UP AHEAD: AI’S TRANSFORMATIVE POTENTIAL

DRIVER RETENTION

It starts with recruiting

March 2024 | FleetOwner.com POWERTRAINS: Diesel still rules Page 28

Page 16

Page 42

THE ALL-NEW VOLVO VNL

Designed to change everything

Once again, we’re changing the industry - with quantum leaps forward in fuel efficiency, safety, productivity, connectivity, and uptime. Just what you’d expect from Volvo Trucks, in a totally unexpected way.

volvotrucks.us

A number of strategies can be implemented during the driver recruitment process that will make turnover less of a ‘big deal.’

28

Today’s fleet leaders must balance decarbonization with focusing on and finding the best equipment supported by today’s best trucking power infrastructure: diesel fuel.

4 FleetOwner | March 2024 Contents March 2024

16 Driver retention

Diesel

still rules

42 Unlocking AI in trucking Artificial intelligence o ers optimization and e ciency opportunities not previously possible, and for trucking companies, that can be a distinct competitive advantage.

Feature

Feature :: Cover story SAFETY & OPERATIONS EQUIPMENT TECHNOLOGY NEWS & PERSPECTIVES

::

::

| Getty

Photo: Vadym Ivanchenko | 1677712121, Andy 1145585748

Images

| Getty

Photo: kali9

| 856729754

Images

Photo: Orange EVw

| 1279002529 | Getty Images Photo: A. Duie Pyle 16 38 50 28 42 Safety 411 22 ZE regs threaten supply chains Truck Taxes 24 Oregon trucking fights weight tax Finance 26 Freight recession silver linings Tire Tracks 34 Tires are another EV obstacle New Models 36 Volvo shows o all-new VNL truck Yard Trucks 38 Orange EV blossoms in Kansas City Product Spotlight 40 Focus on suspensions and steering Technology Briefs 46 Kodiak, Bestpass, and new study from NMFTA 8 Lane Shift Ahead 10 News 47 Private Fleets 48 Fleet Profile 50 Last Word

Photo:

RichLegg

U.S.A. Owned & U.S.A. Made BORN TO BE BETTER. From engineering to assembly, Stoughton trailers are designed with decades of experience in quality and craftsmanship. The processes, the tools, the people and the equipment all impact the excellence of Stoughton products. Our first class tools and equipment are chosen for value, reliability and effectiveness. With Stoughton, you know you’re getting a dependable, long-lasting trailer that will keep you on the road longer. Stoughton trailers – they’re just born to be better. 877-776-5505 • StoughtonTrailers.com

Online Exclusives

Webinars

The U.S. Labor Department’s new independent contractor rules create a new test for the trucking industry. Learn the dos and don’ts for fleets in the evolving landscape. FleetOwner.com/ContractorWebinar

Sign Up

Delivered to your inbox, FleetOwner newsletters provide regular industry news and event updates, and breaking news alerts. Manage your email subscriptions at FleetOwner.com/subscribe.

Connect with Us

Online

Class 8 EV growth in the Southeast

Far from the California regulations transforming the trucking industry out West, Benore Logistic Systems is adding more electric Class 8 Peterbilt 579EVs to its fleet operations in South Carolina. Ranked No. 213 on the FleetOwner 500: For-Hire, Benore hauls vehicle parts for OEMs and Tier 1 suppliers. Most of Benore’s customers have strong sustainability goals, according to fleet VP Dennis Kunz. He told FleetOwner that adding EVs sets Benore apart from other carriers by showing customers that “we’re pulling in the same direction as they are. Plus, we, as a company, believe that it’s the right thing to do.”

FleetOwner.com/BenoreEVs

IdeaXchange

When someone sees one of your trucks on the road, what impression do they come away with? The condition of your trucks can be the first impression a potential customer has of your company. According to Gino Fontana, clean trucks are also part of your driver retention practices. FleetOwner.com/TruckWashing

EVP/Transportation

Kylie Hirko Kylie@fleetowner.com

VP/Market Leader

Michael R. Uliss michael@fleetowner.com

Editorial Director

Kevin Jones kevin@fleetowner.com @KevinJonesTBB

Editor in Chief Josh Fisher josh@fleetowner.com @TrucksAtWork

Senior Editor

Jade Brasher jade@fleetowner.com

Editor

Jeremy Wolfe jeremy@fleetowner.com

Digital Editor

Jenna Hume jennah@fleetowner.com

Art Director

Eric Van Egeren

VP Customer Marketing

Angie Gates angie@fleetowner.com

Customer Marketing Manager

Leslie Brown leslie@fleetowner.com

Production Manager

Patti Brown patti@fleetowner.com

Ad Services Manager

Carmen Seeber

Contributors

Geert De Lombaerde

David Heller

Gary Petty, Private Fleets Editor

Kevin Rohlwing

Seth Skydel

Endeavor Business Media, LLC

CEO Chris Ferrell

President June Griffin

COO Patrick Rains

CRO Reggie Lawrence

Chief Digital Officer Jacquie Niemiec

Chief Administrative and Legal Officer

Tracy Kane

Linkedin/fleetowner Facebook/fleetowner twitter.com/fleetowner

MEMBERS ONLY

Access comprehensive reports, engaging industry topics, and exclusive multimedia content...and best of all...it’s FREE. Register at FleetOwner.com/members.

30

EVP/Transportation

Kylie Hirko

Published by

Nashville, TN 37215

800-547-7377

6 FleetOwner | March 2024

Endeavor

LLC

Business Media,

Hills Blvd., Suite

Burton

185

Photo: 137538936 | Welcomia Dreamstime

Photo: Benore Logistic Systems

Think again. Hudson’s new Inland Marine product offers motor carriers, freight brokers, freight forwarders and logistics providers legal liability protection for cargo losses. In addition to cargo, we also offer ancillary coverage for onboard and off-board electronics, transportation equipment, trailer interchange, and even auto physical damage. Our team consists of experienced professionals who have a deep understanding of the nuances and challenges of the industry, and who work collaboratively to learn about each client’s concerns and needs to offer tailored, effective solutions that will help their business grow.

When you need to protect your cargo, THINK HUDSON.

Rated A+ by AM Best, FSC XV

HudsonInsGroup.com

Admitted coverages underwritten by Hudson Insurance Company and non-admitted coverages underwritten by member companies of Hudson Insurance Group.

AI is a tool, not a weapon

Save your brainpower for your fellow humans

By Josh Fisher Editor in Chief

@TrucksAtWork

By Josh Fisher Editor in Chief

@TrucksAtWork

The future is closer than ever—and in some ways, it is already here. But we have to find the right way to implement it.

SOMETIMES, IT JUST doesn’t feel like there are enough hours in the day to get it all done. Amidst the constant barrage of email pings and instant message pop-ups on my laptop, text messages buzzing on my phone, social media alerts, and even phone calls, it’s a miracle I can focus on this column. Is there a manager today who couldn’t use an extra hand?

With how short-handed the industry seems to be, I’m guessing the answer is no. We’re certainly not immune here. While working on this issue, we also had to backfill an editor’s position vacant since December, balance staff travel, plan how FleetOwner and our affiliated commercial vehicle publications will cover a very busy March and April season of events, attend mandatory corporate trainings, and everything else that comes with managing a news website and print publication.

As I struggled to find enough quiet time to write this column, I thought it would be great if artificial intelligence could help. AI, after all, is working wonders for fleets, and it’s still in its infancy. Could AI be the answer to finding more time in the day? Spoiler: It is not, but it does have its place.

“Imagine a future where AI seamlessly connects networks, automates responses, empowers efficient asset utilization, and frees humans from repetitive tasks,” McLeod Software’s Doug Schrier told FleetOwner for this month’s cover story on AI (see page 42).

That future is closer than ever—and in some ways, it is already here. But we have to find the right way to implement it.

Many of us have done this for years by optimizing routes and tracking shipments in real-time. This can free up people to focus on human interactions that still fuel business.

As college professors and high school teachers across the nation have been learning since ChatGPT and other AI systems have come online, artificial intelligence does not make writers sound intelligent. It can make writers sound robotic and uninteresting.

For example, we’ve noticed more public relations companies relying on AI for press releases. It’s usually easy to spot because AI can be good at writing a lot without saying much at all. Good writing, on the other hand, is ingrained with humanity.

Just like you wouldn’t want to rely on AI to make essential fleet decisions, I don’t want AI to create content for you. However, I can use AI to review written content for errors and grammar. And you, as a fleet leader, can use AI to improve efficiency in your operations.

Human relationships still reign supreme, Schrier noted. AI is not about replacing human connections. If used correctly, AI strengthens the powers of those relationships. “Imagine AI-powered tools that personalize interactions, analyze customer preferences, and anticipate needs, allowing you to deliver an exceptional and customized experience for each customer,” he said.

AI turns massive amounts of data into rich and highly accurate predictions. This makes it capable of turning raw data too complex for humans into actionable information fleets can use to improve safety, maintenance, and driver behavior, for example. This can help reduce crashes and improve driver safety. Leaders in the field told us that it can attract and retain drivers by optimizing their routes and loads based on preferences and skills.

It could improve your customer service. AI-powered tools reduce customer questions and resolve issues before they arise.

AI is rapidly evolving, but it’s not a silver bullet or the ultimate weapon. It’s a tool that all managers must watch and figure out how it can help—because if you aren’t using it, your competitors are.

