Distributor Issue EnTrans revitalizes, repurposes vintage tank wagon Page 18 HDAW 2024 Highlights • Market remains ‘robust’ Page 30 • eCommerce, REPAIR Act Page 32 • Execs dish on suppliers Page 40 Distributor challenges coming in 2024 Page 42 March 2024 | TrailerBodyBuilders.com

MADE WITH PRIDE IN THE USA ALL YOUR WORK TRUCK PRODUCTS WHAT IS NEW AT BUYERS Wide range of Steel, Stainless Steel, & Poly municipal plows UNIVERSAL OPEN TOP CARGO AND TOOL BASKETS SERVICE BODY KABGARDS SNOWDOGG® ILLUMINATOR LP LOW PROFILE LED PLOW LIGHTS AVAILABLE IN TWO SIZES TO ACCOMMODATE EITHER A SINGLE OR DUAL REAR-WHEEL SERVICE BODY Available in black or white powder coat finish. PLUG AND PLAY COMPATIBILITY WITH ALL PAST & CURRENT SNOWDOGG® PLOWS Patent pending integrated 5-pattern strobes powered by 4 Amber LEDs on each light. ADD ADDITIONAL STORAGE TO YOUR VEHICLE Each basket measures 18" wide by 10" tall and is available in 24" or 36" lengths. Combine multiple kits to create the right length for any application. NEW NEW NEW 1744136 shown 5404927 shown 16160900 shown

ALL THE TIME NOTHING WORKS LIKE A DOGG ™ NOTH I NG LI KE A BuyersProducts.com 304 Stainless Steel municipal grade spreaders configured to meet your specific needs Full Radius Poly Fenders ADJUSTABLE TRI-BALL HITCH FOR 2" RECEIVERS SADDLE MOUNT ALUMINUM HYDRAULIC RESERVOIR LED MULTI-MOUNT MINI LIGHT BARS THREE DIFFERENT TOW BALLS GIVE YOU FLEXIBILITY FOR DIFFERENT JOBS Quick, tool-free ball and height adjustment. Features under bumper storage position. 25 GALLON CAPACITY WITH 1-1/4 IN. NPT PORTS New 3054526 Saddle Mount Bracket Kit is also compatible with other 24" diameter Reservoirs. PERMANENT/MAGNETIC MOUNT Featuring 48 LEDs and 10 adjustable flash patterns. NEW NEW NEW 1802000 shown SMC25A shown 8891179 shown 8891172 shown 8891170 shown under bumper storage

4 Trailer|Body Builders ● March 2024 Featured Build Tale of the tank EnTrans revitalizes vintage tanker 24 Contents March 2024 In Each Issue Cover image: vm | #48519543 | Getty Images 5 Online 6 Editorial 8 Industry News 44 Product Focus: Truck and Trailer Body Hardware 46 New Products 48 Events Calendar 48 Advertisers Index 50 People & Positions 18 HDAW coverage 24 HDAW 2024 set records in gathering of aftermarket There was a whole lot of dealmaking going on in meeting rooms and on the floor at the MEMA show 25 Cummins Meritor delves into positive progress at HDAW 30 Truck market to remain ‘robust,’ Mack boss says Relationships, collaboration with suppliers will drive performance in the future Feature 42 Aftermarket outlook: Improved economy and new challenges 32 Industry to see eCommerce, Right to Repair changes in ‘24, aftermarket leaders say at HDAD 36 Forecasting trucking’s next 30 years: ICE, EVs, and AVs 40 So, what do you think of your suppliers?

VP/Market Leader

Commercial Vehicle Group – Michael Uliss muliss@endeavorb2b.com

Editorial Director – Kevin Jones kjones@endeavorb2b.com

Associate Editor – Alex Keenan akeenan@endeavorb2b.com

Marketing/Advertising – Dan Elm delm@endeavorb2b.com

Art Director – Patricia Bernard pbernard@endeavorb2b.com

Directories/Listings – Maria Singletary msingletary@endeavorb2b.com

Audience Development Manager – Jaime DeArman jdearman@endeavorb2b.com

CEO Chris Ferrell

President June Griffin

COO Patrick Rains

CRO Paul Andrews

Chief Digital Officer Jacquie Niemiec

Chief Administrative and Legal Officer Tracy Kane EVP/Transportation Kylie Hirko

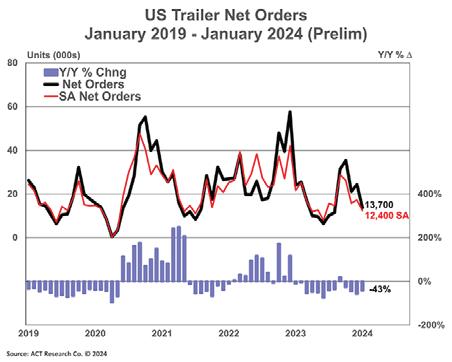

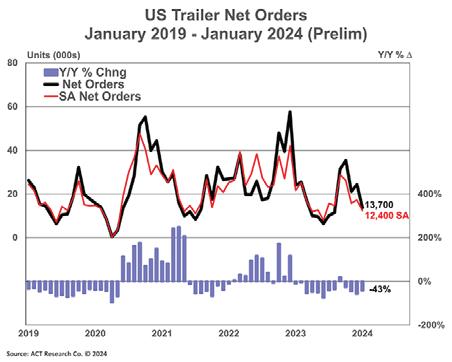

Trailer orders soften to open 2024—as expected: ACT Research Trailer-BodyBuilders.com/

TRAILER|BODY BUILDERS (USPS Permit 636660, ISSN 0041-0772 print, ISSN 2771-7542 online) Volume 65 Issue 5, is published monthly by Endeavor Business Media, LLC. 201 N Main St 5th Floor, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI, and additional mailing offices.

POSTMASTER: Send address changes to Trailer/ Body Builders, PO Box 3257, Northbrook, IL 60065-3257.

SUBSCRIPTIONS: Publisher reserves the right to reject nonqualified subscriptions. Subscription prices: U.S. ($79 per year); Canada/Mexico ($79 per year); All other countries ($157 per year). All subscriptions are payable in U.S. funds. Send subscription inquiries to Trailer/Body Builders, PO Box 3257, Northbrook, IL 60065-3257. Customer service can be reached toll-free at 877-382-9187 or at trailerbodybuilders@ omeda.com for magazine subscription assistance or questions. Printed in the USA. Copyright 2024 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

Corporate Office: Endeavor Business Media, LLC, 30 Burton Hills Blvd, Ste. 185, Nashville, TN 37215 USA; 800-547-7377

Thermo

Trailer-BodyBuilders.com/subscribe Stay up-to-date on industry news and events, new products launches, and more. Market Watch Sign up for the official newsletter of Trailer|Body Builders linkedin.com/in/company/ trailer-body-builders @trailerbb Follow us at: Trailer|Body Builders Endeavor Business Media, LLC ARTICLE Phase 3 of the Clean Trucks Plan: Two perspectives Vehicle manufacturers want to push EPA Phase 3 through; ATA, EMA think otherwise Trailer-BodyBuilders.com/21283843 Photo 257411382 © Scharfsinn86 | Dreamstime.com ACT Research MARKETS Photo 190694134 © Scharfsinn86 | Dreamstime.com

Want your own issue?

Go online to: Trailer-BodyBuilders.com/subscribe

the

Read the

TrailerBodyBuilders.com/magazine/51765

1.

2. Complete

online subscription form.

digital edition online at

21283003 Predictive insights take guesswork out of maintenance Technology leverages vehicle data to plan maintenance schedules, decreade downtime Trailer-BodyBuilders.com/21283840 Visit TrailerBodyBuilders.com for more information from stories in this issue, plus online exclusives on pertinent topics in the trailer manufacturing industry.

Distributor Issue EnTrans revitalizes, repurposes vintage tank wagon Page 18 HDAW 2024 Highlights Market remains ‘robust’ eCommerce, REPAIR Act Execs dish on suppliers Distributor challenges coming in 2024 Page 42 March 2024 TrailerBodyBuilders.com March 2024 ● TrailerBodyBuilders.com 5 Online

King celebrates top TRU technicians

21283842

Trailer-BodyBuilders.com/

HONORS REGS

Photo: Thermo King

Ouch! Why didn’t you say something sooner?

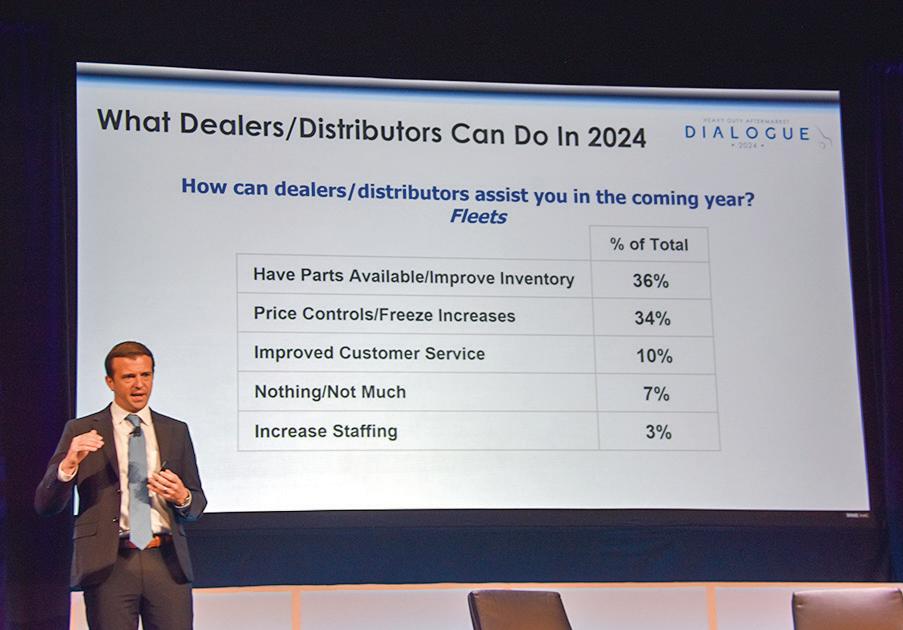

MEMA survey rips the bandage off of supplier/distributor relationships

Kevin Jones Editor

Kevin Jones Editor

When I was in my second year of kindergarten—don’t ask—on my report card I received all “S”s, as in “satisfactory,” except for “U”s across the board for “Accepts constructive criticism.”

Not only did I not improve that year, I imagine “thin skinned” would show up on my performance reviews today—except my boss has learned it’s best to just leave it alone.

I say this to preface TBB’s annual Distributor Issue because industry suppliers keep the lights on here, and I’d hate for our good friends to overreact. But I’m using this page to pass along some of the comments included in “Talk from the Top,” MEMA’s first anonymous and candid survey of heavy duty aftermarket distributor execs and their feelings about their supplier partners. The polite summary of the report is included in our coverage of HDAW’24 (beginning on Page 24), but to borrow from the parlance of our times, this tea just begs to be spilled.

In channeling my kindergarten teacher, MEMA’s Shannon O’Brien (who conducted the confidential interviews) explains that the purpose of constructive criticism is to help us improve. She also noted: “Please, don’t shoot the messenger!”

So let’s keep that in mind as I share some unfiltered quotes from the report (or, again, just skip to the summary if your BP is being monitored).

On the topic Lacking True Partnerships & Poor Service Levels:

• You can’t call yourselves a people business and not have people involved. Suppliers have to figure this out financially.

• I expect better communication from suppliers!

• It’s amazing how many of them wait until there’s an HDAW to reach out and have a conversation with us. That is highly disturbing.

• When suppliers started tightening things, the more experienced folks were let go or left. A lot of the people that would go the extra step are gone.

• You can’t just show up and check the box on your CRM. You need to show up with an agenda and a plan. Most salespeople are not doing that.

• They need a more tailored approach to who they’re dealing with. You need to deal with the big distributors in a different way than mom-and-pops.

Lack of Focus on IAM

• Stay invested in the independent side of the aftermarket. The suppliers that are really sharp and understand where their margins come from are aware of that.

• I’m hoping a challenging 2024 economy will push focus back into the AM as being a valuable channel and re-focusing on growing this channel.

• The aftermarket continues to be an afterthought, and almost every supplier’s service level has deteriorated over the last 3 years.

• In the past I would hear quite often that distributors are “costs” in the value chain. It’s fair to say that in the last 2-3 years, the distributor came out of this supply chain challenge as being considered capable to take care of their customers.

• Sometimes the AM doesn’t get the appropriate time and effort from suppliers, particularly the big ones. I get that the OEMs are going to pay the bills, but what you’re seeing is this creep of new suppliers, private label, slip in .... and that proliferation will continue and hurt these branded suppliers if they don’t give the appropriate attention to the aftermarket.

Guiding Thoughts for Suppliers

• These “cracks” will allow some Amazon, Elon Musk or whatever to come in and swoop our business away. It will require a whole other level of trust and partnership integration to take us into the next decade or so.

• Modernizing the sales and marketing approach and doing a better job with the training: Technology can help with both of those.

• They have to look at their distribution model and make sure they are not creating situations where people may walk away from their product and make other choices.

• In the aftermarket speed and availability is everything. Suppliers have to get back to being fast and easy, and having some level of consistency.

• The best vendors invest time and effort in our relationship. They have a business plan. It’s hard to move the needle beyond the industry average if you don’t have a plan to get you there.

6 Trailer|Body Builders ● March 2024

EDITORIAL | Positive Camber

@trailerbb

Follow us at:

linkedin.com/in/company/ trailer-body-builders

Spec the SAF CBXAN23 AeroBeam™ to make your flatbed lighter and more profitable. Achieve greater profits by weight optimizing your flatbed trailer fleet with the ultra-light, ultra-rugged AeroBeam™ suspension. You’ll boost payload capacity to maximize your profits. Add safety with the superior stopping power of optional P89 Air Disc Brakes and launch a fleet that can’t be beat! FROM YOUR PAYLOAD. EVEN MORE PAY See the complete model line-up CBXAeroBeam.com The Industry’s Lightest is Even Lighter with Haldex Brakes © 2024 SAF-HOLLAND, Inc. All rights reserved. www.safholland.com 800.876.3929 Follow us on

NATDA to hold Trailer Tech Expo in 2025

The North American Trailer Dealers Association (NATDA) is unveiling a brand-new event for trailer professionals in 2025. The Trailer Tech Expo is scheduled to take place at the Reno-Sparks Convention Center in Reno, Nevada, Feb. 25-27, 2025. The event will highlight the latest in trailer technology and hands-on technical training for lightto-medium duty trailer dealership owners and staff.

The event will offer an immersive experience in all things trailer technology, including workshops and displays highlighting innovations in trailer design and dealership operations.

Dealers can also partake in social and networking events, including an award ceremony that will recognize pioneering dealers, industry vendors, and manufacturers.

“We are extremely pleased to be able to offer another event designed to elevate dealer performance,” said NATDA Executive Director Andria Gibbon, CEM. “While our August event, the NATDA

Trailer Show, focuses on all aspects of the trailer industry, this new event in February is strictly focused on technology and innovation and offers increased opportunities for hands-on experience in the maintenance and repair of mechanical, hydraulic and electronic enhancements to trailer design.”

