SPIKED SODA Behind the boozy soft-drink trend THIRD SHIFT How retailers make 24/7 operations work Advancing Convenience & Fuel Retailing OCTOBER 2022 convenience.org TAKE IT FROM SNOOP DOGG AND MARTHA STEWART: CHOOSE BIC® EZ REACH® FOR QUALITY, SAFETY & SALES! VISIT BIC® AT NACS SHOW BOOTH 4027 8.25".265"

SPIKED SODA Behind the boozy soft-drink trend

THIRD SHIFT How retailers make 24/7 operations work

Advancing Convenience & Fuel Retailing OCTOBER 2022 convenience.org

SPIKED SODA Behind the boozy soft-drink trend THIRD SHIFT How retailers make 24/7 operations work Advancing Convenience & Fuel Retailing OCTOBER 2022 convenience.org

Help responsibly connect & engage with your ATCs 21+ in the digital environment

• Establishes a digital foundation to optimize the ATCs 21+ journey

• Enables an integrated marketing approach for your ATCs 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Invest in digital infrastructure that responsibly optimizes & enables new channels for ATCs 21+ experiences

Enhance your retail digital capabilities & build a foundation of responsibility to meet the evolving ATCs 21+ expectations & improve their experiences

ONTENTS

NACS / OCTOBER 2022

On the cover: TeddyandMia/Getty Images. This page:

FEATURES

42

Today’s Customer Journey

Want to better engage customers? Master the nuances of meeting them where they’re at, and then prompt nextlevel connections.

51

Recruiting Foodservice Pros

Here are tips for surviving the current labor shortage in the kitchen.

69

Think Like a Restauranteur

Convenience veterans share the special sauce for a successful foodservice business.

76

Next-Level Convenience

Here’s why Core-Mark sees foodservice and tech as essential to the industry’s future.

80

A Boozy Blur

Beverage brands, alcohol suppliers cross category lines to quench consumer thirst for new products.

87

A Healthy Investment

Tiger Fuel’s CareTeam approach has paid dividends in both employee health, retention and recruitment.

92

CBD Opportunity

A Q&A with cbdMD Inc.

95

The Corporate Culture Evolution

How convenience retailers are rethinking their approach to management and employee expectations.

Pour Me a Drink Beverage equipment innovations are sweeping the c-store industry, powered by automation and customization.

NACS OCTOBER 2022 1

60

FEATURES

108

Why Adding Ultra-Fast EV Charging Is a Smart Move

A quick rollout of ultra-fast chargers— without costly utility upgrades in low-power areas—is in reach.

113

Midterm Prime Time

In a redistricting year, Republicans look to retake the House, and Democrats fight to keep the Senate.

118

Do You Crypto?

Cryptocurrency acceptance and kiosks are growing in the c-store industry.

129

Biofuels in the Mix

A new Fuels Institute report shows how alternative fuels can and should be part of a decarbonized future.

ONTENTS

NACS / OCTOBER 2022

Always Open

These convenience retailers say operating 24/7 sets them up for success.

135

Pursuit of Healthiness

An emphasis on better-for-you food and drinks helps c-stores overcome unhealthy perceptions.

STAY CONNECTED WITH NACS

@nacsonline

facebook.com/nacsonline instragram.com/nacs_online linkedin.com/company/nacs

Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily

103

* THE ULTIMATE LIGHTER FOR HARD-TO-REACH PLACES MAXI CLASSIC®, AMERICA’S SAFEST & LONGEST-LASTING LIGHTER1 Whatever your consumers’ lighting needs are, we’ve got you covered. Featuring options and styles for everyone, BIC® is the perfect choice for quality, safety and sales. TO ORDER, VISIT NEWREQUEST.BIC.COM LIGHT UP YOUR SALES WITH QUALITY AND SAFETY. © 2022 BIC USA Inc., Shelton, CT 06484 1vs. fixed-flame, non-refillable lighters of comparable size; *Source: Information Resources, INC. C-MULO 52 weeks ending 06/05/22 VISIT BIC® ATNACS BOOTHSHOW 4027

IT’S A FACT

ONTENTS

NACS / OCTOBER 2022

DEPARTMENTS

08 From the Editor

10 The Big Question

12 NACS News

24 Convenience Cares

26 Inside Washington

New legislation would force Visa and Mastercard to finally compete for retailers’ transactions.

32 Ideas 2 Go

Little’s Restaurant and Convenience Store pivoted to fresh foodservice more than 40 years ago.

36 Ideas 2 Go

How Golden Pantry is reinventing its traditional convenience store model.

144 Cool New Products

160 Gas Station Gourmet At Oak Grove Market, brick oven pizza, chicken salad and fire-blasted wings take center stage.

164 Category Close-Up

Consumers sought the comfort of confections during the pandemic, and the trend continues.

176 By the Numbers

The per-store, per-month gross profit for the candy category in 2021.

The presence of an article in our magazine should not be permitted to constitute an expression of the association’s view.

4 OCTOBER 2022 convenience.org

PLEASE RECYCLE THIS MAGAZINE Marat Musabirov/Getty Images CATEGORY CLOSE-UP PAGE 164

$3,410

premium quality cigarettes, pipe tobacco, cigarette tubes, and roll-your-own tobacco products are all made from the finest U.S. tobacco.

The Rich,The Bold FlavoBold FlavoR o oF Our

ContaCt us today! www.gopremier.com/contact a customer favorite — now available— in enticing NeW PacKaGiNG

EDITORIAL

Kim Stewart Editor-in-Chief (703) 518-4279 kstewart@convenience.org

Lisa King Managing Editor (703) 518-4281 lking@convenience.org

Sara Counihan

Contributing Editor (703) 518-4278 scounihan@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Sarah Hamaker, Jim Ellis, Al Hebert, Maura Keller, Keith Reid, Renee Pas, Pat Pape

DESIGN

Imagination www.imaginepub.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth

National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Rose Johnson

Audience Development and Production Manager (703) 518-4218 rjohnson@convenience.org

NACS BOARD OF DIRECTORS

CHAIR: Jared Scheeler, The Hub Convenience Stores Inc.

OFFICERS: Lisa Dell’Alba, Square One Markets Inc.; Varish Goyal, Loop Neighborhood Markets; Brian Hannasch, Alimentation Couche-Tard Inc.; Chuck Maggelet, Maverik Inc.; Ken Parent, Pilot Flying J LLC; Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store; Don Rhoads, The Convenience Group LLC

PAST CHAIR: Julie Jackowski, formerly Casey’s General Stores Inc.; Kevin Smartt, TXB Stores

MEMBERS: Chris Bambury, Bambury Inc.; Frederick Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; Chris Coborn, Coborn’s Inc. Little Dukes; George Fournier, EG America LLC

NACS SUPPLIER BOARD

CHAIR: Brent Cotten, The Hershey Company

CHAIR-ELECT: Kevin Farley, GSP

VICE CHAIR: David Charles, Cash Depot; Vito Maurici, McLane Company; George Ubing, E&J Gallo Winery

PAST CHAIR: Rick Brindle, Mondelez International; Kevin Martello, Keurig Dr Pepper; Drew Mize, PDI Technologies

MEMBERS: Tony Battaglia, Juul Labs; Alicia Cleary, AnheuserBusch InBev; Matt Domingo, Reynolds; Mike Gilroy, Mars Wrigley; Josh Halpern JRS Hospitality; Danielle Holloway,Altria Group Distribution Company; Jim Hughes, Molson Coors

Terry Gallagher, Gasamat Oil/Smoker Friendly; Anne Gauthier, St. Romain Oil Company LLC; Douglas S. Haugh, Parkland USA; Raymond M. Huff, HJB Convenience Corp. dba Russell’s Convenience; Ina (Missy) Matthews, Childers Oil Co.; Charles McIlvaine, Coen Markets Inc.; Lonnie McQuirter, 36 Lyn Refuel Station; Jigar Patel, FASTIME; Elizabeth Pierce, Applegreen LTD; Glenn M. Plumby, 7-Eleven Inc.; Robert Razowsky, Rmarts LLC; Richard Wood III, Wawa Inc.

SUPPLIER BOARD REPRESENTATIVES: Brent Cotten, The Hershey Company; Kevin Farley, GSP

STAFF LIAISON: Henry Armour, NACS

GENERAL COUNSEL: Doug Kantor, NACS

Beverage Company; David Jeffco, Dirty Dough LLC; Kevin M. LeMoyne, Coca-Cola Company; Kevin Martello, Keurig Dr Pepper; Bryan Morrow, PepsiCo Inc.; Lesley D. Saitta, Impact 21; John J. Thomas, iSEE Store Innovations LLC; Sarah Vilim, Keurig Dr Pepper; Dean Zurliene, Monster Energy Company

RETAIL BOARD REPRESENTATIVES: Scott E. Hartman, Rutter’s; Steve Loehr, Kwik Trip Inc.; Chuck Maggelet, Maverik Inc.

STAFF LIAISON: Bob Hughes, NACS

SUPPLIER BOARD NOMINATING CHAIR: Brad McGuinness, PDI Technologies

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2022 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices.

1600 Duke Street, Alexandria, VA, 22314-2792

COME TOGETHER. DO MORE. Join us at conveniencecares.org / OCTOBER 2022

FRONT FROM THE EDITOR

FRONT FROM THE EDITOR

All About the Journey

One hot summer morning found me in a TXB in Georgetown, Texas, a suburb of Austin, where I had the chance to chat with Anna Felz, director of brand manage ment for TXB Stores, and TXB CEO Kevin Smartt and his team about the new concept store, now a year old, and the innovation showcased there.

