It speaks your language.

RS+ TPMS sensors from feature

RS+ TPMS sensors from Alligator feature OEM matched firmwares for 99.7% of vehicles on the road.

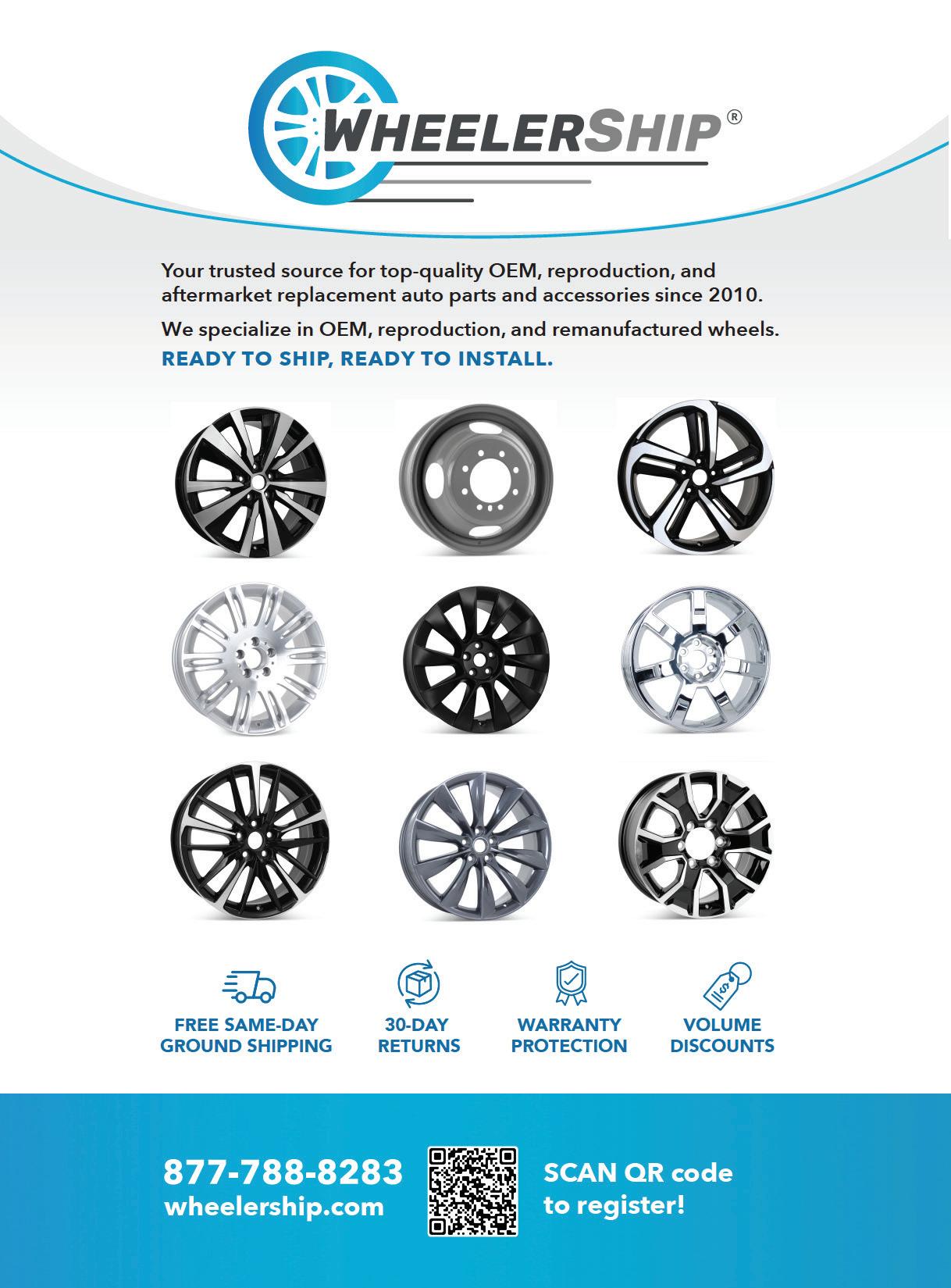

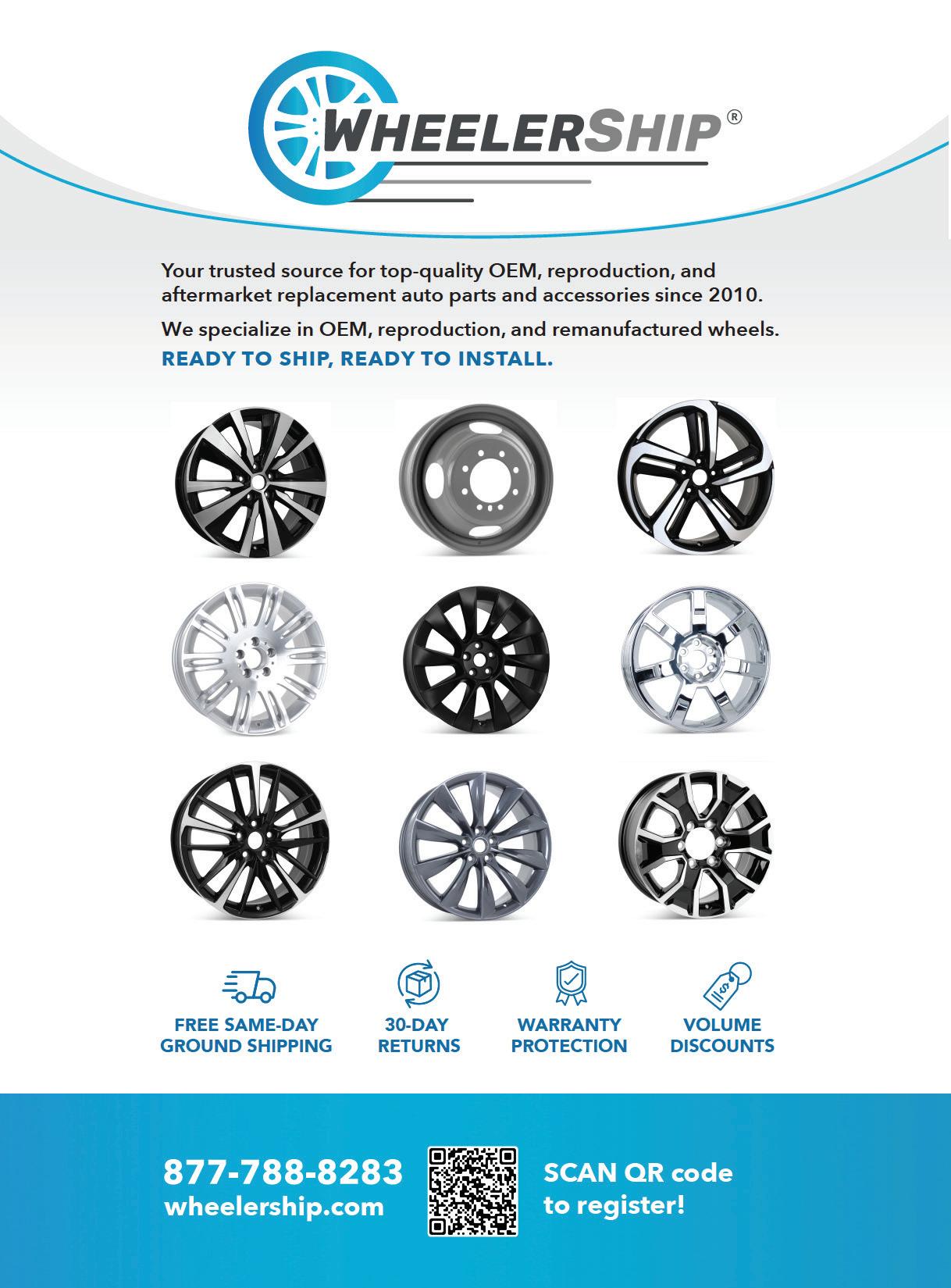

ADVERTISEMENT

Howdy. Domo arigato.

Simplicity

Sens.it RS+ TPMS sensors just work. Simple as that. They’re a snap to install and easy to program with our premium tools or your own.

Coverage

Nobody talks to more vehicles than our innovative Sens.it RS+ TPMS sensors. Our industry-leading sensors cover 99.7% of vehicles.

Functionality

Don’t let our simple sensor design fool you. Whether programmed or cloned, Sens.it RS+ TPMS sensors replicate full OEM functionality.

Support

Our US-based tech support is here anytime you need to talk. And all of our products are backed by 100 years of innovative German engineering.

Call: 855-573-6748

We’ve never met a stranger.

RS+ TPMS sensors talk to 99.7% of cars.

Hallo!

Ciao!

Let’s talk.

Hey!

Want to learn more about our customizable, universally compatible, cloneable Sens.it RS+ TPMS Sensors? We’re just a call away.