“This event will be a unique opportunity for NATDA to not only recognize innovation in our industry, but also to expand our technical education programming by developing the first accreditation program for trailer technicians,” said NATDA Chief Executive Officer Rick McConnell.

The event’s programming is currently underway with ongoing input from NATDA’s Dealer Advisory and Manufacturer Councils along with extensive surveying of NATDA membership.

Over the next few months, more details will be released leading up to the NATDA Trailer Show, which takes place August 28-29, with Dealership Performance Training on August 27.

8 Trailer|Body Builders ● March 2024 INDUSTRY News

Photo: NATDA

The Engineered Suspension Company THE RAR-266 TRAILER AIR SUSPENSION A fully integrated large diameter axle suspension system with the optimum balance of weight and performance makes the RAR-266 the better choice for a large range of applications. Delivering a Smooth, Seamless Ride We’ve got you covered — smooth suspensions, fast lead times, and exceptional customer service. Spec Ridewell. Give us a call today at 800-641-4122 www.ridewellcorp.com © Copyright Ridewell Corporation. All rights reserved. Ridewell Suspensions is a registered trademark of Ridewell Corporation.

Clarience Technologies acquires Safe Fleet

“Clarience Technologies and Safe Fleet share a common mission of making transportation safer and smarter through technology,” said Brian Kupchella, chief executive officer of Clarience Technologies. “The acquisition of Safe Fleet provides our company with critical technologies, deep vocational segment expertise, and a portfolio of powerful and complementary safety products that support our vision to provide comprehensive solutions to a broader set of transportation customers around the world.”

The acquisition of Safe Fleet increases Clarience Technologies’ total workforce to over 4,000 employees at nearly 50 locations worldwide. Safe Fleet joins the Clarience Technologies team of companies, which includes Truck-Lite,

EnTrans, Drōv extend Tank Ai partnership

Engineered Transportation International (EnTrans) and Drōv Technologies recently extended their partnership on Tank Ai, an intelligent tank system available on Heil Trailer, Polar Tank, and Jarco products. The partners say the technology will be offered exclusively on new builds for these brands, as well as retrofits within the installed base.

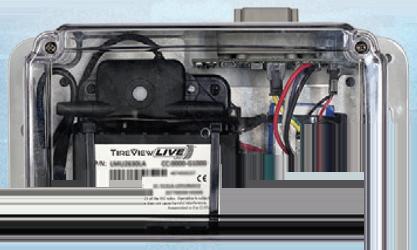

Tank Ai gives fleet managers and drivers a full view of the trailers’ systems, using sensors and equipment that provide real-time monitoring. The captured data is aggregated through Drōv’s AirBoxOne, the system’s central command. Fleets can use the information to enhance the safety, productivity, and uptime of their trailers, while also lowering maintenance costs, the companies said. Additionally, fleets can extend tire life by more than 50% with AirBoxOne’s proprietary automated

ECCO, Code 3, Pressure Systems International, DAVCO, Road Ready, Fleetilla, LED Autolamps, Rigid Industries, and Lumitec.

“Safe Fleet employees, customers, and partners will benefit from becoming a part of Clarience Technologies,” said John Knox, chairman and CEO of Safe Fleet. “We look forward to joining their team of companies, where together we will expand global reach, accelerate innovation, unlock new benefits for customers and strengthen our safety mission.”

The Safe Fleet product portfolio includes technology-enabled solutions for fleet video and evidence management, collision prevention, violation detection, and trailer temperature control, as well as cargo storage systems and several other safety solutions. Clarience Technologies will also have access to Safe Fleet’s network of service centers and affiliates across North America.

With Safe Fleet, Clarience Technologies strengthens its position in several industry segments, including school transportation, transit, fire and emergency, law enforcement, waste, industrial, and recreational vehicles. The acquisition also paves the way for cross-selling opportunities and increased innovation.

In particular, Clarience Technologies noted in a press release that the company’s acquisition will allow it to provide more complete solutions by connecting select complementary safety and visibility technologies through a common digital software platform, forming a digital ecosystem that advances safety and visibility.

UBS Investment Bank served as exclusive financial advisor to Clarience Technologies. Genstar Capital, BMO Capital Markets, and KKR Capital Markets served as capital markets advisors, and Weil and Gotshal & Manges LLP served as legal counsel.

tire inflation/deflation technology offered with Tank Ai.

“We are excited to extend our partnership with Drōv and continue to offer these advanced tank trailer technologies exclusively on Heil, Polar and Jarco products,” Jake Radish, EnTrans SVP and CCO, said in a news release. “TANK Ai is a perfect example of our proven innovation, performance, and safety-driven focus.”

With the extended partnership between EnTrans and Drōv, Tank Ai features will become available on all Heil, Polar, and Jarco product lines, and as a retrofit option on existing tank trailers. The offering adds value to new OEM customers and customers who have these technologies installed as aftermarket equipment at a certified dealer service center.

“We are proud to extend our exclusive partnership with the leading tank trailer manufacturer in North America and continue to bring new technology advancements to the tank trailer industry,” Drōv CEO Lisa Mullen said. “The integration of Drōv’s AirBoxOne Smart Trailer solutions into Tank Ai provides differentiated safety and operational efficiencies for tank trailer fleets.”

10 Trailer|Body Builders ● March 2024 INDUSTRY News

Photo: Safe Fleet

Photo: Drōv Technologies

Clarience Technologies acquired Safe Fleet, expanding the company’s capabilities in the safety, security, and productivity technology segment.

Actual product performance may vary depending upon vehicle configuration, operation, service and other factors. ©2024 Hendrickson USA, L.L.C. All Rights Reserved. All trademarks shown are owned by Hendrickson USA, L.L.C., or one of its affiliates, in one or more countries. Reduced Maintenance ZMD ® Shockless Ride Technology INTRAAX ® Lightweight, Durable Trailer Air Suspension System hendrickson-intl.com Optimizes Performance

Maverick, SKF, Road Ready partner to catch wheel-off events

No driver, commercial or otherwise, wants the experience of a tire freeing itself from their vehicle and bouncing away down the road.

To avoid such incidents, Maverick Transportation, which has about 2,400 flatbed trailers and specialty units, has turned to technology such as SKF’s TraX wheel end monitoring (WEM) system with Road Ready advanced trailer telematics.

“Wheel separation is a catastrophic failure that sends a wheel assembly rolling down a highway—and it’s incredibly dangerous,” said Mike Jeffress, vice president of Maintenance, Maverick Transportation. “With Road Ready and TraX, we caught this failing wheel bearing way ahead of true failure—and that’s a significant cost savings.”

The TraX WEM monitors wheel bearing vibrations to detect damage caused by raceway spalling, which is when a bearing begins to pit or flake. Cengiz Shevket, president of Vehicle Aftermarket Sales, North America at SKF, said that this kind

of damage occurs if a wheel bearing hasn’t been properly lubricated or has been poorly set.

Installed at the outboard side of the truck wheel, the TraX sensor can set a threshold for normal bearing vibration frequencies, and then provide a visual alert via LED lights if the bearing deviates from this threshold. The lights can display certain sequences for different wheel-bearing failures and sensor statuses, such as if the sensor’s battery is running low or if it detects a wheel-end temperature anomaly.

Additionally, the sensor’s vibration sensitivity can also be altered depending on a fleet’s environment and application, such as on well-paved highways for long-haul vehicles versus potentially rougher roads for waste applications.

More recently, Shevket explained that SKF has incorporated machine learning to help sensors establish a fleet’s baseline vibrations, and then adjust this baseline as the fleet travels.

“What we have really built in is new algorithms and connectivity,” he said. “The principle of wheel-end monitoring was with SKF for a long time, but it had limited usage and limited applications. But today, with the new algorithms, the sensor can be used in steer axles, drive axles, trailer axles, driven or non-driven, making its applications much, much broader.”

The TraX WEM is retrofittable, too, Shevket noted, and is affixed via wheel lugnuts. Maverick Transportation also reported on the installation’s simplicity.

“[It was] Seamless. Easiest telematic install to date,” said Kyle Mitchell, regional service manager, Maverick Transportation. “We used the app to pair the WEM with the trailer number and specific wheel-end location, mount, and then activated it with a magnet.”

Maverick Transportation uses TraX and Road Ready trailer telematics on 900 of their trailers and aims to expand their use to the entire fleet by the end of this year.

12 Trailer|Body Builders ● March 2024 4309 Erdman Ave., Baltimore, MD 21213 (410) 327-4500 • Fax: (410) 327-0241 sales@clendeninbrothers.com Clendenin Brothers, Inc. Manufacturers of Solid Aluminum and Stainless Steel Rivets for the Truck Trailer Industry. www.clendeninbrothers.com 2103TBB_Clendenin.indd 1 3/17/21 3:53 PM INDUSTRY News

DOT warns of potential ‘nurse tank’ failures

The Federal Motor Carrier Safety Administration and the Pipeline and Hazardous Materials Safety Administration recently issued a safety notice on the possibility of “catastrophic failure” of “nurse tanks,” or heavy duty trailers used to transport various types of hazardous materials and liquids.

The advisory pertains to nurse tanks manufactured by American Welding and Tank (AWT) at its Freemont, Ohio plant between Jan. 1, 2007, and Dec. 31, 2011, the agencies reported. AWT nurse tanks made from 2009 to 2010 were the subject of a prior FMCSA investigation in response to improper manufacturing procedures.

On Aug. 23, 2023, a 2009 AWT nurse tank containing anhydrous ammonia experienced a catastrophic failure in a farm co-op lot, resulting in the release of all product, FMCSA said. The failure caused the tank shell to “rocket” over 300 ft. from its original location. While no injuries were reported, the event is an indicator of potential continuing problems with AWT nurse tanks that now have been in service for over a decade.

As a result of the incident, the nurse tank’s owner contracted with a third-party testing company to examine their AWT tanks manufactured between 2008 and 2012. Radiographic testing showed seven of the eight nurse tanks tested had extreme stress corrosion cracking, porosity, and inclusions/voids in the welds where the heads and shells of the tanks were joined. Only the 2012 tank passed.

Based on the test results and the review by the experts, the owner voluntarily placed the nurse tanks out of service. The parent company of the farm co-op subsequently conducted similar radiographic testing on 142 AWT nurse tanks manufactured between 2007 and 2012, and 100 failed the test. All 2012 tanks passed. Agency recommendation Current Hazardous Materials Regulations (49 CFR Parts 171-180) don’t necessitate periodic inspection and testing of nurse tanks with attached American Society of Mechanical Engineers (ASME) identification plates that meet all requirements in 49 CFR §173.315(m)(1). The requirements

only apply when the ASME plate is missing or illegible.

However, FMCSA and PHMSA “strongly recommend” that owners of AWT nurse tanks manufactured between Jan. 1, 2007, and Dec. 31, 2011, periodically conduct visual inspections, thickness testing, and pressure testing.

The agencies further recommend

graphic or ultrasonic testing when

March 2024 ● TrailerBodyBuilders.com 13

OVERSEAS HARDWOODS COMPANY APITONG Not all is the same. We guarantee responsibly sourced Apitong. We offer custom manufacturing. We supply 100% Apitong - No mixed species. 1

We maintain significant inventories to protect customers from global disruptions. We develop innovative and cost-effective solutions for customers.

There’s a reason OHC IS THE LARGEST SUPPLIER OF APITONG for the OEM, Aftermarket, and Military trailer industries throughout North America. Contact us to learn how we can lower your per unit cost. 800.999.7616 | OHC.net | sales@ohc.net 2403TBB_OHC.indd 1 2/23/24 3:58 PM

Photo:

421828189 | Adobe Stock

2

3 4 5

radio-

pres-

possible.

sure testing isn’t

FMCSA renews MirrorEye camera exemption for five more years

The Federal Motor Carrier Safety Association recently renewed the exemption for Stoneridge’s MirrorEye camera monitor system for an additional five years. The exemption, originally granted in 2019, allows owners of MirrorEyeequipped trucks to remove the conventional rear-view mirrors and operate with an integrated system of cameras and digital displays.

“This exemption renewal reinforces the benefits of our MirrorEye system from both a fuel economy and safety perspective,” Jim Zizelman, Stoneridge president and CEO, said in a news release. “MirrorEye provides enhanced, real-time visibility from nearly every angle of a commercial truck, which can reduce the frequency and severity of accidents, especially when turning, during lane changes, and in close-corner maneuvers.

“In addition to its important safety benefits, MirrorEye-equipped trucks can achieve a 2-3% increase in fuel savings when traditional mirrors are removed, which translates to roughly 2.5 tons of CO2 reduction

annually per vehicle [in North America commercial vehicle applications].”

MirrorEye was the first camera monitor system to receive this exemption.

Since then, the company has partnered with more than 40 fleets in North America to equip the system on existing vehicles through retrofit applications, the company reported. In addition, MirrorEye

Polar King Mobile adds Denver area dealer to network

Polar King Mobile has made Jayhawk Trailers its newest authorized dealer. With this partnership, customers in the Denver metro area gain access to strong over-theroad cold storage solutions and expands Polar King’s footprint in Colorado.

has been integrated on multiple original equipment commercial truck and bus platforms in North America and Europe.

“During the last five years, we’ve worked closely with our fleet and OEM partners to validate the benefits of MirrorEye and make it the leading camera mirror system on the market today,” Zizelman concluded.

“Everyone at Polar King Mobile is pleased to partner with Jayhawk, which has a reputation that we believe matches the quality of our refrigerated trailers,” said Christian Aitken, Polar King Mobile EVP. “Being a fellow family-owned business, our mutual commitment to integrity and excellence fortifies our partnership.”

Polar King Mobile refrigerated and freezer trailers are designed and engineered for outdoor and over-the-road use. The units only require 110V (15 AMP) for power and can be attached to vehicles, including SUVs and pick-up trucks. However, Polar King Mobile does not sell its refrigerated units directly to the public.

“We are creating a national network of value-added resellers by recruiting the best trailer distributors from the North American Trailer Dealers Association,” Aitken explained.

