The Model 579 is the most advanced Peterbilt ever, combining aerodynamic styling with the integrated PACCAR Powertrain for maximum fuel economy and outstanding performance. Innovative technologies like the 15-inch digital dash and advanced driver assistance systems improve driver productivity and safety, while the spacious cab interior and UltraLoft sleeper surround the driver in unparalleled comfort for a best-in-class working and living environment.

Available in EPA and CARB-compliant configurations, the enhanced 2024 MX-13 delivers new levels of efficiency and uptime. The MX engine is also supported by a wealth of connected truck data enabling a prognostic approach to field support by proactively scheduling a repair to improve customer uptime.

Limited safe truck parking has been an ongoing problem. Growing hours-of-service requirements coupled with infrastructure issues are pushing drivers to the shoulders.

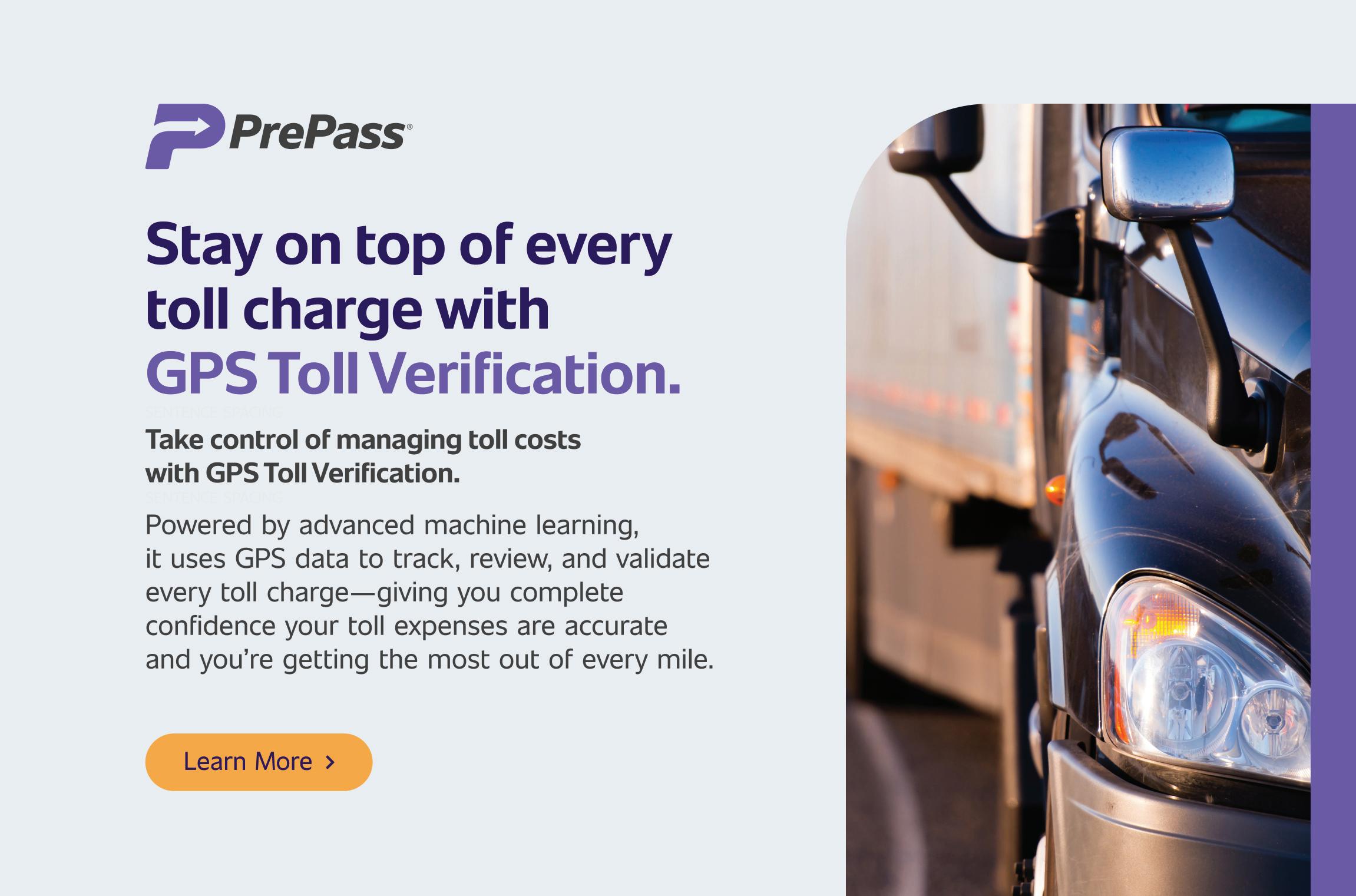

Any asset that isn’t tracked is a liability for fleets. Asset trackers now do more than just locate assets—they help improve the bottom line and boost e ciency.

Aerodynamic add-ons for fleets

Ford’s F-250 o -road ready work truck

The way that carriers, brokers, and shippers interact is becoming more automated. Freight tracking and bot-driven rate negotiations are more prevalent today.

Fleetworthy, PCS Software, Aurora, Gatik, Teletrac Navman

When you're hauling hazardous materials or liquid cargo, there’s no room for error. Safety is everything. That’s why top tank-truck fleets rely on Halo Connect i3® from Aperia Technologies. Halo helps prevent tire-related road calls and blowouts by automatically maintaining optimal pressure in every tire, mile after mile.

Proper inflation delivers better control, sharper handling, and a more sta ble ride—even when cargo shifts. It also protects your suspension, extends tire life, and lets drivers focus on the road, not on tire pressure.

Smarter pressure. Safer hauls. Peace of mind for every mile—and every driver.

This summer, EndeavorB2B launched The Fleet Lead podcast, featuring journalists from Endeavor Business Media’s commercial vehicle brands, including FleetOwner, Fleet Maintenance, Bulk Transporter, Refrigerated Transporter, and Trailer Body-Builders. It aims to help fleet managers, trucking professionals, and transportation industry leaders navigate the rapidly changing industry, covering topics like new technologies, e ciency, and regulatory shifts. The podcast features expert analysis and real-world insights from trusted trucking industry editors and industry guests. New episodes will o er information essential for managing fleets, maximizing uptime and e ciency, and understanding the future of trailer design and autonomous trucks. Search for “The Fleet Lead” on your favorite podcast app or find links to episodes at FleetOwner.com/podcast.

Future fleet tech: From cutting-edge inspection protocols to the rise of autonomous vehicles, the industry is experiencing a seismic shift in how safety, compliance, and e ciency are managed. This free webinar dives deep into the innovations shaping the future of fleet operations and enforcement. FleetOwner.com/FutureFleets

What’s the tari temp? Trump tari s on aluminum and other imports are impacting vehicle manufacturing, freight movement, and the economy. Check out updates and analysis of how to plan amid uncertainty and more at FleetOwner.com/tari s.

Delivered to your inbox, FleetOwner newsletters provide regular industry news, event updates, and breaking news alerts. Manage your email subscriptions at FleetOwner.com/subscribe.

Connect with Us

Market Leader

Commercial Vehicle Group

Dyanna Hurley dhurley@endeavorb2b.com

Editorial Director

Kevin Jones kevin@fleetowner.com @KevinJonesTBB

Editor in Chief

Josh Fisher josh@fleetowner.com @TrucksAtWork

Senior Editor

Jade Brasher jade@fleetowner.com

Editor

Jeremy Wolfe jeremy@fleetowner.com

Digital Editor

Jenna Hume jenna@fleetowner.com

Art Director

Eric Van Egeren

VP Corporate and Customer Marketing

Angie Gates angie@fleetowner.com

Customer Marketing Manager

Leslie Brown leslie@fleetowner.com

Production Manager

Patricia Brown patti@fleetowner.com

Ad Services Manager

Karen Runion

Contributors

Geert De Lombaerde

David Heller

Gary Petty, Private Fleets Editor Kevin Rohlwing

Seth Skydel

Endeavor Business Media, LLC

CEO Chris Ferrell

COO Patrick Rains

CRO Paul Andrews

CDO Jacquie Niemiec

CALO Tracy Kane

CMO Amanda Landsaw

EVP Transportation Group

linkedin.com/fleetowner facebook.com/fleetowner x.com/fleetowner

Chris Messer

Access comprehensive reports, engaging industry topics, and exclusive multimedia content...and best of all...it’s FREE. Register at FleetOwner.com/members.

Published by

As the clouds of uncertainty gather on the horizon, rise above them with the power, eff iciency and unflinching reliability of the most trusted engine in the industry.

Lane Shift Ahead ]

While the industry is flat and full of uncertainty, this just might be our new normal [

By Josh Fisher Editor in Chief

While a return to that postpandemic boom appears unlikely, fleets need to focus on this new normal’s reality.

COLUMBUS, INDIANA—The future of trucking looks like a forecasting nightmare. Just when it seems like the prolonged freight recession is hitting bottom, it stalls out. Every time the U.S. economy looks like it’s headed for a crash, it holds steady or even grows. Everyone is staring at the same data, but the conclusions are all over the map.

“That’s the world that we live in: You can take the same set of facts and have three different people analyze them and come up with four different opinions or conclusions,” Steve Tam, an ACT Research VP and analyst, said after three industry economists laid out their outlook for the sluggish freight market during ACT’s Market Vitals seminar here.

Longtime industry economist Jim Meil, an ACT Research principal, summed up ACT’s 73rd seminar that wrapped August 21 as the “F.U.N. conference.”

“F is for flat, perhaps the second-most used word the last two days—or for fear, in some senses, for what could happen,” Meil said on stage as he and his colleagues shared their closing thoughts.

“U is for the most used word, which is uncertainty—and unprofitability,” he said. “We’re going to need a change in uncertainty and unprofitability to turn things around.”

N, he said, stands for new normal. He pondered a question he was asked: Why has the trucking industry been calling the past three and a half years a freight recession? “Maybe the oddball was actually what happened in late 2021 and early 2022—that was the outlier,” he said. “Maybe this is the new normal.”

The pandemic-driven freight surge raged into a freight fireball after 2020’s supply chain problems, creating generational freight market opportunities. This led to the formation of many new carriers, which today are among those struggling to keep up with expanded capacity, and sluggish spot rates amid what is probably the most technologically transparent freight market in history. In

comparison to past freight dips that bounced back within quarters, not years, this downturn has been prolonged.

Think of how much easier drivers can find a load anywhere in the country compared to just 10 or 20 years ago. When one lane or region gets hot, every carrier can see it in real time. So as more drivers and small fleets chase those hot zones, they cool quickly.

But all of this is happening as the U.S. economy recalibrates to Trump’s economic policy of tariffs and deregulation, upending many long-term business plans.

“I think the good news is we’re not forecasting a recession,” ACT analyst Carter Vieth said. “We still have economic growth. The bad news is that tariffs sort of put a speed limit on it—or a governor, if you will.”

ACT is forecasting below-replacement level Class 8 builds in 2026. “I think, to some extent, that correction was inevitable, but it got delayed by the growth of private fleets and pent-up demand coming into 2023 as we were coming out of the supply chain issues during the pandemic,” Vieth explained.

While a return to that post-pandemic boom appears unlikely, fleets need to focus on this new normal’s reality. Said Tam: “We’ve got all this data coming at us. We’ve got all these conditions. We simply have to be prepared for whatever the outcome is, whatever is going to hit us. We don’t know what it’s going to be. We don’t know when it’s going to be. We don’t know how quickly it’s going to change, but we have to react. And we will. And we do.”

ACT President Ken Vieth noted it’s hard to see through all the noise from tariffs, and struggling manufacturing and housing markets. “But at some point, low prices are going to take capacity out of the market,” he said. “We are going to get that freight inflection … Everybody’s going to go from standing around to being asked to run very fast in a very short order.” FO

by Jeremy Wolfe

The Environmental Protection Agency is eliminating its authority to regulate greenhouse gases by proposing to rescind its 2009 Endangerment Finding, EPA Administrator Lee Zeldin said. Revoking the finding will not be easy. EPA will still face a grueling rulemaking process and many challenges in court.

