Making Possible

Our team at Avery Dennison again delivered strong results across our businesses last year, achieving top- and bottomline growth at the upper end of our guidance and making excellent progress toward our long-term strategic and durability of our portfolio, the resilience of our industryleading market positions, the agility and talent of our global

These factors have and will continue to provide us with multiple levers to deliver strong results and compound

Our Materials and Solutions Groups both delivered strong top- and bottom-line results, once again demonstrating recovered from downstream inventory destocking, as expected, our relentless focus on productivity drove margin expansion, and our continued investment in innovative materials and digitally enabled packaging solutions delivered strong growth across high-value of delivering GDP-plus growth, margin expansion and top

In the Solutions business, with apparel industry volumes having normalized, our apparel growth was strong across all products and solutions that serve our customers’ evolving needs and create potential new avenues of growth and of our overall portfolio, provides the platform for us to

Our ability to continually expand the value proposition of our foundational products is a key to our consistent

Catalysts for strong growth and margin expansion in high-value categories

Our base business foundation delivers consistent results and strong cash flow

Our leadership position in our base businesses remains productivity initiatives to drive margin improvement and materials innovation initiatives to expand our market share business, our focus on material reengineering, lean operating

into high-value categories that can deliver faster, more further innovation and above-average growth well into specialty and durable labels, industrial tapes, graphics, Embelex, Vestcom and our Intelligent Labels platform, where we are uniquely positioned to enable digital build on our well-established position in these categories, creating a more differentiated and, ultimately, more valuable half of our portfolio and have accounted for roughly three percentage points of our organic sales growth annually categories continues to expand, we will continue to invest

Much of our forward momentum and growth is now driven by strategies focused on solving the new and increasingly

accelerating technological change and evolving consumer expectations, our customers are increasingly turning to Avery Dennison for solutions that can optimize their supply chains, reduce waste, advance the sustainability, circularity and transparency of their products, and increase

Our efforts in 2024 resulted in new innovations and portfolio extensions that help our customers expand supply chain visibility and reduce waste, extend product performance and lifespan, foster packaging circularity and enable deeper solutions and advanced materials innovations are making ideas and the value we create that we have embedded them of successful innovation and our path to sustainable long-

Sustainability remains a driver of innovation and operational material circularity, the environmental impact of our to develop differentiated products and solutions that create value for our customers by addressing some of their most environmental impact by eliminating waste and using our

year advancing our sustainability goals and are largely on

Our commitment to making a positive impact on our employees and the communities in which we operate is

disaster relief efforts, the Avery Dennison Foundation supports critical community needs worldwide, including

exceptional value to all our stakeholders, execute our clear competitive advantages in both our Materials and global team, we are uniquely positioned to unlock substantial growth opportunities in 2025, marking 90

Thank you to our entire Aver y Dennison team for their passion and dedication and to you for your interest in

report and our 2025 notice and proxy statement and highlights our water are publicly available on our website esg.averydennison.com

comprehensive branding and information solutions portfolio

By harnessing our portfolio’s strength and breadth, our teams deliver products and solutions that optimize labor and circularity and transparency, and better connect brands and

(RFID) inlays and tags and software applications that carry or display

solutions for the home and personal care, food and grocery, apparel, general

Our commitment to innovation, creating value and growth is fueled by a label and underlies our nearly century-long commitment to innovation, as

As leaders in the industries we serve, our businesses have unique

Our Materials Group is a leading global provider to the pressure-sensitive label and include label materials, graphics and enhance brands’ shelf appeal, inform shoppers, advance circularity, increase transparency, help reduce waste and

Our graphics portfolio offers highly engineered products ranging from vehicle portfolio includes bonding and functional materials for applications in various industr y sectors such as automotive, building and the group’s materials science capabilities and process engineering expertise to develop and manufacture Intelligent Labels at scale and drive their further adoption

Our Solutions Group is a leading provider of information and branding solutions that cover worldwide marketplace needs

data management to branding and embellishment, productivity, pricing

frequency RFID solutions provider, we empower customers across multiple retail and industry segments, including apparel, logistics, food and grocery and general retail, to connect the physical and digital worlds by enabling a digital identity and

Our innovation and data management capabilities, global footprint and market access continuously expand our

Our culture is the foundation of everything we do, and our company

Employees

Communities

Investors

These core values shape our behavior and support our business

growth and top quartile returns across cycles and expanding our growth

Our Strategies Drive outsized growth in high-value categories

Grow profitably in our base businesses

Lead at the intersection of the physical and digital

Effectively allocate capital and relentlessly focus on productivity

Lead in an environmentally and socially responsible manner

Sustainability is a strategic business imperative and a customer expectation that presents opportunities to create differentiated solutions with our customers’ evolving needs and preferences while simultaneously

Innovating products and solutions that reduce their environmental impact and address platforms improve our products’ recycled content and recyclability and create solutions

Innovation also extends to our manufacturing operations, where we continuously seek strategies and collaborating with industry partners to develop solutions to improve measurement methodology by shifting from a spend-based approach to one that is available on investors.averydennison.com and esg.averydennison.com

7 For detailed information on our progress toward our 2025 and 2030 goals, please refer to our ESG Download available at esg.averydennison.com

Our proprietary technologies, scale and innovation create targeted high-value categories. We continue to invest in developing innovations that deliver value to

Peel and reseal lidding film cuts plastic package usage by up to 30%

Our Materials Group is helping brands reduce plastic usage by replacing rigid plastic tops with consumerplastic usage by up to 30% and allows consumers improvements boost productivity and cut costs for produce packers while offering food industry converters

Peel and reseal lidding helps reduce environmental impact, offers visual appeal compared to traditional clamshell packaging and meets increasing demands options and extends product freshness; its easy peel/ capabilities and adhesives make peel and reseal package per formance in multiple produce sectors and

Our innovation mindset is rooted in our extensive experience developing solutions bolstered by our fundamental expertise in materials science, radio-frequency design, engineering and process technology.

Kroger tracks bakery department inventory with RFID automation technology

grocer, to provide an item-level RFID inventory

The item-level RFID solution captures critical data to maximize freshness, reduce waste and optimize associates’ are optimally fresh and on shelves at peak retail hours, our Intelligent Labels platform in a key market sector and

End-to-end supply chain solutions improve item-level visibility and efficiency

By leveraging our RFID-enabled intelligent labels and our SM businesses with transparency across the supply chain, enabling them to make decisions that optimize production

As we expand our RFID technology into the logistics sector, we are improving item-level tracking and accuracy, accelerating operational productivity and saving time and labor. We are also changing how brands and retailers view supply chain operations and implementing improvements that quickly deliver savings and advance overall efficiency.

distributors and retailers have the visibility they need to give apparel brands, retailers and factories traceability

improve operations, productivity, inventor y and order

Optica™ end-to-end solutions supply accurate

extensive experience in developing

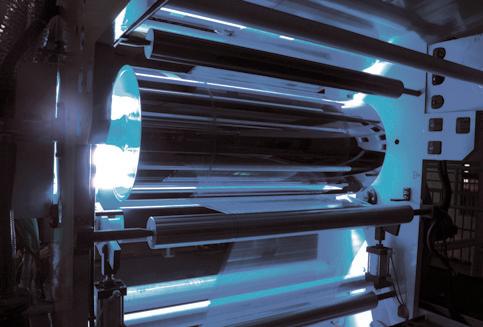

Our Materials Group’s research and development (R&D) team differentiates our company through vertical integration in adhesives and innovations in polymer advancements in acr ylic emulsion adhesives and the performance requirements of solvent-based acrylic, These solvent-free alternatives use less energy, have low or no volatile organic compounds, are cost effective and enhance the performance of core labels, tapes and Our innovative adhesives, coatings and wide-web laminating platforms are foundational technologies that, teams embody decades of materials science and process industry associations invite us to partner with them for adhesives innovations are providing sustainable solutions

Innovative labeling solutions unlock last-mile efficiencies

innovative labeling solutions for the logistics sector,

Our materials science expertise means we are able to continuously improve all label qualities at scale, allowing

To address the challenges of last-mile delivery, we partnered with a multinational logistics technology solution dramatically reduced misloads by 70% and from the initial facility scan to the recipient’s door, enhanced carrier sorting accuracy provided customers

The scalable solution boosts productivity by automating manual scanning, freeing up valuable staff time and allowing for faster and more accurate loading and

storeLink™ unlocks customer value through digital innovation

Our Vestcom business combined its industry-leading portfolio of analog shelf-edge solutions and longestablished knowledge of managing complex price and retailers to integrate electronic shelf labels and screens while continuing to employ print mediums where it

to in-venue activations.

labels in real-time, schedule and stream dynamic digital display content, enhance the shopper experience and

Group developed unique in-venue customized fan experiences powered by innovative digital technology that

large American retailer as proof of technology and then

In-venue customization elevates the fan experience in U.S. sports

in 2024, we are elevating cutting-edge fan experiences, an achievement that employs our capability to innovate

Digital technology enhances every business transaction at sports venues, from ticketing and concessions to

Innovations are evident in kiosks, software and hardware

Through various applications that connect the physical and digital, we provide an array of experiences, including frictionless checkout , to create a smooth and convenient

while returning cash to shareholders through share repurchases and

that enable us to continuously improve and make more made available by digitalization, we enhance our decision-

In terms of productivity, we are initiating new manufacturing processes, streamlining existing ones and optimizing and improvements constitute a growth component that allows us to broaden our service and quality offering, and

Data-driven innovation and digital technology add customer value to our manufacturing processes

Manufacturing innovation is driving value in our Solutions Group’s apparel business by improving the customer

driven ecosystem creates a foundation for meeting system, along with advanced production scheduling, IoT, automation and innovative technologies and processes, is

Our standardized global processes reduce errors and driven decision-making improves production speed, solves and Lean Six Sigma are eliminating waste; at the same

Manufacturing innovation employs new technologies, platforms and processes to enhance our capabilities and R&D digitalization accelerates innovation, enhances collaboration and improves data-driven decisions Materials Group’s R&D team embarked on a digitalization services, enhance decision-making capabilities and digitalization streamlines the product development and connected technologies to drive collaboration and digital mindset of our workforce, where R&D employees gained access to online learning tools complemented by

Our digitalization initiatives support our goal of integrating materials science and business model data into the decision-making process and creating a cognitive business tangible results include data science models for solvent adhesives, release systems and accelerated aging that are each individual’s power to contribute and innovate and that

Manufacturing modernization supports high-value category growth

In 2024, we made decisive moves to address global marketplace challenges by modernizing and consolidating manufacturing resources and intently focusing on growth

production locations, we streamlined operations across Europe to allow our teams to focus on a cohesive set of

For example, in Europe, we reimagined and modernized our facility in Soignies, Belgium, shifting the production of labels and industrial tapes to other sites in Belgium, Soignies plant address global customer needs and focus

Plant modernizations also took place in North America, a multi-continent effort to enhance our innovation and

Lead

our understanding that doing so

the industry’s top talent.

