Topic Legend

Reporting and Training for REs

Health Benefits

Information Security

General

Reporting and Training for REs

Health Benefits

Information Security

General

We’ve moved! TRS is now settling into our new Austin home at 4655 Mueller Blvd. Members started visiting the new Member Center in May, and we’re excited to welcome you too! Check out the TRS website for more info.

The signing of HB 2 into law does not have major impacts on the monthly TRS reporting process. However, there are key legislative changes employers should be aware of to ensure continued compliance and accurate reporting.

HB 2 repeals Subsection 825.4092(f) of the Government Code, which prohibits employers from passing the cost of applicable surcharges to employed retirees. After this repeal, employers may choose to pass surcharge costs onto the retiree just as they did before Subsection 825.4092(f) became law in 2021. There is no impact to the reporting process based on this change, and employers remain responsible for remitting surcharges owed in the calendar month(s) that the retiree exceeds one-half time employment.

HB 2 also introduces two new allotments to provide pay increases to classroom teachers and other support staff: the Teacher Retention Allotment and the Support Staff Retention Allotment. HB 2 further provides that any increased compensation paid to teachers or support staff employed by a TRS-covered employer with funds from these allotments qualifies as creditable compensation for TRS purposes.

As we near the end of the fiscal year, TRS will begin the annual contribution review and collection for fiscal year 2025. The collection process will involve reminders to Reporting Employers (REs) with outstanding balances through the end of the fiscal year. The review and collection efforts apply to all REs.

Please take a moment to log in to the RE Portal and review all your fund type accounts on the RE Ledger, including Penalty Interest (PI), TRS-Care

Agentic AI is a new type of smart technology that can work on its own. Unlike traditional AI, which waits for specific commands, agentic AI can make decisions and take action to achieve goals all by itself. It learns from what it observes and can adapt to different situations.

In workplaces, for example, agentic AI can take care of repetitive tasks, manage complex projects and even predict needs before anyone asks. Additionally, in education, agentic AI opens up new possibilities.

Like any powerful tool, it’s important to use agentic AI responsibly. Users should understand what the technology can and cannot do and ensure it only has access to the data it needs. Regularly checking on its activities can help catch any unexpected behavior early. Establishing clear guidelines and keeping a human involved in important decisions is essential. Protecting personal and sensitive information must always be a top priority, especially in schools and workplaces.

As a condition of employment in Texas public education, an employee must be a member of the Teacher Retirement System of Texas if employed in a position that meets the membership eligibility requirements.

To meet eligibility, the employment must meet the three requirements listed below. Membership eligibility in the retirement system is established through a single employer.

1. Employment must be on a regular basis for either an indefinite period of time e.g., at-will employment, or a definite period of 4½ months or more.

2. Employment must be for one-half or more of the time required of the standard workload for the same or similar full-time position.

3. Salary must be comparable to the rate of pay earned by other employees in the same or similar position types.

TRS membership eligibility must be determined at the time of hire and any time the employment expectations have changed, and at the beginning of each school year. There is no in-state residency requirement for TRS membership if the membership eligibility requirements are met.

The standard workload for the same or similar full-time position mentioned in requirement two is referred to as the Full-Time Equivalent (FTE). When determining whether the employee will be working half time or more of the FTE for the position, please use the following chart for reference.

Definition: FTE is defined by TRS as the number of hours per week an employee must work in a position to be considered full time.

It is important to remember FTE is based on the position and not the employee filling the position. For reporting purposes, this must be a whole number between 30-40 hours per week. If a position does not have any full-time employees or if the full-time hours are less than 30 for the position, TRS defines the position as having no FTE and it is reported as “00” on the contract record (ED40).

Bus drivers working at District A are required to work 15 hours per week to be considered full time.

• The FTE for bus drivers at this RE is 00.

• Bus drivers expected to work 15 hours or more per week may be TRS membership eligible if they meet the other requirements.

• If the bus drivers are expected to work less than 15 hours per week, they are not eligible for TRS membership.

Custodians working at District B are required to work 38 hours per week to be considered full time.

• The FTE for custodians at this RE is 38 hours.

• Custodians expected to work 19 hours or more per week may be TRS membership eligible if they meet the other requirements.

