Navigating Construction to Permanent SYSTEMS BUILT

FAQS

What is Systems-Built Construction to Perm?

When do we do the middle draw?

How many inspections are required?

When can the retailer set the house?

How do payments during the construction period work?

When is the home considered “finished” and ready for final draw?

Can the borrower be the general contractor on their build?

Can a family member of a borrower be the general contractor on their build?

C2P Systems Built Steps

Overview

STEP 1: APPLICATION

STEP 2: CP WORKSHEET

STEP 3: CP SUBMISSION

STEP 4: CP PURCHASE CONTRACT

STEP 5: APPRAISAL, TITLE, & PAPERWORK

STEP 6: RATE LOCKS / FLOAT DOWNS

STEP 7: LOAN CLOSES

STEP 8 & 9: MIDDLE & FINAL DRAW

SystemsBuilt

/ˈSISTƏM/- BILT/

A manufactured home is a factory-built residence that can be placed on a piece of land. It costs much less than a traditional new build.

GETTING STARTED WITH CONSTRUCTION-TO-PERM (SYSTEMS-BUILT)

What you should know about C2P before you get started.

Whether you’re working directly with a customer that has inquired about modular/manufactured financing or you’ve struck up a relationship with a dealer or Realtor, it’s important to know that Construction to Permanent financing has several moving parts.

This guide is designed to walk you through setting up this unique product offering according to our set of standard operating procedures, from structuring the loan, the necessary purchase contract documents, and various required inspections, from closing to the final draw

We’ve outlined this information in a linear fashion but understand that Construction to Permanent financing by its very nature can feel like a non-linear process by comparison to other loan products at the beginning.

But no worries – you have a team to support you along the way

Please note: As this program and processes evolve, this guide will act as a living document to keep you in tune with those changes

Bookmark the link for Navigating Construction to Permanent Systems Built to your web browser and ensure you always have the most current edition!

You’ve met with your borrower.

And they’re vibing on a manufactured/ modular home. To begin, you’ll take the application and prequalify the customer as you normally would

�� One quick reminder: CP Systems Built goes by Agency Guidelines with 3 exceptions Please note these exceptions and proceed accordingly!

As your borrower considers the type of manufactured/modular home they’re after and settle on the options for their home, you can begin set up of the CP Worksheet for Systems Built. TAKE THE APPLICATION

C2P Systems Built Exceptions to Agency Guidelines are:

Owner Occupied Only (for all loan options)

620 Min. Credit Score for Government

700 Min. Credit Score for Conventional; A/E required on Conventional & Max 95% on Conventional

It’s possible, if not extremely likely, your borrower has already met with a manufactured housing dealer. Once they have been prequalified for a loan amount, your borrower will either return to their dealer or (perhaps) meet with a manufactured housing dealer for the first time to zero in on a home model that fits their prequal amount and, if they do not own land, they might also meet with a Realtor to discuss land options

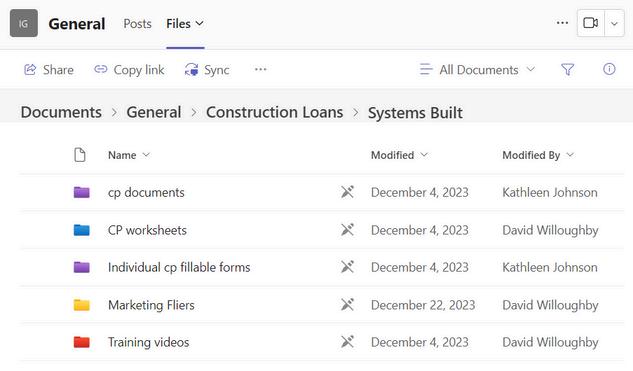

Q: Where do I find the CP Worksheet?

