By

hey may only make up 9.5% of the replacement consumer tire sales channel in the United States, but car manufacturers and their dealers continue to make significant investments in their tire programs.

I recently had an opportunity to discuss Ford Motor Co.’s Quick Lane Tire & Auto Center operation with Doug Danstrom, Ford’s director of service performance.

Ford has two formats that operate under the Quick Lane banner: Quick Lane Tire & Auto Center, which has around 800 locations, and Quick Lane Express Service, which includes 900 locations.

Quick Lane Tire & Auto Center locations “can be (located) on or off” a Ford dealership’s main property, while “Quick Lane Express is primarily an in-bay program to help (dealers) with throughput,” Danstrom told me.

Together, the formats provide “a strategic advantage for us. Quick Lane has been going for over 20 years at this point. It’s a mature program. We feel it helps us with service retention. That’s probably the number-one thing most of the (vehicle) OEMs work on with their dealers. How can we retain service business?

“We think the biggest defection point where we lose customers is oil changes and we think tires are the second area where they jump,” said Danstrom. “And when they jump, they’re probably less likely to come back to the (car) dealership for maintenance services. Our goal has been to attack those deflection points — both in the offerings we have and the time it takes to do those services.”

Ford hasn’t established a target turnaround time for tire replacement at Quick Lane facilities, “but we definitely track what we call key-to-key metrics on oil services and tire rotations. Most Ford dealers and Quick Lanes (offer) something called ‘the works package,’ which is a multi-point inspection, as well as tire rotation and an oil change — all combined — and we have the goal to (do that) in less than one hour.”

Like most independent tire dealerships, Quick Lane offers tires at different price points. When customers bring in their vehicles for first tire replacement, “we have a strategy of offering the OE tire fitment, especially if the customer likes the way the vehicle rides or likes the life they got out of their tires. In many cases, it’s a ‘best-better-good’ offering.”

As vehicles age, “there are different price points,” said Danstrom. “We find customers may move away from that OE fitment and go toward” less-expensive tires.

Quick Lane locations also sell tires for electric vehicle (EV) applications, Danstrom told me. “Any tire that’s sold OE on the vehicle when it leaves the factory floor, we have that fitment available for our customers. In the case of EVs, we know there aren’t as many parts in a lot of EVs, so we feel we have to be good at the tire side of EVs. It’s still a small piece of what we do.”

Tire supply is never an issue at Quick Lane locations, accord-

ing to Danstrom. “Our dealers stock x number of tires and in most cases, have relationships with distributors who can get them tires two or three times a day in most markets. Because most of our vehicles are Fords — not all — we have a pretty good feel for what in each dealer’s protected area are the vehicles that will be coming in and how many are out there.”

Danstrom said that “along with growing the (Quick Lane) program, we’ve invested a lot in additional coaches and training the past couple of years. That’s a lot of in-dealership time on a monthly basis to work with (service) advisors” on the process of selling tires, with a focus on product education and presentation skills.

Ford also is investing in the technology offered at Quick Lane locations. “We’ve worked hard to connect Hunter drive-over tire (devices) and alignment machines — building those right in to connect with our tire selling tools to make it easier for our advisors to present offerings very quickly to our customers.”

Danstrom says the company looks at Quick Lane and the services offered there as being complementary to Ford dealerships. “Most dealers who operate Quick Lanes...that portion of their business is where they do the lion’s share of their light repair work and maintenance. Then at their main shops, they’re doing warranties and some of their larger repairs.”

Independent tire dealerships remain the dominant replacement consumer tire sales channel in the U.S. with 67% share of the market, according to MTD’s recently published Facts Issue. This isn’t going to change. (In fact, I believe that percentage will increase.) However, auto dealerships will remain formidable competitors. ■

If you have any questions or comments, please email me at mmanges@endeavorb2b.com.

DIGITAL RESOURCES FOR THE INDEPENDENT TIRE DEALER

The Modern Tire Dealer Show is available on Apple Podcasts, Spotify, iHeart Radio, Amazon Music, Audible and MTD’s website.

Sign up for Modern Tire Dealer ’s eNewsletters to receive the latest tire news and our most popular articles. Go to www.moderntiredealer.com/subscribe

The interim CEO of American Tire Distributors Inc. (ATD) says the company “is poised to move forward as a stronger partner to manufacturers and customers.”

Changes in the industry are expected, but sometimes there are forces at work that are so grand and beyond the scope of the typical ebb and ow of business that they require extra monitoring. The bankruptcy of American Tire Distributors Inc. (ATD) has had that kind of impact on the market in the last six months, as have the actions of President Donald Trump more recently. The threat of additional tariffs has tire dealers paying attention.

1. ATD expects to have a new owner this month

2. Trump tariffs: A look at the numbers

3. Photos: Inside K&M Tire’s 2025 meeting

4. Les Schwab acquires Pete’s Road Service

5. Goodyear to invest in new products and U.S. plant in 2025

6. Photos: Black’s Tire mixes fun with business at leadership meeting

7. Toyo unveils Open Country R/T Pro

8. ATD calls sale the ‘best path forward’

9. More details on Bridgestone plant shutdown

10. Goodyear TBR plant changes to cost $130 million

DIGITAL EDITION

Check out MTD ’s digital edition at the top of our website’s homepage.

Like us Facebook: facebook.com/ModernTireDealer Follow us X: twitter.com/MTDMagazine

3515 Massillon Rd., Suite 200

Uniontown, OH 44685 www.moderntiredealer.com

PUBLISHER

Greg Smith gsmith@endeavorb2b.com (330) 598-0375

EDITORIAL

Editor: Mike Manges (330) 598-0368, mmanges@endeavorb2b.com

Managing Editor: Joy Kopcha (330) 598-0338, jkopcha@endeavorb2b.com

Associate Editor: Madison Gehring (330) 598-0308, mgehring@endeavorb2b.com

PRODUCTION

Art Director: Erin Brown

Production Manager: Karen Runion (330) 736-1291, krunion@endeavorb2b.com

ACCOUNT EXECUTIVES

Darrell Bruggink / dbruggink@endeavorb2b.com

Marianne Dyal / mdyal@endeavorb2b.com

Mattie Gorman-Greul / mgorman@endeavorb2b.com

Cortni Jones / cjones@endeavorb2b.com

Diane Braden / dbraden@endeavorb2b.com

Sean Thornton / sthornton@endeavorb2b.com

Kyle Shaw / kshaw@endeavorb2b.com

Lisa Mend / lmend@endeavorb2b.com

Chad Hjellming / chjellming@endeavorb2b.com

Annette Planey / aplaney@endeavorb2b.com

MTD READER ADVISORY BOARD

Rick Benton, Black’s Tire Service Inc.

Jessica Palanjian Rankin, Grand Prix Performance

John McCarthy Jr., McCarthy Tire Service Co. Inc.

Jamie Ward, Tire Discounters Inc.

CUSTOMER/SUBSCRIPTION SERVICE

(877) 382-9187

moderntiredealer@omeda.com

ENDEAVOR BUSINESS MEDIA, LLC

CEO: Chris Ferrell

COO: Patrick Rains

CRO: Paul Andrews

CDO: Jacquie Niemiec

CALO: Tracy Kane

CMO: Amanda Landsaw

EVP Transportation: Kylie Hirko

VP Vehicle Repair: Chris Messer

VRG Editorial Director: Chris Jones

Northbrook,

Publisher reserves the right to reject non-qualified subscriptions. Subscription prices: U.S. ($81.25 per year). All subscriptions are payable in U.S. funds. Send subscription inquiries to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. Customer service can be reached toll-free at 877-382-9187 or at moderntiredealer@omeda.com for magazine subscription assistance or questions.

Printed in the USA. Copyright 2025 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

A highlight of the Safety Leadership Summit was the sharing of best practices. Nearly 70 people from a mix of commercial and retail tire dealerships participated in the most recent summit.