So, while I had to rely on my limited brainpower to write this column on deadline, you can save some of your brainpower for the human side of trucking and start figuring out how AI can help cover a lot of tedious tasks and give your fleet an edge. FO

8 FleetOwner | March 2024

[ Lane Shift Ahead ]

Coalition of rivals: OEMs share vision

Competing executives partner to solve trucking’s ZE infrastructure problems

by Josh Fisher

WASHINGTON, D.C.—OEMs can build electric heavy-duty vehicles, but the nation doesn’t have the infrastructure to support longhaul zero-emission freight. It’s enough of a challenge to create a rare sight in the nation’s capital: Daimler Truck North America, Navistar, and Volvo Trucks North America executives sharing a stage and agreeing they need one voice to meet their lofty decarbonization paths.

The leaders were touting their parts as founding members of a new coalition focused on education and advocacy for building a nationwide zero-emission fueling infrastructure for medium- and heavy-duty vehicles. They were joined by federal officials to celebrate the new Powering America’s Commercial Transportation coalition, or PACT.

“This is bringing together people like us that never used to talk to each other,” John O’Leary, DTNA CEO, said from a shared stage at the National Press Club. “We never did. In fact, we might have talked about each other—but we never talked to each other. So it’s really encouraging to be up here hearing what is coming out of their mouths.”

While sitting beside Navistar CEO Mathias Carlbaum and VTNA President Peter Voorhoeve, the DTNA leader said PACT has great promise because the OEMs share goals. “The commitment is there from our industry,” O’Leary noted. “All we’re saying is we need some help. We want other players out there— whether it’s utilities, whether it’s equipment manufacturers, all that—we need everybody in this game together and then all rowing in the same direction.”

Voorhoeve said the leaders are moving into a new era. “We like to say ‘partnership is the new leadership.’ You don’t often see us all on the same stage.”

The VTNA leader said they are partnering to drive decarbonization forward.

“It’s super important now to get people around the table that don’t normally speak to each other in order to drive speed to market and get this done.”

All three companies produce 70% of new medium- and heavy-duty U.S. trucks and represent five of the seven largest truck OEMs: DTNA’s Freightliner and Western Star, Navistar’s International Trucks, and Volvo Group’s Volvo and Mack Trucks. The three corporations also have goals to become carbon neutral by 2050 and have similar plans to sell all net-zero- emission vehicles by 2040.

“We’re on this journey here with or without regulations,” Carlbaum said.

ZE transport education

PACT is focusing on education because there is still a lot that legislators, regulators, and other policymakers are learning about the challenges to creating a decarbonized U.S. supply chain. While most U.S. charging infrastructure projects focus on light-duty passenger vehicles, electrifying the trucking industry is a more significant challenge. According to the International Council on Clean Transportation, the U.S. needs nearly 600,000 chargers to support the 1.1 million Classes 4-8 ZEVs expected in operation by 2030. Those ZEVs could

use 140,000 megawatts daily, the same as 4.9 million U.S. homes.

“Through PACT, we will spend a lot of time educating and helping the utility sector, helping the fleet sector, helping others really understand about the technology that’s needed,” Dawn Fenton, VP of public affairs for Volvo Group, said during a discussion with trucking industry media after the launch event in which she was announced as PACT chairperson. “If we’re going to be successful in reaching our goals, the government reaching their goals, and the environmental community reaching their goals, we all need to pull up these obstacles and roadblocks.”

Fenton said some help could come through legislation to alleviate or expedite permitting and zoning processes.

Ritchie Huang, Daimler AG executive manager of government affairs, noted that while there are more than 60,000 public light-duty vehicle chargers, there are just 10 for heavy-duty trucks.

Through work with other founding members, Huang said PACT wants more focus on medium- and heavy-duty ZEVs. Along with the three OEMs, founders include ABB E-mobility, Burns & McDonnell, Greenlane, J.B. Hunt Transport, Prologis, and Voltera. FO

10 FleetOwner | March 2024 NEWS INFRASTRUCTURE

DTNA CEO and President John O’Leary, Navistar President and CEO Mathias Carlbaum, and VTNA President Peter Voorhoeve discuss their new coalition during a moderated panel at the National Press Club in Washington, D.C., on Jan. 30.

Photo: Powering America’s Commercial Transportation

Go with NEWAY ADZ Vocational Air Ride Suspensions for the Very Best in Stability and Handling.

The ADZ severe-duty, heavy-haul air ride suspension features more bests than the closest competitor. The lightest weight, the longest warranty coverage, and an unsurpassed roll stability make it the best choice in vocational air suspensions.

THE ORIGINAL AIR RIDE IS REASON ENOUGH

© 2024 SAF-HOLLAND, Inc. All rights reserved. Follow us on

For more information TheOriginalAirRide. NewaySuspensions.com

Fleets begin 2024 in equipment-buying mood

Following 2023’s sluggish freight economy, fleets opened 2024 in a buying mood, according to data from two leading commercial vehicle research firms.

FTR reported that January Class 8 preliminary data in North America came in at 26,400 units, up 2% from December and up 35% year over year. ACT Research’s preliminary data showed 27,000 orders, up 600 units from December and 45% year over year.

“Weak freight and carrier profitability fundamentals and large carriers guiding to lower capex in 2024 would imply some pressure in the North American Class 8 market’s largest segment, U.S. tractor,” Kenny Vieth, ACT president and senior analyst, said. “While we do not yet have the underlying detail for January orders, Class 8 demand continuing at high levels at the start of 2024 suggests that over-the-road U.S. truckers are still buying.”

Ryder acquires Cardinal Logistics

Ryder System is expanding its customized dedicated contract carrier offerings in North America after acquiring Cardinal Logistics, a fellow FleetOwner 500 carrier, the transportation company announced.

Concord, North Carolina-based Cardinal offers complex route structures across distribution centers, suppliers, stores, and freight brokerage services. The carrier also has last-mile delivery and contract logistics operations. Cardinal’s dedicated fleet business serves consumer-packaged goods, omnichannel, grocery, building products, automotive, and industrial businesses.

“With complementary contractual services in many of the same industries, we gain greater economies of scale, and we can provide even more

flexibility for transportation networks when seasonality and fluctuating demand inhibit the continuous use of resources,” Steve W. Martin, SVP of dedicated transportation for Ryder, said in the deal announcement.

“Combined with our end-to-end visibility and collaboration technology RyderShare, we can deliver tremendous value for customers looking for more dynamic and resilient transportation solutions.”

The acquisition will give Ryder more network density with another 200 locations, 2,900 power vehicles, and 3,400 professional drivers. Cardinal also comes with more than 7,000 registered trailers, according to FleetOwner records.

Knight-Swift to pick up more Yellow properties

Knight-Swift Transportation Holdings is preparing to take over 10 Yellow Corp. properties, adding to deals it struck late last year for 15 other sites Yellow once operated.

Attorneys for Yellow, one of the country’s largest less-than-truckload carriers until it abruptly closed its doors last July, told a U.S. Bankruptcy Court that the company’s marketing of the 10 leased sites in Colorado, Georgia, Idaho, Kansas, Missouri, and Nebraska led to Knight-Swift submitting a $2.2 million bid that still needed a judge’s approval.

Phoenix-based Knight-Swift (No. 3 on the 2024 FleetOwner 500:

For-Hire list) has been one of the big real estate beneficiaries of Yellow’s demise. In December, the company’s leaders secured owned and leased properties from Yellow. Its previous bids of nearly $52 million have secured properties in 10 states.

Yellow and its advisers sold 118 buildings the company had owned and 25 leased properties. Combined, those transactions generated roughly $1.9 billion, which will close in on $2 billion as a handful of other sales are finalized early this year. Yellow’s executives have used those proceeds to pay off their most considerable debts, including the $700 million CARES Act loan granted by the federal government in 2020 and post-bankruptcy financing provided by hedge fund Citadel and investment firm MFN Partners.

Saia capitalizes on ‘generational type of moment’

Fritz Holzgrefe could hardly have been more emphatic: “At no time in the company’s 100-year history have we had a similar opportunity,” the president and CEO of Saia Inc. told analysts and investors Feb. 2 when discussing his team’s plans to spend up to $1 billion this year on real estate, equipment, and technology—a quarter more than the fleet’s outlays in 2022 and 2023 combined.

The opportunity Holzgrefe and his lieutenants see stems from LTL Yellow Corp.’s bankruptcy. On a

12 FleetOwner | March 2024 NEWS BRIEFS

Photo: Cardinal Logistics

YOU’RE WAY AHEAD WITH A FRUEHAUF BEHIND YOU.

the and of Fruehauf dr y van

Experience the exceptional strength and durability of Fruehauf composite dry van trailers, setting new standards in the industry. Boasting some of the strongest side and front walls, they surpass the typical dry van on the road. Designed to last and increase trailer life, Fruehauf dry vans are available in range of lengths from 28 to 57 feet. They can be customized to fit your unique application requirements. You’re way ahead of the competition with a reliable Fruehauf trailer behind you.

With its beginnings in 1918, Fruehauf is recognized as the pioneer of the semi-trailer. So today, Fruehauf is committed to delivering superior quality products.

(270) 282-0605 | FRUEHAUFINC.COM

conference call, Holzgrefe called Yellow’s closure “a generational type of moment” for the trucking industry.

Saia (No. 19 on FleetOwner 500: For-Hire) was among the competitors that moved quickly to pick up Yellow freight: The Georgia-based company hired 1,500 people in the second half of 2023 to handle growing volumes, which were up 18% in Q4 versus late

2022 (tonnage rose about 8%) and powered Saia to a record revenue quarter of $751 million.

