside. If names are ambiguous, include gender.

Parents: Grandparents:

Sons:

Daughters: Stepchildren:

Brothers:

Sisters:

Stepbrothers and sisters:

Grandchildren: (by name or a number):

Great-grandchildren: (by name or a number):

Others to be named:

Preceded in death by:

Notifications

Family members may be unaware of all the people or agencies to be notified of your death. Please list full names (middle initials, too) and address, phone numbers of all who should be notified. If more space is needed, use the blank pages at the end of this booklet.

Pastor:

Executor:

Attorney:

Accountant:

Financial Advisor:

Insurance Agent:

Insurance Agent:

Employer:

Retirement Plan:

Retirement Plan:

Retirement Plan:

Veterans Administration:

Social Security:

Medicaid:

Bank:

Bank:

Bank:

Physician:

Other notifications:

Notify Family and Friends

List Full Name, Relationship, Address, Phone:

Special/Private Notes to My Family

Immediately…

Unfortunately, there are a few matters that must be taken care of very soon after someone passes away.

RESPONSIBILITY STEPS

Obtain a legal pronouncement of death

Notify family, personal representatives, friends, the deceased’s employer and clergy

A doctor will handle this if the death was pronounced at a hospital. If passing occurred at home under hospice care, the hospice nurse can arrange it.

What works for some families might not work for others. Some friends and family may take offense if they’re not informed in person or with a phone call. An email or even a text message may be acceptable in other situations. Emotionally difficult conversations can be draining, so divide these calls among family members, if possible.

Arrange care for dependents and pets, if any If the deceased was a caregiver for people or pets, find temporary care until a long-term solution can be arranged.

Find and review the deceased’s expressed funeral and burial wishes

Prepare and arrange for publication of an obituary

A funeral home can help arrange for burial or cremation. Determine whether your loved one made any prearrangements for services and remains.

Your funeral director, clergy, or a friend or family member can help you compose the obituary. This is also something you can do in advance. While it can feel awkward to raise the subject, your loved one may welcome the opportunity to decide how they are remembered.

Contact the deceased’s financial adviser and estate attorney Inform professionals overseeing your loved one’s financial and investment accounts and determine if any immediate action should be taken.

In the first two weeks…

After informing family members and arranging a funeral, it’s time to take the less urgent steps of attending to core pieces of your loved one’s financial affairs. Here are some good places to start.

RESPONSIBILITY STEPS

Obtain multiple copies of the death certificate

Most financial institutions, businesses and agencies will require an official copy of the death certificate (DC) before giving you access to accounts or other information about your loved one’s affairs. We recommend getting at least 15 copies. (The rightmost column indicates instances where they are likely to be needed, or not.) The funeral director may help you obtain certificates. You can also order them from your state’s vital statistics office and, in some states, obtain them at the deceased’s town hall of residence.

Contact the deceased’s employer about benefits

Notify life insurance companies

Notify property insurance providers

Forward mail

Collect key documents

Notify banks

Handle mortgages and other debts

Inquire about safety deposit boxes

In the first month…

If employed at the time of death, there may be outstanding benefits due to the estate (paid vacation days, pension, union death benefits, employee life insurance).

File appropriate claim forms on any life insurance policies in place you will need to provide policy numbers.

Contact providers of auto, homeowners, etc., policies to switch coverage to a personal representative’s or other’s name.

Notify the post office to forward mail to an appropriate address.

Gather the will, trust and other important items (featured in the Financial Documents Checklist below).

Compile account numbers and other account information before contacting the bank(s) and providing proof of death and a letter of authorization (LOA) that states you or a personal representative are authorized to act on the decedent’s behalf.

Notices to creditors often occur after probate is opened, and there may be benefits to allowing a court to sort out debts for you. Debt-related issues can be tricky and highly state-dependent; legal representation is strongly recommended.

Access to safety deposit boxes varies by state; ideally, you have a password or key. Without them, a court order may be needed to open and inventory the contents.

Once the funeral and initial requirements are behind you, you may want to start thinking about settling the estate. Don’t take on more than you feel you can handle. Making measured, steady progress can fend off feeling overwhelmed down the road.

RESPONSIBILITY

Pay the bills

Meet with a probate attorney (if estate assets not already in trusts)

Inquire about business relationships

Ensure that recurring payments are made on loans, mortgages, property taxes and other bills, where applicable.

The deceased’s personal representative or executor should choose an attorney if an estate-planning lawyer is not already in place. If there is a will, the personal representative and attorney will enter the document into probate court. Without a will, the probate court judge will assign an administrator.