By using our linerless

Deliver innovations that advance the circular economy

and acknowledge the crucial role that labels, materials and information play in advancing a more sustainable and innovation and product designs that foster circularity, minimize material usage and waste, incorporate recycled

In 2024, we continued to utilize our materials science and digital innovation capabilities to introduce new products

In 2024, we extended our portfolio of solutions to provide customers with multiple options to solve challenges

wound, micro-perforated linerless labels, offer converting customers in the food, beverage and home care sectors the option of recycling release liners through our AD

Innovation leadership label recycling solutions for high-density polyethylene

Guidance Path recognition from the Association of

A range of our paper label solutions for paper and passed the European Paper Recycling Council (EPRC) are necessary to bring products into compliance with

innovations are being recognized as addressing key industry challenges, which strengthens our differentiation

“GOAL 2

Reduce our environmental impact in our operations and supply chain

environmental impact by reducing waste and making these initiatives throughout our supply chain to improve our operational resilience and lower our supply chain

In 2024, we continued reducing our operations’ energy intensity by investing in real-time energy monitoring, optimizing our manufacturing equipment and exploring

We commissioned a state-ofthe-art RFID manufacturing and innovation center in Querétaro, Mexico. The site is our largest and most sustainable RFID manufacturing facility, having received the U.S. Green Building Council’s LEED Gold accreditation.

a new virtual power purchase agreement (vPPA) to vPPA initiates our 10-year commitment to purchase multi-technology, customer-focused renewable energy

an amount equivalent to the annual consumption of 25,000 Spanish households, and prevent the emission of 2

Our commitment to reducing our environmental impact commissioned a state-of-the-art RFID manufacturing and largest and most sustainable RFID manufacturing facility, 1 that a building has excelled in its sustainable design and operation and meets strict standards for energy and

ADF makes grants to nonprofit organizations worldwide that serve local communities and support disaster response.

ADF supports the Global Fund for Children

Environmental sustainability is an ADF strategic pillar that

In 2024, ADF awarded a grant to the Global Fund for Children, which then expanded its Spark Fund in Southeast

GOAL 3

Make a positive social impact by enhancing the livelihood of our people and our communities

Our community investment through the Avery Dennison Foundation (ADF ) increases education access, advances environmental sustainability and supports secure organizations worldwide that serve local communities

Young leaders from Thailand, Vietnam and Singapore participated in workshops on grantmaking and decision-

concentrate efforts on climate programs and addressed the disparities in access to resources among the three communities and grassroots organizations, with nine

Grants ranged from $10,000 to $15,000, with grantee organizations attending to climate programs for local

focused on carbon neutrality and net zero emissions, climate resilience and adaptation, as well as biodiversity

Global grantmaking

In 2024, we granted approximately $700,000 for girls’

provided nearly $350,000 to support secure livelihoods by improving economic access in Pakistan, provided support for refugee women and children in Greece and sponsored

1 LEED (Leadership in Energy and Environmental Design) is

Our employees volunteer and contribute funds to help advance community investments with monetary in Brazil, Japan and Spain and provided support in the assists employees impacted by natural disasters and other

“Youth education and entrepreneurship

Scholarship America, annually awards scholarships to in 2024, ADF partnered with the Institute of International Education to provide scholarships to children of employees

In 2024, ADF partnered with the Institute of International Education to provide scholarships to children of employees in Bangladesh, Brazil, Honduras, India, Malaysia, Mexico, Sri Lanka, South Africa, Turkey and Vietnam.

[THISPAGEINTENTIONALLYLEFTBLANK]

UNITEDSTATESSECURITIESANDEXCHANGECOMMISSION WASHINGTON,DC20549

FORM10-K

È ANNUALREPORTPURSUANTTOSECTION13OR15(d)OFTHESECURITIESEXCHANGEACTOF1934 ForthefiscalyearendedDecember28,2024or

‘ TRANSITIONREPORTPURSUANTTOSECTION13OR15(d)OFTHESECURITIESEXCHANGEACTOF1934 Forthetransitionperiodfromto

Commissionfilenumber1-7685

(ExactNameofRegistrantasSpecifiedinItsCharter) Delaware95-1492269 (StateofIncorporation)(I.R.S.EmployerIdentificationNo.)

8080NortonParkway Mentor,Ohio44060 (AddressofPrincipalExecutiveOffices)(ZipCode)

Registrant’stelephonenumber,includingareacode: (440)534-6000

SecuritiesregisteredpursuanttoSection12(b)oftheAct:

TitleofEachClass TradingSymbol(s) Nameofeachexchangeonwhichregistered Commonstock,$1parvalueAVYNewYorkStockExchange 1.25%SeniorNotesdue2025AVY25NasdaqStockMarket 3.75%SeniorNotesdue2034AVY34NasdaqStockMarket

SecuritiesregisteredpursuanttoSection12(g)oftheAct: Notapplicable.

Indicatebycheckmarkiftheregistrantisawell-knownseasonedissuer,asdefinedinRule405oftheSecuritiesAct.Yes È No ‘

IndicatebycheckmarkiftheregistrantisnotrequiredtofilereportspursuanttoSection13or15(d)oftheAct.Yes ‘ No È

Indicatebycheckmarkwhethertheregistrant(1)hasfiledallreportsrequiredtobefiledbySection13or15(d)oftheSecuritiesExchangeActof 1934duringthepreceding12months(orforsuchshorterperiodthattheregistrantwasrequiredtofilesuchreports),and(2)hasbeensubjecttosuchfiling requirementsforthepast90days.Yes È No ‘

IndicatebycheckmarkwhethertheregistranthassubmittedelectronicallyeveryInteractiveDataFilerequiredtobesubmittedpursuanttoRule405 ofRegulationS-T(§232.405ofthischapter)duringthepreceding12months(orforsuchshorterperiodthattheregistrantwasrequiredtosubmitsuch files).Yes È No ‘

Indicatebycheckmarkwhethertheregistrantisalargeacceleratedfiler,anacceleratedfiler,anon-acceleratedfiler,asmallerreportingcompany, oranemerginggrowthcompany.Seethedefinitionsof“largeacceleratedfiler,”“acceleratedfiler,”“smallerreportingcompany,”and“emerginggrowth company”inRule12b-2oftheExchangeAct.

LargeAcceleratedFiler È Acceleratedfiler ‘ Non-acceleratedfiler ‘ Smallerreportingcompany ‘ Emerginggrowthcompany ‘

Ifanemerginggrowthcompany,indicatebycheckmarkiftheregistranthaselectednottousetheextendedtransitionperiodforcomplyingwith anyneworrevisedfinancialaccountingstandardsprovidedpursuanttoSection13(a)oftheExchangeAct. ‘

Indicatebycheckmarkwhethertheregistranthasfiledareportonandattestationtoitsmanagement’sassessmentoftheeffectivenessofits internalcontroloverfinancialreportingunderSection404(b)oftheSarbanes-OxleyAct(15U.S.C.7262(b))bytheregisteredpublicaccountingfirmthat preparedorissueditsauditreport. È

IfsecuritiesareregisteredpursuanttoSection12(b)oftheAct,indicatebycheckmarkwhetherthefinancialstatementsoftheregistrantincluded in thefilingreflectthecorrectionofanerrortopreviouslyissuedfinancialstatements. ‘

Indicatebycheckmarkwhetheranyofthoseerrorcorrectionsarerestatementsthatrequiredarecoveryanalysisofincentive-basedcompensation receivedbyanyoftheregistrant’sexecutiveofficersduringtherelevantrecoveryperiodpursuantto§240.10D-1(b). ‘

Indicatebycheckmarkwhethertheregistrantisashellcompany(asdefinedinRule12b-2oftheAct).Yes ‘ No È

Theaggregatemarketvalueofvotingandnon-votingcommonequityheldbynon-affiliatesasofJune28,2024,thelastbusinessdayofthe registrant’smostrecentlycompletedsecondfiscalquarter,wasapproximately$17.5billion.

Numberofsharesofcommonstock,$1parvalue,outstandingasofFebruary22,2025,theendoftheregistrant’smostrecentfiscalmonth: 78,994,622.

ThefollowingdocumentsareincorporatedbyreferenceintothePartsofthisForm10-Kindicatedbelow:

Document

Incorporatedbyreferenceinto: PortionsofDefinitiveProxyStatementforAnnualMeetingofStockholderstobeheldonApril24,2025PartsIII,IV

[THISPAGEINTENTIONALLYLEFTBLANK]

Item5.MarketforRegistrant’sCommonEquity,RelatedStockholderMattersandIssuerPurchasesofEquity

Item7.Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations24

Item7A.QuantitativeandQualitativeDisclosuresAboutMarketRisk42 Item8FinancialStatementsandSupplementaryData43 Item9.ChangesinandDisagreementswithAccountantsonAccountingandFinancialDisclosure89

Item9C.DisclosureRegardingForeignJurisdictionsthatPreventInspections89

PARTIII

Item10.Directors,ExecutiveOfficersandCorporateGovernance90

Item12.SecurityOwnershipofCertainBeneficialOwnersandManagementandRelatedStockholderMatters91 Item13.CertainRelationshipsandRelatedTransactions,andDirectorIndependence91 Item14.PrincipalAccountantFeesandServices91

PARTIV

Item15.ExhibitsandFinancialStatementSchedules92

[THISPAGEINTENTIONALLYLEFTBLANK]

ThemattersdiscussedinthisAnnualReportonForm10-Kcontain“forward-lookingstatements”withinthemeaning ofthePrivateSecuritiesLitigationReformActof1995.Thesestatements,whicharenotstatementsofhistoricalfact, containestimates,assumptions,projectionsand/orexpectationsregardingfutureevents,whichmayormaynotoccur. Wordssuchas“aim,”“anticipate,”“assume,”“believe,”“continue,”“could,”“estimate,”“expect,”“foresee,”“guidance,” “intend,”“may,”“might,”“objective,”“plan,”“potential,”“project,”“seek,”“shall,”“should,”“target,”“will,”“would,”or variationsthereof,andotherexpressionsthatrefertofutureeventsandtrends,identifyforward-lookingstatements.Our forward-lookingstatements,andfinancialorotherbusinesstargets,aresubjecttocertainrisksanduncertainties,which couldcauseouractualresultstodiffermateriallyfromtheexpectedresults,performanceorachievementsexpressedor impliedbysuchforward-lookingstatements.

