May 2024 | FleetOwner.com PREBUY STRATEGIES Page 22 SPECIAL SECTION by Refrigerated Transporter Page 36 broker relations Page 14 Building better TRAILER TRACKING: What to look for Page 30

For once, we’re excited to bring you less.

When we set out to rethink what a truck could be, we streamlined the design to minimize wind resistance, for up to a staggering 10% increase in fuel efficiency compared to our legacy model. The all-new VNL.

Designed to Change Everything.

volvotrucks.us

14 Shipper-broker relations

Fleets can gain an edge on the open market by understanding load board challenges and creating trust.

Safety 411

18 State of regs: Patchwork problems Operations

20 Volvo’s zero vision includes fleet profits

22 2027 prebuy strategies

With upcoming emissions regulations bringing higher costs, fleets and manufacturers are making plans for prebuy activity and to meet demand.

Special Section

36 Relationship driven

The dedication to customers and employees fuels Nagle’s reefer business.

42 Alternative acceptance

The pain is real, but the TRU transition is undeniable.

30 GPS trailer tracking

What should fleets look for? Pay close attention to operational needs when choosing a GPS tracker.

4 FleetOwner | May 2024 Contents May 2024

SAFETY & OPERATIONS EQUIPMENT TECHNOLOGY NEWS & PERSPECTIVES Photo: freshidea | 67781215, Sean Gladwell | 7016306, tong2530 | 651918595 | Adobe Stock Photo: Dusit | 746202721 | Adobe Stock Photo: PLM Fleet Photo: stellalevi | 482818710, Vadym Ivanchenko | 1834729590 | Getty Images Photo: Josh Fisher Fleet Owner 14 42 50 30 22

:: Feature :: Cover Story :: Feature

Tire

Technology

34 Motive debuts suite of AI technology 8 Lane Shift Ahead 10 News 46 Private Fleets 48 Truckload 50 Last Word

Tracks 27 Single-tire policy gets risky Product Spotlight 28 Transportation management systems

News

BORN TO BE BETTER.

™

U.S.A. Owned & U.S.A. Made

Designed with decades of experience in quality and craftsmanship, Stoughton® introduces a new standard in refrigerated trailers—PureBlue™ We developed PureBlue using proven components, customer input, thorough testing and the same durability and value you have come to expect from Stoughton. The lighter weight PureBlue will deliver more thermal efficiency and safety than competitive trailers on the road today. PureBlue— It’s just born to be better.

877-776-5505

• StoughtonTrailers.com/PureBlue

Regulations to watch for rest of ’24

In light of the recently finalized Phase 3 of the Clean Trucks Plan by the Environmental Protection Agency, the chatter about speed limiters, and the ever-evolving hoursof-service rules, regulatory change often happens in the trucking industry. But is this change happening too quickly or too slowly? Representatives from Scopelitis Transportation Consulting and the American Trucking Associations shared their insights on what to watch as the year continues. FleetOwner.com/Regs2024

Guide to improved efficiency and profitability: Skyrocketing fuel costs, costly maintenance, and increasing insurance premiums are major challenges for fleets.

FleetOwner.com/ProactiveFleet

Reducing CSA violations and increasing safety: Focus on the top causes of roadside violations for fleets and common problems and solutions.

FleetOwner.com/ReduceCSA

Where natural gas fits in decarbonizing trucking: As with any technology, there are pluses and minuses with natural gas. The obvious big plus is that RNG and CNG can be a near-zero solution. Another is there is already some fueling infrastructure in place for natural gas vehicles. In the case of renewable natural gas, it can achieve negative carbon intensity.

FleetOwner.com/CNGTrucking

Delivered

6 FleetOwner | May 2024 Published by Endeavor Business Media, LLC 30 Burton Hills Blvd., Suite 185 Nashville, TN 37215 800-547-7377 VP/Market Leader Commercial Vehicle Group Michael R. Uliss michael@fleetowner.com Editorial Director Kevin Jones kevin@fleetowner.com @KevinJonesTBB Editor in Chief Josh Fisher josh@fleetowner.com @TrucksAtWork Senior Editor Jade Brasher jade@fleetowner.com Editor Jeremy Wolfe jeremy@fleetowner.com Digital Editor Jenna Hume jenna@fleetowner.com Art Director Eric Van Egeren VP Customer Marketing Angie Gates angie@fleetowner.com Customer Marketing Manager Leslie Brown leslie@fleetowner.com Production Manager Patricia Brown patti@fleetowner.com Ad Services Manager Carmen Seeber Contributors Jason McDaniel David Heller Gary Petty, Private Fleets Editor Kevin Rohlwing Seth Skydel Endeavor Business Media, LLC CEO Chris Ferrell President June Griffin COO Patrick Rains CRO Paul Andrews Chief Digital Officer Jacquie Niemiec Chief Administrative and Legal Officer Tracy Kane EVP/Transportation Kylie Hirko MEMBERS ONLY Access comprehensive reports, engaging industry topics, and exclusive

content...and best of all...it’s FREE. Register at FleetOwner.com/members.

Connect with Us Linkedin/fleetowner Facebook/fleetowner twitter.com/fleetowner Photo: NACFE Online Exclusives White Papers

Up

multimedia

Online

Sign

to your inbox, FleetOwner newsletters provide regular industry news, event updates, and breaking news alerts.

your email subscriptions at FleetOwner.com/subscribe.

Manage

IdeaXchange

Photo: NeoPhoto | 1077089216 | Getty Images

YOUR FLEETPRIDE TEAM IS ALWAYS WORKING HARD TO KEEP YOU ON THE ROAD. That’s why we’re giving you automatic cash back plus free shipping* from the nation’s largest heavy duty truck and trailer parts inventory - with 300+ branches and five distribution centers across the US. Enrolled customers with $10,000+ in eligible online orders in 2024 will get a minimum of 3% cash back, paid in 2025, with bonus buy savings throughout the year. We have the parts you need, when and where you need them. Sign up for eCash today at FleetPride.com

drive

the contiguous United States. See

5137 05/24 ©2024 FleetPride, Inc. | 800.967.6206 | FleetPride.com

savings with eCash rewards SIGN UP FOR FREE TODAY & GET CASH BACK + FREE SHIPPING. *Terms and conditions apply. Cash back rebate, bonus buy savings, and free shipping offers eligible on qualifying purchases only. Free shipping offer valid on eligible $200+ parcel orders within

FleetPride.com for complete details.

A high-def history lesson

The past reminds us technology tends to get better and cheaper

By Josh Fisher Editor in Chief

By Josh Fisher Editor in Chief

@TrucksAtWork

Looking into the crystal ball can be challenging. But I’m optimistic that zero-emission technology will succeed as early adopters find success, and innovation and competition drive down prices.

ANY TIME I GET A CHANCE to drive an electric truck or talk to a fleet leader about the challenges ahead for this transportation transformation our industry is experiencing, I think of HDTVs.

The first time I saw a high-definition TV in person, I was a college student shopping at a Nobody Beats the Wiz electronics store in the late 1990s. The flat screen displayed a football game with such detail that I could count the grass blades. The future was in high-def, but I was bound to walk out that day lugging a heavy box TV. The new technology was amazing—but too expensive for a guy who thought dinner at Wendy’s was splurging.

Along with vivid colors, the HDTV boasted a five-figure price. The classic CRTtube RCA I ended up with (and lugged from apartment to apartment for several years) was a few hundred bucks. I could not fathom ever spending $10,000 on a TV at that point.

And, lucky for me, I never had to. Within a decade, the HDTV technology improved, and prices plummeted as more manufacturers offered crisp pictures on lighter sets. When I bought my first HDTV, it cost only a little more than that RCA box did in 1999.

Fleet leaders looking at new, high-tech altfuel trucks might feel like I did 25 years ago: It’s a fantastic technology, but I don’t see how it could fit into my life. Now, I cannot imagine where I would even fit a tube TV in my house.

Will fleet leaders and truck drivers feel the same way about EVs, fuel cells, and internal combustion engines running on renewable fuels 10 or 20 years from now? It’s almost assured these new transportation technologies will be cheaper and more accessible. After all, the greenhouse gas-reduction technology loaded into newer heavy-duty trucks is getting more expensive to produce and more complex to maintain.

It’s no wonder OEMs and fleets are preparing for the 2027 prebuy (see our cover story on page 22). It makes sense to get as much

current equipment as possible so you feel less push to adopt new tech sooner.

Starting in 2027, the EPA’s Clean Trucks Plan mandates manufacturers to sell more ZE equipment while making traditional trucks pollute less. Federal regulators should allow the market to drive alt-fuel freight adoption (like the market drove HDTV sales). The major OEMs are already focused on decarbonizing themselves, with plans to phase out traditional diesel equipment over the next two decades—with or without mandates.

