Finally, the moment has come: MIPLONDON takes places for the first time at 23-27 February in English main city, to provide networking to the big European traffic that the London screenings

MIPLondon main assets

• 1600delegates

• 70 countries

• 800buyers

• LondonScreeningssynergies

• MIPDocandMIPFormatstraditions

• Goodbuyerdensity

MIPLondon new spaces

• Digital First: YouTube, Tiktok

• Branded Entertainment

• Asia giants focus

• Kids Summit

• 4500 visitors

• Festival meets content business

• Fresh North European buyers

• 2nd tier strong buyers

• French public entities focus

push, quite similar as it happens in Los Angeles with the LA Screenings. Also, we have a new edition of SERIESMANIA, in Lille, France, as an example that a good business market can come from a Festival. First impression? Changes are needed, the challenge is to interpretate them well.

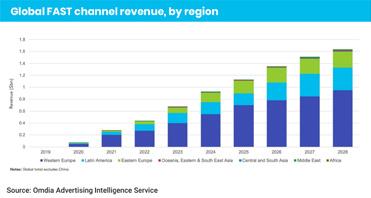

In which picture MIPLONDON is taking place? The last figures we’ve received before the deadline are good: organizer RX France speaks about 1600 registered delegates from over 70 countries, including almost 800 buyers. The last MIPTV had 3500 people from 84 countries and 1100 buyers, so the intention is to make focus on less people more important, with 50% of buyer density from total. There are no booths, sponsors have from tables to suites,

Continue Reading

Latency and performance improvements in

Live Sports Broadcasting main tips

Infobox:

• Events Analyzed: Wimbledon, Olympic and Paralympic Games 2024.

Latency Improvements:

• BBC iPlayer reduced latency from 55.9s (2023) to 40s (2024) at the Olympics.

• Sky Glass had the lowest latency among IP streaming platforms.

• Gaming consoles improved by more than 34s compared to 2023.

Challenges Identified:

• Premium Smart TVs exhibit the longest delays, exceeding 1 minute of latency.

• Android devices with the highest delay times.

• Traditional transmission (DVB-T2/DVB-S2) is still faster than IP platforms.

Accessibility and User Experience:

• Issues with subtitle activation on some platforms.

• Glitches in the Channel 4 app, with no live TV option on certain devices.

• Improved automatic recommendation of UHD transmissions.

Digital TV Group (DTG) has presented an analysis of latency in live sports broadcasting in the UK, conducted during three key 2024 events: Wimbledon, the Olympic Games and the Paralympic Games

The study compared the performance, latency and accessibility of devices compared to the 2023 events, providing insight into the current state of sports content streaming over IP. While progress can be seen, challenges remain for some devices, particularly wellknown brands that continue to experience significant delays.

The analysis highlights progress in reducing latency

Continue Reading

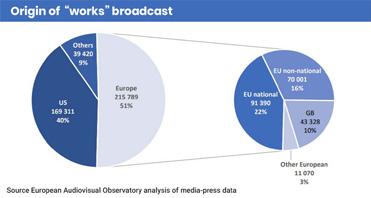

On its latest report, “Works on Television in Europe”, the European Audiovisual Observatory offered an in-depth analysis of the films and television content broadcast across the continent. The whitepaper, covering 1,663 TV channels from 25 European Union (EU) countries, documents 436,000 individual broadcasts. It highlights key trends in the circulation and distribution of European audiovisual works, their competition with content from the United States, and the role of national versus international productions.

Continue Reading

Every year more touchable in Cannes and now both at MIPLONDON and SERIESMANIA, we see Asian companies —especially from Japan and South Korea, but also other countries— lead the main subevents, the main investments at the markets. Other territories as

Asian content map, 2025

• Market leaders: Japan, South Korea

• Other four pillars: China, India, Taiwan, Hong Kong

• Strong production hubs: Singapore, Malaysia

• Steady international players: The Philippines, Indonesia, Thailand

• Emerging markets: Vietnam, Mongolia, Myanmar, Sri Lanka, etc.

