THE FABRICATION ISSUE

Wide range of SnowDogg® plows for trucks 1/2-ton and up

NEW TECH FOR YOUR TRUCK & TRAILER

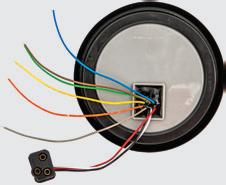

BACKUP CAMERA SYSTEM WITH DVR AND BLIND SPOT DETECTION 59" LED LIGHT BAR TRAFFIC ARROW

EXTRUDED ALUMINUM CONSTRUCTION WITH ADJUSTABLE ARROW POINTS

Featuring 72 LEDs. 8 directional and warning flash patterns, controlled by in-cab controller.

FULL COLOR 7" MONITOR WITH TOUCH SCREEN DISPLAY AND MULTIPLE MOUNTING OPTIONS

Includes four cameras (front, rear, and two side cameras), wireless remote and 128GB SD card.

Offers both

and strobe

light. Available in Amber/Amber or

LED configurations.

shown

TRAILER CONNECTOR STROBE KITS

ADD FLASH AND STROBE FUNCTIONALITY TO YOUR EXISTING TRAILER LIGHTS

Patented, plug-and-play design for RV, OEM, or round pin 7-way trailer connectors with no additional wiring needed. Includes wireless remote.

SnowDogg® Illuminator ™ LED Plow Lights, twice as bright as standard halogens

Part No. 16160800

SAEJ595 CLASS 1 AND CA13 RATED

Featuring 24 LEDs (12 Red, 6 Clear, 6 Amber) with Stop/Turn/Tail/Backup/Strobe functions. Each color has 19 flash patterns. Patent Pending.

LED COMBINATION LIGHTS LED ROTATING SPOT LIGHT WITH WIRELESS REMOTE

CONTINUOUS 360° HORIZONTAL ROTATION AND 110° VERTICAL TILT

Featuring 16 LEDs with 6,720 Lumens. Available with a blunt cut or 12V plug connection. Permanent or magnetic mount.

Online

Trailer|Body Builders

Market Leader

Commercial Vehicle Group – Dyanna Hurley dhurley@endeavorb2b.com

Editorial Director – Kevin Jones kjones@endeavorb2b.com

Senior Editor – Jason McDaniel jmcdaniel@endeavorb2b.com

Associate Editor – Alex Keenan akeenan@endeavorb2b.com

Marketing/Advertising – Dan Elm delm@endeavorb2b.com

Art Director – Rhonda Cousin rcousin@endeavorb2b.com

Directories/Listings – Maria Singletary msingletary@endeavorb2b.com

Audience Development Manager – Laura Moulton lmoulton@endeavorb2b.com

Business Media, LLC

CEO Chris Ferrell

COO Patrick Rains

CRO Paul Andrews

Chief Digital Officer Jacquie Niemiec

Chief Administrative and Legal Officer Tracy Kane

Chief Marketing Officer Amanda Landsaw EVP/Transportation Kylie Hirko

TRAILER|BODY BUILDERS (USPS Permit 636660, ISSN 0041-0772 print, ISSN 2771-7542 online) Volume 66 Issue 2, is published monthly by Endeavor Business Media, LLC. 201 N Main St 5th Floor, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI, and additional mailing offices. POSTMASTER: Send address changes to Trailer/ Body Builders, PO Box 3257, Northbrook, IL 60065-3257. SUBSCRIPTIONS: Publisher reserves the right to reject nonqualified subscriptions. Subscription prices: U.S. ($79 per year); Canada/Mexico ($79 per year); All other countries ($157 per year). All subscriptions are payable in U.S. funds. Send subscription inquiries to Trailer/Body Builders, PO Box 3257, Northbrook, IL 60065-3257. Customer service can be reached toll-free at 877-382-9187 or at trailerbodybuilders@ omeda.com for magazine subscription assistance or questions. Printed in the USA. Copyright 2024 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

Corporate Office: Endeavor Business Media, LLC, 30 Burton Hills Blvd, Ste. 185, Nashville, TN 37215 USA; 800-547-7377

Visit TrailerBodyBuilders.com for more information from stories in this issue, plus online exclusives on pertinent topics in the trailer manufacturing industry.

Randon marks export milestone

O ver the past 75 years, more than 600,000 semitrailers have been delivered by the Brazilbased OEM, including semi-trailers, trailers and bodies, in Brazil and to more than 70 countries Trailer-BodyBuilders.com/55245619

RECOGNITION

Trailer orders improve, still lag 2023 Trailer-BodyBuilders.com/ 55245620

Want your own issue?

1. Go online to:

Complete the online subscription form. Read the digital edition online at TrailerBodyBuilders.com/magazine/51774

Faymonville to build trailers in US

After evaluating locations across the United States, the Faymonville Group has selected a site in Little Rock, Arkansas, for its first U.S. production facility, the Luxembourgbased specialized heavy-duty trailer manufacturer reported.

The 54-acre site, located at the Port of Little Rock, provides access to major interstates, Class I railroads, navigable waterways, and a national airport. The production site covers 409,000 sq. ft. in Phase 1. In Phase 2, the area will expand to 624,000 sq. ft.

Once fully developed, the project will create 500 jobs, according to the company, and Faymonville intends to invest more than $100 million into the site. The project is expected to create 389 indirect and induced jobs in Little Rock and the surrounding communities, generating a $239 million economic impact.

The Faymonville Group is a family-owned company now in its 7th generation, where a dedicated team—the “Faymily”—of 1,400 people operates across four locations in Belgium, Luxembourg, Poland, and Italy. Together, they produce approximately 3,000 units annually. Their vehicles are delivered to 125 countries, generating a revenue of around $500 million in 2023.

With their three vehicle brands, MAX Trailer, Faymonville, and

After the vote: Pulse report

Endeavor Business Intelligence, a part of Endeavor Business Media like TBB, has taken the temperature of the business community for its latest EBI Pulse Survey report, entitled ‘After The Vote.’

The report captures how the 2024 presidential election is shaping strategic priorities, market expectations, and confidence levels. The majority of respondents—58%—express optimism about the

Cometto, the Faymonville Group builds semi-trailers, low-loaders, modular vehicles, and self-propelled trailers that are used to transport anything exceptionally heavy, long, wide, or tall. The brand portfolio includes transport solutions for payloads from 16.5 U.S. tons to 27.5 U.S. tons and beyond.

“We don’t just supply special vehicles, we provide comprehensive transport solutions,” said Paul Hönen, representative for the U.S. market. “We proudly delivered our first vehicle to the U.S. in 2016. What we particularly value about the U.S. market is its enormous potential, its practical, solution-driven mindset, and the much simpler administration compared to Europe.”

Currently, a team in Luxembourg is working on new products that will bring significant added value to the U.S. market, the company noted. In the first phase, individual components will be manufactured in Little Rock while preparations for in-house production are underway. Additionally, service and spare parts support for Cometto-branded vehicles will be strengthened.

“By early 2026, the production will be operational, and the vehicles will proudly bear the ‘Made in America’ label, with the goal of longterm success in the U.S. market,” Managing Director, CEO, and

The 54-acre site, located at the Port of Little Rock, provides access to major interstates, Class I railroads, navigable waterways, and a national airport.

President Alain Faymonville said.

Faymonville was first introduced to Arkansas through a relationship with Hale Trailer, a dealership in North America with 16 branches, including a branch in North Little Rock.

In June of 2024, Faymonville was hosted by the Little Rock Regional Chamber and the Arkansas Economic Development Commission to tour potential locations and meet key business stakeholders. Executive leadership from Faymonville returned to Arkansas in August for further examination of properties before selecting the site in late September.

“Our new location offers exciting career opportunities for driven and passionate specialists in steel construction, surface treatment, final assembly, as well as various office roles – all within a company culture that values pragmatism and straightforward communication,” summarized Lisa Faymonville, HR Manager for Faymonville Group.

coming year, anticipating positive impacts on their businesses despite some divided opinions on the new administration’s approach to key economic issues.

With economic growth, trade policies, and fiscal policy taking center stage, businesses are preparing for potential market shifts. Top priorities include strategy adjustments, financial forecasting, and workforce planning.

