convenience.org Advancing Convenience & Fuel Retailing JULY 2023 TRENDSETTERS Find (and profit from) hot new products IS IT OVER YET? Category managers find ways to battle inflation July 1 Creative Ice Cream Flavor Day September 22 Ice Cream Cone Day July 16 Ice Cream Day for That There’s a

Help responsibly connect & engage with your ATCs 21+ in the digital environment

• Establishes a digital foundation to optimize the ATCs 21+ journey

• Enables an integrated marketing approach for your ATCs 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Invest in digital infrastructure that responsibly optimizes & enables new channels for ATCs 21+ experiences

Enhance your retail digital capabilities & build a foundation of responsibility to meet the evolving ATCs 21+ expectations & improve their experiences

30

Get In on the National Day Craze

C-stores are tying food and drink deals to microcelebrations— and it’s working.

46

Category managers are staying nimble in the face of ongoing inflation.

50

Trendsetters

Here’s how c-store retailers—big and small—keep their shelves stocked with the latest products.

54

Clear the Clutter: Rethinking Merchandising

Are you bombarding customers with too many product choices?

NACS JULY 2023 1 Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily STAY CONNECTED WITH NACS @nacsonline facebook.com/nacsonline instragram.com/nacs_online linkedin.com/company/nacs 38 On the cover: Pixelliebe/Shutterstock. This page: Africa Studio/Shutterstock ONTENTS NACS / JULY 2023

FEATURES

Is It Over Yet?

Customers Want Today’s hottest products can help you boost unit sales.

Selling the Brands Your

IT’S A FACT

$3,977 the average per store, per month sales of frozen dispensed beverages in 2022

CATEGORY CLOSE-UP PAGE 66

ONTENTS NACS / JULY 2023

DEPARTMENTS

06 From the Editor

08 The Big Question

10 NACS News

18 Convenience Cares

20 Inside Washington Building strong coalitions is one way NACS advocates for the convenience industry.

28 Ideas 2 Go

Wally’s locations are 10 times the size of traditional c-stores to accommodate more foodservice, bathrooms and merchandise.

62 Cool New Products

64 Gas Station Gourmet Ozarks TravelCenter has a winning recipe for success … and a winning recipe for brisket.

66 Category Close-Up

Customers love the flavor, the fun and even the brain freeze of frozen dispensed beverages, while packaged beverages remain vital to c-store profitability.

80 By the Numbers

2 JULY 2023 convenience.org

presence of an article in our magazine

to constitute an expression of the association’s view. PLEASE RECYCLE THIS MAGAZINE PhotoMavenStock/Shutterstock

The

should not be permitted

v . / f ff Fu N 3 A / f E / ’ v W ’ L R v fi Z E T ’ q L ff -’ T W E A

EDITORIAL

Jeff Lenard V.P. Strategic Industry Initiatives (703)518-4272 jlenard@convenience.org

Ben Nussbaum Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Lisa King Managing Editor (703) 518-4281 lking@convenience.org

Sara Counihan Contributing Editor (703) 518-4278 scounihan@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Sara Counihan, Sarah Hamaker, Al Hebert, Pat Pape

DESIGN Imagination www.imaginepub.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

NACS BOARD OF DIRECTORS

CHAIR: Don Rhoads, The Convenience Group LLC

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Varish Goyal, Loop Neighborhood Markets; Brian Hannasch, Alimentation Couche-Tard Inc.; Chuck Maggelet, Maverik Inc.; Ken Parent, Pilot Flying J LLC; Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

PAST CHAIRS: Jared Scheeler, The Hub Convenience Stores Inc.; Kevin Smartt, TXB Stores

MEMBERS: Chris Bambury, Bambury Inc.; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC

NACS SUPPLIER BOARD

CHAIR: Kevin Farley, GSP

CHAIR-ELECT: David Charles Sr., Cash Depot

VICE CHAIRS: Josh Halpern, JRS Hospitality; Vito Maurici, McLane Company; Bryan Morrow, PepsiCo Inc.

PAST CHAIRS: Brent Cotten, The Hershey Company; Drew Mize, PDI Technologies

MEMBERS: Tony Battaglia, Tropicana Brands Group; Alicia Cleary, Video Mining LLC; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo Reynolds; Mark Falconi Oberto Snacks Inc.; Mike Gilroy, Mars Wrigley; Danielle Holloway,Altria Group Distribution Company;

Terry Gallagher, Gasamat Oil/ Smoker Friendly; Raymond M. Huff, HJB Convenience Corp. dba Russell’s Convenience; John Jackson, Jackson Food Stores Inc.; Ina (Missy) Matthews, Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Charles McIlvaine, Coen Markets Inc.; Lonnie McQuirter, 36 Lyn Refuel Station; Tony Miller, Delek US; Jigar Patel, FASTIME; Robert Razowsky, Rmarts LLC; Richard Wood III, Wawa Inc.

SUPPLIER BOARD

REPRESENTATIVES: David Charles Sr., Cash Depot; Kevin Farley, GSP

STAFF LIAISON: Henry Armour, NACS

GENERAL COUNSEL: Doug Kantor, NACS

Jim Hughes, Krispy Krunchy Foods LLC; Kevin Kraft, Q Mixers; Kevin M. LeMoyne, Coca-Cola Company; Lesley D. Saitta, Impact 21; Sarah Vilim, Keurig Dr Pepper

RETAIL BOARD

REPRESENTATIVES: Scott E. Hartman, Rutter’s; Steve Loehr, Kwik Trip Inc.; Chuck Maggelet, Maverik Inc.

STAFF LIAISON: Bob Hughes, NACS

SUPPLIER BOARD

NOMINATING CHAIR: Kevin Martello, Keurig Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

COME TOGETHER. DO MORE. Join us at conveniencecares.org / JULY 2023

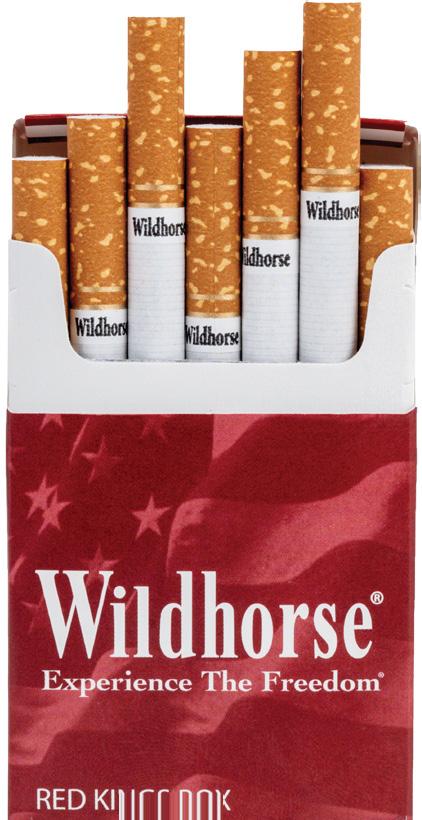

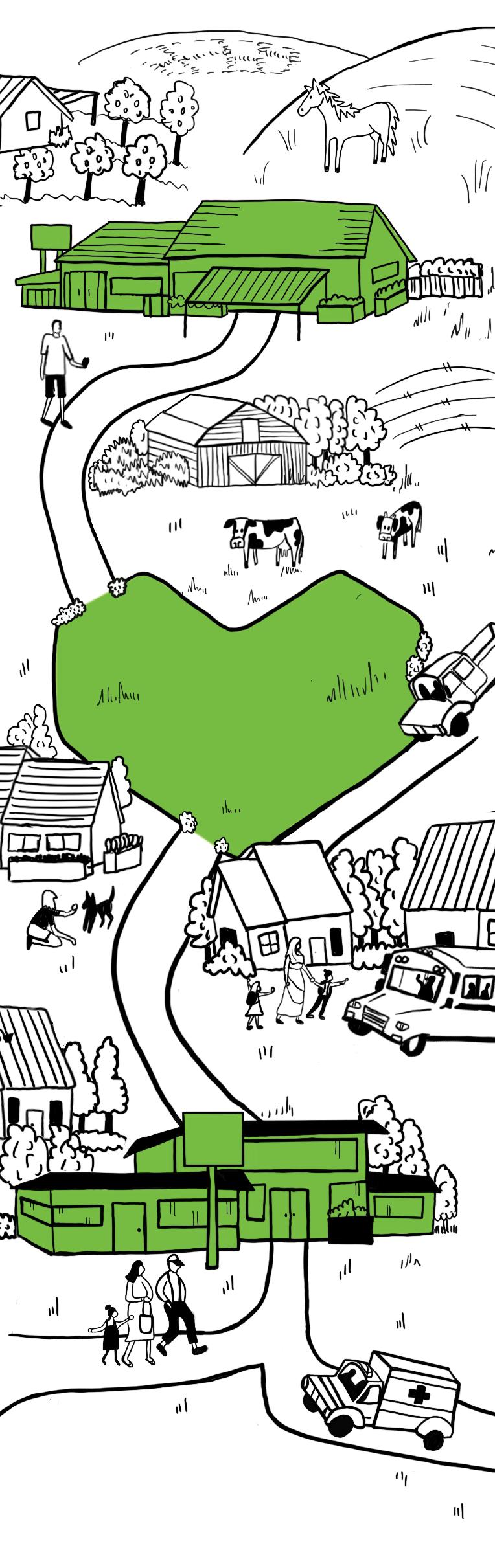

Premier Manufacturing:

Bran s Built on Integrity

Owned by a cooperative of proud American farmers using the best U.S.-grown tobacco blends among their competitors, Premier provides high-quality, value-priced cigarette brands for the adult consumer. C-stores across the country are buying in.

