DOWNTOWN BROOKLYN Q1 2023 MARKET REPORT

Updated quarterly, this report provides insight on Downtown Brooklyn market data, development progress, commercial leasing activity, and recovery trends for Downtown Brooklyn Partnership’s (DBP) member firms.

DOWNTOWN BROOKLYN Q1 2023 MARKET REPORT

Updated quarterly, this report provides insight on Downtown Brooklyn market data, development progress, commercial leasing activity, and recovery trends for Downtown Brooklyn Partnership’s (DBP) member firms.

COMPLETED PROJECTS (SINCE 2004)

22,005 housing units

2.77M

UNDER CONSTRUCTION

hotel

rooms

5,803 housing units 70K

PIPELINE PROJECTS

sq. ft.

103 hotel rooms

405K 71 hotel rooms

sq. ft.

For more detail information, please see the full Q1 2023 Development Matrix summary and map at: https://www.downtownbrooklyn.com/about/publications/downtown-brooklyn-development-matrix

One Pierrepont Plaza, Brookfield Properties’ 19-story, 775,000 sq. ft. office building signed a lease with the Metropolitan Transportation Authority (MTA) for 192,000 sq. ft. The MTA is moving from office space at 180 Livingston Street in Downtown Brooklyn and at 333 West 34th Street in Manhattan. Expected occupancy is late 2023.

Community High School, a charter school that operates in the Community Partnership Charter School network, signed a 35,000 sq. ft. lease at 250 Jay Street. The building was previously occupied by New York City College of Technology (City Tech).

Nevins Associates has renewed its lease with the New York City Police Department’s Special Victims Division for the entire 42,179 sq. ft. building at 45 Nevins Street. The NYPD has occupied the building for more than 20 years.

The overall office vacancy rate in Downtown Brooklyn held steady year-over-year at 20.1%. Overall vacancy rates in Downtown Brooklyn remain below all three Manhattan submarkets which saw overall vacancy rates increase. This is the second consecutive quarter with Manhattan’s office submarket having overall vacancies above 22%. Vacancies are expected to rise as 141 Willoughby Street hits the market this spring.

Downtown Brooklyn saw overall office rents increase 5.6% year-over-year to $56.71 per sq. ft. This is the third consecutive quarter where overall rents are higher in Downtown Brooklyn than in Lower Manhattan. The increase in rents was partially due to larger spaces at 15

177 Livingston Street, an 86,000 sq. ft. office building, recently signed a 15,170 sq. ft. lease with HeartShare Human Services of New York, an organization focused on people with intellectual and development disabilities.

16 Court Street, CIM Group’s 36-story, 317,600 sq. ft. office building, signed four leases in the first quarter, totaling nearly 24,000 sq. ft. Sasaki Associates, an architecture, landscape and design firm, will occupy 9,500 sq. ft. Sasaki acquired Brooklyn-based firm, DLANDstudio in May 2022, which was originally based at 44 Court Street. Pineapple Street Studios, a podcast production company, will relocate from Midtown South and occupy 5,535 sq. ft. New Deal Strategies, a political consulting firm, has taken 4,200 sq. ft., moving from 137 Montague Street. Lastly, personal injury law firm Freidman Sanchez, LLP has extended its 4,400 sq. ft. lease.

Metrotech, 26 Court Street and 195 Montague Street become available with asking rents starting in the $50s per sq. ft.

Between available space and comparable asking rents, competition with the Lower Manhattan office market is stiff. Lower Manhattan has as much direct office space being marketed for lease as the entire inventory of Downtown Brooklyn - 13.4 million sq. ft. Lower Manhattan also has a larger quantity of older office product and a significant number of sublet spaces, pushing overall office rents lower than Downtown Brooklyn.

Downtown Brooklyn saw several new retail leasing announcements during the first quarter of 2023. Highlights include:

• Filthy Flats, a fast-casual restaurant specializing in open-faced sandwiches, opened at 32 Court Street. Just Salad will be coming soon to 58 Court Street

• Mochii, a dessert shop serving Japanese mochi ice cream, has opened in DeKalb Market Hall at City Point. On the horizon, Osteria Brooklyn and Punto Cubano, will open soon at DeKalb Market Hall.

