Takeaways from the 2025 NACS Show reveal an industry accelerating forward

Learn from global trends

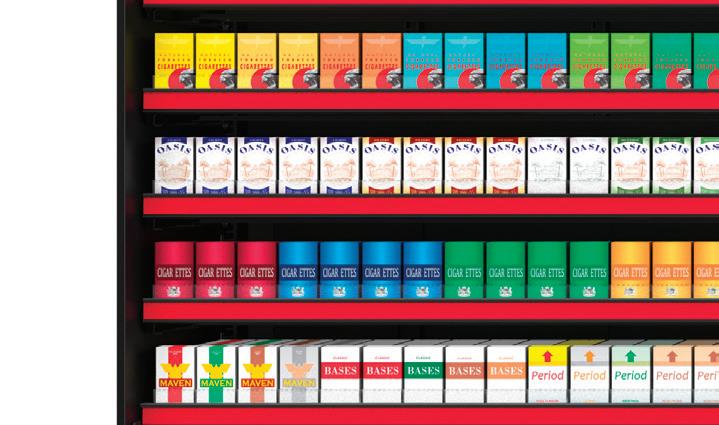

PRIVATE LABEL Sales slow but potential remains

FOODSERVICE IDEAS

Learn from global trends

PRIVATE LABEL Sales slow but potential remains

Takeaways from the 2025 NACS Show reveal an industry accelerating forward

Learn from global trends

PRIVATE LABEL Sales slow but potential remains

FOODSERVICE IDEAS

Learn from global trends

PRIVATE LABEL Sales slow but potential remains

Takeaways from the 2025 NACS Show reveal an industry accelerating forward

SCAN DATA BASE INCENTIVE

Receive a Scan Data Base Incentive payment for each eligible Scan Data transaction timely submitted to AGDC.

Boost your business with a responsible digital platform that enhances customer engagement and loyalty. The AGDC Digital Trade Program helps retailers connect with Adult Tobacco Consumers 21+ while driving business growth through incentives.

CONSISTENT LOYALTY ID (CID) PROMOTIONAL FUND

Earn incremental per-transaction incentive funds for each identified Consistent LID appearing 5 or more weeks in Scan Data.

SCAN DATA MAINTENANCE INCENTIVE

Submit weekly Scan Data files for 13 out of 13 weeks to receive additional incentive payments.

Contact your AGDC Representative to learn

32

Takeaways From ‘The Greatest Show on Earth’ (That Isn’t a Circus)

From TikTok (customizing the customer experience) to ‘tick tock’ (giving back time and providing energy), the 2025 NACS Show delivered on its promise.

46

Packaging Priorities

Consumers are gravitating to more sustainable packaging, but it’s not just the material that matters— performance does too.

48

Global Foodservice Trends

What can you learn from foodservice operators around the world?

58

Protein Possibilities

This Q&A is brought to you by Lower Foods.

Lower Foods shares insights into the evolution of proteins in foodservice.

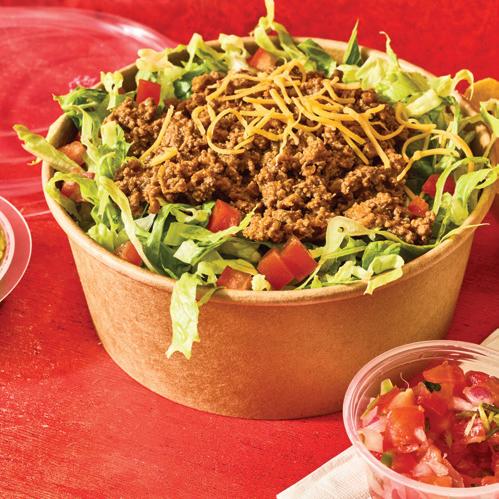

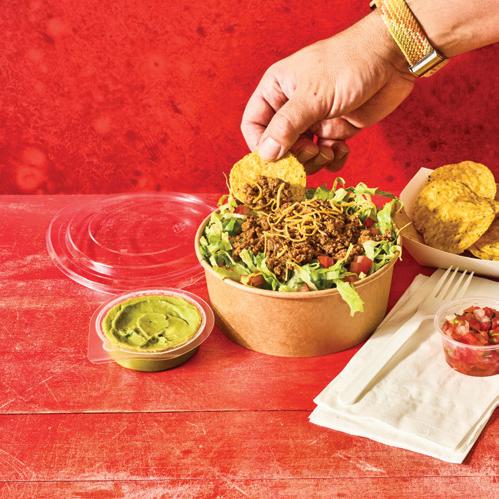

60 A Multicultural Opportunity

Items inspired by traditional Hispanic cooking can attract consumers of all backgrounds and appetites.

Hungry customers flock to foodservice operators that have chicken on the menu.

66

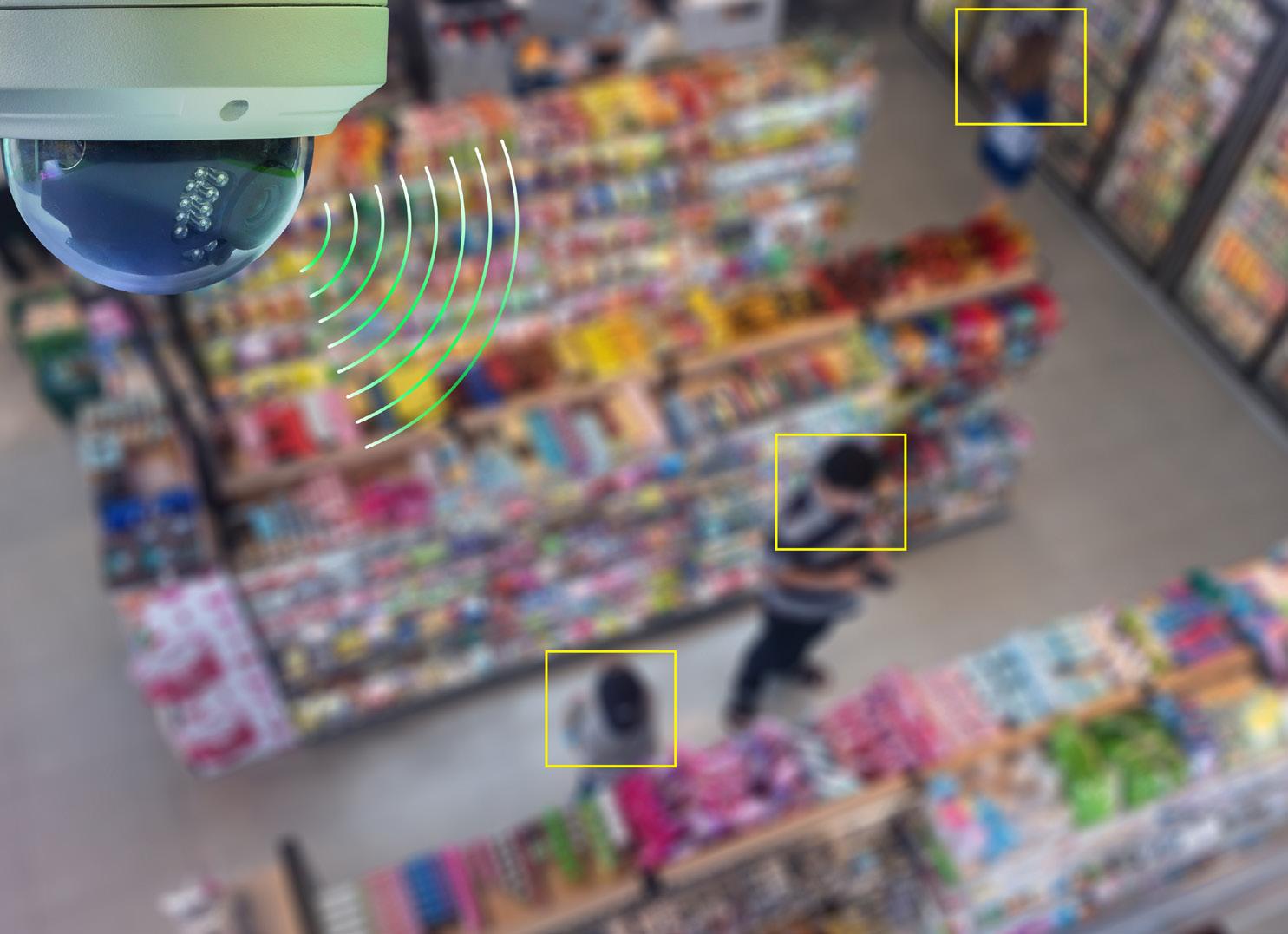

Key Trends in Loss Prevention

More retailers are focusing on addressing total loss, implementing AI to prevent loss before it happens and training employees to help build confidence and capability.

74

A NACS survey reveals how consumers view c-stores, what they care most about and how to capture more of their business.

80

Private Label Profit Potential

Private label brands bring healthy margins and differentiation to c-stores.

88

Building Character

An effective mascot can dress up a company’s brand and create connection with customers.

Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily

Jeff Lenard VP of NACS Media & Strategic Communications (703) 518-4272 jlenard@convenience.org

Ben Nussbaum

Publisher & Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Leah Ash Editor/Writer lash@convenience.org

Lauren Shanesy Editor/Writer lshanesy@convenience.org

Noelle Riddle Editor/Writer nriddle@convenience.org

Chrissy Blasinsky Digital & Content Strategist cblasinsky@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Lauren Fritsky, Sarah Hamaker, Al Hebert, Pat Pape, Adam Rosenblatt, Emma Tainter

DESIGN

Ji Ho

Creative Director jho@convenience.org

Erika Freber Art Director efreber@convenience.org

David Marvin Graphic Designer dmarvin@convenience.org

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

NACS BOARD OF DIRECTORS

CHAIR: Annie Gauthier, CFO/Co-CEO, St. Romain Oil Co. LLC (dba Y-Not Stop)

TREASURER: Lonnie McQuirter, Director of Operations, 36 Lyn Refuel Station

OFFICERS: Chris Bambury, Bambury Inc.; Tom Brennan, Casey’s; Varish Goyal, Loop Neighborhood Markets; Charles McIlvaine, Coen Markets Inc.; Natalie Morhaus, RaceTrac Inc.; Travis Sheetz, Sheetz Inc.