• If the custodians are expected to work less than 19 hours per week, they are not eligible for TRS membership.

Office staff employees working at District C are required to work 40 hours per week to be considered full time.

• The FTE for office staff at this RE is 40 hours.

• Office staff employees expected to work 20 hours or more per week may be TRS membership eligible if they meet the other requirements.

• If the office staff employees are expected to work less than 20 hours per week, they are not eligible for TRS membership.

Once an FTE is established for a position, it is extremely important to confirm the FTE is reported correctly on the ED40 contract/position record for all employees working in the position. TRS uses this data in the verify membership eligibility process which can cause a warning or error on the Regular Payroll report if an inaccurate FTE is reported. You can find the reported FTE by your RE on the View Employee Information screen in the RE Portal under View Employee Information > View ED Contract Info.

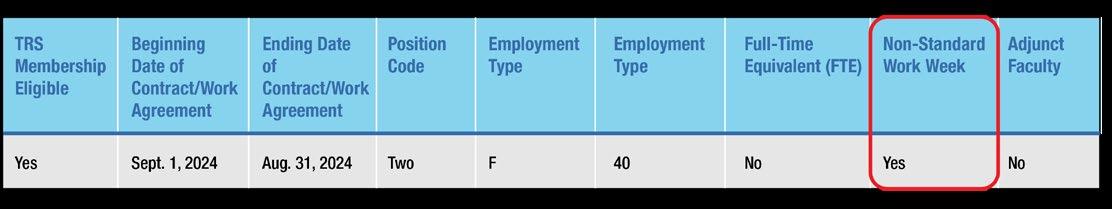

As some employers transition to varying workweeks, TRS recognizes that not all employees work the standard Monday-Friday schedule. TRS calculates a year of service differently for these employees, as it takes them longer to earn a year of service due to working fewer days per week. (Benefits Handbook).

For these employees, it is important that the Non-Standard Work Week flag is correctly set on the ED40. This flag indicates when an employee is regularly scheduled to work in a full-time position less than five days per week. These employees can earn a year of service by working at least four and one-half months, provided that this period includes:

• four (4) full calendar months in which the member renders service and is paid or the member uses paid leave, for at least eight (8) days and an additional five (5) days of service rendered and for which the member is paid or paid leave used in another calendar month or months, but not to include the four (4) full calendar months.

Example: Employee is hired for a contract from Aug. 28, 2025 through May 31, 2026 to work Monday-Thursday four 10hour days

In this example, the employee would earn their year of service in January, since they have been reported for four full calendar months for at least eight days each (September-December 2025) and at least five additional days in another calendar month (January 2026).

The days worked in August would not count toward the year of service for FY2026. These days will count toward FY 2025.

Employee works a total of 17 calendar days in the month of September 2025. This would count as month one for earning a year of service.

Employee works a total of 18 calendar days in the month of October 2025. This would count as month two for earning a year of service.

Employee works a total of 12 calendar days in the month of November 2025. This would count as month three for earning a year of service.

Employee works a total of 12 calendar days in the month of December 2025. This would count as month four for earning a year of service.

Employee works a total of 16 calendar days in the month of January 2026. This would count as the fifth month for earning a year of service.

Many people find that a video explanation is the best way to learn! Take advantage of more than a dozen informative videos in the TRS Employers Video Library to understand TRS processes and reports for reporting employers.

We all experience life and job changes that can be both exciting and challenging. These events often require updates to your account information and other essential actions. Keeping your information current ensures you receive timely support and services tailored to your needs. Visit our dedicated webpage for “Life and Job Changes” - it’s a comprehensive guide to assist in navigating these events.

TRS members will find “Returning to Employment After Separation” section of our Life and Job Changes webpage holds valuable answers to common questions like:

• I withdrew my TRS account after terminating. How does that affect my tier for retirement?

• Does the withdrawn account affect my eligibility for TRS-Care at retirement?

• I have an existing TRS account. Do I need to do anything now that I’ve returned to TRS-covered employment?

• How do I update my address?

Explore the Life and Job Changes webpage today! Whether starting a new job, transitioning or planning for retirement, these events have a significant impact. We’re here to help you make the most of your benefits – in all ways possible – with each step forward.