Photo: MTD

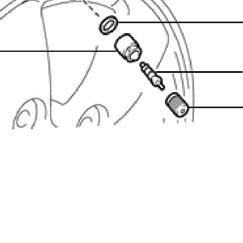

Among the universal concerns facing tire dealers of every generation is how to prevent wheel-offs. It’s an issue that so far has not been eliminated by advancements in technology and instead often relies on consumers returning to a tire store for a torque check.

At the recent Safety Leadership Summit, which was held in Nashville, Tenn., tire dealers talked about this age-old struggle. Three shared how their teams are presenting torque checks to customers.

Charles Campagna, loss prevention and safety manager for Auburn, Mainebased VIP Inc. dba VIP Tires & Service, said his dealership’s service advisors “are supposed to have the conversation with the customer at (vehicle) pick-up to explain that any time we have a wheel off the vehicle, (the customer needs) to come back and get the lug nuts rechecked.”

VIP Tires asks its customers to return for that torque check after 25 miles of driving “as a precautionary measure, just to make sure that there’s no issue. If we find that the torque wasn’t correct, we may disassemble (the tire/wheel combination), reinspect it, make sure everything’s clean and put it back together and ask them to come again, just to verify.”

Josephine Foley, manager of safety and fleet at Norwell, Mass-based Sullivan Tire Co., said front counter personnel are supposed to have a similar conversation, except that Sullivan Tire asks its customers to return within 50 miles of the wheel being installed. She noted a message alerting customers to the need for a torque

check is printed on the invoice. And for those customers who do follow the rules and return, Foley said there’s a code in Sullivan’s point-of-sale system to note that on the customer’s record.

Sam’s Club customers are also advised to return after 50 miles of driving. Tim Gearhart, Sam’s Club senior project manager, said the recommendation is printed at the bottom of every service order. “We do a wheel retention analysis on every wheel retention claim that occurs and unfortunately, we have had too many. But the number-one common denominator in all wheel retention claims was the consumer failed to return for the 50-mile retorque. It’s huge. Even though we have it printed on the bottom of the work order, we’ve encouraged associates to highlight it, circle it, have the (customer) initial it.

Sam’s Club is working on an in-house system that will send email reminders to customers to return for torque checks.

As for an industry standard, Kevin Rohlwing, chief technical officer for the Tire Industry Association (TIA), said the organization’s recommendation is to check torque after anywhere from five to 50 miles.

“For the most part, wheel and loosewheel incidents that happen shortly after installation can be traced back to failure to follow procedure. Once you cross that 100-, 200-mile mark, then it could have occurred because of a pothole. There’s a lot of things that could have happened for that loose wheel to occur.”

The issue is that so many customers don’t return for the torque check. Foley

said most don’t come back. But in her investigations of incidents where wheels did come loose soon after installation, it’s been because the “procedure has not been followed … because proper torque was not completed.”

After five years of Safety Leadership Summits, attendees have swapped ideas and brainstormed solutions to all kinds of problems in both commercial and retail tire dealerships. Sometimes, the fixes come down to equipment.

Jim Lanham oversees safety for the southern region of Wilkes Barre,Pa-based McCarthy Tire Service Co. Inc.’s territory. He said tools and equipment are needed to keep technicians safe. “I don’t sell tools. I try to protect people.”

At McCarthy Tire Service, that investment has included the addition of tire safety cages for retail stores. Russ Devens, director of safety and risk management at McCarthy Tire, said he spotted a technician kneeling in front of a 39-inch tire as he aired it up on a lifted vehicle. The tire’s required air pressure exceeded that of the maximum available from the tire changer, so the only option was to inflate the tire on the vehicle. The compressor was pushing air at 180 psi. “These tires on the passenger/light truck side are just getting bigger, wider, (with) more psi (and) more dangerous. My recommendation is make sure you have a cage in the retail shops.”

— Joy Kopcha

The Yokohama TWS ag tire manufacturing plant in Spartanburg, S.C., will close at the end of March. The plant, which started production in 2015, builds Trelleborg brand tires. Yokohama bought Trelleborg in 2023.

Goodyear Tire & Rubber Co. has finalized the sale of its OTR tire business to Yokohama Rubber Co. Ltd. The all-cash deal is valued at $905 million.

Telle Tire & Auto Centers has acquired two more locations, extending its footprint to 30 stores. The dealership bought the assets of Shore Tire in Lenexa, Kan., which included a store and distribution center. Telle Tire also has acquired Miller Tire in Mexico, Mo.

Former MTD Tire Dealer of the Year Tom Gegax took his story to Apple TV and Amazon Prime Video in “Confessions of a CEO,” a documentary that chronicles Gegax’s life and career journey and the lessons about empathetic leadership that he learned and put into practice.

Attendees of the California Tire Dealers Association (CTDA)/1-800EveryRim New Year luncheon donated more than $4,700 for tire industry fire victims. The money collected will be donated to the Automotive Aftermarket Charitable Foundation.

Stepan Boyajian and his brother, Harry Boyajian, have opened their sixth Tire Pros store in California. The store, which is in Long Beach, Calif., is an acquisition. It features seven bays and will operate under the Royal Tire Pros & Auto Repair banner. Its existing team has been retained.

A“Every day, we’re striving to be more efficient in our systems and procedures — from the ordering process to planning at the factory level — and making sure we have the right logistics partners,” says Chris Brackin, president of American Omni Trading Co.

new, multi-installment ad campaign from American Omni Trading Co. (AOT), which is celebrating its 35th year in business, highlights the company’s product development, supply chain, logistics and marketing capabilities.

The campaign, which begins in this issue of MTD and features AOT employees, is designed to let customers know that “we have a fantastic team both inside our office and in the field who are experts in their specific areas,” says AOT President Chris Brackin. “We really want to show to our customers that we’re not just selling tires. We have a professional, high-level staff.”

The themes of the ads “are relatively simple. When it comes to marketing, we’re taking a more tailored approach, looking at a combination of traditional and non-traditional marketing. When it comes to logistics and supply chain, this is the backbone of being what an importer is all about. You have to make sure you’re getting that right for the customer. We’ve invested heavily in this area — in both systems and people — to allow for an efficient flow of information and products, from start to finish.

“Lastly, from a people perspective, it goes back to hiring experts to help us provide better service for our customers. There’s a lot of things in the background that you have to do as an importer. Our customers don’t necessarily need to worry about that because we’re taking care of it for them.”

“At the end of the day, the tier that AOT services is the growth tier in the market: value-based propositions,” says Jon Vance, AOT director of business development. “Everybody’s chasing that because they want a bigger share of where the growth is. There are certain things we bring to the table to make sure you do that the right way. We’re not just sending a price sheet on a transactional basis. Our message is, ‘Let us help you.’”

“Every day, we’re striving to be more efficient in our systems and procedures — from the ordering process to planning at the factory level — and making sure we have the right logistics partners,” says Brackin. “We’re very proud of what we’ve developed at AOT and what we continue to evolve to.”

No matter how challenging your needs, AGRIMAX V-FLECTO is your best ally when it comes to soil tillage and haulage applications. The tire features excellent traction along with enhanced driving comfort both in the fields and on the road. With the exclusive VF technology, AGRIMAX V-FLECTO can carry very heavy loads with a lower inflating pressure even at high speeds providing reduced soil compaction, best self-cleaning properties as well as fuel economy.

AGRIMAX V-FLECTO is BKT’s response in terms of both technology and performance for high-power tractors.

BKT USA Inc.

202 Montrose West Ave. Suite 240 Copley, Ohio 44321

Office: (+1) 330-836-1090

Sun Auto Tire & Service Inc. has opened a new Plaza Tire Service store in Centerton, Ark. The outlet, which spans 6,500 square feet and has eight service bays, offers a full range of tires and auto services and adds to Plaza Tire’s footprint in the northwest section of Arkansas.

Prinx Chengshan Tire North America Inc. has announced a partnership with the American Hockey League (AHL), naming Fortune Tires as the official tire of the AHL. The partnership launched during Fortune’s sponsorship of the 2025 AHL All-Star Classic.