Webelievethatthemostsignificantriskfactorsthatcouldaffectourfinancialperformanceinthenearterminclude: (i)theimpactonunderlyingdemandforourproductsfromglobaleconomicconditions,geopoliticaluncertainty,and changesinenvironmentalstandards,regulationsandpreferences;(ii)competitors’actions,includingpricing,expansionin keymarkets,andproductofferings;(iii)thecostandavailabilityofrawmaterials;(iv)thedegreetowhichhighercostscan beoffsetwithproductivitymeasuresand/orpassedontocustomersthroughpriceincreases,withoutasignificantlossof volume;(v)foreigncurrencyfluctuations;and(vi)theexecutionandintegrationofacquisitions.

Certainrisksanduncertaintiesarediscussedinmoredetailunder“RiskFactors”and“Management’sDiscussionand AnalysisofFinancialConditionandResultsofOperations”inthisAnnualReportonForm10-K.Actualresultsandtrends maydiffermateriallyfromhistoricaloranticipatedresultsdependingonavarietyoffactors,includingbutnotlimitedto, risksanduncertaintiesrelatedtothefollowing:

•InternationalOperations–worldwideeconomic,social,geopoliticalandmarketconditions;changesin geopoliticalconditions,includingthoserelatedtotraderelationsandtariffs,China,theRussia-Ukrainewar,the Israel-HamaswarandrelatedhostilitiesintheMiddleEast;fluctuationsinforeigncurrencyexchangerates;and otherrisksassociatedwithinternationaloperations,includinginemergingmarkets

•OurBusiness–fluctuationsindemandaffectingsalestocustomers;fluctuationsinthecostandavailabilityof rawmaterialsandenergy;changesinourmarketsduetocompetitiveconditions,technologicaldevelopments, lawsandregulations,customerpreferences;environmentalregulationsandsustainabilitytrends;theimpactof competitiveproductsandpricing;theexecutionandintegrationofacquisitions;sellingprices;customerand supplierconcentrationsorconsolidations;thefinancialconditionofdistributors;outsourcedmanufacturers; productandservicequalityclaims;restructuringandothercostreductionactions;ourabilitytogenerate sustainedproductivityimprovementandourabilitytoachieveandsustaintargetedcostreductions;thetimely developmentandmarketacceptanceofnewproducts,includingsustainableorsustainably-sourcedproducts; ourinvestmentindevelopmentactivitiesandnewproductionfacilities;thecollectionofreceivablesfrom customers;andoursustainabilityandgovernancepractices

•InformationTechnology–disruptionsininformationtechnologysystems;cybersecurityeventsorothersecurity breaches;andsuccessfulinstallationofneworupgradedinformationtechnologysystems

•IncomeTaxes–fluctuationsintaxrates;changesintaxlawsandregulations,anduncertaintiesassociatedwith interpretationsofsuchlawsandregulations;outcomeoftaxaudits;andtherealizationofdeferredtaxassets

•HumanCapital–recruitmentandretentionofemployeesandcollectivelaborarrangements

•OurIndebtedness–ourabilitytoobtainadequatefinancingarrangementsandmaintainaccesstocapital;credit ratingrisks;fluctuationsininterestrates;andcompliancewithourdebtcovenants

•OwnershipofOurStock–potentialsignificantvariabilityofourstockpriceandamountsoffuturedividendsand sharerepurchases

•LegalandRegulatoryMatters–protectionandinfringementofourintellectualproperty;theimpactoflegaland regulatoryproceedings,includingwithrespecttocomplianceandanti-corruption,environmental,healthand safety,andtradecompliance

•OtherFinancialMatters–fluctuationsinpensioncostsandgoodwillimpairment

Ourforward-lookingstatementsaremadeonlyasofFebruary26,2025.Weassumenodutytoupdatethese forward-lookingstatementstoreflectnew,changedorunanticipatedeventsorcircumstances,otherthanasmaybe requiredbylaw.

AveryDennisonCorporation(“AveryDennison”orthe“Company”andgenerallyreferredtoas“we”or“us”)was incorporatedinDelawarein1977asAveryInternationalCorporation,thesuccessorcorporationtoaCalifornia corporationofthesamenameincorporatedin1946.In1990,wemergedoneofoursubsidiariesintoDennison ManufacturingCompany(“Dennison”),asaresultofwhichDennisonbecameourwholly-ownedsubsidiaryandin connectionwithwhichwechangedournametoAveryDennisonCorporation.Youcanlearnmoreaboutusbyvisitingour websiteatwww.averydennison.com.Ourwebsiteisnotintendedtofunctionasahyperlinkandtheinformationonour websiteisnot,norshoulditbeconsidered,partofthisreportorincorporatedbyreferenceintothisreport.

Weareaglobalmaterialsscienceanddigitalidentificationsolutionscompany.WeareMakingPossibleTM products andsolutionsthathelpadvancetheindustriesweserve,providingbrandingandinformationsolutionsthatoptimizelabor andsupplychainefficiency,reducewaste,advancesustainability,circularityandtransparency,andbetterconnectbrands andconsumers.Wedesignanddeveloplabelingandfunctionalmaterials,radio-frequencyidentification(“RFID”)inlays andtags,softwareapplicationsthatconnectthephysicalanddigital,andofferingsthatenhancebrandedpackagingand carryordisplayinformationthatimprovesthecustomerexperience.Weserveanarrayofindustriesworldwide,including homeandpersonalcare,apparel,generalretail,e-commerce,logistics,foodandgrocery,pharmaceuticalsand automotive.

Webelievethatourexposuretodiverseandgrowingmarkets,thesizeandscaleofoperations,ourinnovation capabilities,productivityculture,andbrandstrengthacrossourbusinessesaretheprimaryadvantagesinmaintainingand furtherdevelopingourcompetitiveposition.

Ourreportablesegmentsforfiscalyear2024wereMaterialsGroupandSolutionsGroup.In2024,ourMaterials GroupandSolutionsGroupreportablesegmentscomprisedapproximately69%and31%,respectively,ofourtotalnet sales.

In2024,internationaloperationsconstitutedasubstantialmajorityofourbusiness,representingapproximately 70%ofournetsales.AsofDecember28,2024,weoperatedover200manufacturinganddistributionfacilitiesandhad locationsinmorethan50countries.

OurMaterialsGroupisaleadingglobalprovidertothepressure-sensitivelabelandgraphicsindustries.Our innovativeproductsincludelabelmaterials,graphicsandreflectivematerialsandfunctionalbondingmaterials,liketapes. Ourlabelmaterialsenhancebrands’shelfappeal,informshoppers,advancecircularity,increasetransparency,helpreduce wasteandimproveoperationalsupplychainefficiency.Ourgraphicsportfoliooffershighlyengineeredproductsranging fromvehiclewrapstoarchitecturalfilms.Ourtapesportfolioincludesbondingandfunctionalmaterialsforapplicationsin variousindustrysectorssuchasautomotive,buildingandconstructionandelectronics.Weleveragethegroup’smaterials sciencecapabilitiesandprocessengineeringexpertisetodevelopandmanufactureIntelligentLabelsatscaleanddrive theirfurtheradoptionthroughourconverterchannelaccess.

OurMaterialsGroupmanufacturesandsellsFasson®-,JAC®-,andAveryDennison®-brandpressure-sensitive labelmaterialsandperformancetapesproducts,AveryDennison®-andMactac®-brandgraphics,andAveryDennison®brandreflectiveproducts.MaterialsGroup’sbusinesstendsnottobeseasonal,exceptforcertainoutdoorgraphicsand reflectiveproducts.

Pressure-sensitivematerialsconsistprimarilyofpapers,plasticfilmsandmetalfoils,whicharecoatedwith internally-developedandpurchasedadhesives,andthenlaminatedwithspecially-coatedbackingpapersandfilms.They arethensoldinrollorsheetformwitheithersolidorpatternedadhesivecoatingsinawiderangeoffacematerials,sizes, thicknessesandadhesiveproperties.

Apressure-sensitive,orself-adhesive,materialisonethatadherestoasurfacebypress-oncontact.Itgenerally consistsoffourlayers:afacematerial,whichmaybepaper,metalfoilorplasticfilm;anadhesive,whichmaybe 2 2024AnnualReport | AveryDennisonCorporation

permanentorremovable;areleasecoating;andabackingmaterialtoprotecttheadhesivefromprematurecontactwith othersurfacesthatcanalsoserveasacarrierforsupportinganddispensingindividuallabels.Whentheproductsare readyforuse,thereleasecoatingandprotectivebackingareremoved,exposingtheadhesivesothatthelabelorother facematerialmaybepressedorrolledintoplace.Becausetheyareeasytoapplywithouttheneedforadhesiveactivation, self-adhesivematerialscanprovidecostsavingscomparedtoothermaterialsthatrequireheat-ormoisture-activated adhesives,whilealsoofferingaestheticandotheradvantagesoveralternativetechnologies.