14 Trailer|Body Builders ● March 2024 INDUSTRY News

Photo: Stoneridge

Photo: Polar King Mobile

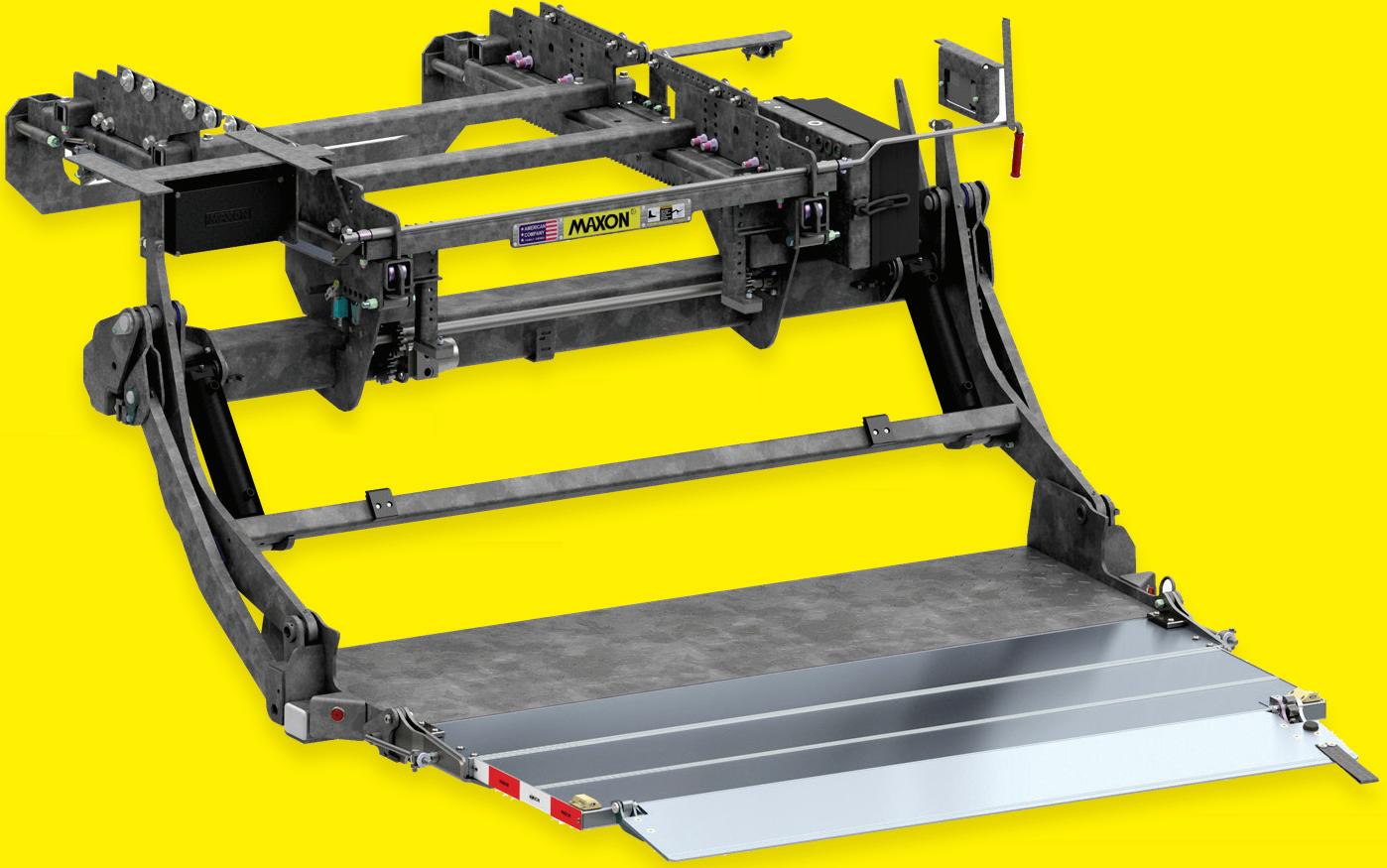

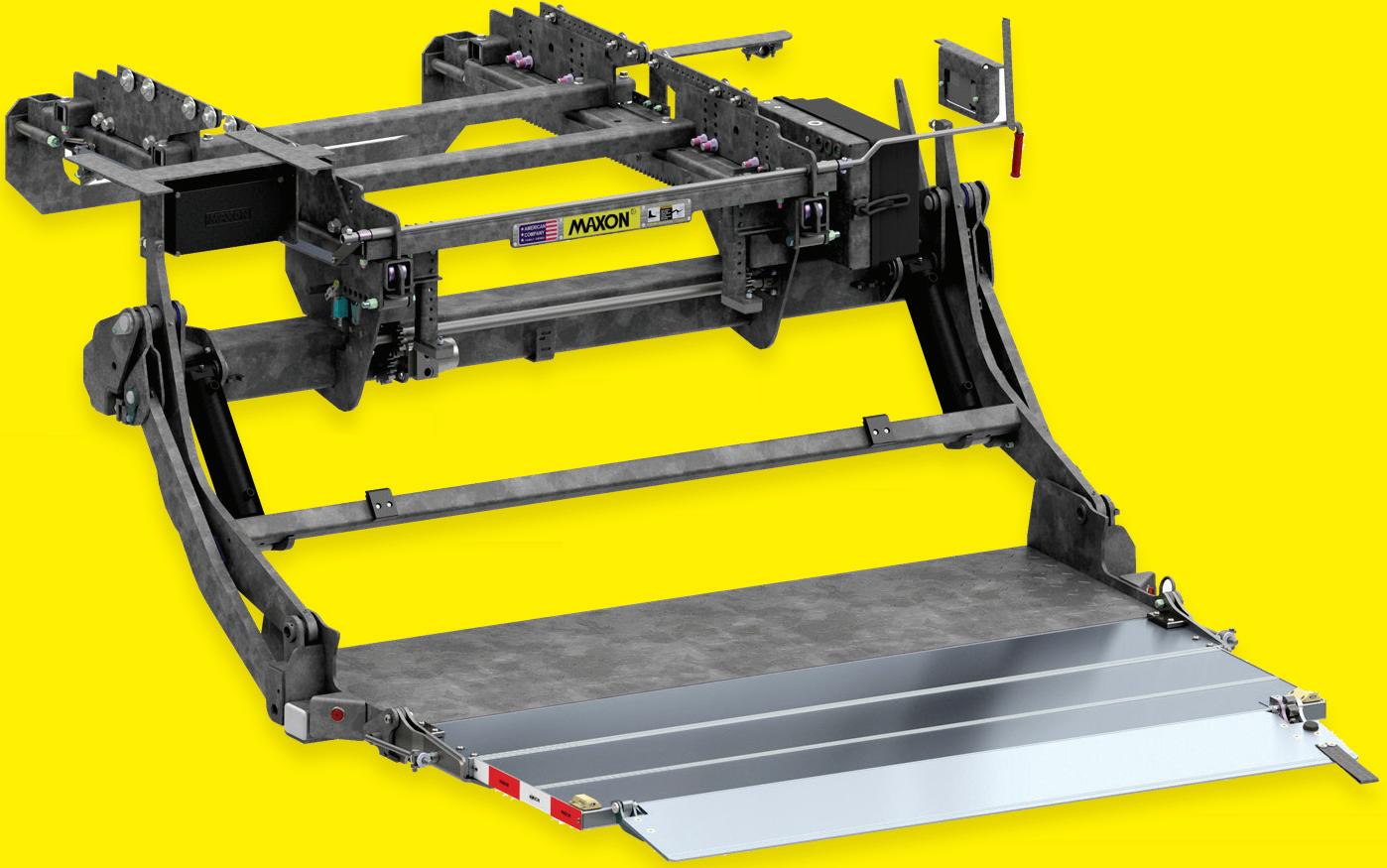

INDUSTRY-LEADING, LEVEL-RIDE SLIDELIFT® LIFTGATES IN ONE! 2

RA

Side door

Slidelift

GPSLR/ GPSLRT

Level-Ride

Slidelift for Trucks and Trailers

Revolutionize Your Deliveries with Maxon’s Dual Innovation!

Introducing the combined might of the GPSLR

Level Ride Slider and RA Side Door Slider in one revolutionary design. Now enjoy the best of both products with Maxon’s groundbreaking new series of level-ride Slidelifts.

Unmatched Durability and Performance

Step into the future of efficient delivery with the integrated prowess of the GPSLR Level Ride Slider and RA Side Door Slider. Merging the best features of both worlds, our new series of level-ride Slidelifts are designed to enhance your fleet’s performance with a seamless rack and pinion drive mechanism and a unified lifting system. The same robust power unit now comes standard in both models.

Advanced Technology for the Long Haul

Our newly engineered controller brings sophistication to your fingertips, offering built-in diagnostics and troubleshooting capabilities that ensure your deliveries run smoothly. With Maxon’s proprietary MAX ECU ® technology coming as a standard addition, rest assured that the lifespan of critical electrical components is significantly extended.

Introducing the GPSLRT

The launch also includes the first-ever truck version of the GPSLR – the GPSLRT, showcasing our commitment to innovation. Additionally, flashing platform lights now come standard to enhance visibility during operations. Each liftgate boasts a hot dip galvanized finish, ensuring years of corrosion-free service.

To learn how the dual power of Maxon’s latest liftgates can take your fleet to the next level, contact us at 800.227.4116 or visit www.maxonlift.com today!

WWW.MAXONLIFT.COM

Level-Ride

‘3 Dragons,’ ‘4 Bulls’ presenting at 2024 Vision Conference

“3 Dragons” and “4 Bulls” will take the stage at the 2024 MEMA Aftermarket Suppliers Vision Conference on April 10, 2024 in Dearborn, Michigan. The two sessions will highlight distinct vantage points on the automotive aftermarket and opportunities stemming from future technologies.

The “3 Dragons: Aftermarket Outlook” session returns in 2024 to feature a 360-degree view of the aftermarket through the lens of an economic expert, Wall Street professional, and seasoned aftermarket analyst. The session’s three dragons diving into prevailing trends will be:

• Elizabeth Clark – team lead, Automotive Team, U.S. Department of Commerce

• Greg Melich – senior managing director, Evercore ISI

• Todd Campau – associate director, Aftermarket Solutions, S&P Global Mobility

New to this year’s Vision Conference will be “4 Bulls: Future Technologies = Future Opportunities,” a panel where four industry-leading companies share why they are bullish on growth opportunities created by emerging technologies. An expert panel will share concrete case studies and product examples as well as answer audience questions to illustrate why the technology shifts to ADAS and EVs have the potential to expand the aftermarket. The session’s four bulls will be:

• Tim Albritten – director of Business Development & Market Research, BG Products

• Rosa Meckseper – head of Business Area Smart Mobility Americas, Continental

• Dave Miller – vice president of Global Product Line Management, Gates Corporation

• Russ Stebbins – general manager, Global Aftermarket Business Unit, Sensata

The MEMA Aftermarket Suppliers Vision Conference will be held at The Henry Hotel in Dearborn. As a forum for aftermarket professionals to engage and learn current industry trends, the conference will feature presentations, breakout sessions, and networking. In line with the rapidly changing aftermarket landscape, the theme of this year’s conference is “The New Aftermarket: Embracing Change to Drive Growth.”

Childers Auto and Truck Parts joins Power Heavy Duty

Although only founded less than a year ago, Childers Auto and Truck Parts of Pikeville, Kentucky, is a new Power Heavy Duty member. The distributor and service provider is a subsidiary of Ken’s Towing & Service, and features a customer-first, solution-oriented business model.

“Our company, although young, has rapidly evolved this year to meet the needs of our customers,” said Ken Childers, president of Childers Auto and Truck Parts (and owner of the six-location towing business). “Joining Power Heavy Duty provides us access to the resources, support and opportunities that will help us grow our business and stay competitive in our markets,” Childers said.

a new 20,000-sq.-ft. facility on eight acres. Their new warehouse will include five service bays and additional space

ability to meet the full range of customer requirements.

The expansion is physical as well, with the company moving next month into

for its flywheel resurfacing and hydraulic hose fabrication operations. The investment, Childers said, will allow for continued growth and strengthen their

“Childers Auto and Truck Parts is really a jack of all trades, and they make a great addition to the Power Heavy Duty network,” said Jim Pennig, vice president of business development for the VIPAR Heavy Duty Family of Companies.

“Not only are they well positioned for growth, but they’re equipped to fulfill the parts and service needs across nearly every segment – everything from long haul to construction, and from school bus to waste management – they serve a very diverse marketplace.”

The opportunities for Childers Auto and Truck Parts are many, and according to Childers, membership in Power Heavy Duty will help them take full advantage and be a complete resource for the Pikeville region.

16 Trailer|Body Builders ● March 2024 INDUSTRY News

Photo: MEMA: The Vehicle Suppliers Association

Ford opens orders for 2025 MY Police Interceptor Utility

Order banks are now open for the 2025 MY Ford Police Interceptor Utility (PIU), which is built to suit both patrol and pursuit duty cycles across the country with several new productivity and safety in-cab tool offerings.

New features for the 2025 MY PIU include a bigger center display with better imagery, graphics, and advanced OTA capabilities over the previous model year. It also features the Ford Pro Upfit Integration System (UIS), which simplifies the upfitting process while enabling added functionality and smart vehicle programming.

The vehicle also offers Manual Police Pursuit Mode, which is available in addition to the Automatic Pursuit Mode

present in previous models. Manual Police Pursuit Mode enhances drivability and power delivery in situations between regular driving and intense pursuits, such as passing through tight traffic in congested areas. As well as this, the 2025 Ford Police Interceptor Utility also has the same frontend build of previous models, including the grille, so police agencies can avoid extra expenses when transitioning frontend upfitting content to new vehicles as they decommission older models.

Additional safety features

To increase officer safety while on the road, the updated PIU offers several safety and productivity features as standard. These include Police Perimeter Alerts,

Range Energy to invest $23.5 million for electric trailers

Range Energy received $23.5 million in new funding led by Phillip Sarofim’s Trousdale Ventures, with participation from UP.Partners, R7, and Yamaha Motor Ventures. Range will use this fresh capital to accelerate its work on customer pilot programs to advance full-scale production of its electric powered trailers. In addition, Range will invest resources towards the initial development of its trailer data and telematics platform to bring unique insights to customers and further enhance the company’s growing technology portfolio. This additional financing brings Range’s total funding to $31.5 million inclusive of the company’s $8 million seed financing.

“Commercial-led innovation is material for achieving the electrification of on-road transportation,” said Ali Javidan, CEO

and founder, Range Energy. “Range is poised to ensure commercial fleets are able to adopt and transition to electric with speed and ease and our investors are committed to helping get our trailers into the hands of fleet owners, and quickly.”

Range’s electric trailers can hook up to any of today’s diesel-powered trucks to immediately improve fuel economy by 36.3%, the company stated.

The financing comes on the heels of other Range milestones, including the development and debut of its first powered 53’ dry van, becoming the first trailer electrification platform eligible for California’s Clear Off-Road Equipment (CORE) voucher incentive project, and launching its Dealer Advisory Council with top commercial OEM dealers.

which detect moving threats around a vehicle to give officers better situational awareness while they complete tasks in the cab, such as filling out reports. When the system detects a moving threat, it automatically activates the rear camera, sounds a chime, rolls up any lowered windows, and locks the doors. The Police Engine Idle feature secures the vehicle like the Perimeter Alerts function but keeps vital systems and equipment running with anti-theft keyless engine idling when officers must exit the vehicle quickly.

When officers need to remain undetected, such as during a stakeout, the Police Dark Car feature turns off all interior lights in the vehicle except the drive console, which is dimmed. Courtesy lamps are also disabled when any door is opened.

For additional safety, the 2025 MY PIU also includes driver assist technology such as automatic emergency braking, BLIS (Blind Spot Monitoring with Cross-traffic Alert), reverse sensing, and cross-traffic brake assist. All of these come standard on the vehicle, along with new radar on the fascia.