GENERAL COUNSEL: Doug Kantor, NACS

MEMBERS: Lisa Blalock, BP North America Inc.; Brian Donaldson, Maxol Limited; Tony El-Nemr, Nouria Energy Corp.; Terry Gallagher, Gasamat Oil Corp./Smoker Friendly; Erin Graziosi, Robinson Oil Corp.; Raymond Huff, HJB Convenience Corp. (dba Russell’s); Mark Jordan, Refuel Operating Co.; Thomas Love, Love’s Travel Stops & Country Stores; Crystal Maggelet, Maverik Inc.; Rich Makin, Wawa Inc.; Brian McCarthy, Blarney Castle Oil Co.; Andrew Mitchell, Toot’n Totum Food Stores LLC; Jigar Patel, Fastime; Robert Razowsky, Rmarts LLC; Stanley Reynolds, 7-Eleven Inc.; Kristin Seabrook, Global Partners LP; Babir Sultan, Fav Trip; Doug Yawberry, Weigel’s Stores Inc.; Scott Zietlow, Kwik Trip Inc.

NACS SUPPLIER BOARD

SUPPLIER BOARD CHAIR: Bryan Morrow, Chobani & La Colombe

CHAIR-ELECT: Kevin LeMoyne, The Coca-Cola Co.

VICE CHAIRS: Mike Gilroy, Mars Wrigley; Jim Hughes, Supplying Demand Inc. dba Liquid Death; Danielle Holloway, Altria Group Distribution Co.

MEMBERS: Tony Battaglia, PMI U.S.; Ryan Calong, Pabst Brewing Co.; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Fueling Solutions; Matt Domingo, Reynolds; Mark Falconi, Greenridge Naturals; Ramona Giderof, Diageo Beer; Kevin Kraft, Tropicana Brands; Adam Gryzbek, BIC Corp.;

PAST CHAIRS: Brian Hannasch, Alimentation Couche-Tard Inc.; Victor Paterno, Philippine Seven Corp.

SUPPLIER BOARD REPRESENTATIVES: Bryan Morrow, Chobani & La Colombe; Kevin LeMoyne, The Coca-Cola Co.

Jay Nelson, Excel Tire Gauge LLC; Jordan Nicgorski, JUUL Labs; Nick Paich, TriggerPoint Media; Bria Troy, PepsiCo Inc.; Melissa Vonder Haar, iSEE Store Innovations LLC; Derek Zahajko, CAF Inc.; Jason Zagaria, Primo Brands

GENERAL COUNSEL: Doug Kantor, NACS

STAFF LIAISON: Bob Hughes, NACS

RETAIL BOARD REPRESENTATIVES: Tom Brennan, Casey’s; Scott Hartman, Rutter’s; Kevin Smartt, TXB

PAST CHAIRS: Vito Maurici, McLane Co. Inc.; David Charles, Cash Depot; Kevin Farley, Farley Retail Advisors

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2025 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

The 2025 NACS Show was my third and it was the best yet. The NACS team is super talented and works hard, but ultimately the NACS Show is a success because of the industry itself.

Every retailer who attends, whether they’re a regular, a first-timer or a company finding a way to send one more team member than the year before, is a part of the success. Every supplier who invests in creating a great booth experience is doing their part, too. Each Education Session depends on people stepping up to share their expertise with their industry colleagues. And the dozens of industry representatives who serve on NACS committees keep NACS—and the NACS Show—humming. At the end of the day, convenience is a team sport.

I was reminded how collaborative the industry is during an Education Session on THC beverages. One message shared from the stage was that advocacy groups, suppliers, distributors and retailers all need to work hand-in-hand right now to support this category so that it can be consistently profitable in the future. No one can do the work by themselves.

Advocacy groups rely on retailers to show up and tell their story. Retailers rely on suppliers to understand and stay up to date on regulation—such as when labeling changes are mandated. Everyone has to work together to educate consumers with a consistent message. Each c-store depends on every other c-store: If there are bad actors when it comes to age verification, that impacts everyone.

That need to work together is a strength, not a weakness. As 2025-26 NACS Chairman of the Board Annie Gauthier said during a NACS Show General Session, “As an

industry, we are there for each other. We share with each other and we lift each other up so that we can lift up the communities we serve.”

Interested in more ways to stay connected with the convenience community? Check out convenience.org/events for a full list of upcoming NACS events.

The NACS Show is the place to be for all kinds of nerds: data nerds, fuels nerds, foodservice nerds, technology nerds and Nerds nerds.

WARNING: This product contains nicotine. Nicotine is an addictive chemical.

Working in a convenience store is “the ultimate people person job,” said

Patty Peterson, manager at Farmer’s Grandson Eatery, a foodservice concept and convenience store with locations in Lakeville and Eagan, Minnesota. She has worked at Farmer’s Grandson since 2018 and spent years managing other c-stores prior to that. “In a c-store, you really get to know people, your regulars and other customers, and develop a relationship with them. If you’re a people person who truly loves to connect with people, you won’t get this kind of job satisfaction many other places. It’s one of the reasons why I love coming to work everyday,” she said.

WHY SHE LOVES WORKING IN THE CONVENIENCE INDUSTRY

It wasn’t until Covid that I really discovered how important we as convenience stores are to people. We were the only businesses open. We could be the only place for a parent who needs a fever reducer for their young child at night, a diabetic person who needs orange juice or just someone that needs a clean restroom. There are so many things that we provide to the community, even if it’s just the basics, that makes us so much more than just somewhere to grab a pop or a snack.

“Working in a c-store, I really feel like we are heroes.”

It’s one thing to tell people how to do something, but I like to lead by example, that way the people I work with can feel relaxed, be themselves and really let their personalities come out. There’s not a whole lot of businesses where you can do that because you have to be really professional. But in our store, we are friendly, greet customers by name and really get to know them. And regular customers really appreciate that too, because you are part of the community for them and they connect with you that way.

HER MOST MEMORABLE MOMENT AT WORK

Last year a young gentleman came into the store, he smiled at me and said ‘you don’t remember me, but I sure remember you.’ He shared with me that when he’d come into the store years ago, he’d been in a very bad place in his life. I had asked him how his day was going and talked to him for a little bit, and whatever I said to him made such an impact on him that that was the day he started making decisions to turn his life around and get back on track…and now he’s doing really well.

He came back to the store to tell me that—that it all started with me. I tear up when I think about this story. We all know that kind words make a difference to people, but mine really changed his life. That means so much to me.

Annie Gauthier, CFO/Co-CEO of St. Romain Oil Company (Y-Not Stop), is the 2025-2026 NACS Chairman of the Board. Gauthier will also lead the NACS Political Engagement Committee.

In 2005, Gauthier joined her family company, which now owns and operates 15 Y-Not Stop convenience stores in Louisiana. She created the company’s first human resources role and moved into accounting and finance before succeeding her mother as CFO in 2014. Gauthier and her two brothers have

continued to grow the business since they bought it in 2016.

Gauthier spoke with NACS Magazine about her personal journey into the industry, Y-Not Stop, and her role with NACS for the upcoming year.

WHAT BROUGHT YOU INTO CONVENIENCE, AND WHY HAS IT BEEN A CAREER THAT YOU’VE LOVED EVER SINCE?

I grew up in this business but never wanted it for my career. I fell in love

with our industry while I was in college working for the Louisiana Oil Marketers & Convenience Store Association in Baton Rouge. When Hurricane Katrina devastated New Orleans and other areas of the Gulf South 20 years ago, I was wowed by how the industry showed up. In the middle of such uncertain times, suppliers and retailers, like my family, just kept plugging away and working crazy hours to find ways to take care of their communities. Courage, sacrifice and selflessness were everywhere. I love how the convenience industry offers a tangible benefit to every community across the world, making a real difference for our customers and our team members. And it’s a fun business, too! It’s never boring!

WHAT ARE YOU LOOKING FORWARD TO ABOUT SERVING AS CHAIRMAN THIS UPCOMING YEAR? WHAT ARE SOME TOP PRIORITIES ON YOUR MIND FOR THE YEAR AHEAD?

I’m excited to serve as chair in this transitional year for NACS. With the legendary Henry Armour transitioning from CEO to his new international role and past chair Frank Gleeson bringing his unique perspective as the fourth NACS CEO in 65 years, NACS is poised to move boldly into its next chapter. I’m excited to work with the board and staff to continue to build on past successes, to fully realize existing initiatives and to map the future. A successful CEO transition is a priority, and I am confident that it will be smooth

because Henry and Frank both share incredible professionalism, pragmatism and passion for the industry.

WHAT’S ONE OF THE MOST IMPORTANT THINGS YOU’RE FOCUSED ON RIGHT NOW IN YOUR BUSINESS?

I am focused on strengthening our store managers’ leadership and coaching skills so we can build the best workplace and create customer superfans. We’ve made strides the past few years, and we continue to learn and level up.

ON THAT NOTE, TELL US ABOUT THE TEAMFEST YOUR COMPANY HOSTS EVERY YEAR. WHY IS THIS A CRITICAL PART OF YOUR COMPANY CULTURE AND EMPLOYEE DEVELOPMENT?

TeamFest is an annual employee celebration event and training session we host every year. Every team member is invited to join a half-day session and we give them full pay.

The event evolved from all-team meetings my parents started decades ago. Our first TeamFest was in 2017, where we brought in our key supplier partners to share samples and product knowledge with our team. We have expanded it since then to include over 30 partners, as well as games run by our ops team, company updates and team recognition.

At TeamFest, I really want the new team members to learn what we stand for, to connect to what we do and to commit to stay and grow with us. With the right training and support, these new team members are our future. TeamFest is one way we show our love of our industry and connect them to something bigger than themselves and their store.

WHAT’S A MOTTO OR MISSION STATEMENT YOU HAVE FOR RUNNING YOUR BUSINESS?

I believe in moving forward intentionally and optimistically. I frequently quote St. Francis of Assisi: “Start with doing what’s necessary, then do what’s possible, then suddenly you’re doing the impossible.” I also remind myself and others of the competing ideas of “better done than perfect” and “better right than fast.” We are free to choose; we are not free from the consequences of our choices. So choose wisely.