A few years ago, I listened to a futurist talk about transportation. He warned how complicated electrification will be, which, in retrospect, is even more apparent today.

He noted that it wouldn’t be easy if every vehicle was electric. Not every car-owning American has a garage to park and charge their car. Even if trucking fleets could build out infrastructure at their depots, they would end up with fewer spaces because you need more room to charge trucks. He felt green hydrogen would win out because fuel cells are lighter than truck batteries, and most Tier 1 suppliers and manufacturers were working on FCEV technology.

Looking into the crystal ball can be challenging. The freight downturn today that’s hampering for-hire fleets won’t last forever, but it can be hard to look years ahead while making less money today. Predicting the future is hard. Private fleets, which aren’t as susceptible to freight downturns as the forhire fleets, are already planning.

Just as my younger, hamburger-budget self couldn’t fathom buying an HDTV, early adopters did, and the technology became more popular, driving innovation up and prices down. Trucks aren’t TVs, but I’m optimistic that as more fleets succeed with ZEVs, adoption will ramp up. The big question, though, is what happens if mandates outpace normal market forces? Let’s hope we don’t find out. FO

8 FleetOwner | May 2024

[ Lane Shift Ahead ]

GHG3 reality worries fleet leaders

Fleet leaders feel EPA puts them in a predicament

by Jade Brasher

The trucking industry is still grappling with Phase 3 of the Greenhouse Gas Emissions Standards. The contentious Phase 3 rule, part of the Clean Trucks Plan, requires manufacturers of heavyduty vehicles to meet stringent standards in the coming years.

Finalized in late March, it pushes increasing percentages of new zero-emission vehicle sales. By 2032, the U.S. EPA rule requires 25% of new long-haul and 40% of heavy-duty short-haul and medium-duty vehicles to be zero-emission.

Although the EPA requirements are aimed at manufacturers, trucking companies will be the most affected, as manufacturers pass the cost of research, development, and higher-priced equipment to customers. Trucking companies, already faced with the rising prices of maintaining cleaner-burning diesel engines and current emissions requirements, can see this problem coming.

“I really think the trucking community understands the predicament with this regulation,” Dan Ruoff told FleetOwner. “Massive reductions in diesel-truck emissions already exist, plus more to come. The trucking industry has gone above and beyond in their part to clean the air.”

Ruoff is the maintenance supervisor for Lodi, California-based Frank C. Alegre Trucking, a fleet that hauls bulk food-grade products, food-grade liquids, and aggregate building materials. He is responsible for ensuring the fleet of 200-plus trucks reaches and maintains emissions compliance—both locally and federally. In advance of the EPA Clean Trucks Plan’s 2027 start date, Alegre Trucking already modified operations and invested a small fortune to comply with the California Air Resources Board.

“I’ve been here 32 years, so I’ve experienced the entire transition toward stricter emission regulations,” Ruoff

told FleetOwner . “We have had to install exhaust filters on trucks before the manufacturers even built trucks with exhaust filters. We have had to retire trucks prematurely that still had plenty of life left in them—less than 600,000 miles. We have to budget now for the cleaning of all exhaust filters on a regular basis. We are constantly plagued with performance-related issues due to the complications that encompass the emission control systems.”

While Alegre Trucking operates in the state with the strictest emissions regulations, other states have adopted similar rules.

Trucking companies and drivers aren’t alone in their frustrations toward EPA and CARB. Several trucking associations, including the American Trucking Associations, Truck and Engine Manufacturers Association, Owner-Operator Independent Drivers Association, and others, also pushed back on Phase 3 of the Clean Trucks Plan, even before it was finalized, citing that the rule focused too much on BEVs, that industry technology is not yet ready to move forward with these strict regulations, and others.

“ATA opposes this rule in its current form because the post-2030 targets remain entirely unachievable given the current state of zero-emission technology, the lack of charging infrastructure, and restrictions on the power grid,” ATA President and CEO Chris Spear said after the rule was finalized.

How will we get there?

It will take a joint effort from all involved parties to see a significant portion of the trucking industry running zero-emission vehicles, especially if 40%—the EPA goal—is the magic number. Involving all parties includes listening to those with boots on the ground and rubber on the road—the truck owners and operators.

Andress Alegre, owner of Alegre Trucking, said that the company supports all efforts to contribute to a cleaner environment, but like many in the industry, he wants to do so “as the technology and feasibility to transition to BEVs becomes available.”

Unfortunately, some individuals behind trucking companies and organizations feel they aren’t being heard. “They don’t care about what we have to say,” Ruoff told FleetOwner, referring to EPA and CARB.

Ruoff mentioned multiple examples from his fleet and the trucking industry that outline diesel engine improvements developed over the years “to help clean the air,” but he wants to see this information get in front of the “right people.”

“EPA and CARB certainly don’t care, but somehow, we need to get this info to the lawmakers and the general public,” Ruoff said.

A 25-45% zero-emission future could come with excessive costs and disrupt the trucking industry. With the strides the industry has already made, is it worth investing that much money and forcing the adoption of BEVs regardless of their current viability in trucking?

“Isn’t it time to allow the electrification of vehicles to progress at a realistic rate rather than prematurely force this transition onto an industry that has already done so much?” Ruoff asked. FO

10 FleetOwner | May 2024 NEWS REGULATIONS

Alegre Trucking operates in California.

Photo: Frank C. Alegre Trucking

Volvo to build new truck plant

The Volvo Group will build a new heavy-duty truck manufacturing plant in Mexico to supplement the group’s U.S. production. The plant will provide additional capacity for Volvo Trucks and Mack Trucks in the U.S. and Canadian markets and support Mack sales in Mexico and Latin America. The plant is expected to be operational in 2026.

The Mack LVO plant in Pennsylvania and the Volvo NRV plant in Virginia will remain the company’s main production facilities for heavy trucks in North America, it noted. The group invested more than $73 million over the last five years in LVO expansion and upgrades and is currently investing an additional $80 million to prepare for future production. The NRV plant is completing a six-year, $400 million expansion/upgrade to prepare for production of the new Volvo VNL model.

The new plant will be approximately 1.7 million square feet in size and will focus on the production of heavy-duty conventional vehicles for the Volvo and Mack brands. It will be a complete conventional vehicle assembly facility including cab bodyin-white production and paint.

Greenlane plans 280-mile EV corridor

Greenlane announced its first commercial EV charging corridor with more than 100 chargers, modern amenities designed to increase the comfort of drivers, resilience for high uptime, and ultimately moving freight more efficiently.

Greenlane is a joint venture between Daimler Truck North America, NextEra Energy Resources, and BlackRock. The new charging corridor along Interstate 15 aims to accelerate the rollout of carbon-neutral

freight transportation with initial charging locations in Colton, Barstow, and Baker, California. Further locations will be added along the corridor over the next year, extending beyond Southern Nevada and to San Pedro in California.

At full build, the Colton site is planned to have more than 60 chargers, including 400 kW direct current fast chargers to speed charging of medium- and heavy-duty zero-emission vehicles. More than 200 kW DCFC charging options on-site will enable long-duration and overnight charging for heavy-duty tractors, medium-duty ZEVs, and school buses. Greenlane will also deploy multiple passenger car charging stalls to support light-duty and passenger vehicles.

Later project phases will support both long-duration and overnight charging lanes for tractor-trailer combinations as well. FO

May 202 4 | FleetOwner.com 11 NEWS BRIEFS 2405FO_GabrielRideControl.indd 1 4/4/24 8:15 AM

Driver-focused fleets earn honors

For the Best Fleets to Drive For, it’s company culture, appreciation, kindness

by Jeremy Wolfe

Gathering actionable feedback, maintaining stellar company culture, and simple moral kindness drew international appreciation during this year’s Best Fleets to Drive For overall winners. CarriersEdge announced the 2024 winners at the first Best Fleets to Drive for Education & Awards Conference, held at the Nascar Hall of Fame in Charlotte, North Carolina, April 8-9.

Best Fleets identified winners across three awards: Best Overall Fleet in the large carrier category, Best Overall Fleet for small carriers, and the new inaugural Stratosphere Award.

Best overall large carrier: Challenger Motor Freight

Challenger Motor Freight, a Canada-based fleet operating about 1,500 trucks, won Best Overall Fleet in the large carrier category. A key contributor to Challenger’s standout driver service was gathering employee feedback and directing that information toward company improvement.

“I think that our main pillars for our organization have always been people, customer, profits,” Steve Newton, director of safety and driver development for Challenger Motor Freight, told FleetOwner. “Our philosophy is if we take care of our people, they’re going to do well by our customers, and then, obviously, the profit comes on later.”

Best overall small carrier: K&J Trucking

The Best Overall Fleet in the small carrier category was K&J Trucking, a South Dakota-based fleet operating across the lower 48 states. For K&J, hiring the right people to support the fleet’s core values helped win the Best Overall Fleet recognition.

