QUICK QSR LESSONS Innovation is critical for fresh menus

ILLICIT INDUSTRY Inside the illegal vape market

QUICK QSR LESSONS Innovation is critical for fresh menus

ILLICIT INDUSTRY Inside the illegal vape market

Insights from the 2025 NACS State of the Industry Summit guide retailers through uncertainty

Available now in over 78,000 stores.*

NJOY Daily® Disposable has received FDA authorization on both Menthol and Rich Tobacco varieties.

Stock your store, contact your wholesaler or call your Altria Group Distribution representative at 1.877.968.5323.

Available in 4.5% and 6% nicotine by weight strengths.

28

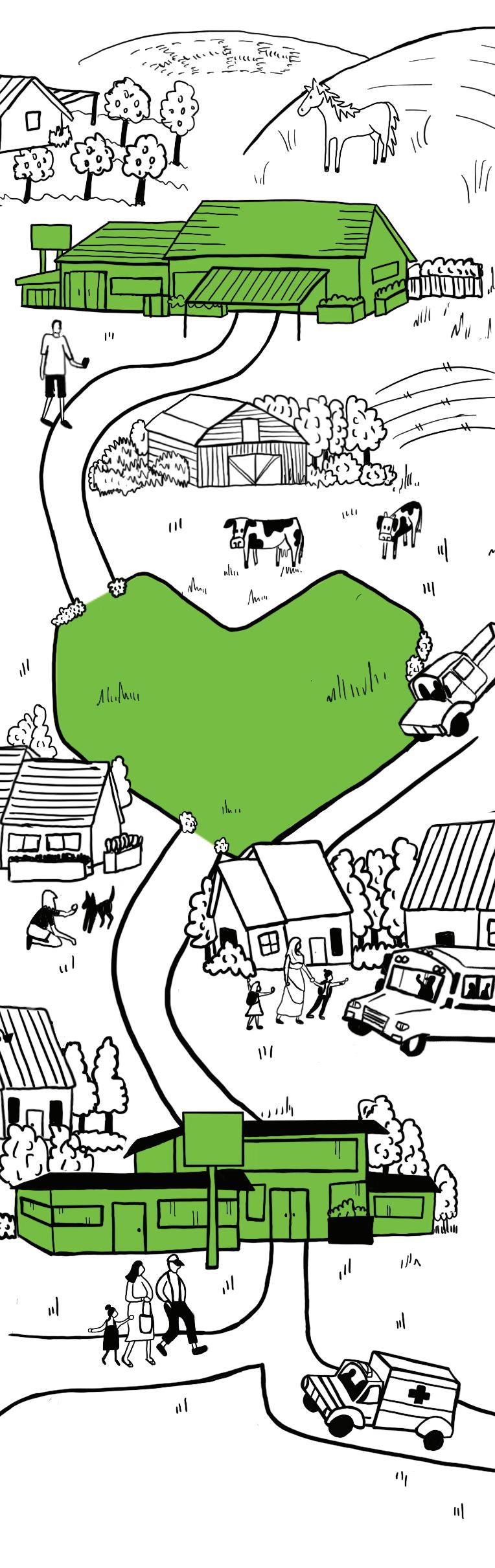

Fueling Local Communities

This article is brought to by Cenex.

Cenex helps retailers stand out by supporting local community needs.

46

Sluggish Start, Strong Finish

How did the industry perform in 2024?

58 Inside the Store

Key categories continue to shift, with foodservice and OTP in growth mode.

69

Keeping Up With the Fast-Moving Fuels Market

From how tariffs could impact gas margins to electric vehicle charging data, here’s a look at the current state of fuels.

78 Approaches to M&A

Majors Management and Yesway have each found success through different acquisition strategies.

80

4 Ways to Be on the Forefront of AI

Retailers can start using generative AI today to get things done better, faster and more efficiently.

90 The Foodservice Playbook

Value, variety, innovation and the overall customer experience are top of mind.

98

Targeting the GLP-1 Shopper

Attracting these consumers—and their households—means supporting their shopping mission.

104 Coast to Coast

Data from the six NACS regions offers insights into local trends and opportunities.

Despite uncertainty, retailers can take steps to position their business for success in 2025.

110

Master Your Merchandise

Unlock strategies for building baskets, driving sales and connecting with customers.

118 Bringing New Life to Old Equipment

This Q&A is brought to you by Marmon Renew. Remanufacturing beverage dispensers and foodservice equipment offers significant cost savings and environmental sustainability.

120 Culture and Connections

The annual NACS HR Forum links industry peers and offers best practices.

126

Honoring Hometown Heroes

High’s convenience stores turned the NACS Foundation 24/7 Day into a celebration of those who work tirelessly to keep neighborhoods safe.

130

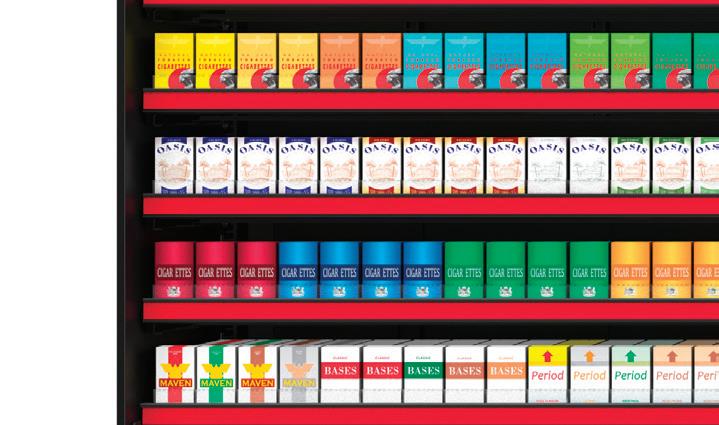

High Quality, Low Prices

This Q&A is brought to you by Xcaliber International.

Fourth-tier cigarettes are a backbar bright spot, but what’s next for the industry?

Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily

Inside Washington From tariffs to potential food regulations, retailers have a lot to navigate in the year ahead.

Gourmet

Category Close-Up Despite inflationary headwinds, the candy category still provides attractive margins and basket-building opportunities. 144 By the Numbers

EDITORIAL

Jeff Lenard VP of NACS Media & Strategic Communications (703) 518-4272 jlenard@convenience.org

Ben Nussbaum Publisher & Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Leah Ash Editor/Writer lash@convenience.org

Lauren Shanesy Editor/Writer lshanesy@convenience.org

Noelle Riddle Editor/Writer nriddle@convenience.org

Chrissy Blasinsky Digital & Content Strategist cblasinsky@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Amanda Baltazar, Sarah Hamaker, Al Hebert, Steve Holtz, Emma Tainter

DESIGN

Ji Ho Creative Director jho@convenience.org

Erika Freber Art Director efreber@convenience.org

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

NACS BOARD OF DIRECTORS

CHAIR: Brian Hannasch Alimentation Couche-Tard Inc.

TREASURER: Annie Gauthier, CFO/Co-CEO, St. Romain Oil Co. LLC

OFFICERS: Chris Bambury, Bambury Inc.; Varish Goyal, Loop Neighborhood Markets; Lonnie McQuirter, 36 Lyn Refuel Station; Charles McIlvaine, Coen Markets Inc.; Tony Miller, Retail Delek US

GENERAL COUNSEL: Doug Kantor, NACS

MEMBERS: Lisa Blalock, BP North America Inc.; Tom Brennan, Casey’s; Andrew Clyde, Murphy USA; Brian Donaldson, Maxol Limited; Terry Gallagher, Gasamat Oil Corp./Smoker Friendly; Erin Graziosi, Robinson Oil Corporation; Raymond Huff HJB Convenience Corp.

NACS SUPPLIER BOARD

SUPPLIER BOARD CHAIR: Vito Maurici, McLane Co. Inc.

CHAIR-ELECT: Bryan Morrow, Chobani & La Colombe

VICE CHAIRS: Mike Gilroy, Mars Wrigley; Jim Hughes, GALLO; Kevin LeMoyne, The Coca-Cola Co.

MEMBERS: Tony Battaglia; Ryan Calong, Pabst Brewing Co.; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Fueling Solutions; Matt Domingo, Reynolds; Mark Falconi, Greenridge Naturals; Ramona Giderof, Diageo Beer; Danielle Holloway, Altria Group Distribution Co.; Kevin Kraft, Tropicana Brands; Jay Nelson,

dba Russell’s; Mark Jordan Refuel Operating Co.; Brian McCarthy, Blarney Castle Oil Co.; Natalie Morhaus, RaceTrac Inc.; Jigar Patel, Fastime; Robert Razowsky, Rmarts LLC; Stanley Reynolds, 7-Eleven Inc.; Kristin Seabrook, Global Partners LP; Travis Sheetz, Sheetz Inc.; Babir Sultan, Fav Trip; Doug Yawberry, Weigel’s Stores Inc.; Scott Zietlow, Kwik Trip Inc.