HOW DID YOU FIRST GET INVOLVED WITH NACS, AND WHAT BENEFITS HAVE YOU GOTTEN FROM BEING ENGAGED? WHAT’S YOUR ADVICE TO THOSE WHO AREN’T INVOLVED WITH NACS YET?

I started attending HR Forum and the State of the Industry Summit early in

DECEMBER

NACS Loss Prevention and Safety Symposium

December 03-04 | Hyatt Regency

DFW International Airport Dallas, Texas

2026

FEBRUARY

NACS Leadership Forum

February 10-12 | Fontainebleau, Miami Miami, Florida

MARCH

NACS Convenience Summit Asia March 10-12 | Shanghai, China

NACS Human Resources Forum March 16-18 | Galt House Hotel Louisville, Kentucky

NACS Day on the Hill March 17-18 | Four Seasons Washington D.C.

my career, and then went to my first NACS Show in 2012. I then attended executive education courses in 2015 and 2016. I joined the convention content committee in 2017, the NACS board of directors in 2018, and chaired the retail engagement committee in 2023. Most recently, I served as NACS vice chairman and treasurer.

I’ve benefited from NACS in three key ways: building community among retailers, suppliers and NACS staff; learning about our industry’s challenges and opportunities; and growing as a leader.

My advice to anyone who is not involved yet is simple: if you want to grow yourself and your business, get involved. NACS has something to offer anyone who wants to learn and grow, from events to education to advocacy and more. Attend an event that catches your attention. Meet new people during the networking breaks. Go deeper with acquaintances you’ve met before. Sign up for an executive education course—the three I’ve done were all transformational, and I still keep in touch with people I met there 10 years ago. Interested in serving on a committee? Talk to a board member or staff member to learn more.

APRIL

NACS State of the Industry Summit April 14-16 | Renaissance

Schaumburg Convention Center Hotel Schaumburg, Illinois

OCTOBER NACS Show

October 06-09 | Las Vegas Convention Center Las Vegas, Nevada

For a full listing of events and information, visit www.convenience.org/events.

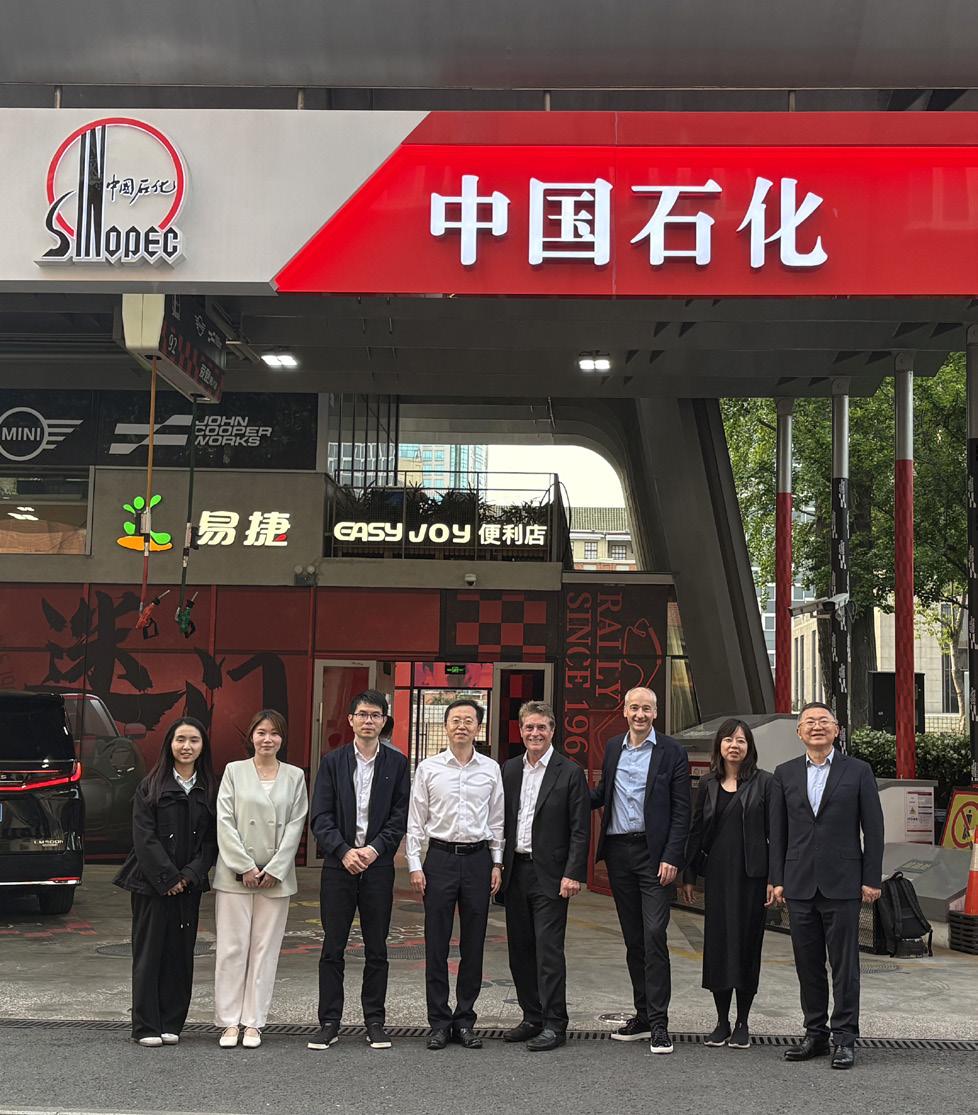

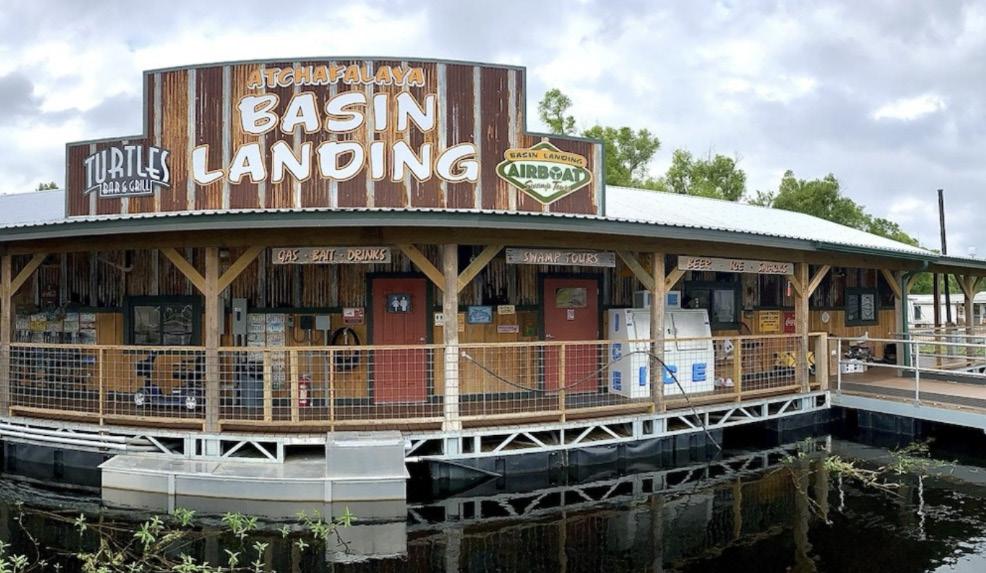

Registration is now open for 2026 Convenience Summit Asia (CSA), taking place March 10-12 in Shanghai, China.

“Shanghai is the commercial capital of China and one of the most innovative and dynamic markets in Asia,” said George Zheng, NACS director of Asia-Pacific, based in China. The city is home to 25 million people, has a GDP of over $700 billion USD and houses the world’s biggest port, as well as global financial institutions and stock exchanges. “Its character is profoundly shaped by its open, inclusive and innovative nature, and its pioneering spirit makes Shanghai the preferred launch city for global brands and innovation concepts across retail, technology and consumer goods. It’s a gateway to the future of retail, where trends are not just predicted, but created.”

At the summit, attendees will learn about current and emerging trends shaping the future through panel presentations and thought-leadership discussions, hear retailer case studies and share best practices, visit a number of stores in person on the Ideas 2 Go store tours, and network with industry peers and convenience industry leaders.

Store tours will take attendees to the city’s first gas station and convenience store (pictured above), and

they’ll see Shanghai’s unique innovations and their retail applications firsthand—such as food delivery platform Meituan’s commercial drone delivery services; the Neolix Robovan, an automatic robotic van that retailers are using for logistics and supply delivery; cutting edge e-payment systems in retail stores; and automated technologies such as the unmanned CloudPick Store, MiniStore24’s remote store operation system, and Convenience Bee’s store inspection robot. They’ll also experience Shanghai’s booming coffee scene, with over 9,000 coffee shops in the city, making it a global leader in café culture.

“These innovations exemplify how Shanghai is not only adopting global technologies but also redefining them through groundbreaking applications—making it a living laboratory for the future of retail, automation and AI-driven services,” said Zheng.

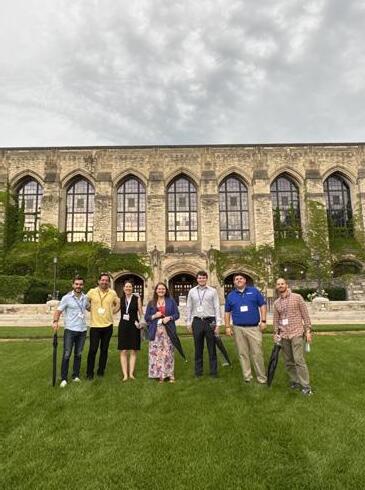

BY BRANDI MAURO, NACS PROGRAM MANAGER, EXECUTIVE EDUCATION

This summer, I had the privilege of attending our Executive Education programs at Wharton, Cornell and Kellogg.

Each program offered a unique experience. At Wharton, leaders sharpened their financial acumen and explored frameworks that can transform how they approach their business. At Cornell, strategy and leadership took center stage, enriched by inspiring stories from Henry Armour and Frank Gleeson. Kellogg brought us together around marketing strategy and innovation, with a powerful reminder that growth takes work—and that even small, intentional steps can drive lasting change.

