34

Making a Brand Stand

Partnerships, differentiation and even playfulness in branding and marketing can keep customers coming back.

46 Level Up!

Developed by retailers for retailers, NACS Show Education Sessions help the entire industry succeed.

58 Wake Up Call: Get Ready for Sunrise 2027

This Q&A is brought to you by GS1 US.

It’s time for retailers to prepare for the transition to 2-D barcodes.

70 Charging Forward

The environment for EV charging has changed but opportunities remain.

80 Making a Menu

Creating new prepared foods requires research, testing and innovation.

Check out expected—and unexpected— ways to enjoy your temporary home during the 2025 NACS Show.

Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily

106

Is Zero a Hero?

Ethanol-free gasoline can be a destination fuel for niche customers and operators of specialty equipment.

FEATURES

92

Lottery in Every Lane

This article is brought to you by Abacus Lottery.

New integrations with POS systems can provide c-stores a winning ticket to increase lottery sales.

96

What’s Driving Travel Center Growth?

The why—and how—convenience retailers are investing in separate diesel fueling islands.

114

EVs and the Three C’s

This article is brought to you by Ionna.

As EV usage continues to grow, and the pool of EV drivers expands, confidence, comfort and convenience drive charging visits.

118

Path to the Pump

An increasing number of drivers are willing to go out of their way to visit a convenience store just because they like it.

126

Q&A: Onvo

Harman Aulakh of Onvo shares what went into the company rebrand, what makes Onvo stand out and insights on its partnership with Penn State.

134 Making Giving Back a Core Value

Parker’s Kitchen fuels change for women in need at Parker’s House.

A FACT

$4,057

The average gross profit dollars per store, per month from hot dispensed beverages in 2024.

CATEGORY CLOSE-UP PAGE 150

face regulatory confusion and risk customer frustration as USDA approves unprecedented state-level SNAP restrictions.

Ideas 2

Gas Station Gourmet

Category Close-Up Hot dispensed beverage sales slow down but a hot cup of coffee remains an essential c-store staple.

EDITORIAL

Jeff Lenard

VP of NACS Media & Strategic Communications (703) 518-4272 jlenard@convenience.org

Ben Nussbaum

Publisher & Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Leah Ash

Editor/Writer lash@convenience.org

Lauren Shanesy Editor/Writer lshanesy@convenience.org

Noelle Riddle Editor/Writer nriddle@convenience.org

Chrissy Blasinsky Digital & Content Strategist cblasinsky@convenience.org

CONTRIBUTING WRITERS

Amanda Baltazar, Joe Beeton, Sarah Hamaker, Al Hebert, Steve Holtz, Leigh Kunkel, Pat Pape, Keith Reid, Emma Tainter

DESIGN

Ji Ho Creative Director jho@convenience.org

Erika Freber Art Director efreber@convenience.org

David Marvin Graphic Designer dmarvin@convenience.org

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

NACS BOARD OF DIRECTORS

CHAIR: Brian Hannasch Alimentation Couche-Tard Inc.

TREASURER: Annie Gauthier, CFO/Co-CEO, St. Romain Oil Co. LLC

OFFICERS: Chris Bambury, Bambury Inc.; Varish Goyal, Loop Neighborhood Markets; Lonnie McQuirter, 36 Lyn Refuel Station; Charles McIlvaine, Coen Markets Inc.; Tony Miller, Retail Delek US

GENERAL COUNSEL: Doug Kantor, NACS

MEMBERS: Lisa Blalock, BP North America Inc.; Tom Brennan, Casey’s; Andrew Clyde, Murphy USA; Brian Donaldson, Maxol Limited; Terry Gallagher, Gasamat Oil Corp./Smoker Friendly; Erin Graziosi, Robinson Oil Corporation; Raymond Huff HJB Convenience Corp.

NACS SUPPLIER BOARD

SUPPLIER BOARD CHAIR: Vito Maurici, McLane Co. Inc.

CHAIR-ELECT: Bryan Morrow, Chobani & La Colombe

VICE CHAIRS: Mike Gilroy, Mars Wrigley; Jim Hughes, GALLO; Kevin LeMoyne, The Coca-Cola Co.

MEMBERS: Tony Battaglia; Ryan Calong, Pabst Brewing Co.; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Fueling Solutions; Matt Domingo, Reynolds; Mark Falconi, Greenridge Naturals; Ramona Giderof, Diageo Beer; Danielle Holloway, Altria Group Distribution Co.; Kevin Kraft, Tropicana Brands; Jay Nelson,

dba Russell’s; Mark Jordan Refuel Operating Co.; Brian McCarthy, Blarney Castle Oil Co.; Natalie Morhaus, RaceTrac Inc.; Jigar Patel, Fastime; Robert Razowsky, Rmarts LLC; Stanley Reynolds, 7-Eleven Inc.; Kristin Seabrook, Global Partners LP; Travis Sheetz, Sheetz Inc.; Babir Sultan, Fav Trip; Doug Yawberry, Weigel’s Stores Inc.; Scott Zietlow, Kwik Trip Inc.

PAST CHAIRS: Victor Paterno, Philippine Seven Corp.; Don Rhoads, The Convenience Group LLC.

SUPPLIER BOARD

REPRESENTATIVES: Vito Maurici, McLane Co. Inc.; Brian Morrow, Chobani & La Colombe

Excel Tire Gauge LLC; Jordan Nicgorski, JUUL Labs; Nick Paich, TriggerPoint Media; Sarah Vilim, Keurig Dr Pepper; Derek Zahajko, CAF Inc.

GENERAL COUNSEL: Doug Kantor, NACS

STAFF LIAISON: Bob Hughes, NACS

RETAIL BOARD REPRESENTATIVES: Tom Brennan, Casey’s; Scott Hartman, Rutter’s; Kevin Smartt, TXB

PAST CHAIRS: David Charles, Cash Depot; Brent Cotten, The Hershey Co.; Kevin Farley

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2025 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

Ben Nussbaum Editor-in-Chief

hat’s a brand? It’s more than a logo. It’s a feeling, a vibe—a personality. Nike, Apple, Starbucks, Chipotle: These companies have a brand—a personality— that’s more than just the items they sell.

The industry has always had logos, of course, but not necessarily strong brands. That’s changing. Retailers are focused on a consistent personality across all customer touch points, whether that’s social media, the coffee bar or the prepared food menu.

Logos are easy. Brands are hard. “Making a Brand Stand” offers ideas for how to build retail brands. When it comes to brands, by definition, there’s no one-size-fits-all approach, but I hope the article provides great food for thought.

Speaking of food for thought—and food, for that matter—it’s almost time to meet in Chicago at the 2025 NACS Show. Bring your appetite to the Expo floor, where there are countless samples. Bring your preferred note-taking device as you capture the ideas, big or small,

that can change your business as you walk the Expo, catch up with old friends or meet new ones, and attend any of the Education Sessions. Attending Education Sessions—about 50 opportunities to learn from the industry’s best and brightest, spread out over three days—is one of the highlights of my year. This issue of NACS Magazine contains previews for every 2025 NACS Show Education Session.

Another article highlight of this issue, for me, is on the charitable engagement of Parker’s Kitchen, “Making Giving Back a Core Value.” To go back to the idea of retail operations having a brand—a personality—how can companies choose their charitable engagement in a way that maximizes their impact in the community and simultaneously tells a narrative about the brand?

It turns out there’s an Education Session for that: “Crafting Stories that Amplify Your Brand Message.” Chances are good I’ll be in the audience for that one.

From the #1 Coconut Water SKU nationwide * to iconic Latin favorites like Malta, Aloe Vera, and tropical sodas, GOYA® Beverages deliver the authentic taste your shoppers crave. With broad appeal, trusted quality, and proven sales, GOYA® keeps your beverage set refreshing and fast-moving. Stock up and watch the demand grow.

Josie Johnson was a regular customer at 36 Lyn Refuel Station in Minneapolis for 13 years before she became the store’s manager in 2022.

“My son practically grew up in the store. Lonnie [McQuirter, store owner] was always there to scoop him up when we came in, let him behind the counter, play Matchbox cars with him … there was always someone working at 36 Lyn who cared about us,” she said. “I was at a crossroads in my career—I have a background in social work, education and low-income advocacy—and when I interviewed at 36 Lyn, I told Lonnie, ‘I want to be the person for someone that you guys always were for me.’”

She spoke with NACS about:

We are that constant for the community. We open early and close late. We are that reliable destination that’s here with your coffee every day, no matter what. To be that for someone, to be the place that has everything they need— that’s what convenience means. It’s so meaningful to work in this industry and be the person who can always deliver or just put a smile on someone’s face so that they walk out of the store happy. People will always need convenience stores, so I try to think about what I can do with that opportunity. You are the one setting someone up for success after they leave your store, whether they’re going to work in the morning

or starting a road trip—whatever it is they’re on their way to do, they come to us for what they need to make their day better.