PAST CHAIRS: Victor Paterno, Philippine Seven Corp.; Don Rhoads, The Convenience Group LLC.

SUPPLIER BOARD

REPRESENTATIVES: Vito Maurici, McLane Co. Inc.; Brian Morrow, Chobani & La Colombe

Excel Tire Gauge LLC; Jordan Nicgorski, JUUL Labs; Nick Paich, TriggerPoint Media; Sarah Vilim, Keurig Dr Pepper; Derek Zahajko, CAF Inc.

GENERAL COUNSEL: Doug Kantor, NACS

STAFF LIAISON: Bob Hughes, NACS

RETAIL BOARD REPRESENTATIVES: Tom Brennan, Casey’s; Scott Hartman, Rutter’s; Kevin Smartt, TXB

PAST CHAIRS: David Charles, Cash Depot; Brent Cotten, The Hershey Co.; Kevin Farley

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2025 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

•

NACS CEO and President Henry Armour identified six big themes at the 2025 NACS State of the Industry Summit.

Ben Nussbaum Editor-in-Chief

It’s a tradition that NACS President and CEO Henry Armour is the final speaker at the NACS State of the Industry Summit. He takes the stage and synthesizes everything he’s heard during the event. His “What We Saw and Heard” presentation is consistently one of the highest rated sessions at the SOI Summit—as well as other NACS events—year after year.

Here are the six big themes of the event, in Armour’s view:

1. Resilience isn’t about looking in the rearview mirror and seeing what you’ve weathered; it’s a core part of business strategy going forward. And resilience has two faces: Being prepared to overcome external shocks and being prepared to take advantage of unexpected opportunities.

2. Convenience is a nimble, agile industry and the muscle memory from managing supply chains during the pandemic will help the industry navigate issues like tariffs.

3. No channel can move as quickly on trends than ours, particularly when it comes to those operators who have a culture that allows a quick response.

4. Foodservice can offset the declines in cigarette sales and fuel volume. Not all companies will excel at foodservice at

a high level, but beverages are still a differentiator. “The breadth and depth of our beverage offer is second to none. The number one reason customers visit convenience stores is for immediate refreshment, so keep focusing on this moving forward,” Armour said.

5. The basics of retail execution matter a great deal, and it’s vital that this industry offers “friendly faces who brighten someone’s day” when they visit their local c-store. “People often get distracted by the bright, shiny objects and forget the importance of a quick, clean, easy and hassle-free shopping experience.”

6. Smart investments in developing and retaining staff is money well spent. “At the end of the day, the top-performing companies in the c-store industry have a clear commonality: They focus on their people.”

Our coverage of the event starts on page 32, with in-depth coverage of the latest data and what it means as well as key insights from the many experts who took the stage. Look for even more SOI coverage in our July issue. What did you think of the NACS State of the Industry Summit this year? Let me know at bnussbaum@convenience.org.

“I just love hearing customers’ stories [at work]—there’s no shortage of great ones from those passing through,” said Bryce Johnson, overnight shift lead at Love’s.

“My mom also works here at Love’s! I actually convinced her to come to the hiring event. We worked on the same shift before I moved to overnights.”

Before working at Love’s, Bryce Johnson had a variety of jobs—a warehouse worker, retail positions at Walmart and Target and several jobs in security. He never stayed at a job longer than six months.

Now he’s an overnight shift lead at a Love’s in Morris, Illinois, outside of Chicago, where he has worked since November 2022.

He spoke with NACS about:

To me, it’s all about taking pride and ownership in my store and working with my team to ensure it is up to Love’s standards 24/7. And it’s the sense of camaraderie with the customers,

Celebrating the people who make our industry great.

especially our regulars, that I find so fulfilling. I genuinely do feel like I’m seeing my friends when they come in every morning.

My team is such a close-knit group, so I love making sure they have what they need to succeed. A lot of what we do overnight, in addition to being there for our customers, is to get the store ready for the next day, so we handle a lot of cleaning, detailing and making sure everything looks great. I feel really proud when management comes in the next morning and remarks about how great the store looks.

I still remember one of my first overnights as a shift lead. A contractor came into the store and asked me for the manager. For half a second I was thinking “Oh yeah, let me go get them,” but then I remembered “Oh wait, that’s me, I’m the manager on overnights!”

There are so many opportunities to build a fulfilling career if you put in the work and are open to learning something new. When I came to Love’s, I didn’t see this as a lasting career. Six months in, when my general manager asked me to be a shift lead, I was shocked. I think I told my GM “Are you for real right now?” It caught me off guard that anyone could see me as promotable.

through one-timepasswords or biometric selfie checks.

Success in the convenience industry requires knowledge and insights— knowing where you should invest and how to harness data to deliver targeted, personalized offerings and customer experiences.

The NACS State of the Industry (SOI) Report® is the industry’s leading tool for improving your business. For more than 50 years, the convenience and fuel retailing industry has relied on the SOI Report as a benchmarking tool with the most comprehensive collection of data and trends in critical categories, including financials, store operations, merchandising, foodservice, fuels and more. The report of 2024 data is available for purchase beginning June 15.

Next year, submit your data to the NACS State of the Industry Survey and receive a complimentary license of the 2026 NACS State of the Industry Report and one complimentary registration to the annual NACS State of the Industry Summit. Please contact Chris Rapanick at crapanick@convenience.org for more information.

The SOI Report will help you:

• Understand the industry big picture with data and analysis on economic, market and shopper dynamics.

• Maximize effectiveness and profitability with access to aggregate financial, operational and category data from more than 30,000 convenience stores across the United States.

• Benchmark against top performers in the industry and determine key drivers to their success.

In the report, you’ll find:

• Valuable consumer insights about the convenience shopper from the NACS Convenience Voices program.

• Comprehensive regional performance data.

• An industry overview with critical findings and actionable recommendations from veteran industry analysts.

• Data visualizations giving you the insights you need at a glance with

compelling charts, graphs and tables that illustrate key trends and patterns.

• A deep dive into category and subcategory performance data across a broad spectrum, including fuels, grocery, tobacco, foodservice and more.

• The NACS/NIQ Convenience Store Census. Developed by NIQ TDLinx, the premier source of retail/onpremise channel information and endorsed by NACS, the Convenience Store Census offers universally accepted counts and classifications of businesses in the convenience and fuel retailing channel.

Upon purchase of a digital license, you will receive access to the report through a DRM-secured PDF through your convenience.org login profile. Discounts are available for purchasing multiple licenses. Purchase your copy of the State of the Industry Report at convenience.org/SOIReport or contact Chris Rapanick, managing director of NACS Research, at crapanick@ convenience.org .

2025

JULY

NACS Financial Leadership Program at Wharton

July 13-18 | The Wharton School, University of Pennsylvania Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg

July 20-25 | Kellogg School of Management, Northwestern University

Evanston, Illinois

AUGUST

NACS Executive Leadership Program at Cornell

August 03-07 | Dyson School, Cornell University Ithaca, New York

OCTOBER

NACS Show

October 14-17 | McCormick Place Convention Center Chicago, Illinois

NACS offers members a subscription to its NACS State of the Industry Data Archive, which puts 10 years’ worth of convenience fuel and retailing industry data from over 27,000 convenience stores at your fingertips.

Retailers can quickly view historical data and gain immediate year-over-year industry perspective, including quartile rankings by store, operating profit and chain size with weighted average based on the annual NACS NIQ/TDLinx Store Census. Other features of the archive include viewing inside sales, gross profits and gross margin

percentage across all years at the category level as well as fuel sales volume in gallons, price per gallon and margin in cents per gallon by fuel grade.

The State of the Industry Data Archive is available for purchase by NACS members only.

Want to know more? Schedule a demonstration of the SOI Data Archive with Chris Rapanick, managing director of NACS Research, by emailing him at crapanick@convenience.org.

“In today’s world of intense competition, rising costs, labor shortages and digital disruption, financial acumen is more critical than ever before,” said David Wessels, adjunct professor at the Wharton School and leader of the NACS Financial Leadership Executive Education Program.

The Financial Leadership program, which will take place July 13-18, 2025, at the Wharton School of the University of Pennsylvania in Philadelphia, is designed for convenience and fuel retailing professionals who want to elevate their financial acumen, enhance their organizational impact and drive success through financially strategic leadership.

“As an HR professional, I was very pleased to see a blend of attendees including operators and financial professionals. I appreciated the blended approach to learning, including instructor-lead discussions and group learning. The dynamics of the groups and understanding how peers think about scenarios only deepens the learning,” said Sherri Hart, VP of total rewards at Casey’s General Stores and a program alum. “The presenters were

clearly experts in their field and were able to challenge the group to think differently about business planning and the use of analytics in decision making. Attending definitely increased my retail business acumen as well as helped me think about questions I should be asking when getting data.”

The NACS Financial Leadership Program at Wharton empowers convenience leaders to:

• Develop strategic skills within the framework of financial leadership.

• Build strong partnerships with key stakeholders.