While the professors’ insights were invaluable, what struck me most were the conversations I had with our members and the ones they had with each other. I learned not only about the challenges they face, but also the creative solutions they are putting into action—like the innovative ways retailers are minimizing the impact of swipe fees by encouraging customers to use debit cards and passing the

savings directly along to them; how retailers are working more closely with vendors and suppliers to use data strategically and strengthen loyalty programs; and the big question every retailer faces—how to win over customers. Location still matters, but today’s game-changers are personalization and differentiation, and technology and AI can help retailers tailor offers.

Beyond the classroom, I was impressed by the energy and openness of these leaders. They came curious, ready to challenge themselves and eager to exchange ideas. They weren’t just learning for themselves—they were investing in the future of their teams and the entire industry.

One story in particular really stuck with me. A member attending his first Executive Education program shared how he was preparing to take over his family business. He admitted feeling intimidated sitting among more experienced leaders, but also energized. He could see what success looks like in this industry, and that vision gave him confidence about his own future.

Hearing members’ stories reminded me why I love what I do. Exec Ed is not just about growing skills and developing professionally; it is about inspiring growth in people and in our industry, and helping our members create a vision for the future of their stores. That’s what makes these programs so special. They give retailers the tools, insights and network to envision what’s next—and the confidence to go after it.

It’s also about personal connections. One of the things I loved most about this summer was the relationships formed during these courses. Hearing stories of members sending kids to college, growing their families, preparing for new roles or stepping into family businesses reminded me that growth happens on multiple levels.

This summer proved something I deeply believe: Executive Education is about more than knowledge—it’s about creating lasting connections, inspiring change and growing both individually as a leader and together as an industry.

To learn more about NACS’ Executive Education programs, reach out to me at Bmauro@convenience.org.

Yesway announced the appointment of Ray Harrison as its new chief marketing and merchandising officer. Most recently the chief marketing officer at Cal's Convenience, Harrison led marketing, merchandising, category management, loyalty programs and communications for more than 500 retail locations. He spearheaded the design and launch of a highly successful digital loyalty program, drove private brand share penetration and implemented innovative omnichannel marketing initiatives across loyalty, social media, delivery and in-store media networks.

Doug Martin was named chief marketing officer at Wawa. Prior to joining Wawa, Martin worked at General Mills for nearly 20 years, spanning multiple roles—most recently serving as its CMO.

Pilot appointed Julius Cox as executive vice president, chief people and administrative officer for Pilot. He leads all aspects of human resources, including attracting, retaining and developing more than 30,000 team members across North America. He also oversees the company’s safety, communications, compliance and procurement practices,

furthering Pilot’s purpose-driven strategy and advancing its people-first culture.

Eva Rigamonti has been named chief legal officer for Pilot. She is responsible for leading all legal functions across several disciplines, including corporate governance, regulatory compliance, government affairs, privacy and artificial intelligence, commercial transactions, and mergers and acquisitions. Rigamonti and her team help Pilot navigate the evolving legal and policy environment and foster strong relationships that shape Pilot’s growth, policy advocacy and compliance strategies.

7-Eleven named Dan Gordan as its senior vice president of fuel supply and trading. In this role, he will be responsible for providing executive leadership over end-to-end supply chain operations, including strategic sourcing, commodity trading, fuel procurement and risk management.

The Hershey Company appointed Natalie Rothman as chief human resources officer. Rothman will lead Hershey's global human resources function and report to President and Chief Executive Officer Kirk Tanner.

Rothman brings leadership credentials as a two-time CHRO and public/private company board member with over 25 years of human resources experience. Prior to joining Hershey, Rothman served as CHRO at Inspire Brands, where she modernized the company's HR operations through business process automation and AI tools.

OPW, a Dover Company, named David Malinas as the company’s new president. He succeeds Kevin Long, who spent 11 years with Dover, including serving as president of OPW since 2017. Malinas most recently served as chief operating officer of Duravant, a global automation equipment company headquartered in Chicago. Prior to Duravant, Malinas served as president of the Industrial Process segment at ITT and held senior executive roles at Thermo Fisher Scientific and Danaher Corporation. NACS in the know—send your updates to news@convenience.org

Keep NACS in the know— send your updates to news@convenience.org

NACS welcomes the following companies that joined the Association in August 2025. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting convenience.org/create-login. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership.

MAJOR OIL

Sunoco LP Dallas, TX

RETAILERS

Axis Investments LLC Louisville, KY

Cooperative Energy Company Sibley, IA

Fast Eddy's Meridian, ID www.fasteddys.com

Glen Echo Investments Bellvue, CO www.glenechoresort.com

H-E-B Food Stores San Antonio, TX www.heb.com

Jack Flash Effingham, IL www.jackflashstores.com

Manro Stores LLC Miami, FL www.manroenterprises.com

Medford Oil Company Inc. Jerseyville, IL www.medfordoilco.com

Sisbro Energy Inc. Washington, MO

Tri-State Oil Belle Chasse, LA www.tristateoil.com

SUPPLIERS

A2Z POS El Cajon, CA a2zpos.io

All-In Licensing LLC Atlanta, GA www.allinlicensing.com

Alto-Shaam Inc. Menomonee Falls, WI www.alto-shaam.com

Amazon Web Services Seattle, WA aws.amazon.com/retail

Chubby Checker Snacks Conshohocken, PA www.chubbycheckersnacks.com

CO2 Monitoring LLC Las Vegas, NV www.aerospheremonitoring.com

Curtis Montebello, CA www.wilburcurtis.com

Daily’s Premium Meats Kansas City, MO www.dailysmeats.com

Dawn Food Products Inc. Jackson, MI www.dawnfoods.com

DrinkPak Santa Clarita, CA

GLR Inc. Dayton, OH

Hoist Cincinnati, OH www.drinkhoist.com

Izzio Artisan Bakery Louisville, CO www.izziobakery.com

Mockups 4 You LLC Marco Island, FL www.mockups4you.com

Nexii www.nexii.com

Pacific Floorcare Muskegon, MI www.pacificfloorcare.com

Parts Town LLC Addison, IL www.partstown.com

Portland Pet Food Company Portland, OR www.portlandpetfoodcompany.com

RBC Capital Management Atlanta, GA

Reece Distributing Inc. Fruitland, ID www.reecedistributing.com

Schaerer Montebello, CA www.schaererusa.com

Senneca Holdings West Chester, OH

State of PA (Dept of Revenue) Pennsylvania Lottery Middletown, PA www.palottery.state.pa.us

Valtrust Orlando, FL www.valtrust.com

W.A. DeHart Inc. New Columbia, PA

WD Partners Dublin, OH

WMF Fort Lauderdale, FL www.wmfnorthamerica.com

$183,000 to Local

An annual campaign ran from March through June and surpassed last year’s record total by almost $7,000.

Pennsylvania-based Nittany MinitMart’s sixth annual Fuel the Cause campaign raised a record high of $183,570.91 to support volunteer fire companies across central and northern Pennsylvania.

The campaign ran from March through June and surpassed last year’s record total by almost $7,000, bringing the grand total raised since the fundraiser began in 2019 to over $700,000. Nittany MinitMart said this year’s campaign will directly support 40 volunteer fire stations, impacting over 900 firefighters and the 250,000-plus residents they serve.

“We’re thrilled to break another record,” said Nicole Masullo, Nittany MinitMart’s operations division manager. “Every year, we push harder— reaching out to sponsors, promoting the cause

throughout our region and making it easier for customers to get involved. And every year, our community shows up in a bigger way.”

Nittany MinitMart and Pennsylvania Skill Games each donated one cent per gallon of gas sold, along with other partner brands who sponsored the effort. Customers joined in by rounding up their purchases, making donations in-store and ordering from an LTO Firehouse Foods menu, with a portion of all sales from the menu going to the campaign.

This year also marked the second time Nittany MinitMart successfully petitioned the governor’s office to formally recognize the impact of volunteer firefighters. Governor Josh Shapiro declared April 9 through 15 as Volunteer Firefighter Recognition Week in Pennsylvania to raise awareness across the state about the issues volunteer fire companies are facing.

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America and to share these powerful stories. Learn more at www.conveniencecares.org

$75,000 TO FOLDS OF HONOR

Mirabito Cares, the community engagement arm of Mirabito Convenience Stores, raised $75,000 to benefit Folds of Honor, an organization that provides educational scholarships to the spouses and children of fallen or disabled military service members and first responders.

Texas-based Yesway raised $200,000 to support Texas Hill Country communities impacted by the Independence Day weekend floods—“far surpassing its original fundraising goal” of $100,000. Donations will go to The Community Foundation of the Texas Hill Country's Kerr County Flood Relief Fund.

Parker’s Kitchen presented a check for $360,000 to the Wounded Warrior Project (WWP) to support local injured veterans and their families across Georgia and South Carolina.

Parker’s Kitchen matched 25% of all customer donations during a round-up campaign held earlier this year. WWP CEO Lt. Gen. (Ret.) Walt Piatt accepted the donation at Parker’s Kitchen headquarters in Savannah, Georgia.

The Wills Group, parent company of Dash In stores, donated more than $50,000 to the Folk Memorial Park project in Newark, Delaware.

“[We] will be enhancing a 0.4 mile long walking path, planting a robust garden with herbs, flowers, pollinator beds and fruit trees. All of which are being executed in partnership with the City of Newark Parks and Recreation Department and Ruppert Landscape,” the retailer said.

QuickChek held its Annual QuickChek Golf Outing. “[It] was another unforgettable day on the green—filled with friendly competition, generous hearts and a whole lot of QuickChek spirit! This year, we proudly supported Alternatives Inc. and America's Grow-a-Row, with both organizations joining

us on-site to share how this event directly fuels their missions,” the retailer posted on LinkedIn.

Oklahoma-based OnCue has been named a 2025 Oklahoma Journal Record Beacon Award recipient in the Philanthropic Impact category for its “pivotal role in establishing the OnCue Neonatal Intensive Care Unit (NICU) at Stillwater Medical Center,” according to a press release.