Labelmaterialsaresoldworldwidetolabelconvertersforlabeling,decoratingandspecialtyapplicationsinthe food,homeandpersonalcare,beerandbeverage,durables,pharmaceutical,wineandspiritsandlogisticsmarket segments.Whenusedinpackagedecorationapplications,thevisualappealofself-adhesivematerialscanhelpincrease salesoftheproductsonwhichthematerialsareapplied.Self-adhesivematerialsarealsousedtoconveyvariable informationthroughvariousdigitaltriggers,includingbarcodes,QRcodesandRFIDinlays,forapplicationssuchas shippinglabelsandweightandpriceinformationforpackagedmeatsandotherfoods.Self-adhesivematerialsprovide consistentandversatileadhesionandareavailableinalargeselectionofmaterials,whichcanbemadeintolabelsof varyingsizesandshapes.

Ourgraphicsandreflectiveproductsincludeavarietyoffilmsandotherproductsthataresoldtothearchitectural, commercialsign,digitalprintingandotherrelatedmarketsegments.Wealsoselldurablecastandreflectivefilmstothe construction,automotiveandfleettransportationmarketsegmentsandreflectivefilmsfortrafficandsafetyapplications. Weprovidesignshops,commercialprintersanddesignersabroadrangeofpressure-sensitivematerialsthatallowthem tocreateimpactfulandinformativebrandanddecorativegraphics.Weofferawidearrayofpressure-sensitivevinyland specialtymaterialsdesignedfordigitalimaging,screenprintingandsigncuttingapplications.

OurperformancetapesproductsincludeavarietyofFasson®-brandandAveryDennison®-brandtapesandother pressure-sensitiveadhesive-basedmaterialsandconvertedproducts,mechanicalfastenersandperformancepolymers. Ourpressure-sensitiveadhesive-basedmaterialsareavailableinrollformandinawiderangeoffacematerials,sizes, thicknessesandadhesiveproperties.Thesematerialsandconvertedproductsareusedinnon-mechanicalfastening, bondingandsealingsystemsforvariousautomotive,electronics,buildingandconstruction,generalindustrial,personal care,andmedicalapplications.Themechanicalfastenersareprimarilyprecision-extrudedandinjection-moldedplastic devicesusedinvariousautomotive,generalindustrialandretailapplications.

OurlargercompetitorsinlabelmaterialsincludeUPMRaflatac,asubsidiaryofUPMCorporation;FedrigoniSelfAdhesives;LintecCorporation;FlexconCorporation,Inc.;andanarrayofsmallerregionalandlocalcompanies.For graphicsandreflectiveproducts,ourlargestcompetitorsare3MCompany(“3M”)andtheOrafolGroup.Forperformance tapesproducts,ourcompetitorsinclude3M;Tesa-SE,asubsidiaryofBeiersdorfAG;NittoDenkoCorporation;and numerousregionalandspecialtysuppliers.Forfastenerproducts,thereareavarietyofcompetitorssupplyingextruded andinjectionmoldedfastenersandfastenerattachingequipment.Webelievethatentryofcompetitorsintothefieldof pressure-sensitiveadhesivesandmaterialsislimitedbytechnicalknowledgeandcapitalrequirements.Webelievethat ourtechnicalexpertise,sizeandscaleofoperations,broadlineofqualityproducts,reliableservice,productandprocess innovation,distributioncapabilitiesandbrandstrengtharetheprimaryadvantagesinmaintainingandfurtherdeveloping ourcompetitiveposition.

OurSolutionsGroupisaleadingproviderofinformationandbrandingsolutionsthatcoverworldwidemarketplace needsrangingfromdigitalidentificationanddatamanagementtobrandingandembellishment,productivity,pricingand retailmedia.Asalargeultra-high-frequencyRFIDsolutionsprovider,weempowercustomersacrossmultipleretailand industrysegments,includingapparel,logistics,foodandgroceryandgeneralretail,toconnectthephysicalanddigital worldsbyenablingadigitalidentityandlifeonphysicalitems.Ourinnovationanddatamanagementcapabilities,global footprintandmarketaccesscontinuouslyexpandoursolutionsplatform.

ThebrandingsolutionsoftheSolutionsGroupincludebrandembellishments,graphictickets,tags,andlabels,and sustainablepackaging.SolutionsGroup’sinformationsolutionsincludeitem-levelRFIDsolutions;visibilityandloss preventionsolutions;priceticketingandmarking;care,content,andcountryoforigincompliancesolutions;brand protectionandsecuritysolutions;andVestcom®-brandshelf-edgeproductivityandmediasolutions.

IntheSolutionsGroup,ourprimarycompetitorsincludeCheckpointSystems,Inc.,asubsidiaryofCCLIndustries Inc.;R-pacInternationalCorporation;SMLGroupLimited;ArizonRFIDTechnologyCaymanCoLtd;andTageos,a AveryDennisonCorporation | 2024AnnualReport 3

subsidiaryofFedrigoniGroup.Webelievethatourproduct,processandsolutioninnovation,globaldistributionnetwork, reliableservice,productqualityandconsistency,andabilitytoservecustomersconsistentlywithcomprehensivesolutions closetowheretheymanufacture,sourceandsellarethekeyadvantagesinmaintainingandfurtherdevelopingour competitiveposition.

Asagloballeaderinmaterialsscience,weinnovatetodevelopandintroducenewproductsandsolutionsthathelp customerssolvesomeofthemostcomplexproblemsintheindustriesweserve.Ourvisionistoleveragethestrengthsof ourMaterialsandSolutionsgroupstocontinuetodrivegrowthwithinthesebusinessesandleadattheintersectionofthe physicalanddigitalworlds.Ourdecadesofexperiencecreatingsolutionsforcustomersandourcorecapabilitiesin materialsscience,engineeringandprocesstechnologyenableustodrivecontinuousinnovationthroughoutour industries.Ourinnovationeffortsfocusonanticipatingmarketandcustomerchallengesandopportunities,andapplying technologytoaddressthem.Ourinvestmentininnovationaimstoaccelerategrowthbydevelopingnewproductsand solutions,expandmarginsthroughmaterialre-engineering,andenablecustomersuccessbyleveragingscalable innovationplatformsanddeliveringsustainabilityinitiativesandadvancedtechnologies.

Manyofournewproductsresultfromourresearchanddevelopmentefforts.Theseeffortsaredirectedprimarily towarddevelopingproducts,solutionsandoperatingtechniquesandimprovingproductivity,sustainabilityandproduct performance,oftenincloseassociationwithourcustomersorendusers.Theseeffortsprovideintellectualpropertythat leveragesourresearchanddevelopmentrelatingtomaterialsscience,suchasadhesives,films,inksandreleaseliners, andprocessengineeringtechnology,suchascoating,laminatingandprintingtechnologiesinMaterialsGroup.Wefocus onresearchprojectsrelatedtoRFID,externalembellishments,dataanddigitalsolutionsandprintingtechnologiesin SolutionsGroup,ineachcaseforwhichwehaveandlicenseanumberofpatents.Additionally,ourresearchand developmenteffortsincludesustainableinnovationanddesignofproductsthatadvancethecirculareconomy,reduce materialsandwaste,userecycledcontent,andextendproductend-of-lifeorenableproductrecycling.

Inadditiontoourinvestmentstosupportorganicgrowth,wehavepursuedcomplementaryandsynergistic acquisitions.In2023,weacquiredSilverCrystalGroup(“SilverCrystal”),aCanada-basedproviderofsportsapparel customizationandapplicationsolutionsacrossin-venue,direct-to-businessande-commerceplatforms;LGGroup,Inc. (“LionBrothers”),aMaryland-baseddesignerandmanufacturerofapparelbrandembellishments;andThermopatch,Inc. (“Thermopatch”),aNewYork-basedmanufacturerspecializinginlabeling,embellishmentsandtransfersforthesports, industriallaundry,workwearandhospitalityindustries.Theaggregatepurchaseconsiderationfortheseacquisitionswas approximately$231million.During2024,wealsomadeventureinvestmentsinthreecompaniesdeveloping technologicalsolutionsthatwebelievehavethepotentialtoadvanceourbusinesses.Forinformationregardingour acquisitions,seeNote2,“BusinessAcquisitions,”intheNotestoConsolidatedFinancialStatements.Forinformation regardingourventureinvestments,seeNote9,“FairValueMeasurements,”intheNotestoConsolidatedFinancial Statements.

Thelossofindividualpatentsorlicenseswouldnotbematerialtoustakenasawhole,nortoouroperating segmentsindividually.OurprincipaltrademarksareAveryDennison,ourlogo,andFasson.Webelievethesetrademarks arestronginthemarketsegmentsinwhichweoperate.

Withapproximately70%ofour2024netsalesoriginatingoutsidetheU.S.andapproximately40%ofournet salesoriginatinginemergingmarkets(LatinAmerica,EasternEurope,MiddleEast/NorthernAfrica,andmostcountriesin AsiaPacific),ouremployeesarelocatedinmorethan50countriestobestserveourcustomers.Approximately83%of ouremployeesatyear-end2024werelocatedoutsidetheU.S.andapproximately66%werelocatedinemerging markets.

Thechartsbelowshowourglobalemployeepopulationbyregionandoperationalfunction.Over19,000ofour approximately35,000employeesatyear-end2024,representingapproximately58%ofourglobalworkforce,werein AsiaPacific,servingourcustomersinthatregion.Atthattime,approximately65%ofourglobalworkforceworkedinthe operationsofourmanufacturingfacilitiesorinpositionsdirectlysupportingthemfromotherlocations.

Attracting,developingandretaininghighly-skilledtalentiscriticaltoourabilitytocontinuedeliveringsustainable growth.Weprovideongoingsupportandprofessionaldevelopmentresourcestoourteammembersworldwidetoensure thattheirskillsevolvewithourbusinessneeds,industrytrendsandhumancapitalmanagementbestpractices,aswellas enableincreasedproductivity,peakperformanceandcareergrowth.Wehaverobusttalentreviewandsuccession planningprocessesthatprovideindividuallytargeteddevelopmentopportunitiesforourteammembers.Weemphasize on-the-jobdevelopmentandcoaching,andalsoprovidefacilitator-ledanddirect-accessonlinetraining,leadership opportunitiestoexecutespecialprojectsand,insomecases,cross-functional,cross-regional,orcross-divisionalwork assignments.In2024,weintroducedanenterprise-widecompetencymodelthatprovidestransparencyandclarity aroundwhatweexpectfromourleaders,whichwillserveasthego-forwardfoundationofallofourtalentpractices,from talentselectionandretentiontoindividualandcareerdevelopmenttosuccession.