855-573-6748 | Alligator-tpms.com/MTD

SPEED RATINGS, SIZING AND MORE THE LATEST HP/UHP TRENDS MARKET VOLATILITY WHAT WILL IMPACT OTR TIRES IN 2024

KEEP AN EYE ON GLOBAL SHIPPING RECENT DISRUPTIONS COULD IMPACT YOUR BUSINESS

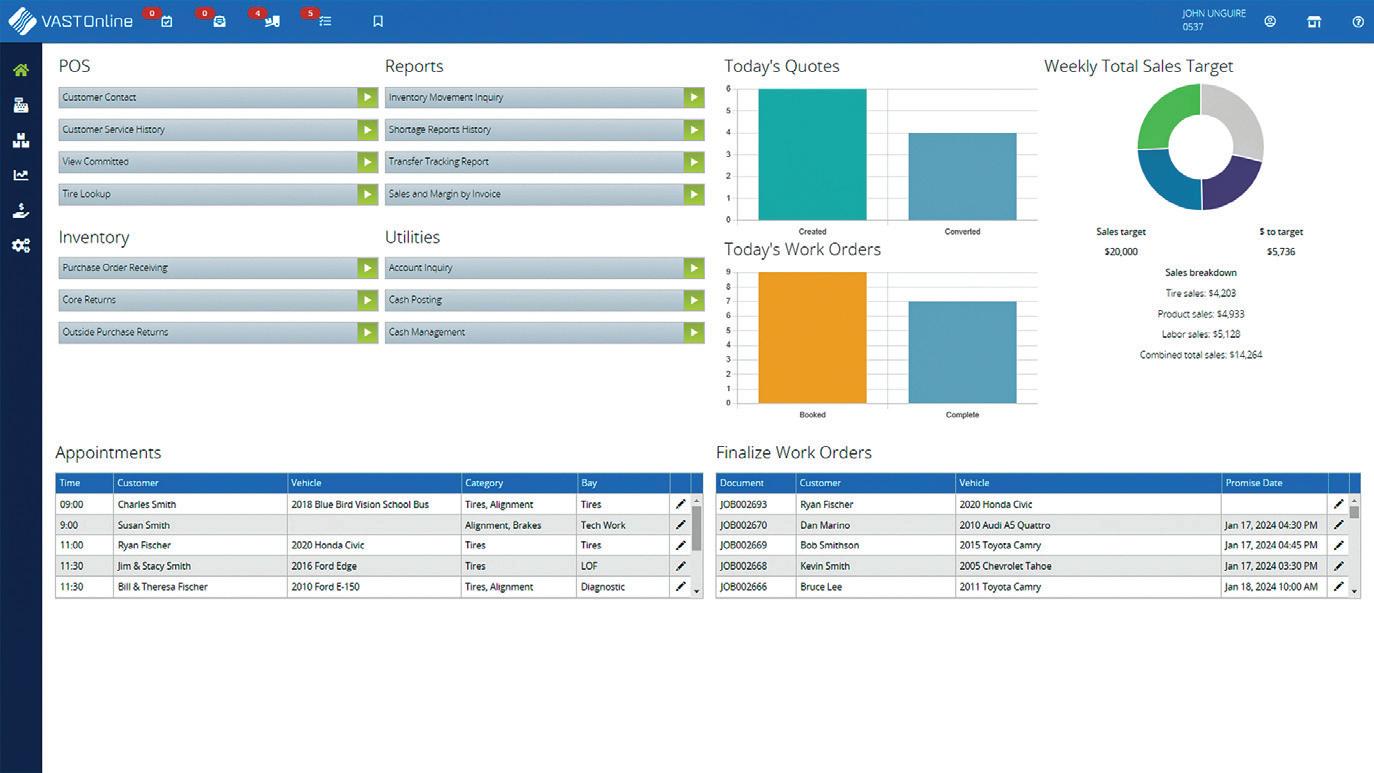

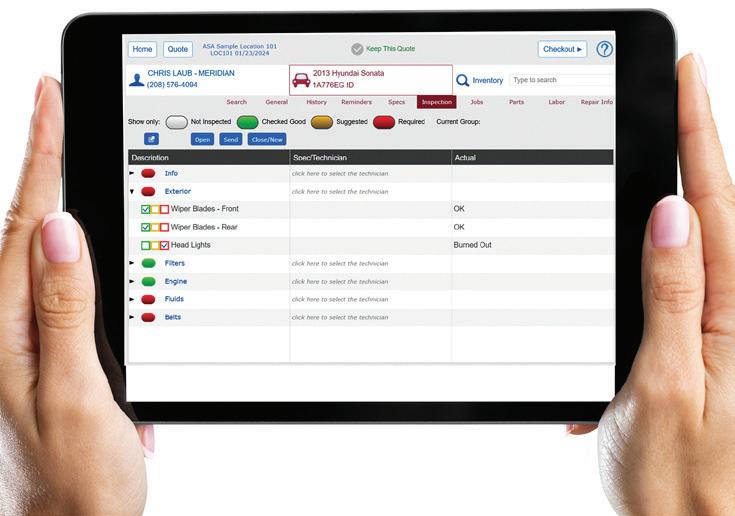

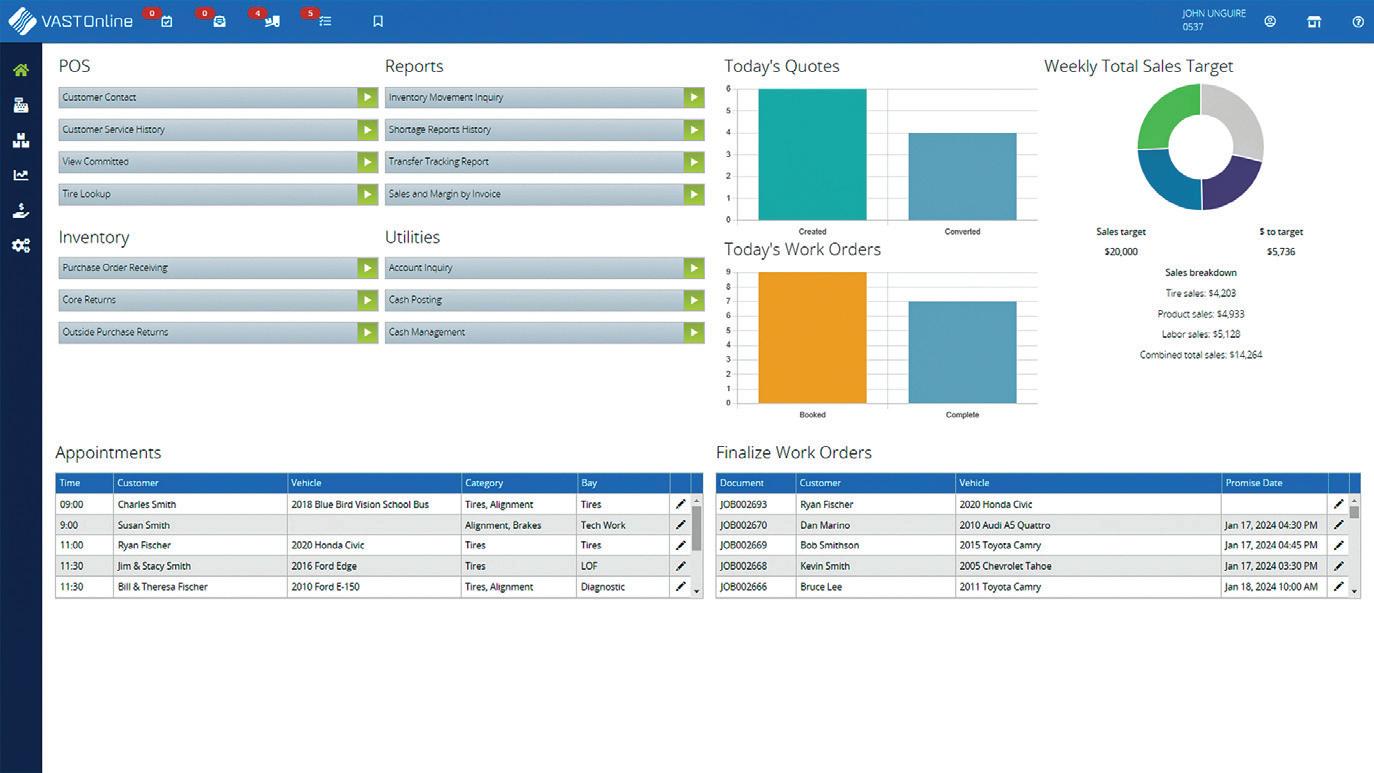

POINT-OF-SALE EVOLUTION

Systems offer more features than ever

February 2024 | Vol. 105, No. 2 | $10 | www.moderntiredealer.com

20

6

8

34

36

40

Tiremakers discuss the latest HP/UHP trends

Las Vegas dealership says personal touch is key to selling HP/UHP tires

Systems offer more features than ever

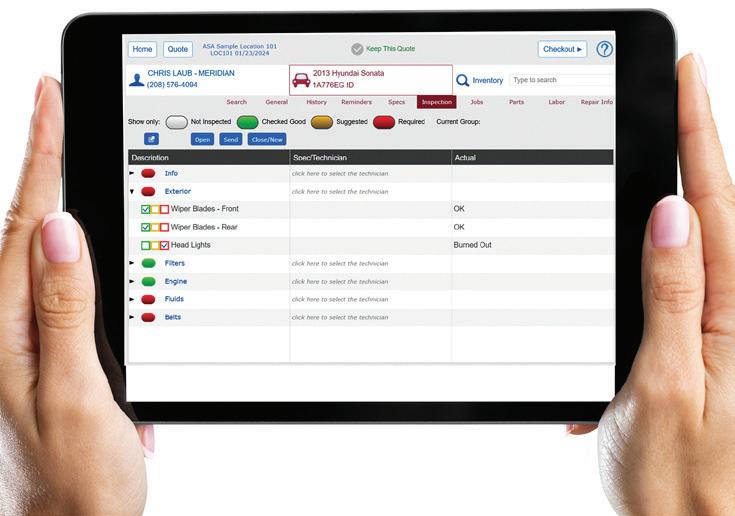

Best-One of Indy tests new tool to improve engagement

42

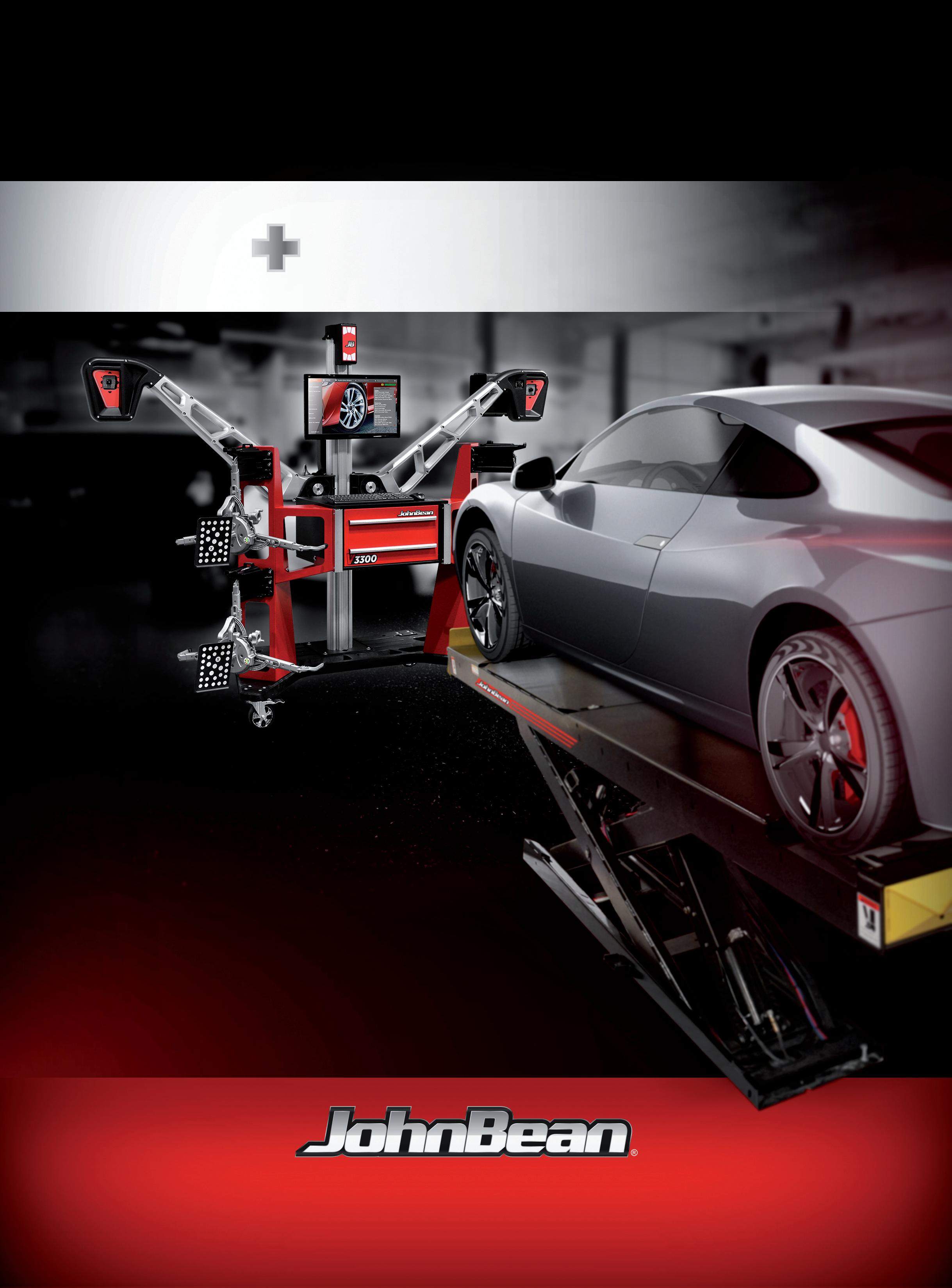

Today’s technicians expect more technology, ease of use Commercial Tire Dealer™

44

50

Are

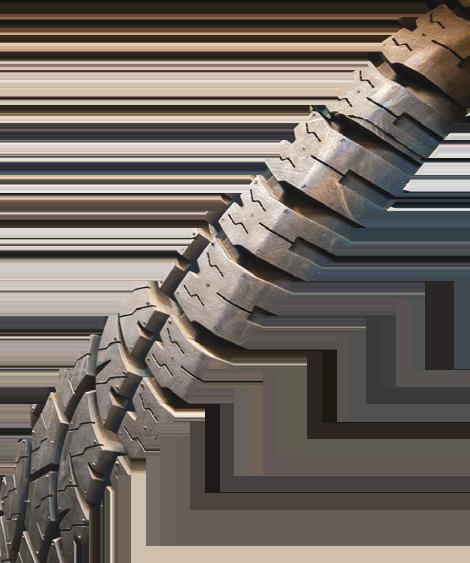

What will impact OTR tires in 2024

Father

56

3 www.ModernTireDealer.com The Industry’s Leading Publication February 2024, Volume 105, Number 2 Modern Tire Dealer is a proud member of:

Speed ratings, sizing and more

‘We’re your amigos’

Point-of-sale evolution

Making Facebook a VIP experience

Automation and digitalization in mounting and balancing

Market volatility

‘It’s service, service, service’

and son lead Weaver’s Tire Service

AG Tire Talk: The benefits of using IF and VF tires

just one

many

Editorial

an eye on global shipping Recent disruptions could impact your business

Reduction in soil compaction is

of

4

Keep

Online News and navigation tools for MTD’s website

Industry News

looks for growth in North America

focus on sales team, dealers and new products

Numbers That Count Relevant statistics for an industry in constant motion

Your Marketplace Will tire prices come down in 2024? 2023 unit sales closed on a high note

Business Insight

to prevent theft at your dealership Proven strategies to protect your business

Dealer Development

to create customer loyalty Balancing customers’ expectations with your business needs

Mergers and Acquisitions

aren’t more tire dealerships going public? Private equity — that’s why

EV Intelligence

Linglong

Will

16

18

60

How

62

How

64

Why

66

you really listening to what EV customers need?

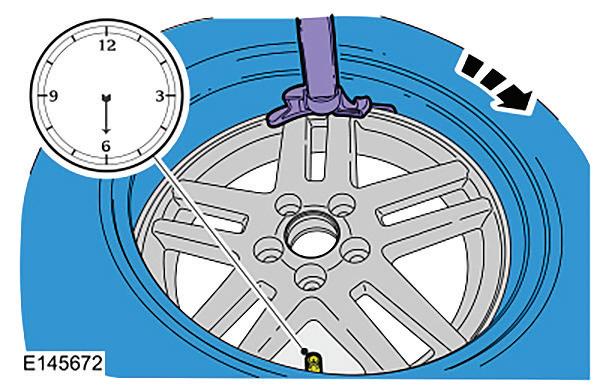

you truly listen, sales will follow 68 Focus On Industry Hankook says mutual profitability is a top priority ‘We are dealer focused’ 70 Focus On Dealers Point S achieves record expansion in 2023 ‘We believe we’re set for the future’ 72 TPMS Ford F-150 — 2023