Dive into the report to see how the election outcome may shape investor confidence, regulatory engagement, and business resilience over the next 12 months. Download the survey at intelligence.endeavorb2b.com

Faymonville Group

Nearshoring supports Mexico trailer growth: ACT Research

The Mexican economy is growing, post-pandemic nearshoring is exploding, and freight activity is increasing across the border, but what does this mean for the Mexican trailer market?

That’s the teaser for ACT Research’s new Mexican Trailer Market report, with the release reporting that commercial trailer registrations in Mexico increased 21% year to date through June 2024, though the number of trailer manufacturers with business in Mexico has declined.

“Unlike other ACT Research reports, the information in this report does not come from confidential data provided directly from OEMs,” noted Jennifer McNealy, director, CV research analysis and publications at ACT Research. “It represents registration data, which gave us the opportunity to not only dissect by manufacturer, but also to share industry and segment data by trailer maker. And while this does not represent manufacturer build, in lieu of any other market-sizing data, it does provide an excellent proxy.”

In 2016, there were 293 trailer manufacturers registering units in Mexico. Since then, the number of companies has “oscillated around that near midpoint,” added Bailey Schnur, research and publications manager at ACT Research.

“In 2023, a record-high 335 manufacturers were adding trailers to the fleet. Through the first half of 2024, that number declined to 297,” Schnur said. “It will be interesting to see if any additional OEMs enter the market during the second half of the year.”

While the number of OEMs has declined slightly, trailer registrations in Mexico have increased since 2016. In that year, there were 21,070 commercial trailers registered, with that number increasing to 32,620 new trailers registered in 2023, and 18,358 units registered in the first half of this year.

“Compared to June 2023 when 15,224 trailers were registered, industry capacity is up 21% with half the year remaining,” Schnur added. “Of the new trailers through June 2024, 73% of them were registered by the top 25 manufacturers in Mexico. Four of those top

manufacturers are US-based and hold 14% of the total trailer market below-theborder registrations.”

Nearshoring presents a “significant opportunity” to enhance the economic importance of both Mexico and the United States, acting as a catalyst for increased manufacturing investment, infrastructure development, and supply chain resilience, explained David Teolis, ACT Research chief economist.

“Though the path to realizing these strategic advantages involves navigating certain risks and challenges, nearshoring is poised to drive regional economic competitiveness, growth, and stability over the long term,” Teolis said.

Indeed, truck crossings at the Mexican border rose 4.4% year over year in September and are up 3.3% year to date through the third quarter, according to ACT Research, reflecting strong US growth and deepening economic ties with Mexico.

“Truck crossings from Mexico have grown considerably since the pandemic,” Carter Vieth, research analyst at ACT Research, said. “Risks to nearshoring, and by default cross-border activity, remain, particularly political risks in the US and Mexico.”

ACT Research’s Mexican Trailer Market report provides an in-depth overview of Mexico’s trailer market activity and factors influence and demand. The report details the Mexico trailer market, cross-border freight, and nearshoring. It also provides an overview of the top trailer manufacturers by total market and segment, and dissects registration data from 2016 to YTD 2024 with segmentation analysis.

Wabash expands parts distribution network

Wabash is expanding its parts distribution network to make it as easy as possible for customers to access genuine trailer and truck body parts and services.

The manufacturer’s network of authorized dealers serves as the backbone of its aftermarket support, providing expert service, maintenance and Wabash genuine parts to keep fleets operating efficiently. In addition to Wabash’s established dealer channel, the company has added 14 new locations to its Preferred Partner Network, expanding Wabash Parts availability in areas not currently served by Wabash dealers.

“When it comes to keeping trailers and truck bodies on the road, Wabash Parts delivers unmatched reliability and quick access through a rapidly expanding and integrated network across North America,” Dan Millar, Wabash Parts managing director, said in a news release.

“Our highly skilled Wabash dealers are the cornerstone of our aftermarket support, providing expert service and genuine parts.

“Our Preferred Partner Network further enhances parts availability in regions where coverage is limited, ensuring that all customers receive the dependable support they need to maximize uptime and keep their operations running smoothly,” he continued.

The new network members are:

• Blaine Brothers of Blaine, Minn.

• Blaine Brothers of Clearwater, Minn.

• Blaine Brothers Truckaline of Columbus, Minn.

• Blaine Brothers of Scanlon, Minn.

• Blaine Brothers of St. Paul, Minn.

• Blaine Brothers of Baldwin, Wis.

• Great Western Trailer of Alburquerque, N.M.

• Great Western Trailer of Oklahoma City, Okla.

• Great Western Trailer of Tulsa, Okla.

• Great Western Trailer of Houston, Texas

• North American Trailer of Inver Grove Heights, Minn.

We build Towmaster trailers to withstand years of rigorous use on the job site, day in and day out. Get the most out of your trailer.

Whatever size or quantity of equipment you’re hauling, Towmaster has the right trailer for the job! Our trailers are made right here in the U.S. with quality techniques and materials so you can be sure you’re getting a trailer that will last for years to come.

‘Real world’ panel returns to aftermarket meeting

MEMA Aftermarket Suppliers, in partnership with MacKay & Company, will host the “Real World View of the Aftermarket” panel featuring members from MEMA’s Heavy Duty Business Forum (HDBF) at the upcoming Heavy Duty Aftermarket Dialogue (HDAD) on January 20, 2025, in Grapevine, Texas.

This panel, to be moderated by Paul McCarthy of MEMA Aftermarket Suppliers, will feature industry leaders Dominic Grote from Grote Industries, Matt Wolfefrom SAF-Holland, and Chip Stuhrfrom STEMCO. Together, they will share their unique supplier perspectives on the current landscape of the heavy-

Technologies. Masters will spotlight how Atmus is navigating the aftermarket landscape through innovation and collaboration, to drive their business forward.

“Having these industry leaders share their experiences presents a fantastic opportunity to foster dialogue among suppliers

CONTINUED FROM PAGE 8

• North American Trailer of Stanley, N.D.

• North American Trailer of Chippewa Falls, Wis.

• U.S. Trailer Parts & Supply of Chicago, Ill.

Wabash Parts was created in 2022 to unify and expand Wabash’s tech-enabled parts distribution capabilities across all of its transportation solutions product lines, including van trailers, platform trailers, tank trailers, and truck bodies, all while ensuring immediate scalability. This single distribution channel utilizes Wabash’s extensive network of equipment dealers’ service capabilities, along with the infrastructure of industry-leading partners in national wholesale distribution for aftermarket heavy-duty truck and trailer parts. This system also utilizes multiple distribution centers across both the United States and Canada.

Registration open for NATDA’s first Trailer Tech Expo

The North American Trailer Dealers Association reports that registration has opened for the inaugural Trailer Tech Expo Powered by NATDA, sponsored by Dealer Spike and Novae. The event will take place at the Reno-Sparks Convention Center in Reno, Nevada, from February 25-27, 2025.

The three-day immersive event will focus on trailer innovations and technologies for the light- to medium-duty trailer industry and features a full day of dealership education, two and a half days of technician training, a full day of exhibits, NATDA’s very first industry awards banquet and more, according to the association.

“This event provides the most expansive hands-on technician training

curriculum that NATDA has ever hosted,” NATDA Executive Director Andria Gibbon said. “We are proud to partner with Dexter to offer technicians a chance to earn credit towards the NATDA Technician Certification.”

The dealer education program, sponsored by Dura-Haul Trailers, will offer Tow Talks, seminars and in-depth software demonstrations on Tuesday, February 25. Topics covered will include the use of technology and AI in sales and operations, dealership succession planning, recruiting and retaining employees, measuring service productivity and more. The program will also feature industry experts such as Sara Hey from Bob Clements International, Kent Lewis from FreeGren, Jeff Robertson from Jeff Robertson Consulting, among many others.

On Wednesday, February 26, the event’s Expo Hall will be home to interactive displays and demonstrations featuring

the latest groundbreaking products, design enhancements, and partnerships from trailer and truck bed manufacturers, as well as related industry vendors.

“To qualify to exhibit at this event, companies must showcase a new innovation or technology,” Gibbon explained. “So, attendees are guaranteed to see the latest from our exhibitors.”

NATDA will host its first-ever awards banquet, also on Wednesday, to recognize and celebrate the most forward-thinking dealers, manufacturers, and vendors in the industry.