Global Rubber Industries (Pvt) Ltd. (GRI) has appointed Tharindu Atapattu as its next CEO. He has more than 20 years of leadership experience and expertise in financial planning, cost optimization, data-driven decision making and customer service strategies.

Hankook Tire America Corp. has promoted Kyuwang (Ken) Cho to senior vice president of PCLT sales and marketing for its North American division. He is responsible for marketing strategy, technical services, Canadian marketing and supply chain and logistics operations.

Monro Inc. has promoted Nick Hawryschuk to the role of senior vice president of operations. He will lead all of the company’s retail and commercial operations and strategy.

EAS Tire & Auto, part of the Straightaway Tire & Auto network, has acquired four Integrity Tire stores in Colorado. This deal gives EAS Tire & Auto more than 20 locations in the Denver, Colo., market and strengthens its presence in Parker, a fast-growing area.

Tire Discounters Inc. has opened a concept store that offers a full range of electric and hybrid vehicle services. The outlet — officially called TD/EV by Tire Discounters — is located in the Cincinnati, Ohio, suburb of Symmes Township and was created to fill what the dealership considers to be a “void” in the automotive aftermarket.

“We noticed a lot of uncertainty in tire dealers and repair shops on how to work on high-voltage systems,” says Jamie Ward, president and CEO of Tire Discounters. And many customers “are unaware of the amount of routine maintenance that these vehicles require.”

The TD/EV store is equipped with the latest tools and technologies to work “on all facets of the modern EV,” the company said.

“We’re talking high-voltage vehicles that are coming in with all the new bells and whistles — all new technologies,” says Ward. “We have a battery room where we can do full diagnostic analysis of all (battery) modules and cells. We do services like load balancing. We do battery repair and replacement. We’re fully trained to get into and work on every single piece of an EV, whether it’s a Tesla, Rivian” or another EV or hybrid. “You name it, we have the capabilities.

“When we looked at getting into this, we knew there was a high barrier of entry,” says Ward. “We had to figure out how we could train our guys. When ASE introduced their certifications for EVs, we were already moving forward with a select group from our team, working on EV training” with various vendors.

The TD/EV store also offers ADAS recalibrations “and highly sophisticated alignments.” And the outlet performs maintenance on other EV and hybrid components and systems.

“When Tesla rolled out, Elon Musk told everybody there’s no maintenance required,” says Ward. “That’s a total myth. These vehicles have a cooling system similar to an internal combustion engine with a series of hoses and fittings that are rubber and plastic and over time, will break and crack and need to be replaced. The fluid itself does not last forever. There will be leaks that happen. The shocks and struts are pretty similar to the shocks and struts on everyday vehicles. Tie rods, ball joints, bushings — all of those components typically have a rubber failure point and those failure points (also) are on electric vehicles. Newer-tech vehicles require a lot of the same maintenance that older-tech vehicles require.”

The new TD/EV store carries EV-specific tires, according to Ward. “We stock the major name brands for downstream options for Teslas, Rivians” and other EVs.

“We keep a core group of products in-house that are EV-specific,” but the store’s tire selection “isn’t limited to that. A lot of hybrids are coming in with tires that have been replaced once or twice with aftermarket products. A lot aren’t EV-specific. So we need to have a full depth and breadth of inventory available to us.”

Ward says Tire Discounters has no plans to open more TD/EV outlets at the moment. “We’re using this as our central source for learnings to establish workflows and to build processes” for EV and hybrid service.

“Before we expand, we’re going to make sure that this facility has done what its original purpose was and that’s to educate and train our employees.”— Mike Manges

Unicorn Tire Corp. has three warehouses in the U.S., and says plans for a fourth are underway. The current warehouses are in Memphis, Tenn., Houston, Texas, and Las Vegas, Nev.

Goodturn Tire & Auto has promoted Christian Seem to CEO. David Manning and Seth Sands remain involved with Goodturn Tire as co-founders. Seem is a 20-year auto industry veteran.

Continental Tire the Americas LLC says its General brand tires — both passenger and light truck products — now feature a new warranty and protection package, the Shield+ Advantage plan. It applies to all replacement tires purchased in the U.S. and Canada.

Nexen Tire Americas Inc. has been named the official original equipment tire supplier for the latest model of Hyundai’s flagship SUV, the Palisade. The Nexen N’Fera Supreme S is an all-season tire designed for high-performance and premium vehicles.

VIP Tires & Service

Johnathan Bemis has been honored with a legislative sentiment from the Maine State Legislature. Bemis is an ASE World Class Technician who won the 2024 Technician of the Year award at AAPEX.

Bridgestone Americas Inc. has been chosen by Porsche to develop bespoke tires for its new Macan Electric and Panamera models.

Wheel and hub manufacturer

Moveero has named Kevin Bailey its product manager, Americas. He’s been with the firm since 2020.

Tire Rack has named longtime Michelin North America Inc. leader Scott Clark to be its new CEO, effective April 21, 2025.

Clark was previously the CEO of Michelin North America and has most recently been based at Michelin headquarters in France as executive vice president, serving as a member of the Michelin Group’s executive committee. He will retire from Michelin in March.

“I am extremely grateful for the 29 years I spent with Michelin and have the utmost respect for the people, values and products that make Michelin unique,” says Clark.

“I’m very excited to join the Tire Rack team and am passionate about what they have been doing for 45 years: helping consumers make informed choices about the best tire for their needs and then providing them unparalleled product availability and an outstanding experience. I look forward to working with the Tire Rack team to build on such an incredible foundation.”

Tire Rack’s current CEO and co-founder Michael Joines will continue to have a leadership role within the company, transitioning to the role of executive chairman, with a focus on strategies that will expand and accelerate growth of the business.

Joines founded Tire Rack alongside Peter and Wilma Veldman in 1979.

“We’re so pleased to have Scott join the team because in addition to his exceptional leadership skills and industry knowledge, he has really been a valued Tire Rack friend for many years,” says Joines.

Clark will relocate to Tire Rack’s South Bend, Ind., headquarters. Additionally, he will join The Reinalt-Thomas Corp. board of directors. The corporation, which does business as Discount Tire, acquired Tire Rack in 2021.

Les Schwab Tire Centers Inc. has acquired Pete’s Road Service, which has 10 stores, a retread plant and a distribution center in southern California.

Founded in 1969 by Pete Fletcher, Pete’s Road Service will continue to operate under its current name.

“Pete’s is one of the strongest and largest independent commercial tire dealers in southern California and this acquisition is a great opportunity for Les Schwab Tires,” says Les Schwab CEO Mike Broberg. “We’re excited to welcome Pete’s into our combined family of brands — including 12-store CMC Tire in Utah, Nevada and Colorado — and to benefit from the unique perspectives and capabilities of its 175 team members.”

Broberg adds that Les Schwab, which is based in Bend, Ore., and Pete’s Road Service “are well aligned and operate under the same core values. We share a culture of excellent customer service and a commitment to supporting and creating opportunities for our employees.”

“After 50 great years in business, the time was right for new ownership,” says Kyle Fletcher, president of Pete’s Road Service. “Les Schwab Tires has the resources, customer focus and expertise to foster our success for the next 50 years.”

No changes to staffing are planned at either company following the acquisition, according to Les Schwab officials.

Les Schwab has more than 500 locations throughout Oregon, Washington, Idaho, Montana, California, Nevada, Utah, Colorado, Wyoming, Alaska, Minnesota, South Dakota, North Dakota and New Mexico.

Relevant statistics from an industry in constant motion

5

11%

Share of repairs a shop performs that require an ADAS calibration

Source: IMR Inc. October 2024 survey

Photo: 98949849 © Ryzhov Sergey | Dreamstime.com

12

Truck maintenance bays Love’s Travel Stops & Country Stores plans to add in 2025

Source: Love’s Travel Stops & Country Stores

Photo: Love’s Travel Stops & Country Stores

Consecutive months of new vehicle sales growth

Source: J.D. Power and GlobalData February forecast

Photo: 132852888 © Pramote Polyamate | Dreamstime.com

1.23 MILLION

Small farm tire replacement units shipped in 2024

Source: MTD market share data

Photo: BKT USA Inc.