Commitment to Quality

Premier Manufacturing, Inc. is the consumer products division of U.S. Tobacco Cooperative Inc. (USTC), an American grower-owne marketing cooperative base in Raleigh, NC.

500+ member farmers throughout the Southeast

Members maintain GAP Connections Certification Standards Ensures sustainable, ethical agricultural practices

Robust Partnerships

Premier’s support staff pri es itself on meeting customer goals with seamless execution in achieving the highest regulatory standards.

• Provides sales/service support across the U.S.

• Develops POS materials for high visibility

• Creates custom sales & merchandising programs

• Maintains strong relationships with top distributors

Trackable process includes all aspects of manufacturing under one roof Tobacco processing & stemmery Primary blending / Cigarette finishing

A Cut Above the Rest

All products made in USA & 100% guaranteed

Premier pro ucts use only top-en tobacco blen s.

The finest flue-cure tobacco in the worl

• All U.S. grown

• Environmentally sustainable

• Compliant with every regulation

The best blen among competitors

• Highest concentration of flue-cured tobacco

• Partners with top national and regional retail chains

• Vibrant color

• Blends provide exceptional aroma and flavor experience

Manufacture on in ustry-lea ing equipment

• Laser perforation

• Inked code dating

• Latest high-tech advancements

Your Truste Premier Brands Choose the brand that suits your loyal consumers. Each brand features a variety of styles to satisfy every taste. Contact Premier Manufacturing to ay! www.gopremier.com/contact

Focus on Fun

One of my favorite insights in this issue of NACS Magazine is in our cover story, “Get In on the National Day Craze.”

It’s from Jeff Hoover of Paytronix, who says these national days (think National Hot Dog Day or National Ice Cream Day) bring “new news to talk about.”

New news: Something a little different, just quirky and fun enough to prompt the customer to buy a soft pretzel on National Pretzel Day instead of a bag of chips or to eat fried chicken for lunch on National Fried Chicken Day instead of a sandwich.

An observation I hear occasionally from my NACS co-workers is that, at the end of the day, convenience stores are fun. That rings true for me: The c-store in my neighborhood might be the only store I go to regularly where shopping doesn’t feel like a chore.

My local c-store is always bright and colorful. The clerk I see most often knows me and is friendly. I’m in and out as quickly as I want to be. Sometimes I can’t resist an impulse item that seems … fun, maybe some new flavor I haven’t seen before.

I’m still pretty new at NACS, but I was initiated into the world of convenience stores years ago. When I was 19, I spent a summer working as a cashier at a Kum & Go in Grinnell, Iowa, the town where I went to college. I stayed on part time for a few months after school started, working second shift on the weekends.

I loved working there. I found it incredibly interesting because of the customers, many of whom came in frequently enough that felt like I got to know them. I think I learned more standing behind the register than I did in any of my classes that year. But most

of all the experience of working there was … fun. People came in with a smile on their face and left with a smile on their face.

Of course, operating c-stores is serious business. It takes a lot of hard work to make shoppers happy. This issue is packed with content of special interest to category managers, the decision-makers who take the lead in figuring out how to delight customers.

“Is It Over Yet?” looks at how category managers are navigating the ongoing effects of inflation. “Trendsetters” examines how they keep their assortments fresh. And “Selling the Brands Your Customers Want” gives category managers the scoop on the top brands, including which are trending up.

Going back to the idea of fun, be sure to check out our Ideas 2 Go profile of Wally’s, a retailer making big waves in Illinois and Missouri by making its stores quirky, colorful and memorable— especially for road trips.

Thanks for reading. And if you have a minute, let me know what you think of this issue by sending me a note at bnussbaum@convenience.org.

Ben Nussbaum Editor-in-Chief

6 JULY 2023 convenience.org

LauriPatterson/Getty Images Want to sell more hot dogs? Try celebrating National Hot Dog Day (July 19).

UP FRONT FROM THE EDITOR

It takes a lot of hard work to make shoppers happy.

UP FRONT THE BIG QUESTION

Let me give one example: When I started in this industry, Wawa did not sell gas. Now they sell massive amounts—yet I can also see a time when Wawa will no longer sell gas and will focus on EV charging or other fuels.

In the early 1990s, convenience stores were primarily small, independently owned businesses. NACS member leaders ran their businesses and were highly entrepreneurial. They also focused on relationships, whether in communities or in the industry. Those relationships fused our organization together, and that personal connection continues to hold tremendous value in how we view NACS and the industry today.

What changed? With success, those smaller operators got larger, and their sophistication helped reimagine convenience. Sheetz wanted to become the company that put Sheetz as we knew it out of business. That’s a radical concept that pushed innovation around how it interacted with customers, focusing on customization and made-to-order foodservice. Sheetz also put a focus behind the scenes, adopting computerized inventory systems, improving efficiency and selfdistribution to ensure popular items were always in stock.

Outside our channel, indirect competitors started to become

How has the industry changed over the past 30 years?

direct competitors. Hypermarkets set their sights on our gas business. Supermarkets and big-box retailers put more of a focus on convenience in their stores, and even launched their own convenience store concepts. Some of our new competitors succeeded. Many did not. The problem was they were replicating what they saw as the convenience model, but our industry was reinventing itself yet again, with a focus on enhancing the overall customer

experience, providing clean and well-lit environments, introducing loyalty programs and offering freshly prepared food options. And a big focus on nice, clean restrooms—no more restroom keys for customers attached to 2x4s.

The smartphone also revolutionized our industry, and that doesn’t mean that it was all for the better. When I started at NACS, a top traffic driver to c-stores was drivers getting lost and asking for directions— or buying maps. Camera film was a big seller, and so were greeting cards. The smartphone wiped out all of that in about a decade, and the Internet took a big bite out of magazine and newspaper sales. But that spurred another reinvention. Many stores introduced mobile apps that allowed customers to locate nearby stores, browse promotions and make mobile payments. This digital transformation made transactions more seamless and convenient for consumers.

The past decade we’ve seen our industry pivot around big, emerging trends, especially healthy choices. In the early 1990s, you never saw fresh fruits, vegetables, salads or organic snacks in stores. Today, customers increasingly expect them. Similar innovation happened with beverages—flavored water, functional beverages, kombucha, you name it.

On the surface, over the past 30 years everything’s changed. But really nothing has changed. Our industry remains highly entrepreneurial. We focus on our ever-changing customers’ needs, and our success is tied to our willingness to share great ideas with each other and to collaborate with our supplier partners. But if I were to boil the past 30 years down to one word, which will probably define our next 30 years as well, it’s the word “fun.”

When you genuinely like what you do and who you work with and believe in what we can all achieve together, a lot of great things can happen in what feels like a blink of an eye.

8 JULY 2023 convenience.org

Brian Kimmel, NACS EVP, COO and CFO In May, Brian celebrated 30 years as a member of NACS staff.

ZIP UP BEVERAGE PROFITS

Z I P

With The Most Versatile System for Grab-and-Go Beverage Sales.

® is a modern merchandising system that forwards and faces its product offerings at all times. Quickly add new facings with this cost-effective easy to install and adjust system. Trion Industries, Inc. TrionOnline.com/ZipTrack info@triononline.com

ZIP

Perfect for all beverages including alcohol Use in multiple storewide categories SELL IT 3

IT 1 FILL IT 2 Use actual product to set lane width. Slide product front-to-back to ‘ZIP’ tracks together in final position. Fill it with product. ZIP Track® maintains its width accurately for the entire length of facing without the need for a rear anchoring system. Deploy ZIP Track® for many different size and shape beverages. CUSTOM DEPTH ADJUSTABLE SPRING TENSION ADJUSTABLE WIDTH 2.00”- 3.75” 7 tensions match any shelf depth ©2022 Trion Industries, Inc. 800-444-4665 Adaptable, multi-use Zip Track ® system handles different size and shape packages with ease.

ZIP

NACS Show Registration Is Open

The NACS Show is back in Atlanta in 2023. From thousands of products to top-notch education sessions led by industry thought leaders, you don’t want to miss this year’s event. And don’t forget about the invaluable opportunity to tap into a co-learning network of 20,000+ attendees. When our industry wins, everyone wins.

Full conference registration includes access to all general sessions, education sessions, expo and the NACS Show Kick-Off Party taking place on Tuesday, October 3 from 5:30 p.m.-7:00 p.m. at Mercedes Benz Stadium (located next door to the Georgia World Congress Center, the location for the NACS Show).

There are also one-day registration options available for buyers only:

10 JULY 2023 convenience.org UP FRONT NACS NEWS

• Wednesday one-day registration : Includes access to all education sessions and general sessions on Tuesday and Wednesday, the expo on Wednesday and access to the NACS Show Kick-Off Party Tuesday, October 3 from 5:30 p.m.-7:00 p.m. at Mercedes Benz Stadium. Note: You must be 21 years of age or older to attend the Kick-Off Party. ID (with proof of age) is required to access the event.

• Thursday one-day registration : Includes access to all education sessions, general session and expo on Thursday.

• Friday one-day registration : Includes access to the general session and expo on Friday. Visit www.nacsshow.com/register to register today!

NACS Food Safety Forum

Now in its second year, the NACS Food Safety Forum—the only industry-specific event of its kind for the global convenience retail community—will take place on October 3, 2023. The Forum will be co-located at the NACS Show in Atlanta.