Saia’s growth strategy is now getting another jolt from 17 former Yellow terminals the company bought for $236 million. That figure is included in the fleet’s 2024 $1 billion capex budget and will grow slightly because of the required investments

to reopen them. On top of that, CFO Doug Col said that another roughly $300 million will go to other real estate projects nationwide.

Mack invests $14.5M to expand RVO plant

Mack Trucks is investing $14.5 million to expand its Roanoke Valley Operations manufacturing plant in Virginia to prepare the facility for higher demand for its MD Series and MD Electric vehicles.

“Mack is committed to making the industrial and product investments we need to be a North American market leader,” said Stephen Roy, Mack Trucks global president. “The expansion of the plant will help us grow in a strategic market segment and support our sustainability goals.”

Virginia Gov. Glenn Youngkin announced the $14.5 million investment during an event with state and local officials at RVO. Youngkin approved a $255,000 grant from a state fund. The project creates 51 jobs. Roanoke County also offered $842,420 in incentives.

Hyzon helps fleet implement FCEVs

Running Class 8-sized routes with an electric truck is a tall order. Whether it’s finding a truck with the power to haul the load and the weight capacity to bring a profit or being able to access/build charging infrastructure, fleets looking to electrify have their work cut out for them. Some fleets are finding Class 8 hydrogen fuel-cell electric vehicles to fit the bill—without sacrificing range.

Performance Food Group (No. 18 on FleetOwner 500: Private) celebrated receiving four hydrogen fuelcell-powered electric trucks at its Vistar facility in Fontana, California. Another truck is expected in March.

Jeff Williamson, SVP of operations at PFG, said the company chose the

14 FleetOwner | March 2024 NEWS BRIEFS 2403FO_Hutchens.indd 1 2/16/24 9:20 AM

Hyzon fuel-cell electric truck solution because of its range compared to a battery-electric, heavy-duty truck.

“The particular fuel-cell vehicles that we’re launching today ... have a range between 300 and 350 miles, which is very suitable for the mix of routes that we have out of this facility and, quite honestly, many of our facilities,” Williamson told FleetOwner

PFG’s new hydrogen fuel-cell trucks join dozens of others in

operation. Nikola Corp. sold 35 FCEV Class 8 trucks in 2023.

Nikola opens first Hyla H2 refueling station in SoCal

Through the Hyla brand, Nikola recently opened its first Hyla hydrogen refueling station in SoCal. With its modular fueler, Nikola’s station in Ontario, California, is its next step to offer H2 refueling for Class 8 trucks.

The station can refuel up to 40 hydrogen fuel-cell electric Class 8 trucks daily. The station is part of a plan for up to 60 H2 refueling stations in the coming years, nine of which are scheduled to open by July.

Feds to fund $300M in truck parking

The U.S. DOT plans to invest $300 million in truck parking projects in seven states to help alleviate the

trucking industry problem.

“The severe shortage of truck parking continues to rank among drivers’ highest concerns, which is why we appreciate that Secretary Buttigieg and a growing number of states are making these projects a top priority,” said Chris Spear, American Trucking Associations president and CEO.

“America’s highways are our shop floor. When drivers finish their shifts, they deserve to know that they can find a safe place to sleep that night.”

Last year, the American Transportation Research Institute named truck parking the second biggest issue the industry faces, topped only by the economy.

According to ATA, these federal investments will add about 1,000 new truck parking spaces in Florida, Missouri, Pennsylvania, California, Oregon, Washington, and Wisconsin. Funding comes from the Infrastructure Investment and Jobs Act. FO

March 202 4 | FleetOwner.com 15 2403FO_AncraCargo.indd 1 2/7/24 2:08 PM

Photo: Hyzon Motors

begins during recruitment

16 FleetOwner | March 2024 SAFETY & OPERATIONS FEATURE

Strategies to implement during driver recruitment that make turnover less of a ‘big deal’

by Jade Brasher

Labor is on the industry’s mind, as evidenced by the results of a survey conducted by the American Transportation Research Institute in 2023 on the top trucking industry issues. Survey respondents, which included motor carrier executives and personnel, truck drivers, and other industry stakeholders, indicated that the driver shortage was among the top five issues facing the trucking industry in 2023. While down two spots from No. 2 in 2022, the fact that the driver shortage remains among the top five issues facing industry professionals is enough to warrant a remedy.

ATA surveyed carriers and found that from 1995 to 2017, the average driver turnover for large truckload carriers was 94%, while the average turnover rate for smaller truckload carriers was 79.2%.

While LTL seems to be a segment that’s more favorable to drivers (with an average turnover rate of 11.7% between 2000 and 2017), the truckload segment is a necessary part of the supply chain; therefore, it’s essential to keep it staffed—and that comes at a high price. Estimates vary, but a study published in 2000 by the Upper Great Plains Transportation Institute found turnover cost fleet companies $8,234 per driver on average. That’s the equivalent of $14,828 today.

“Always, turnover is a big deal when we talk to our trucking customers,” said Jasper Purvis, VP of business development at Selerix, a benefits administration platform. “How do they reduce

ATA estimates the industry was short 78,000 drivers at the start of 2023, down from the 81,000 peak in 2021.

Source: American Trucking Associations

turnover because the cost of that is so high for them? Just to try to recruit and get new people that are good is always difficult.”

Ways to improve recruitment

There are multiple ways to improve a fleet’s recruitment process, beginning with how the job is posted. Additional changes include improving driver benefits—which can be achieved at little cost to the fleet—and building a company culture that fosters employee growth.

● Advertise for the job

Improving the driver recruitment strategy begins before the opening is advertised. Mark Murrell, president and co-founder of CarriersEdge, a provider of online driver training for the trucking industry, said fleets should decide what kind of driver they are looking for and then advertise for that position.

The trucking industry has various driving roles: Some keep drivers away for weeks at a time, while others allow them to come home each evening; other positions come with stressful driving scenarios, such as frequent tight parking or urban driving. Because the trucking industry is so varied, it’s crucial that fleets make the position details known from the start.

“Every fleet has somebody who is going to be an ideal fit for them and a terrible fit for them,” Murrell told FleetOwner. “You have to know, ‘What kind of person are we looking for?’ … Figure out what is the job that you’re offering, and be very clear on marketing that.” Next, “screen applicants that will fit with that type of work.”

Murrell said that hiring managers tend to focus on clean driving records, jobs held in the past few years, and drug and alcohol issues, but he said those aspects of the job are “table stakes.” While necessary to look at when considering employment, having a clean record won’t ensure a driver will be an excellent fit for the open position.

March 2024 | FleetOwner.com 17

Photo: kali9 | 856729754 | Getty Images

● Benefits extend beyond working hours

When a driver considers a new job, they’ll also consider company bene ts. The driver might be on company time eight to 11 hours a day, but the bene ts eets can provide should extend well beyond those hours of service.

“[The drivers’] whole life, to me, is about bene ts,” Purvis said. Fleets should ask whether they “incorporate bene ts and, more important, rewards for your employees outside of work ... so when they are at work, they’re focused and doing the best they can.”

This requires eets to think beyond traditional bene ts such as PTO, health care, and 401(k). Purvis said eets could encourage their drivers to do things outside of the workplace and with their families. This could mean rewarding a driver with a short stay at a nice hotel for them and a guest.

It’s easy for eets to xate on the driver alone when considering their health and wellness, but Purvis noted driver wellness isn’t about just one person—“it’s that entire ecosystem that lives around them,” which is their family.

“How do you encourage health and wellness for the [drivers’] entire families?” Purvis said. “What we’ve come to nd is that when the families are healthy, the employee becomes healthier.”

Distribution of Industry Issue Prioritization Scores

The driver shortage has a ected the industry, evidenced by the results of a 2023 American Transportation Research Institute survey about top trucking industry issues. Driver retention was the industry’s eighth-highest concern, according to survey results. Source: American Transportation Research Institute

● Culture is key

Another bene t that leaders might forget about, but drivers are often keenly aware of, is the company culture. The bene ts a company provides, primarily when related to driver wellness, go hand

There were 2.19 million heavy-duty trucking jobs in the U.S. in 2022.

in hand with the company’s culture. To improve company culture, Purvis said eets should start by understanding that work is a “ nite point for an employee’s life cycle.” He told FleetOwner that eet leaders should acknowledge that while work is an important aspect, it also impacts the employees outside the cab.

Developing a healthy, positive company culture begins with the hiring process. Purvis said health and wellness should be highlighted throughout the process as a differentiator from other eets. This also underscores the importance your company places on health and wellness. If new hires see this as an obstacle to their happiness, they will likely decide on their own whether they are a good t.

Retaining driver recruits

Recruiting drivers is only half the equation. Once those drivers are recruited, a

18 FleetOwner | March 2024 SAFETY & OPERATIONS FEATURE

*

rankings may appear

issues 0 100 200 300 400 500 600 700 800 900

#1 Votes Total #2 Votes Total #3 Votes

*The bars reflect total points from first, second and third place rankings Issues that generate more second and third place

to have a higher ranking than preceding

Total

Heavy-duty and tractor-trailer truck driver employment is projected to grow 4%

Source: U.S. Bureau of Labor Statistics

from 2022 to 2032

fleet leader’s next challenge is keeping them. The same ATRI study that found the driver shortage to be the fourth top industry concern in 2023 found driver retention to be the eighth.