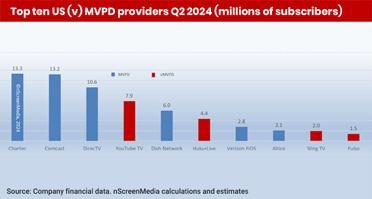

The television industry in the Americas is undergoing a profound transformation, shaped by the rise of digital alternatives, shifting consumer behaviors, and evolving business strategies. In the United States, the growth of virtual multichannel video

Continue Reading Continue Reading

Barb published its last Establishment Survey which revealed that AVOD services in the UK saw continued growth in the final quarter of 2024. Amazon Prime Video maintained its position as the leader in ad-tier subscriptions, while and Disney+ showed notable, albeit slower, growth in their ad-supported offerings.

Amazon Prime Video’s ad tier reached 11.6 million UK households in Q4, representing 39.4% of homes, a slight increase from 11.5

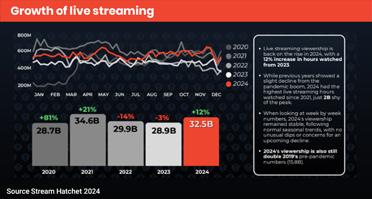

The live streaming industry has experienced remarkable growth in 2024, with a 12% increase in hours watched compared to the previous year, reaching a total of 32.5 billion viewing hours. This

million in Q3. However, overall Prime Video subscriptions dipped marginally from 13.4 million to 13.3 million. Doug Whelpdale, Head of Insight at Barb, commented: ‘Set against a modest decline in overall Amazon Prime Video access, this would suggest newcomers to the service are taking the ad tier’.

Meanwhile, and Disney+ trailed behind Amazon in adtier subscribers but demonstrated stronger growth rates. Netflix’s ad tier reached 4.7 million households, up 24% from

The MENA region is becoming an increasingly attractive market for streaming and media companies, with subscription video-ondemand (SVOD) revenues expected to exceed $1.2 billion by the

Over the past three years, YouTube has paid out more than $70 billion to creators, artists, and media companies, solidifying its position as a cornerstone of the digital creative economy. In 2023 alone, the platform generated $31.5 billion in ad revenue, underscoring its dominance in the online video space.

What began as a platform for anonymous, user-generated content has evolved into a sophisticated ecosystem where creators operate like mini-studios, complete with production teams, advertisers, and agents. According to a report by , the service

now supports 150,000 jobs worldwide, reflecting its transformation into a major industry player.

Pedro Pina, Head of , emphasized the platform’s pioneering role in sharing revenue with creators. ‘YouTube has been the pioneer of a new creative economy. It’s the first and only platform that shares its revenue with creators, he said recently on a interview. This model has not only empowered individual creators but also spurred the growth of a new media landscape, where content production has become increasingly professionalized.

Spain: A YouTube powerhouse

Spain stands out as a key player in the global YouTube ecosystem. Creators like AuronPlay and have dominated the Spanish-speaking world for over a decade, helping to export Spanish content to Latin America and beyond. Pina

ZDF Studios operates across three main genres: drama, junior, and unscripted, regarding acquisition and distribution of its catalogue of original, coproductions or third-parties. Linette Zaulich, Manager of Unscripted for VoD & B2C Channels, is at the forefront of the area, overseeing FAST channel strategy and ensuring content reaches audiences through multiple platforms.

Linette Zaulich, Manager of Unscripted for VoD & B2C Channels

Offers and indentify content within the German market differs significantly from international sales, explained Zaulich during an interview. ‘We’re lucky enough to have the ZDF brands, which are well-known and sought-after for FAST channels’. However, aligning with the broadcaster’s strategy remains crucial in the domestic market. ‘We have to ensure that our approach complements the public broadcaster’s interests’.