Foodservice sales in convenience stores are about 26% of in-store sales. It’s a category that continues to be a key focus area for retailers, representing an impressive 36.1% of inside gross margin in 2022, according to NACS State of the Industry data. Food safety is paramount, as outbreaks affect not only individual brands but the entire industry.

Join convenience retail food safety, foodservice, quality assurance and risk management professionals at the NACS Food Safety Forum. This event is tailored to global convenience retailers who are leading their company’s food safety and food handling procedures and protocols.

Participants can expect to achieve the following objectives:

• Understand how food safety culture can support, align with and contribute to your company’s vision and mission.

• Learn how to communicate the why behind food safety protocols and how certain behaviors can enhance and protect your people, your customers and your brand.

• Discover collaborative solutions to the safe food handling challenges of today and the future.

Food safety is not a competitive advantage—it’s how foodservice will continue to elevate the industry. Register to join your colleagues at the NACS Food Safety Forum at www. convenience.org/education/food-safety-forum

NACS JULY 2023 11 Sean Malloy/Getty Images

Max Your NACS

Did you know NACS retail member companies receive discounted registration rates for the NACS Show?

Becoming a NACS retail member is a business investment that will deliver solutions for your company to thrive today and solve tomorrow’s challenges. Paying less for the NACS Show is just the first benefit.

Plug into the latest insights, trends, tools and innovations from around the globe. NACS makes it easy for you to exchange knowledge and cultivate partnerships with leading retailers and experts in our industry.

All employees of NACS member companies enjoy:

Calendar of Events

2023

JULY

NACS Financial Leadership Program at Wharton

July 16-21 | The Wharton School University of Pennsylvania | Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg

July 23-28 | Kellogg School of Management | Northwestern University | Evanston, Illinois

NACS Executive Leadership Program at Cornell

July 30-August 03 | Dyson School Cornell University | Ithaca, New York

OCTOBER

• Free or discounted rates for reports, resources and a global portfolio of events.

• Members-only access to VIP and industry-leading events, expos and education.

• Personal introductions and representation through our national advocacy.

From Capitol Hill to the forecourt, learn how NACS membership is something your company cannot afford to operate without. For more information on membership dues, applications and more, contact the retail membership team at MaxYourNACS@convenience.org.

NACS Advanced Category Management Certification Course

October 03 | Georgia World Congress Center | Atlanta, Georgia

NACS Food Safety Forum

October 03 | Georgia World Congress Center | Atlanta, Georgia

NACS SHOW

October 03-06 | Georgia World Congress Center | Atlanta, Georgia

NOVEMBER

NACS Innovation Leadership Program at MIT

November 05-10 | MIT Sloan School of Management | Cambridge, Massachusetts

NACS Women’s Leadership Program at Yale

November 12-17 | Yale School of Management | New Haven, Connecticut

2024

FEBRUARY

NACS Leadership Forum

February 13-16 | The Ritz-Carlton

Amelia Island, Florida

MARCH

NACS Convenience Summit Asia

March 05-07 | Signiel Seoul Hotel

Seoul, Korea

For a full listing of events and information, visit www.convenience.org/events.

12 JULY 2023 convenience.org We Are/Getty Images UP FRONT NACS NEWS

NACS JULY 2023 13

Member News

RETAILERS

Steve Ward joined VP Racing Fuels Inc. as director of marketing. With over 30 years of marketing experience across a broad range of product categories, Ward brings a background in product and channel expansions. Most recently, as director of marketing at financial services giant H&R Block, Ward led the vision and strategy for H&R Block web properties.

Darren Rebelez , president and CEO of Casey’s General Stores Inc. now serves a member the Genuine Parts Company’s board of

of Casey’s, Rebelez is responsible for the company’s overall strate gic plan and operating success. Previously, he served in executive roles at IHOP Restaurants, 7-Elev en, Inc., ExxonMobil and Thornton Oil Corporation. Reblelez brings a wealth of experience as a busi ness leader and senior executive in the convenience retail, fuel and restaurant industries.

SUPPLIERS

Scott Erickson, chief technology officer and fourth-generation owner of Harbor Foods, passed away unexpectedly. He began working in the family-owned distribution business back in high school and worked at Harbor in many capacities

Scott was instrumental in taking Harbor from a small, local Aberdeen, Washington, company to a thriving business across the entire West Coast.

Josef Matosevic joined the Electrolux Professional Group Board of non-executive directors. Matosevic brings over 26 years of global operating and business experience and has a strong background from the commercial foodservice equipment industry after his years with Welbilt Inc. Additionally, Helios Technologies, where Matosevic is president and CEO, is a global leader in highly engineered motion control and electronic controls technology for diverse end markets.

Katie Brewer joined Flexeserve Inc. as office manager. Brewer will support the overall growth strategy and spearhead the creation of the company’s U.S. headquarters. Highly experienced in management and operations, Brewer has expertise in client and financial management.

Patrick Walker joined Flexeserve Inc. as vice president of technical service. In this role Walker will oversee third-party suppliers, maintenance and repair services, and training across the technical service

network. Walker will utilize his technical, sales and account management skills to help ensure continuity for a variety of hot food operators.

KUDOS

OnCue convenience stores received 2023 Top Workplaces National Culture Excellence recognition for Compensation & Benefits. Issued by Energage, Top Workplaces awards are based solely on employee feedback. OnCue focuses on building and maintaining a work environment where employees feel engaged, appreciated and fulfilled through strong foundational practices like industry-leading pay, professional development, robust benefits and an employee-sponsored 401k.

14 JULY 2023 convenience.org

NEWS

UP FRONT NACS

Steve Ward

Darren Rebelez

Scott Erickson

Josef Matosevic

Katie Brewer, Office Manager – Flexeserve Inc.

Katie is supporting Flexeserve Inc.’s sales and marketing functions and is also playing an instrumental role in the creation of Flexeserve HQ, which will feature a state-of the-art Culinary

Support Center.

Brewer said: “I’m delighted to join this amazing team, and we have some exciting challenges ahead of us as we establish this incredible brand’s rightful place at the forefront of the American foodservice market.

“I’m passionate about solving complex problems and empowering a team’s progress through excellent organization. This is perfect for Flexeserve, and I couldn’t apply my breadth of skills like this anywhere else.

“I take great pride in being part of something revolutionary. The facility we are creating here in Dallas is unlike anything our market has ever seen. The only comparable location is 5,000 miles away – at Flexeserve’s Global HQ in the UK!”

Building the nerve center

Located less than 10 minutes from DFW Airport, Flexeserve’s forthcoming 8,000 sq ft. U.S. HQ will offer its customers and independent rep partners the freedom to utilize its facilities and inhouse team of world experts – with the latest digital technologies for remote collaboration.

Katie Brewer

Patrick Walker

NACS JULY 2023 15 conexxus.org/join Info@conexxus.org Garnet Sponsors Emerald Sponsors Diamond Sponsors Thank You 2023 Conexxus Annual Sponsors Conexxus addresses technology standards to improve business processes, reduce costs and increase productivity for the convenience and fuel retailing industry.

New Members

NACS welcomes the following companies that joined the association in May 2023. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting www.convenience.org/create-login. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership.

NEW RETAIL MEMBERS

6 Carat Enterprise Inc. Encinitas, CA

Bill Gray Inc. dba Wild Bills New Albany, MS

Corner Store Seminole, TX www.cornerstoretx.com

Figueiredo Branco Belo Horizonte, Brazil FLOW Beverly Hills, CA

Gas King Oil Co. Ltd. Lethbridge, AB, Canada www.gasking.com

Georgia C-Stores LLC Smyrna, GA

Midway Petroleum Group LP Conroe, TX

Narragansett Gasoline Narragansett, RI

R & E Petroleum Harvey, LA

Redbud Retail Inc. dba C Express Norman, OK

Sourdough Fuel Fairbanks, AK www.sourdoughfuel.com

Sunpro dba Sunpro Chevron Springville, UT

Tillamook Farmers’ Cooperative Tillamook, OR www.tillamookfarmerscoop.com

Tommy’s Petroleum LLC Granbury, TX

Valley Petroleum Wilkes-Barre, PA www.valleypetroleum.com

Ware Oil & Supply Company Inc. Perry, FL www.wareoil.com

Zanbaka USA 30 LLC DBA Duke’s Canton, TX

NEW SUPPLIER MEMBERS

Barrier1 Systems LLC Greensboro, NC www.barrier1.com

Basse Nuts Inc. Laval, QC, Canada www.bassenuts.com

Bazo Construction Taylor, MI www.bazoconstruction.com

Biztracker POS Seminole, FL www.biztracker.com

Bollin Label www.bollin.com

Clarity Retail Services West Chester, OH www.clarity-retail.com

Cloverdale Foods Mandan, ND www.cloverdalefoods.com

Columbus Consulting International LLC Columbus, OH www.columbusconsulting.com

DYMA Brands Demotte, IN

Father Sam’s Bakery Buffalo, NY www.fathersams.com

First In Services Marietta, GA www.thefirstinservices.com

FLO EV Charging Quebec, QC, Canada www.flo.com

G.O.A.T. Fuel Inc. Plano, TX goatfuel.com

Giganto Brecksville, OH www.gigantoagency.com

Guangdong OFL Automatic Display Shelf Co. Ltd. Zhuhai, China www.gdofl.com

I Bake Um Pico Rivera, CA www.lahvash.com

Ideal Shield LLC Detroit, MI www.idealshield.com

Illinois Wholesale Cash Register Elgin, IL www.IWCR.com

iVueit Westerville, OH ivueit.com

Lazlo 326 Inc. Alpharetta, GA www.playlazlo.com

Litehouse Sandpoint, ID www.litehousefoods.com

McIntyre Metals Inc. Thomasville, NC www.mcintyremfg.com

Merchants Grocery Co. Inc. Culpeper, VA www.merchants-grocery.com

Microfiber and More LLC Holland, MI www.microfiber4sale.com

Mondoux Confectionery Laval, QC, Canada sweetsixteen.ca

Nature’s Way Green Bay, WI www.naturesway.com

o’sole mio inc Boisbriand, QC, Canada osolemio.ca

PD International Inc. Newnan, GA www.pdinternational-inc.com

PDS Solutions dba PetroDataSync Atlanta, GA www.petrodatasync.com

ProGlove Chicago, IL www.proglove.com

Richelieu Foods Inc. Braintree, MA www.richelieufoods.com

Rise Baking Company Minneapolis, MN www.risebakingcompany.com

S&P Global Commodity Insights Houston, TX www.spglobal.com/commodityinsights/en

Small Refrigerated Trailer Sales LLC Marietta, GA www.smallrefrigeratedtrailersales. com