I watched a mom carrying a baby navigate the bright, fresh space along with another woman—Grandma?—and a preschool-age girl. Mom grabbed a hand shopping basket, and the family set out exploring the store. Mom picked up blueberries and cut-up watermelon from a grab-and-go case filled with fresh fruit, eyed the prepared graband-go foods and put a dozen eggs in her basket. She then headed to the TXB Market for breakfast—TXB has a fabulous menu of breakfast burritos and other freshly made-on-site foods. While waiting for her order, she selected a TXB private-label bottled tea from a gondola near the foodservice counter and examined one of the grab-and-go fresh salads the store stocks.

Meanwhile, Grandma spotted a display of apples and selected one. Then the little girl ran back and picked up two apples—one Red Delicious and the other Golden Delicious—and with Grandma’s help selected a bottle of chocolate milk from the cold case. By the time they made it to the counter to pay, the hand basket was full, and Mom had even add ed a jug of windshield washer fluid.

I got a kick out of watching the family’s journey through the store—as did Smartt, who had been taking in the scene from a different vantage point. I

jokingly asked him if he’d paid the fami ly to hit many of the special touchpoints I was there to see. He smiled and said, no, but he appeared tickled to see how the visit played out.

This family’s c-store trip may have started out as routine—a stop for gas and breakfast—but clearly became one of discovery and delight. Which brings us to our cover story this month: “Today’s Customer Journey,” in which we share insights from NielsenIQ, Cardlytics and Casey’s on behavioral segmentation, digital marketing strategies and advice for influencing customer journeys.

If you are reading this at the NACS Show in Las Vegas, you are on a discov ery journey of your own. I hope you’ll stop into the General Sessions this week where NACS will debut the 2022 Ideas 2 Go video series, introducing you to TXB and the five other c-stores our team visited over the past few months to help you think about the journeys your customers take to and within your stores—and how to engage them every step of the way.

Enjoy the Show!

A gondola at TXB Stores in Georgetown, Texas, is brimming with fresh salads, sandwiches, fruit, veggies, yogurt parfaits and more! Fresh fruit is a perfect on-the-go snack, says Anna Felz, director of brand management.

Kim Stewart , Editor-In-Chief

Kim Stewart , Editor-In-Chief

This family’s c-store trip may have started out as routine—a stop for gas and breakfast—but clearly became one of discovery and delight.

8 OCTOBER 2022 convenience.org

UP

THE BIG QUESTION

As a small convenience retailer from western North Dakota, I’ve treasured my decade-long participation in NACS leadership. Not only have I had a tremendous opportunity to give back to the industry I love so much, but it’s also enabled me to take my businesses to levels that wouldn’t have been possible without NACS.

NACS has a broad reach, and as chairman over the past year I’ve been blessed with the opportunity to impact on a national scale the small operators in our industry. In this age of consolidation, the role of small operators who invest in our local communities in deeply personal ways is becoming more and more critical. At the same time, it’s also harder for us to compete against larger retailers. That’s why it’s so important that small c-store operators pay attention to what’s happening in the wider industry and become involved in NACS and likeminded groups where our voices can be amplified.

When I became NACS chairman in 2021, I set the intention to be a voice for small retailers. During the past year, I’ve hosted in North Dakota three different small retailers from all areas of the country, and we learned so much from one another. Iron sharpens iron, and I encourage independent convenience retailers to continue to share their experiences with each other into the future.

Relationships are essential in our industry. Whether we’re talking about the relationships with our customers,

our suppliers, or our community, relationships are at the heart of convenience stores. I’ve had the opportunity to forge many industry relationships in the past year, and I’m so grateful for that.

In one of my other jobs as a high school girls basketball coach, I work to help my players understand that ‘the process is the real prize.’ To me, that means that all of the little things— the wins and losses, lessons learned, adversity faced and relationships strengthened—are the things that

endure. I applied this mindset to my tenure as NACS chairman as well.

It’s been an amazing year, but more so, it’s been a remarkably positive experience serving on the NACS Board of Directors since 2011. My engagement has helped move the needle on Capitol Hill. I’ve developed friendships that will last a lifetime. My business is flourishing. And in hindsight, it’s not just the past year that has impacted me. The past decade of engaging with NACS has been the real prize.

Jared Scheeler, CEO, The Hub Convenience Stores Inc., based in Dickinson, North Dakota, and 2021-22 NACS Chairman

What are the highlights of your year as NACS chairman?

10 OCTOBER 2022 convenience.org UP FRONT

POWERFUL BRAND.

HOMETOWN FEEL.

RUNNING YOUR BUSINESS YOUR WAY. POWERED LOCALLY.

We know that the true power behind the Cenex® brand comes from our locally-owned retailers – valued partners who are invested in their customers and community. That’s why we’re committed to your success and helping you build your business from the moment you become a Cenex® retailer.

From flexible brand conversion and marketing, to convenient payment processing and training programs, we can provide your business with the support it needs to help you grow.

A name your customers trust, a brand you can count on –visit cenex.com/businessopportunities to learn more.

© 2021 CHS Inc. Cenex® is a registered trademark of CHS Inc.

Fuels Institute Report Examines EV Infrastructure

The latest Fuels Institute Electric Vehicle Council report, “EV Charger Deployment Optimization: An Analy sis of U.S. State-level Electric Vehicle Supply Equipment Demand Forecast and Supporting Infrastructure Consid erations,” is now available. The report, which was written by S&P Global Mo bility, was designed to help government bodies and industry decision makers de termine how to best support the expan sion of the EV market with the strategic installation of charging stations.

“The market for electric vehicles (EVs) continues to grow at an accelerat ing pace, yet there remains great uncer tainty regarding how fast these vehicles will gain significant market share, how many chargers we will need, when and where we will need them and what kind of chargers will be required in different locations,” said John Eichberger, Fuels Institute executive director.

“Recognizing that billions of dollars would be invested in building out EV charging infrastructure, we commis sioned S&P Global Mobility to model

what the demand for EV chargers might look like over the next 10 years throughout the United States. This re port helps prioritize where those funds should be deployed to most effectively leverage business and taxpayer dollars, as well as to deliver the greatest value to drivers.”

Among the key findings:

• The report forecasts EV adoption nationwide will reach almost 6% of vehicles in operation by 2030. If accurate, to satisfy an optimal vehicle to charger ratio of about 10:1, the U.S. will need as many as 1.7 million charging stations, of which more than 90% could be strategically deployed Level 2 chargers.

• EV adoption rates vary by state, with 82% of all EVs in 2021 registered in just 15 states. By 2030, this concen tration is projected to remain high, with the top 15 states hosting 76% of all EVs.

• Given the diversity of population, market conditions and travel patterns, there is no one-size-fits-all solution

across the U.S. The report leverages a census track market analysis to prior itize EV charger deployment by state.

• To assist with strategic planning and analysis, the report presents three case studies detailing the benefits of market-specific insights when con sidering EV deployment plans. Cities profiled include Detroit, Dallas and Portland, Oregon.

Download the report at www.fuelsinstitute.org/Research/ Reports/EV-Charger-Deploy ment-Optimization .

12 OCTOBER 2022 convenience.org EduardHarkonen/Getty Images UP FRONT NACS NEWS

FOR TRADE PURPOSES ONLY | ©2022 Swedish Match North America LLC Call 800-367-3677 or contact your Swedish Match Rep to learn more. *Source: Nielsen scan data through 5/29/2022 CANS SOLD PER STORE PER WEEK 20 SKUs 12-19 SKUs 6-11 SKUs RETAILERS WHO CARRY THE FULL ZYN PORTFOLIO SELL 5.7x MORE CANS *

UP FRONT NACS NEWS

Help Your Business Soar Using the NACS State of the Industry Report®

Today’s dynamic convenience retail landscape requires agility, a balance of efficiency and effectiveness that can free up resources and fuel new growth. Success requires knowing where you must invest in technology and how to harness data to deliver targeted, personalized offerings and customer experiences—it’s essential to winning trips and edging out the competition.

The NACS State of the Industry Report® is the industry’s best tool to navigate the maze of improving your business.

WHY IS THE NACS STATE OF THE INDUSTRY REPORT ESSENTIAL READING?

For more than 50 years, the convenience and fuel retailing industry has relied on the NACS State of the Industry Report to provide a benchmarking tool and the most comprehensive collection of data and trends. This report will help you:

• Understand the “big picture” with data and analysis on economic, market and shopper dynamics.

• Maximize effectiveness and profitabil ity with insider access to aggregate fi nancial, operational and category data from more than 27,000 convenience stores across the United States.

• Benchmark against top performers in the industry and determine key driv ers to their success.

WHO IS IT FOR, AND HOW WILL THEY BENEFIT?

Convenience and fuel retailers: Stay one step ahead with data and analysis that saves you time and money. Get a behindthe-scenes look at aggregate competitor data in critical areas, including finan cials, store operations, merchandising, foodservice, fuels and more.

Suppliers to convenience retailers: Streamline R&D resources with targeted

insights that will help you discover your next big product innovation or develop ment opportunity.

Investors, real estate developers, ap praisers, management consultants: Find out why investment partners and con sultants like you are getting behind the $650 billion convenience industry and adding convenience to their investment portfolios. Get savvy quickly and accu rately, with industry overviews, industry financial performance data and market performance comparisons.