For more information, please visit www.ford.com

“Range is at the forefront of broad electric equipment adoption and the overall electrification of on-road transportation,” said Hinrich J. Woebcken, general partner at Trousdale Ventures and former president and CEO of Volkswagen Group of America. “We believe in the company’s mission to make towing cleaner, safer, and more efficient and are excited to have skin in the game.”

March 2024 ● TrailerBodyBuilders.com 17

NEW on Wheels

Photo: Ford Pro

Photo: Range Energy

Tale of the tank

EnTrans revitalizes vintage vehicle

By Jason McDaniel

CIUDAD JUÁREZ,

Mexico—Oh the tales this tank would tell, if only tanks could talk.

Thankfully, Engineered Transportation International’s newly restored vintage tank wagon doesn’t need a voice to deliver a powerful message to customers who cross the U.S.-Mexico border from El Paso, Texas, to visit this Heil Trailer and Polar Tank plant—the most prolific tank trailer production facility on the continent.

“It combines the old and the new,” EnTrans CEO Ryan Rockafellow said. “It highlights our heritage, it’s something employees can be proud of, and customers will understand when they come through that we’ve been doing this a long time. Then fast forward to 2024, with where we’re at right

now, introducing TANK Ai and developing new trailer lines, and they’re walking into the largest and best tank trailer plant in North America.

“We truly believe this vehicle ties it all together.”

The first customer to visit the expansive, 425,000-sq.-ft. facility after EnTrans uncovered the antique vehicle on Feb. 27—in a ceremony for Mexican officials and other special guests—was duly impressed.

“It’s amazing to see a trailer like that, fully restored, from the late 1930s,” said Jon Sarrazin, president of Quest Liner and Foodliner Mexico, whose team travelled here to discuss their equipment needs. “It’s like going back in time when you see it. So anytime you get to appreciate an antique like that, which ties into the history of the company, the business, and

18 Trailer|Body Builders ● March 2024 FEATURED BUILD | EnTrans

“We didn’t really have the full appreciation for it, or really understand what we had done, until it was totally finished,” Lemon said in a 42-minute-long documentary video played on loop during the unveiling and factory tour.

“To be honest, I’m [still] somewhat dazed, and kind of in shock, as to how it looks now.”

‘A piece of history’

Shell-Mex BP (British Petroleum), a joint venture between Shell and a Mexican oil company, commissioned the vintage vehicle in 1937. Thompson Brothers built and mounted the 500-gallon, two-compartment tank on an Albion ELP615 truck chassis at its factory in Bilston, West Midlands, England.

The tanker was designed to deliver petroleum in the London area—and often brought fuel to Buckingham Palace, according to EnTrans.

Heil acquired the vehicle when it purchased the ThompsonCarmichael plant in 1998.

“That’s a piece of history down there,” Rockafellow insisted from an office overlooking the lobby-turned-showroom floor.

It is now. But it was a discarded piece of rusted-out junk when Johnson discovered it in an outside storeroom at EnTrans’ headquarters in Athens, Tennessee, where the vehicle sat neglected for 20 years after Heil closed its U.K. facility in 2002.

Johnson, who previously led a project to restore Heil founder Julius Heil’s desk, alerted Rockafellow, who tasked Johnson with restoring the tanker.

After a prolonged search, Johnson selected ColorKraft, which cautiously agreed to accept the challenge. The rest is recent history. And the result is an awe-inspiring restoration that fully reflects the trailer manufacturer’s 123-year-old legacy in one vehicle.

“Clearly the technology has come a long way, and the overall size of the tank has changed significantly, but in our industry, the tank trailer industry, fleets take pride in what they haul behind their truck, and it’s interesting that it was no different way back in the 1930s,” Rockafellow said.

the industry overall, it’s great. It’s a really cool preservation of history.”

The reveal was the culmination of an all-consuming effort spearheaded by Jarrod Johnson, EnTrans marketing director, to rescue, revitalize, and repurpose the classic tanker as a show-stopping piece with help from ColorKraft Auto Refinishers in Columbia, Tennessee, one of the top vehicle restoration companies in North America, along with the assistance of Josh Lemon, ColorKraft founder and managing partner, who spent more than a year on the most complex project of his career.

March 2024 ● TrailerBodyBuilders.com 19

Shell-Mex BP (British Petroleum), a joint venture between Shell and a Mexican oil company, commissioned the vintage vehicle in 1937.

Photo: Jason McDaniel | TBB

Mexican officials and other invited guests filled the Juarez facility lobby for the dramatic unveiling.

Photo: Jason McDaniel | TBB

Now EnTrans proudly displays the tanker at its flagship factory in a fitting, full-circle finish.

“It looks awesome,” EnTrans CCO Jake Radish enthused. “It absolutely appears original, but it’s also brand new. A lot of detail went into the truck, just like a lot of detail goes into everything we do every day on that plant floor—and that’s the point.”

A painstaking process

Lemon and his apprentice, Daniel Heffelfinger, spent countless hours bringing the truck back to life, starting with the tank, which they removed, attached to a custom stand, and

then sand-blasted to reveal the bare metal. “We found the whole bottom of the unit had holes in it, incredible amounts of body filler, and tons of paint,” Lemon said. “So as soon as we got it stripped, we went, ‘Uh oh, this is going to be an enormous amount of work.’”

First, they sealed the tank with a corrosion-resistant epoxy primer. Then they smoothed the side seams and endcap welds with filler, shaved it for a uniform profile, and applied three coats of red paint for like-new coverage and gloss. Lemon’s team also restored internal tank components and much of the truck’s hardware, including “thousands” of fasteners and 40 bolts with thread pitches and head sizes that no longer exist.

“A hundred years ago, there was no major manufacturing, so everything I took apart was designed specifically to go back where it came from,” Heffelfinger said. “That was the best part of working on this tanker project.”

Equal amounts of time and energy went into renewing the truck body, window frames, and chassis, which was coated with a powerful rust inhibitor, POR-15, in satin black. ColorKraft also restored the wheels without removing the original tires—which still hold air—and carefully preserved the “centerpiece” radiator with a red Albion logo. Then Lemon painstakingly recreated the gold-leaf lettering using an electro pounce machine to make chalk outlines on the tank in a task that took 72 hours and reapplied the highly detailed royal crests on both doors with tiny brushes and magnifying glasses. “It was an incredibly long process,” he said.

20 Trailer|Body Builders ● March 2024 FEATURED BUILD | EnTrans

Josh Lemon, ColorKraft founder and managing partner

Photo: EnTrans

EnTrans executives and Mexican officials stand with the tank wagon.

Photo: Jason McDaniel | TBB

Lemon phoned a friend for the cushions with cross-diamond green stitching that replaced the old horsehair-filled seat and back pads, providing a “tremendous amount of character” in the cab, which features a wood panel with brass instruments and a black box covering a four-cylinder flathead engine. “It’s incredibly close to my heart,” Lemon said. “This is the largest project I’ve ever been involved with.”

An atypical tanker

Relocating the finished vehicle to Juarez was another massive endeavor.

“I wanted a trucking company to pick it up in Columbia and drive it all the way to Juarez,” Johnson explained. “That was my big idea, but it didn’t pan out that way.”

Instead, one company hauled the tank wagon to the PSC

March 2024 ● TrailerBodyBuilders.com 21 The Secure Solution for Cargo Control Cargo Securement Curtainside Solutions Decking Solutions Heavy-duty cargo control products for flatbed trailers and interior vans. Provides safety and reliability for fleets and drivers. Offering fast access to freight, optimizing delivery times, and minimizing driver injury. Boost trailer load capacity and optimize space with less equipment and fewer drivers. Discover all Kinedyne Products Kinedyne .com We’ve been holding it down since 1968. 2403TBB_Kinedyne.indd 1 2/22/24 2:36 PM

Sand-blasting the tank to the bare metal revealed numerous rusted-out holes.

Photo: EnTrans

The original wood-grain dash with brass instruments.

Photo: Jason McDaniel | TBB

yard in New Horizon, Texas, just outside El Paso, and a second company with the proper authorization transported it to Mexico after two weeks of searching and securing permission from Mexican authorities. A Conestoga trailer protected the

vehicle on both legs of the trip, and EnTrans added extra security for its final journey. “An armed guard followed the tanker across the border, and another armed guard escorted it here,” Johnson said.

German Performance Options, ColorKraft’s sister shop in Nashville, made the truck run again, and EnTrans disassembled the front lobby for Johnson to drive it in—with some muscle since it’s a heavy vehicle with no power steering.

“When I first took it out to drive, I didn’t know it would be as rough as it was,” Lemon said. “It’s like driving something with straight axles and no suspension. What’s crazy is the driving position you’re in is such a foreign position to all other types of vehicles we have today.”

You’ll have to visit a foreign country to see this tanker. It’s in a class by itself—a showstopper, for sure. But it’s unlikely to trek back across the border to tour any U.S. shows.

“It really is here to stay,” Rockafellow said. TBB

22 Trailer|Body Builders ● March 2024 FEATURED BUILD | EnTrans www.MACTrailer.com Follow us on INNOVATION, DELIVERING DRIVING QUALITY Visit us at the Mid-America Trucking Show in Louisville, KY March 21-23 Booth #32125 2403TBB_MACTrailer.indd 1 2/12/24 8:38 AM

The vintage tank wagon before restoration. Photo: EnTrans

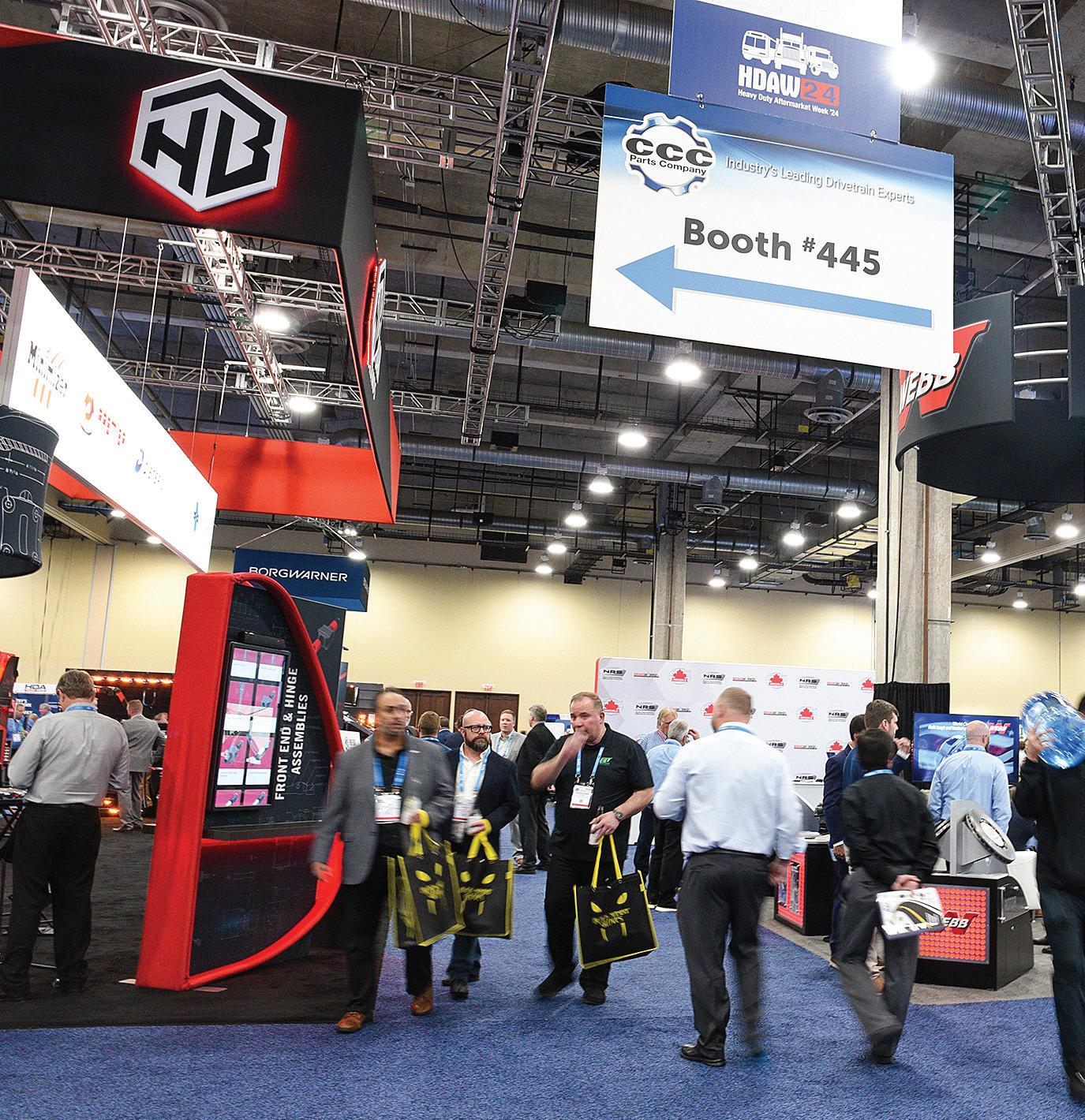

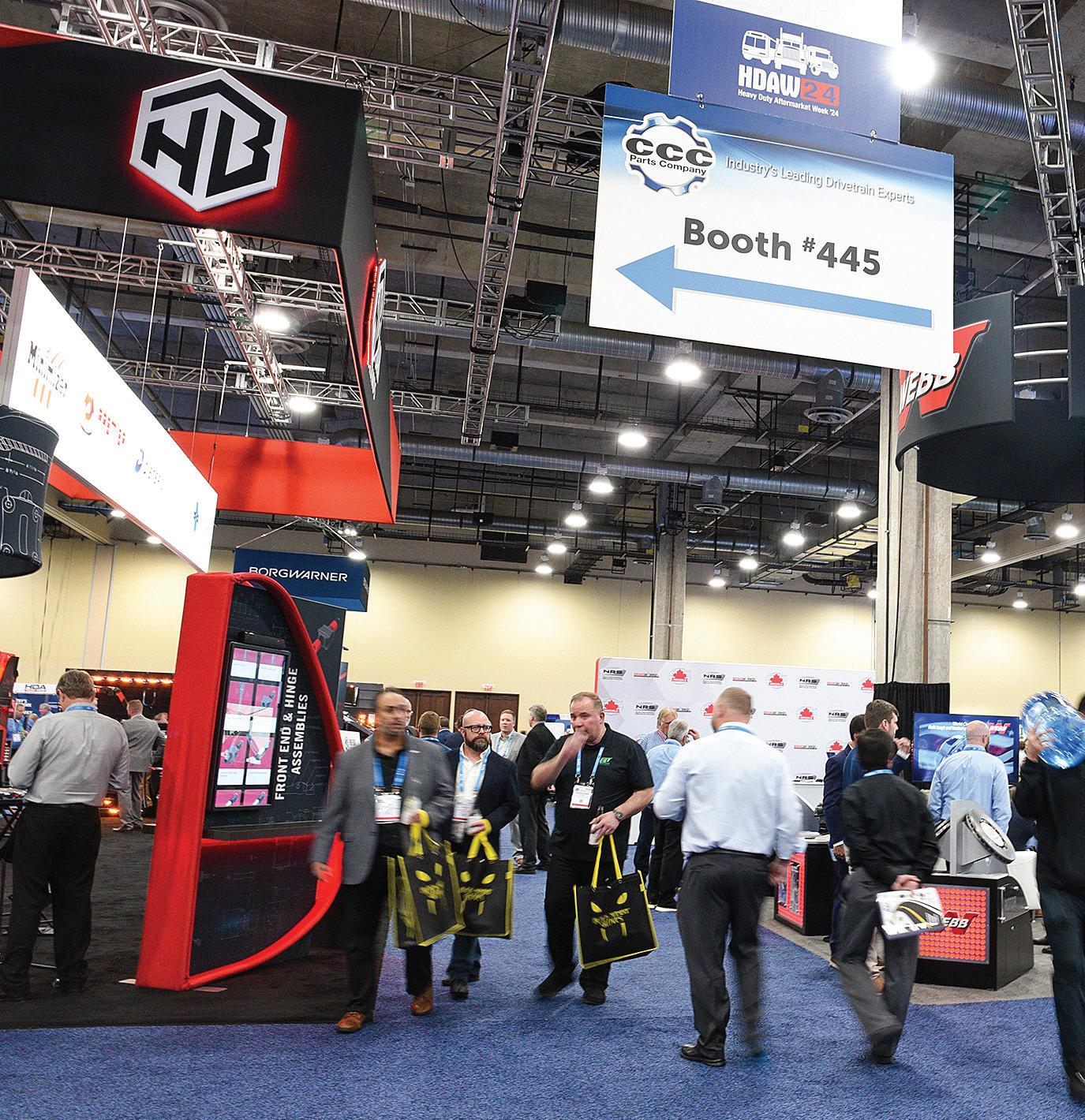

HDAW 2024 set records in Texas

There was a whole lot of dealmaking going on in meeting rooms and on the floor at the MEMA show