Ad index

If

74

FEATURES DEPARTMENTS 34

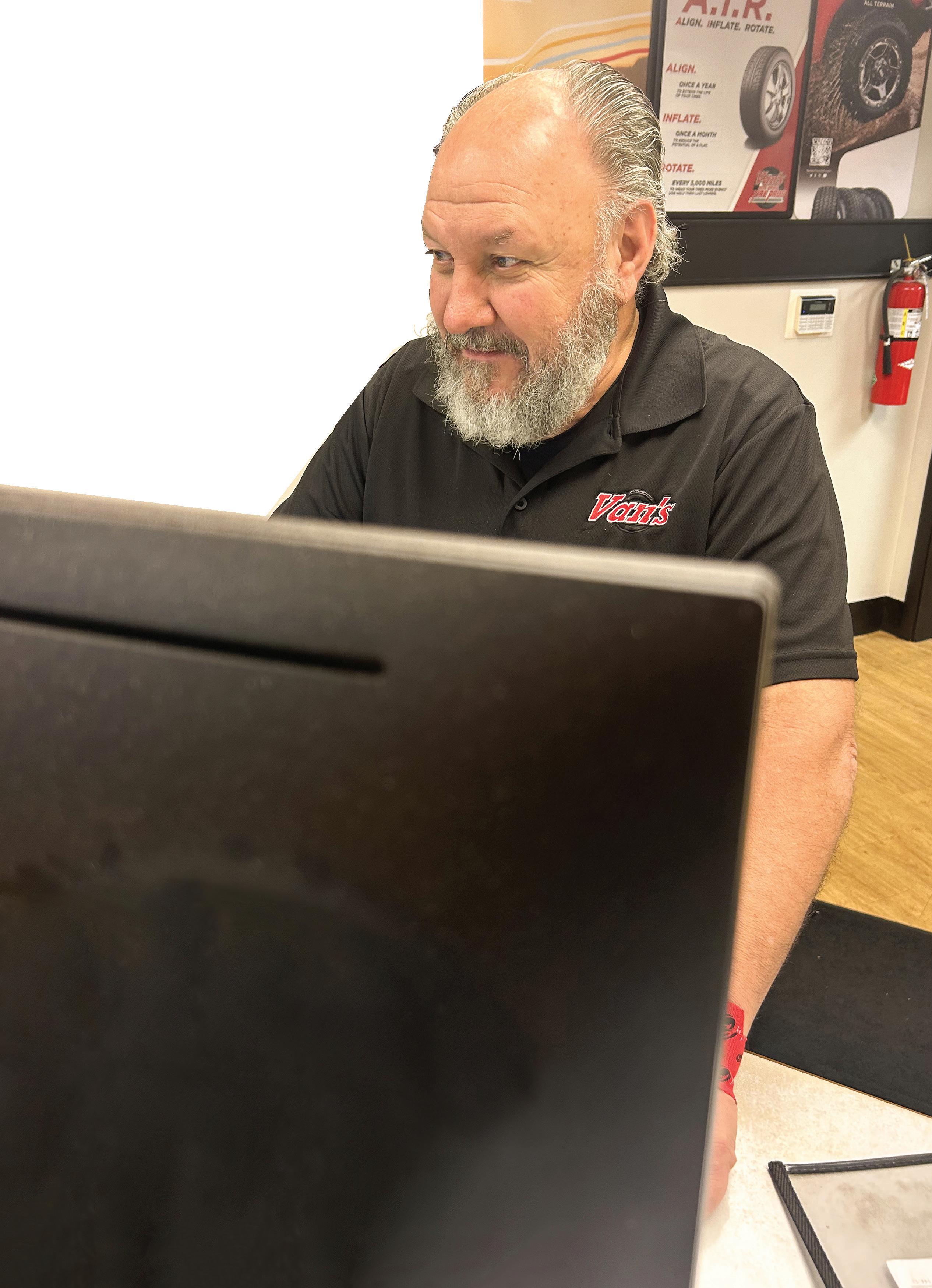

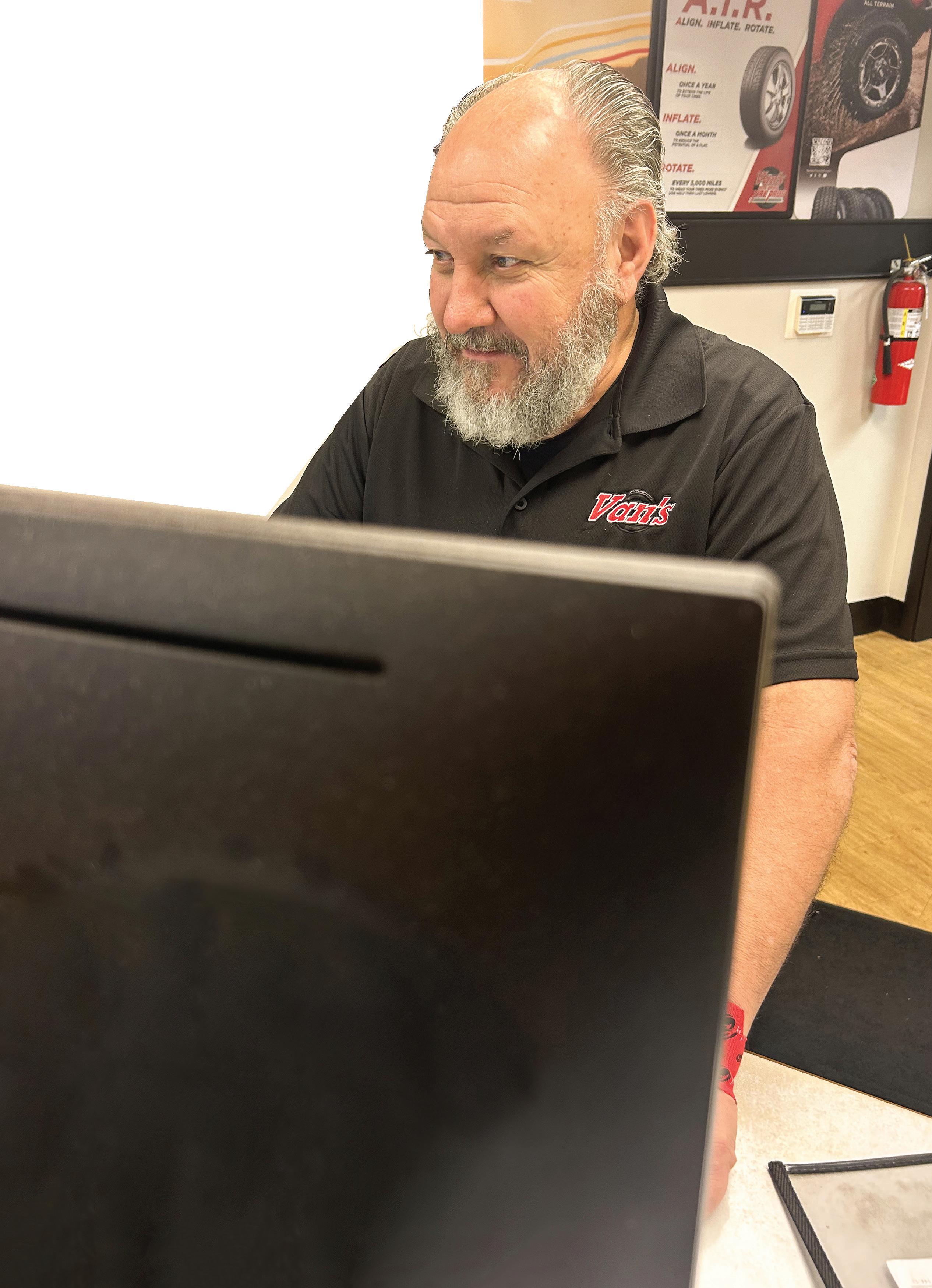

Pictured on the cover: Mike Spitale, Van’s Tire Pros (Akron, Ohio)

Tires

Amigo

offers expert advice to its HP/UHP tire customers.

Photo: Amigo Tires

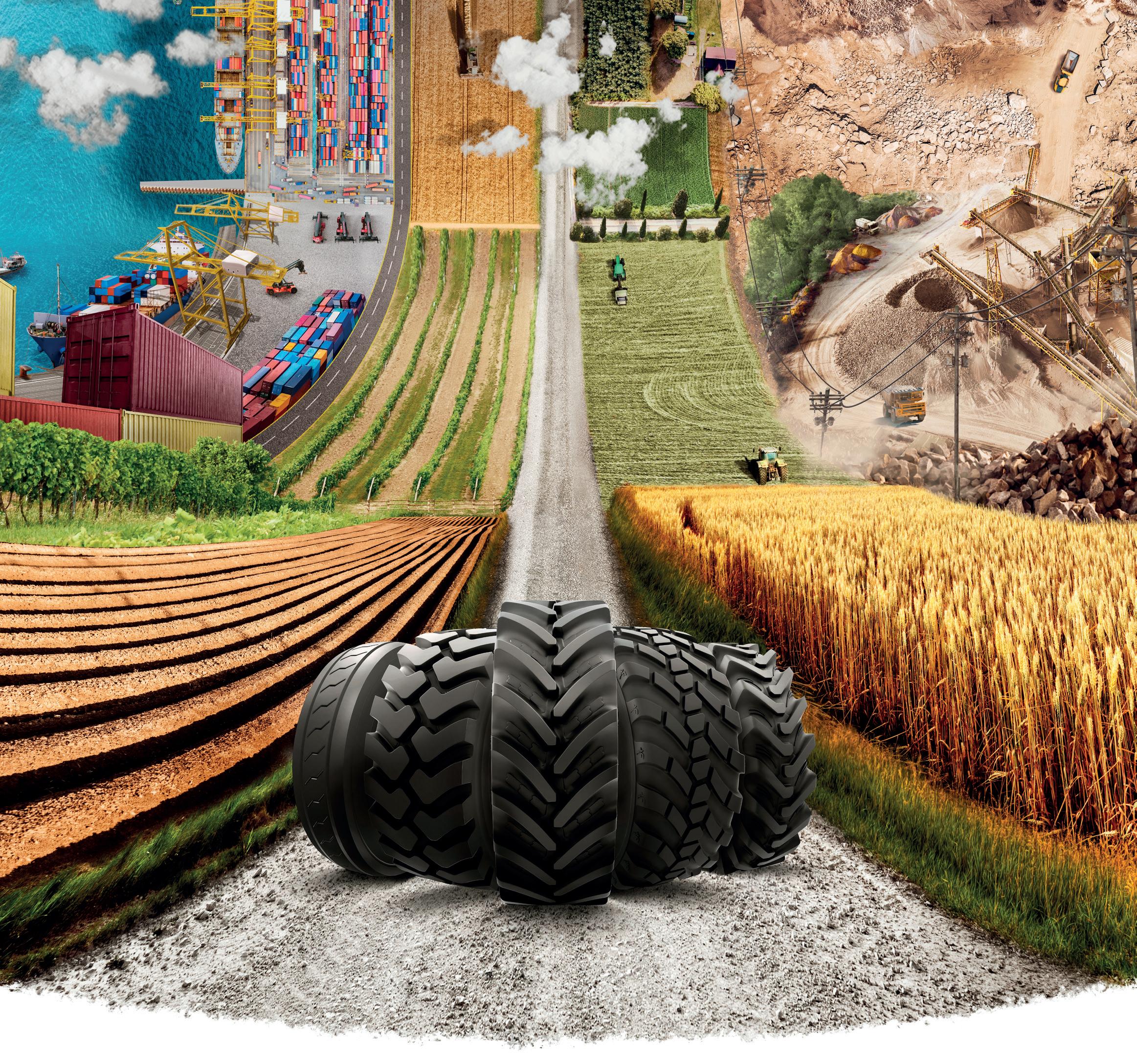

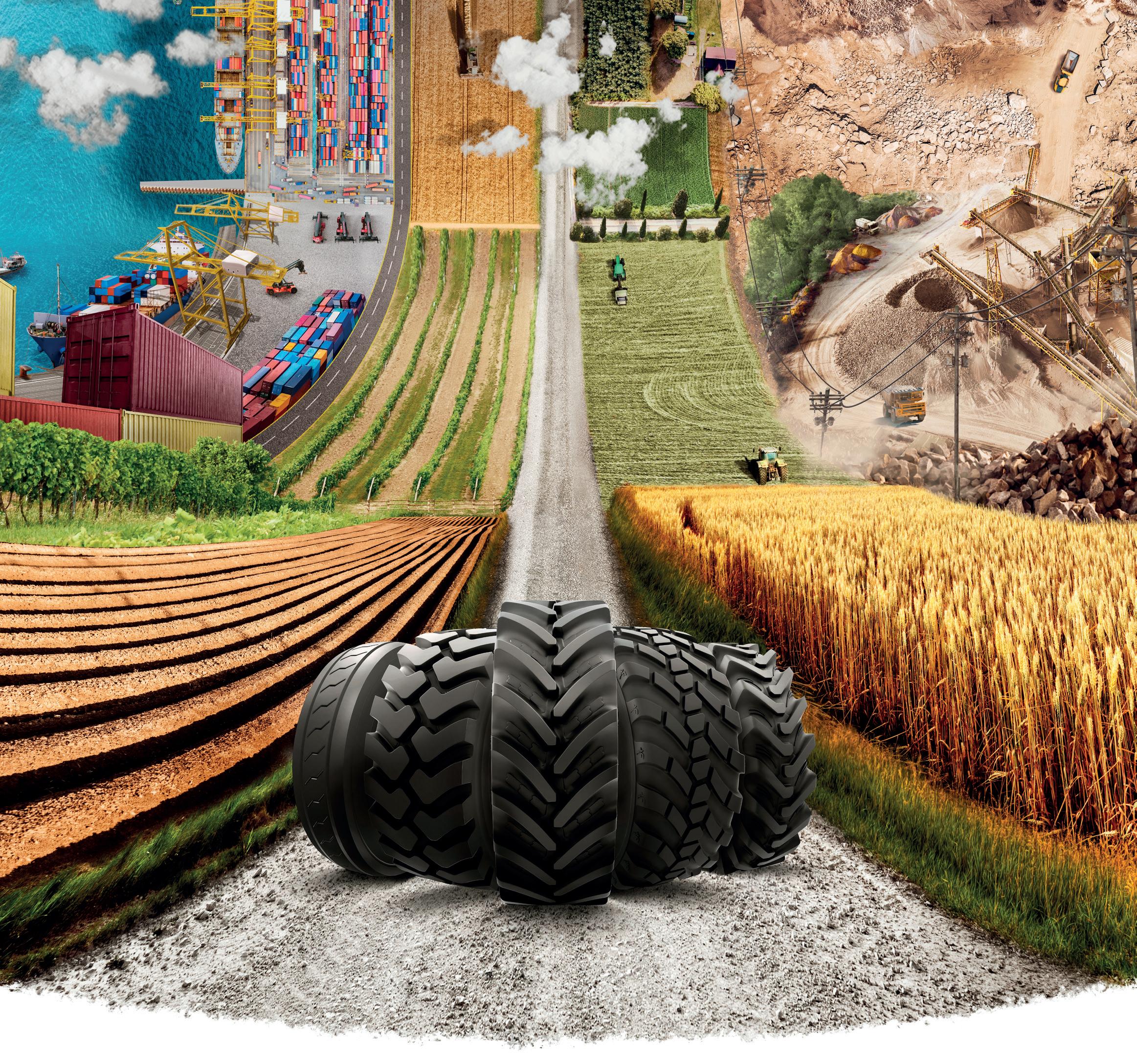

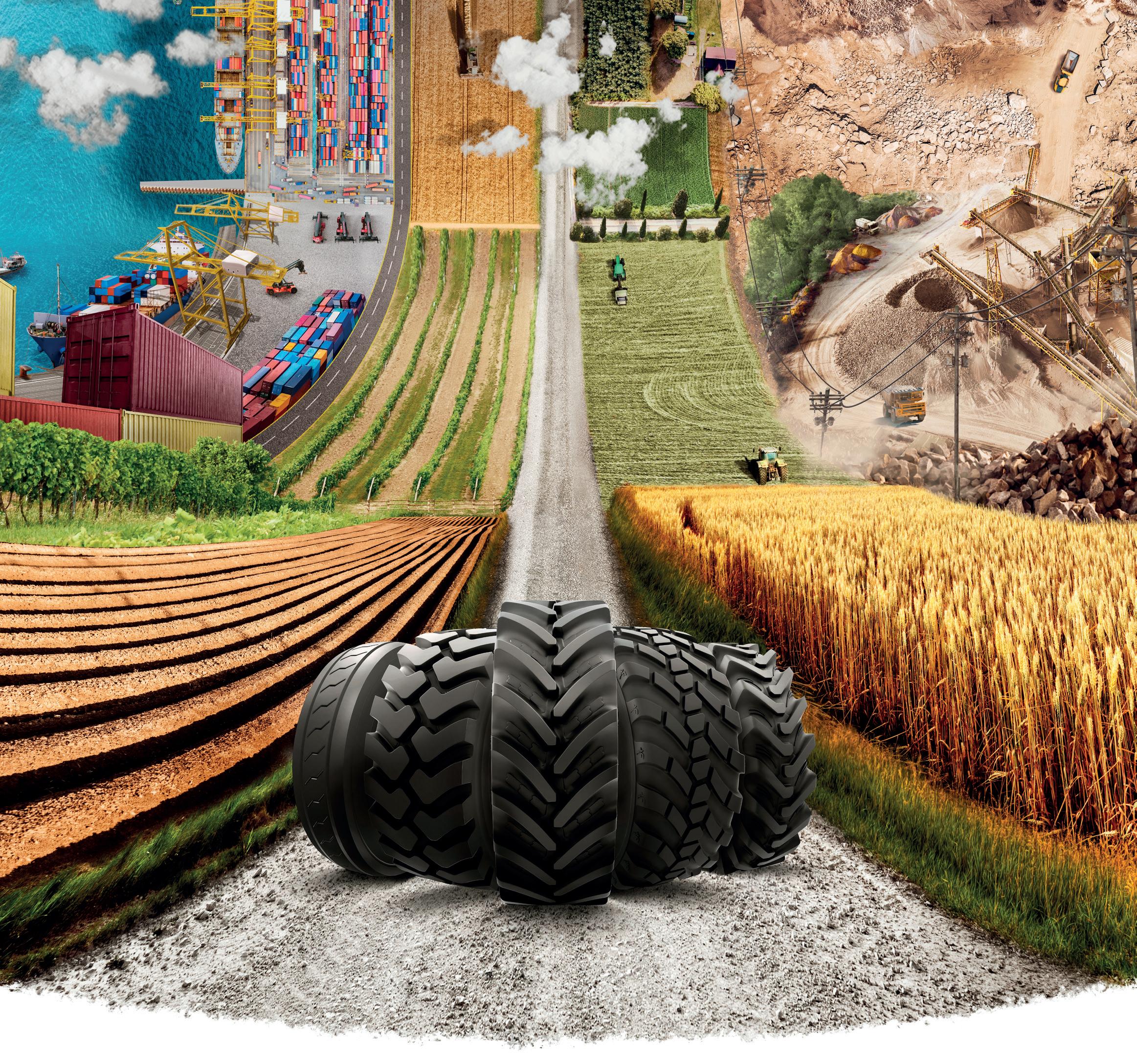

Global unrest and other factors could all play a part in the OTR tire market during 2024.

Photo: BKT

44

By

JMike Manges

JMike Manges

Keep an eye on global shipping RECENT DISRUPTIONS COULD IMPACT YOUR BUSINESS

ust when you thought the latest shipping crisis was a distant memory, here comes another disruptive situation. Though happening thousands of miles away from North America, continued attacks on container ships in the Red Sea — which showed no sign of abating at press time — have the potential to impact tire importers, dealers and distributors who order products from overseas plants and/or work through a manufacturer or distributor that brings in tires from off-shore points of origin.