WHAT’S INCLUDED?

Here’s what you’ll find: The Convenience Shopper—Valuable consumer insights from the NACS Con venience Voices program

Regional Performance—Comprehen sive regional data

Industry Overview—Critical findings and actionable recommendations from veteran industry analysts

Data Visualizations—Get the insights you need at-a-glance with compelling charts, graphs and tables that illustrate key trends and patterns

Category Studies—Deep dive into mainline and subcategory performance

data across a broad spectrum, including motor fuels, grocery, tobacco, foodser vice and more.

NACS/NielsenIQ TDLinx Convenience Store Census—Developed by NielsenIQ TDLinx, the premier source of retail/on-premise channel informa tion, and endorsed by NACS, the Conve nience Store Census offers universally accepted counts and classifications of businesses in the convenience and fuel retailing channel.

HOW IS IT DELIVERED?

Upon purchase of a digital license, you will receive access to the report through a DRM-secured PDF through your convenience.org login profile. Discounts are available for purchasing multiple licenses. Purchase your copy of the State of the Industry Report at www.conve nience.org or contact Chris Rapanick at crapanick@convenience.org

New this year: NACS Research has imported all the data from the past 10 years of the NACS State of the Industry Report into a searchable database. The NACS State of the Industry Data Archive is now available online via sub scription to NACS members only.

14 OCTOBER 2022 convenience.org

jittawit.21/Getty Images

Learn How to Leverage Loyalty Programs

Convenience loyalty pro grams offer shoppers rewards, point accruals for discounts and promotions, yet these benefits are largely considered a bare minimum in consumers’ eyes. Benefits associated with loyalty programs are pivotal to elevating the offer and building distinction from other retailer loyalty efforts. NACS Research, in partnership with Bounteous, has published the white paper “Driving En gagement from Convenience Retail Loyalty Programs” sharing insight into how retailers can increase engagement with loyalty programs and build goodwill beyond rewards and discounts.

By understanding what shoppers want from a loyalty program, convenience retailers have an op portunity to play an active role in molding their program to increase engagement with shoppers. This research explores:

• Convenience loyalty program membership and competition

• How loyalty program members engage

• Shopper perspective on personalization

• Loyalty program access and communication with members NACS members can access the white paper at www.con venience.org/research

New Members

NACS welcomes the following companies that joined the association in July 2022. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting www.convenience.org/Create-Login All members receive access to the NACS Online Membership directory, latest industry news, information and resources. For more information about NACS membership, call 703-684-3600.

NEW HUNTER CLUB MEMBER

Clear Demand Inc. Scottsdale, AZ www.clear-demand.com

NEW GLOBAL SUPPLIER COUNCIL MEMBER

Techniche Carlsbad, CA www.technichegroup.com

NEW SUPPLIER MEMBERS

Albie’s Foods

Niagara Falls, NY www.pizzalogs.com

American Fuel & Petrochemical Manufacturers

Washington, DC www.afpm.org

ArrowStream Chicago, IL www.arrowstream.com

Congo Brands Louisville, KY www.congobrands.com

DeeSign

West Chester, OH www.deesign.com

E-Alternative Solutions Jacksonville, FL www.ealternativesolutions.com

G&J Marketing Alpharetta, GA www.gandj.com

Milo’s Tea Company Bessemer, AL www.drinkmilos.com

Moss Adams LLP Seattle, WA www.mossadams.com/about/locations/seattle

Oryxe

New York, NY www.oryxe.com

Radar Labs Inc. New York, NY www.radar.com

Rose Paving Co. Bridgeview, IL www.rosepaving.com

S. Abraham & Sons Inc. Grand Rapids, MI www.sasinc.com

The Naked Collective Ltd. www.drinkmood.com

Washie Pocatello, ID www.washietoiletseat.com

16 OCTOBER 2022 convenience.org DNY59/Getty Images UP FRONT NACS NEWS

POWERING

Headquarter Sales

Retail Services

and

Business Process Outsourcing

C-STORE COMMERCE Our dedicated c-store channel experts deliver custom, data-driven solutions that drive demand, increase sales and lower costs for brands, chain retailers, independents, foodservice operators, wholesalers and redistributors.

Cultivating stronger, more strategic partnerships between brands and retailers

Providing superior ROI through dynamic routing and custom coverage Analytics, Insights

Intelligence Delivering actionable shopper, market, category and competitive insights

Improving customer relations and cash flow while reducing costs advantagesales.net NORTH HALL SEE YOU AT THE NACS SHOW BOOTH 1528

Member News

RETAILERS

Liz Howard has joined Parker’s Convenience Stores as its vice president of op erations. Howard first came to the company as a cashier in 2004 working at the Hinesville, Georgia, location. In her new role, Howard will oversee operations of 11 Park er’s Convenience Stores in Glynn, Wayne, Liberty, McIntosh and Ap pling, Georgia, counties.

Ken Parent—a convenience and fuel retail industry veteran, NACS executive committee and board member, and CSP Retail Leader of

the Year 2022— has joined the board of directors of Stuzo, provider of unified loyalty, digital payments and cross-channel customer experi ence products.

Ameet Shetty, chief data officer for Pilot Company, was named to the DataIQ 100 2022 list as one of the most influential practitioners of data and analyt ics. Inclusion on the list reflects outstanding leadership in the field.

The 100 honorees were selected based on three factors: leadership, engagement with the broader data and analytics industry and support of DataIQ’s mission of advancing the profession of data and analytics.

Energy North Group an nounced Jeff Black as chief executive officer of Energy North and its family of companies. Black provides strate gic leadership to the organization. Black joined as a convenience store associate at age 16 and ad vanced to several sales and lead ership roles within Energy North.

Liz Howard

Ameet Shetty

Jeff Black

Ken Parent

Liz Howard

Ameet Shetty

Jeff Black

Ken Parent

18 OCTOBER 2022 convenience.org UP FRONT NACS NEWS

W P I : H D I IZ R/ V DI P R W 10 BOOTH www.masonways.com 800-837-2881 info@masonways.com

IT’S ALL ABOUT THE

when a coffee to go becomes an experience that stays.

At Franke, we’re not just in the business of selling coffee machines. We’re in the business of creating memorable coffee moments for your customers.

The new Franke A400 Fresh Brew system allows for consistent, bean-to-cup, hot coffee every time. This machine has a small footprint that is perfect where space is limited and convenient whether in-house or on-the-go. Creating fresh taste, with less waste for your customers has never been easier.

Discover more at us.coffee.franke.com

NEW! A400 Fresh Brew Visit us at the NACS Show 2022 Booth #5436 | Las Vegas, NV Expo Oct. 2–4, 2022

UP FRONT NACS NEWS

Kevin Riley now serves as pres ident of opera tions and finance at Energy North Group. In his role, Riley oversees heating oper ations, finance, transportation, wholesale and retail. Riley previ ously served as the chief executive officer of Haffner’s.

Energy North Group announced Matt LaLone as president of administration and general counsel. LaLone is responsible for leading the organization’s HR, IT, legal and safety departments.

SUPPLIERS

Unified Brands announced Denny Berryhill as vice president of sales for the company’s central United States territory.

Berryhill will be responsible for driving sales as well as managing independent manufacturer repre sentatives in the central territory. Berryhill has served the foodser vice industry for over 13 years, mostly recently as design manager with Unified Brands.

Rich Products has named Mindy Rich as chair of the global, fami ly-owned corpo rate parent, Rich Holdings Inc., making her the third such chair in the company’s 77-year history. Rich, who most recently served as vice chair, has held a number of lead ership roles in her 37-year career with Rich’s.

Florida-based company. Packrall joined USG in 2014 and was vice president of operations since 2018.

KUDOS

Preston Packrall

Preston Packrall now serves as president of Universal Screen Graphics (USG). Packrall will lead the management of all facets of the Tampa,

Calendar of Events

2022

NOVEMBER

NACS Innovation Leadership Program at MIT

November 06–11 | MIT Sloan School of Management | Cambridge, MA

NACS Women’s Leadership Program at Yale

NACS Convenience Summit Asia February 28–March 02

Waldorf Astoria Bangkok

Bangkok, Thailand

MARCH

NACS Day on the Hill March 07–08

Washington, D.C.

The Spinx Company, the Green ville S.C.-based fuel and conve nience retail company with more than 80 locations, 45 car washes and 1,500 associates statewide, was recently named as the No. 1 Best Place to Work in South Carolina. The ranked companies were recognized at a reception in August at the Columbia Metro politan Convention Center. “Being recognized as the No. 1 Best Place to Work in South Carolina is one of the biggest honors we have been given over the past 50 years,” said Stewart Spinks, founder and chairman of Spinx. “At Spinx, we consider ourselves one big family and our people are the most important part of our company. Without our committed staff, we would not be where we are today. As leaders, making our teammates lives better is truly the only way we can make our guests’ lives easier and after all, at Spinx, that’s why we exist.”

MAY NACS Convenience Summit Europe May 30-June 01 | Intercontinental Dublin | Dublin, Ireland

JULY

November 13–18

Yale School of Management | New Haven, CT

2023

FEBRUARY

NACS Leadership Forum February 08–10 | Eden Roc | Miami Beach, FL

APRIL

NACS State of the Industry Summit April 18-20

Hyatt Regency DFW International Airport

Dallas, Texas

NACS Leadership for Success April 30-May 05 | Virginia Crossings Hotel & Conference Center | Glen Allen (Richmond), VA

NACS Marketing Leadership Program at Kellogg July 23-28 | Kellogg School of Management | Northwestern University | Evanston, Illinois

OCTOBER

NACS SHOW October 03-06 | Georgia World Congress Center | Atlanta, Georgia

For a full listing of events and information visit www.convenience.org/events.