Solut! Lewis Center, OH www.gosolut.com

The Renegade Group Plano, TX Ticon www.ticon.co

Toshiba Global Commerce Solutions Inc. Durham, NC www.toshibacommerce.com

Valley Inventory Service Fairfield, CA www.valleycount.com

Worcester Industrial Products Leominster, MA www.shortening-shuttle.com

World Kinect Energy Services Doral, FL www.world-kinect.com

16 JULY 2023 convenience.org

NEWS

UP FRONT NACS

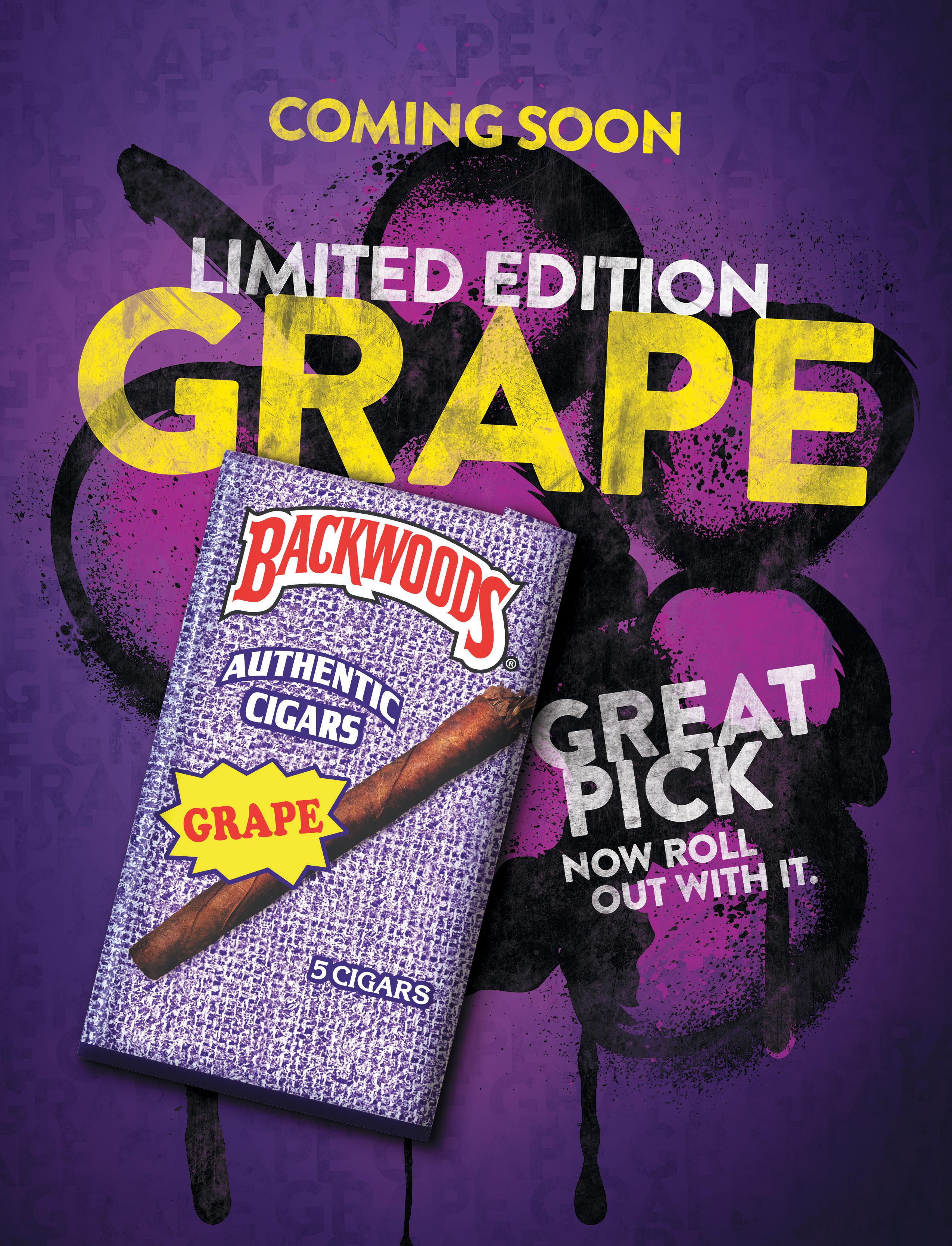

Contact your ITG rep to learn more. ©2023 ITG Cigars Inc. 3 FOR TRADE PURPOSES ONLY Backwoods® is a registered trademark of ITG Cigars Inc.

Wawa Pledges $1 Million to Second Harvest

Wawa pledged a $1 million grant to Second Harvest Food Bank of Central Florida to feed children and families in the area. Second Harvest aims to increase the amount of fresh produce available to kids who are experiencing food insecurity.

Wawa and Second Harvest’s Fly Beyond pilot program set a goal to reach more than 53,000 households over a 12-month period.

“Through this first-of-its-kind investment, Wawa is ensuring children in Central Florida have access to the nutritious, wholesome food they need to thrive,” said Derrick Chubbs, president and CEO of Second Harvest. “Inflation is causing more families to make difficult decisions about what they can afford, and this partnership can help lessen worries about food costs.”

Throughout the year, Wawa’s culinary team will create recipes that feature many of the food items being distributed. Those recipes can be found online at the Fly Beyond landing page. Wawa and Second Harvest intend to use the Fly Beyond pilot program and results as a road map for collaborations with other food banks or for others to implement similar programs.

“Fueling up takes on a whole new meaning with Fly Beyond. We hope this new pilot program inspires goodness by making fresh, healthy foods conveniently available to families to create nutritious meals at home without worrying about how to afford it. Having greater access to fresh produce will improve the ability of kids in our communities to learn, lead and succeed,” said Robert Yeatts, senior director of Florida operations, Wawa.

18 JULY 2023 convenience.org CONVENIENCE CARES

Wawa is ensuring children in Central Florida have access to the nutritious, wholesome food they need to thrive.”

—Derrick Chubbs, president and CEO, Second Harvest

In The Community

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America, and to share these powerful stories. Learn more at www.conveniencecares.org

TRAVELCENTERS OF AMERICA SUPPORTS TRUCKERS RELIEF FUND

1 TravelCenters of America Inc. launched its annual Round Up campaign in support of the St. Christopher Truckers Relief Fund (SCF). From Memorial Day weekend through Labor Day, customers at participating TA, Petro and TA Express locations can round up their purchase to the nearest dollar. The difference will be donated directly to SCF to help support professional drivers who have experienced an injury or illness that has taken them off the road within the last year.

7-ELEVEN BRINGS BACK OPERATION CHILL

2 Now in its 28th year, Operation Chill allows law enforcement officers to create positive connections by awarding a coupon to

kids they see doing good deeds or exhibiting positive behavior— which can be redeemed for a free small Slurpee drink at any participating 7-Eleven, Speedway or Stripes store. This summer marks the first time kids are able to redeem their Slurpee drink coupons at their local Speedway store. Since its inception in 1995, Operation Chill has expanded to hundreds of cities across the country, donating more than 24 million coupons to U.S. law enforcement agencies in 7-Eleven Inc. communities.

RUTTERS RAISES OVER $880,000 FOR KIDS

3 Rutter’s Children’s Charities announced that its 21st Annual Charity Golf Outing, held in May, raised over $880,000 to benefit local charities. This marks the largest amount raised at the outing since its inception. The annual two-day golf event began in 2003 and has helped Rutter’s Children’s Charities raise over $4.7 million to support local children’s charities in Pennsylvania, Maryland and West Virginia over the past 21 years.

LOVE’S SUPPORTS OK CITY ZOO EXPANSION

4 Love’s Travel Stops donated $1 million to the Oklahoma City Zoo and Botanical Garden’s newest habitat expansion, Expedition Africa. Opening in June, Expedition Africa is the zoo’s most ambitious and immersive conservation habitat experience in its history. An iconic feature of

Expedition Africa is the zoo’s historic pachyderm building proudly sponsored by Love’s Travel Stops. The building, which is listed on the National Register of Historic Places, was constructed in the early 1960s to provide habitat space for the zoo’s elephants, rhinoceroses and hippopotamuses.

PILOT COMPANY HONORS VETERANS WITH $100K

5 In honor of Military Appreciation Month in May, Pilot Company donated $100,000 to Hire Heroes USA in an effort to further its commitment to helping veterans transition back into the workforce. USA Heroes is an organization dedicated to providing employment opportunities to U.S. military veterans and spouses.