● Invest in career growth CarriersEdge facilitates an annual rewards program called the Best Fleets to Drive For. Company drivers or owner-operators working with the fleets must nominate these companies for them to be considered. CarriersEdge conducts surveys from nominated fleets to determine the winners. Murrell told FleetOwner that these surveys reveal that “companies that invest in their employees tend to have happier employees who don’t leave or are less likely to leave.”

Investing in employees to increase retention could include investing in driver training and driver coaching. This will also help break up some of the monotony in a professional driving job, according to Murrell.

Companies that invest in having substantial education programs for their drivers always have better retention and better performance, Murrell said.

Additionally, fleet leaders can use driver training practices to turn their best drivers into driving coaches. This shows drivers there are growth opportunities within the company.

John Luciani, COO of A. Duie Pyle, a transportation and logistics services company, said his company provides a “career path” for its drivers. During orientation, drivers meet some managers who were promoted out of the truck.

Luciani said this practice effectively demonstrates to employees “that we are committed to their long-term growth and achieving their career goals.”

● Have a culture drivers want to work for Purvis pointed out that during the hiring process, staff members provide endless communication and a heightened level of engagement with a driver. But once

new drivers

The industry will need to hire 1.1 million over the next 10 years to replace its retiring workforce.

Source: American Trucking Associations

the driver becomes a successful team member, that level of engagement tapers off drastically.

“We put so much effort into trying to find people,” Purvis emphasized, “but how much effort do we really provide in keeping them?”

This is where developing open communication can significantly benefit both drivers and managers. Purvis suggested having an internal communication dashboard, such as a private Facebook group or a Slack channel. Still, Luciani said his drivers seem to appreciate a simple open-door policy and regular company newsletters.

Luciani said Pyle also facilitates an annual, anonymous company-wide survey to allow Pyle leaders to make improvements and give drivers a “vehicle” to provide constructive feedback “so their voices can be heard.”

Involvement is closely tied to engagement; for that, incentivization goes a long way. Purvis said friendly competition gets people involved and helps build and maintain a positive company culture. For example, fleets can use incentives to have departments, terminals, or regions compete for the most efficient or safest performance scores. This sense of competition also helps managers communicate consistently with their drivers. Incentivize managers to continue that engagement by getting their driving teams fully involved in the competition.

Build up your greatest competitive advantage

Murrell’s advice to fleets regarding recruitment is to measure the results, not the actions taken. Instead of measuring how many calls a recruiter made or how many days it took to hire a new driver, Murrell suggests that fleets should focus on how long new hires stick around, which drivers have the most longevity, and which hires don’t work out.

“Start at the end point of the successful hire, and then move forward in the process until you get to the recruiting stage,” Murrell told FleetOwner.

In terms of retention, he advised looking “across the organization at where the issues are and including drivers in the solution.”

In line with involving drivers in solutions, Luciani stressed the need to build trust with each driver and staff member.

“It’s the trust of ownership and senior leadership where we earn the discretionary effort of our employees to do the right things to satisfy the needs of our customers or to exceed the expectations of our customers,” Luciani said.

Companies hire employees, but individuals fill open positions. Luciani recognizes that A. Duie Pyle’s employees are the company’s “greatest competitive advantage” and have been throughout the company’s 100-year history. FO

20 FleetOwner | March 2024

FEATURE

SAFETY & OPERATIONS

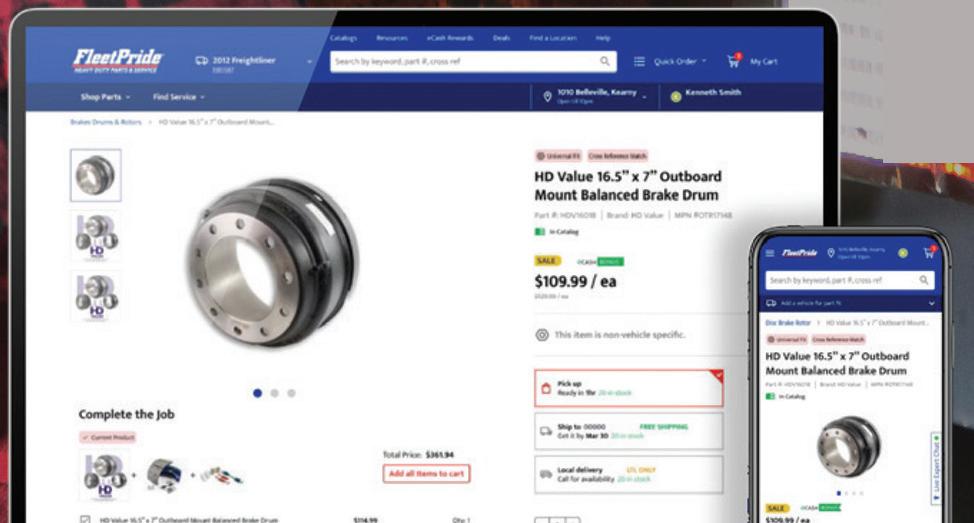

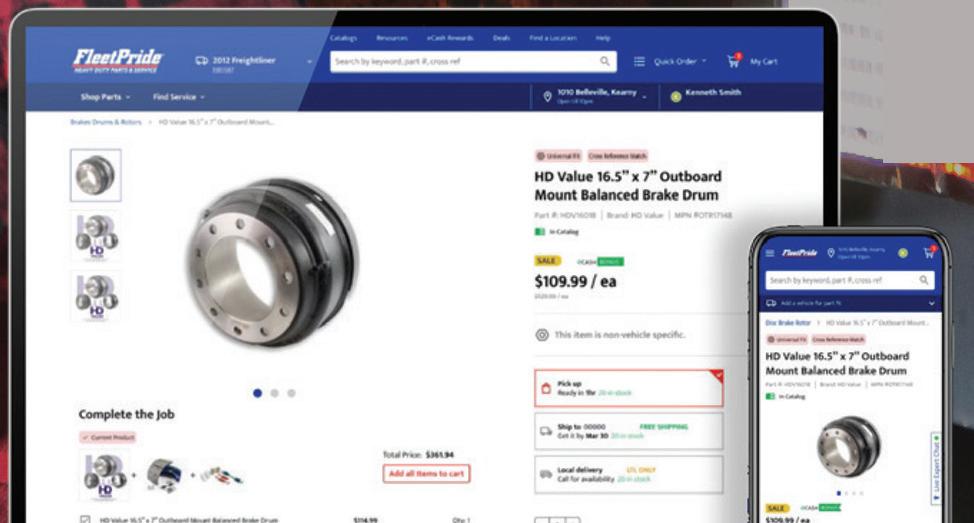

HEAVY DUTY PROS LOVE FLEETPRIDE.COM – THAT’S WHY THEY KEEP COMING BACK FOR MORE. NOW YOU CAN EXPERIENCE IT FOR YOURSELF WHEN YOU REGISTER ON FLEETPRIDE.COM, AND AS A NEW CUSTOMER, WE’LL GIVE YOU 20% OFF YOUR FIRST ONLINE ORDER .* FleetPride.com is fast, easy, and packed with features you’ll love, like real-time 24/7 access to nationwide inventory, millions of cross references, fleet data storage, quick order, live chat and so much more. Order from over a million heavy duty truck and trailer parts – for same-day pickup or shipping straight to your door. FleetPride.com is the First Click In Heavy Duty™ and the last online ordering tool you’ll ever need. SHOP ONLINE. SAVE BIG. NEW CUSTOMERS SAVE 20% *Offer valid for new FleetPride customers only. Use Promo Code FIRST20 at checkout for discount. Exclusions apply. See details at FleetPride.com. 5137 03/24 ©2024 FleetPride, Inc. | 800.967.6206 | FleetPride.com

by David Heller

ZE regs threaten supply chains

Is the industry being rushed to push the decarbonization cart?

THROUGHOUT THIS column space, I have frequently referenced idioms. Nothing rings truer today than the old reliable “cart before horse” scenario playing out in California and nationally as our industry grapples with a zero-emission transition.

The freight delivery model began with a cart and a horse. Let’s ensure we maintain the correct order when considering the potential impacts of the future.

There are deadlines stipulated by the Advanced Clean Fleets Rule out of California that have inevitably created more questions than answers over what must happen first. In any case, a normal sequence of events is being abandoned in place of compliance dates and assumptions that everything will fall into place

after that. The cart is officially in front of the horse.

Indeed, the trucking industry favors a cleaner environment; our history proves it. In 36 years, the industry’s emissions output has changed so drastically that it takes 60 of today’s trucks to emit what just one truck did in 1988. The industry will eventually achieve zero, but when it will happen is another question. The “when” has far-ranging implications for multiple industries across the nation.

As an industry, trucking simply cannot support regulations that set unachievable standards and force motor carriers into a transition on unproven equipment. Range and weight problems continue to raise questions, price tags make electric tractors unaffordable compared to diesel-powered trucks, and current regulation deadlines will likely pass on costs and consequences to the American public.

We must view these regulations realistically: How do they relate to affordability, achievability, and reliability?The Department of Energy estimates that a battery-electric Class 8 truck costs about $457,000, while a diesel-powered truck costs around $160,000. That’s a huge difference—particularly when BEVs have yet to prove they can fit into longhaul operations.

Unfortunately, pricing is not the only question for carriers across the country. Does this nation’s infrastructure have the capability to support a transition to electric vehicles? What about how they operate during extreme weather conditions? Hot summers and cold winters already come with state-based announcements and warnings that suggest charging vehicles in off-peak hours because of cooling and heating needs in these states. Imagine the strain on our nation’s power grid if more fleets need

to charge vehicles to deliver freight.