In response to the seemingly nonstop attacks on their boats, shipping companies have been diverting vessels away from the Suez Canal, which connects the Red Sea to the Mediterranean Sea, to protect their people, freight and assets.

A growing number of logistics companies are sending ships around the southern tip of Africa rather than risk assault.

“Nearly all container services previously using Suez have decided to divert via the Cape of Good Hope,” says Simon Heaney, senior manager, container research, for Drewry, a leading provider of consulting services to the global shipping industry.

While the Suez Canal remains open, “the decision to reroute is more of an exercise in risk management on the part of carriers.”

Heaney notes that North American importers have been “impacted less directly” from container ship diversions than their European counterparts “as services from Asia mainly use West Coast gateways” across the Pacific or by way of the Panama Canal.

But that doesn’t necessarily mean the North American tire market will be immune to the knock-on effect of what’s happening in the Middle East.

If the Red Sea situation persists for the rest of the year, global container capacity “will be greatly reduced, which will make the market tighter than it otherwise would have been,” according to Heaney.

“Shipping lines will have to adjust networks to cater for extra distances and time.”

Heaney says rerouting ships around the Cape of Good Hope adds about 10 days of shipping time from Asia to Europe.

This, of course, increases the expense of doing business for shipping companies, which then “reroute” their new costs to customers.

With that in mind, it’s worth taking a deeper look at the impact all of this is having in Europe, especially as it pertains to price.

In a Jan. 18 report from Drewry, Heaney wrote that “new (shipping company) surcharges related to the Suez crisis have quickly appeared under different nomenclatures, including Transport Disruption Surcharge, Emergency Operation Surcharge and Contingency Adjustment Surcharge, just to name three.

“One carrier told Drewry that because of the many additional costs related to the Suez Canal diversion are dynamic, it is very complex to break down and itemize all of the various cost com-

“Disruption is a proven recipe for driving up shipping costs and the more chaos it causes, the bigger the freight rate inflation will be,” says Simon Heaney, senior manager, container research, for Drewry, a

ponents that make up the overall surcharge price at any given time. These could involve things such as additional equipment utilization days, implementation and use of added shuttle services,” as well as “costs incurred due to higher sailing speed, additional storage charges, additional cost for crew being onboard for longer voyages” and other factors. (I imagine the cost of military escorts also factors into the equation.)

On the bright side, “the surplus of container ships is much greater today than it was during the pandemic,” which “provides more resilience to cope with disruptive events.”

The demand situation for most products is different today than during COVID-19 lockdowns, when “there was a surge in demand for physical containerized goods, which when coupled with logistics capacity shortages, sent shipping costs into orbit,” wrote Heaney. “Affected markets will be much tighter than they otherwise would have been, but there is sufficient spare capacity.”

A “worst case scenario” outlined by Drewry predicted that if the Suez Canal was avoided for the remainder of 2024, “assuming a 30% increase in trade distance for the roughly 30% of container ships capacity that previously transited Suez,” overall shipping capacity would be reduced by around 9%.

In Drewry’s report, Heaney noted that “disruption is a proven recipe for driving up shipping costs and the more chaos it causes, the bigger the freight rate inflation will be.”

COVID-19 proved that the world is more interconnected than anyone had ever imagined. I urge you to keep an eye on the global shipping situation. It will be worth your time. ■

If you have any questions or comments, please email me at mmanges@endeavorb2b.com.

4 Editorial

MTD February 2024

leading provider of consulting services to the global shipping industry.

Photo: ID6274873© Alptraum | Dreamstime.com

DIGITAL RESOURCES FOR THE INDEPENDENT TIRE DEALER

Stay tuned to MTD’s podcast!

The Modern Tire Dealer Show is available on Apple Podcasts, Spotify, Google Podcasts, iHeart Radio, Amazon Music, Audible and MTD’s website. Download it today!

Sign up for Modern Tire Dealer ’s eNewsletters to receive the latest tire news and our most popular articles. Go to www.moderntiredealer.com/subscribe

Leadership changes make headlines

Sometimes, one event or one company drives the news cycle and in early 2024, Goodyear Tire & Rubber Co. has had that role. There have been a number of personnel changes at Goodyear as of late, most notably the naming of Rich Kramer’s successor. Mark Stewart, Goodyear’s new president and CEO as of Jan. 29, comes to the tiremaker from Stellantis. Here’s a look at how that announcement shook up the top headlines of the month.

1. Goodyear to pay new CEO $20 million bonuses

2. Photos: MTD takes you inside Hankook dealer event

3. Photos: Black’s Tire Service celebrates 95th anniversary

4. Goodyear appoints Mark Stewart as CEO, president

5. Goodyear’s Steve McClellan to retire this year

6. Linglong looks for growth in North America

7. Tire Discounters continues to add locations

8. Tiremakers moved forward with big projects in 2023

9. RoboTire files for bankruptcy

10. Tire dealers share outlook for 2024

DIGITAL EDITION

Check out MTD ’s digital edition at the top of our website’s homepage.

SOCIAL MEDIA

Like us Facebook: facebook.com/ ModernTireDealer

3515 Massillon Rd., Suite 200 Uniontown, OH 44685 (330) 899-2200, fax (330) 899-2209 www.moderntiredealer.com

PUBLISHER

Greg Smith gsmith@endeavorb2b.com (330) 598-0375

EDITORIAL

Editor: Mike Manges, (330) 598-0368, mmanges@endeavorb2b.com

Managing Editor: Joy Kopcha, (330) 598-0338, jkopcha@endeavorb2b.com

Associate Editor: Madison Gehring, (330) 598-0308, mgehring@endeavorb2b.com

PRODUCTION

Art Director: Erica Paquette

Production Manager: Karen Runion, (330) 736-1291, krunion@endeavorb2b.com

ACCOUNT EXECUTIVES

Darrell Bruggink

dbruggink@endeavorb2b.com (608) 299-6310

Marianne Dyal mdyal@endeavorb2b.com (706) 344-1388

Sean Thornton sthornton@endeavorb2b.com (269) 499-0257

Kyle Shaw kshaw@endeavorb2b.com (651) 846-9490

Martha Severson mseverson@endeavorb2b.com (651) 846-9452

Chad Hjellming chjellming@endeavorb2b.com (651) 846-9463

MTD READER ADVISORY BOARD

Rick Benton, Black’s Tire Service Inc.

Jessica Palanjian Rankin, Grand Prix Performance

John McCarthy Jr., McCarthy Tire Service Co. Inc.

Jamie Ward, Tire Discounters Inc.

CUSTOMER/SUBSCRIPTION SERVICE

(877) 382-9187

moderntiredealer@omeda.com

ENDEAVOR BUSINESS MEDIA, LLC

CEO: Chris Ferrell

President: June Griffin

COO: Patrick Rains

CRO: Reggie Lawrence

Chief Digital Officer: Jacquie Niemiec

Chief Administrative and Legal Officer: Tracy Kane

EVP Transportation: Kylie Hirko

VP Vehicle Repair: Chris Messer

VRG Editorial Director: Matthew Hudson

Follow us X: twitter.com/ MTDMagazine @MTDMagazine

6 MTD February 2024

ModernTireDealer.com

Executive changes at the top of Goodyear Tire & Rubber Co. have attracted the attention of MTD readers.

Photo: Goodyear Tire & Rubber Co.

Modern Tire Dealer (USPS Permit 369170), (ISSN 0026-8496 print) is published monthly by Endeavor Business Media, LLC. 201 N Main St 5th Floor, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI, and additional mailing offices. POSTMASTER: Send address changes to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. SUBSCRIPTIONS: Publisher reserves the right to reject non-qualified subscriptions. Subscription prices: U.S. ($81.25 per year). All subscriptions are payable in U.S. funds. Send subscription inquiries to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. Customer service can be reached toll-free at 877-382-9187 or at moderntiredealer@omeda. com for magazine subscription assistance or questions. Printed in the USA. Copyright 2024 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

Linglong looks for growth in North America

WILL FOCUS ON SALES TEAM, DEALERS AND NEW PRODUCTS

Linglong North America Sales, the North American subsidiary of Shandong Linglong Tire Co., will focus on building its sales team, signing new dealers and rolling out new products in 2024.

“Linglong has been growing its business here in North America for 20-plus years,” says Geoff Doster, president of Linglong North America Sales.

Doster assumed his current role last summer after nearly two decades at TBC Corp., where he most recently served as executive vice president, as well as president and COO of TBC Brands LLC and TBC International.

“Linglong is very committed to our current, long-term, strategic partners, but we also understand we have to develop opportunities to provide value through our products and programs.

“Building and growing a local team to better support our dealers and growth objectives” will be a high priority for the company this year.

“We also want to add like-minded customers,” says Doster. “The industry, over the last couple of years, has seen consolidation in all channels.

“As a manufacturer, we want to ensure we’re working with our dealer partners, while making sure we adjust to their changing needs. This is a continual process.”

NEW PRODUCTS

In North America, Linglong sells Atlas, Crosswind, Leao, Gritmaster, Green Max and Evoluxx brand tires.

“When I look at Linglong’s business, we are very strong in the passenger car tire market,” says Doster, who adds that the U.S. passenger tire market “has recalibrated.”

Doster says he also sees an affinity in the marketplace “for segments where Linglong has traditionally played.

“We are aligned with the market — making sure we have products that are ready for any demand we may see.”

During 2024, Lingling North America Sales plans to bring an electric vehicle (EV) tire to North America.

“We’re very advanced in our EV products that are marketed in China and other markets. I see the EV market as growing in North America.

“We want to make sure we’re introducing products that will be able to cover” both plug-in EV and hybrid vehicle applications.

“Another segment we’re focused on is high-diameter tires — not only in passenger, but also light truck.”

And the company will expand its lastmile van offerings in 2024, according to Doster. “We want to be able to grow our brands and their reach and depth, in the sense of making sure we’re covering all market segments.”

MANUFACTURING INVESTMENT

Doster says Linglong has a global manufacturing strategy. Most of the company’s North American market tires are built at its plant in Thailand.

Linglong’s plant in Serbia, which recently came online, will supplement the company’s production in Thailand.

“We’ve made tremendous progress at our Serbia facility,” which, once fully operational, will produce 12 million passenger tire units annually, according to Doster.

Right now, the plant produces commercial truck tires.

“The plan is to produce 1.6 million TBR products” each year at the facility, when it’s at full capacity.

“We hope to be through phase one and two” of the factory’s development by the mid-point of 2024.

“There’s always continued investment in terms of our manufacturing facilities’ capabilities and efficiencies.

“We’ve made a lot of investments in manufacturing.

“And a lot of investment has been made in research and development.

“Long-term, we’re setting the stage to execute on our global strategy to be a leader in the market and then ultimately, have better customer collaboration and partnerships, where we can grow together,” adds Doster.

— Mike Manges

Industry News MTD February 2024

“Long-term, we’re setting the stage to execute on our global strategy to be a leader in the market,” says Geoff Doster, president of Linglong North America Sales.

Photo: Linglong North America Sales

8

Bites

Sentury has AvanTech

Sentury Tire USA has assumed full control of AvanTech Tires LLC’s sales and marketing operations, effective Jan. 1, 2024. Sentury Tire USA’s vision for the AvanTech TBR lineup includes a range of tires, including all-position, trailer, closed-shoulder, open-shoulder and other products.

Nexen goes to MSG

Attendees at Madison Square Garden events will see advertising from Nexen Tire Americas Inc. The Nexen logo will appear on numerous marketing assets, including digitally enhanced dashboards, billboards, in-arena branding, signage and more. In 2023, Nexen became the New York Rangers’ official tire partner.

TGI names sponsorship

Tire Group International LLC’s Cosmo brand is the official tire sponsor of Clean Culture, an automotive event organizer spanning 25 states and three countries. Clean Culture’s events feature numerous vehicles, entertainment drifting, burnout competitions and more.

SRNA promotes Klimm

Sumitomo Rubber North America Inc. (SRNA) has named Bob Klimm director of corporate accounts. Klimm started at SRNA in 2009 and has led the Falken brand commercial truck tire business since 2015. In this new role, he will focus on the growth and success of the company’s primary corporate accounts.

Ascenso honors techs

Ascenso Tire North America has unveiled its Ascenso Farm Service Truck Technician Program for farm service truck technicians. Ascenso is asking agriculture and construction tire dealers, end users or colleagues to nominate farm service truck technicians, starting on April 1.

Pirelli wins Porsche fitment

Pirelli & Cie SpA announced it is the original equipment manufacturer for the new Porsche Cayenne with the P Zero, P Zero Corsa and Scorpion Winter 2 tires.

Goodyear names new CEO

Goodyear Tire & Rubber Co. has appointed Mark Stewart as its new CEO and president. He succeeds Rich Kramer, who announced his retirement from the company in late-2023.

Stewart joins Goodyear from automaker Stellantis, where he served as a chief operating officer of North America and a member of the company’s group executive council.

Laurette Koellner, independent lead director of Goodyear’s board since 2019, also has become the Akron, Ohio-based tiremaker’s non-executive board chair. Stewart will be added to the Goodyear board as a director.

Steve McClellan, president of Goodyear’s Americas business since 2016, will retire in April after 36 years with the company.

Before his current role, McClellan served as president of Goodyear North America, a position he assumed in 2011, and earlier led Goodyear’s North American commercial truck and consumer tire businesses.

Alma Tire acquires Jerry’s Tire

Alma Tire Companies, which is headquartered in Alma, Mich., has acquired Jerry’s Tire, a four-outlet dealership based in Lake Odessa, Mich. Terms of the deal, which expands Alma Tire’s footprint to 12 total locations, were not disclosed.

“We have had the goal of expanding our operations” throughout Michigan, says Alma Tire CEO Tony Grace.

In addition to Lake Odessa, Jerry’s Tire has stores in Flint, Mich.; Wyoming, Mich.; and in the greater Detroit, Mich., area.

According to Grace, Mark Carpenter, the longtime president of Jerry’s Tire, “had been looking for a buyer that would be a good steward of their business, employees and vendor and customer relationships.

“After a few months of discussion, Mark felt that Alma Tire was the company best-suited to carry Jerry’s Tire forward.

“Like Alma Tire, Jerry’s Tire is a family business,” says Grace. “Also like Alma Tire, Jerry’s Tire puts a heavy emphasis on service. So culturally, the values align very well. Then in looking at Jerry’s geographical footprint, their locations were in the markets we were wanting to break into next. It just made sense.”

The transaction is Alma Tire’s first acquisition “on the commercial side.” (Jerry’s Tire sells Goodyear, Dunlop, Kelly, Titan and Cooper brand products.)

Alma Tire, which was founded in 1954, goes to market in the commercial truck tire space under the name ATS Fleet Service.

Jerry’s Tire, which opened in 1948, “is and has been the premier name in the farm and agricultural tire sales and service sector” in its area, according to Grace.

ITC to review China TBR tariffs

It’s been five years since tariffs were imposed on commercial truck and bus tires made in China. That means it’s time for the International Trade Commission (ITC) to review whether those tariffs should remain in place.