By Alex Keenan, Kevin Jones

GRAPEVINE, Texas—Heavy Duty Aftermarket Week wrapped its 2024 event here by rewriting the record book. Over four days at the Gaylord Texan Resort & Convention Center, HDAW’24 brought together more than 2,900 executives and managers from various industry sectors, including distributors, suppliers, and service providers.

Themed “Fully Equipped,” HDAW’24 embraced the industry’s forward-thinking perspective during a significant digital shift. The event achieved 11.8% growth in overall attendance over 2023, and the sold-out show floor, hosting 330 exhibitors, underscored the industry’s dedication to leading in a swiftly

evolving business landscape. Notably, 47 first-time exhibitors attended as well, showcasing the industry’s expansion and commitment to innovation.

“The resounding success of HDAW’24, marked by substantial growth, underscores the resilience and forward-thinking spirit of heavy-duty aftermarket

professionals,” Michael Callison Jr., president and CEO at Midwest Wheel Companies and HDAW’24 co-chair, said. “It’s truly gratifying to see our commitment to innovation and collaboration reflected in the record-breaking numbers and vibrant atmosphere of this year’s event.”

HDAW’24 featured the industry’s largest One-on-One Business Meeting program, hosting nearly 2,000 meeting sessions scheduled across three days, with more distributors registered than suppliers. This marked a significant milestone of this popular program and fostered an environment for distributors and suppliers to engage in meaningful connections and seize deal-making opportunities.

“The continued interest and success of HDAW’s One-on-One Business Meeting program reflects the commitment of each of the 11 organizing associations to fostering impactful connections,” Nicole Oreskovic, VP of sales and marketing at Bendix Commercial Vehicle Systems and HDAW’24 supplier co-chair, said. “The sheer scale of the

24 Trailer|Body Builders ● March 2024 EVENT COVERAGE | HDAW

HDAW moved from its longtime Las Vegas location to the Gaylord Texan near DFW to provide easy access for industry representatives across North America.

Photo: Alex Keenan | TBB

meetings provided a unique platform for professionals to navigate opportunities and solidify strategic partnerships in our dynamic business landscape.”

Attendees also participated in many networking programs. The revamped Leaders of Tomorrow (LOT) program provided a platform for emerging professionals to connect and collaborate, fostering the industry’s next generation of leaders. The HDAWomen reception created a lively space for professionals to support women in the heavy-duty aftermarket industry to build meaningful connections, share insights, and discuss how to inspire confidence in younger generations. The Wednesday Night Lights Closing Reception at AT&T Stadium, home of the Dallas Cowboys, brought together industry professionals in a celebratory atmosphere, adding a rich and exciting dimension to HDAW’24.

The education program highlighted the critical elements that will shape the industry in the next three to five years

and actionable steps to secure its overall health and viability. Updates on topics included electrification, recruitment and retention, powertrain outlooks, and Right to Repair legislation.

Additionally, NFL Legend Cris Carter took the stage for a keynote address, wowing attendees with anecdotes from his storied career and drawing parallels with the challenges and triumphs in the heavy-duty aftermarket industry. Carter encouraged the audience to consistently work toward the best versions of themselves to make a positive impact on their businesses, families, and communities.

“HDAW is a great place to network, better understand your customers and competitors, and learn what your

company can do to more effectively interact with all of your stakeholder groups,” Cara Mitchell of BBB Industries said. “Others in the industry should take advantage of this week because it gives you a chance to see so many of your peers in one place and hear about things that are impacting the industry.”

When asked about the benefits of attending HDAW, Kevin Hopton of CBS Parts Limited called the event “a gamechanger” for anyone in the industry.

“Not only does it strengthen your connections with manufacturers, but it also opens doors to explore new product lines,” Hopton said. “It’s a crucial step in building and growing your business, fostering relationships that prove invaluable. I definitely recommend it.”

Planning for HDAW’25 is already well underway, with the event scheduled to take place January 20-23, 2025, once again in Grapevine, Texas. TBB

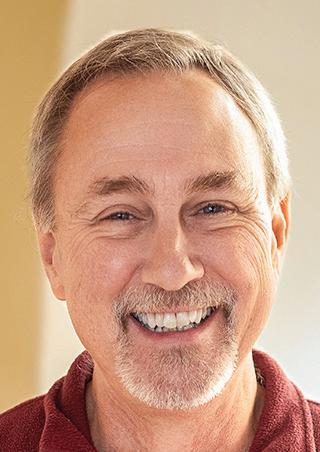

Cummins Meritor delves into positive progress at HDAW

It’s been almost one year since Cummins first acquired Meritor in August 2022, and Heavy Duty Aftermarket Week 2024 marked the second HDAW the company attended under its new organization. But while last year’s HDAW marked the first big show the two companies did together, and thus came with its fair share of anxiety and growing pains, now Cummins-Meritor leadership emphasized the positive progress of the integration, despite operating in an aftermarket environment fraught with supply chain difficulties.

Alan Rabadi, Cummins-Meritor’s global aftermarket leader, attributed this to the company’s careful approach to integration.

The first step in this methodical approach meant focusing on the “people side” of the business, including examining the company structure and helping employees make a smooth transition.

“We’ve got a good balance of what we call ‘Legacy Meritor, legacy company,’”

“We’ve been overall slow and methodical,” Rabadi emphasized. “And that was intentional. We didn’t want to rush anyone, we didn’t want to break anything. But at the same time, there’s a lot of uncertainty and a lot of change in the environment we’re in.”

March 2024 ● TrailerBodyBuilders.com 25

Nearly 50 first-timers were among the 330 exhibitors at this year’s HDAW.

Photo: Alex Keenan | TBB

Rabadi said. “We’re doing a good job of bringing the balance and perspective of both [Cummins and Meritor].”

This includes integrating Ken Hogan’s team, the current VP and GM of Cummins Meritor and former longtime executive for Meritor, and keeping an overall balance of legacy Cummins

and Meritor individuals throughout the transition.

The global aftermarket team worked the same way, as Cummins Meritor has worked to hire legacy Cummins employees alongside Meritor’s expert personnel. The result of this balance, according to Rabadi, has been a positive

customer response to the integration with few interruptions.

“The test I always give has been to ask our customers and our partners ‘How are you doing?’” Rabadi explained. “’How are you experiencing [the Meritor integration]? Are we causing any interruptions or any changes to your

28 Trailer|Body Builders ● March 2024 EVENT COVERAGE | HDAW DELIVERING THE HARDEST HEAVY-DUTY SOLUTIONS. ANYWHERE. EVERY WEEK. WHOLESALE DISTRUBUTOR OF AFTERMARKET PARTS WITH WEEKLY DELIVERIES AND NATIONWIDE COVERAGE. THE AUTHORIZED AFTERMARKET PARTS SUPPLIER FOR OEM MANUFACTURERS. NATIONWIDE COVERAGE. GRAND RAPIDS, MI - ATLANTA, GA - CHICAGO, IL - DALLAS, TX - MINNEAPOLIS, MN - PHILADELPHIA, PA - ONTARIO, CA - OAKLAND, CA YOUR SOURCE FOR GENUINE OEM REPLACEMENT PARTS VISIT OUR WEBSITE AN COMPANY 2403TBB_HintonTransportationInvestments.indd 1 2/21/24 10:56 AM

Alan Rabadi, global aftermarket leader for Cummins-Meritor, updates media at HDAW on the integration of the suppliers.

Photo: Kevin Jones | TBB

The primary hosts of Heavy Duty Aftermarket Dialogue 2024 gather onstage after the final presentation.

Photo: Alex Keenan | TBB

business?’ And for the most part, the answer has been no.”

Additionally, Cummins Meritor has been working behind the scenes to adapt the nitty-gritty systems that every business needs, such as HR and IT, to the acquisition. But overall, Rabadi noted that the company is on target, or even ahead of schedule, on achieving the synergetic goals they first announced when acquiring Meritor. These included growing Meritor’s core business, investing in technology and net-zero emissions, and generating annual pre-tax run-rate synergies of roughly $130 million from SG&A savings, supply chain operations and facilities, and operations.

Based on these initial acquisition targets, Cummins Meritor has another two years to achieve these goals.

In the meantime, the company is leveraging its combined expertise to continue growing its diesel-driven business and the transition to new powertrains. Rabadi explained that they were handling this by making Cummins Meritor one of Cummins’ five sub-businesses, specifically in the components division.

“If you think about Meritor previously as it existed before Cummins, 99% of that business sits within components, whether it’s the axle, brake, or driveline business, as well as the aftermarket business, that all sits within components,” Rabadi said. “Then there’s the new power piece, which

now we call Accelera. That is where the former Blue Horizon epowertrain component sits now.”

With this transition, Rabadi emphasized that Cummins Meritor brings together both the products and

technical expertise necessary for a fully integrated driveline, a natural step in the company’s growth from an engine provider to a system optimizer.

“We’re already seeing a lot of innovation between the teams, [including] product plans coming together for a next-generation product that we think will continue to lead in the market,” Rabadi concluded. TBB

March 2024 ● TrailerBodyBuilders.com 29 Components aluminum springs / spring assists w ath r stripping ladd rs / ladd r and luggag racks lighting / v nts ramps / flooring and Eliminate Freight Eliminate Freight www.theraynorcompany.com (229) 423 - 4966 Shipping Nationwid from Multipl Distribution Locations Accessories with Pool Freight Distribution 2403TBB_TheRaynorCo.indd 1 2/23/24 2:06 PM

Ann Wilson, EVP of government affairs, MEMA, greets “Bill” on his way to becoming a law during her talk on R2R legislation.

Photo: Alex Keenan | TBB

Truck market to remain ‘robust,’ Mack boss says

Relationships, collaboration with suppliers will drive performance in the future

Trucking is an industry in transition, and “partnership is the new leadership,” explained Jonathan Randall, Mack Trucks North America president, recalling pre-pandemic discussions with company executives—and nothing has changed since. Indeed, the pace of change has accelerated as new partnerships and technologies are developed.

“The transparency and the collaboration required to get us through the last four years is going to be even more important for the next decade and beyond, as the commercial vehicle industry changes at a pace that we haven’t seen,” Randall said, opening the Heavy Duty Aftermarket Dialogue presentations here ahead of HDAW. “The importance of our relationships with our suppliers will continue to grow— again, the transparency, collaboration, inclusiveness—in driving performance in the future.”

Randall noted that Volvo Group, Mack’s parent company, has invested an “unprecedented” $2 billion in its North American operations. And it’s not all going toward e-mobility and alternative fuel systems.

“Diesel is going to be here for a long while, as far as we’re concerned,” he said. “Obviously, we’re making the investments to continue to meet the industry requirements.”

Heavy-duty outlook

Of course, an audience of parts suppliers and distributors needs to know what to expect from truck manufacturers in the coming years, so Randall provided a market update. North American heavyduty truck production came in slightly above projections for 2023, finishing the year at 330,849 units, while the industry built 109,500 medium-duty units, also slightly above forecasts.

For 2024, the forecast calls for 290,000 heavy-duty trucks and 115,000 medium-duty trucks to be produced. Randall noted that a “big chunk” of the big-truck reduction would come from the long-haul segment after over-theroad fleets purchased new tractors at a high rate during the market boom.

On the other hand, he suggested that straight trucks likely will see their share of the Class 8 market grow in 2024, rising from 12% to 15-16%.

Day cabs, likewise, will continue to outperform historical norms, projected to come in at about 28% of the market.

“Pickup-and-delivery, hub-and-spoke businesses are still doing very well,” Randall said. “Our straight-truck order board is incredibly strong.”

Randall also noted that Mack dealers typically carry as much of a third of their inventory in stock trucks—but that changed during the market run-up.

“On the heavy-duty side, we haven’t had a truck on a dealer lot in the last

three years without a customer name on it,” he said. “Our orders now, 94% are coming in with customer names on them—we’re normally at 65 to 70%— so the market this year still remains incredibly robust, at least for Mack and in our core markets.”

While the Class 8 market was down somewhat from peak levels, the medium-duty segment continues to grow, according to Randall.

“I will tell you right now that we already see upward pressure on that forecast for the medium-duty segment,” he said, pointing out that the Mack MD6 and MD7 models, introduced in 2021, have already claimed 5% of the market. “We see ’24, ’25, ’26 as strong markets in the commercial Class 8 and Class 6-7. We’ll see what happens after we hit the ’27 emissions [regulations].

But for right now, when customers are buying and planning, they’ve got to plan on that on that three-year cycle.”

30 Trailer|Body Builders ● March 2024 EVENT COVERAGE | HDAW

Mack Trucks President Jonathan Randall emphasizes the importance of supplier relationships at HDAD.

Photo: Kevin Jones | TBB

ZF highlighted its range of aftermarket solutions at this year’s HDAW.

Photo: Alex Keenan | TBB

Evolving technology

While autonomy got a lot of attention three or four years ago, the focus has shifted more toward electrification, Randall explained. Still, electrification has “challenges.”