Questions about reliability almost always accompany this conversation. Our nation and professional driving population is built around diesel-powered engines. Over the years, this traditional power source has connected the supply chains. Any change in reliability could dramatically affect the fragile economy and the goods that our industry delivers to a nation that needs them.

Achieving comparable range is one thing, but so is how well that vehicle holds up over those miles in tremendous changes in weather and fluctuating temperatures. As we know, freight is not delivered in a vacuum—not all days are sunny and 72 degrees. It can be below zero or well above 100 degrees, and tomorrow’s truck will need to deliver in those elements, some of which can significantly affect the charge life of a battery.

Indeed, we hold to the notion that our nation needs environmental improvements so that our grandchildren will inherit a planet in a better condition than when we did—and our industry continues to demonstrate that notion. However, we cannot simply provide a deadline, wave a magic wand, and pray that it happens. Any of these changes must be strategic and consider the unintended consequences of furthering a date-based rule without fully understanding the work behind the scenes.

The freight delivery model began with a cart and a horse. Let’s ensure we maintain the correct order when considering the potential impacts of the future. FO

David Heller | Dheller@truckload.org

David Heller, CDS, is senior VP of safety and government affairs for the Truckload Carriers Association. He is responsible for interpreting and communicating industry-related legislation to TCA members.

22 FleetOwner | March 2024 SAFETY 411

Photo:

Scharfsinn86 | 1367678437 Getty Images

PROVEN RELIABILITY AND TOUGHNESS As a fleet operator, you face many challenges and dealing with equipment downtime shouldn’t be one of them. That’s why BendPak lifts are designed and built to be some of the most dependable and safe lifts in the world. Constantly changing work conditions and long hours can be tough on fleet operators, but through smart engineering and unmatched reliability, our lifts will ensure your workforce is always moving at maximum efficiency. Check out the full line of BendPak heavy-duty hydraulic vehicle lifts at bendpak.com or call us at 1-800-253-2363. 1-800-253-2363 • BENDPAK.COM ©2024 BendPak Inc. All rights reserved. SS BendPak Model XPR-18CL Two-Post Lift Certified to meet the standards of ANSI/ALI ALCTV: 2017 SUPER-DUTY TELESCOPING ARMS AUTOMATIC ARM RESTRAINTS FRAME CRADLE PADS XPR-18CL

Oregon trucking fights weight tax

OTA leader says trucks could overpay $500M in taxes by 2025

by Jenna Hume

Oregon is one of the few remaining states with a vehicle weightmile tax. But a new lawsuit filed by the Oregon Trucking Association (OTA) and several Oregon fleets against state lawmakers and the state’s Department of Transportation claims “motor carriers have been overcharged for road use under the state’s weight-mile tax,” according to OTA’s website.

OTA’s leader told FleetOwner that trucking fleets could end up overpaying $500 million in state taxes by 2025. When contacted, ODOT declined to comment for this article. The fleets involved in the lawsuit with the OTA are A&M Trucking, Sherman Bros. Trucking, and Combined Transport (No. 238 on the FleetOwner 500: Top For-Hire list).

Jana Jarvis, OTA’s president and CEO, outlined how long these overcharges have been a problem for Oregon fleets. A highway allocation study is conducted every two years to ensure fair charges because of the state’s weight-mile tax. Oregon has a constitutional amendment that requires the state to ensure heavy and light vehicles pay weight-mile taxes that are fair and proportional, Jarvis explained to FleetOwner

The 2019-2021 Highway Cost Allocation study forecasted that trucks would overpay 3.5%, and passenger vehicles would underpay 1.5%. The 2021-2023 allocation projected trucks would overpay by 16%. “I started talking about what we needed to do to fix that,” Jarvis said. “At the same time, our Department of Transportation started talking about not having enough money for maintenance.”

Since Oregon has the second-most passenger EVs in the U.S., ODOT concluded that the state’s highway maintenance revenue was falling because EVs

don’t contribute to the fuel tax.

The 2023-2025 Highway Cost Allocation study expects trucks to overpay by 32.4%. Jarvis wanted to address these overcharges then, but she said, “Nobody wanted to talk about it, and ODOT was complaining about not having enough money, so they pushed it off and said ‘we’ll deal with it when we do a new transportation package in 2025.’ When you look at the numbers, if they wait until the 2025 legislative session, heavy vehicles will overpay in this state in excess of half a billion dollars.”

When communication with ODOT, lawmakers, and the governor’s office failed, Jarvis said she, the OTA, and Oregon fleets felt their only other option was to file a lawsuit.

According to Jarvis, this lawsuit has been brewing since 2017. That year, Oregon’s legislature passed House Bill 2017, a transportation funding package. She said this legislation “instructed ODOT to divert most of the additional tax increases into new construction projects, primarily.” These construction projects included the Rose Quarter, I-205, and Highway 217.

“We have been historically the most

expensive state in the nation for trucking taxes and fees,” Jarvis said. “And yet, we went ahead and agreed to House Bill 2017 primarily around the ability for us to fix the congestion problems in the Rose Quarter. ... It’s just hugely important to Oregon’s economy.”

Jarvis claims ODOT underestimated the cost of this project, and money had to be redirected from the Rose Quarter construction to the Abernathy Bridge on I-205.

“They need to roll the rates back,” she said. “We need to just bite the bullet and get us back into an equitable position in the way we’re being taxed here in the state. And then we’re willing to have a conversation about how we’re taxed.”

Jarvis believes a fuel tax would be the most cost-efficient way to tax vehicles in Oregon, rather than the current weight-mile tax or a fuel tax with a modified VMT.

“But first and foremost, in Oregon, we have to start caring about having roadways and understanding the connection between roadways and economic development in our state, and that seems to be sadly missing here,” Jarvis said. FO

24 FleetOwner | March 2024 SAFETY & OPERATIONS TRUCK TAXES

Photo: Florin Seitan | 121687647 Dreamstime

regi.com Renewable fuels drive change and power possibility. Lower carbon fuel solutions for your fleet—starting today. A complete line of high-quality biofuels, Chevron Renewable Energy Group’s EnDura Fuels™ is a simple way to move your fleet forward by enabling reduced carbon intensity, improving engine performance, and maintaining profitability—now. Visit regi.com for lower carbon fleet solutions. Renewable Energy Group, REG, the logo and the other trademarks and trade names referenced herein are trademarks of Chevron U.S.A. Inc. © 2023 Chevron U.S.A. All Rights Reserved. RENEWABLE DIESEL + BIODIESEL R RENE RENEWABLE BIODIESEL Visit for fleet solutions. BIODDIESEL BIODI REENEWABLE LE DIESSEL RENEWABLE DIESEL REN D SE BIODIE DIESELBIODIE DIESEL+B

Freight recession silver linings

Fleet leaders see signals that the ’23 downturn is bouncing back in ’24

by Geert De Lombaerde

Looking for a sign that today’s drawnout freight downturn might soon move into history books? Old Dominion Freight Line CFO Adam Satterfield said the North Carolina-based carrier, one of the largest in the country, expects to soon begin hiring more people to meet growing volumes.

Speaking to analysts after Old Dominion (No. 10 on FleetOwner 500: For Hire list) reported fourth-quarter profits of $323 million on revenues of nearly $1.5 billion, Satterfield noted that the company finished last year with a workforce of about 22,800, which was more than 4% smaller than at the end of 2022. That figure is even more notable because Old Dominion was among the less-than-truckload carriers that picked up thousands of shipments after Yellow Corp. shuttered its doors in July.

And while Satterfield added that Old Dominion’s payroll is “appropriately sized for our current shipment trends,” he noted that his team is replenishing its talent pipeline. Old Dominion was able last year to move some workers from its docks into trucks, but that’s not a repeatable strategy.

“We’re running our truck driving schools right now to continue to produce more employees that have their CDLs and will be available to drive as demand continues to improve,” he said.

Old Dominion’s fourth-quarter profits and revenues were just about even with those from the last three months of 2022. The company’s operating ratio ticked about half a percentage point to 71.8% as its daily shipments grew 1.5%, but tons per day slipped 2%, reflecting the smaller loads Yellow gravitated toward.

Another indicator that the freight recession may be nearing its last breaths came from Mark Rourke, president and

“2024 is shaping up to be a transition year as shipments should recover ... and capacity continues to leave the market slowly and steadily.”

— Mark Rourke, Schneider National

CEO of Schneider National. The leader of the Wisconsin-based carrier (No. 6 on the FO500 list) said 2024 is shaping up to be a transition year as shipments should recover—especially in the second half of the year—and capacity continues to leave the market slowly and steadily.

Rourke said those factors are becoming apparent to a growing segment of

Schneider’s truckload, intermodal, and logistics customers. He and EVP Jim Filter said that some clients are trying to get one last set of concessions from their shippers, but a growing number are recognizing that freight prices can’t fall anymore.

“No one believes we’re in this condition for the long term. It’s just a matter of when,” Rourke said on his team’s Q4 earnings conference call on Feb. 1. “I think you’re seeing more balanced thinking going forward than we would have described as we were coming into this juncture in 2023.”

That’s what Bruce Chan and other Stifel analysts are seeing as well. Commenting on Old Dominion’s results, they wrote that the pricing environment now looks “constructive and rational” even if volumes haven’t rebounded to the levels many market players last spring expected them to.