Parties who wanted to weigh in on the issue had until Feb. 1 to do so.

In February 2019, both anti-dumping and countervailing duties were imposed on TBR tires built in China. At the time, the anti-dumping tariffs of 9% were imposed on most producers, while countervailing rates ranged from 20.98 to 63.34%.

And as is the case with any tariff investigation, at the five-year mark the ITC studies whether revoking the tariffs would cause a recurrence of injury to the domestic industry.

Industry News 10

Former Stellantis executive Mark Stewart is Goodyear Tire & Rubber Co.’s new CEO and president.

Photo: Stellantis

MTD February 2024

WHEREVER YOU ARE, BKT IS WITH YOU

A LONG WAY TOGETHER

matter how challenging your needs, BKT is with you offering an extensive product portfolio for every field such as agriculture, OTR and industrial applications. BKT provides concrete, reliable and high-quality solutions to your requests and working needs. Wherever you are, BKT is with you. BKT USA Inc. 202 Montrose West Ave. Suite 240 Copley, Ohio 44321 Toll free: (+1) 888-660-0662 - Office: (+1) 330-836-1090 Fax: (+1) 330-836-1091 Discover the BKT Radial Range

No

Bites

Monteith retires

Scott Monteith, one of the founding partners of the business now known as Best-One of Indy, has retired. Monteith, a founder of and Best-One of Indy vice president, partnered in 1986 with Paul Zurcher, Ray Monteith, Ross Kubacki and Dennis Dickson to form Indy Truck Tire Center, which from day one has partnered with the Best-One Tire Group.

Telle Tire opens new store

Telle Tire & Auto Service Inc. opened its 25th location in January 2024, following two recent acquisitions in the St. Louis, Mo., metro area. Telle Tire has acquired Rasch Automotive Service Center in Kirkwood, Mo., which has operated in the St. Louis suburb since 1944. Telle Tire President and CEO Aaron Telle says the Rasch Automotive business will transition over time to the Telle Tire brand and add a larger mix of tires.

Tire Discounters expands

Cincinnati, Ohio-based Tire Discounters Inc., one the 10 largest tire dealerships in the U.S., says it has added more than 40 locations to its network within the last two years. Locations added during 2023 include stores in Loganville, Dawsonville, Fayetteville and Kennesaw, Ga., plus a location in Alcoa, Tenn. In addition, the dealership added two stores in the Cincinnati suburbs.

Straightaway Tire grows

Straightaway Tire & Auto has acquired two Minnesota businesses — Maple Grove Auto Service and Warzecha Auto Works. Maple Grove Auto Service is a full-service auto repair facility in Maple Grove, Minn., while Warzecha Auto Works is based in Zimmerman, Minn.

New owner for Pilot

Berkshire Hathaway Inc. has finalized its acquisition of the Pilot Flying J truck stop network. Founded in 1958, Pilot Travel Centers bills itself as “the largest operator of travel centers in North America, with more than 750 locations across 44 states and six Canadian provinces.”

Record turnout for CTDA luncheon

Arecord number of attendees gathered for the 2024 California Tire Dealers Association (CTDA)/1-800EveryRim New Year luncheon on Jan. 18.

The more than 90 CTDA members heard from industry speakers Mike Spagnola, CEO and president of the Specialty Equipment Market Association (SEMA); Dick Gust, CEO of the Tire Industry Association (TIA); and Joel Ayres, executive director of the Automotive Aftermarket Charitable Foundation (AACF).

Spagnola told attendees that SEMA had a terrific 2023 and that attendance at the 2023 SEMA Show was up 16% from the previous year.

Spagnola said pre-registration for the 2024 SEMA Show is ahead of last year’s pace and work is underway to attract more companies to the show.

Gust talked about ongoing efforts surrounding Right to Repair, as well as the importance of supporting organizations like CTDA and TIA.

Ayres talked to CTDA members about the focus and work of the AACF and invited them to get involved in giving back to the industry.

Chris Barry, president of the CTDA, said he was pleased with the event and noted that “the crowd was enthusiastic” and engaged throughout the presentations. Barry said the luncheon also had a new feature — a small trade show.

Barry said tire dealers in California should join CTDA because “it helps with legislation (and) state policies. You’ve got to have a voice.” (The association maintains a lobbying presence in Sacramento, Calif.)

Neil Mellen, Edwin Pilger die

Neil Mellen, who founded Town Fair Tire in 1967, has died. He was 90 years old. Mellen attended New York University while working at his father’s auto parts store. In 1967, he opened his first Town Fair Tire store in Fairfield, Conn. Under his direction, Town Fair Tire grew to 115 stores throughout New England.

According to Mellen’s obituary, “the success of the company was Neil and his management team. Neil was a visionary with keen intellect — a man of uncommon compassion and integrity.”

Edwin Fredrick Pilger, a past president of the Texas Tire & Automotive Association (TTAA) and founder of Pilger’s Tire & Auto Center in College Station, Texas, also recently died. He was 92 years old.

Pilger purchased an Exxon gas station in College Station, Texas, in 1971 and opened Pilger’s Tire & Auto Center three years later with his wife, Doris.

Pilger’s Tire & Auto Center continues today and is operated by Edwin’s son, Rick Pilger, and Rick’s wife, Beverly.

Edwin also was a founding member of the TTAA, then known as the Texas Tire Dealers & Retreaders Association. He served on its board of directors and as president from 1989 through 1991.

News 12

Industry

MTD February 2024

More than 90 California Tire Dealers Association members attended the group’s new year luncheon, which took place in mid-January.

Photo: CTDA

Bites

TBC hires Stearman

TBC Corp. has appointed Chris Stearman to the newly created role of chief supply chain officer. He will be responsible for supply chain strategy, planning, purchasing, manufacturing and more for the company. Stearman recently served as vice president of supply chain operations leader for Tyson Foods.

Ultimate ADAS update

Hunter Engineering Co.’s Ultimate ADAS system has been approved for use by Nissan and Infiniti dealerships.

Honda and Accura approved use for its dealerships earlier in 2023. Ultimate ADAS combines alignment technology and a target placement system for around-the-vehicle coverage.

Turbo, Ireland team up

Turbo Wholesale Tires LLC has announced its new brand partnership with Kathy Ireland Worldwide (kiWW), along with a new ambassador for its Lexani brand. Actress Kathy Ireland will serve as Lexani’s brand ambassador and will apear in promotional campaigns.

ATD adds Steer to Radius

American Tire Distributors Inc. (ATD) is adding Steer’s customer relationship management (CRM) tool to its new Radius digital hub. “This partnership will bring first-class marketing technologies to ATD’s new digital hub, Radius, and allow customers to streamline their marketing operations,” say ATD officials.

Victor Capital buys Coats

Victor Capital Partners, a middle market private equity firm, announced it has completed the acquisition of the Coats Co. from Vontier Corp. Terms of the deal have not been disclosed. Coats’ current manufacturing location and office in LaVergne, Tenn. will serve as headquarters of the newly independent company.

Mayhew names director

Mayhew Steel Products Inc. announced the appointment of Brian Reznik Sr. as its new director of sales. In his new role, Reznik will expand Mayhew’s brand reach, drive revenue growth, identify new market opportunities and more.

Tiremakers take future tech to CES

Anumber of tire manufacturers highlighted their future mobility solutions at the 2024 Consumer Electronics Show (CES) in Las Vegas, Nev.

Bridgestone Americas Inc. discussed “how its end-to-end customer experience, comprised of a suite of solutions, is driving sustainability, efficiency, safety and productivity for fleets large and small,” and highlighted its Bridgestone Fleet Care program, which it describes as “an end-to-end resource for fleets.

“Fleet Care provides end-to-end solutions for fleet management, leveraging sophisticated platforms to help keep vehicles, assets and drivers safe and operating efficiently. These solutions include GPS tracking, video telematics, driver behavior management, accident reduction solutions, route optimization and asset utilization tools.”

According to Bridgestone officials, another component of Bridgestone Fleet Care is Bridgestone’s ENLITEN technology, which “marks a major pivot in how the company approaches tire design to deliver both dynamic performance and increased use of renewable and recycled materials.

“Bridgestone’s recently announced expansion to its Warren County, Tenn., tire plant will integrate ENLITEN technology for commercial applications.”

The company “aims to integrate the exceptional capabilities of ENLITEN technology across its business, providing excellence in casing durability, retreadability, rolling resistance and wear for all applications. With ENLITEN, Bridgestone will develop and deliver ENLITEN technology- equipped tires customized for customers, all while working to exceed customer and market demands.”

Bridgestone also highlighted its suite of tire monitoring and management solutions. “By making tires smarter through real-time tire monitoring, these solutions are designed to help fleets reduce tire costs, increase productivity and improve safety,” say Bridgestone officials.

Goodyear Tire & Rubber Co. announced plans for new collaborations and unveiled a new tire, the Goodyear ElectricDrive 2, which is an all-season tire designed for electric vehicle (EV) applications.

Available in May 2024, the Goodyear ElectricDrive 2 will come in 17 sizes to fit EV sedans and CUVs, including the Tesla Models Y, 3 and S; the Ford Mustang Mach-E and others.

More consumers pick independents

Consumers are turning to aftermarket repair shops sooner in the vehicle’s life cycle than before, according to research from IMR Automotive Research.

IMR research trends show that over the past decade, car dealership service centers are losing preference to aftermarket service providers like independent tire dealerships and others.

“Aftermarket outlets have been increasing in share for vehicle repairs and services in younger model vehicles over new car dealerships over the last 10 years, mainly due to convenient location and price,” say IMR officials.

Industry News 14

MTD February 2024

Bridgestone Americas Inc. was among the tiremakers that highlighted new technology and fleet solutions during the 2024 Consumer Electronics Show.

Photo: MTD

More vehicle owners are turning to independent auto service providers, according to IMR Automotive Research.

Photo: Virginia Tire & Auto LLC

Numbers ThatCount

Relevant statistics from an industry in constant motion

3

Number of new passenger tire sizes introduced to the market in 2023.

Source: Tire & Rim Association and MTD Facts Issue

15.8 MILLION

Units of medium truck tire retreads produced in 2023 in the U.S.

Source: MTD Facts Issue

66% Independent tire dealers’ share of the consumer tire retail channel.

Source: MTD Facts Issue

Photo: MTD

35.3 MILLION

of

62% Percentage of independent tire dealerships with only one location.

Source: MTD Facts Issue

Photo: Hank’s Tire

16

Number

U.S. passenger tire units that came from Thailand in 2023.

Source: MTD Facts Issue

Photo: South Carolina Ports Authority

MTD February 2024

Photo: Toyo Tire Corp.

Photo: Bridgestone Americas Inc.

GROUNDSPEED’S VOYAGER HP ULTRA-HIGH PERFORMANCE TIRE DELIVERS ENHANCED HANDLING AND TRACTION PERFORMANCE. THIS UHP FEATURES THE FOLLOWING:

GX SILICA COMPOUND

TO BECOME A GROUNDSPEED DISTRIBUTOR CONTACT 305.621.5101

Your Marketplace

By John Healy

By John Healy

RWill tire prices come down in 2024?

2023 UNIT SALES CLOSED ON A HIGH NOTE

etail sellout trends in December turned positive, with dealers seeing retail unit sales growing 1.1% yearover-year in the month, following a flat November. It was far from robust, but just three of the twelve months in 2023 saw positive sellout trends, thus the December result is an improvement compared to the majority of the year.

Regionally, the Southeast saw the strongest trends, up double digits compared to a year ago. Based on feedback from the tire dealer community, it appears the positive momentum in December 2023 was mainly due to outsized results from the Southeast region, as several industry contacts indicated sales were slow for the time of year, given the mild winter.

The consumer trade-down dynamic continued in December, as dealers who saw the most positive momentum indicated this was due to higher sales of tier-two and tier-three tires.

We have long felt that last year’s “green winter” may provide a catch-up period for replacement tire sellout. Given this, we would not be surprised to see sellout levels in January on the positive side of the ledger, with a continued shift to lower-tier brands.

Miles driven trends were again positive in December, with our miles driven momentum index registering a 1.8% increase year-over-year and that follows a 2% gain in November. For 2023 as a whole, eight out of 12 months had positive

miles driven gains, which was an improvement from the lackluster 2022. From our view, the tire replacement industry and broader automotive aftermarket are seeing a healthier backdrop compared to this time a year ago.

OUTLOOK ON TIRE PRICES

In aggregate in 2023, our tire raw material index fell 9.7% from 2022 levels, though with the lapping of price declines on the horizon, we expect the rate of decline to continue to diminish as we move forward. And it is notable, in analyzing specific input costs, that natural rubber prices climbed 14.5% during the fourth quarter due to heavy rainfall in Southeast Asia that put pressure on supply. Carbon black prices also increased during the quarter, while oil, synthetic rubber and tire fabric and cord prices fell. With a level of stability in raw material prices and waning demand for premium-tire tiers, we wonder if an incremental price concession could be on the horizon from some tire manufacturers.

However, our surveys continue to point towards a level of stickiness regarding upper-tier tire prices. That said, we do see the potential for price decreases at some point in 2024, as raw material costs continue to cool, inventory levels appear to be more normalized and manufacturers may concede some price in order to encourage wholesalers to begin taking on more inventory.

Snapshot of Dealer’s PLT Tire Volumes (Year-Over-Year Change)

LOW PRICE LEADERS

Despite positive volume trends, recent dealer commentary suggests consumer demand for passenger and light truck replacement tires was negative on a net basis, compared to December 2022. One out of four of our dealer contacts saw negative demand trends in December, down from the 10% who reported downward trends in November. Dealer feedback indicates the bulk of consumer demand in December was in lower-priced categories.

We continue to believe there is a hidden level of pent-up demand in the tire replacement market due to snowfall a year ago being consolidated into a few big storms, which shortened the window for weatherrelated tire purchases.

We still see a scenario in which demand returns to positive territory as vehicle owners pursue needed maintenance when winter weather arrives.

MIXED TRENDS

Our dealer survey indicated tier-two brands were the most in-demand, and we continue to see tier-two and tier-three tires swapping places month after month at the top of the chart, while tier-one tires remain in last place in our rankings for the third straight month. One dealer told us he believes the shift away from the top tier will continue in 2024.

Given the elevated prices that remain for premium brands and the inflationary environment that is stretching consumers’ wallets, it seems logical consumers continue to trade down. Longer term, we continue to believe that consumers will opt for tier-two tires as a balance of cost and performance. ■

John Healy is a managing director and research analyst with Northcoast Research Holdings LLC, based in Cleveland, Ohio. Healy covers a variety of subsectors of the automotive industry. If you would like to participate in the monthly dealer discussions, contact him at john.healy@northcoastresearch.com.

