STATE of DOWNTOWN 2024

The 2024 edition of the State of Downtown highlights the momentum, adaptability, and resilience of our central business district.

● Texas A&M University’s $185M Law and Education building topped out in 2024. Completion is expected in 2026. Texas A&M is planning three additional projects:

– Research and Innovation building

– Gateway building

– Performance, Visualization, and Fine Arts building

● The Fort Worth Convention Center’s $700 million expansion continued with significant progress on Phase 1.

● Deco 969’s 2024 opening of their 27-story apartment tower set a new benchmark for luxury Downtown living.

● In 2024, Dart Interests expanded its Downtown Fort Worth investment by acquiring 4.6 additional acres adjacent to the former Fort Worth Central Library acquired by DART in 2023.

● The T&P Passage, linking Lancaster and the passenger platform, was completed.

● The City of Fort Worth acquired the Center for Transforming Lives building to serve as our new Downtown Central Library.

● The City began moving into the new City Hall in earnest. The parking garage expansion began, and work continued on the new Council Chambers (opened March 2025).

● Hillwood, a Perot company, made a significant investment in Downtown by purchasing an entire city block in late 2023.

● Trinity Metro continued planning its 1.2-mile rail extension, connecting Downtown with the Fort Worth Medical District.

● Planning, design, and fundraising continued on Heritage and Paddock parks.

● Panther Island Plan 2.0 was released.

● While interest rates and economic conditions have slowed the pace, more than 1,479 hotel rooms and 978 new residential units are in various planning stages.

If you would like more information about Downtown Fort Worth, contact Shane Smith at shane@dfwi.org.

ABOUT US

DFWI’s Mission

Downtown Fort Worth, Inc.’s (DFWI) mission is to be the catalyst for transforming Downtown into a vibrant place to live, visit, enjoy, and conduct business through aggressive leadership of programs, projects, and partnerships.

Who We Are

Formed in 1981, DFWI is Downtown Fort Worth’s planning, advocacy, public space, and project management organization. DFWI also builds Downtown Fort Worth’s vitality by serving as a liaison, ombudsman and information source for property owners, residents, business owners, lenders, developers, community organizations, and policymakers.

What We Do

DFWI is a 501(c)(6) nonprofit membership organization. In addition to coordinating the Downtown planning process, advocacy, member services, communications, and Downtown leadership, DFWI members founded the first Public Improvement District (PID) in the state of Texas in 1986. DFWI continues to manage PID #1 and PID #14. These PIDs provide enhanced services to property owners including maintenance and landscaping, public space management, promotions and marketing, transportation, planning, research, and security enhancements to 564 acres of Downtown.

DFWI also administers the Downtown Tax Increment Finance District (TIF) by contract with the City of Fort Worth. Eligible TIF projects include parking, infrastructure assistance to new developments, historic preservation, affordable housing, transportation, and education.

DFWI staffs the Downtown Neighborhood Alliance, an organization of Downtown residents that promotes, preserves, encourages, and enhances residential quality of life in Downtown Fort Worth.

Downtown Fort Worth Initiatives, Inc. (DFWII) is a 501(c)(3) nonprofit corporation that provides a pathway for foundation grants, philanthropic donations, and other contributions to help fund charitable, educational, and public-purpose Downtown projects. Each year DFWII helps to bring hundreds of thousands of people to Downtown by producing the MAIN ST. Fort Worth Arts Festival and the GM Financial Parade of Lights. DFWII also developed the JFK Tribute in Fort Worth, redeveloped Burnett Park and is currently administering the Heritage Park restoration design. DFWII is a partner with Fort Worth Housing Solutions in the 172-unit, mixed-income Hillside Apartment community.

DOWNTOWN SUMMARY

Office Market

12 million square feet of office space

50% of total office space is Class A

Average rent for Class A is $36 per square foot

90% total office occupancy rate

Residential

Fort Worth’s population reached 989,878 in 2024, solidifying its position as the fourth-largest city in Texas, surpassing Austin (986,928)

Downtown’s estimated population grew to 11,596 residents, a 17% increase from 2023

910 condos and townhomes

5,616 apartment units

978 additional multifamily units are in various stages of the planning process

250 multifamily units are actively under construction

Hospitality

3,999 current hotel rooms

17 existing hotels

1,724 additional rooms are in various stages of the planning process

The Convention Center expansion will add 97,000+ square feet of additional exhibit hall space, additional flexible meeting rooms, and a new 40,000-square-foot ballroom

Planned development includes 400-room Omni expansion and 600 to 1,000 additional Convention Center hotel rooms

Tourism

20 million Downtown visits in 2024

9% of Downtown visitors have household income of greater than $200,000

253,000 square feet of Convention Center exhibit hall space

● Sundance Square Plaza

● Sid Richardson Museum

● JFK Tribute in Fort Worth

● Panther Island Beach

● Bass Performance Hall

● Jubilee Theatre

● Circle Theatre

● Water Gardens

● Burnett Park

● Central Station/T&P Station

Entertainment Venues Downtown Fort Worth VENUE

(Arena Seating)

Transportation

2,562 free metered parking spaces after 6 p.m. on weekdays and all day on weekends

Trinity Metro Bikes launched in early January 2025, featuring new electric bikes and updated docking stations

14 bus routes serve Downtown

Trinity Railway Express rail connects Central Station to downtown Dallas Union Station in one hour

TEXRail rail connects Central Station to DFW International Airport Terminal B Station in one hour

College Campuses

University of Texas at Arlington Fort Worth Tarrant County College

Texas A&M University School of Law

Tier 1 Texas A&M University campus (under construction)

Big Picture:

Fort Worth is now the 12th largest city in the United States according to Census 2023 estimates.