24

Number of 20-inch LT high otation tire sizes available

Source: Tire & Rim Association

Photo: Mickey Thompson Tires & Wheels

F1 F2 F3 F4

#LANDSAILTIRES @LANDSAILTIRES

The L and s ail is a true 50K mile All-Terrain tire, built to s tand the te s t of time. In rain, snow or dir t, this tire is reliable on a variet y of road s and terrains The s taggered middle block deliver s a high-s tabilit y tread and meet s the highe s t severe snow s tandard s with the 3-Peak Snow Flake

The Landsail Rangeblazer is a true 50K mile All-Terrain tire, built to stand the test of time. In rain, snow or dirt, this tire is reliable on a variety of roads and terrains. The staggered middle block delivers a high-stability tread and meets the highest severe snow standards with the 3-Peak Snow Flake rating. For factory direct and warehouse programs call 305.621.5101.

*Specific sizes only

RANGEBLAZER A/T

John Healy By

or a third consecutive month, retail tire sellout trends were in positive territory. In January 2025, dealers indicated sellout growth of 0.7%. That’s a slight slip from the 1.1% growth in December, but it’s still a gain from the January 2024 report.

Tire dealers in the Northeast saw the strongest gains, with volumes up 6.3% due to heavy snowfall in the region. The results were still positive in the Northwest and Midwest, with low-single digit volume trends, while tire dealers in other regions saw flat or negative volume trends. The Southwest reported the weakest market, with a 1.3% decline in year-over-year volume.

Dealers say winter weather events drove this uptick in tire sales this past January, as drivers in affected areas wanted to make sure their vehicles would function properly in the winter weather conditions. Looking ahead, we notice that February had a flat comparison and we expect if the weather cooperates, we could see another month of flat-to-slightly-up volumes.

Miles driven data showed another slight gain in January. The increase of 0.1% was softer than the 1.1% increase recorded in December 2024.

The cost of raw materials needed to build a basic replacement tire continued to edge upward in January, with prices up 6.2% during the month, an increase from the

2.3% recorded in December. This January gain follows a 5.3% increase during the fourth quarter of 2024 and a 10.5% yearover-year increase in the third quarter.

Holding raw material prices flat would equate to a 4.7% year-over-year increase in the first quarter and it would mark a 2% sequential increase over the fourth quarter.

Natural rubber costs continue to rise by double-digit margins, with a 29% yearover-year increase in January.

The pricing of other inputs is more measured, with oil up 0.5% year-overyear and synthetic rubber costs up 12.4% year-over year. Carbon black and fabric/ cordage prices both dropped in January compared to their year-ago comparisons, down 2.3% and 8.1%, respectively.

For the full year of 2024, our raw material index rose 7.1% compared to the prior year. In 2023, the index fell 9.7% from 2022 levels.

Given the rapid price deceleration of 2023 following two years of pricing gains, we’re not that surprised to see raw material costs moderate and increase on a year-over-year basis.

We view this as a nod toward stability and a positive, given the volatility experienced since 2020.

Dealer commentary suggests consumer demand for passenger and light truck replacement tires was slightly positive

on a net basis compared to January 2024. And that’s despite the fact that 10% of our independent tire dealer contacts said they experienced a drop in demand in January 2025.

The upside comes from those dealers seeing gains due to recent winter weather events.

Their boosts in demand are outweighing the declines in other parts of the country. Dealers experiencing gains from winter storms are also reporting healthy gains in volume.

But one thing remains consistent — consumers are continuing to trade down from premium tire brands.

But even in that trend, there was a bit of movement in January 2025. After eight straight months of tier-three tires being the most sought-after brands, tier-two took over the top of the demand chart in January. That matches the historical trend of our decade-plus of monthly surveys.

Tier-three tires fell to second place. We believe tier-two brands saw strong results during the month as consumers were looking to balance quality with price, while also facing winter weather challenges.

Whether tier-two tires remain in the lead remains to be seen. We traditionally see a high level of volatility in our monthto-month tier rankings.

We continue to see tier-one tires struggling in the market, with consumer balance sheets negatively affected by inflation and high interest rates. The result is consumers are choosing less-expensive tires. ■

SOURCE: NORTHCOAST

John Healy is a managing director and research analyst with Northcoast Research Holdings LLC, based in Cleveland, Ohio. Healy covers a variety of subsectors of the automotive industry. If you would like to participate in the monthly dealer discussions, contact him at john.healy@ northcoastresearch.com.

By Mike Manges

he all-weather segment has made big waves in recent years, but manufacturers and other tire suppliers agree that dedicated winter tires remain a smart, viable option for customers navigating snow, slush and ice-covered roads.

In this MTD exclusive, several tiremakers and distributors discuss how winter tire design and technology continue to evolve. ey also provide insight into what customers now expect from winter tires.

Your customers trust you for the best—count on Yokohama to deliver it. The all-new GEOLANDAR A/T4™ features long-lasting durability, excellent all-season traction, and precision handling on or off-road. Give your customers the confidence to conquer anything in their path with the GEOLANDAR A/T4.

MTD: What’s the biggest advancement in winter tire technology that has taken place over the last few years — both in general and if applicable, speci c to your company?

STEVEN LIU, vice president of product development, Hercules, American Tire Distributors Inc. (ATD): In recent years, there has been a signi cant increase in investments toward the research and development of winter tire technology, with a particular focus on advancements in tire compounds and tread pattern design to enhance grip on snow and ice. Additionally, substantial progress has been made in optimizing winter tire performance to align with the capabilities and dynamics of sportier vehicles.

PHILIPP SCHRADER, Continental product manager, touring and U.S. winter tires, Continental Tire the Americas LLC: Continued improvements in low rolling resistance technologies remain a top priority for us. Not only is this an important performance attribute for electric vehicle owners, but also for consumers with hybrids and normal internal combustion engine vehicles. In addition to low rolling resistance technology, the continued push into better compounding technologies that improve snow and ice performance are also very high on the list of priorities. Ice performance, in particular, has become a bigger focus since most consumers experience icy conditions more frequently than heavily snow-covered roads. Our new VikingContact 8, for example, now comes equipped with the Ice Grip symbol, which is proof to our customers that our tires perform at the highest possible levels in icy road conditions.

JENNY PAIGE, director, product planning, North America business, Goodyear Tire & Rubber Co.: In 2024, Goodyear introduced the Goodyear Ultra Grip Performance 3, a state-of-the-art performance winter tire that embodies our latest advancements in winter tire technology.

DAVID WANG, managing director, Gripmax Tires Inc.: In recent years, advancements in winter tire technology have been focused on improving grip, safety and fuel e ciency through innovative materials, tread designs and manufacturing techniques. Modern winter tires feature advanced silica-infused

“Consumers’ expectations of winter tires are shifting similar to what we’re seeing in other segments,” says Jin Han, product manager, Hankook Tire America Corp. “They want strong value and versatility.”

Photo: Hankook Tire America Corp.

‘Ice performance, in particular, has become a bigger focus since most consumers experience

icy conditions more frequently than heavily snow-covered roads.’

Philipp Schrader, Continental product manager, touring and U.S. winter tires, Continental Tire the Americas LLC

David Wang, managing director, Gripmax Tires Inc., says that in recent years, “advancements in winter tire technology have been focused on improving grip, safety and fuel effi ciency through innovative materials, tread designs and manufacturing techniques.”

Photo: Gripmax Tires Inc.

rubber compounds that remain exible at extremely low temperatures, providing better traction on icy and snowy surfaces. Some manufacturers have incorporated

nano-technology to optimize compound performance for better grip without compromising durability.

Tread patterns now include more intricate and densely packed sipes that improve grip on snow and ice by increasing biting edges. Multi-directional tread designs provide better handling and stability, especially on wet or slushy roads. Gripmax has introduced several advancements in winter tire technology in recent years, focusing on enhancing performance, safety and driver satisfaction. Notable developments include SureGrip Pro Winter and SureGrip Pro IceX.