• Jack’s Stir Brew will debut at 11 Hoyt, following up on Taim Mediterranean Kitchen that opened next door late last year.

• Along Fulton Mall, construction is underway for Raising Canes at 445 Fulton Street and Smashburger at 523 Fulton Street.

• Additional food and beverage establishments that have signed leases include: Daves Hot Chicken at 345 Adams Street, Mighty Quinn’s BBQ at 1 Boerum Place, Imani Grill at 21 Flatbush Avenue, DIG at 1 City Point and Quality Greens at 57 Willoughby Street.

• The Black Home, a Black-owned home décor boutique, has opened in the Prince Street passage at City Point, while veterinarian clinic GoodVets and One Medical will open in the coming months.

• Salons by JC, a luxury salon suite company, will open soon on the entire 2nd floor at 1 Boerum Place.

• PingPod, an automated 24/7 indoor table tennis space, opened at 620 Fulton Street in February. The Roller Wave, a Black-owned roller-skating rink opened as a pop-up at Atlantic Center in a former Office Max. Other indoor recreation uses coming soon include: Golfzon, an indoor virtual golf and lounge at 11 Hoyt Street, and Court16, a tennis and pickleball club, at City Point.

• Ambition Fitness opened at 57 Court Street. Other boutique fitness facilities coming soon to Downtown Brooklyn include: Barry’s Bootcamp at 200 Montague Street and [solidcore] at 11 Hoyt Street. Additionally, Chelsea Piers Fitness will open this summer at 595 Dean Street, followed by Life Time opening in 2024 at 18 Sixth Avenue and at 9 DeKalb Avenue.

The average residential rent in Downtown Brooklyn was $4,444 in March 2023 – a 6% increase year-over-year. Average rental prices in Downtown Brooklyn were up across all unit sizes. Rent for two-bedroom apartments rose most dramatically over the past year at over 9% as remote work trends have created a higher demand for more space.

Overall, average rental pricing across Brooklyn increased 13% year over year. Average rents were up double digits across areas surrounding Downtown Brooklyn. Boerum Hill, Brooklyn Heights, Cobble Hill and Fort Greene and saw rent increases year-over-year by 22%, 18%, 11% and 10%, respectively. Dumbo also saw average rents increase by 6%, on par with Downtown Brooklyn.