Major ongoing initiatives further reinforce Downtown’s progress, including Texas A&M University’s construction and commitment to Downtown, the Fort Worth Convention Center expansion, Butler Place’s evolution, Panther Island’s continued progress, Dart Interest’s acquisitions, and Trinity Metro’s TEXRail extension.

Development pipeline momentum remains strong, with more than 978 residential units and 1,724 hotel rooms at various stages of planning.

At year-end, the Downtown development pipeline included $2.9 billion in construction projects over the next five years.

ChisholmTrailPkwy

Downtown Fort Worth Boundary

Top 15 Largest-Gaining Cities – by Numerical Change

Between July 1, 2022, and July 1, 2023

Office:

Downtown Fort Worth’s office market remains strong, with a 90% occupancy rate as of Q4 2024, according to CoStar—significantly higher than the national average of 84%.

Downtown’s 12.3 million-square-foot office market includes over 1,400 businesses.

While historically centered around the oil and gas industry, the office user base has diversified over the past 15 years, enhancing resilience against industry-specific fluctuations. In addition to petrochemical businesses, key employment sectors include law, accounting, finance, real estate, architecture, engineering, and other professional services.

A new 30,000 SF market entrant, Probably Monsters, Inc., attracted by Texas A&M’s commitment to high-tech programming in Downtown, signals a potential new space user category for existing and new office developers.

Placer.ai’s foot traffic analysis reports a total of 56,000 Downtown employees in 2024, a 2% increase from 2023. Additionally, employee visits have risen by 7.5% from the previous year, indicating a steady increase in employees returning to work.

Class A & B Office Occupancy Rates

Total Office Occupancy Rates

As of 2024, Fort Worth has a population of 989,878, according to the Texas Demographer, making it the fourth-largest city in Texas, surpassing Austin. Additionally, according to 2023 census estimates, Fort Worth is now ranked the 12th most populated city in the U.S.

This steady population growth drives demand for new and existing developments, contributing to Downtown’s expanding residential inventory.

Downtown features 5,616 apartment units with average asking rents of $1.90 per square foot.

The 12-month net absorption rate climbed to 406 units in 2024, a 35% increase from the previous year. Year-over-year rents dipped slightly but rebounded to year-end 2023 levels.

Downtown Fort Worth has a total of 6,684 multifamily units, including apartments, townhomes, condominiums, and senior housing. Additionally, 250 units are currently under construction, and 978 units are in various planning stages, including The Harden at the Public Market, a 199-unit, active senior living development set to begin leasing in early 2025.

The 2024 opening of Deco 969, a luxury high-rise, has elevated the standard of Downtown living with high-end finishes, a full suite of amenities, and asking rents exceeding $3.00 per square foot.

Key developers, including Dart Interests, Resia, 3L Real Estate, and Hillwood, are poised to capitalize on Downtown’s residential demand.

Downtown Apartment Vacancy Rate

YoY Market Rent Growth, by Market

YEAR IN REVIEW

Hospitality:

With the opening of Le Méridien and the avid hotel Fort Worth, Downtown’s hotel inventory expanded to 3,999 rooms – an 8% increase from the previous year. An additional 1,724 rooms are in various planning stages. Other significant planned additions include the highly anticipated return of the 245-room Sandman Signature Hotel, a new 600- to 1,000-room Convention Headquarters Hotel, a 400-room Omni expansion, a 330-room conversion of the Oil & Gas building, and a 149-room Residence Inn of the Bob Simpson building.

According to CoStar, Downtown’s 12-month hotel occupancy rate reached 69% in Q4 2024, a 3% increase from Q4 2023. Revenue per available room (RevPAR) reached $138, a 5% increase over the prior year.

Construction on the Fort Worth Convention Center expansion is well underway, with completion expected by 2030. The project will increase Downtown’s capacity to host simultaneous large-scale events, driving demand for further hotel development. As part of the expansion, a new commercial kitchen has been completed, infrastructure has been upgraded, and a new entrance and contemporary facade have been added along Commerce Street. Additionally, nine new loading docks will be added, and Commerce Street will be straightened, creating approximately three new city blocks for the New Convention Headquarters Hotel.

Downtown is minutes from key regional destinations such as the Fort Worth Stockyards, Near Southside/Hospital District, Dickies Arena, and the Fort Worth Cultural District. Close-by Arlington attractions include AT&T Stadium, Globe Life Field, Six Flags Over Texas, and the new Medal of Honor Museum.

DFW International Airport, the world’s third-busiest and the nation’s leader in nonstop destinations, is just 22 miles from Downtown. Trinity Metro’s TEXRail service from Downtown to DFW is provided by 34 trains serving two Downtown stations.

