Clearing the

GIVING BACK

GENERATION ALPHA What you need to know about young consumers

How the Wills Group builds community

GENERATION ALPHA What you need to know about young consumers

How the Wills Group builds community

18 Inside Washington

Expect to see action on joint employers, independent contractors and overtime pay; how fire codes could affect EV charging sites.

24 Ideas 2 Go

Godega Market aims to meet the everyday needs of its Omaha customers in 1,200 square feet. 54 Cool New Products

56 Gas Station Gourmet

The PRIDE Stores’ three restaurant concepts offer fresh, made-to-order fare.

58 Category Close-Up Expect more changes and higher prices in the cigarettes category. 64 By the Numbers

Kim Stewart

Editor-in-Chief (703) 518-4279 kstewart@convenience.org

Lisa King Managing Editor (703) 518-4281 lking@convenience.org

Sara Counihan

Contributing Editor (703) 518-4278 scounihan@convenience.org

CONTRIBUTING WRITERS

Sarah Hamaker, Al Hebert, Pat Pape

DESIGN

Imagination www.imaginepub.com

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich

National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas

Marketing Director (703) 518-4290 npappas@convenience.org

CHAIR: Don Rhoads, The Convenience Group LLC

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Varish Goyal, Loop Neighborhood Markets; Brian Hannasch, Alimentation Couche-Tard Inc.; Chuck Maggelet, Maverik Inc.; Ken Parent, Pilot Flying J LLC; Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

PAST CHAIRS: Jared Scheeler, The Hub Convenience Stores Inc.; Kevin Smartt, TXB Stores

MEMBERS: Chris Bambury, Bambury Inc.; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC

Terry Gallagher, Gasamat Oil/ Smoker Friendly; Douglas S. Haugh, Parkland USA; Raymond M. Huff, HJB Convenience Corp. dba Russell’s Convenience; John Jackson, Jackson Food Stores Inc.; Ina (Missy) Matthews, Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Charles McIlvaine, Coen Markets Inc.; Lonnie McQuirter, 36 Lyn Refuel Station; Tony Miller, Delek US; Jigar Patel, FASTIME; Elizabeth Pierce, Applegreen LTD; Robert Razowsky, Rmarts LLC; Richard Wood III, Wawa Inc.

SUPPLIER BOARD REPRESENTATIVES: David Charles, Cash Depot; Kevin Farley, GSP

STAFF LIAISON: Henry Armour, NACS

GENERAL COUNSEL: Doug Kantor, NACS

NACS SUPPLIER BOARD CHAIR: Kevin Farley, GSP

CHAIR-ELECT: David Charles, Cash Depot

VICE CHAIRS: Josh Halpern, JRS Hospitality; Vito Maurici, McLane Company; Bryan Morrow, PepsiCo Inc.

PAST CHAIRS: Brent Cotten, The Hershey Company; Rick Brindle, Mondelez International; Drew Mize, PDI Technologies

MEMBERS:

Tony Battaglia, Juul Labs; Alicia Cleary, AnheauserBush/In Bev; Jerry Cutler InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falconi, Oberto Snacks Inc.; Mike Gilroy, Mars Wrigley;

Danielle Holloway,Altria Group Distribution Company; Jim Hughes, Molson Coors Beverage Company; David Jeffco, Dirty Dough LLC; Kevin Kraft, Q Mixers; Kevin M. LeMoyne, Coca-Cola Company; Lesley D. Saitta, Impact 21; Sarah Vilim, Keurig Dr Pepper

RETAIL BOARD REPRESENTATIVES: Scott E. Hartman, Rutter’s; Steve Loehr, Kwik Trip Inc.; Chuck Maggelet, Maverik Inc.

STAFF LIAISON: Bob Hughes NACS

SUPPLIER BOARD NOMINATING CHAIR: Kevin Martello, Keurig Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2022 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

I’ve spent a lot of time recently re connecting with one of the Virginia highways of my youth, U.S. Route 29, which stretches from Washington, D.C., to Danville in southern Virginia. Heading southwest from Fairfax, once I’ve exited Interstate 66 in Gainesville, I relax a little. Then when the Blue Ridge Mountains come into view, my heart tells me I’m heading home to winding roads and farmland, a place I haven’t lived for over 30 years.

The drive south to help care for a fam ily member affords me a great excuse to stop in convenience stores that dot the way. So far, I’ve hit Wi-Not Stop, where I found the perfect Bible word search book for my mother; Wawa, where I tried the iced caramel coffee for the first time and was surprised that I prefer it to Starbucks (and the price is right, too); Royal Farms for fried chicken, of course; and Jiffy Mart, where I was thrilled to find Stuckey’s Pecan Log Rolls, another nod to the road trips of my youth.

Driving those country roads has given me time for reflection, too, which is a wonderful practice as the year draws to a close. Likewise, this issue of NACS Magazine is packed with features that invite you to consider the future.

Our cover story, “Clearing the Smoke,” delves into trends in other tobacco products as some tobacco com panies contemplate a smokeless future, and consumers are increasingly becom ing poly-users of nicotine, alternating between combustible cigarettes, snuff and nicotine pouches.

Anyone currently raising Generation Alpha? Writer Pat Pape interviewed Mark McCrindle, the Australian social researcher who coined the term, and he

A new fave—Wawa iced caramel coffee—and an old fave— Stuckey’s Pecan Log Roll.

shared his insights about this diverse and digital generation that already has more than $350 million in spend ing power.

One of the stories I best love in this issue is Sarah Hamaker’s profile of the Wills Group, which operates Dash In c-stores and Splash In car washes in the mid-Atlantic region. This company has giving back ingrained in its purpose, and it loves on its communities in ways both big and small.

That’s my wish for you as we head into 2023. May you find peace, love and joy in your homes and communities.

Have a wonderful holiday season!

Driving those country roads has given me time for reflection, too, which is a wonderful practice as the year draws to a close.”

It has been an honor to serve and work sideby-side with the NACS retailer and supplier membership and staff over the past 10 years. I have been awed by the entrepre neurialism, collaboration and spirit of this very special community.

I think we are in the midst of a pretty substantial transformation in retail in general . How it ap plies to each sector will be a little different.

In 2020, COVID-19 really put convenience retailing to the test. There were so many factors against us all—especially our retailer community. Not much about convenience retailing coincided with social distancing. Further, quarantines aren’t great for gas sales. Still, both the retailer and supplier community dug in deep, leveraged our understanding of our customers and communities; actively collaborated with each other; adjusted strategies and tactics accordingly; and rallied our teams to record success. Most of us emerged stronger than we were going into the crisis—a true measure of greatness

Against this backdrop, and coupled with the record results of October’s NACS Show, I have no

doubt in my mind that the future of convenience retailing is FULL SPEED AHEAD!

Of course, there are obvious headwinds in our near future. Labor, supply chain, inflation, recession and regulation to name a few. However, the convenience community that I know will thrive. We will continue to be laser-focused on …

• Building strong teams

• Satisfying the needs, wants, conditions and limitations of our shoppers and communities

• Eliminating friction for the shopper at every turn

• Collaborating toward breakthrough innovation to win in the marketplace … and knocking down whatever the hell else stands in our way!

If I have any advice, it would be to …

• Aggressively cultivate your youth (Think: Relevance. Diversity. Recruitment/Retention. Future.)

• Leverage #ConvenienceCares to the next level (Consider: Synergy. Awareness. Recruiting. Market Share.)

• Double down on digital, both shopper-facing and operations (Think: Frictionless. Productivity. Loyalty. Market Share.)

• Win in foodservice—innovation,

local and dayparts (Consider: Your Brand. Trips. Margin. Market Share.)

As many of you know, I will be retiring at the end of this year. I want to take this opportunity to thank you for your guidance, partnership, confidence, patience and especially for your friendship over the years. It has truly been an amazing ride. In fact, these have been the best of my 46year career in this wonderful industry!

Here’s to our next chapter! FULL SPEED AHEAD!

How has the industry changed in recent years, and where do you see it going? Rick Brindle, vice president, industry development, Mondel ēz International

Access industry experts that presented at the 2022 NACS Show at your convenience. Get nearly 40 education sessions covering the most important issues in conve nience retailing today.

The insights, innovations and compelling content can now be accessed through online streaming audio-video format for $249. Once purchased, access to all 38 sessions will be available on demand until October 2023.

Sessions include:

• Winning the War for Talent

• A Force for Good: We’re in Business to Make an Impact

•

•

•

•

On-demand NACS Show education sessions are de signed to make you and your entire team better. Whether you’re starting out with a new idea, growing your skill set or thinking strategically about an expansion, these ses sions will help you plan a customized learning experience. Learn more at www.nacsshow.com