We have a very diverse demographic in our area of south Minneapolis and we have a large Somali customer base. When I first started, the Muslim holiday Eid—which marks the end of Ramadan—came around, and I wanted to learn about its significance. I asked customers what Eid meant to them, and they told me with so much fervor and excitement because someone had actually even asked. They told me about how the prophet Muhammad would break his fast with a date, and we carry

Medjool dates in our store. We also carry sesame cookies and Ethiopian coffee, which they also said reminded them of home. After that, they would bring us plates of food after sundown and want to celebrate with us too. I’ve now learned to speak a couple phrases of Somali. When you speak to a child in their language who isn’t expecting it, their face really lights up! It shows you care about them, and it was really special to me that they wanted to share their culture with me.

WHY SHE WOULD ENCOURAGE OTHERS TO WORK IN CONVENIENCE

I would challenge people to forego the status quo. This is so much more than working at a gas station. We are a family and a strong community, and there is so much gratitude in all my everyday interactions. You can have a huge impact on someone’s life, even just by being there as a smiling face. It’s magical.

Do you have a frontline worker that showcases why convenience jobs are great jobs? We want to hear about them. Submit candidates for Faces of the Industry by emailing news@convenience.org.

In June, NACS won a U.S. Supreme Court case regarding whether it could challenge the state of California’s Advanced Clean Cars I rule. With the win, the challenge is sent back to the trial court.

The California rule set standards requiring 22% of new vehicles sold in the state to be “zero emission” in model year 2025. The rule is a precursor to later California rules that over time would require 100% of new vehicles sold in California to be “zero emission.”

The D.C. Circuit Court of Appeals had previously ruled against NACS on the grounds that automakers would do the same thing regardless of whether the rules were in place. In the court’s view, that left NACS and its partners without any legal complaint because invalidating the rule would not help them, leading the Supreme Court to consider whether that was the correct reading of the law and whether the

case can proceed to the ultimate question of the legality of Environmental Protection Agency’s (EPA) waiver for California.

NACS argued that its members were harmed by the rule as written and the entire intent of the rule was to reduce the sale and use of motor fuel.

“We are pleased that the Supreme Court rejected California’s attempt to hide behind a hollow legal technicality,” said Doug Kantor, NACS general counsel. “Everyone knows that by mandating specific vehicle technologies, the California rule limits the cars that could be bought in California and other states. If the rule had no impact, as California argued, there would be no reason for it to defend the rule in Court. The state’s own actions showed our coalition was right to bring this case.”

For California to set its own rules, it must be granted a waiver to do so by the EPA. Those waivers are supposed to be based upon the specific air quality needs in California. Instead, California asked for a waiver based on its concern about global climate change, not California-specific air quality. NACS, coalition partners in the traditional and renewable fuels industries and several other states filed challenges to the waiver on the basis that global issues must, under the law, be addressed by national standards.

NACS presented evidence that picking one technology over others leads to worse outcomes for the environment and the economy.

“What if food wasn’t the problem, but the solution?” asked José Andrés, Emmy Award-winning TV personality, restauranteur and founder of World Central Kitchen, in a welcome video kicking off the Good Food for All Summit 2025, which took place in June in Washington, D.C.

The Summit, hosted by the Partnership for a Healthier America (PHA) and the Global Food Institute, brought together leaders to address and improve the nation’s current food system.

NACS, which was named PHA’s 2019 Partner of the Year for spearheading the industry’s move toward healthier options, was a sponsor of the event. NACS Foundation Executive Director Kevin O’Connell and NACS Vice President of Media & Strategic Communications Jeff Lenard attended the event to represent the industry.

OCTOBER

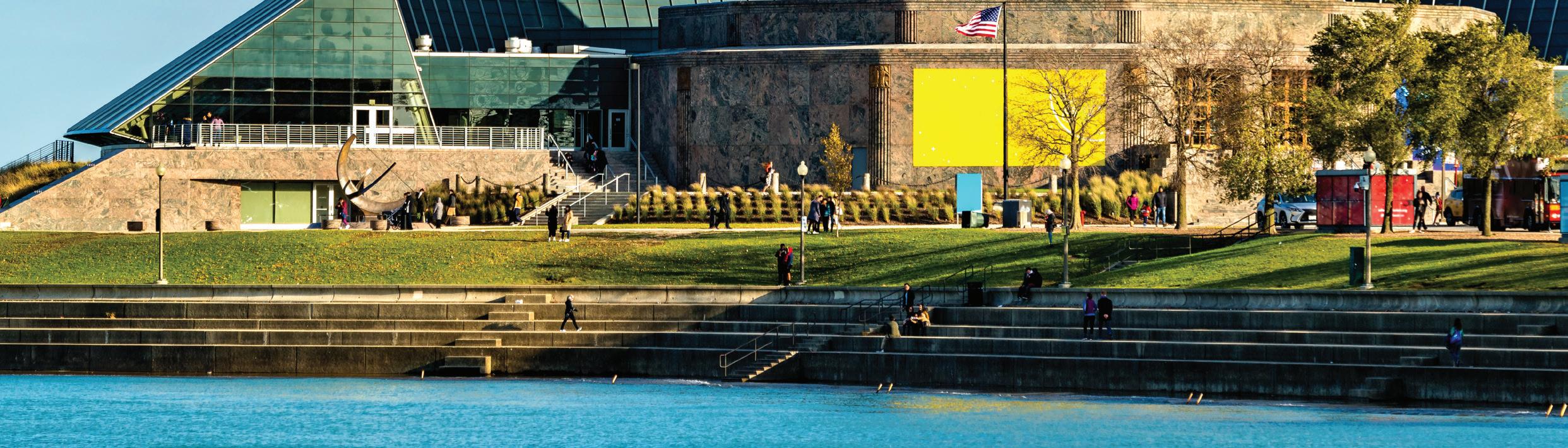

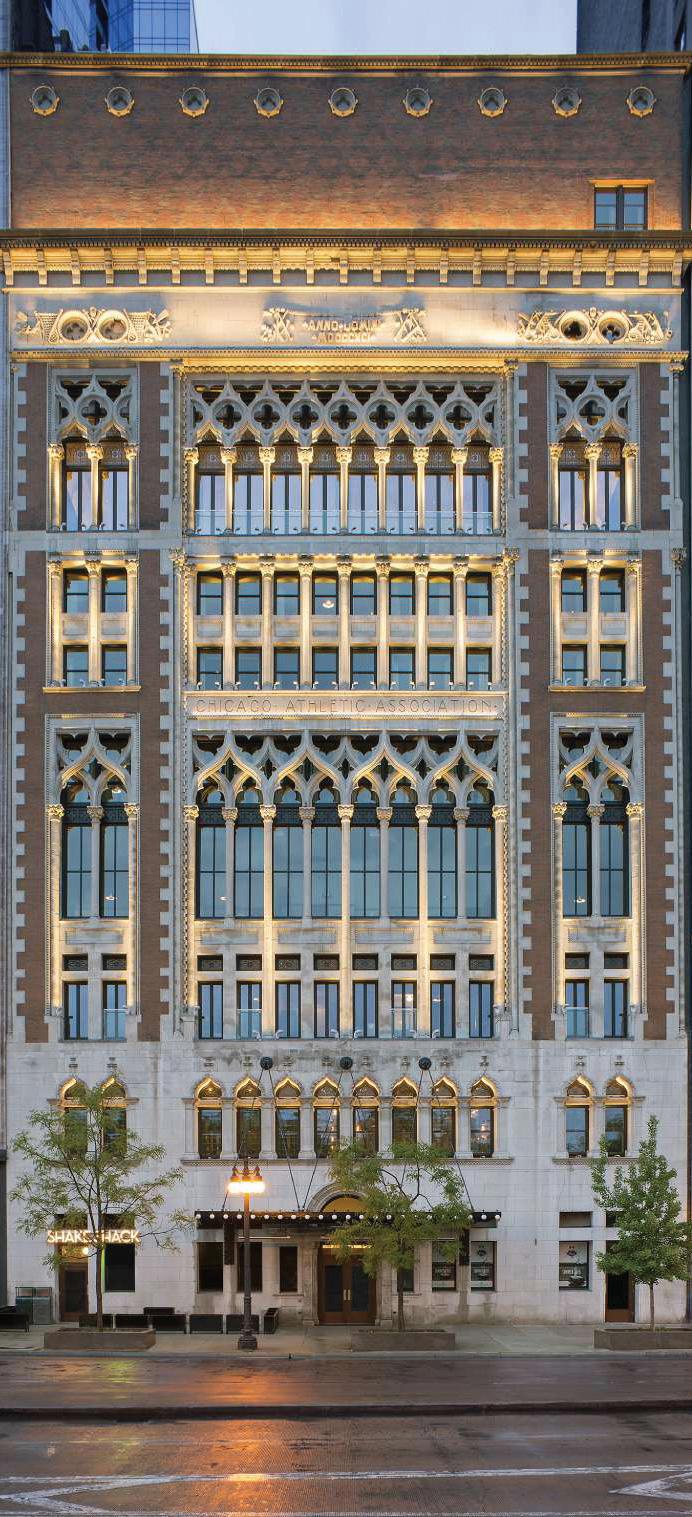

NACS Show

October 14-17 | Chicago McCormick Place Chicago, Illinois

NOVEMBER

NACS Innovation Leadership Program at MIT

November 02-07 | MIT Sloan School of Management Cambridge, Massachusetts

NACS Women’s Leadership Program at Yale

November 09-14 | Yale School of Management, Yale University New Haven, Connecticut

The summit focused on which levers can be pulled to realize the power of food to build health. As one speaker noted, 18% of the current U.S. gross domestic product is spent on healthcare, and 80% of healthcare expenses can be traced back to diet.