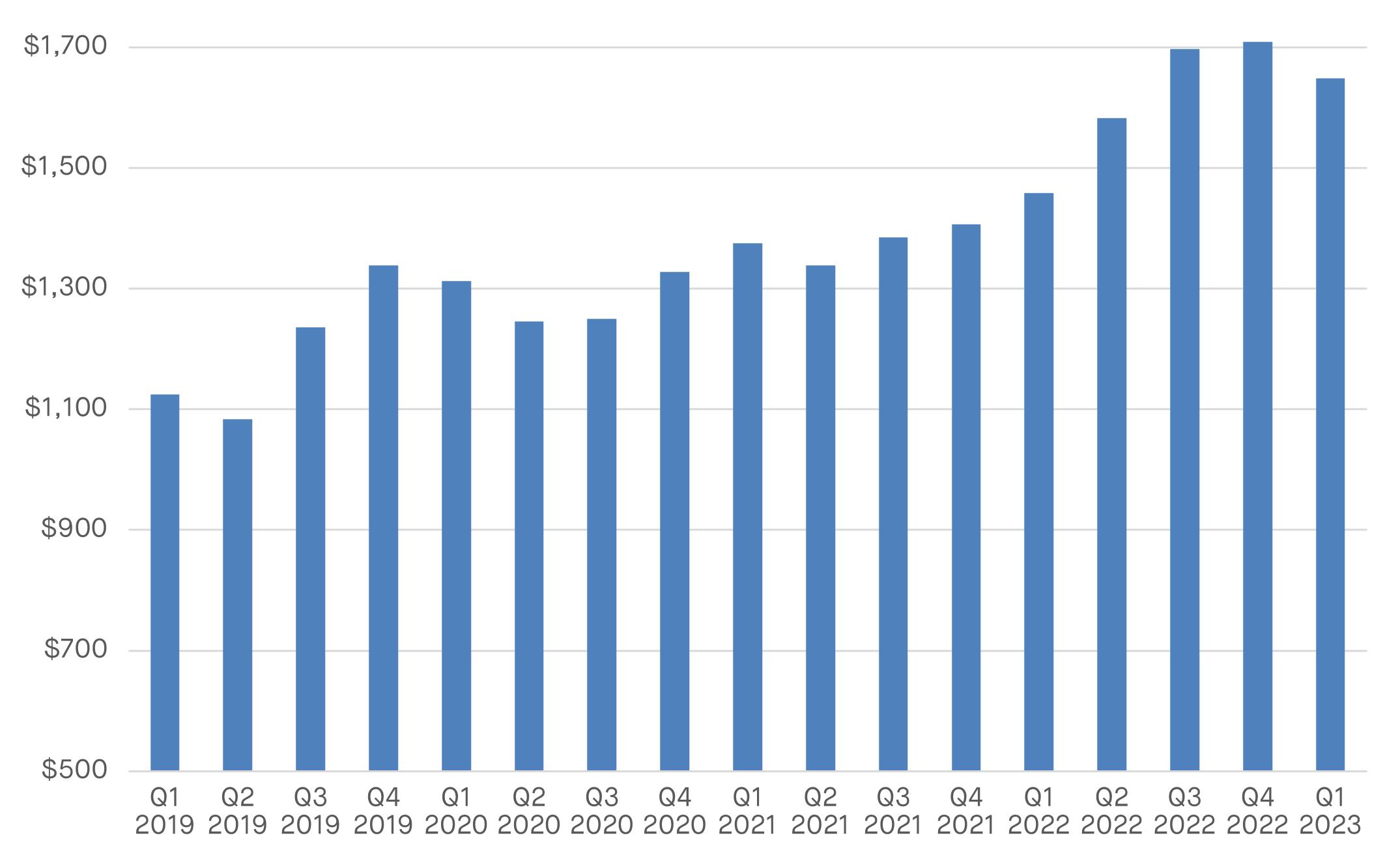

The median condo sales price in Downtown Brooklyn was $1.95 million in Q1 2023, a 28.8% increase from the previous quarter and a 15.3% increase year-over-year. The median price per square foot hit $1,648, up 13% year-over-year. One and three-bedrooms comprised the bulk of all sales in Downtown Brooklyn, at 42% and 33% respectively.

Over the past quarter, the median price paid for sponsor units across all of Brooklyn decreased by 19.7% from $1.3 million to $1 million. Downtown Brooklyn accounted for the highest share of three-bedroom sales by any neighborhood in Brooklyn, making up 24% of all threebedroom units sold throughout the Borough. Overall, Downtown Brooklyn sponsor sales volume reach 24 units in the first quarter, making up 10.8% of all sponsor unit sales borough-wide, trailing behind just Crown Heights (12.2%) and Williamsburg (11.3%).