CROSBY’S PRESENTS $86,805 DONATION

6 Crosby’s and Reid Petroleum Corp. donated $86,000 to the Patricia Allen Fund benefiting John R. Oishei Children’s Hospital in Buffalo, NY. Crosby’s offered multiple ways for customers to support pediatric critical care through a variety of donation programs. Lenny Smith, vice president and general manager of Crosby’s, stated: “Our Crosby’s customers really responded to supporting the Hospital. Donations through our fuel pumps and customers enjoying the Bills Mafia endorsed signature The Mafia Pizza proved to be a huge success!”

NACS JULY 2023 19 3 4 5 6 2

1

Marshanna J. is one of nearly 3,700 truckers out of work due to illness or injury helped by St. Christopher Truckers Relief Fund.

Many Twisted Fibers Make the Strongest Rope

BY THE NACS GOVERNMENT RELATIONS TEAM

Key Figures

20+

The number of issue-specific coalitions with which NACS works

42 million

The number of Americans who receive assistance from SNAP

As we like to say in the NACS government relations department, “The convenience store industry has more issues than National Geographic.” Unlike other industries that can focus on specific committees (banking, for example), activity in every committee in Congress can affect us.

One of the key tactics we use to effectively represent the industry is to identify and work with other industries and organizations with aligned positions on a given issue. There are currently over 20 issue-specific coalitions with which we are working to achieve positive results … and more are formed on a regular basis as new issues arise. On issues of top priority to our industry, NACS usually forms and leads the coalition. With other issues, we may just participate. Either way, the coordination with like-minded organizations is essential to success on Capitol Hill. Following are some examples of how we use coalition armies to fight some of our biggest battles.

SWIPE FEES

In the early 2000s, NACS co-founded the Merchants Payments Coalition (MPC), a group of merchant trade associations seeking legislation to curtail an ever-increasing cost for Main Street businesses—swipe fees. Over time the MPC’s membership has grown to include associations representing

everything from general retail to grocers, restaurants, college bookstores, theater operators, sporting goods stores, beverage stores, lumber companies and more. MPC’s policy objective—tackling unfair swipe fees—is one that unites almost any business accepting payment cards today because the business is completely beholden to the Visa and Mastercard duopoly. The global networks not only determine the rails transactions run over but the operating rules, who is liable for fraud and the swipe fee rates levied by their issuing banks. The current system leaves Main Street businesses bearing enormous operating costs and American households paying more than $1,000 a year in these hidden fees.

In 2010, NACS and its coalition partners were successful in passing legislation known as the Durbin Amendment that regulated debit card swipe fees. The legislation also required there be two network routing options on debit cards. Since its implementation, debit card

20 JULY 2023 convenience.org INSIDE WASHINGTON gremlin/Getty Images

swipe fee reform has saved U.S. merchants billions of dollars.

Most recently, the MPC has advocated for the passage of the Credit Card Competition Act, bipartisan legislation that would require there be two network routing options for retailers on credit cards, similar to what we have on debit cards today. The legislation has gained traction, with more than 220 associations at the federal, state and local level endorsing the bill. NACS estimates that credit card routing competition would save the convenience store industry more than $1 billion a year in swipe fees, an average of about $7,000 per location.

While the coalition focuses primarily on legislation, NACS regularly coordinates with other retail associations to raise these issues with regulatory agencies that have jurisdiction over the networks and their issuing banks, including the Department of Justice, the Federal Reserve, the Federal Trade Commission and the Consumer Financial Protection Bureau.

SNAP

Convenience stores play a unique yet essential role in the Supplemental Nutrition Assistance Program (SNAP) as small format retailers. NACS works with several nonprofits and associations in order to ensure our retailers have the ability to participate in the program and provide food to the 42 million Americans who rely on SNAP.

Congress is currently drafting the 2023 Farm Bill, which authorizes SNAP. One of the top issues NACS is focused on this Farm Bill is removing the hot food restriction. Bipartisan legislation was introduced in the House and Senate to allow SNAP customers to purchase hot foods at SNAP-authorized retail stores. NACS strongly supports the legislation and is working with industry leaders, such as the Food Research and Action Center, to advocate for its inclusion in the Farm Bill.

NACS is also working with an informal coalition of associations repre-

NACS JULY 2023 21

The current system leaves Main Street businesses bearing enormous operating costs.

senting SNAP retailers to advocate for a permanent ban on state-contracted EBT processing fees. The Department of Agriculture, which oversees SNAP, is planning a migration of EBT cards to chip card technology. NACS and other retail groups believe it is imperative that the ban on processing fees is made permanent in the Farm Bill to ensure that retailers are protected from bearing costs of this costly transition and from other fees that should be borne by state-contracted EBT processors.

FUELS AND EVS

In the fuels and EV area, NACS has effectively created and used coalitions, formal and informal, to advance our issue priorities. With so many issues at the federal and state level affecting what type of transportation fuel we sell and how we sell it, identifying allies and working together with like-minded stakeholders is even more important than it is with other issues.

Creating a Competitive Electric Charging Market

As part of its climate agenda, the Biden Administration has focused its efforts on expediting the electrification of the transportation system, including the goal of installing at least 500,000 EV chargers in the transportation refueling system. The Infrastructure Investment and Jobs Act and the Inflation Reduction Act included major incentives programs for EV charging.

At the state level, many states are pursuing policies to promote EVs, including banning the sale of cars using internal combustion engines or mandating zero-emissions vehicles. In several states, electric utilities have been approved to charge all customers (or ratepayers) to subsidize the cost to build the necessary infrastructure as well as own and operate the chargers themselves. In addition, some states require businesses that sell electricity for the purpose of charging

EVs to be regulated like a utility. Further, businesses are also having to pay additional fees or tariffs, called demand charges, above and beyond the cost of the electricity itself. This outdated market design dampens private sector investment and makes it difficult for convenience and fuel retailers to participate in the EV charging market.

As part of its advocacy strategy in responding to these policies, NACS works with a wide range of stakeholders, including other fuel retail groups, oil and gas producers and refiners, ethanol producers, EV equipment suppliers and manufacturers and state associations. NACS co-founded the Charge Ahead Partnership to advance our priority of creating a competitive EV charging market and stop efforts that favor one industry sector, such as investor-owned utilities, from monopolizing this emerging market.

NACS believes that EV charging should be an open, competitive market. Convenience and fuel retailers should have the option to sell any legal source of transportation energy in a competitive market with a level playing field. Allowing the private sector to compete evenly is the best way to spur investment in and the development of electric charging infrastructure. It is also the best way to ensure that vehicle owners get the best prices and experience over the long term.

With over 116,000 fueling locations, the convenience industry is well-positioned to meet the energy needs of future drivers—regardless of the energy source. All industries, whether it be a gas station, utility, technology company or other type of business, should have fair access to incentive and investment opportunities to provide consumers the widest range of choices in fueling their vehicles.

E15

Today, fuel retailers are unable to sell E15 year-round to their customers unless the EPA grants an emergency waiver. A permanent one-pound Reid vapor pressure

22 JULY 2023 convenience.org INSIDE WASHINGTON Young777/Getty Images

NACS believes that EV charging should be an open, competitive market.

Conference: October 3-6, 2023

Expo: October 4-6, 2023

Georgia World Congress Center, Atlanta

BE PART OF A WINNING TEAM

“Nobody understands what I do, what I go through, what’s real for me like my peers. I get my best ideas at the NACS Show, and I feel like I belong to something bigger than my company. I’m part of a winning team.”

Join the thousands of attendees this fall in Atlanta for PEER TO-PEER LEARNING AND NETWORKING — share best practices, discuss challenges and so much more over four days!

part of the winning team and register today!

Explore and learn with the industry’s best

brightest

Be

nacsshow.com/winning

and

waiver is needed to fix this obstacle for the fuel retailing industry.

NACS has informally worked with a wide group of associations representing the ethanol industry, the oil and gas industry and fellow fuel retailer groups to push legislation that would provide a permanent waiver for E15 and allow for the sale of E15 the entire year.

NACS believes fuel retailers should have the opportunity to sell any legal fuel, such as E15, to customers who wish to buy and fuel their vehicles with that fuel. As a result, NACS supports the Consumer and Fuel Retailer Choice Act (S. 785/H.R. 1608), introduced in the Senate and House by a bipartisan group of members of Congress. While the EPA has granted a temporary emergency waiver to allow E15 to be sold this summer, a permanent legislative solution is needed.

CONSUMER DATA PRIVACY

In response to advances in technology, numerous media reports about privacy abuses and the proliferation of state legislation on consumer data privacy, Congress is working to create a federal privacy law and grant consumers rights with respect to information about them. NACS supports a national uniform privacy bill that applies to all industry sectors that does not shift the requirements solely onto the retail sector of the economy and does not pick regulatory winners and losers among different business sectors, nor exempt any industry or business.

ONE VOICE

This month, NACS talks to Lance Klatt, Executive Director, Minnesota Service Station Association

What role in the community do you think convenience stores should play?

Convenience stores are cornerstones within our communities—they are a great place for creating jobs (many first jobs) and a place everyone visits. They are places of togetherness! C-stores support their communities through grassroots agendas, such as supporting youth sporting activities, educational funding and getting involved in local student participation programs. Communities matter.

What does NACS political engagement mean to you and what benefits have you experienced from being politically engaged?

NACS allows myself and members of the Minnesota Service Station and Convenience Store Association to build stronger relationships with Minnesota’s federal congressional delegation. Communication is essential to our political platforms and the future of our industry, and engagement is key to the survival. NACS provides informative data leading to better opportunities to a better tomorrow.