Denny Berryhill

Matt LaLone

Kevin Riley

Mindy Rich

20 OCTOBER 2022 convenience.org

|

|

|

|

|

|

your shoppers an authentic Latin alternative to their usual side

are ready in minutes. Whether they want the sweeter taste of Maduros or the

Tostones, your shoppers will love these distinct Caribbean staples from the national category leader*

bite

GOYA!®

Contact your GOYA representative or email salesinfo@goya.com | GoyaTrade.com *Nielsen answers on demand, total U.S. (All Outlets Combined), dollar sales, 52 weeks ending: 5/21/22 ©2022 Goya Foods, Inc. TO CONVENIENT AUTHENTIC SIDE DISHES! Offer

dishes. GOYA’s line of frozen plantains

crunchy

of

–

Introducing the 16-box rack Maximize your sales opportunities without taking up more valuable counter space. Holds 192 bottles. More choice for your customers and more profits for you. Visit NACS Booth #1762 to see the latest 5-hour ENERGY products. Hot flavors, cool displays Check out what’s new in 2023 from 5-hour ENERGY®

Say

‘Aloha’ to Hawaiian Breeze Set sail for profits with Hawaiian Breeze, the latest 5-hour ENERGY shot. With an island-inspired blend of passion fruit, orange, and guava flavors, it’s the one your customers will be asking for. 3 new, delicious and bold flavors Make room in your cooler for Tropical Burst, Pineapple Splash, and OrangeSicle, the new 5-hour ENERGY drink flavors. Individual results may vary. See 5-hourENERGY.com for more details. Regular Strength 5-hour ENERGY® shots contain caffeine comparable to a cup of the leading premium coffee. Extra Strength 5-hour ENERGY® shots contain caffeine comparable to 12 ounces of the leading premium coffee. Limit caffeine products to avoid nervousness, sleeplessness, and occasional rapid heartbeat. 5-hour ENERGY® drink Tastes Better Works better for 2 oz. energy shot consumers who are thirsty and prefer carbonation. ©2022 Living Essentials Marketing, LLC. All rights reserved. THIS STATEMENT HAS NOT BEEN EVALUATED BY THE FOOD AND DRUG ADMINISTRATION. THIS PRODUCT IS NOT INTENDED TO DIAGNOSE, TREAT, CURE OR PREVENT ANY DISEASE. Join the FREE program designed for c-store owners: 5hourEnergyRetailer.com

Take a Stand Against Human Trafficking

Stopping human trafficking is a serious responsibility. With close ties to the community, conve nience stores are positioned to share important messages that employees and customers can use to recognize and help victims of human trafficking.

“As a convenience store owner, I care about the community and our staff cares about the community. We can spot when something isn’t right, and sometimes that is human trafficking,” said Kent Couch, CEO of the Stop and Go conve nience store in Bend, Oregon.

Couch became involved with In Our Backyard, a national nonprofit known for its anti-trafficking work that operates the Convenience Stores Against Traf ficking (CSAT) program. “We wanted to make a difference in our community and keep it safe,” he said.

The restroom is often the only safe place where a victim is alone and able to call or text for help. CSAT’s “Freedom Stickers” are designed to be posted in restroom stalls and contain the National Human Trafficking Hotline number, 888-373-7888, or text INFO or HELP to BeFree (233733).

According to CSAT, Freedom Stickers raise awareness to 4 million people ev

ery day. More than 30,000 convenience stores and 17 state-based convenience store associations and 184 conve nience store companies have partnered with CSAT.

Human trafficking survivor Sara Perkins shares in a joint CSAT and Ready Training Online training video that she frequented convenience stores multiple times a day. “As a victim, I know that if I had gone into any bathroom and saw an In Our Backyard sticker it would’ve been an open door for me to get the help I needed,” she said.

More than 148,000 U.S. convenience stores conduct 165 million transactions a day in every community, and most of these businesses are open 24/7. Longer hours of operation, public restrooms and ease of access increase the likelihood that convenience stores can help those in peril, such as victims of human traffick ing or youth in need.

January is human trafficking aware ness month. To learn how you can get involved in the fight to stop human traf ficking and spot the signs of someone in need of help, visit www.convenience. org/humantrafficking for resources and information from NACS and antihuman trafficking groups.

SOCIAL SHARES

NACS encourages retailers to share their giving-back news on social media using #ConvenienceCares

In The Community

Every year, the convenience and fuel retailing industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America, and to share these powerful stories.

Learn more at www.conveniencecares.org

SHELL GIVING PUMP

FUELS 500+ LOCAL CHARITIES

1 From August 1 through October 31, Shell’s The Giving Pump will support 527 local charities across the U.S. Now in its second year, the pumps are located at 6,500 Shell conve nience stores in 48 states, and a portion of purchases made by consumers who use the desig nated pump will support nonprofits such as children’s hospitals, school and litera cy programs.

“We are thrilled to bring back The Giving Pump to make an even bigger impact this year and give customers the chance to support local charities across the country,” said Shannon Bry an, manager of brand and com munications for Shell Retail US. “We encourage our customers to pay it forward at the pump and choose The Giving Pump on their next fill up or road trip pit stop to help us fuel the fu ture of local communities.”

Convenience stores across the U.S. are involved in the fight against human trafficking via the Convenience Stores Against Trafficking program.

24 OCTOBER 2022 convenience.org CONVENIENCE CARES

Storewide Merchandising Solutions American Ma nufacturing50 YEARS ofYEARS of American Manufacturing OV ER

WonderBar ® Merchandiser For coolers, freezers and center store Clear Scan® AdjustaView ® Label System Auto-feed Tray System Pusher Hook and Display Hook Label & Sign Holder System Flip Scan® Hooks, Label Holders & Signing Accessories Glass, Wood & Solid Shelf Label Holders Glass, Wood & Solid Shelf Label Strips Wire Basket & Wire Shelf Label Strips Magnetic Pallet Rack Label Strips Electronic Ticket Label Strips & Holders Wire Basket & Wire Shelf Label Holders

WonderBar

Trays

More ways to boost productivity

Dual Lane

Made from U.S. steel and

Multiple-Depths range from 13" to 24".

Adjustable-Widths adapt from 1 3/4" to 17 1/2".

Tool-free installation.

Bar and shelf capable.

Auto feed any product.

Double-Wide TrayRadius or Square Tray Sidewalls

Locking, Molded Pusher

Oversize

Standard Tray with

Tray Standard Tray with Finger Product Stop Mini Tray n

heavy-duty wire frames. n

n

n

n

n

®

Create Exciting Cross-Sells

n Asymmetrical lanes sell different-width products.

n Each lane adjusts to fit products as small as 13/4" wide.

impulse buying with cross-sells and adjacencies.

n Unique design features a separate paddle to push each item forward individually in its own lane.

with Dual Lane merchandising

Display Cheese & Salad

Improve rotation and reduce shrinkage

WonderBar® Trays

n Face more packages, accommodate a wider range of shapes and sizes, restock easily, and manage dated produce better.

temperature & extend shelf life.

n Durable cooler-capable steel construction ensures long life.

n Trays lift out for rear restocking & proper rotation.

n Versatile spring tension is gentle on delicate produce.

Cooler-Capable EWT

Expandable Wire Tray for refrigerated retail

n Quick drop-on, one-piece installation.

n Accommodates any style or size package adjusting from 3 3/8" to 17 1/2" lane width.

n Various built-in mounting capabilities available based on shelf component.

n Molded pusher paddle available, both locking and non-locking styles with wire- or metal-sided trays.

n Auto feed any product.

n Clear or Imprinted Front Product Stops.

n Vends oversize items like pizza.

™

Display & Scan Hooks

Hooks for every purpose

Right Angle Label Holder Hook

n A simple, inexpensive design.

n Use with Quick Back® to maximize product density, provide easy mounting and relocation of stocked hooks in tight places, under shelves or in fully loaded displays, and speed re-merchandising and display changeover.

Economical All Wire Hook n Safer, rounded Ball-End Tips are available on all hooks at no extra charge and no minimum order.

Slatwall Hooks

n Use the Peg Hook Overlay to quickly convert All Wire Hooks to Scan Hooks.

Pouch Hook™ Merchandising

Pouch Hook™ Merchandising

n Standard and Gravity-Feed options keep items forwarded and automatically faced.

n Tool-free installation on most common gondola and cooler uprights.

n Stocked in 4 lengths compatible with all standard shelf sizes allowing mixed use in display.

Flip-front Label Holder swings up for easy access and product removal.

Protect Your Merchandise

Anti-theft security hooks

n Prevent the removal of any stock or display 1 or 2 items unlocked to prevent sweeping.

Anti-Sweep™ Hooks

n Camel-back profile prevents sweeping while providing direct access for customers.

n Flip Scan® Label Holder swings up and out of the way.

n Use of plain-paper labels can save up to 65% on labels and up to 75% on labor.

n Molded-in openings improve refrigeration air circulation.

n Top-tier sidewall available for support and containment of tall or multi-tier products.

n Adjustable width trays, designed for yogurts, ice cream, and other difficult to organize products.

n Trays lift out with easy-grip handles to allow quick restocking or cleaning.