If EPA successfully revokes the Endangerment Finding, it will dethrone all greenhouse gas standards for vehicles and engines, completely altering the market for fleet vehicles and components.

“With this proposal, the Trump EPA is proposing to end 16 years of uncertainty for automakers and American consumers,” Zeldin said. “If finalized, rescinding the Endangerment Finding and resulting regulations would end $1 trillion or more in hidden taxes on American businesses and families.”

EPA said it will soon publish the proposal in the Federal Register, initiating the public comment period.

The 2009 Endangerment Finding is a landmark document that recognized public health dangers from the effects of global greenhouse gas pollution. The finding laid the groundwork for GHG standards for trucks. The agency deemed six gases a threat to public health: carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, and sulfur hexafluoride. Notably, EPA issued the finding after the Supreme Court ruled in 2007 that EPA can—and must—regulate greenhouse gases from engines under the Clean Air Act.

The finding is essential for all carbon dioxide regulations, including those affecting truck manufacturers and the California Air Resources Board’s waivers. The finding is not essential for other industry emissions standards, such as

NOx or fuel efficiency requirements. However, EPA is also working to revoke other recent emissions standards, including the latest NOx reduction rule.

Zeldin announced his plans to revise the finding in March, when he called the document “the ‘holy grail’ of the climate change religion” and said EPA would reevaluate all dependent regulations.

The American Trucking Associations quickly issued a statement supporting the revocation, focusing on how the change could remove the latest GHG standards for heavy-duty vehicles.

“We thank the Trump Administration for returning us to a path of common sense so that we can keep delivering for the American people as we continue to reduce our environmental impact,” Chris Spear, ATA president and CEO, said.

But CARB, with many of its heavyduty emissions regulations dependent on the Endangerment Finding, denounced the step: “Let’s be clear, this move doesn’t help the trucking industry. It hurts it, it penalizes fleets that have already committed to electric trucks, and it throws a wrench into long-term planning for businesses across the industry,” Craig Segall of CARB, said. “It creates market instability just when we need certainty.”

EPA will issue its proposal in the Federal Register and undergo a lengthy rulemaking process to revoke the standards. Environmental and political groups will challenge the proposal through courts, leaving the ultimate fate of the Endangerment Finding unclear for now.

Revoking the finding is no small feat. Regulatory procedures require EPA to follow a notice-and-comment procedure, which can be a long process. EPA will also need to describe how the revocation would affect all related regs and markets.

“The agency must consider and address adequately all significant comments to avoid the taint of arbitrariness. That is no small feat,” one legal expert said. “A rule that alters a major agency policy, such as the Endangerment Finding, is likely to engender thousands of comments.”

Reviewing courts may require EPA to provide new evidence that greenhouse gases pose no threat to public health.

Emissions regulations are a massive component of vehicle markets and pricing. If the revocation survives this gauntlet, the repercussions could be noticeable across all commercial vehicle fleets in the nation. This year’s tariff and GHG3 uncertainties are already disrupting U.S. commercial vehicle markets. FO

For once, we’re excited to bring you less

When we set out to rethink what a truck could be, we streamlined the design to minimize wind resistance, for up to a staggering 10% increase in fuel efficiency compared to our legacy model. The all-new Volvo VNL. Designed to change everything.

A shift to AV fleets will require managing computers rather than drivers by

Kevin Jones

PORTLAND, Maine—Self-driving trucks aren’t a business, they’re a tool, albeit a tool that will be “transformative” for the movement of freight. For fleets and the supply chain, the key will be understanding autonomous vehicles—the opportunities and challenges— and shaping operations strategically, as a panel of entrepreneurs explained here at the recent WEX Venture Capital Summit: The Future of Fleet Investment.

The rise of AVs is no longer a futuristic concept but a present reality, reshaping the landscape of fleet management. From Waymo’s increased rides in San Francisco to police departments in Texas practicing how to stop an errant autonomous tractor-trailer, the integration of autonomy into daily operations is underway.

“Autonomous driving trucks is not autonomous trucking. Autonomous driving is a behavior. If I’m a driver, it’s a job, it’s an occupation, it’s not a business,” Paul Lam, CFO for Houston-based Bot Auto, said. “Autonomous trucking is being driverless, seamless, paperless, and, hopefully, relentless. So you’re only doing a quarter of it.”

Bot Auto is a Level 4 autonomous trucking company focused on developing and operating its transportation-as-a-service autonomous truck fleet. As Lam noted, operating an autonomous trucking business requires solving “10,000 different small problems” operationally to make the business model work.

“It’s not just about the 1-to-1 [replacement of the driver] of the technology,” Lam said. “It’s 1-to-1 of the product. Coming back to fleet management, it’s figuring out the right business—to make a profit and to serve your customers.” That technology piece, he said, is “really, really difficult,” but it’s been in development for a while and is finally viable.

“You want to control and guarantee the outcome. And as we run our fleet,

AVs have become a reality, reshaping fleet management in a big

we have to think about several things, apart from the driverless technologies,” he continued. “Think about what a driver actually does when not driving: checking the tires, doing the paperwork, having coffee. How do we mimic that customer service, as we do not have a truck driver?”

Adoption drivers

Autonomy’s most significant adoption has gained a foothold in three key areas: ride-sharing, last-mile delivery, and hubto-hub (middle mile) trucking, noted Gagan Dhillon, CEO and co-founder of Synop, a software platform focused on supporting commercial EV fleets.

Early successes focused on controlled settings like ports. Ride-sharing, for instance, builds upon existing concepts of automated people movers found in airports, now applied to a wider segment.

“You have a pretty good idea of what those vehicles are going to do on their duty cycle every single day,” Dhillon said, adding that data gathered now is being used to build out future AV infrastructure.

Likewise, with more than 2 million vehicles and 5,500 U.S. locations, Enterprise sees opportunities as the AV fleets evolve. “We’re not an OEM. We’re not a tech company. We’re not going to develop our own AV stack,” Mariano Menkes, Enterprise director of corporate

development, said. “But when we think about the operations, we think that’s a very important part of the value chain that we can play in.”

Panelists agreed that autonomous fleets present enormous opportunities, despite their challenges:

• Enhanced safety: Autonomous technology promises to drastically reduce accidents, especially those caused by human factors, leading to fewer massive payouts for insurance companies.

• Operational efficiencies: AVs enable improved scheduling, vehicle dispatching, and energy management for electric fleets, which can benefit energy grids.

• Increased utilization: Technologies like AI and in-house calibration systems can increase vehicle uptime, ensuring trucks are on the road as much as possible.

• Economic resilience: At a macro level, autonomous trucking can bolster supply chain resilience, bringing manufacturing back and serving as the “backbone of the economy,” leading to re-industrialization.

• Financial innovation: Particularly in middle-mile trucking, increased liquidity without human drivers will necessitate revisions to contracts, changes in risk and transfer points, and create new opportunities in areas like letters of credit and invoice factoring. FO

Wfi’rfificonfifinufingfifiofiofffirficufifiomfizfidfiprofificfifionfifindfirfifik-fihfirfingfiopfifionfififorfi fifirgfifi&fimfidfiumfiflfififififi,fifindfipfindfinfificonfirficfiorfi,fifindfimorfififi

NACFE

by Jeremy Wolfe

The “chicken and egg” problem for alternative fuel trucking has been repeated, loudly and often, for several years: Which comes first, the vehicles or the infrastructure?

It is an analogy that the North American Council for Freight Efficiency encountered countless times in its work to promote more efficient hauls. As NACFE reflected on this year’s Run on Less Bootcamp Series, it highlighted that the industry is solving the problem that haunted alternative powertrains for over a decade.

“We’re at the point now where there’s enough chickens and enough eggs out there that it’s irrelevant to the discussion,” Rick Mihelic, director of emerging technologies for the North American Council for Freight Efficiency, said during NACFE’s latest webinar.

Since February, the group’s Bootcamp Series shared presentations from 35 expert speakers, provided 13 hours of content, and hosted an average of 800 registrants per session. Themed after the abundant choice of alternative fuels, the boot camp sessions highlighted significant growth in the alt-fuel space.

Custom strap solutions built to meet the specific challenges of your operation. Maximize performance, enhance safety, and improve efficiency where it matters most.

“We’re not talking about paper projects or some 2017 vision by some rich guy. We’re talking about real trucks being produced by all the traditional manufacturers,” Mihelic said. “It’s no longer theoretical; these things are really happening. The investment is being made, and progress is being seen.”

The tech is growing—despite weaker federal support Though the current federal administration has little enthusiasm for supporting alternative powertrains, NACFE is finding that equipment and infrastructure development continues.

“All these technologies needed some help to take baby steps to get off the ground,” Mihelic said. “What you’re finding is that those baby steps are behind them, and all these technologies are learning to walk now.”

The Trump administration is broadly removing financial incentives for alternative fuels and regulatory requirements for emissions reductions, significantly weakening the trucking industry’s demand for emissions reductions.

Add your company name or logo to any strap for a professional finish that stands out.

Choose your colors, lengths, and finish - engineered for durability, efficiency, and style.

“The role of regulations, and a lot of the grants and incentives, is lessening,” Mihelic said. “You’re going to see all these alternatives have to compete on the same scale—and that’s going to make them more successful in the long run because they’re going to have to get cheaper, get lighter, and get better deployed.”

Combine end fittings and tensioning devices to build the perfect strap for your job.

We’ve been holding it down since 1968.

Despite the change in regulations and incentives, trucking still has many reasons to pursue emissions reductions. Fleet executives, their shareholders, or their shippers may be committed to reducing emissions; cutting fuel consumption still reduces one of the biggest for-hire operational costs; and many alternative fuels have the potential to outperform diesel in specific applications.

“Emissions reduction was a big driver for all these different alternatives,” Mihelic said. “But what I found in a lot of the interviews out in the field on Run on Less is that many of these

companies are finding that it’s a competitive advantage; they’re finding cost reductions in using these new technologies. And that’s what the marketplace really wants.”

Natural gas for long haul is maturing Natural gas powertrains have come a long way for Class 8 tractors.

“In 2010, when the 12 liters came out, they were somewhat underpowered in comparison to the diesels that they were going up against, and it kind of stunted the marketplace,” Mihelic said.

The launch of Cummins’ X15N, a 15-liter natural gas engine for heavy-duty tractors, was a watershed moment for longhaul natural gas powertrains. In addition to Paccar and Daimler Truck, other major manufacturers are including the engine in their trucks. J.B. Hunt and WM are among the major fleets embracing natural gas in their operations.

According to the latest State of Sustainable Fleets report, registrations for Class 8 tractors running natural gas surged 50% in 2024 to 2,317 units. In addition, the production of biofuels is booming and is expected to continue to grow at a rapid pace.

“The growth in the industry that’s producing renewable natural gas is huge,” Mihelic said, pointing out that 98% of freight operations still run on diesel. “They’ve got nothing but

opportunity to expand significantly. The RNG marketplace doubling in the next few years from 400 to 800 facilities is still just a toe in the water; there’s a lot of room to grow.”

Hydrogen still has momentum Mihelic voiced optimism for hydrogen as a future powertrain option for fleets.

Hydrogen production and distribution are still very promising. Seven major hydrogen hubs are likely still being developed across the nation, and the 45V hydrogen production tax credit survived the latest Republican tax bill.

In addition, global hydrogen powertrain technology is improving, with the joint venture between Daimler Truck and Volvo producing a power unit that could overcome long-haul range anxiety.

Hydrogen trucking in the U.S, however, is still on very uncertain ground. Major hydrogen truck pioneers Nikola and Hyzon both filed for bankruptcy earlier this year, and future federal support seems bleak.