What federal legislative or regulatory issues keep you up at night (with respect to the convenience store industry)?

All of them … there are so many issues that touch our industry, including flavor bans on tobacco, EPA requirements, labor issues and more! Of course, credit card fees are always on our mind.

What c-store product could you not live without?

Mountain Dew Kickstart and Wenzel’s Farm beef sticks. Kickstart has only 80 calories per can and the Wenzel’s Farm beef sticks are the real deal! Just call me Bubba!

24 JULY 2023 convenience.org INSIDE WASHINGTON

While the EPA has granted a waiver to allow E15 to be sold this summer, a permanent legislative solution is needed.

76% of all nicotine pouch dollars come from ZYN. Stock up on America’s #1 Nicotine Pouch and keep your customers coming back. Call 800-367-3677 or contact your Swedish Match Rep to learn more. FOR TRADE PURPOSES ONLY. | ©2023 Swedish Match North America LLC

As part of its advocacy strategy, NACS co-founded the Main Street Privacy Coalition (MSPC), which is comprised of a broad array of national trade associations representing businesses that line America’s Main Streets. From retailers to realtors, hotels to home builders, grocery stores to restaurants, and gas stations to convenience stores, the businesses represented by member associations interact with consumers every day.

Throughout the legislative process, including markup of the House Financial Services Committee privacy bill and hearings and markup of the House Energy and Commerce Committee privacy bill, NACS has worked closely with its Main Street partners in sending letters, hosting district meetings with Main Street business owners and their member of Congress, educating members and staff on the committee and testifying at legislative hearings.

To date, NACS and the Main Street Privacy Coalition have convinced members of the House Energy and Commerce Committee to make significant improvements from the original draft in preserving loyalty and rewards programs and ensuring Main Street businesses are not responsible for the misuse and mishandling of consumer data by third parties and service providers. NACS and the coalition continue to push for changes to protect Main Street businesses from frivolous lawsuits, strengthening federal preemption over state laws and ensuring business sectors under different privacy requirements or regulatory regimes are able to work with Main Street businesses

in complying with consumers’ requests regarding their personal information.

LABOR

One of the concerns we hear about most frequently from members is the limited availability of labor. The convenience retailing industry is certainly not alone in struggling to find reliable workers to fill shifts. It is a challenge being felt by all industries across the economy. NACS has helped launch the Critical Labor Coalition, which is a group of varied industry interests who have come together with the goal of finding unique ways to help expand the U.S. labor force. The coalition is focused on finding ways to improve the availability of specific universes of workers, including immigrants, asylum seekers, seniors, caregivers and second-chance workers. The goal is to enact meaningful legislation to help reduce barriers that keep some of these populations from entering or reentering the workforce.

While working to expand the workforce, employers are also finding themselves facing headwinds in terms of the cost of labor. In some cases, much of that cost is being driven not by natural market forces but by regulatory actions taken by federal agencies. Both the National Labor Relations Board and the Department of Labor have been busy lately proposing rules that will unnecessarily drive up direct store operating expenses. To help push back on many of these efforts, NACS is also a part of a few different coalitions focused on specific efforts, be it joint-employer regulations or overtime.

These are also areas where we rely on you as well. Direct comment campaigns, such as the one many of you supported in relation to the NLRB’s joint-employer rulemaking, can have a real impact on the outcome of these proceedings. The government relations team will continue to encourage you to file comments and write letters to legislators.

NACSPAC DONORS

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www. convenience.org/nacspac NACSPAC donors who made contributions in May 2023 are:

Karla Ahlert RaceTrac Inc.

Scott Apter Apter Industries Inc.

Dell Cromie Glassmere Fuel Service

Michael Custer Whirley Industries Inc.

Brandon Duckett RaceTrac Inc.

Jim Garret Volta Oil Company Inc.

Matt Harris RaceTrac Inc.

Henry Latifzadeh Callaway Oil Inc.

Eva Rigamonti RaceTrac Inc.

Tom Wake Core-Mark International

Todd Walker Altria Client Services LLC

26 JULY 2023 convenience.org INSIDE WASHINGTON Thinkstock/Getty Images

•T •L•N lowest •S •P •8 • •L•N •S •P •8 • •

Bigger Is Better

Name of company:

Wally’s

Year founded:

2020

# of stores:

2

Website: www.wallys.com

BY SARAH HAMAKER

When cousins Michael Rubenstein, president and CEO, and Chad Wallis, chairman, formed Wally’s in 2019, they immediately agreed on one thing—their new convenience store concept needed to have lots of space. “We wanted to create a destination and an experience for people to stop, and that meant we needed to expand beyond the usual 3,000 to 5,000 square feet of a typical interstate gas station,” Rubenstein said. “Our ideas put guests at the forefront, and we designed an inviting,

28 JULY 2023 convenience.org IDEAS 2 GO

Wally’s locations are 10 times the size of traditional c-stores to accommodate more foodservice, bathrooms and merchandise.

open space with a glass storefront to create the right guest experience.”

“My personal background in real estate development and Chad’s in operations meant we understood both the retail landscape and the need for travelers to have a family-oriented destination stop between Chicago and St. Louis,” Rubenstein said. Wally’s currently has two locations: one in Pontiac, Illinois, and the other in Fenton, Missouri.

FILLING THE SPACE

When drawing up the plans for Wally’s, the duo focused on the main areas most important to a road trip store—bathrooms, foodservice and merchandise.

“We made sure to install large, clean bathrooms,” Rubenstein said. “The women’s has 20 private stalls and the men’s has 10, along with open floor space.”

In the 10,000 feet of retail space, they put in a full-size Winnebago with merchandise in and around it to highlight being a road trip stop. “That goes quite well with our retro-vintage branding and private label,” Rubenstein said. Naturally, Wally’s has branded apparel, including t-shirts and hats.

The retail space also has grocery items, such as milk, beer and wine, and typical c-store snacks and packaged beverages, plus camping items. “We tried to have what you would want on your road trip as well as what you might need from a grocery store,” Rubenstein said.

The foodservice section has branded fresh-prepared options, including a popcorn station, sandwich and barbecue station, a beef jerky bar and a bakery. “You watch the food being prepared right in front of you,” Rubenstein said. The store prepares all grab-and-go items fresh as well as made-to-order items.

CONNECTING WITH CUSTOMERS

The cousins feel an obligation to the communities in which their two stores

are located. “We advertise Wally’s on billboards along the highway, but also sponsor golf tournaments, high school basketball teams, etc., to develop a good presence in the communities,” Wallis said.

Social media, including Instagram and Facebook, are a large part of the store’s marketing, which has drawn in a younger crowd. For example, during prom season, many high schoolers come to Wally’s before and after the dance. “We didn’t plan on this becoming a meeting spot for high school kids, but it has definitely become that,” Rubenstein said.

“It’s also become a meeting spot for politicians on their way to the Illinois State Capitol building, and we’ve been asked many times about putting in a conference room,” Wallis added, saying they’ve discussed it but haven’t decided whether to accommodate the legislators.

The management team put a lot of time and effort into standard operating procedures and training team members how Wally’s works. “We hire people who believe in the things Chad and I believe in,” Rubenstein said. “It’s a family-oriented business, and we give our whole team ownership of making sure we uphold our vision.”

The cousins extend that hospitality to every customer. “It’s important for us that people are greeted right off the bat and welcomed to our store,” Rubenstein said. For example, when customers ask where the bathroom is, a team member walks them to the location, rather than pointing in the correct direction. “We go out of our way to ensure every customer has the best experience we can give them,” Rubenstein said.

Sarah Hamaker is a freelance writer, NACS Magazine contributor, and romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

BRIGHT IDEAS

At Wally’s, private label merchandise is a big part of the store, from retail to foodservice. The Wally’s retro ’70s brand taps into nostalgia in the fonts and colors. The entire foodservice is under the Wally’s brand. “We don’t want to promote anyone else in our food program,” said Chad Wallis, chairman. “We decided to get our brand on as many items as seems reasonable and are always looking for new opportunities to promote Wally’s private label products.”

“We’ve been experiencing growth in our private label foodservice and try to be thoughtful about which items we take private label,” said Michael Rubenstein, president and CEO. For example, the retailer sells Wally’s branded popcorn, beef jerky, hot sauce and coffee beans. “We pick products with enough sales to justify the expense of having them private label,” he noted. The retailer also sells branded merchandise, such as hats, t-shirts, drinkware, coffee mugs, air fresheners, stickers and coasters.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2022 and earlier, go to www.convenience.org/Ideas2Go

NACS JULY 2023 29

CRA Get In on the National Day

are tying food and drink deals to microcelebrations— and it’s working.

30 JULY 2023 convenience.org

E

As the calendar flips to July, Spinx stores gear up for one of their busiest traffic days of the year. National Fried Chicken Day is July 6, and the annual celebration serves as a springboard for the South Carolina-based convenience retailer to promote its fried chicken offerings for the remainder of the month. “Spinx is known for its fried chicken—it’s fresh, homemade and delicious,” remarked Hayley Thrift, director of marketing and advertising. “Celebrating National Fried Chicken Day makes sense for us.”

An increasing number of c-stores have gotten behind special days that salute products such as coffee, doughnuts, pizza, hot dogs and even ice cream for breakfast. The promotions are effective in driving guest visits and create novel interactions with customers. “National ‘holidays’ provide marketing and merchandising teams with easy tools to capitalize on,” explained Thrift, noting that Spinx starts planning its National Fried Chicken Day programming six months in advance. “They’re fun holidays and consumers want to participate. So why not join in?”

