Mike Manges By

Mike Manges By

re your technicians meticulously checking tread depth levels on customers’ tires as soon as their vehicles roll onto your lot? I hope so. Tread depth checks can mean the difference between life and death. Alex Bebiak knows this all too well.

On Feb. 10, 2023, his son, Jackson, died after the car he was riding in hydroplaned and collided with an 18-wheeler. Jackson, who was wearing a seat belt, was 19 years old. The cause of the accident? Excessively worn tires.

In response, the Bebiak family established the Road Ready Foundation, whose mission is to “save lives on our roadways through crash prevention by educating young and experienced drivers on tire safety and roadside safety education.”

They aren’t stopping there. Alex Bebiak and Jamie Ward, CEO of Cincinnati, Ohio-based Tire Discounters Inc., recently formed the Safe Tread Alliance (STA), a non-profit that “brings together a powerhouse team of industry experts dedicated to addressing tread awareness and advancing tire safety education.”

STA is advocating for the modernization of tire safety standards and the elimination of outdated tread depth check practices. The group held its first board meeting in Las Vegas, Nev., before the start of the 2025 SEMA Show. I was there.

“Every year, thousands of crashes across the U.S. are linked to worn or unsafe tires,” said STA officials. “Between 2019 and 2023, the Fatality Analysis Reporting System documented 2,740 fatal crashes and 3,136 deaths involving tire-related factors.

“The Safe Tread Alliance believes these tragedies can be prevented through stronger tread standards, better consumer education and a renewed focus on proactive maintenance.”

STA is proposing that consumers replace the old “Lincoln penny test” with a tread depth check using quarters.

“For decades, drivers have been told to use the penny test to judge tire safety, placing a penny in the tread and assuming the tire is safe if Lincoln’s head is partially covered. However, research shows that by the time a tire reaches the penny’s benchmark of 2/32 of an inch, its stopping distance, traction and ability to resist hydroplaning are already dangerously compromised.”

Instead, STA is calling for widespread adoption of the “quarter test, a simple, accessible method for determining when tires are no longer safe. When a quarter is placed into the tire’s tread with (George) Washington’s head down, if the top of his head is visible, the tread depth is at or below 4/32 of an inch — the point where performance and wet-weather safety begin to drop significantly.

“Independent testing has shown that vehicles with tires worn to 2/32-inch can take up to 87 feet longer to stop in wet conditions than those with 4/32-inch tread,” according to STA officials. (Pulling worn tires at 4/32-inch isn’t a new idea. Former MTD Editor Bob Ulrich wrote about the topic in 2008.)

“Unsafe tires shouldn’t be a matter of opinion or luck,” said Bebiak. “We have the data, the technology and the responsibility to act. The quarter test is more than a tool. It’s a movement towards a new standard to save lives.”

That covers the consumer component. But what can you, as a tire dealer, do?

It may sound basic, but make sure that tire pressure checks are performed every time, all the time, without exception, on every vehicle that arrives at your dealership.

Make sure each person who works at your dealership knows how to conduct a proper tread depth check.

Use appropriate tools when checking tread depth, whether it’s a mobile phone app, a scanner or an old-fashioned tread depth gauge. (The dealer who sold a new set of tires to me a few years ago scanned the tread depth of our old tires and showed me the results almost instantly, making the tire replacement decision a “no-brainer.”)

Set a policy and stick to it. Removal at 4/32-inch? Removal at 2/32-inch? Consistency is critical.

Also make sure that you clearly communicate your dealership’s policy to both employees and customers. Customers should understand that you’re doing it for their safety.

Finally, consider supporting the STA and its efforts. Visit www.safetread.org for more information.

We’ll revisit the topic of tread depth checks in an upcoming edition of MTD. ■

If you have any questions or comments, please email me at mmanges@endeavorb2b.com.

DIGITAL RESOURCES FOR THE INDEPENDENT TIRE DEALER

The Modern Tire Dealer Show is available on Apple Podcasts, Spotify, iHeart Radio, Amazon Music, Audible and MTD’s website.

Sign up for Modern Tire Dealer ’s eNewsletters to receive the latest tire news and our most popular articles. Go to www.moderntiredealer.com/subscribe.

Big Brand Tire & Service recently purchased Burt Brothers Tire & Service, adding nearly 40 stores to its expanding network.

Private equity rms are now selling tire dealerships to other private equity rms. Big Brand Tire & Service, which is owned by Percheron Capital, recently acquired Burt Brothers Tire & Service, which was owned by Bestige Holdings. That was just one of the most widely read www.moderntiredealer.com stories of the past month. Below are some others.

1. Michelin deploys TreadEye technology

2. Goodyear launches new Wrangler Outbound AT

3. Who are the biggest commercial tire dealerships?

4. S&S Tire doubles down on family ownership

5. Big Brand buys Burt Brothers Tire

6. New Plaza Tire location opens in Illinois

7. Rema unveils virtual reality tire repair training

8. Big Brand owner closes recapitalization

9. Kumho wins design excellence awards

10. Retail sellout remains in growth mode

Check out MTD ’s digital edition at www.moderntiredealer. com/magazine Like us Facebook: facebook.com/ModernTireDealer Follow us X: X.com/MTDMagazine

3515 Massillon Rd., Suite 200

Uniontown, OH 44685 www.moderntiredealer.com

PUBLISHER

Greg Smith gsmith@endeavorb2b.com (330) 598-0375

EDITORIAL

Editor: Mike Manges mmanges@endeavorb2b.com

Associate Editor: Aden Graves agraves@endeavorb2b.com

PRODUCTION

Art Director: Erin Brown

Production Manager: Karen Runion (330) 736-1291, krunion@endeavorb2b.com

ACCOUNT EXECUTIVES

Darrell Bruggink / dbruggink@endeavorb2b.com

Marianne Dyal / mdyal@endeavorb2b.com

Mattie Gorman-Greuel / mgorman@endeavorb2b.com

Cortni Jones / cjones@endeavorb2b.com

Diane Johnston / djohnston@endeavorb2b.com

Sean Thornton / sthornton@endeavorb2b.com

Kyle Shaw / kshaw@endeavorb2b.com

Lisa Mend / lmend@endeavorb2b.com

Chad Hjellming / chjellming@endeavorb2b.com

MTD READER ADVISORY BOARD

Rick Benton, Black’s Tire Service Inc.

Jessica Palanjian Rankin, Grand Prix Performance

John McCarthy Jr., McCarthy Tire Service Co. Inc.

Jamie Ward, Tire Discounters Inc.

CUSTOMER/SUBSCRIPTION SERVICE (877) 382-9187

moderntiredealer@omeda.com

ENDEAVOR BUSINESS MEDIA, LLC

CEO: Chris Ferrell

COO: Patrick Rains

CDO: Jacquie Niemiec

CALO: Tracy Kane

CMO: Amanda Landsaw

EVP Transportation Group: Chris Messer

VP of Content Strategy, Transportation Group: Josh Fisher

VSRG Editorial Director: Chris Jones

LLC. 201 N

5th Floor, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI, and additional mailing offices. POSTMASTER: Send address changes to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. SUBSCRIPTIONS: Publisher reserves the right to reject non-qualified subscriptions. Subscription prices: U.S. ($81.25 per year). All subscriptions are payable in U.S. funds. Send subscription inquiries to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. Customer service can be reached toll-free at 877-382-9187 or at moderntiredealer@omeda.com for magazine subscription assistance or questions.

Printed in the USA. Copyright 2025 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

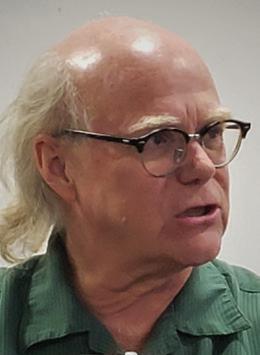

Tomo Mizutani, chairman emeritus, Toyo Tire Holdings of Americas Inc., was instrumental in many notable achievements during his 33-year tire industry career.

Under his leadership, Nitto Tire U.S.A. Inc. grew from a company that was on the verge of bankruptcy when he joined it to a thriving corporation with nearly $1 billion in annual revenue.

Mizutani was an early and very successful adaptor of social media and digital marketing. He also has been a longstand-

ing champion of Japanese-American business relations, which has earned him various honors, including the International Citizen Award from the Japan America Society. And he recently was named to the Tire Industry Hall of Fame.

In this MTD exclusive, Mizutani looks back on his career and discusses how he was instrumental in the revitalization of Nitto. (For a full, unabridged version of this interview, see the Modern Tire Dealer Show podcast episode, “Interview with a Hall of Famer,” available on www.moderntiredealer.com and various podcast platforms.)

MTD: How does it feel to be a member of the Tire Industry Hall of Fame?

Mizutani: It’s beyond my dream and I feel extremely honored.

MTD: How did you get your start in the tire industry?

Mizutani: After graduating from college, I began my career at a major Japanese trading house, where HR placed me in the tire division. At that time, I had little say in the matter and was not particularly enthusiastic about the mandate. In hindsight, what began as a mandate grew into a remarkable, rewarding career path that proved far greater than I could have imagined.

MTD: What made you decide to come to the U.S.?

Mizutani: I was the person in charge of the rest of the world, except the U.S. and Japan, in mainly mining tires. I had no idea about the U.S. market. Then the

company bought a company called Tire Masters. Unfortunately, Tire Masters was not doing well. At that time, I had a great competitive record in my territory and management decided that, ‘Even though that guy is young and has no experience in the U.S, let him handle it. He may have an interesting way to fix that issue.’

MTD: What do you remember about your fist tire industry job in the U.S.? Was it easier or more difficult than you thought it would be?

Mizutani: It was extremely difficult. Our tire was a red ocean product (with) no unique feature ... (with) probably no name recognition among consumers. It was almost impossible to move the products that our factory wanted us to move. When I came to the U.S., Nitto had only $6 million in sales with $8 million in inventory. It was not in good shape and the company demanded $15 million in sales, which then equated to around 500,000 tires, to keep the ship afloat.

MTD: However, you managed to make that happen, taking Nitto from the verge of bankruptcy when you started to the thriving, growing $1 billion-a-year corporation it is today. Can you tell us a little bit about how you transformed the company?