“As the demand environment firms this year, we expect yields to accelerate modestly to the mid-single digit range,” Chan wrote on Jan. 31. FO

26 FleetOwner | March 2024 SAFETY & OPERATIONS FINANCE

Photo: Old Dominion Freight Line Inc.

Paccar planning for busy 2024

Company’s plans include expansion as forecasts hold steady

by Geert De Lombaerde

Those looking for a notable drop in 2024 North American truck sales won’t have much luck knocking on the door of Paccar CEO Preston Feight.

On a conference call after Paccar reported its fourth-quarter profits, Feight said he and his team are sticking to their fall forecast of 260,000 to 300,000 Class 8 sales in the U.S. and Canada this year. The midpoint of that range is about 6% below 2023’s 297,000 unit sales.

Paccar’s Kenworth and Peterbilt brands accounted for 109,000 trucks (versus 96,000 in 2022). Feight said demand is holding up, especially for vocational, less-than-truckload, and medium-duty vehicles. “As far as a slowdown in orders, I’m not sure I can

recognize that in our major North American markets,” Feight said. “We see good order intake and good visibility.”

Asked if significant emissions regulation changes planned for 2027 are pulling forward some sales to now, Feight told analysts that “might be a little much” but added that such orders could begin to come in late this year or 2025.

Paccar produced Q4 profits of more than $1.4 billion versus $921 million in late 2022. Trucks and parts sales were $8.6 billion, up 11% year over year, while financial services climbed more than 20% to $485 million, but its profitability fell due to higher interest costs.

Those numbers help Paccar maintain its investment pace. CFO Harrie Schippers told analysts he is projecting capital spending to grow to $750 million from 2023’s $698 million. This could cover adding truck manufacturing capacity in Chillicothe (Ohio) and Mexico.

Further, Feight said Paccar could use some of its cash and marketable securities—up from $6.2 billion a year earlier—to buy competitors. FO

March 2024 | FleetOwner.com 27

2403FO_GabrielRideControl.indd 1 2/7/24 10:34 AM

Photo: Paccar Inc.

STILL RULES

But OEMs want to work with fleets on the future

by Josh Fisher

28 FleetOwner | March 2024

EQUIPMENT FEATURE

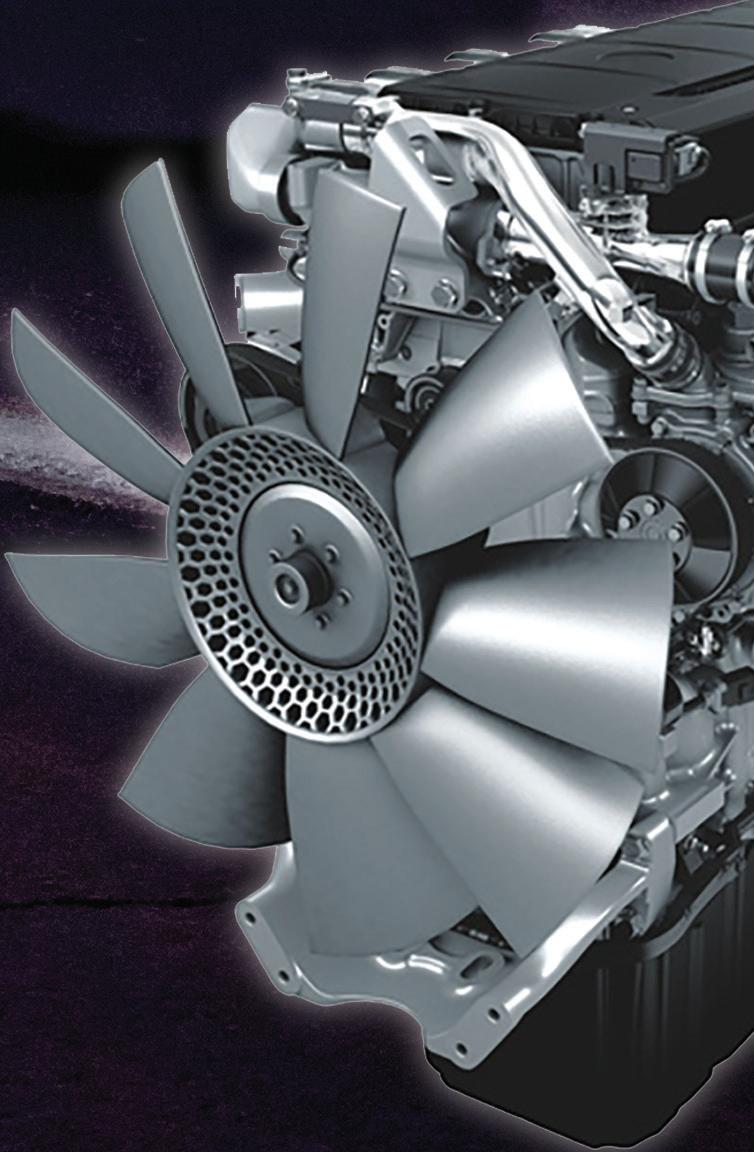

The clock is ticking on modern heavy-duty trucking. But today’s eet leaders must balance that push to embrace decarbonization with the pragmatic pull to focus on and nd the best equipment supported by today’s best trucking power infrastructure: diesel fuel.

medium-duty electric truck offerings. “Electric vehicles are still a small portion of the market, and while adoption is expected to grow over the next few years, the trucking industry is very large and diverse in both applications and routes of operation.”

That more regulated, fossil-free-fuel future is getting closer with initial federal clean truck emissions regulations beginning with 2027 models. Those regulations are supposed to be phased in over time, which means most eets will still rely on diesel powertrains well into the next decade.

Being clean and green isn’t new to trucking. Today’s eet leaders and drivers operate in a much different world than previous generations. Contemporary clean diesel-powered Class 8 equipment produces 99% less emissions than heavy-duty trucks built in the 1980s, according to the American Trucking Associations.

Diesel’s not done

And with many of those post-2027 clean trucking regulations still yet to be nalized, DTNA’s strategy is evolving.

“As far as the timeline to transition away from diesel, our ambition is to transition to exclusively CO2-neutral new vehicles by 2039,” Copeland explained. “It’s important to remember, these are new technologies—and it will take time for eets to begin to test them out in smaller numbers.”

He noted that eets might want to try out a few trucks operating on alternative fuels, such as battery-electric. “Their site may only be able to support those one or two units,” he said. “And adding more after they evaluate their needs is likely to take several years of progress to continue working on getting scaled up.”

Developing more ICE options

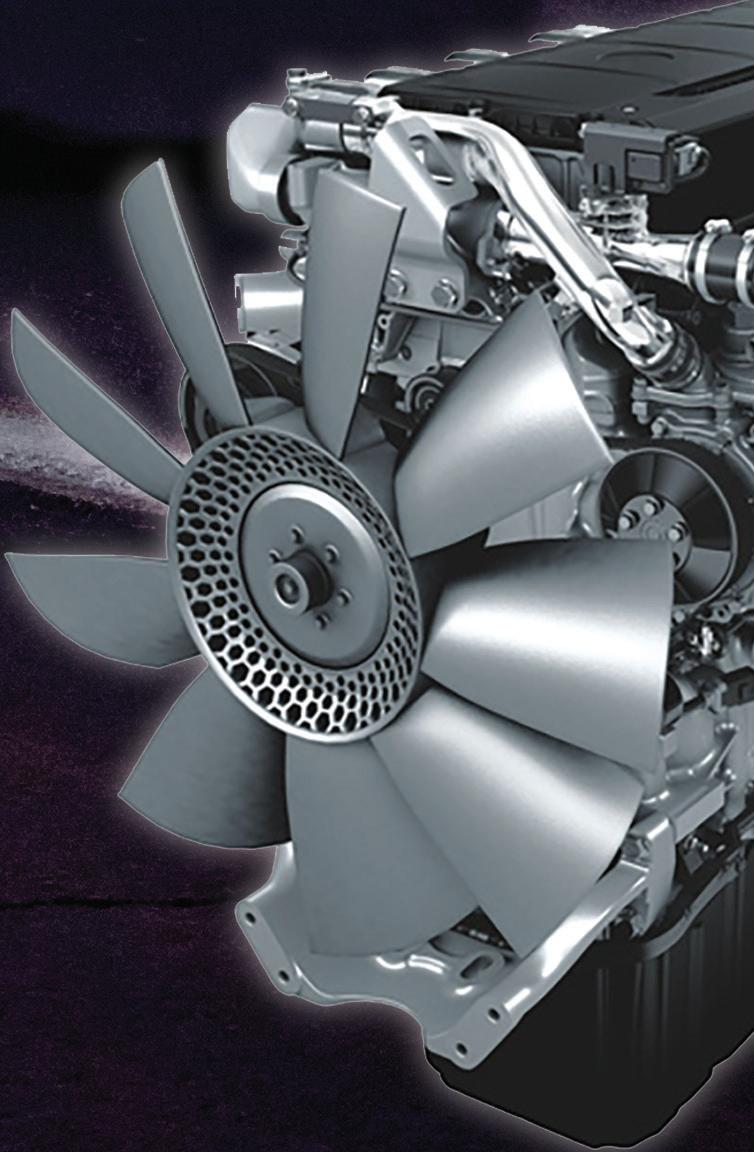

“We still expect diesel to be a major factor in transportation for many years— and we are investing in the next generation of Detroit engines,” Len Copeland, product marketing manager for Daimler Truck North America’s Detroit brand, told FleetOwner

of Detroit in

Diesel will continue as trucking’s primary fuel for long-haul operations in the coming years. Copeland noted that electric commercial trucks are better suited for pickup-and-delivery and regional haul operations on set routes.