Showing how far the convenience industry has come in terms of being seen as a solution to the problem—as opposed to a contributor to it—the closing session focused on healthy corner stores, with an emphasis on how small-format stores can lead change and improve health.

“Beyond the presentations, a huge benefit for us was to connect with some of the leaders in the room, both in sharing ideas and finding possible opportunities to work together,” said Lenard.

2026

MARCH

NACS Human Resources Forum

March 16-18 | Galt House Hotel

Louisville, Kentucky

NACS Day on the Hill

March 17-18 | Four Seasons

Washington D.C.

Washington, D.C.

APRIL

NACS State of the Industry

Summit April 14-16 | Renaissance Schaumburg Convention Center Hotel

Schaumburg, Illinois

NACS Leadership for Success

April 27-May 01 | Hershey Lodge Hershey, Pennsylvania

JUNE

NACS Convenience Summit Europe

June 02-05 | Hilton Warsaw City Warsaw, Poland

OCTOBER

NACS Show

October 06-09 | Las Vegas Convention Center Las Vegas, Nevada

For a full listing of events and information, visit www.convenience.org/events.

Medium- and heavy-duty vehicles (MHDVs) are a critical component of the economy, but they also represent a significant source of emissions—despite accounting for only 5% of on-road vehicles in the United States. MHDVs contribute over 20% of the country’s transportation emissions. Reducing emissions from these vehicles while not imposing unreasonable costs on the owners and their customers requires careful consideration and evaluation of available options.

The Transportation Energy Institute (TEI) released a new report, “Practical Guide to Cost Effective Fleet Emissions Reductions,” which provides a flexible roadmap that can be tailored to the requirements of a variety of fleets, vehicle types and use cases. Small to large fleet operations can benefit from taking a close look at the options available to reduce emissions and how such options may affect capital and operational expenses.

“Zero-emission technologies like battery electric vehicles (BEVs) and hydrogen fuel cell electric vehicles (FCEVs) are still emerging but have demonstrated effectiveness in applications like transit bus fleets and urban delivery. Some estimate that BEVs could meet the needs of 49–65% of MHDV truck routes, especially for regional delivery fleets,” the report said. “Meanwhile, FCEVs hold promise for long-haul operations due to their extended range and fast refueling capabilities. Although initial costs are high, advancements in zero-emission vehicle (ZEV) and fuel technologies are projected to bring total cost-of-driving parity with diesel by 2035, according to the National Renewable Energy Laboratory (NREL).”

For fleets that are still waiting for technology and cost profiles to meet their needs, sustainable fuels provide an excellent interim option, particularly for legacy vehicles relying on internal combustion engines (ICEs), the report also stated.

TEI also released the AltFleet Economic Impact tool, which enables fleet owners and interested stakeholders to evaluate the environmental and economic impact of different vehicle technologies and fuel choices. Users can customize the tool to fit their markets and operations, from how the vehicles are used to how they will access energy to how the company will pay for them. The tool calculates all of these variables to deliver an economic and emissions reduction report to help guide decision makers as they consider their options.

For more, visit transportationenergy.org/research.

For easy, sustainable grab-and-go solutions, Placon’s Fresh ‘n Clear® Bowls, Trays, and GoCubes deliver. Made from our EcoStar® post-consumer recycled PET, these durable containers with anti-fog lids ensure clear visibility and freshness while keeping food secure. From snacks to party-sized salads, Placon makes it easy for customers to see, grab, and go—without sacrificing quality or the environment. Visit Placon.com to learn more about our full lines of grab and go packaging solutions.

Refuel promoted Travis Smith and Jon Rier from co-presidents to co-chief executive officers.

Mark Jordan, founder and current CEO of Refuel, stepped into the role of chairman of the Board.

Smith partnered with Jordan in 2016 and co-founded FR Refuel with First Reserve. He led the company’s acquisition-based growth strategy, expanding Refuel from South Carolina across the Southeastern United States.

Rier joined Refuel in 2019 as chief financial officer, leading the company’s finance, accounting, and IT functions. He previously spent 14 years with RaceTrac Petroleum in various leadership roles.

Love’s Travel Stops named Tim LangleyHawthorne as the company’s new chief technology officer (CTO). In this role, he will report to Love’s president and be responsible for aligning technology with overall company strategy, driving product development and fostering technical innovation including the responsible deployment of artificial intelligence.

Abhi Patel has been promoted to vice president of information technology at Nouria, following the retirement of former CIO Doug New. Patel was previously

an assistant store manager before becoming Nouria’s first IT team member.

The Wills Group appointed Matt Simon as its chief marketing officer for its Dash In convenience stores and Splash In car washes. He will support Dash In and Splash In’s multi-state expansion, with a focus on Dash In’s growth in North and South Carolina.

Simon is the first chief marketing officer for the Wills Group family of companies. He will lead Dash In and Splash In’s ongoing efforts to deliver service excellence and ensure that Dash In Rewards mirrors Dash In’s elevated in-store experience.

Erin Sunderman joined Liquid Barcodes as director of customer success. Sunderman will lead the customer success team operations across the United States and Europe and will be an influential member of the global management team. Most recently, she served as customer insights and loyalty manager for the 170-plus store convenience chain United Dairy Farmers, and before that, she worked with loyalty data at The Kroger Company.

Liljana (Lea) Marom joined the Liquid Barcodes U.S. team as an onboarding project manager. Marom will provide new retail customers with concierge services to ensure a smooth program implementation. Marom joins the team with a SaaS and technical background, most recently with Zoom.

Lucky Energy drink announced Lou Fabiano’s appointment as President. Fabiano will report to Richard Laver, founder and CEO. Fabiano will oversee essential functions that drive velocity at Lucky Energy, leveraging his extensive experience in the beverage industry to promote transformational growth. He served as chief sales officer at AriZona Iced Tea for the past five years, having been promoted from vice president of convenience.

NACS welcomes the following companies that joined the Association in June 2025. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting convenience.org/create-login. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership.

AFE Marianas LLC

Saipan, Northern Mariana Islands

America Petroleum South Salem, NY

American Petroleum and Convenience Store Association Sacramento, CA www.apca.us

Australian Association of Convenience Stores Burleigh Heads, Queensland, Australia www.aacs.org.au

Avi Smoke Shop & Fort Mojave Smoke Shop Mohave Valley, AZ

Aztec Oil Inc. Little Orleans, MD

Big Y Foods Inc. Springfield, MA

Bob’s Country Store Jackson, MI

Buddies 1 Stop Lakeway, TX

Bunnell & Almann’s Petroleum Inc. Fresno, CA

Fuel N Go Sugar Land, TX

Lenawee Fuels Inc. Tecumseh, MI

McFarland Oil Salida, CO

www.mcfarlandoil.wixsite.com/ mcfoil

Michigan Petroleum Association Lansing, MI www.mpamacs.org

Mr. Cartender Inc. Uvalde, TX

Reddy 99 Inc. Oklahoma City, OK

Roettgers Company Inc. Milwaukee, WI

Sandy’s Enola, PA

Self Serve Petroleum Inc. South San Francisco, CA www.selfservepetro.com

StoneCreek Partners LLC Las Vegas, NV www.stonecreekllc.com

Stop & Go LLC McMinnville, TN

Temecula Fuels Corporation Temecula, CA

Temperance Fuel Stop Inc. Temperance, MI

The Depot Express Oxford, IA

Top Star Express Inc. Emma, PA

Urban Market LLC Bellingham, WA

Gas King Oil Co. Ltd. Lethbridge, Alberta, Canada

Grupo Eco Tijuana, Mexico

Migrolino AG Suhr, Switzerland www.migrolino.ch

Sareni Spa Orzinuovi, Italy

Yukon Capital Toronto, Ontario, Canada

Aonic Inc. San Francisco, CA www.aoniclife.com

ARC Gaming & Technologies LLC Norcross, GA www.arcgt.com

Attensi USA Inc. Boston, MA www.attensi.com

Bartelt Insulation Supply Inc. Appleton, WI www.barteltinsulation.com

Bespoke Foods USA Ridgewood, NJ

breathROX Neenah, WI

CGI Technologies and Solutions Inc. Fairfax, VA www.cgi.com

Cirkul Inc. Tampa, FL www.drinkcirkul.com

Complete C-Store Solutions Taylor, AL www.ccsal.com

Deligo Vision Technologies Ltd. Budapest, Hungary

Drive Wheel Minneapolis, MN

Echo Lake Foods Inc. Burlington, WI

Epsilon Retail Media Broomfield, CO www.epsilon.com/us/industries/ retail

FÜM

Las Vegas, NV www.tryfum.com

GS Packaging Istanbul, Turkey www.gorselsanatlar.com.tr

Illum Chicago, IL www.illumus.com

JF Petroleum Group Morrisville, NC www.jfpetrogroup.com

Jumex USA Doral, FL www.jumexinternational.com

Kentucky Lottery Corporation Louisville, KY

LAMP Nutra Carlsbad, CA

Lassonde Pappas and Company Carneys Point, NJ www.lassondepappas.com

Live Large Distribution Elkhart, IN www.amishpretzelco.com

Manage Petro North Vancouver, British Columbia, Canada www.managepetro.com

Mile High Graphics Denver, CO www.milehighgraphics.com

Morton Salt Inc. Chicago, IL www.mortonsalt.com

My Brand Promo Inc. Saint Louis, MO

Nextech Melbourne, FL www.nextechna.com

NSA Field Service Solutions San Antonio, FL

Plastic Ingenuity Cross Plains, WI

Solink Corporation Kanata, Ontario, Canada www.solink.com

South Texas Merchants Association San Antonio, TX www.mystma.com

Stanpac Inc. Smithville, Ontario, Canada www.stanpacnet.com

Trax Retail Denver, CO www.traxretail.com

Trophy Nut Co. Inc. Tipp City, OH www.trophynut.com

Ultimate Brands LLC Katy, TX

Your Dough Co. Watkinsville, GA www.yourdoughco.com

The retailer’s Annual Miracle Tournament & Celebration Dinner benefits the Children’s Miracle Network.