NACS JULY 2023 31

A

Liudmila Chernetska/Getty Images

AR TO

BONUS

At Pilot Flying J—which promotes occasions like National Cold Brew Coffee Day (April 20) and National Hot Dog Day (the third Wednesday in July)—the promotions allow the retailer to stand out from the competition. “We’re always looking for ways to support and interact with our guests, whether through national day deals, food innovation or seasonal LTOs,” said Jamie King, senior director, food and beverage, Pilot Flying J. Thierry Lyles, head of digital marketing for Family Express, added that with the national days already built into today’s consumer culture, they are a readily available sales tactic. “Often, retailers get hung up on executing a promotion, but it doesn’t have to be complicated,” he said. “C-stores should take advantage of these days.”

STRATEGIC TIE-INS

The celebration of product holidays isn’t benefitting just convenience stores. Other purveyors are getting in on the action as well.

In April, Family Express c-stores promoted National Burrito Day by offering a BOGO deal on its heatto-eat burritos via its app. The program was designed to be a bit of an internal test. “We wanted to track how our app users responded to the offer,” explained Thierry Lyles, head of digital marketing at the Indiana-based chain. “We wanted to know who redeemed the offer and who didn’t take advantage of it.”

First Thursday in April National Burrito Day

Many customers were attracted to the two-for-one deal, he said, but in an effort to win over those who weren’t, the company followed up with a free burrito, available via the app. “Overall, we were very happy with the results,” Lyles said of the program.

In fact, Family Express did such a good job promoting National Burrito Day that a local burrito shop reaped some of the benefits. According to Lyles, the restaurant reported to the c-store that due to Family Express’s promotion, the burrito shop received numerous phone calls from consumers asking about deals. “We were even able to help other local businesses capitalize on National Burrito Day,” he remarked.

Spinx’s celebration of National Fried Chicken Day in July follows its support of National Grilled Cheese Day in April. With the recent addition of grilled cheese sandwiches to its menu, the chain offered Spinx Xtras loyalty members a $1.49 deal on its Ultimate Grilled Cheese sandwich. Other food-related holidays promoted by Spinx include National Peanut Butter Day (January 24) and National Ice Cream for Breakfast Day (the first Saturday in February).

Indiana’s Family Express, meanwhile, has promoted national day deals with vendor support for years, according to Lyles. Since the chain launched its made-to-order food program in 2017, the promotions—which include National Pizza Day (February 9), National Chicken Wing Day (July 29) and National Breadstick Day (the last Friday in October)— have taken on a greater prominence. “Our strategy is to make sure they pair well with our in-store sales strategy, including foodservice,” he explained. “With so many national holidays—at least one for every day of the year—you can’t promote them all. We try to stay focused on about six every year.”

Love’s Travel Stops celebrated National Coffee Day (September 29) last fall by offering customers any sized coffee or hot beverage for the reduced price of $1.

32 JULY 2023 convenience.org Pixel-Shot/Shutterstock

REWARDING LOYALISTS

September

29 National Coffee Day

National day offers tied to loyalty and app platforms are setting the course today. The fast-casual restaurant chain Blaze Pizza, for example, has been running a successful Pi Day (March 14, in honor of the mathematical constant π, which rounds up to 3.14) promotion for rewards members for a decade, but a recent emphasis on encouraging customers to download the app to access the deal has seen particularly impressive returns. During this year’s promo, the app reportedly registered 500,000 downloads, bringing the chain’s loyalty membership to 3.5 million.

Moreover, proceeds from coffee purchases made through the Love’s Connect app went to the chain’s Children’s Miracle Network Hospitals campaign. According to Bryan Street, manager of deli at Love’s, the $1 coffee promo resulted in more than 40,000 redemptions. For National Hot Dog Day, meanwhile, app users were entitled to one free hot dog or roller grill item via a partnership with Schwab Meat Co. “We saw more than 13,000 redemptions,” Street reported, a 14% increase from the previous year. Other holidays promoted by the Oklahoma Citybased chain include National Cold Brew Coffee Day and National Mac and Cheese Day (July 14).

Pilot Flying J stores also promoted National Coffee Day (app users could get a free cup of coffee), National Cold Brew Coffee Day, and National Hot Dog Day (customers could purchase one hot dog and receive another for free). The Oscar Mayer Weinermobile also made stops at Pilot Flying J travel centers on National Hot Dog Day, courtesy of Kraft Foods. “Pilot Flying J saw a positive response to these promotions and the overall in-store experience from guests,” King remarked.

Family Express experienced its own successful National Pizza Day promo this year, thanks to its rewards program, powered by Paytronix Loyalty. Under the program, loyalty members could purchase two extra-large pizzas for $12. But since only 30 of the chain’s

Third Wednesday in July National Hot Dog Day

34 JULY 2023 convenience.org

National days allow for communication that breaks through the general loyalty message and bring new news to talk about.

Irina Shilnikova/Getty Images; LauriPatterson/ Getty Images

81 units offer the pies, the campaign was targeted to just members in close proximity to participating stores via push notifications and emails. The targeted approach worked, Family Express and Paytronix said, with nearly 10 times the number of typical orders.

Spinx’s National Fried Chicken Day promo helps launch the chain’s annual CluckaPalloza contest, which runs throughout July. Under the program, customers who scan their loyalty cards and purchase chicken during the month are entered into a contest to receive free chicken for a year. According to Thrift, the implementation of Spinx’s mobile app a few years ago brought attention to the contest to a “whole new level,” and made it easier for the chain to promote. For National Ice Cream Day (the third Sunday in July), meanwhile, Spinx loyalty members receive a coupon on the app for a free cone.

“National days allow for communication that breaks through the general loyalty message and bring new news to talk about,” remarked Jeff Hoover, director of strategy and data insights at Paytronix. “Tying this to loyalty can also help drive acquisition of new members who want to take advantage of the offer.” That’s been the case at Spinx with the CluckaPalloza program, Thrift said. “We see a lot of new registrations in loyalty, particularly in-store signups,” she explained. “Customers feel that they might as well sign up because with just one purchase they could win free chicken for a year.”

July 14

National Mac and Cheese Day

September 22

National Ice Cream Cone Day

BUILDING BASKETS

Higher basket rings are another benefit of national day programming, Thrift and King said.

According to the Pilot Flying J executive, promos like the chain’s coffee and hot dog deals led “many guests to engage in other high-quality offerings available in our store, on top of the national holiday deal being offered.” Similarly, this year’s Family Express National Pizza Day promo spurred additional purchases, with the average ticket price rising to $18.

Pilot’s recent offers were supported via social media channels, emails and its app, King reported, along with media pitching. Family Express’s National Pizza Day offer relied entirely on digital messaging, including push notifications, emails, social media and digital billboards. “We found it to be the perfect messaging formula,” said Lyles. Added Paytronix’s Hoover, “Digital marketing allows for one-to-one targeting that can enable differentiated offers based on a guest’s purchase behavior. It’s also much more cost-effective and flexible to extend the offer if it’s going well. Very little planning or time is needed to execute versus promos that require in-store signage or other media planning.”

C-stores are clearly smitten with the opportunities national days offer. Love’s is celebrating National Mac and Cheese Day this month, followed by National Taco Day (October 4). After this month’s National Ice Cream Day, Family Express is looking ahead to National Sausage Pizza Day (October 11) and National Breadstick Day (October 27). For nearly every product offered by c-stores today, there’s a day for that!

subjug/Getty Images; LauriPatterson/Getty Images

Terri Allan is a New Jerseybased freelance writer. She can be reached at terri4beer@aol.com , and on Twitter at @terriallan.

NATURAL + AROMATIC SMOKING ALTERNATIVE

A Better Way, A Better You. Refreshing simple way to relax

Stop Vaping Aid

Stop Smoking Aid

It looks like a cigarette, is inhaled like a cigarette, and is used like a cigarette but it is not a cigarette

Cigtrus is an aromatic plastic mouthpiece inhaler, suitable for both smokers and non-smokers. It is used as a natural quit smoking alternative, as a substitute for cigarettes, and helps with stress relief for fidget sensor y. It is also excellent for those who want to enjoy an aromatic sensation of freshness, in place of gum or candy Unlike cigarettes, Cigtrus inhalers can be used anywhere; such as the airpor t, airplanes, cinemas, offices, and more. This product was developed in Japan

Directions: Remove caps from both sides of the Cigtrus pipe and inhale as if it were a cigarette