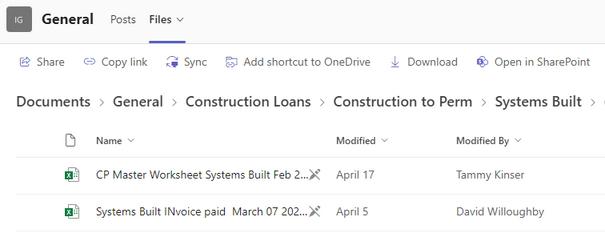

You can find the CP Worksheet in the Investor Guidelines and Loan DocsGRP in Teams, under General. Click on the Construction Loans folder, then click Systems Built, then click CP worksheets. There, you’ll see a CP Master Worksheet Systems Built.

Download the Excel worksheet from Teams to your files locally (i.e. your downloads folder, your desktop, wherever you choose on your hard drive)

Rename your downloaded CP Worksheet using this naming culture: Borrower Last Name + Loan Number + Date Example: Willoughby 1234567 3 21 24

PLEASE NOTE: You will need the following information to proceed: Sales agreement (to ensure all necessary items are included) Land details

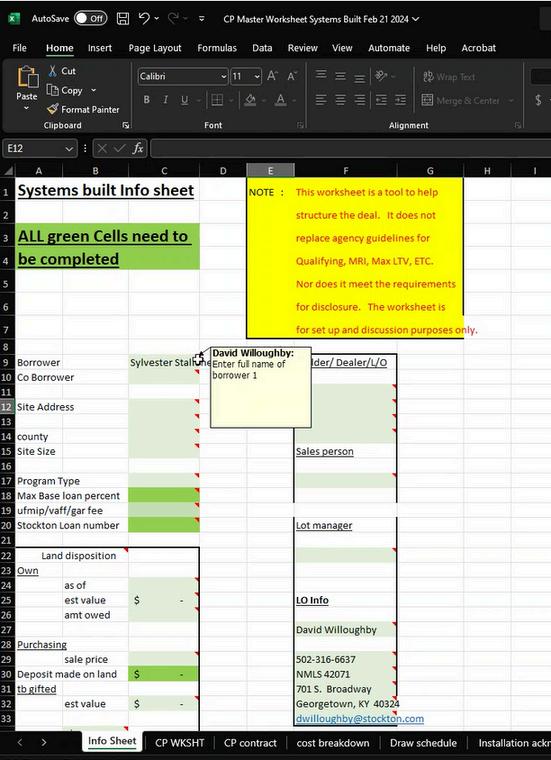

Completing the CP Worksheet

On the first tab of the Info Sheet, complete each green field with the required information. You need only to enter info into the fields on the Info Sheet and the Excel’s logic will populate the remaining tabs, which include the CP Worksheet, Contract, Cost Breakdown, Draw Schedule, etc. You can hover over the red dog ear for clarity on the precise information needed to complete each field

After you have completed the Info Sheet in full, save your changes and send the Excel document as an attachment to construction@stockton.com for review, with Subject line: Borrower Name CP Worksheet Review Request. (Again, please be sure your Excel is titled: Borrower Last Name + Loan Number + Date) The C2P team will review the worksheet and reach out with any questions they have

Before proceeding beyond this point in the process, you’ll wait for approval from David Willoughby / designated C2P point persons to move forward. Reviews typically take 1 business day to complete, at which point someone from the C2P team will reach out to you to greenlight the loan

You’ve gotten the greenlight to proceed.

Now you’re ready to sit down with your customers and review the numbers together!

Once the customer is comfortable with those numbers, the next step is for the customer circle back to the dealership to firm up costs.