• Transition from information provider to strategic partner.

• Gain an understanding of emerging trends in finance.

• Apply financial insights that drive profitability and long-term growth.

“Our course is designed to fine tune your strategic thinking and elevate your financial skills so that you can navigate these challenges effectively. Our week together will feature some of Wharton’s very best instructors, known for their deep expertise and styles of innovative teaching,” Wessels said.

Attendees apply the principles and tools they’ve learned to a fictional convenience store business to “gain a deeper understanding and truly internalize the material. This simulation will prepare you to tackle similar issues in your own business, ensuring that you’re ready to lead effectively when you return home,” added Wessels.

For more information, visit convenience. org/FLP or contact NACS education program manager Brandi Mauro at bmauro@ convenience.org.

Pilot Company appointed Kari Irons as vice president of brand, bringing her extensive retail-marketing expertise to lead the next phase of Pilot’s brand evolution.

“Guided by our purpose of showing people they matter at every turn, Pilot is dedicated to creating meaningful connections with our guests that go beyond the pump. Leveraging Kari’s extensive retail-marketing expertise, we will continue to create exceptional experiences that fill up, fuel up and lift up all the journey makers out here on the road with Pilot.”

Parker’s Kitchen hired Darrin Samaha as vice president of marketing. In his new role, Samaha develops and executes the overall marketing strategy for Parker’s Kitchen, driving brand awareness, customer engagement, loyalty and growth through digital marketing, promotions, merchandising and customer experience optimization. Samaha brings more than 20 years of marketing, brand and advertising experience to his new position.

Onvo hired Stephanie Mihal, CPA, as its chief financial officer. Mihal has 20 years of experience as a CPA with McGrail Merkel Quinn & Associates. There, she honed her public accounting skills and sharpened both her technical and soft skills.

Kwik Trip promoted Ben Wilson to director of foodservice. Wilson previously has spent 25 years in other roles with the retailer across its food safety and general operations teams.

Derek Gaskins joined BP as head of guest experience. In his new role, he leads teams for merchandising and buying, fresh food and proprietary beverage and store design, and development for BP, as well as Thorntons, TravelCenters of America, Amoco, Ampm and Arco c-stores. Gaskins was formerly Yesway’s chief marketing officer. Gaskins joined Yesway seven years ago as senior vice president of merchandising and procurement before becoming CMO.

EG Group, parent company of EG America, named Russell Colaco as its new CEO. Russell Colaco joined EG Group as CFO in June 2024 bringing extensive U.S. and international experience, both in the wider consumer retail sector and investment banking. Reflecting the growing importance of non-U.K. markets for the Group, Russell will be primarily based in the United States, EG Group’s single largest market.

The Hershey Company named Tiffany Menyhart chief customer officer. With 30 years of sales and CPG experience, including 15 years in confection, Menyhart will lead Hershey’s U.S. confection sales team to advance the company’s vision of becoming a leading snacking powerhouse. Joining from Kraft Heinz, Menyhart has a proven record of driving profitable growth, creating transformational change and elevating relationships with retail partners.

Nestlé appointed Josh Morton as head of corporate communications for Nestlé Zone Americas. Morton is responsible for leading strategic communications across North America. He will oversee corporate messaging, media relations, crisis communications, executive positioning, digital storytelling and internal engagement across diverse markets that account for nearly half of Nestlé’s $100 billion in sales.

NACS welcomes the following companies that joined the Association in March 2025. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting convenience.org/create-login. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership

BRONZE

MPACT Beverage Company Cypress, TX www.mpactbeverage.com

Throne Sport Coffee www.sportcoffee.com

AllOver Media Minneapolis, MN www.allovermedia.com

Amos Sweets Inc. Las Vegas, NV www.amossweets.com

Perdue Farms Salisbury, MD www.perdue.com

RETAILERS

FASTIME Daphne, AL

Good2Go Stores LLC

Idaho Falls, ID www.good2gostores.com

Horizon Retailers Association Smyrna, GA www.hraga.com

M.G. Oil Company Inc. dba Corner Pantry Rapid City, SD Prince Oil Philadelphia, MS www.princeoil.com

Southern Sandoval Investments dba Tamaya Ventures Bernalillo, NM

SUPPLIERS

5 Generation Bakers LLC McKees Rocks, PA www.jennyleeswirlbread.com

Alvarez and Marsal New York, NY www.alvarezandmarsal.com

Andersen’s Crazy Candy Farmington, UT www.crazycandyfun.com

Better Life Foods Inc City of Industry, CA

Beverage Equipment Repair LLC Cape Coral, FL

CB Brands LLC King of Prussia, PA www.boozibles.com

Custom Made Inventory St. Petersburg, FL www.cmi.com

Dade Coolers Miami, FL www.dadecoolers.com

DeIorio Foods Inc. Utica, NY www.deiorios.com

Elements Supply LLC Bensenville, IL

Frey-Moss Structures Inc. Conyers, GA www.frey-moss.com

Garvey Products Inc. West Chester, OH www.garveyproducts.com

Genpak Charlotte, NC www.genpak.com

Gerrit J Verburg Co Fenton, MI www.gerritjverburg.com

Go & Fun International Ltd Handaq Qormi, Malta www.goandfun.mt

Good Times USA LLC Tampa, FL www.goodtimestobacco.com

Highly Crafted Inc Davie, FL www.drinkamigos.com

Ionna Durham, NC

Jane Foods Inc. Lagrange, GA www.cornflakecandy.com

Just Ingredients Orem, UT www.justingredients.us

Kickballz Los Angeles, CA www.kickballz.com

LM Nutra Kenosha, WI www.rebelenergygummy.com

Lockwood Mfg. Co. Livonia, MI www.lockwood-mfg.com

MBC Companies McDonald, TN www.mbccompanies.com

Neuro Las Vegas, NV

New Brew Los Angeles, CA www.drinknewbrew.com

Newport Bakers Costa Mesa, CA www.newportbakers.com

Niche Bakers USA Corp Toronto, Ontario, Canada

Partron ESL Co Plano, TX

n Increased facings from 70 to 90, a 29% increase*.

n Automatically billboards and faces product.

n Reduces losses from bag hook tearout.

n Cuts over 1 hour/day labor for restocking.

n Allows rear restocking and proper date rotation.

n Dramatically increases sales in the same space.

n Adjusts to accommodate various package widths.

*

PBI Sales Hicksville, NY www.pbisales.com

Performance Display & Millwork Grimes, IA www.performancedisplay.com

PrepWizard Knoxville, TN

RadiusAI Inc. Tempe, AZ www.radius.ai

Redefine Nutrition Alpharetta, GA www.finaflex.com

Scoot Frozen Lemonade Clinton, NC www.heyscoot.com

SPG International LLC Atlanta, GA www.spgusa.com

Taylor Policy Group Inc Hyannis, MA

The Clearly Food and Beverage Company LLC Pittsburgh, PA www.clearlycanadian.com

The Howard Company Brookfield, WI www.howardcompany.com

The Lagunitas Brewing Co Petaluma, CA

ThinkLP New York, NY www.thinklp.com

Uptime Energy Inc. Van Nuys, CA www.uptimeenergy.com

Vivunt Pharma OTC Medicines Miramar, FL www.vivunt.live

VusionGroup Chicago, IL www.vusion.com

Wayvee Analytics New York, NY www.wayvee.com

Wild Fox Foods Modesto, CA www.wildfoxfoods.com

Willow Ridge Global Louisville, KY

Wilshe Enterprises LLC Line Lexington, PA

WizCommerce Washington, D.C.

Offering the medication free of charge in an easy-toaccess way has the potential to save multiple lives.

Nashville-based convenience store Twice Daily, in collaboration with Fund Recovery, installed the city’s first-ever naloxone vending machine available at a convenience store. “This groundbreaking initiative … makes life-saving opioid overdose reversal medication accessible to the community 24/7, free of charge.”

“As a Nashville-based, locally owned business, we understand our responsibility to address the urgent needs of our community,” said Dawn Boulanger, vice president of marketing at Tri Star Energy, parent company of Twice Daily. “This initiative goes beyond traditional convenience store offerings—it’s about leveraging our location and accessibility to provide potentially life-saving resources to our guests and neighbors. We’re proud

to be at the forefront of this innovative approach to combating the opioid epidemic in Middle Tennessee.”

Fund Recovery supports people struggling with mental health or substance misuse who cannot afford help otherwise. Naloxone is an inhaled medication used to reverse an opioid overdose while it’s happening. Naloxone vending machines, which provide the medications for free, can help people access doses quickly and reduce someone’s risk of dying from an opioid overdose since the medication should be taken immediately.

“The hope is that providing naloxone in a convenient way at no cost will encourage all people, whether they personally use substances or not, to carry the life-saving drug,” the retailer said.

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America and to share these powerful stories. Learn more at www.conveniencecares.org

The 2025 Enmarket Charity Classic raised about $264,228 for local charities. The funds will go to Make-A-Wish Georgia and the Two Hundred Club of the Coastal Empire. Since its inception in 2020, the event has raised over $1.25 million.