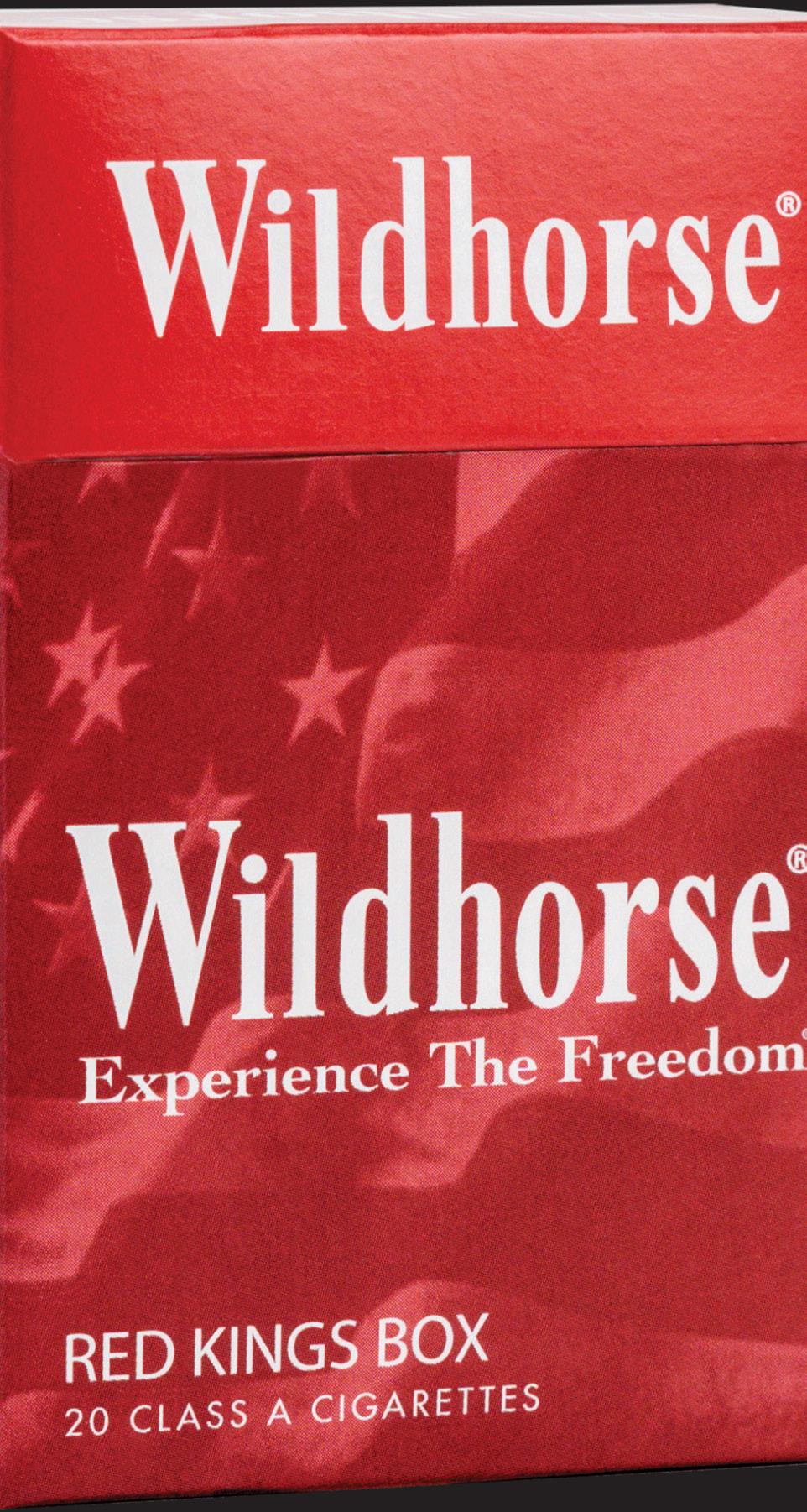

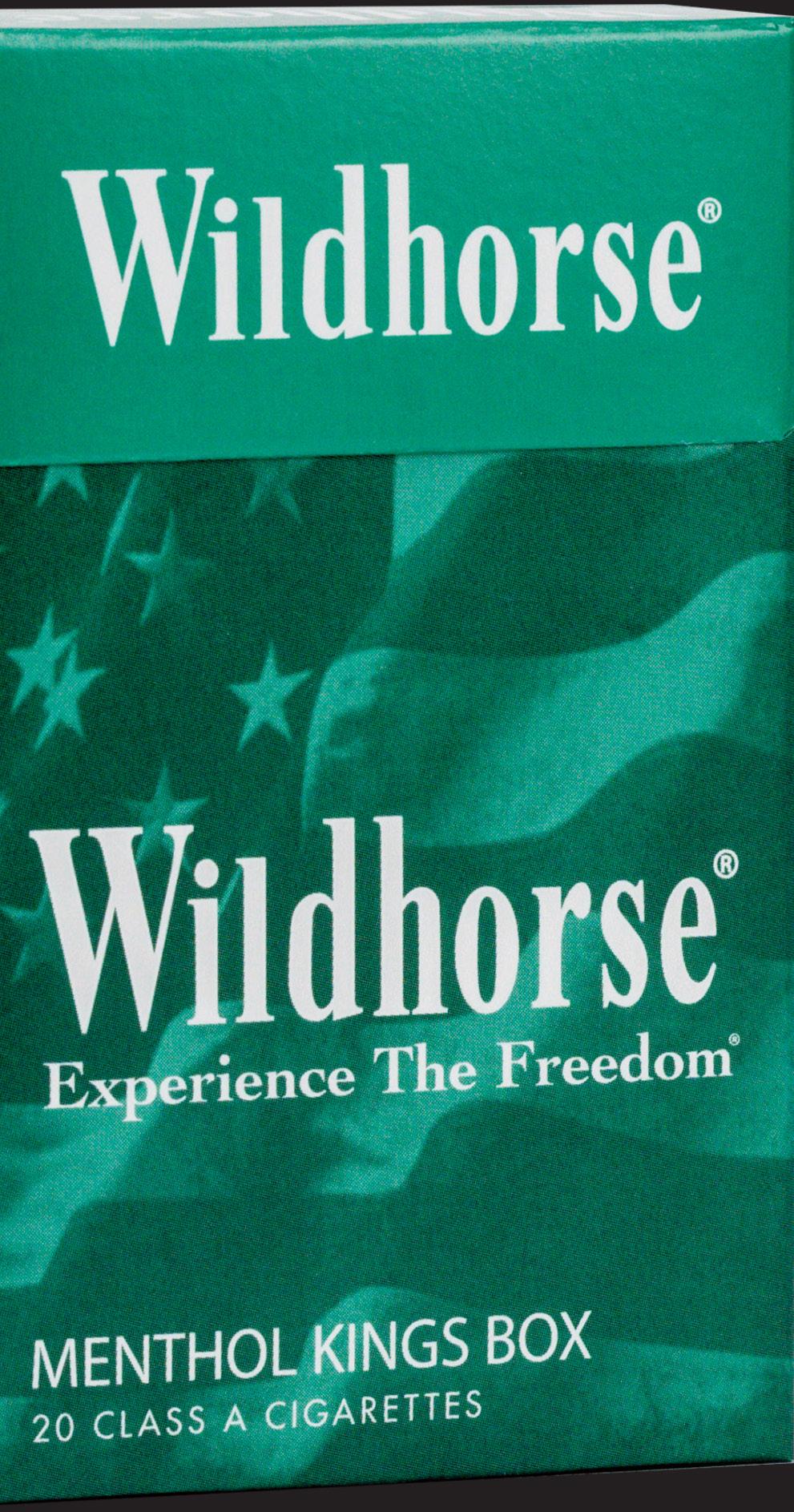

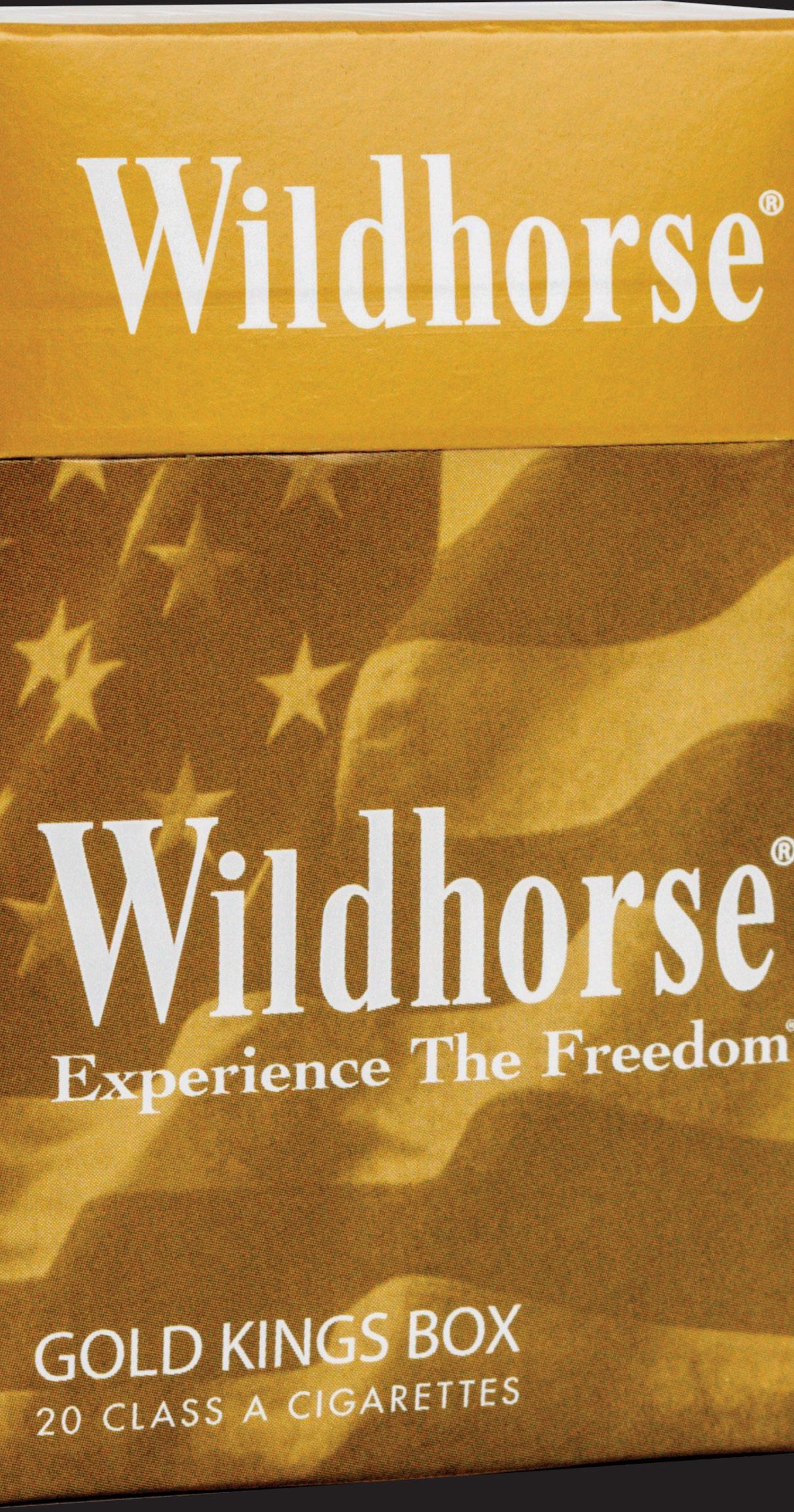

Big taste and big savings are two things you get with Wildhorse cigarettes. Our American blend tobacco comes from the finest crops. Enjoy a bold, rich taste and smooth smoking experience. Are you ready to EXPERIENCE THE FREEDOM?