“We have four values at K&J that we

hire to, and everybody that works there embraces them,” Shelley Schipper, president of K&J Trucking, told FleetOwner

K&J’s four values are: Do the right thing, go the extra mile for drivers, own it, and be geared to the community.

“We own it ... What does that mean?” Shelley Schipper said. “We just own the process, and we own our jobs. We own our mistakes. We own our freight. We own our decisions; we own it.”

She said that the K&J workforce collectively embraces these four values, which have been key to its successful driver relations. “Those four core values were developed by our team. Everybody believes in them, and everybody does them. We practice them every day, and I think that’s what elevates our company to a Best Fleet.”

To ensure that these values are reinforced, K&J carefully chooses employees who buy into the company culture. This workplace culture and careful hiring have helped K&J consistently onboard and retain great drivers, according to Dan Schipper, marketing manager for K&J.

“I can unequivocally say that we have the best drivers that I’ve seen. We have the highest standards that I’ve ever seen,” Dan Schipper told FleetOwner. “These men and women have fed our family for years, and they are consummate professionals; it’s easy to want to do the

right thing for them and try to show up because that’s what they’re doing.”

The Stratosphere Award: Garner Trucking

The first Best Fleets Conference also featured a new overall winner category: the Stratosphere Award. This award recognizes the top-scoring fleet among those in the Best Fleets Hall of Fame.

Garner Trucking, an Ohio-based fleet, won the inaugural Stratosphere Award. According to Sherri Garner Brumbaugh, CEO, president, and owner of the company, simple moral rules can help direct a fleet to greater driver service.

“I think it’s simple. It’s do unto others as you would have them do unto you. You just live by those golden rules,” she told FleetOwner. “I get out in the truck as often as I can, and I go out for a whole week.”

Garner’s driver service has drawn drivers to appreciate both the company and Brumbaugh herself.

“Sherri, there’s no other like her,” Rich Robinson, company driver for Garner Trucking, told FleetOwner. “She’s not a boss, but she’s more than a boss, and she treats her employees like gold, like family. Employees start to realize that. I told my dad one time that, sometimes, it feels like Garner hires you to retire you. I can see it myself for the long run, working for retirement.” FO

12 FleetOwner | May 2024 NEWS WORKPLACE

Garner Trucking won the inaugural Stratosphere Award. Photo: CarriersEdge.

CRH acquires Calif. companies

CRH, the 2023 FleetOwner 500 Private Fleet of the Year, recently acquired BoDean Company and Northgate Ready Mix in Santa Rosa, California. The acquisitions represent the first entry by CRH’s Materials Solutions business into California and enhance its ability to provide integrated solutions to customers in the Northern California market.

Both companies complement CRH’s Materials Solutions business in the Western U.S. and add quarries, readymix concrete, asphalt, and recycle plants to its operations.

Nikola sells more fuel-cell trucks

Nikola Corporation produced 43 and wholesaled 40 Class 8 hydrogen fuel cell electric vehicles during Q1. And the Nikola team has commenced the return process for the BEV “2.0” trucks to customers.

“We are on track for a successful 2024 by continuing the momentum set in 2023,” said Nikola CEO Steve Girsky. “It’s about more than just setting goals. It’s about following through on our commitments. This includes not only the production and sale of our hydrogen fuel cell electric trucks but also the start of returns for our battery-electric trucks to customers.”

All trucks wholesaled to Nikola dealers are destined for end customers. The three remaining hydrogen fuel cell electric trucks in the finished goods inventory at the end of the quarter have already been allocated.

Class 8 orders fall

Orders for Class 8 units dropped significantly to end the first quarter of 2024, according to preliminary reports from FTR and ACT Research. Both firms’ preliminary findings noted that March’s net Class 8 orders were down compared to February and March 2023.

“Despite weakness in the freight markets that has persisted for more than a year, fleets continue to be willing to order new equipment,” Eric Starks, chairman at FTR, said. “Order levels in March were below the historical average but remained in line with seasonal trends. Demand is not declining rapidly, but neither is the market doing significantly better than

replacement level demand.”

FTR’s preliminary data counted 18,200 net orders for Class 8 units, down 34% from February and down 4% year over year. Meanwhile, ACT’s preliminary data found 17,300 orders, down roughly 50% from February and down 8.7% year over year.

FTR noted that March’s activity fit seasonal expectations. FO

May 202 4 | FleetOwner.com 13 NEWS BRIEFS

Building better broker

Knowing load board challenges to look for and creating trust can give fleets an edge on the open market

by Jade Brasher

14 FleetOwner | May 2024

SAFETY & OPERATIONS FEATURE

Photo: Dusit | 746202721 | Adobe Stock

Trucking companies that rely on brokers and load boards might be frustrated with the process. Finding a load, connecting with a broker, bidding on a rate, and negotiating for it comes with many challenges, whether it is due to fraud, miscommunication, or a lack of trustworthy relationships. How can those challenges be avoided?

Most trucking companies are classified as small businesses, according to the American Trucking Associations’ latest trend report: 95.8% of fleets operate 10 or fewer trucks, and 99.7% operate fewer than 100. Larger fleets are often private carriers that ship goods for businesses.

Ed Stockman, co-founder and CEO of freight booking platform Newtrul, told FleetOwner that after you remove private fleets from the equation, about 80% of the trucking industry is transactional, which makes finding loads a competitive part of the trucking business.

Of that 80% that Stockman mentioned, about 95% of loads are passed through load boards, requiring shippers and carriers to shift through posting after posting, lane after lane, and equipment requirement after equipment requirement to find a load to haul. This process leaves room for mistakes and, even worse, bad actors.

Freight challenges

While load boards are a necessary part of the trucking industry, they can be a source of headaches.

“You could find five brokers that have Chicago to L.A. [lanes], and then you have to figure out who’s paying what, negotiate with all of them, and then make a decision,” Stockman said. “There’s so much back and forth, and it’s so highly transactional that it’s a waste of time for both sides.”

He also said that shippers and brokers might not always advertise the whole truth of the load on the load board, mentioning that a carrier might discover a load to be rubber tires when

“Are you dealing with a good actor? Because quite frankly, bad actors aren’t always fraudsters; sometimes they’re just knuckleheads.”

– Andy Dyer, president of transportation management, AFS Logistics

the load they accepted was food. Then there’s the question of whether a load or broker is legitimate.

“The amount of real freight out there compared to postings and real brokers compared to fraudulent folks and bad actors is another obviously huge problem in the market right now,” Stockman told FleetOwner.

What Stockman referenced is a genuine and damaging problem in the industry. Trucking has seen a rise in freight fraud over the years. Load board platform Truckstop reported instances of fraud have increased on its platform by 130% from 2022 to 2023 alone. In 2023, Truckstop denied account access to thousands of unverified entities that were unqualified, had inactive authority, or various other reasons to prevent fraud on its platform.

As bad actors pose as carriers and brokers, both brokers and carriers can be victims of freight fraud.

With this negative attention surrounding freight, it’s more important now than ever that fleets give thoughtful review and attention to every load and every interaction with a broker or shipper.

Fleets should practice due diligence

Andy Dyer is the president of transportation management at AFS Logistics, a global third-party logistics provider. Dyer believes fleets can best improve their experiences with brokers and shippers through due diligence.

“A broker is responsible to understand if they are dealing with a reliable fleet,” Dyer told FleetOwner. “I would argue a fleet is responsible for understanding if they are dealing with a responsible customer, whether it be a shipper or broker.”

“Brokers very much inspect the capacity that they’re buying ... to understand, ‘Am I buying from [and] am I working with a reliable source of capacity?’” Dyer continued. “I would encourage fleet owners to do the exact same thing.”

Along with ensuring a broker or shipper is legitimate, it’s important that carriers confirm the requirements of the load they intend to carry. Not only is it essential, it’s their responsibility, Dyer said, and they should be the ones to communicate the load requirements to the driver. He suggested that fleet owners and carriers again practice due diligence when working with a broker or shipper to ensure they are a “good actor,” including communicating well.

“Are you dealing with a good actor? Because quite frankly, bad actors aren’t always fraudsters; sometimes they’re just knuckleheads,” Dyer told FleetOwner “To me, it’s all about asking the right questions, making sure you get it right, and making sure you communicate it to the driver.”

How to be a carrier of choice

While fleet owners and carriers cannot be held accountable for the actions of shippers and brokers, they can be held accountable for their own. And it’s these actions that will show brokers and shippers whether the fleet will make a good carrier partner.

Dyer said one of the best ways a fleet can prove they are a carrier of choice and stand out among other carriers is by simply being reliable.

“Do you show up when you say you’re going to? Do you deliver when you say you’re going to? It is all about reliability,” he explained. “As a buyer of capacity services, I want reliability. If I hire you to do a job, are you going to do the job that I asked you to do as

May 2024 | FleetOwner.com 15

SAFETY & OPERATIONS FEATURE

you say you’re going to do it?”