During its 34th Annual Miracle Tournament & Celebration Dinner, 7-Eleven Inc. raised more than $3 million to support Children’s Miracle Network (CMN) Hospitals, benefitting member children’s hospitals across the United States.

“Over 600 supporters—including 7-Eleven Inc. franchise owners, vendors, suppliers and employees—came together to raise funds and celebrate the children who benefit directly from donations to CMN Hospitals,” said the retailer.

This year, more than 50 Champion Children and their families, each representing their local member children’s hospital, were present to engage with attendees, share their incredible journeys and take part in the fun and festivities.

Since 1991, the company has “raised more than $200 million for CMN Hospitals. Along with the Miracle

Tournament & Celebration Dinner, fundraising efforts also include in-store campaigns at participating 7-Eleven, Speedway and Stripes stores. The funds directly benefit local member hospitals.”

From June 25 through August 26, 7-Eleven and Stripes customers were invited to round up their purchase at checkout or donate $1 to their local member children’s hospital. Speedway stores continue to offer their year-round, in-store fundraising campaign benefiting CMN Hospitals.

According to the company’s 2024 Impact Report, the 7-Eleven family of fundraising efforts, which includes volunteer initiatives, charitable donations and instore fundraising campaigns, generated more than $17 million, supporting 112 local member children’s hospitals nationwide.

1 CUBBY’S DONATES TO LOCAL SCHOOLS

Cubby’s ongoing Raise Some Dough campaign, which donates $1 for every large one-topping Godfather’s Pizza Express pizza or breakfast pizza sold, raised $216,651 by the end of the first quarter of 2025, the retailer said.

The funds directly support local schools and youth-serving organizations. From classroom materials to athletic equipment and spirit merch for students and faculty, the donations “help create more enriching environments for learning and growth.”

2 REFUEL RAISES OVER $190,000 FOR CHARITY

Refuel Operating Company hosted its 2nd Refuel Cares Annual Fishing Tournament in support of the Leukemia & Lymphoma Society (LLS), and it raised $192,979.32. “Refuel has proudly donated over $1 million to LLS through our Refuel Cares initiatives and Point of Sale campaigns,” the company said.

“We were honored to be joined by Zach, our Honored Hero and a T-cell leukemia survivor, who was diagnosed at just 10 years old. His strength, resilience and positive spirit remind us why this mission matters—and his story continues to inspire everything we do,” Refuel said.

The Wills Group, Maryland-based parent company of Dash In, was honored with a philanthropy award from Washington Business Journal.

“We are thrilled to announce we received Washington Business Journal’s 2025 Corporate Philanthropy Award. As part of our commitment to our ongoing community engagement work across the Mid-Atlantic region, we also announced a $100,000 donation to Capital Area Food Bank—a longstanding Wills Group partner and the featured nonprofit for the 2025 Corporate Philanthropy Awards event,” Wills Group said.

$25,000 TO LOCAL CHARITY

Rutter’s Children’s Charities made a $25,000 donation to the United Way of York County ALICE (Asset Limited, Income Constrained, Employed) scholarship program. “High childcare costs force some York County parents out of work. Many households need affordable and accessible childcare to stay employed,” Rutter’s said. The donation will go toward 35 scholarships.

Murphy USA raised $1,195,451.46 for its local Boys & Girls Clubs. “We’ve crossed the finish line of Sprint 1 in our Great Futures Fueled Here campaign. … This achievement reflects the power of our people and our shared belief in building brighter futures for kids in our communities,” the retailer said.

Retailers face regulatory confusion and risk customer frustration as USDA approves unprecedented state-level SNAP restrictions.

BY MARGARET MANNION

The Supplemental Nutrition Assistance Program (SNAP) is a critical lifeline for working families and individuals, providing food access to millions of Americans during times of temporary hardship. A key strength of the program is its flexibility, empowering participants to select from a wide variety of foods based on their dietary needs, personal preferences or cultural values. This ability to make personal food choices is essential to helping families manage their health and maintain their dignity, without the federal government dictating how Americans feed themselves and their loved ones. For convenience stores and other SNAP retailers that are an

essential partner in this program, these freedoms also provide clarity and consistency in how they serve their customers. But that principle is now at risk. A growing number of states are requesting federal waivers from the U.S. Department of Agriculture (USDA) to limit what SNAP benefits can be used to purchase, targeting items such as soda, energy drinks and candy. And for the first time in history, USDA is approving each waiver.

THE MAHA MOVEMENT GIVES NEW LIFE TO OLD SNAP BATTLES

Health advocates, states and cities have attempted for years to get the federal government to ban foods or beverages they

deem unhealthy from being purchased with SNAP benefits. Each time, the federal government has denied these requests, in large part due to the administrative burden that restrictions would impose. USDA has studied what implementing purchase restrictions would mean and concluded that limiting the food choices of SNAP recipients is both conceptually flawed and impractical.

The movement has new life now thanks to the Make America Healthy

Again (MAHA) agenda promoted by Health and Human Services

Secretary Robert F. Kennedy Jr., with support from Agriculture

Secretary Brooke Rollins. After being sworn into office in February 2025, Secretary Rollins sent a letter to all 50 states encouraging them to act as “laboratories of innovation” and called on governors to submit SNAP waivers to encourage healthier eating.

Notably, this isn’t the first time that the Trump administration has received

SNAP waiver requests to ban certain foods. During President Trump’s first term, the state of Maine requested a SNAP waiver to ban the purchase of soda and candy. USDA denied the request, stating concerns that a ban would impose burdens on small businesses, increase administrative costs and “restrict what individuals could eat in their own homes without demonstrating clear evidence of meaningful health outcomes,” according to an article in The Washington Post. At the time, Agriculture Secretary Sonny Perdue explained, “We don’t want to be in the business of picking winners and losers among food products in the marketplace, or in passing judgment about the relative benefits of individual food products.”

In May, however, Agriculture Secretary Rollins made history by approving the very first SNAP waiver request for the state of Nebraska, which plans to ban the sale of soda and energy drinks. Days later, USDA also approved waivers in Indiana and Iowa seeking to ban certain soft drinks and candy. At the time of this article’s writing in July, USDA has also approved waivers in Utah, Idaho and Arkansas, and many

more states are awaiting their own waiver approvals. USDA is granting these waivers as state pilot projects for two years, with the ability to request yearly extensions for an additional three years. All states except Arkansas currently have a target implementation date of January 1, 2026.

While these proposals are framed as public health measures, the implications for SNAP retailers are severe, especially for small-format retailers like convenience stores and multistate operators. Implementing complicated product-specific restrictions at the state level will mean major point-ofsale system overhauls, complex compliance protocols and extensive staff training. For many retailers, the cost and complexity of complying could be enormous, potentially forcing them to stop accepting SNAP altogether.

Take a look at the Iowa waiver that was approved in May. The state plans to prohibit customers from using SNAP benefits to purchase “all taxable food items as defined by the Iowa Department of Revenue,” using Chapter 423 of the Code of Iowa and Iowa Administrative Code Chapter 701-220 to define taxable and nontaxable food items. Idaho is planning to ban the purchase of soda and candy, but the definition the state uses for candy specifically excludes items containing flour—meaning you will still be able to buy certain candies, like Twix or KitKat bars for example, because they contain flour.

Simple, right?

In reality, the tax codes that many states like Iowa and Idaho are using to define “soda” or “candy” were written solely for sales tax administration, not federal nutrition policy. They are notoriously difficult to interpret—

Under the Nebraska waiver, the state will exclude soda, soft drinks and energy drinks, as defined by:

• Soda or soft drinks: Any carbonated non-alcoholic beverage that contains water, a sweetening agent (including but not limited to sugar, high-fructose corn syrup or artificial sweeteners), flavoring and carbon dioxide gas to create carbonation.

• Energy drinks: Carbonated or non-carbonated beverages containing a stimulant such as fortified caffeine, guarana, glucuronolactone or taurine. They may also include herbal extracts such as ginseng, mineral salts and vitamins, or high doses of organic acids, amino acids, inositol, sugars or other similar compounds in addition to sweeteners. Juices or natural fruit pulp or concentrates may also be added. Energy drinks are specifically formulated to enhance energy, alertness or physical performance.