“The trailer industry is changing rapidly,” Gibbon noted. “You cannot afford to run a business without embracing technology and innovation. We’re excited to be able to acknowledge and showcase those businesses that exemplify the very best practices that will move the industry forward.”

Stellar Industries acquires Ohio-based

Stellar Industries has acquired Elliott Machine Works, a manufacturing company based in Galion, Ohio, to enhance its growth and product offerings. Elliott Machine Works produces mobile fuel and lube service equipment with a portfolio that includes fuel trucks, lube trucks, water trucks, lube skids, vacuum tanks and other mobile service equipment.

“By incorporating fuel trucks and lube trucks into our existing line of service trucks, we can now serve a broader mission, reach more customers and meet their needs even better by filling gaps in our offerings,” said Dave Zrostlik, president of Stellar. “We anticipate that

our customers will start to send more opportunities our way, and we’re ready to deliver. In addition, this acquisition strengthens our commitment to rural communities, ensuring we are making the biggest impact to the places our employees call home.”

The acquisition will not only enhance Stellar’s work truck product offerings but also benefit its vendors, distributors and customers by adding complementary products that serve many of the same markets, including mining, construction and oil and gas. The Elliott manufacturing facility and main office will remain in Galion, Ohio, where it will continue to manufacture the full lineup of specialized service trucks.

“By maintaining operations in Ohio and integrating Elliott’s talented workforce, we are not only preserving jobs but also enhancing economic stability in the region,” noted Zrostlik. “This commitment reflects our dedication to supporting local economies and the communities we serve.”

In addition, joining the Stellar team

Elliott Machine Works

opens the door to new opportunities for career development and growth for Elliott employees, as they will receive access to a broader professional network, expanded roles and additional resources and training.

As part of the acquisition, Stellar

will also work to keep the integration seamless for customers and employees.

“Leadership from both organizations will work closely together to ensure a smooth transition, fostering open communication and supporting all employees throughout this process,” Zrostlik said.

Elliott Machine Works

Kinedyne moves into new West Coast DC

Cargo control specialist Kinedyne LLC has relocated its West Coast distribution center from Azusa, California, to a new, larger facility in Phoenix—a decision designed to optimize the company’s logistical operations.

The transition to the new, state-of-theart distribution center has been unfolding over the last few months, with careful planning ensuring a seamless shift of operations, according to Kinedyne.

Situated at 7205 W. Buckeye Rd., the location offers increased square footage and improved infrastructure, promising heightened efficiency and accessibility, enabling Kinedyne to better cater to its valued customers across the region.

“We are genuinely excited about the opportunities our new Phoenix facility will bring,” said Dan Schlotterbeck, president of Kinedyne. “At Kinedyne, customer satisfaction and efficiency is paramount. With this relocation, we are not only expanding our footprint but also enhancing the convenience in acquiring our comprehensive product range, with reduced lead times.”

This relocation represents not just a physical move, but a strategic investment in the future growth and success of Kinedyne and its customers alike, the company noted in its news release.

Buyers Products backs after-school fun for employees’ kids

Buyers Products recently launched its first annual All-Star Dogg program, which is designed to provide financial assistance for employees’ dependents’ extracurricular activities, covering registration fees, equipment, and other related expenses. This program supports activities such as sports, arts, swimming lessons, music, theatre, outdoor education, and more.

“Extracurricular activities at an early age are important for our family, as they help balance work and home life while still giving my child fun learning experiences,” said employee Alana W., whose son is taking swimming lessons through the All-Star Dogg program. “Being able to watch and participate in his lessons has been a great bonding time for the both of us, all without having to worry about the cost. I am so appreciative!”

Along with the formal application, employees were encouraged to submit a 250-500-word essay written by their dependent(s) explaining how the activity

CONTINUED FROM PAGE 12

On Thursday, February 27, the event will close with a keynote breakfast focused on “The Future of Technology in the Trailer Industry.”

Attendees will also have time on Thursday to explore attractions and areas of interest in the burgeoning RenoTahoe area.

“This event location is truly something special,” Gibbon added. “It’s our hope that our attendees will take advantage of this exciting destination with their families.”

Trailer dealers interested in registering for this event can do so at natda.org/ trailer-tech-expo. Companies interested in exhibiting at the event can learn more and apply at natda.org/tte-exhibit.

See the January issue of Trailer-Body Builders for a detailed preview of this industry event.

aligns with Buyers’ core values: pride, teamwork, integrity, passion, innovation, and a sense of urgency.

“Buyers Products would not be where we are today without the hard work and dedication of our employees,” said Gwen Blagg, director of human resources. “The All-Star Dogg program is an opportunity for us to show our appreciation, not only to our employees but to their families as well. We’re honored to be able to help

the children in our local communities explore their passions, whether it be dancing, swimming, playing soccer, or anything in between.”

Over 50 employees have participated in this year’s inaugural program. In addition to the monetary contributions, Buyers Products also provided each child with an All-Star Dogg t-shirt. The second annual All-Star Dogg program will kick off in the summer of 2025.

Kinedyne

Buyers Products | Gabriel Muzzi

Routeway 360 and Comvoy launch work truck distributor portal

Comvoy is partnering with Routeway 360 so that the latter’s member website now features a “Find a Truck” portal to the Comvoy.com nationwide commercial truck and van marketplace. This strategic partnership provides independent distributors with an efficient platform to help them secure vehicles suitable for their distribution needs.

“This marketplace not only helps distributors find the right vehicle, but also simplifies the entire process from searching to financing, ultimately driving efficiency and growth in their operations,” said Michael Jones, managing director at Routeway 360.

The new “Find a Truck” service enables distributors to browse, search, and connect with dealers with the commercial trucks and vans that match their distribution needs. Comvoy’s collaboration with Routeway 360 opens a network with over 230,000 trucks, vans and SUVs alongside tailored financing options—all through one platform.

Key features of Comvoy include:

• Broad Vehicle Selection: A national online marketplace featuring trucks and vans that are ideal for food, beverage, and tool distributors, such as box trucks, box trucks with lift gates, cargo vans, upfit cargo vans, step vans and refrigerated trucks.

• Extensive Inventory: Access to over 230,000 vehicles for the perfect fit for any business.

• Nationwide Network: Connections with work truck dealers across all 50 states, offering the flexibility of shopping locally or nationwide.

• User-Friendly Interface: Extensive search and filter functionality, expediting the search process for exactly the right vehicle configuration for the business’ use.

• Built-In Financing Options: Payment estimates, pre-approval and

integrated financing solutions for streamlined payment.

• Integrated Vehicle Transportation Options: A vehicle transportation guaranteed quote tool, eliminating the complexity of transporting the vehicle for the business.

At the Godwin Group’s Champion Hoist manufacturing facility, a 20kW Eagle Laser automated system is used to fabricate scissor hoist arms and subframe rails. When purchased, the unit was billed as the world’s fastest and most powerful fiber laser.

Photos: The Godwin Group

Good people, processes make better products

The Godwin Group continues to grow and gain market share by investing for the future.

By Kevin Jones

Even through the unprecedented economic swings of the 2020s, the Godwin Group has held fast to its founding principle: Invest to grow. And that includes investment in people, production equipment, and plant expansions—totaling some $20 million over the past five years. And that doesn’t include an ongoing project aimed at doubling the dump body capacity at the company’s R/S Godwin manufacturing facility in Eastern Kentucky.

Godwin Group CEO Ryan Taylor characterizes the company’s thinking as “proactive.”

“We’ve always put money into equipment, returned it back into the business,” Taylor told Trailer-Body Builders. “We’ve been fortunate that, over the last 10 years, we’ve seen extraordinary growth—and a lot of this is truly driven by the need for more capacity and more production.”

Group CMO Patrick Godwin III, representing the third generation of founding-family leadership, added, “there’s a general philosophy that to produce a superior product, you need to have superior equipment.”

OPERATIONS PROFILE | Godwin

But, as many transportation equipment manufacturers learned the hard way through the supply chain disruptions of the past several years, you can’t deliver a superior product if you can’t build it in the first place.

Once again, the willingness to invest proved decisive in the Godwin Group’s ability to claim market share.

“We don’t have shareholders to satisfy, and the Godwin family has always been of the mindset that we spend money to make money,” Taylor said. “Our philosophy of inventory is backwards to what most people do. We don’t mind having that money invested in products sitting on the floor.”