Mizutani: Simply speaking, tire products (are) negative purchases. When consumers purchase (tires), it’s a negative feeling. ‘I don’t want to buy that. I have to buy’ — like a water bill, like an electric bill or a gas bill. So it’s a very difficult product to make money (with). However, there are segments in this world (that are) positive purchases. ‘I don’t need, but I want to buy.’ Apparel, jewelry, nice bags... you name it. We tried to leave the negative purchase segment... (and move to) a positive purchase.

MTD: You were instrumental in the revitalization of Nitto. How did that come about? How did you revitalize the company?

Mizutani: We tried to get into the positive purchase segment. Of course, there were a bunch of positive products already in the market. However, if you are belonging to (the) copycats, you cannot be a price leader. So we needed to do something. One day, I spent time in a tuning shop. There were a bunch of 20-inch wheels ... however, no tires properly fitting to the luxury sedans. People were dreaming (of having) a 20-inch tire. I studied it and we issued a (size) 245/35/20. Prices were high, profit was great. Within a couple of months, (we) sold out. We needed to have a second mold — sold out. Third mold — sold out. Fourth, fifth ... eventually, we had 10 molds. We owned that market for probably a couple years until some other manufacturers (joined). We revitalized the company because (we created ) a positive purchase.

“What began as a mandate grew into a remarkable, rewarding career path that proved far greater than I could have imagined,” says Mizutani.

Photo: MTD

MTD: You also were a very early adaptor of digital marketing. Can you tell us about your social media strategy and innovations on the digital side?

Mizutani: I have to name a few people, especially Mr. Andy Ando. He was gracious enough to show me there was a huge opportunity stemming from the rising import performance car market. He was the person who opened my eyes to the import performance market and that was the trigger in getting into the ‘want’ product (category). If we followed other companies (that had) a much bigger budget, we had no way to compete against big national name brands, so we had to do something unique. Digital marketing gave us a chance to be better, if we were nimble. At that time, I had no idea about IT. However, I met a person named Justin Choi. He was my mentor to lead digital marketing. At the same time, we had the lucky opportunity to have great talent to drive our engine, like (Nitto’s Senior Director, Brand Publishing) Stephen Leu, (Nitto’s Senior

Manager, Brand Publishing) Harry Kong and (Nitto’s Senior Director, Brand Experience and Technical Services) Efrain Viveros. These people are driving our digital marketing.

MTD: What are some of the changes you’ve seen in the U.S. tire industry during your career?

Mizutani: The biggest change is private equity (PE) all of a sudden appeared and they really changed the format of distribution. Basically, I think there are two reasons. Number one is politics. Probably the majority of people do not remember, (but the) U.S. federal government limited banks to stay only in (their) state. However, deregulation came in the ‘80s and deregulation allowed bankers to have multi-state (presence). Then they started supporting multi-state, interstate dealerships. Secondly, communication cost is way down. Used to be, we depended on telephone ground lines, but now have the internet. The cost reduction has been huge. These are things that invited PE to be a major player in the tire industry (at

a) much bigger financial scale, as well as more sophisticated IT technology. These changes were huge for the tire industry.

MTD: You’ve made an incredible impact on Japanese-American business relations and have been instrumental in advancing understanding between the two countries and cultures in a business setting.

Mizutani: I had a different cultural background in Japan. And also I started in the tire business with a trading house. I didn’t get formal tire training when I was young. So the answer was, ‘Work harder — double or triple.’ We put in a lot of effort to understand the market.

MTD: So innovation, communication, capitalizing on opportunities, sheer hard work, recognizing what customers want and working very hard and very innovatively to deliver that to them have all contributed not just to Nitto’s success, but your success. In your current position as chairman emeritus, what’s next for you?

Mizutani: Japanese companies have their own policy (governing) retirement age. I’m still young. I’m still capable. I’d like to find a way to keep working. I’m looking for the right opportunity in the future.

— Mike Manges

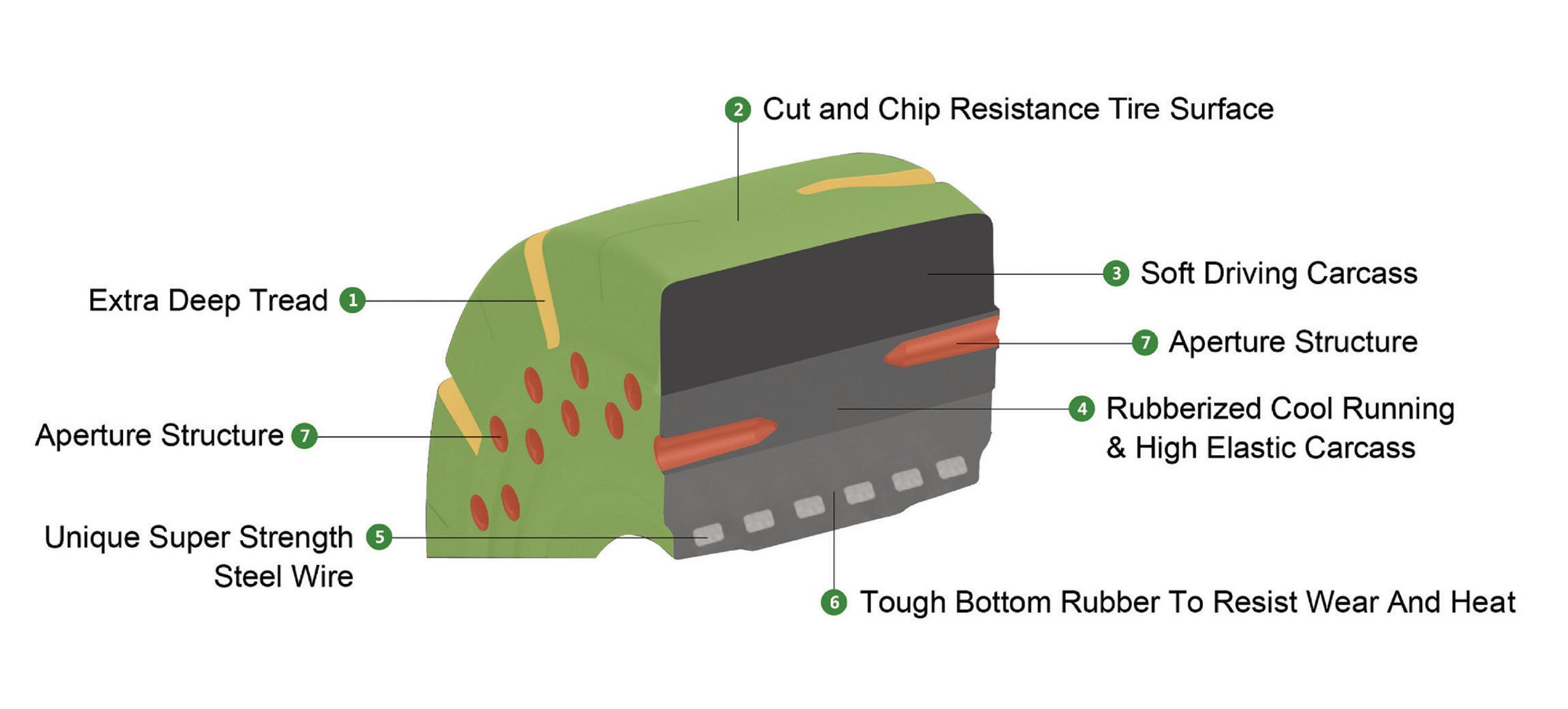

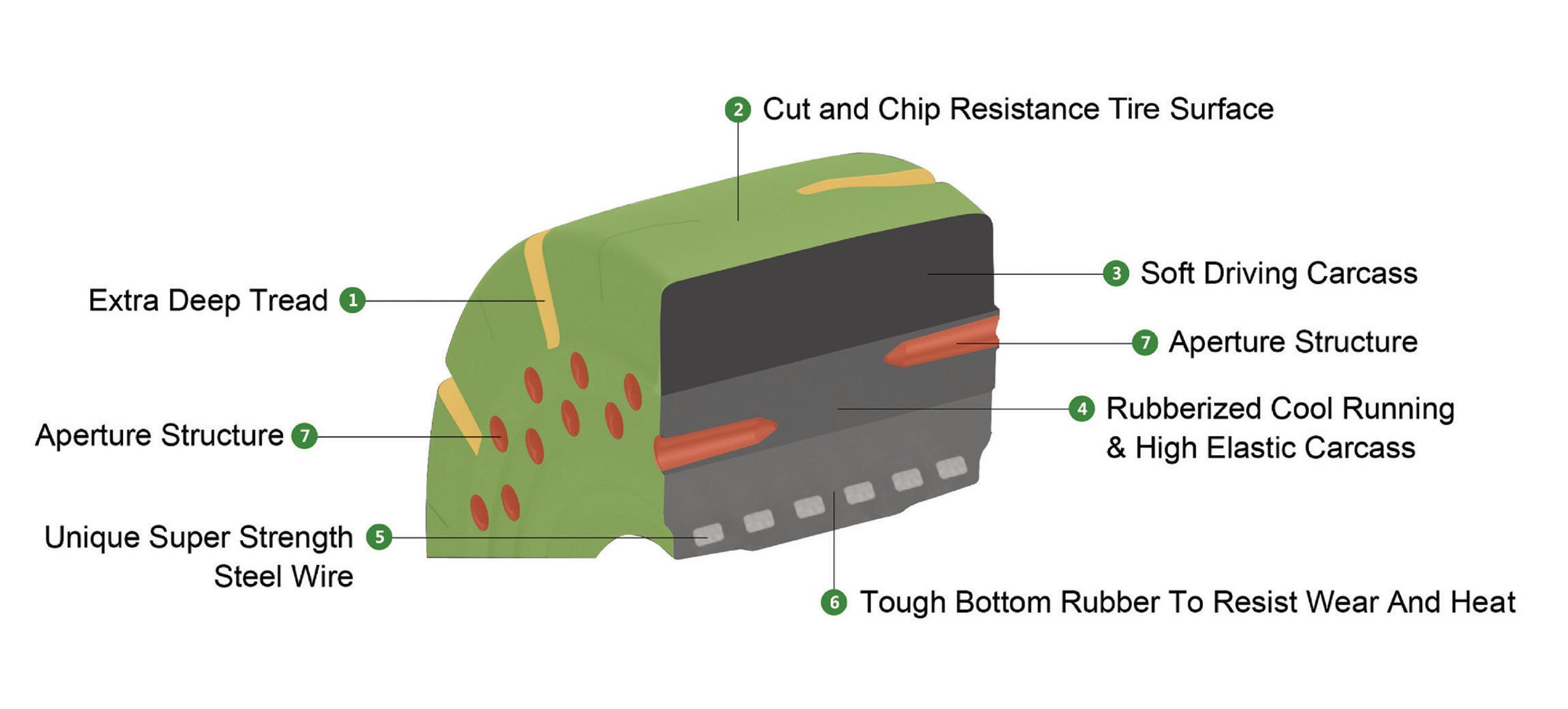

Sentury Tire USA’s new AxisA3 tire technology is “a branded representation of the company’s existing advanced tire engineering.” According to Sentury Tire USA officials, AxisA3 technology “equips tires with features that deliver longer-lasting, more durable tires, along with multiple other benefits, including 3-Peak Mountain Snowflake-rated winter traction.” Two Landsail tires from Sentury currently include the technology.

