Froth Recovery Upgrade Improve metallurgical performance with advanced froth phase control

The Froth Recovery Upgrade package enables you to better control the froth phase. The addition of the radial froth crowders adds a new dimension to the control strategy, enabling you to shift the grade recovery curve by allowing either deeper froth or faster froth removal.

Read more at flsmidth.com

Features and Benefits

■ Improved recovery

■ Higher grade

■ Enhanced flexibility

■ Reduced use of reagents

■ Better control of froth level

■ Better control of surface stability

Real liberation is measured in 3D.

ZEISS Mineralogic 3D

Unlike traditional 2D measurement techniques, Mineralogic 3D uses a 3D-quantitative-CT scan to measure the surface and interior of every particle S o you can discover the real liberation of your valuable minerals.

28 Finding common ground

Agreements with Indigenous communities in Canada are evolving into sophisticated partnerships

By Dinah Zeldin35 Flotation’s new frontier

New flotation technologies work to bring savings on costs and energy with greater recoveries

By Tijana Mitrovic

By Tijana Mitrovic

72 Market watch

As part of our celebration of 125 years of CIM, we have pulled pages from a 1927 edition of the CIM Bulletin for a temperature-taking of the metal markets at the time

in each issue

8 Editor’s letter

9 President’s notes tools of the trade

10 The best in new technology

Compiled by Ashley

Fish-Robertsondevelopments

11 Mining's tech boom

By Matthew Parizot14 Gold and copper likely to win big in 2023

By Ashley Fish-Robertson17 Canada’s plan for critical minerals

By Ashley Fish-Robertson

column

19 The integrated approach of Towards Sustainable Mining enhances community confidence in the way companies mine

By David Clarry and Charles Dumaresqmodern miner

20 Metallurgist Brenna J.Y. Scholey combines knowledge of mining law, arbitration and consulting with technical expertise

By Sarah St-Pierrelithium

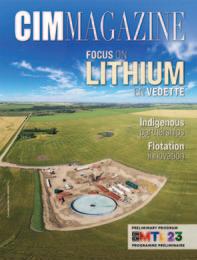

22 Canada is primed to become a supplier of lithium to help fill the looming gap for the energy transition

By Alexandra Lopez-Pacheco24 E3 Lithium CEO Chris Doornbos said the company plans to break new ground in Alberta with its ion-exchange technology

By

Tijana Mitrovic26

17

contenu francophone

64 Table des matières

64 Lettre de l’éditeur

65 Mot de la présidente

profil de projet

66 Kiena creuse plus profond Wesdome Gold Mines ouvre un nouvel avenir à un producteur d’or québécois historique

Par Carolyn Gruske

project profile

32 Wesdome Gold Mines sets up historic Quebec gold producer for a new future

By Carolyn Gruske

By Carolyn Gruske

CIM news

62 The Alex & Gillian Davidson Family Endowment will sustain in perpetuity two important CIM Foundation education grants

By

Michele BeacomLithium demand sees companies looking at recovering low grades of the critical mineral from clay

By Sarah Treleaven62 Mining, materials and earth sciences students gathered at CIM Vancouver Branch’s premier networking event look forward to an exciting future

By Michele Beacomlithium

69 L’exploration du lithium s’intensifie

Le Canada est en bonne voie de devenir un fournisseur de lithium qui aidera à combler la pénurie prévisible de ce minéral dans le contexte de la transition énergétique

Par Alexandra Lopez-Pacheco

2023

CLIMATE CHANGE AND SUSTAINABILITY

Advanced Manufacturing | Integration for Better Outcomes | Light Metal in Transportation | Pressure Hydrometallurgy | Mineral Processing

Fundamentals | Sustainability in Pyrometallurgy com.metsoc.org

Milestones

This year, which has arrived as though shot from a cannon, will be, is, a big one for the publication and the institute. It marks CIM’s 125th anniversary. For the magazine, we will take advantage of the milestone to dig into CIM’s vast archives for colour and commentary on the industry and its achievements, and for buried treasures and curiosities.

Given that this issue will be at the PDAC convention in early March, where the industry gathers to get a reading on the market and the prospects for metals, we went back to the 1920s for a commodity review from another era. Nickel, it turns out, was the star performer.

As we uncover items from our archives, we want to invite you to do the same. We would love to hear from you about milestones and memories from your own careers.

Over the year we will have a few other new features. In this issue we are launching “Modern Miner,” in which we interview professionals who are under-represented in the industry. Rather than repeat the figures that expose mining’s difficulty in creating a diverse workforce and the long-term risk that follows, the aim of this series of articles is simply to give a profile to leaders and experts who – and this becomes abundantly clear when we leaf through our century-plus of published works – do not look like the typical “miner.”

Beyond the pages of the magazine, we will be partnering with industry experts to create online content including panel discussions and presentations. The first of which, made in collaboration with CIM’s Health and Safety Society, is “The Safety Share” webinar. You will find it on the CIM Magazine website and on CIM Academy. We will host more of such safety-focused webinars throughout the year, along with others devoted to topics critical to the industry. Follow CIM Magazine on LinkedIn to get the latest details.

Editor-in-chief Ryan Bergen, rbergen@cim.org

Finally, we begin 2023 with a change in personnel at the publication. We have added Ailbhe Goodbody as Senior Editor at the magazine. Keen-eyed consumers of mining periodicals may recognize her name from her time at the U.K.-based Mining Magazine. Ailbhe, now a Quebec resident, will be working the mining beat on our behalf. I am excited to have her talent and expertise helping inform our coverage of the industry.

We are also saying farewell to our Section Editor Matthew Parizot, who is taking his career in an exciting new direction. Matt began as an intern and, through his enviable knack for blazing speed and accuracy, established himself as a news writing force. In his four years at the magazine, he grew into a trusted colleague with excellent instincts and vision, and an editor with an appetite for ambitious projects; I welcome readers to point me to a more comprehensive public database of tailings facilities in this country than the one he compiled in “A counting of tailings in Canada,” which is available on the CIM Magazine website.

Finally, in this issue you will find a preview of CIM’s upcoming Convention + Expo, which returns to Montreal for the first time since 2019. It promises to be a great event with an excellent lineup of speakers and a big and buzzing tradeshow. So come celebrate 125 years of CIM with us!

Ryan Bergen, Editor-in-chief editor@cim.org @Ryan_CIM_Mag

Managing editor Michele Beacom, mbeacom@cim.org

Senior editor Ailbhe Goodbody, agoodbody@cim.org

Section editors Carolyn Gruske, cgruske@cim.org; Matthew Parizot, mparizot@cim.org

Editorial intern Ashley Fish-Robertson, afrobertson@cim.org

Contributors David Clarry, Charles Dumaresq, Alexandra LopezPacheco, Tijana Mitrovic, Sarah St-Pierre, Sarah Treleaven, Dinah Zeldin

Editorial advisory board Mohammad Babaei Khorzhoughi, Vic Pakalnis, Steve Rusk, Nathan Stubina

Translations Karen Rolland, karen.g.rolland@gmail.com

Layout and design Clò Communications Inc., communications.clo@gmail.com

Published 8 times a year by: Canadian Institute of Mining, Metallurgy and Petroleum 1040 – 3500 de Maisonneuve Blvd. West Westmount, QC H3Z 3C1 Tel.: 514.939.2710; Fax: 514.939.2714 www.cim.org; magazine@cim.org

2020 2021 2022

Advertising sales Dovetail Communications Inc. Tel.: 905.886.6640; Fax: 905.886.6615; www.dvtail.com

Senior Account Executives

Leesa Nacht, lnacht@dvtail.com, 905.707.3521

Dinah Quattrin, dquattrin@dvtail.com, 905.707.3508

Christopher Forbes, cforbes@dvtail.com, 905.707.3516

Subscriptions

Online version included in CIM Membership ($197/yr). Print version for institutions or agencies – Canada: $275/yr (AB, BC, MB, NT, NU, SK, YT add 5% GST; ON add 13% HST; QC add 5% GST + 9.975% PST; NB, NL, NS, PE add 15% HST). Print version for institutions or agencies – USA/International: US$325/yr. Online access to single copy: $50.