Internationally, the company has more flexibility. ‘I have the freedom to monetize across different platforms—AVOD, FAST, SVOD—without limitations’, she said. However, global markets present a different challenge: ‘We don’t have a vast

Continue Reading

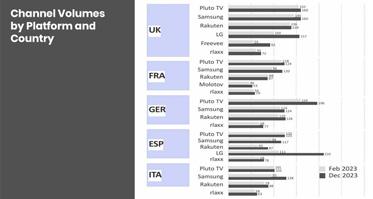

Rakuten TV has evolved significantly since its launch in 2013 as a transactional TVOD service. Today, the platform combines this business model, AVOD, and FAST channels, offering a diverse content ecosystem to over 140 million households across 43 European territories. , Chief Content Officer at Rakuten TV, recently shared insights into the platform’s growth, challenges, and strategies for the future.

The service began as a TVOD service, providing users with the latest movie releases to rent or purchase. However, in 2019, the

French media group it’s about to complete a year since the launch of its free streaming service, , which marked a significant step on its digital transformation strategy.

‘Given the challenges that lie ahead and the giants that surround us, embodies our ambition to become the obvious choice for online entertainment for the French’, said Nicolas de Tavernost, Chairman of the Executive Board. ‘We have invested in technology, exclusive content, and a quality user experience. Our ambition is big, but it is rooted in our history and fueled by our passion for TV’.

Doubling content, expanding reach is designed as an AVOD platform that is significantly expanding the group’s digital content offering. The company aims to double the amount of free programming available to 30,000 hours within a year, including 10,000 hours of exclusive content. The service boasts an extensive catalog, featuring 300 films per year, 11,000 hours of series from major studios such as Disney, CBS, Sony, and Paramount, as well as a substantial offering of reality shows, youth programming, and original Nicolas de Tavernost, Chairman

of the Groupe M6 Executive Board

Continue Reading

platform expanded its offerings to include AVOD and FAST services, responding to the growing demand for free, ad-supported content. Today, OTT boasts 10,000 AVOD titles and over 500 FAST channels, including 100 owned and operated (O&O) channels tailored to key markets like Western Europe, the Nordics, the Netherlands, and Poland.

‘FAST has become a cornerstone of our business’, explained. ‘It complements our TVOD and AVOD offerings, giving users the freedom to choose how they want to consume content— whether they prefer to buy, rent, or watch for free with ads’. In fact, the executive attributes Rakuten TV’s success in the FAST space to three key pillars: scale, ad monetization, and content expertise.

Regarding scale pillar, the service’s decade-long partnerships with TV manufacturers and device providers have enabled the platform to reach millions of households. Its

DAZN is today one of the leading streaming platforms in the sports segment. The company recently released an update outlining its strategy, milestones, and financial performance for the past year. The report highlights significant growth in revenue, user engagement, and market expansion, as well as key partnerships and acquisitions that position the company as a major player in the

Kerrie McEvoy, Head of Factual Channels for Discovery Networks in EMEA with focus on CEE Market, at Warner Bros. Discovery

Discovery Channel is celebrating its 40th anniversary since global launch, and its legacy of long-running factual entertainment remains stronger than ever. , Head of Factual Channels for Discovery Networks in EMEA with focus on CEE Market, at Warner Bros. Discovery, during recent edition of NEM

Continue Reading

sports entertainment industry.

In 2024, DAZN streamed over 90,000 live events across more than 200 markets, reaching an audience of over 300 million regular viewers. The company credits its success to its ability to introduce viewers to new sports, experiences, and brands. ‘The scale that an audience of over 300 million regular viewers affords enables DAZN to successfully introduce its customers to new sports, experiences, and brands’, the company stated.

Financially, the platform has seen substantial growth. Between 2021 and 2024, the company more than doubled its revenues to $3.4 billion, with projections to reach $6 billion by 2025. This growth has been driven by strategic investments, unbundling sports content, and introducing tiered subscription models.