Nouria Energy signed a definitive agreement to acquire Enmarket in October 2024. Nouria said that it is “excited to continue the tradition of the Enmarket Charity Classic and ensure its ongoing success.”

Through the Cash for Classrooms program, Casey’s General Stores awarded $900,000 in grants to 80 public and private schools across 17 states.

The retailer’s annual Cash for Classrooms program provides grants of up to $50,000 to each school to support physical improvements to school buildings and playgrounds, requests for books and educational materials and community engagement and extracurricular activities.

RaceTrac was the presenting sponsor of Camp Sunshine’s first-ever Sunshine Spectacular, an event “dedicated to bringing joy and support to children with cancer and their families.”

“Camp Sunshine is a non-profit organization that provides yearround recreational, educational and support programs for children with cancer and their families. Over the years, RaceTrac has helped raise more than $1.4 million to support Camp Sunshine, and this event is another meaningful way to make a difference,” the retailer said.

DONATES $20,000 FOR

After hosting a round-up program at the end of 2024, Pennsylvaniabased Nittany MinitMart donated $20,615 to Angelina’s Song, a nonprofit dedicated to providing music therapy to children in hospitals. “Employees and customers came together to raise funds for Angelina’s Song, a Williamsport-based organization founded in honor of Angelina, a young girl whose battle with cancer inspired her family to create an organization that would bring the joy and comfort of music to children across the country,” said Nittany MinitMart.

Following the powerful storms and wildfires that caused devastation across the Midwest and South, Maverik donated $15,000 to the American Red Cross of Oklahoma’s Tulsa chapter. The donation directly supports the Red Cross in providing critical resources, including shelter, food and emergency supplies to individuals and families in need of assistance.

Idaho-based convenience retailer Stinker Stores raised $57,500 in its latest Stomp Out Hunger campaign, which will help provide 172,000 meals to The Idaho Foodbank.

“Stinker strives to be a bright spot in our communities,” said Steve Cook, district manager. “The Stomp Out Hunger campaign has been a fantastic pathway to help make that possible.”

From tariffs to potential food regulations, retailers have a lot to navigate in the year ahead.

BY DOUG KANTOR

At the 2025 NACS State of the Industry Summit, I had the unique opportunity to be a part of a panel discussing some of the most relevant new policy trends and how those are affecting the industry. The conversation certainly gave me more to consider.

I was joined by Brad Clarkin, vice president of production operations at Kwik Trip, and Eric Hildenbrand, senior vice president, chief strategy officer for McLane Company. Clarkin oversees Kwik Trip’s sweets bakery, bread and bun bakery, dairy and commissary divisions. With two decades at Kwik Trip, he has dealt with everything from advanced technologies and automation systems to ensuring efficient production processes that support Kwik Trip’s extensive network of 850 convenience stores.

Hildenbrand leads McLane’s enterprise strategy, strategic execution and government relations teams, ensuring McLane continues to grow and innovate in a competitive market. He joined McLane in 2013, and his previous roles include chief transformation officer and general counsel.

With the two of them guiding things, we dove into how the Make American Healthy Again movement is impacting policy. One of the issues to consider is ingredients. The two pointed out that some ingredients might get banned given the current discussions in Washington. Seed oils and some dyes are the focus of attention at the time of this article. Clarkin, in fact, has heard from customers on both sides of such issues—some are complaining about the presence of certain additives needed to stabilize products on the shelves, while others are complaining about the lack of stabilizers leading the product ingredients to separate. Obviously, that presents a no-win situation.

They both noted that there could be restrictions with respect to the foods that can be sold through the Supplemental Nutrition Assistance Program (SNAP). Many retailers participate in SNAP and provide a service to customers in need who use the program. But doing that could get harder. A number of states are asking

The difficulty with SNAP restrictions won’t necessarily come from a loss of sales, but from the complexity of implementing those restrictions.

the U.S. Department of Agriculture to waive its requirements so that those states can experiment with restricting the types of foods people can buy with SNAP. The most common targets of such restrictions are sodas and candy.

The difficulty with restrictions won’t necessarily come from a loss of sales, but from the complexity of implementing those restrictions. With so many different products on the market, how can you know which ones are allowed and which ones aren’t? It might seem easy to figure out what is candy and what isn’t, but what is the line between a candy bar and a protein bar (especially when Snickers, for example, has products in both categories)? Clarkin and Hildenbrand

walked through some of the factors stores might need to consider regarding their customer base and how difficult it is to remain in the program. SNAP revenue can vary quite a bit from one store location to the next.

Clarkin and Hildenbrand also touched on changing customer preferences in the market, including those resulting from the use of GLP1 medications. There are already demands for more protein-rich products in some markets as a result. In spite of those changes, Clarkin made sure to promise that the greattasting cookies at Kwik Trip would not be going away.

The panel also discussed one of the most talked about policy changes for

the year—tariffs. With a 90-day pause on reciprocal tariffs hitting just the day before the panel, no one could be certain exactly where those tariff levels would land for different countries and products. Regardless, they are likely to have an impact on a large number of products that convenience stores sell. For example, Hildenbrand pointed out that even if a specific food product is not subject to a tariff, the packaging for that product may well have a tariff and that will impact the cost structure for getting it into the store.

There was general agreement, at least at the time, that the fact that products covered by the United StatesMexico-Canada trade agreement were not hit by tariffs was helpful. With a large volume of oil, gasoline, diesel fuel and some renewable fuels coming from those countries, the reprieve should be helpful in avoiding upward pricing pressure at the pump. But, the longevity of those exceptions as well as others was not certain.

Even if a specific food product is not subject to a tariff, the packaging for that product may well have a tariff.

As a manufacturer of many food products sold in its store, Clarkin talked about the evaluations Kwik Trip was doing to determine where it gets different ingredients and other products used in making food and, therefore, how different tariff decisions might impact the business. There were

also questions about where different costs would hit in the supply chain as products get imported into the United States.

In spite of the uncertainty overall, the panel did think that elevated tariffs on products from China were likely to remain for some time. The concerns about China and its practices on the international stage are extensive (and bipartisan). The number of materials and products coming from China, however, is huge. The impacts of long-term elevated tariffs could be felt throughout many parts of the business.

One question that policymakers have discussed, and the panel grappled with as well, is whether that could lead to changes or diversification in where some products are made or sourced. While it’s tempting to conclude that businesses will relocate, the uncertainty around tariff policy makes that a more complicated question. The panel agreed that there was hesitation to make investments in changing many parts of the supply chain when tariff policies could change unexpectedly and undermine the rationale for making those investments.

Given the extensiveness of McLane’s supply arrangements, Hildenbrand noted how diligently the company needs to work and communicate with

customers throughout the supply chain to ensure these changes don’t disrupt commercial relationships. By the same token, Clarkin noted the importance of customer relationships and the need to communicate clearly with them. No one in the supply chain or customers in the store like to be hit with unexpected price increases that are not justified. That puts a burden on business owners to be transparent about the realities they face as tariff policies impact different aspects of their operations.

Overall, the discussion provided great insight into everything from high-level strategies to on-the-ground execution that come up as these policies relating to food and tariffs impact the market. With the changing landscape that convenience store owners face right now, it was helpful to get the perspectives of experienced hands about how to navigate things.

That, of course, is the central mission of the NACS State of the Industry Summit—providing members of the industry with the insights they need to understand what is happening in the market, what is coming their way and how to deal with it. I was happy to be a part of it and walked away a lot smarter regarding all of those topics. I hope those who joined us were able to get that value as well.

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac. NACSPAC donors who made contributions in April 2025 are:

Hal Adams Cadena Comercial OXXO S.A. de C.V.

Carlton Austin The Coca-Cola Company

Thomas Bachrodt HJB Convenience Corp. dba Russell’s Convenience

John Benson Alvarez and Marsal

Grant Bleecher TruAge

Kathleen Byrd Home Market Foods

Tyler Cameron Rovertown

Dave Charles Jr. Cash Depot

Max Clark PAR Retail

Mandy Coffey Alvarez and Marsal

Lucia Crater Chomps

Jack Dickinson Dover Fueling Solutions

Mike Gilroy Mars Wrigley

Adam Grzybek BIC Corporation

Matt Hagquist Chestnut Market

Edward Holmes Holmes Oil Company Inc.

Mark Hopkins J & M Distributors Inc.

Sam Johnson J & M Distributors Inc.

Sam Jonas nData Services LLC

Jeromy Jones Oberto Snacks Inc.

Nancy Jones Stinker Stores

Sharan Kalva C-StoreMaster

Jake Kiser PAR Retail

Scott Klepper Pace-O-Matic

Aaron Littlefield Littlefield Oil Company

Jerry Marfut Pace-O-Matic

Kevin Martello Keurig Dr Pepper

James McNutt Midwest Petroleum Company

Drew Mize PDI Technologies

Kelly Naudain Altria Group Distribution Company

Jason Noll Capital One Bank

Erik Ogren Patron Points

Pam Parma Taiga Data Inc.