Copyright©2023. All rights reserved.

ISSN 1718-4177. Publications Mail No. 09786. Postage paid at CPA Saint-Laurent, QC.

Dépôt légal: Bibliothèque nationale du Québec. The Institute, as a body, is not responsible for statements made or opinions advanced either in articles or in any discussion appearing in its publications

An Institute for the Ages

In March 1896, CIM was founded in Montreal at the second annual meeting of the Federated Canadian Mining Institute and it was quickly thereafter incorporated by an Act of the Parliament of Canada in 1898.

125 years ago, the founding members likely didn’t envision the Canadian landscape currently experienced by the minerals and metals industry. They didn’t imagine surveying by drone technology, moving muck via autonomous scoop trams or webinar participants sharing knowledge simultaneously to global audiences. Heck, I didn’t envision any of this when I started my career in the 1980s. And I’m almost certain they didn’t imagine a future with women in mining as welders, mine managers and investment bankers. It has, however, been documented that the founding members came together seeking a vehicle for lobbying for safety laws and workers’ protection, as well as a method of ensuring the communication of ideas.

125 years later, these founding tenets are as relevant as ever. Promoting healthy, safe, sustainable and productive practices, fostering diversity and inclusion, improving mineral literacy, pre-

paring the next generation of leaders, volunteering within the communities where we operate, and celebrating the achievements of our industry and its members are the focuses of CIM’s many societies, branches and committees across Canada and internationally.

With the recent escalation of geopolitical instability and risk and re-nationalization of items of strategic importance, Canada is increasingly a favoured jurisdiction in the world for the exploration, extraction, refinement and recycling of the minerals and metals needed to address the global challenges that society is facing including having adequate food, clean water and transitioning the world’s energy requirements. By consistently demonstrating our commitment to environmental, social and governance values, partnering with Indigenous and local communities for sustainable prosperity and seeking collaborative alliances with those beyond traditional mining boundaries, we can continue to improve safety, productivity and environmental performance for generations to come.

Just like CIM’s founding members, we will not correctly imagine what the minerals and metals industry in Canada will look like a century from now. I am however confident that our industry will resiliently evolve for the better by being curious, inviting and continuing to collaborate. Together as an institute, we can accomplish so much more than we can achieve individually.

As we prepare to celebrate CIM’s 125th anniversary in Montreal from April 30 to May 3 at the CIM Convention and Expo, it’s the perfect time to pause, reflect and then boldly step forward to shape the role Canada’s national institute of mining will play in the exploration, extraction, refinement and recycling of the minerals and metals needed by the world.

Happy 125th anniversary, CIM!

Anne Marie Toutant CIM President

High-tolerance analysis

Agilent ’s new ICP (Inductively Coupled Plasma) mass spectrometer serves mining industry users with reliable metal and mineral sample data collection. The spectrometer offers top matrix tolerance by utilizing ultra-high matrix introduction technology that analyzes samples with 25 per cent total dissolved solids. According to Agilent, the 7900 ICP-MS swiftly processes transient signals used during the analysis process of single nanoparticles, single cells and laser ablation. Additional accessories can easily connect to the spectrometer to offer users advanced features.

Elite crushing

Scott Automation recently released the new Rocklabs BOYD Elite, a crusher that utilizes double-acting jaws that, according to the company, can compress mineral samples by 35 times the original size in less time, carry up to five kilograms of sample and easily adjust its jaw gap while also effectively removing dust particles. The tool also features durable plates manufactured from high chrome iron. A version with a rotating sample divider is also available, which can aid in providing users with a hassle-free sample splitting process.

Reliable mixing

FLSmidth’s latest release, the Essa FMX150 Flux Mixer, seeks to provide users with consistent mixing during the fire assay analysis process. The FMX150 can mix up to 50 samples at a time and efficiently analyze various sample container sizes, while limiting dust contamination during the assay process. FLSmidth’s multipour systems and additional assaying tools can be easily linked to the FMX150 mixer and, according to the company, the FMX150 can withstand the wear and tear of high usage over a long term period.

Compiled by Ashley Fish-Robertson

Developments

Mining’s tech boom

Financing for clean mining technologies is higher and more available than ever

By Matthew ParizotOn Dec. 7, 2022, MineSense Technologies announced that it had closed a US$42 million Series E financing round led by J.P. Morgan Asset Management’s Sustainable Growth Equity Team and Evok Innovations, a clean-tech-focused venture fund, which it said will be used to accelerate the commercial deployment of its ore data visibility technology.

At the time of the announcement, MineSense declared that its revenues had tripled over the past year, and it was recognized as one of the fastest growing companies in North America by Deloitte. It is not alone, however, as the mining and metals sector has seen its largest bump in private technology investment in quite a while.

Last year contained a steady wave of mining and metals technology startups raising large amounts of cash, sometimes with huge names attached. February saw Bill Gates-backed KoBold Metals and its AI exploration technology raise US$192.5 million from investors such as mining giant BHP. Jetti Resources and its copper extraction technology raised US$100 million in October before BMW purchased an undisclosed stake in the company in December. In November, battery recycler Redwood Materials agreed to supply nickel-cathode to Panasonic Energy in a deal that, according to Redwood, is worth billions.

And that is not an exhaustive list. According to data compiled by Cleantech Group, mining and metals technology companies in 2021 saw US$113.7 billion in financing from 2,869 deals. The year after saw US$81.9 billion in investment from 2,341 deals, almost double the amount of investment from just five years prior.

These deals did not appear out of nowhere. Most countries with net-zero targets signed them into law between 2018 and 2020. Countries such as the

United States and Canada have made the development of critical minerals needed for clean energy transition a major priority moving forward. According to Holly Stower, lead associate for resources and environment at Cleantech Group, the high figures in 2021 saw those net-zero commitments “come to fruition,” with several aspects of the mining industry ripe for clean tech disruption.

“Battery metals are a key theme with clear downstream demand and heavy investment. EV battery producers and EV producers in general are trying to secure the battery metal supply chain. Lithium producers and refiners are also seeing lots of activity. Companies that are able to produce lithium from more challenging sources (e.g. brines) as well,” Stower said. “Electrification of heavy-industry vehicles is the ‘low hanging fruit’ of mining operations decarbonization. On the upstream side of things, investment in subsurface imaging and mineral detection [is growing],

making mineral exploration more databased and informed.”

With all this opportunity to invest, funds are starting to take notice. J.P. Morgan’s Sustainable Growth Equity Team was announced at the beginning of 2022 with US$150 million to invest in “resource efficiency and climate adaptation solutions.” Venture capital firm BDC announced its $400 million Climate Tech Fund II in November, the follow up to its $600 million Climate Tech Fund I from 2018.

Mining companies themselves are getting in on the action as well. In addition to BHP Ventures, the miner’s venture capital arm launched in 2020, Vale announced in June 2022 its US$100 million venture capital unit, aptly named Vale Ventures.

While it seems that the money hose has been turned on for these clean tech companies, it likely will not last forever. According to a report published by PwC, a decline in investment following a mas-

sive spike across all clean technologies is expected given the often-cyclical nature of corporate deal-making. However, according to the International Energy Agency, demand for five key critical minerals (lithium, cobalt, nickel, copper and neodymium) could increase by 1.5 to seven times by 2030 should countries look to stick to their net-zero 2050 goals, meaning there will likely still be opportunity for technologies that can help produce those materials sustainably.

Rio Tinto completes renewable diesel trial

Rio Tinto has successfully completed a renewable diesel trial at its open-pit borax mine in Boron, California.