Continue Reading

Arelys Carballo, VP of Programming at ViX

ViX (TelevisaUnivision), is reshaping its content strategy following a significant internal restructuring. The company is now prioritizing content that aligns with a ‘windowing’ model—leveraging its multiple distribution channels, including

Continue Reading

Starz ON is one of the best performing services in the MENA market (cuadro en el drive. Quitarle el titulo y dejarle la fuente)

On a recent interview, Sunil Joy, Head of Content and Strategy at eVision, the media and entertainment arm of e& (formerly Etisalat Group), shared insights into the company’s transformation and its latest initiatives. With over two decades of experience in the media industry, Joy has played a pivotal role in shaping company’s journey, from launching

Continue Reading

Revolving around the financial strategies of broadcasters and platforms in supporting Spanish cinema, José Pastor, Director of Film and Fiction at , recently shed light on the public broadcaster’s approach to the market, while also speaking about the company’s strategy in the feature film segment.

As a public broadcaster, is legally required to allocate 6% of its revenue to European productions, with 45% of Continue Reading

’s focus in APAC is paying off, with the region leading global subscriber growth for the streaming giant. In Q3 2024, the region added 2.28 million net subscribers, outpacing Europe, EMEA with 2.17 million and significantly surpassing the US and Canada, which saw only 0.69 million net additions. Latin America, meanwhile, experienced a slight decline.

This subscriber boost contributed to streamer’s overall growth, bringing its total global subscribers to 282.7 million and driving a 15% year-over-year revenue increase to $9.8 billion. Co-CEO Gregory K. Peters credited the company’s ‘decade-plus investment in creative communities’ across APAC as a key factor

Continue Reading

For MipLondon 2025 edition, Prensario International reviews a special survey made by RX into the mindset of top content buyers and commissioners, and what they are looking at the international markets.

Director Acquisitions & Distribution Investment

• Editorial strategy: We serve as preferred partner for broadcasters and platforms around the world as a one-stop-shop for high quality content offering a wide range of titles from all genres: Blue-Chip Documentaries, TV-Series and Movies, Children’s Programs, Music as well as scripted and non-scripted Formats. We are looking for projects that are in an early stage of production, with a strong international focus and matching withour preferred genres.

• Projects/Programs search: Blue Chip 4K Documentaries. Nature & Wildlife. Sustainability & Conservation. History & Ancient. History Science. Reenacted History and Archive Driven Content.

• Acquisition territory: North America, Europe.

Head of content

• Editorial strategy: Channel dedicated to history in the broadest sense, from ancient civilisation to present wars, and from geopolitics to arts and culture. Mainly through documentaries but also some fiction.

• Projects/Programs search: We look for original, momentous and sharp content proving that history is exciting and significant for us all. We acquire, prebuy and coproduce, also on an international level.

• Acquisition territory: Asia, North America, Europe.

Senior Executive in Charge of International Co-Productions and Acquisitions.

• Editorial Strategy: When measured by ratings and audience satisfaction YLE is the number one multi-platform destination for Finnish Kids. It transmits annually over 1300 hours of children’s programming for a two- to 12-year-old audience on linear tv, FVOD service YLE Areena and YLE’s add-free YouTube Channels. Pikku Kakkonen - magazine show is one of the biggest brands at YLE. Its main focus is the 3-6 y old kids. It reaches about 55% of the target group every week on linear television. For the 7-12 y old kids YLE has an interactive brand-named Galaxi. It reaches about 10% of its target group every week on linear tv. Galaxi universe can be found on www.yle.fi/galaxi. Buu-Klubben is aired by the Swedish-speaking channel YLE Fem. Its main focus is the 3-7 years olds. YLE’s FVOD service Areena gets about 4 Mio starts on kids programming per week (population of Finland is 5,4 Mio).

• Projects/Programs search: I am looking for content that will enhance YLE’s offering for kids. The shows need to entertain, bring laughter and awoke curiosity. For preschoolers the top priorities are diversity, bravery as well as enhancing emotional and social skills. For school kids we are also looking for themes like mental health and coping with difficult topics as poverty, loneliness and bullying.

• Acquistion territory: Europe, Asia, North America.

Editor children’s acquisitions

• Editorial strategy: FAST TV. Revenue share model.

• Projects/Programs search: All kind of genre.