Ourtotalrewardsphilosophyistooffermarket-based,competitivewagesandbenefitsinthemarketswherewe competefortalent.Allofouremployeeswerepaidatleasttheapplicablelegalminimumwage,andover99%ofour employeeswerepaidabovetheapplicablelegalminimumwage,atyear-end2024.Payisgenerallypositionedaround themarketmedian,withvariancesbasedonknowledge,skills,yearsofexperienceandinlinewithourpayfor performancephilosophy.Inadditiontobasewages,ourcompensationandbenefitprograms—whichvarybyregion, countryandbusinessunit—includeshort-termincentives(generallypaidincash),long-termincentives(e.g.,cash-or stock-basedawards),employeebenefitandretirementplans,healthcareandinsurancebenefits,healthsavingsand flexiblespendingaccounts,paidtimeoff,leaveofabsenceandemployeeassistanceprograms.Weoffertheopportunity forflexibleworkarrangementsformostofouroffice-basedworkforcetoprovidethemwithgreaterflexibilitytobalance theirworkandpersonalcommitments,whileensuringthatwemeettheneedsofourbusiness.Ourinformation technologyinfrastructure,informationsecurityprotocolsanddigitaltoolssupportemployeeefficiencyandeffectiveness wherevertheywork.

Payequityisanimportantpartofourglobalpayplanningandpractices.Eachyear,weengageanindependent thirdpartytoevaluatepayequity,makingmerit-basedpayadjustmentswhereappropriate.In2024,wereviewedpay equity(consideringtotalbase,annualincentivesandlong-termincentives)withrespecttogenderfor93%ofourglobal employeepopulation,andwithrespecttogenderandrace/ethnicityforallU.S.employees.Wecontinuetoenhanceour managereducation,toolsandprocessestoprovidefairandequitablepay.

Becausewebelievethatanengagedworkforcepromotesretentionandminimizesemployeeturnover,weannually conductaglobalemployeeengagementsurvey.Withafocusoncontinuousimprovement,in2023welaunchedour AveryDennisonCorporation | 2024AnnualReport 5

surveyusingamoreadvancedplatformprovidingreal-timeaccesstoresults,improvedanalyticsandabilitytoconnect datathroughouttheemployeeexperience,moremeaningfulcomparisonstoexternalbenchmarks,andongoingpulse surveycapability.Wedeployedthissameplatformin2024,enablingyear-over-yearcomparabilityofresults.Our businessandfunctionalteamsusetheanonymizedresultsofoursurveytoidentifyandimplementactionstoaddress potentialopportunitiesforimprovement.Whileemployeeengagementistheresultofmanyfactors,webelievestrong, encouragingandopenleadership,aswellasacontinuedefforttofosteracollaborative,supportiveculture,leadsto strongworkforceengagement.

Safetyisoneofourhighestpriorities,andwecontinuallyworktoensureourmanufacturingfacilities,distribution centersandadministrativeofficesfocusonsafety,sothatanyoneworkinginorvisitingoneofourlocationsfeelsand remainssafefrominjury.OurglobalRecordableIncidentRateof0.21in2024wassignificantlylowerthanthe OccupationalSafetyandHealthAdministrationmanufacturingindustryaverageof2.8in2023(themostrecentavailable industryaverage).

Weaimtofosteranenvironmentwhereouremployeeswithvariousskills,experiencesandbackgroundscangrow andbeincreasinglyproductiveandinnovative,allowingustobenefitfromahighlyengagedteamandattractandretain talentforthebenefitofourstakeholders.Ourglobalpeople-focusedstrategicpillarsincludeenhancingtheexperienceof ourmanufacturingemployeesandmakingmeritandtransparencyevenmorefoundationaltoouremployeeexperience. Wehaveaglobalteamthathelpsadvancetheseprioritiesincoordinationwithregionalcouncilsandouremployee resourcegroups,whichareopentoallourteammembersandprovideindividualswithsharedinterestsaforuminwhich toidentifywaysinwhichwecanimproveouremployeeexperience.

Weusevariousrawmaterials–primarilypaper,plasticfilmsandresins,aswellasspecialtychemicalspurchased fromvariouscommercialandindustrialsources–thataresubjecttopricefluctuations.Althoughshortagescanoccurfrom timetotime,theserawmaterialsaregenerallyavailable.

Weproduceamajorityofourself-adhesivematerialsusingwater-basedemulsionandhot-meltadhesive technologies.Aportionofourmanufacturingprocessforself-adhesivematerialsutilizesorganicsolvents,which,unless controlled,couldbeemittedintotheatmosphereorcontaminatesoilorgroundwater.Emissionsfromtheseoperations containsmallamountsofvolatileorganiccompounds,whichareregulatedbyfederal,state,localandforeign governments.Wecontinuetoevaluatetheuseofalternativematerialsandtechnologiestominimizetheseemissions.In connectionwiththemaintenanceandacquisitionofcertainmanufacturingequipment,weinvestinsolventcaptureand controlunitstoassistinregulatingtheseemissions.

Wehavedevelopedadhesivesandadhesiveprocessingsystemsthatminimizetheuseofsolvents.Emulsion adhesives,hot-meltadhesives,andsolventlessandemulsionsiliconesystemshavebeeninstalledinmanyofourfacilities.

Basedoncurrentinformation,wedonotbelievethatthecostofcomplyingwithapplicablelawsregulatingthe emissionordischargeofmaterialsintotheenvironment,orotherwiserelatingtotheprotectionoftheenvironment,will haveamaterialeffectuponourcapitalexpenditures,consolidatedfinancialposition,resultsofoperationsorcompetitive position.

Forinformationregardingourpotentialresponsibilityforcleanupcostsatcertainhazardouswastesites,see Note8,“Contingencies,”intheNotestoConsolidatedFinancialStatements.

AvailableInformation

OurAnnualReportsonForm10-K,QuarterlyReportsonForm10-Q,CurrentReportsonForm8-Kand amendmentstothosereportsfiledwith,orfurnishedto,theSecuritiesandExchangeCommission(“SEC”)pursuantto Section13(a)or15(d)oftheSecuritiesExchangeActof1934,asamended(the“ExchangeAct”),areavailablefreeof chargeonourinvestorwebsiteatwww.investors.averydennison.comassoonasreasonablypracticableaftertheyare electronicallyfiledwithorfurnishedtotheSEC.Thiswebsiteaddressisnotintendedtofunctionasahyperlinkandthe informationlocatedthereisnot,norshoulditbeconsidered,partofthisreportorincorporatedbyreferenceintothis report.Wealsomakeavailableontheinvestorssectionofourwebsiteunder“GovernanceDocuments”thefollowing 6 2024AnnualReport | AveryDennisonCorporation

documentsascurrentlyineffect:(i)AmendedandRestatedCertificateofIncorporation,asamended;(ii)Amendedand RestatedBylaws;(iii)CorporateGovernanceGuidelines;(iv)CodeofConduct,whichappliestoourdirectors,officersand employees;(v)CodeofEthicsforourChiefExecutiveOfficerandSeniorFinancialOfficers;(vi)chartersoftheAudit, TalentandCompensation,GovernanceandFinanceCommitteesofourBoardofDirectors;and(vii)AuditCommittee ComplaintProceduresforAccountingandAuditingMatters.Thesedocumentsarealsoavailablefreeofchargeupon writtenrequesttoourCorporateSecretary,AveryDennisonCorporation,8080NortonParkway,Mentor,Ohio44060.

ReportsfiledwithorfurnishedtotheSECmaybeviewedatwww.sec.gov.

Theriskfactorsdescribedinthissectioncouldmateriallyadverselyaffectourbusiness,includingourresultsof operations,cashflowsandfinancialcondition,andcausethevalueofoursecuritiestodecline.Thislistofrisksisnot exhaustive.Ourabilitytoattainourgoalsandobjectivesisdependentonnumerousfactorsandrisks,including,butnot limitedto,themostsignificantonesdescribedinthissection.

Thedemandforourproductsisimpactedbytheeffectsof,andchangesin,worldwideeconomic,social,geopolitical andmarketconditions,whichhavehadinthepastandcouldinthefuturehaveamaterialadverseeffectonour business.

Wehaveoperationsinmorethan50countriesandourdomesticandinternationaloperationsarestrongly influencedbymattersbeyondourcontrol,includingchangesingeopolitical,social,economicandlaborconditions,tax laws,andU.S.andinternationaltraderegulations(includingtariffs),aswellastheimpactthesechangeshaveondemand forourproducts.In2024,approximately70%ofournetsaleswereproducedininternationaloperations.

Macroeconomicdevelopmentssuchasimpactsfromslowergrowthinthegeographicregionsinwhichwe operate;inflation,resultingfrom,amongotherthings,increasedrawmaterial,energy,andfreightcosts;laborshortages; geopolitical,social,supplychainandotherdisruptions;epidemics,pandemicsorotheroutbreaksofillness,diseaseor virus;anduncertaintyintheglobalcreditorfinancialmarketscouldresultinamaterialadverseeffectonourbusinessasa resultof,amongotherthings,lowerconsumerspending,fluctuationsinforeigncurrencyexchangerates,reducedasset valuations,diminishedliquidityandcreditavailability,volatilityinsecuritiesprices,andcreditratingdowngrades.

TensionsremainintraderelationsbetweentheU.S.andcertainotherregionsandcountries,includingCanada,Mexico, China,IndiaandtheEuropeanUnion.TheU.S.recentlyannouncedintentionstoimposeasignificanttariffoncertaingoods fromCanadaandMexicoandasmallertariffoncertaingoodsfromChina.Eachofthesecountriesannouncedthattheywould imposereciprocaltariffs,withCanadaandMexicoeachagreeinguponcertainconcessionswiththeU.S.totemporarilydelay themutualimpositionoftariffs.ThetariffoncertaingoodsfromChinahasgoneintoeffect,withChinaimposingreciprocal tariffs,andtheamountofthesetariffsortheclassesofgoodsonwhichtheyareimposedcouldsignificantlyincrease.TheU.S. hasalsoindicatedthatitmayimposereciprocaltariffsongoodsfromothercountriesorregions.Whiletheimpactsonour operationstodatehavenotbeensignificant,ourbusinesscouldbemateriallyadverselyimpactedbychangesinU.S.and non-U.S.tradepolicies,includingpotentialmodificationstoexistingtradeagreementsandadditionaltariffsorrestrictionson freetrade,impactingourrawmaterialsorfinishedproducts.Theseactionsorotherdevelopmentsininternationaltrade relationscouldhaveamaterialadverseeffectonourbusiness.