18 MTD February 2024 Oct-22 Nov-22 Dec-22 Oct-23 Nov-23 Dec-23 Average Increase 50% 57% 13% 20% 50% 31% 40% Flat 20% 29% 49% 20% 10% 13% 26% Decline 30% 14% 38% 60% 40% 56% 34% Total 100% 100% 100% 100% 100% 100% 100% SOURCE: NORTHCOAST RESEARCH ESTIMATES

Two Machines. One Price. Limitless Performance. www.rangerproducts.com *Price valid until March 31st, 2024. **Free shipping to direct shipping points within the 48 contiguous United States only. © 2024 BendPak Inc. Ranger Products is a registered trademark of BendPak. Revolutionize your tire and wheel service center with the ultimate pairing of precision and efficiency. Our combos redefine the standard, bringing you cutting-edge features without the hefty price tag. Elevate your services, amplify your efficiency, and see a direct impact on your profits. Don’t miss out on this opportunity to upgrade your workshop to the next level of performance. Connect with us at 1-800-253-2363 to speak with our experts or explore our combo offerings at www.bendpak.com. Discover the innovation, efficiency, and satisfaction that only Ranger can deliver – brought to you by BendPak. Tire Shop Package Includes: (1) DST30P Wheel Balancer + (1) R980AT Tire Changer + (1) Tape Wheel Weights Blk. & Slv. 1400 PC. 24 Month Warranty OEM Approved Max Performance Free Shipping** RimGuardTM Wheel Clamps Forged Steel Foot-Pedal Controls High-Volume Storage Wheel Weight Dispenser Stay Hold Brake Pedal Precision-machined, Hardened-Steel 40mm Shaft Easy-to-Read LED Control Panel Auto Hood Start Adjustable Bead Breaker Power Assist Tower Swing-Arm Bead Handling Tools SPEED Tire Shop Package SKU# 5140127 $8,320* Model: DST30P Model: R980AT

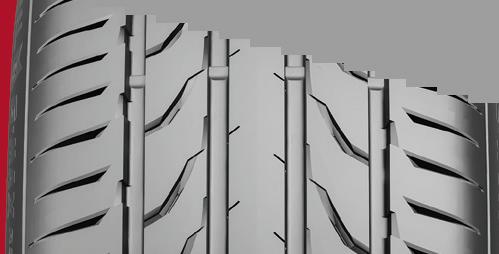

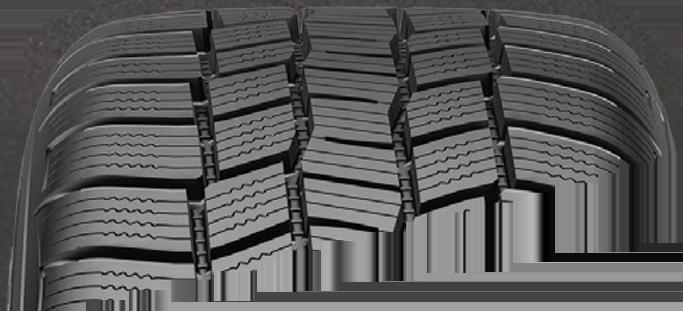

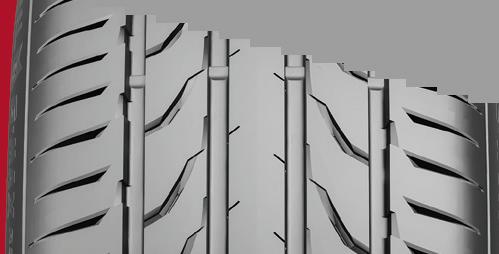

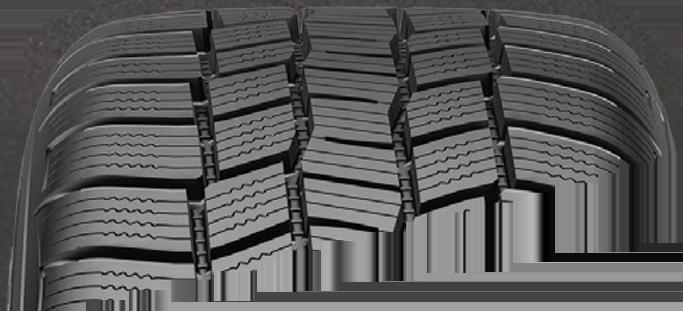

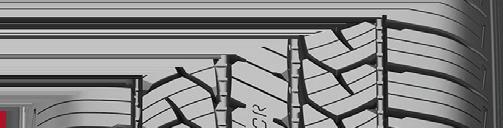

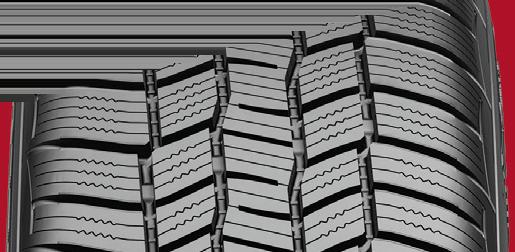

Speed ratings, sizing and more TIREMAKERS DISCUSS THE LATEST HP/UHP TRENDS

By

Madison Gehring

As the automotive industry hurtles into a new era of sustainability and performance, tire manufacturers are at the forefront of innovation, striving to meet the demands of customers seeking high performance (HP) and ultra-high performance (UHP) tires.

As the market for these products rapidly evolves, tire manufacturers provide updates on the latest HP and UHP tire trends and technologies in this MTD exclusive.

MTD: What new trends in HP and UHP tires are you seeing right now?

Brandon Stotsenburg, vice president of automotive, American Kenda Rubber Industrial Co. Ltd.: Kenda sees several key trends in the North American market in the true performance segment. First, HP tires have been moving from H-rated to primarily V-rated for new vehicle applications. UHP further segments into summer and all-season, with UHP all-season growing increasingly more prevalent.

Summer UHP breaks down further to include max performance and competition tires that are often stamped DOT for street use, but not seen outside of weekend competition. There has been an increasing trend to see UHP tires in weekend competitions. Kenda has translated the street performance that we demonstrate with our Vezda brand through our DOT racing activities, competing on the same tires that we sell via our Kenda retailers and we identify as “Podium2Pavement.”

“Kenda sees the primary need for the UHP segment innovation for a true fourseason tire that offers all of the dry, wet and winter benefits that are available in grand touring tires now offered by leading brands,” says Brandon Stotsenburg, vice president of automotive, American Kenda Rubber Industrial Co. Ltd.

We learn and improve the materials and construction using the racing activities that translate directly to the end consumer for UHP driving.

Another trend has been for many of the crossover and small SUV applications to have performance requiring UHP tires. As these are automotive platforms with suspension systems, the tire applications are increasingly reflecting the necessary performance. This is particularly apparent with EV vehicles that often require the high-speed ratings of UHP tires.

Steven Liu, vice president of product development, Hercules, American Tire Distributors Inc.: We are seeing the trend towards small- to mid-size (and) even full-size CUV/SUV and electric vehicle (EV) applications for performance tires, thus pushing for higher rim diameters sizes on the OEM side, which ultimately will trickle down to replacement tire demand. Beyond the traditional classification method between HP/UHP (tires), with speed rating, rim diameters, load index and specific performance attributes such as dry/wet traction, nowadays there’s a bigger push for lower rolling resistance and this (has) resulted in a diverse assortment of performance-oriented products.

develop is geared towards the driver, with vehicle dynamics in mind.

Karl Jin, divisional head of product and pricing for passenger car and light truck, Apollo Tyres Ltd. (Vredestein): We continue to see the broad prolifera-

“We are seeing the trend towards small- to mid-size (and) even full-size CUV/ SUV and electric vehicle (EV) applications for performance tires, thus pushing for higher rim diameters sizes on the OEM side,” says Steven Liu, vice president of product development, Hercules, American Tire Distributors Inc.

tion of HP and UHP products across the industry, with a noticeable trend around expanded sizing as tire manufacturers cater to CUV and SUV drivers. In addition, there’s a market shift underway, as some all-season volume transitions to the allweather category. UHP’s summer demand holds steady, with minimal adjustments.

We believe this evolution provides a great opportunity for our customers to optimize margin and (place) a renewed focus on the performance segment. At the end of the day, we believe as the car parc has evolved, while there are many performance sub-segments, our goal is making sure every performance (HP or UHP) tire we

From a manufacturer standpoint, addressing the market demand across all three UHP categories — all-season, allweather and summer — calls for a diverse size range to address market preferences. For instance, despite being a smaller segment in terms of overall demand, UHP summer requires more than 100 different sizes to cover the need for staggered fitments. In line with our strategic vision, we have invested in the UHP summer lineup and are preparing to launch 100 SKUs for the new Vredestein Ultrac Pro — half in 2024 and the remainder in 2025, all of which carry a Y speed rating. In the UHP all-weather segment, we’re poised to launch 100 SKUs of the new Quatrac Pro Plus, with availability starting in January 2024.

MTD February 2024 20

HP/UHP tires

Photo: American Tire Distributors Inc.

Photo: American Kenda Rubber Industrial Co. Ltd.

“In line with our strategic vision, we have invested in the UHP summer lineup and are preparing to launch 100 SKUs for the new Vredestein Ultrac Pro—half in 2024 and the remainder in 2025,” says Karl Jin, divisional head of product and pricing for passenger car and light truck, Apollo Tyres Ltd.