The objective was to determine the suitability of renewable diesel for haulage at open-pit operations. This is part of Rio Tinto’s plans to move away from using conventional diesel in haul trucks at its U.S. operations and replacing it with renewable fuel, with the aim of reducing the carbon footprint of its fleet.

The trial was conducted in partnership with Neste and Rolls-Royce in 2022. The trial used Neste MY Renewable Diesel in the haul trucks, which is a hydrotreated vegetable oil (HVO) made from renewable raw materials, for example, used cooking oil or animal fat from food industry waste. Rolls-Royce provided new fuel-system components for the test, along with technical support to inspect the parts after the test was complete.

According to Stower, sustainable minerals production will be key for the world to achieve its goal of decarbonization.

“Overall, the technologies that we will need to decarbonize require massive amounts of minerals. An EV, for example, requires significantly more mineral/metals components than an internal combustion engine vehicle. So, we have a massive demand for critical minerals, battery minerals, but we are

using mining techniques and equipment that were developed 150 years ago,” Stower said. “Aside from that, critical mineral resources are harder to find and general ore quality is lower. Investing in mining sustainability and optimization is not just a question of cleaning up the EV battery value chain, the bigger picture is finding a sustainable way to provide the critical minerals that are essential to global decarbonization.” CIM

A second trial, which is taking place in collaboration with Cummins at Rio Tinto’s Kennecott copper operations in Utah, was launched in October 2022 with a planned duration of seven months. This trial is testing renewable diesel in a different operational environment to the first trial and on different mining equipment; it will look at the acceleration, speed, cycle times, fuel usage and engine inspection reports of two trucks running on renewable diesel, then compare the results to two trucks running on conventional diesel.

According to Rio Tinto, the trial delivered positive results, showing that a truck running on renewable diesel “delivered similar performance and reliability as trucks running on conventional diesel.”

Marc Schlichting, senior manager, mining North and Latin America at RollsRoyce Power Systems, said: “The engine ran over 6,000 hours on HVO. A trial like this is important for us to demonstrate the reliability of our engines in the field, and not just on a test stand under ideal conditions.”

Rio Tinto’s goal is to achieve a full transition of its heavy machinery fleet onsite to renewable diesel by next year, which it anticipates would remove about 12 per cent of the mine’s carbon emissions for the full year 2024, or up to 45,000 tonnes per year of CO2 equivalent.

Rio Tinto U.S. Borax will continue working with the U.S. Environmental Protection Agency, the state of California and engine manufacturers to achieve this goal.

Rio Tinto stated that the two trials support its global decarbonization objectives. This includes the reduction of its scope 1 and 2 emissions by 50 per cent by 2030; the company estimates that 13 per cent of its scope 1 and 2 emissions are carbon emissions from its diesel-run mobile fleet and rail. The company also has a pledge to achieve net-zero emissions by 2050. –

Ailbhe GoodbodyCôté Gold receives muchneeded funding from two deals

In August, Iamgold revealed it would need more money than initially expected to complete its Côté Gold project in Ontario. On Dec. 19, Iamgold shared that the project, jointly owned 70/30 with Sumitomo Metal Mining, had secured the needed funding for the project to continue development and meet its revised early-2024 production target.

Sumitomo will contribute approximately US$340 million to the project over the next year. In return, Iamgold will offer the company roughly 10 per cent further interest in Côté Gold.

The agreement will have Sumitomo provide up to US$250 million to fund ongoing construction in exchange for expanded interest in the project. Once

the US$250 million limit has been reached, each party will contribute funds based on their revised ownership stake in the project towards construction costs, which for Sumitomo is estimated at US$90 million.

Iamgold will have the option to repurchase the transferred ownership stake in the future. According to board chairman and interim president and CEO Maryse Bélanger, Iamgold intends to return to its original 70 per cent stake once the company has improved its liquidity.

Sumitomo president and representative director Akira Nozaki said: “the Côté Gold project has the potential to become a world-class, low-cost, long-life gold mine, and is one of the major pillars of Sumitomo Metal Mining’s growth strategy…. We believe that this transaction will further strengthen the friendly relationship between Iamgold and [Sumitomo], while ensuring that the construction of this project will proceed without delay and secure the early start-up of operations.”

Iamgold also announced the sale of its 90 per cent stake in the Senegalbased Boto Gold project, the Diakha-

Siribaya gold project in Mali, the Karita gold project and other associated exploration locations based in Guinea, as well as any other early-stage exploration locations of the aforementioned projects, to Moroccan-based company Managem for roughly US$282 million.

“The proceeds of the sales, coupled with the financing agreement with Sumitomo, meet the remaining funding requirements for completion of construction at the Côté Gold project, which

is approximately 70 per cent complete and on track for production in early 2024,” said Bélanger.

The anticipated capex was US$1.3 billion when construction was approved in 2020, but in August, with the project nearly 60 per cent complete, Iamgold estimated it would need US$1.9 billion to see construction through. Once producing, the mine is expected to average 365,000 ounces of gold per year over 18 years. – Ashley Fish-Robertson

stantec.com/net-zero-mining

Stantec designs creative, innovative, and industry-leading energy solutions that advance mining companies and communities they serve.

Let’s partner to treat our Earth like the precious resource it is.Iamgold will secure roughly US$282 million from the sale of its African assets to fund the construction of Côté Gold, which the company said is approximately 70 per cent complete. Courtesy of Iamgold

Gold and copper likely to win big in 2023

Theo Yameogo from Ernst & Young breaks down this year’s forecast for five different metals

By Ashley Fish-Robertsonenergy lead partner at EY Latin America North.

Copper

Despite copper’s indisputable importance in the decarbonization shift, the last decade has seen the metal receive less investment from mining companies.

“For copper (and iron as well) the key anchor is China. You can see that during Chinese Lunar New Year, there was a reopening of the border in China, so there are people expecting that China’s economy will get back into full swing,” explained Yameogo. If and when this happens, Yameogo noted that China will require a lot of iron and copper.

Last year saw several base metals perform well, even amidst the ongoing Russian war against Ukraine, the decarbonization shift, China closing its borders and the continued impact of COVID-19. Theo Yameogo, EY Americas, and Canada mining and metals leader, spoke to CIM Magazine about five different metals, looking at how they have performed recently and what we can expect from them during 2023.

Gold

In 2022 the demand for gold continued to grow, with a 67 per cent increase in demand for jewelry and a 31 per cent increase for bars and coins. Due to raised costs of mining operations amidst the last two years, coupled with geopolitical tensions, several expansions of Canadian gold projects suffered delays. EY forecasts 2023 to be the year when these stalled expansions begin to progress.

As mining companies continue to meet their ESG targets, sustainability is expected to be at the forefront of many gold operations. According to EY, Canada witnessed the biggest increase in gold exploration budgets, reaching up to 85 per cent year-over-year to US$1.5 billion. As the shift to decarbonize the economy continues to gain momentum, 2023 will likely see gold producers applying more ecoefficient measures to their operations.

Yameogo sees three possible outcomes for gold in 2023: “If we have a recession, which is what many are predicting, then many will likely turn to gold. Some bank analysts predict it could go up to US$4,000 [an ounce], but more conservative analysts are thinking more like US$2,000.” Yameogo believes it is important to note that when the U.S. currency plummets, the price of gold increases. As of now, the U.S. dollar is strong.

A second scenario for gold would see a milder recession than expected, which would allow gold prices to stabilize. Finally, the third scenario for gold would consist of “not reaching a recession at all,” which could result in lowered prices.

Silver

There was a sharp spike in the demand for silver in 2021 where it reached 1.05 billion ounces, triggering a deficit in the silver market. This remains the highest level since 2015. This increase in demand can be attributed to more eco-friendly initiatives that are powering the economy.

“The impact of the energy crisis, the higher cost of operations and geopolitical uncertainty around operations will likely be offset by high cash at disposal, driving capital allocation strategies,” explained Alfredo Alvarez Laparte,

According to Yameogo, there are not any forecasted new mining projects dedicated to mining copper beginning production in 2023 that can be expected to boost supply. Meanwhile, the demand for copper is increasing due to the electrification of vehicles.