Hotel Occupancy Rates

Source: CoStar

One of Downtown’s strengths is accessibility, including direct access to I-30 and I-35 and the one-hour transit ride to DFW International Airport via TEXRail. The TRE also connects Downtown Fort Worth to Downtown Dallas in an hour. The Alliance Global logistics hub is 20 minutes from Downtown. Additionally, Downtown is just minutes from the Near Southside medical districts, the renowned Dickies Arena and Fort Worth’s Cultural District. Trinity Metro’s Orange Line provides convenient access to the Stockyards. These factors contribute to Downtown’s appeal as a hub for business and leisure travelers. Meacham International Airport (a full-service aviation facility) is five minutes from Downtown.

Local Visitors and Tourism:

Fort Worth Visits by Month

COMPANIES GET MORE IN DOWNTOWN.

Nationally, office vacancies remain at a 10-year high of 14%. Over the next five years, a quarter of pre-pandemic leases will expire. Whether this period will lead to market shifts that differ significantly from past recovery cycles remains uncertain. As of Q4 2024, the national office construction pipeline has declined to 72 million square feet, down from 101 million square feet in Q4 2023. This total marks the lowest construction pipeline estimate since 2012.

In the greater DFW market, signs of stability are emerging. After a period of occupancy losses, annual net absorption turned positive in 2024, reaching 1.5 million square feet. While the vacancy rate hit a 10-year high of 18%, this increase is primarily due to the addition of 3.2 million square feet of new office space in 2024.

Downtown Fort Worth continues to outperform national and regional office markets, with a vacancy rate of 10% as of Q4 2024. The average private sector payroll per employee increased by 7% across 1,400 businesses, according to the most recent 2022 census CBP survey. Placer.ai’s foot traffic analysis reports a total of 56,000 Downtown employees in 2024, a 2% increase from 2023. Additionally, employee visits have risen by 7.5% from the previous year, indicating a steady increase in employees returning to work.

Downtown’s workforce remains diversified across professional services, with strong representation in oil and gas, law, accounting, finance, architecture, engineering, and other professional firms.

A key factor bolstering Downtown’s occupancy rates is the adaptive reuse of office buildings into residential and hospitality developments, including the Oil & Gas, Bob Simpson, Oncor, and Binyon O’Keefe buildings. The Pier 1 building has been successfully transformed into the new City Hall.

Significant investments continue to enhance Downtown’s appeal as a premier office destination. The entry of Probably Monsters, Inc., a 30,000 SF tenant, illustrates growing demand from emerging sectors tied to Texas A&M University’s expanding high-tech presence Downtown. Interstate improvements, regional rail investments, the Convention Center expansion, new hotels, and Texas A&M University’s new Tier 1 research campus continue to strengthen Downtown’s position as a business hub.

35,358

National Trend

The AIA/Deltek Architecture Billings Index (ABI) is a diffusion index derived from the monthly Work-on-the-Boards survey, conducted by the AIA Economics & Market Research Group. The ABI serves as a leading economic indicator that leads nonresidential construction activity by approximately 9-12 months.

According to the December 2024 AIA ABI report, the ABI score fell to 44.1 for the month as the share of firms reporting a decline in firm billings increased. Firm billings have now decreased for the majority of firms every month except two since October 2022. While not a full-fledged recession, this period of softness and uncertainty has been challenging for many firms. Prospects for future work remain soft as well. Although inquiries into new projects continued to increase at a relatively slow rate, the value of newly signed design contracts decreased further in December as clients remained hesitant to commit to new work.

Source: AIA/Deltek Architecture Billings Index

Metro Area Class A Office Vacancy Rates

Frisco/The Colony

Dallas Uptown

Las Colinas

Downtown Fort Worth holds a solid competitive stance among its DFW peers, mainly through its

and relatively balanced rental rates.

Downtown Fort Worth

Dallas Stemmons Freeway

Frisco/The Colony

Dallas Uptown

Dallas Central Expressway Las Colinas

National CBD Office Market Rent Q4 2024

National CBD Office Market Vacancy Q4 2024

LAUS

Miami-Dade County, FL

Broward County, FL

King County, WA

Maricopa County, AZ

Santa Clara County, CA

Orange County, CA

Tarrant County, TX

Bexar County, TX

Dallas County, TX

San Diego County, CA

Harris County, TX

Cook County, IL

Queens County, NY

San Bernardino County, CA

Riverside County, CA

Los Angeles County, CA

Clark County, NV

Kings County, NY

$135,000,000

$130,000,000

$125,000,000

$120,000,000

$115,000,000

$110,000,000

$105,000,000

$100,000,000

$95,000,000

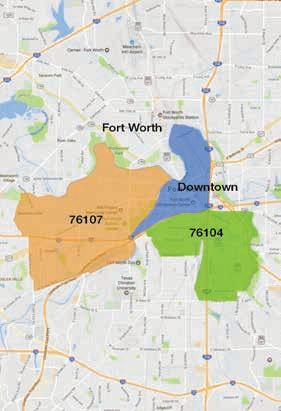

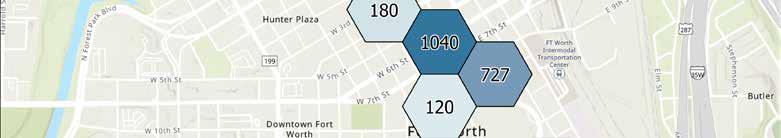

Downtown, the Near Southside, and the West Side combined generate $8,159,351,000 in annual payroll. Downtown Fort Worth has the highest number of employees and generates the largest payroll among all the employment centers in the county.