The Fuels Institute’s Electric Vehicle Council (EVC) released a new report on the regulatory environment of the electric ve hicle market. The report, “A Best Practice Guide for EVSE Regula tions,” harnesses the vast market experience of key stakeholders and identifies policies imple mented by authorities having jurisdiction that support the effi cient installation of EV charging stations, as well as those that impede such installations.

The report serves a critical need identified by previous EVC reports, as well as those pub lished by other organizations, that the soft costs incurred nav igating inadequate or outdated regulatory requirements are a significant barrier to develop

ment of a robust EV charging in frastructure.

The report also includes best practice recommendations from regulated entities themselves. These are stakeholders that have accumulated years of experience installing and operating EVcharging infrastructure around the U.S.

Stakeholders from the EVcharging industry, fuel retailing, utility and metropolitan plan ning organizations shared their expertise and actionable and practical recommendations as ju risdictions begin to develop and implement EV-charging policies.

Download a copy of the report at www.fuelsinstitute.org .

2023

FEBRUARY

NACS Leadership Forum

February 08–10 | Eden Roc | Miami Beach, Florida

NACS Convenience Summit Asia

February 28–March 02 |

Waldorf Astoria Bangkok | Bangkok, Thailand

MARCH

NACS Day on the Hill

March 07–08 | Washington, D.C.

NACS Human Resources Forum

March 20-22 | The DeSoto | Savannah, Georgia

APRIL

NACS State of the Industry Summit

April 18-20 | Hyatt Regency DFW International Airport | Dallas, Texas

NACS Leadership for Success April 30-May 05 | Virginia Crossings Hotel & Conference Center | Glen Allen (Richmond), Virginia MAY

NACS Convenience Summit Europe May 30-June 01 | Intercontinental Dublin | Dublin, Ireland

JULY

NACS Financial Leadership Program at Wharton July 16-21 | The Wharton School University of Pennsylvania | Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg July 23-28 | Kellogg School of Management | Northwestern University | Evanston, Illinois

NACS Executive Leadership Program at Cornell July 30-August 03 | Dyson School, Cornell University | Ithaca, New York

OCTOBER

NACS SHOW October 03-06 | Georgia World Congress Center | Atlanta, Georgia

NOVEMBER

NACS Innovation Leadership Program at MIT November 05-10 | MIT Sloan School of Management | Cambridge, Massachusetts

For a full listing of events and information visit www.convenience.org/events.

Five Star Food Service Inc. an nounced James Fargo as one of its new regional vice presidents. Fargo oversees the Atlanta region. Prior to Five Star Food Service, Fargo held several senior leadership roles with Walmart Stores.

Greg Lucia has been named a regional vice president of Five Star Food Service responsible for the Gulf Coast region. Lucia has 33 years in sales management and operations experience.

Excel Dryer Inc. announced that Scott Kerman is its new business development manager - speci fications. Kerman will work with the sales and market ing teams to grow profits; nurture, retain and support partner rela tionships and conduct demonstra tions and sales presentations.

Gilbarco Veeder-Root an nounced Karthik Ganapathi as president, GVR Retail Solutions. He will be respon sible for GVR’s global retail solutions strategy, point-of-sale and payment solutions and cloud platforms to expand the compa ny’s convenience retail offering.

Hormel Foods Corp. has ap pointed Katie Larson as senior vice president of human resourc es. She assumes responsibility for leading the global human resources function at the company, bringing more than 20 years of experience in HR leader ship at Hormel Foods.

Daryl Erbs has joined Hoshizaki America Inc. as vice president of innovation, a new position. Erbs brings industry experience, tech nical expertise, understanding of industrial design and a passion for making a posi tive impact.

Scott Meyer is Hoshizaki Amer ica’s new vice president of sales for the U.S. and Canada. Meyer has over 16 years in the foodservice industry and 20 years collectively in sales.

Impact 21 has named Kelly Schimmel-Fink senior pro gram manager. Schimmel-Fink will play a key role in client rela tions, resource management and project quality assurance. She will manage proj ect administration, helping teams through strategy development and execution.

Alan Connor has joined KIC Team Inc. as its new CEO, succeeding Ian McCormick. Connor previous ly served for the past 11 years as CEO of Cadence Inc.

Confectioner

Perfetti Van Melle has named Paula Dart as vice pres ident, growth and transforma tion, for Perfetti Van Melle North America. Dart’s experience and history of success in growth and business transfor mation with leading global con sumer companies will be key in reaching company confectionery goals in gum, candy and mints.

Petroleum Equip ment Inc. has named Joe Barker as president and owner of the fourth genera tion, familyowned business.

Paytronix Sys tems Inc. has named Elizabeth King to the new position of chief people officer. King will work closely with com pany leadership on talent acquisition, engage ment, training and development, employee experience, infrastruc ture and organizational design for the company’s worldwide em ployee base. King comes to Paytr onix from Motif FoodWorks Inc.

In 2023, Longhorn turns 20.

To celebrate, we’re getting a bold, new look to compliment our premium tobacco. We’ll also be launching some BIG surprises to thank our customers and drive sales. To join the value stampede, contact your SMNA sales representative for more information.

Every year, the convenience and fuel retailing industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America, and to share these powerful stories.

Learn more at www.conveniencecares.org.

Enmarket partnered with MakeA-Wish Georgia to grant one teenager’s wish of going to the Walt Disney World Resort in Orlando, Florida. DeMichael, 13, loves Christmas and Disney World, so Enmarket threw him a Christmas-themed party at its headquarters while surprising him with his wish. His mother said Mickey Mouse is his favorite Disney character.

Enmarket supports Make-A-Wish Georgia through the annual Enmarket Charity Classic golf tournament. Since 1995, Make-A-Wish Georgia has been granting the wishes of local children facing critical illnesses.

“We are so thankful for the generous support of Enmarket as they help us ignite hope for our local wish kids like DeMichael,” said Meghan Lowe, south east development director for Makea-Wish Georgia. “We look forward to

celebrating more wishes with Enmarket in the future.”

“It is an honor for all of us to share this special day with DeMichael and his family and the Make-A-Wish Georgia team,” said Matt Clements, president of Enmarket. “Our hope in helping grant DeMichael’s wish is that he and his fam ily will be able to look to the future with hope and strength.”

Enmarket, Savannah’s largest con venience store chain, is committed to giving back to the community through many charitable contributions and volunteer efforts, and to offering fresh food, healthy snacks and competitively priced quality fuel as part of its mission to enrich life. The company employs more than 1,300 people and operates 129 convenience stores in Georgia, South Carolina and North Carolina, as well as 24 Marketwash car washes.

1 Wawa announced its first-ever college athletics spon sorship of four Florida universi ties, which includes being designated as the official hoagie of the Miami Hurricanes and the UCF Knights and partner of the Florida Gators and the Florida State Seminoles.

The multi-year partnership begins during football season and extends to include men’s/ women’s basketball, soccer, softball and baseball in select markets where Wawa will offer sweepstakes, in-store promo tions, sampling at select events and on-site activations.

2 Love’s Travel Stops cele brated military veterans with a food and drink deal on Veterans Day in addition to extending a $150,000 donation to Opera tion Homefront, a national nonprofit whose mission is to build strong, stable and secure military families. The donation came from the sale of special edition Operation Homefront

NACS encourages retailers to share their giving-back news on social media using #ConvenienceCares

tumblers, combined with a gift from the company.

Separately, Love’s in October donated $15,000 to the Oklaho ma Lions Service Foundation to make Lions Park in Perry, Oklaho ma, more accessible to children of all abilities in honor of the grand opening of Love’s 600 th location.

$100,000

3 This holiday season, four local charities are receiving $25,000 each from Rutter’s Children’s Charities Holidays Donation Giveaway. “Through our $100,000 for the Holidays donations, we hope to make this season a little brighter for those in need,” said Chris Hartman, president of Rutter’s Children’s Charities.

The donation applications were collected from November 1-21. Qualifying charities focus on benefiting children and are a 501(c)(3) organization. At the conclusion of the submission period, Rutter’s Children’s Chari ties reviewed the applications and selected four winners to receive a $25,000 donation.

4 TXB Stores Inc. donated $5,000 to Court Appointed Special Advocates (CASA) to celebrate the groundbreaking of its new location in Kyle, Texas. CASA advocates for children in the foster-care system.

In addition to the initial dona tion, the president of Cheyenne Construction Group matched TXB’s donation to present CASA with $10,000.

5 Maverik—Adventure’s First Stop will donate $50,000 to Feeding America to kick off its Round Up Your Change register donation program in stores through December 15. Customers can round up their cash or credit transaction to the nearest dollar or more to benefit the Feeding America network of food banks.

Ninety percent of Maverik’s initial donation will be distributed to Feeding America member food banks across the Intermountain West in communities where Maverik operates. The remaining funds will be focused on the Feeding America national organization. Maverik donated more than $580,000 to Feeding

America in 2021 and has so far donated over 320,000 pounds of surplus food through its food waste reduction program running in more than 90 stores in five states.

GIVING PUMPS

6 MAPCO celebrated the October grand opening of its newest store in Birmingham, Alabama, by unveiling on-site “Fueling Our Future” dedicated gas pumps benefiting George Carver High School students. MAPCO donated 25 cents for every gallon pumped to the Rams’ athletic programs through November 17.

“At MAPCO, we are always looking for new ways to give back to the communities where we live and serve,” said Frederic Chaveyriat, CEO of MAPCO. “We are honored to celebrate this new store by giving back to local youth recreation. We invite the Birmingham community to come out, enjoy MAPCO’s unparalleled customer service and quality products and help us ‘Fuel Our Future’ through the donation pumps.”

The estimated number of people working as indepen dent contractors in the U.S.