Dyer also believes that reliability goes hand in hand with honesty and owning up to your actions and circumstances. When life happens, such as time spent in traffic that wasn’t factored in or weather conditions that prevent a driver from proceeding, Dyer said it’s best that fleets honestly communicate those circumstances to the shipper or broker.

“Transportation is not like running a manufacturing plant where it’s a closed site or four walls where you can tightly engineer and control that environment,” Dyer said. “Stuff happens. Accidents happen. Traffic happens. Weather happens. All that goes on. So just raise your hand, be honest, own it ... And if you make a mistake, it’s OK. We all do. Own it. Raise your hand, and we’ll work on it. We’ll fix it.”

Relationships and integrations

Establishing your fleet as a carrier of choice is the first step in building relationships with brokers and shippers. While Stockman has seen that relationships aren’t required to get great loads, Dyer believes they are important.

“Connections with people matter,” Dyer told FleetOwner. “If [brokers] have a choice to make between the same rate with two providers, and they know one and they don’t know the other, they’re going to go with the one they know.”

Dyer sees this daily in his office. While he said his capacity managers welcome new carriers into their rotation, he often hears them making calls or connecting with already proven, reliable, and trustworthy carriers.

On the other end of the spectrum, Stockman said building relationships with brokers, while helpful, isn’t necessary—especially when working from a freight booking platform. He also said that carriers and brokers working from an integrated platform might find that integration simplifies how they do business. In some instances, Stockman sees technology “outperforming and outpacing the human relationship

“About 80% of the trucking industry is transactional, which makes finding loads a competitive part of the trucking business. Of that 80%, about 95% of loads are passed through load boards.”

– Ed Stockman, co-founder and CEO of freight booking platform Newtrul

component” when booking loads.

“We have carriers who don’t have any load boards and only have integrations into shippers and brokers. They have algorithms that are quoting those loads on their behalf, and they don’t pick up the phone,” Stockman noted.

With these integrations, everything is automated, from the quoting to the negotiating, which means fleet companies don’t have to devote time and energy searching for and acquiring loads. With integrations, carriers don’t need to quote

loads, call multiple brokers or shippers, or negotiate rates because everything is automated, Stockman explained. This automation has even led to repeat business, he said.

“What’s crazy about it is with those integrations and those automated, quoting, bidding, booking, negotiation-type carriers, they’re doing way more repeat business than anybody else,” Stockman told FleetOwner

Find what works

Dyer, like Stockman, recognizes the importance of integration and technology, but he emphasized that relationships must not be overlooked as part of being a responsible actor as a carrier. Yet, they both see the value in individual business owners doing what works best for them and their businesses.

Stockman encourages fleet owners and carriers to “pick a metric,” or an aspect of business they’d like to improve, be it time management, increased profits, or more miles, and then find strategies to improve those specific metrics.

Dyer’s advice to fleets when it comes to acquiring loads and standing out is to “know your customers.” By knowing their customers, fleets can adapt and improve their operations to meet their customers’ needs more efficiently. FO

16 FleetOwner | May 2024

It’s important that carriers confirm the requirements of the load they intend to carry.

Photo: Serhii Hryshchyshen | 1540100704 | Getty Images

NARROW STREETS BRING OUT OUR BEST.

THE WORLD’S BEST ™

Tight corners? Heavy traffi c? Bring it on. Because when the job demands versatility, the hard-working Kenworth Medium Duty family delivers for you—and your drivers. All share a robust cab design and off er premium, cutting-edge, driver-centric operating systems. Build your fl eet at Kenworth.com/TheWorldsBestDelivery

© 2024 Kenworth Truck Company

by David Heller

© 2024 Kenworth Truck Company

by David Heller

State of regs: Patchwork problems

Drivers don’t deserve different laws in each state

IF YOUR WALLET is anything like mine, you have a little less in there because of the rising costs of almost everything. One constant in your billfold is that every dollar is issued by the United States of America and marked as a Federal Reserve Note. A single currency for all 50 states eliminates the need for each state to issue its own currency.

While our monetary system abides by a single federal standard to prevent confusion and inconvenience, a troubling trend is regulatory issues that seem to be promulgated on a state-by-state basis.

Being a professional truck driver is a tough job, and our government entities should recognize that by not making the profession harder but rather easier.

In this particular instance, California stands out as the most obvious example. I previously wrote about the California meal and rest break laws, which the state has applied for an FMCSA waiver to implement. The professional truck driver does not operate in a state

vacuum, and California is no different. A driver’s typical day can involve crossing multiple state lines, so abiding by rules at a state level when operating in interstate commerce can lead to confusion and non-compliance, especially if these laws are constantly changing.

Meal and rest breaks are one thing, but states are also beginning to follow suit with technology in the industry. Speed limiters certainly come to mind here. Once again, California has proposed a bill requiring 2027 model year and newer vehicles to have a speed limiter preventing them from traveling more than 10 mph over the speed limit. If passed, drivers would still be able to override the system temporarily. Why are states considering a patchwork of laws ahead of potential federal regulations?

It’s no secret that FMCSA is working on a rule that would require speed limiters on commercial vehicles. Due diligence takes time, especially in the world of federal agencies. However, if or when FMCSA issues a rule that differs from the state rule, confusion is certain to set in.

Are there instances where this is already the case? Although state laws continue to legalize marijuana use, federally speaking, professional truck drivers operating in interstate commerce are prohibited from ingesting the substance, knowing it would be detected under DOT drug screenings. Ultimately, the moment another state legalizes the drug, inquiries regarding drivers and their ability to use the drug arise due to the contrast between federal and state laws.

I am not advocating marijuana use. In our industry, state laws often get thrown into the mix among the giant bucket of rules and regulations that our drivers must abide by federally. As one nation, we should set rules and regulations that make the driving job easier, not

muddying the waters of regulations that drivers and carriers are trying to decipher.

While California is easy to point out for its meal and rest break laws, AB5, and recent emission regulations, it is not the only state that has walked this befuddling path, especially since similar rules have been or are currently being developed by the federal government.

Washington has also applied for waivers to enforce its meal and rest break laws, and New York City is proposing a rule that would require side underride guards for vehicles traveling in the city and registered in the state. Though California’s law has drawn the most attention, similar AB5 legislation has popped up among other states, including New Jersey, New York, and Washington.

We can all agree that one federal standard works best for our industry. It eliminates confusion, redundancy, and questions about compliance. Being a professional truck driver is a tough job, and our government entities should recognize that by not making the profession harder but rather easier.

Remember, these knights of the road continue to rise to the occasion by stocking our shelves, feeding the hungry, and providing medicine to those who need it. This is clearly a profession that should be applauded, not admonished, by imposing different rules that may or likely will be promulgated by the federal government.

Next time you pull a dollar from your wallet, imagine what it would look like to have separate bills for each state you visit. That’s a problem our professional drivers should avoid. FO

David Heller | Dheller@truckload.org

David Heller, CDS, is senior VP of safety and government affairs for the Truckload Carriers Association. He is responsible for interpreting and communicating industry-related legislation to TCA members.

18 FleetOwner | May 2024 SAFETY 411

Photo: vitpho | 931676334 Getty Images

ENHANCED SAFETY IS REASON ENOUGH.

Go with SAF Tire Pilot Plus™ to Optimize your Fleet’s Tire Safety.

A roadside tire service is not only expensive, but also creates an unsafe situation.

Tire Pilot Plus™ ensures all trailer tire pressures are automatically managed preventing premature tire failure.

Managing proper trailer tire inflation not only maximizes tread life and fuel efficiency, it also adds an additional layer of safety.

For More Information TirePilotPlus.com © 2024 SAF-HOLLAND, Inc. All rights reserved.

us on

Follow

Volvo sees profitability in path to zero

In Sweden, OEM makes case that going green makes business sense

by Josh Fisher

GOTHENBURG, Sweden—The uncertain future of transportation isn’t just about what power systems will prevail; it’s about how fleets will make money with emerging yet unproven technologies. But after spending a week here, it’s apparent Volvo Trucks believes trucking’s future profitability is green— because the world is demanding it.

The OEM, which hosted North American transportation journalists on Sweden’s western coast, showed how the company is creating a cleaner and safer future for trucking and is determined to successfully convert its 1.2 million trucks operating worldwide to carbon-neutral equipment by 2040.

Volvo Trucks President Roger Alm said it is vital to become net-zero, which the parent of Volvo Trucks North America and Mack Trucks began in 2019.

“Because if you are not all moving to this situation on net-zero, we will not have this fantastic weather that we are having today; we will not have this world that we are living in today,” Alm said while looking out on a bright, sunny Gothenburg sky from a top-floor conference room at the new World of Volvo.

