Four young companies built with intention tackle the future of medicine

Leveraging lean innovation principles

Navigating the smaller batch market

Four young companies built with intention tackle the future of medicine

Leveraging lean innovation principles

Navigating the smaller batch market

The Ross HSM 100LCI-t Laboratory Mixer delivers POWER, PRECISION and VERSATILITY. Variable speed up to 10,000 rpm, constant torque operation and HMI touchscreen controls ensure optimal results in critical formulations. Record information in 20-second increments with an optional Data Station. Take on virtually any mixing challenge with interchangeable High Shear Rotor/Stator, Disperser, Inline and Micro mixing assemblies.

Batch volumes from 50mL to 15L. Call or buy online. Ask about our Trial/Rental Program

Process improvement is like a trapeze act. You need a trusted partner who lends a hand at the right moment.

Just as athletes rely on their teammates, we know that partnering with our customers brings the same level of support and dependability in the area of manufacturing productivity. Together, we can overcome challenges and achieve a shared goal, optimizing processes with regards to economic efficiency, safety, and environmental protection. Let’s improve together.

tailored integrated pest management solutions.

will protect your pharmaceutical facility and ensure that pests won't compromise your products, your reputation or your bottom line! For effective pest prevention and exclusion strategies, trust the experts at IFC.

Philadelphia has played a pivotal role in shaping the American Pharma Industry and is hailed as its birthplace in the United States. Since the early nineteenth century right through to the present day, Philly has maintained its status as a prominent pharma hub, and we are confident it will remain that way into the future.

Delving into Philly's rich pharma legacy — a legacy that began in the 1810s when America's first drug mill was established in the city. Philadelphia became the place to be for drug production, chemical manufacturing, and vital institutions such as universities and hospitals.

The city has been home to many pioneers

of the industry. From John Smith and John Wyeth of John Smith & Company to Robert Shoemaker, the first commercial manufacturer of Glycerin, and Robert McNeil, Jr., overseeing the development of Tylenol. Philadelphia truly stood, and remains to stand at the heart of Pharma. That's why we're thrilled to return in May 2024 to Philadelphia! Discover the industry's history, advancements, and its promising future by registering for CPHI North America today. With a robust attendance of over 3,550 participants, 332 exhibitors, and four tracks of expert-led content, CPHI offers the ideal platform to transform connections into endless opportunities.

Join us at CPHI North America and gain not only valuable industry insights but also a piece of U.S. Pharma history as a bonus!