JP Patel FASTIME

Giulio Petraccaro Schaerer

Michael Quinn Pinnacle Financial Partners

Lisa Rountree TruAge

Ashley Scheele Alvarez and Marsal

Alyssa Snyr Imperial Trading Company - S. Abraham & Sons Inc

Saurabh Swarup Liquid Barcodes Inc.

Gray Taylor Conexxus

Matt Taylor Anheuser-Busch LLC

April VanApeldorn NACS

Mike Vanderwagen Weigel’s Stores Inc.

Filippo Vitale Altria Group Distribution Company

Heather Webb Patron Points

Chris Welcelean CORD Financial Services LLC

Kathy Williams The Coca-Cola Company

Kim Wolfe Island Energy Services LLC

Les Wooley Excel Tire Gauge

Erica Worrell Imperial Trading Company - S. Abraham & Sons Inc.

Name of company: Crescent Market

Date founded: 2017 # of stores: 1

Website: www.facebook.com/ CrescentMarketatSnoqualmie

Crescent Market has found its formula for success.

BY SARAH HAMAKER

Not many convenience stores start life as tobacco shops, but that’s the backstory of Crescent Market in Snoqualmie, Washington. “In 2011, it was a less than 2,000-square-foot store selling mostly tobacco products and liquor,” said John Willson, director of retail operations. Six years later, the store reopened with a 5,500-square-foot building and fuel pumps. “We saw there was a growth opportunity for us in fuel and food, so we expanded and renamed it Crescent Market,” he said.

Today the store serves the local community as well as the Snoqualmie Indian Tribe. “We also draw tourists exploring Snoqualmie Falls due to our location right off Interstate 90,” said Mary Lou Patterson, interim CEO of Snoqualmie Casino & Hotel, which is adjacent to the Crescent Market. The locally famous

waterfall attracts more than a million visitors each year.

The mix of locals and tourists played a large part in how the tribe stocks the store and interacts with the community.

Part of what makes Crescent Market unique is its focus on tribal artists. “We rotate the art of six Snoqualmie artists through our store every couple of months because we want to support our tribal artists,” Willson said. The store stocks tribal jewelry and beadwork as well as postcards, shirts, cozy blankets and other artwork.

The program has been popular with both the artists and customers. “We offer something for everybody, and by alternating our tribal artists, we give customers a reason to keep stopping by,” Willson said.

Beyond the artwork, the store also developed its own brand of clothing, Apparel 268, which is the height in feet Snoqualmie Falls. T-shirts, hats, beanies and other clothing have the Apparel 268 branding. “Apparel 268 merchandise has been good for our convenience store, drawing in customers and promoting the falls,” he said.

Crescent Market has fresh foodservice, although it has scaled back its offering. “Given the location and the community served, plus sharing close proximity with the casino, having a fresh food offering in the convenience store wasn’t as important,” Patterson said.

In addition, Crescent Market boasts more than 400 square feet of beer, wine and spirits. “Unique to Washington state, we have a liquor license, which not many gas stations have, so we can offer a wider selection of alcohol,” he said.

Rounding out the food and beverages is the store’s salty and healthy snack lines. “We have a robust selection of sweet and salty trail mix, pretzels, protein bars and many options with zero sugar,” he said. “With a large patron base of hikers, we needed to make sure we had what they like on hand.”

The biggest task for the Crescent Market team isn’t selling items—it’s connecting with customers. “Our staff understands how to make our customers smile,” Patterson said.

“My manager taught me to set high expectations, to be consistent and to always follow up—that sounds cliché, but it translates to employees giving our guests a great experience,” Willson said. To achieve those expectations, he taps into NACS educational resources as well as partnering with the casino on its training programs.

John Wilson, director of retail operations at Crescent Market has one word of advice for his fellow c-store operators: adapt. “What’s unique today might not be unique tomorrow,” he said.

For example, he’s constantly looking for new ways to train employees to engage with customers. “This year, we’re in the process of using avatar training to elevate the guest experience through our team,” he said.

Patterson credits Crescent’s low employee turnover to the training. “That, in turn, builds on the customer experience because with continuity of staff, they get to know regular customers by name,” Patterson said. The store also runs promotions to generate interest, such as free gas giveaways, and hosts an annual customer appreciation day each July. “Our mission is to provide a frustrationfree experience for our customers, and so we celebrate them on the anniversary of the store’s opening, July 18, each year,” Willson said. The event, which draws more than 2,200 people, has fuel and grocery giveaways, raffles for gift cards and barbecue food.

For Patterson and Willson, the best return on their investment into staff and customers comes when a guest tells a friend about their experience. “Word of mouth is always the best advertising,“ Patterson said.

Instead, the store carries freshmade sandwiches and yogurts in its grab-and-go section. “We also focus on beverages,” Willson said. For instance, its enhanced coffee bar has 10 different flavors and an extensive condiment section with a variety of milks, including nondairy options. NACS Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2024 and earlier, go to www.convenience.org/Ideas2Go

Sarah Hamaker is a freelance writer, NACS Magazine contributor and award-winning romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Cenex® helps retailers stand out by supporting local community needs.

In an evolving industry where it is increasingly difficult to get customers to turn left, branding with a partner that embraces individuality and local ties is key to increasing loyalty with community members. Cenex®, the energy brand of CHS Inc., has partnered with retailers for over five decades to improve the communities it serves. Today, the Cenex brand is present in over 1,000 communities across 19 states.

“Local businesses offer something that others can’t: personal connections, exceptional service and community-focused experiences,” said Erin Wroge, senior director, energy marketing for CHS Inc., “Because they’re part of the same community they serve, retailers understand their customers on a deeper level, which creates authentic, personalized experiences that meet local needs.”

Cenex provides retailers with innovative programs and the flexibility to tailor store

Beyond the in-store experience, focusing on ‘local’ encourages retailers to partner with local artists, vendors and contractors.

operations to address unique community needs. “All of our stores are locally owned and operated, and we give every store owner the freedom to customize their store,” Wroge said. “It is so critical for us to understand our business owners’ point of view, because they know their community the best. We see ourselves as a partner and support system that allows them to optimize their stores for their communities.”

Store updates can take a great deal of financial and staffing resources. The Cenex LIFT program seeks to transform convenience stores through lighting, image and facilities upgrades. Through the Cenex LIFT program, CHS Inc. offers low-interest financing for qualifying interior and exterior improvements, aimed at enhancing customer experience. To date, CHS Inc. has paid nearly $8 million in interest on behalf of retailers to support store enhancements.

Sioux Valley Co-op in Harrisburg, South Dakota, recognized that its rapidly growing town had limited options for food. Utilizing the LIFT program, the team incorporated several food choices in its store, including Godfathers Pizza,

Caribou Coffee and Flyboy Donuts. This location has now become a pillar within the community, and its new enhancements speak to the community’s needs.

In Harwood, North Dakota, Petro Serve USA knew that the lack of a grocery store in the city was an obstacle for residents, requiring them to venture outside of town to get the items they needed. Petro Serve USA utilized the LIFT program to add a wide variety of food choices and upgrade both the interior and exterior of the location at the same time. Improvements included built-in LED lighting, an assortment of refrigerated products, a walk-around deli counter and the Café USA. Additional interior upgrades included expanded bathrooms, an improved seating area for customers to meet with neighbors and new showers to accommodate truckers passing through town.

“Whether it’s hot food stations, comfortable dining areas or inviting store designs, creating a welcoming, community-centered atmosphere builds customer loyalty and fuels long-term success,” Wroge said. “Beyond the in-store experience, focusing on ‘local’

Cenex® is a brand of CHS Inc., a diversified company with over five decades of experience meeting retailers’ needs. With a heritage rich in innovation and a deep connection to the industries it serves, Cenex works hard to build top-performing energy solutions retailers can count on. Its expansive portfolio makes Cenex a strategic partner, offering turnkey, endto-end solutions for retailers.

Benefits of adopting the Cenex brand include:

The backing of America’s largest cooperative refiner.

A dedicated account manager to help you stay on top of the latest industry news and trends.

A team of product experts, retail consultants and brand marketing professionals.

Competitive re-imaging rebates and yearly volume incentives based on gasoline sales.

Image enhancement programs to ensure the Cenex brand image always appears fresh and eye-catching to encourage repeat business.

Marketing funding to promote your brand and encourage repeat business.

Flexible conversion policies and full-service branding programs to support your business.

A robust media plan that includes television, radio, social media and more.

encourages retailers to partner with local artists, vendors and contractors. These are important partnerships that fuel the local economy, support small businesses and strengthen the very communities retailers call home.”

Cenex also aids retailers by providing robust retail and marketing support.

For instance, every retailer can access professionally crafted advertising materials that are fully customizable. This allows each store to tailor them with their unique products and services, ensuring the local community remains the focal point.