“The eCascadia and eM2 are in production and ready to be put into service provided infrastructure is in place to operate them,” Copeland said of Freightliner’s heavy-duty and

Major truck OEMS are still working on making internal combustion engines more ef cient. “As we’ve said, we see a long future for the internal combustion engine—particularly running on renewable, fossil-free fuels, which will make an even greater reduction in CO2 emissions,” Johan Agebrand, product marketing director at Volvo Trucks North America, told FleetOwner

He said VTNA is focusing on its “three-pillar” decarbonization powertrain strategy. “We understand that there is no silver bullet answer to address all applications to decarbonizing transportation.”

The rst major OEM to market with an over-the-road Class 8 BEV, Volvo VNR Electric trucks already have more than 3.65 million customer miles in the U.S. and Canada. However, the OEM is still focused on making its diesels more ef cient.

VTNA is launching its all-new Volvo

March 2024 | FleetOwner.com 29

Detroit DD15 engine is among the latest in DTNA’s heavy-duty power technology.

Photo: Daimler Truck North America

Photo: RichLegg | 1279002529 | Getty Images

VNL flagship Class 8 truck this year (see page 36). The new model is up to 10% more efficient than the 2018 VNL, Agebrand said. “The platform that the all-new Volvo VNL is built on will be the platform for all our future technologies, including BEV and fuel cell, and the future of the ICE running on drop-in fossil-free renewable fuels, including hydrogen. In terms of investment, we must continue to invest heavily in all three strategies.”

Paccar, which produces Kenworth and Peterbilt trucks, also focuses on multiple powertrain technologies. Sarah Abernethy, Kenworth powertrain marketing manager, told FleetOwner the OEM wants to ensure its fleet customers have options “as we head into the future.”

‘A long way to go’

Paccar’s California Air Resources Board-compliant MX-13 engine will be released later this year. “And we’re developing the next generation of cleaner diesel engines alongside our zero-emission lineup of battery-electric and fuel-cell powertrain options,” Abernethy noted.

Along with its powertrain systems, including Class 8 hydrogen fuel cell

technology developed with Toyota, Kenworth offers Cummins’ compressed and liquid natural gas lineup of powered products, including X15N and L9N systems. “Both are CARB compliant to ensure our California customers have options,” she said.

While California boasts the strictest fleet emissions rules in the nation, Abernethy noted that Kenworth still focuses on all its North American customers. “While we know that zero-emission powertrains are critical to our success, we also know we have a long

It’s not too early to think green

If you are considering—or being pushed into—new zero-emission powertrain technologies, you can’t start planning too early. Though the motors are simpler than today’s complex diesel systems, your fleet operations might need more thought.

“One of the biggest pieces of advice we often give to our customers is to start early,” Trish Reed, Navistar VP of zero emissions, told FleetOwner. “When we’re talking about zero-emission vehicles, we’re no longer just talking about the equipment. We’re talking about route analysis, infrastructure evaluation, charging installation, discussions with local utilities—the list goes on.”

The potential zero-emission vehicle landscape is broad. It’s not just battery-electric vehicles. Dozens of hydrogen-powered, fuel-cell-electric vehicles are already in operation in California. And engine-makers,

way to go—which is what is driving our continued development of more efficient diesel powertrains as well,” she said.

As regulations become firmer, she expects customer demand for cleaner technologies to grow.

“Kenworth is focused on offering products and services to help our customers adopt ZEV vehicles, including a dedicated Kenworth grant-writing resource who is familiar with current and upcoming grants that can help fleets manage and navigate the application process,” Abernethy explained. FO

such as Cummins and Bosch, are developing hydrogen-powered internal combustion engines for heavyduty trucks. There are other low- and near-zero emission fuels, such as natural gas and renewable diesel.

More options, more planning

“The future landscape of ZEVs is pretty broad when looking at the sources of propulsion,” Len Copeland, product marketing manager for Daimler Truck North America’s Detroit brand, told FleetOwner. “If you look at diesel configurations today across many fleets, you will see many configurations. Seeing different solutions based on individual needs will continue into the future.”

Copeland said that right now, electric configurations fit best with regional operations. “These electric configurations will spread into some areas of long-haul applications that will also likely have units powered by

30 FleetOwner | March 2024 EQUIPMENT FEATURE

Freightliner Cascadia features Detroit’s integrated diesel powertrain.

Photo: Daimler Truck North America

“THE FUEL SAVINGS WE RECEIVE HAS BEEN, ON AVERAGE,

BETWEEN 2 AND 2.5%”

-

Brundage-Bone National Service Manager, Jeff LaBounty

And we can do the same for you.

LET US PROVE IT.

H2 fuel cell setups and then hydrogen combustion for heavier and vocational types of applications,” he said. “Just like today, I would say to spec vehicles for your application, and DTNA is committed to helping find the best propulsion source for your specific need.”

All of these propulsion options can be daunting. That’s why Copeland and other OEM executives said it’s easiest to go right to the source as you start to plan out your fleet’s zero-emission options.

“This is where discussions with customers and early engagement in the sales process becomes key,” Sarah Abernethy, Kenworth powertrain marketing manager, told FleetOwner. “Understanding the intended route is a critical first step in the discussion, and alongside that— talking through fueling and infrastructure will help ensure success with ZEVs.”

Infrastructure lags

Infrastructure can be the biggest hurdle fleets face when adding in non-diesel equipment. Long-haul trucks can find diesel along any major road in the U.S. However, finding a high-powered electric truck charger or hydrogen outside a dedicated distribution center is rare.

“The technologies are being deployed, and the industry needs scale for the infrastructure to be built,” Abernethy noted. “Every day, we get closer.”

California has the most H2 fueling options, with more public hydrogen stations expected to come online in the Golden State this year. Public heavy-duty electric truck chargers are also rare, so fleets need to plan ahead before investing in these emerging technologies.

“On the battery-electric side, we continue to take a consultative approach with our customers, ensuring that we match the right truck to their application,” Johan Agebrand, VTNA’s product marketing director, told FleetOwner. ”This includes providing strategic route-planning guidance, access to charging hardware through our Vendor Direct Shipping program, and end-to-end infrastructure support through our Turnkey Solutions partners.”

VTNA now has more than 50 certified EV dealers in 27 states and provinces. Another 40 dealers in the U.S. and Canada have started the certification process, Agebrand noted. Volvo aims to sell 50% zero-emission vehicles by 2030 and 100% by 2040.

“The product o ering is only one portion of the equation,” Agebrand explained. “In order to reach a 1:1 scale in great numbers of zero-emissions vehicles, infrastructure improvements must continue and must increase in speed for our customers to scale at their desired rate. Incentives and grants are also critical components in the adoption of zero-emission vehicles.”

It’s about more than the truck

Agebrand said that dealers can help fleets assemble their decarbonization puzzle pieces.

“The truck is a very small piece of the total equation,” he explained. “It’s critical first to understand where they’ll be deploying a ZEV. We want to make sure that it’s in an area serviced by one of our certified EV dealers. Then, understand exactly what the routes and type of cargo being utilized are. Does the customer need a six-battery pack configuration, or is a four-battery pack su cient for their operation?”

From there, they focus on utility timelines to set up depot charging or find other ways to power the EVs, such as charging-as-a-service options. “Zero-emissions deployment is a complex and changing landscape,” Agebrand added.

Beyond infrastructure, Kenworth’s Abernethy noted that fleets should consider how weight and wheelbase impact BEVs and FCEVs “to ensure the truck is set up for success and will meet the customers’ needs.”

Navistar’s Trish Reed said that International Truck dealers take a “holistic approach to transition to help guide the customer.”

She added: “We also understand that based on vehicle application, usage, and customer motivations, the speed to carbon-reduction goals will vary. So, if there was one thing that is di erent when spec’ing out a zero-emissions vehicle, it would be that you have a lot more to consider than just the vehicle.” FO

32 FleetOwner | March 2024

EQUIPMENT FEATURE

Shown is a rendering of the Kenworth T680 FCEV powertrain, which uses hydrogen to power the fuel cell that runs the electric motor. Paccar developed the FCEV with Toyota.

Photo: Kenworth Trucks

STAY UP-TO-DATE On the latest industry news, events, and breaking news delivered to your inbox. FleetOwner newsletters provide regular industry news, event updates, and breaking news alerts. MEMBERS ONLY Access comprehensive reports, engaging industry topics, and exclusive multimedia content...and best of all...it’s FREE. Register at FleetOwner.com/members www.FleetOwner.com FleetOwner.com/subscribe SUBSCRIBE NOW

by Kevin Rohlwing

Another EV obstacle: Tires

Electric trucks wear out tires faster, adding to total cost of ownership

A FEW SHORT YEARS ago, the buzz around a Class 8 electric vehicle manufacturer was impossible to ignore. It was a masterclass in marketing and promotion that culminated in the founder being found guilty of deceiving investors in December 2023. Everyone was so happy to hear that electric trucks were on the market that they wanted to believe everything he said. A jury determined he was less than truthful in his claims, which defrauded investors of more than $660 million.

Given the reduced tread mileage, fleets with electric trucks need a comprehensive retread program to control tire costs.

The lack of infrastructure is a significant obstacle for electric vehicles. It’s the combination of electricity production and charging accessibility that is a long way from being able to support a national network of electric trucks. Daimler Truck, Navistar, and Volvo recently formed Powering America’s Commercial Transportation to generate government support in Washington to develop a national heavy-duty

charging infrastructure (see p. 10).