EDITORIAL TEAM

karen langhauser Chief Content Director klanghauser@endeavorb2b.com

andrea corona Senior Editor acorona@endeavorb2b.com

EDITORIAL ADVISORY BOARD

BiKaSh chattErJEE, Pharmatech Associates

EMiL ciurcZaK, Doramaxx Consulting

roBErt DrEaM, HDR Company

BarrY hoLtZ, Phylloceuticals

Eric LangEr, BioPlan Associates

iVan Lugo, INDUNIV, Puerto Rico

giriSh MaLhotra, Epcot International rich MYEr, Tergus Pharma

garY ritchiE, GER Compliance

MichaEL touSEY, ImmunityBio

DESIGN & PRODUCTION TEAM

michael annino Art Director mannino@endeavorb2b.com

anetta gauthier Production Manager agauthier@endeavorb2b.com

rita fitzgerald Ad Services Manager rfitzgerald@endeavorb2b.com

ADMINISTRATIVE TEAM

keith larson VP/Group Publisher klarson@endeavorb2b.com

bold

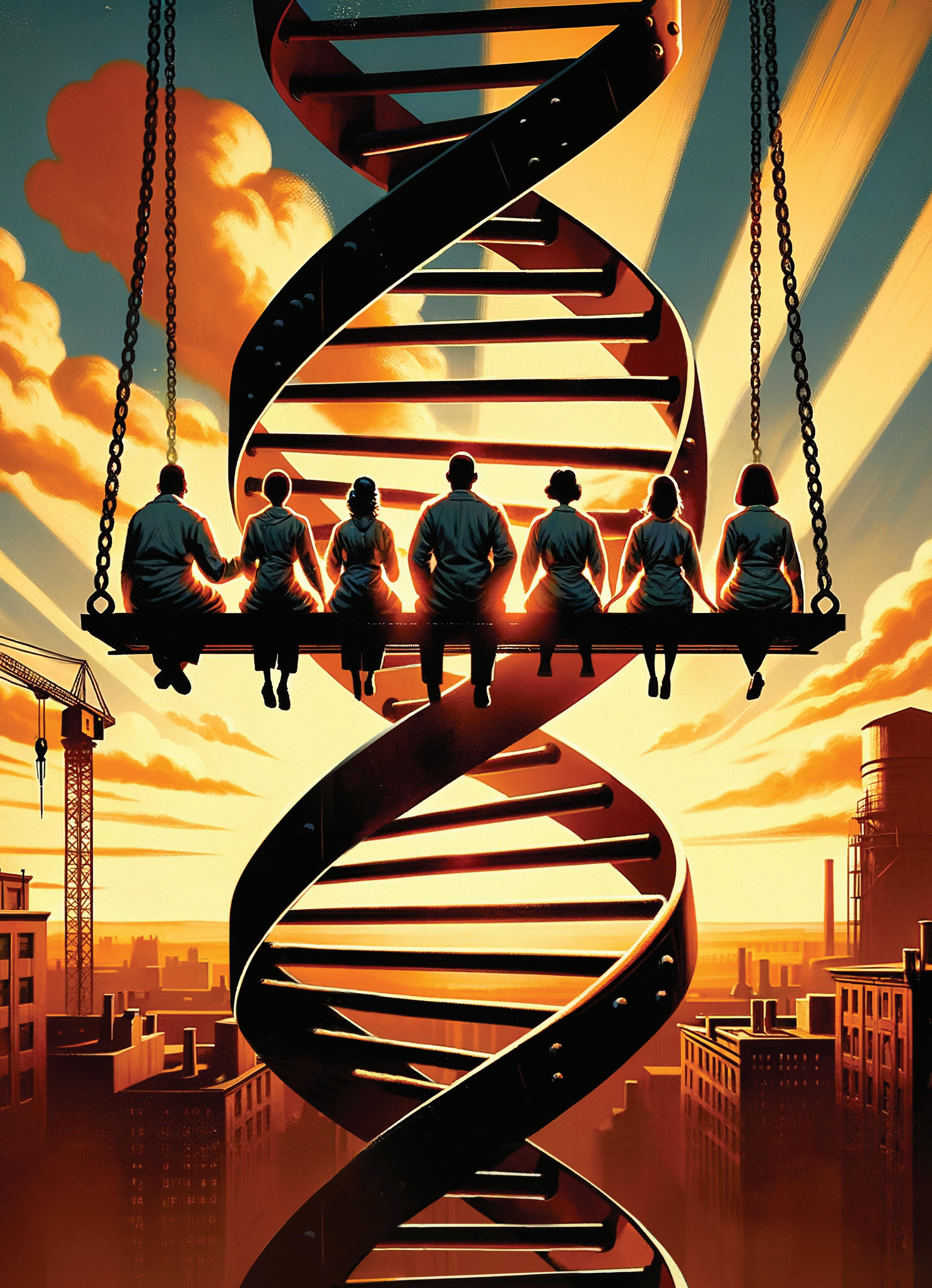

While many images depict history, few images make it. On October 2, 1932, with the U.S. fully in the grips of the Great Depression, a photo appeared in the New York Herald-Tribune Sunday edition, and quickly struck a chord with the public.

Captioned “Lunch Atop a Skyscraper,” the photo showed 11 ironworkers eating lunch on a steel beam 850 feet above New York City. Although the shot eventually came under fire for being a staged publicity stunt during the construction of Rockefeller Center, it still became an iconic part of American history.

The photo is legendary both because of what it captured and what it came to symbolize. The public saw anonymous immigrant laborers, casual in the face of an extremely imposing endeavor. The workers came across as gritty, courageous and confident in what they do.

During one of the toughest times in our country’s history, the photo represented ambition and resilience amidst tremendous obstacles. It was emblematic of the building project that put tens of thousands of people to work in the middle of the Depression, showing the world that America was still constructing a future.

Though it’s one of the most replicated and reimagined photos in history, we could think of no better way to convey the message of this month’s cover feature.

Across the board, the pharma industry is facing sky-high pressures to bring drugs to market quickly, safely and affordably. Those hoping to bring complex modern therapies to market are in a particularly precarious situation. As sterile injectables and cell and gene therapies become more embedded in the foundation of health care, pharma has reached a critical juncture where science has outpaced the industry’s ability to build treatments. For some patients, such as those on growing waitlists for approved CAR-T cell therapies, this dearth of manufacturing capacity is potentially deadly.