“Companies are investing in this technology irrespective of all the noise that’s going on in the political world,” Mihelic said. “It may get harder for some of these technologies to succeed. You may see some vehicle manufacturers stumble, as we saw earlier this last year, but others are stepping in to take their place.” FO

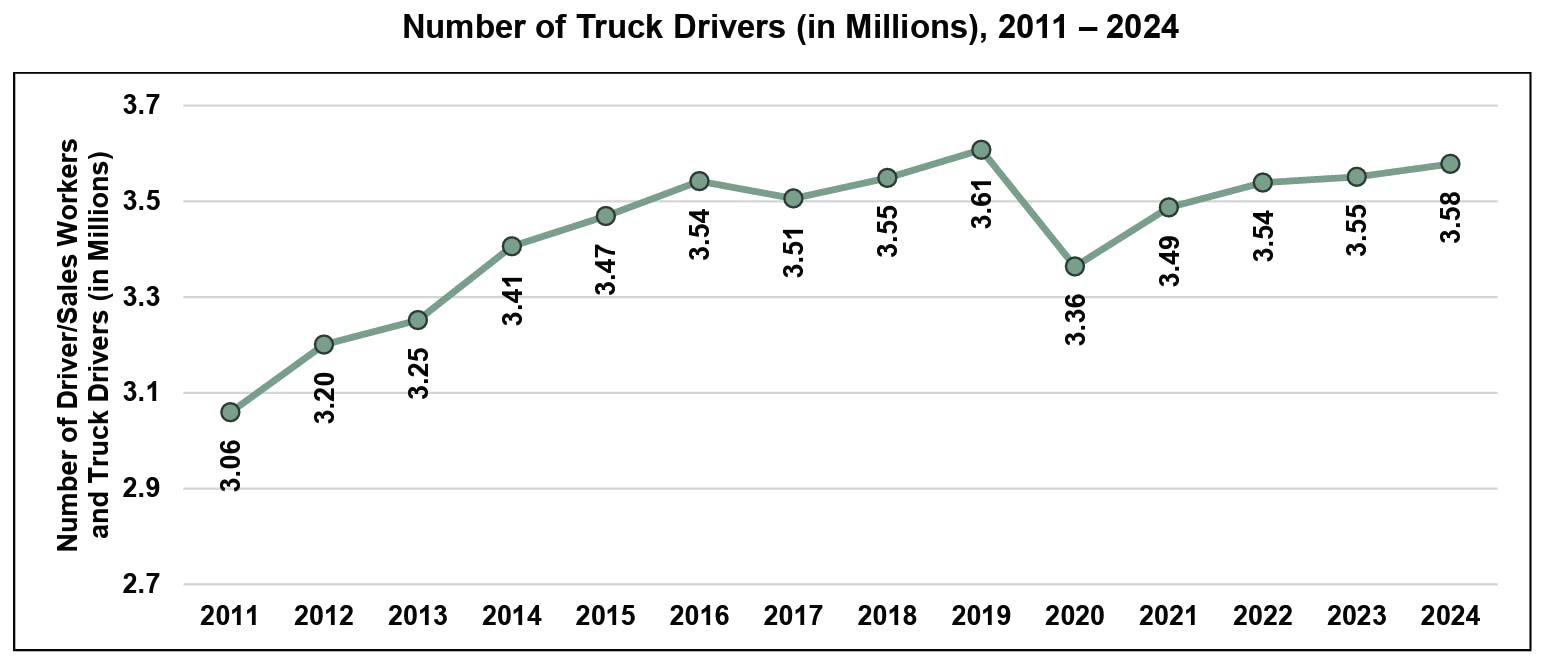

The long-haul CDL population continues to grow despite overcapacity

by Jeremy Wolfe

Excess capacity has helped weaken carriers’ pricing power for years. Despite this hostile environment, the CDL population is growing: the American Transportation Research Institute estimates that there are about 3 million long-haul CDL holders today, up 30% from 2016’s estimate of 2.3 million.

While the driver shortage has remained one of the top fleet concerns for several years, not everyone agrees with the concept of a labor shortage in trucking. In a recent Stifel webinar, analysts with Transportation and Logistics Advisors argued that the market is plagued with too many drivers.

On the other hand, a recent Tech.co survey argued that carriers don’t have enough qualified drivers. So who’s right?

An excessive driver population could be the prime reason for excess capacity, suggested analysts with Transportation and Logistics Advisors.

To illustrate their point, analysts compared driver populations during the Great Recession and recovery (20082012) versus the current economic environment (2019-2024). For-hire tonnage grew, while the number of drivers shrank in the recession period. In the current period, the dynamics reversed: Drivers grew 2.2%, while tonnage shrank 0.7%.

In recent years, not only did the number of drivers increase, but their pay spiked dramatically as well, rising over 20% after adjusting for inflation. The American Trucking Associations found that the average truck driver’s salary in 2023 was $76,420.

The issue is compounded by private fleet growth. For several years, private fleets have been growing their driver base, which impedes what might have been a more natural capacity reduction.

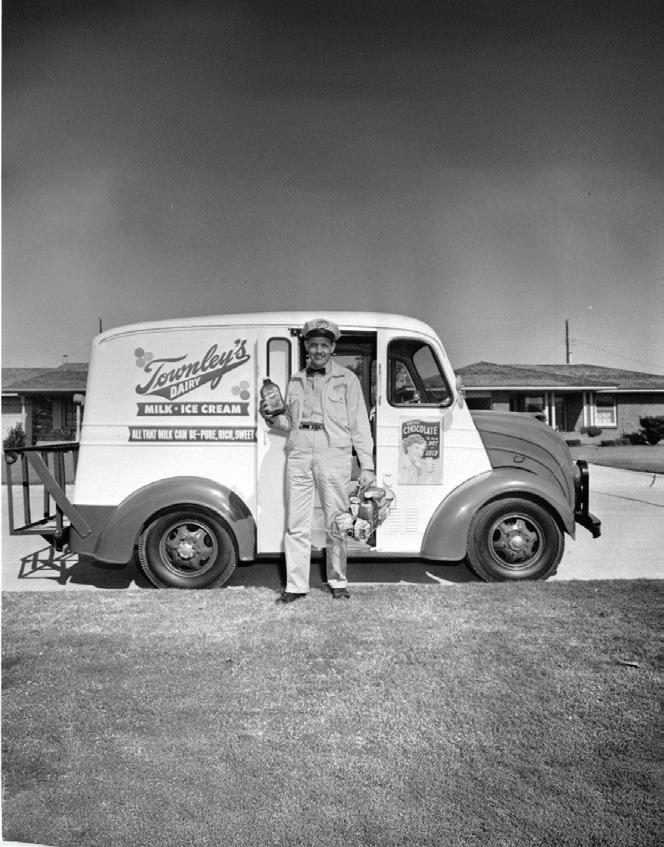

While slightly lower than 2019’s record driver population, the overall population of truck drivers has grown steadily despite a long, difficult market trough. Photo: ATRI

In a white paper on the topic, Transportation and Logistics Advisors predicts that trucking overcapacity will still stabilize through the reduction of overall driver counts.

Trucking’s labor problems are never without disagreements. Tech.co’s “Moving Goods with Fewer Hands” report, based on a survey of 521 logistics professionals, concluded that freight demand was abundant, and the real problem was a driver shortage: 69% of respondents said a driver shortage had an impact on their ability to meet freight demand. Nearly the same number of respondents, 63%, said that their ability to recruit and retain drivers either stagnated or worsened over the past year.

When asked about the biggest challenges in maintaining a steady driver workforce, the greatest number of respondents (45%) cited “lack of qualified applicants.” About 34% cited “competition from other employers,” and only 31% cited “high turnover.”

Regardless, the driver population is changing

Overcapacity or not, the only constant in trucking is change. According

to ATRI’s latest report on truck driver demographics, the driver population is growing older and more racially diverse. The report used historical survey data, government datasets, state driver’s license data, and a recent ATRI survey of 1,242 drivers.

The survey found an average driver age of 58 years old, a sharp increase from about 51 years in ATRI’s 2023 survey and 50 in 2013.

Among the major truck driver classifications, the population of owner-operator or independent contractor drivers has grown in recent years. From 2016 to February 2025, the share of CDL holders working for a one-truck fleet grew from 6.2% to 7.1%.

The truck driver population is also becoming more racially diverse. From 2014 to 2023, the truck driver population went from 77% White to 63%.

The number of Hispanic and Black truck drivers grew the most among the overall driver population and remain greater in trucking than in overall U.S. labor demographics.

Despite the increase in racial diversity, women are not entering the cab. Census data from 2023 found that women made up only 4.1% of truck drivers, consistent with previous driver surveys. FO

The more you look at East, the more one thing becomes clear: These trailers are built to take the load — and keep going.

From our one-piece aluminum I-beam chassis with fewer welds to the Genesis® smooth sidewall design, East Dump Trailers and Dump Truck Bodies are built with strength where it counts. Interlocking floor plates, cross members, and sidewalls create a rigid structure with superior twist resistance when raised.

Robotic vertical welds reduce bowing and corrosion. Solid box-extruded cross members deliver unmatched floor support.

Whether you’re running one tractor-trailer or hundreds, you’re choosing a trailer built to stand up to the demands of the job—day after day, load after load.

by Geert De Lombaerde

One of the trucking sector’s more downbeat voices during the freight recession is sounding a lot more chipper in the wake of the recent passage of the One Big Beautiful Bill Act (OBBBA).

Speaking after TFI International reported improved Q2 results, Chairman, President, and CEO Alain Bédard said his teams are hearing positive chatter from industrial customers among the companies most likely to benefit from expense deduction rules (re)instated by the OBBBA. Business confidence is coming back, thanks to the Trump administration’s budget plan, he added.

“We feel way better—that we’re finally going to get out of this freight recession,” said Bédard, who in recent quarters has been more sober even than most of his peers about the prospects of an upturn. “Hopefully, things will start to roll. We haven’t seen anything concrete yet, but all the signs are there.”

Montreal-based TFI stands to benefit

from industrial freight market growth not just via its less-than-truckload business but also because it last year acquired flatbed carrier Daseke for about $1.1 billion. Through the first six months of this year, TFI took in half of its revenues from customers in the manufacturing, building materials, automotive, and metals/mining sectors.

During a conference, Bédard—who said his team was “maybe one year too early” in buying Daseke—and CFO David Saperstein said the tax elements of the OBBBA should quickly flow through to the “real” economy. Saperstein pointed out that the accelerated capital investment depreciation will save TFI itself $20 million this year and another $20 million in 2026.

“Think about that throughout the economy, and this is really going to go toward companies that are doing capex, right?” Saperstein said. “These are the companies that are our customers.” FO

by Geert De Lombaerde

Auto-hauling venture Proficient Auto Logistics posted a 28% jump in Q2 unit volumes compared to the first three months of the year, thanks both to the acquisition of a Northeast peer and the closure of Jack Cooper Transport.

Jacksonville-based Proficient and its subhaulers delivered a about 631,000 vehicles in Q2, up from nearly 495,000 early this year. Despite the average revenue per unit slipping about 3% from the first quarter, that volume jump helped grow Proficient’s revenue up 21% to more than $115 million. Adjusted for non-cash items related to stock compensation and amortization, operating profits were $3.8 million for the quarter, more than triple Q1’s but about half those of the second quarter of last year. Those numbers and commentary from CEO Rick O’Dell about focusing

on cutting costs and gaining more market share boosted shares of Proficient closer to where it traded in late July, while still down more than 30% over the past six months. Proficient’s market capitalization now stands at nearly $200 million, slightly more than half of the value investors accorded the company in the wake of its initial public offering 15 months ago.