Average Payroll per Employee in Private Sector

Average Private Sector Payroll per Employee

Downtown Employee Visits by Day of Week – Yearly Comparison

Downtown Employee Visits by Month – Yearly Comparison

LIVING THE DOWNTOWN LIFESTYLE.

The Dallas-Fort Worth multifamily market is experiencing a resurgence in demand, with apartment net absorption reaching 31,000 units over the past year – surpassing pre-pandemic levels. However, the new supply has kept the vacancy rate at 11%, near a 20-year high. Despite this vacancy level, DFW rental rates declined by only 1% in 2024.

As of January 2024, Fort Worth's population is 989,878, surpassing Austin and solidifying its position as the fourth largest city in Texas, according to the Texas Demographer. According to the 2023 U.S. Census estimates, Fort Worth now ranks as the 12th most populated city.

As of 2024, Downtown has approximately 11,596 residents. The number of residential units in Downtown has increased by 13.8%, totaling 6,684 multifamily units, which include apartments, townhomes, condominiums, and senior housing. The residential inventory will expand on the completion of 250 units currently under construction, including The Harden at the Public Market, a 199-unit senior living development scheduled to begin leasing in early 2025. Additionally, 978 units are in various stages of planning.

Downtown’s apartment market remains strong, with 5,616 units and an average rent of $1.90 per square foot. The 12-month net absorption in Downtown reached 406 units in 2024, a 35% increase over the previous year. While the DFW market experienced negative rent growth in Q4 2024, declining by 1.2% due to supply outpacing demand, Downtown Fort Worth demonstrated resilience. As such, the apartment market rebounded to its year-end 2023 levels.

The 2024 opening of Deco 969, a luxury high-rise, has elevated the standard of Downtown living with high-end finishes, a full suite of amenities, and asking rents exceeding $3 per square foot. Major developers, including Dart Interests, Resia, 3L Real Estate, and Hillwood, are all well positioned to contribute to Downtown’s growing residential inventory.

At a Glance

Total existing residential units: 6,684 Total under construction/planned: 1,228

Total apartment unit growth increased by 810 units, a 17% rise compared to 2023.

Source: CoStar

Source: CoStar

The apartment occupancy rate for Q4 2024 reached 90%, surpassing the 10-year average.

Source: CoStar

The 2024 median sales price for condos and townhomes was $323,750, a 3% decrease from 2023.

Average asking rents for apartments remained relatively stable between 2023 and 2024 at $1.96 per square foot.

Source: CoStar

37% of Downtown residents have a bachelor’s degree or higher.

Source: U.S. Census 2023

Median earnings for Downtown postgraduate residents is $89,024.

Source: U.S. Census 2023

POPULATION

2023 Top National City Population and Growth Rate

States

Texas ranked among the top four states for the highest year-over-year growth from 2022-2023

Condominiums and Townhomes Sold - Average Price per Square Foot by Region

Condominium and Townhome Sales in Downtown in 2024

67 Days

The average number of days properties stayed on the market was 67.

$409,000 The median price for all condos sold is $409,000.

$320,000 The median price for all townhomes sold is $320,000.

Multifamily Developments

Building Status Planning Under Construction

Downtown Total Multifamily Units and YoY Growth Rate

In 2024, the DFW MSA led the nation with 72,151 new privately owned housing units authorized through building permits, amounting to over 17 billion dollars in development. Source: U.S. Census BPS 2024

BUSINESS AND LEISURE TRAVELERS AGREE, DOWNTOWN IS THE PLACE TO STAY.

Downtown Fort Worth offers a unique blend of historic charm and modern amenities, an extraordinarily well-maintained public realm, and a well-coordinated safety culture. This combination sets the stage for Downtown as a prime hospitality destination.

In 2024, the Downtown market saw a boost with the addition of the 188-room Le Méridien Fort Worth and 104-room avid hotel Fort Worth. Downtown’s total hotel inventory expanded to 3,999 rooms – an 8% increase from the previous year. According to CoStar, Downtown’s 12-month hotel occupancy rate reached 69% in Q4 2024, a 3% increase from Q4 2023. RevPAR increased by 5%, reaching $138 during the same period.

An additional 1,724 rooms are in various planning stages, including:

● 600- to 1,000-room Convention Headquarters Hotel

● 245-room Sandman Signature Hotel

● 400-room Omni expansion

● 330-room conversion of the Oil & Gas building

● 149-room Residence Inn of the Bob Simpson building

This growth mirrors the broader Fort Worth/Arlington market, which has 15 hotels under construction, slated for completion by 2026. Group demand is increasing in both areas, driven mainly by conventions, conferences, and sports.