Facing this daunting landscape, pharma companies are enlisting the help of focused contract manufacturers to shape their therapies from the ground up. CDMOs, who so often go unnamed and unsung, have now become integral to forging the future of pharma.

Endeavor Business Media, LLc

chriS fErrELL, CEO

JunE griffin, President

MarK ZaDELL, CFO

PatricK rainS, COO

rEggiE LaWrEncE, CRO

JacQuiE niEMiEc, Chief Digital Officer

tracY KanE, Chief Adm. and Legal Officer

1501 E. Woodfield Road, Suite 400N, Schaumburg, IL 60173

Phone: (630) 467 1300 • Fax: (630) 467 1179

Subscriptions/customer Service

Local: (847) 559 7598

Toll free: (877) 382 9187 or PharmaManu@omeda.com

The four promising CDMOs we’ve chosen to profile in this issue — ten23 health, Cellares, INCOG BioPharma Services and Matica Biotechnology — are elevating themselves above the rest with disruptive technologies, nontraditional organizational structures and deeply ingrained commitments to their company values.

Launching a new company into a crowded contracting space isn’t for the faint of heart — it demands expertise, ingenuity and a willingness to embrace risk. Fortunately, a new generation of CDMOs are boldly positioning themselves to become pillars of pharmaceutical progress.

AAM’s Access! 2024 made its Tampa, Florida debut in February, bringing together industry leaders and decision-makers to explore the business, breakthroughs and politics that shape the future of generic drugs.

“The generic and biosimilar industry faces unprecedented threats to long-term sustainability,” warned David Gaugh, AAM’s interim president and CEO, in the opening plenary.

During the annual meeting, panelists tackled the issues behind the increasing fragility of the industry that supplies more than nine out of every 10 prescriptions in the U.S. Price deflation, unfavorable policy, pharmacy benefit managers and biosimilar uptake were top of mind.

Affordable prices are what make generics the ‘backbone of the prescription drug market.’ The average generic copay is $6.16 versus the average brand copay of $56.12, according to AAM data. And while this is great news for patients, in some cases, low price points have led to unintended consequences for the generics industry.

Driven by increased volume and new generic launches, generic prices in the U.S. have been deflating. Doug Long, vice president of industry relations at IQVIA (and also a long-time fixture at AAM events and winner of the AAM Lifetime Achievement Award) presented a startling statistic: In 2018, it took total sales from eight brand drugs to equal the total generics business; in 2023 it took sales from just two drugs — AbbVie’s Humira and Novo Nordisk’s Ozempic.

It has become increasingly difficult for drugmakers to survive in the highly competitive, low margin industry — a reality that was frequently mentioned during the conference. “The economics of the generics industry are untenable,” said Keren Haruvi, AAM board chair and president, Sandoz North America.

The financial challenges facing the sector have in some situations forced generics manufacturers to reconsider making older drugs. Market withdraws are frequent — an average of one generic drug has gone off market every other day for the last decade, pointed out Gaugh.

A multitude of factors are contributing to the drug shortage problem in the U.S., but the financial headwinds faced by generics play a role. High profile shortages of antibiotics, chemotherapies and ADHD drugs have captured the attention of policymakers and government agencies. While shortages affect both branded drugs and generics, they are more common at lower price points — more than half of the drugs currently on shortage are priced less than $1, according to Long.

No country in the world has achieved the level of generic penetration like the U.S. — but why is that not being replicated in biosimilars?

— Arunesh VermaWhile the battle against policy is not a new one for the generics industry, this year, it was the Inflation Reduction Act’s turn to be in the hotseat.

Passed into law in 2022, the IRA mandates that drug manufacturers pay a rebate to the federal government if the prices of certain drugs covered under Medicare rise at a rate that exceeds inflation. Though the policy’s intended target is ‘Big Pharma’ and branded drugs, the generics industry will also feel the ripple effects.

“It’s actually one of the areas where there is some alignment between pharma and AAM,” said Brian Hoffmann, president, U.S. Generics, Hikma Pharmaceuticals, during the ‘CEOs unplugged’ panel. “The impact that this has on prices of branded drugs eventually will impact our generics industry.”