“We are seeing more adoption of the technology, but maybe at a slower pace than we anticipated,” he said. “The interesting thing about e-mobility is that we know the operations pretty well. We know what’s in front of us; we know the challenges, and we’re trying to develop the technology to achieve the routes that our customers are trying to get.

“We’re probably a long way from that one-for-one replacement, electric to diesel—that’s the holy grail. We’re not there yet, but as technology improves—as battery density improves—we should get there. The industry is making the investments; we can’t and won’t do it alone.”

Autonomy presents a different set of challenges, Randall continued.

“We know the benefits: efficiencies, sustainability, safety,” he said. “But understanding how it actually operates and fits, and within what applications, remains a bit of a challenge for us.”

While Mack is working on autonomous applications within “contained environments” that can be safely controlled, such as refuse transfer stations, the open road can’t be controlled similarly.

“We absolutely want to pursue autonomy, and we are,” Randall said. “However, again, it creates different, unique challenges that we’re facing.”

The third area critical to the trucking industry remains connectivity.

“You can argue that connectivity is not new. However, the benefits that come from it—what we’re able to share with our customers and how we’re able to help them run their business—continue to multiply,” Randall said. “When I started peddling trucks back in 1995, it was all about the truck: It was big, beautiful, bold; it was about horsepower, torque, gradability.

“But what’s changed through the years is the truck is now not the end; it’s a means to an end. It’s a piece of the equation that we need to be able to provide to our customers in order for them

to ultimately service their customers in the most efficient and profitable way they possibly can.”

To that end, Mack is increasingly focused on working with partners to develop solutions “to drive performance.”

“Whether it’s connectivity, whether it’s subscription contracts, whether it’s power by the hour or charging

customers for usage—[these are] things to take out of the purchase of the truck and bring in the purchase of a transportation solution,” Randall said. “This is an industry in transition: We all love our iron, but the iron is only a piece of the equation. In order to get where we need to go, we’re going to need to partner with suppliers who can help us achieve, ultimately, these goals.” TBB

March 2024 ● TrailerBodyBuilders.com 31 2402TBB_Waytek.indd 1 2/6/24 9:49 AM

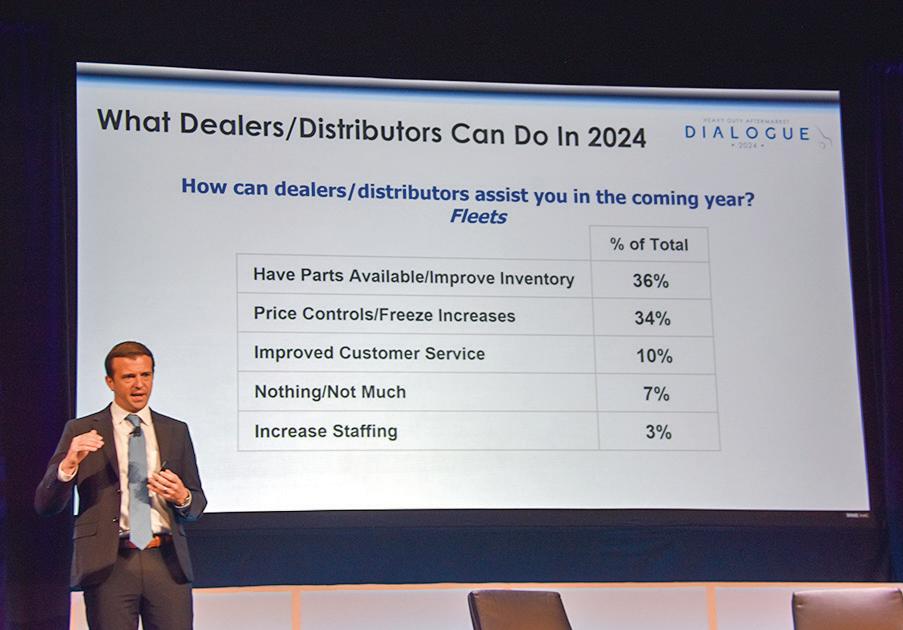

Industry to see eCommerce, Right to Repair changes in ‘24, aftermarket leaders say at HDAD

GRAPEVINE, Texas—Expect big changes to aftermarket part distribution and Right to Repair legislation, expert panelists at Heavy Duty Aftermarket Dialogue 2024 expressed.

On the parts ordering front, executives from distributors and fleet maintenance managers all emphasized that aftermarket distributors can no longer rely on brick-and-mortar shops to get parts into fleet hands. Instead, they will turn to digital catalogs, which will alter the typical role of parts counter personnel.

“We’re seeing more digital orders come into our branches,” said FleetPride President Mike Harris during the HDAD’s session entitled ‘Insights from Distributor CEOs.’ “Inside the workings of the branch and our distribution centers, we’re packaging and shipping a lot more products than we traditionally have. And so those roles within the branch will shift over time, maybe not [leading to] less people, but the roles themselves may have to adapt to accommodate for the increase in digital force.”

This necessity is partly fed by the generational shift taking place on shop floors and fleet counters, where younger workers increasingly expect to be able to find the components they need online.

Within the next 10 to 15 years, it will be critical for vendors to digitize all relevant parts data that will help customers find the right parts, according to Brad Fulkerson, president & CEO, Aurora Parts & Accessories, who joined Harris on the panel.

“And if you don’t do that, it’s going to be the equivalent of having 100 people that don’t tell the customer about your part,” he warned.

This means that parts distributors must have strong, easily accessible product data and images on their site, all so that fleet customers can locate what they need without struggling through the pages of a grainy parts catalog. Otherwise, “[fleets are] gonna buy a competitive part, regardless of whatever brand loyalty they might have had,” Fulkerson emphasized.

Fulkerson and Harris’ insights were confirmed during the final HDAD session, a fleet panel featuring Doug Arns, director of maintenance at Freymiller; Justin Olsen, Eastern regional maintenance manager, TCW; and Terry Wall,

32 Trailer|Body Builders ● March 2024 EVENT COVERAGE | HDAW

From left to right: Mike Harris, president, FleetPride Parts & Service; Tina Hubbard – president & CEO, HDA Truck Pride; Brad Fulkerson –president & CEO, Aurora Parts & Accessories.

Photo: Alex Keenan | TBB

From left to right: Terry Wall, sr. manager, Maintenance Technical Support – National Accounts, Ryder System, Inc.; Justin Olsen, Eastern regional maintenance manager, TCW; Doug Arns, director of maintenance, Freymiller; and moderator Molly MacKay Zacker, VP, Operations, MacKay & Company

Photo: Alex Keenan | TBB

1.877.630.7366 | safefleet.net YOUR SINGLE SOURCE FOR INDUSTRY-LEADING Trailer Safety Solutions. Trusted Fleet Safety Experts from our family of brands provide best-in-class commercial vehicle solutions, from Tarping Systems to Tractor-Trailer Wireless Camera Systems. Protecting payloads, operators, and other drivers on the road is the goal, and we welcome Vango Rolling Tarp Solutions as the latest Safe Fleet brand to join us on this mission. Automated Covering Solutions Automatic Tarping Solutions Safety Camera Systems Rolling Tarp Solutions Make Your Fleet Safer safefleet.net/trailer-safety

sr. manager, Maintenance Technical Support – National Accounts, at Ryder System, Inc.

“One of the things that drives where a part comes from around my shop is the ability of the parts person to take the VIN number, look it up, and then go to access it from one of two or three places around town,” Arns noted. “If an aftermarket part pops up and they’re able to see that in the web search, then that’s what we buy. But more often than not, they’re giving that VIN number to the counter guy at a dealer…That’s probably a good 50-60% of all the parts that we purchase.”

At the very least, this lays a clear path forward for aftermarket distributors, showing that if they want to work with fleets, their products need to be as accessible as possible. This availability, or lack thereof, came up throughout HDAD, despite improvements in parts supply since the pandemic.

“I believe the one thing that we’re still having issues with is hardware items like harnesses, fuel tanks, body parts, things like that,” Olsen explained. “I know in the past we had to rebuild some parts, it was to that point. We’re still rebuilding some of them.”

This is especially true with electronic components, which Olsen noted don’t last as long and aren’t available in the aftermarket. Arns chimed in to note that sluggish supply chains contribute to this as well.

“As an order item, [a harness] takes two, three weeks to arrive; those [delivery times] have still not eased up, and a lot of those items are still very difficult to access,” the Freymiller maintenance director said. “And some of them are still on allocation, you’ll call a dealer and they’ll say, ‘Hey, we only get one this week, we had to pick who we give it to.’”

Vehicle data and Right to Repair legislation

As well as ensuring that fleets have the parts that they need to succeed, HDAD also focused on how to ensure they have the necessary repair data as well, specifically by calling on attendees to support the federal Right to Equitable and

Professional Auto Industry Repair Act (REPAIR Act), H.R. 906, which is currently in Congress.

“We need to get this through the House of Representatives by July 1, at the very, very latest,” stated Ann Wilson, sr. VP, government affairs, MEMA, The Vehicle Suppliers Association during an afternoon session. “If we can’t... then we’re going to be looking at a bill that we’re going to have to consider next year, not this year.”

To do so, Wilson asked that the assembled distributors and suppliers participate in MEMA’s grassroots platform supporting the legislation, as well as take part in outreach regarding the law, hold district meetings, and provide feedback on the current bill through MEMA’s Tech Council.

Aftermarket distributors noted their interest in the legislation as well and the impact it could have on their, and fleets’, business.

“If Right to Repair doesn’t pass, that means a fleet can’t fix their own vehicles,” said Tina Hubbard, president and CEO of HDA Truck Pride. “You can’t decide where you want to take it; you’re forced to go to a dealer. So, do you want to tow your tractor trailer to the next closest town to have a dealership to work on it? Or do you want the independent service shop that’s right there in your base to be able to fix that vehicle?”

To take action locally, Hubbard explained how distributors and suppliers can help their representatives, whether senators or congresspeople, understand the importance of the industry and the REPAIR Act by inviting them to their facilities to explain their work and how many people they employ.

“We believe it’s really important to the industry that we maintain the access that’s there today for our customers, and also our own businesses and distributors, with service,” FleetPride’s Harris affirmed. “[It’s important] as technology evolves and things become more wireless and telematics expand, that we have similar access in the future that we do today to ensure affordability and accessibility for the customer.” TBB

34 Trailer|Body Builders ● March 2024 EVENT COVERAGE | HDAW

Mark Gottfredson, advisory partner, Bain & Co., provided HDAD attendees strategies for coping with uncertain times.

Photo: Kevin Jones | TBB

Travis Kokenes, research manager for MacKay & Co., provides the firm’s aftermarket analysis and outlook at HDAD.

Photo: Kevin Jones | TBB

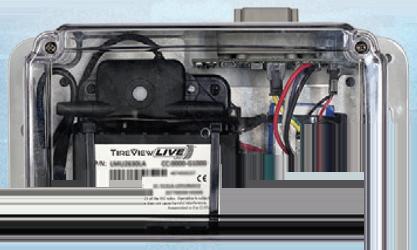

www.psitireinflation.com PRESS PLUGinstalled in wheel-end critical heat area 1 THERMAL CONDUCTOR WIRE LEAD - conducts heat signature to sensor 2 AXLE-MOUNTED SENSORtransmits signal to receiver, then to TireView LIVE portal 3 INTEGRATION TireView® LIVE™ supplies tire analytics to your existing Telematics Provider, so no additional logins needed. TireView LIVE can also stand alone with cost-effective plans . TIRE ANALYTICS AND MORE Customizable alerts and reports allow Fleets to make best decisions about tire management, wheel ends and critical systems . CLOUD ACCESS TireView LIVE™ allows commercial fleet operators to manage their equipment costs for trucks and trailers , online, in real-time , from any computer or device that is connected to the internet. NOW AVAILABLE (requires P.S.I. ATIS) REAL-TIME WHEEL-END TEMPERATURE › Full visibility of wheel-end temperatures in real-time via our TireView LIVE Portal or through one of our integration partners › Aids in identifying YOUR equipment’s normal wheelend operating temperature © 2023 Pressure Systems International, LLC. A Clarience Technologies Company. P.S.I. products are covered by one or more U.S. Patents: www.psitireinflation.com/ip TPMS TPMS TPMS ATIS PORTAL YOUR TELEMATICS PROVIDER SMART TRUCKS & TRAILERS NEED SMART TIRES, AND MORE.