Nickel

Among other base metals, nickel performed notably well this past year, increasing by 29 per cent since the start of 2022. However, some expect the demand for the metal to decrease in 2023 due to the looming recession that certain economies will confront.

Yameogo notes that nickel is up in value yearly, especially with one of its biggest uses going towards stainless steel production.

“We’re also taking nickel, making it higher purity, and using it for NFC batteries. So, nickel is expected to remain hot in 2023.”

Iron

As previously mentioned, due to China finally reopening is borders, iron will be one of the most sought-out metals by the country. “China will need a lot of iron,” said Yameogo. “Iron is already up anyway, but it is expected to continue to increase because there is now a large consumer of it that is coming into the market.”

Like copper, there seems to be no planned major new disruptive mining projects producing iron in 2023. CIM

Osisko Mining releases positive Windfall feasibility results

Osisko Mining released the findings of the independent feasibility study for its fully owned Windfall gold project on Nov. 28. The Abitibi-based project, located on the Cree First Nation of Waswanipi’s lands, will feature an underground mine with dual ramp access and a central processing mill on the mine site.

Highlights from the study, conducted by BBA Inc., include the project producing roughly 306,000 ounces of gold annually from ore with an average grade of 8.1 grams per tonne. A peak production rate of 374,000 ounces of gold is to be expected during the second year of production. After-tax net present value for the project is currently estimated at $1.2 billion with a 34 per cent internal rate of return.

“We are very pleased to deliver the Windfall feasibility study, outlining the supporting economics indicating Wind-

fall can become a significant and highly profitable new gold mine in Quebec,” said the company’s chief executive officer John Burzynski.

The Windfall gold project is expected to mill 3,400 tonnes per day at an aver-

A power change that changes everything.

age recovery rate of 93 per cent, and an all-in sustaining cost of $985 per ounce. Bringing in an anticipated $6.2 billion in gross revenue, this project is expected to open over a thousand new job opportunities during its construction phase, and

United. Inspired. Boost productivity, enhance safety and cut emissions –all while lowering your total cost of operation.

FROM THE WIRE

Compiled by Ashley Fish-Robertson

Teck Resources has appointed Charlene Ripley as the company’s senior vice-president and general counsel. Ripley brings with her over 30 years of experience from a variety of positions, including vice-president and generalcounsel roles at Goldcorp and Linn Energy.

Grant Moenting will be joining Osisko Gold Royalties as vice-president of capital markets. Moenting has held several positions with Teck Resources, Scotiabank Global Bank, Paradigm Capital and more, bringing with him 16 years of experience to this new position.

Alison Atkinson has been appointed by Anglo American as group director of projects and development. Atkinson is currently AWE’s CEO and has assumed various roles within the company since 2005. She has a bachelor of engineering from the University of Manchester, is a chartered civil engineer and is a fellow of the Royal Academy of Engineering.

NorthWest Copper will be welcoming Tyler Caswell to the company as vicepresident of exploration. As a registered professional geologist, Caswell brings with him 18 years of mineral exploration experience with him. Caswell received a bachelor of science with distinction from the University of Victoria.

Bryce Clark will be joining Vital Battery Metals as the company’s chief financial officer. Clark is currently the principal of Bryce A. Clark & Associates and brings over 20 years of board experience to this new position.

J.L. Richards & Associates is welcoming Darren Radley to the company as the new chief environmental engineer. This new role will see Radley lead the development and expansion of staff throughout the company. Radley has almost 25 years of experience working as an engineer.

Wesdome Gold Mines president and CEO Duncan Middlemiss has retired from his positions and resigned from its board of directors. Middlemiss led the company for six and a half years, bringing the Kiena mine to production through the COVID-19 pandemic.

over 670 permanent positions once operations are running.

The project’s probable mineral reserve estimate is 12,183,000 tonnes with 3,159,000 ounces of gold at a grade of 8.06 grams per tonne.

Engineering work for this project has commenced, and as the project advances, the company expects to release its environmental impact assessment study in the first quarter of 2023,

Nickel in demand

The clean energy transition was the topic that was top of mind at the 2023 Annual Canadian Mineral Processors National Conference, and it made its presence known during almost every presentation.

The main portion of the Ottawa-based event (a day of short-courses was held prior to the official start) kicked off with an opening plenary presented by Johnna Muinonen, president of Dumont Nickel, Magneto Investments, and it started the trend of talking about the electrified future and what it means for mining, mineral processing and metallurgy.

The demand for nickel, in particular for the consumer electric vehicle market, is expected to be so strong that it is creating a shift across the entire industry. “It’s a huge opportunity for us to add a brand new market to an existing metal and that so very rarely happens,” Muinonen said. “You know, 70 per cent of all new nickel today goes into stainless steel. Stainless steel is still going to be a massive demand, but its growth is much more moderated. When we talk about

which will allow Osisko to begin the mine permitting process.

“As we move to complete the EIA study in Q1 2023 and begin the permitting process, we expect to advance our underground exploration and continue to grow the scale and quality of the deposit,” said Burzynski.

Plans for the financing of Windfall will come in 2023, with a production decision following in early 2024.

– Ashley Fish-Robertsonopportunities for nickel today, it’s all about the battery supply chain.”

As for the size of that demand, based on the number of gigafactories (supersized battery manufacturing plants) being announced, Muinonen described it in terms that miners can easily visualize: “It’s somewhere around 40 to 60 new projects, all of which would produce an average of 38,000 tonnes of nickel annually. And to put that into perspective, that means every project has to be half of the size of the Glencore smelter… It basically means we need 40 new Raglans or 60 new Raglans. How are we going to get our heads around that? And the reality is, we’re not. We’re going to see some substitution for LFP [lithium iron phosphate battery chemistry] and we’re going to see a lot of nickel coming out of Indonesia, but there is an opportunity for Canada to play a role and advance some of our projects and take advantage of this opportunity.”

She told the audience that all forms of nickel – including both Class 1 (sulfide) and Class 2 (laterite) – can be used to produce batteries, but processing Class 2 just costs a bit more, which, in turn, just creates a new floor price for nickel. She also said that HPAL [high-pressure acid leach] plants are being built by Chinese companies and are meeting nameplate capacity within four quarters.

Muinonen told the crowd of 505 that in order for the industry to survive and break out of mining’s typical boom and bust cycle, nickel producers need to rethink how they finance projects, how they strike deals with customers and how they price their products.

She noted that despite investments being made in battery processing and manufacturing facilities, the same type of investment has not been poured into mining and refining, and that single-source producers are still relying mainly on debt

financing to get their projects going. To get around those issues, Muinonen explained that miners need to partner with vehicle manufacturers and not underplay the value they offer as experts in mineral sourcing and refining, making them a vital part of the BEV supply chain.

She also suggested that nickel companies consider a new pricing strategy.

“If we could get away from some of the boom and bust and have fixed prices on our floor and ceiling, we’d be able to spread [the profits] out a little bit and keep people engaged, and keep innovation and R&D continuously happening because we would understand what our profit would be and what we’d be making every year as opposed to [asking] ‘What is the nickel market going to be? What is the price?’ I’m not saying it’s for everybody… I’m just saying that I think that in some places we could really improve the overall health of the industry and really retain and attract more people if we could look at the markets differently. And I think this battery supply chain really gives us the opportunity to do that.”

20 YEARS OF HIGH SPEED SPLIT-FEED JUMBO DEVELOPMENT

– Carolyn GruskeCanada’s plan for critical minerals

The strategy identifies six metals as priorities for development

By Ashley Fish-RobertsonOn Dec. 9, 2022, Jonathan Wilkinson, Canada’s natural resources minister, introduced the federal government’s official Critical Minerals Strategy, outlining the strategy’s objectives, benefits, and allocation of funds. The main objectives of the strategy consist of supporting economic growth and creating jobs, promoting climate action and environmental protection, advancing reconciliation with Indigenous people, fostering diverse and inclusive workplaces and communities, and finally, enhancing global security and partnership with allies.