Monro Inc. says its comparable store tire sales were flat during its second fiscal quarter versus the same period last year. However, the Rochester, N.Y.-based company saw comparable store sales gains in front end/shocks, up 18% year-over-year, and brakes, up 6%. For the second quarter of Monro’s fiscal year, which ends in March 2026, the firm posted $288.9 million in sales, a decrease of 4.1% on a year-over-year basis.

Telle Tire & Auto Centers continues to expand, recently opening a store in Ballwin, Mo., and another in Chesterfield, Mo. The openings give the Webster Groves, Mo.-based dealership 16 Telle Tire-branded locations in the St. Louis, Mo., area. Telle Tire & Auto Centers also operates three stores in the St. Louis market under other names. The dealership has nearly 70 locations.

Bethlehem, Pa.-based Service Tire Truck Centers (STTC) has acquired the assets of Oasis Truck Tire Service, which has three locations in Connecticut. Founded 30 years ago by Dave Petros, Oasis Truck Tire Service “has built a strong reputation for providing exceptional truck and earthmover tire services,” according to STTC officials.

The new year will bring a new leader to the top of Bridgestone Corp. Yasuhiro Morita will replace Shuichi Ishibashi as CEO on Jan. 1, 2026.

Ishibashi is retiring on Dec. 31 and will leave his seat as a board member at the company’s annual shareholder’s meeting in March 2026.

Morita joined Bridgestone in 1996 and has extensive experience, primarily in Europe and Asia. He’s been a managing director for the tiremaker’s Thai and Chinese operations and in 2023, was named CEO of Bridgestone Asia Pacific Pte. Ltd.

In 2024, he became a vice president and senior officer and in 2025, was named an executive vice president and representative executive officer.

Morita will replace Shuichi Ishibashi as Bridgestone Corp.’s CEO.

Bridgestone says a new global management structure for 2026 will be announced once it is finalized.

GreatWater 360 Auto Care has acquired Muskego, Wis.-based Richlonn’s Tire & Service Centers, a five-location tire dealership serving the greater Milwaukee area.

“Richlonn’s has become a household name in southeastern Wisconsin,” say GreatWater 360 Auto Care officials.

Photo: GreatWater 360 Auto Care

Founded in 1964 by Dick Matschke and Lonn Stone and most recently owned by Dick’s son, Brett Matschke, “Richlonn’s has become a household name in southeastern Wisconsin for full-service automotive repair and tire expertise,” say GreatWater 360 Auto Care officials.

“With shops in Greenfield, Racine, Waukesha, Muskego and Greendale, the brand has built a loyal following through its customer-first approach, team longevity and deep community ties.”

“For over 60 years, Richlonn’s has been delivering top-tier service and building lasting relationships across the Milwaukee area,” says Brett Matschke. “Our brand and legacy remaining intact, along with the reassurance the team was in great hands, were my focus when going through this transition.”

High Ridge, Mo.-based Dobbs Tire & Auto Centers will open nearly 40 new locations through both new construction and brownfields.

“This expansion marks another exciting chapter for the company, further strengthening their presence in Missouri and Ohio, while entering Michigan, Minnesota, Pennsylvania and Wisconsin and increasing their ability to serve even more customers with the expert care and dependable service Dobbs is known for,” according to Dobbs Tire & Auto Centers officials

The dealership recently opened two new locations: one in St. Louis, Mo., and another in Tyler, Texas. Three more Dobbs Tire & Auto Centers locations are scheduled to open in the St. Louis market within the next 60 days.

JON VANCE Global Director of Marketing

When AOT partners wanted hard data that proved our tires could perform in a variety of conditions, we gave them a lot more than a spreadsheet. Our marketing team held an exclusive event at a race track to demonstrate their real-world performance. After days of grueling testing under different conditions, the tires left no doubts of their capabilities. They also made the job of selling the tires a lot easier for our partners.

WHAT’S YOUR CHALLENGE?

Relevant statistics from an industry in constant motion

3

Number of tire brands American Tire Distributors added to its portfolio in September and October 2025.

Source: MTD

Photo: American Tire Distributors

$650 MILLION

What Gemspring Capital Management LLC paid for Goodyear Tire & Rubber Co.’s chemical business, a deal that the two parties nalized on Oct. 31.

Co.

1993

When MTD’s Tire Dealer of the Year Award program was established.

Source: MTD

Photo: K&M Tire Inc.

1,000

Number of stores that Big Brand Tire & Service wants to have by the year 2030.

Source: MTD

460-PLUS

Number of Big O Tires franchise locations located throughout 24 states.

Source: TBC Corp.

Photo: TBC Corp.

ENROLLMENT IS NOW OPEN!

LANDSAIL TIRES IS EXCITED TO ANNOUNCE THE LAUNCH OF THE NEW ELYTE ASSOCIATE DEALER PROGRAM™.

INDEPENDENT TIRE DEALERS WHO SIGN UP NOW AND PURCHASE FROM AN AUTHORIZED LANDSAIL DISTRIBUTOR

CAN EARN UP TO $3 PER TIRE, SHOWCASING OUR COMMITMENT TO REWARDING YOUR DEDICATION AND PARTNERSHIP WITH THE LANDSAIL BRAND.

No opening order required - just sign up and start earning!

PAYOUTS ARE AS FOLLOWS

Level 1: Minimum 48 units - $1.00/tire

Level 2: Minimum 120 units - $2.00/tire

Level 3: Minimum 240 units - $3.00/tire

ANNUAL PAYOUT POTENTIAL

Level 1: $192

Level 2: $ 9 6 0

Level 3: $2,880+

DISTRIBUTORS

If you want to sell Landsail Tires and offer ELYTE rewards to your dealers, contact us today on our website at LANDSAILTIRES.COM/dealer-inquiries.

John Healy By

ur recent check-ins with independent tire dealers indicate that retail sellout trends were roughly up in the low single digits year-over-year in October 2025, ahead of September results.

Dealers highlighted average sellout increases of 1.2% during the month of October, up from an increase of 0.8% the previous month, with trends flat to slightly up, on average, during the third quarter of 2024.

Looking more closely at volume for October 2025 on a regional basis, the Southeast, Midwest and Southwest experienced positive volumes.

Other regions saw flat or negative volumes, with the Northwest experiencing the weakest trends, down a moderate 1.3% year-over-year.

From our view, the fall of 2025 yielded strong sellout trends, with September and October both showing increases. Early fall brought a lift in seasonal activity as dropping temperatures and visible signs of the changing seasons encouraged consumers to address maintenance and replacement needs.

We also note that November 2025 had a flatter comp, with retail sellout volumes of 0.7% due to a healthy increase in October and the weather continuing to change in some regions. We would not

be surprised to see full-month November volumes to be flat or event slightly positive.

In addition, we note that 62% of dealers who responded to our latest survey reported that they experienced positive demand trends in October, up sequentially from the 40% demand seen in September.

Consumer deferment and trade-down have been consistent themes over the past several months. We believe that we may have seen this begin to soften as consumers think about winter weather.

We do note that consumers continue to trade down to tier-two and tier-three tires. Dealers continue to call out softer trends for tier-one tires.

Our recent survey of tire dealers indicates tier-two and tier-three brands remain the most in-demand by consumers for the second month in a row. This marks the third time that tier-two tires have been in the most in-demand segment, with the first month being January 2025.

October results are in-line with the long-term trends we have seen in our survey, with tier-two being the most in-demand segment in the decades-plus history of our Tire Demand Index.

Tier-three maintained a position of

Snapshot of Dealer’s PLT Tire Volumes (Year-Over-Year Change)

SOURCE: NORTHCOAST RESEARCH ESTIMATES

being second as consumers try to balance value and performance while they prepare for winter.

We continue to see weaker sellout trends in tier-one, with a tough macroeconomic environment putting a level of strain on consumers, leading to a tradedown dynamic.

With tier-two and tier-three being atop our survey, we continue to believe that consumers are still opting for less-expensive tires. We do see a high level of votality in our month-to-month tier rankings, but expect tier-two brands to be the most in-demand segment longterm, offering consumers a balance between cost and performance.

Given volatile industry conditions due to the cost of inflation and other macroeconomic factors, we continue to look at several data points to assess the health of automobile travel demand, which correlates to tire usage and wear. Looking at miles driven, trends were down in the low single digits during October, following a low single digit decline during the second quarter of 2025. The third quarter, on average, showed declines of 1.9%.

More specifically, our Miles Driven Momentum Index showed declines versus a healthy 5.5% comp in October 2024. We continue to see miles driven trends being ahead of pre-pandemic trends and expect to continue to see trends that are flat to slightly elevated. ■

John Healy is a managing director and research analyst with Northcoast Research Holdings LLC, based in Cleveland, Ohio. Healy covers a variety of subsectors of the automotive industry. If you would like to participate in the monthly dealer discussions, contact him at john.healy@ northcoastresearch.com.