“It will be something different,” he continued. “We need to take our responsibility. The society needs to take their responsibility. You, as you’re now listening, need to take your responsibility into this development because it’s all about what we are going to give to the next generation of people. Are they interested in what kind of trucks we will drive? What kind of TCO there is on the trucks? What kind of range there is? They are not interested at all. They are interested in what we will give to them for the future.”

Volvo executives conceded that this transition will not be easy, and they don’t yet know what alternative

powertrain systems will win. But they see three paths: battery-electric, fuel-cell electric, and renewable internal combustion engines.

It’s a challenge to change trucking, Kristina Nilsson, SVP of charging and infrastructure for Volvo Energy, acknowledged a couple of days later at CampX, Volvo Group’s start-up accelerator division. “North America, [which] is very unique, I would say needs to see that this new landscape requires different methodologies,” she said.

Transportation transition from yesterday to today

Volvo executives pointed out several times this is not the first massive transportation makeover. More than once, they flashed a slide with two photos of New York City’s Fifth Avenue: one taken in 1900 full of horse-drawn carriages and the same thoroughfare 15 years later packed with automobiles.

That timeframe is what Volvo Group and its rival OEMs with similar Paris Accord plans to decarbonize by 2040 have left. Volvo leaders note that trucks have 10-year life cycles, so to meet the complete carbon-free goals of 2050, all its diesel-burning equipment should be

replaced a decade earlier.

But moving from horse-drawn carriages to automobiles made much more sense a century ago: The internal combustion engine is far more efficient than a horse. Today, companies like Volvo must convince skeptical fleets that nascent power technologies will help them be profitable. Most North American fleet leaders see ZE as a much more expensive, complicated way to move goods across our vast continent. The Clean Freight Coalition claims it will cost $1 trillion to electrify U.S. trucking.

Nearly a third of Americans oppose the U.S. taking steps to become carbon neutral by 2050. Within the trucking industry, that number is higher. When I asked our readers last year if we were spending too much time focusing on EVs here at FleetOwner, many of you told me that you don’t want to read about electrification because you can’t see it ever making sense in your operations.

However, the way to win trucking’s mind is through its wallet—not its heart. Much of the industry back in the States simply sees more costs when going green. But Volvo sees it differently (as do a majority of Americans, by the way).

Volvo leaders noted that more

NEWS OPERATIONS 20 FleetOwner | May 2024

The Volvo FH16, which offers up to 780 hp, is seen here with a duo-trailer setup. Volvo Trucks says the heavy-duty truck will decrease emissions because it can haul more than other European equipment. Photo: Josh Fisher | FleetOwner

companies are looking for greener transportation because their customers, who don’t know or care how complicated it is, are demanding it. While many fleets can’t see how BEVs, FCEVs, and H2 ICE will make them more money tomorrow, Volvo believes its customers who embrace the path to zero will ultimately win. That is because people, including two-thirds of the U.S., who want more alternative fuel development will demand it.

“They need to improve their margins, and they need to be able to make this type of investment,” Lars Mårtensson, Volvo Trucks’ director of environment and innovation, said. “And if we look at most of our customers, especially in Europe, they are small and medium-sized companies that can’t take risks. They can’t take big investments if they are not sure that this can be profitable.”

How does Volvo win the hearts and minds of skeptical Americans, who see green energy as an enemy?

“It is obvious that when we come up with new technology and new solutions, it has to have value for our customers,” Mårtensson said. “They need to be willing to pay, and they need to see that this adds to their business. And if it’s too costly and there’s no business case, we need to enhance incentives there.”

Right now, our transportation industry is in what the North American Council for Freight Efficiency calls the “Messy Middle.” Truck makers are focused on exploring all solutions because our days of one dominant fuel are over, as the State of Sustainable Fleets report ominously declared a year ago: The sun is setting on the Diesel Era, and there is no one true path forward.

Battery electric works better for regional routes, while hydrogen, biodiesel, and other renewables are more likely to power long-haul transportation.

“All these different things, including the availability of energy, will determine how fast certain things will go,” Mårtensson added. “Remember, we will not see it overnight like the New York

example. Maybe it will take a longer time, but it can also depend on where we are in the world.”

“In order to make this happen, in a way, we need to recognize that we are in a quite conservative industry. Our customers are used to having excellent efficiency running this type of truck,” he said, pointing at a diesel-powered Volvo FH16 heavy-duty European cabover on display in the Volvo Trucks HQ lobby.

“Together, we need to demonstrate this is working and that this makes good business as well. It’s not only good for the environment but also good for the business.”

– Lars Mårtensson, Volvo Trucks’ director of environment and innovation

A potentially profitable leap

The trucking industry operates on thin margins, and most fleets can’t afford to take a leap of faith just because it might benefit Earth. They are thinking about what will get through this quarter.

“There are different ways to address this, and one is to obviously demonstrate this type of new technology is working,” Mårtensson said. “Our customers who test this early are also part of the journey together with us to scale this up.”

Volvo expects its early-adopting fleets to show off how its BEV and fuel-cell technology can scale up. “We need to have customers who dare to test it and show others in the industry that this is working,” Mårtensson said.

Possibly the biggest driver of decarbonization is fleet customers—or, as Mårtensson called them, “our customers’ customers, the transport buyers.”

“I think they would play an extremely important role because they really set

the conditions for our customers. I think many of them also have very clear objectives where they want to go,” he said.

Shippers and corporations looking for more sustainable goods movements are going to support the fleets at the forefront. “Together, we need to demonstrate this is working and that this makes good business as well. It’s not only good for the environment but also good for the business.”

In the U.S., a general fear is that these more expensive yet decarbonized transportation technologies will trickle down to Volvo Trucks’ customers’ customers’ customers—the consumers. How much can they be pushed to pay more for goods hauled by electric trucks?

“This is tricky—especially since there still are people in society that really don’t believe in the science,” Mårtensson said.

While he agrees that trucking’s decarbonized future could drive up consumer costs in the near term, he doesn’t believe it will be as outlandish as some fear.

“The challenge for the transport sector is that if we add the cost of this new technology, and when we transfer that to the consumer when we transport a bottle of water, then the transport cost is quite small in that,” Mårtensson said. “So, in a way, we need to transfer costs and I think that, in the end, it will not be a significant cost for the end consumer.”

The future of business is green. Despite a healthy chunk of Americans either not believing in or caring about climate change, most want the peace of mind of not being part of the problem. Volvo believes those consumers here and across the globe will be the driving force for fleet transformation and profitability.

Just like Americans in 1900 didn’t know what business opportunities lay ahead for transportation, we don’t know what new revenue potential a green transportation economy could create in the years to come. Just like New Yorkers in 1900 couldn’t fully grasp what Fifth Avenue would like in 15 years, maybe we still can’t fathom what Fifth Avenue will look like in 2050. FO

May 2024 | FleetOwner.com 21

PREBUY STRATEGIES

22 FleetOwner | May 2024

EQUIPMENT FEATURE

As upcoming emissions regulations bring widespread anticipation of higher costs, fleets and manufacturers are making plans for prebuy activity and to meet anticipated demand in the next few years

by Seth Skydel

After 20 years in the making, when 2027 model-year trucks hit the road, they will be equipped with technology that meets the most signi cant changes in emissions regulations since 2010.

Due to the widespread expectation that 2027 model-year trucks will cost significantly more than 2024-2026 models and the uncertain production volumes still being experienced, many eets and manufacturers have begun planning now for these changes.

Upcoming emission regulations dominate 75% of conversations Fleet Advantage is having with eets.

“We’re looking at projected increases in vehicle cost of $25,000 or more beginning with the 2027 model year, including higher prices and increased extended warranty coverage expenses,” said Brian Antonellis, SVP of eet operations at the independent lessor of more than 20,000 heavy-duty Class 8 trucks.

“With those estimations, our customers are focused on acquisition costs, not just because of the higher prices but also because buying earlier than originally planned doesn’t align with normal capital allocation practices,” he added.

Antonellis noted that it can be challenging to weigh the bene ts of acquiring trucks earlier than planned against the risk of implementing new technology. Furthermore, it is important to consider the value of an extended warranty with a higher price over an unknown service life, the higher maintenance cost for older trucks, and how fuel economy is affected over time. Potential changes in a eet’s business must be considered as well.

Antonellis also advised fleets to remember that available order slots can change quarterly in the current production environment for new trucks.

“We believe that 2026 model allocations could already be sold out and that demand for new trucks will be higher beginning in the second half of 2025,” he stated. “Fleets should [already] be thinking about their approach to when they want to acquire new equipment.”

May 2024 | FleetOwner.com 23

EQUIPMENT FEATURE

“With the anticipated higher cost of ownership, a fleet’s strategy for replacing vehicles will look different,” Antonellis added. “The fleets that will have the lowest cost of ownership are the ones that subscribe to a flexible procurement strategy and use actionable data to avoid being reactive. They think holistically and establish multiyear plans for their optimum procurement strategy.”