The per-week minimum salary threshold to exempt white-collar workers from overtime pay

We’ve long expected aggres sive action from the Biden Administration in the labor space, and during the past couple of months we’ve started to see it. Some of the action out of the U.S. Department of Labor (DOL) likely has been delayed by the failure to get former Obama Labor Department Wage and Hour Division Director Dr. David Weil confirmed to the same position. Weil’s nom ination was rebuffed by moderate Democrat senators, who rejected a procedural motion to bring the nomination to a floor vote for confirmation back in March. In early Au gust, President Biden nominated the divi sion’s acting director, Jessica Looman, to be the confirmed director, and her nomination is still pending Senate action as of this writ ing in mid-October. Looman, though, has not been sitting on her hands as acting di rector as she has overseen the department’s rescinding of a handful of Trump-era rules, including the joint-employer standard and independent contractor analysis.

We’ll get back to the DOL in a moment, but the first major rulemaking proposal in

the labor arena was issued by the National Labor Relations Board (NLRB). In early September, the NLRB issued a notice of proposed rulemaking outlining its intent to loosen the rules governing analysis of joint-employer relationships. The guide lines and rules surrounding what consti tutes a joint-employer relationship have been volleyed back and forth by successive administrations since 2015. That year, the Labor Board decided in Browning-Ferris that one company need only have the contractual right to control an employee’s working conditions to be deemed a joint employer. The Trump Administration re versed those guidelines and took the extra step of issuing a formal rule tightening up

Expect to see action on joint employers, independent contractors and overtime pay.

the guidelines and laying out that one em ployer would have to actually enforce such a right to be deemed a joint employer. That rule was remanded back to the Labor Board by the D.C. Circuit Court of Appeals at the end of July.

So, while the Browning-Ferris case remains alive at the NLRB, the board has issued the notice of proposed rulemaking to attempt to formalize not only a return to the Obamaera interpretation but also a significant expansion of it. Under the current pro posal, the existence of a contractual right to determine even one essential term or condition of another companies’ employee, regardless of whether such right is execut ed, can determine a joint-employer status. The proposal goes further by leaving the list of what terms and conditions are “essen tial” open-ended and attempting to satisfy a 2018 federal court decision by saying that any such right is automatically substan tive to that employee no matter what it is. Such a rule would dramatically expand the universe of who could be deemed a joint employer of another companies’ workers, potentially subjecting them to sanctions for violations of labor law and or required collective bargaining. NACS has filed comments with the NLRB opposing this new proposal, but as of this writing, the board has not released a final rule including implementation deadlines.

Turning our attention back to the DOL, as we said, Acting Administrator Looman already rescinded a few different Trumpera rules and recently started the process of formally rewriting them. First on her agenda is the independent contractor rule. The rule is used to determine if a worker should be properly classified as an indepen dent contractor or an employee. The Trump Administration had put the onus on two factors, control over the work and opportu nity for profit or loss in making such a de termination. The current DOL has proposed

There is another lesser-known entity that could impact retailers’ ability to operate EV chargers at their gas stations—the National Fire Protec tion Association. The NFPA is in the process of updating its 30A Handbook for 2024 to establish model fire codes, and NACS is working to ensure that the proposed codes do not become a barri er to creating a competitive EV charging market.

The NFPA is a nonprofit organization with the mission to help save lives and reduce losses due to fire, electrical and related hazards by provid ing information, education and expertise, and that includes developing model codes and stan dards for fire mitigation and prevention.

The Technical Committee on Automotive and Marine Service Stations has jurisdiction over codes and standards relating to fuel retailing and gas stations. It is made up of stakeholders from installers, enforcers, manufacturers, researchers and testers, special experts, users and insurers.

The technical committee in 2019 created a task group to develop guidance in siting EV charging at refueling facilities as part of the 2024 hand book revision process. The passage of the federal infrastructure bill, which included billions of dollars of incentives to install and operate EV chargers, raised concerns among some of the group’s members about the need to speed up the process to address EVs. A proposed Tenta tive Interim Amendment fell short of the needed votes for passage earlier this year.

NACS argued against rushing the process. Now, the proposal is going through regular order and will face a technical committee vote in February 2023, preceded by a public comment period. There are additional hurdles before any proposed revision is adopted.

NACS has been actively engaged throughout the process, sharing concerns that these propos als will make it difficult, if not impossible in many cases, for convenience and fuel retailers to put EV chargers on their sites because of unwork able hazard buffer zones, overly broad defini tions of what is considered a hazard and what is an EV charging area.

This month, NACS talks to Kay Segal, president and managing executive, Business Accelerator Team.

a larger “totality-of-the-circumstances” analysis, which doesn’t put greater weight on any individual factors. The loosening of that rule will make it much easier for people currently classified as independent contractors to be reclas sified as regular employees and thus covered by more-stringent labor laws and eligible for some benefits. While the focus of the change is on so-called gig workers, like delivery and rideshare drivers, the impact would likely be felt in wider segments of the economy.

What does NACS political engagement mean to you, and what benefits have you experienced from being po litically engaged?

Involvement in NACS political engagement efforts has pro vided an opportunity to gain firsthand insights about the major issues that affect both our industry as a whole and the retail ers within our industry. This has helped the partners at Business Accelerator Team to ed ucate clients about issues and challeng es facing the industry. Since I’m writing this around elec

Your voice can save your business. Scan the QR code to tell us what’s keeping you up at night and where you’re willing to lend your voice to NACS’ advocacy efforts.

tion time, I am compelled to mention that the NACS government relations team has shared key points of importance to the industry, while providing information on where candidates stand on positions crucial to the industry. Business Accelerator

Team highly recommends getting involved with NACS political engagement efforts for both retailers and suppliers. As an added benefit, the net working at the NACS in-person events is excellent!

What federal legislative or regulatory issues keep you up at night?

Legislative issues related to labor, transportation, fuel, transaction fees, food retailing and foodservice keep me up at night. Business Accelerator Team works with suppliers and retailers in the industry; there fore, it is imperative that we understand the holistic nature of the convenience and retail petroleum business to both empathize with retailers and foster appropriate and mean ingful interactions for and with our clients. Too much regula tion is not good for retailers or consumers.

What c-store product could you not live without?

Aside from being able to satis fy almost any snack craving, a well-brixed fountain drink with chewy ice, especially on a hot Arizona day, cannot be beat!

Looman also has indicated that the DOL will seek to make changes to the overtime rule’s “white-collar exemp tion,” which was just formally changed in 2020. Recall that the Obama Admin istration under former WHD Director Weil attempted to sharply increase the salary threshold that established the minimum salary for exempting employees from overtime pay under the white-collar exemption to over $900 per week from its then-current level of $455 per week. That action was ultimately nullified by a federal judge.

In 2019, the Trump DOL issued its own rule, setting the salary at $684 per week, a level that essentially adjusted the old number for inflation. Now, the Biden DOL has indicated that it intends to once again look at that rule and those thresholds. The department likely will seek to increase the salary thresholds

and also may look to adjust the “duties tests” meant to evaluate an employee’s actual job responsibilities in determining eligibility for exemption.

The Labor Department had indicated that the overtime proposal could be issued as early as October 2022, but as of this writing, no such proposal is out. In April 2022, NACS government relations staff and former NACS Chair Rahim Budhwani participated in a DOL listen ing session to make the case for leaving the current rule in place.

Those are just the big-ticket items that the Biden Administration labor agencies have either started work on or have announced intentions to address. There may be more labor-friendly regulation coming down the pike soon enough. NACS will work to keep you informed of any future developments or proposals.

Jon Taets is NACS director of government relations. He can be reached at jtaets@ convenience.org

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac NACSPAC donors who made contributions October 1-31, 2022, are:

Aloki Advani SuckerPunch

Rafay Ahmad NSR Petro Services LLC

Dan Alsaker Alsaker Corp dba Broadway

Rich Amador Capital One Bank

Miko Angeles Coen Markets Inc.

Ismail Arslangiray DuPont Grocery Inc.

Ashley Baird Mr. Cartender

Michael Bendt Moyle Petroleum Company

John Bertucci RowLogic LLC

Gary Bevers Bevers & Co.

Joshua Birdwell Pilot Travel Centers LLC

Jeff Blalock Oberto Snacks Inc.

Katie Bohny NACS

Crystal Brown cbdMD Inc.

Robert Buhler

Open Pantry Food Marts of Wisconsin Inc.

Scott Burchfield Impact 21

Jim Bursch Winsight LLC

Kathleen Byrd Home Market Foods Inc.

Spencer Cavalier Matrix Capital Markets Group Inc.

Philip Chamblee

Mississippi Petroleum Marketers & Convenience Stores Association

David Charles Sr. Cash Depot Nirav Chaudhari Panhandle Wholesale

Noam Cohen KeyBanc Capital Mar kets

Sarah Collins Nevada Petroleum Marketers & Convenience Store Association

Tim Columbus

Tom Corcoran Winsight LLC Kelsie Cortinas Mr. Cartender

Sheryl Coyne Batson Techniche

Joel Davies WP Davies Oil Com pany

Meggie Davlin Illinois Fuel & Retail Association

Rick Derose TSN-A Bunzl Company

Bill Douglass Douglass Distributing

Julie Farmer

Circle K Grand Canyon Region

Chris Fitterer

The Hub Convenience Stores Inc.

Mike Flebotte Business Accelerator Team Rob Forsyth FKG Oil Company dba Moto Mart

George Fournier EG America LLC Jessi Frend NATSO Inc.

Tony Gaines Stewart’s Enterprise Holdings Inc. Rick Gobel Apter Industries Inc. LeeAnn Goheen NATSO

Erin Graziosi Robinson Oil Corporation

Mark Griffin

Michigan Petroleum Association

Leva Grimm

J.M. Davis Industries Inc.

Mark Hanners InComm Payments

Shalen Haribhai KESSS Investments #10001 dba The Market

Continues on page 22

The guidelines and rules surrounding what constitutes a joint-employer relationship have been volleyed back and forth by successive administrations since 2015.

Continued from page 21

Elizabeth Hoffer

Weigel’s Stores Inc.