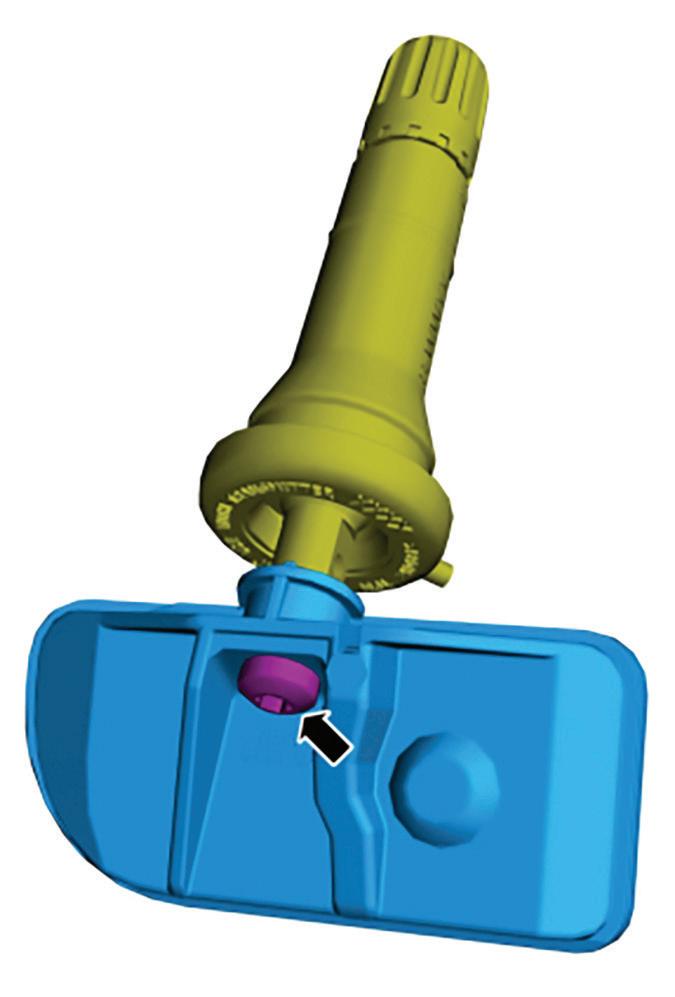

The TPMS universal sensor that can communicate with any vehicle.

By Mike Manges

Anumber of tire manufacturers and suppliers displayed new — and in some cases, already-established — tires at last month’s SEMA Show inside the Global Tire Expo. Tire pressure monitoring system (TPMS) scanner and sensor suppliers — as well as tool, technology and shop equipment providers — also showcased new and existing products at the show. Here’s a look!

American Kenda Rubber Co. Ltd. highlighted a number of new tires. Among them were the Klever A/T Trail and the Klever H/T 4S.

e Klever A/T Trail is an all-terrain tire that targets light trucks, CUVs and small SUVs. “Enigneereed for adventure and daily driving,” the tire delivers “rugged, o -road capability, re ned on-road performance and certi ed winter traction,” according to Kenda o cials.

The Klever A/T also has earned 3-Peak Mountain Snow ake (3PMS) certi cation and is available in 15 sizes in T, H and V speed ratings. e tire comes with a 60,000-mile warranty.

Kenda describes the Klever H/T 4S as a “highway, four-season tire.” e product is designed for CUVs, SUVs and light trucks and has been engineered “to deliver a dependable, comfortable highway ride with true four-season capability.”

Also 3-Peak Mountain Snow ake-certi ed, the Klever H/T 4S boasts enhanced sidewall styling with an updated design that “adds rugged visual appeal.” e tire is available in 22 metric sizes that come with a 60,000-mile warranty and 14 LT sizes that come with a 50,000-mile warranty.

Atturo Tire Corp. and Artis Wheels collaborated to create the new Artis, which Atturo bills as the “ rst luxury high performance tire on the market.

“Born in southern California, Artis Wheels emerged from a community de ned by passion and precision,” said Atturo o cials. “Inspired by the region’s deep-rooted car culture and the individ-

American Kenda Rubber Co. Ltd. highlighted a number of new tires at the 2025 SEMA Show. Among them were the Klever A/T Trail and the Klever H/T 4S.

Photo: MTD

MTD December 2025

uals who shape it, Artis was created for those who see their vehicle not merely as a mode of transport, but as a personal statement of class and identity.

“In keeping with the Artis ethos crafted to embody artistry, innovation, luxury and quality with refined performance, each tire is a sculpted expression of balance, strength and durability.”

Atturo officials said the Artis boasts a construction “more similar to a premium touring tire, combined with an ultra-high performance tread compound.”

The tire’s debut size range emphasizes staggered fitments and ultra-low-profile sizes for premium vehicles.

Coker Tire Co. launched several new tires and added sizes to its Firestone Wide Oval Radial line.

The new Coker Classic Star Series tire has been engineered with new molds and compounds, “with a sharp focus on balance and performance,” according to Coker officials.

Coker Classic Star Series tires are available in 28 sizes, fitting wheels ranging from 13 inches to 17 inches in diameter, with most offered in 14-inch to 15-inch sizes for fitment on 1940s through 1970s classic cars and trucks.

Also new from Coker Tire was the Excelsior Roadster, a “bias-look radial tire” designed to provide the traditional look of a bias-ply tire, “while offering the smooth ride of a modern radial.”

The product is available in five sizes, including 600R16 that fits 1935 through 1948 Ford cars, as well as light-duty trucks into the 1950s. The complete size line-up includes 450/475R16, 600R16, 650R16, 700R16 and 750R16.

“These sizes cover most Amerian makes and models from the 1930s and 1940s, as well as select European sports cars.”

New sizes for the Firestone Wide Oval Radial, which Coker officials say are “perfect for Day Two muscle cars with aftermarket wheels and mild modifications,” include Er60-15, FR60-15, GR60-15, HR60-15, LR60-15 and NR50-15. Tires in these sizes carry the alpha-numeric sizing structure of the original Firestone Wide Oval.

Fury Tires showcased its new Street Hunter SS and Track Hunter ET.

The Street Hunter SS fits wheels up to 28 inches in diameter and has been “engineered for high performance in all seasons,” according to Fury Tires offi-

cials. “Its deep grooves and sipes channel water fast to fight hydroplaning while maximizing wet grip and safety. On dry roads, a wide contact patch and special compounding deliver precise handling, quick response and confident cornering.”

The Track Hunter ET is a DOT-compliant competition tire “built for big horsepower and dry pavement dominance. A sticky compound and unique tread deliver fierce grip, stable launches, predictable handling” and other benefits.

The Track Hunter ET is available in a range of sizes, fitting wheels from 20 inches in diameter to 26 inches in diameter.

A new Mickey Thompson “ultra ultra high performance” tire and the new Mickey Thompson Baja Belted II were introduced by Goodyear Tire & Rubber Co.

The Street Comp GHT is a “next-generation ultra ultra high performance summer tire built for high-horsepower American muscle,” said Goodyear Tire & Rubber Co. officials. “Designed for drivers who demand precision, grip and control, the GHT marks a bold reinvestment in Mickey Thompson’s street and performance tire segment and a clear signal of where the brand is headed.”

Features include an aggressive tread design “that channels water away while enhancing dry traction and reducing road noise;” lightweight construction and aerodynamic profile for improved steering response and reduced drag; and more.

The tire’s initial size line-up “will be modest, targeting key fitments and applications, and will be available through authorized Mickey Thompson retailers beginning spring 2026.”

The new Baja Belted II “blends vintage attitude with modern engineering. Available in sizes for 15-inch, 16-inch, 17-inch, 20-inch, 26-inch and 30-inch wheels, it’s designed to fit everything from classic lifted 4x4s to modern custom builds.”

Features include steel-belted radial construction in select sizes for enhanced ride quality and reduced flat-spotting; a precision-tuned tread pattern for a smoother ride, longer wear and reduced road noise; and more.

Excelsior Roadster from

Tire is designed to provide the traditional look of a bias-ply tire, “while offering the smooth ride of a modern radial,” said Coker Tire officials.

The Baja Belted II also will be available for purchase through authorized

Mickey ompson retailers beginning in spring 2026.

Hankook Tire America Corp.’s Dynapro line once again took center stage at the company’s SEMA Show booth.

“Speci c o -road products — including Hankook’sDynapro AT2 Xtreme, XT and MT2 — (were) featured across a range of enthusiast builds on display at this year’s booth,” said Hankook o cials. “Alongside Hankook Tire’s comprehensive, o -road-focused Dynapro line-up, which includes the Dynapro MT2, AT2 Xtreme, and XT,” Hankook also showcased its newly launched Dynapro evo AS and Dynapro HT2.

“With its full portfolio of Dynapro SUV and light truck o erings on display, event attendees (experienced) rst-hand the innovative technology designed to perform across a wide spectrum of onand o -road environments.”

“ e SEMA Show is not just an event,” said Rob Williams, president, Hankook Tire America Corp. “It’s a unique opportunity to connect innovation with industry.”

NAMA Tires unveiled the NM627, an all-steel specialty trailer tire in the company’s Overload series.

“Engineered with strong carcass structure, the NM627 features ultra-hightensile alloy steel cords, which e ectively increase the rated single-tire load capacity by 15%,” said NAMA Tires o cials.

“This advancement significantly enhances the tire’s resistance to deformation and fatigue. rough utilizing hybrid steel-aromatic fiber composites and anti-aging formulations, (it) ensures superior stability, heat resistance and durability against environmental degradation.”

e tire is available in the following sizes: ST225/75R15, ST235/80R16 and ST235/85R16.

Nexen Tire America Inc. showcased the new N’Priz S and N’Fera Sport at its SEMA Show booth.

e N’Priz S is a grand touring all-season tire and is Nexen’s rst electric vehicle (EV)-compatible o ering.

Available in 48 sizes, tting wheels ranging from 15 inches to 20 inches in diameter, the N’Priz S targets EVs and internal combustion engine sedans and features a reinforced center block and enhanced footprint “to deliver high torque smoothly to the road,” according to Nexen o cials.

e N’Priz S comes with an 80,000mile tread wear warranty. It replaces three tires: the Nexen Roadian GTX, the Nexen

Aria AH47 and the N’Priz AH8. Also on display was the N’Fera Sport, a premium ultra-high performance summer tire. Available now in 63 sizes, fitting wheels ranging from 17 inches to 21 inches in diameter, the N’Fera Sport replaces the Nexen N’Fera SU1.