Under the Nebraska waiver, beverages marketed primarily as sports drinks to increase hydration, like Gatorade, and medically necessary nutritional products are not included in the ban.

Under the Indiana waiver, the state will ban soft drinks and candy, defined as:

• Soft drinks: Any nonalcoholic beverages that contain natural or artificial sweeteners. The term does not include beverages that contain milk or milk products, soy, rice or similar milk substitutes, or are exclusively naturally sweetened using natural vegetable and/or fruit juice.

• Candy: Any preparation of sugar, honey or other natural or artificial sweeteners in combination with chocolate, fruits, nuts or other ingredients or flavorings in the form of bars, drops or pieces. The term does not include any preparation requiring refrigeration.

The Iowa waiver will prohibit SNAP purchases of “all taxable food items as defined by the Iowa Department of Revenue.” The state will use Chapter 423 of the Code of Iowa and Iowa Administrative Code Chapter 701-220 to define taxable and nontaxable food items.

The waiver approval contains a list of food products that are subject to sales tax, which includes but is not limited to:

• Candy, candy-coated items and candy products, including gum, candy primarily intended for decorating baked goods and hard or soft candies including jelly beans, taffy, licorice and mints.

• Fruits, nuts or other ingredients in combination with sugar, chocolate, honey or other natural or artificial sweeteners in the form of bars, drops or pieces.

• Dried fruit leathers or other similar products prepared with natural or artificial sweeteners.

• Ready-to-eat caramel corn, kettle corn and other candy-coated popcorn.

• Caramel wraps, caramel or other candy-coated apples or other fruit; sweetened coconut; marshmallows; and granola bars, unless they contain flour.

• Carbonated and noncarbonated soft drinks, including but not limited to colas, ginger ale, near beer, root beer, lemonade, orangeade and all other drinks or punches with natural fruit or vegetable juice less than 50% by volume.

• Sweetened naturally or artificially sweetened water.

Under the Arkansas waiver, the state is banning the following items: “soda, low and no-calorie soda, fruit and vegetable drinks with less than 50% natural juice, other unhealthy drinks and candy.” The ban will not extend to flavored water, carbonated flavored water or sports drinks. It does not provide further clarification for “other unhealthy drinks.”

The waiver explains that the state will use the GS1 US product classification framework and standards, including the Global Trade Item Number (GTIN) (part of the UPC), to define ineligible foods. The waiver notes that GS1 US product classification standards offer industry-accepted categories to help businesses speak a common language when classifying and identifying products. However, it does not provide any further detail on how those standards will be applied or enforced under the waiver.

Under the Idaho waiver, the state plans to ban soft drinks and candy, defined as:

• Soft drinks: Any nonalcoholic beverage containing sweeteners. The definition does not include drinks with milk or milk substitutes, beverages with more than 50% juice and products that require preparation before consumption.

• Candy: Any preparation of sugar, honey or other sweeteners in combination with chocolates, fruit, nuts or other ingredients in the form of bars, drops or pieces. This definition does not include those items containing flour or requiring refrigeration.

The Utah waiver prohibits customers from using their SNAP benefits to purchase soft drinks, as defined by:

• Soft drinks: Any nonalcoholic beverage that is made with carbonated water and is flavored and sweetened with sugar or artificial sweeteners. This definition does not include a beverage that contains milk, milk products, soy, rice or other milk substitutes, or that is greater than 50% vegetable or fruit juice by volume.

especially when trying to determine where the 650,000 food and beverage products on the market today fall on the list (plus the thousands of new products introduced each year). Expecting SNAP retailers to navigate these complex definitions at the register is both unrealistic and unsustainable, and it may lead to a reduction in retailers participating in the program.

This would be a significant loss for the communities that SNAP retailers serve. Convenience stores operate in every corner of the country, including in rural areas and urban neighborhoods where grocery options are limited or nonexistent. Retailers are proud to serve as reliable food access points in their communities, especially for their SNAP customers. Pushing these retailers out of the program risks reducing food access for millions of Americans.

The differences among each state’s SNAP restrictions will also chip away at the consistency and predictability that has defined the program since its beginning. A fragmented system, where the same product may be eligible for SNAP in one state but not another, creates confusion for customers and compliance headaches for retailers who operate across multiple states.

Restrictions on SNAP purchases are planned to take effect January 1, 2026, in Idaho, Indiana, Iowa, Nebraska and Utah. Arkansas is expected to follow with a July 1 implementation date. Colorado, Florida, Kansas, Louisiana, Oklahoma, Texas and West Virginia have also requested waivers, but as of this article’s writing, they are still awaiting USDA approval.

Unfortunately, detailed guidance from each state’s SNAP agency remains limited or unclear. Retailers are still waiting for definitive banned

product lists and clear implementation timelines. To stay ahead, it’s essential to keep an open line of communication with your state agency and proactively seek clarification as new information is released. Reaching out to your state trade association may also provide helpful resources.

In the meantime, retailers should try to prepare now. Work with your point-of-sale system providers to ensure they can support these statespecific exclusions and product definitions. Also note that some states, like Arkansas, are using GS1 product classification codes to distinguish between eligible and ineligible items.

Staff training will also be critical. Frontline employees need to clearly understand which products are banned under the new rules, especially since some states have indicated they will use secret shoppers to monitor retailer compliance. Retailers should also be prepared for increased customer confusion or frustration at checkout. Posting clear signage or shelf tags to indicate SNAP-ineligible products may help make the checkout process smoother and less frustrating for customers.

As USDA considers additional waiver requests, NACS is urging policymakers to fully account for the operational burden on retailers, the threat to food access and the risk of undermining the SNAP program’s integrity.

For more information on each state waiver as they are approved, visit USDA’s website at www.fns.usda.gov/ snap/waivers/foodrestriction. For additional questions or information, reach out to me—Margaret Mannion at mmannion@convenience.org.

Margaret Mannion is a NACS director of government relations. She can be reached at mmannion@ convenience.org.

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www. convenience.org/nacspac NACSPAC donors who made contributions in July 2025 are:

Steve Bramlage Casey’s General Stores Inc.

Nathaniel Doddridge Casey’s General Stores Inc.

Dan Dolgner Vollrath Company LLC

Linnea Fohlbrook Noka

Brad Heetland Ultimate Sales and Services

Lonnie McQuirter 36 Lyn Refuel Station

James Morgan J.R. Morgan Oil Company Inc.

Sarah Nesci Cheesewich Factory

John Peyton Gate Petroleum Company

Darren Rebelez Casey’s General Stores Inc.

Paul Reid Reid Petroleum Corporation

Elizabeth Waring Johnson & Johnson Inc.

Name of company: Let’s Go Market

Date founded: 2023

# of stores: 2

Website: www.facebook.com/ letsgomarket2281/

A second-generation convenience store owner builds on the foundation laid by his parents.

BY SARAH HAMAKER

After growing up in the family business, owning a convenience store became a natural career choice for Dennis Kim, owner of Let’s Go Market, which has two locations in Cleveland, Texas. “I’m a second-generation operator,” he said. His parents came to the United States from South Korea in 1979, and the first business they opened was a convenience store. “I joke that my current career was forty years in the making, since I helped my brother manage my parents’ chain of five to six locations,” he said.

When the opportunity to build his own store from the ground up presented itself, he took advantage and opened the first Let’s Go Market location in 2023.

He credits his parents, who are now transitioning to retirement, for teaching him the ins and outs of the convenience store industry. “I didn’t realize how much of the entrepreneurial spirit was in me, especially because I used to resent being the owner’s son. Now I appreciate it more as I serve the community and value the relationships we’ve created with customers,” Kim said.

For Kim, it took self-growth to transition into his role as a store owner. “I have a real big advantage because I essentially grew up in the industry, but it took a paradigm shift from thinking ‘why do I have to do this?’ to ‘I have all this wealth of knowledge and experience, so why wouldn’t I do this?’” he said.

When Kim first opened Let’s Go Market, he listened to his customers before rushing to fill the shelves with generic items. “I wanted to match the needs of our customers to what we stocked,” he said. “While I stocked the c-store essentials, I deliberately left about 30% of my shelf space vacant to put in what my customers wanted.” A majority of his customers asked for an expanded automative department, and when he increased the items in that section, he found it brought in a higher dollar amount per transaction.

They also asked for Hispanic brands of ice cream, chips, candies, laundry detergent and other sundries. “I realized I was filling a huge need and the items have been very popular,” Kim said. He also partnered with a Mexican bakery to deliver sweet treats three

times a week and changed his coffee program to match what his customers wanted to drink.

To gather suggestions, each shift lead has a request sheet. Kim reviewed them on a daily basis in the store’s early days but now looks at them weekly. “We give all new items a try for a month or so, then determine if we should keep it or perhaps stock it seasonally,” he said.

One thing he’s made a priority since day one is making sure his employees feel valued. “You can say ‘customer service is very important’ to your employees and cashiers, but from my perspective, it’s how the staff are treated that translates into good customer service,” he said. “I spend more time at work than with my own family, so I want to enjoy the people I work with.” Many of his employees previously worked for his parents—one of his managers has been with his family for 25 years and several others for a decade or more.