Forecasting trucking’s next 30 years: ICE, EVs, and AVs

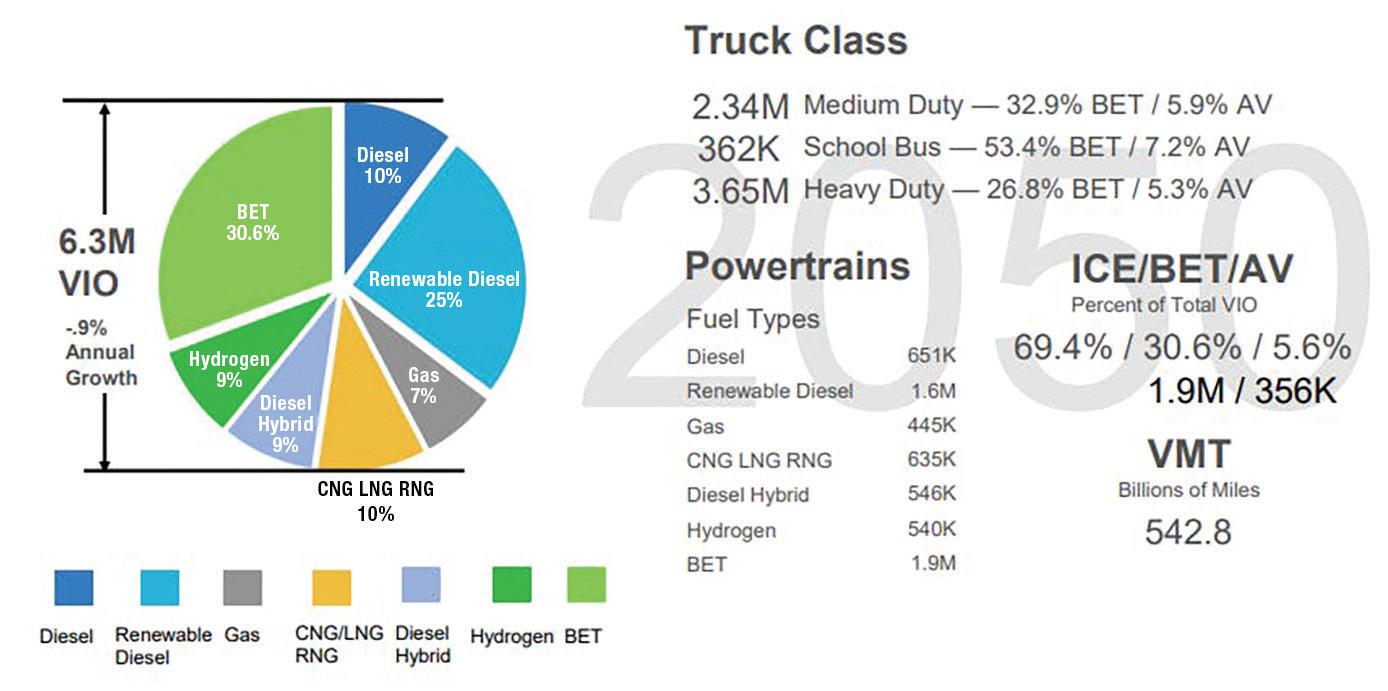

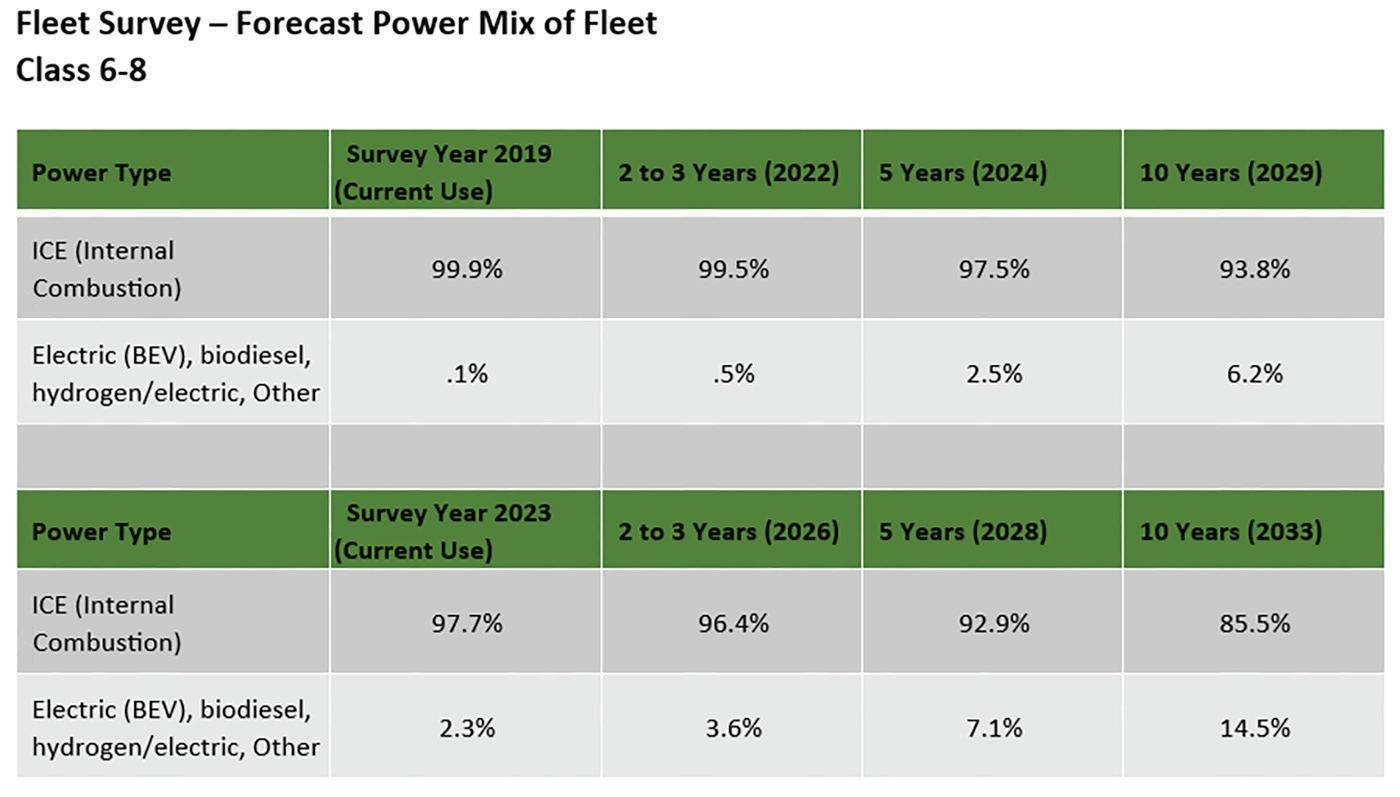

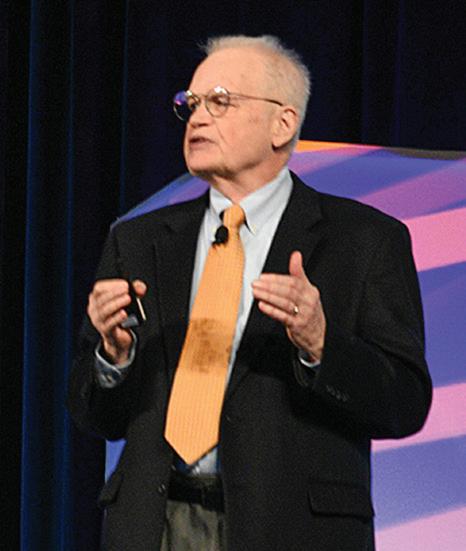

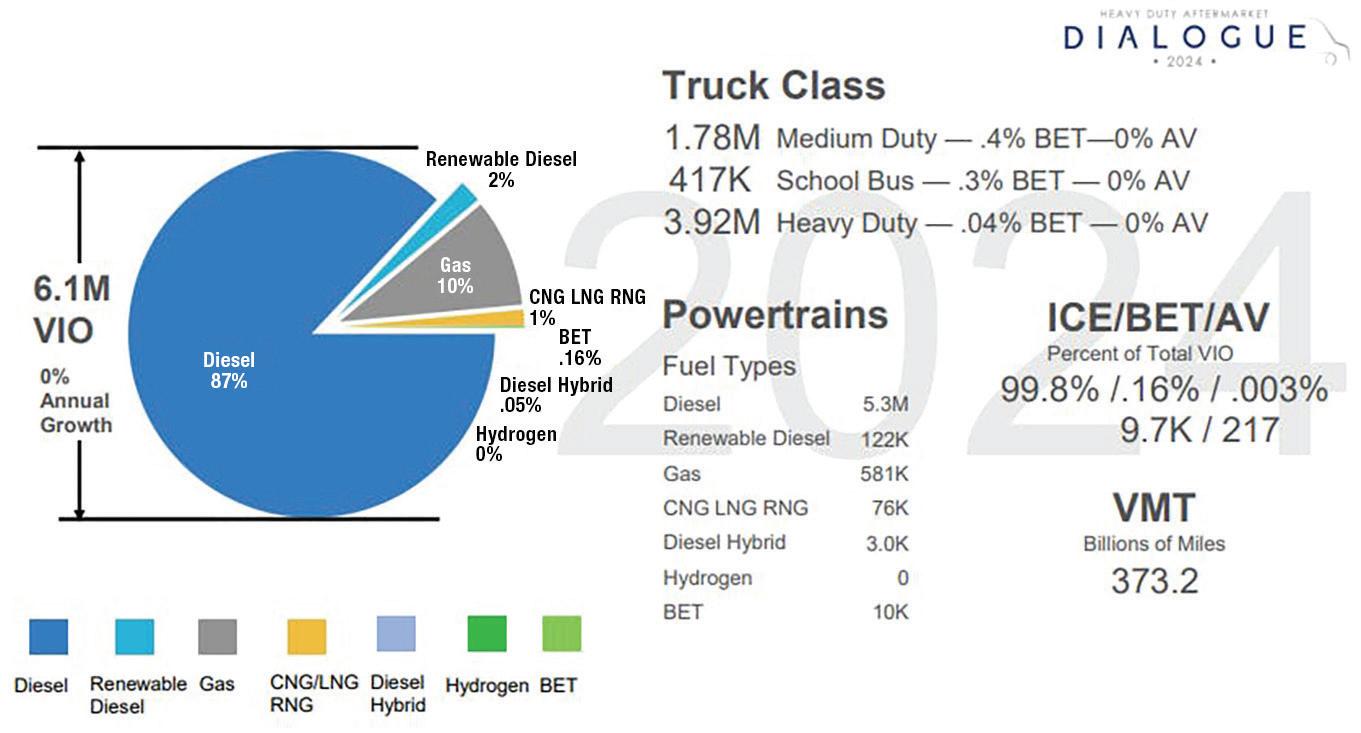

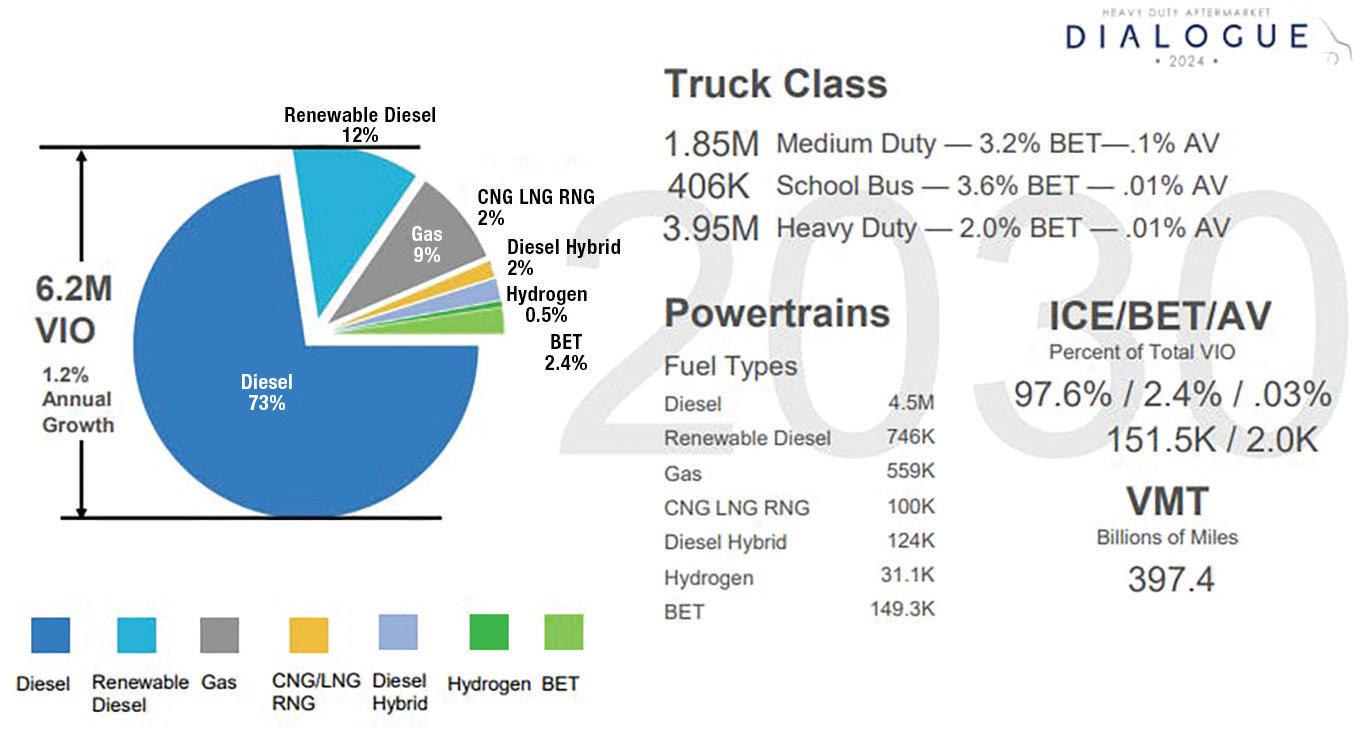

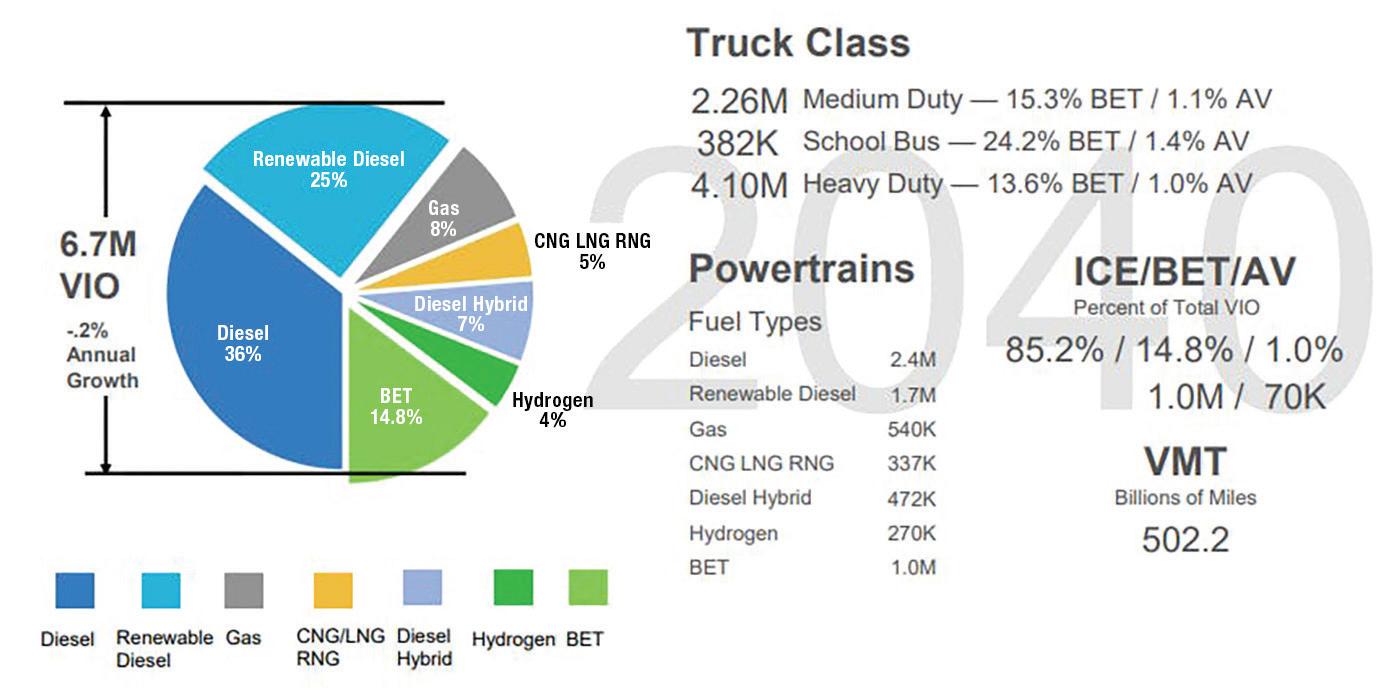

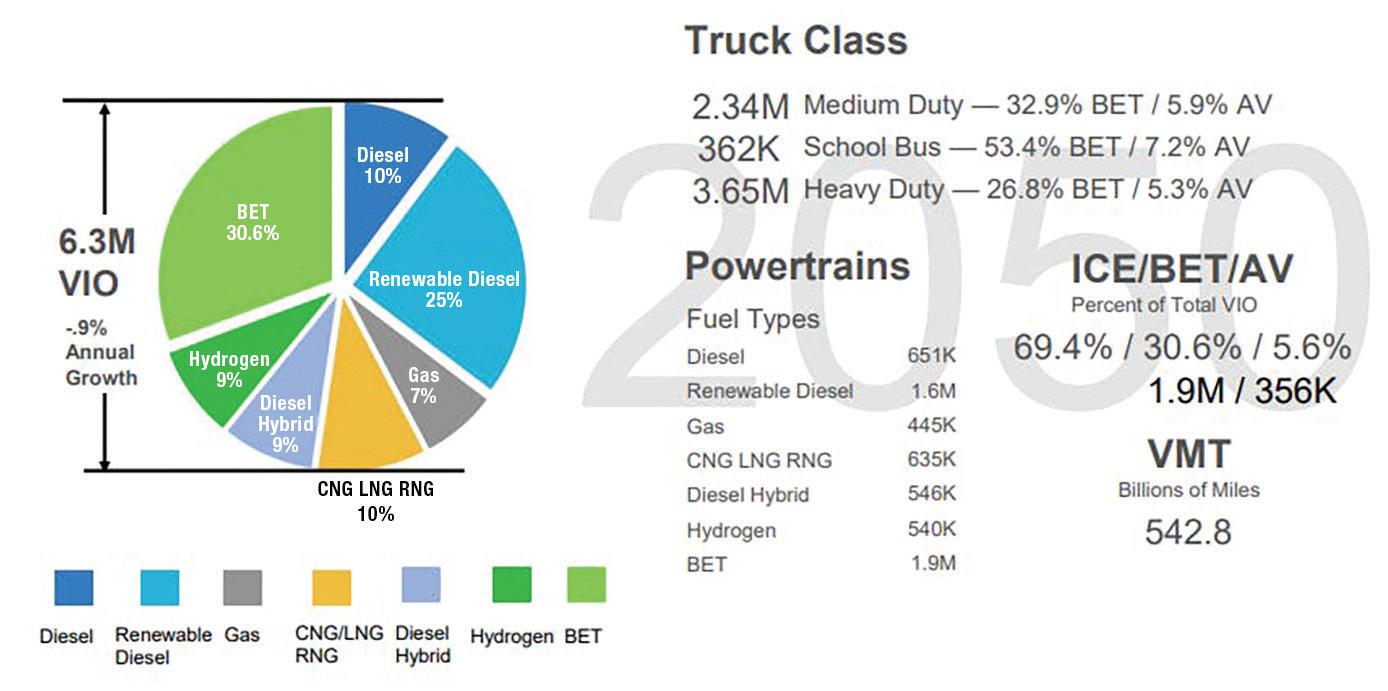

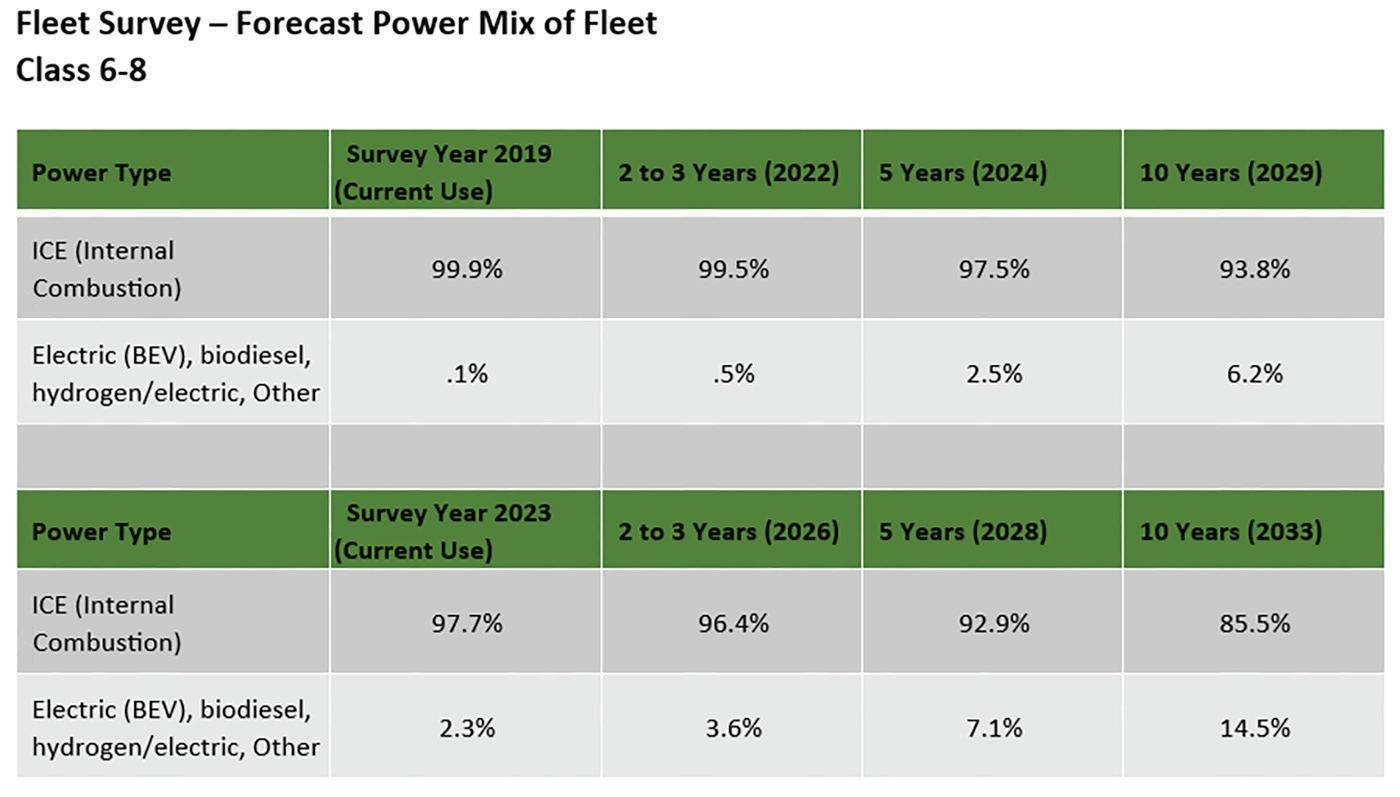

GRAPEVINE—On Jan. 22, Derek Kaufman, managing partner of Schwartz Advisors, took to the stage at Heavy Duty Aftermarket Dialogue at the Gaylord Texan Resort & Convention Center to offer the vehicle aftermarket consulting firm’s forecast for a mix of low-carbon or carbon-neutral fuels, near-tozero emissions fuels, internal combustion engines (ICE), and full battery-electric (BET) solutions.

“We understand that runs counter to the EPA and [California Air Resources Board], who are pushing primarily BET solutions,” Kaufman noted. “But we think it’s better representation of the technological reality of where we are today and therefore, a solid platform on which to build your parts and services.”

To do this, Kaufman broke his analysis into three time periods: present to 2030, 2030 to 2040, and beyond 2050. He included diesel, renewable diesel, gas, natural gases, diesel hybrids, hydrogen, and BET powertrains in his analysis of the medium-duty, heavyduty, and school bus sectors.

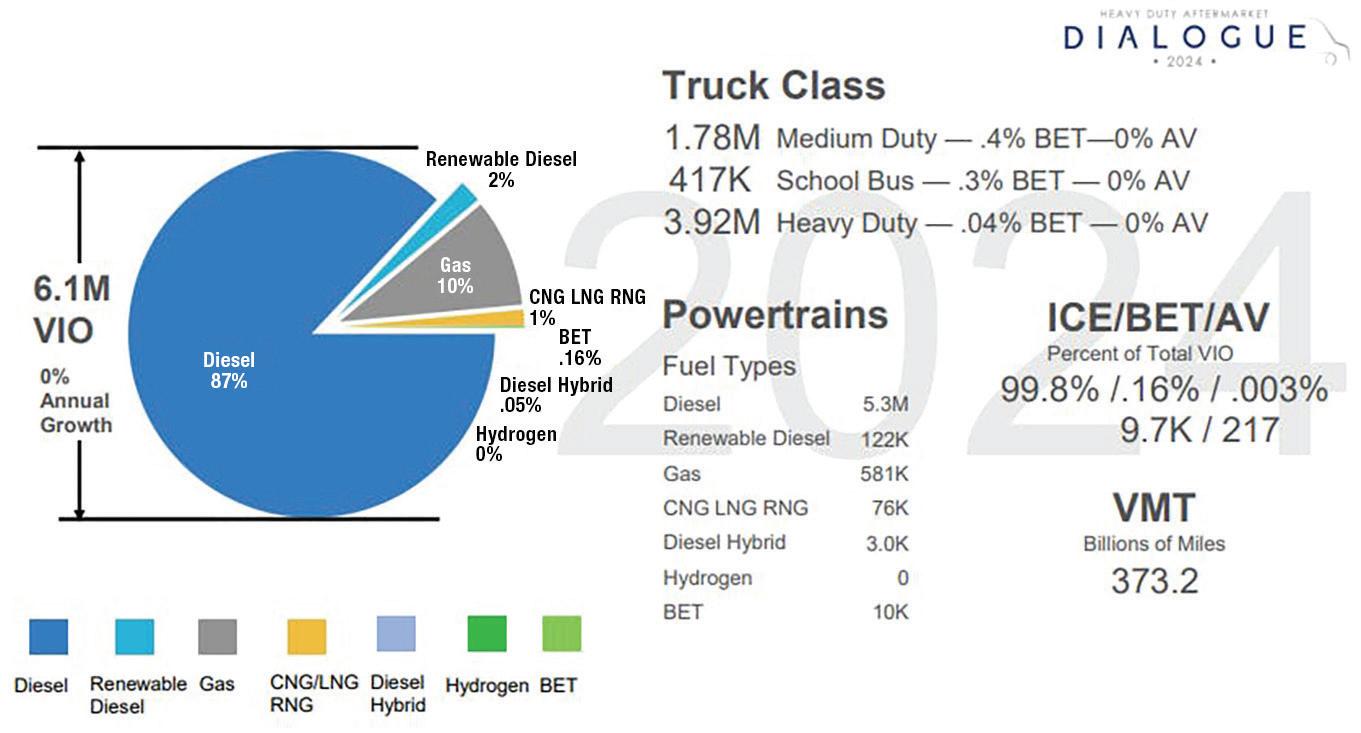

2024 to 2030: ICE still dominates

First, Kaufman established the current powertrains in operation going into 2024. Of the 6.1 million vehicles in operation (VIO) that Schwartz Advisors counted, 5.3 million were diesel and 581,000 gas.