• Acquisition territory: Asia, Middle East. Director of content channels, business development

• Editorial strategy: Public TV, Broadcaster.

• Projects/Programs search: Kids programs, target audience 2-10 years.

• Acquisition territory: North America, Europe.

Expand audience reach, increase engagement, and boost monetization

Scan here

Head of acquisitions

• Editorial strategy: LRT is a public broadcaster. The foreign production is broadcasted on LRT TV and LRT PLIUS.

• Projects/Programs search: The priority is given to drama and documentaries applicable to all the family. On the main channel we have got 5 daily daytime series. Weekends go for day time series and movies. The prime time series slot at 11.00 pm. is more focused to action, thrillers, male target.

• Acquisition territory: Europe.

Editorial strategy: streaming. Projects/Programs search: broad entertainment, broad scripted. Acquisition territory: Europe. Head of content and programming.

Head of acquisitions Rai Kids

• Editorial strategy: Rai Ragazzi is the department for children and kids of Rai, italian pubblic broadcaster, operating the 2 free-to -air channels Rai Yoyo and Rai Gulp and providing content for the linear channels, the Rai free VOD digital platform and Rai Yoyo app. Our editorial strategy is offering to the young italian audience the best programmes from the international market.

• Projects/Programs search: We are looking for Animation, kids drama – series and miniseries - and formats with a strong storytelling, mostly european content. We offer to kid’s audience shows to entertain as well as raise curiosity, openmindedness, emotional and social skills.

• Acquisition territory: Europe.

• What is your editorial strategy?

• What type of projects/programs are you looking for?

Head of development

• Editorial strategy: RTL Deutschland, together with Gruner + Jahr, is Germany’s leading entertainment company, spanning all types of media: TV and streaming, print and digital, radio and podcasts. It is home to some of the country’s strongest media brands, from RTL and VOX to Stern, Brigitte and Geo to NTV, and operates Germany’s largest streaming platform, RTL+, with > 2.4 million subscribers. RTL Deutschland stands for positive entertainment and independent journalism, employing around 1,500 journalists covering all the issues shaping contemporary society. Encompassing everything from news to sport, living to lifestyle, and women to family, RTL Deutschland reaches 99% of the German population.

• Projects/Programs search: Unique and scaleable non-scripted primetime formats for TV or online programming that are adaptable for the German territory.

• Acquisition territory: Europe, Asia, North America, Latin America, Oceania.

Director of acquisitions and co-productions

• Editorial strategy: We are a mainstream public broadcaster with the largest share of audience in Ireland. Commissioning and coproducing Irish programming across all key genres is unique selling point. However, we do also acquire movies, drama, comedy, natural history, documentaries, lifestyle and kid’s content.

• Projects/Programs search: Stand out drama series. New and library feature films. 1/2-hour comedies. Blue chip natural history. Documentaries. Lifestyle series. Kids live action and animation.

• Acquisition territory: Europe.

During MIP London 2025, Broadcast Program Export Association of Japan (BEAJ) along to Ministry of Internal Affairs and Communications (MIC) is set to host a deep dive into the country’s expanding entertainment industry with the sessions “Fresh TV Japan” and “The Japan Effect: The Rising Global Influence”. Taking place on Tuesday, February 25, at the Turing Theatre, these special sessions explore the factors driving the success of Japanese intellectual property worldwide and the evolving landscape of co-production opportunities.

Fresh TV Japan: a showcase of innovation

The event will kick off with “Fresh TV Japan”, presented by , CEO of The Wit. The executive,

Continue Reading

Channel 4 has significantly expanded its digital footprint over the past year, with YouTube viewership of full episodes from its most popular shows more than doubling. Series like First Dates, Murder Case: Digital Detectives, and Grand Designs have played a

Continue Reading

, through its subsidiary Rai Com, maintains a significant presence in international broadcasting, connecting Italians worldwide with their homeland. With a reach spanning

Continue Reading

Currently, OTTera is one of the most prominent companies providing monetization and development solutions for the streaming sector. The company has been actively

Continue Reading

With different worldwide business units,

Limited is present at MIP London 2025 to highlight its catalog of local dramas that fit perfectly with the storytelling needs of the global market.