In his foreword for the strategy, Wilkinson stated that: “Critical minerals are the building blocks for the green and digital economy. There is no energy transition without critical miner-

Development

Shaft Sinking

Mass Excavation

Production Mining

Raiseboring

Raise Mining

5,000 m OF LATERAL DEVELOPMENT IN A MONTH ON A SINGLE PROJECT

Underground Construction

Mechanical Excavation

Engineering & Technical Services

Specialty Services

als: no batteries, no electric cars, no wind turbines and no solar panels… It is therefore paramount for countries around the world to establish and maintain resilient critical minerals value chains that adhere to the highest ESG standards. It is also important that we partner with Indigenous peoples –including ensuring that long-term benefits flow to Indigenous communities.”

In the discussion paper, the government outlined six clear steps to achieve these goals: advance research and exploration; speed up project development; develop sustainable infrastructure; advance reconciliation with Indigenous communities; grow a diverse workforce and thriving communities; and strengthen global leadership and security.

The strategy highlights the need for critical minerals in our daily lives, from the copper and aluminum that are used to manufacture electrical wiring to the indium and other rare earth elements that power electronic devices.

In the country, 31 minerals are currently considered “critical.” Although Canada currently produces over 60 different minerals and metals, the strategy outlines the untapped potential of utilizing even more critical minerals located within the country.

Out of those 31, there are six minerals in particular that are being prioritized for their important role in Canada’s economic growth. These minerals include lithium, graphite, nickel, cobalt, copper, and rare earth elements. The discussion

paper noted that while an initial focus will be placed on these six minerals, “many other minerals present notable prospects for the future.”

Of the $3.8 billion in funding from the government’s 2022 budget, several initiatives will be supported to drive innovation and research within the country. These initiatives include supporting public geoscience and exploration with $79.2 million, the deployment of the 30 per cent Critical Mineral Exploration Tax Credit, $47.7 million for targeted upstream critical mineral research and development and the introduction of technologies and materials to support this research for $144.4 million.

To satisfy the strategy’s objective of advancing responsible project development, a portion of the funds will support projects concerned with critical minerals ($1.5 billion), aid northern regulatory processes in permitting critical minerals projects ($40 million), and support the Critical Minerals Centre of Excellence ($21.5 million).

To advance the development of sustainable infrastructure within the country, an allotment of up to $1.5 billion is being supplied. Concerning Indigenous reconciliation, the government will supply $103.4 million, which will go towards supporting Indigenous participation in the strategy. Finally, an allotment from the funding will be used to maintain global partnerships through the promotion of Canadian leadership in the mining industry. CIM

Nouveau Monde assessment shows boosted production

Quebec’s Nouveau Monde Graphite (NMG) shared the positive results from a preliminary economic assessment (PEA), performed by BBA and GoldMinds Geoservices, of its open-pit Uatnan mining project. The project, located on the Lac Guéret graphite deposit in the CôteNord region, is considered to be one of the largest graphite projects in development across the globe.

Overall, the project is expected to produce roughly 500,000 tonnes of graphite concentrate annually over the course of 24 years. The project’s net present value, with an eight per cent discount rate, is $2.17 billion, with an after-tax internal rate of return of 25.9 per cent.

Total Measured and Indicated mineral resources for the project add up to 10.8 million tonnes of in-situ graphite from 62.2 million tonnes grading at 17.3 per cent graphite.

After re-examining Mason Graphite’s 2018 feasibility study for the Lac Guéret deposit, the new PEA looked to take the original plan for the project while multiplying annual production ten-fold from its original target of 51,900 tonnes. To accomplish this, NMG made two significant changes to the mine plan. First, the location of the project’s concentrator, initially located 285 kilometres from the site, has now been relocated to only 70 kilometres away. Second, the intended end-use of the material was changed to be used for the battery market only, which removed the need to preserve graphite flake size during processing. This resulted in a simplified processing circuit with the number of polishing and cleaner flotation stages reduced from four to two.

The assessment highlighted “favourable conditions” for the commercialization of the Uatnan project’s production based on an anticipated structural deficit of natural flake graphite this year.

“NMG’s vision is to become North America’s most important producer of battery-grade graphite,” said Eric Desaulniers, founder, president and CEO of NMG. “The Uatnan mining project aligns with our vision of progressive, integrated growth that caters to the market’s requirements for high-quality graphite materials, local supplies, ESG-driven development, and large volumes to meet EV production levels.” – Ashley Fish-Robertson

Community engagement and tailings management must go hand in hand

By David Clarry and Charles Dumaresq

In 1908, the silver mining town of Cobalt, Ontario, took the Coniagas Mine to court. The problem? Tailings from the mine regularly flooded nearby homes and businesses and the company refused to fix it. A few years later, Coniagas demanded that the owner of a butcher shop pay to divert a waste rock pile away from the shop. The butcher moved instead, and the former shop was buried.

Such stories were once common in mining camps across Canada, as companies frequently operated with little regard for communities or the environment. Fortunately, the mining industry has changed immeasurably, including how tailings are managed, and how communities are engaged.

By engaging constructively and proactively building relationships and exchanging information, community engagement can help to build trust and reduce the potential for conflicts. It can also help ensure that communities have an understanding of the risks associated with tailings, and how the company is managing them.

Community engagement is a two-way street, and local communities have knowledge that can be valuable to mining companies, including by helping to inform better decisions throughout the life of tailings facilities in areas such as: setting performance objectives; assessing and managing risk; planning and designing tailings facilities; and closure and emergency planning.

The Global Industry Standard on Tailings Management, released in 2020, has a strong focus on community engagement. Internationally, this is new to many companies that have not previously engaged with communities on tailings management, or engaged only as part of project approvals.

However, both tailings management and community engagement have been cornerstones of the Towards Sustainable Mining (TSM) program since it was first launched by the Mining Association of Canada (MAC) in 2004. TSM is an international standard for responsible mining that provides performance measurement protocols that address a range of environmental and social topics, and focuses on effective tailings management and community engagement in addition to numerous other topics such as biodiversity conservation, climate change and water stewardship.

Since the introduction of TSM, there have been requirements to engage communities regarding tailings management, and initially, these requirements were in the TSM Tailings Management Protocol, with more comprehensive requirements for community engagement in a separate protocol. TSM has continued to evolve and improve to reflect best practice and for tailings this evolution has been informed by an independent review that was conducted after the 2014 tailings failure at the Mount Polley Mine in British Columbia. This review concluded that the existing protocol did not “adequately prior-

itize tailings-related topics that are of high importance to communities of interest.”

TSM now takes a more integrated approach, with the Indigenous and Community Relationships Protocol updated in 2019 and designed to address the need for community engagement on all aspects at the site-level, including tailings management. This allows flexibility, recognizing that each situation is unique, with different communities having different priorities.

It also recognizes that engaging communities on one specific topic, such as tailings management, in absence of a broader whole-of-mine approach may potentially be problematic and counterproductive.

This commitment to sustainable practices and community engagement via TSM is illustrated well through the work of companies like Hudbay Minerals, which recently invested over $60 million into upgrading its tailings facilities in Manitoba. These enhancements came about in large part due to recognition of needed improvements identified through the company’s use of the TSM Tailings Management Protocol.

Community engagement was integral to Hudbay’s planning process, with the company holding meetings regarding tailings construction plans and the relationship of those plans to protecting the community from inundation in the event of a failure, with the goal of ensuring local concerns were heard and addressed. This collaborative process, with input received informing Hudbay’s plans, enhanced understanding of the company’s tailings management responsibilities, increased community engagement and resulted in substantial tailings upgrades. A win-win.