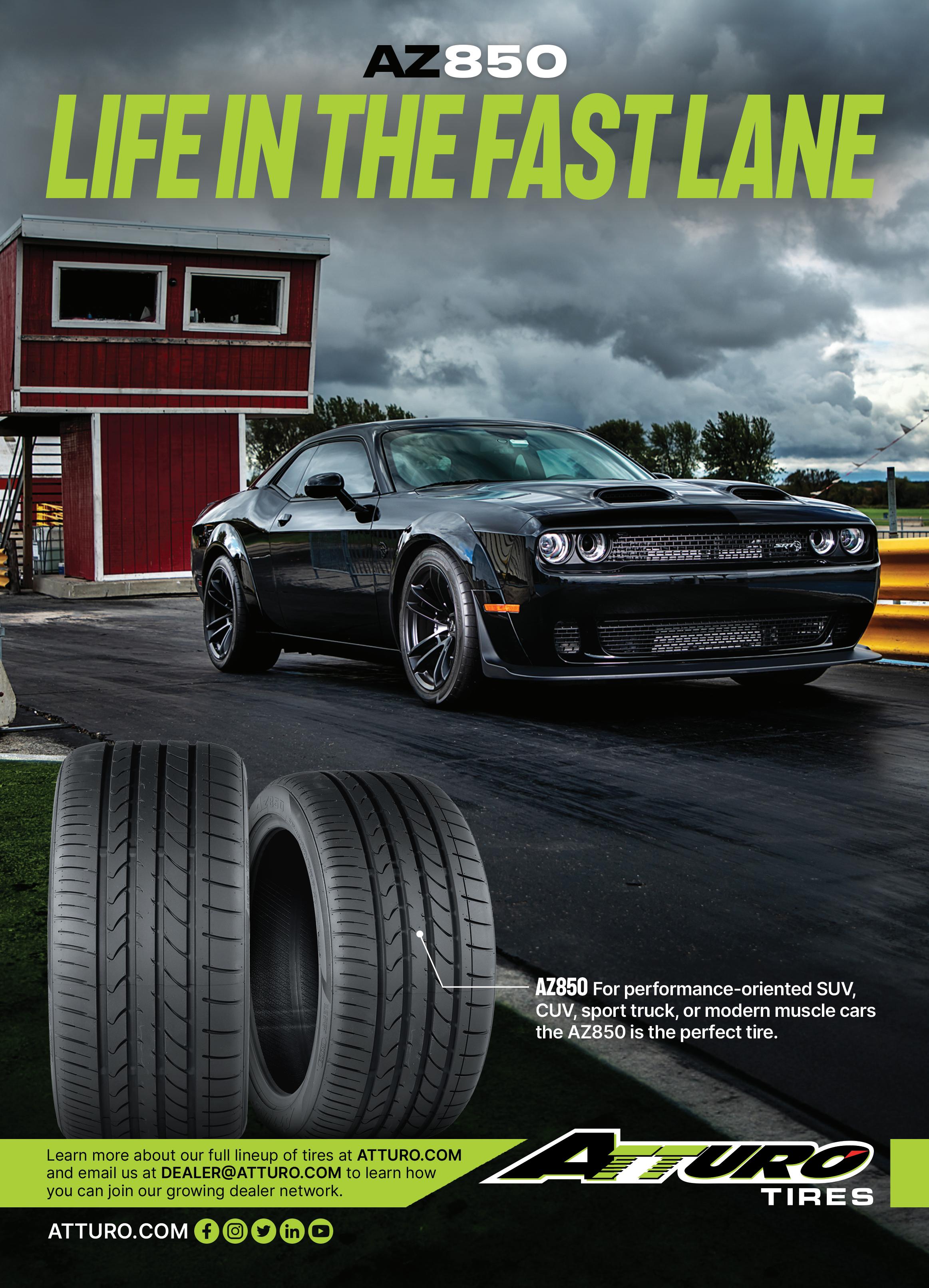

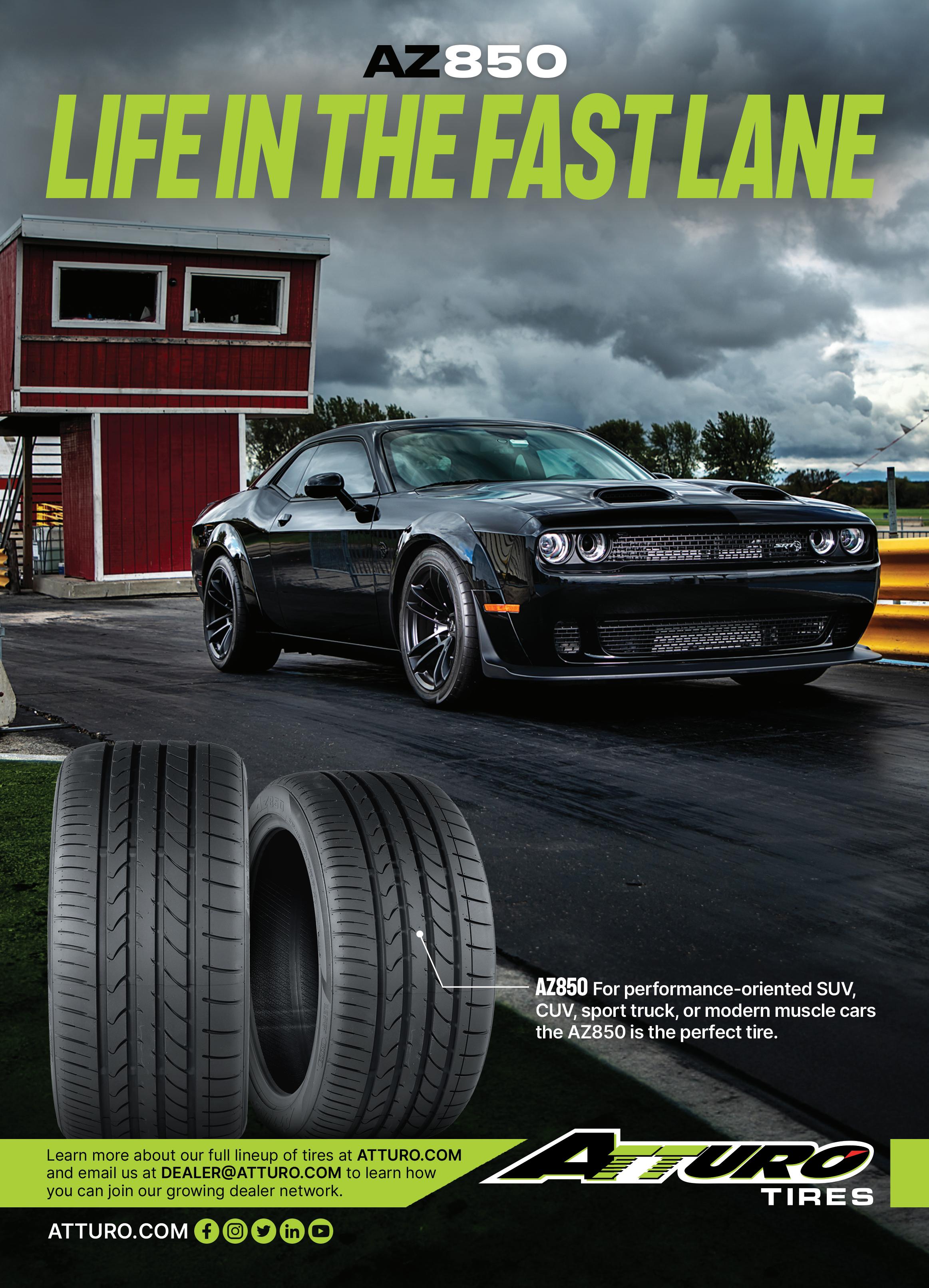

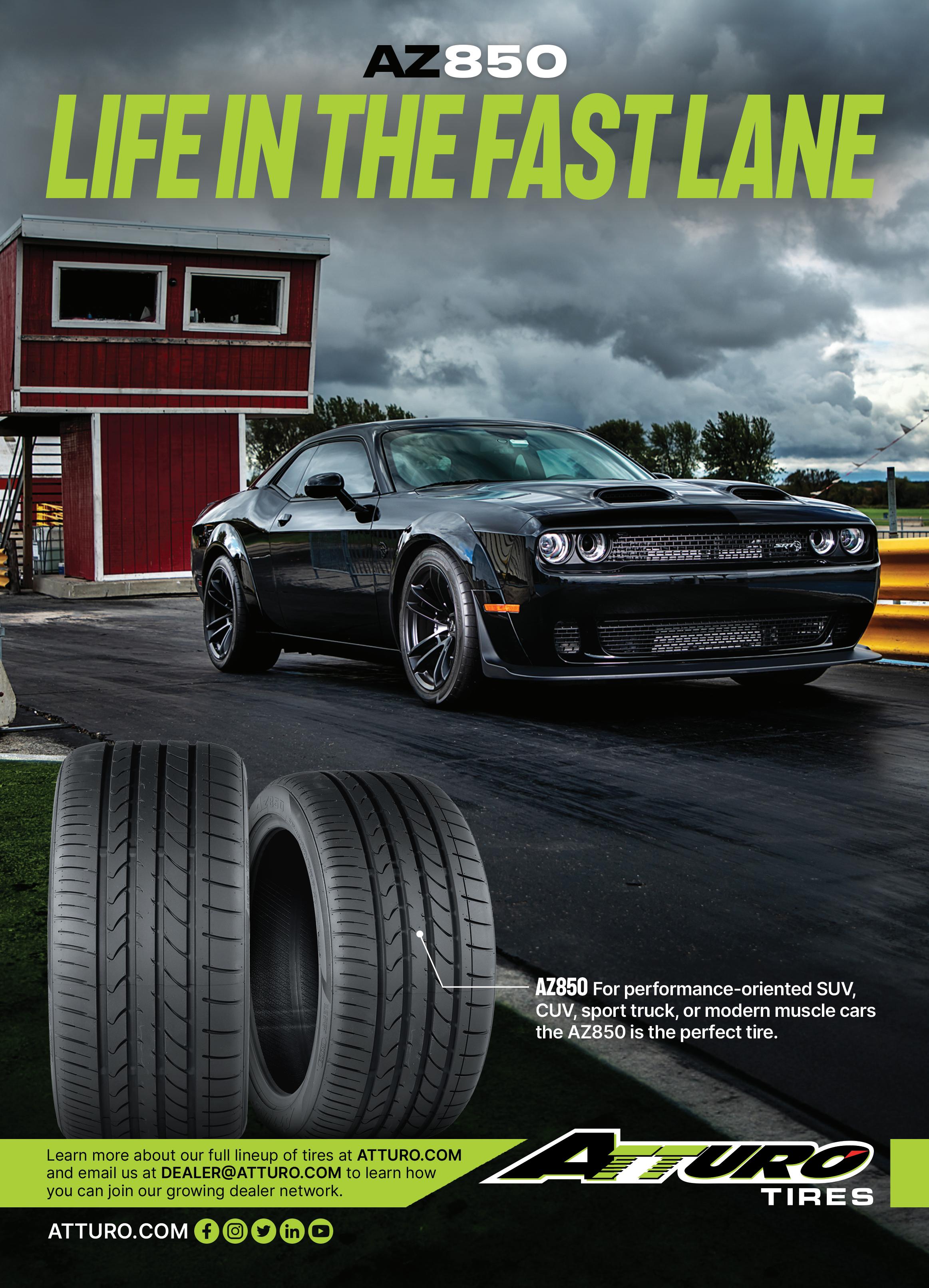

Michael Mathis, president, Atturo Tire Corp.: Overall, the HP/UHP market is growing. We see broad trends in the continual increase in rim size, increase in staggered fitments (for) both OE and aftermarket and the development of all-weather, 3-Peak Mountain Snowflake (3PMS)-certified high performance tires. Atturo strives to educate dealers on how to qualify customers who are potential HP/UHP customers. There is an increasing number of vehicles that can achieve increased performance by a simple tire change.

Ian McKinney, senior product manager, Bridgestone Americas Inc.: The automotive industry is witnessing a persistent trend toward the adoption of larger rim diameters for wheels and tires by both consumers and OEMs. The shift is particularly notable in the performance tire segment, where there’s a growing emphasis on accommodating higher rim sizes, especially on CUV applications. As the performance tire market continues to expand and adapt to these trends, we’ve seen smaller rim diameter tire sizes decrease with new product offerings. While we continue to develop products within the HP and UHP segments, it’s crucial to be attentive to these industry trends. This involves maintaining a diverse range of traditional 17-inch and 18-inch performance (tires) and sizes, while simultaneously extending coverage to meet the rising demand for 19-, 20- and 21-inch sizes requested by OEMs.

In terms of volume, performance tires see their highest demand from sports cars and sports sedans dominating today’s roads. The 17-inch sizes — catering to

popular imports such as the Toyota Camry, Nissan Altima and Honda Accord — are particularly favored. Additionally, there is significant traction in domestic muscle car fitments, exemplified by the 18-inch size for the Ford Mustang. Meanwhile, the 17-inch and 18-inch sizes for German offerings like the BMW 2 and 3 series also have considerable popularity.

Additionally, the HP and UHP segments have been affected by an increase in speed ratings. Previously, a performance all-season tire line would be competitive with a speed rating of H (max 130 mph) or V (max 149 mph). As the modern car parc has adapted to vehicle trends, all-season performance tires often need a speed rating of W (max 168 mph) or even Y (max 186 mph) to have appropriate coverage in this segment. When it’s time to replace their OE tires, consumers now must look for a comparable speed-rated tire, which means we’re elevating speed ratings on replacement tires to match the new OE standards.

that provides the ultimate in response and handling for their sports car or other type of performance vehicle. In all categories, OEMs continue to push for lower (rolling) resistance tires in order to improve the overall efficiency of the vehicle, whether it’s an EV or an internal combustion engine vehicle.

“Atturo strives to educate dealers on how to qualify customers who are potential HP/UHP customers,” says Michael Mathis, president, Atturo Tire Corp. “There is an increasing number of vehicles which can achieve increased performance by a simple tire change.

Nate Dodds, product manager for performance tires, Continental Tire the Americas LLC: One of the most recent changes in the HP segment has been the introduction of all-weather products that are more geared towards wet and winter performance, while also offering competitive highway handling and tread life.

In UHP, specifically UHP all-season, we continue to add fitments for performance CUV/SUV vehicles. Consumers are looking for a tire that can do it all, in regard to balancing wet, dry, rolling resistance, wear and winter capability. Second, with the increasing trend towards electrification, mileage will continue in importance for customers purchasing a UHP all-season tire due to the increased torque and weight of those vehicles.

For UHP summer, the trend is to higher and higher levels of dry and wet traction. As well, consumers are looking for a tire

David Poling, vice president, R&D and technical, Giti Tire (USA) Ltd.: Let’s begin by roughly defining HP tires as those having an H- and V-speed rating and UHP as having W and Y. In the past, there was a clearer delineation between HP and UHP tires. The UHP category generally captured the larger rim sizes and lower aspect ratios. However, today we see more HP tires in the larger rim diameters and lower aspect ratios. This trend is driven by the OEMs, who consistently place larger tires on vehicles, but keep the speed rating at H and V in many cases, making the fitments HP. But we shouldn’t assume this means that they are summer tires, because in fact, most of the HP tires going on at OE are all-season (tires). This is why we have seen a drop in HP summer and a rise in HP all season.

A similar situation is happening for UHP tires, as well, where OE fitments are split between all-season and summer, with all-season being the larger volume. This doesn’t mean that the answer for the

“The Bridgestone Potenza Sport AS, designed to support popular sports cars, sedans and performance crossovers, including applicable electric and hybrid performance vehicles, is Bridgestone’s first ultra-high performance all-season tire to feature Bridgestone ENLITEN technology,” says Ian McKinney, senior product manager, Bridgestone Americas Inc.

Americas Inc.

www.ModernTireDealer.com 21

Photo: Apollo Tyres Ltd.

Photo: Atturo Tire Corp.

Photo: Bridgestone

HP/UHP tires

UHP all-season is a traditional UHP allseason, as most of the fitments are touring all-season tires with a W speed rating. I think the solution will be extending traditional all-season lines into the UHP speed rating requirements.

Michelle Baggetta, director, category strategy and planning, high performance and winter tires, Goodyear Tire and Rubber Co.: With the growth of the high performance CUV and EV markets, there is significant demand from OE vehicle manufacturers for W-, Y- and Z-rated tires, which has simultaneously driven growth of HP and UHP tires across the replacement market.

As consumer adoption of EVs shows no signs of slowing, there is a new need to engineer HP tires that are equipped with adequate features to handle EVs’ unique attributes, including requirements for load, noise, torque, rolling resistance and range. With the continued growth of the EV market, there is an opportunity for continued HP tire innovation to keep pace with drivers’ and vehicles’ needs.

The high-performance CUV market has grown substantially over the past five years, which created a new need for performancespecific tires. As consumers continue to show preference for the aesthetic and functionality of CUVs, we anticipate that there will be a growing need for HP tires that provide all-around road performance.

Moonki Cho, product manager, Hankook Tire America Corp.: In the past, HP and UHP tires were normally reserved for sports cars and high-end performance trim levels. Today, especially within the HP category, we’re seeing a much broader application at the OE level across more general trim levels, in addition to rising consumer interest in ways to enjoy their vehicle’s dynamic driving experience across more seasons than

“Innovation in these markets will be driven in large part by the OE requirements,” says David Poling vice president, R&D and technical, Giti Tire (USA) Ltd. “As many (tires) find their way onto EVs, there will be a push for noise reduction.”

“In UHP, specifically UHP all-season, we continue to add fitments for performance CUV/SUV vehicles,” says Nate Dobbs, product manager for performance tires, Continental Tire the Americas LLC. “Consumers are looking for a tire that can do it all in regard to balancing wet, dry, rolling resistance, wear and winter capability.”

before. This has been the spark behind our recently launched Ventus S1 AS tire developed for performance-loving drivers who want to enjoy their car’s dynamic driving features year-round and across all seasons. For both the HP and UHP segments, performance will continue to improve for greater daily applications, whereas the latter may trend toward more specific use cases around racing and track performance.

John Wu, product strategy director, Maxxis International-USA: From a product point of view, the market for HP tires has dwindled as demand for UHP products continues to increase, and we expect UHP products to dominate the market. The extreme-performance summer segment has become quite competitive as more brands attempt to make a name for themselves in the UHP world. This type of UHP tire delivers track-focused performance, such as sharper response, higher cornering speeds, shorter braking distance and quicker dry lap times, while offering an acceptable level of on-road refinement. From an overall industry point of view, we’re seeing larger wheel diameter fitments continue as OE automakers bake in more profitability on sporty trim levels. We don’t see this trend slowing with EVs and hybrids, either.

Jay Lee, product marketing, Nexen Tire America Inc.: The UHP tire market is experiencing a notable shift driven by

the diverse needs of consumers. Two distinct groups have emerged: performance enthusiasts seeking track-worthy UHP tires and consumers with factory-equipped UHP tires for their CUVs and SUVs. The latter group prioritizes comfort, fuel efficiency and a quiet ride over high-speed performance. The increasing prevalence of larger wheel packages on CUVs and SUVs is driving the demand for UHP tires with all-season characteristics. The forecasted fastest-growing segment in the UHP market is for tires that balance performance with features like quietness and comfort, meeting the preferences of consumers who do not prioritize track-level performance, but seek a versatile and enjoyable driving experience. Next-generation UHP tires are expected to incorporate more all-season characteristics to cater to this evolving market demand.

Ian Coke, chief technical officer, Pirelli Tire North America Inc.: The focus on sustainability is growing a lot. And while this has already been a point of emphasis for manufacturers recently, the continued growth of the SUV and CUV market for consumers remains a major influence on the production priorities of manufacturers. With this increased demand on the side of auto manufacturers, the onus is on tiremakers to pump out significantly more HP and UHP tires that lend better handling and decrease rolling resistance in order to benefit fuel efficiency.

Ken Coltrane, vice president of marketing and product development, Prinx Chengshan Tire North America Inc: We are beginning to see more EV-capable designations.

Mike Park, assistant director of marketing, Tireco Inc.: Tire technology is advancing with a strong emphasis on performance improvement through innovative materials and construction techniques. Sustainability is a key focus, driving the development of eco-friendly tire options within the HP/UHP category. There’s also a growing interest in the potential for smart tires that can provide real-time data on tire pressure and tread depth.

Joaquin Gonzalez Jr., president, Tire Group International LLC (TGI): I wouldn’t necessarily call them new trends, rather trends which are gaining popularity:

22 MTD February 2024

Photo: Giti Tire (USA) Ltd.

Photo: Continental Tire the Americas LLC

Powering through precipitation matters.

Want an ultra-high performance tire that shines, no matter the forecast? The Bridgestone Potenza Sport AS tire displayed up to 7% quicker wet acceleration vs. a key competitor 1 . Engineered with Bridgestone’s next generation ENLITEN™ technology, the Potenza Sport AS tire gives you precision performance in wet conditions. Confidence when cornering, even in the rain—that’s what really matters.

2024 Bridgestone Americas Tire Operations, LLC Based on comparative wet acceleration testing (0-40mph) of the Bridgestone Potenza Sport AS tires and the Continental ExtremeContact DWS06+ tires (size 215/55R17). Results may vary based on proper tire and vehicle maintenance, road conditions and driving habits.

©

1

HP/UHP tires

“The added weight and torque associated with EVs can impact several factors when it comes to tire performance, most importantly load capacity, treadwear and vehicle range,” says Michelle Baggetta, director, category strategy and planning, highperformance and winter tires, Goodyear Tire & Rubber Co. “The Goodyear ElectricDrive GT was designed with these elements in mind.”