The award recognizes OnCue’s $1 million donation, along with an additional $200,000 raised through OnCue’s specialty cup program and matching event at the Stillwater Medical Foundation gala. The OnCue NICU officially opened in March 2025 and is reportedly the only Level II NICU in north-central Oklahoma.

EG America raised more than $597,000 for the American Cancer Society during its nationwide in-store fundraiser in July. Throughout the month, customers at EG America's Certified Oil, Cumberland Farms, Fastrac, Kwik Shop, Loaf 'N Jug, Minit Mart, Quik Stop, Sprint Food Stores, Tom Thumb and Turkey Hill stores were able to donate $1, $5 or an amount of their choosing to the American Cancer Society at checkout. EG America matched the amounts raised by the top stores.

Being about a year out from the next Congressional elections, and with some gubernatorial and state elections happening this month, the NACS government relations team wanted to take a look at where things stand in the efforts to claim the majorities in the U.S. House and Senate next November. A lot can change between now and then, but Jim Ellis from Ellis Insight LLC gives his take on where things stand at the moment.

BY JIM ELLIS

As we approach the 2026 midterm election year, both parties face a substantial electoral obstacle.

Looking nationally, 31 states register voters with their political party affiliation. The Democrats’ significant problem is their party affiliation totals are down in all 31 states, including the bedrock partisan domains of California, Illinois and New York.

The registration figures compare party affiliation percentages from the 2020 presidential election to the present. The Democrats are failing to keep pace with historical trends particularly among younger (those 18-34 years of age) and new voters.

The Republicans also must surmount a formidable hurdle. Seeing the GOP vote percentages consistently drop in special elections around the country this year again underscores that the casual Trump voter is not necessarily a loyal Republican. If said

voter participates in an election where President Trump is not on the ballot, the individual will likely vote the Republican line, but strong turnout within this electoral segment has proven arbitrary.

Therefore, the midterm GOP candidates’ challenge is to energize the Trump base without the president’s name on the ballot, which is apparently a more difficult task than initially presumed.

The current election cycle features 35 Senate races, including special elections in Florida and Ohio. Sens. Ashley Moody (R-FL) and Jon Husted (R-OH), succeeding Secretary of State Marco Rubio and Vice President J.D. Vance, respectively, must run in the 2026 election to fill the balance of their terms. They both would be eligible to seek a full term in 2028.

Republicans will fight to maintain, or possibly expand, their 53-47 Senate majority margin, but from a more difficult political position because they

must defend 22 of the 35 in-cycle seats. The most competitive GOP defensive races are the North Carolina open seat, a newly open seat in Iowa, and Texas, Maine and Ohio, while the Democrats must fight hard to defend their open seat in Michigan and attempt to re-elect Georgia first-term Senator Jon Ossoff.

The North Carolina contest could become the premier national Senate race. Former Democratic Governor Roy Cooper and ex-Republican National Committee chairman Michael Whatley will battle in what promises to be a toss-up affair. Expect Cooper

to maintain small polling leads, but Republicans typically underpoll in the Tar Heel State.

The open Michigan battle will feature Republican former U.S. Rep. Mike Rogers, while the Democrats are embroiled in a hotly contested primary that won’t be decided until August.

The open Wolverine state Senate confrontation, remembering that Rogers lost the 2024 Senate race by only 19,006 votes, is likely the Republicans’ best national conversion opportunity.

The Texas situation will be highly competitive in the Republican primary

their congressional boundaries before the 2026 election.

and general election. The incumbent, John Cornyn, has been trailing state Attorney General Ken Paxton, but recent polling data suggests a tightening contest. The Texas primary is early, March 3. The GOP winner will then likely face former Democratic Congressman and 2024 Senate nominee Colin Allred.

As we know, the House again features a razor thin 220 Republican-215 Democrat majority once the three remaining special elections are completed later this year.

The redistricting issue has become front and center. A U.S. Justice Department directive urging Texas to redraw its map because the 5th Circuit Court of Appeals made several of the state’s minority districts illegal has ignited the partisan gerrymandering argument.

Now, as many as ten other states could redistrict their congressional boundaries before the 2026 election. Extended to its fullest, redistricting could drastically change the House balance of power. In addition to Texas, a special California voter referendum to nullify the state redistricting commission map will be decided in November.

The Ohio legislature must redraw its congressional map due to a state law that allows a map to stand for only two elections if 3/5 of the legislature does not approve. Such was the case in 2021 when the current plan passed with only majority support.

Redistricting may occur in Florida at the beginning of the year, while a Utah judge disqualified the Beehive State congressional map in late

August. Missouri Gov. Mike Kehoe (R) has called upon his legislature to begin redistricting. The process has been discussed in Colorado, Indiana and New York.

The Louisiana racial gerrymandering case before the Supreme Court could result in a landmark decision. Upholding the lower court ruling would mean Louisiana would be redrawn and the decision would also probably lead to Alabama redistricting, as well as validating the new Texas map.

At this point, both parties can win the House majority, and it is likely the new Congress beginning in 2027 will again feature a House of Representatives with a very close majority margin.

A plethora of midterm governors races will be on the ballot this year and next. We start with the 2025 elections in New Jersey and Virginia. Polling suggests that the Democratic nominees, U.S. Rep. Mikie Sherrill and former U.S.

Rep. Abigail Spanberger, respectively, are favorites to win the two open races.

In the regular 2026 election, 36 states will host governor’s races. Of the 38 total campaigns, 19 are open, mostly due to incumbent term limits, and 19 feature incumbents seeking re-election.

On tap are major open races in California and Florida. Vermont Gov. Phil Scott (R) may seek a sixth two-year term, while Texas Gov. Greg Abbott (R) will be on the ballot for a fourth. Declaring for third terms are Govs. Brad Little (R-ID), J.B. Pritzker (D-IL) and possibly Ned Lamont (D-CT) and Tim Walz (D-MN). Eligible to run beyond two terms but declining are Govs. Kim Reynolds (R-IA) and Tony Evers (D-WI).

Jim Ellis is the senior political analyst for the business-industry political action committee (BIPAC) and the creator of the Ellis Insight publication.

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac. NACSPAC donors who made contributions in September 2025 are:

Patrick Abernathy Ignite Retail Technology

Karla Ahlert RaceTrac Inc.

Michael Barley Pace-O-Matic

Wynne Barrett Jera Concepts dba Supplyit

Tony Battaglia PMI U.S.

Frank Beard Rovertown

Doug Beech

Casey’s General Stores Inc.

Stace Anne Benu Executive Leadership Solutions Inc.

Matt Bogue Victory Marketing LLC

Ron Brown BF Holdings LLC dba Latitudes

Robert Buhler Open Pantry Food Marts of Wisconsin Inc.

Michael Deal Moyle Petroleum Company

Scott Faber

Casey’s General Stores Inc.

Chad Frazell Casey’s General Stores Inc.

Tony Gaines JOEY

Varish Goyal Loop Neighborhood Markets

Brad Haga

Casey’s General Stores Inc.

Krister Hampton Altria Group Distribution Company

Matthew Hanson Black Buffalo Inc.

John Harris Coulson Oil Company dba Road Runner

Chris Hartman Rutter’s Holdings Inc.

Steph Hoppe

Casey’s General Stores Inc.

Jon Hostasa Casey’s General Stores Inc.

Sam James Casey’s General Stores Inc.

AJ Jha Tustin Arco

Brian Johnson Casey’s General Stores Inc.

Dave Johnson Casey’s General Stores Inc.

David Jordan Jordan Oil Co. Inc.

Paul Kern Invenco by GVR

Leyton Lavigne Lavigne Oil Company

Wolfgang Manz PWM Electronic Price Signs Inc.

Sean McCaffrey GSTV

Steve McKinley Urban Value Corner Store

Phalynn Meeds Haskel Thompson & Associates - Executive Recruiters

Carla Miller Nittany Oil Company dba Minitmart

Scott Minton OnCue Marketing

Nick Paich TriggerPoint Media LLC

Eden Pearson Casey’s General Stores Inc.

Steven Robins Casey’s General Stores Inc.

Kory Ross Casey’s General Stores Inc.

Rick Sales Abierto Networks LLC

Kay Segal Business Accelerator Team

Rajeev Sharma VideoMining LLC

Jessica Starnes Weigel’s Stores Inc. Van Tarver InStore.ai

Nan Thomae

Casey’s General Stores Inc.

Sarah Vilim Keurig Dr Pepper

Joe Vonder Haar iSee Store Innovations

Doug Yawberry Weigel’s Stores Inc

Chuck Young W. Capra Consulting Group

The nine-store Nevada retailer looks for unique ways to build community.

Name of company: Rainbow Market

Date founded: 1982 # of stores: 9 Website: rainbowmarketnv.com

BY SARAH HAMAKER

One of Mark Miller’s proudest moments as a convenience store operator came not from a big sales day, but from a memorable way the store gave back to the community. “My son Nathan wanted to buy shoes for the entire local high school junior varsity basketball team,” said Miller, one of the managing partners of the nine-unit Rainbow Market, which has stores in Las Vegas, Reno and Sparks, Nevada. He and his son wanted to give back in a way that was beyond a typical food or monetary donation. “So we did—[we bought] the nice ones the kids wanted. That’s what I love about this job, the ability to create these community moments. To me, owning a convenience store presents me with opportunities to connect through helping others.”

That’s one of the hallmarks Miller tries to instill at the five stores he runs in Reno and Sparks. Community outreach has been a pillar of Rainbow Market’s culture from the beginning of the family business—Miller’s grandfather-in-law opened the first location in Guam after serving in the military during World War II and the Korean War. Eventually, Miller’s father-in-law moved to Nevada and started the first Nevada

Rainbow Market in 1982, and recently handed over the reins to his daughter, Miller’s wife Lori Miller, who now helms the company as CEO.

While Lori Miller grew up in the convenience store industry, her husband began his career as a teacher. Miller brought his hands-on approach to teaching to running the stores. “I jump in and help no matter what needs doing at the stores, from stocking a cooler to mopping a floor to running a register,” he said. “I will sometimes hear regular customers express surprise when they find me behind the cash register, but because I think it’s a great privilege to run a business that interacts with the community on a daily basis, I’m more than happy to pitch in.”