Now that they’ve firmed up the numbers with the dealer, you’re ready for File Setup in Encompass

Builder/Dealer Verification

As you’re entering your file in Encompass outlined in the steps to follow, you’ll want to verify that the Builder/Manufactured Dealer your borrower intends to use has been fully vetted by the C2P team Reaching out to construction@stockton com with the Builder/Dealer’s name and business information, along with any sales representative’s contact information needed to confirm whether or not further due diligence is needed

IF Stockton has NOT worked with the Builder/Dealer to complete previous transactions, the C2P team will work with you to conduct the necessary due-diligence, ensuring all bases have been covered Typically this process entails the Builder/Dealer completing a questionnaire regarding recent builds and sound financial standing, along with other questions to confirm their proven ability to complete a successful and satisfactory buildas well as clear any potential hurdles or associated risks down the road.

SETTING UP THE FILE IN ENCOMPASS

Setting up C2P in Encompass

Follow the steps described in this section to walk through setting up a C2P file in Encompass

David Willoughby will assist with this process until you’ve been trained 1:1 on the submission of approximately 5 deals, at which point you may refer back to these steps/video/process as a refresher for C2P set up going forward.

If you have not received this 1:1 training and successfully submitted previous C2P deals, please stop here and reach out to construction@stockton.com before proceeding.

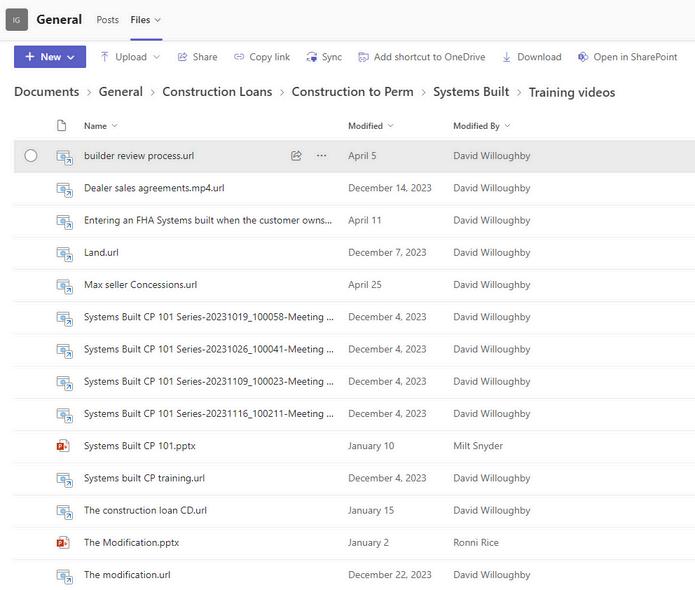

If you have received this 1:1 training but need a refresher, you can refer to the video tutorials found in Teams within the Investor Guidelines folder under Construction Loans > Construction to Perm > Systems Built > Training videos

Docs Go Out for Signature

After the file is set up in Encompass, the C2P team will send out construction documents for all parties to sign. Once signed, the C2P team will upload the docs into Encompass, meanwhile

Collect C2P Contract Docs

As the C2P team works to collect executed docs from the borrower, coborrower, and various other parties, you will need to collect the necessary docs that make the CP Purchase Contract.

The packet of information below will be used to order appraisal and title work:

CP contract

CP budget

CP net to dealer/ Draw Schedule

Land contract (if needed)

Copy of survey and deed (if available)

Printout of USPS address

Plans and specs from the factory (by way of dealer)

❗��PLEASE NOTE: The dealers sales agreement is not part of the CP contract and should not be uploaded to Encompass or sent to the appraiser.

Upload Contract Docs

After you’ve acquired / scanned in the above docs, you’ll need to complete the following form. This will share the C2P Contract Docs with the construction team so they can review and work with you to submit the documents.

If you don’t have everything the form prompts for - not to worry You can use this form to upload additional docs when you get your hands on them later.