JIN HAN, product manager, Hankook Tire America Corp.: Winter tire technology has advanced in the last few years and Hankook is at the forefront as we continuously invest in innovation for all of our lines, including our Winter i*cept lineup. One of the most recent additions to that lineup, the Winter i*cept IZ3, announced last year, features a host of new advancements.

DAVID GRIESE, Michelin product category manager, Michelin North America Inc.: e advancements in winter tire technology are not attributed to a single innovation, but rather a composite of di erent technologies working together to enhance performance across various winter conditions, including ice, snow, slush and wet surfaces. Innovative rubber compounds, such as the FleX-Ice 2.0 tread compound used on Michelin’s X-Ice Snow tires, have been developed to remain exible in extreme cold.

WES BOLING, senior communications and content manager, Nokian Tyres Inc.: Our industry has made strides meeting the needs of EV drivers in the winter space. It’s a challenging proposition to deliver a quiet ride without sacrificing winter grip. Tiremakers are achieving that balance through innovative solutions like our SilentDrive Technology, which minimizes cabin noise at the frequencies that are most irritating to drivers. And they’re producing these advancements while expanding the engineering triangle in other ways, such as lowering rolling resistance to achieve better range per charge. In general, it is energizing to see the ways our industry is innovating in the EV winter market.

BRYCE JONES, head of product marketing and training, Pirelli North America Inc.: One of the most significant advancements in recent years has been the improvement in non-studded tire performance on ice. The introduction of the Ice Grip symbol under European legislation has set a new benchmark, requiring tires to meet both the 3PMS (3-Peak Mountain Snowflake) standard and additional ice performance criteria. While this regulation is not yet adopted in North America, the Ice Grip symbol serves as a valuable indicator of a tire’s capability on icy surfaces. At Pirelli, we’ve incorporated this innovation into our lineup with the Pirelli ICE FR tire.

JAMES MCINTYRE, senior vice president of sales, Canada/product development, North America, Sailun Tire Americas: The biggest advancements in winter tire technology over the last few years have centered around improved rubber compounds (and) advanced tread designs. Specific to us, the Ice Blazer WSTX is Sailun’s latest studdable winter tire, designed to provide exceptional traction in various winter conditions, including snow, slush and ice.

MIKE PARK, assistant director of marketing, Tireco Inc. One of the most notable changes in recent years has been the introduction of the ice grip symbol, which assesses a tire’s performance specifically on ice. While many tires carry the 3PMS symbol for snow performance, the 3PMS does not account for ice traction — a critical factor for drivers in colder climates. We’ve responded to these developments by launching the Milestar Winterguard Studdable winter tire.

“Winter tires remain the safest solution for drivers who expect to experience bouts of severe wintry weather, even if those conditions don’t appear quite as often as they used to,” says Wes Boling, senior communications and content manager, Nokian Tyres Inc.

Photo: Nokian Tyres Inc.

“Key changes in consumer expectations (include) better ice and snow performance (as) drivers now expect enhanced grip on ice and packed snow without compromising wet or dry road handling,” says James McIntyre, senior vice president of sales, Canada/product development, North America, Sailun Tire Americas.

Photo: Sailun Tire Americas

“Consumers’ expectations are always on the rise for the performance of all tires, not just winter tires,” says Ryan Parszik, manager of product planning, Yokohama Tire Corp. “They feel like a winter tire needs to perform in true winter conditions, as well as milder climates.”

Photo: Yokohama Tire Corp.

PHILLIP KANE, CEO, Turbo Tires Wholesale LLC: In recent years, winter tire buyers increasingly demanded greater optimization between traction and tread wear in winter tire performance. This trend led

first to the appearance of never-seen-before mileage warranties on winter tires, then ultimately — and most importantly — to the dawn of the all-weather tire phenomenon, which has resulted in a significant drop in winter tire sales.

RYAN PARSZIK, manager, product planning, Yokohama Tire Corp.: There are several factors that are very important, but two that are key are the major advancements in compounds and tread design. The compounds used in winter tires have improved with a silica-enhanced mixture that can still stay flexible in extremely cold temperatures, which makes sure drivers maintain traction at all times. The tread design, with the inclusion of 3D sipes, gives more biting edges in the tire for improved traction. Also a common theme among most snow tires is being directional for better water and slush evacuation. Some good examples are Yokohama’s iceGuard iG53 and iceGuard G075.

MTD: Have consumers’ expectations regarding winter tires changed and if so, why?

LIU (ATD): Consumer expectations vary by region and product segmentation, particularly between passenger and SUV/LT vehicles. Additionally, performance expectations differ based on whether the tires are studless or studdable, as their design and capabilities cater to distinct needs. In recent years, there has been a growing consumer focus on winter tire education, driven in part by the rise of all-weather products seeking to differentiate themselves. Consumers are increasingly evaluating winter tires based on their intended purpose and overall value. Our observations indicate that buyers prioritize enhanced grip, improved handling and greater stability across a range of wintry conditions and surfaces. Moreover, mainstream consumers are now seeking higher-value winter tires that offer extended durability and a longer lifespan over multiple seasons.

SCHRADER (Continental): This truly depends on the personal preferences of each individual consumer. Some consumers want the absolute best, ice grip-certified, severe winter weather-rated, soft compound winter tire on the market, because they truly need that level of performance based on their geographic location and

TOM AND CHRIS BRACKIN CEO and President

When you partner with AOT, you benefit from our decades of experience, connections, and expertise. Whatever your challenge, we don’t rest until it’s solved. Because we’re about more than tires. We’re about helping people achieve great, big things.

Smithers explains differences in tread design, compounding

What are the key differences between winter tire tread designs and all-weather tread designs and what elements of each create the performance benefits that consumers are seeking in these two types of tires?

“Compared to an all-weather tire tread, a winter tire tread may have less contact area, more void area and greater tread depth; more lateral structures, such as sipes; and minimized tie bars,” according to Eric Pierce, a representative from Akron, Ohio-based global tire testing giant Smithers.

“These design changes support two primary objectives: an increased number of biting edges that can grab the snow (and) more squirm, which provides more biting edges as the tire deforms.”

Commenting on differences in compouding, Pierce says that winter tire tread compounds “have a lower glass transition temperature and, in some cases, plasticizer technology, which allows for better snow and ice performance.

“The silica in winter tire tread compounds often has a lower surface area to achieve a better balance of traction and rolling resistance performance. Lastly, winter tire tread compounds do not incorporate reinforcing carbon black technology at the same level as all-weather tires.

“By comparison, all-weather tire tread compounds are more balanced in terms of carbon black and silica loading, with more reinforcing surface areas, which provides superior wear performance,” he notes. “All-weather tires may also use resins to achieve additional traction performance.”

personal preferences. On the other hand, there are consumers who only need a tire that performs good enough in winter weather conditions and may not be willing to pay for a dedicated set of winter tires. The good news is that we have all of those needs covered with our current product portfolio and will continue to push the envelope in tire design and development.

PAIGE (Goodyear): Historically, winter tires were primarily a utilitarian purchase, with consumers focusing almost exclusively on improved grip and traction during winter conditions. However, today’s consumers want more. They now seek not only winter grip and traction, but also a comfortable, quiet ride and extended longevity. Essentially, consumers expect their winter tires to offer the same attributes they look for in all-season tires.

WANG (Gripmax): Consumer expectations for winter tires have indeed evolved significantly in recent years. Several factors — including advancements in technology, increased awareness of road safety and changing climate patterns — have contributed to this shift. Consumers now demand superior performance on snow, ice and slush, along with reliable handling on dry and wet winter roads. Tires that offer durability and performance over multiple winter seasons are becoming a priority. Economic pressures and sustainability concerns drive consumers to look for long-lasting options that deliver value.