That mindset has been the foundation of Rainbow Market’s success. “We have competition with larger chains, so we have to try harder to be what our communities need and want,” Miller said. What drives him the most is that “we live here too. There’s no substitute to being part of the community and to invest in the community.” That attention to customers is ingrained in the employees as well. “I’ve been doing this for 30 years and we’ve had

Mark Miller, one of the managing partners for the nine-unit Rainbow Market, listens to customers, staff and family alike when it comes to bringing in new merchandise to the five stores he oversees in Reno and Sparks, Nevada— like when his son Nathan suggested the store start carrying Pokémon cards several years ago. “Some of the general merchandise vendors had gotten out of the game, and it was becoming harder to find suppliers for toys, earrings, sunglasses, etc.

maybe two managers [leave] during that time,” he said. “We pay a good wage and employees know their point of view matters.”

Rainbow Market brings a taste of the islands to landlocked Nevada as a nod to its roots in Guam. Its signature blue branding color creates a “waves” effect on the walls that follows the natural flow of foot traffic through the store. “I came up with the design myself,” Miller said. “We wanted something evocative of waves on the walls to point back to our company’s start on the island of Guam, and we took that idea without getting corny.”

When Nathan came up with the Pokémon idea, I was willing to try it,” Miller said.

The cards became a huge hit, especially when the stores, which are open 5:30 a.m. to 1 a.m., started hosting midnight release parties for exclusive cards. “We would have three to four hundred people show up for these midnight releases,” Miller said. “What I didn’t initially realize was what a community builder carrying these collector cards would be. These trading cards have been a nice way to get to know our neighbors and customers.”

focused on keeping the cooler doors well-stocked. “I didn’t want our staff to think that because we have a beer cave, we don’t have to worry about low [inventory],” he said. “I wanted us to keep on top of the inventory and make sure customers always have the cold drink they want at hand.”

The retailer holds a gambling license that allows it to offer slot machines in addition to lottery. “Because the gaming customers sit there for an hour playing slots, we get to know them,” Miller said. “This allows us to develop relationships with our customers beyond the transaction.”

Since most of the locations weren’t new builds, the owners removed center islands and put the checkout counter against the wall to reconfigure the existing spaces. “We also added a third register to get people in and out more quickly,” Miller said.

Miller eschewed a common c-store staple— the beer cave—and instead

Those relationships are what sets Rainbow Market stores apart. Miller posts his name and number on the wall of the five stores he manages. “I return every phone call I get,” he said. “I want our customers to leave with a feeling of community. You can buy the stuff we sell anywhere, but you can’t buy a sense of community.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor and award-winning romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

NACS Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2024 and earlier, go to www.convenience.org/Ideas2Go

Look for more 2025 NACS Show coverage in the December issue of NACS Magazine.

(THAT ISN’T A CIRCUS)

From TikTok (customizing the customer experience) to ‘tick tock’ (giving back time and providing energy), the 2025 NACS Show delivered on its promise.

BY JEFF LENARD

Afew years ago, NACS President and CEO Henry Armour said that the NACS Show could be described as “The Greatest Show on Earth.” It’s a tagline associated with the Ringling Brothers circus, which was on hiatus at the time. While the circus has since returned, the NACS Show demonstrated once again that, at the very least, it’s the greatest four days on the convenience calendar.

More than 25,000 attendees—a record for a Chicago-hosted NACS Show—swarmed a 440,000 net-squarefoot Expo hall, 50 Education Sessions and four days of General Sessions. In addition, the attendees made the most of countless networking opportunities.

Here are few of the big trends from this year.

Befitting an industry that conducts well over 100 million face-to-face transactions every single day, customer service was a focus in a half dozen Education Sessions, ranging from enhancing communications skills to leveling up highpotential employees.

The focus on people extended to the General Session stage as well. Incoming NACS President and CEO (beginning in 2026) Frank Gleeson said that he learned how to be a leader attending the NACS Executive Leadership Program at Cornell 20-some years ago. He said that the week-long course transformed how he saw his role as he transformed from a highly competent manager that occasionally had “sharp elbows” to a leader who focused on growing people and teams.

Meanwhile, his fellow panelists, former Alimentation Couche-Tard President and CEO Brian Hannasch and current NACS President and CEO Henry Armour, stressed that culture is what allows companies to accomplish great things, especially when faced with adversity.

NACS Chairman Annie Gauthier (Y-Not Stop stores based on Mansura, LA) said that the company’s TeamFest program, which allows employees to learn more about the company and its values in a fun half-day retreat, is how she seeks to keep and grow newer employees.

“With the right training and support, these team members are our future. TeamFest is one way we show our love of our industry and connect them to something bigger than themselves and their store,” Gauthier said.

And in a NACS Convenience Matters podcast (conveniencematters.com) recorded directly after his General Session presentation, “Clerks” creator Kevin Smith said that customer experience is everything. “You can make a person’s day.… When I was working at the convenience store, I did it with simple acts. … Make sure that they feel better than when they came in.”

When c-stores become that “Cheers” equivalent, where everyone feels like they belong, it creates a fun place to work—and shop.

In the opening General Session, Seb Terry, creator of the 100things Movement, said that when he first defined dreams he wanted to achieve, they were personal—but the focus changed the first time he completed a bucket list dream item that was purely about helping someone else.

“As the cost to culture, morale and performance grows too high to ignore, we must remember: the height of our success isn’t driven only by the strength

At a data conference I attended earlier this year, speakers talked about the looming threat that the TikTok Shop posed to retailers, including c-stores, because items can be ordered directly from videos. Interestingly, it’s not the first time that a Tik Tok shop has been considered a threat to c-stores.

More than 20 years ago a different type of Tik Tok posed a threat when vending machines called the Tiktok Easy Shop popped up in Washington, D.C., selling common convenience items. They were the brainchild of a McDonald’s executive and owned and operated by the QSR.

“It’s the latest achievement in technology’s dubious quest to eliminate the human in human interaction. The machine is robotic, precise, odor-free and utterly without attitude,” wrote The Washington Post in 2002 on the new phenomenon that was drawing local attention.

While the kiosk drew plenty of attention— both good and bad—sales lagged and the concept was modified. Tiktok Easy Shops were made smaller and relocated to the parking lots of local McDonald’s restaurants. In addition, they were given a new name: Redbox. These convenience kiosks featured many of the same items, but were designed to provide fill-in grocery items like bread and milk—plus DVDs. They were featured in the NACS Ideas 2 Go video program at the 2003 NACS Show.

The concept still didn’t last. The kiosks were again reimaged with a singular purpose: to rent videos. This third iteration took off, McDonald’s sold the company, and in a matter of a few years, Redboxes, ironically often at c-stores, were the top distribution channel for DVDs.

How TikTok Shop evolves remains to be seen, but it is certain that this is a trend that NACS will continue to track.

of our actions, but by the depth of our connection to those around us. Put another way, we are strong alone—but we are better together,” Terry said.

The session didn’t just inspire attendees to seek their dreams—it helped two retailers come closer to accomplishing theirs. NACS worked with Terry to solicit goals of attendees and NACS provided the financial support to make two dreams come true: One related to education and one focused on family. (Look for more coverage on their progress in a future issue of NACS Magazine.)

The NACS Foundation also presented its inaugural First Responders of the Year Awards, recognizing the everyday heroes among us. And it helped coordinate food rescue following the NACS Show that delivered over 71,000 pounds of food, beverages and supplies with nine full trucks sent to five local nonprofit organizations. The recovered goods were distributed across these Chicagoarea partners: Greater Chicago Food Depository; Mission of Our Lady of the Angels; Breakthrough; Shepherd’s Hope Food Pantry; and Hands of Hope.

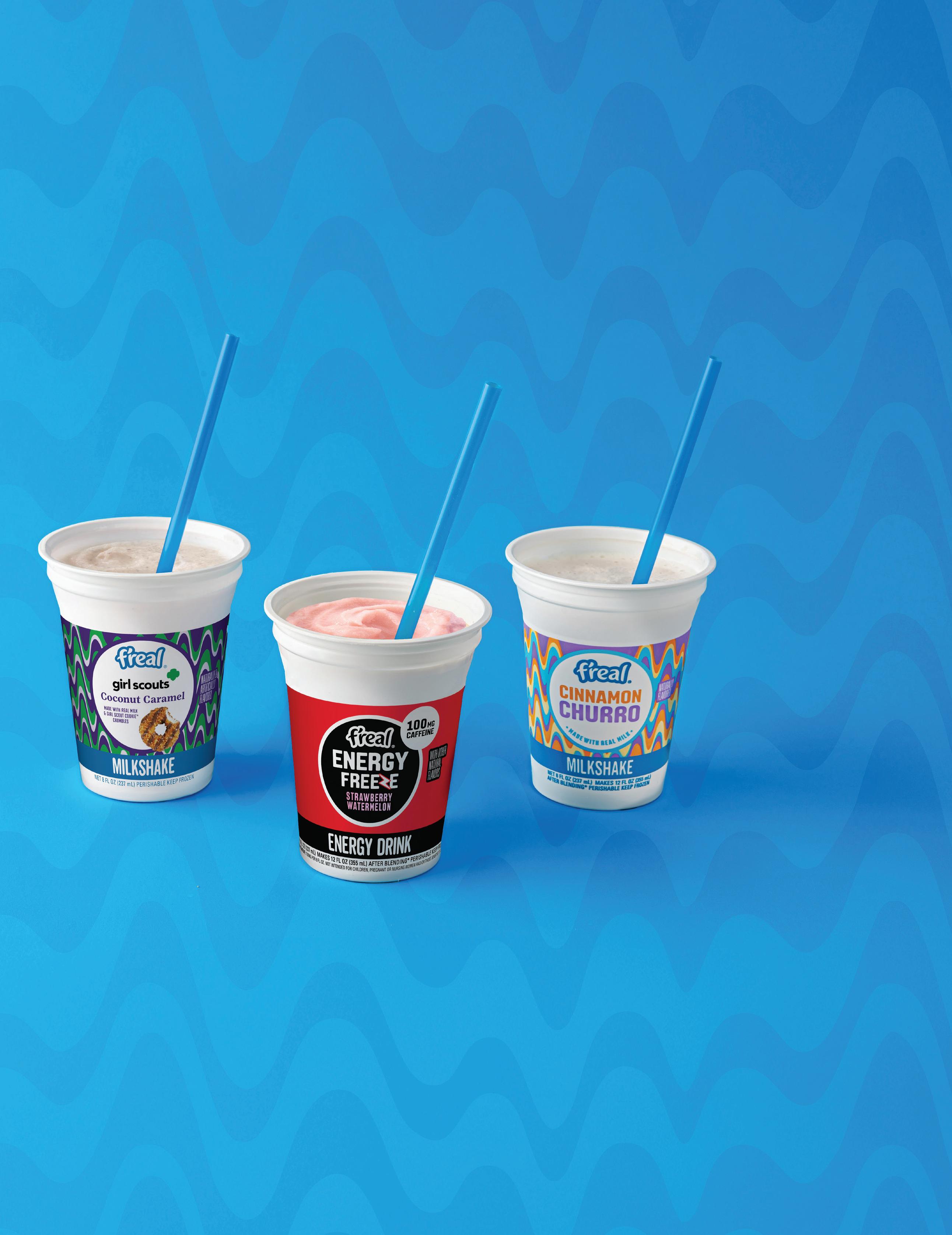

Of course, the Expo focused on products and services that can speed up customer transactions. Artificial intelligence to enhance operational

efficiency, self-checkout and new technologies to help customers order online for in-store pickup were plentiful on the Expo floor. So were beverages and food that delivered energy, including coffee, energy drinks and energy bars. After all, c-stores provide the rocket fuel that propels everyday life forward.