Indeed, Taylor relayed an anecdote about company founder Pat Godwin Sr.

“Pat Sr. loved lean inventory. He loved walking up and leaning on it,” Taylor quipped. “He didn’t want it coming in just in time.”

On-hand stock ranges from 400-700 dump bodies across the group’s brands. Body building brands include Godwin Manufacturing, Galion, WilliamsenGodwin, and R/S Godwin along with Champion Hoist, snow equipment supplier Good Roads, and hydraulics specialist Allied Mobile Systems. Champion’s inventory goals are 3,0006,000 hoists in stock noted Godwin III.

“If it’s just in time, there’s a higher chance of it being too late,” he said. And that available inventory has

paid off, with the Godwin Group meeting demand when competitors couldn’t, explained Kristie Stockman, national sales manager. New customers have tried Godwin products and liked them.

“We have grown into markets that we had previously not been in at all, or not very strong in,” Stockman said. “We’ve seen customers make the switch because of some of the innovations we can offer, because of the equipment we have. We can build lighter bodies than most other body companies, and then some of the techniques that we use that makes it stronger, again while keeping it lighter.

“I tell everybody: if they’ll get one, then they’ll want more.”

Big plans at R/S Godwin

Doubling capacity for any operation would seem to be a daunting proposition. That’s even more so when the facility is one of the largest dump body suppliers in the U.S.

To meet the challenge requires more space, more machinery and technology, and more people—none easy to come by.

Then unexpected weather and logistical issues pop up, as Taylor noted, which have the big project at R/S Godwin a little behind schedule. Nonetheless, a new, 32,000 sq.-ft. building is “dried in,” with cranes being installed at press time.

The plan is to relocate the fabrication shop into the expansion from the plant’s primary building, along with metals storage, enabling an expansion of the body lines in the current fab space. New cranes, another lift, and additional welding equipment will be added to the production line.

Once the electrical work is complete in the expansion, two new plasma tables will be installed to supplement the four existing plasma tables being moved.

“Demand for all of our products has been really high for the last 10, 15, years—and it’s really coming to a head now; our capacity has been absolutely, completely maxed out,” Godwin III said. “So this expansion is just to increase manufacturing space, fabrication space, in order to be able to push out more product in the future.”

Champion goes high tech

While the R/S expansion is largely just about making room for more, over at Champion the Godwin Group has invested in a 20kW Eagle Laser automated system that, when purchased, was billed as the world’s fastest and most powerful laser, Taylor noted.

The system is being used to fabricate scissor hoist arms and subframe rails. The laser can output as much as 6 plasma tables.

“It’s got two shuttle tables so you can load and unload while the other table is being processed with the laser,” Taylor said. “We’ve added all the storage, racking, feeding, loading and unloading automation to it.”

The system selects the brand-new, SSAB 110-ksi steel from the racks, which can hold 100,000 lbs, and loads it onto one shuttle table then, in the same motion, removes the cut parts from the second shuttle table and unloads them, Taylor explained.

“You have to have the automation, because the machine is so fast human beings can’t keep up with it,” he continued. “So to get the full capacity out of it, you have to invest in a mass production facility, like Champion, where you’re using highly repetitive parts over and over and over again. So that’s where it pays for itself.”

The plant had to be expanded to house the new laser, along with another weld line and additional warehouse space for raw goods and inventory.

Additionally, the Champion facility employs FANUC robots dedicated to a pair of Baykal hydraulic press brakes, with one robot bending the inner arms of a scissor hoist and the other handling the outer arms. The system is critical to managing Champion’s high volume.

“These things will pick the flat part up off of the pallet, orient it, position it into the press brake, reposition it for the other bin, and then offload it into a pallet— all without any human intervention,” Taylor said. “There is a human being for quality control and for monitoring both machines. So you go from having two people standing there all day to one person managing those two systems and

The Ursviken press brake can perform the bends needed for Godwin’s steel body sides in one punch, when three were needed before.

checking the quality on them.”

To produce Champion’s hydraulic cylinders, the Godwin Group added Bardons & Oliver tube and shaft machines.

“We load bundles of chrome-plated rod in one machine and bundles of honed tubing in the other, and, about every two and a half to three minutes, they will produce a hydraulic cylinder for assembly,” Taylor said.

The machines are “sisters” to equipment installed in the early 2010s, and have doubled the cylinder capacity.

“We had them designed to be mirror-imaged from the original machines, to allow one operator to operate both of the machines at the same time,” he noted. “While he’s running one tube machine, he then turns around and runs the other tube machine—saving additional headcount.”

Quality machines, materials

To improve their dump body products and also improve production throughput, the Godwin Group has invested in Ursviken press brakes. The unit is a 1,200-ton, 24-ft capacity bed with automated bottom dies.

“You don’t have to change the dies. You just program in your bottom die opening, because it’s so heavy and so bulky that you’d lose time,” Taylor said. “So it will automatically adjust the bottom die laser bending calculations.”

And that’s important as the group moves to AR500 quality steel, Hardox 500 Tuf, with higher “spring back” properties. The Ursviken system recognizes that spring-back rate and adjusts accordingly, without relying on the operator to make the calculations.

“That’s a highly specialized machine,” Taylor explained. “Because of the tonnage, putting V-bends in the sides would take three different bends. So we also invested into specialized punches, and

Launched in 1979, Godwin Mfg., the group’s original dump body manufacturing unit, grew out of Pat Godwin Sr.’s welding business and still operates in Dunn, N.C.

we can put that bend in with one punch now, which is very, very beneficial when you’re building the sides of bodies.”

That equipment is in place, or on order, at various facilities. And, again, the investment pays for itself—and gives Godwin Group products a competitive advantage, as Godwin III emphasized.

“The importance of the machine and our manufacturing process is that it helps improve our products,” he said. “Because a lot of dump bodies, when made with AR sheet material, you don’t want to box up the sides because AR material is meant to flex and move. So when you weld a sheet on the side of the body, you often get these waves in it. That’s unattractive, and it looks like there was an issue in the manufacturing process—that’s kind of industry wide.

“We found a way to combat that by putting these V-pressed bends in the side; it adds a little bit of extra structure without boxing up the sides. With our machines, we can literally do all three bends at one time, when our competitors can’t even do a single bend because, on these long sides, they don’t have the machinery.”

Similarly, Taylor credited the adoption of AR 500 steel with keeping Godwin products ahead of the field.

“A lot of people use AR 400 plate, so we decided to go to AR 450 when we got into that market. So late last year, we decided to take it a step further and go into the new product, Hardox 500 Tuf. It gives you a little bit more formability and extra abrasion resistance. It’s been a good change for, and we were the first duck body company in North America that made that change across the board.”

Stockman pointed out that customers praised the move from AR 400 to AR 450, and she is hearing the same with 500 Tuf.

“They’re loving it,” Stockman said. “Of course, the 450 had a lot of strength to it and they were seeing a lot of longevity with that. But with the 500 now, they are anticipating it even looking a lot better, a lot longer. And when they do decide

to trade them in, their resale value will continue to be higher.”

Investing in people

Along with using machines to double capacity, the Godwin Group uses a “piece rate” compensation plan for jobs across production facilities, a program Godwin Sr. came up with decades ago.

“For every widget you make, it pays a certain amount to the employee,” Taylor said. “When we implemented piece rate with those cylinder machines, our volume increased by another 40%. It incentivizes the employees to really put their nose down.”

The company also has initiatives to ensure the quality remains high.

“If production welders start just trying to push products through, quality drops,” he said. “There’s a system in place that takes them off of piecework, and they have to repair or correct the issues they had. So they want to make sure that when they do it, they do it right. The first time.”

And they are rewarded: A record was recently set at the Williamsen-Godwin facility in Salt Lake City, with a fabricator posting a weekly rate of $141/ hour—“which is great, because it give us more product to sell,” Godwin III said.

Taylor suggested that the Godwin Group’s long-held practice of encouraging employee engagement is where people, manufacturing technology, and products come together.

Again, he recalled the founder’s commitment to support anything that would improve productivity and products.

“One thing that Pat Sr. really emphasized is that ‘I don’t want to replace men; I want to put the men in places where they are best utilized,’” Taylor recalled. “If there’s a machine that can do these monotonous jobs that a man struggles to do, he wants to be able to automate that. He always wanted to put men in positions where they were best utilized, especially skilled positions.