Vibrant Appeal

Downtown’s vibrant mix includes the Fort Worth Convention Center (undergoing a $700 million expansion with an expected completion date of 2030), Sundance Square, a variety of restaurants, retail shops, entertainment venues, horse-drawn carriages, and a 12 million-square-foot office market.

Access

Downtown is served by I-30 and I-35, two commuter rail routes, the regional transit system, Amtrak, Vonlane, and a Downtown circulator.

Airlift

DFW International Airport, the world’s third-busiest and the nation’s leader in nonstop destinations, is just 22 miles from Downtown. Trinity Metro’s TEXRail service from Downtown to DFW is provided by 34 trains serving two Downtown stations.

Fort Worth Meacham International Airport is five miles from Downtown, and Fort Worth Spinks Airport is 13 miles away.

Regional Amenities

The area’s appeal is further enhanced by its proximity to cultural attractions like the Near Southside, Fort Worth’s Cultural District, and the historic Fort Worth Stockyards. Access to Dallas includes rail options via TEXRail and TRE lines.

Hotels Planned (P) or Under Construction (UC)

Source:

Fort Worth, Inc.

Tourist Visits to Downtown’s Core 2024 vs. 2023

This chart shows the number of visits from visitors who live more than 50 miles away and stayed overnight in hotels or participated in conventions and events.

Source: Placer.ai

Hotel Total Room Tax Receipts

$250,000.000

$200,000.000

$150,000.000

$100,000.000

$50,000.000

Downtown’s share of Fort Worth’s total hotel tax receipts for 2024 was 34%.

City’s Share of Hotel Inventory Relative to DFW Metroplex

Hotel Occupancy by City

HOSPITALITY

3,999 total hotel rooms

Downtown Fort Worth Visits by Month YoY

Downtown Fort Worth vs. City of Fort Worth Visits by Month 2024 1,600,000 1,550,000 1,700,000 1,650,000 1,800,000 1,750,000 1,500,000 1,450,000 1,400,000

14,000,000 13,000,000 15,000,000 14,500,000 12,000,000 11,000,000 10,000,000 10,500,000 11,500,000 12,500,000 13,500,000

Downtown hosted a total of: 19.9 million visits in 2024, a 1% increase from 2023.

Source: Placer.ai

In 2023, the Wedgwood neighborhood had the most visits by home ZIP code to Downtown, while the Meadowbrook neighborhood had the highest year-over-year increase in visits.

Downtown City of Fort Worth

TABC Sales

TABC’s alcohol sales receipts reflect retail activity and transaction volumes over time. Increases in these receipts may indicate higher consumer traffic, spending, and economic activity. Monitoring alcohol sales data can offer insights into consumer confidence and overall retail trends in Downtown.

Downtown Fort Worth – Total TABC Receipts by Month

$7,500,000

$7,000,000

$6,500,000

$6,000,000

$5,500,000

$5,000,000

$4,500,000

$4,000,000

Downtown Fort Worth – Total TABC Receipts by Year

Retail Drivers

Circle Theatre offers a newly renovated space with speakeasy vibes. Patrons can relax and talk before each show and enjoy cocktails, soft drinks, beer, wine, and snacks from their new cocktail bar.

Bass Hall is recognized worldwide for its unique architecture and spectacular acoustics. The Bass Performance Hall hosts over 200 performances annually, reaching more than 300,000 patrons.

Household Income Distribution of Downtown Fort Worth Visitors

Parks, Plazas, and Recreation

Ten parks totaling 385 acres.

Sundance Plaza features water fountains, restaurants, outdoor dining, entertainment, and programming throughout the year.

Burnett Park features play equipment and seasonal programming.

Access to more than 100 miles of scenic trails for running, walking, cycling, and horseback riding.

Downtown’s Trinity River Waterfront offers seasonal canoeing, kayaking, paddle boarding, and year-round fishing.

General Worth Square includes the JFK Tribute in Fort Worth.

The Fort Worth Water Gardens is a beautiful and surprising oasis adjacent to the Fort Worth Convention Center.

Fort Worth Water Gardens

PID #1 & #14

Created in 1986, the Downtown Fort Worth Public Improvement District (PID) #1, administered by DFWI, offers a comprehensive program of services, including research, marketing, Downtown planning assistance, sidewalk cleaning, street sweeping, security enhancement, litter removal, and bird abatement.

From 1986 to 2009, the PID services were renewed by petition every five years by an overwhelming majority of property owners.

Because of the PID’s ongoing success, it was reestablished in 2009 for a 20-year period by Downtown property owners.

PID #14 was established in June 2009. Since then, District contractors have provided services along Samuels Avenue daily.

$3,518,877 in services annually

1,249 trees serviced within PIDs

13,500 square feet of planters in bloom year-round

75,000 flowers planted annually

1,984 cubic yards

(53,568 cubic feet) of dirt/debris removed from streets, curbs, and gutters annually

14 Ambassadors who patrolled 39,884 miles in 2024

12 full-time clean-team members

6 full-time sidewalk pressure washers

15,660 linear miles of sidewalks cleaned annually

4,088 miles of curb and gutter cleaning annually

6 Bird Abatement Specialists and 2 Harris’s Hawks

Over 150 Downtown trees illuminated and managed by the PID

Tax Increment

Finance District #3

A significant partnership that adds to the success of Downtown is Tax Increment Finance (TIF) District #3 and the other Downtown-oriented TIFs.