He encourages his employees to show that same form of care to customers and within the community. Let’s Go Market sponsors local sports teams and donates to charitable drives. “I really train my managers

Dennis Kim recently opened the second location of Let’s Go Market and has expansion plans in his sights. “By next year, I hope to start bringing one or two new stores online per year to build on the foundation my parents laid out,” Kim said. “I have aggressive growth plans for Let’s Go Market, and as I build the business, I will be able to implement some of the ideas I have that only make sense for multiple stores, such as private label products and branded fresh foodservice.”

He has a large kitchen area waiting for when he’s ready to start a foodservice offer. “I want to do a more bespoke model for us as a way to differentiate ourselves from other convenience stores,” Kim said.

and employees to tell me about ways to help our community,” he said.

Overall, Kim is thoughtful about building his company. “In the current landscape, independent operators are surrounded by large chains, which can make business very tough and time intensive,” he said. “You have to sacrifice a lot, and if you don’t love what you do, you shouldn’t do it. But if you do love it, it won’t feel like work. For me, I love dealing with people and meeting different people, so it’s a great business to be in every day.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor and award-winning romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

NACS Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2024 and earlier, go to www.convenience.org/Ideas2Go

NOT FOR SALE TO MINORS: This is an age-restricted product Age verification is required for purchase

CALIFORNIA PROPOSITION 65 WARNING: This product contains chemicals known to the State of California to cause cancer, birth defects, or other reproductive harm

BY AMANDA BALTAZAR

Partnerships, differentiation and even playfulness in branding and marketing can keep customers coming back.

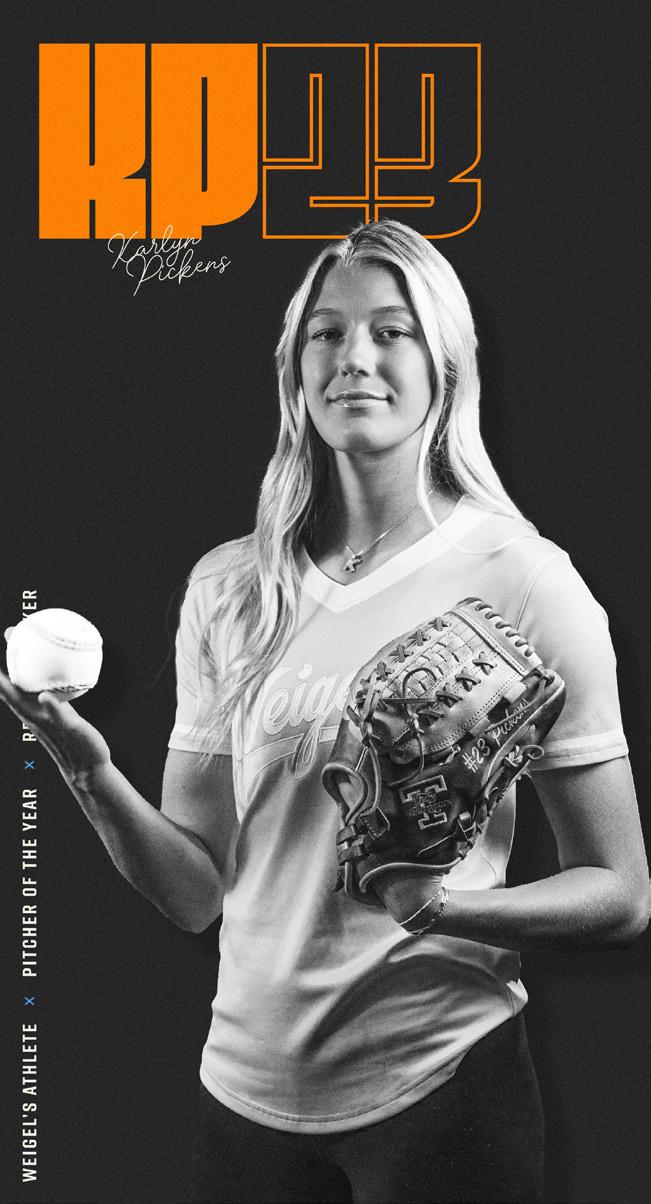

In 2021, Weigel’s began working with University of Tennessee (UT) athletes, and that has become “the most exciting part of our branding strategy,” said Nick Triantafellou, director of marketing and merchandising for the Powell, Tennessee-based company.

“We’re not just a gas station,” he said. “We’re part of the starting lineup now. We are more than tradition and milk; now we are humor, fandom and sports.”

Weigel’s NIL partnerships have “transformed” its brand: “People view us as part of sports. We’re still a gas station, and we now belong in this [other] space,” said Nick Triantafellou, director of marketing and merchandising.

These [NIL] promotions build more than transactions— they build pride and belonging in the communities we serve.

Creating a strong brand for a convenience store is essential to creating loyal customers, building brand recognition and keeping sales up. According to a 2024 NielsenIQ study, 30% of company revenue is generated on the strength of a brand.

Weigel’s agreement with the UT athletes is a name, image and likeness (NIL) agreement. This has gone a long way toward boosting Weigel’s engagement with its customers, Triantafellou said.

The c-store company began working with baseball players when Weigel’s noticed its social media posts about player performance and other details were getting thousands of likes. “We saw the opportunity—this is what they’re passionate about, so let’s meet there,” he said. “We realized everyone who’s our customer is a humongous University of Tennessee fan.”

Weigel’s has also done special promotions, such as offering customers a free 24-ounce Coca-Cola every time one of its sponsored athletes hit a home run or struck out six batters. The company gave away 97,000 free drinks last year.

“The cost of the drinks is nothing compared to what we gained. The engagement, the brand lift and the growth in our loyalty program made the ROI on those promotions undeniable,” said Triantafellou. “NIL has created brand fans for life: customers who won’t shop anywhere else because they feel seen by what we do on social and how we reward them through our loyalty program. These promotions build

We saw the opportunity—this is what they’re passionate about, so let’s meet there.

more than transactions—they build pride and belonging in the communities we serve.”

Weigel’s has also caught the attention of sports commentators, who talk about the partnership during games.

“The loyalty and fandom we’ve achieved is amazing,” said Triantafellou. “People view us as part of sports. We’re still a gas station, and we now belong in this [other] space.”

The branding has taken on a life of its own. Since it began, Weigel’s has created 12 commercials featuring the UT athletes, with “many more” in the pipeline, replacing its commercials about what consumers can buy at the convenience stores. Said Triantafellou: “We have changed ourselves in the eyes of the consumer.”

Weigel’s has expanded its athlete partnerships beyond just one sport—now including

teams such as volleyball and soccer—and has started working with athletes from regional universities as well. “With over 60 athletes signed, we believe every one of them represents the heartbeat of the communities we serve,” Triantafellou said.

Cenex has also used sporting events to boost its branding. The company partners with the Northern Rodeo Association and previously partnered with the National Intercollegiate Rodeo Association. It also partners with 12 colleges and universities throughout the Midwest within the Cenex footprint, such as the University of Wisconsin and the University of Iowa, and professional sports teams such as the Green Bay Packers.

“It creates great brand recognition,” said Kim Bobzien, expert marketing specialist

Cenex partners with the Northern Rodeo Association to help boost its branding. Many of its customers are farmers with family members involved in the rodeo.

Wally’s built a brand based around nostalgia— and sells plenty of merchandise based around its brand. Visitors will often buy the branded items as a gift, spreading the Wally’s brand around the country.

for Cenex parent company CHS, Inver Grove Heights, Minnesota. “We love our sports sponsorships.”

Cenex’s branding is slightly different for each group it works with. Some campaigns feature in-stadium branding (such as on the scoreboard, the wraparound board, the concessions area or the TV screens); some include radio or TV commercials; and some are digital, such as banner ads on the partner’s website. Cenex might sponsor a sweepstakes and provide the prize for it, or it might run a contest on social media featuring Cenex’s logo.

The rodeo associations are important to Cenex customers because many are farmers with family members involved in the rodeo, said Matt Mohs, vice president, Go To Market, CHS. “It’s important to keep that branding in front of people’s eyes,” he said.

For the Northern Rodeo Association partnership, Cenex creates cobranded social media posts and tags Cenex. For the Green Bay Packers, there are ongoing social media campaigns. “It’s a great opportunity to get the logo out there and be really ingrained in these partnerships with teams people love,” Bobzien said.

Branding is central to the design of Wally’s convenience stores.

This Fenton, Missouri-based company’s stores are full of Wally’s-branded merchandise, from playing cards to bumper stickers, and the stores are unlike any other. They’re designed to be fun with a road trip vibe, appealing especially to people traveling through the area. Each features a 1970s Winnebago that’s open on one side and displays merchandise on interior shelving. The stores also feature a diorama of taxidermied animals using and wearing Wally’s merchandise and clothing.

“The branding is part of the experience,” said Andy Strom, chief experience officer. “We’re trying to create something that not only elicits an experience, nostalgia, timelessness and fun but that’s also extremely memorable.”

We design our merchandise to be fun, bold and giftable.