David Hutchinson Hutchinson Oil Co. Inc.

Tom Jackowski

John Jackson Jacksons Food Stores Inc.

Larry Jackson GTG Business Resources LLC dba Good to Go Markets

David Jaffer Jaffer Law PC

Amar Jamal Chestnut Market

Mickey Jamal Chestnut Market

Sharif Jamal Chestnut Market

David Jordan Hotspot

Robert Jordan Jordan Oil Co. Inc.

Johnathan Kemp Moyle Petroleum Company

Vanessa Kidd Mr. Cartender

Tom Kirby Love’s Travel Stops

Lance Klatt Minnesota Service Station Association

Rob Knight Independent Buyers’ Company LLC

Jack Kofdarali J&T Management

Jeff Kramer NRC Realty & Capital Advisors LLC

Jeff Larson

The Convenience Group LLC

Steve Larson The Convenience Group LLC

Charles Lawton United National Consumer Suppliers

Kevin LeMoyne Coca-Cola Company

Ron Leone Missouri Petroleum & Convenience Store Association

Michael Lipton Lipton Inc. dba LiptonMart

Gregg MacQueen Coen Markets Inc.

Crystal Maggelet Maverik Inc.

Quratulann Malik NSR Petro Services LLC

Gaurang Maniar Dash In Food Stores Inc.

Nick Marino CORD Financial Services

Brian Marks cbdMD Inc.

Missy Matthews Childers Oil Co. dba Double Kwik

Colin Mayer

Omega ATC

Brian McCarthy Blarney Castle Oil Co.

Michael McDade McDade Products LLC

Brad McGuinness PDI Technologies

Andy McIlvaine Coen Markets Inc.

Lonnie McQuirter 36 Lyn Refuel Station

Collin Meyer The Convenience Group LLC

Johnny Milazzo Lard Oil Company Inc.

Josh Milazzo Lard Oil Company Inc.

Tony Miller Delek US

Gib Moyle Moyle Petroleum Company

Sydney Moyle Moyle Petroleum Company

F. Scott Myers Altria Group Distribution Company Matt Nelson Excel Tire Gauge LLC

Brian Neutze Mr. Cartender

Claire Neutze Mr. Cartender

Daniel Neutze Mr. Cartender

Ethan Neutze Mr. Cartender

James Neutze Mr. Catender Mabel Neutze Mr. Cartender

Said Neutze Mr. Cartender

William Neutze Mr. Cartender

McCrae Olson 36 Lyn Refuel Station Kirk Owens Symphony RetailAI

Darcy Paluch Moyle Petroleum Company

Shreepal Parikh Panhandle Wholesale Akash Patel Cherry Blossom Gas

Alok Patel Shrikrushna LLC dba Quick Mart

Ashok Patel A&M Food Stores Inc.

Bipin Patel Speedy Mart Development Inc. dba Speedy Mart

Dhiren Patel Raceway

Dhruv Patel Sai Aarya Inc.

Harry Patel SAASOA

Kalpesh Patel Express Stop dba Fast Lane Minesh Patel Ram’s of Virginia Inc. dba Rams Petroleum Mukesh Patel ASOA of NC

Priyank Patel Raceway Ralpesh Patel Univer-Sale Novelty

Ramesh Patel Sunrise Market of Soddy-Daisy Saurabh Patel Om Corporation

Saurin Patel Harry’s

Vipul Patel Master America

George Penyak

Tim Peterson Clear Demand Inc.

Channing Phillips Einstein Bros Bagels Elizabeth Pierce Applegreen Ltd.

Sean Piper CAF Inc. Richard Poye RaceTrac Inc.

Jay Price Business Accelerator Team

Charles Reesman

Nittany Oil Company

Giovanna Rhoads

The Convenience Group LLC

Justin Robinson Hutchinson Oil Co. Inc.

Thomas Robinson Robinson Oil Corporation

James Rogers Society of Independent Gasoline Marketers of America

James Sachs Moyle Petroleum Company

Mariah Saldana Mr. Cartender

Bo Sasnett

D&H United Fueling Solu tions

Deann Scheeler

The Hub Convenience Stores Inc.

Kelly Schimmel Fink Impact 21

Kristin Seabrook

Pilot Travel Centers LLC

Justin Sears good2grow

Jerome Sedelmeyer

KickBack LLC dba KickBack Rewards Systems

Kay Segal Business Accelerator Team Maulki Shah Spur Market

Katie Shak Lockton Insurance Brokers LLC

Josh Sharp Illinois Fuel & Retail Association

David Simendinger Wesco dba Champlain Farms

Blake Skebe good2grow

Kevin Smartt TXB Stores

Steve Spinks

The Spinx Company Inc. Gray Taylor Conexxus

Rick Tellez TXB Stores

John Thomas iSEE Store Innovations LLC

Nick Unkovic EG America LLC

Sesh Vasireddy SAASOA

Kurt Weigel

Weigel’s Stores Inc.

Michael Winton Republic Amusements

Doug Yawberry

Weigel’s Stores Inc.

Chuck Young Impact 21

Dathan Zang Harbor Industries

Joseph Zietlow Kwik Trip Inc.

BY SARAH HAMAKERAfter living and working in downtown Omaha, Nebraska, for several years, Nate Flick and David Kerr noticed the lack of grab-and-go convenience in the historic district. “It was a food and grocery desert down here,” Flick said. “While there were plenty of restaurants, bars and apart ment buildings, there wasn’t anything in the way of groceries or quick to-go food options.”

That epiphany led to Flick and Kerr opening the Godega Market in February. “It’s a play on the bodegas of bigger cities,” Flick said. “We’re a convenience store and coffee shop in the heart of downtown Omaha. We like to say we’re here for the customers’ everyday needs from sun up to sun down.”

“Being from the U.K. and now living in the U.S., I really missed corner shops,” Kerr said. “They are such a ubiquitous part of our culture, and now we have a literal corner shop on the main intersec tion of Omaha’s historic district.”

The two owners focused much of their attention on getting the right product mix for their customers. They stock gr ab-and-go food, fresh coffee, craft beer, wine, liquor, ice cream, sweets, sodas, baked goods, household essentials and personal care items.

For now, the c-store’s prepared food is sourced from outside vendors, but recently, it acquired more space a block away with plans to open a commissary to supply to-go products. The break fast menu features sausage and vegan breakfast sandwiches, mush oats and nondairy yogurt. On the lunch menu are wraps (chicken, falafel), salads (chicken, egg), subs and sandwiches. Snacks and sweets include dill pickle bites, peanut butter cups and Milk Bar cookies.

For made-to-order drinks, customers can choose among espressos, macchi atos, cortados and lattes, plus options like shots of syrup, espresso, Bailey’s or Jameson liquors. Teas are also available, as well as chai tea and matcha lattes. Godega serves beer on tap and wine by the glass in addition to a wide selection of cocktails, such as mimosas, spiked warm apple cider, Italian coffee breaks and Irish coffee.

“For a lot of the products we carry, it’s been trial and error,” Flick said. “We get feedback from our customers, and we

ran Instagram polls before we opened our door to help gauge product interest from the area.”

With 1,200 square feet, “we really have to hit every little nook and use the space wisely,” he added. As much as pos sible, the store carries local products, such as baked goods from an Omaha baker and milk from a local farm.

Godega stocks a lot of toiletries, given its nearness to hotels. In addition to its grab-and-go products sourced from local vendors, the store also does a brisk business in snack boxes and trail mixes.

The owners strive to modernize the experience with customers by talking to them in person and through social media about store products and what they want Godega to carry. “We origi nally thought because there’s no grocery store in the downtown area that grocery items would be more of a fast-selling category, but it’s really been coffee and café items,” Flick said. “We have limited room for products, so we’ve become very selective and keep a close eye on what’s moving and what’s not. We con sider ourselves to be very nimble when it comes to stock.”

For example, when Nebraska law changed to allow to-go cocktails, Go dega tried the waters with two options. “It was insanely popular, and now we have seven different to-go cocktail options,” he said.

When a customer recommend ed a build-your-own six-pack of beer, they decided to try it. “It’s our second-fastest-selling item now,” Flick said. They installed an extra fridge with the single beers and seltzers avail able for the pick-six promo.

The Godega staff, whom Kerr and Flick train, greet customers with a smile. “We encourage the team to learn the reg ulars’ names to make a visit to our store seem more personable,” Flick said. A loyalty program tracked through Square improved the frequency of visits, and a

Location is always import ant when it comes to conve nience stores. For Nate Flick and David Kerr, finding the right space for their Gode ga Market took time. “We looked at a lot of spaces as we talked about starting the store,” Flick said. “But we knew we needed the right one for this to really work.”

One day, while walking home through the neighbor hood, Flick spotted a vacant storefront on a corner. “I knew right away this was the space we needed—it had great windows and was right in the heart of the whole neighborhood,” Flick said. “To have this convenience model be sustainable for the neighborhood, we needed people living in close prox imity to the store. For us, there wasn’t a better spot for Godega Market to be.”

focus on garnering positive reviews has helped residents and tourists find Gode ga online ahead of an in-person visit.

While Godega continues to evolve, Flick hopes customers who visit think of the store “as a younger, fresher version of your convenience store, a real neigh borhood bodega.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor, and romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2022 and earlier, go to www.convenience.org/Ideas2Go

Long gone are the days of the nicotine consumer only having the choice between a cigarette, cigar or a can of dip. Today’s nicotine choices are robust, innovative and everchanging, as the modern nicotine consumer now demands convenience and expects tobacco manufacturers to meet them where they’re at.

“The modern nicotine consumer is totally dif ferent than they were three years ago, five years ago, 10 years ago. The evolution has been absolute ly incredible. Warp speed,” said Bill McCloskey, chief operating officer, RMarts, a c-store retailer with 13 locations in the Chicagoland area. “The tobacco user is not satisfied with what’s out there, so they continue to try new and different items.”