Inaddition,businessandoperationaldisruptionsordelayscausedbygeopolitical,socialoreconomicinstabilityand unrest–suchasrecentcivil,politicalandeconomicdisturbancesinArgentina,Afghanistan,Syria,Iraq,Yemen,Iran,Turkey, NorthKorea,andBangladeshandtherelatedimpactonglobalstability,theRussia-Ukrainewar,theIsrael-Hamaswar, terroristattacksandthepotentialforotherhostilitiesornaturaldisastersinvariouspartsoftheworld–couldcontributetoa climateofeconomicandgeopoliticaluncertaintythatcouldhaveamaterialadverseeffectonourbusiness.SincetheRussiaUkrainewarbeganinFebruary2022,wehavemaintainedourpositionofnotshippingproductsfortheRussianmarket.The impactofthecontinuingwar,aswellasanyfurtherretaliatoryactionstakenbyRussia,theU.S.,theEuropeanUnionandother jurisdictions,isunknownandcouldhaveamaterialadverseeffectonourbusiness.Inaddition,sincethebeginningofthe Israel-Hamaswarinlate2023;oursalesinIsraelhavedeclined,withsalesrepresentinglessthan1%ofourtotalnetsalesin 2024.Wehaveexperiencedsomedisruptionsinouroperations inIsraelandtheMiddleEastandimplementedplansto addressthesedisruptions,aswellastheimpactsthereofinGaza,LebanonandotherareasoftheMiddleEast,whilefocusing onthecontinuedsafetyofourIsraeliemployeesandtheirfamilies.Thecontinuedimpactofthiswarandanyrelatedhostilities intheMiddleEastregionorelsewhereisunknownandcouldhaveamaterialadverseeffectonourbusiness. AveryDennisonCorporation | 2024AnnualReport 7

Wearenotabletopredictthedurationandseverityofadverseeconomic,social,geopoliticalormarketconditions intheU.S.orothercountries.

Foreigncurrencyexchangerates,andfluctuationsinthoserates,affectourbusiness.

Themajorityofournetsalesin2024wasdenominatedinforeigncurrencies.Ourfinancialresultsaretherefore subjecttotheimpactofcurrencytranslation,whichmaybematerial.Overall,ourforeigncurrencytransactionexposureis largelymitigatedbecausethecostsofourproductsaregenerallydenominatedinthesamecurrenciesinwhichtheyare sold.

Fluctuationsincurrencyexchangerates,suchastheunfavorableimpactsassociatedwiththeArgentinepeso, Chineserenminbiandeuroin2024,mayresultinavarietyofnegativeeffects,includinglowernetsales,increasedcosts, lowergrossmargins,increasedallowanceforcreditlossesand/orwrite-offsofaccountsreceivable,andrequired recognitionofimpairmentsofcapitalizedassets,includinggoodwillandotherintangibleassets.Foreigncurrency translationdecreasedour2024netsalesbyapproximately$33millioncomparedtotheprioryear.

Wemonitorourforeigncurrencyexposuresandsometimesusehedginginstrumentstomitigatesomeofour transactionalexposuretochangesinforeigncurrencies.Theeffectivenessofourhedgesinpartdependsonourabilityto accuratelyforecastourfuturecashflows,whichisparticularlydifficultduringperiodsofuncertaindemandforour productsandservicesandvolatileforeigncurrencyexchangerates.Ourhedgingactivitiesmayoffsetonlyaportion,or noneatall,ofthematerialadversefinancialeffectsofunfavorablemovementsinforeigncurrencyexchangeratesover thelimitedtimethehedgesareinplaceandwemayincursignificantlossesfromtheseactivities.

Ourstrategyincludescontinuingtogrowinemergingmarkets,whichcreatesgreaterexposuretounstable geopoliticalconditions,civilunrest,economicvolatility,andotherrisksapplicabletooperatingintheseregions.

Approximately40%ofournetsalesin2024originatedinemergingmarkets,whichincludescountriesinAsia Pacific,LatinAmerica,EasternEuropeandMiddleEast/NorthernAfrica.Theprofitablegrowthofourbusinessin emergingmarketsisanimportantpartofourlong-termgrowthstrategyandourregionalresultshaveandcanfluctuate significantlybasedontheireconomicconditions.Ourbusinessoperationshavebeenandmaycontinuetobeadversely affectedbythecurrentandfuturepoliticalenvironmentinChina,bothrelatingtoin-countrychangesinlawsand regulationsortheinterpretationthereof,aswellasaresultofitsresponsetotariffsimposedbytheU.S.governmenton goodsimportedfromChina,tariffsimposedbyChinaonU.S.goods,theincreasinguseofeconomicsanctionsandexport controlrestrictions,andtensionsrelatedtoHongKongandTaiwan.

Ifweareunabletosuccessfullyexpandourbusinessinemergingmarketsorachievethereturnoncapitalwe expectfromourinvestmentsinthesecountries,ourfinancialperformancewouldbemateriallyadverselyaffected.In additiontotherisksapplicabletoourinternationaloperations,factorsthathavenegativelyimpactedouroperationsin theseemergingmarketsfromtimetotimeincludethelessestablishedorreliablelegalsystemsandpossibledisruptions duetounstablegeopoliticalconditions,civilunrestoreconomicvolatility.Thesefactorscanhaveamaterialadverseeffect onourbusinessintheaffectedmarketsbydecreasingconsumerpurchasingpower,reducingdemandforourproductsor increasingourcosts.

OuroperationsandactivitiesoutsideoftheU.S.subjectustorisksdifferentfromandpotentiallygreaterthanthose associatedwithourdomesticoperations.

AsubstantialportionofouremployeesandassetsarelocatedoutsideoftheU.S.and,in2024,approximately70% ofoursaleswasgeneratedoutsideoftheU.S.Internationaloperationsandactivitiesinvolverisksthataredifferentfrom andpotentiallygreaterthantheriskswefaceinourdomesticoperations,includingchangesinforeigngeopolitical, regulatoryandeconomicconditions,whethernationally,regionallyorlocally;changesinforeigncurrencyexchangerates; differinglevelsofinflation;reducedprotectionofintellectualpropertyrights;lawsandregulationsimpactingourabilityto repatriateforeignearnings;challengescomplyingwithforeignlawsandregulations,includingthoserelatingtosales, operations,taxes,employmentandlegalproceedings;establishingeffectivecontrolsandprocedurestomonitor compliancewithU.S.lawsandregulationssuchastheForeignCorruptPracticesActandsimilarforeignlawsand regulations,suchastheUK’sBriberyActof2010;differencesinlendingpractices;andchallengeswithcomplyingwith applicableexportandimportcontrollawsandregulations.

8 2024AnnualReport | AveryDennisonCorporation

Asamanufacturer,oursalesandprofitabilitydependupontheavailabilityandcostofrawmaterialsandenergy, whichmaybesubjecttosignificantpricefluctuations,andourabilitytocontroloroffsetincreasesinrawmaterial andlaborcosts.Rawmaterialandfreightcostincreaseshaveimpactedourbusiness.

Rawmaterialsrepresentasignificantportionofourcostsandacriticalelementofourprofitability.Themarketsfor therawmaterialsusedinourbusinessesarechallengingandcanbevolatile,impactingavailabilityandpricing. Additionally,energycostscanbevolatileandunpredictable.Shortagesandinflationaryorotherincreasesinthecostsof rawmaterials,labor,freightandenergyhaveoccurredinthepast,andcouldrecur.In2021and2022,weimplemented targetedpriceincreasesinourMaterialsGroupreportablesegmenttoaddressrawmaterialinflation,whichbegan moderatingin2023andlargelystabilizedin2024.Ifweexperienceinflationaryheadwindsinthefuture,wemay implementsimilarpricingmeasures.Ourperformancedependsinpartonourabilitytooffsetincreasedrawmaterialcosts byraisingoursellingpricesorre-engineeringourproducts.

Itisalsoimportantforustoobtaintimelydeliveryofmaterials,equipment,andotherresourcesfromsuppliers,and tomaketimelydeliverytocustomers.Wemayexperiencesupplychaindisruptionsduetonaturalandotherdisastersor otherevents,orourexistingrelationshipswithsupplierscoulddeteriorateorendinthefuture.Whileweundertake businesscontinuityplanningandtakeactionstomitigatethesedisruptionswhentheyoccur,suchassourcingfromother regionsorsuppliers,anydisruptioninoursupplychaincouldhaveamaterialadverseeffectonoursalesandprofitability, andanysustainedinabilitytoobtainadequatesuppliescouldhaveamaterialadverseeffectonourbusiness.

Weareaffectedbychangesinourmarketsduetocompetitiveconditions,technologicaldevelopments,lawsand regulations,andcustomerpreferences.Ifwedonotcompeteeffectivelyorrespondappropriatelytothesechanges,it couldreducedemandforourproductsandsolutions,orwecouldlosemarketshareorreduceoursellingpricesto maintainmarketshare,anyofwhichcouldmateriallyadverselyaffectourbusiness.

Growingtheproportionofourportfolioinhigh-valuecategoriesthatservemarketsthataregrowingfasterthan grossdomesticproduct,representlargepoolsofpotentialprofitandleverageourcorecapabilitiesisanimportantpartof ourlong-termgrowthstrategy.High-valueproductsandsolutionsincludeourspecialtyanddurablelabelmaterials, graphicsandreflectivesolutions,andindustrialtapes;intelligentlabelsthatuseRFIDtagsandinlays;shelf-edgepricing, productivityandconsumerengagementsolutions;andexternalembellishments.Wefacetheriskthatexistingornew competitors,whichincludesomeofourcustomers,distributors,andsuppliers,willexpandinourkeymarketsegmentsor developnewtechnologies,includinginhigh-valuecategories,enhancingtheircompetitivepositionrelativetoours. Competitorsalsomaybeabletoofferproducts,services,lowerpricesorotherincentivesthatwecannotorthat,to maintainprofitability,wemaynotbeabletooffer.Therecanbenoassurancethatwewillbeabletocompetesuccessfully againstcurrentorfuturecompetitorsornewtechnologies.