Plenty of products also addressed the reason that people need an energy boast—too little sleep. There were plenty of drinks, tabs and gummies to help people relax and get a great night’s sleep.

Part of the bigger trend to save people time is the continuing growth of functional products. The trend of adding protein to food and beverages has accelerated, with dozens of products packing in additional protein, whether to appeal to timestarved customers or to GLP-1 users looking for a protein-based snack.

And for those who want to adjust their moods, hemp-based products were very noticeable this year, especially in the Cool New Products Preview Room.

TikTok and harvesting customer experiences was a common theme among exhibitors. Many said that they closely monitor social media to see how their products are being used—and whether there is a way to celebrate it and even create new products.

In one example, Van Holten’s had a “TikTok table” where it showcased some of the TikTok-inspired combinations you could try with the pickle—plus one collaboration with Warheads Extreme Sour candy that came to market because of social media posts.

MASH-UPS: 1 + 1 = 3

Van Holten’s and Warheads wasn’t the only collaboration at the Expo. Last year, two of the bigger trends seen on the Expo floor—pickles and freeze-dried items—have gotten together. This year, welcome the freeze-dried pickle.

And mash-ups also extended to companies. Slim Jim and Buffalo Wild Wings combined for a new chicken stick. And Hershey’s and Mondelēz, usually seen as competitors, combined two of their iconic products—Reese’s and Oreos—into new items. NACS has long stressed that the c-store industry is unique because retailers share ideas and help each other. So, it makes perfect sense that suppliers also would work together on the Expo floor.

Given that the previous few paragraphs were about pickles, it’s fair to say that pickles—or more accurately, the pickle flavor—was once again everywhere on the Expo floor, sometimes with a twist. For one, they were joined by olives in some booths, highlighting a “briny snacks” category.

But the pickle is also alive and well as a standalone flavor, including in beer. Pabst Blue Ribbon showcased its new pickle-flavored beer. So instead of calling out for a PBR, will people ask for a PPBR, with the first P for pickle?

The year 1969 featured at least two monumental events: Man landed on the moon and fried chicken was introduced in convenience stores. And while it’s been more than 50 years since man has been on the moon, more than 28% of in-store sales at c-stores today is prepared food, including fried chicken. (See “Foodservice Pioneers” in the August 2011 issue of NACS Magazine for a history of c-store chicken.)

Everyone on the Expo floor had no problem finding ways to sate their appetites with food—or to enhance their operations with new foodservice strategies and programs.

There is only so much space to talk about some of the big trends seen and heard at the NACS Show. Clearly, there is the growing importance of global, something that we will continue to see as Henry Armour transitions to leading the global activities of NACS in 2026. There were also plenty of booths that showcased products for dogs and cats, either in cars or at home. And there was so much fun with new product innovation in snacks.

But most of all, the NACS Show was a clear example of an industry that continues to thrive because it constantly is seeking new ways to delight customers and reinvent convenience.

Jeff Lenard, NACS vice president of strategic communications and media, shared his love for Godzilla in his May 2025 article “Big Ideas From the NACS Convenience Summit Asia.” At that time, he was near a statue. Here he’s next to the real deal at the 2025 NACS Show Expo. (It was real, right?)

The NACS State of the Industry Report® and Talent Insights Dashboard surveys open for participation this winter.

Your data doesn’t just tell a story—it sets the standard for how the convenience and fuel retail industry measures success, identifies trends, and drives growth.

Participants receive valuable benefits:

• State of the Industry Report®:

- 2 complimentary digital licenses

- 1 complimentary State of the Industry Summit registration

• Talent Insights Dashboard: Complimentary enterprise-wide access

Contribute your data and make your mark on the metrics that matter.

Contact research@convenience.org today!

BY PAT PAPE

Chicken of all configurations—tenders, wraps, wings, sandwiches, nuggets—is an increasingly hot category.

According to Datassential, the number of limited-service chicken restaurants expanded by nearly 5% in 2024, and sales jumped almost 10%. A 2025 Technomic chain report found that chicken is the second-fastest-growing restaurant category behind beverage/snack chains.

Among QSRs, McDonald’s recently introduced McCrispy Chicken, its first permanent new menu item in four years, and brought back its crispy chicken Snack Wrap; Taco Bell revived Crispy Chicken Nuggets for a limited time and expanded its chicken offerings overall; and Culver’s said it improved the fillet on its chicken sandwich, which comes crispy, spicy or grilled.

Proving that people love chicken on their table and also in their portfolio, the 300-unit Dave’s Hot Chicken—Nashville-style chicken that popped up in a Los Angeles parking lot eight years ago—recently sold to private equity firm Roark Capital in a deal valued at $1 billion.

The Market stores, owned by Charlottesville, Virginia-based Tiger Fuel, have developed a successful foodservice program, but the retailer didn’t put chicken on the menu until it acquired a location that already offered it.

After tweaking the original program,

The Market now sells bone-in chicken and tenders, along with potato wedges, mac and cheese, green beans, mashed potatoes with gravy and occasional specials. “The big thing is our Tiger Sauce,” said Nico Robinson, culinary program manager at The Market.

“Tiger Sauce has a good amount of tang, but it’s not spicy. People tell us it’s better than [Raising] Cane’s sauce.”

To produce a Southern fried chicken like The Market’s, “you have to have the crispy, you need the flake, and it’s got to have the snap when you break into that skin,” said Robinson. “If everyone follows the system and doesn’t take shortcuts, it comes out amazing. We’re fortunate to have great people who do that every day.”

The Market manages a tremendous catering business. Although most catering orders are for box lunches with sandwiches, the stores also fulfill large orders of chicken. “We package the chicken in foil that has holes to vent the steam so we don’t lose our breading, and we transport the order in our Market-branded carrying cases, which look a little like a pizza bag,” Robinson said. “We

after three hours, and it tastes just as fresh as if it just came out of the fryer.

deliver it to the customer and set it up for them, making sure they are stocked with utensils and everything they need.”

In 2020, 7-Eleven rolled out its Raise the Roost Chicken & Biscuits concept, which features made-from-scratch, hand-breaded, fried chicken tenders; bone-in and boneless wings; and chicken sandwiches, including chicken breakfast sandwiches and burritos, that are made to order or available as graband-go options.

“We developed Raise the Roost to meet the growing demand for high-quality, restaurant-style food in a convenient setting,” said William Armstrong, senior vice president of restaurant operations and innovation at 7-Eleven. “Chicken is one of the fastest-growing menu categories in the U.S. restaurant sector, and customers increasingly expect quick-service options that don’t sacrifice flavor, freshness or quality.”

Currently available in 116 7-Eleven stores across 18 states, the program aims to deliver chicken favorites with a focus on freshness, flavor and speed. “What makes the program work long term is our commitment to continually evolving the menu and introducing craveable, on-trend products and LTOs to surprise and delight our guests,” Armstrong said.

Winning LTOs for Raise the Roost have included a hot honey chicken biscuit and chicken sandwich, cobranded in October 2024 with Mike’s Hot Honey, and spicy versions of the chicken biscuit and chicken sandwichduring the summer.

“Launching a successful chicken program requires more than great food—it takes consistency, speed and a standout guest experience that captures attention and turns first-time trial into long-term loyalty in an already crowded category,” Armstrong said. “We continue to evaluate new formats and flavors as part of our broader food innovation strategy.”

Turnkey programs are solutions for c-store retailers who want to offer hot, ready-to-eat chicken meals without starting a proprietary program from scratch. The programs typically provide chicken, sides, equipment,

marketing, training, supply chain support and menu development.

Chester’s Chicken began serving c-stores in the late ’80s and is now available in 1,100 locations. The operation was created with limited space in mind.

“Retailers need a merchandiser to hold chicken, the fryer, a prep table, the proper amount of refrigeration, storage, freezer space, a small Cadco oven, about 400 square feet of kitchen space and 60 square feet of counter space,” said William Culpepper, vice president of marketing for Chester’s International. “Some operators put the fryer in the back of the house and bring the fried chicken out to the merchandiser. Some put it behind the merchandiser, which lets customers see the process. It does require some dedicated staffing, especially during busy times and preparing for the lunch rush.”

The program is especially attractive to small and midsize operators. “They understand that foodservice will drive their business,” said Culpepper. “We come in and become an extension of their team.”

At the NACS Show in October, Chester’s unveiled a new merchandiser dubbed the Krispy Station, which can hold hot chicken and prepackaged sides for up to three hours—two hours longer than the hold of the company’s previous hot box.

“Take a tender out of there after three hours, and it tastes just as fresh as if it just came out of the fryer,” Culpepper said. “It improves product quality, provides a better experience for the customer and is less expensive than the unit we sold previously. We’re also excited about our new fryer, which has two baskets. It lets stores fry two items at one time and cook in small batches.”