Features include a four-channel groove design for optimal water evacuation; a slant shoulder block design for improved braking; an upgraded profile “using infinite analysis technology to reinforce handling, braking, performance and durability” and more.

An expanded range of Prinx allweather, all-terrain and TBR tires were on display at Prinx Chengshan Tire North America’s (PCTNA) SEMA Show booth.

“With 400-plus SKUs spanning passenger, light truck, and commercial categories, Prinx continues to deliver value without compromise,” said PCTNA officials.

Showcased products included the HiCountry A/T; HiSeason 4S; and the new PDW1 winter drive tire, “each engineered to deliver superior traction, durability and comfort. Prinx also (introduced) a new 5-rib AM210-A and 445/65R22.5 AM211 to strengthen its commercial line-up."

The HiCountry A/T is a “rugged all-terrain tire offering off-road capability and quiet highway comfort, backed by a 50,000-mile limited warranty.”

The HiSeason 4S is an “all-weather touring option with 3PMS certification, engineered for safety and confidence year-round.”

The new PDW1 winter drive tire has been designed for “severe commercial use, combining deep tread and advanced compound technology for longer service life. And the five-rib 315/80R22.5 AM210-A and 455/65R22.5 AM211 expansions” help deliver greater stability, handling and mileage for mixed-service fleets.

PCTNA also highlighted several Fortune brand tires at the SEMA Show.

“Every Fortune tire is developed with dealer feedback in mind,” said Ken Coltrane, vice president of marketing and product development, PCTNA. “From expanding our all-weather line to introducing new drive and mixed-service TBR options, Fortune continues to evolve in ways that support dealer profitability and consumer confidence.”

Tires on display include the all-terrain, 3-Peak Mountain Snowflake-rated Tor-

menta A/T, which PCTNA officials said has been designed “with aggressive tread and quiet comfort, is ideal for light truck and SUV applications and (is) backed by a 50,000-mile warranty;” the ClimaFlex 4S, “a true all-weather touring and CUV tire, available in 61 SKUS and 3PMScertified for year-round traction;” and the FDW802 winter drive tire, built for severe conditions “with enhanced tread depth and stability for dependable winter performance.”

All Fortune TBR tires are supported with a seven-year, three-retread warranty. Sentury Tire USA displayed its new Groundspeed Voyager GT-AS all-season tire.

The Groundspeed Voyager GT-AS “features a tread design that aids in water evacuation and helps prevent hydroplaning, combining dry grip and rapid water dispersal technology to improve traction in both wet and dry road conditions,” said Sentury Tire USA officials. “Additional grooves and siping add all-season performance, increased traction and improved handling.”

The design of the tire also “ensures even contact pressure distribution and provides increased tread block stiffness, which improves handling and increases fuel efficiency.”

“We are excited to add this versatile all-season offering to Groundspeed’s range of quality passenger tires,” said Maxwell Wee, executive vice president of Sentury Tire USA. “The Voyager GT-AS meets the needs of today’s touring driver by providing a fuel-efficient tire with excellent traction and handling year-round.”

Sentury Tire USA also launched five new commercial tires for regional and

mixed-service use under its Landsail brand. All feature Sentury Tire USA’s specialized KTM Tread Compounds, which “enhance (their) functionality

and longevity,” according to Sentury Tire USA officials.

The Cargoblazer AP360 is a regional all-position tire “designed for superior performance and durability,” while the Cargoblazer CSD780 regional closed shoulder drive tire as been built “for ultimate durability” and offers long tread life.

The Cargoblazer OSD550, a regional open shoulder drive axle tire, provides “improved mileage performance and confidence in challenging terrain.”

The Cargoblazer TRL400 regional trailer tire “is durable and performs in any condition, with an optimized footprint for fuel efficiency and extended tread life,” said Sentury Tire USA officials.

And the Cargoblazer APM555, a mixed-service tire, has been designed to provide “maximum durability, enhanced traction and cut/chip resistance.”

“The new Cargoblazer line-up, refined through key industry collaboration, marks the beginning of a series of long-lasting products built to exceed the demands” of truck drivers across the United States, said Nick Gutierrez, ter-

ritory sales and marketing director for Sentury Tire USA.

Tesche Tires’ new Sport A/S integrates the company’s racing tire technology “with daily driving needs,” said company officials

The all-season tire’s asymmetric tread pattern and specialized compound “deliver reliable traction in dry, wet and low-temperature conditions,” while its optimized structure and noise reduction technology “balance EV compatibility with a comfortable driving experience, truly delivering on the ‘one tire for all seasons’ concept and offering a comprehensive solution for quality-focused drivers.”

The Sport A/S is available in 17 16-inch sizes, 12 17-inch sizes, more than 10 18-inch sizes, two 19-inch sizes, two 20-inch sizes and one 22-inch size.

The new Cosmo Mud Kicker X from Tire Group International LLC (TGI) was showcased during the SEMA Show. The tire is now available and features “a multitude of upgrades,” according to TGI officials. It features patent-pending Shoulder Claws that have been redesigned

THE MR. TIRE AND BIG 3 TIRE PROGRAMS ARE DESIGNED TO HELP YOU SHAPE THE FUTURE OF YOUR INDEPENDENT TIRE DEALERSHIP WITH THE TOOLS NEEDED TO REACH YOUR MAXIMUM POTENTIAL WITHOUT SURRENDERING YOUR IDENTITY.

with “a deeper, industry-leading 9 mm shoulder depth for next-level traction. Add to that our patent-pending Bead Claw Technology for unbeatable bite in deep mud and snow and you’ve got a tire that simply refuses to quit.”

Other features include a mud rating “to excel in deep mud and snow;” Cosmo Quiet Kat Technology, boasting “geometric isolation” that reduces road noise; dual sidewall styling with bold raised lettering on one side “for an aggressive look” and another side with indented lettering and a “textured pebble shoulder aesthetic;” a three-ply sidewall and robust undertread construction for optimal strength and impact resistance; tread block divots and stone ejector ridges that push out mud, rocks and debris “to maintain grip and extend tire life;” and more.

The tire is initially available in size

37x13.50x22, with an additional eight sizes “as part of our phase one development that customers will be able to order by the end of Q1 2026.”

Nine more sizes will be introduced during phase two, according to TGI officials.

The Cosmo Mud Kicker X comes with a 50,000-mile warranty and Cosmo’s Hassle-Free Road Hazard Warranty, “giving our retailers an edge and every driver peace of mind.”

Toyo Tire U.S.A. Corp., in its popular Treadpass area, displayed the recently unveiled ProxesSport R, an extreme performance summer tire “designed for passionate drivers and motorsports enthusiasts.

“Delivering outstanding capability in dry conditions, the Proxes Sport R features an aggressive directional tread pattern, reinforced internal casing and a high-grip compound,” according to Toyo officials.

The tire will be produced in over 50 unique sizes and load/speed combinations for 13- to 21-inch wheel diameters. Initial sizes will be available for sale in the first half of 2026, with additional fitments released throughout the remainder of next year.

Trimax Tire unveiled its new Chinhoo brand, which includes nearly 300 sizes. According to Trimax Tire officials, the 2025 SEMA Show saw the debut of tires in the following applications and sizes: “summer (15 sizes; 17 inches to 22 inches), all-season UHP (65 sizes; 16 inches to 20 inches), HP-PCR/SUV (57 sizes; 14 inches to 24 inches), HT-PCR/LTR (42 sizes; 15 inches to 20 inches), AT-PCR/LTR (78 sizes: 15 inches to 24 inches), RT-LTR (27 sizes; 17 inches to 24 inches) & MT-LTR (11 sizes: 16 inches to 22 inches).”

Trimax Tire, which has been importing tires primarily from China since 2014, “represents the following brands for North America: Haida, MileKing, ANSU, Farroad Kapsen, Opals and Saferich. With all the recent tariff turmoil this year, we are excited to introduce the Chinhoo Tire brand to North America, positioned as a quality value tire.”

Unicorn Tire Corp. displayed several new Travelstar brand tires at the 2025 SEMA Show. They include the Travelstar Ecopath ATX, Travelstar Ecopath RT and Travelstar Eco-Mile 4S.

“These three tires are the first offerings from Travelstar’s new second-generation

line,” said Unicorn officials. All are 3-Peak Mountain Snowflake-certified, “meeting severe snow standards for confident winter performance.”

The Eco-Mile 4S is an all-weather tire designed for CUVs and SUVs. Its features include an asymmetric tread design for enhanced handling and wet and snow traction; strong outer blocks for extra stability; 3D inner blocks for grip; four wide grooves for efficient water evacuation; a multi-pitch tread for road noise reduction; and more. The tire is available in 64 sizes.

The Ecopath ATX is available in 14 sizes, fitting wheels up to 20 inches in diameter.

Features include an all-terrain tread for balanced on- and off-road performance; an advanced compound for rain, dirt, mud and snow performance; two wide longitudinal grooves for wet surface handling; and others.

The Ecopath RT is a rugged-terrain off-road tire that comes in 23 sizes, fitting wheels up to 24 inches in diameter. Features include dual-sidewall design for aesthetic flexibility and mounting options; raised branding and tread lettering; and more.

Bartec TPMS continued to build on its Connected Support strategy with the launch of the new Bartec365 App.

Available for both Apple and Google devices, the Bartec365 App “is an all-inone solution for automotive service professionals working in tire pressure monitoring systems (TPMS),” said Bartec officials.

“Designed to streamline technician workflow, Bartec365 brings together tool management, detailed service reports, a comprehensive knowledge base and direct access to Bartec’s technical support team.”

The app allows users to update tools, purchase software, configure WiFi, collect service data from Bartec TPMS tools, create and print reports and contact Bartec support staff. It also includes TSBs, videos, articles, parts numbers and vehicle relearns.

“The Bartec365 application is a platform that Bartec will continue to build upon, with future features including Rite-Sensor warranty registration and tracking, TPMS tool updating and training and field support requests.”

Hamaton Inc. showcased its latest

Heavy-Duty TPMS product line-up. The products, according to Hamaton officials, are designed to “deliver durability, flexibility and advanced diagnostic capabilities for commercial vehicles, trailers and mixed fleets.”