Speaking after reporting those numbers, O’Dell said the former Jack Cooper business Proficient picked up—three months ago, they said they expected that to be worth $60 million annually—has performed according to their expectations. Rice added that the April acquisition of Brothers Auto Transport, which runs terminals in Pennsylvania, New York, Maryland, Ohio, and Virginia, has done better than expected. FO

The PACCAR MX Engine brings out the best in your new Kenworth. No matter the job, this engine is ready to handle it with ease and efficiency. Learn more at Kenworth.com/TheBestEngines

TheGrowing hours-of-service requirements coupled with infrastructure issues are pushing drivers to the shoulders.

by Jenna Hume

Truck parking is one of the top issues for both fleets and drivers, according to the American Transportation Research Institute (ATRI). Limited safe truck parking has been an ongoing problem because of limited infrastructure, hours-of-service (HOS) changes, and more.

There is one parking space for every 11 drivers on the road, noted Doug Marcello, trucking and commercial transportation attorney with the law firm Saxton & Stump. “[When] you couple that with the hours-of-service requirement, that drivers can only drive 11 hours, be on duty 14 hours, it increases not just a demand but a timing for that demand, resulting in a number of them having to park on exit ramp sides of roadways, etc.”

The lack of truck parking is not only problematic but also complicated.

Why truck parking is problematic in the U.S.

Truck drivers deserve to feel safe

Truck drivers don’t typically park in these unsafe places willingly. Usually, it is because they could not find safer parking or have to stop because of HOS. According to Marcello, most of the accident cases he sees in his work occur when a truck driver who parked on the side of the highway is trying to reenter traffic or when another driver loses control and hits them.

Parking under these conditions isn’t just a safety problem; it’s a legal problem. There are some areas right off the highway where truck parking is not permissible, depending on the location. Marcello noted that in some locations where truck drivers may need to park, there are federal requirements put in place by the Federal Motor Carrier Safety Administration (FMCSA), such as setting up emergency triangles or turning on the truck’s flashers.

always have safety measures—like security cameras, fences, gates, security guards, well-lit areas, etc.—in place to keep drivers, their trucks, and their cargo safe.

Truck drivers deserve to have their needs met

Aside from safety, amenities are also important to truck drivers when looking

for parking, especially for long-haul drivers. Amenities truck drivers prioritize when traveling, other than parking, include clean bathrooms with showers, restaurants or stores with healthy food options, laundry services, stable Wi-Fi, and maintenance services. According to a recent report from Truck Parking Club, a provider of paid truck parking, rest

Gray Manufacturing builds products that meet the “Buy American Act,” ensuring your dollars fuel the domestic economy and guaranteeing that parts and product are always available to you.

Even when a driver does manage to find free parking at a truck stop, rest stop, or elsewhere, that still doesn’t mean they’re safe. Free parking options don’t

areas may provide a few basic amenities but nothing extensive.

Truck drivers deserve ample parking, no matter where they are

The availability of truck parking depends on demand and supply, according to Evan Shelley, CEO and co-founder of Truck Parking Club.

“There are areas like Southern California that do have a lot of supply of truck parking on a per-space basis, but the demand is so high that it outnumbers the supply,” Shelley said. “But if you’re considering it from supply versus demand, not total number of spaces available in a specific market, typically you’re going to see more availability across the Midwest.”

According to a recent ATRI study on public truck parking, the South and Midwest have the most truck parking at public rest areas. The West, Southwest, and Northeast had below-average public truck parking.

How the truck parking shortage affects everyone

A common misconception is that the lack of truck parking only affects truck drivers. In reality, the truck parking shortage has ramifications that affect the rest of the industry and the public.

For drivers, especially long-haul drivers, hard-to-find truck parking is a constant source of stress. Instead of focusing on driving safely, drivers must think 10 steps ahead to where they are going to park when their HOS runs out.

“I’ve been here 35 years, and over the last 35 years, the momentum and the pressure on truckers to continue working, with the change to the hours of service, they really don’t have the control over their time like they used to,” said Delia Meier, SVP of the Iowa 80 Group, which owns the world’s largest truck stop. “I feel bad for them that they have that much pressure.”

This stress on drivers to find truck parking, paired with the overall stress of the job and a more sedentary lifestyle, can lead to health issues. A recent FleetOwner article discussed how truck drivers are more at risk for heart disease, diabetes, obesity, and more.

Truck parking isn’t just a safety and convenience issue for drivers; it’s also a profit issue for fleets.

“There are actual studies showing that they [fleets] are losing $4,600 a year, on average per driver, because they have to cut their day short to try to find accessible parking,” Marcello said. “And it’s costing about 9,300 miles per driver per truck out there because of this lost time as well.”

If fleets are losing money because of drivers struggling to find truck parking, then the industry is losing money as well. Especially at a time when fleets are struggling with the heavily debated driver shortage, the truck parking struggle is only making things worse. When drivers are slowed down because of a

lack of truck parking, the supply chain also slows down. This means the public is receiving needed goods more slowly, and the economy is affected.

According to Marcello, truck parking is an issue that has a domino effect. In ATRI’s 20th annual Top Industry Issues report, the economy ranked as the industry’s top concern. Despite struggles regarding freight rates and a freight recession, it’s safe to say the trucking industry isn’t currently thriving; however, fleets remain hopeful that the tides will turn. The last thing the industry needs right now is a truck parking issue causing drivers, the supply chain, and the economy to slow down.

Is there a solution to the truck parking shortage?

Fixing the U.S.’s truck parking shortage is easier said than done. Creating more parking takes time, money, and often government approval. But even while waiting for more parking to be built, there are other avenues fleets and drivers can explore.

Federal and state governments need to take action, not just talk Some proposed federal legislation and regulations promise to expand truck

parking. This includes the Pro-Trucker Package, which would provide more than $275 million to expand truck parking availability and open up additional grant programs and discretionary grants for truck parking projects.

But this package and many others are either still pending approval or have yet to begin construction. Shelley emphasized the importance of advocating for truck parking, and the Truck Parking Club recently did so on Capitol Hill.

Slow government action leads many in the industry to believe the government alone isn’t the answer to the truck parking shortage. For change to occur, some even believe the private sector and government need to team up.

“I think there’s going to have to be some type of governmental, private joint ventures on this,” Marcello said. “It’s great if the government can do it, but we’re limited in terms of the number of provisions out there …” However, he believes that federal and local government incentives could encourage private businesses to open more commercial parking facilities.

Fleets should consider paid truck parking

While waiting for the government to create more free truck parking, fleets can consider whether investing in paid truck parking would be beneficial.

The main benefits of free truck parking are that it’s free and usable for anyone. But paid truck parking has benefits, too, such as guaranteed availability, ease of mind, and sometimes advanced security and amenities.

The Truck Parking Club has nearly 2,500 locations across the U.S. and about 50,000 parking spaces. Fleets or drivers can reserve parking through its app. According to Shelley, the company is adding 8 to 10 new locations every day.

Shelley claims that paid truck parking is something fleets and drivers should consider, especially when drivers are expecting longer wait times while on the road.

“When considering truck parking as a whole, there’s a lot to be discussed, even more than taking a 10-hour break and not having available parking,” Shelley said. “There’s also [the issue] that rest areas and, typically, truck stops do not

While there’s no debate that the U.S. is lacking in truck parking, a problem that is often overlooked is how Hours of Service rules negatively affect drivers. Since HOS rule changes earlier this decade, Delia Meier, SVP of the Iowa 80 Group, has noticed a major change in truck driver behavior.

Before the changes, Meier saw drivers take a break at the Iowa 80 Truckstop during prime rush hour times, since many drivers stopped at the truck stop on their way to Chicago. This allowed them to take a break for a meal and avoid rush hour traffic.

Meier, however, claims that truck drivers no longer have this luxury; they don’t get to stop for dinner and instead sit in two- or three-hour-long traffic en route to Chicago. Furthermore, HOS not only forces drivers to waste time in traffic rather than allowing them to make the best decisions

allow for anyone to park there for more than 10 hours. You might be able to get away with 24 hours at those locations. So, what availability is there for multiple-day parking options?”

A drawback of paid truck parking is the cost, but the benefit is providing drivers with more peace of mind.

Drivers should still leverage free parking when able

For many fleets and drivers, free truck parking is ideal. That’s why planning ahead is crucial, according to Meier.

“Truck parking needs to be more important on trip planning, and if they [fleets] put it as a priority, things will change for drivers,” Meier said.”

Trip planning involves routing realistically and determining when and where drivers will need to stop on their route. When selecting options where drivers should park, it may be beneficial to choose a location with the largest number of parking spaces in the area.

“A lot of truck stops no longer offer very much parking,” Meier said. “And that has changed over the last

possible on the road, it also prevents them from eating a healthy meal, which exacerbates health concerns related to truck drivers.

“I think that the government should look at the hours of service because they have pushed most drivers to daytime hours,” Meier said. FO

20 years, where part of a truck stop was to have 100 spots, but now it’s not necessary. Drivers will go to places that have 10 spots or 20 spots, and so a lot of those old truck stops that had 100 spots have closed and been replaced with smaller places that only have 20 or 50 spots.”

The Iowa 80 Truckstop is the world’s largest, with 900 truck parking spaces, nine restaurants, a truck wash, a store, 25 private showers, a museum, and many other services.

While not every driver can always park at a truck stop with 900 spaces, every driver does have technology available to them to determine the best place for them to park. In addition to private company apps like Truck Parking Club and Pilot Flying J, fleets can use apps like Trucker Path, AllStays Truck & Travel, and iExit Trucks to find free and paid truck parking with the different amenities important to drivers. FO

by David Heller

JUST WHEN YOU thought it was safe to go back in the water...

This summer, “Jaws”—and this tagline—celebrated its golden anniversary. In our industry, however, you might be uttering: “Just when you thought you understood Hours of Service” as it pertains to a driver’s daily schedule and the nuances that seem to always exist for our industry’s much maligned regulations.

Let’s make life easier for those who put food on the table, provide medicine to those who need it, and allow our first responders to respond first—just by doing their job.

This column might seem to be about personal conveyance, electronic logging devices, or emergency exemptions issued for our nation’s trucks when needed. However, I want to deal with the recent Pro-Trucker package the Trump Administration issued to improve the lives of America’s truck drivers.

The order itself suggests that Transportation Secretary Sean Duffy and

President Trump are loyal readers of my monthly columns, given my repeated calls for increased flexibility in the HOS regulations. Just when I thought my request had fallen on deaf ears, the administration said it would study the impact of Hours of Service. Through the launch of two pilot programs, the Federal Motor Carrier Safety Administration will be exploring the increased flexibility in HOS regulations by reviewing the sleeper berth portion and the possibility of incorporating a pause of up to three hours in the 14-hour clock, a worthwhile effort to improve driver working conditions. I have said for years that if we can extol the virtues of our industry being the most flexible forms of freight delivery in this country, then we must insist that truck driver be afforded ultimate flexibility. We aren’t talking about extending the day either. After all, there is no feasible way we can crank out a 25th hour in a 24-hour day. In fact, in most cases, we average approximately 6.5 to 7 hours of drive time per cycle—not anywhere close to what the current regulations allow for. Knowing that, we don’t need more time, but we do need the luxury of flexibility.

In the professional driver’s world, no two days are ever the same. On a daily basis, traffic, weather, and detention present challenges. In other words, a driver must adapt to the conditions that arise, aware that a ticking clock is the battle they fight to remain compliant. As an industry, we cannot advocate noncompliance. We can, however, argue that our drivers need the wherewithal to adjust their day, and that is what these two pilot programs will seek to do.

Studying the ramifications of a 6/4 or 5/5 split to the sleeper berth portion of the 10 hours off-duty can be paramount to increasing the productivity that our nation needs. Faced with traveling in

an urban area during the heights of rush hour? Split your sleeper berth into a more reasonable option to avoid it altogether. Our nation’s infrastructure challenges almost require a driver to do that.

Here we are, following an announcement in which the administration has recognized the value of our industry and its driving diversity by acknowledging that a strict rule could still allow for changes to an atypical day. In today’s age of deregulation, this is not a case of removing a rule but rather streamlining one and making it better. It is not as if the results can be misconstrued either.