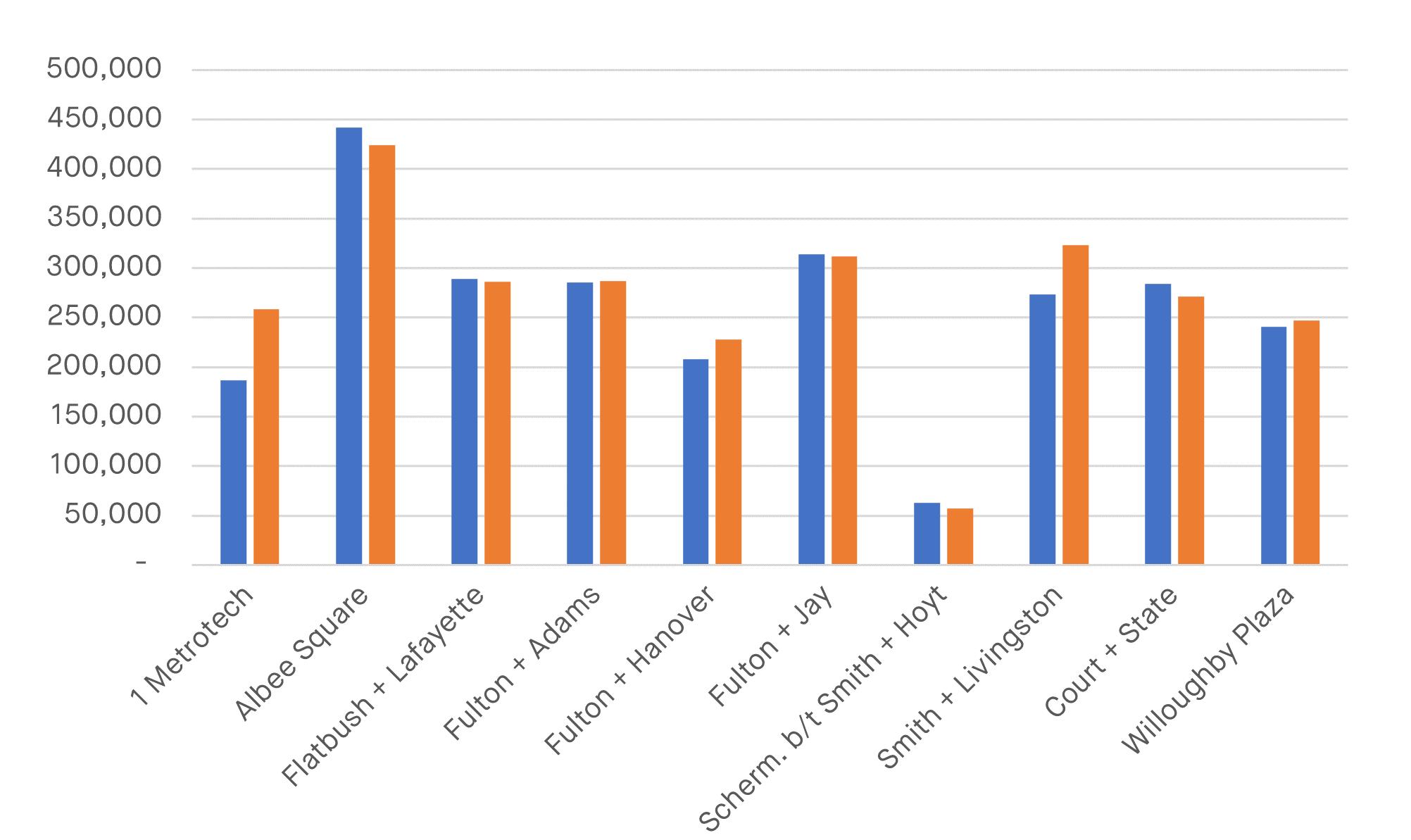

Across Downtown Brooklyn, monthly pedestrian activity in March 2023 exceeded March 2022 levels by 4%, averaging 3,500 more pedestrians a day than this time last year. Monthly foot traffic this past March recovered 65% of pre-pandemic levels from March 2019, which remains consistent with trends over the past year.

• The most noticeable spike in pedestrian activity occurred at MetroTech, where our sensor on Jay Street at the entrance of Brooklyn Commons showed a 38% increase in pedestrian activity year-over-year.

• Of all locations, Smith + Livingston has seen the greatest recovery from pre-pandemic activity. Smith + Livingston saw an 18% increase in pedestrian activity year-over-year and has recovered 88% of pre-pandemic foot traffic.

Weekdays remain the busiest days in Downtown Brooklyn, with 41% more pedestrians on any given weekday compared to Saturday or Sunday. Across the district, overall weekday foot traffic in March 2023 was up over 8% year-over-year from March 2022. Conversely, weekend foot traffic in March 2023 was down 10% yearover-year from March 2022. Surprisingly, Wednesdays were the busiest day of the week during March 2023, surpassing Fridays which were the busiest days of the week in March 2021 and March 2022. For comparison, in March 2019, Thursdays were the busiest days.