All-season performance: Having a tire that offers great performance in various weather conditions and provides a balance of grip, handling, and comfort, making them suitable for year-round use.

More and more HP and UHP tires are now equipped with noise-canceling technologies. Consumers are becoming much more educated on their tire purchases and requesting features such as this, making it important for manufacturers to provide solutions.

Enhanced wet traction: Utilizing innovative tread patterns and compounds to provide better grip and handling on wet roads.

As sustainability becomes increasingly important, many tire manufacturers are introducing eco-friendly HP and UHP tire options. These tires are designed to have lower rolling resistance, which can result in improved fuel efficiency and reduced carbon emissions.

Chris Tolbert, director of sales, Trimax Tire: With continued market demand for high performance vehicles, we see optimistic growth towards luxury CUVs, EVs,

hybrids and SUVs, plus sports vehicles. With advanced technology and innovative tread patterns, HP and UHP tires are specifically designed to enhance the driving experience. The Haida HD937 all-season UHP is designed for many of these applications. Currently it is available in 42 sizes, from 16- to 30-inches. In the first quarter of 2024, we will introduce four sizes (in) 23 inches. Later in 2024, we will continue to expand 18 sizes in 17-, 18-, 19-, 20-, 21- and 22-inches.

Phillip Kane, CEO, Turbo Wholesale Tires: The new trends we are noticing in the market are that certain sizes that were historically known to be UHP tires are seen more as HP tires today. If you look back five to 10 years ago, 17-, 18- and, especially, 19-inch tires were traditionally known to be UHP. In the present day, these tires are seen coming OEM on most new models. You see these tires today come more as touring tires with 60,000-plus mileage warranties. This is also the case for some 20-inch tires.

partly due to changing vehicle dynamics and the positioning of HP and UHP tires across a wider range of platforms. For example, a current model year Toyota Camry comes equipped with a 19-inch, V-rated tire. Historically, the tire industry would have considered that option as a pure performance tire. However, a Camry buyer and owner likely isn’t looking for a pure performance tire in the traditional sense of the word.

Now, that tire must do all the things a V-rated tire needs to do in terms of handling and braking, but also deliver a comfortable ride and provide extended longevity. So we see big performance improvements and categories like “grand touring,” where Yokohama’s Avid Ascend GT is a perfect option in the Camry example. We also see more traditional performance tires

Ryan Parszik, manager, product planning, Yokohama Tire Corp.: Overall, tires continue to get better in terms of actual performance (i.e., handling characteristics, braking distance, ride, noise, etc.), but customer and consumer expectations have also increased. This is

“As the performance of regular vehicles improves, HP tires will start to take on more and more touring tire qualities concerning seasonal flexibility along with mileage, comfort and traction in a premium performance product,” says Moonki Cho, product manager, Hankook Tire America Corp.

“The next tire innovations will involve designs that adapt to the heavier, higher-torque and higherhorsepower hybrid or electric sports cars and sports sedans, delivering ultimate dry and wet traction while also addressing considerations such as noise, vehicle and harshness and even range,” says John Wu, product strategy director, Maxxis International-USA.

like Yokohama’s Advan Apex with an extreme focus on performance handling now coming with mileage warranties.

Zhongce Rubber Group Co. Ltd. (ZC Rubber): One of the major trends that is currently being seen in the HP and UHP tire segment is the rise of electric vehicles. As more and more people switch to EVs, there is a growing demand for tires that are specifically designed to meet the unique requirements of electric vehicles.

MTD: What will be the next innovation for HP/UHP tires?

Stotsenburg (Kenda): Kenda sees the primary need for UHP segment innovation for a true four-season tire that offers all of the dry, wet and winter benefits that are available in grand touring tires now offered by leading brands. The current tradeoffs in

24

MTD February 2024

Photo: Hankook Tire America Corp.

Photo: Goodyear Tire & Rubber Co.

Photo: Maxxis International-USA

HP/UHP tires

“The increasing prevalence of larger wheel packages on CUVs and SUVs is driving the demand for UHP tires with all-season characteristics,” says Jay Lee, product marketing, Nexen Tire America Inc.

North America are providing all of the benefits with a true UHP W- or Y-rated tire, including 3PMS certification, while not sacrificing expected wear rates that the North American consumer desires for 40,000-mile to 50,000-mile warranties. The material solutions combined with the mechanical tread designs are now offered in touring tires like the Vezda Tou Touring 4S, which is H or V-rated, offers excellent wet and winter performance in addition to a 60,000-mile warranty. The next innovation will be to increase the performance of a true UHP tire, which offers a strong dry and wet grip for UHP applications with the addition of 3PMS certification and good wear.

Liu (Hercules): Based on Hercules Tires’ current product screen and forward strategy, we saw the technological advancement in both auto and tire manufacturers and the shift to CUV/SUV vehicles. For us, with the traditional HP category, we’re

“With the significant growth in the electric vehicle market — and particularly in high performance EVs from manufacturers like BMW, Rivian and Porsche — expect to see much more research and development on materials and tread patterns that will be able to provide a premium driving experience,” says Ian Coke, chief technical officer, Pirelli Tire North America Inc.

combining into standard/grand touring, where the focus is mileage, comfort (and) ride quality, with the added dose of performance elements.

Jin (Vredestein): The HP/ UHP segment is constantly innovating, as incremental performance benefits are very important to that consumer. A new frontier in HP/UHP tire innovation is achieving equal mileage warranties for both CUV and SUV sizes — finding an optimal balance in treadwear. Our latest UHP summer tire, the Vredestein Ultrac Pro, looks to address exactly this through its finely tuned blend of comfort and control.

This is in addition to the ongoing push for innovations tied to sustainability, which spans all segments, including HP/UHP. This covers a range of focus areas, from sourcing more eco-friendly raw materials to compound development to final manufacturing. The objective is to deliver tires that perform at the levels customers demand, while integrating materials and processes that lighten the environmental footprint.

Mathis (Atturo): We see continual evolution in reducing the tradeoffs of rolling resistance versus grip. Another innovation will be the advancement of connected tire technology integrated with the tire, vehicle and back to the retail dealer.

McKinney (Bridgestone): The performance tire market is incredibly competitive, with tire manufacturers vying for incremental performance improvements. Present-day products exhibit enhanced wet and dry handling performance, as anticipated. However, there has been remarkable progress in winter traction and wear life within the past few years. While a revolutionary shift in the performance segment is not expected, the focus is likely to remain on improving wet and dry handling and enhancing winter traction.

With the increasing prevalence of electric vehicles, there is a growing need for an additional level of scrutiny on wear life and noise performance to ensure consumer satisfaction. Given the hyper-competitive nature of the industry, tiremakers are actively seeking distinguishing factors for their products. Therefore, we can anticipate

“It would be very tough to single out one specific innovation,” says Joaquin Gonzalez Jr., president of Tire Group International LLC. “There is no doubt we will continue to see improvements across the board on performance, noise reduction, grip, comfort and durability of tires.”

Photo: Tire Group International LLC

ongoing innovations aimed at reducing rolling resistance, preserving range and prioritizing top-tier performance, with material sustainability in mind.

Dodds (Continental): The innovation areas will continue to be on reducing rolling resistance for the OEMs and increasing tire mileage for the end consumer.

Poling (Giti): Innovation in these markets will be driven largely by OE requirements. As many (tires) find their way onto EVs, there will be a push for noise reduction. In the same way, rolling resistance reduction will continue to play a key role across EV, hybrid and ICE vehicles. Some regulations currently coming out of the European Union will drive innovation around treadwear and tire abrasion.

Baggetta (Goodyear): The rise of vehicle connectivity has unlocked new capabilities for cars to process data and deliver information to drivers. The tire is the only part of the vehicle that touches the road. This contact point has the potential to provide important data to the vehicle.

Cho (Hankook): As the performance of regular vehicles improves, HP tires will

26

MTD February 2024

Photo: Pirelli Tire North America Inc.

Photo: Nexen Tire America Inc.

HP/UHP tires

start to take on more and more touring tire qualities concerning seasonal flexibility, along with mileage, comfort and traction in a premium performance product. This innovative success will only further as R&D teams test new rubber compounds, tread patterns and structural architectures to further diversify the growing segment. A similar methodology will be applied within the UHP segment and upgraded for specific customers concerning heightened performance for competitive driving. This kind of pursuit in extending and evolving the application of a category also applies to new platforms as we’ve begun to see and support within the electric vehicle segment.

Wu (Maxxis): The next tire innovations will involve designs that adapt to the heavier, higher-torque and higherhorsepower hybrid or electric sports cars and sports sedans, delivering ultimate dry and wet traction while also addressing considerations such as noise, vibration and harshness and even range.

Lee (Nexen): The tire market is witnessing a significant trend with the introduction of heavy load (HL) tires into the HP and UHP segments. Traditionally, standard load and extra load tires were prevalent, but the emergence of electric vehicles has led to the need for tires capable of handling the increased weight of modern EV batteries. The HL classification is designed to address this demand, providing tires with a higher load rating to accommodate the heavier batteries in EVs. This development underscores the dynamic nature of the automotive industry, where evolving vehicle technologies, especially the widespread adoption of electric vehicles, are influencing tire demands. Even within the UHP category, which was traditionally associated with sports cars, there is a growing need for more capable tires that can meet the diverse requirements of a wide range of vehicles, including the expanding market of electric vehicles.

Coke (Pirelli): With the significant growth in the electric vehicle market, and particularly in high performance EVs from manufacturers like BMW, Rivian and Porsche, expect to see much more research and development

on materials and tread patterns that will be able to provide a premium driving experience. EVs carry much more weight than traditional vehicles with internal combustion engines, so electric HP and UHP tires need to be designed to better handle that weight and enable drivers to have the precise control and zip they’ve come to expect without sacrificing battery range or tread life.

Coltrane (Prinx): I would not be surprised to see the new HL prefix for tire sizes begin to show up more frequently in this segment.

Park (Tireco): There will be continuous advances in materials and construction that will contribute to improved fuel efficiency and overall vehicle performance.

Gonzalez (TGI): It would be very tough to single out one specific innovation. There is no doubt we will continue to see improvements across the board on performance, noise reduction, grip, comfort and durability of tires. Maybe we will find a way of utilizing smart technology to integrate or connect tires to our vehicles in more ways than just with lug nuts. As of right now, the only feedback we get on tires in our vehicles is through the tire pressure monitoring systems. Maybe there (will be) a day where we will be able to see how all the different characteristics of our tires are performing in real time.

Kevin Arima, senior product manager, Toyo Tire U.S.A. Corp.: With anticipated growth in the number of sports BEVs and sporty BEVs, future generations of tires will better

“Manufacturers are developing tires with advanced tread compounds and construction that can provide low rolling resistance tires, which enhance energy efficiency and extend overall range,” says Mike Park, assistant director of marketing, Tireco Inc.

Ken Coltrane, vice president of marketing and product development for Prinx Chengshan Tire North America Inc., says he expects to see more EVcapable designs for HP/UHP tires.

address these performance needs of instant torque while improving range and tread life and maintaining a quiet ride. This will be accomplished by adopting innovative compounding, new materials and incorporating new development methods, all the while accounting for sustainable practices to develop tire solutions to meet end-user needs.

Tolbert (Trimax): Tire manufacturers continue to focus on improving tire performance characteristics for dry and wet traction, cornering stability, braking efficiency, rolling resistance, fuel efficiency, tire noise and weight requirements.

Kane (Turbo): I think the next big innovation for HP/UHP tires is going to be in the EV tires segment of the industry. As EV tires become more and more common in the industry, companies and brands will look to innovate and continue to expand product sizing. There is also a huge innovation in the mid-tier SUV/CUV market because the demand for those types of vehicles has exploded in the last couple of years.

Parszik (Yokohama): Familiar benefits in the form of all-season traction, wear resistance and load carrying capacities will all drive innovation in the performance segment. The increasingly common adoption of the 3PMS symbol in a multitude of segments will make its way into all-season offerings within the category. Additionally, changes in vehicles, led by EVs, have increased weight and put tremendous pressure on tire life. The new Yokohama Advan Sport EV A/S was designed specifically to take on some of these challenges.

ZC Rubber: Looking towards the future, the next big innovation for HP/UHP tires is expected to be the development

28

MTD February 2024

Photo: TireCo Inc.

Photo: Prinx Chengshan Tire North America Inc.

HP/UHP tires

of specialized EV tires. These tires will be designed to meet the specific requirements of EVs, such as higher load-carrying capacity, lower rolling resistance, improved tread wear and excellent braking performance. Additionally, there is also a rising demand for all-season EV tires that can perform well in various weather conditions.

MTD: With the rise of electric vehicles and hybrid cars, how are HP/UHP tires adapting to meet the unique requirements of these vehicles? Do they require specific technologies or materials?

Stotsenburg (Kenda): Vehicle application specifics determine the answer to these questions, with some specific consumer preferences or needs further defining the answer. Kenda’s current Vezda lineup will fit EV applications depending on the speed/ load ratings, but optimized performance for wear will require additional construction, mechanical design and material modifications based on the following elements. Specifically, the following application elements are the drivers in this decision (as) within the North American (tire) market, right now EV applications are primarily W- or Y-rated and UHP by definition:

• Load/heavier weight (is) based on the weight of the vehicle, primarily affected by the battery. This may require a tire with a higher rating, including XL or HL for non-light truck designations. This also affects the expected wear of the tire;

• The higher performance and torque for most EVs have required V- or W-rated tires that affect the wear of tires on EV applications. To improve the grip needed from stronger initial acceleration and higher output, this may require both mechanical and compounding changes for the tires;

• As EV vehicles are inherently quieter than ICE vehicles, tire noise from nonEV tires will be more

Trimax Tire will roll out the Haida HD937 allseason UHP tire, which will be designed for EV applications, in key sizes of 16-, 17-, 18-, 19- and 20-inches in 2024, says Chris Tolbert, director of sales, Trimax Tire.

Trimax Tire

“I think the next big step innovation for HP/UHP tires is going to be in the EV tires segment of the industry,” says Philip Kane, CEO, Turbo Wholesale Tires.

noticeable. There are noise reduction technologies available to improve this issue, but it does require potentially more costly changes to the tire. This issue is important for most consumers, particularly in initial replacement cycles;

• EV vehicle range is affected by the rolling resistance of the tire. There are trade-offs to offering enhanced rolling resistance which may affect wear;

• Currently, many EV applications are provided with tires that have limitations related to four season performance. Depending on the application, summer performance has been prioritized. Many consumers require four-season capability.

As always, the load and speed rating requirement as defined by the vehicle applications cannot be compromised. The other elements likely affect performance and benefits that consumers need to understand relative to trade-offs. The most obvious one that everyone is seeing relates to wear, as most EV tires currently have shorter expected wear primarily due to the vehicle design and use, but also related to the design decisions from the tire manufacturer or OEM.

As the EV vehicle market is currently evolving both globally and in North America, there are many potential options to determine EV tire decisions. Although Kenda is not currently offering EV-specifc options in North America, we are accelerating the analysis.

Liu (Hercules): With the ongoing changes and improvement in the EV/hybrid vehicle world related to both auto and tire manufacturers, we believe the market will sort it out over the course of the next few years. Needless to say, as Hercules Tires remains one of the premier