“Retailers can use the templates with their own brand and imaging to create professional pieces on their own,” Wroge said. “We fund a very robust media plan that has television, radio and social media campaigns. So, whatever we design for the local markets is going to piggyback off those corporately placed messages.”

In the competitive convenience store space, every decision a retailer makes matters. That’s why choosing a fuel brand partner who supports and understands your local community is crucial to stand out from competitors.

“Cenex was born out of agriculture and is rooted in supporting the communities where we work and live. That translates to the brand and the retail space, as well,” Wroge said. “Cenex partners with the retailer to give them the tools and resources that they need, fill expertise gaps to help them elevate their business and support them in making a meaningful impact at their stores for their community. We offer competitive programs that allow retailers to enter and stay in the game and capture maximum share of their local market.”

Petro Serve USA used the LIFT program for a wide variety of interior and exterior upgrades, including increased food choices, expanded bathrooms and an improved seating area for customers to meet with neighbors.

Despite the uncertainty, retailers can take steps to position their business for success in 2025.

BY JEFF LENARD

While the word of the year in 2023 and 2024 was “inflation,” the word of the year in 2025 is “uncertainty,” said Charlie McIlvaine, the chairman and CEO of Coen Markets and a NACS executive committee member, kicking off the 2025 NACS State of the Industry Summit.

The event took place in early April as the stock markets were roiled by the introduction of—and modifications to—tariffs.

“Unfortunately, a lot of my speaker notes are a week old,” joked Mark Daniels, Yesway’s chief strategy officer. “Everything I say now could be wrong in a couple of hours,” OPIS Chief Oil Analyst Denton Cinquegrana quipped.

The bar is really low to execute the most important transaction there is: The relationship between the sales associate and the customer.

—Henry Armour, President and CEO, NACS

11 ONE

“It’s a great time to have a crystal ball,” said Brad Clarkin, VP of production operations at Kwik Trip.

“Over the next 12 months, anything can happen—both good and bad,” noted McIlvaine.

On the regulatory front, some things seem probable. The “Make America Healthy Again” initiative will likely lead to some ingredient restrictions and dye and flavor bans. The question is which items are banned—and how long a lead time will be in place so the supply chain can manage change.

The supply chain could face an even larger disruption in the form of tariffs.

“The supply chain is dialed in for what it knows—and consumers are largely predictable in their behavior,” said Clarkin. But sudden changes can lead to immediate shortages that takes months to resolve. Just look back five years ago during the start of the pandemic when everyone wanted to buy a four-pack of toilet paper at the same time. Supply-chain shortages across the board lead to spikes in the cost of goods and helped push up inflation several years later, he noted.

Economic uncertainty may also cause some companies to hold onto capital to be fiscally conservative, and some capital investments may get delayed. Another possible outcome: Uncertainty may spur continued mergers and acquisition (M&A) activity. “Money is looking for a flight to certainty in periods of uncertainly. And that could accelerate M&A activity,” said Yesway’s Daniels, especially in the convenience channel, which continues to be attractive to companies looking to grow or expand their portfolios.

Speakers agreed that tariffs are here to stay in some form or another, especially because once they are enacted they are hard to unwind.

“I think resilience is part of a strategy going forward. … How do you absorb external shocks and take advantage of opportunities?” said NACS President and CEO Henry Armour.

Foodservice sales in convenience stores now account for 28.7% of instore sales and 39.6% of in-store profit dollars, a huge increase from two decades ago when foodservice accounted for only 11.9% of in-store sales.

At the end of the day, uncertainty may not be bad for convenience retailers. The industry saw that during the pandemic. People need fuel, hot coffee and affordable food, and that’s what convenience stores sell, noted Yesway’s Daniels.

“During times of uncertainty, we do well,” said Daniels.

Over the past decade, both real and anticipated decreases in demand for key categories has forced convenience retailers to examine their offers. Tobacco sales continue to decline, but some OTP products have seen strong sales.

Meanwhile, predictions for the demise of the gas station—usually by someone who had a competing product or interest—are premature. Fuel demand in 2024 was up by 0.8%, and it remains to be seen how much electric vehicle sales will grow—if at all—as they have become politicized by both parties.

Fuel demand will likely decline over the coming years, but it will primarily be because of increased fuel efficiency with newer cars, not a switchover to EVs, which have accounted for only about 2% of new car sales over the past 12 years, according to Transportation Energy Institute research.

Meanwhile, another c-store staple—lottery—is facing challenges from legal sports betting. C-store lottery commissions declined 7.3% in 2024. It’s increasingly tough to compete against the thrill of betting on your phone— anytime and anywhere.

None of this change, both current and anticipated, means that c-stores need to reinvent themselves. “Instead of walking away from our traditional Cokes and smokes model, let’s refine it,” said McIlvaine.

That means looking for new opportunities to attract customers to solve their problems. The industry’s evolution overseas can offer inspiration: See “Big

Ideas From Convenience Summit Asia” in the May 2025 issue of NACS Magazine for some examples, including how Japanese c-stores have evolved their ATMs to be more than just places to get quick cash.

Services like car washes can deliver strong revenue dollars. Despite increased competition from specialty chains like Mister Car Wash and apps like Spiffy and Washos that provide at-home car washing, c-store car wash programs developed solid sales. Retailers could take a page from the unlimited wash subscriptions from standalone operators that draw repeat customers to their location, said Varish Goyal, CEO of Loop Neighborhood Markets.

There is also the opportunity to expand general merchandise sales. Younger consumers are far more likely to seek out c-stores for phone chargers and groceries. (See “Need. Something. Easy. Close.” in the April 2025 issue of NACS Magazine.)

But most of all, diversifying revenue means offering more prepared food.

3Foodservice sales in convenience stores now account for 28.7% of in-store sales and 39.6% of in-store profit dollars, a huge increase from two decades ago when foodservice accounted for only 11.9% of in-store sales.

Prepared food is the largest component (68.4%) of the broader foodservice category that includes commissary (8.8%) and hot, cold and frozen beverages (a combine 22.8). It’s also seeing strong sales growth, with a strong 43% increase over the past four years.

But that doesn’t mean that foodservice, specially prepared food, is easy.

“There’s a whole lot of opportunity in foodservice and a whole lot of challenge,” said Andrew Baill, Wawa’s senior manager of customer insights and strategy.

For one, the cost of shrink needs to be carefully managed. Food spoilage has increased 42% over the past three years. “This is one of the reasons that people stay out of foodservice,” said Loop’s Goyal.

[GLP-1 users] have one big meal a day and then they snack. And who’s the best at offering snacks?

—Eric Hildenbrand, Chief Strategy Officer, McLane Company

NACS staff hits the road every year to find great ideas to share with retailers, whether through store tours at the NACS Convenience Summits in Asia and Europe or via the video program Ideas 2 Go that debuts at the NACS Show. That increasingly means finding

Also, QSRs are pulling pages from the c-store playbook. Some, like Krispy Kreme, are offering more limited time offers to bring excitement to their locations.

And fast feeders are increasingly acting more like c-stores. “QSRs are unquestionably trying to be more convenient,” said Baill.

While c-store foodservice numbers have grown, not all consumers are sold on it. Consumers perception of c-store food is a challenge. Only 18% of consumers say c-stores are as capable of offering fresh, quality foodservice as QSRs.

Worse, even hungry customers already inside c-stores don’t necessarily purchase foodservice there; 28.7% of customers go to a QSR within 30 minutes of shopping in a c-store.

Despite the challenges, foodservice done well can deliver strong sales and profits. The average c-store in the NACS CSX Benchmarking Database has foodservice sales that exceed the average Subway and top foodservice decile performers have foodservice sales that surpass those of a typical Taco Bell.

“Whatever you do, do it really well and consumers will notice and keep shopping with you,” said Wawa’s Baill.

You heard it here first; call them ‘mission managers,’ not ‘category managers’ … and focus on what consumers are looking for, not how you stock items.

—Jenna Freese, Director of Strategy, Numerator

Sure, there is a lot of uncertainty and we live in divided political times. But there are still some things that (as of mid-April) are very good news for retailers and suppliers, noted Charlie McIlvaine:

1. We have a continued, strong labor market, with unemployment hovering around 4.0%.

2. There is continued strong productivity growth across the country, and it’s accelerating with the use of AI.

3. There is a possible fiscal stimulus with tax cuts (one of the top issues discussed at the NACS Day on the Hill in March).

4. There could be interest rate cuts that free up capital.

And while gas prices are a bright spot for consumers, down 6.5% last year, they could spike significantly in New England and the Midwest if tariffs are enacted on Canadian petroleum products, said OPIS’ Cinquegrana.

Retailers that acknowledge consumers’ current and potentially future financial pain are best positioned to capture consumers’ shrinking spending dollars.

Retailers also can communicate a value message to consumers who may not be facing severe economic stress. For example, Walmart and Dollar General have both had success in appealing to a higher-income customer base.