If the deceased was an owner or partner in any small businesses or partnerships, consult with the representative attorneys.

Notify Social Security, Medicare, Veterans Administration, relevant pension administrators and other agencies

Close credit card accounts

Notify credit reporting agencies

Freeze or maintain financial accounts

Forward email and cancel social media accounts where authorized and permitted

The funeral director generally will contact the local Social Security office; if not, call (800) 772-1213 to ensure overpayments are not made they can be complicated to repay. (Do inquire about a one-time payment of $255 to the surviving spouse and dependents.) The Social Security Administration will contact Medicare, but you will need to call the numbers on the deceased’s Medicare plan insurance card to terminate Medicare Part D and Medicare Advantage plans or any other supplemental medical insurance plans.

Provide credit card companies with a copy of the death certificate; they will shut down the card as of the death date. Be sure to ask for interest and fees to be waived. Keep records and inform the personal representative about outstanding debts.

Unfortunately, fraudsters often target people after they’ve passed. To prevent identity theft, provide the three major credit bureaus TransUnion, Equifax and Experian with copies of the death certificate.

Do you want to keep any banking or investment accounts? Contact your financial adviser for guidance.

Talk to the probate attorney about accessing email and social media, as the laws on accessing a deceased’s digital accounts continue to evolve. Consider canceling social media accounts to prevent identity theft. Procedures vary by account (some sites require a copy of the death certificate and proof of your relationship to the deceased).

By the end of the second month…

By now, most of the time-sensitive requirements are in your rearview mirror and you can take a big-picture perspective of your loved one’s estate and possessions, as well as get ahead of tax deadlines and any potential identity theft risks.

RESPONSIBILITY

Create a list of income, assets and liabilities

Prepare federal and state income tax returns for the estate

Cancel the deceased’s driver’s license and passport

This is an especially important step if you’re going through the probate process, which typically requires an inventory of all assets, including personal property, jewelry, furniture, cars, brokerage and retirement accounts, etc.

Gather material you’ll need to file income tax returns for both the individual and the estate. A tax preparer can help you account for everything. Keep all monthly financial statements that show balances at the time of death. Income tax returns are due in the April following the death.

Alerting the Department of Motor Vehicles as well as the U.S. Department of State of their passing can help protect against identity theft.

Inside three months…

You can begin to make plans for the road ahead, including distributing assets to beneficiaries and adjusting the investment strategy for inheritances or other legacy wishes.

RESPONSIBILITY STEPS

Reevaluate your investment strategy

Retitle assets such as homes, vehicles and related insurance policies

Update your estate plan and beneficiary designations to remove the deceased as a beneficiary

Identify new beneficiaries for recently acquired accounts

If you inherited invested assets, you may have a different investment timeline than the deceased. Working with an experienced financial adviser can help you make the right investment decisions for yourself and other beneficiaries.

State laws and procedures about retitling homes and cars vary greatly. Work with your estate or probate attorney to transfer all the deceased’s assets.

Remove the deceased’s name from accounts or insurance policies on which they were a named beneficiary and replace with heirs, if applicable.

Determine who the beneficiaries are on accounts you’ve assumed control of (siblings, grandchildren, charities, educational institutions).

Financial Documents Checklist

Life events often occur suddenly and unexpectedly. Getting organized now—with documents, account numbers and passwords will help you feel more in control during stressful times. This checklist outlines the items you may need to settle your loved one’s affairs. Many can be found and organized ahead of time.

CRITICAL DOCUMENTS

Death certificate

Past five years of income tax returns

Any gift tax returns ever filed

Paystubs for the past six months

Will and trust documents

Beneficiary designations

Pre- and postnuptial agreements

Divorce agreements

Bank and credit union accounts

Investment statements and brokerage accounts

Business financial statements

Credit card accounts (business and personal)

Certificates of deposit (CDs)

List of safety deposit boxes, location of keys and names of authorized users

Partnership or interest in limited liability companies (LLCs)

Promissory notes owed by family members or third parties

Patents, trademarks, royalty payments or rental income

Dividend reinvestment plans (DRIPs)

401(k)s and 403(b)s

Pensions (defined benefit plans)

IRAs (traditional, Roth, SEP)

Profit-sharing plans

Annuities

Health savings accounts (HSAs)

Original purchase documents Mortgage agreements

ADDITIONAL INFORMATION, DOCUMENTS AND ITEMS TO GATHER

Passwords, usernames and PIN numbers for all relevant accounts and websites

Records of charitable giving

Pending litigation or arbitration proceedings

Safety deposit box keys

Educational records

Birth and marriage certificates

Social Security card

Veterans service member paperwork (DD214) or ID

Driver’s license, state ID card and passport

Auto registrations, titles, handicap placard and toll transponders

List of valuables (antiques, artwork, collectibles, jewelry)

Professional Will

If you are a clinical psychologist or other healthcare professional, there are additional needs to have a Professional Will and identify a Practice Executor.