TOP CAP PIPE BOT TOM CAP cigtrus.com

Citrus Grapefruit

Citrus Zesty Lemon Lime Icy Peppermint

n

s r

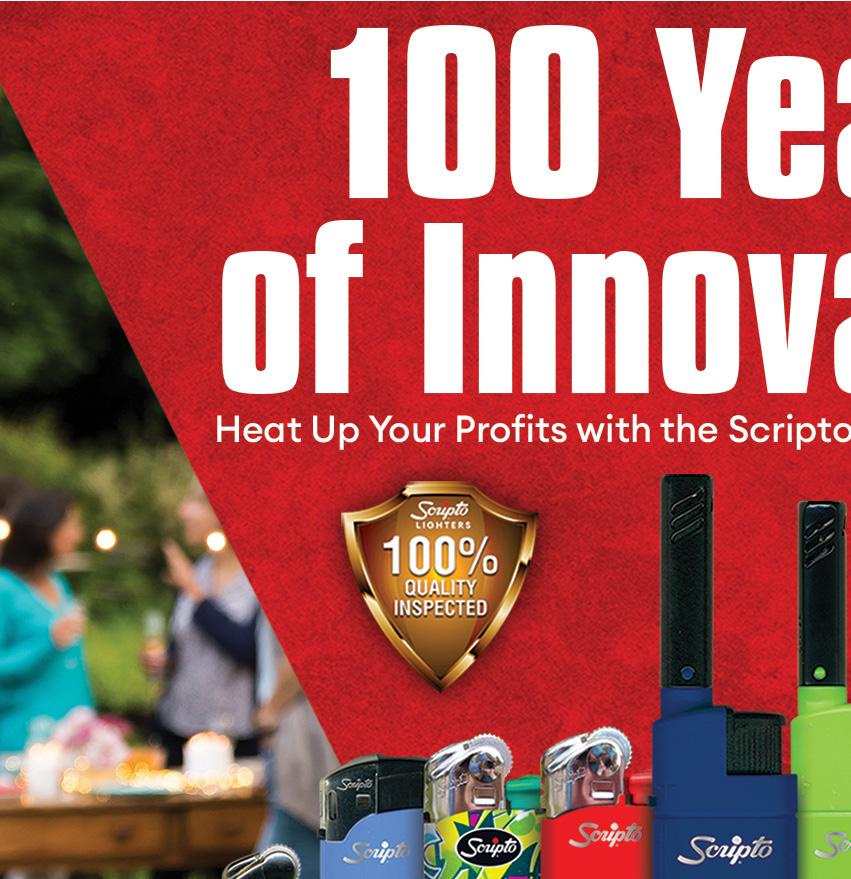

Selling the Brands Your Customers Want

BY CHRISSY BLASINSKY

BY CHRISSY BLASINSKY

38 JULY 2023 convenience.org Africa Studio/Shutterstock

… or didn’t even know they wanted. Today’s hottest products can help you boost unit sales.

NCEO Henry Armour said it best at this year’s NACS State of the Industry Summit: “You have to run a business very differently in an inflationary environment, and you learn quickly that focusing on dollar metrics is a fool’s errand. The focus has to shift to units.”

Inflation had a major impact on the products convenience stores sold in 2022 and continues to do so in 2023. Although sales were strong for the top six merchandise categories, with the exception of cigarettes, NIQ data revealed that units were down for packaged beverages, cigarettes, beer and candy. The only category to increase units was salty snacks.

In-store trips are on the rise again, which is fantastic news. The average basket—what customers spend per visit—increased 4.9% to $7.52 in 2022. Convenience retailers can keep this momentum going by stocking the products their customers are looking for, or better yet, the products that people didn’t know they wanted until they saw them in their favorite c-store.

Now that we’re halfway through 2023, we can use 2022 insights not as a look back but to show us where we sit now and the situation heading into 2024. With that in mind, we dive into the top brands that can help drive trips and bigger baskets, and ultimately let you do what you do best: excite and delight your customers.

Data for the six top merchandise categories throughout this article is from NIQ (formerly NielsenIQ) and based on total convenience sales for 2022. This data reveals the brands that are driving category growth within the biggest convenience store merchandise categories.

NACS JULY 2023 39

Packaged Beverages

alcoholic beverages. Larger 8,000-square-foot to 10,000-square-foot formats may have even more space for beverages, as well as a walk-in beer cave. This industry is serious about refreshments.

Packaged Beverages

We could argue that no other retail channel is a destination for packaged beverages quite like convenience retail—and we’d likely win.

In 2022, the industry experienced a significant sales increase for packaged beverages on a consistent month-over-month basis, with 2022 coming in 10.1% higher in sales than 2021; however, unit sales were down about 1%.

NIQ data shows that the top 11 packaged beverage brands accounted for 58% of sales. There are more than 2,000 total brands available in the c-store space, giving customers ample choice for refreshments.

Notice the top two brands are Red Bull and Monster. Could energy drinks be the new morning coffee? A bit of a spoiler alert, but the answer may be yes, according to heatmap data by PDI Insights Cloud that you can access in the NACS SOI Report.

Dive Into the Data

%ACV (all commodity volume) is a measure of the distribution of a brand’s products, weighted by the size of the stores that carry them. For example, if a brand’s %ACV is 75%, that means all the locations that carry that brand, added together, account for 75% of the convenience industry’s revenue—meaning the brand is not carried in stores that, in the aggregate, account for 25% of the convenience industry’s revenue.

40 JULY 2023 convenience.org

Brand Chg YA Units % Chg YA %ACV Overall results 99.8% Red Bull Red Bull North America Inc. 99.6% Monster Monster Energy Company 99.2% Coca-Cola The Coca-Cola Company 99.4% Gatorade The Gatorade Company 98.2% Mountain Dew Pepsi Cola Co/Div PepsiCo Inc. 98.1% Pepsi Pepsi Cola Co/Div PepsiCo Inc. 98.9% Starbucks North American Coffee Partnership 97.8% Dr Pepper Dr Pepper/Seven-Up Company 98.4% Private Label 39.5% Bodyarmor The Coca-Cola Company 92.2% Sprite The Coca-Cola Company 99.1%

Beer

The top 11 brands accounted for 73% of beer category sales in 2022, with more than 2,000 total brands selling in the c-store channel, according to NIQ.

If you haven’t been paying attention to imports like Modelo and Corona, it’s time to start looking for cooler door space. Mexican lagers have been driving the imported beer subcategory the past few years. Unit sales for Modelo were up more than 19% in 2022, while Corona had an 8.3% increase.

Although conversations around flavored malt beverages tend to include the word “saturation,” it’s a different conversation with hard seltzers. The top two brands, White Claw and Twisted Tea, saw double digit increases in unit sales in 2022.

SNACKS

Convenience stores are where the residents of Snack Food Nation lay their head at night.

According to Mondelez International’s 2022 State of Snacking report, globally 71% of consumers snack at least twice a day, and more consumers are replacing meals with snacks.

Consumers are also loyal to their favorites. The Mondelez report found that six in 10 (61%) people will go out of their way to find their favorite snack, while a similar percentage (63%) would pay extra to bring back some of their favorite childhood snack brands. Also, the top brands are winning: two-thirds (65%) of snackers prefer brand-name snacks to store brand or generic ones.

Salty Snacks

Bold flavors, redonkulously hot and spicy flavors, tangy, salty, traditional, cheesy, barbecue—you name it, the salty snacks category has it.

In 2022, salty snacks was the only top six merchandise category that saw both sales and unit increases year over year, with units up by 2.8%.

There are more than 1,500 salty snacks brands selling in the convenience store space, and the top 11 brands cited by NIQ make up 57% of category sales. Frito-Lay dominates the top products, with the top two potato chip brands, Lay’s and Ruffles. Potato chips have historically been the dominant salty snacks subcategory at about 40% of overall category sales.

What’s impressive is that every top 11 salty snacks brand was up in both sales and units, except for a very—and we mean very—slight dip in unit sales for Fritos.

Salty Snacks

42 JULY 2023 convenience.org

Beer Brand $ Chg YA Units % Chg YA %ACV Overall results 98.8% Budweiser Anheuser-Busch Inc. 98.5% Modelo Crown Imports LLC 89.7% Michelob Anheuser-Busch Inc. 95.2% Coors Coors Brewing Company 96.5% Corona Extra Crown Imports LLC 95.0% Miller Miller Brewing Company 94.3% Busch Anheuser-Busch Inc. 82.1% White Claw Hard Seltzer Mark Anthony International 88.4% Natural Anheuser-Busch Inc. 86.6% Twisted Tea Twisted Tea Brewing Company 85.8% Heineken Heineken USA Inc. 78.0%

Brand $ Chg YA Units % Chg YA %ACV Overall results 99.6% Doritos Frito-Lay Inc. 97.3% Cheetos Frito-Lay Inc. 97.0% Lay’s Frito-Lay Inc. 97.2% Ruffles Frito-Lay Inc. 94.9% Barcel Barcel USA LLC 66.5% Sabritas Frito-Lay Inc. 79.7% Fritos Frito-Lay Inc. 95.1% Pringle Kellogg Company 95.6% Funyuns Frito-Lay Inc. 91.9% Chester’s Frito-Lay Inc. 85.5% Cheez-It Sunshine Biscuits Inc. 93.8%

Candy

The top 11 confection brands were responsible for 63% of c-store sales, with more than 1,600 brands selling in the channel.

Let’s talk about seasonal opportunities for confections. The standout subcategory for convenience stores in 2022 was novelties/seasonal candy. This subcategory is growing at a faster rate than all other candy subcategories, with the obvious spikes around Valentine’s Day, Easter, Halloween and the winter holidays in November and December.

Here’s some advice from candy suppliers: Get ahead of the game and get your orders in a few months prior to the holiday selling period. Also, don’t be afraid to be the first to drive excitement among consumers who cannot wait to get their hands on their favorite holiday-inspired treats. Case in point: Pumpkin spice everything doesn’t wait for the fall.

One trend that continues to live on is strong sales of gummies, and no shape or animal is off limits to being gummified. Gum is also making a comeback, a subcategory that suffered a bit during the pandemic. Now that more people are buying coffee again, going to work again and communicating closer than six feet again, they’re remembering the refreshing role of gum and mints.

Alternative Snacks

The alternative snacks category first cracked the top 10 list of in-store categories in 2017 in terms of gross profit contribution. These products appeal to customers who are looking for a healthier option or a protein-rich snack, as well as an energy boost or meal replacement.