AMT ® Adjustable Merchandising Tray For dairy, freezer and center store

Clear Scan® Label Holders

The complete shelf edge labeling system

n Easy-to-use design flexes open at a touch for fast, drop-in, plain-paper labeling, then automatically springs shut to secure the label in place.

n Unsurpassed range of sizes, styles & lengths.

n Labels shielded from dirt, spills, moisture & wear so they last longer, read easier & scan more accurately.

n Long lasting PVC construction retains “memory” and shape, resists yellowing, darkening & aging.

Choice of magnetic, adhesive or clip-on mounting systems.

Being Seen Means Being Sold® ©2022 Trion Industries, Inc. 297 Laird St., Wilkes-Barre, PA 18702 Ph 570-824-1000 | Fx 570-823-4080 Toll-Free in the U.S.A. 800-444-4665 info@triononline.com www.TrionOnline.com American Ma nufacturing50 YEARS ofYEARS of American Manufacturing OV ER

In 2021, Shell wholesalers and retailers donated more than $1.5 million, supporting 400-plus chil dren’s charities through The Giving Pump. In the U.S., the designated giving pumps were used 7.2 million times and pumped 72 million gal lons of gasoline.

VOLTA OIL TOPS $1 MILLION TO HELP CURE ALZHEIMER’S 2 Family-owned Volta Oil in Plymouth, Massachusetts, raised more than $170,000 during its annual campaign to benefit the Alzheimer’s Association, bringing the total amount raised in its 11-year history to $1.1 million. Volta’s Purple Pump Up is the largest convenience store cause-marketing campaign in the U.S. to bolster awareness and raise funds toward the care, support and research efforts of the Alzheimer’s Association.

“I applaud our store personnel and the Purple Pump Up team members for another successful campaign,” said Jim Garrett, chair man of Volta Oil Company, adding, “I am also grateful to our dedicat ed sponsors who never fail to show their support for our communities through their generous donations.”

Eighteen Rapid Refill Conve nience and Garrett’s Family Market locations throughout Massachu setts, New Hampshire and Rhode Island participated in the cam paign from May 27-July 18, allow ing customers the option to give donations both inside stores and at the gas pumps.

“It is incredible to see Purple Pump Up reach the $1 million milestone, a clear testament to Volta Oil’s commitment, and the generosity of its customers, to make a difference in the fight to end Alzheimer’s,” said Jim Wessler, CEO of the Alzheimer’s Association Massachusetts/New Hampshire Chapter. “We are so grateful for this partnership which continues to have a direct impact supporting vital research and essential programs and ser vices in our local communities.”

LOVE’S SUPPORTS

TRUCKERS

3 Love’s Travel Stops showed its support of professional truck drivers by donating $100,000 to the St. Christopher Truckers Development and Relief Fund. This is the third year the compa ny has given to the organization that helps professional truck drivers and their families during trying times.

“Professional truck drivers are essential to the country’s suc cess, and Love’s can’t think of a better way to say ‘thank you’ than supporting them during difficult times,’’ said Jenny Love Meyer, executive vice presi dent and chief culture officer of Love’s. “St. Christopher is a great organization that helps drivers every day, and we’re glad to continue to support the organization.”

ALTA CONVENIENCE RAISES $36,523 FOR WINGS FOR LIFE

4 Alta Convenience’s 110 stores throughout Colorado, Kansas, Nebraska, New Mexico and Wyoming raised $36,523 for Wings for Life, a nonprofit created in 2003 by two-time motocross world champion Heinz Kinigadner and the founder of Red Bull, Dietrich Mateschitz, to raise money for spinal cord research.

FERRERO USA SUPPORTS CMNH

5 Ferrero USA donated $25,000 to benefit Children’s Miracle Network Hospitals as part of Ferrero’s 31 Days of Halloween Countdown Calendar fundraiser to help families celebrate Halloween while raising money for Children’s Miracle Network Hospitals. Consumers who visited Ferrero Halloween.com through Sep tember 15 and made a $31 donation to Children’s Miracle Network received a limitededition countdown calendar featuring Ferrero’s confections and cookies. Ferrero also donated treats to select local children’s hospitals located near the company’s offices and plants throughout North America to bring Halloween fun to young patients and their caregivers.

NACS OCTOBER 2022 25 1 2 3 4 5

Competing for Swipes

New legislation would force Visa and Mastercard to finally compete for retailers’ transactions.

BY ANNA READY BLOM

Key Figures

$900

What U.S. consumers pay in swipe fees on average each year

Groundbreaking legislation intro duced in the Senate would bring relief to excessive credit card swipe fees. The Credit Card Competi tion Act (S. 4674) was introduced by Sen ators Richard Durbin (D-IL) and Roger Marshall (R-KS). The legislation gives retailers the ability to choose which net work to route a credit card transaction, creating competition that will have real benefits for retailers and their custom ers. Here is what the legislation could mean for convenience stores.

WHAT IS TRANSACTION ROUTING?

How much the Credit Card Competition Act could save U.S retailers each year

Whenever customers pay with their credit card, information is exchanged over a network (such as Visa or Master card) that allows the transaction to be settled. A helpful way to think of this process is that it is in many ways anal ogous to the way a phone call is routed through a carrier. A business chooses which phone carrier to use, whether it be AT&T, Verizon or another provid er, based on a number of factors from reliability to cost. Having that choice is crucial to ensuring competition. But to day, retailers have no choice of network when it comes to credit card transac tions. They must use the only one that is enabled on that particular credit card.

WHY IS ROUTING COMPETITION IMPORTANT?

There are nearly a dozen independent networks that are equipped to route transactions, but Visa and Mastercard

have prevented them from competing in the credit space. We know that these smaller networks are typically cheaper, have less fraud and run just as fast as the dominant global players. However, in their operating rules, Visa and Mas tercard prohibit the banks that issue their credit cards from putting a second network on those cards. Nearly 10 years ago, Congress passed the Durbin Amendment, which required the banks to have at least two networks on debit cards, and businesses and consumers have benefited.

WHAT WILL THE CREDIT CARD COMPETITION ACT DO?

The legislation requires that the largest banks issuing credit cards must enable a second, smaller network on a credit card. They can no longer just put Visa on their card or just Mastercard. That will

26 OCTOBER 2022 convenience.org INSIDE WASHINGTON

$11 Billion

make all the networks on cards compete to be the retailer’s preferred choice when routing transactions, and their pricing will reflect that new competi tive landscape.

COULD VISA AND MASTERCARD BE THE TWO NETWORKS ON THE CARD?

No. The legislation ensures that when selecting the two networks on a card, banks could not choose both Visa and Mastercard and would have to choose at least one smaller network. Visa and Mastercard centrally set the swipe fees of their issuing banks, and instead of competing with each other and nego tiating those fees with merchants, the banks charge the same fees. Retailers in the U.S. paid $138 billion in swipe fees in 2021, and the convenience store channel paid $13 billion.

How You Can Support the Credit Card Competition Act

1. Call your senators and urge them to cosponsor the Credit Card Competition Act.

2. Scan the QR code to send a message to your members of Congress, asking them to support the bill.

3. Tag your members of Congress on Twitter or Facebook, and share how much your swipe fees have gone up and how they can help solve the problem.

4. Recruit a friend to do the same.

The only way this bill will get past the finish line is if our industry comes together to use our collective voice in Washington. With 148,000 locations across the country, we will be hard to ignore.

If you have any questions about other ways you can get involved in this fight or want specific talking points, contact Mar garet Hardin, NACS grass roots manager, at mhardin@ convenience.org

NACS OCTOBER 2022 27 coldsnowstorm/Getty Images. mustafaU/Getty Images

Retailers in the U.S. paid $138 billion in swipe fees in 2021, and the convenience store channel paid $13 billion.

WILL THIS SAVE RETAILERS AND THEIR CUSTOMERS MONEY?

It’s estimated that the legislation will save American businesses $11 billion annually. For the convenience chan nel specifically, that means $1 billion, or $7,000 a store, each year. Just as swipe fees inflate the prices custom ers pay, savings from this legislation will benefit customers given the retail industry’s highly competitive nature.

WHAT WOULD BE OTHER BENEFITS FROM THE LEGISLATION?

A competitive market drives innova tion, and other savings will be seen from new technologies that don’t exist in the Visa/Mastercard monop olized market today. For instance, when dual routing on debit cards was implemented, the smaller debit net works developed PIN-less capabilities to compete for debit transactions that weren’t associated with a PIN, and they started offering security features like end-to-end encryption of payments data.

WHAT MAKES THIS ISSUE ES PECIALLY RELEVANT TODAY?

Swipe fees are out of control. In flation, an uptick in card usage and increased fees have combined to cre ate the perfect storm. For merchants across the nation, card fees were up

What role in the community do you think convenience stores should play?

Convenience stores should support and in vest in their local com munity organizations, such as Little League, scouting organizations and other fundraising events that benefit their communities.

What does NACS political engagement mean to you, and what benefits have you experienced from being politically engaged?

NACS has my back when it comes to federal leg islation and regulations. The NACS government relations team is en gaged and knowledge able, which is a primary benefit for members and state associations. NACS grassroots efforts are ef fective and useful in let ting our federal elected officials know what our members are thinking about important issues.