People want to come back and discover something new, he said, and they often buy branded items as gifts. “Then the branding travels across the country,” Strom said. “We design our merchandise to be fun, bold and giftable so people buy it for themselves, but they can’t wait to give it to someone else. It’s a walking billboard. We’re turning everyday items into brand ambassadors.”

InConvenience Inc, Chicago, is remodeling several stores previously owned by SQRL Service Stations and rebranding them as The Gas Spot convenience stores. Twelve are open so far. There are four in Missouri, with another coming by year-end; of the five in Arkansas, one is open, with the rest to follow later this year. The company also has stores in Iowa that it will remodel or open by the end of the year.

The company is taking the rebranding very seriously while having fun at the same time, said brand manager Alicia LaFollette. To build the new brand, InConvenience executives asked themselves what they want the company to be known for and how they could carry that experience through all of the stores.

LaFollette spent her first weeks with the company diving into market research and exploring details about the stores’ audience. She discovered that 52% of the audience is female and came up with the key terms of warm, inviting, friendly, clean and safe. Those words guided the team to the colors they chose and how they selected interior signage, including fun bathroom and beer cave signage.

The colors, said LaFollette, “make a huge difference.” There’s a darker dusty blue, a lighter blue, a mustardy gold and a cream

InConvenience Inc dug into its market to determine the brand for its new c-stores the Gas Spot. The research helped the company determine the brand colors, along with signage and the store layout.

color as an accent, and every location has a two-tone wall with a chair rail. Including blues and having more than white walls means that Gas Spot locations “lean toward that boutique market,” she said.

The company wanted the stores to feel different. “We had a goal of making it a place you want to spend some time in,” said LaFollette. Areas with chairs meant for customers who’d like to stay awhile are called Gathering Spots—or, more familiarly, G Spots. “We want people to have fun with it,” she said.

“Everyone I initially pitched this [G-Spot branding] to said, ‘You’re crazy—you’ll offend people,’ and that is not my intent,” said CEO Tiffany Fraley. “We need to stop taking ourselves so seriously, and then it becomes fun. As our branding strategy grows and we put more and more into it, we have more opportunity, and there’s nothing out there like this.”

Other parts of the stores are also branded. Packaged beverages and the coolers are always The Gulp Spot; coffee and soda is Refresh and Refuel (featuring a gas pump

When you create a personality that is super highly targeted, you’ll actually get more loyal customers.

logo pouring liquid into a coffee mug); private label general merchandise is in The Gear Spot. “We try to use a letter G wherever we can,” LaFollette said.

Gas Spot also recently introduced Clutch the Clam as its brand mascot.

A lot of thought went into Clutch’s creation and the strategy behind it.

Clams, says Fraley, “are nature’s unsung heroes. They keep their ecosystems clean, they stabilize their environments and they thrive by doing the little things right.” This was all part of the backstory InConvenience has created to make its brand strong. Clams are usually the first to let us know when things go wrong, she said, “which is a reminder to us to pay attention, adapt and protect what matters.” Clutch’s name is a reminder to people not to clutch their pearls.

The most important thing to look at when analyzing your brand is to determine what makes it unique, said Ernie Harker, president of ErnBurn, a brand development consultancy in Salt Lake City, and former head of marketing for Maverik.

The second thing to think about is who your customer is and why they would care about your brand—and be very specific. Customers want a brand, Harker said, that’s “highly attractive” to them. But if you put the customer’s identity before the store’s identity, he said, “you lose yourself—[then] you don’t have the energy to maintain the brand, and it doesn’t come across as authentic.”

For Maverik, for example, he said, it’s all about adventure elevating life, and that vein

runs through everything. For Stinker Stores, all branding revolves around its mascot, Polecat Pete, which “helps people remember what’s unique about them,” said Harker. “They have a little moxie. Getting away from that … would have taken the difference and the attractiveness out of that company,” Harker said.

“When you create a personality that is super highly targeted, you’ll actually get more loyal customers.”

Harker likes to start with some questions when creating a brand: What makes you unique? What do your customers want? What are your six brand adjectives? Exciting, safe, clean, fun? Harker has a rule that two of these must be adjectives that can’t be used to describe any other c-store company, and those are the

Once you’ve determined your brand, “you have to make sure it’s in everything you do,” he said. It even helps you hire the right people: those who care about what you care about. It makes sure your message is internal as well as external. “You have to drink the Kool-Aid too.”

Harker is also a big fan of rebranding or refreshing “so your customers know you’re alive—that someone is breathing behind the steering wheel.” C-stores should do a brand refresh every 15 years or so, he said.

A small refresh can emphasize what you stand for, and it’s important to change for more than change’s sake. If you’re environmentally friendly but have a red and black logo, it’s not inherent, so a simple color change to greens, yellows, or blues could communicate a lot to customers. That color change can ripple through everything in the store. “Brand colors, fonts and tone are all based on a specific strategy to elicit

The most important thing to look at when analyzing your brand is to determine what makes it unique.

a reaction from your customers,” Harker said. “If you know what it is, you can architect a visual and an experience that will elicit that reaction.”

To make sure there’s an easy or seamless transition, c-stores should be thorough in showing employees first how and why they’ve made the changes, maybe through a video or written materials, Harker pointed out.

It’s important to make a big deal about this, he continued. Launch it, create new marketing materials and heavily invest for the first three to six months to explain what the difference is from the old brand to the new one. “Make sure you draw a connection,” he said. “If there’s a vacuum of information, customers will come up with their own reasons for the change. Promote the messaging in your marketing and advertising so you bring them along with you.”

Rebranding is a good idea “when there becomes a disconnection from a chain’s original strategy to what the current brand stands for,” said Tim Girvin, founder and chief creative officer of Girvin, a strategic branding and design company in Seattle. “This could wrap around market trends, experience expectations, the c-store is changing, the footprint for offerings is widening, and what people want, or expect, has shifted.”

To get started with a rebrand, he suggested first conducting an audit to create “renewed clarity about positioning, values and personality—where the brand was, where it is and goals for future representation.” This strategic reckoning, Girvin said, will help the brand “get to the next level of experiential expression and customer relationship strategies.”

Once you’ve done this, “there should be a recognizable brand style that flows through every touchpoint for guests’ journeys in the c-store experience strategy,” he said. Stores should build a style and a disciplined, no-nonsense brand guide and stick with its

principles. The most important things to remember, he added, are consistency and cohesion. “If the experiences and brand contacts are consistent, they cohere in the mind of the experiencer.”

Girvin recommends convenience companies ask themselves: What’s their story? Who’s telling it? What does it sound and feel like? Who’s it for—and, crucially, who cares? “Any good brand has a story, and it’s important to reflect on how this story would be told. And what is its voice and origination? Feeling counts for everything and is the vibe of the brand, so people say ‘I know this place, I fit in here, it’s made for me.’”

In your rebranding strategy, think big and think small, Girvin suggested. Make a big statement with some kind of spectacle, but “it’s often the small touches that people remember,” he said. “Big opening statements have their own memorable character, but the interior arrays of experience contact are where the sales are.”

Amanda Baltazar writes about retail, food and restaurants from an island in the soggy Pacific Northwest. She covers operations, design, marketing and trends for B2B publications.

Chic go | Oct. 15–17

off to go b com xp r nc t st ys.

c nt r s rch sho s 8 % of consum r ho bought coff n th ro -Stor spr sso d b r * ith mor stom rs r lying on c-stor s for coff n sp c lty rin s trong s lf-s r rogr m i ss nt l. Is your coff progr m m ting consum xp ct tions?

Th 1000 FLEX l rs both tr ition lly br coff n spr sso, hot or ic , in on chin ith m ximum FLEXibility ith f tur s li ol - t r By s for ic b r n t nt Br nit sp cific lly sign for coff n spr sso, it off rs customi , consist nt, high-qu lity b r t th ouch o utton.

The NACS Show heads to McCormick Place in Chicago this year, with the event kicking off October 14 and running through October 17. More than 24,000 people will converge on the Windy City for ideas on how to better run their business, networking, inspiration and fun.

Education Sessions take place Oct. 14-16 and cover everything from underground storage tanks to the art of negotiation to building a tech stack. There’s something for everyone.

Use this list to find your favorites and start to build your schedule, and be sure to check out NACSShow.com for Education Session speakers and updates and a complete schedule of the 2025 NACS Show.

THE 2025 NACS SHOW TAKES PLACE OCT. 14-17 AT MCCORMICK PLACE IN CHICAGO.

TUESDAY, OCTOBER 14 AT 3:15 P.M.

As we look ahead to 2026, this session will provide an overview of the economic trends impacting the retail and convenience sectors, from inflation and consumer spending shifts to supply chain and technology. We’ll break down what these trends mean for your business, offering insights to help you adapt, stay competitive and plan for future growth. Whether you’re looking to optimize pricing, improve operational efficiency or understand consumer behavior, this session will help you navigate current and future economic trends.

WEDNESDAY, OCTOBER 15 AT 9:00 A.M.

For years, Gen X has been dubbed “the forgotten generation” in media, policy, and even marketing. Skipped over or bundled in with Boomers or Millennials, this small but mighty generation has quietly led global consumer spending since 2021—and will continue to do so until 2033.