Wearealsoexposedtochangesincustomerorderpatterns,suchaschangesinthelevelsofinventorymaintained bycustomersandthetimingofcustomerpurchases,whichareaffectedbyannouncedpriceincreases,changesinour customerincentiveprograms,orchangesinthecustomer’sabilitytoachieveincentivetargets.Changesincustomers’ preferencesforourproductscanalsodecreasedemandforourproductsandhaveamaterialadverseeffectonour business.InourMaterialsGroupreportablesegment,assupplychainconstraintseasedin2022,customersincreased inventorylevelsfollowingaperiodofreducedavailability.Inthefourthquarterof2022,inventoriesdownstreamfromour companybegantounwindswiftly,resultinginlowerdemand.Thiscontinuedin2023,withvolumeimproving sequentiallythroughoutthatyearandnormalizingin2024.

Weareaffectedbychangesinourmarketsduetoincreasingenvironmentalregulationsandsustainabilitytrends.If wedonotrespondappropriatelytothesechanges,itcouldnegativelyimpactmarketdemand,ourmarketshareand pricing,anyofwhichcouldmateriallyadverselyaffectourbusiness.Adverseweatherconditionsandnatural disasters,includingthoserelatedtotheimpactsofclimatechange,adverselyaffectourbusiness.

Asubstantialamountofourlabelmaterialissoldforuseinplasticpackaginginthefood,beverage,andhomeand personalcaremarketsegments.Inrecentyears,therehasbeenanacceleratedfocusonsustainabilityandtransparencyin sustainabilityreporting,withgreaterconcernregardingclimatechangeandsingle-useplastics,corporatecommitments andincreasingstakeholderexpectationsregardingthereuseandrecyclabilityofplasticpackagingandrecycledcontent, andincreasedregulationinmultiplegeographiesregardingthecollection,recyclinganduseofrecycledcontent.Changes AveryDennisonCorporation | 2024AnnualReport 9

inconsumerpreferencesandlawsandregulationsrelatedtotheuseofplastics,particularlyinEuropeandcertainstates intheUnitedStates,presentstheriskofreduceddemandforcertainofourproductsifcustomersseekdecoration technologyalternativestopressure-sensitivelabeling,butalsotheopportunityforincreaseddemandforourmore sustainableproducts,asignificantfocusofourresearchanddevelopmentandrelatedinnovationefforts.Wehave establishedstrategicinnovationplatformsandprioritiesfocused,amongotherthings,ondeliveringproductsand solutionsthatadvancethecirculareconomy,reducesupplychainwasteandaddresstheneedforincreasedrecyclability ofplasticpackaging.Wehavemadesubstantialinvestmentsinoursustainability-drivenproducts,buttherecanbeno assurancethattheywillbesuccessful,andasignificantreductionintheuseofplasticpackagingcouldmaterially adverselyaffectdemandforourproducts.

Continuedgrowthinsustainability-focusedregulationpresentsanincreasingrisktoourbusiness.Reporting requirementssuchastheCorporateSustainabilityReportingDirectiveandtheCorporateSustainabilityDueDiligence DirectiveinEuropeandthestateofCalifornia’sclimatereportingrequirementsareincreasingtheamountofsustainability disclosureswearerequiredtomake,aswellasrequiringtheauditofagreateramountofoursustainabilitydata.Coststo complywiththeseregulationswillcontinuetogrowandanyfailuretomeettherequirementsoftheseregulationscould resultinfinesorotherpenalties.Aspartofoureffortstomitigatetheimpactsofclimatechangeonourbusiness,we engagedathirdpartytohelpusassessourphysicalandtransitionalriskrelativetotherecommendationsoftheFinancial StabilityBoard’sTaskForceonClimate-RelatedFinancialDisclosures.

Thescientificconsensusisthatemissionsofgreenhousegases(“GHG”)arealteringouratmosphereinwaysthat areadverselyaffectingglobalclimate.Thereiscontinuingconcernfrommembersofthescientificcommunityandthe generalpublicthatGHGemissionsandotherhumanactivitieswillcontinuecausingsignificantchangesinweather patternsandincreasethefrequencyorseverityofextremeweatherevents,includingdroughts,wildfiresandflooding. Thesetypesofextremeweathereventshaveandmaycontinuetoadverselyimpactus,oursuppliersandourcustomers, includingtheirabilitytopurchaseourproductsandourabilitytotimelyreceiveappropriaterawmaterialstomanufacture andtransportourproductsonatimelybasis.Concernregardingclimatechangehasledandislikelytocontinueleadingto increasingdemandsbylegislatorsandregulators,customers,consumers,investors,employeesandnon-governmental organizationsforcompaniestoreducetheirGHGemissions.Oneofour2025sustainabilitygoalsistoachieveatleasta 3%absolutereductioninourGHGemissionsyear-over-yearandatleasta26%absolutereductioncomparedtoour 2015baselineby2025;wehavealreadyexceededthecumulative2025GHGemissionsreductiongoal.Aspartofour moreambitious2030sustainabilitygoals,weareaimingby2030toreduceourScope1and2GHGemissionsby70% comparedtoour2015baselineandworkwithoursupplychaintoreduceScope3GHGemissions.Wecouldfacerisksto ourreputation,investorconfidenceandmarketshareifweareunabletocontinuereducingourGHGemissionsatlevels satisfactorytoourstakeholders.

Increasedrawmaterialcosts,suchasforfuelandelectricity,andcompliance-relatedcostscouldalsoimpact customerdemandforourproducts.Theextentoftheimpactofclimatechangeonourbusinessisuncertain,asitwill dependonthelimitsimposedby,andtimingof,neworstricterlawsandregulations,morestringentenvironmental standardsandexpectations,andevolvingcustomerandconsumerpreferences,butitislikelytoincreaseourcostsand couldhaveamaterialadverseeffectonourbusiness.

Wehaverecentlyacquiredcompaniesandarelikelytoacquireothercompanies.Acquisitionscomewithsignificant risksanduncertainties,includingthoserelatedtointegration,technologyandemployees.

Todriveourstrategiestoincreasetheproportionofourbusinessfromhigh-valuecategories,enhanceourportfolio bygrowingourexistingbusinessesandexpandingintonewareas,andacceleratemarket-driveninnovation,wehave madeacquisitionsandarelikelytocontinueacquiringcompanies.Althoughwemadenoacquisitionsin2024,in2023, weacquiredSilverCrystal,LionBrothersandThermopatchforaggregatepurchaseconsiderationofapproximately $231million.Thesuccessofanyacquisitiondependsontheabilityofthecombinedcompanytorealizetheanticipated benefitsfromcombiningourbusinesses.Realizingthesebenefitsdepends,inpart,onmaintainingadequatefocuson executingthebusinessstrategiesofthecombinedcompanyaswellasthesuccessfulintegrationofassets,operations, functionsandpersonnel.Wecontinuetoevaluateacquisitiontargetsandensurewehaveapipelineofpotential opportunities.

Variousrisks,uncertaintiesandcostsareassociatedwithacquisitions.Effectiveintegrationofsystems,controls, employees,productlines,marketsegments,customers,suppliersandproductionfacilitiesandcostsavingscanbe difficulttoachieveandthesuccessofintegrationactivitiescanbeuncertain.Whilewehavenotexperiencedsignificant 10 2024AnnualReport | AveryDennisonCorporation

issueswithourrecentacquisitions,ifmanagementofourcombinedcompanyisunabletominimizethepotential disruptionofthecombinedcompany’songoingbusinessduringtheintegrationprocess,theanticipatedbenefitsofany acquisitionmaynotbefullyrealized.Inaddition,theinabilitytosuccessfullymanagetheimplementationofappropriate systems,policies,benefitsandcomplianceprogramsforthecombinedcompanycouldhaveamaterialadverseeffecton ourbusiness.Wemaynotbeabletoretainkeyemployeesofanacquiredcompanyorachievetheprojectedperformance targetsforthebusinessintowhichanacquiredcompanyisintegrated.Bothbeforeandaftertheclosingofanacquisition, ourbusinessandthatoftheacquiredcompanymaysufferduetouncertaintyordiversionofmanagementattention. Futureacquisitionscouldresultinincreaseddebt,dilution,liabilities,interestexpense,restructuringchargesand amortizationexpensesrelatedtointangibleassets.Therecanbenoassurancethatacquisitionswillbesuccessful, contributetoourprofitabilityordriveaccretivereturns.Further,wemaynotbeabletoidentifyadditionalvalue-accretive acquisitiontargetsthatcanadvanceourstrategiesorbeabletosuccessfullyexecuteadditionalacquisitionsinthefuture.

Asignificantconsolidationofourcustomerbasecouldnegativelyimpactourbusiness.

Asignificantconsolidationofourcustomerbasecouldnegativelyimpactourbusiness.Whileourcustomerbase tendstobehighlyfragmented,inrecentyears,someoftheconvertercustomersservedbyourMaterialsGroupreportable segmenthaveconsolidatedandintegratedverticallyandsomeofourlargestcustomershaveacquiredcompanieswith similarorcomplementaryproductlines.Industryconsolidationcouldcontinuetoincreasetheconcentrationofour businesswithourlargestcustomers.Furtherconsolidationmaybeaccompaniedbypressurefromcustomersforusto loweroursellingprices.Whilewehavebeengenerallysuccessfulatmanagingcustomerconsolidationsinthepast, increasedpricingpressuresfromourcustomerscouldhaveamaterialadverseeffectonourbusiness.

Becausesomeofourproductsaresoldbythirdparties,ourbusinessdependsinpartonthefinancialconditionof thesepartiesandtheircustomers.

Someofourproductsaresoldnotonlybyus,butalsobythird-partydistributors.Someofourdistributorsalso marketproductsthatcompetewithourproducts.Changesinthefinancialorbusinessconditions,includingeconomic weakness,markettrendsorindustryconsolidation,orthepurchasingdecisionsofthesedistributorsortheircustomers couldmateriallyadverselyaffectourbusiness.