The expanded offering includes the VT Truck 2.0 Tool, the HD Band-Mounted Sensor and the HD Valve-Mounted Sensor — “a powerful combination engi-

neered to simplify TPMS maintenance, improve reliability and reduce downtime for heavy-duty applications.”

The Hamaton VT Truck 2.0 Tool “provides a powerful, user-friendly interface for TPMS maintenance and programming.” Designed for heavy-duty trucks, buses and trailers, the tool features an allin-one display that shows complete TPMS information on a single screen. It can read

sensors “with ease” and quickly activate sensors, “even in twin-wheels set-ups.”

Also new is the HD Band-Mounted Sensor, which Hamaton said “delivers a reliable and cost-effective TPMS solution for one-piece, 17.5-inch to 24.5-inch wheels.”

Schrader TPMS Solutions is launching its new Heavy Duty OE Replacement TPMS portfolio, including sensors, valves and the VT Truck 2.0 TPMS Tool.

Schrader says its HD TPMS sensors “are engineered for leading OEMs and a wide variety of heavy-duty applications.”

They include the PN 53707, for Scania G, L, P, R and S Series (2022-plus); PN 53715, for Volvo New VNL (2024-plus); PN 53718, for Prevost H-Series (H3-45); X-Series (X3-45, X3-45 Commuter) and Volvo 9700 (2022-plus), as well as the PN 53736, for Kenworth T180, T280, T380, T480, T680, T880, W990 and Peterbilt 520, 535, 536, 537, 548, 567, 589 (2025-plus.)

Features and benefits include “reliable 433 MHz frequency for robust performance;” design that enables “seamless integration with OEM systems;” and more. In addition, they are “built for durability and long service life in demanding environments.”

Key features of the VT Truck 2.0 TPMS Tool include the ability to diagnose and relearn “all TPMS sensors and features;” an integrated OBD-II module for fast, accurate diagnostics; all TPMS information on one screen for easy access; and others.

Bosch Mobility highlighted a number of products at the SEMA Show, including the Bosch TPA400, which is “fit with an integrated OBD module and over-theair software updates” and is compatible “with over 20 universal sensor brands and boasts vehicle coverage of over 95,” accordng to Bosch officials.

Gaither Tool also showcased several new products, including additions to its Bead Bazooka tool.

The Bead Bazooka Car Seat mounting system serves as a holster that keeps “your Bead Bazooka secure and out of harm’s way while conducting service on the move in the most demanding of environments,” said Gaither officials.

“It is designed to be bolted directly on to service vehicles regardless of make or model and can accommodate all of our Bead Bazooka bead seater models.”

Also new is the Bead Booster GB-38L3, a “more powerful 3in Rapid Air Release (RAR) valve replacing the previous two -inch valve. This new upgrade retains the

same renowned reliability and repairability of the original valve, but adds more power by allowing more air to escape the tank more quickly during discharge.”

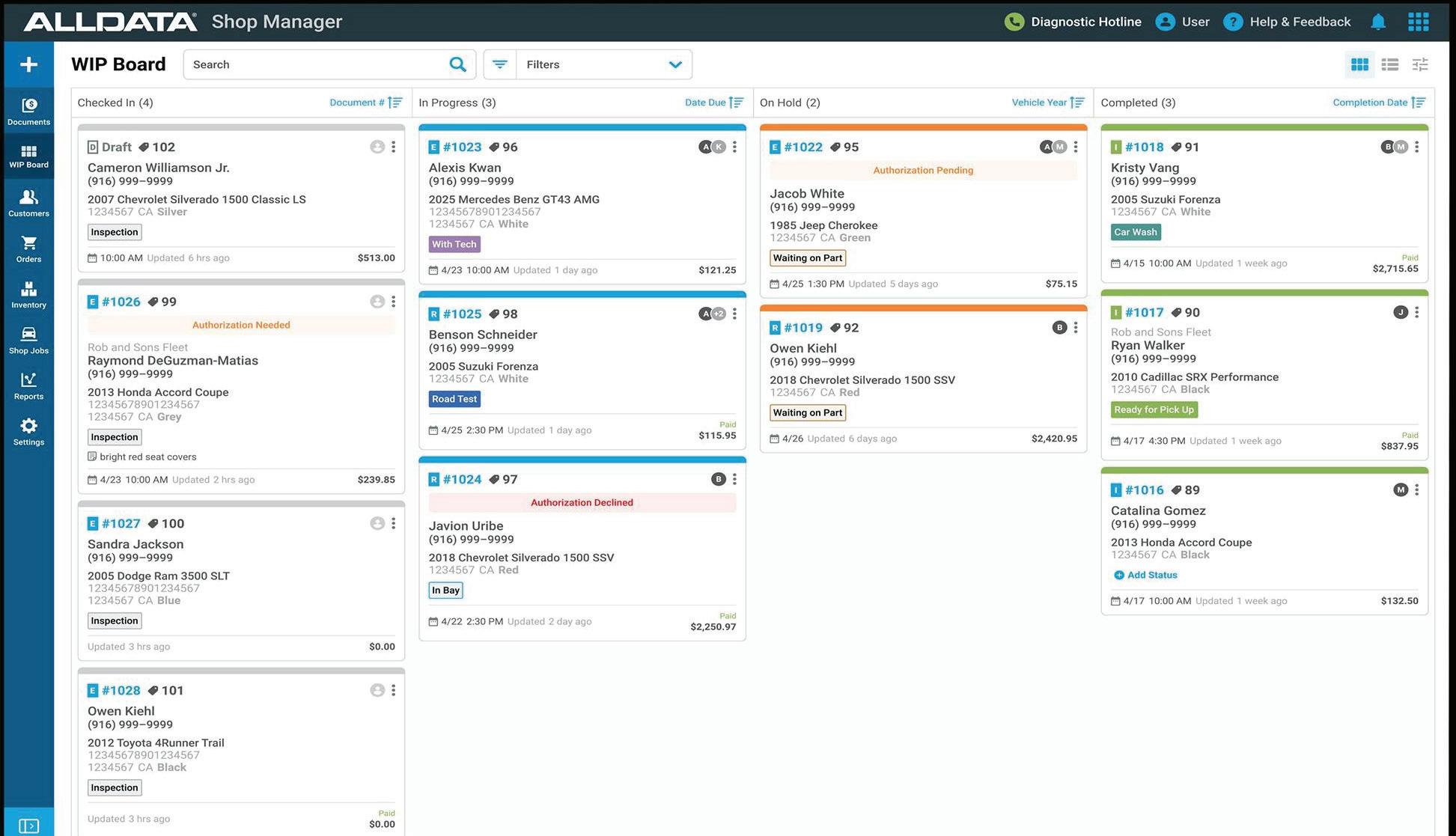

ALLDATA launched Shop Manager Pro, a shop management platform with enhanced functionality. Shop Manager Pro is designed “to help growing shops work smarter and scale with confidence,” according to ALLDATA officials.

ALLDATA said the platform is the only shop management platform that provides seamless integration with ALLDATA Repair, leveraging the full extent of ALLDATA Repair’s parts, labor and repair information, plus unedited factory diagrams, data and procdures,

Features include attachable photos and videos and two-way texting to enable the sharing of real-time updates, request work approvals and document repairs; automated parts and labor look-up with automated workflows for faster, more accurate estimates; and more.

Anyline unveiled major upgrades to its TireBuddy app at the 2025 SEMA Show.

“Built on a foundation of advanced AI, the enhanced TireBuddy app now delivers a more intuitive user experience,” said Anyline officials.

Key upgrades include an AI Assistant that autofills inspection notes, flags potential tire issues and improves technician-to-customer communication; improved on-boarding, which allows first-time users to benefit “from guided tips and intuitive walk-throughs to quickly master the app and its features;” enhanced scan guidance with visual overlays to help technicians capture accurate sidewall and tread area scans: and others.

Autel introduced the MaxiHVAC

Tire Shop Package Includes: (1) LS45DS-220V Wheel Balancer + (1) R980DP-220V Tire Changer + (1) Tape Wheel Weights

Revolutionize your tire and wheel service center with the ultimate pairing of precision and efficiency. Our combos redefine the standard, bringing you cutting-edge features without the hefty price tag. Elevate your services, amplify your efficiency, and see a direct impact on your profits. Don’t miss out on this opportunity to upgrade your work shop to the next level of performance. Connect with us at 1-800-253-2363 to speak with our experts or explore our combo offerings at www.bendpak.com. Discover the innovation, efficiency, and satisfaction that only Ranger can deliver – brought to you by BendPak.

AC909, “a revolutionary four-port manifold system designed to bring skill, understanding and precision back to HVAC diagnostics.”

Autel o cials said the MaxiHVAC AC909 combines “advanced technology, intelligent workflow and true system insight to restore the lost art of vehicle climate diagnostics and servicing.

“The AC909 is built to empower technicians with the knowledge and precision-focused tools and procedures that true HVAC system analysis demands and that technicians need to con dently service their customers’ vehicles today and tomorrow.”

Net Driven made several enhancements to its Connected Digital Platform to help tire dealerships strengthen their visibility, attract additional customers and more.

Hunter Engineering Co. demonstrated its new Road Force WalkAway wheel balancer, which the company says can cut tire changeover times by up to 45%.

“ e key component for the dramatic timesaving is the WalkAway In ation System, which automatically releases the inflation chuck when inflation is completed, allowing the machine to then perform the balance spin,” said Hunter o cials. “ is greatly reduces the time spent in ating assemblies on the tire changer.

Features include a shop performance dashboard, which provides real-time visibility into car count, repair orders and campaign results “to drive con dent decisions,” according to Net Driven o cials; smart quoting tools that will help provide “accurate service estimates online or by phone using each shop’s real parts and labor data;” and a digital marketing suite that provides automated outreach “that keeps shops top of mind with maintenance reminders and declined-service follow-ups.”

“ e time saved frees up the technician to tend to other tasks during in ation, such as retrieving more assemblies from the vehicle, cleaning vehicle hubs, changing tires on the tire changer, installing and pre-torquing assemblies or removing old wheel weights.”

When used in tandem with “a basic tire changer,” the Road Force WalkAway can help technicians change tires up to 29% faster, according to Hunter o cials. When paired with Hunter’s Revolution tire changer, “the time savings jumps to a potential 45%.