Around the world, mining companies, investors and regulators are rightly putting a strong emphasis on the need for safe, responsible management of tailings, and ensuring community engagement is at the forefront of this process is essential. With 11 national mining chambers around the world, including heavyweights like Australia and Brazil, now participating in TSM and with over 200 mining companies currently in the process of implementation, the program is undoubtedly enhancing confidence in the way companies mine. CIM

The integrated approach of Towards Sustainable Mining enhances community confidence in the way companies mine

modern miner

Expert witness

Metallurgist combines knowledge of mining law, arbitration and consulting with technical expertise

By Sarah St-PierreBrenna J.Y. Scholey

Principal metallurgist and global disputes coordinator

SLR Consulting (Canada) Ltd.

B.A.Sc. in metals & materials engineering

University of British Columbia

P.Eng.

Ontario and British Columbia

What is the biggest challenge the industry is facing this year?

Increased geopolitical risk in the critical minerals sector and its future impact on international mining disputes.

What is the one thing you would like to see this year?

I would like to see in-country, downstream metals processing experience a renaissance in Canada, as observed in other places like Europe.

What is your most recent accomplishment?

Ranked by Who’s Who Legal (WWL) as a Global Elite Thought Leader –Mining Experts 2023

Over the course of a 34-year career, Brenna J.Y. Scholey has moved from the lab to the processing plant, to the corporate office, and to the courtroom, and her journey into new territory continues. Right now, she is a principal metallurgist who is recognized as a consulting expert and global thought leader by Who’s Who Legal: Mining (and has been recognized every year since 2019). As a global disputes coordinator for SLR Consulting’s Mining Advisory group, she can be advising on a dozen international mining disputes and arbitration cases at any given time, performing due diligence and consulting on mining projects, all while keeping up her metallurgical engineering practice.

Scholey’s keenness to touch on a broad range of industry facets has been manifest since the earliest days of her career. As an undergraduate student at the University of British Columbia (UBC), she chose metals and materials engineering over mining engineering to get a taste of chemical engineering, metallurgy, mechanical engineering, and mining all at once. The degree naturally led her down the extractive metallurgy and process engineering path. The choice she made back then is still paying off: “I’ve been very, very fortunate. All of the arbitration and litigation cases I’ve been involved with, there’s always some element of metallurgical processing related to the case,” she said.

After graduation, Scholey worked for Placer Dome as a development engineer at Equity Silver Mines focusing on tailings reprocessing and providing support to the mill operation. “Having operating and technical experiences in industry are invaluable for career development as an engineer,” she said.

Scholey returned to UBC as a senior research engineer, conducting research in the bioleaching of ores and experimenting on solvent extraction and the ion exchange removal of impurities from copper electrolytes. “Working on experiments that were 24 hours or longer, that required me to actually go into the lab at three in the morning and start an experiment,” she said. Her research led to her being a co-holder of a patent for an impurity removal process that was implemented by Noranda Inc. The experience taught her about the value of dedication and hard work and the application of theory to practice. Yet it wasn’t until she was actively working in the field that Scholey thought she had advanced in her career.

For her, that turning point came while working in Illinois for Eichrom Industries as a research hydrometallurgist and accruing more field experience in project management, operation, and design of ion exchange pilot plants for impurities removal in copper processing. In 1996, she returned to Canada and worked at INCO (Vale) for more than 17 years, adding experience with commodities beyond copper, as she moved from plant operations into the custom feed business. By 2008, she had been in charge of coordinating the company’s entire precious metals production throughout Canada and the U.K.

Scholey had also served as manager of project evaluations and senior business analyst in the Vale Base Metals Technical Excellence Centre in Mississauga, Ontario, where she conducted business evaluations of strategic projects in Vale’s global base metals units. Through the role, she got to travel and to work on Vale’s base metal projects in Brazil, Indonesia, New Caledonia and more. “It gave me a tremendous opportunity, at the time, to see and to learn about other operations,” Scholey said.

Those experiences were key in creating the possibility for her to move into consulting, where she has been since 2014. “I had a background in hydrometallurgy and pyrometallurgy of nickel, copper, cobalt, and precious metals. I was able to apply that knowledge to the processing of other metals. If I didn’t have the operations and technical experience, I don’t think that I could have pursued certain consulting assignments,” she said.

The types of legal disputes Scholey provides expert witness services for are often international in nature, typically involving governments expropriating mining projects or operating mines to nationalize them or to put a different company in charge. Sometimes, the government’s actions are motivated by interest in a project’s financial potential or for nationalistic reasons, but other times governments rescind licences because companies have failed to hold up their ends, as in instances where investment promises are not kept.

Both the global nature of her work and her point of view as a metallurgical engineer make Scholey sensitive to the growing push for sustainability reforms in mining. “I think we, as members of the industry, need to promote responsible and sustainable practices. Through the code of ethics, professional engineers have a clearly defined duty to the public and to society,” she stressed. “I hold that very strongly in terms of what I do as a consulting engineer, in terms of the projects I am involved with, and I see a big shift happening. I think it’s going

to be very important for the mining industry to be responsive in that regard.”

As for her own future prospects, Scholey wants to expand her areas of expertise even further still. Already, arbitration work has allowed her to familiarize herself with iron ore processing, something she had not worked on much beforehand. “I would like to continue building my experience in lithium processing and working with other critical minerals,” she said. “To work on different metals processing and to continue to learn, I think, is important and broadens what I can offer in terms of technical capability and expertise to clients.”

Mining is a varied, multi-faceted industry and the people who work in the sector are equally diverse. Modern Miner will run through 2023 and showcase mining professionals from a range of backgrounds and highlight the ways they are leading, innovating and pushing the industry forward. If you know somebody who should be profiled, email editor@cim.org.

Lithium exploration ramp up

Canada is primed to become a supplier of lithium to help fill the looming gap for the energy transition

By Alexandra Lopez-Pacheco

By Alexandra Lopez-Pacheco

In 1950, the authors of a federal government document entitled “The Miscellaneous Non-Metal Mining Industry” noted that Canada had little to no known use for lithium. “Thus, an outside market would have to be found for any production,” the authors concluded. Such uses for lithium as lubricants, glass, ceramics and pharmaceuticals would subsequently open up niche markets for the white mineral, but over the decades lithium exploration and mining in Canada have remained sporadic, with mines being few and far between. Today, a market has been found for Canada’s lithium – a booming one – and dozens of Canadian junior mining exploration companies have joined the global lithium rush by looking for the mineral here at home. According to Natural Resources Canada, spending on exploration and deposit appraisal activities for “other minerals,” which includes cobalt, lithium and rare earths, rose by 167 per cent in 2021 to $95 million, and is anticipated to have increased by another 77 per cent in 2022 to $169 million. Collectively, these juniors are part of something much bigger than just building a business, they are helping to pioneer a new batterygrade lithium mining industry in Canada.

Lithium is listed by the Canadian government, and others including the U.S. and the European Union, among the minerals critical for the decarbonization of the world’s energy supply required to help thwart climate change. According to a 2022 International Energy Agency report, the demand for lithium is projected to increase sixfold to 500 kilotonnes by 2030. The equivalent of 50 new average-sized mines not currently in the pipeline will be needed to fill the gap. Although most of the world’s supply comes from Australia, Chile, Argentina and China, in 2022 the Canadian government said

Canada was primed to become a supplier of lithium to help fill the looming gap.

Currently, however, the country has only 2.5 per cent of the world’s known lithium deposits, only one lithium mine – Sayona/ Piedmont’s North American Lithium operation in Quebec – slated to open in 2023 and no lithium refining facilities necessary to turn the raw material into a battery-grade product. Nevertheless, prospectors and exploration companies are undeterred because, until recently, few have put much effort into looking for the mineral. Some argue there is a lot more lithium in this country than the 2.5 per cent of known lithium deposits.

“We have not been exploring for lithium in Canada for a very long time,” said Killian Charles, president and CEO of Montrealbased Brunswick Exploration, a greenfield exploration company. “Australia, which contains a lot of the known lithium deposits, has been more aggressive and has built a larger repertoire of the known lithium deposits.”