““He never denied a piece of equipment that anybody could say how it would make our jobs and our product better, and that thought process still holds true today.” TBB

The best of times ...

A down year in the trailer market didn’t diminish participation in 34th Annual NTDA Convention

By Kevin Jones

INDIAN WELLS, CALIFORNIA

—While the trailer market has been challenging, a gathering of the National Trailer Dealers Association hardly reflected the difficult times, at least in terms of attendance, exhibitors, and sponsorships here for the 34th Annual NTDA Convention in October.

“This is a down year for all of us—a really tough year that brings back 2008-2009 memories for a lot of us, and they’re not great memories,” said NTDA Chairman Justin Deputy, CEO of 1580 Utility Trailer. “But our attendance here at the convention exceeds last year. We were very nervous early in the year, as a board, of what we were going to have, and we’re just grateful that all of you showed up to support us in what’s been a tough year for the industry.”

Along with encouraging NTDA members to consider serving on the board, Deputy’s State of the Association address highlighted several important achievements and initiatives.

Topping his list, the NTDA Foundation has raised $144,000, “a nice chunk of money,” in its first year—and Deputy suggested an annual goal that should be “far in excess” of $150,000 to reach “a firm footing” to support the scholarship program for member employees and their children. The association awarded 14 scholarships this year.

“We create a committee of the board that analyzes a whole bunch of scholarship applications,” Deputy continued. “It’s a great experience to review those applications and to see these young people coming in with great grades and a bunch of extracurricular activity. And it’s actually really difficult to select the awardees. It pays for a whole year of college, in some cases, so it’s a big deal.”

On the policy front, NTDA is launching a lobbying effort to address the federal tax on dealer inventory (see the sidebar). The association is looking to raise $100,000 to fund the push.

“Advocating on behalf of our members in the trailer industry is a cornerstone of NTDA—it’s why it exists,” Deputy said. “At our board meeting, the foundation created a subcommittee. So if you’re interested in politics, Washington, lobbying, etc.—first off, my condolences to you—but if you have an interest, we really do want you to join this committee and be involved.”

The association also has made some “significant” technology updates over the past year, led by the new website, NTDA.org, Deputy added.

“We’ve integrated the website with the new CRM system to help keep everyone informed and connected,” he said. “The new site includes job boards, press releases, a membership directory, and

a whole bunch more. So please check it out—it’s very valuable. We’ve made a significant investment to offer more value to members.”

Likewise, ongoing NTDA programs designed to keep members “ahead of the curve” include webinars on the application of the Federal Excise Tax on trailers, along with association newsletters and various publications featuring industry updates and market trends.

“We’ll continue to seek out ways to add more value to you, as members. If you have ideas, we’re open to them. Reach out to a member of the board, reach out to Gwen [Brown, NTDA president], and express what you’re looking for. We’re very open and very flexible.”

In closing his remarks, and in

Outgoing NTDA Chair Justin Deputy, left, is recognized by 2024-25 Chair Mack Keay. NTDA | John Carr

NTDA board members who gathered prior to the convention banquet are, from left, Christopher Shuemake, Central Valley Trailer Repair; Bobby Briggs, Peak Trailer Group; Charlie Blyth, Blyth Trailer Sales; Stephen Schneider, Pace Transportation Services; Trey Gary, Dorsey Trailer; NTDA President Gwendolyn Brown; Gene Masteller, Atlantic Great Dane; Mack Keay, Ocean Trailer; Chad Strader, Ervin Equipment; and David Saunders, Florida Utility Trailer.

closing out his term as chairman, Deputy encouraged attendees to take advantage of the networking opportunities the annual convention provides.

“We need to stay sharp. We need to stay informed. We need to keep our eyes looking forward on the horizon, to see what’s coming in the future,” he

NTDA launches PAC to tackle inventory tax

A tough market is a really tough time for unfair taxes (and high interest rates), so NTDA is looking to Congress to give trailer dealers a break regarding floor plan financing.

As outgoing NTDA Chairman Justin Deputy explained during the annual convention, while federal tax code exempts truck dealers, the trailer dealer tax deduction for floor plan interest is capped at 30%. And the promised push to fix the discrepancy is now underway with late November’s launch of the NTDA Commercial Semi-Trailer Advocacy PAC.

NTDA President Gwen Brown distributed several documents to association members to educate and empower them to support the cause, including a letter detailing the issue, a PAC donation flyer and contribution form, a sample letter/template to contact representatives in Washington and contact information for the House Ways & Means Committee, along with an attention-grabbing infographic to simplify the matter. Basically, the floor plan tax deduction allows dealerships to deduct the interest on loans used to purchase inventory, including semi-trailers. This deduction is essential for businesses reliant on floor plan financing, helping them maintain adequate inventory and liquidity, NTDA explains. However, the 2017 tax reform reduced this benefit, limiting the deduction to a 30% cap on adjusted taxable income (ATI).

An initial exemption was modified in 2018, leaving out trailers.

A REAL-WORLD EXAMPLE:

Booth space was sold out for this year’s NTDA Convention exhibition and strolling luncheon. Kevin Jones | Trailer-Body Builders

said. “We need to work with each other and share ideas to have continued joint success.”

NTDA will be hosting its 35th Annual Convention Oct. 7-9, 2025, at JW Marriott Starr Pass Resort & Spa in Tucson, Arizona. TBB

Potential for Owning Taxes Despite Losses — if a semi-trailer dealership loses money and has no taxable income, it might still owe taxes on certain items. Even if a trailer dealer incurs a $500,000 loss and holds a $10 million line of credit with a 6% interest rate, they would owe taxes. Here’s how:

Loss -$500,000

Interest addback for adjusted taxable income $600,000

Adjusted taxable income $100,000

30% interest deduction limitation $30,000

Taxable income $70,000

The dealer would still owe income tax on $70,000 despite the loss.

At issue, specifically, is Internal Revenue Code § 163(j). NTDA wants the code amended to redefine “self-propelled vehicles” as “any self-propelled or titled trailer designed for transporting people or property on public streets, highways, or roads, as well as boats or farm machinery and equipment,” thereby including semi-trailers.

“This critical change would grant trailer dealers the same tax benefits currently available to auto and truck dealers, promoting fairness, business growth, and economic stability,” NTDA states.

Leading the effort for NTDA is Paul Christenson of North American Trailer LLC, who also happens to be an attorney who knows tax law and has experience on Capitol Hill. And, as Deputy emphasized, anyone with the aptitude and inclination should also consider joining the committee.

As NTDA President Gwen Brown told TBB following the PAC launch, the association has lobbied Congress before to seek a

repeal of the FET. That effort will continue, as NTDA will have a voice in the upcoming Highway Bill reauthorization. Additionally, the organization is monitoring how some $4 trillion in business tax incentives are set to expire at the end of 2025, Brown noted. NTDA has retained the firm of Morgan, Lewis & Bockius LLP to manage the effort in Washington, with Senior Director Timothy P. Lynch serving as the association’s lobbyist. NTDA is also organizing a member flyin for early next year. While NTDA currently is not coordinating efforts with other trade groups, that is “a possibility” in the future, Brown added.

“We need to raise about $100,000 to get this done,” Deputy emphasized at the convention. “It’s a bipartisan issue; we think we can get both sides of the aisle to get behind this.”

The materials mentioned above and additional information regarding the NTDA PAC is available at NTDA.org, under the Resources tab.

TRANSCORE EVERYWHERE!

TransCore is a Light Weight, Resilient, Impervious Solution for ALL Final Mile Roofs, Walls, Floors and Doors.

Specify TransCore

TransCore developed by Ridge Corporation is an engineered greener composite solution. TransCore is lighter and more resilient upon impact than traditional fiberglass/ wood or steel/plastic structural panels. Upon impact, TransCore gets out of the way!

Proven with years of Truck/Trailer interior impact protection, TransCore is highly resistant to puncture and abrasion, requires less maintenance, and is structurally bondable. TransCore’s interior and exterior surfaces are FDA direct food contact approved with long lasting UV protection.