“It’s about the social cues. It’s all about what your customers value,” said Costagli. “You have to know what your guest wants.”

More than half (53.3%) of beer customers looked for promotions, said Wawa’s Baill. Meanwhile, OTP customers are more likely to be in a loyalty program.

In-store excitement also can draw in customers, especially around salty snacks and candy, the two categories that have experienced the steepest price increases.

“This [center store] is the best area of the store to try something new and build that basket,” said Baill. “This section is all about impulse,” with more than one third of all salty snacks (34.6%) bought on impulse, he said.

Most of all, find out what your customers want by listening to them.

“Everyone good in innovation has a real good understanding of the customer,” said John Benson, senior director at Alvarez & Marsal.

Finally, think of your stores as a refuge in an often-chaotic world. Execute on the basics and you can grow sales. “Refocus on doing the nuts and bolts well. A clean store, friendly people and machines that work” can go a long way, stressed NACS’ Armour.

The numbers are staggering: One in six households has a family member who is on or has tried GLP-1 weight-loss drugs like Ozempic, Trulicity or Wegovy. Eight million weekly convenience store customers are currently on a GLP-1 drug, said Jenna Freese, director of strategy at Numerator. And if consumers follow through on their intentions, demand could double, she said.

GLP-1 users don’t just change their own behavior; they also shape the eating habits of everyone in the family, whether at home or on the road.

“We’re already seeing a meaningful change in eating behavior; there has been a 9% reduction in early morning trips,” Freese noted.

But that doesn’t mean that there aren’t opportunities for convenience stores.

“[GLP-1 users] have one big meal a day and then they snack. And who’s the best at offering snacks?” asked McLane’s Hildenbrand. “Us.”

These snackers also are looking for items that fit their diets, seeking out better-for-you items that are high in protein and low in sugar. “They’re not

eating less—but with more intent,” said Freese. “This is a shopper on a mission; they are looking for foods that work harder” and have functional properties.

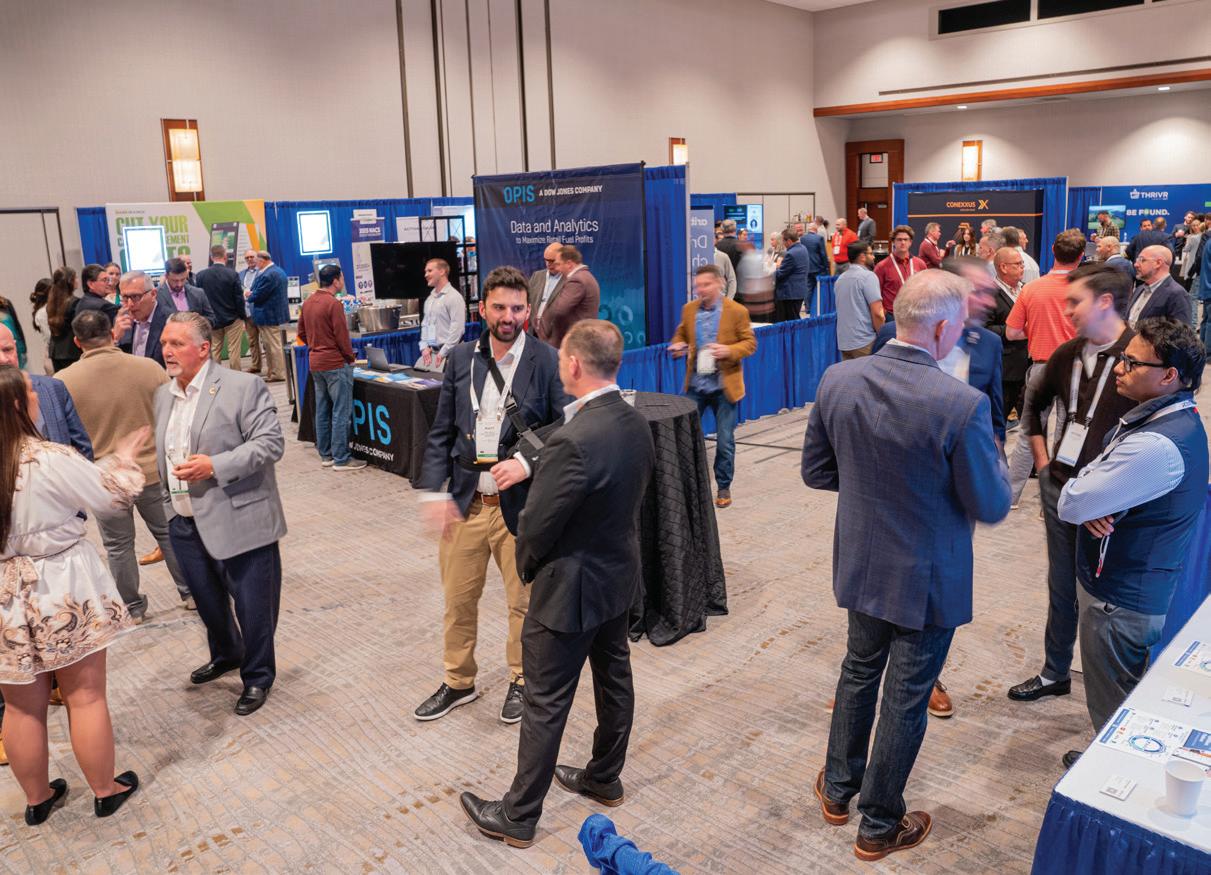

The Technology Solutions Center at the SOI Summit allowed cutting-edge exhibitors to connect directly with hundreds of convenience retail leaders interested in identifying solutions to meet their business goals. The following companies exhibited at the Center in 2024.

• Arity

• Cash Depot

• Conexxus

• Crisp

• Disruptive Technologies

• Fintech

• Ignite Retail Technology

• InStore.ai

• NRS – National Retail Solutions

• OPIS

• Paragon Praxis

• PriceEasy

• Rovertown

• RTO – Ready Training Online

• Taiga

• Testo

• Xenia Platform.io

Interested in exhibiting next year? Contact Chris Wise at cwise@convenience.org

There could be opportunities for retailers to add food high in protein in the grab-and-go and center store areas. But better-for-you items shouldn’t only be targeted to those on weight-loss drugs: 39% of QSR customers say they want healthier items, according to NIQ’s Costagli.

Talk about health without saying “diet,” suggested Freese. And for those who are on weight-loss drugs, market and merchandise food by how it helps someone accomplish goals. Focus on their mission.

“You heard it here first; call [your category managers] ‘mission managers’ … and focus on what consumers are looking for, not how you stock items,” said Freese.

So, how can convenience retailers best face the opportunities and challenges before them? It starts with their people, just like it always has.

“The guest experience is at the cornerstone of everything we do,” said NIQ’s Costagli.

NACS’ Armour agreed: “[Top decile performers] are the ones that pay the most attention to people.”

Those who don’t focus on their people can also find it affects the bottom line. Store-level turnover cost the average store $31,500 per year and cumulatively costs the industry more than $4.8 billion, said Loop’s Goyal.

The challenges of the past five years, starting with the pandemic, also play a role. Many retail companies have deemphasized front-line employees, replacing their most valuable commodity—the personal touch—with self-checkout or other options, whether or not they are embraced by customers. “People forget the value of a satisfactory experience,” said Armour.

The good news is that the decline in customer service across all of retail presents a massive opportunity.

“The bar is really low to execute the most important transaction there is: The relationship between the sales associate and the customer,” said Armour.

Jeff Lenard is the vice president of NACS media and strategic communications. He can be reached at jlenard@convenience.org.

How did the industry overall perform in 2024? It depends on which half of the year you look at.

BY CHRISSY BLASINSKY

When a doctor sounds the alarm that something is not OK, the patient tends to listen. So when Varish Goyal, the CEO of Loop Neighborhood Markets, a NACS executive committee member and a medical doctor, gave a diagnosis on the U.S. c-store industry a year ago, it was an attention-grabber.

When he took the stage last year, his prescription to NACS State of the Industry Summit attendees was to “tighten your belts, fight for every sales dollar and cut expenses.” Otherwise, the year was going to be really tough.

And he was correct. At the time fuel gallons were down … inside sales were down … foodservice wasn’t growing … expenses were up … transactions were down.

Thankfully, as 2024 progressed, a cure for what was ailing the industry kicked in and better results arrived by July and August.

Goyal returned to the stage this year at the NACS SOI Summit to recap the convenience retail industry’s operational, financial and performance metrics in 2024. “Q3 brought improvements and Q4 was significantly better than expected,” he said.

Goyal’s diagnosis last year suggested that the industry’s 21-year streak of record inside sales would end. Turns, out he was happily incorrect.

“We’re a resilient industry, and the second half of last year was amazing and total inside sales grew 2.4% to continue our streak, which is now 22 years,” he said.

Industry-wide, however, total sales were down 2.3% in 2024—a second year of decline—but like 2023, the decline was due to the 5.7% decrease in fuel sales, driven by the 6.5% decrease in the average fuel price ($3.55 per gallon in 2023 vs. $3.32 in 2024).