Monthly ridership has recovered 86% of its ridership from pre-pandemic levels seen in March 2019. Subway rides that ended in Downtown Brooklyn during March 2023 have increased by nearly 15% year-over-year. On average, there are 11,600 more subway riders exiting stations in Downtown Brooklyn on a daily basis compared to March 2022.

While every subway station in Downtown Brooklyn saw notable monthly ridership increases since 2022, only the DeKalb Av station, which services the B, Q, and R lines, has fully recovered and exceeded pre-pandemic levels. In March 2023, the station exceeded pre-pandemic levels by 19%, which equates to about 1,500 more average daily riders than compared to March 2019.

Downtown Brooklyn Monthly Subway Ridership by Station, March 2019-2022

Over 76,000 Citi Bike rides either began or ended at one of Downtown Brooklyn’s 21 Citi Bike stations in March 2023, representing over 9,500 additional rides and a 14.4% increase compared to March 2022.

The increase in cycling ridership correlates to the positive momentum in citywide bicycle transportation. Over the past year, Citi Bike has been adding capacity at existing stations across the city, as well as expanding deeper into the boroughs. Additionally, DOT’s redesign of Schermerhorn Street, including a two-way dedicated bicycle lane, has proven successful and led to a large boost in ridership. This helped lead to the greatest year-over-year increase in activity at the Nevins St & Schermerhorn St Citi Bike docking station, which saw a 78% increase in usage.

The top five Citi Bike stations in Downtown Brooklyn during March 2023 are 1) Hanson Pl & Ashland Pl (7,742 rides), 2) Fulton St & Adams St/Columbus Park (6,388 rides), 3) Court St & State St (5,558 rides), 4) Schermerhorn St & Hoyt St (5,075), 5) Lawrence St & Willoughby St (4,743).

As of Q1 2023, Downtown Brooklyn development includes:

• 141 projects completed since the 2004 rezoning, including over 22,000 residential units (including over 4,500 affordable units).

• 20 projects under construction with over 5,800 units (including 1,500 affordable units).

• 18 projects in the pipeline, including nearly 1,700 residential units (with over 500 affordable rental units).

22,005

5,803

1,679

• Brooklyn Tower at 9 Dekalb Avenue: JDS Development has received a temporary certificate of occupancy for the 93-story, mixed-use tower, standing as the tallest structure in the outer boroughs. The building includes 150 market rate condos, 280 market rate rentals, and 120 affordable rentals. Rental tenants have begun to move in, while condo closings are expected to begin this fall. The Brooklyn Tower is integrated into the landmarked Dime Saving Bank, which will bring 150,000 sq. ft. of retail space, including Life Time Fitness. Full building completion is anticipated in late 2023.

• The Alloy Block: Phase one of Alloy Development’s tower topped out in January 2023. The 44-story building will include 440 rental units, including 45 units of affordable housing. Phase one at 100 Flatbush Avenue, including the two schools, is expected to be completed in summer 2024. Phase two at 80 Flatbush Avenue will include a second, larger tower and will include residential, office space and a cultural center

• 240 Willoughby Street: Adjacent to The Brooklyn Hospital Center campus, Rabsky Group’s 30-story, 300-unit building at 240 Willoughby Street is quickly rising. The tower, fronting Fort Greene Park,

• • 595 Dean Street at Pacific Park: TF Cornerstone’s two-building, mixed-use development was recently completed and leasing has commenced. The development includes a 28-story east tower and a 23-story west tower, yielding a combined 798 rental units, of which 240 units are affordable. The building also includes a 60,000 sq. ft. Chelsea Piers Fitness Center and Field House, two acres of public park space, and a 455-vehicle parking garage.

will include 147 affordable units. Rabsky is also renovating the existing 21-story, 189-rental-unit tower at the site.