“Measured in minutes, the time savings are approximately 10 minutes with a basic tire changer, 12 minutes with Hunter’s Maverick tire changer and 15 minutes with Hunter’s Revolution tire changer.”

Other features include a new two-piece hood that enables the balancer to sit 4.5 inches closer to the wall; a new hood angle sensor to provide a smooth opening; and updated so ware. ■

As shopper expectations evolve, dealers are turning to datadriven insights and reliable tire options, with brands like Sailun providing products designed to meet the needs of tomorrow’s buyers. Modern buyers increasingly prioritize verifiable performance, family safety, and dependable choices when selecting tires.

As the tire industry moves forward, dealers are seeing notable changes in consumer behavior. Today’s buyers are more informed, often researching tire specifications, traction ratings, treadwear, rolling resistance and overall value. Many pay attention to performance certifications and approvals, such as wintercapable ratings or independent familyfocused endorsements. These patterns indicate that modern tire buyers increasingly prioritize longterm value, consistent handling, and safety rather than simply price.

Consumers are more focused on the practical benefits of a tire. Drivers want to understand how a tire performs in dry, wet, or winter conditions, how long it will last, and whether it contributes to fuel efficiency or ride comfort. Dealers that provide objective, datadriven guidance are better positioned to meet these expectations and build customer trust.

Meeting these demands requires balancing inventory to accommodate different vehicle types and driving conditions, while offering tires that are reliable and costeffective. Tires with published performance ratings helpstreamline conversations with customers, allowing dealers to present options that meet realworld needs rather than relying on marketing claims.

Several Sailun tires in the current lineup carry certifications and approvals that provide added assurance.

The Atrezzo 4S and Terramax AT2 have earned the 3Peak Mountain Snowflake (3PMSF) designation, indicating they meet industry standards for winter traction performance. Additionally, the Atrezzo 4S , ERANGE EV and Terramax AT2 have been granted the Today’s Parent Approved badge, reflecting independent evaluation for familysafe performance. These verified ratings help dealers guide customers toward tires that deliver allweather performance and peace of mind.

The Atrezzo 4S is a touring allweather tire for drivers who want a single tire for varied road and weather conditions, eliminating seasonal changeovers.

The Atrezzo SVA2 UHP is positioned for ultrahighperformance passenger vehicles, combining responsive handling with published performance ratings for wear and traction. These specifications allow dealers to offer factbased guidance to customers evaluating different performance priorities.

Electric vehicles are also influencing tire selection trends. Tires designed with rollingresistance optimization are increasingly relevant to EV drivers focused on efficiency and range. Sailun’s ERANGE EV uses proprietary EcoPoint3 technology engineered to balance grip, wear, and energy efficiency, making it an example of how tires can meet specific needs for a growing EV market segment.

SUVs and light trucks are another area where consumers are seeking versatile and reliable tire options. Sailun’s Terramax line provides allterrain and highwayfocused choices. The Terramax AT2 combines guaranteed on and off road traction with highway manners, while the Terramax HT2 emphasizes premium comfort, quiet cabin and longwear performance. Both models carry verifiable ratings, enabling dealers to explain realworld benefits in measurable terms.

All Sailun tires mentioned are covered by mileagebased limited warranties ranging from 50,000 to 65,000 miles / 60 months , depending on the model, and are included in a 2-year Road Hazard replacement program, giving drivers added protection and peace of mind.

Underlying these product lines is a focus on consistent manufacturing and quality control, which ensures that tires perform reliably across production runs. Technical resources, such as spec sheets and application guides, help dealers address common questions about tread life, seasonal capability, and vehicle compatibility.

Looking toward 2026, dealers will face a market in which buyers are increasingly selective, research driven, and focused on tangible data. Tires with verified ratings, consistent manufacturing, and multiseason capability are expected to influence purchasing decisions. Offering products that can be explained clearly and factually — supported by technical resources — enables dealers to deliver a confident, datadriven shopping experience.

Success in 2026 will depend on a dealer’s ability to translate technical information into meaningful customer guidance. By leveraging tires with documented performance, using available educational resources, and understanding evolving consumer expectations, dealers can help drive repeat business and longterm satisfaction.

Models like the Atrezzo 4S , Atrezzo SVA2 UHP , ERANGE EV , and the Terramax series exemplify how tire options can meet practical performance needs across multiple vehicle types. ■

Visit GoSailun.com

Sailun tires are distributed exclusively by the TBC Corporation in the United States.

Ben Tire has six wholesale warehouses and 25 retail stores that go to market as Neal Tire & Auto Service. The business operates in Illinois, Indiana and Kentucky.

Joy Kopcha By

With a century of service that spans six warehouses, 25 retail stores and about 300 employees, the story of Ben Tire Distributors Ltd. began on a much smaller scale, with a single service station in Toledo, Ill.

Edgar Neal opened that service station as Neal Oil Co. in 1925 and grew it into a medium-sized petroleum distributorship in central Illinois. In 1943, he became a B.F. Goodrich distributor.

Two years later, Edgar Neal’s son, Burnham E. Neal, returned home a er completing his military service.

e younger Neal took over operations at the service station and was eager to expand its tire business.

In 1959, the Neals opened a warehouse in Tuscola, Ill., and began to sell Dayton tires.

A year later, a tire dealer in Mattoon, Ill., sold his business to the Neals. It became the rst Neal Tire & Auto retail store.

In the decades since, both the wholesale and retail arms of the operation have grown and expanded with locations in three states: its original home turf in Illinois, plus Kentucky and Indiana.

Burnham Neal used his own initials to rename the corporate entity Ben Tire. e

retail stores continue to operate under the Neal Tire name.

A er 100 years in business, Ben Tire has withstood plenty of challenges. Jim La Neve is Ben Tire’s fourth CEO and he says in 2025 the company is well-positioned for the future. ese are “exciting times for Ben Tire. We’re in a really strong position (and) we can look at the next step, which is growth.”

Burnham Neal was ahead of his time in some regards. In 1991, he sold 30% of his shares of Ben Tire to employees to start an employee stock ownership plan (ESOP).

Preston Smith is chairman of Ben Tire’s board of directors and a retired banker.

Smith met Neal in 1979, when he took a new bank job as vice president of commercial lending. Neal was on the bank’s board of directors.

ey got to know each other well over the years and eventually became good friends. Smith remembers fondly Sunday morning rounds of golf. Neal and his wife, Nancy, had a home near the 12th hole and “you never went by … without stopping at Burnham’s house for a Bloody Mary.”

Over time, Smith watched Ben Tire grow and saw the Neal Tire footprint expand.

He remembers being in the bank president’s o ce the day Neal decided he wanted to create the ESOP.

“It was all Burnham’s idea from the beginning,” he says. One bene t, as Smith sees it, is that it allowed employees “to have skin in the game. at was certainly a big reason that he did it.”

Creating the ESOP also presented Neal with some signi cant tax bene ts, which Smith believes paved the way for Neal to make sizeable philanthropic contributions in his hometown and across Illinois.

Burnham and Nancy Neal’s names are attached to everything from the YMCA that was built in Toledo to student scholarships of Lake Land College. A nursing institute opened in 2004 with their names and in 2012, when Burnham Neal died, Eastern Illinois University recognized him as one of “the biggest nancial supporters in the university’s history.”

Smith says Ben Tire comes from a region heavily focused on agriculture. He’s seen with his own eyes how both the dealership’s wholesale and retail businesses are focused on customer service.

“ at was Burnham’s corporate culture: ‘Be nice to your customers because you’re going to need them worse than they’ll need you.’”

Amy Robinson is well-acquainted with Ben Tire’s hometown roots. She grew up in Toledo and was aware of the importance of the Neal family. When her sons were young, she took a part-time secretarial job at the company.A few months later, she was asked to join as a full-time worker. She took on di erent roles and landed in human resources, the department she now manages.

“My dad was talking about it (and said), ‘ at place has been around for a long time and it’s going to be around for a long time. I’m sure they have good bene ts. ey’re going to take care of you.’”

Robinson now spends much of her time working on things tied to those bene ts — and to the work of nding and retaining employees.

“Retaining talent is hard,” she says. “One of the things about the ESOP ... we try to get that in (a new employee’s) system quickly, so that they can understand it. It is our retention tool.

“Our hiring strategy is, ‘We’re not here to hire temporary people.’ We want to bring people on board, tell them the history (and tell them), ‘ is is what you’re part of now.’”

La Neve says the ESOP will serve an important role in Ben Tire’s future. It’s a critical piece in retaining employees. (In 2016, Ben Tire became fully owned by its employees.)

“If we can get them to stay a year, where they get that rst ESOP statement, people stay,” says La Neve. “Our turnover then is a lot lower. But that rst six months is the hardest part.”

He adds that paying a competitive wage is imperative, but also just the starting point. Ben Tire goes to market promoting its ESOP as “an investment for you.” e company also o ers a 401(k), and a company match.

Ben Tire started as a service station and then an oil distributor in Toledo, Ill. Today, the company has 300 employees who are celebrating the dealership’s centennial.

Photo: Ben Tire Distributors

“A lot of ESOPs don’t have that,” explans LaNeve, who say that many workers are so heavily focused on their hourly rate that they o en dismiss the extras that come with bonuses, plus the perks of the ESOP.

Ben Tire is poised to grow and La Neve

says the bene ciaries of that growth will be employees. In the rst 25 years of the ESOP’s existence, its share price grew by 2.7 times. In the last eight years, La Neve says it’s grown another 3.2 times.

“We can maintain that, but we want to keep it going and get some more multiples,” he says.

“To do that, we’ve got to grow the top line even more.” ■

• 61 sizes available to order

• Outstanding traction and handling

• 3PMS-rated for wet and wintry conditions

• Special grooves and sipes for clearing snow and water

Scan here to become a Prinx Tires dealer.

heat, and snow.

“2025 has been a challenging year,” says

To those who closely follow the United States ag tire market, it almost goes without saying that 2025 has been a tough year for ag tire suppliers and dealers. Ag tire manufacturers explain why — and o er a preview of what 2026 might bring — in this MTD exclusive.

MTD: What factors are negatively impacting ag tire demand and sales?