ONE VOICE This month, NACS talks to Peter D. Krueger, state executive, Nevada Petroleum Marketers & Convenience Store Association

What federal legislative or regulatory issues keep you up at night?

Partisanship at the feder al, state and local levels keeps me up at night. We have lost the art of compromise and honest discussion of the issues.

What c-store product could you not live without?

Fuel, coffee and donuts!

Your voice can save your business.

Scan the QR code to tell us what’s keeping you up at night and where you’re willing to lend your voice to NACS advocacy efforts.

It’s estimated that the legislation will save American businesses $11 billion annually.

28 OCTOBER 2022 convenience.org INSIDE WASHINGTON

The credit card industry may have more resources, but the convenience industry has always outpaced them in passionate people.

25% in 2021. Through the first half of 2022, convenience industry swipe fees were up 38%. That can’t continue. And, with the inflationary environment, members of Congress are looking for op portunities to bring relief to Americans.

Swipe fees, of course, serve as in flation multipliers because they are a percentage of the transaction amount. The industry’s pretax profit in 2021 was 2.47%, and the average credit card fee is 2.25%. That shows retailers have no choice but to pass the cost of swipe fees onto their customers. The result is that American households paid $900 a year in swipe fees in 2021, and we know that number will be higher this year given inflation. This legislation is one way to bring a measure of relief to Americans.

WHAT IS THE PATH FORWARD FOR THE LEGISLATION?

NACS is aggressively advocating for its passage and is meeting with every mem ber of Congress to ask them to support the legislation. We are working with the Merchants Payments Coalition, a broad coalition NACS helped found that spans the retail sector. Our hope is that we can coalesce enough support for the legis lation that the Senate considers it for a vote this fall. However, the credit card industry is fighting the legislation with all of its might, spending millions on paid advertising to blanket the airwaves with mistruths about the bill.

The only way the convenience indus try will succeed in passing the Credit Card Competition Act is if every c-store retailer contacts their members of Congress. The credit card industry may have more resources, but the conve nience industry has always outpaced them in passionate people. Use your voice today, and ask Congress to support credit card competition.

Anna Ready Blom is NACS director of government relations. She can be reached at ablom@convenience.org.

NACSPAC DONORS

NACSPAC was created in 1979 by NACS as the entity through which the associa tion can legally contribute funds to political candidates supportive of our industry’s issues. For more informa tion about NACSPAC and how political action com mittees (PACs) work, go to www.convenience.org/ nacspac . NACSPAC donors who made contributions August 1-31, 2022, are:

Tod Butler Matrix Capital Markets Group Inc.

Angela Gearhart Nittany Oil Company

Jane Hartgrove Tres Picosos LLC

Nicole Masullo Nittany Oil Company

Vito Maurici McLane Company Inc.

Gilbert D. Moyle Moyle Petroleum Company

John Peyton Gate Petroleum Company

Darren M. Rebelez

Casey’s General Stores Inc.

Enrique Sales Abierto Networks LLC

Keith Solsvig

Buddy’s Kitchen Inc.

Van Tarver PDI Sustainability Solutions

Lynn Wallis Wallis Companies

Ena Williams

Casey’s General Stores Inc.

30 OCTOBER 2022 convenience.org INSIDE WASHINGTON Chainarong Prasertthai/Getty Images

Ahead of the Curve

Name

BY SARAH HAMAKER

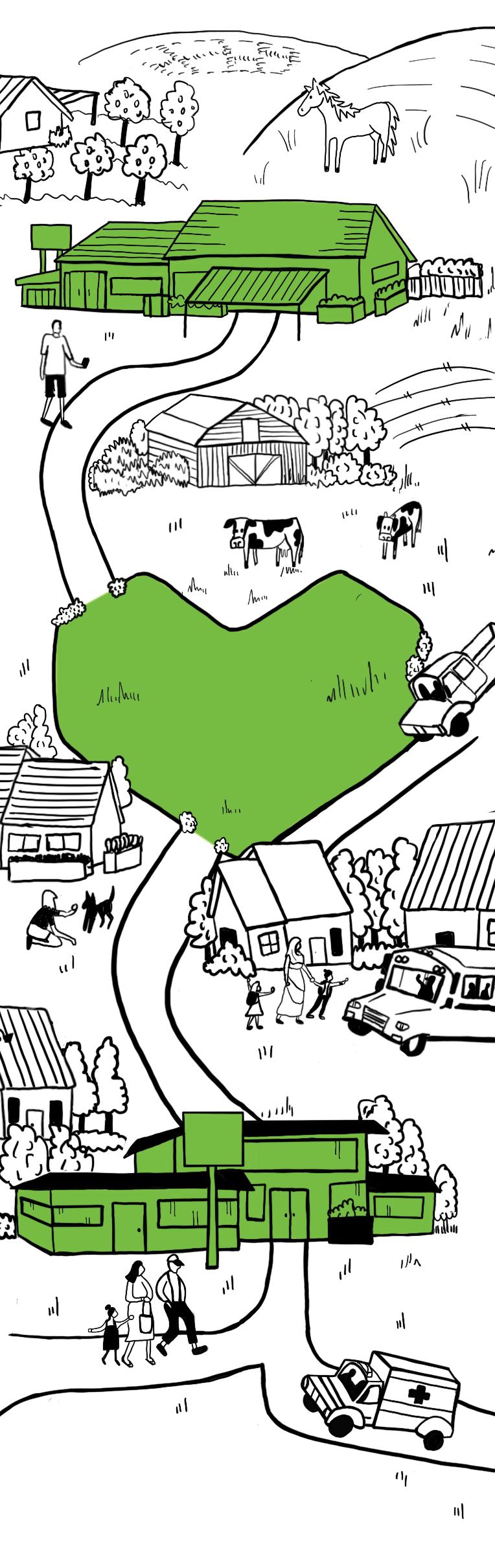

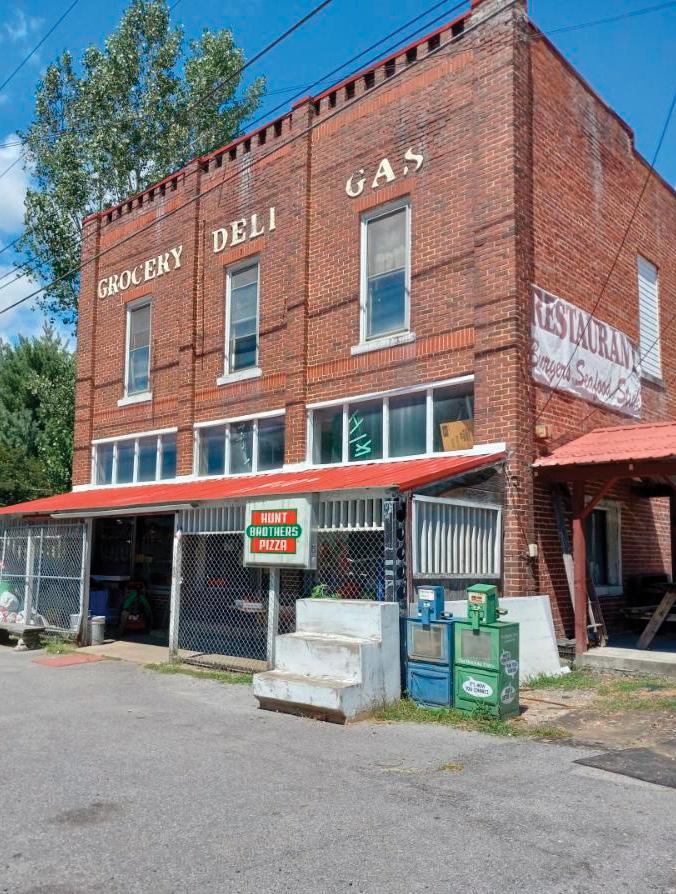

Little’s Restaurant and Convenience Store in Marion, Virginia, doesn’t have the ap pearance of being a trendsetter. The business, housed in a 100-year-old brick building, has served the local community as a general store since it was built. Its current owners recognized early on the value of offering fresh foodservice to its clientele.