The Downtown TIF is a collaboration of the City of Fort Worth, Tarrant County, Tarrant County Hospital District, Tarrant County College District, and Tarrant Regional Water District. It invests strategically in public infrastructure, abatement, historic preservation, and targeted developments.

To date, the TIF has obligated roughly $97 million, leveraging $911 million in private development and facilitating $55.05 million in public investment.

In tax year 2023, the TIF returned $6.9 million in tax increment to the partners. Between 2014 and 2023, the TIF returned $83.8 million to its partners.

In late 2024, the annual and lifetime caps were removed, and the TIF was extended to 2045.

Downtown TIF Investments, Tax Increment Value, and Expenses

EDUCATION IS A GROWING MARKET SEGMENT IN DOWNTOWN FORT WORTH. TARRANT COUNTY COLLEGE, UTA FORT WORTH, AND TEXAS A&M EACH HAVE A PRESENCE IN THE CENTER CITY.

Fort Worth ISD’s highest-performing school is Downtown’s Young Women’s Leadership Academy. With a 100% college attendance rate, this STEM school for young women has an attendance of 436. Fort Worth ISD is working on a plan to improve the school in light of enrollment growth, program expansion, Title IX, and parking needs.

I.M. Terrell Academy is ranked 37th among all high schools in the DFW Metroplex and 4th in the Fort Worth Independent School District (FWISD). It has maintained an "A" rating in both FWISD and Texas for seven consecutive years. Students in I.M. Terrell’s Visual and Performing Arts programs excel at state and national levels in UIL and other competitions, while the STEM Robotics program competed in the VEX Robotics World Competition in Dallas against participants from over 50 countries.

EDUCATION

Texas A&M University

Texas A&M University acquired the Texas Wesleyan Law School in 2013. Since then, it has experienced the most significant jump in reputation scores of any law school in the United States. The law school is now ranked #29 nationally. It recently passed its Texas counterparts at Baylor University, Southern Methodist University, and the University of Houston in the latest U.S. News & World Report rankings.

The enrollment is currently 1,530 and rose 17% over the prior year. The new $185 million Texas A&M Fort Worth Law & Education building is well under construction, with an opening planned for 2026.

In addition to the Law and Education building, Texas A&M Fort Worth is working on programming for three future buildings: the Research and Innovation building, the Gateway building, and a building dedicated to A&M’s expansion in the arts.

The expanding Texas A&M Fort Worth campus, emphasizing innovation, entrepreneurship, and technology, will help advance the region's economic development and corporate workforce goals. The campus will help elevate Fort Worth’s position in the Metroplex as a hub of the new economy – including in aerospace and mobility, healthcare, energy, telecommunications, and other growth areas.

UTA Fort Worth Center

As the Downtown presence of The University of Texas at Arlington, UTA Fort Worth is committed to providing accessible, high-quality education for busy professionals seeking to advance their careers.

UTA Fort Worth delivers industry-relevant degrees in Nursing (RN to BSN), Healthcare Administration, Executive MBA, MBA, Real Estate, Software Engineering, Engineering Management, and Social Work.

Beyond academic offerings, the Institute of Urban Studies (IUS) at UTA Fort Worth plays a pivotal role in addressing the challenges of urbanization, regional growth, and community resilience. Through strategic partnerships, IUS provides modestly priced technical assistance, training, and applied urban research that empowers governments, nonprofits, and community organizations to operate more efficiently and effectively.

TCC Trinity River Campus

Downtown’s Tarrant County College (TCC) Trinity River campus served over 10,000 students in 2024, awarding 1,300 degrees and certificates. More than 400 students were enrolled in the Texas Academy of Biomedical Sciences, TCC’s Early College High School initiative.

Partnerships with health systems and hospitals, a wide variety of programs, industrystandard equipment, and true-to-career learning opportunities equip graduates for work from day one as anesthesia, ophthalmic, imaging, and surgical technicians, respiratory therapists and medical assistants, long-term care administrators, and nurses.

Beyond healthcare, TCC Trinity River offers programs as diverse as sign language interpretation, geographic information systems, criminal justice, and policing.

The nationally accredited Tarrant Small Business Development Center, hosted by TCC, provides resources for entrepreneurs.

Trinity River’s Lifestyle and Community Learning Division offers classes and community connections for all ages.

TCC Trinity River Campus

UTA Fort Worth Center

ONE OF DOWNTOWN FORT WORTH’S KEY STRENGTHS IS ACCESSIBILITY.

Interstates: Interstate I-30 and I-35 intersect Downtown. Planning has begun for significant improvements to I-30 through Downtown, from Interstate 280 to Camp Bowie Boulevard.

Rail: TEXRail provides a one-hour transit to DFW International Airport with further connectivity to downtown Dallas. The Trinity Railway Express (TRE) links Downtown Fort Worth to downtown Dallas in under an hour. Amtrack operates from Fort Worth’s Central Station. Each day, 65 trains depart from the Downtown stations.