With the introduction of the ELD, we gain valuable insights and accurate data that support the notion of a change. Inaccurate or fraudulent logs could have always reflected the perfect driving day. In our ELD-based world, that rarely exists. Through this pilot program, congestion, detention, and even opportunities to rest can be examined, giving our industry the chance to be more efficient and productive.

At TCA, one of our fundamental core beliefs is to improve the driving job. Let’s make life easier for those who put food on the table, provide medicine to those who need it, and allow our first responders to respond first—just by doing their job. Applauding the administration for supporting America’s truck drivers, we look forward to participating in these pilot programs that will positively impact professional truck drivers.

Looks like it’s time to dive back into the HOS waters after all. FO

David Heller | Dheller@truckload.org

David Heller, CDS, is senior VP of safety and governmental affairs for the Truckload Carriers Association. He is responsible for interpreting and communicating industry-related legislation to TCA members.

1,800+ ATTENDEES

100+ SPEAKERS

150+ EXHIBITORS

70+ SESSIONS

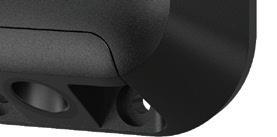

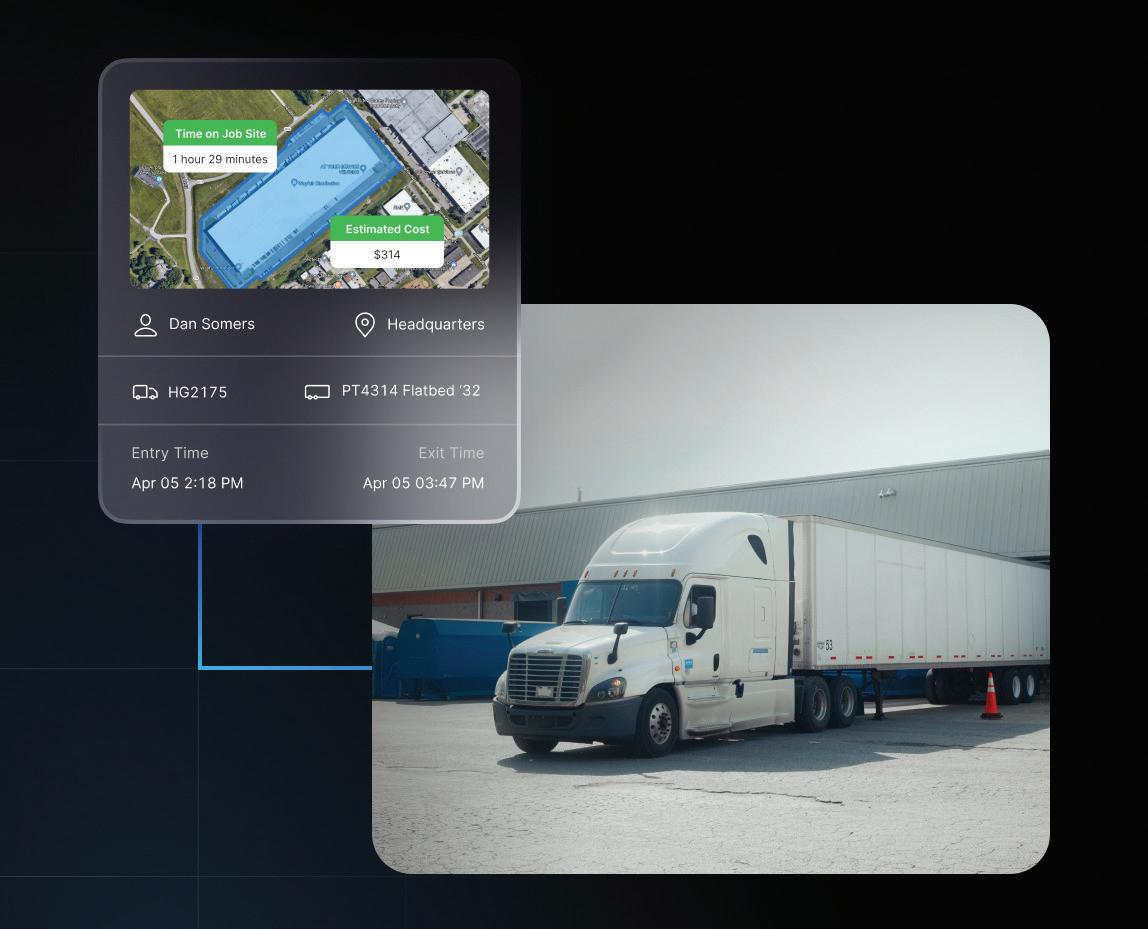

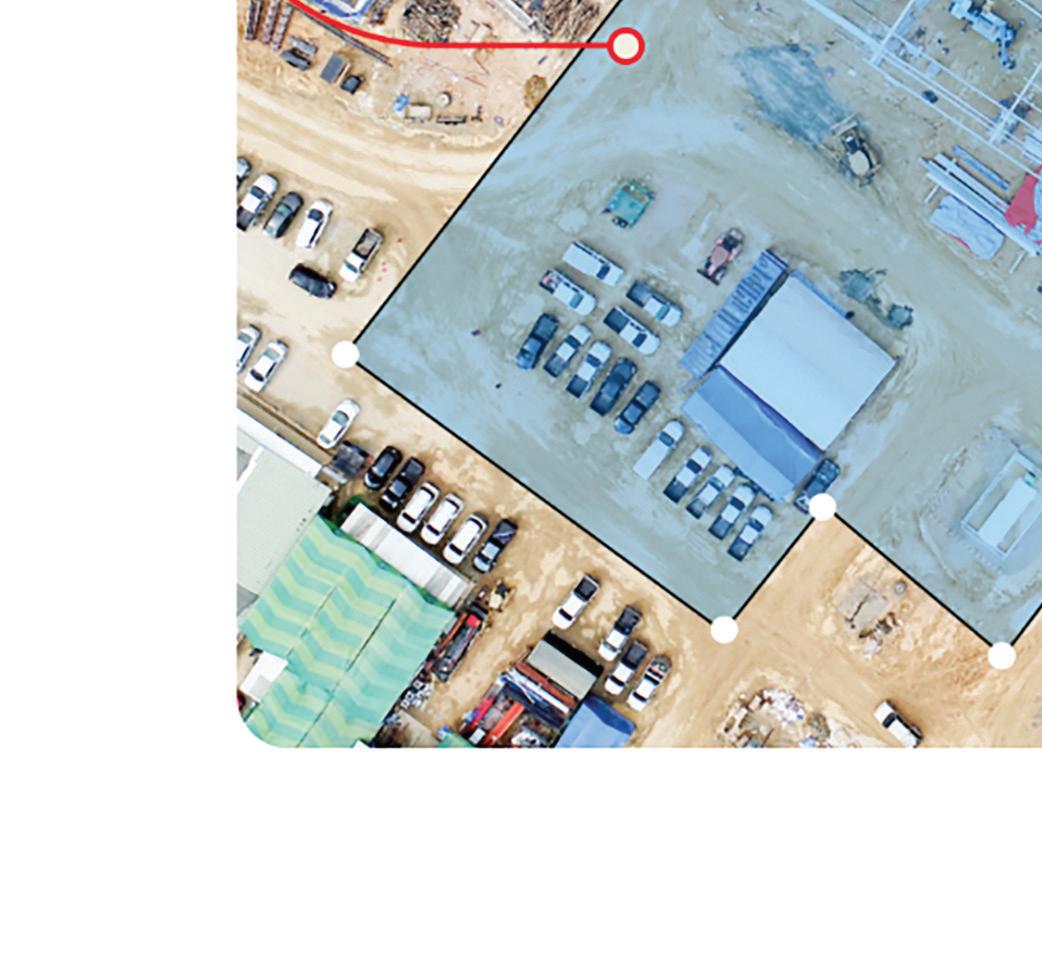

Asset trackers are no longer devices that simply pinpoint an asset’s location. They can help improve the bottom line, determine accurate asset utilization, and even help set fleets up for a connected future.

by Jade Brasher

Any asset that isn’t tracked is a liability for fleets. Rogue assets cut into the cost of operations, safety, and maintenance, according to Frank Schneider, director of product management at Phillips Connect, an asset tracking provider that specializes in Class 8 trailers.

“That’s something that we hear a lot from our clients, and [safety, maintenance, and operations] talk right to the value proposition of our solution,” Schneider told FleetOwner

For Schneider, tracking assets isn’t just about pinpointing an asset’s location— although that’s still an important aspect of the technology. Instead, Schneider said Phillips Connect tracks “the dots on a map” and analyzes how to “improve the performance of those fleets—all of which are tied to a financial component,” he explained.

To boil it down into one term, asset tracking is all about visibility.

Theft costs fleets thousands. Take construction fleets, for example. A 2019 study from the Associated Schools of Construction analyzed 15,000 reported incidents of theft and found that contractors lost an average of $6,000 per theft incident. When a truck was involved, the average cost of an incident rose to $42,000. What’s more disturbing is that less than 7% of those incidents resulted in equipment recovery.

Underutilized assets also incur high costs. According to the American Transportation Research Institute (ATRI), the average cost of operating a truck is about $90 per hour. Using this data, mobile maintenance provider Torque by Ryder deduced that for each hour a truck spends idle, fleet owners should consider that as $90 lost.

Assets that are overused and require maintenance can be even more costly for fleets. For every vehicle experiencing downtime, light-duty commercial fleets lose an average of $760 per day, Michelin reports. Heavy-duty fleets can

expect even higher costs. The solution comes in one form: an asset tracker.

While GPS tracking devices aren’t new to the industry, their popularity is growing.

“Demand for asset trackers is accelerating,” said Robert Higdon, director of product for equipment monitoring

at Motive, a fleet management provider. He believes that it stems from companies’ use of vehicle tracking technology, which provides operational visibility down to incremental metrics.

Echoing that sentiment, Frank Bussone, VP of technology and data analytics

at Corcentric Fleet Solutions, wrote in a blog for FleetOwner: In eet operations, “it’s impossible to manage what you can’t see.” Therefore, the highest performing eets in the industry all rely on data from telematics and fuel management systems, maintenance systems, and more.

When that data is analyzed, it provides eet operators the “visibility into the actual operating cost of each truck, enabling smarter decisions on maintenance, utilization, routing, and replacement,” Bussone said.

Asset tracking is an extension of that visibility, providing eets with a detailed look into operations beyond the vehicle.

Fleet owners “see the value in having real-time data for vehicles and what that’s brought to the ef ciency of their operations,” Higdon said. “They may say they have the same set of problems for their trailers, for their heavy equipment. [Just as] they don’t want their vehicles to get lost or stolen or ... underutilized when they could have a more productive purpose for them.”

Once eet operators employ asset trackers, the data they receive can lead to multiple bene ts.