Less Repair Needed

TransCore Structural Solutions are engineered with a unique recyclable closed cell foam encased in recyclable/repurposable skins that are 3x stronger than steel without a weight penalty. THAT’S GREEN IMPACT PROTECTION! There’s no glue line, no rot, no rust, and no moisture penetration. Impacts bounce off TransCore (see our website) providing long lasting beauty.

When you choose TransCore, you are getting years of FIELD-TESTED reliability backed by the industry’s longest warranty. Ridge Corporation is the industry’s innovation leader with performance backed by rigorous testing. Choose a quality ONE-PIECE solution that saves assembly time and LABOR …... Go TransCore!

RELIABILITY BACKED BY ISO 9001 STANDARDS! IATF 16949 STANDARDS COMING SOON!

TRANSCORE IS YOUR ONE PIECE UNEQUALED ENGINEERED SOLUTION! WWW.RIDGECORP.COM

IF YOU’RE LIGHT-WEIGHTING VEHICLES, DON’T BE SURPRISED IF YOU SAVE 30% IN WEIGHT REDUCTION!

TRANSCORE IS THE SOLUTION!

TRANSCORE DOOR

TRANSCORE ROOF

TransCore VCR roofs are prearched and require no roof bow or support. This smooth roof comes in a translucent or opaque version.

TransCore Roll-up door panels feature a living hinge with thousands of performance cycles. This continuous light-weight panel means NO EXTERIOR JOINTS or HINGES for clean decaling.

TRANSCORE FLOORS

TransCore “DONKEY” floor is designed to carry the load and save weight. Walk-in or Pallet Jack; Donkey’s one-piece solution is built to protect your freight. STOP UNDERCOATING!

TRANSCORE WALLS

TransCore smooth interior walls have memory! TransCore absorbs impact and bounces back. Light duty or heavy duty, Transcore walls save weight.

Up to 140 lbs less than a wood / composite door. Reduced trailer weight / improved driver comfort.

High impact resistance will not dent or crack! Fewer parts, less maintenance.

Long lasting living hinge design. No door panel replacement. Spring life exceeding 100K cycles! No hinges.

Seamless design = marketing billboard with no paint fade. 100% sustainable.

50% Lighter, 500% Stronger… 1000% Better Looking!

RIDGE ROLL-UP DOOR HAS 1 MILLION TEST CYCLES! How many test cycles does your roll-up door have?

OEM PANEL:

By Kevin Jones

Collaboration and communication between equipment manufacturers, their dealers, and customers are ever more important during challenging market conditions, suggested a panel of trailer OEM representatives during a discussion at the NTDA convention.

Likewise, now more than ever, a forward-thinking approach is critical to managing the lingering challenges of a downturn—and to be in position to seize the opportunities that are coming with the freight rebound.

PREPARE FOR THE COMEBACK, DEALERS

know that they like it, but sometimes you’re forced into it.”

What’s coming next?

Looking ahead, however, more than traditional economic cycles will be in play.

Dealer relations

So how are OEMs evaluating their dealer network during a downturn?

“I don’t see us working out of [the market slump] real fast, but we’ll come back and I think it’ll be business as usual,” said Bill McKenzie, MAC Trailer Mfg. president of sales. “We were so blessed for the last four or five years, it’s been incredible. I think people just lose sight of that, and that this [current market level] is kind of normal. In the fall it gets a little stagnant, and then we get a big rush at the end of the year, and then we get spring orders—it starts moving again.

“So I think it’s going to be fine. We’ve just got to be patient, and we’ve got to weather the storm.”

For many trailer customers, however, patience means extending the lifecycle of equipment.

“It comes down to customers making decisions: Do they capitalize, or do they continue to expense maintenance-related items?” suggested Jeremy Sanders, CCO for Stoughton Trailers. “Customers who typically have a shorter replacement cycle are extending that. Interest rates are part of it. Inflation is part of it.

“It’s a difficult time for customers to know what to do. And I don’t

“We’re going to continue to see technology play a big part in this industry, with customers adopting different elements,” Sanders added. “Think about the efficiency needed in a market that is profit constrained. A lot of folks are going to invest in making their equipment smarter, easier to use, autonomy.

“As OEMs, we keep an eye on that as we talk to customers, to understand what they need, what their customers need.”

Along those lines, electrification is “a tremendous trend” that isn’t going away, added Rob Ulsh, Great Dane v.p., dealer and international sales.

“Where does that technology end up at the end of the day, and what can we accomplish with it?” Ulsh said. “How can we make it cost effective, efficient, reliable—so that you can actually do what you need to do?”

Ulsh cited the push toward electrification in refrigerated transport—due to emissions rules and idling restrictions— as emerging technology that’s already embedded in the supply chain. But one change leads to another, he continued, pointing to zero-emissions mandates resulting in heavier tractor-trailers.

“The biggest concerns are the ones they haven’t told us about yet. As an industry, we’ve done well answering the challenges that have been put in front of us, but the big 800-pound gorilla in the room still remains environmental, and where we end up with the emissions piece,” Ulsh said. “Where do we go with weight and what might that regulation or legislation environment look like as we go forward? That’s going to have to be addressed.”

“I’ve been around this industry for a lot of years, and it’s hard to pinpoint performance and expect the same thing every year—because the market’s not the same every year,” Fontaine Trailer Sr. Director of Sales Al Cox said. “Try to gage that, read into how they’re doing. Help them manage the inventory they’re carrying, make sure they’re getting the product they need, when they need it.”

Beyond metrics, a “qualitative aspect” is important in evaluating a dealer’s performance, noted Stoughton’s Sanders.

“Service, covering your territory, knowing your customers: What relationships are you building, not just for the quarter we’re in or the year we’re in, but what does this look like over time?” Sanders explained. “Do we have the right people representing our brand for the future? That matters. That’s important.

“We can talk about sales, we can talk about volume, but do we have the right behaviors? Do we have the right team chemistry? Are we going to be able to weather the cycles in this market together? Those are the characteristics that we look for as an OEM.”

MAC does electronic monitoring and evaluates dealers every six months, McKenzie added.

“We like to do personal visits, and it’s not necessarily that we do it just to check up on them—because we know what the metrics are,” he said. “Are we doing everything we can do to support you? Is there an issue? Are you ordering enough equipment for the AOR that we’ve provided?

“But it still comes down to that personal relationship with the distributor, and whether or not it’s working for them and whether it’s working for us.” TBB

Al Cox NTDA | John Carr

Bill McKenzie NTDA | John Carr

Rob Ulsh NTDA | John Carr

Jeremy Sanders NTDA | John Carr

MANUFACTURING TIPS | Welding

Navigating the nuances

What trailer builders need to know about aluminum welding

By Justin Heistand, Corporate Account Manager, ITW Welding

Aluminum is a critical material in trailer manufacturing, prized for its excellent weight-to-strength ratio and corrosion-resistant properties. Despite these advantages, welding aluminum presents unique challenges. This article, prepared for Trailer-Body Builders by the welding experts at Miller Electric Mfg. LLC, delves into the specifics of aluminum welding for trailers, addressing common pitfalls and emphasizing the importance of preparation, filler metal selection and advanced welding equipment to optimize performance and productivity.

Aluminum’s role

Aluminum is indispensable in the commercial trailer segment, utilized for flooring, structural components, sidewalls and tanks. Its lightweight nature reduces overall trailer weight, increasing payload capacity and fuel efficiency.

Additionally, aluminum’s natural corrosion resistance makes trailers more durable and easier to maintain, as the material withstands harsh weather conditions without rusting. Aluminum’s inherent strength and flexibility also enable it to endure strains and stresses during operation, making it ideal for heavy-duty use.

However, aluminum’s high thermal conductivity and low melting point introduce significant complexity in welding. These properties increase the likelihood of heat-related issues, such as warping or burn-through, and necessitate precise welding techniques.

Aluminum’s inherent strength and flexibility also enable it to endure strains and stresses during operation, making it ideal for heavyduty use.

Miller Electric Mfg.

Overcoming common pitfalls

Welding aluminum requires addressing several challenges to ensure strong, defect-free welds.

• Joint Preparation: Proper joint preparation is vital for a successful weld. Contaminants such as grease, oil and oxidation must be removed using a solvent and a stainless-steel brush. Aluminum’s naturally occurring oxide layer, which melts at a much higher temperature than the base metal, can cause fusion issues and porosity if not properly cleaned.