The IRA allows Medicare to negotiate prices for branded drugs with pharma companies, but these provisions come with uncertainties in terms of which branded drugs will be subjected to negotiations and when, as well as what the price will be. Because generic manufacturers make business decisions about which drugs to target years in advance, these unanswered questions create risk.

All is not lost though, with some panelists expressing hope that going forward, Congress might be convinced to make changes that could protect generics and biosimilars.

“My hope with the IRA is that we can shape it in a way that encourages preference for generic competition,” said Hoffmann.

Although biosimilars are delivering on their promise of lower prices — averaging more than 50% less than reference brand biologics — adoption in the U.S. has been slower than anticipated.

“No country in the world has achieved the level of generic penetration like the U.S. — but why is that not being replicated in biosimilars?” probed Arunesh Verma, president and CEO at Cipla North America. “Why are we not leading the world when it comes to biosimilar penetration?”

The most striking example discussed during the event was that of adalimumab. While the introduction of biosimilar competition in 2023 for the world’s best-selling drug, AbbVie’s Humira, should have been a watershed moment for biosimilars, adalimumab biosims have captured less than 2% of the market

share. Not only was this unexpected, but it is far below the average biosimilar market rate one year postloss of exclusivity — 22%.

“Unfortunately, Humira has become the poster child for why we should leave biosimilars,” said Verma, “As result of lack of penetration, there are companies that have stepped away from biosimilars.”

While many panelists acknowledged that there is still work to be done in terms of educating health care providers about the safety and benefits of biosimilars, the bigger issue in the U.S. is a familiar foe to the broader generics sector — pharmacy benefit managers.

PBMs — the so-called ‘middlemen’ between drug manufacturers and pharmacies — have been accused of denying patients coverage of lower-cost generics and biosimilars by creating drug formularies that favor more expensive drugs. The rebate system, in which PBMs generate revenue from drugmakers when list prices are high, has proven especially damaging in the context of biosimilars, blocking patient access to more affordable medications.

Ultimately, the goal of AAM’s aptly-named Access! annual meeting — and the broader goal of the generic and biosimilar industry — is facilitating patient access to lifesaving medicines.

“Our challenge as we leave this meeting will be to continue our engagement, support and leadership in our collective goal to increase patient access to affordable medicines,” said Haruvi. “And while we are all — as companies and individuals — dedicated to achieving a future where patients can get the medicines they need at the right time and at the right cost, in this case, the whole is greater than the sum of its parts. We must work together to chart a sustainable path for generics and biosimilars.”

The coming year will be characterized by seismic shifts — a consequence of 2023’s historic regulatory highs as well as its economic lows. From the groundbreaking FDA approval of the first CRISPR-based gene therapy for sickle cell disease to the impact of the Inflation Reduction Act on drug pricing, the industry now stands at the intersection of innovation and adaptation. Here’s a glimpse at what industry leaders are predicting for 2024.

Whilst it is essential to focus on patient disease management and providing safe, effective and high quality treatment options, pharma manufacturers and CDMOs must redesign the way they work, to ensure the sector is operating sustainably. My prediction (and hope) for 2024 is that the industry will focus on sustainability by: developing formulations with sustainability as one key criterion (beyond compliance, stability and usability); building lab and manufacturing operations that focus on energy efficiency and consider quick wins (e.g., motion controls, energy controls, LEDs, waste reduction); operating using self-generated (renewable) energy; focusing on research on alternative options for pharma (e.g., moving away from single-use disposable plastics to biodegradable components).

—Hanns-Christian

Mahler, CEO, ten23 healthThe Inflation Reduction Act will keep pharma company leaders up at night in 2024. Medicare drug price negotiation will impact more than just the 10 drugs on the current negotiation list by creating competition in those therapeutic categories and could force price adjustments, including higher commercial drug prices. Pharma manufacturers must navigate this complex market to maintain revenue for research and development of new medications.

— Jesse Mendelsohn, Senior VP, Model NIn 2023, we will likely see the first year of over $5B in global sales of cell and gene therapy products. While this represents a significant milestone for maturity of the field, manufacturing costs remain a major barrier to more widespread adoption. We are seeing increased momentum towards a variety of orthogonal approaches to this problem, including automated manufacturing systems, allogeneic approaches, in vivo CAR-Ts, stable cell lines, non-viral delivery, and capsid engineering for improved tropism. Given the breadth and depth of innovation represented by these approaches, I have no doubt that the field will find solutions to drive down costs and enable broader adoption of CGT products in the not-too-distant future.