To meet the demands of today’s nicotine consumers—and to address continued health con cerns about tobacco products in general—some tobacco companies are shifting their business away from combustible cigarettes. Philip Morris

International, for instance, has a goal to have “smoke-free” products account for more than half of its total revenue by 2025, while Altria has said its vision is to “responsibly lead the transi tion of adult smokers to a smoke-free future.” In NACS State of the Industry category definitions, smoke-free nests under the subcategory other to bacco products (OTP), which includes smokeless, e-cigarettes, cigars and other forms of nicotine.

OTP is lighting up, but cigarettes will burn for years to come.Photography by Nate Smith

That’s one of the biggest questions, consider ing that cigarette smoking rates have been in steady decline—from 20.9% in 2005 to 12.5% in 2020, according to the U.S. Centers for Dis ease Control. All the while, the OTP category is booming.

Not surprisingly, cigarette sales growth in the c-store channel has slowed. Prior to 2020, sales of combustible cigarettes had been on a downward trend, but during the pandemic shutdowns of 2020, sales ticked higher as work-from-home smokers seized the oppor tunity to light up. That year the category saw sales grow 3.6% over 2019, and then continued growth again from 2020 to 2021 (1.2%). This year, however, cigarette sales declined in five of the first six months of 2022 compared with 2021, according to NACS CSX data.

McCloskey is seeing that play out in his stores. “In cigarettes, over the last six months, we’re down about 10 to 12%,” he said.

Inflation also is influencing how consum ers are purchasing cigarettes. According to Jason Zelinski, client director, NielsenIQ, consumers are downsizing in the number of cigarettes they’re purchasing, such as going from a double pack to a single pack or a carton to a pack, and they’re trading down in brands.

“If you look at all of the subcategories of cigarettes, mid-level, premium, they are in negative decline. The only one that’s in posi tive is economy/value,” said Zelinski.

Babir Sultan, president of FavTrip, which has three locations in the Kansas City, Mis souri, area, sees this behavior among his cus tomers. “Carton sales are down, and packs are increasing, but also those cheaper brands that no one would consider are gaining momen tum now for sure,” said Sultan. That includes customer requests for FavTrip to carry 24/7 cigarettes, an economy brand. “We started off with trying out six cartons. Now, we’re ordering 28 cartons a week for just that brand alone. And that’s two months later,” he said.

Also, having an impact on sales: Tobacco companies have raised their product prices at a faster clip recently than in years past. Sultan said he used to see price increases once a year, but now, he’s seeing them almost becoming a

quarterly occurrence. McCloskey said higher prices are affecting what his customers buy. “I’ve never seen the aggressive price posture that the tobacco companies are doing right now—every quarter with a sizable price increase, not just a slight increase, but over a dollar, so that’s definitely impacting the consumer,” said McCloskey.

Still, don’t count cigarettes out just yet. Cigarettes remain the largest in-store cate gory for convenience stores in terms of sales, according to the NACS State of the Indus try Report of 2021 Data. They represented 26.18% of inside sales last year and were the third-highest gross profit contributor behind prepared food and packaged beverages. One factor in cigarettes’ c-store success is that most Americans buy their cigarettes at a convenience store. C-stores have sold 88.3% of all cigarettes in 2022 so far, according to NielsenIQ data.

Drug stores have largely given up their tobacco and nicotine business. CVS Health stopped selling all tobacco and nicotine products in 2014, and while Walgreens sells cigarettes and OTP, the company removed all e-cigarettes from its stores in 2019. Gro cers are also cutting back on their tobacco and nicotine offerings. Earlier this year, Walmart said it would stop selling cigarettes in some of its stores. However, instead of the grocery-store customers migrating to c-stores, they are going to the dollar store to get their nicotine products, according to Zelinski.

Even though cigarette sales are huge for convenience stores, the category is known for less-than-stellar margins. Margins on cigarettes decreased year over year 0.86 point in 2021, from 14.40% to 13.54%. What’s more, gross profit per store, per month decreased 4.8% year over year. “The difficulty with ciga rettes is that it is a unit/volume game. The margins on cigarettes are very low, especially compared to something in the other tobacco/ nicotine space like e-cigarettes, which have sometimes double the margin,” said Jayme Gough, NACS research manager.

According to NACS SOI data, OTP was the fifth-largest inside sales contributor and the fourth-largest inside gross margin contrib utor in the store last year. In-store sales for OTP grew 7.2% from 2020 to 2021, and margins for OTP are much higher than those for cigarettes. They increased 0.26 point year

The tobacco user is not satisfied with what’s out there, so they continue to try new and different items.”

over year, from 29.96% in 2020 to 30.22% in 2021. Gross profit for OTP grew 8.1% year over year.

“Right now, other tobacco as a category is actually beating total c-store in sales, so other tobacco is up 5.6% versus the total store, which is 4.8%,” said Zelinski. “There’s good growth that’s happening there.”

Zelinski said typical OTP users are younger adults and more affluent, and they are more digitally engaged and more likely to order their OTP online where available. There also are new consumers in the OTP category, and while the OTP consumer isn’t coming into the store as often, there are more of them, so there’s higher penetration among the average shopper. And because OTP users typically have more disposable income, they’re willing to pay for these products, despite inflation.

However, nicotine consumers are not making a complete switch from cigarettes to OTP. “They’re poly-users,” McCloskey said.

“They alternate between cigarettes, snuff and nicotine pouches.”

Trenna Harris, director of corporate analytics at Swisher, agrees with McCloskey. “[Modern oral nicotine] has not truly impacted other categories of tobacco products. So it’s your traditional tobacco consumer using it as an alternative in the marketplace,” said Harris.

Zelinski said consumers are transitioning from cigarettes to OTP somewhat, though cigarettes are still the dominant player. OTP was at $17 billion in sales last year versus $52 billion in cigarettes. “If you look at all of

tobacco, 70% of sales are cigarettes versus the 30% in OTP, and that’s total OTP,” said Ze linski. However, there’s plenty of growth to be had in the OTP category, he said. “Cigarettes have been on the decline both in units and in dollars, and OTP is on a rise. And that’s been happening year over year.”

Within the OTP category, smokeless is the top subcategory in terms of percent of sales at 38.7%, indicates the NACS SOI Report of 2021 Data. In the past 52 weeks, the subcategory grew 47%, according to NielsenIQ data.

“The majority of that growth is coming from brands like ZYN. It’s the top brand right now, and it’s growing leaps over bounds,” said Zelinski. ZYN was up 41% in the 52 weeks ended October 1.

According to Swedish Match, the maker of ZYN, a pouch containing white powdered nic otine, U.S. shipments of the product were up 52% in 2021 year over year, from 114.1 million cans to 173.9 million.

“The volume growth was attributable to both increased store velocities and an increase in store count. By the end of 2021, ZYN was available in more than 120,000 stores in the U.S.,” writes Swedish Match on its website.

“Based on the measure of distributor ship ments to retail, ZYN is by far the largest brand in the nicotine pouch category, representing nearly two-thirds of the category volume.”

Scott Haddad, vice president at Capi tal Sales Company, a c-store distribution company, says nicotine pouches have gained significant traction in his business. “I’d say every month, they’re growing,” said Haddad. “People who use them don’t completely stop cigarettes or e-cigarettes, but it is that addi tional source [of nicotine].”

McCloskey says his stores have seen dou ble-digit growth in nicotine-pouch sales over the past 18 months. The retailer has seen sales declines in snuff, and he believes it’s because his customers are moving to less expensive nicotine pouches rather than moist smokeless products. “They want the nicotine. They’re used to pouches, and it’s just a cheaper alter native,” he said.

Harris explains that nicotine pouches are a convenient way for consumers to get their nicotine. Rogue is Swisher’s nicotine pouch brand, and the product saw $82 million in sales and was up 84% in the 52 weeks ended October 1, according to NielsenIQ data.

In convenience, it is definitely the pouches that have taken off and do very well for us and our competitors.”

“In convenience, it is definitely the pouches that have taken off and do very well for us and our competitors,” said Harris, adding that one of the things that differentiates Rogue from ZYN is the number of pouches per can. ZYN offers 15 pouches, where Rogue has 20.

Swisher also has gum and lozenge nicotine products, which are intended to be used as an alternative product within the modern oral nicotine (MON) segment for the consumer. “We focused on pouches for our initial launch into the MON segment and are now transi tioning into offering a full portfolio lineup of different products, including gum and lozeng es, that [consumers] can use as an alternative to traditional tobacco products,” said Harris.

Though a very small percentage of in-store sales, alternative other tobacco products are on the rise and could be the next subcategory to take off. Until this year, NACS SOI data bucketed alternative tobacco products in the OTP subcategory, which has enjoyed strong sales growth in recent years. The new NACS Category Definitions, version 8.0, designate a subcategory within OTP specifically for these products called “Smokeless Tobacco Alternatives.”

Black Buffalo is an alternative tobacco com pany, and instead of using tobacco, its prod ucts are made from an edible leafy green that behaves just like tobacco in texture, aroma, color and flavor, except it does not have nat urally occurring nicotine or other unwanted compounds specific to the tobacco plant.

“It’s for people [who were] looking for an alternative who are now looking for [another] alternative,” explained Matthew Hanson, chief growth officer, Black Buffalo.

Hanson believes the alternative to the alternative that consumers are looking for is going to be something that more closely resembles the familiarity, tradition and ritual of traditional OTP products but without the actual tobacco. “If you think about going from a Copenhagen long cut … to a ZYN pouch, for example, that’s a radically differ ent experience in terms of flavor, in terms of aroma, in terms of ritual, in terms of packing that pinch,” he said.

“We’re seeing so many people do that triangulation, where they wanted an al ternative. The only alternative was there, and they came back to another alternative,” Hanson said.

As the nicotine product market becomes increasingly crowded, and consumers grow more selective in their nicotine choices, how can retailers keep up?

McCloskey advises talking to your cus tomers—and people who aren’t. “I have a 36-year-old son and a 31-year-old daughter, and I constantly talk to their friends. They’re trying anything that comes up, anything new, anything. They move around in category,” said McCloskey, who added that retailers also have to offer multi-pack discounts on their cigarettes.

“The days of working off of 25 cents a pack, 30 cents a pack [are gone]. You have to make more margin when you sell the category. Otherwise, you won’t survive,” he said.