• Feed ability : Feeding filler metal during GMAW (MIG) welding is a common challenge due to aluminum’s softness. Push-pull guns are effective in mitigating feed issues, although they add complexity to the system. Using a larger wire diameter and ensuring proper cable management, such as avoiding loops and tangles in the MIG lead, are also critical for a welder to achieve consistent feed performance.

• Cracking : Heat management is essential to prevent cracking, especially in thicker aluminum sections. Excessive heat input or rapid cooling can compromise weld integrity, leading to failure and non-compliance with welding codes. Selecting appropriate filler material and designing joints with reduced stress concentration are critical strategies to minimize cracking and ensure long-term durability.

• Puddle Control : Maintaining control of the weld puddle is essential for precision and consistency. The

puddle should be small and focused to minimize heat input and prevent excessive melting. Welders must also manage travel speed carefully, maintaining a consistent pace to ensure proper penetration and avoid defects.

Selecting filler metal

Choosing the appropriate filler metal is paramount for achieving strong, aesthetically pleasing welds.

The filler metal’s alloy composition must be compatible with the base metal to avoid cracking or failure. A few popular aluminum alloys in trailer manufacturing include:

• 5356: Known for its high strength and ductility, this alloy is ideal for structural applications.

• 4043: Valued for its corrosion resistance and excellent bead appearance. For enhanced performance, some manufacturers offer specialized solutions. For example, Hobart MaxalTig 4943 and Hobart MaxalMig 4943 combine the strength of 5356 with the weldability of 4043. These options provide a balanced solution for various trailer applications. Selecting the correct filler diameter based on the material thickness can further ensure optimal performance for a welder.

Leveraging pulsed welding

Pulsed welding is a specialized technique that helps address common challenges in aluminum welding while boosting productivity and reducing costs. By alternating between high- and low-current pulses, this technology minimizes heat input and improves weld quality.

• Reducing Heat Input: Pulsed welding allows precise control over heat input, reducing the risk of distortion and cracking. This technique is particularly effective for thinner materials, enabling the use of larger diameter wires that can increase travel speeds, which reduces heat input.

• Improved Weld Quality : Pulsed current helps break up the oxide layer on aluminum, promoting better fusion and reducing porosity. Advanced pulsed welding machines can be programmed to match your specific material, gas and filler metal requirements, allowing the machine to automatically adjust based on position of contact tip to work distance, travel angle, travel speed, etc., further enhancing weld quality.

• Versatility : Pulsed welding is effective across various alloys and thicknesses. It is particularly advantageous for out-of-position and thinner base material welding, making it a versatile solution for trailer manufacturers.

Dual wire feed benefits

In multi-material operations, the need to switch between different wire types can introduce inefficiencies. Dual wire feed systems address this challenge by enabling seamless transitions without the need to change spools. Systems like the Deltaweld from Miller Electric offer several advantages:

• Enhanced Flexibility : Dual wire feed systems allow operators to switch between materials such as stainless steel and aluminum effortlessly, eliminating interruptions and boosting productivity.

• Cost Savings: By reducing downtime and material waste, these systems lower overall production costs. Having both wire types available on the same machine eliminates the need for frequent change-outs and additional welding machines, further optimizing resources.

Optimizing aluminum welding

Welding aluminum for trailers requires a thorough understanding of material properties and the application of specialized techniques.

By addressing challenges such as joint preparation, feed ability, cracking and filler metal selection, manufacturers can improve weld quality and productivity. Advanced technologies like pulsed welding and dual wire feed systems simplify operations, minimize defects and enhance efficiency.

Embracing these innovations not only addresses the complexities of aluminum welding but also positions trailer manufacturers for long-term success in a competitive market. With the right tools and techniques, manufacturers can achieve high-quality, durable welds that meet the demands of modern trailer production . TBB

Additional Resources: Hobart’s Advanced Aluminum Seminar provides in-depth knowledge on aluminum alloys, welding processes, weld design, procedure development, troubleshooting and quality control, equipping attendees for aluminum welding success. Contact MillerTraining@ MillerWelds.com for more information and the 2025 course schedule.

Makeyourvoic sheard

2025 NATM Convention & Trade Show heads to Music City to sing the praises of the trailer industry

educational experience—it provides exceptional networking opportunities with industry leaders.

The week will start off with melody and a cheer, as NATM is shaking things up and inviting attendees to the Dueling Pianos opening event on Monday, Feb. 17.

Attention, light- and medium-duty trailer manufacturers: The next National Association of Trailer Manufacturers (NATM) Convention & Trade Show is scheduled for Feb. 17-20, 2025, at the Gaylord Opryland Resort & Convention Center in Nashville. The show, as always, promises to offer unparalleled access to suppliers, service providers, and education. What distinguishes NATM from other industry events is that the proceeds from the show are reinvested into association programming—such as the national Trailer Safety Week— and industry success. As a 501(c)(6) not-for-profit organization, NATM is uniquely equipped to offer exceptional educational opportunities for members and the industry. From insightful workshops on pressing topics to technical forums showcasing the latest developments in trailering, NATM provides valuable resources for everyone.

New attendee promotion

But attending the NATM Convention & Trade Show is more than just an

Additionally, the new attendee promotion offers two complimentary full registrations, two complimentary spouse/partner registrations, and two complimentary hotel nights at the host hotel for eligible trailer manufacturing companies that have never attended or have not attended in the last five years.

To establish eligibility for the new attendee promotion, contact Catie. Rutkowski@natm.com.

Trade show exhibit hall

This year, the NATM Events Team experienced remarkable demand and worked diligently to expand the show floor multiple times to accommodate new and returning exhibitors alike. The good news, except for would-be exhibitors who haven’t reserved booth space, is that the 2025 NATM Convention & Trade Show Floor has sold out.

So attendees are in luck: Are you in search of a new chain supplier? Interested in exploring new lighting options? Looking for innovative software to simplify your operations? Walk through the trade show floor packed with suppliers and service providers ready to offer the solutions your trailer business needs and meet directly with company decision-makers at their booths.

“We are absolutely thrilled to announce that the 2025 NATM Convention & Trade Show Floor is officially sold out,” said Meghan Ryan, NATM assistant director. “This unprecedented demand showcases NATM’s position as a leader in the trailer industry, and it underscores our commitment to continuously improving the show and reinvesting in our industry. We do this for our members and industry at large, and it’s always exciting to see these early indicators of what we are confident will be another successful NATM Convention & Trade Show.

“We look forward to welcoming everyone to an event that not only highlights innovative solutions but also fosters invaluable connections within our community.”

Product showcase

The show also will feature the latest innovations in the light- and medium-duty industry in Trailer Trends & Tech Showcase . Although the name has changed, it continues to highlight new products that will improve trailer safety, manufacturing and production, as well as cost-saving services. The showcase offers NATM Trade Show exhibitors an additional avenue to captivate prospective customers, expanding their reach beyond the limits of their booth space.

Peers and customers also will be able to participate in the selection process by voting for awards in multiple categories on the NATM Convention Mobile App. The recognition and awards gained from participation in this showcase will assist in raising market awareness of innovative new products.

The winners will be presented with awards on the trade show floor during the event. The winning awards will be announced on Thursday, Feb. 20, at 10:00 a.m.

And since innovation is best experienced firsthand, NATM will offer the Trailer Trends & Tech Showcase raffle. By participating in the raffle, attendees get a chance not only to witness the innovative products but also to take them home. The raffle will take place following the announcement of the showcase winners.

Celebrate the industry’s best

Finally, NATM honors and celebrates outstanding industry professionals each year during the Convention & Trade Show at the awards luncheon . Recognizing and celebrating industry achievements unites the entire sector like no other event can.

Also at the luncheon, documentary filmmaker Brett Culp will deliver the convention’s timely keynote address, “Superhero Leadership in Uncertain Times.”

Culp is a master storyteller with a passion for capturing the human spirit. Through The Rising Heroes Project, a notfor-profit organization, Culp creates films that move beyond entertainment to spark change and encourage viewers to discover their inner hero.

With a sold-out show floor, an impressive lineup of industry leaders, and countless opportunities for networking and education, this event—as always—is a must-attend for anyone in the trailer industry.

Register now at www.natm.com/convention to secure your spot in Music City, where the rhythm of progress meets the harmony of collaboration.