The new technology was tested in two Break Time stores, the convenience brand owned by Columbia, Missouri-based MFA Oil, and received two thumbs-up from store management. “When a customer ordered a meal in the past, you had to stop the process and cup up small side items, lid them and box it,” said Roger Hudson, senior foodservice manager at Break Time. “With the new equipment, the sides are already in the case,

Turnkey programs are a great solution for c-store retailers who want to offer hot, ready-to-eat chicken meals.

and it takes about half the time to pack the customer’s meal than it did before. We hope to roll this out to our other stores soon.”

The Krispy Krunchy Chicken program features hand-breaded, Cajun-spiced fried chicken; all-white-meat tenders and nuggets; and honey-butter shrimp and biscuits, plus sides. No specific store footprint is required, but each store needs room for a hood, an 85-pound fryer and a hot food case. Krispy Krunchy provides comprehensive training for store staffers and marketing and point-of-sale materials. “It’s the easy button for operators,” said Joe Gordon, chief supply chain and technology officer at Krispy Krunchy. “It’s a turnkey program and we come in with everything from equipment to product to

Be sure to get the right equipment. … Not investing in the right equipment will cost you down the road.

lift from retailers [to start their own foodservice program]. We design our products to be simple to execute in a c-store, while also being top of the line, gold-standard products that can compete with any restaurant out there.”

Krispy Krunchy Chicken introduced chicken nuggets earlier this year after determining they were a high-demand item. Locations that have added nuggets are selling an average of 7.8% more poultry than stores without nuggets, according to Krispy Krunchy’s data. The company said it has done extensive research and user testing to develop its menu and focuses on designing a program that’s specific to c-stores. According to company data, operators that add Krispy Krunchy Chicken see foot traffic increase 10-12% and merchandise sales increase 15-20%.

Broaster Co. offers two branded, trademarked programs, Genuine Broaster Chicken and Broaster Express. Like most turnkey programs, Genuine Broaster Chicken uses fresh chicken, but Broaster Express relies on frozen products, which are simple and more convenient for c-stores, said Katie Klaus, senior marketing manager at Broaster. The programs are in 5,000 locations today, with about 20% being Broaster Express and 80% Genuine Broaster Chicken.

“With a fresh chicken program, operators run the risk of ordering too much chicken that expires before it’s used,” said Klaus. “Plus, fresh chicken requires stringent food safety practices due to the increased risks of foodborne illness, which some smaller stores may not be prepared to execute.”

Broaster Express requires four square feet on a back counter for the program’s ventless fryer. No hood is necessary in most municipalities, a key benefit of the program. C-stores can operate the program as a madeto-order concept or put a merchandising case on a front counter, allowing customers to grab precooked products.

“C-store operators can add Broaster Express for as little as $14 per day, with as few as four menu items,” Klaus said. “With Broaster Express, the operator chooses which items to offer, ensuring the flavors and product mix are what their customers crave.”

The McLane Company recently launched its first branded chicken offer,

HiBird. The program is designed for graband-go offerings and includes fully cooked chicken filets and strips, as well as sides of white cheddar mac and cheese and potato wedges. The chicken can be cooked either in an oven or fried, said Farley Kaiser, senior director, culinary and innovation, The McLane Company.

Each day, Love’s Travel Stops feeds thousands of road warriors with a combination of proprietary foodservice offerings, turnkey programs and a range of QSRs.

“Customers want fast, fresh food offerings on the road that are also affordable,” said Wade Arthur, senior manager of food operations at Oklahoma City-based Love’s. “It’s important for those items to be portable and easy to eat on the go. Love’s offers Chester’s, Bojangles, Hardee’s and Carl’s Jr., depending on the location. Love’s Fresh Kitchen offerings include chicken tacos, chicken salad wraps and spicy chicken drumsticks.”

For a retailer that wants to add chicken items to its menu board, Arthur stressed the importance of food safety and training team members to follow proper procedures, especially when working with hot oil and fryers.

“We also understand the importance of prep work,” he said. “Breading, seasoning and frying food, frequent restocking and cross-training team members to handle both prep and service is essential for standardizing processes that reduce points of friction and improve consistency for customers.”

No matter which program a retailer chooses, it’s important not to cut corners, Robinson said. “Be sure to get the right equipment,” he said. “Not investing in the right equipment will cost you down the road. Make your process as simple as it can be. The [finished product] may not be right the first time, but continue to try it. As successful as our chicken program is, we still go back frequently to review it. Chicken is amazing.”

Freshchickenrequiresstringentfood safetypracticesduetotheincreased risksoffoodborneillness.

Pat Pape worked in the convenience store industry for more than 20 years before becoming a full-time writer. See more of her articles at patpape.wordpress.com.

BY LAUREN SHANESY

Demand from consumers for more sustainable foodservice packaging has increased in recent years as many begin to consider their carbon footprint and environmental impact.

“More and more, consumers are seeking sustainable packaging options that align with the values of the foodservice businesses they choose,” said Mark Medovitch, content manager at Inline Plastics.

According to the Food Packaging Institute’s (FPI) latest Consumer Perceptions Survey & Report, the top environmental concern consumers have about packaging is that single-use items will end up as litter on land and in waterways.

“This is something we have grappled with for a long time because of the tangible, emotional relationship people have with foodservice packaging. They see the coffee cup they get every morning on their way to work as litter on the side of the road and start to correlate it with waste,” said Natha Dempsey, president of FPI, while speaking at IDDBA 2025. But in actuality, she said, foodservice packaging is a very small portion of the waste stream—less than 2%. “About 98.5% of the waste stream is other stuff [such as plastics, food scraps, paper, metals, textiles, yard trimmings, etc.]. But people don’t have that tangible feeling for those items the way they do with things they put in their own trashcan.”

Charlotte McMullen, chief operating officer at Ronpak, said BPI compostable status is being sought and requested by

consumers, who value environmental claims and view them as a positive message. “There is also still an emphasis on recyclability and lighter content substrates, and natural substrates are largely replacing bleached white alternatives due to environmental impact and cost,” she said.

However, having food packaging that is recyclable or compostable isn’t as straightforward as it seems. Many products are multi-material, so while they may have sustainable or eco-friendly elements, they often don’t make it through the entire material recovery process.

There has been a move toward using more molded fiber and paperbased products that are marketed as compostable, particularly for hot food applications, said Medovitch. “However, most of these items include a thin plastic liner to provide moisture resistance and barrier protection. That liner means they are not truly compostable and instead end up in landfills where they generate methane emissions.”

He said that there has been increasing demand for post-consumer recycled (PCR) materials, which when used in PET packaging “not only maintains recyclability but also preserves key benefits like barrier protection, extended shelf life and food safety when paired with proper sealing. This makes PCR a far more practical and impactful path toward sustainability.”

Proper packaging, even if not made with eco-friendly materials, can impact sustainability in other ways

and help reduce in-store waste, said Kurt Richars, director of market development and sustainability at Anchor Packaging. “High-performance packaging keeps food fresh longer, which reduces shrink and lets staff stock displays ahead of peak hours. It also supports hot-to-cold case flexibility, so unsold meals can safely move to the cold case instead of being thrown away.” He also noted that new innovations in design—like new singlepiece containers that use the same part for the base and lid—can simplify handling, eliminate base-lid miscounts, cut storage needs and limit the number of products retailers must inventory.

“Cutting waste isn’t just about throwing less away—it’s about saving labor, protecting food quality and increasing efficiency to boost profit. The right packaging makes it happen,” he said.

Looking ahead, Medovitch said he expects to see stronger demand for solutions that are “truly sustainable. … Packaging that can actually be recycled and that fits seamlessly into existing waste streams will be critical.”

FPI’s Dempsey added that having sustainable packaging options will continue to be key as states introduce policy or regulations regarding single-use plastics. As of May 2025, there were around 180 proposed pieces of legislation relating to foodservice packaging in 30 states, she said.

And while eco-friendly materials are an important feature because of consumer perception and demand,

what’s more critical is the performance of the packaging product.

“Performance that protects food quality must come first: preventing leaks, preserving presentation and maintaining temperature. The good news is operators don’t have to choose between performance and sustainability. Materials like PET, PP and paperboard deliver both the performance that protects the food and the recyclability that consumers prefer,” said Richars.

Medovitch also said that food safety is a top priority for many consumers and retailers. “Tamper-evident and tamper-resistant packaging has become an expectation, giving customers confidence that their meals are protected and safe to eat.”

Retailers should remember that foodservice packaging “isn’t just something that holds a meal—it’s a powerful tool to unlock profitable foodservice growth. It protects the investment you’ve made to win a customer, shapes their perception of value and can streamline your operations,” said Richars. “Retailers should view packaging as a tool for customer retention and operational efficiency. High-performance packaging creates consistent quality, operational savings and a path to profitable, scalable foodservice growth.”

Customers eat with their eyes, said Kurt Richars, director of market development and sustainability at Anchor Packaging. “When customers see, you sell more,” he said. Clear packaging that showcases the freshness and quality of food and enhances presentation can impact a sale, manufacturers agreed.

“Creating a highly visible, appealing display converts more visitors into foodservice customers. Also, because many customers only have minutes to spend in the store, enough food must be ready-to-go. Retailers win when packaging delivers both presentation and performance—capturing impulse sales today while creating repeat business that fuels foodservice growth,” said Richars.

To learn more about NACS Global, including upcoming events, visit convenience.org/global.

BY LAUREN SHANESY AND LEAH ASH

Convenience foodservice continues to undergo an evolution worldwide. According to experts, the same trends that are so visible in the United States are impacting foodservice globally. That includes c-stores becoming more of a destination for fresh offerings across all dayparts; a marriage of grab-and-go and prepared on-site meals; an emphasis on technology; and global borrowing, as c-store operators look outside their own national borders for best-inclass ideas.

There’s great opportunity in foodservice for convenience retailers, said Dan Munford, CEO of Insight Research and a NACS relationship partner based in the United Kingdom, as “c-stores hold a price advantage over quick-service restaurants, making them attractive for budget-conscious consumers. They also really value the efficiency of c-stores being a one-stop shop.”