Sultan also says to talk to customers and adds that retailers should not fear raising their prices. As soon as a manufacturer announces a price increase, don’t hesitate, he said. “We don’t want a single day to go by where we’re losing money. We want to make the business work,” he said.

Both Hanson and Zelinski say seeking innovation is the only way to survive in the modern nicotine space.

“People take for granted how fast innova tions have come into play, and how impactful they’ve been at stores,” said Hanson. “When customers are demanding something, and innovative products are showing up, I would always give room for those.”

Sara Counihan is contributing editor of NACS Magazine and NACS Daily. She can be reached at scounihan@ convenience.org.

Right now, other tobacco as a category is actually beating total c-store in sales.”

Trademarks are the properties of their respective owners. Certain of Black Buffalo’s smokeless tobacco alternative products contain pharmaceutical-grade nicotine, which is an addictive chemical, and Black Buffalo’s products are intended for use solely by adults age 21 and over who are existing users of tobacco or nicotine products.

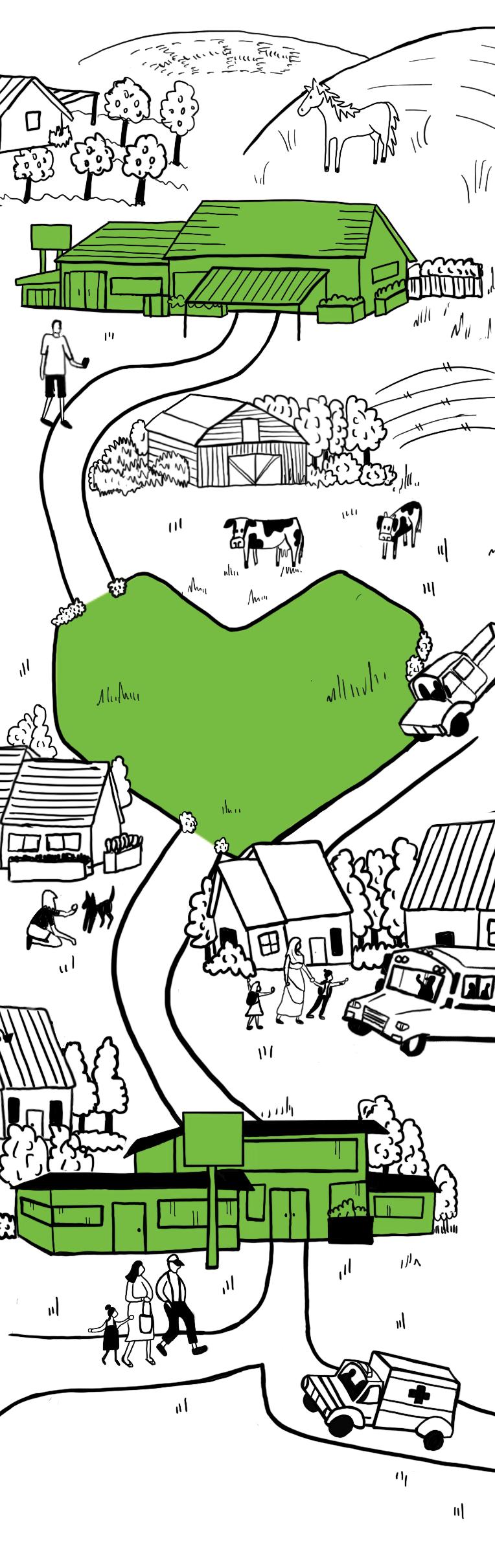

Caring for their neighbors is a core tenet of company culture at the Wills Group and Dash In.

BY SARAH HAMAKER

BY SARAH HAMAKER

Like many convenience store chains, the Wills Group and its family of companies strive to deliver an excellent custom er experience at its 277 retail locations across the mid-Atlantic region, including 54 Dash In convenience stores, 13 of which are corporate stores with the remain der franchise-operated, 51 Splash In ECO Car Washes and SMO Motor Fuels. While the Wills Group continues to focus on improving and growing its business through opening new locations, rebranding legacy stores and launching a new loyalty and rewards program in early 2023, the company also has a heart for community engagement.

Since its founding in 1926, the Wills Group has made giving back to its local communities a top priority. “My great-grandparents donated a park to the town of La Plata, Maryland, where we’re headquartered,” said COO and President Julian B. (Blackie) Wills III. “We’ve always been heavily involved in our communi ties, and we’ve stepped that up in recent years.”

Part of the company’s Community Engage ment work includes several yearly events. These include regular employee volunteer opportunities, an annual charitable match campaign to support employee giving and the annual Blackie Wills Golf Classic in Septem ber, which raised over $342,000 this year for the Blackie Wills Community Leadership Fund. The fund supports the company’s two

signature programs: Nourishing Children and Families and Reimagining Outdoor Spaces.

The company has long supported regional and local food banks under its Nourishing Chil dren and Families program. “So many people struggle with food insecurity, and since a big part of our business is serving food, working with food banks is a great natural tie for us,” Wills said. “It’s one of those core needs we think can’t be underscored enough, and we want to support local food banks within our communities as best we can.”

The Wills Group began its partnerships with food banks by providing food, employ ee volunteer hours and grants to purchase food for their clients. “Now, we’re focused on working with our food bank partners to develop community education initiatives that solve food insecurity, such as community gardens to teach families to grow vegetables,” he said. For example, the company has given grants totaling more than $150,000 to Farm ing 4 Hunger, which hosts more than 5,000 volunteers, groups, individuals and families at Serenity Farm, and provides 26% of the fresh food that goes to the Maryland Food Bank.

“We want to go beyond providing food alone and work with our partners to solve the problem of food insecurity at its roots,” he said. This fall, the Wills Group employ ees volunteered during the fall harvest at Serenity Farm. “We like doing this kind of hands-on volunteering so our staff can see what our partners do up close and personal,”

Our goal is to have two Reimagining Outdoor Spaces projects done per year.”Blackie Wills, president and COO of the Wills Group, is joined by Kaprece James, founder and CEO of Stella’s Girls, at the dedication of the reimagined Phoenix Run Park in La Plata, Maryland, on June 18.

Wills said. “This can stir their support for our local causes.”

A second major focus of its Community En gagement is the Reimagining Outdoor Spaces program. “Near our Dash In stores, we find community gathering places, such as parks, that need updating or refurbishing,” he said. This past summer, the Wills Group, along with community officials and members of the Phoenix Run Park community, dedicated the reimagined park in La Plata. The Wills Group invested more than $130,000 to transform the park, supported by hundreds of volunteer hours across the Phoenix Run Park commu nity and Wills Group employees. Community groups provided input into the park design and enhancements, as well. The revitalization took two years to complete and now includes vibrant, art-inspired basketball courts, walk ing paths, landscaping and seating areas that create a destination for families.

The company has a second location lined up for its Reimagining Outdoor Spaces program—Tanglewood Park in Clinton, Maryland, near a Dash In store that opened in October 2021. “We’re communicating with the neighborhood to find out what they want in a park, with completion targeted for the first quarter of 2023,” Wills said. “Our goal

Community Engagement is core to the Wills Group’s purpose of keep ing Lives in Motion. Employees recently built a pergola at the Edgewater Library in Maryland.

Now, we’re focused on working with our food bank partners to develop community education initiatives that solve food insecurity, such as community gardens to teach families to grow vegetables.”

is to have two Reimagining Outdoor Spaces projects done per year.”

“We hold out these signature programs as our beacons for where we want to spend our time and resources,” said Rayma Alexander, director of corporate communications and DEI at the Wills Group. “We do our community work geographically near our Dash In stores, so we can make a community impact where we work, live and shop,” Alexander said.

“In recent years, we’ve been a lot more intentional to ensure opportunities align with our two signature programs,” Wills added. “While national charities are great causes, we want to strengthen the natural ties to our business through supporting local food banks and community spaces.”

The company also has regular opportunities to both give funds and raise charitable funds to support to its partners. For example, at each Dash In grand opening, “we celebrate with targeted grants to local schools and fire de partments, as well as ongoing support for food banks,” Alexander said. Typically, grand open

ing gifts include $5,000 to a food bank, $1,000 to a school and $500 to a fire department. From August 1 to October 31, the stores participate in Shell’s annual The Giving Pump campaign, designating one pump per station for community giving. “One cent per gallon pumped at that pump is allocated for our food bank partners,” Alexander said. “Over more than two months with 220 pumps, that adds up to several hundred thousand dollars.”

Part of the mission focuses on getting staff involved in company campaigns and volunteer opportunities. The company provides each full-time employee with 16 hours of paid time off for outside volunteer work. “We offer three to four company-sponsored volunteer oppor tunities each year, such as the farm harvest, and also encourage our workers to volunteer at the nonprofit of their choosing,” Wills said.

An annual matching campaign asks em ployees to designate payroll deductions for charities, and the company matches dollar for dollar. “We regularly raise more than $100,000 this way, and the staff elects where the donations go, so it’s a nice way to get em ployees involved in giving,” he said.

To facilitate employee involvement in Community Engagement, the Wills Group has a community leadership team with staff seats on committees within that team. “We really want our employees to have a forum to share their ideas because we think it’s important for them to identify opportunities for us,” he said. Those efforts have worked because 70% of employees on average participate in volunteer ism throughout the year, with 90% employee participation in the Wills Group’s annual employee match campaign..

Its Community Engagement component also has driven employee retention and hiring. “Current employees and potential workers can see how we engage in our communities ... that it’s not just words for us but true company values,” Alexander said. “Everything ties together to support our diversity, equity and inclusion strategies and translates into a better experience for our customers, too.”

While national charities are great causes, we want to strengthen the natural ties to our business through supporting local food banks and community spaces.”

Alexander pointed to the Wills Group’s receiving a Great Place to Work Certification in February 2022 as evidence of its success in making employees feel welcomed and noticed. “This is based on feedback from our staff, and it’s something we’re very proud of and will continue to work on keeping the certification,” Alexander said. “We recognize it is our em ployees who make this a good place to work, and offering them opportunities to better their communities is part of that equation.”