Mathew Long, Verizon Connect’s senior manager of product marketing, believes the core bene ts of asset tracking come down to cost savings tied to

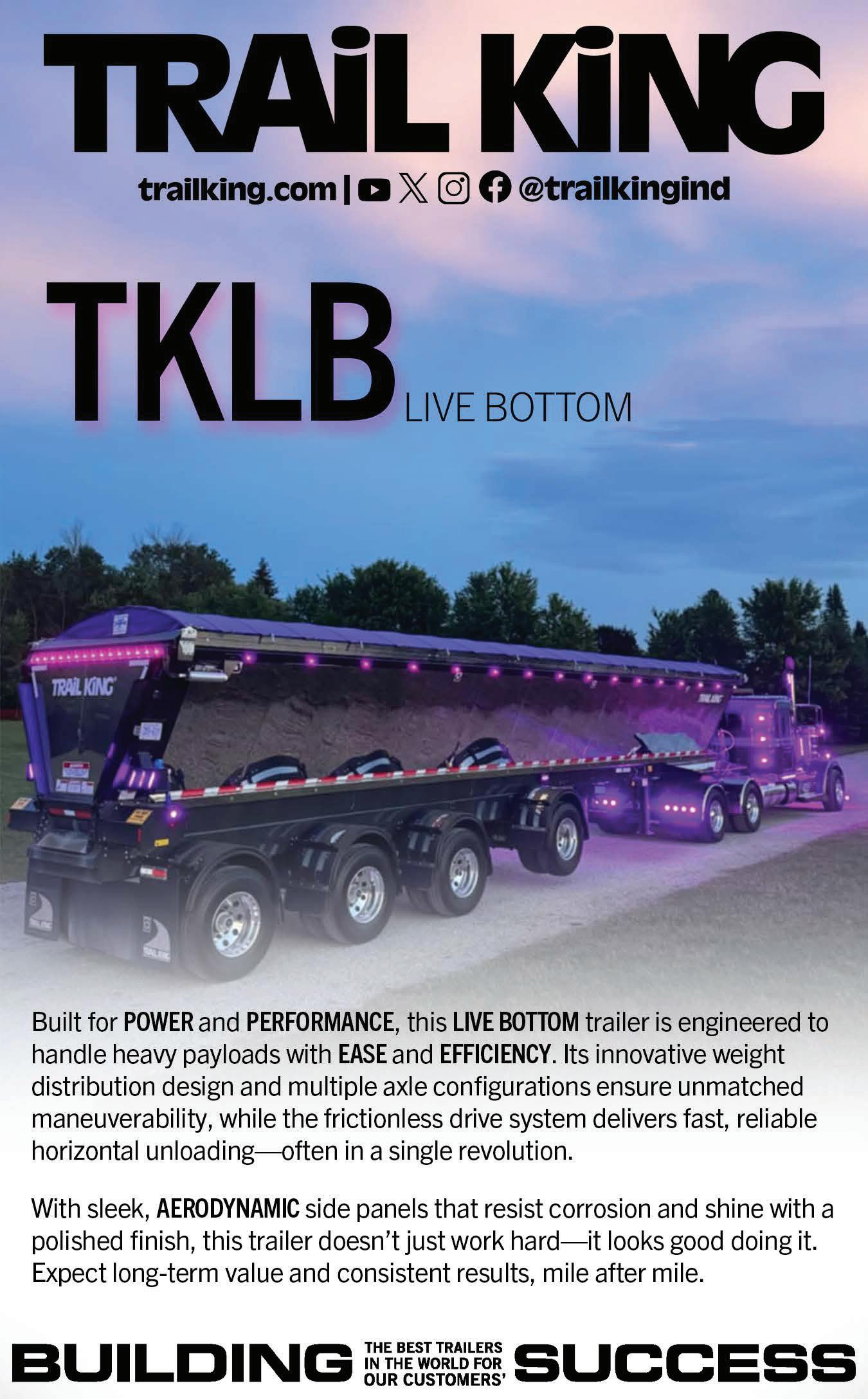

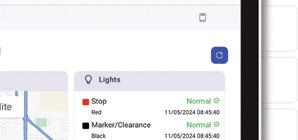

Phillips Connect’s sensors monitor the trailer’s metrics and specific details such as what percentage of the tires are low, how much cargo space is available, whether the trailer is located near a maintenance provider, if the trailer door is closed, and more.

Photo: Phillips Connect

accurately monitoring asset utilization, especially if data determines that assets can be of oaded.

You might think an asset is used one way, but when you look at the asset tracker data, “suddenly you realize that the asset hasn’t been touched in the last three days,” Long told FleetOwner It is through this data that a eet can determine whether an asset should be of oaded or moved where it is needed.

Understanding proper asset utilization can help eets save hundreds and even thousands of dollars.

Higdon provided the example of Motive customer Agmark, a bulk liquid

transport eet. Having clear visibility of its asset utilization allowed the company to cut its asset count by 11% without losing capacity. It also increased asset utilization by 10%. While each eet is different, even if a eet off-loads a single asset, it could save on monthly payments and insurance.

Additionally, simple location tracking can assist eets with recovery.

Long recalled an instance where a $50,000 backhoe was stolen from a construction eet. Because Verizon Connect allows customers to receive alerts when assets have moved from a geofenced area or when assets are operational during non-working hours, the eet manager was able to relay the exact location to law enforcement within a timely manner and recover the asset.

At its core, asset tracking provides “that quick peace of mind to know that a particular vehicle or, respectively, an asset, is where it’s supposed to be at that moment in time,” Long said.

With asset loss, Motive’s Higdon recalled multiple instances when his customers would spend valuable working hours locating single pieces of equipment to move from one site to another.

Road Ready helps you track, monitor and optimize your fleet with confidence.

Stay connected to your trailers with critical insights into location, cargo status, and tire health. Road Ready gives you the tools to reduce downtime, improve efficiency, and protect your bottom line.

• GPS-Based Tracking – Know where your trailers are, even when untethered

• Cargo Monitoring – Instantly see loaded vs. empty status for better utilization

• Tire Health Alerts – Detect pressure or temperature issues before they lead to breakdowns

See how Road Ready can transform your fleet — learn more at roadready.com.

• Fleetwide Visibility – Access data when you need it through the Road Ready dashboard

He said one company even made it a common practice to reserve an entire week for asset retrieval or “yard hunts.” The hours wasted cut into the company’s bottom line.

However, those with asset tracking technology can use data to shift that asset retrieval time from weeks to minutes. This results in “assets that are being returned to your inventory to distribute across other jobs,” he explained. For equipment rental companies, “that’s rentable inventory that you can then reassign to the next job and start to secure new revenue.”

While asset tracking can be a one-sizets-all solution—for both powered and non-powered assets, according to Long—some assets may bene t from more sophisticated tracking.

Phillips Connect’s solution essentially equips trailers with a GPS tracker, a modem, multiple sensors, and sometimes even cameras that communicate with Phillips Connect’s software, which eet operators can access on a digital platform, Schneider said.

Those sensors monitor the trailer’s metrics and speci c details such as what percentage of the tires are low, how much cargo space is available, whether the trailer is located near a maintenance provider, and if the trailer door is closed.

By tracking these metrics, Phillips Connect can help eet operators understand operational aspects, such as a trailer’s location as well as its “preparedness,” including whether the trailer is t to be loaded and hauled across the country, Schneider said.

Phillips Connect’s trailer trackers can help from a maintenance perspective through tire monitoring, including noti cations of hot wheel bearings, open trailer doors, and more. If the maintenance problem could lead to a safety event, eet managers can set automatic maintenance orders to resolve the problem quickly. Improper maintenance or

Motive’s Robert Higdon believes the increased popularity of asset trackers stems from the use of vehicle tracking technology, which provides fleets operational visibility down to incremental metrics.

Motive’s Asset Gateway Mini is available battery-powered or cabled and provides asset metrics and accurate asset location.

overdue maintenance can lead to roadside incidents, which can directly affect the eet’s overall safety.

“These are some of the things that our clients are really concerned about and that we see in the eld,” Schneider said.

Fleets’ need for asset tracking technology has grown alongside its popularity, as asset trackers are becoming a competitive advantage.

Early adopters of asset trackers are bene ting from the ef ciency gains and “positive impact to their nancial operations,” Schneider said. He explained that companies that have yet to or have been slow to adopt asset trackers are competing with early adopters that are now nancially better off.

What’s more, asset trackers of today support the industry’s current trend toward “digitization,” Motive’s Higdon said, as many asset trackers send data straight to a eet manager’s dashboard.

Today’s asset trackers not only provide visibility to a variety of assets and vehicles but also provide reports, analytics, insights, and even live locations all in one place, according to Verizon Connect’s Long. And not to mention, these trackers are becoming more rugged and are built to last. (Verizon Connect’s asset tracker comes with a battery life of up to 13 years.)

Additionally, asset trackers from telematics providers such as Motive and Verizon Connect further support digitization efforts by indicating eetwide performance metrics on a single pane of glass. Fleet managers have access to everything from the vehicle to the trailer to on-site generators, all from one dashboard.

Phillips Connect’s trailer tracking solution takes that digitization several steps further, nearly to the future, by ushering in the industry’s “connected trailers.” Using Phillips Connect technology, one eet is even able to load pallets from a warehouse to a speci c location within

the trailer—all without any human interaction, Schneider said. This is all possible because of the increased visibility trucking technology providers are offering their eet customers.

While their name indicates a single function—simply tracking assets— employing these devices in a eet can boost fleet efficiency and improve the bottom line. Higdon sums it up perfectly: “Ultimately, asset tracking is about getting the most out of the equipment that you already have, making smart investment decisions about what equipment you need in the future, and then keeping that equipment that you already have on the road and on the job,” he said.

Although not every fleet is ready to deploy robots for trailer loading and unloading, all fleets can benefit from asset tracking that offers bene ts comparable to telematics tracking on eet vehicles. FO

by Kevin Rohlwing

SUMMER HAS TRADITIONALLY been the busiest time for commercial truck tire service. Among construction restarts, retailers stocking up for the upcoming holiday season, and the hot weather that leads to an increase in underinflated tire failure, June to August is usually busier. But reports from the field indicate that 2025 is going in a different direction.

F east or famine benefits no one. Tires continue to be a major expense for the trucking industry, and fewer options put even more pressure on maintenance.

Uncertainty is kryptonite for businesses and financial markets. The current state of affairs in the U.S., Canada, and Mexico is chaotic with trade imbalances and reciprocal tariffs. Global markets do not fare any better, with the Port of Los Angeles averaging five ships a day rather than the usual 10-plus, according to Bloomberg. There are numerous headwinds facing the transportation industry. Domestic truck tire manufacturers are also caught in the crosshairs. The major brands are more focused on OEM and national account business, as the smaller

fleets turn to Tier 3 and Tier 4 tires to save money. While large carriers continue to emphasize cost per mile when purchasing tires and retreads, buyers now have a variety of tires to choose from at better price points and quality. If this trend continues, the trucking industry will become even more dependent on offshore manufacturing as domestic production adjusts to reduced demand.

Competition is the best tool for controlling prices. In the commercial truck tire service space, smaller dealers keep larger dealers honest by offering fleets alternatives. Based on what I’m hearing, both are in feast or famine mode to some degree, with more business they can handle one day and a total drop-off the next. Dealers on the larger end of the spectrum can more easily weather the storm, while the smaller companies are faced with much tougher decisions when it comes to staffing and payroll. If this trend continues, carriers will have fewer options for truck tires and service.

Low-cost offshore brands will still be available, but the quality of the service will suffer. The best technicians could gravitate away from the smaller dealers to the larger ones with the promise of consistent pay, benefits, and overtime.

It’s still possible to get a Tier 3 or Tier 4 tire with good service, but the future could feature economy tires accompanied by economy service. Poorly trained and equipped technicians may not follow recommended practices, so fleets should expect reduced performance and more roadside tire failures.

I fear that we are losing the middle. There will always be the pickup truck and compressor crowd that offers bargain-basement prices. A fleet usually gets what it pays for in those instances; in many cases, they are not paying for insurance. If that bargain-service

provider improperly installs or repairs a tire that leads to an accident, the fleet will be the primary defendant. Plaintiff attorneys don’t care where the money comes from, so the deep-pocketed carrier becomes the primary target.

The smaller, reputable tire dealers between the mega-dealers and the pickup trucks help maintain balance in the commercial truck tire market. They have adequate insurance and offer the most products and services because they aren’t bound by contracts with the major manufacturers that limit what they can sell. Quality service is often their focus since they have fewer locations and technicians to manage. Many are being bought out as aging owners struggle to remain profitable under uncertain market conditions.

There will always be truck-tire service providers to handle demand. Large, multistate commercial tire dealers have systems in place to ensure qualified technicians have the tools and equipment they need to keep trucks on the road. They will always be there to keep freight moving safely with tires that are correctly installed, repaired, or retreaded. In addition, they have the assets and insurance to provide an added level of protection for the fleet in the event of an accident.