Laws governing the closure of a practice are not uniform; they vary from state to state and can evolve over time. Many state associations, like SDPA, offer members a template to help navigate this process, while others may prefer to work closely with their attorney to craft a document tailored to their unique circumstances. It's important to recognize that these templates are based on collective experience and should be viewed as a starting point rather than definitive legal guidance. I always encourage colleagues to consult with an attorney well-versed in these matters to ensure their individual needs are addressed.

When it comes to creating a professional will, the first and perhaps most crucial decision is selecting a trusted professional executor ideally, another respected mental health professional. Having a backup executor is just as important, adding a layer of security and continuity. Additionally, it's wise to provide your professional executor with the contact information for your personal will's executor and to ensure your lawyer holds a final copy of your professional will. Associations like San Diego Psychological Association and the Arizona Psychological Association compiled helpful recommendations for structuring these documents, highlighting key areas to include:

• Client records: Executors must know the location of these records, which should be organized into active and former clients. Adherence to state laws and the APA’s Ethics Code is essential.

• Billing and financial documents: Your will should clearly indicate where these are stored to facilitate resolution of outstanding accounts.

• Appointment books and patient contacts: Patients deserve timely notification in the event of a psychologist’s death or incapacitation ideally before their next appointment.

• Access information: Executors will need access to email, voicemail, office keys, and secure storage to manage the practice responsibly.

• Patient notification methods: Some may prefer written notification, a newspaper notice, or phone calls; others may trust the executor to determine the best approach.

• Liability insurance: Malpractice carriers should be notified promptly about the psychologist’s passing or illness.

• Executor compensation: A comprehensive professional will not only eases the transition for patients, but also lifts a significant burden from the psychologist’s family at a profoundly difficult time.

As Felix Saloman, PhD, has noted, few professionals go to such lengths to ensure care for their clients after they’re gone. This is not just a responsible practice, it’s an important opportunity for psychologists to reflect on and shape their legacy, and to consider their own perspectives on mortality in a meaningful and constructive way.

Use the checklist below to first consider the specific needs of your practice, then determine who you could rely on to fulfill all these duties as your Practice Executor.

Task Details/Considerations

Possession of Clinical Records

Retention of Records

Notification of Past Clients

Transmission of Clinical Records

Collection of Outstanding Payments

Insurance Statements

Determine how the Executor would take possession of digital and paper clinical records, securely and in compliance with HIPAA regulations.

Determine how, where, and at what expense the Executor should retain records for the required retention period.

Determine and make a plan for the Executor to fulfill state-specific requirements for notification of past clients such as sending letters or posting announcements in newspapers.

Determine how the Executor would securely transmit any clinical records that were requested to be sent to new providers.

Plan how your estate will collect payment for therapy services you have provided but not yet collected for.

Determine how clients will receive necessary statements for insurance purposes.

Office and Professional Affairs

Communication with Clients

Memorial Service

Registration with Licensing Board

Determine what should happen to your office, automatic bill payments, professional licenses, malpractice insurance, and websites.

Decide how much detail can be shared with clients who inquire about your condition.

Establish whether clients would be welcome at a memorial service if they ask.

Determine and fulfill state-specific requirements for registering the Professional Will with the State Licensing Board.

Practice Executor

Task Description

Identify a practice executor

Calculate expected completion time

Confirm executor's confidence

Confirm executor's availability

Estimate and reserve executor fee

Assess emotional attachment

Evaluate autonomy

Fulfill state registration requirements

Choose someone you trust to be competent and available to perform urgent tasks with sensitivity and expertise.

Estimate the time needed using the guideline: 2 hours per active client and 1 hour per 25 archived client files (retained for 7 years or per state requirements).

Ensure potential executors feel confident completing all required tasks.

Verify that the executor can devote the calculated time alongside their usual work and family responsibilities.

Calculate the likely bill based on time estimate and consulting fee, and plan to reserve this amount for payment.

Ensure executors do not have an emotional attachment that could interfere with executing your Will during a time of grief.

Consider how independently the executor can operate and whether they would seek help from family or colleagues during their time of grief.

Determine and complete state-specific requirements for registering the Practice Executor with the State Licensing Board.