According to the Department of Energy data, only nine fast-charging stations in the U.S. can accommodate heavy trucks. If electric trucks are ever to replace diesel engines, charging infrastructure must be significantly expanded

Electric trucks are here in tiny numbers, and a few fleets have operational success. Like their passenger vehicle counterparts, the rate of tire wear is accelerated, so it must be factored in when determining the total cost of operation. With fewer than 1,000 overthe-road heavy-duty EVs, fleets are still in the data-collecting stage, but tread mileage will be an unavoidable trade-off.

Tire manufacturers are in various stages of supplying tires for electric trucks and buses. There will likely be some construction, rubber compound, and/or tread design changes to account for the additional torque and weight. The small number of electric trucks is creating data to help shape the first generation of EV truck tires. Still, the applications are limited, so the data is limited.

Inflation pressure maintenance is even more critical for electric trucks because battery weight creates added stress on the tires when the vehicle is empty. It also affects rolling resistance, which affects range. In an application where the treadwear rate is already accelerated, underinflation will only increase irregular wear conditions. There is some room for error when it comes to inflation pressure maintenance on diesel trucks. Electric trucks have a finer line between underinflation and overloading, so checking and maintaining inflation pressure is crucial.

In addition, service considerations must be addressed. Lifting points on diesel Class 8 tractors are usually relatively easy to identify and utilize. The same cannot be said for electric trucks. Using

the incorrect lift point on a diesel truck can damage a specific component. Using an electric truck’s incorrect lift or support point can result in a six-figure repair because the entire drive motor may need to be replaced. Fleets with electric Class 8 tractors must ask the manufacturer for the proper lift and support points to communicate with service providers.

Tires on electric trucks have a reduced tread mileage, so fleets need retreading programs to control tire costs. Replacement intervals will be shorter, so the lack of retreading will result in higher expenses. Like other high-scrub applications, casings must be capable of multiple retreads because of the limited mileage.

It’s also easier for retread manufacturers to offer special rubber compounds and tread designs for application-specific electric trucks. The goal of getting every mile out of every casing doesn’t change with an EV. It just becomes more difficult. Retreading will make it easier.

We are still a long way from mass operation of EVs in the passenger space, and with only nine fast-charging stations at the national level for heavy trucks, future projections for Class 8 electric trucks are not promising. There will be applications where the electric model works, but the benefits will be measured in areas like reduced emissions and noise.

It will take time for electric trucks to be widely adopted. There are fewer than 1,000 on the road today and many unknown factors still being found. The lessons being learned for the fleets currently testing or operating electric trucks will determine the future of the heavyduty EV market. FO

Kevin Rohlwing | krohlwing@tireindustry.org

Kevin Rohlwing is the SVP of training for the Tire Industry Association. He has more than 40 years of experience in the tire industry and has created programs to help train more than 180,000 technicians.

34 FleetOwner | March 2024 TIRE TRACKS

Photo: Tramino 1276475303 | Getty Images

Volvo shows off all-new VNL truck

First redesign in a generation creates efficiency inside and outside the cab

by Josh Fisher

DUBLIN, Virginia—Efficiency has become one of the buzziest of buzzwords. While a big focus is on how efficiency can make trucking greener, Volvo Trucks North America leaders said the all-new Volvo VNL truck could help fleets save more green.

“We are confident that this truck will deliver customers a value of $20,000,” Magnus Koeck, VTNA VP of marketing and strategy, told industry media gathered at the Volvo Customer Center in the Blue Ridge Mountains in southwestern Virginia.

It’s the first complete redesign of the OEM’s flagship Class 8 vehicle since the 1990s. Volvo testing of the new VNL, which Koeck said was created from a “white sheet paper,” has shown fuel efficiency improvements of more than 10%, which could be worth $5,000 to $6,000, based on the current diesel prices. More annual savings come through the new Class 8 truck’s safety (which VTNA values at $5,800 per year), driver productivity ($5,000), connected services, and better uptime ($3,400). “We actually believe these are quite conservative numbers,” Koeck added.

The new VNL—available in six configurations from day cab to 74-inch sleeper—is still in pre-production. Serial production is expected to begin around April, with the first customer deliveries in the third quarter.

“We say ‘all-new’ for a reason,” Koeck said. “Ninety percent is new. This platform was developed in North America for North American prerequisites by North American engineers. And we’re also building them here.”

A 10% efficiency gain for Volvo

To measure the 10% fuel savings, VTNA ran the new VNL against equipment with the same horsepower, rear-end

ratio, and transmission, and it ran the same routes with the same drivers. The OEM showed off an overhead side-byside comparison of the new VNL to the current model, which showed a stark shape contrast.

A lot of the fuel savings come from improved aerodynamics, including a wedge-shaped cab and sloped windshield. It also features a more aerodynamic roofline and improved Flow Below. Furthermore, Volvo engineers designed the truck to use the wind to enhance operations and keep the engine cool without sacrificing horsepower.

“The more you can keep the engine cool and utilize that wind, the less the fan turns on,” according to Bobby Compton, VTNA product market manager. “There’s still a lot of horsepower used when a fan comes on. And any time that horsepower is not being used to drive the tires, it’s not creating value for our customers.”

Heavy-duty aerodynamic improvements can significantly reduce fleet operating costs and emissions by decreasing the energy needed to move vehicles down the road, according to a Tractor Aerodynamics Confidence Report by the North American Council for Freight Efficiency. “Whatever powers the

vehicle—whether traditional diesel, natural gas, propane, hydrogen, electricity, or combinations of those as hybrid vehicles—the efficiency of converting energy into motion always depends heavily on aerodynamic design,” according to the 2020 NACFE study.

This new VNL is also VTNA’s platform for future power systems, including battery-electric, fuel-cell electric, and renewables, as well as hydrogen, which is part of VTNA’s three-path approach to decarbonization. Initially, the new VNL runs on diesel. The aerodynamic-focused redesign contributes about 70% of the fuel efficiency gains in the new VNL, according to Compton. The rest is under the hood.

The new VNL features the Volvo D13 engine and I-Shift transmission. Design enhancements to the D13 engine include a new wave piston with a shorter piston height and a longer connecting rod, smaller injector needle control valves, a variable vane oil pump, and improvements to the turbo compounding unit and turbocharger.

Volvo Trucks engineers enhanced the I-Shift to improve shift speeds up to 30%, which creates more efficiency. A truck transmission likely shifts gears thousands of times daily, Compton said.

EQUIPMENT NEW MODELS 36 FleetOwner | March 2024

Volvo Trucks North America’s all-new VNL 840 on the test track. Photo: Josh Fisher | FleetOwner

“If every time that transmission shifts gears, from eight to nine, first and second, whatever it may be—you go through neutral,” he explained. “Isn’t that just like idling? So, of course, we attacked it.”

Safety systems and connectivity

“At Volvo, safety will always be about saving lives. Always,” Compton said. “The reality is there’s a cost. There’s a cost to safety.”

Average heavy-duty truck crashes cost $148,000. VTNA said its safety technology could improve front-end collision risk reduction by 82% to 92% and improve side collisions by 92%. The OEM calculates this to $5,834 annually per truck, in addition to more than $8,000 in risk-reducing technology already on Volvo trucks.

The Volvo Active Driver Assist Plus with Pilot Assist showcased its active lane-centering capability in a successful demonstration on a three-mile test track. The new pedestrian detection feature alerts the driver when a person walking or on a bicycle might be in the truck’s path or in a blind spot, activating frontal automatic emergency braking if needed. Passive safety systems in the new Volvo VNL include the bonded and wrapped windshield. Along with its aerodynamic benefits, it improves visibility for drivers and reduces wind noise in the cab.

E-Call, a new safety feature, connects the driver to emergency services where cellular connectivity is available and provides precise location details. This automatically happens after a rollover crash or airbag deployment.

In addition to its environmental focus on efficiency, VTNA prioritizes the uptime of the new VNL. According to Chris Stadler, VTNA product market manager, the truck employs over-the-air updates to enhance performance. Moreover, Volvo Trucks has consolidated all its digital offerings, including insights from vehicle data, diagnostics, remote programming, fuel economy reports, safety reports, and location services,

into a centralized Volvo Connect platform. This all-in-one fleet management portal streamlines access to various digital services.

With the Volvo MyTruck app, drivers can access truck data remotely to see estimated remaining fuel range, DEF and coolant levels, and get notifications about potential issues such as light

malfunctions, low washer fluid levels, and other essential items so they can address them at rest breaks or in their pre-trip inspection. The MyTruck app also allows drivers to schedule specific days and times to start the climate control so that the cabin temperature is at their preferred level when they arrive at their truck to begin their workday. FO

March 2024 | FleetOwner.com 37

Orange EV blooms in Kansas City

Electric terminal tractor OEM opens new factory to meet growing demands

by Josh Fisher

KANSAS CITY, Kansas—Almost 20 years ago, Kurt Neutgens failed to build an electric sports car company out of his garage. In January, the governor was here to congratulate him and Orange EV co-founder Wayne Mathisen on opening a 440,000-sq.-ft. factory so they can build thousands more electric yard trucks.

No company in the U.S. has built more electric Class 8 trucks than Orange EV, which sold its first terminal tractor to DHL Supply Chain in 2015. The OEM delivered its 1,000th tractor last November. Neutgens hopes to eventually double that output annually.