Addressing uncertainty

Moran Transportation has a lot of equipment in operation. The Elk Grove Village, Illinois, carrier provides regional less than truckload and regional less than container load service from seven facilities in Illinois, Indiana, Wisconsin, Missouri, and Minnesota.

“For the past couple of years, we have been incredibly concerned about the upcoming challenge of new engine requirements for 2027,” Mike Moran, president, said. “The technologies that were implemented in 2008 and 2010 are still posing big issues from an operational standpoint and now we’re heading into unchartered waters with another level of complexity that has not been proven. For anyone that owns or operates trucks, this hurdle is going to be far greater.”

Concerned about supply chain issues and prolonged delays for new trucks, Moran took the initiative and placed orders for new equipment in late 2022 and early 2023.

“We actually added or replaced 25% more equipment than we normally would have to try to avoid having to acquire anything new in 2027,” he related. “The added costs and uncertainty surrounding the new emissions technology are going to continue to push freight rates up and cause products to be much more costly. In some cases, that will also cause some small and midsized carriers to exit the market if they can’t afford this new technology.”

Having a strategy and a plan

Penske Transportation Solutions, the umbrella company that encompasses

Penske Truck Leasing, Penske Truck Rental, and Penske Logistics, operates more than 442,000 trucks. According to Paul Rosa, SVP of procurement and fleet planning at Penske Truck Leasing, the company has yearly replacement needs. “Regardless of what the freight market is doing, every year each of our product lines requires a strategy and a plan,” he said.

“Our 2024 calendar year plan was completed last year, and we are now finalizing the plan for 2025 and beyond,” Rosa explained. “We will continue to support our growing logistics business with new equipment as needed, and the rental fleet gets an annual refresh as we continue to focus on fielding as much new equipment as possible. Like our logistics fleet, our lease fleet will also have significant replacement and considerable growth needs.”

Additionally, Rosa stated that the industry will soon respond to what lies ahead in 2027 once OEMs share more information or more details on costs become available.

“We expect prebuy activity to start later in this year as 2024 production fills,” he said. “Once 2025 production for the 2026 model year opens, there will be a huge spike in orders.”

“Many fleets remember what happened from 2021 to 2023 with OEMs selling out quickly,” Rosa added. “They will not want to fall behind and miss out on ordering equipment, so we are very aware of this and have a plan. We will operate using normal cycles, but we will be ready to take action and respond aggressively.”

Uptick in planning

Generally, operators do not prioritize regulatory changes when replacing or expanding their fleets, according to Chuck Davis, director of sales at PacLease. Instead, he believes their focus is finding the most cost-effective and reliable trucks to minimize downtime.

“However, as we approach the implementation of the 2027 emissions regulations, we’re observing a discernible uptick in procurement planning among customers,” Davis said. “Fleets are strategically evaluating their vehicle acquisition timelines, with many considering a prebuy approach to secure trucks that comply with current regulations,” he continued. “This trend is not only driven by the desire to get ahead of more stringent emissions standards but also reflects an understanding of the potential cost

24 FleetOwner | May 2024

Moran Transportation added or replaced more equipment than they normally would have to avoid having to purchase anything new in 2027. Photo: Moran Transportation

implications associated with the forthcoming regulations.”

“Additionally, given the cyclical nature of the freight market, we see customers aligning their vehicle replacement strategies with projected market demands,” he continued. “With the aim of maximizing operational efficiency and competitiveness, fleets are increasingly prioritizing the integration of newer, more reliable, and fuel-efficient models into their operations. This replacement trend is indicative of a proactive stance toward both maintaining compliance with environmental standards and ensuring readiness to meet the evolving needs of the freight industry.”

Manufacturers looking ahead

In early March, global Daimler Truck CEO and interim CFO Martin Daum told analysts and investors that the OEM will be prepared to respond to any surge in purchase orders before the

2027 introduction of more stringent emissions standards.

“After several years of aggressive fleet replenishment and upgrades, customer purchasing activity continues to normalize,” Daum said. “If we see in 2025 and 2026 a pull-forward effect, we’ll go from there.”

Daum didn’t say that Daimler Truck North America expects to see fleets ramping up orders ahead of the California Air Resources Board’s stricter rules, which will align with 2027 nitrogen oxide emissions standards laid out by the U.S. Environmental Protection Agency. He did note, however, that the relative strength of the U.S. economy will be a significant factor in new truck orders in the coming years.

“We are seeing in 2025 and 2026 fleets will increase their orders to prebuy ahead of 2027,” said Magnus Koeck, VP of strategy marketing and brand management at Volvo Trucks North

Supersize your alignment capabilities.

America. “It’s even possible we will see a prebuy effect at the end of this year as customers realize the capacity won’t be there in 2026.”

With the strong sales for Class 8 trucks it experienced in 2023 and the improved supply chain, Koeck noted that most of the pent-up demand for new trucks has been satisfied, so Volvo is anticipating

Hunter’s new HawkEye® XL commercial aligner measures three axles in four minutes or less.

May 2024 | FleetOwner.com 25

or visit

hunter.com/hawkeye-xl Scan

capabi

2405FO_Hunter.indd 1 4/4/24 10:44 AM

Penske Transportation Solutions is regularly replacing equipment for its leasing, rental, and logistics divisions. Photo: Penske

EQUIPMENT FEATURE

a lower total market in 2024.

“We still think this year will be good overall,” Koeck added. “Looking further ahead, in 2026 the total market could be the highest we have ever seen, and with the launch of our next generation of trucks, we believe we are in a very good position to meet that demand.”

While final compliance costs with EPA 2027 are yet to be fully known, related Blake Routh, senior highway product manager at Mack Trucks, fleets are aware of the potential increase and have begun planning so it doesn’t impact their operations during the next five years.

“We expect demand to be pulled forward as fleets prebuy vehicles in order to offset potential cost increases and more complex emissions equipment on compliant vehicles,” Routh said.

“Prebuy activity depends on the ability to purchase; right now, trucking companies face profitability headwinds from low freight rates,” Routh continued. “As the market recovers and rates increase, we expect to see a rise in order activity related to the prebuying. Fleets have a long memory, and the supply chain challenges after COVID will also likely weigh in their decisions to order trucks sooner rather than later in the upcoming market cycle.”

“As the final GHG3 rule is pending, the commercial vehicle industry is in a divisive period,” said Diane Hames, VP of commercial strategy at Navistar. “Our focus remains on providing products and solutions for International customers that are compliant and support their business objectives.”

Stacking up

Dealing with revised emissions regulations is not unfamiliar to the trucking industry, but there has never been as much activity as there is now.

On a federal level, EPA has determined engine OEMs must increase the useful life and further reduce emissions for model year 2027 vehicles and later. For example, NOx emissions during normal operation will be capped at

0.035 grams per horsepower hour.

Currently, CARB Heavy-Duty Engine and Vehicle Omnibus regulation related to low-load and idle conditions is playing an important role in NOx reduction.

EPA released the final Phase 3 Greenhouse Gas Emissions Standards for model years 2027-2032 at the end of March. For day cab and sleeper tractors, the newest standards vary by vehicle type and are as much as 40% more stringent than the previous Phase 2 rules for model year 2032. For heavy-duty vocational vehicles, including delivery, refuse, and utility trucks, the new standards are up to 60% more stringent than the previous rules for model year 2032.

Regulatory storm forecasts truck order surge

The North American market is already beginning “to feel the storm surge of the coming regulatory hurricane,” according to ACT Research, which produces widely read commercial vehicle truck, trailer, and bus industry data and forecasts. This trend is evident in its latest North America Commercial Vehicle Forecast, which includes market analyses and forecasts for commercial vehicle demand over five years.

“With February’s confirmation of ongoing strength in Class 8 orders, among other supportive signs, the U.S.

Class 8 tractor market is experiencing demand pulling forward in 2024,” Kenny Vieth, ACT president and senior analyst, said. “February orders underscore the ongoing above-demand-level trend in an otherwise over-capacitized U.S. tractor market.”

Vieth noted that the ACT data indicates that private fleets are driving prebuying in 2024. On the for-hire fleet side, he said, “load-to-truck ratios and freight rates confirm the continuation of profoundly bad for-hire freight economics.”

“Private fleets’ longer trade cycles are supportive of more aggressive capacity planning three years ahead of the EPA’s 2027 Clean Truck mandate,” Vieth added. “The strength in private fleet demand and expansion is fueled by both strong corporate profits and pandemic-era for-hire capacity constraints. Private fleet capacity additions were a major story in 2023 that appears set to continue through 2024.”