In 2024, DFWI completed construction of the TIF 8-funded T&P Passage, a new portal to the T&P Station featuring new monumental signage on Lancaster, a new landscaped and illuminated walkway to the building, wayfinding signage, historical displays, and public art.

In early 2025, Trinity Metro announced a $25 million federal grant for extending TEXRail to the Near Southside. More funding is required, but this commitment adds momentum to the effort.

Airlift: DFW International Airport, the world’s third-busiest and the nation’s leader in nonstop destinations, is just 22 miles from Downtown. Trinity Metro's TEXRail service from Downtown to DFW is provided by 34 trains serving two Downtown stations. In addition, Fort Worth Meacham International Airport is five miles from Downtown, and Fort Worth Spinks Airport is 13 miles from Downtown.

Bus: Trinity Metro operates the Molly the Trolley Downtown circulator, the Orange Line to the Stockyards, and 15 bus routes throughout Fort Worth that serve the Downtown transit hub.

Bike: Relaunched in January 2025, the Trinity Metro Bikes program has been improved through a partnership between Trinity Metro and Lyft Urban Solutions. The updated program includes electric bikes and smart charging stations powered by electricity or solar energy. Downtown is home to 14 Trinity Metro Bike stations.

Downtown visitors can take advantage of 2,562 free metered parking spaces available after 6 p.m. Additionally, visitors can benefit from 3,311 free garage parking spaces on weekdays and all day on weekends, thanks to the Downtown Tax Increment Finance District.

Since its launch in 2016, the FW Park mobile payment app in Fort Worth has experienced significant growth, with transactions increasing by 136% and app users by 424% by 2024, reflecting a shift toward mobile payment preferences over cash, coins, and manual use of cards.

Dallas-Fort Worth International Airport

• 22 miles from Downtown

• Direct access to the Terminal B Station via TEXRail

• 87 million passengers in 2023, a 7% increase

• Ranked 2nd busiest in the United States for passenger boardings for 2022

four hours

• Every major city in the continental United States can be accessed within four hours

• 193 domestic and 67 international nonstop destinations worldwide

Every major city in the continental United States can be accessed within four hours

Source: DFW International Airport Traffic Statistics

Meacham International Airport – Texas’s premier general aviation facility since 1925

• Located five miles from Downtown

• Serves private and business flights as well as flight training

• Has a $170 million CIP plan to update its facilities and infrastructure (Sadek, 2023)

Perot Field Fort Worth Alliance Airport is 14 miles north of Downtown. Owned by the City of Fort Worth and managed by Alliance Air Services, it is the second-largest airport facility in North Texas, behind only DFW International Airport. Perot Field features two 11,000-foot runways and offers full general aviation services but is primarily focused on cargo operations.

Highways Serving Downtown:

TEXRail:

• The 25-mile commuter rail connects Downtown Fort Worth to DFW International Airport within one hour.

• Each train has 229 seats and a total capacity of 488.

• Amenities include a designated quiet car, level boarding, bike racks, USB charging ports, seatback trays and tables, and overhead luggage racks.

• TEXRail operates on the same schedule seven days a week.

• A proposed 2.1-mile extension would continue south from the Fort Worth T&P Station to a new Fort Worth Medical District station.

TEXRail: In December, Trinity Metro TEXRail recorded 103,312 rides, marking the highest ridership month in its history. Furthermore, TEXRail experienced a 13% increase in total annual ridership compared to 2023.

TRE: 1,265,690 in total annual ridership for Trinity Railway Express for 2024, a 10% increase from 2023.

TEXRail Monthly Ridership

Railway Express Monthly Ridership

Molly the Trolley

• The Molly route travels from the Fort Worth Convention Center to Sundance Square seven days a week. Service runs from 10 a.m. to 10 p.m. daily in 15-minute headways.

• Molly also serves Trinity Metro's Fort Worth Central Station, which gives passengers access to commuter rail, Amtrak, and inner-city and interstate bus services.

• Rider fares are paid for thanks to subsidies from Visit Fort Worth, Downtown Fort Worth, Inc., and Downtown hotels.

• This Downtown circulator will be rebranded as the “Blue Line” in Summer 2025. The service will run seven days a week, maintaining the same route, with updated hours from 7 a.m. to 7 p.m. at a seven-minute frequency.

Molly the Trolley Annual Ridership

Trinity Metro Bus

Trinity Metro operates 47 regular bus routes with more than 2,000 bus stops. All of their standard buses are powered by compressed natural gas (CNG).

Trinity Metro Bus Monthly Ridership

Source: Federal Transit Administration 400,000 300,000

Resident Transportation Analysis:

This data comes from the 2023 American Community Survey and provides insights into how sampled residents in the following central business districts commute to work. This information is essential for urban planning, transportation policy, and economic analysis.