For the Wills Group, being involved in its communities is simple. “To me, our business is not going to be a success or thrive without the support of the community,” Wills said. “We’re never going to be the only option in town. Building a lasting relationship with the community through these efforts will eventu ally pay us back,” Wills said.

“Community engagement is also critical for employees because people want to work for companies who care for their communities,” Alexander said. “It’s both the right thing to do and makes employee life at work more enrich ing. When we interview potential employees, one of the top things that come up in conver

sation is where can they volunteer? It’s great that we have a story to tell and invite people to join us on this journey.”

While the Wills Group will continue to support its food bank partners and seek new outdoor spaces to reimagine, Wills is already considering the next iteration of Community Engagement. “We have two good programs, and we’re looking at education and how we can incorporate that into those initiatives as well,” he said. “We’re also considering our ge ography here in the mid-Atlantic region near the Chesapeake Bay, so we might be branch ing out into some environmental initiatives in the future. What we do know is that our Community Engagement isn’t static—as our organization grows, we want to do more for our communities.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor, and romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

The new Phoenix Run Park basket ball courts served as the centerpiece of the two-year revitalization project. Designed by La Plata artist and founder of Three Ring Studio Donald Ely, the mural was brought to life by Wills Group employees and community partners.

Current employees and potential workers can see how we engage in our communities ... that it’s not just words for us but true company values.”Jimmy Frangis Chief Executive Officer PDI Technologies

From inflation to supply chain disruption, here’s how to prepare for 2023’s challenges.

s the convenience industry continues to transform at a rapid pace, recessionary fears and rising inflation rates threaten to delay investment and business growth. However, convenience retailers would be wise to embrace technology innovation as a way to improve efficiency and position themselves to act upon new business opportunities in this macroeconomic climate.

Achieving that vision will require new levels of collaboration and connectivity across the industry, with digital transformation at the forefront. Led by CEO Jimmy Frangis and COO Linnea Geiss, PDI Technologies is focused on simplifying the industry’s technology ecosystem and delivering the right solutions to help retailers future-proof their businesses for whatever comes next.

Jimmy Frangis: First, it’s always good to remember that c-stores provide a solid value proposition that appeals to a lot of consumers. Even in times when fuel consumption might be down, operators can focus on growing their in-store business in terms of profit generation.

There’s opportunity during an inflationary environment to provide good value and convenience. You can’t stand still as a business, but you need to make smart investments that can benefit you for a long time. And, once you decide to invest, you really need to shorten your time to value. Even during recent economic downturns, the convenience industry has performed well because it’s resilient, and consumers view it as baked into their daily lives.

Linnea Geiss: It’s extremely important to get to know your customers better, which often means building off your loyalty or CRM data to deliver greater personalization. Can you gain insight into their behavior before they even enter your store? Can you identify a pattern of what motivates their purchases? The more data and insights you can extract from areas such as advertising and CPG offers, the better you can predict and influence their behavior—and ultimately deliver a more per sonalized experience.

Differentiating your brand is also essential—from your pricing strategy and foodservice offerings to your mascot. The best brands express a unique personality that distinguishes them as industry leaders. They also focus on future-proofing their business. That might mean building sustainability into your loyalty program, being an early provider of EV charging stations, or simply using your entire digital toolbox to really stand out.

Linnea Geiss: Yes, cyberattacks are still on the rise, and they pose an existential threat if you don’t have a strong security posture. On one side, you need to protect your physical assets and infrastructure. You also need to secure the digital realm beyond the walls of your business by proactively monitoring for bad actors and potential threats across your supply chain.

Unfortunately, it’s increasingly difficult to find skilled cybersecurity professionals. When you add regulatory and

compliance mandates into the mix, security management becomes extremely complicated. You can’t be an expert in ev erything, and cybersecurity is one area where you can’t afford any missteps. Complementing your own IT team by working with a reputable security services provider is often the fastest way to increase your security posture.

Jimmy Frangis: We’re still seeing a lot of consolidation in the marketplace. As operators get bigger, they’re moving into new lines of business, and that added complexity results in a more complicated supply chain. But that consolidation also opens a big opportunity to drive efficiency and consistency across multiple supply chains. We’re seeing greater use of AI and machine learning technologies to increase efficiency and productivity across the supply chain.

Investing in efficiency is critical, especially with the current workforce shortages. It’s getting harder to hire and retain skilled employees, so technology can be a game changer. Any time you can leverage technology that lets one person do what five people did, that’s a huge benefit—especially as it allows your team to focus on what really matters. You can also invest in managed services to complement your own staff to support specific areas of your business.

Jimmy Frangis: There’s still a lot of complexity in our in dustry, in terms of brand relationships, partnerships and IT systems. The key to success is turning potential confusion into an opportunity. During the pandemic, we saw how tech nology helped our industry adapt to rapid change and gave convenience retailers an opportunity to outmaneuver other competitors. Using flexible technology is critical for creating a more collaborative industry that benefits everyone.

If you think about the economic challenges for 2023, you can’t expect to do everything on your own, and neither can we. You must be open to collaborating with others in the convenience industry. At PDI, we have a vision of connecting convenience across the entire industry ecosystem. We’re investing in new levels of collaboration and partnership with a wide range of companies that offer solutions for our customers to solve industry-wide challenges, and I can’t think of a group that’s more prepared or resilient than the people in our industry.

To learn more about the latest industry trends and technolo gies, visit www.pditechnologies.com/trends

BY PAT PAPE

BY PAT PAPE

What you should know about the next mega-cohort of consumers.

Five-year-old Lyndon Arrington likes to call his older cousins and chat or Facetime.

“He can scroll on my iPhone, and when he sees their photos, he’ll call them,” said his mother. “He’s been doing that for a year.”

The son of Andy and Devony Arrington of McKinney, Texas, Lyndon got his own Kindle device when he was three-and-ahalf. With a Kindle, his mom can download age-appropriate programming, such as PBS Kids, that he can watch whenever he choos es. But he has no access to the internet.

According to research by GWI, an audience research company that annually surveys kids, about 96% of U.S. children ages 8-15—or 31 million youngsters—cur rently have phones. As for giving Lyndon his own phone, “I’m going to resist that as long as I can,” Arrington said. “And I’d rather it not be a smart phone.”

Lyndon zooms around the room while his mom is being interviewed for this ar ticle. During a pause in the conversation, he asks, “Mom, when do I get my own keyboard?”

Lyndon is a member of Generation Alpha, the individuals born from the mid-2010s through the mid-2020s and the first generation to be born entirely in the 21 st century. While establishing the beginning and ending of the various generations is not an exact science, researchers value the distinctions, which help them under stand how different age groups see the world and react to it.

Generation Alpha is the group to watch, according to Mark McCrindle, the Austra

lian social researcher who coined the term that describes them. Around the world, about 2.7 million babies are born into this generation every week. By 2025, they will be two billion members strong and the larg est generation in history, and already they have economic power. Last year, Bloomberg reported that these young shoppers have $360 million in disposable income annually.

“We already see them having a lot of influence on purchasing even beyond their own spend and pocket money,” said McCrindle. “They are influencing paren tal purchasing decisions—‘kidfluence’ as it’s being called. They understand the pop culture. They’re on the websites, and they know what the latest trends are. They’re growing up in society where in many ways young people have more power than they used to.”

Generation Alpha is clearly the most technologically supplied generation in history. They’ve been “wired” from birth, which gives them influence and leverage. In addition, “they’ll be the most formal ly educated generation in history, and normally what follows education levels is earning levels,” he added. “We think that will make them the most materially supplied generation. They are quite unique in so many ways.”

Diversity is a standard for this group. During their young lives, women have always been in the workplace, inclusion is valued and a focus on equality is the norm.

By 2030, these newbies will make up 11% of the global workforce, McCrindle said, and will likely delay standard life markers, such as marriage, childbirth and retire ment, as the previous generations have done. They’ll have smaller families, and they’ll live longer—most of them into the 22nd century.

They are influencing parental purchasing decisions—‘kidfluence’ as it’s being called.”

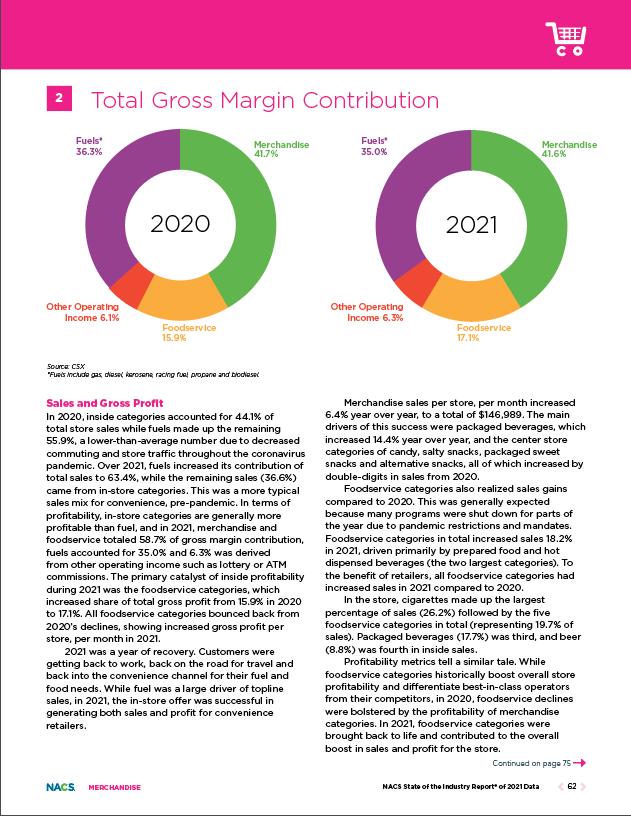

In addition, they’re visual. They prefer to share and receive content in a visual form, such as YouTube, rather than in written form. A recent Pew Research Center survey of American teens (13-17) found that their usage of text-heavy Facebook has declined in the past decade. Today, only 32% of teens report having used Facebook, compared to 2014-15 when 71% said they had used the channel. Twitter has seen a similar decline with only 23% of teens using the app today compared to 33% in 2014-15.