C2P DOCS SUBMISSION

Ordering the Appraisal & Title Work

After you’ve met the Contract Docs requirements, you can proceed with ordering your appraisal

The appraisal ordering process is handled the same way you would order an appraisal on any loan, which will be processed through Reggora

Appraisal, Title & Initial Underwrite

With Appraisal, Title, and the Initial Underwrite in hand, you’ll submit those docs back to the C2P team, and they will work to submit all the information to Land Gorilla for approval

Land Gorilla Approval

You can expect a review period of 3-5 business days before you receive approval from Land Gorilla Once Land Gorilla has approved, the C2P team will upload everything into Encompass for final submission.

Locking C2P Loans

When the file is ready to submit for Clear-to-Close, you’ll be ready to lock the loan! To lock your loan, reach out to David Willoughby for assistance

At the time your borrower’s C2P loan closes, your borrower’s terms will likely consist of interest-only payments until the home is ready for them to begin occupancy

Please note: With the exception of USDA, your borrower may have a capped interest rate with a float down option. USDA is not eligible for float-down.

The interest-only payments owed after closing and during construction are issued to the builder as a soft cost - so your borrower makes no payments during the construction period. Because this expense is rolled into the builder’s costs, it will be charged back to the borrower once the loan is modified

Closing & Modification

After the loan closes - the real work begins!

Closing signifies the issuance of funds to begin the build You will work with the C2P team to issue the draws necessary to complete the project.

Once the house is finished, a final inspection and the issuance of official documentation signifying the home is complete and ready to be occupied means it’s time to modify the loan.

If the product is eligible and the borrower agreed to it at closing, it’s at this point in the process the loan is modified and rate is floated down

How many inspections are required?

Pre-pour foundation inspection on the HUD forms (Foundation Letter)

Middle Draw Inspection: the engineer will do this inspection to show that the home has been delivered and anchored to the foundation and meets HUDs minimum property standards.

Final Inspection: The engineer to do the final inspection This can be used in place of an appraiser for a final inspection The final inspection includes the required HUD forms and the final photos to show the home is complete.

Stockton’s C2P team requests that the retailer order all inspections which gives them control over the draw process The retailer would know before the lender to order inspections and draws which should speed up the process.

After the loan closing, is the retailer is ready to set the house?

Yes. The initial inspection is the pre-pour. Most all retailers have a relationship with an engineer. It is up to the retailer to determine who to use as the engineer Hayman is a good option They have done many of these inspections and are familiar with the paperwork required

What happens after the Anchored/Second Draw?

Stockton’s C2P Team asks that the retailer contact us hopefully a week in advance of needing a draw.

The Lender will request the title update from the title company

·The retailer will order the inspection with the engineer, ideally the same engineer that did the pre-pour inspection. If the engineer is not able to do the inspection, we can contact Land Gorilla for the inspection Normally it is a slower process with Land Gorilla

·Once the middle draw is initiated, we will contact Land Gorilla requesting documents that need to signed by both the borrower and the retailer.

We will need copies of building permits, the draw inspection, title update and the signed draw request forms to release the middle draw

When is the home considered “finished” and ready for final draw?

To initiate the final draw, the C2P team asks the retailer to follow similar procedures as the middle draw. The retailer initiates the final draw inspection with the engineer and alerts us that the home is finished and ready for the final draw.

The engineer does the final draw inspection

The C2P team will initiate the final title update.

Overview of Final Draw Release Items:

The final engineer inspection on the HUD forms along with pictures

Termite pre-treat 99a and 99b

Final certificate of occupancy

Final title update

Final health department approval for septic and or well

Any remaining new construction exhibits

The final request forms with both the buyer and retailer’s signatures

Can the borrower be the general contractor on their build?

No

The borrower cannot build the home or act as the general contractor The borrower cannot do any of the work on the build. C2P requires one entity we can look to finish the transaction; i.e. one party to be responsible for every line item on the build

Can a family member of a borrower be the general contractor on their build?

The short answer is “no”. The borrower’s immediate family cannot build the home or act as the general contractor. There may be some exceptions if the family member is far enough removed from the borrower - if this is the situation for your borrower, please contact David Willoughby to discuss specifics before proceeding further