According to the Australian government, active exploration between 2007 and 2017 grew the country’s economic demonstrated resources of lithium by 1,600 per cent. Canadian junior exploration companies are rolling up their sleeves to help build Canada’s repertoire as well.

“Canada has the right geology for there to be many major new discoveries across all of the country,” said Charles. “We’re just getting warmed up.”

Hard rock lithium

Most current lithium resources are found in hard rock pegmatite deposits. Some Canadian juniors such as Grid Metals are exploring for this in Manitoba. Its Donner Lake project is in the

Bird River Greenstone Belt in the southeastern part of the province. But the majority of hard rock lithium exploration activity by Canadian juniors today is found in Ontario and Quebec. Sudbury-based Frontier Lithium, for example, is exploring for lithium at Pakeagama Lake in the province’s Kenora area and stirring up a lot of excitement in the region. The company actually launched its project back in 2013. Up to 2022, it only drilled some 14,000 metres at its project, called PAK, one of the largest land packages hosting premium lithium-bearing pegmatites in the province. In 2022 alone, Frontier Lithium completed an additional 16,000 metres of drilling.

In Ontario, some juniors are reinventing themselves as mining/ chemical manufacturing companies. Frontier’s plan, for example, includes building a battery-grade lithium refining facility as well as a mine.

German-Canadian Rock Tech, based in Vancouver, plans to build an open-pit mine at its Georgia Lake lithium project 160 kilometres northeast of Thunder Bay, as well as a battery-grade lithium-processing facility in Guben, Germany. Last year, the company signed a supply agreement with Mercedes-Benz.

Some Canadian juniors are proving themselves to be very agile. Avalon Advanced Materials, which originally intended its Separation Rapids lithium project near Kenora to focus on the lithium market for glass and ceramics, has switched gears. In 2022, it signed a non-binding memorandum of understanding with LG Energy Solutions to supply it with battery-grade lithium beginning 2025. Avalon is also planning to build a lithium processing facility in Thunder Bay to supply the EV battery industry.

Quebec, which hosts some of the world’s largest known hard rock lithium deposits, is also luring a growing number of Canadian junior lithium exploration companies. In 2021, one of these companies, Vancouver-based Patriot Battery Metals, discovered a previously unknown lithium pegmatite district at its Corvette property in the province’s James Bay region.

Brunswick Exploration was founded in 2020 with the goal of testing as many lithium-containing pegmatites as quickly as possible across Canada – starting with its current projects in Quebec, Ontario, Manitoba and Atlantic Canada – to identify the approximately two per cent of the pegmatites that could potentially contain lithium. On the ground, the company’s team uses handheld XRF analyzers to identify the presence of pathfinder elements, which can indicate the presence of lithium mineralization. “Unlike in gold or base-metal exploration, we’re actually immediately able to ascertain in the field as to whether or not a pegmatite has the potential of containing lithium. It allows us to be incredibly efficient in terms of exploration,” said Charles. “With better efficiency, we decided to go a bit outside the box and focus on rapidly acquiring as many targets as possible.”

Western innovation

In 2014, Chris Doornbos, CEO of E3 Lithium, saw a potential lithium shortage building. For two years, he looked for lithium exploration opportunities around the world. Then he came across an Alberta Geological Survey report. “They had sampled oil and gas formation water and completed a full-suite analysis,” he said. “What we realized from this report is that there were samples with lithium that had been collected in the southern half of the province where we are now. We started to dig into that and the whole Leduc Aquifer had lithium. I am not sure if the people who understood that lithium was in the aquifer understood how big this aquifer is.”

It turns out that for decades, western Canada’s subsurface saltwater bodies had been drilled for oil but the lithiumenriched brines had been injected back into the ground. The Leduc Aquifer is massive, running some 2,500 metres below the surface and spanning hundreds of square kilometres between Calgary and Edmonton. In 2016, the private company that became E3 was incorporated and quickly began acquiring land for its Clearwater lithium brine project. “I think now we own most, if not all, of the Leduc south of Edmonton,” said Doornbos.

At first, exploring in this new burgeoning lithium brine sector was a little different than traditional mining exploration. It involved E3 working with oil companies to let it sample at the back of their operations “so we didn’t have to drill to get the data needed to build a resource,” said Doornbos. Since then, E3 has conducted some drilling to delineate its resource, which now stands at an inferred resource of 24.3 million tonnes of lithium carbonate equivalent. The resource has been long understood, though overlooked until E3. The company has mostly been focused on the development of an extraction technology and the engineering for a commercial facility for the project by combining western Canada’s gas and oil and with mining.

E3 is not the only junior Canadian company that is exploring for brine. LithiumBank is doing the same for its Boardwalk lithium project at Sturgeon Lake, first discovered in the 1950s by the oil and gas industry, which hosts some 1,100 wells. Its second exploration project, Park Place, is located in the oil- and gas-rich Fox Creek area.

In Saskatchewan, Canadian juniors such as Prairie Lithium, which is exploring in the province’s Williston Basin, and Grounded Lithium, whose Kindersley lithium project is in the southwest of the province, are paving the way for a new lithium sector that leverages the infrastructure of the oil and gas sector to expedite the path to development. (Australia-based Arizona Lithium entered into an acquisition agreement with Prairie Lithium at the end of 2022.)

“I think people need to understand it takes a long time to build a mine,” said Matthew Dreis, a research and development senior analyst with Prairie Lithium. “With the lithium industry, to build a mine and develop the minerals, it’s an average time of about 10 years. But we’re talking about a demand for lithium that will increase around 500 per cent by 2030. So we have to provide a lot of production in the next decade extremely fast.”

Extracting lithium from brine in western Canada could come in just a couple of years. Alex Wylie, founder of Volt Lithium and now president of Allied Copper, which acquired Volt in December 2022, believes that lithium-brine mining can be modelled after the conventional oil industry. His company is exploring in the Rainbow Lake oil fields in Alberta and developing a lithium extraction technology that can be added as a second step to current oil extraction.

“As an oil and gas person, the way I look at it is I need a single well… If I can get a single well that produces oil and I know there’s a reservoir below, I can expand with more wells, but I have to have the oil first. I want to get the oil to the surface, process it and show it works. Well, we’re doing the same thing with lithium," he said.

“Canada will be at the forefront of the energy transition in terms of supplying minerals and metals necessary for it,” Brunswick Exploration’s Charles said. “Honestly, it’s not even a question of political will or dollars; it’s a question of time.” CIM

As CEO and director of E3 Lithium, Chris Doornbos believes the company’s ion-exchange technology will help it lead the way for the lithium industry in Canada.

The company’s Clearwater lithium project sits on the Leduc aquifer, an oil field that helped start Alberta’s oil and gas industry in the 1940s and which is rich in lithium brine. E3 Lithium took the first-mover advantage, recognizing the potential value located in the brine found deep underground. The low lithium concentrations have meant the area has needed an extraction technology, but with global interest in lithium batteries on the rise, redeveloping this area into a lithium producer is more worthwhile than ever.

The key, Doornbos said, is in E3 Lithium’s technology, which would allow the company to bring brine liquid to the surface and directly extract lithium from it before refining it into battery-quality product. And with a $27 million investment from the federal government’s Strategic Innovation Fund and a plan to pilot its technology, the company is setting its sights on commercialization.

CIM: Can you tell me what E3 Lithium has been working on since its founding?

Doornbos: It seemed to us at the beginning that the real key was the ability to take the lithium out of the brine and do it economically. We spent a lot of time looking at how we might do that and realized that the market did not have something that would work, so we started to develop our own technology. From the end of 2017 onwards, we really worked on the development of our technology. It was the main focus until 2021, when we got to a point where the technology development started to shift towards commercialization. Now, we are aiming to pilot the technology sometime in 2023, likely Q3.