Feast or famine benefits no one. Tires continue to be a major expense for the trucking industry, and fewer options put even more pressure on maintenance. Operating costs increase when tires are poorly maintained, forcing fleets to choose between higher-priced roadside service and bargain-basement tires with equally low service and no insurance. FO

Kevin Rohlwing | krohlwing@tireindustry.org

Kevin Rohlwing is the chief technical officer for the Tire Industry Association. He has more than 40 years of experience in the tire industry and has created programs to help train more than 220,000 technicians.

BendPak’s new 16AP and 20AP Series superduty two-post lifts are the ultimate solution for mixed fleets, handling Class 1 through 5 vehicles with ease—from passenger vehicles to school buses. Offering higher reach, greater stability, and top-tier safety features, they protect your technicians while boosting efficiency. With fewer moving parts, they’re easier to maintain and more costeffective to run. Maximize your shop’s uptime with BendPak’s superior performance and unbeatable value. To learn more, visit bendpak.com or call us at 1-800-253-2363.

Ford said this work truck is as off-road capable as a Tremor. We tested it.

by Jade Brasher

It looks like a work truck. No chrome, no fancy wheels, no leather-wrapped accents. Yet, it’s what’s on the inside that really counts for the Ford F-250 Super Duty XL 6.7L Power Stroke Turbo Diesel.

When a member of the Ford team first told me about the F-250 XL Power Stroke, he said this particular truck was just as capable as a Super Duty equipped with the brand’s Tremor Off-Road package, designed for the road less traveled. Naturally, I had to test that theory.

Before testing the truck’s off-road capabilities, I used it as my daily driver for the week. Navigating a vehicle this size through the one-way streets in my neighborhood isn’t exactly a walk in the park, but the F-250 handled it with ease.

The engine is also quiet compared to the older diesels you’ll hear puttering around town. The Power Stroke turbo diesel won’t wake up the neighbors when work starts before the sun, and the person taking your order in the drive-thru won’t ask you to cut the engine so they can hear you properly. All in all, my daily driving experience with the F-250 Super Duty XL wasn’t half bad.

The weekend came, and it was time to test the truck’s 4x4 capabilities at Silver Lake Sand Dunes. The dunes are in West Michigan, about a four-hour drive from my Metro Detroit home.

While it wasn’t equipped with the finer things like poweradjustable seats, I wasn’t aching during that long drive—and that means a lot coming from someone with herniated discs.

One thing that was surprising about the Ford F-250 Super Duty XL, however, was that it didn’t have a regular power outlet, which was noticed on the way back because my occupant needed to charge their laptop. Designed as a work truck (even equipped with a stowable work surface), one would think having a 115V AC outlet would be a no-brainer. Go figure.

While driving, I noticed how well the truck handled: first through the tight streets of my neighborhood, then along the crowded Interstate highways, and then through the winding state routes. Though it appears to be a Plain Jane work truck, its suspension is tuned perfectly. It also handled well because— unlike your typical off-road truck with beefy tires—its smaller wheels keep the truck nimble and feeling lighter.

I have plenty of off-road experience, but I’ll admit I was nervous to take this truck out on the dunes. Surrounded by Jeep Wranglers and dune buggies, the sheer size of the F-250 Super Duty made it seem totally out of place. To make matters worse, Silver Lake Sand Dunes consist mostly of “scramble” areas, which basically means there are NO RULES.

Friends who’d been there before had already shared horror stories about nearly being hit, both when they were inside and

outside their vehicles. Other friends shared their stories of a broken window and damaged bumper. As far as I’m concerned, Silver Lake Sand Dunes is Michigan’s Wild West.

My worries subsided once I got the truck out on the dunes. The weekend crowd had mostly gone home by Sunday afternoon when we got there, leaving plenty of room in the park for my test drive.

The first hill I tried to tackle was a no-go—but that’s likely because of me. The F-250 scaled the first half well, but just before reaching the top, I saw the flag of a buggy coming up the other side and opted to slow down and let it pass. By the time it passed, the truck had sunk too low into the sand, and the only way out was to reverse downhill. Taking another angle, I got it up the hill the second time.

That first hill wasn’t much to write home about, though it was steep. Really, it was the hills that the buggies were gliding over that had my interest.

I had never driven over sand dunes, but I discovered that in a vehicle of this size, navigating dunes requires a perfect dance between speed and control. Speed is required to scale the steep hills without sinking too far into the sand. Yet once you get over the hill, control is required to master all the bumps going down. I’ll admit that there were moments when the hills and dips were closer together than I anticipated, and I crossed them with too much speed. In those moments, I just thanked God for seat belts.

Regardless of the inexperienced driver behind the wheel, the increased weight from the diesel engine, and its long wheelbase, the Ford F-250 XL handled the sand as if it were designed for it.

The verdict

While I do not expect drivers of this work truck to venture onto sand dunes, it was refreshing to know that my friends at Ford don’t mince words when touting their vehicles’ capabilities. After this experience, I believe this F-250 Super Duty XL can go anywhere the job requires—from the suburbs to the sand dunes. FO

ConMet says its tractor-mounted TruckWings system automatically deploys at highway speeds to close the tractor-trailer gap, reducing aerodynamic drag. At lower speeds, it retracts to allow full clearance for turning and maneuvering. By managing airflow, the system enhances vehicle stability and fuel efficiency. Designed for compatibility with all truck configurations, including day cabs, sleeper cabs, and

even reefers, the TruckWings system helps improve efficiency for diesel, compressed natural gas, hydrogen, and electric powertrains. It can be installed in under two hours.

The system features an aluminum frame and operates autonomously. Cloud-connected telematics provide realtime data, including uptime reporting, to help fleets track and evaluate performance. TruckWings technology is backed by a 5-year/500,000-mile warranty.

FlowBelow’s trailer wheel covers with universal latch brackets simplify installation across multiple trailer makes and models with a one-size-fits-all mounting system. Users need only choose their color preference; the universal latch brackets eliminate the need to

specify hub type and wheel offset, fitting any application.

The manufacturer says that trailer wheel covers deliver fuel savings of 0.81%, equivalent to about 0.5 cents per mile, through improved aerodynamic efficiency. The covers are designed to last the lifetime of the trailer, providing long-term operational benefits for fleet operators and measurable ROI.

Installation kits include an optional hub odometer stand that integrates with

the latch system, allowing easy access for hubometer readings during maintenance operations. The covers are available through trailer OEMs for new builds or can be purchased for retro t applications on existing equipment.

Transtex’s Edge Elite Aero System+ is a streamlined aerodynamic solution designed to increase fuel ef ciency across full trailer coverage. Comprising Edge Skirts, Edge TopKit+, Edge Flaps, and Edge Fins, Transtex states that this lightweight, virtually maintenance-free package delivers up to 10.49% fuel savings,

or 12.09 gallons per 1,000 miles, equating to about $2,877 in savings per trailer, with a typical six-month ROI. Its minimal-parts design and no driver interaction reduce operating costs, while installation is quick and payload impact is negligible. Built for durability, the system withstands harsh weather, road impacts, and features materials that resist permanent deformation. Independently tested by MVTS, the manufacturer says it also achieved 7.88% fuel savings (8.88 gallons per 1,000 miles) on corrugated refrigerated trailers—yielding up to $2,832 annual savings per unit.

ZF’s OptiFlow TrailerSkirt is a durable aerodynamic solution designed to improve fuel economy and meet industry compliance standards. Built for easy installation and engineered to reduce drag and CO2 emissions, it features a patented one-bolt mono-clamp system and exible thermoplastic struts that hold up in both hot and cold conditions. Tested and certi ed for aerodynamic performance, the manufacturer states that OptiFlow TrailerSkirt promotes fuel savings at highway speeds.

Available in multiple lengths and standard black or white nishes, it helps improve efficiency without adding operational complexity. Now available in a compact 115-inch length, the latest addition to the trailer skirt line is said to provide exibility for a broader range of trailer con gurations without sacri cing aerodynamic performance. FO

Chevron can fuel your fleet with solutions that range from traditional diesel to R-CNG. But our solutions go beyond the fuel tank. We’ll be there to help keep your goods on the go — and help keep your business ahead.