• 625 Fulton Street: The structure of Rabsky Group’s 35-story residential building is ascending rapidly. The building will have 1,098 rental units, with 329 affordable units, 26,000 sq. ft. of retail space, and a 250-car parking garage. The building is anticipated to be completed in 2025.

• 15 Hanover Place: Lonicera Partners’ 34-story tower is quickly taking shape on the corner of Hanover + Livingston. The project will include 314 rental units, 95 of which are affordable. Completion is estimated in late 2024.

• 285 Schermerhorn Street: Construction continues at the redevelopment of the Brooklyn Community Services headquarters. Second Development Services is planning a renovation of the 7-story building for the nonprofit and an addition of 7 new floors that will have 129 condo units. Completion is set for 2024.

• 111 Willoughby Street: Foundation work continues at Triangle Equities/The Michaels Organization’s 40-story residential tower. The project will bring 227 rental units, 69 of which will be affordable. There will also be a 20,000 sq. ft. ministry center for the neighboring Oratory Church of St. Boniface. The site

• 55 Willoughby Street: Foundation work for Lonicera Partners’ 42-story, 293-rental unit residential tower is underway. The tower will include nearly 107,000 sq. ft. of air rights transferred from 57 Willoughby Street.

• 9 Chapel Street: Tankhouse Development is nearly topped-out on a 12-story building that will include 27 market-rate condo units. Completion is estimated in late 2024.

• 131 Concord Street: Chess Builders has begun construction on a 13-story, 73-unit building. Completion is anticipated for late 2024.

• 356 Fulton Street: The site is being prepped for excavation at 356 Fulton Street. Extell is planning for a 43-story tower with 421 residential units and 100,000 sq. ft. of commercial space.

• 91 DeKalb Avenue: RXR recently completed demolition of the former parking garage and has begun excavation. Construction is slated to begin this summer on a 29-story, 320-unit tower (96 units will be affordable). Approximately 55,000 sq. ft. at the base will be used by Long Island University.

also included 16,000 sq. ft. of air rights transferred from 115 Willoughby Street. The development is slated for completion in Spring 2025.

• 180 Ashland Place/98 DeKalb: Rockrose continues foundation work on its 49-story residential tower. Located across from The Brooklyn Hospital Center, the tower will yield 569 rental units, 171 of which will be affordable. Completion is expected in 2025.

• The Brook at 565 Fulton Street: Witkoff and Apollo continue foundation work for The Brook at 565 Fulton Street. The 51-story tower at Fulton and Flatbush will have 591 rental units, including 178 affordable units. The project also includes 25,000 sq. ft. of retail space at the base of the tower and a jewel-box site next to Albee Square.

• 27 Rockwell Place: Brookstone Developers has begun construction on an 18-story building with 147 units.

• 101 Fleet Place: The Jay Group began environmental cleanup at the brownfield site in February 2023. Remediation is expected to last seven months. A 21-story, mixed-used tower is planned at the site and will have 292 units and 205,000 sq. ft. of commercial space.

• 362-370 Livingston Street: Developing NY State has begun demolition work on the existing 8-story building to make way for a proposed 22-story, 268-unit residential development. The building will include 7,162 sq. ft. of retail space.

• 180 Remsen Street: In March 2023, St. Francis College (SFC) sold its former campus at 180 Remsen Street to Rockrose Development for $160 million. The five-building site allows for 500,000 sq. ft. of as-of-right buildable space. SFC operated out of the Remsen Street campus from 1960 through 2022, before moving to a new 255,000 sq. ft. campus at Tishman Speyer’s The Wheeler, located at 179 Livingston Street.

• 88 Schermerhorn Street: Jankos Group recently announced plans to build a 20-story, 58 rental unit tower. The building will also include 14 affordable units.

• 91 Court Street: Michael Calabrese announced plans for a nine-story building with 29 units. The new building will replace two four-story buildings.

• 570 Fulton Street: The proposed 45-story rental project was recently sold for $24 million by Davis Companies to Yitzchok Katz. The original design was to include 87,000 sq. ft. of commercial space at the base and 139 rental units in the tower level. Updated plans are still forthcoming.