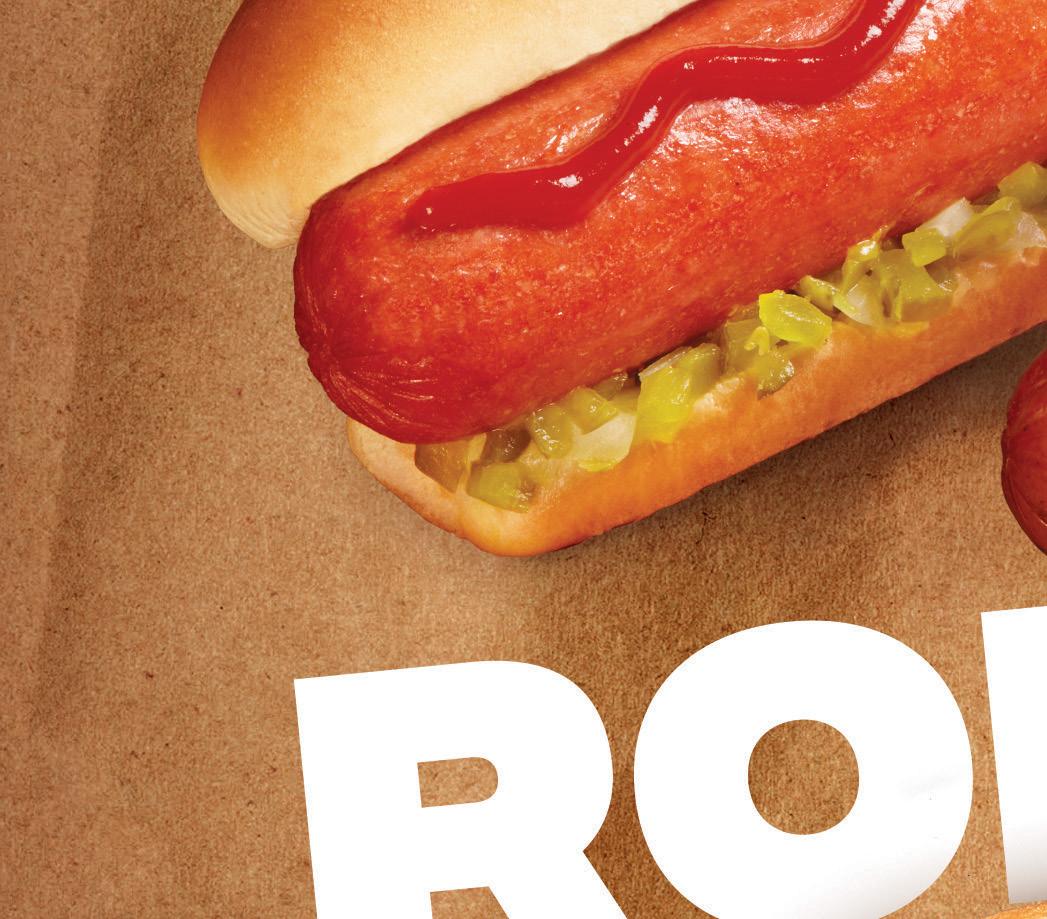

“My mom and dad put in a hot dog machine shortly after purchasing the store in 1972,” said Mike Little, who worked in the store for 43 years before semi-retiring in January. “We sold 300 to 400 hot dogs a day because of the store’s proximity to several factories in the area.”

Little’s Restaurant and Convenience Store pivoted to fresh foodservice more than 40 years ago.

32 OCTOBER 2022 convenience.org IDEAS 2 GO Florian Remer/Getty Images

of company: Little’s Restaurant and Convenience Store Year founded: 1972 # of stores: 1 Website: www.facebook.com/LittlesRestaurant-ConvenienceStore-778336822233042

IDEAS 2 GO

THE RESTAURANT SIDE

The journey from the hot dog roller grill to a full-service kitchen took Little’s Restaurant and Convenience Store only a few short years. “The location has always been a general store,” Little said. “Back in the early days, staff made gro cery deliveries and got ice off the train to keep meat and other perishables cold.”

When his parents bought the store, groceries were the biggest seller, along with fuel. “It was basically a small grocery store with gas pumps,” he said. Even back in the mid-1970s, competi tion from Walmart, dollar stores and other retailers horned in on Little’s grocery business.

“The competition for groceries effec tively killed that part of our business, so we decided serving food would be the way to keep customers coming in,” Little said. After seeing the popularity of the hot dogs, they started the restaurant a few years later. “I made the first menu when I started working there full time in 1977,” he said.

The most popular menu item is the Big Daddy Burger—a double cheese burger with everything on it. “We’ve had people from California, Washington and elsewhere say it’s the best burger they’ve ever had,” Little said. “It’s con sistently been our top seller.”

Other menu items include hot dogs, cheesesteaks, chicken sandwiches, fries and tater tots. The restaurant also has daily specials such as chopped steak, spaghetti and meatloaf. Guests can en joy a meal in the 24-seat indoor dining area or outdoors on picnic or four-top tables, as well as order it to-go. “During the pandemic shutdown, our customers still came by regularly for takeout, so we

didn’t lose as much business as we might have,” he said.

THE CONVENIENCE SIDE

While the restaurant is flourishing, the convenience side of the store hasn’t fared as well. About 25 years ago, the Littles decided to remove their gas pumps because of new government regulations concerning underground storage tanks.

“We would have had to pull the existing tanks and install new ones to the tune of $150,000—money we didn’t have and weren’t likely to recoup, given the low gas margins and volume,” Little said. So, they tore out the pumps and had the underground tanks removed, a move Little has a few regrets about. “If I were a younger man, I would probably consider adding fuel pumps back, given the amount of traffic on Highway 11, which goes right by our store,” he said. “But even then, I’m not sure the margins on fuel would make it worth the effort.”

Instead, he focuses on stocking essen tial groceries, like bread and milk, and snacks, like chips and sweets. About five years ago, he ditched tobacco because the number of tobacco outlets popping up nearby siphoned off his cigarette business. Then a year ago, he stopped carrying alcohol because the profit margins weren’t enough to keep it on the shelves. “I really thought not having cig arettes would hurt my bottom line, but the truth of the matter is, we’re more of a fast-food place than a convenience store, and not carrying tobacco or alcohol hasn’t really impacted our profits.”

While Little officially retired in January after leasing the restaurant and store to Kevin Shaffer, he still comes in

BRIGHT IDEAS

For Mike Little, the best advice he has for other retailers is to “be nice and treat everyone fair. If you’re an honest person putting out a product you’d eat yourself, you’ll do OK.” He said that attitude has taken him through more than four decades of working in the industry and helped to cre ate a restaurant-store with loyal customers.

“I learned early on to run a friendly atmosphere be cause that makes custom ers feel at home,” he said.

“Smile a lot and treat them like you like to be treated.”

a few days a week to help out. “I don’t work as much as I used to, but I’m still part of Little’s,” he said. “It’s always been my hope that our customers are happy and enjoying good food—and that they keep coming back for more.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor and romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow.

To see videos of the c-stores we profiled in 2021 and earlier, go to www.convenience.org/Ideas2Go.

34 OCTOBER 2022 convenience.org

High quality shouldn’t mean a higher price tag. That’s why Eagle 20’s is the #1 VALUE PRICED CIGARETTE BRAND IN THE COUNTRY FOR THE FOURTH YEAR RUNNING.* With Eagle 20’s, your customers can feel good about a great product at the right price. Liggett Vector Brands is the exclusive sales, marketing and distribution agent for Liggett Group and Vector Tobacco. © 2022 Vector Tobacco MSA Participant *Based on full year 2021 MSAi retail shipment data: value priced category includes all brands with manufacturing list price of $40 per carton or less. Join more than 80,000 retailers and grow your business today. Call 1-877-415-4100 to order, or contact your LVB rep today. VISIT US AT NACS BOOTH #717

BY JEFF LENARD

Golden Pantry Food Stores are a mainstay in the Athens and Northeast Georgia area. The family-owned company’s 32 convenience and deli stores are go-to destinations for traditional convenience items and are well-known by loyal customers for made-from-scratch biscuits and a robust breakfast menu.

The 57-year-old company opened its first store without fuel in 2019 in downtown Athens, Georgia, called the Golden Pantry Market—a stone’s throw from the Uni versity of Georgia campus.

How a midsize Georgia retailer is reinventing its traditional convenience store model.

36 OCTOBER 2022 convenience.org IDEAS 2 GO

Eat. Drink. Be Golden. Name of company: Golden Pantry Food Stores Year founded: 1965 # of stores: 32 Website: www.goldenpantry.com

IDEAS 2 GO

The Market features a retail store and inviting restaurant space for its diverse customer base. Situated in a student apartment complex, the Mar ket serves as a pantry and kitchen away from home for its customers.

Wooden endcaps and woven baskets throughout the store accent traditional shelving units and offer a unique op portunity to display local merchandise. Smaller gondolas and a large, curved checkout area create a new experience that encourages customers to shop the entire store. Indoor and outdoor seat ing makes the store a destination for students and professionals in the area to sit down and stay awhile.

“Local businesses endure when they adapt,” said Katie Morris, director of marketing for Golden Pantry Food Stores. “Our goal is to evoke comfort and curiosity when customers enter our stores. Even though I’m part of the team that oversees changes in these stores, I still feel like I’m on a treasure hunt every time I go in the Market— and that’s the experience we want for our customers.”

Like many convenience stores, break fast and lunch tend to be the busiest dayparts for food, while dinnertime foot traffic is slower. Golden Pantry’s solution is to make its state-of-the-art kitchen available to local chefs or food truck entrepreneurs at no charge. The company views the space as a place to foster innovation and community with in the store. The rotating pop-up “Sup per Clubs” are helping dinner sales and reinforce local ties to the community.

OUT WITH THE OLD

Another Golden Pantry store in Bishop, Georgia, is the retailer’s first raze and rebuild of a traditional store. The new design features a sleek new exterior, new deli items and a “biscuit theater” where guests can watch biscuits being made each morning.

Recognizing the importance of being a trusted neighborhood store, Gold en Pantry designed the new c-store concept to attract new customers but still feel comfortable to longtime, loyal patrons.

Morris said the new concept lends itself to creative test-and-learns within the store. The new floor plan, openair cooler and built-in shelving allow local businesses and creators to have dedicated shelf space that leads to browsing and a stronger connection to the community.

“Customers will continue to notice nods to our company heritage through out our stores. The door handles in our new stores are bowties reminiscent of our vintage logo and marquee signs,” said Morris.

Golden Pantry will continue to roll out its new concepts, introducing at least three more stores in the next two years.

And while they are still available, the stores will sell Golden Pantry Nation al Champs T-shirts that say, “33-18.” Those in the Athens area know that references a college football team that beat the University of Alabama on January 10, 2022.