GAVIN BROUSSARD, national sales head, Apollo Tyres Ltd. (Vredestein): It’s been a tough year for both OE and replacement. Fortunately for us, the business still continues to grow strong.

ALAN ESKOW, head of replacement sales, BKT USA Inc.: e uncertainty of the market and the recent changes in U.S. trade policy had an impact on both OE and replacement agricultural tire sales in the U.S, thus causing an increase in production costs and supply chain complexities. Additionally, it paved the way for a reduction in export opportunities.

By under severe nancial strain. Commodity prices have slipped dramatically — corn recently dropped by more than 50% from its highs — and yet input costs remain stubbornly elevated. Meanwhile, global demand has so ened and trade tensions continue to undermine export prospects. A recent poll of U.S. growers suggests that anxiety about the future is widespread. Nearly half believe the sector is approaching a crisis. More than twothirds say they are more worried about their farms' nances in 2025 compared to the year prior. e capital investment outlook is also dim. According to surveys and lender reports, roughly 58% of farmers are likely to delay new equipment purchases. An estimated 38% may cut back on fertilizer or other input. Such belt-tightening is compressing margins and reducing reinvestment in operations. e extended use of aging machinery is slowing demand in the new equipment market. e fact that farmers are holding onto their equipment longer is adversely a ecting OE equipment sales, but bene ting ag tire replacement sales. In the replacement market, farmers are doing thorough research, looking for the best tire they can get at the very best price.

RYAN LOETHEN, president, CEAT Specialty Tires, North America: Over recent years, U.S. farmers have operated

TONY CRESTA, director of product management, CMA: Demand across the board was weak in 2024 and persisted into 2025. On the OE side, farmers have delayed new equipment purchases, while replacement sales are also so due to many macroeconomic factors. Higher interest rates, tighter farm margins and tari concerns have slowed down demand.

JAMEY SMART, vice president, North America, Firestone Ag: 2025 has been a challenging year for the U.S. ag tire market across both OE and replacement segments. So er commodity prices, high interest rates and persistent input costs have put pressure on farmers, prompting many to delay major purchases and extend tire replacement cycles. Dealers and OEMs are also taking a cautious approach a er the inventory build-up in 2022 and early2023, focusing on managing existing stock rather than placing new orders. In addition, newer equipment cycles in recent years have already refreshed much of the eet, leading to less immediate replacement demand. Weather has added another layer of di culty, with late planting and uneven growing seasons limiting eld time and extending tire life. Despite these headwinds, the long-term outlook for U.S. agriculture remains strong,

CHRIS RICE, executive vice president of sales, Galileo Wheel: 2024 through early 2025 has been di cult. Both OE and a ermarket segments show clear declines. Industry data backs this up. Dealers who over-ordered in 2024 are being more careful. What’s happening at the farm level explains why. e core problem is simple: farmers are making less money. Corn prices dropped to $4.10 to $4.40 per bushel in 2024 and forecasts show $3.90 for 2025. Soybeans follow the same pattern: $10.80 in 2024, trending toward $10.00 or below in 2025. Meanwhile, input costs haven’t come down to match. Fuel, fertilizers, labor costs, interest rates — all remain high. When margins get squeezed like this, equipment purchases wait, so

CALLING ALL DEALERS. ARE YOU READY TO HYPERDRIVE YOUR BUSINESS?

Delinte Tire’s NEW HYPERDRIVE Associate Dealer Program™ is here to give independent tire dealers an opportunity to put some extra cash in their pockets.

Join the HYPERDRIVE Associate Dealer Program today and start earning up to $3 per tire.

IT’S EASY. NO OPENING ORDER REQUIRED. JUST PRE-ENROLL>SELL>START EARNING.

All Delinte PCR and LTR tire models, including the new DV3 LMD AS Last-Mile Delivery tire are eligible for the rewards.

EASY MONEY HYPERDRIVE REWARDS LEVELS:

LEVEL 1 Buy 48 units - GET $1 per tire [ $192 per year ]

LEVEL 2 Buy 120 units - DOUBLE your rewards to $2 per tire [ $960 per year ]

LEVEL 3 Buy 240 units - TRIPLE your rewards to $3 per tire [ $2,880+ per year ]

YES! YOU CAN EARN OVER $2,880 DOLLARS A YEAR WITH HYPERDRIVE.

DISTRIBUTORS:

IF YOU WANT TO SELL DELINTE TIRES AND OFFER HYPERDRIVE REWARDS TO YOUR DEALERS, CONTACT US TODAY ON OUR WEBSITE AT DELINTETIRES.COM/ DEALER-INQUIRIES.

ENROLL TODAY TO START RECEIVING REWARDS SCAN TO ENROLL

farmers respond by keeping equipment longer instead of buying new. This hits OE sales hard, but provides some support to the replacement market. Farmers still need tires to keep older equipment operational. We’re also seeing weakness in adjacent sectors like construction, which affects demand for skid steer and construction-oriented tires. Another point is that the agricultural sector moves in cycles. U.S. gross farm income grew from $250 billion in 2001 to over $604 billion by 2022. During and after COVID-19, demand for irrigation equipment stayed strong. Center pivot machines use a lot of tires. That demand started falling in 2024 as the cycle turned down. It will turn back up eventually. Timing depends on how various market factors play out. Longterm direction stays positive even when short-term numbers look rough. Food production doesn’t stop, so farmers need equipment and equipment needs tires. The sector proves recession-resistant time and again. The real question isn’t if recovery happens, but when — and which companies come out stronger. The ones that keep innovating and serving customers well during tough periods usually get higher profits when things improve.

GREG GILLAND, vice president, global agriculture, Maxam Tire North America: The answer is going to be unique for each tire manufacturer. Maxam is a newer brand to the U.S. ag market and we are still growing our brand footprint both in the dealer/distributor-driven aftermarket,

while engaging the OEMs to grow our footprint. Our performance in 2025 has allowed us to positively grow our sales year-after-year, despite having to make capacity changes due to the newly tariff conditions. From the farmer or grower perspective, commodity crop prices remain stable versus 2024, with some short-term gains or losses crop by crop. The current outlook for 2026 — with fuel costs lower than in 2024, with improvements in 2025 — means that despite operational costs being high but stable, crop prices, especially for corn and soy beans, are expected to increase in 2026. As always, farmers are going to buy when they can to keep profit amortized or invested in their business versus paying higher profit taxes.

PAUL HAWKINS, senior vice president, aftermarket sales, Titan International Inc.: It’s been a challenging year in these channels. Lower farm income and uncertainty with corn and soybean sales this year are delaying farmers making large investments, including replacement tires. Farmers are limiting expenditures to essential needs — prioritizing equipment repair over replacement to maintain operations at minimal cost.

TOM RODGERS, commercial director, ag, North America, Yokohama TWS: The U.S. agricultural tire market has certainly faced headwinds in 2025, shaped by a combination of global and local factors. Lower commodity prices, partly influenced by

“The uncertainty of the market and the recent changes in U.S. trade policy had an impact on both OE and replacement agricultural tire sales,” says Alan Eskow, head of replacement sales, BKT USA Inc.

Photo: BKT USA Inc.

ongoing trade tensions with China; a weaker farm bill; and persistently high input costs have all put pressure on farmers’ budgets. As a result, many producers have chosen to delay investments in new machinery and equipment, which has primarily impacted the OE segment. On a more positive note, we’ve seen above-average crop yields across much of the Midwest, which should translate into stronger farm incomes and consequently, improved replacement demand toward the end of the year.

CHAN PHOTHISANE, OTR national sales director, ZC Rubber America Inc.: The ag tire industry is down due to

When the work is heavy and conditions are punishing, Yokohama OTR bias tires deliver the durability, stability, and cut resistance that tough earthmoving jobs demand. Their strong sidewalls and solid, proven construction make them ideal for dozers, loaders, and scrapers operating on rock, dirt, or uneven terrain — where long hours, sharp turns, and constant torque can challenge even the best radial. Dependable. Proven. Built to last shift after shift, year after year.

Ask your Yokohama OTR rep about our complete line of bias tires, or visit yokohamaotr.com

www.yokohamaotr.com

several factors. Inflation has affected the operating cost and crop price has fallen. The Midwest states experienced abnormal drought to severe drought and other farm areas had too much rain. Slow demand from OE carried over from 2024 into 2025. This did not help move domestic inventory stock out of the warehouse. Aftermarket factory-direct container sales are down due to the uncertainty of tariffs. Everyone

was waiting for the final tariff decision. Many tire dealers did not want to overstock and were ordering domestically. Tire wholesalers were watching their inventory closely and only ordered what was needed.

MTD: Have tariffs had an impact on your ag tire business? If so, what are you doing to mitigate the impact? How are your dealers and distributors reacting?

¶ Visual inspection relating to damage

¶ Cracked welds

¶ Retention pin holes oblong-shaped

¶ Correct retention pins

¶ Readable decals and placards

¶ Compromised

BROUSSARD (APOLLO/VREDESTEIN): Tariffs have certainly created headwinds and questions for us. We’re managing this through tighter cost controls, smarter logistics and closer coordination with our dealer partners to stay competitive during the shift.

¶ Visual inspection relating to damage

¶ Excessive wear

¶ Missing components

¶ Leaks

¶ Complete functional test

¶ Readable decals and placards

¶ Visual inspection relating to damage

¶ Leaking fluids

¶ Non-OEM conforming, tampered with or missing components

¶ Readable decals and placards

Visual inspection relating to damage

Cracked welds

Excessive wear

Missing components

Complete functional test

Readable decals and placards

Compromised

ESKOW (BKT): Despite the difficulties and the many challenges that have arisen in the global and local scenario — both related to recent changes in U.S. trade policy and due to the geopolitical landscape — BKT is working in synergy with its distributor partners and dealers to mitigate the effects of this situation. For example, we have carefully managed our spending to minimize the impact of tariffs and maintain our position.

LOETHEN (CEAT): The marketplace is extremely unpredictable right now, largely because of the ongoing tariff situation. With so much uncertainty about how things will develop, I’m encouraging our dealers to stay laser-focused on their farmers’ immediate needs. The priority should be having enough inventory on hand to support customers through the upcoming season, whether it’s harvest or planting.