— Katy Spink, Ph.D., COO and Managing Partner, Dark Horse Consulting GroupFill-finish capacity will be tight

We will see increases in scale due to specific molecules, such as glucagon-like-peptides, reaching broader therapeutic indications (e.g. diabetics and obesity). This will require massive investments to increase scale in peptides’ manufacturing, sterile fill-finish operations, as well as devices. The developments will result in tighter capacity situations in fill-finish and devices in the coming years, potentially affecting other therapeutic areas as well.

— Anne Marie de Jonge, Board Member, Swiss Biotech AssociationCompanies will integrate people and technology

When organizations acquire technology and are unaware of how to use or properly leverage it, they can end up with large amounts of data and not know how to appropriately apply it to improve solutions. Organizations need to remember that technology requires a workforce that supports integration and is onboard to learn and train to effectively use the technology. Moving forward, organizations that can create a culture that embraces change across people, processes and technology will benefit in the coming years. Those who can jump into and embrace new innovations while supporting their staff and internal processes to fully understand and integrate new technologies will take full advantage of any change.

— Philip Johnson, Senior Principal, Quality and Compliance Solutions, IQVIAPlant floor digitalization will mature

Manufacturing facilities will increase the pace of digitalization as they look to adopt advanced technologies like predictive analytics and artificial intelligence. The implementation of robotic automation in more areas, including distribution, will improve the cost to produce and delivery

As

for advertising sales or production information, contact the following

For subscription information call

Local: (847) 559 7598

Toll free: (877) 382 9187 or PharmaManu@omeda.com

SALES

amy loria Group Sales Director (352) 873 4288 rdexter@endeavorb2b.com

regina dexter Media Advisor (234) 201 8709 rdexter@endeavorb2b.com

betsy norberg Strategic Account Manager (913) 956 1670 bnorberg@endeavorb2b.com

greg zamin Account Manager (704) 256 5433 gzamin@endeavorb2b.com

lori goldberg Advertising Coordinator lgoldberg@endeavorb2b.com

To purchase custom reprints or e-prints of articles appearing in this publication contact reprints@endeavorb2b.com (574) 303 8511

times. Smaller, finely-tuned, vertical-specific large language models will make the use of generative AI in manufacturing a reality. AI is expected to revolutionize the industry by making it faster, more efficient, and more cost-effective to analyze and act on data. The final consideration is around IIoT. The industry will finally begin to see the fruits of standardization rather than continue in a state of disparity that hampers the digital revolution that needs to occur in manufacturing.

— Matt Lowe, CSO, MasterControlPrecision medicine will target obesity

We’re in the middle of an obesity drug gold rush, and the momentum is set to continue into 2024 and beyond with an influx of pharma companies working to add weightloss drugs to their development arsenal. This surge goes beyond the appetite-suppressing GLP-1s, as companies explore alternative mechanisms. As the race continues and more drugs are introduced, the need to apply precision medicine only grows. 2024 will be the year of precision medicine for obesity, to eliminate the trial-and-error approach and fundamentally transform the way we treat this pervasive disease.

— Mark Bagnall, CEO,Phenomix Sciences

AI will advance quality management Quality management has traditionally been cautious about integrating AI tools into their processes, given the sensitivity of information in quality management systems. However, a shift is occurring as more organizations embrace large language models and other AI capabilities. The use of recommendation engines, combining AI with personal experience for augmented intelligence, is on the rise — enhancing responsiveness, cycle times, accuracy and efficiency. Public generative AI adoption may take longer due to intellectual property concerns, but private GPT is

gaining traction. These trends drive increased investment in predictive and preventative analytics. Additionally, breaking down siloes between quality and other departments using AI fosters connectivity, benefiting overall productivity and efficiency.

— Kari Miller, Senior Director, Product Management, IQVIAAI will revolutionize training

In 2024, AI’s role in workforce training will evolve into a more dynamic, interactive partner in the learning process. Gone are the days of passive data crunching. AI is set to revolutionize how knowledge is captured and shared, turning raw data into customized, interactive learning experiences. This will not only enhance learning outcomes but arevolutionize how industries approach training and knowledge retention.