Means of Transportation to Work: Car, Truck, or Van

Means of Transportation to Work: Public Transportation

Means of Transportation to Work: Carpool

Means of Transportation to Work: Walk or Bicycle

Means

An average of 523,738 vehicles travel daily on the state and federal highways connecting Downtown, reflecting a 5% increase from

Source: Texas Department of Transportation

DEVELOPMENT INCENTIVES

The City of Fort Worth, Tarrant County, and other taxing jurisdictions are committed to thoughtful, high-quality center-city growth. For meritorious development and redevelopment projects consistent with the City’s economic development objectives, there are incentives available. The descriptions below provide a summary, along with QR code linking to additional information.

CITY OF FORT WORTH

City economic development efforts are focused on projects or opportunities that produce a meaningful impact on the City and its economy and result in one or more of the following:

● Growth of business activity, employment, or investment in target industries

● Creation of high-wage jobs

● Significant capital investment

● Growth of CBD business activity, employment, or investment

● Revitalization with a likelihood of ancillary development in designated areas

● Major employer retention or expansion

● Expansion project with potential to generate additional supply chain activity

TAX ABATEMENT PROGRAM

A tax abatement is a full or partial exemption from ad valorem taxes on eligible properties for a period of up to 10 years.

TAX INCREMENT FINANCE DISTRICT #3 AND #8

These TIFs make strategic investments in parking, public infrastructure, historic preservation, and residential development.

CHAPTER 380 ECONOMIC DEVELOPMENT PROGRAM GRANTS

These local grants reimburse private developers for expenses that may contribute to a financing gap making projects financially infeasible. To this end, the City will be sensitive to the tax implications these grants may have for the developer.

TEXAS HISTORIC PRESERVATION TAX CREDIT PROGRAM

State historic tax credits are worth 25% of eligible rehabilitation costs and are available for buildings listed in the National Register of Historic Places, as well as Recorded Texas Historic Landmarks and Texas State Antiquities Landmarks.

TEXAS DEPARTMENT OF HOUSING AND COMMUNITY AFFAIRS

The TDHCA Housing Tax Credit (HTC) Program directs private capital toward the development and preservation of affordable rental housing for low-income households.

DEVELOPMENT INCENTIVES

PID ADVISORY BOARD

Laura Bird Anthracite Realty Partners (Chair)

Johnny Campbell City Center Fort Worth

Gary Cumbie

The Cumbie Consultancy

Drew Hayden

The Worthington Renaissance Fort Worth Hotel

Michael Hiltabidel Omni Fort Worth Hotel

Marie Holliday, DMD Flowers to Go

Stacy Hollingsworth Burnett Plaza

Ashlee Johnson

Ron Investments, Ltd.

Whit Kelly 777 Main

Ed Kraus

Sundance Square

Walter Littlejohn The Fort Worth Club

Michelle Lynn Building Owners & Managers Association

Renee Massey Red Oak Realty

Don Perfect Oncor Electric Delivery

Mark Pierce

Courtyard by Marriott Fort Worth Downtown/Blackstone

Amber Reynolds Finley Resources, Inc.

Carissa Taylor AC Hotel Marriott

Carlos De La Torre Fort Worth Downtown Neighborhood Alliance

Courtney Towson Sheraton Fort Worth Downtown Hotel

Credits

Downtown Fort Worth, Inc., is grateful to the following organizations and individuals for their assistance in producing the State of Downtown publication:

City of Fort Worth

Mary Margaret Davis Real Estate Broker

Phil Dupler Director of Planning

Trinity Metro

Peter Elliot Parking Manager

Fort Worth Transportation and Public Works

Downtown Fort Worth, Inc.

Publications

• Annual Report

• In View

• Residential Survey Report

• State of Downtown

Information Sources

City of Fort Worth CoStar

Downtown Fort Worth, Inc.

ESRI

Federal Transit Administration

Greater Fort Worth Association of Realtors

National Association of Realtors

North Texas Real Estate Information Systems, Inc.

Placer.ai

Southern Land Company

Tarrant County

Tarrant County

Appraisal District

Tarrant County College

Texas A&M Real Estate Research Center

Texas A&M School of Law

Texas Alcoholic Beverage Commission

Texas Comptroller of Public Accounts

Dr. Sean Maddison Tarrant County College

Nina Petty Texas A&M University School of Law

Paige Witherspoon Visit Fort Worth

Texas Department of Transportation

Texas Education Agency

Texas Workforce Commission

Trinity Metro

U.S. Bureau of Labor Statistics

U.S. Census Bureau

University of Texas at Arlington

Visit Fort Worth Young Women’s Leadership Academy

Downtown Fort Worth, Inc. Staff

Andy Taft President Matt Beard Director of Public Improvements

Cleshia Butler Administrative Assistant

Jay Downie

Event Producer

Brandi Ervin Controller

Becky Fetty Director of Membership and Marketing

Michael Wollman

The University of Texas at Arlington, Fort Worth Center

Special thanks to

Rachel Delira, Joseph Haubert, Darah Hubbard, Brian Luenser, and DFWI partners for their photography and renderings.

Kennedy Gardner

Event Production Manager

Melissa Konur Director of Planning

KayLee Pratt Marketing and Special Projects Manager

Shane Smith Director of Research

Barbara Sprabary Executive Assistant and Office Manager

A service of Downtown Fort Worth, Inc.