Consumers increasingly prefer environmentally conscious tire designs with reduced carbon footprints and lower environmental impact during production and use. Winter tires with minimal road noise and smooth handling are now seen as essential, even in harsh conditions. Advances in tire technology have set a new benchmark for comfort and consumers now expect premium features at accessible prices. Customers want high-performing winter tires at competitive prices, especially with rising costs of living.

HAN (Hankook): Consumers’ expectations of winter tires are shifting similar to what we’re seeing in other segments. They want strong value and versatility. Typically, drivers who opt for specific winter tires versus an all-season or all-weather option know they will be navigating icy and snowy conditions.

However, just as the all-season driver is looking for strong handling in more adverse conditions, winter tire drivers are seeking strong performance on dry and wet roads, not just snow-covered ones. Similarly, consumers are seeking increased safety awareness, especially as winter weather becomes more unpredictable across the country. Other expectations revolve around longevity and fuel efficiency, ride comfort and environmental considerations. All of these expectations — for winter tires or others — speak to the continued consumer appetite to enjoy their daily drive.

GRIESE (Michelin): Consumer expectations regarding winter tires have evolved significantly, driven by increased usage and awareness of their importance. As more drivers recognize the need for appropriate winter solutions, there is a heightened demand for tires that provide winter driving confidence. Additionally, with the rise of electric vehicles, consumers are increasingly expecting winter tires to not only deliver winter driving confidence but also enhanced wear life and reduced noise levels.

BOLING (Nokian): As winter conditions become milder in some areas, drivers may be tempted to gravitate toward 3-Peak-certified all-weather tires. This is especially the case as more drivers become aware of all-weather tires. We like to remind dealers and consumers that all-weather tires are best sold as an upgrade to all-season tires for those who insist on using one set of tires per year. Winter tires remain the safest solution for drivers who expect to experience bouts of severe wintry weather, even if those conditions don’t appear quite as often as they used to.

JONES (Pirelli): Consumers’ expectations of winter tires have evolved, with an increasing demand for products that combine performance, convenience and year-round usability. The rise of the all-weather tire segment highlights this shift. These tires, certified with the 3PMS symbol, offer reliable snow and winter performance while eliminating the need for seasonal tire changes. This is particularly appealing for drivers seeking a practical, one-tire solution across diverse conditions.

MCINTYRE (Sailun): Consumer expectations for winter tires have evolved

significantly over the past few years due to advancements in technology, shifting driving habits and environmental concerns.

Key changes in consumer expectations (include) better ice and snow performance (as) drivers now expect enhanced grip on ice and packed snow without compromising wet or dry road handling. Modern consumers look for 3-Peak Mountain Snowflake-certified tires, ensuring toptier winter performance.

Consumers demand winter tires that last multiple seasons without a major drop in performance. Advances in tread compounds and siping patterns have helped extend tire lifespan.

With the rise of EVs and fuel-conscious driving, buyers want low rolling resistance winter tires that don’t drastically impact fuel economy or battery range. This has driven innovations in tire compound technology. Older winter tires were often noisy and stiff, but today’s consumers expect a smoother, quieter ride, especially for highway driving. Tiremakers have developed optimized tread

“In regions with harsher winters, drivers continue to prioritize tires with true winter performance to ensure enhanced safety and performance on icy roads,” says Mike Park, assistant director of marketing, Tireco Inc.

Photo: Tireco Inc.

patterns and sound-absorbing technology to meet this demand.

PARK (Tireco): There is an increasing demand for all-weather tires that offer both convenience and safety, appealing to consumers who prefer year-round traction without the need for seasonal tire changes. However, in regions with harsher winters, drivers continue to prioritize tires with true winter performance to ensure enhanced safety and performance on icy roads.

KANE (Turbo): As vehicles have become more complex, consumer requirements for winter tires have, as well. Higher performance ratings, increased rolling resistance, sound dampening tread blocking and other features have been added to mere traction as consumer priorities in these tires.

But I think the most important expectation shift on the part of consumers has been in regard to their requirement for increased tread life from these tires, which has required most manufacturers to entirely re-think the segment.

PARSZIK (Yokohama): Consumers’ expectations are always on the rise for the performance of all tires, not just winter tires. They feel like a winter tire needs to perform in true winter conditions, as well as milder climates. This is due to weather variations in some regions differing quite a bit.

With the increase of EVs, rolling resistance to preserve battery range is an important factor due to the already shorter range in colder climates. ■

CUSTOMERS AND EMPLOYEES HAVE CHANGED — AND YOU HAVE TO CHANGE WITH THEM

What makes a retail tire store — or even a sales region — successful?

MTD recently sat down with ve Black’s Tire Service Inc. region and store managers, who shared their hard-earned secrets of success.

Panelists included Greg Nobles, coastal regional manager; Jonathan Ransom, central regional manager; Brian Pierce, who runs Black’s Tire Service Myrtle Beach, S.C., area locations; Danny McNally, retail store manager in Clinton, N.C.; and Porsche Spann, retail store manager in Fayetteville, N.C.

Each has spent years in the tire industry and has witnessed rst-hand how employees, customers and the tire industry itself have evolved over time.

ey were joined by Cole Benton, who works in retail management and analytics for the dealership. Benton is part of the third generation of the Benton family who has joined the dealership in the last year and is learning from his grandfather, father and uncles.

By Madison Gehring

talk about how employees, customers and the tire industry have changed over the years. (From left to right: Cole Benton, who works in retail management and business analytics at the dealership; Greg Nobles, coastal regional manager; Jonathan Ransom, central regional manager; Brian Pierce, manager of the company’s Myrtle Beach, S.C., area; Danny McNally, retail store manager in Clinton, N.C.; and Porsche Spann, retail store manager in Fayetteville, N.C.)

MTD

• Wireless Touchscreen/Android 9.0

• Activates, Reads and Relearns All Known Sensors

• On-Tool DOT Tire Registration with CIMS Account

• Program AUTEL MX-Sensors to replace 99% of TPMS sensors on the vehicles on the road today

• Enhanced, At-a-Glance Diagnostics Status Screen + TPMS Health Report

• Read/Erase All System Codes and Perform OLS, BMS, SAS & EPB

• Compatible with Autel’s new Telsa-ready & programmable Bluetooth Low Energy TPMS Sensors

Includes all features & functions of the ITS600 plus... Android 11 OS

• Perform Bi-directional Active Tests & Special Functions

• Extensive Service Menu with direct access to over 40 maintenance tasks

• Generate Detailed Pre- & PostScan Reports

• Wi-Fi sharing and printing

Spann, who has been with Black’s Tire for six years, has been a retail store manager for the last three years. She said customers are coming into tire dealerships more informed, which has changed the way she interacts with them. Many customers want to get right to the point — with price as their top factor.

“We’ve had to learn how to consolidate vital information to answer for the dollar amount that the customer is spending,” said Spann.

McNally, a 35-year tire industry veteran who has worked as a Black’s Tire store manager for the last four years, agreed that customers are more focused on price than ever before. He also agreed that customers are much more informed than in the past.

“As they say in the old days — because I am an old guy — ‘ ere was no internet,’ so the only way for customers to know the price of the tires we carried was by being here and (us) telling them,” said McNally. Pierce, who has been with Black’s Tire for 14 years and in his current role for the last six years, said technology has changed how he approaches selling. “You can buy tires pretty much anywhere” these days.

“You have to go that extra mile for customers now because people come in and they’re more knowledgeable, they’re more tech-savvy, they understand the size of tires, what tread wear is or how many miles they will get out of the tire. But they still have to come see us to have those tires put on, so we still have to provide that service.”

“You have to get back to the basics and do them right because if you don’t, you’ll never get that customer back in again,” said McNally, who adds that “the basics” could mean doing simple things like shaking customers’ hands or o ering them something to drink when they walk into a store.

Ransom added that customers are more time-oriented than in past years. “Customers are more informed, for sure, but I would also say that even though our customers did not say they’ve never valued time before, everyone’s time is a little more valuable these days.”