Ourreputation,sales,andearningscouldbemateriallyadverselyaffectedifthequalityofourproductsandservices doesnotmeetcustomerexpectations.Inaddition,productliabilityclaimsorregulatoryactionscouldmaterially adverselyaffectourbusinessandreputation.

Therearetimeswhenweexperienceproductqualityissuesresultingfromdefectivematerials,manufacturing, packagingordesign.Theseissuesareoftendiscoveredbeforeshipping,causingdelaysinshipping,delaysinthe manufacturingprocess,or,occasionally,cancelledorders.Whenissuesarediscoveredaftershipment,theymayresultin additionalshippingcosts,discounts,refundsorlossoffuturesales.Bothpre-shippingandpost-shippingqualityissues couldhaveamaterialadverseeffectonourbusinessandnegativelyimpactourreputation.

Claimsforlossesorinjuriespurportedlycausedbysomeofourproductsariseintheordinarycourseofour business.Althoughwemaintainproductliabilityinsurancecoverage,claimsaresubjecttoadeductibleormaynotbe coveredunderthetermsofthepolicy.Inadditiontotheriskofsubstantialmonetaryjudgmentsandpenaltiesthatcould haveamaterialadverseeffectonourbusiness,productliabilityclaimsorregulatoryactionscouldresultinnegative publicity,reputationalharmandlossofbrandvalue.Wealsocouldberequiredtorecallandpossiblydiscontinuethesale ofproductsdeemedtobedefectiveorunsafe,whichcouldresultinadversepublicityandsignificantexpense.

Changesinourbusinessstrategiesandtherestructuringofouroperationsaffectourcostsandtheprofitabilityofour businesses.Inaddition,ourprofitabilitymaybemateriallyadverselyaffectedifwegeneratelessproductivity improvementfromourrestructuringandothercostreductionactionsthananticipated.

Asourbusinessenvironmentchanges,wehaveadjustedandmayneedtofurtheradjustourbusinessstrategiesor restructureouroperationsorparticularbusinesses.Aswecontinuetodevelopandadjustourgrowthstrategies,wemay investinnewbusinessesthathaveshort-termreturnsthatarenegativeorlowandwhoseultimatebusinessprospects areuncertainorcouldbeunprofitable.

Weengageinrestructuringactionsfromtimetotimetoreduceourcostsandincreaseefficiencies.Weexpended approximately$42millionin2024comparedto$79millionforrestructuringactionsin2023.Ourrestructuringactionsin 2024relatedtovariouslocationsacrossourcompany,primarilyinourSolutionsGroupreportablesegment.Our restructuringactionsin2023includedarestructuringplantofurtheroptimizetheEuropeanfootprintofourMaterials Groupreportablesegment.Wehadincrementalsavingsfromrestructuringactions,netoftransitioncosts,of approximately$63millionin2024.Aspartofourcontinuousefficiencyimprovementculture,weintendtocontinueour effortstoreducecosts,whichhaveinthepastincluded,andmaycontinuetoinclude,facilityclosuresandsquarefootage reductions,headcountreductions,organizationalrestructuring,processstandardization,andmanufacturingrelocation. Thesuccessoftheseeffortsisnotassuredandtargetedsavingsmaynotberealized.Inaddition,costreductionactions canresultinrestructuringchargesandcouldexposeustoproductionrisk,lossofsalesandemployeeturnover.We cannotprovideassurancethatwewillachievetheintendedresultsofanyofourrestructuringandothercostreduction actions,whichinvolveoperationalcomplexities,consumemanagementattentionandrequiresubstantialresourcesand effort.Ifwefailtoachievetheintendedresultsofsuchactions,ourcostscouldincrease,ourassetscouldbeimpaired,and ourreturnsoninvestmentscouldbelower.

Ourabilitytodevelopandsuccessfullymarketnewproductsandapplicationsimpactsourcompetitiveposition.

Thetimelyintroductionofnewproductsandimprovementstocurrentproductshelpsdetermineoursuccess.Many ofourcurrentproductsaretheresultofourresearchanddevelopmentefforts,forwhichweexpensed$138millionin 2024.Theseeffortsaredirectedprimarilytowarddevelopingnewproductsandsolutionsandoperatingtechniquesand improvingproductperformance,oftenincloseassociationwithourcustomersorendusers.Theseeffortsincludepatent andproductdevelopmentworkrelatingtoprintingandcoatingtechnologies,aswellasadhesive,releaseandink chemistriesinourMaterialsGroupreportablesegment.WefocusonresearchprojectsrelatedtoRFID,external embellishmentsanddigitalsolutionsinourSolutionsGroupreportablesegment.Additionally,ourresearchand developmenteffortsincludesustainableinnovationanddesignofproductsthatincreasetheuseofrecycledcontent, reducewaste,extendlifeorenablerecycling.Researchanddevelopmentrequiresinnovationandanticipationofmarket trends,whichmeansthatthecostsoftheseexpendituresmaynotberecoveredthroughadditionalsales.Wecouldfocus onproductsthatultimatelyarenotacceptedbycustomersorendusersorwecouldexperiencedelaysintheproduction orlaunchofnewproductsthatcouldcompromiseourcompetitiveposition.

Ourinfrastructureneedsimpactourbusinessandexpenditures.

Wecontinuetoinvestinourlong-termgrowthandmarginexpansionplans,withapproximately$240millionin capitalexpenditures,includingfixedassetsandinformationtechnology,in2024.Wemaynotbeabletorecoupthecosts ofourinfrastructureinvestmentsifactualdemandisnotasweanticipate.Inrecentyears,weexpandedourMaterials Group’smanufacturingcapabilitiesinFrance,IndiaandOhio;movedourSolutionsGroup’sVietnambusinessintoanew, expandedfacility;andmadeadditionalinvestmentsinbothcapacityandbusinessdevelopmentgloballyforourIntelligent Labelsplatform,includingnewfacilitiesinBrazilandconsolidatedoperationsinMexico.Inaddition,weaddedcapacity throughouracquisitionsofSilverCrystal,LionBrothersandThermopatchin2023.Infrastructureinvestments,whichare long-terminnature,maynotgeneratetheexpectedreturnduetochangesinthemarketplace,failuresinexecution,and otherfactors.Significantchangesfromourexpectedneedforand/orreturnsonourinfrastructureinvestmentscould materiallyadverselyaffectourbusiness.

Difficultyinthecollectionofreceivablesasaresultofeconomicconditionsorothermarketfactorscouldhavea materialadverseeffectonourbusiness.

Althoughwehaveprocessestoadministercreditgrantedtocustomersandbelieveourallowanceforcreditlosses isadequate,wehaveinthepasthadtoincreasetheallowancedueto,amongotherthings,epidemics,pandemicsor otheroutbreaksofillness,supplychainchallenges,regulatoryrestrictionsandinflationarypressures,andinthefuture mayexperiencelossesasaresultofourinabilitytocollectsomeofouraccountsreceivable.Acustomer’sfinancial difficultiesarelikelytoresultinreducedbusinesswiththatcustomer.Wemayalsoassumehighercreditriskrelatingto receivablesofacustomerexperiencingfinancialdifficulty.Ifthesedevelopmentsweretooccurwidelyinourcustomer base,ourinabilitytocollectonouraccountsreceivablefromcustomerscouldsubstantiallyreduceourcashflowsand incomeandhaveamaterialadverseeffectonourbusiness.

Thereisarapidlyevolvingawarenessandfocusfromcertainstakeholders,includingourinvestors,customersand employees,withrespecttoourcompany’ssustainabilityandgovernancepractices,whichcouldaffectourbusiness.

Investorandsocietalexpectationswithrespecttosustainabilityorgovernancematterscontinuetoevolve,withsome stakeholdersseekingcompaniestodemonstrateprogresswithrespecttoenvironmentalstewardship,humancapital, corporategovernance,supportforourcommunities,andtransparency,andotherstakeholderssuggestingthatcompanies focusondeliveringfortheirstockholderstotheexclusionoffocusintheseotherareas.Afailuretoadequatelymeetevolving stakeholderexpectationsandtimelycomplywithcompetingregulatoryrequirementsatthefederal,stateandlocallevelscould resultinlossofbusiness,dilutedmarketvaluation,aninabilitytoattractandretaincustomersandpersonnel,increased negativeinvestorsentimenttowardusand/orourcustomersandthediversionofinvestmenttootherindustries,whichcould haveanegativeimpactonourstockpriceandaccesstoandcostofcapital.

Significantdisruptiontotheinformationtechnologyinfrastructurethatstoresourinformationandrunsour operationscouldmateriallyadverselyaffectourbusiness.

Werelyontheefficientanduninterruptedoperationofalargeandcomplexinformationtechnologyinfrastructureto linkourglobalbusiness.Likeallinformationtechnologysystems,oursaresusceptibletoanumberofrisksincluding,butnot limitedto,damageorinterruptionsresultingfromobsolescence,naturaldisasters,powerfailures,humanerror,viruses,social engineering,phishing,ransomwareorothermaliciousattacksandcybersecurityevents.Weupgradeandinstallnewsystems, which,ifinstalledorprogrammedincorrectlyoronadelayedtimeframe,couldcausedelaysorcancellationsofcustomer orders,impedethemanufactureorshipmentofproducts,ordisrupttheprocessingoftransactions.Wehavecontinuedto implementmeasurestomitigateourriskrelatedtosystemandnetworkdisruptions,butifasignificantdisruptionwereto occur,wecouldincurlossesandremediationcoststhatcouldhaveamaterialadverseeffectonourbusiness.

Additionally,werelyonservicesprovidedbythird-partyvendorsforcertaininformationtechnologyprocesses, includingsysteminfrastructuremanagement,applicationmanagement,andsoftwareasaservice.Whilewehavematuredour cybersecurityduediligenceprocess,thisrelianceonthirdpartiesmakesouroperationsvulnerabletoafailurebyanyoneof thesevendorstoperformadequatelyormaintaineffectiveinternalcontrols.

Cybersecurityorothersecuritybreachescouldcompromiseourinformationandexposeustoliability,whichcould haveamaterialadverseeffectonourbusinessandreputation.