One year earlier, ACT began predicting a significant prebuy of Class 8 trucks before the next round of emissions regulations targeting diesel exhaust took effect in 2027. They, and other industry analysts and observers, continue to believe the new standards will result in the most extensive truck prebuy ever beginning in mid-2025 or early 2026. FO

26 FleetOwner | May 2024

Operators do not prioritize regulatory changes when replacing or expanding their fleets, according to Chuck Davis, PacLease director of sales. Photo: PacLease

by Kevin Rohlwing

Single-tire policy gets risky

The number of companies refusing to single out dual tires is rising

MY GENERATION represents the last of the real risk-takers. We rode bikes without helmets on the shoulders of busy highways and drank water out of hoses wherever we could find them. Streetlights were the universal signal that it was time to head home for the night. Everyone, myself included, had a beat-up old car because all it had to do was run. There were no emission tests, inspections, or seat belt laws back then. Looking back, it’s incredible we survived the ’80s.

For the past 40-plus years, singling out a tire in a dual application has been widely accepted and practiced. The concept is simple enough. A dual tire fails, and rather than purchase a replacement, the fleet decides to operate the vehicle with three tires on the axle instead of four. It typically applies to an empty vehicle or one with a light load; in theory, there is enough inflation pressure to support the weight on the single tire in that position to get the vehicle to a repair facility.

As long as the single tire has enough weight-carrying capacity for the load, an out-of-service condition (OOSC) would not exist. Enforcement officials can note that the vehicle is empty, so the tire load limit should be sufficient, or they can use the portable scale to check. Regarding an OOSC, the outcome depends on the actual weight on the axle and whether the single tire’s inflation pressure and load limit can support the weight on that side.

The debate focuses on 49 CFR Part 571.120, which covers the tire and rim selection and load-carrying capacity information for motor vehicles with a gross vehicle weight rating of more than 10,000 lb. Part 571.120 is one of many Federal Motor Vehicle Safety Standards (FMVSS) that apply to all vehicles

operating in the United States. The regulations are directed at manufacturers by setting performance and labeling requirements and establishing other measures that improve motor vehicle safety. In this case, the requirements in S5.1.2 are central to the debate.

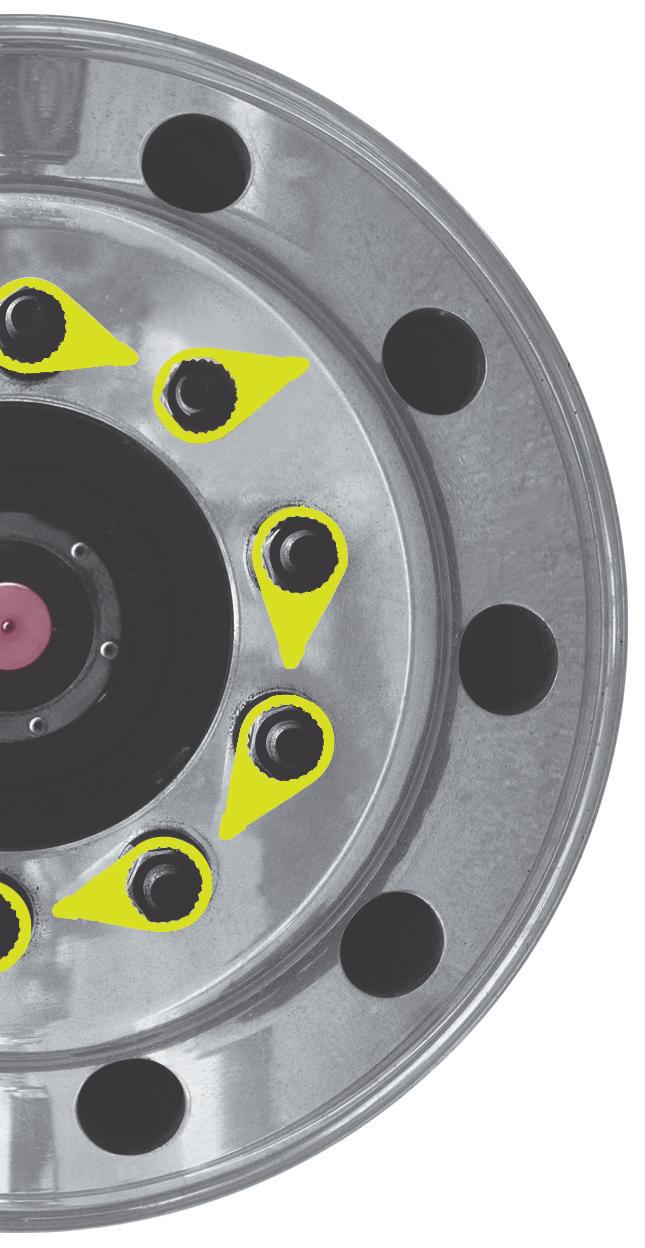

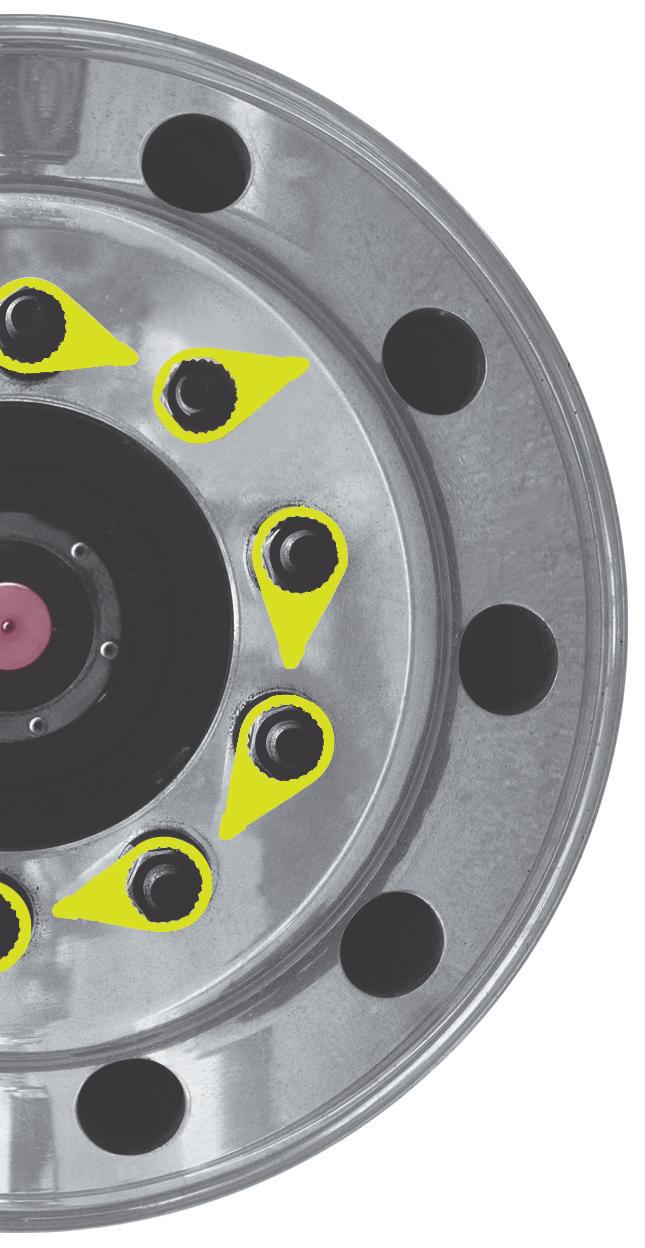

FMVSS 571.120 S5.1.2 states the sum of the maximum load ratings of the tires fitted to an axle cannot be less than the gross axle weight rating (GAWR) of the axle system specified on the vehicle certification label required by 49 CFR part 576. In other words, if a truck or trailer has a GAWR of 20,000 lb., then the tires on that axle must be capable of supporting 20,000 lb. regardless of the load.

A 295/75R22.5 Load Range G tire has a maximum capacity of 5,675 lb. at 110 psi. When there are four tires across the axle, no violation exists. When one of the dual tires is singled out, the maximum load rating would be 17,525 lb. (5,675 x 2 plus 6,175 for the single). The math either adds up or doesn’t.

Complicating the matter is 49 USC 30122, which covers making safety devices and elements inoperative. It defines a “motor vehicle repair business” as “a person holding itself out to the public to repair for compensation a motor vehicle or motor vehicle equipment.” The prohibition requirement under paragraph (b) states that a “motor vehicle repair business may not knowingly make inoperative any part of a device or element of design installed on or in a motor vehicle or equipment in compliance with an applicable motor vehicle safety standard.”

The design element prescribed in 571.120 requires the sum of the tire capacity on the axle to meet the GAWR. When a motor vehicle repair business singles out a 295/75R22.5 on a vehicle with a GAWR of 20,000 lb., it would

appear they are violating 571.120 due to 30122(b). In this instance, the inflation pressure and actual load on the tire would be irrelevant because the combined maximum load capacity does not add up. So, they knowingly made it inoperative by removing and not replacing a tire.