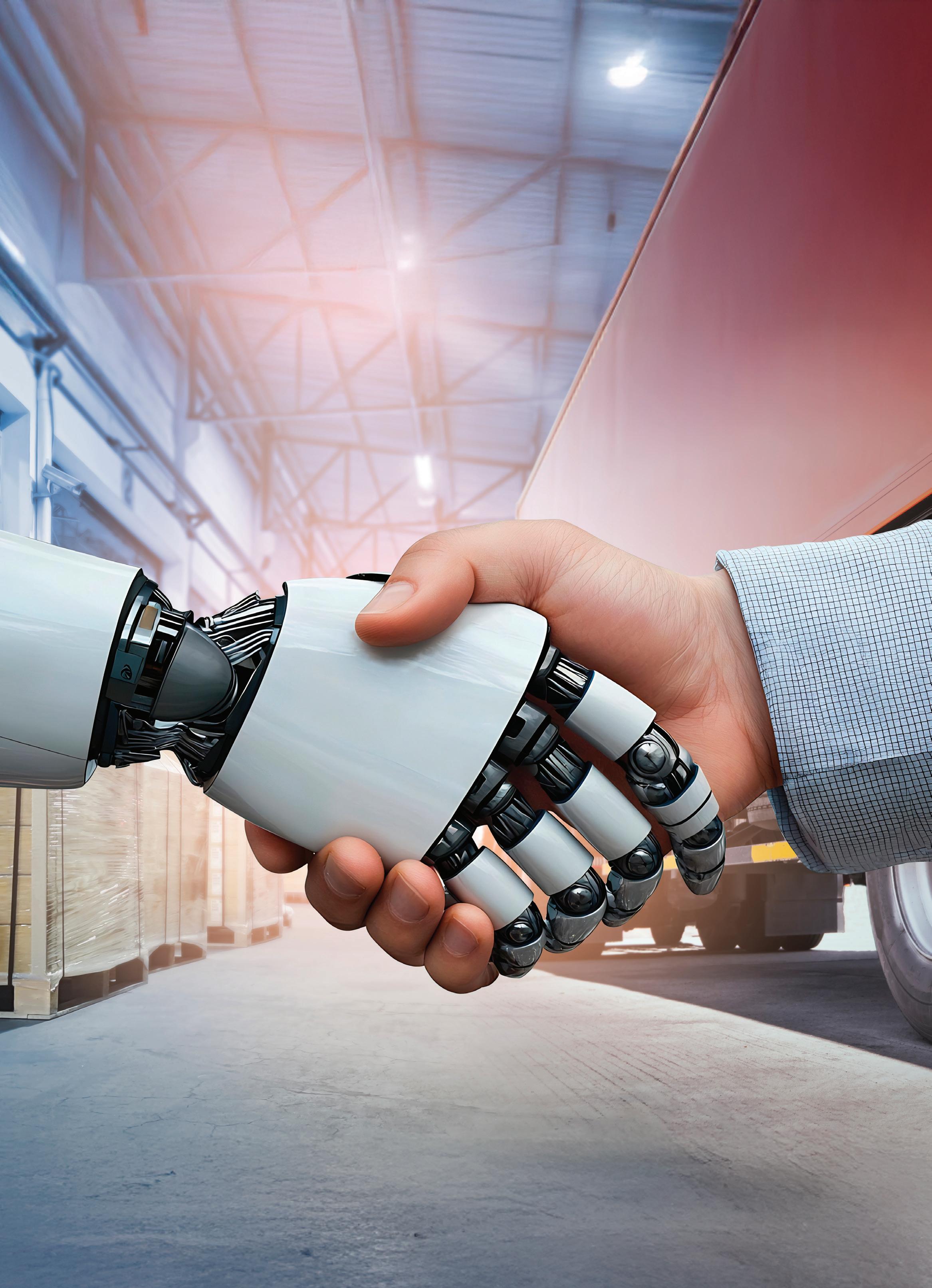

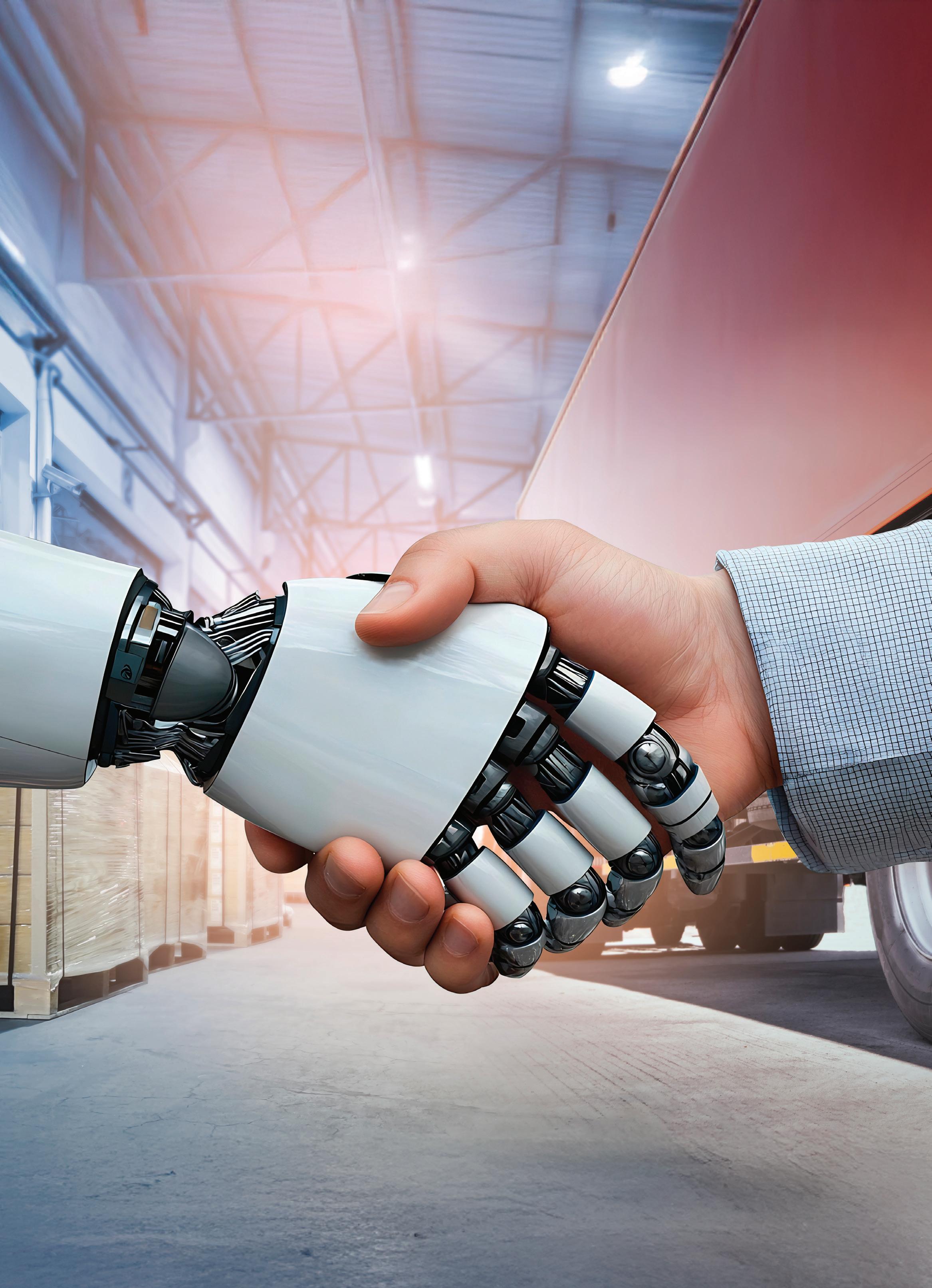

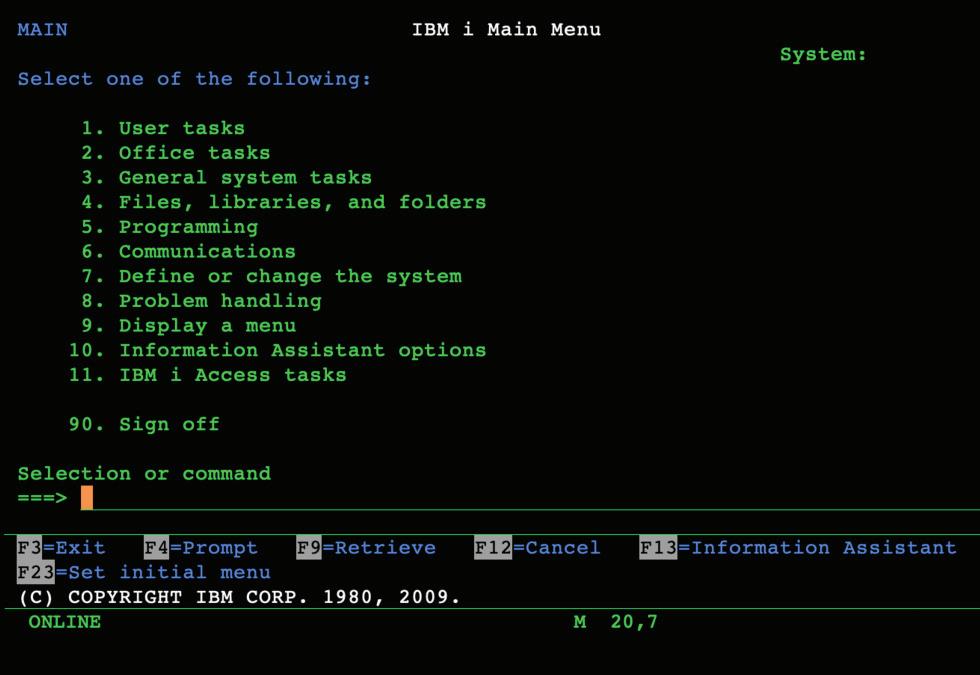

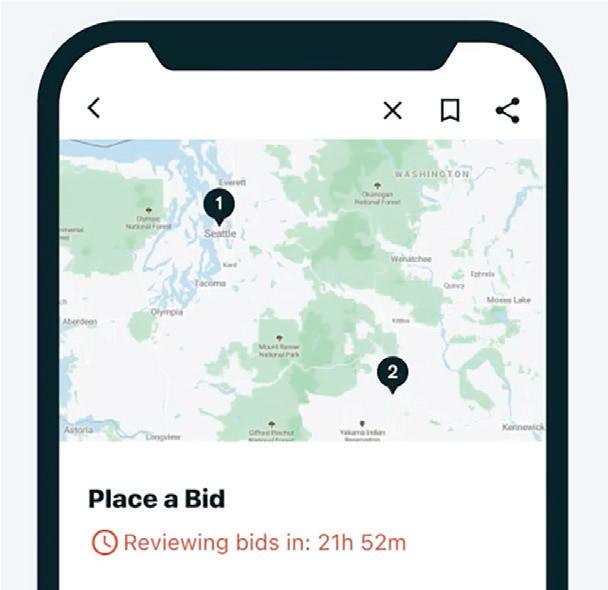

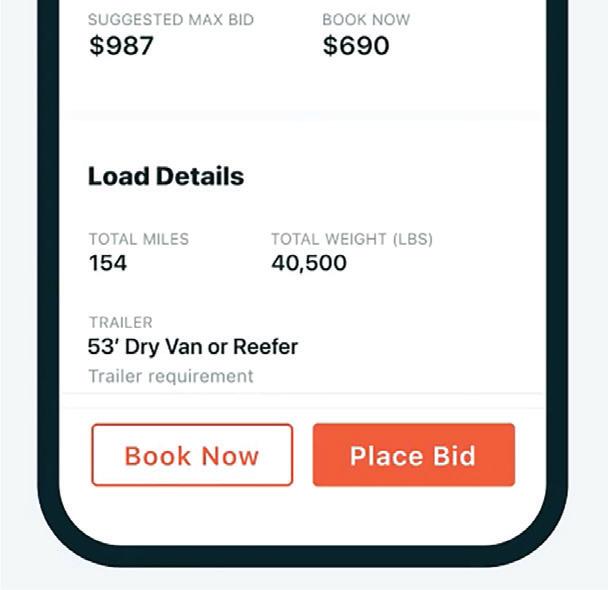

For-hire trucking is becoming more robotic.

Technology is changing how carriers, brokers, and shippers interact. Demand is growing for both real-time shipment tracking and the automation of several interactions.

“You’re seeing these technologies take over those transactional bits of relationships so that the broker and carrier relationships can become much more focused on the human and business elements, as opposed to the very operational and manual tasks,” Kary Jablonski, VP and GM of broker growth and Trucker Tools for DAT Freight & Analytics, told FleetOwner

Mobile apps, arti cial intelligence, load boards, and transportation management systems are automating a range of manual tasks—from tracking to rate negotiation. However, the march toward automation is also followed by fraud and theft.

Tracking, communications, verification—automated by Jeremy Wolfe

The trends: tracking, automation, fraud

Logistics is still a relationship-driven industry, but the dynamics around those relationships are always changing. Throughout the last several years, online platforms have drastically changed the expectations that brokers and shippers have for their loads.

“Relationships are extremely important in this industry, whether that’s a shipper with a broker who doesn’t have any of their own trucks, or the shipper with the asset capacity providers … relationships are critical. That will never change,” Danielle Prigge, chief commercial of cer at Mastery, told FleetOwner “What has changed is how those relationships are managed throughout the day-to-day.”

According to DAT’s Jablonski, the rise of mobile apps a decade ago began to automate many of the interactions between parties.

“Mobile apps started to become a thing in 2012, 2013 in the trucking space to help carriers, especially small eets, automate a lot of the manual processes they go through when working with brokers,” Jablonski said.

Over the last several years, demand for automation and real-time tracking is growing—but so is the risk of fraud.

One of the most signi cant expectations is shipment visibility/load tracking. Surveys of shippers since the pandemic tend to agree that over half of shippers require real-time visibility for their loads.

Tracking was supported by the electronic logging device mandate from 2017. An ELD in every vehicle meant that carriers could GPS location updates for signi cantly less hassle.

“We are seeing shippers demand more real-time visibility to where their freight is and when,” Prigge said.

“With Trucker Tools, we’ve seen tracking adoption, and using mobile devices to track, skyrocket over the last six to seven years,” Jablonski said.

One of the larger and more recent shipper surveys, the 2024 transportation benchmark survey by Descartes, found that the emphasis on freight tracking is still high. According to 630 respondents—mostly manufacturers and shippers—the most important capability to manage their transportation was visibility (42%) for the seventh year in a row.

Most shippers (over 50%) said they used real-time tracking portals, direct TMS updates, or carrier/broker shipment status portals to track loads—but about 40% or more of respondents also said they still used spreadsheets, emails, phone calls, and electronic data interchange (EDI).

Prigge said that rate visibility is becoming more important as well—and, with that, automated rate negotiations.

“We are seeing them [shippers] demand more visibility to rates so that they can shop rates in a more digital way. And with that, you have some tech platforms available out there that can help manage that interaction, between a capacity provider and the shipper, to say, ‘Here’s my lane, how much would you move it for?’ And then it can actually transact that freight at that point,” Prigge said.

Shippers aren’t the only party looking for easier interactions through tech platforms. Carriers also have the opportunity to spare their labor the tedious back-and-forth. Traditional processes take signi cant manual effort.

“They [carriers] are looking for the right loads. They’ll bid on a load on the DAT load board, for example, and then they’ll have to go back and forth via email, via phone, via text message—10 years ago it would have been via fax,” Jablonski said. “You go from nding a load to then bidding a load, going back and forth, hopping on a phone with a

broker, getting an email con rmation, picking up the load, having to schedule over the phone, getting paid in a manual way, and then managing those documents quite manually.”