Additionally, renewable fuel vehicles made up 2% of the overall assets and natural gas about 1%. Overall, ICE dominated the industry at 99.8% of the total VIO.

Meanwhile, the organization also found the amount of autonomous vehicles and BETs to be negligible going into 2024, with under 1% of school buses, medium-duty, and heavy-duty vehicles using battery-electric powertrains.

Kaufman noted that the lack of BETs could be due to how current regulations from CARB and the EPA outstrip infrastructure and manufacturer

capabilities to create these vehicles. The same is true for natural gas resources, with the U.S.’s renewable volume obligations below renewable refineries current capacity.

“We think the industry now pushes back,” Kaufman said. “[It] pushes back against the EPA, against CARB to say,

36 Trailer|Body Builders ● March 2024 EVENT COVERAGE | HDAW

Derek Kaufman discusses evolving truck tech. Photo: Alex Keenan | TBB

Charts: HDAD

‘Look, give renewables a chance to ramp here, to show that ICE can be a part of climate sustainability.’”

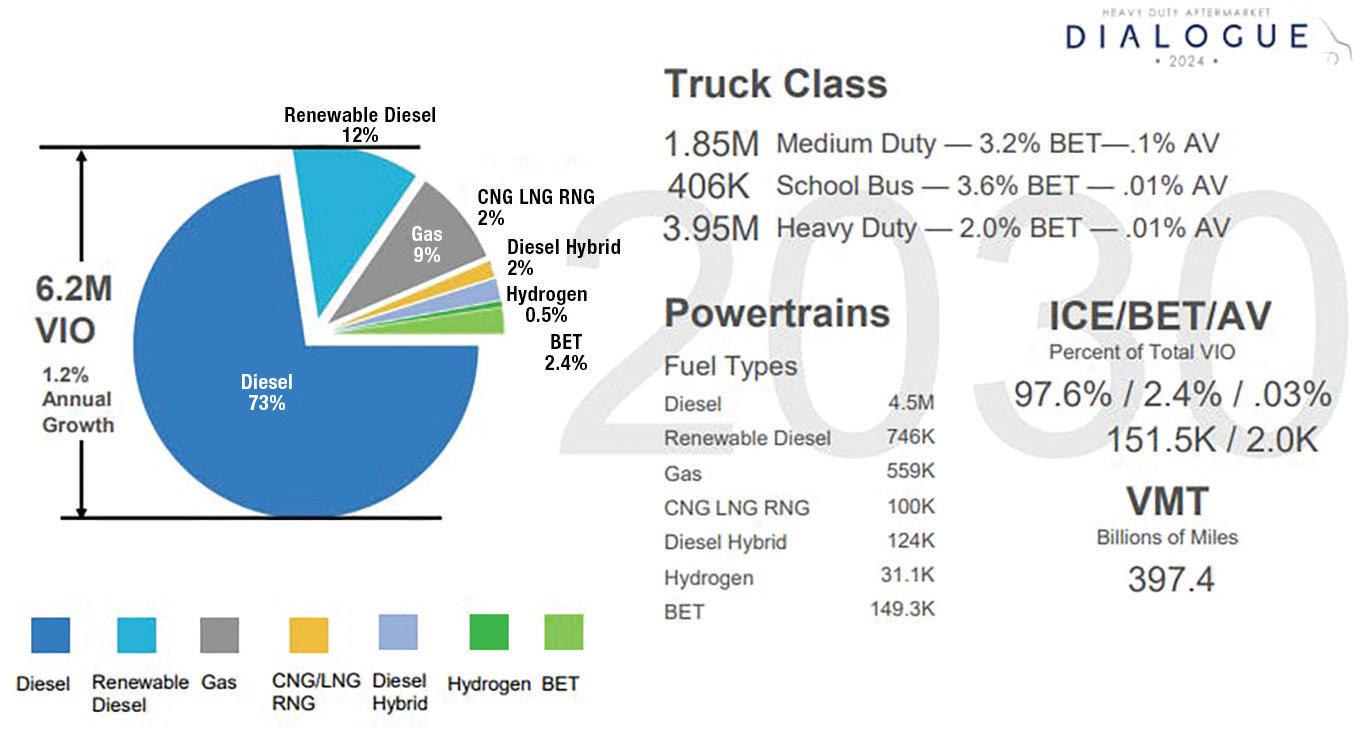

2030s: Shift to carbon neutrality

By the 2030’s, Kaufman anticipated that the VIO will grow to 6.2 million, with a decrease in diesel powertrains from 87% to 73%.

Meanwhile, gas vehicle powertrains are projected to remain consistent and renewable diesel will grow by 10%. By class, BETs will increase to 3.2% for MD and 2% for HD trucks, and 3.6% for school buses.