He said this isn’t surprising as he’s seen the same trend in other industries, including the introduction of tools like Uber Eats or Instacart, which help people make the most of their time.

basics and do them right because if you don’t, you’ll never get that customer back in again,” said Danny McNally, who manages Black’s Tire Service’s retail store in Clinton, N.C.

Photo: MTD

Because customers are more informed, Spann said it’s become easier to explain necessary services to them. “If they need (brake) pads or rotors, they know what they look like and where they should be at. ey’re already shopping before they come in, so when they do come in, they’re coming for something.”

However, Ransom said this can create new challenges. “No one likes to hear they’re wrong, so it’s hard to educate a customer on something else if they come in with a speci c product in mind. e challenge for us is to not make them feel that they’re ‘wrong.’ It’s our job to educate them and that comes back to customer service in the way we approach and have this conversation with customers.”

“We’ve seen a shi in employment and employees” over the years, said Ransom. “We went from a point where we couldn’t really nd any employees and I think now we’re actually on the transition up.”

to change the way you go about things, even if they weren’t necessarily bad or wrong,” said Brian Pierce, manager of Black’s Tire Service’s Myrtle Beach, S.C., area.

Photo: MTD

“I think it’s better that customers are coming in more informed,” said Spann, who explained that this presents an opportunity to sell the value of the product versus the price of the product.

“I can explain to them that they can go to an a ermarket store and get all the parts for their cars, but when they bring them in, ultimately if those parts fail, the warranty is no longer through us. ey may save dollars now, but will they save dollars in the long run?”

Ransom said he is seeing more quali ed individuals apply for positions and believes this trend will continue.

Spann has noted this shi in employment trends, as well. “I had a lot of trained employees before COVID-19 and then COVID-19 hit and they all went away,” she said. “I had a sous chef from a Japanese restaurant who (recently) applied” to work at her store, plus “another guy who has never had a job before and another person still in school who applied” for a job at the outlet. “I just hired them all and trained them for what I needed.”

Spann said that when it comes to specialized technicians, the pool of skilled, highly quali ed candidates has expanded. However, on the general service side, Spann has had to grow her own talent.

“If you don’t want scratched rims, you show them how to mount a tire properly. If you want rotations done quickly, you show them your standard operating procedure and how it should be handled.

“It (can be) discouraging, but depending on how you look at it, you’re either entering a shop full of people who are afraid they’re going to mess up because you’re afraid or a shop full of people willing to take the risk and try,” she said.

McNally said finding employees during the pandemic was di cult. “You kind of had to take whatever you could

get during COVID-19. I always hated that. But once you got that person who didn’t know anything and you were able to build them from the ground up, it’s rewarding.”

He said he once hired someone who was a hostess at Texas Roadhouse to work the front counter of one of his stores. “She didn’t know the di erence between a tire plug and a spark plug, but now she does” thanks to the training she received. “And she’s an absolute rock star.”

Roundtable participants agreed that there isn’t a one-size- ts-all approach to managing employees from di erent generations.

“What I have learned is that it can’t be the way it used to be,” said McNally. “I’m 56 now and I’ve been doing this a long time, but I’ve had to change my whole thought process of doing things. Now, I have two younger people at the counter and a shop full of young guys, so I’m the old guy!”

McNally noted that adapting to the expectations and circumstances of different generations requires exibility. “You have to learn to be able to adapt to the guy who has an electric bill that needs to be paid this week and he doesn’t have the money to the guy who makes $150,000 a year. You can’t put yourself in (any one) box if you want to be able to manage people the way they need to be handled and taken care of. So that was a personal challenge for me.”

“I grew up in a family where my dad was really disciplined and you worked,” said Pierce. “That’s just what life was. You worked hard. My dad was direct and everything with him was direct. en, when I rst started at Black’s Tire, the guy I worked for was the exact same way.”

Pierce recalled that when he moved into a managerial position, he realized that not everyone responded to this type of direct communication in the same way. He also noticed that younger workers value personal time more than older employees.

“When times change, you have to change the way you go about things, even if they weren’t necessarily bad or wrong,” said Pierce.

Ransom believes some younger people can have a more di cult time communicating than their older counterparts. “I don’t think it’s them, necessarily, but more how they were conditioned,” he said. “You

employment and employees” over the years, said Jonathan Ransom, central regional manager for Black’s Tire Service. “We went from a point of where we couldn’t really fi nd any employees and I think now we’re actually on the transition up.”

Photo: MTD

have to nd out how to communicate with them and which way is most e ective.”

However, Ransom makes it clear that although Black’s Tire managers are adaptable and willing to meet their team members wherever they are, they don’t bend on non-negotiables. “It’s the same as when I teach my teenage son to look me in the eye when he’s talking to me or shake people’s hands when he meets them. We teach our team members that, too.”

McNally said some employees’ personal dynamics have changed over the years, which means managers have had to adjust. “We are in the age of single parents being a larger statistic. I can’t be so dogmatic (with) my employees by saying, ‘You have to be here by 7:15,’ when that’s the time the single moms and dads have to get their kids ready and on the school bus. You have to adapt.”

Pierce added that “the days of ‘ is is our way and this is how it is going to be’ are pretty much over.”

Ransom believes one of the great things about Black’s Tire is that the organization has a large population of older team members and a large population of young team members. However, there are not a lot of team members that fall in between those two groups. Because of this, knowledge transfer can be a challenge.

“We want to get the knowledge and skill the older group has to the younger group and we want to get the energy and

creativity the younger group has and give it to the older group,” he said.

Nobles shared his experience hiring both women and men for various roles and some of the di erences he’s noticed between the two genders.

“I recently hired a lady who went through the NASCAR Institute and graduated from that and came looking to change tires, change oil and do all that,” he said. “She’s been with us six or seven weeks and she’s really one of the top people in the shop. Her attention to detail is incredible and she brings an energy because she’s also young. I didn’t realize how much of a win-win it’d be for the both of us. I’m fortunate to have her.”

Pierce said his team members who are women have “outstanding attention to detail” and customer service comes easily to them.

“I think it’s essential to have di erent people at each of our locations for this reason,” said Cole Benton, who is being trained in all aspects of Black’s Tire Service’s business by his father, Rick Benton, and uncles, Jeremy and Ryan Benton. Benton says that having different people with di erent strengths within the organization helps Black’s Tire Service be more successful.

Panelists agreed electric vehicles (EVs) will change certain aspects of tire sales and service. Benton noted that Black’s Tire Service is looking into EV tire training for its managers and other employees. e panel also noted that customers have been “tiering-down” to less-expensive brands, but the extent depends on what communities they serve.

“I’m in a rural area and there’s still a lot of old-school people who will say, ‘You tell me what to get,’ but in other areas, people are looking for the cheapest option,” said Pierce.

Ransom said customers have become less brand-focused and are more focused on tire performance. “Customers aren’t coming in asking for specific brands. ey’re asking for tires that give them certain results.”

Spann said the biggest challenges she’s facing as a manager are new hires and

what they want and expect due to the rising cost of living.

“Often times, because of the new hire situation and cost of living, we’ll sometimes get pinned into a corner where we will get a person with little to no experience (who’s) expecting experienced pay. It becomes a challenge because you have the guy who has been working with you for five to six years and you’ve just hired someone for potentially the same wage. So balancing performance reviews along with bringing in potential help and (also) keeping current employees at a rate in which they can live has been a tough balance.”

Ransom said he always thinks about what drives Ricky Benton, the owner of Black’s Tire Service.

“Ricky always told me if we can get to a point where we care enough about our people to see them do well, that’d be the goal. That’s what drives us and the guys in the shop.”

Spann recalled a piece of advice Ransom gave her when she first moved into a managerial role. “He told me ... with

coaching my people, I will be quite busy.” This even applies to matters outside of work. “I have a 21-year-old who got their first paycheck and I sat down with them and told them how to cut their paycheck so they can pay their bills. Guiding and teaching your people goes beyond just the skills they need for their jobs.”