Jeff Lenard is the NACS vice president of strategic industry initiatives and can be reached at jlenard@ convenience.org

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow.

To see videos of the c-stores we profiled in 2021 and earlier, go to www.convenience.org/Ideas2Go

The door handles in our new stores are bowties reminiscent of our vintage logo and marquee signs.”

38 OCTOBER 2022 convenience.org

Don’t Gamble With Your Lighting lsicorp.com/rcs Visit us at the NACS Show in Vegas Come see the next game-changing innovation from LSI. With us, the odds are always in your favor. Booth #7143

42 OCTOBER 2022 convenience.org TeddyandMia/Shutterstock

Want to better engage customers?

BY RENEE PAS

his article is a think piece, meaning it’s intended to provoke thought and contemplate customers in a different way. It’s impossible not to speculate when pondering shopper behavior. Data tell us the “what” but not always the “why.” With the overwhelming amount of consumer data that exist today, the question becomes how to absorb it and channel the data into meaningful, usable bits of information.

Sometimes a story or research triggers you to think and connect information in a new way. Indeed, that is precisely what prompted this story: another story. An article in Harvard Business Review, “What You’re Getting Wrong About Customer Journeys,” engrossed Lori Buss Stillman, NACS vice president of research. The content immediately struck a chord with her affinity for c-store analytics, and the connections to convenience retailing kept coming as she contin ued through the article’s framework of a customer journey matrix, which outlined different experiences marketers can create to target consumers (see sidebar: The Story That Prompted a Story).

“For me, that article just connected on many different levels and brought new thinking on customers and journey maps and how technology has allowed all of it to be more personalized and directed today,” said Stillman.

Master the nuances of meeting them where they’re at, and then prompt next-level connections.

NACS OCTOBER 2022 43

This is not a story designed to give you all the answers but instead fill you in on some new ideas that others are talking about—and executing—to draw you into the conversation so you can in turn engage your team in this conversation. For some readers, this informa tion will prove a box they can already check. For others, it may seem a bit aspirational. Either way, time spent re-examining the cus tomer journey is time well spent.

BEHAVIORAL SEGMENTATION

Understanding the customer journey directly connects to understanding the customer, of course. The process of sorting customers into behavioral segmentation has been ramping up to something convenience retailers—all segment retailers, actually—are doing more frequently, according to Jason Zelinski, client director, convenience and growth accounts, NielsenIQ. “Retailers used to plan out and assess behavioral segmentation maybe every three or four years, but now I’m finding many retailers are doing this every year. The behav ioral triggers of the different segments are changing faster now, so waiting two years is just too long. Those customers change faster today, and their triggers to buy from you are different.”

The idea of behavioral segmentation is to break consumers down in different lifestyle groups. For example, empty nesters and impulse shoppers have different shopping patterns, Zelinski notes. “Those customers are vastly different, and their triggers to buy from you are different. Once you determine how much of your business is made up of the segments you define, then you can determine which segments are worth defending and which you may not care that much about.”

Simply put, Zelinski believes audience segmentation drives better business decisions, particularly when it comes to marketing and making sure the messaging is on target, in addition to having the right product on

the shelves. Naturally, the pandemic had an impact on this. Shopping patterns changed throughout that period. For example, Ze linski points to a “newly cautious” customer segment that evolved from consumers who had money but were uneasy about spending it. Now NielsenIQ identifies “rebounders” as those who are back on their feet with spend ing habits.

“The whole way people are shopping has changed every single year for the past three years,” Zelinski notes.

As much as the way consumer shopping patterns are changing, so too is the way c-store retailers are approaching the role they play in guiding the customer journey. In similar fashion to the “first comes love, then comes marriage” lyrics, first comes gaining a grasp of the different customer segments. “Creat ing a successful digital marketing strategy should start with a strong understanding of the different customer segments visiting a particular c-store,” said Mike Novosel, head of industry, gas, grocery and convenience at Cardlytics. That means looking at the accumu lation of data, which often comes via rewards programs. “One of the best starting points is a loyalty program,” he said. “By starting there, brands can get an immediate understanding of who visits each store and their behavior, which lays the foundation for what will over time become an intentional, individualized marketing strategy.”

Once a strategy aligned primarily with only the most tech-sophisticated and large c-store retailers, today digital marketing’s value is viewed by even midsize operators as a key way to help shape the customer journey, according to Novosel. “Last year, I noticed an increase in digital marketing strategy among more regional c-store chains,” he said. “They are now seeing the value of having a loyalty program and looking at being more intentional in who they market to through that approach. That’s where digital tools come into play as incremental sales drivers and targeted marketing.”

It’s about establishing a more conscious, focused marketing target, Novosel said. He points to Casey’s as a leader in that arena.

The retailer’s scale—more than 2,000 stores— grants it the critical mass to be able to react to the data accumulated from customers. Even then, Novosel said, it only yields a certain level of loyalty penetration. The challenge becomes remaining laser-focused on how to reward

to

44 OCTOBER 2022 convenience.org

Customers change faster today, and their triggers

buy from you are different.”

GAMECIGARS.COM © 2022 SMCI Holding, Inc. AVAILABLE IN 2 FOR 99¢ AND SAVE ON 2 POUCHES FOR MORE INFORMATION, CONTACT YOUR SWEDISH MATCH REPRESENTATIVE. 800-367-3677 • CUSTOMER.SERVICE@SMNA.COM NOW AVAILABLE VISIT US AT NACS BOOTH #1829

customers that spend every day, “which can be a challenge for even the best of the best when using digital marketing,” he said. “And it is an even greater challenge for chains wishing to move the bar today due to a talent gap in resources. You really need someone long term on your team who specializes in digital mar keting.”

CASEY’S JOURNEY

Unquestionably, Casey’s has put the resources behind understanding how to advance the customer journey with a digital-first philos ophy led by Art Sebastian, the Iowa-based retailer’s vice president of digital experiences. “We’ve made great progress in the last four years,” he said, which includes the launch of the retailer’s loyalty program in 2020, re launching its website, adding curbside pickup and delivery options and, most recently, test ing kiosks as an ordering solution in stores.

With more than five million rewards participants (Casey’s reported 5.5 million members in its fiscal first-quarter earnings report September 7), the program has quickly established itself with customers. While the five-million mark brings with it an immense amount of data, the rewards piece does not actually serve as the primary entry point for Casey’s, says Sebastian. Instead, the first step begins with building awareness of Casey’s in the market. Joining the rewards program reflects the endgame (or better yet, prompts the next level of marketing). “Ultimately, we want to recruit customers into the guest fun nel,” Sebastian explained, which begins by looking at the base of potential customers within a five-mile range of a store. After building awareness, the next filter is to draw those customers into the store.

For Casey’s, pizza frequently prompts the first entry, specifically via digital order ing. “Ordering a pizza through our website is a common entry point,” Sebastian said. “Pizza is a unique part of our business and what we are most known for. Other ways people funnel in are by subscribing to our

marketing channels or downloading the mo bile app. Then that leads to them joining the rewards program.”

The approach Casey’s takes follows much of what has become a traditional sales funnel model, which guides prospects through the funnel (widest at the top with awareness and narrower toward the bottom as the potential customer converts to an active customer). It’s a visual metaphor often referenced in sales and marketing teachings, and yet another way to think about the customer journey.

While a large chunk of Casey’s digital ex periences team works on acquiring a broader base of rewards members, another part of the team focuses on engagement, Sebastian says. “When looking at engagement, we have a very high active rate. Our engagement metrics are actually better than some large QSR brands.” When asked what he considers more im portant, acquisition or engagement, he leans toward engagement. “Both are important, but we want to engage more with those that joined the rewards program,” he said. “We have several behavioral segments available to us and leverage that to create the right audience and guide behavior. We look at the customer journey and how we can influence that journey once customers have joined. We want customers to transact business with us as a routine.”

Even operators without the scale and resources the likes of Casey’s can work toward a better mastery of the customer journey. Sebastian points to transaction-level data as one opportunity, as well as considering white-label options as an entry point into dig ital engagement. “Smaller operators can even look at their base of transactions and consider how to market to a select group,” he added. “For instance, the data may show a subset of customers use the store for a morning coffee run or as a tobacco convenience run. From there, it’s about how to communicate to cus tomers based on those trip types,” he said. “I do believe, however, that any size operator can benefit from making digital a priority.”

For Casey’s the next frontier lies in per sonalizing experiences. “There is so much opportunity with personalization,” Sebastian said. “We also see an opportunity to digitize the team member experience. There is a whole other world we can still tap when it comes to digitizing experience. Digital is more than e-commerce and loyalty programs.”

We look at the customer journey and how we can influence that journey once customers have joined.”

MicroStockHub/Getty

46 OCTOBER 2022 convenience.org

• No long-term contracts • Curated channels exclusive for business use • Low monthly subscription fee of $26.95 • Easy installation • Music scheduling and custom in-store messaging capabilities • Create Pandora stations based on your favorite artists STOCK THE FRESHEST SOUNDS With our advanced custom messaging feature, and over 240 channels of fully licensed music, SiriusXM Music for Business has got you covered. Visit siriusxm.com/business or call 800-684-7050 for more information. © 2022 Sirius XM Radio Inc. SiriusXM, Pandora and all related logos are trademarks of Sirius XM Radio Inc. and its respective subsidiaries. All rights reserved.

WHEN THE JOURNEY FLATLINES