The benefit now is that direct lithium extraction (DLE), the extraction method like E3’s to remove lithium from brines, has matured dramatically in the last couple of years. There are other DLE technology companies that have processes that could work for lithium brines. From our standpoint, that’s really good news because it de-risks all low-concentration brine projects like ours. There is huge inherent value in E3’s resource, which totals

The direct approach

E3 Lithium CEO Chris Doornbos said the company plans to break new ground in Alberta with its ion-exchange technology

By Tijana Mitrovic24.3 million tonnes of inferred lithium carbonate equivalent. It is one of the largest single lithium deposits on the planet. The big risk for us has always been around the technology to get the lithium out of the brine once it’s out of the ground, and now that has been de-risked significantly by ourselves and others. It really sets us up to move firmly into commercial development.

CIM: How do you think the company’s technology will make your Clearwater lithium project effective and viable?

Doornbos: Where our technology stands out is in its kinetics, which refers to how rapidly the lithium is extracted from the brine. While the system we use is fairly typical ion-exchange, like we see in water-treatment processes and water softeners in homes, the material we use – called sorbent – is highly selective for lithium. Our proprietary sorbent achieves high lithium recovery in a very short amount of time. The concentration of lithium in our brine is about 75 milligrams per litre. We have this significant deposit and when you have a streamlined process that enables you to extract lithium very effectively, you start to move towards commercialization. At that point, it fundamentally doesn’t matter what the lithium grade is.

Using DLE technology on our resource not only supports the viability and economics of the project, it also results in a much reduced environmental footprint compared to conventional lithium mining and evaporation processes.

CIM: Can you speak more to E3 Lithium’s economics?

Doornbos: The economics are pretty good. The preliminary economic assessment (PEA) outlined an estimated net present value of US$1.1 billion for the project using a price metric –US$14,000 per tonne – far below what we are likely to sell our product for. The spot price right now is more than US$80,000 per tonne. There’s a really good margin for this company and good value to create for this project.

The operating costs estimated in our PEA are US$3,656 per tonne of battery-quality lithium hydroxide, which means we’re well under the required cost threshold for an economic project. With an estimated capital expenditure of US$600 million

required for our first commercial facility, we’re at about US$30,000 per tonne of installed capacity, which is right in line with industry average.

CIM: The company recently released the results from its inaugural 2022 drilling program. What do those results mean for the project’s future viability?

Doornbos: The results of our drilling and sampling program are extremely positive, and it’s important to note, this is a historic program for Alberta. Starting in summer last year, we drilled Alberta’s first ever brine production wells for the purposes of evaluating lithium. We drilled two new wells and acquired one existing well from the oil and gas industry.

The program demonstrated consistency across our aquifer, not only in lithium concentrations, but in aquifer properties and brine chemistry as well. When the feedstock going into the plant, in this case the brine, is consistent, you can build the plant with very narrow tolerances, which means the complexity of the plant is reduced. Consistent product in the plant is fundamental to its efficient operations. The fact that the grade and the chemistry of the brine are fairly consistent across the whole aquifer is very important.

The consistent results we received propels our development and helps de-risk the project. We now have the data we need to complete an upgrade to our resource from inferred to measured and indicated.

CIM: One of the things often discussed with lithium mining is the environmental impact of its extraction. How does E3 Lithium’s way of extracting that lithium address those concerns?

Doornbos: Direct extraction methods like DLE have several environmental advantages. It’s part of a closed-loop system, meaning once you pull the brine out of the ground and extract the lithium from it, the brine is then returned back to the aquifer. The biggest concerns with conventional mining processes have been land disturbance and freshwater interference, both of which are addressed by DLE as it uses less than three per cent of the land of traditional lithium mining projects and there is no freshwater aquifer interaction.

Our project in Alberta is being developed using the sophisticated tools and processes created by the province’s oil and gas industry. We’re using conventional oil and gas equipment to drill the brine production wells, and after each well is drilled, we’ll immediately reclaim most of it. That’s the industry standard: immediate reclamation. That well can operate for 20 or 30 years with a minimal footprint and just road access for maintenance.

CIM: What are the next steps for E3 Lithium?

Doornbos: The two big things we’re working on right now are the pilot plant, which we hope to start operating in Q3 of this year, and the pre-feasibility study, which we want to complete in the next 12 months. There’s a lot of other work happening, but those are the two big milestones that we believe will solidify that, yes, we’re going to build this, that a pilot is operating, and it’s successful.

CIM: What are some strategies the company will take to achieve those next steps?

Doornbos: Most important to all the strategies we will employ is the solid foundation we have built over the last several years.

We’ve made steady progress on the development of our resource at the same time as advancing our technology. We have a very strong team that has decades of experience developing best-inclass resources. The market demand for lithium is growing steadily, built on the battery-electric revolution. Every jurisdiction sees electric vehicles, and the lithium required in their batteries, as a core component of a net-zero economy.

Last year was a big year for us. We announced a strategic agreement with Imperial Oil, a global energy industry leader, and a $27 million investment from the Government of Canada. We foresee this year to be even bigger, and the year in which we move from exploration and development into commercialization. We are going to take the foundation we’ve built, the team we’ve put together, and our ambitious yet achievable plans and execute to meet our goal of delivering high quality, sustainable lithium products to market as quickly as possible.

CIM: What do you want people to keep in mind about the future of lithium?

Doornbos: The lithium market is here, and it’s only getting stronger. The adoption of electric vehicles, all based on the lithium-ion battery, is growing and will continue to grow. There are billions and billions of dollars pouring into the electrification space. And it’s all built on the foundation of lithium. There’s a lot of demand for what we have and companies like us are seeing ample support to get our projects running because they’re critical. CIM

A third option

Lithium demand sees companies looking at recovering low grades of the critical mineral from clay

By Sarah Treleaven

By Sarah Treleaven

The electric vehicle (EV) revolution has driven an intensification in the demand for the lithium required to power EV batteries. As a result, in addition to traditional methods of mining lithium – extraction through either brine or mined ore – a third method is gaining attention: lithium extracted from clay.

Glen Merfeld, chief technology officer, energy storage at lithium producer Albemarle, explained that lithium mineral occurs naturally in three sources: hard rock, brines and sedimentary resources (clays).

While each source has potential for extraction, they vary in how the lithium is bound in each source, the concentration of lithium and the impurities that might have a downstream impact on extraction and processing. Dan Alessi, a professor in the University of Alberta’s department of earth and atmospheric sciences, said that currently, there are two major conventional sources of lithium: one, the fluids located beneath salt flats in locations such as South America, where miners drill “a modest distance” into the subsurface, and where the lithium concentrations are quite high; and two, igneous rocks in locations like Western Australia. After being dug out of the ground and crushed, acid is used to leach out the lithium from the ore, and that lithium solution is sent off to places such as China for further processing to make the lithium salts used by battery manufacturers.

Lithium extraction from clay

A different type of lithium deposit can be found in the sedimentary basins where one also finds oil and gas (including in western Canada). Alongside the hydrocarbons being produced, a highly salty brine – many times the salinity of the ocean – also contains relatively low concentrations of lithium, under 0.01 per cent or 50-150 parts per million. According to Alessi, some of this water returns up the wellbore along with the hydrocarbons. “This water contains relatively low concentrations of lithium, and high concentrations of other ions such as sodium and chloride,” he said. “A highly selective extraction process –one that targets lithium and leaves everything else behind in the brine – is required to economically target the lithium. These processes are generally called ‘direct lithium extraction’ or DLE processes. Developing a DLE process that can be economically scaled to a commercial process is among the greatest current challenges in building an industry around lithium-bearing brines in sedimentary rocks.”

In comparison, the lithium contained in the inter-layers of clays, deposits of which are found in volcanic terrains mostly in the western United States and Mexico, is typically also low concentration – about 0.7 per cent, but often less (higher than in brines, but lower than in many hard-rock mine sources) – and can