NATM

NATM

Unlock innovation, master your craft

2025 educational workshops, technical forums o er tools to succeed

This year’s NATM convention is packed with valuable sessions tailored to empower trailer manufacturers and suppliers with the knowledge and tools they need to excel. Here’s a glimpse of the educational workshop and technical forum lineup, as of TBB press deadlines.

TUESDAY, FEBRUARY 18

WORKSHOP SESSION 1:

Capitol Hill insights: Government Affairs update

Presenter: Brody Garland, K&L Gates, and member panelists

9:30 a.m. - 11:00 a.m.

This workshop will provide a comprehensive overview of current Congressional activities and their potential impact on the trailer manufacturing industry, along with insights into NATM’s advocacy efforts on Capitol Hill.

TECHNICAL FORUM SESSION 1:

Trailer axle and braking systems

Presenter: Bill Snider, Dexter

9:30 a.m. - 11:00 a.m.

This forum will cover everything from braking mechanisms on trailer axles to vehicle limitations and controller compatibility. Participants will gain insights into various brake types, installation considerations, and Dexter’s innovative Tow Assist system, which features advanced safety technologies like antilock braking and sway mitigation.

WORKSHOP SESSION 2:

How to build a high velocity sales team

Presenter: Dr. Rick Goodman

2:00 p.m. - 3:45 p.m.

Learn how to effectively communicate your ability to solve client challenges, build strong relationships, and foster longterm partnerships. Discover actionable strategies to position your business for success by adding value and delivering results.

TECHNICAL FORUM SESSION 2:

Hidden uses of GPS technology for dealerships and manufacturers

Presenter: Cameron Smith, Matrack Inc.

2:00 p.m. - 3:45 p.m.

Transform your trailers into smart trailers. Discover how to leverage wireless GPS trackers for theft protection, inventory monitoring, and fleet optimization, and explore innovative features such as extended battery life, motion sensing, and high-speed connectivity.

WEDNESDAY, FEBRUARY 19

WORKSHOP SESSION 3:

No sweat OSHA inspections for trailer manufacturers, dealers, and suppliers

Presenters: Kevin Hess and Curt Moore, Fisher Phillips

8:00 a.m. - 9:30 a.m.

Prepare for OSHA inspections with confidence. From understanding your rights as an employer to navigating potential pitfalls,

The NATM educational workshops and technical forums are valuable— and well attended—features of the annual convention. NATM

this workshop will equip you with the knowledge to minimize risks, reduce administrative costs, and ensure compliance with OSHA regulations.

TECHNICAL FORUM SESSION 3:

Presenter: Steve Houston, Vitracoat 8:00 a.m. - 9:30 a.m.

10 steps to optimize powder coating operations (advanced session)

Gain expert insights into optimizing powder coating operations for trailers, with a focus on achieving consistent, high-quality results. Whether you’re considering implementing a new powder operation or looking to enhance an existing one, this session will provide practical strategies and tips to ensure efficiency and performance.

WORKSHOP SESSION 4:

Trash talking: A guide to sustainability

Presenter: Bo Howard, Shapiro Metals 10:00 a.m. - 11:00 a.m.

Sustainability is more than just a buzzword — it’s a necessity. This workshop will provide practical guidance on handling hard-to-recycle materials, implementing innovative practices, and staying ahead of regulatory requirements. Learn how to foster a culture of sustainability that not only meets but exceeds industry standards, ensuring a greener future for trailer manufacturing.

TECHNICAL FORUM SESSION 4:

The future of towing with autonomous driving systems (ADS)

Presenter: General Motors (GM) 10:00 a.m. - 11:00 a.m.

This forward-looking session, led by GM, will explore how ADS technologies can enhance towing capabilities, improve safety and optimize trailer design. Attendees will learn about the latest innovations in ADS and their practical applications for light- and medium-duty trailers. Whether you’re a manufacturer seeking to future-proof your designs or a dealer preparing for evolving customer expectations, this presentation will provide insights into the next era of towing technology.

NATM 2025 Convention Exhibitors

Sherwin-Williams

Nudo Products, Inc.

Tuff Wireless

Taskmaster Components

Pneutek, Inc.

Kraken Wiring LLC

Xintai Taida Mirso Co., LTD 1622 CLOOS North America 1624 IFS Coatings 1628 D-LITE Lighting 1630 All State Fastener 403 Lippert 407 Pandit Brothers PBROS LEAF SPRING 409 Boss Trailer Products, LLC 411 Apex Machine Group 413 Trion Products Inc 415 WireCare,

GVS

C.R. Brophy Machine Works, Inc.

Vanguard Manufacturing 621 Bauer Products 622 Cruisemaster Australia Pty. Ltd.

623 The Raynor Company

626 Powerbrace Corporation

627 Myers Spring Company 703 Austin Hardware & Supply, Inc.

706 Fulterer USA

707 Bennett DriveAway

708 MORryde International, Inc.

709 Wieland Metal Services (Wrisco Industries)

710 Wire Wizard Welding Products

711 TOWKING

712 International Extrusions

713 Trim-Lok, Inc.

715 Tie Down Engineering

719 Jammy, Inc.

720 Axles Plus

721 hampton lumber

723 Vision Wheel

724 Michelin NA

726 Cast Products

727 Stillwell

803 PPG Commercial Coatings

805 Spantek Expanded Metal

806 Aura Optical Systems

807 DealersCircle, Inc

808 Anthony Wood Treating

809 TrailerDecking.com

810 PulseTech Products Company

811 Unique Fastener 2020 LLC

812 IntelliFinishing

813 KSC Engineers PVT Ltd

815 K2 Mfg

819 Kampco Steel Products Inc

820 Dutton-Lainson Company

821 FASTENation, Inc.

822 Neelkamal International

823 Intradin (Huzhou) Precision Technology Co.,Ltd

824 Red Oak Inventory Finance

825 Sharpline Converting Inc.

827 Estalia Coatings Usa Corp

829 Iowa Wood Preservers

831 Yisheng Trailer

833 Heskins, LLC

902 Dexter

903 Optronics International

909 Disolac Industrial Coatings

910 Triad Metals International

911 MR Software Solutions

912 Dec-O-Art

913 H-I-S Coatings

915 KTI Hydraulics Inc.

919 LaVanture Products Company

920 Mize & Company

921 Component Solutions Group (FKA A1 Trailer Parts)

922 Qingdao Kemei Trailer Co., Ltd.

923 Advantage Sales & Supply

924 StateWide Windows

925 A.L. Hansen

926 Rugby Mfg.

927 LandAirSea

928 Asquare Parts Inc

929 GK Corpz, India

930 Truck and Trailer Makers Insurance

931 Powerwinch

933 Air-Tight LLC

Automated, data driven

Smart technology takes center stage at FABTECH

By Kevin Jones

ORLANDO, Florida — Long-time attendees of FABTECH are familiar with the chilly, late fall breezes coming off Lake Michigan that keep attendees indoors for the duration of the big, annual show. So organizers hoped a rotating change of venue might offset the Windy City’s meteorological and logisitcal challenges.

Mother Nature always has a say, though. And while she huffed and puffed, FABTECH 2024 carried on as scheduled here at the Orange County Convention Center Oct. 15-17.

Despite Hurricane Milton roaring across the peninsula days before, the event attracted 30,000 manufacturing industry professionals from all 50 states and 70 countries. Some 1,500 exhibitors—including 279 first-timers—endured some anxious moments as the venue closed during peak set-up times, but by the time the event opened they were prepared to showcase more than 500 new product debuts as attendees explored “cutting-edge” solutions, “forged” partnerships, and were “laser-focused” on the latest trends shaping modern manufacturing.

This year’s event marked FABTECH’s Orlando debut, strategically chosen due to Florida’s rapidly expanding position in the U.S. manufacturing landscape, organizers noted. As the 10th largest manufacturing state, Florida has seen a 67.8% increase in manufacturing output over the past decade and is home to more than 422,800 jobs, making it a key hub for innovation.

“FABTECH 2024 showcased the real momentum behind the industry’s evolution, with trends like automation, sustainable manufacturing and advanced materials taking center stage,” said Tracy Garcia, CEM, FABTECH group director at SME. “This year’s event was not only a hub of groundbreaking technologies on the show floor but also a platform for celebrating the vital role of women in manufacturing and empowering the next generation of leaders. The conversations,