Continue Reading

Distributor and producer arrives in London to participate in the MIP market, highlighting two titles that reflect its versatility in content production: the romantic series Dating in Barcelona and the sports documentary Matador

Continue Reading

eSteno, the Chilean company with over 25 years of experience in closed captioning, subtitling, translation, and transcription, has begun its journey through the 2025 audiovisual

Continue Reading

arrives at MIP London with a slate of reality formats that mix competition, strategy, and social dynamics. The South Korean

Continue Reading

Globo arrives at the first edition of MIP London with momentum, following the announcement of its latest international collaboration. The Brazilian media giant has teamed up

Continue Reading

At MIP London 2025, Kanal D presents a lineup of drama series reflecting the evolving landscape of Turkish storytelling. The slate includes new productions

Continue Reading

By Deeny Kaplan - We are all taking a chance. We are gambling on the success of the past , very productive, conclaves, traditionally held in Cannes, France.

Continue Reading

RCN Colombia, through its RCN Studios, hosted the largest cocktail event at the recent edition of Content Americas in Miami, bringing together top executives led by its president,

Continue Reading

StudioCanal, the production and distribution arm of Canal+, has announced two key leadership appointments, effective March 1, as part of its international growth

Among recent deals, has secured a new licensing agreement with for Valley of Hearts, the latest drama from . Premiering internationally at MIPCOM, the series has quickly become one of Turkey’s top-rated dramas, featuring a cast that includes Ece Uslu, Aras

Aksum.

Since its debut, Valley of Hearts has attracted strong international interest, leading to multiple sales across various regions. has confirmed that additional licensing agreements are in the final stages of negotiation.

The deal strengthens ’s ongoing partnership with , which previously acquired Deception, another title. Following its success,

Continue Reading

Continue Reading

presents a diverse lineup at MIP London 2025, featuring documentary investigations, innovative formats, and compelling drama series.

Among the highlights is Irresistible: Why We Can’t Stop Eating, a documentary examining the influence of ultra-processed foods on global eating habits. Produced by Lion TV and Yap Films in collaboration with BBC, Canada’s CBC, and France’s , the film delves into the science behind their appeal and the cultural shift they have created.

In entertainment formats, Bad Boyfriends offers an unconventional take on relationship improvement. Created by Optomen, the show sends unsuspecting boyfriends to a tropical destination, where they must undergo a series

Continue Reading

Turkish distributor has announced new international sales for four of its latest drama series: The Good & The Bad, Leyla, Far Away, and Portrait of a Scandalous Family

Continue Reading

BBC Studios has announced a multi-year partnership with Banijay Asia, to adapt and produce its renowned unscripted and scripted formats for Indian audiences. This collaboration

Continue Reading

Universal Cinergia, the leading company in language dubbing and media localization, has announced that it has been awarded Amazon’s Preferred Fulfillment Vendor status for its studios in the

Continue Reading

continues to consolidate its presence in the audiovisual market with an outstanding creative output. The Austrian company, renowned for its ability to combine quality and volume

Continue Reading

Production (WBITVP) has announced the launch of a new production company in Italy, marking its 15th production territory and its 22nd company worldwide.

Continue Reading

attends MIP London with a curated lineup aimed at showcasing its pivot toward focused content genres, particularly in travel and food. For this category, has

Continue Reading

arrives at first edition fo MIP London with a diverse lineup of series and documentaries, part of its recent productions. Among the highlights is Ena: Queen Victoria Eugenia, a historical

business

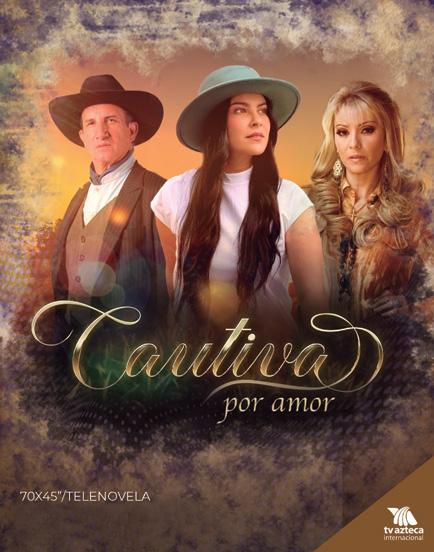

This year, TV Azteca is emphasizing its major prime-time premieres in Mexico, as well as its newly structured distribution and international alliances, now led by Jesica Stescobich.