The X Factor, a continuation of NIQ and World Data Lab’s groundbreaking generational spending series, analyzes the spending priorities and motivations of the Gen X cohort—consumers born between 1965 and 1980. In this session, we will decode and predict Gen X spending patterns worldwide, arming both manufacturers and retailers with the data and insights they need to win more Gen X share of wallet.

Gen X isn’t a transitional generation; it’s your present-day profit center. If you aren’t marketing to or engaging Gen X, you’ve already missed out on roughly $4 trillion in global spending. To maximize their loyalty and customer lifetime value, the time to act is now. Find out how in this session.

THURSDAY, OCTOBER 16 AT 9:00 A.M.

In this data-rich session, attendees will analyze key industry benchmarks from exclusive NACS State of the Industry data. The presentation will focus on the U.S. c-store industry’s financial performance, operational trends and market positioning, highlighting strengths and potential growth areas. Attendees will leave with a more precise roadmap for driving strategic initiatives in 2026, enhancing their competitive advantage and positioning their organizations for long-term success.

TUESDAY, OCTOBER 14 AT 2:00 P.M.

Negotiation isn’t just for larger companies—it’s a skill every operator can master. Whether you’re looking for better contract terms, renegotiating service agreements or resolving a challenging situation, this session will provide you with strategies that successful negotiators use to achieve win-win outcomes. Tailored for smaller operators and district managers with less experience in high-stakes negotiations, this Education Session breaks down the essential steps and offers practical insights to help you navigate negotiations confidently, regardless of your business size.

TUESDAY, OCTOBER 14 AT 2:00 P.M.

Data-driven decisions aren’t just for the big players. This session is tailored for small operators looking to harness the power of data analytics without an in-house data team. Learn where to find meaningful data, how to interpret it, and—most importantly—how to turn it into actionable insights. Whether you’re running a single location or managing a small team, you’ll walk away with practical tools and strategies to make smarter, faster business decisions with the data already at your fingertips.

Cracking Open the Potential of THC Beverages

WEDNESDAY, OCTOBER 15 AT 8:00 A.M.

What are THC beverages? Learn about this fastgrowing adult beverage category—from what they are to who’s buying them. Learn how to stock, display and educate around this high-potential category. We’ll break down consumer trends and use cases, product formats, merchandising strategies, compliance and staff education.

Effective Inventory Management with Real-Time Data

WEDNESDAY, OCTOBER 15 AT 8:00 A.M.

Discover how innovative convenience retailers are leveraging technology and data analytics to streamline operations, reduce costs and optimize inventory management. Through real-world case studies, you’ll learn how smarter tech-driven strategies are improving product availability, enhancing the customer experience and boosting profitability.

GLP-1s and the New Snack Equation

TUESDAY, OCTOBER 14 AT 3:15 P.M.

The rise of GLP-1 medications is reshaping consumer behavior, and convenience retail is at the forefront of this shift. As appetite patterns change, so do shopping habits. This session dives into how GLP-1s are influencing snacking trends and consumer choices and what it means for the future of convenience retail. Learn how to adapt your product offerings and marketing strategies to meet the needs of a population with smaller appetites and higher expectations.

Protecting Your Business from Counterfeit Products

THURSDAY, OCTOBER 16 AT 9:00 A.M.

The rise of counterfeit lighters flooding the U.S. market poses a significant risk to retailers and consumers alike. In this session, we’ll dive into the dangers of purchasing and distributing fake lighters, covering how to identify counterfeit products and their legal implications. We’ll also highlight how companies protect their customers by offering indemnification for those who purchase authentic products. Experts will provide insights on best practices for preventing counterfeit sales and ensuring compliance. Join us to learn how to safeguard your business and leverage trusted sources to maintain product integrity.

Sort It Out: The Product Category Showdown

THURSDAY, OCTOBER 16 AT 8:00 A.M.

Think you know where every product belongs? Join us for a fast-paced, game show-style session where we put your categorization instincts to the test. Using NACS category definitions, participants will sort real (and sometimes tricky!) in-store merchandise—then learn the reasoning behind each placement. We’ll uncover the logic and strategy behind product categorization, and explore how the right structure can drive discovery, sales and operational clarity. Come for the fun, stay for the insights!

Evolving Tobacco and Vape Landscape

TUESDAY, OCTOBER 14 AT 2:00 P.M.

The tobacco and vape categories continue to evolve rapidly, shaped by shifting consumer preferences, regulatory changes and innovation. In this session, we’ll explore how convenience retailers can successfully manage these highmargin categories while staying compliant and responsive to market trends. Learn strategies to optimize assortment, navigate age-verification and marketing regulations, and adapt to the growing demand for alternative nicotine products. Gain insights from real-world examples and leave with actionable ideas to protect and grow your tobacco and vape business.

The Snack Breakdown

TUESDAY, OCTOBER 14 AT 1:00 P.M.

Explore the evolving world of snacks in convenience retail with a deep dive into what’s driving category trends. From emerging consumer preferences to innovation on store shelves, this session unpacks what’s hot, what’s next and how to stay in the know. It is perfect for anyone looking to understand the pulse of snacking and unlock growth in a fastmoving retail space.

What’s Really in the Can?

Selling Alcohol-Infused Products

WEDNESDAY, OCTOBER 15 AT 9:00 A.M.

As beverage, beer and liquor brand collaborations expand, more adult beverages are hitting store shelves and creating new opportunities for c-stores to attract new customers and grow category sales. This session explores strategies for clear labeling, in-store signage, employee training and responsible merchandising.

Major Developments in Global Convenience Retail That Can Boost or Bust Your Business

WEDNESDAY, OCTOBER 15 AT 8:00 A.M.

Explore a world of inspiration as this session uncovers the most relevant changes in convenience

and fuel retailing, providing insight into how forward-thinking retail companies transform their markets and outpace their competitors across continents. From revolutionary store formats and immersive digital experiences to cutting-edge technologies and innovative customer engagement tactics, we’ll spotlight bold innovations that are redefining the global retail landscape. Walk away with practical ideas and fresh perspectives you can adapt to elevate your own business.

Refreshing Your Stores Without Razing and Rebuilding

WEDNESDAY, OCTOBER 15 AT 9:00 A.M.

A full remodel isn’t the only path to a fresh, modern store experience. In this session, we’ll explore creative, cost-effective ways to breathe new life into older retail spaces. From lighting upgrades and layout tweaks to signage, merchandising tricks and simple cosmetic updates, discover practical ideas that can make a big visual impact. Real-world examples and peer insights will show how small changes can lead to big improvements in customer experience and perception.

Decoding the FDA’s Traceability Rule

WEDNESDAY, OCTOBER 15 AT 8:00 A.M.

While the compliance deadline for the FDA’s food traceability rule has been delayed, retailers still need to be prepared. It’s crucial to use this window to build and test your traceability plan and protocols. In this session, we’ll break down the key components of the rule, including which foods you need to track, how to implement a traceability plan, and steps for compliance as the deadline approaches.

Hot Today, Gone Tomorrow?

Navigating Flavor Trends

WEDNESDAY, OCTOBER 15 AT 8:00 A.M.

In this session, we’ll break down the lifecycle of flavor trends and Limited Time Offers (LTOs), from their initial buzz to their mainstream appeal (or quick fade). Using a retailer case study, we’ll explore the process of identifying a hot flavor, developing it, and then deciding whether it has the potential for longterm success or is just a flash in the pan.

More Than Just a Cup:

Transforming Convenience Coffee

THURSDAY, OCTOBER 16 AT 8:00 A.M.

The range of brewing options in the convenience space is broad, from traditional drip and beanto-cup to espresso, cold brew and bean-to-batch systems. In 2024, coffee accounted for over two-thirds of hot dispensed category sales (67.8%), followed by cappuccino and specialty coffee (21%

of category sales), according to NACS State of the Industry data. Regardless of your set-up and offer, the opportunities to grow this category are immense. This session equips operators with insights and strategies for taking their coffee program to the next level.

TUESDAY, OCTOBER 14 AT 2:00 P.M.

A foodborne illness can disrupt the entire food supply chain, from growers to retailers to consumers. In this interactive session, industry experts will guide you through steps to respond quickly and efficiently. You’ll learn the critical timelines for action, how to manage your risk of regulatory exposure, and the potential civil and criminal liabilities. Prepare your team to take decisive action in a real-world situation, ensuring you can respond in minutes to protect public health and your business.

The Why Behind the Buy: Strategic Equipment Planning for Foodservice

TUESDAY, OCTOBER 14 AT 1:00 P.M.

This session will dive into real-world case studies on how cutting-edge technology and equipment have boosted store sales, enhanced productivity and streamlined operations. Learn firsthand how these game-changing tools are driving efficiency and profitability in today’s competitive retail environment.

Aging Infrastructure and Underground Storage Tanks

WEDNESDAY, OCTOBER 15 AT 9:00 A.M.

More than one-third of underground storage tanks (UST) are over 30 years old. This raises questions about risk of release and eligibility for financial

assurance required by federal tank regulations. Insurance companies and state tank funds apply different policies related to tank age, and tank owners must know their options to remain compliant as their systems age. This panel will look at the state of the current UST inventory, the policies that relate to risk and age and talk about solutions.

EV Charging Report Card

THURSDAY, OCTOBER 16 AT 9:00 A.M.