As commercial tire dealers become aware of the requirements, more companies refuse to single out dual tires.

Compliance aside, motor vehicle repair businesses like commercial tire dealers are at greater risk when they single out a tire. In the event of an accident involving that vehicle, the plaintiff will point to the violation of 571.120, 30122(b), or both as contributing factors. As commercial tire dealers become aware of the requirements, the number of companies refusing to single out dual tires is rising.

It’s just not worth the risk. FO

Kevin Rohlwing | krohlwing@tireindustry.org

Kevin Rohlwing is the chief technical officer for the Tire Industry Association. He has more than 40 years of experience in the tire industry and has created programs to help train more than 180,000 technicians.

May 2024 | FleetOwner.com 27 TIRE TRACKS

Photo: 1933bkk 1415924312 | Getty Images

Transportation management systems

AFS Logistics

AFS Logistics’ AFSmartTMS transportation management system helps shippers manage everyday freight tasks automatically. It integrates with ERP systems and offers real-time updates to streamline processes and capture information.

AFSmartTMS is a key component of the AFSmart technology suite, an integrated cloud package that allows shippers to manage their logistics networks.

Descartes Systems

Descartes offers a suite of cloudbased solutions designed specifically for distributors, retailers, and logistics companies. With Descartes, routes can

be planned to meet customer demand while optimizing costs. Its operational route planning ensures timely deliveries, adapting to the evolving needs of customers; intelligent dispatching helps drivers stay on track.

Isaac Instruments

Isaac Instruments offers in-cab technology that it said goes beyond traditional ELDs. Isaac’s solution provides a comprehensive open platform that allows trucking eets to integrate their business apps on a single device. The company said its predictive interface eliminates driver app fatigue and minimizes screen clicks to update hours-of-service logs and other documents. The real-time, in-cab Isaac Coach feature supports eco-driving for fuel savings and safer driving, while AI empowers informed decision-making.

Magnus Technologies

Magnus Technologies’ said its Magnus TMS streamlines processes, improves dispatch communications, and saves companies time and money. This SaaSbased TMS is scalable, secure against cyber threats, easily integrates with other solutions, and updates automatically. It simpli es freight transactions, backof ce operations, and drivers’ workdays to increase pro tability. The Magnus TMS can provide eets with better clarity and foresight when planning loads.

McLeod Software

Integrable with other transportation management solutions, McLeod’s LoadMaster system can add more than 30 functional modules to other trucking industry solutions. These modules and products range from mobile

EQUIPMENT PRODUCT SPOTLIGHT

2405FO_HighBarPremier.indd 1 4/3/24 11:49 AM

Photo: Descartes Systems

communications to vehicle maintenance management. Some of these modules and add-ons include ACE & ACI e-Manifest, breakthrough fuel, dedicated billing module, detention management, document imaging, driver scorecard module, ETA/out-of-route, and more.

Optym

LoadAi from Optym simplifies dispatch so eets can select more pro table loads, build more ef cient trips, and give teams a better working environment. LoadAi uses a driver-centric approach, placing driver preferences at the forefront of load selection and distribution while optimizing for profitability, possibility, and preference. It works atop existing TMS or with Optym’s TMS LoadOps.

PCS Software

The PCS Software transportation management system is designed to streamline

operations and boost pro tability for carriers and shippers. By offering dispatching, eet management, route optimization, dock and yard management, and reporting tools in a single, mobilefriendly platform, PCS TMS helps eets improve ef ciency and organization. Key features include automation of tasks, streamlined communication, and centralized data management, all of which can bene t commercial carriers and private eets.

Samsara

Samsara’s telematics solution provides real-time visibility, digital work ows, and data-driven insights to streamline eet operations across dispatch, driver productivity, route management, fuel and energy ef ciency, maintenance, and compliance. Customers can integrate this data with their TMS through turnkey integrations with more than 60 TMS partners on Samsara’s App Marketplace

or by building a custom integration with Samsara’s open API.

Trimble

Trimble’s TruckMate is one of the first TMS’s to offer industry dwell time metrics, the company said. Trimble’s Connected Locations workflow intersects a database of more than 5 million North American locations and an archive of vehicle position data. Now, Connected Locations makes dwell time data directly available within TruckMate, enabling proactive planning in the back of ce to combat detentions. By digitizing detailed geofences around the exact perimeter of a location and attaching key details and attributes, Trimble said it is delivering location intelligence that levels up TMS functionality. FO

May 2024 | FleetOwner.com 29

weighing,

the road.

(228-7225) catscale.com weighmytruck.com

Your drivers spend less time

so they can spend more time on

1-877-CAT-SCALE

Guaranteed Accurate. Guaranteed Accurate. 2404FO_CatScaleCo.indd 1 3/13/24 4:30 PM

Drivers get guaranteed, accurate weights on their phone or in-cab tablet saving significant time. You know your drivers can trust CAT Scale for guaranteed accurate weights. They can get those same guaranteed weights even faster by using the Weigh My Truck app.

Photo: Trimble

What should fleets look for?

Pay close attention to operational data needs when choosing a GPS tracker

by Jeremy Wolfe

1834729590 | Getty Images 30 FleetOwner | May 2024

Photo: stellalevi 482818710, Vadym Ivanchenko

TECHNOLOGY FEATURE

Asset tracking is a major component of modern eet management. Regular, automated location data can help improve operational ef ciency and bolster asset security.

Some of the biggest assets that eets track are their trailers, and the use of trailer tracking is growing in popularity. Paul Menig, CEO of Business Accelerants, told FleetOwner that 20 years ago, about 2% of trailers had trackers. Now about half of all trailers have trackers.

But what is the bene t of using a tracker, how does trailer tracking work, and what should eets look for when shopping for a tracking solution?

What fleets should look for

Go Anywhere is AT&T’s tracker device. Photo: AT&T

Finding the right trailer tracking solution requires a eet to look internally. What constitutes a successful tracking program? What tracker data will bene t your operations? How much technology is too much?

“It’s really creating your own asset management journey,” Gail Wong, head of marketing for AT&T IoT Asset Management Solutions, told FleetOwner. “And then go to the various departments and get their goals and objectives and use cases.”

Bryan Dempsey, VP of engineering for Peterson Manufacturing, recommends eets pay attention to the device’s

reliability. “I would say reliability—not only with the device but connectivity as well,” Dempsey told FleetOwner. “From a eet standpoint, connectivity is a big one, because there’s really no sense in putting a GPS or telematics device in there if it’s not going to work.”

This concerns not only the GPS tracker’s communication capabilities but also the tracker’s cellular plan. A reliable cellular plan, one that can pivot between networks to avoid dead zones, is essential.

How trailer trackers work

Generally, trailer trackers gather GPS location data and then use a cellular network to regularly relay this data to a carrier’s chosen platform.

May 2024 | FleetOwner.com 31 2404FO_AncraCargo.indd 1 3/6/24 12:00 PM

TECHNOLOGY FEATURE

A GPS tracker uses radio to communicate with GPS satellites and receive its longitude/latitude at speci c times. The tracker then uses radio to send this data through a cellular network to a carrier’s transportation management system. This information can be used by the TMS to improve a eet’s operations.

Trackers can also include accelerometers to log changes in velocity or detect potential impacts.

The data collection frequency of a tracker can vary according to a carrier’s preferences. In motion, trackers submit data as often as every 10 seconds. When parked, the tracker might only gather and send location data once a day to save battery power.

Built to last

GPS trailer trackers are generally battery-powered, operating reliably for several years. They can also connect to the tractor or a solar panel for extra power. Most trackers use solar energy to provide reliable power over a long period of time, often for several years.

“There are device manufacturers with almost 60-amp hours of battery on there, and if it reports once a day, it’ll probably last years upon years,” Wong said. “The majority of what we

see for trailers is solar power. You stick it on the front or the top of the trailer. We have many customers seven, eight, nine years now on our network with solar-powered asset trackers.”

A good GPS tracker for trailers will also have an ingress protection rating, keeping its interior electrical components safe from dust or liquids. Trackers typically have an IP67 rating for resistance to dust and water.

Fleets often install their trackers on the roof of the trailer.

The main benefit of trailer tracking is obvious: Carriers want to know exactly where their trailers are, and GPS trackers allow carriers to regularly collect trailers’ location data.

The benefits of trailer tracking

Modern telecommunications systems automatically collect location data and communicate it to a carrier. With trailer tracking technology, carriers can receive any trailer’s coordinates as often as every 10 seconds. Up-to-date trailer locations can help carriers reduce late shipments and move trailers to meet demand.

However, this data can do much more than answer the question, “Where is my trailer right now?” Through a carrier’s enterprise resource planning platform or transportation management system, tracking also helps to inform security practices, asset utilization, and predictive maintenance.