With a diverse catalog of entertainment titles and live programs, including the 25th Annual Latin , Alfred Haber Distribution is strengthening its

kicks off the market season in Europe by participating in MIP London 2025. Under the leadership of its CEO, Ana Cecilia Alvarado, the company aims to showcase the vast

At MIP London 2025, distributor presents two of its most prominent titles: Dilemma and 6 of Us. Both productions have made a significant impact on international markets and continue to establish

Calinos Entertainment presents two powerful drama series, Ana and Love with Lavender Scent, at MIP London 2025, reinforcing its reputation for compelling storytelling.

As part of the new productions announced recently, Newly Rich, Newly Poor is one of the titles Caracol TV is showcasing at MIP London 2025.

The telenovela is based on the company’s classic series, originally produced by Caracol Televisión between 2007 and 2008, which gained significant international recognition, including multiple nominations at the TVyNovelas Awards and the India Catalina Awards. Continue

TF1, France: Elizabeth Durand, general director, Sophie Leveaux, artistic director of International acquisitions and co-productions, Benjamin Cappele, deputy creative head of acquisitions, Gregoire Delarue, acquisitions director, Fabrice Bailly, programming & acquisition director, Xavier Gandon, acquisitions

UK: Polly Scates, head of acquisitions, Channel 4 (UK); Harriet Armston-Clarke, senior global acquisitions manager, Richard Watsham, chief creative officer, Emma Ayech, channel director, drama and alibi, inclusion advocate, all from BBC/UKTV

Main UK brodcasters: Paul Mortimer, controller of digital channels, ITV, John Peek, head of operations, Tomorrow TV, Nick Lee, head of international acquisitions, Channel 4, Grace Coleman, head of scheduling, BBC 2&4, Sasha Breslau, head of content acquisitions, ITV

Dutch

VP

Group (Nordic, Baltics); Bastiaan Van Dalen, head of content strategy, Lisa Paulet Vos, manager global acquisitions, Nicky Jaffarian, global acquisitions, all from Talpa Networks (Netherlands)

Jennifer Harrington, acquisitions, Fleur Fahey, director of content acquisitions, both from Foxtel Group (Australia); David Smyth, EVP content partnerships, Fox EG (USA); Alexandre Coscas, exe producer, Aidan Heatley, executive producer, both from Timeless Pictures (Canada); Laura Gaines, acquisitions manager, Hallmark Media (USA).

The buying and production team of Nippon TV, Japan: Kotoko Fujita, producer, Katsunori Kurokawa, content director, Ryutaro Hirose, director, Megumi Hisamichi, senior manager, programming & platform strategy, Mayuko Sakakibara, producer

Hadi Leclercq, head of acquisitions, Sky (UK); Fabian Stein, head of content, Sky (Switzerland); David Smyth, EVP content sales & partnerships, Fox (USA); Facundo Bailez, head of acquisitions, Sky (UK); Simona Argenti, SVP content sales EMEA, Fox EG (USA).

NHK Japan, drama programs department: ThKeiko Tsuneki, senior producer Center 4, Koji Sakabe, senior producer Center 4, Keiko Tanaka, contractor, Genichiro Kachi, producer, Shunichi Uchida, producer

of

& acquisitions,

Kristen Finy, EVP international programming, Disney.

Warner Bros Discovery, Europe: Tom Savage, VP legal affairs, WBD UK; Guillaume Le Gross, general director, programming & acquisitions, France; Helene Goujet, VP of acquisitions, HBO Europe