McNally said a significant part of his job is counseling employees. “These kids come to me — and I call them kids, even though they are in their 30s — and they’ll say, ‘Hey, I’m having problems with my (kids). Can you listen and help?’ When you see a big, burly mechanic come in and he starts crying to you ... you have to respond.”

“It’s that 5:30 p.m. to 7 p.m. window, where you’re standing outside the store and everyone’s just unloading (their problems) onto you,” said Spann, who added that being a manager means you’re stepping into a role where others look to you for both professional and personal guidance.

“It’s the most difficult part of the job, but it’s also the most rewarding part of the job,” said Ransom.

“Managing, to me, is all about the relationship you have with the people you manage,” said Pierce.

Managing others also can come with a dose of humility. “Realize that you’re not always right,” said Ransom. “Remember you had to learn at one point, too, and you may not be right in all situations.”

McNally said if a manager is full of pride and ego, they’ll never be able to hear what their people are saying. “When you become a manager, sometimes a bit of an ego comes with that and it’s important that you check yourself when that happens.”

Spann said it’s important to not only ask for help, but it’s vital to ask for recommendations and advice, too. “Ask from the people you manage — not just those above you. It opens the door for a lot of great conversations and will teach you how to manage your people better.”

Above all, “treat everyone on your team the same and if there is a difficult situation, handle it in private,” said Nobles. ■

Joy Kopcha By

Without a grand economic turnaround or a rebate from a manufacturer, tire dealers might feel a bit helpless in nding ways to make their more-expensive tires nancially attractive to cash-strapped consumers in the current market.

But they do have access to such a tool — it’s nancing.

Whether through a lease-to-own option or a primary, secondary or sub-prime program, nancing experts say the consumers using their products aren’t trading down to lower-priced tire brands like those shoppers who are paying with cash.

And these providers say a growing number of households with incomes of even $100,000 or more are using these options to buy more-expensive tires. MTD talked to ve nancing suppliers to weigh in on the current state of the

economy and how it’s a ecting the market for supplemental nancing options.

MTD: How is the current state of the economy a ecting consumers’ interest in secondary nancing? Is it driving more customers to your service?

CHARLES NANCE, vice president of business development, Acima LLC: Acima Leasing is not a secondary nancing product, but a lease-to-own o ering allowing access to durable consumer goods with short-term, renewable lease arrangements that can be canceled at any time, without penalty. In the current economic environment, consumers are relying more on nancing and lease-to-own transactions to manage rising costs. Millions of Americans have little to

There are several economic pressures prompting more consumers — in all income brackets — to consider using sub-prime fi nancing options, including infl ation, existing debt and credit card limits and uncertainty about what lies ahead.

no access to credit. Retailers can be prepared for any economic climate by offering lease-to-own as an alternative to financing. We’ve seen a growing demand for flexible lease-to-own options, especially among consumers with less-than-perfect credit and those who prefer an alternative to credit products.

HOWARD HAMBLETON, president, American First Finance LLC: The demand for non-prime financing has never been higher, driven by both economic conditions and growing consumer awareness. More customers who once qualified for prime and secondary financing are now exploring below-prime options, leading to increased interest in solutions like American First Finance (AFF). Additional factors we see driving this shift:

• Tighter prime and secondary lending. Many prime and secondary lenders have tightened approval criteria and raised pricing, partly in response to potential late fee caps. As a result, more consumers are being denied traditional financing and turning to tertiary solutions like AFF. This shift has not only increased application volume, but has also brought in higher-creditquality applicants, leading to better approval rates and higher approval amounts for our merchants.

• Credit card constraints. Below-prime consumers often rely on credit cards, but their options are limited. The average credit line for this segment is $1,700 and by the end of 2024, 97% of these cardholders had maxed out their available credit. With fewer alternative payment methods at their disposal, more consumers are seeking flexible options like payment solutions through AFF.

• Low unemployment supports stronger approvals. The sustained low unemployment rate has led to strong repayment performance and lower charge-offs. This stability enables AFF to approve more customers for higher amounts, driving increased sales and larger tickets.

• Inflationary pressures are keeping demand high. The post-pandemic economic landscape saw wage inflation temporarily outpacing market inflation, but that gap has now closed. As inflation remains high, more consumers are seeking payment options to manage essential purchases — creating a growing need for payment solutions through companies like AFF.

In short, shifting credit availability and economic pressures are driving more consumers to below-prime financing. AFF is well-positioned to support both consumers and merchants by providing accessible, flexible payment solutions in today’s evolving financial landscape.

JOHN CULLERTON, chief revenue officer at Snap Finance LLC: Due in part to increased consumer debt, high borrowing costs and uncertainties about the year ahead, many households are exploring secondary financing options. These alternatives can help them manage financial obligations. We know from our proprietary Snap Finance research that 30% of consumers with credit scores less than 670 rely on financing to get the tires or auto repairs that they need. But as day-to-day living costs continue to rise, Snap Finance is seeing more people across all credit types consider secondary financing to keep their cars on the road.

CURTIS HOWSE, executive vice president and CEO of home and auto at Synchrony LLC: There is no question the current state of the economy is impacting consumers’ buying habits. Through Synchrony’s leadership position in the consumer financing industry, we are seeing first-hand how consumers are adjusting their buying habits. The pressure of inflation has increased costs in nearly all categories, including those costs tied to large-ticket items. As a result, consumers deserve and expect a financing experience that starts with helping them find the best possible affordable solution for their evolving budget.

Synchrony has state-of-the-art technology and flexible payment options that partners count on to solve for the majority of their consumers. If Synchrony can’t approve consumers for one of our many programs or products, we have built a robust network of alternative lenders to ‘waterfall’ them that helps them complete their purchase, thus helping our partners keep that consumer engaged. (Synchrony is a primary lender, not a secondary lender.)

Because having reliable transportation is a necessity for so many Americans, finance companies say customers appreciate finance options that help make tires and repairs affordable.

Photo: Jared Navarre | Romph Pou Agency

‘Retailers can be prepared for any economic climate by offering lease-to-own as an alternative to financing.’

Charles Nance, Acima LLC

Within the tire industry, we maintain a roster of more than seven lenders that our partners work with and our technology has direct integration available to deliver a seamless experience. Synchrony helps our partners ensure their consumers are being routed to the best possible outcome for the purchase and their budget. Our goal is to ensure every consumer gets the best option every time.

VICKI TURJAN, president and chief operating officer at Versatile Credit Inc.: Economic uncertainty and rising costs are pushing more consumers to explore flexible financing options — not just for large purchases such as furniture and electronics, but for everyday essentials, including auto repairs.

We’ve seen a growing number of households earning over $100,000 not only applying for financing, but (also) falling into near-prime and no-credit-required categories, meaning that even customers who may not have traditionally relied on financing are now considering it as an option. Dealers already have customers in their shops relying on secondary financing options, even if they aren’t actively asking for them.

For businesses, failing to offer full-spectrum financing means potentially losing customers to competitors who do. However, integrating multiple financing options can be complex and costly. At Versatile, we help businesses offer prime, near-prime and no-credit-required financing in a single, seamless flow. Our technology removes friction from the process, ensuring customers can quickly connect with the financing option that fits their needs, without unnecessary declines, multiple applications or a complicated process.

Many times, consumers choose where to shop based on the availability of financing. If they don’t know financing is an option at your shop, they may not even consider it. That’s why we encourage dealers to make financing a visible part of their sales strategy — not just as a last-ditch “save-the-sale” option, but as a proactive way to drive sales before the customer even arrives. Features like e-commerce prequalification, in-store and online financing promotions and sending application links during appointment scheduling all help customers feel confident in their ability to access financing before they even step into the shop.

MTD: How is the economy specifically affecting the use of secondary financing in the tire and automotive repair industry?

NANCE (Acima): For many consumers, reliable transportation is non-negotiable. However, the cost of maintaining or repairing a vehicle has increased, and more drivers are using lease-to-own as an alternative to financing to get new tires. This shift highlights the importance of accessible options that enable customers to keep their vehicles in safe, working condition without significant financial strain.