“I can’t think of any other industry that could see a $70 billion decline in revenue and still remain profitable,” said Goyal in reference to the decline in fuel sales, which dipped from $859.8 billion in 2023 to $837.4 billion in 2024.

U.S. Energy Information Administration (EIA) data showed that fuel consumption in Q1 2024 was below 2023 levels, although the gap closed toward the middle

Every July 24 (24/7 Day), the NACS Foundation unites convenience stores across America in recognizing first responders, medical personnel and American Red Cross volunteers who work around the clock, 24/7, to serve our communities. Now in its seventh year, the event unifies the collective efforts of 30,000+ convenience stores that honor and thank the extraordinary commitment of hometown heroes with items like a hot cup of coffee, cold beverage or a breakfast sandwich.

To learn more about participating, contact Kevin O’Connell at koconnell@convenience.org, or visit 247Day.org.

of the year and the final result was a slight increase in 2024 compared to 2023. Diesel consumption remained volatile and below 2023 and 2022 levels.

For the current year and 2026, the EIA forecast for both gas and diesel price and demand shows marginal short-term growth in fuel consumption.

“If this holds up, what we see is that in 2025 fuel prices remain steady, but we’re going to see a positive bump in fuel demand. In 2026, both gas and diesel prices are expected to decline, but diesel consumption is showing a little bump in improvement,” explained Goyal.

Fuel margins also held strong in 2024, with the average margin growing by 4.6% to 43.5 cents per gallon. “It never dipped below 30 cents a gallon,” said Goyal, noting that 40 cents may be the new average fuel margin moving forward.

Historically, within the c-store industry when fuel prices and transactions go down, so do credit card fees.

“That’s not what we saw in 2024—our credit card fees were higher by $400 million, even though we had a decline in fuel prices and pump transactions,” said Goyal, adding that consumers are using cash less frequently both on the forecourt and inside the store, resulting in cards being used for 80.8% of transactions in c-stores.

Direct store operating expense (DSOE) growth slowed in 2024, but DSOE was still up $9.8 billion to $159.9 billion.

Through a per store, per month lens, repairs and maintenance within DSOE was up 10.2% in 2024, a signal that good help is hard to find. “It is becoming harder to find good contractors to do the work, and it’s also becoming harder to find materials at a good price,” said Goyal.

In 2024, facility expenses grew at a rate “more than double the entire category of direct store operating expenses,” with depreciation and amortization having a significant impact—a 13% increase in 2024, or $13,661 per store per month.

The largest expense within DSOE, wages and benefits, showed improvement in its rate of growth. “Wage growth has finally slowed to a single digit rate, which is a positive sign that our labor market may be starting to improve,” said Goyal. He cautioned, however, that a 3.4% increase in wages still equates to a $1,331 per store, per month increase within that expense.

The costs associated with health insurance and other benefits, such as referral bonuses or tenure bonuses, also increased double digit rates in 2024. “This has been the case since 2020, and I think it will likely remain as efforts to recruit and retain employees continues to be a focus for our companies,” said Goyal.

Goyal called out foodservice spoilage, which has increased by 42% over the last three years. As the industry continues to double down on foodservice, this is an expense to keep an eye on.

Source: NACS CSX Convenience Benchmarking Database

Taking a look at in-store performance, Goyal noted that 1.2% growth in inside transactions “is a signal that things may have changed and our industry is back to growth mode. … Not only did inside counts grow year over year, but we’re seeing them move to the upside against 2020 through 2022.”

On the forecourt, per store, per month pump transactions were down -1.4% due to lower average gas prices for the year compared to 2023. Combined with inside transactions, total transactions were up 0.5% per store, per month in 2024. “So even though we saw a decline in pump transactions, inside growth more than compensated for that, which is great news for the industry,” said Goyal.

Labor continues to be a top industry concern, and more retailers are increasing compensation in 2024 as a way to both hire and retain employees. “If we compare back to 2020, personnel expenses increased over 39%” in that time period, said Goyal.

Employees were more productive in 2024, indicated by 3.3% per store, per month growth in inside gross profit per labor hour—that’s the positive. The negative, however, was the growth in wages and benefits: “This expense as a percent

of gross profit dollars also marginally increased—a result of faster growth in personnel expenses versus growth in total gross profit,” he said.

Wrapping up labor metrics, there was mixed news regarding turnover—and its associated cost. “Our industry is spending $4 .8 billion due to turnover,” said Goyal, which he said was likely a conservative number.

In 2024, non-manager turnover declined by 12 points and manager turnover declined by 0.8 points. “This is good news. The labor markets may actually be improving, and we may be getting a respite from this high turnover and tight labor market,” said Goyal.

“Our team leader’s job is difficult. When we find the right person, we need to do whatever we can to keep them,” he added.

Goyal offered several metrics to monitor and measure throughout the year on the path to generating more in-store operating profit.

Focusing on transactions is the “basis of our business,” he said, noting that growing transactions counts is a core strategy.

Basket profitability, which is “a game of pennies,” he said, can be attainable by setting a goal of increasing basket value by just three or four cents per transaction over a given period of time. “It will be easier to understand, and over time you will be able to make an unprofitable basket profitable,” said Goyal.

Employee turnover costs $31,000 per store, per year. Getting a handle on retention is a good first step in reducing expenses and building overall basket profitability. “Then you want to also look at expenses that are controllable,” such as supplies, advertising and promotions.

“If you commit to monitoring these things, your in-store operating profit should begin to improve,” he said.

Chrissy Blasinsky is the digital and content strategist at NACS. She can be reached at cblasinsky@ convenience.org.

Source: NACS CSX Convenience Benchmarking Database

BY CHRISSY BLASINSKY

Resilience and reliability are two words we hear a lot in reference to convenience stores. Flexibility and adaptability are key descriptors as well, particularly in the last five years.

In 2024, the U.S. c-store industry experienced its 22nd consecutive year of record inside sales. Foodservice played a key role, delivering strong growth and healthy margins for operators: 39.6% of in-store gross margin dollars in 2024, up from 37.3% in 2023, according to preliminary NACS State of the Industry data for 2024.

Fuels and cigarettes are viable profit generators with high-frequency shoppers, but they have become less reliable. In 2024, total fuels revenues decreased 5.7% to $501.9 billion due to a 6.5% decrease in the average gas price ($3.31 in 2024 versus $3.55 in 2023). Among the top 10 in-store merchandise categories (excluding foodservice), cigarettes was the only category that did not have positive sales and gross profit growth.

When fuel gross profit is stripped from total store operating profit, only the top three deciles are profitable. In other words, 70% of the 2024 NACS State of the Industry survey sample would report negative in-store operating profit.

All that is to say that the business model is changing. C-stores continue to sell an estimated 80% of the fuels sold in the United States, and c-stores are the preferred channel for nicotine consumers. However, more retailers are becoming food-forward. They’ve upped the ante on fresh, quality and safe menu options that rival quick service competitors (more on that later).

Five categories comprise foodservice: prepared food, commissary, and hot, cold and frozen dispensed beverages.

Last year, NACS State of the Industry data for 2023 showed that four of these were in the top 10 in-store sales categories.

In 2024, the foodservice trend accelerated.

Most foodservice sales in convenience stores are from prepared food—and that share has grown significantly in the last five years. In 2024, prepared food accounted for 68.4% of all foodservice sales, up from 63.8% in 2020.

Andrew Baill, senior manager of customer insights and strategy at Wawa, delivered key performance metrics for in-store categories during the 2025 NACS State of the Industry Summit.

Source: Source: NIQ Total U.S. Convenience, Calendar Year Ending 2022, 2023, 2024

There is one consistent truth across all these categories: People are shopping with us for immediate consumption.

Baill highlighted broad inside merchandise trends. “When you think about the sales and gross margin breakdown in our channel, foodservice is a key contributor. On the merchandise side, six categories make up most of our sales and profit: packaged beverages, cigarettes, other tobacco products, beer, salty snacks and candy,” he said. Along with foodservice, these categories account for almost 90% of inside sales and profits. Although inflation pressures eased in 2024, the top six merchandise categories showed unit declines in 2024. Baill noted that this headwind continued into the first two months of 2025 and is one to watch moving forward.

Both cigarettes and other tobacco products (OTP) have seen significant changes over the past decade—one has experienced a decline in sales and volume, while the other has grown substantially. OTP has nearly caught up to cigarettes in terms of total inside profit contribution: 5.8% versus 6.6%, respectively.

“OTP is almost at the point where it’s eclipsed cigarette margins in our stores today. I think that’s a big deal,” said Baill.

Where the stars align for cigarettes and OTP is in their ability to drive shopper frequency. NACS Convenience Voices research found that tobacco/nicotine shoppers are more likely to visit a c-store once per day or more. Retailers can capitalize on that frequency to encourage additional purchases, like beverages, to create larger baskets.