— Sam Zheng, CEO and Founder, DeepHowSustainability will spill into the entire supply chain

For most organizations, 75% to 90% of a company’s footprint sits within their supply chain, making this a key focus area in decarbonization efforts. Many large pharma companies have recognized the impact of indirect emissions generated by their suppliers, distributors and customers and are actively working to reduce this impact. However, doing so at scale remains a huge challenge. It is imperative to solve, as this will multiply the effect of supply chain sustainability across the industry. In 2024, I see momentum building for collaboration and learning, helping accelerate this critical piece of the sustainability puzzle.

— Jeffrey Whitford, VP of Sustainability and Social Business Innovation, MilliporeSigmaVisit pharmamanufacturing.com for a full list of predictions.

In today’s increasingly complex and competitive pharma market, what does it take to rise above?

This question is especially layered for contract manufacturers, who must take on all the efficiency, quality and cost challenges plaguing the broader pharma industry, while also competing within a crowded CDMO space.

There are currently over 500 pharma CDMOs in the world, all jockeying to carve out a unique niche for themselves in key sectors of the modern drug industry. New CDMOs braving this busy space must find a way to elevate themselves above the rest.

Clearly, it is no longer enough for CDMOs to simply offer excess manufacturing capacity. In addition to expertise in the toughest and most popular areas of pharma, such as cell and gene therapies or sterile injectables,

companies must enter the sector with a certain bravado.

Oftentimes, this comes in the form of disruption — founders who survey the current landscape and believe there must be a better way. Other times it comes in the form of cutting-edge technology, and a willingness to go all-in. Companies must also serve as stewards of the environment, contribute to the community and offer an organizational culture that appeals to today’s workforce.

Put simply, modern therapies require modern CDMOs. The four young companies we’ve chosen to profile — ten23 health, Cellares, INCOG BioPharma Services and Matica Biotechnology — were launched, built and nurtured with intention. As a result, they have become key players among a new generation of CDMOs, well-positioned to boldly forge the future of pharma.

Karen Langhauser Chief Content Director

Karen Langhauser Chief Content Director

With a dual mission to serve both patients and the planet, ten23 health takes on today’s most complex sterile medicines

Hanns-Christian Mahler’s first spend as CEO of ten23 health was trash.

Shortly after launching the new Switzerland-based CDMO in 2021, before operations had even begun, Mahler purchased 10 tons of trash via plastic credits. His goal? Preemptively offset the unavoidable plastic waste produced while developing and manufacturing sterile drug products.

“I handed over the invoice to my investors in fear that they would fire me on the spot,” says Mahler.

But Mahler was just getting started. Now, with an ISO9001-certified sprawling lab facility in Basel, a GMP-certified sterile production facility in Visp and further expansions underway, ten23 health has set the stage to more than double its batch production of modern injectable therapies and secure its position as a leader for complex formulations and sterile dosage forms in the rapidly growing sector.

Perhaps more importantly, ten23 has stayed true to Mahler’s vision: To embrace fairness and sustainability in all aspects of business — and to do so with a sense of urgency.

“Back in 2021, I thought it was not enough to make pledges for 2030. That’s too late; we have to act now,” says Mahler. “And that’s when I realized there was a unique opportunity to disrupt a bit in the pharma and CDMO sector by thinking through sustainability and organizational design with a different drive and faster pace.”

In the competitive pharma contracting space historically dominated by a handful of legacy players, the young ten23 health has set itself apart by building an unconventional model that allows the company to offer expertise spanning the life cycle of complex sterile drugs, from early-stage candidate selection to commercial production, all while keeping patients and the planet at the forefront.

It didn’t take ten23 long to make its first large purchase (and this time, it wasn’t trash). A month after the company’s commercial launch in September 2021, the fledgling CDMO acquired sterile filling leader swissfillon and its Swissmedic- and FDA-inspected facility in Visp, Switzerland.

The purchase enabled ten23 to quickly offer integrated services for both development and manufacturing of sterile medicines. And the timing couldn’t have been better.

The demand for sterile pharmaceuticals is surging — according to McKinsey, the world will need more sterile products than manufacturers have or can build capacity for in the near future.1 Specialist CDMOs like ten23 are ideally positioned to help.

But the advantages of teaming with an integrated CDMO go beyond capacity. According to Mahler, when

Sustainable from the start ten23 built a sustainable company in much the same way it approaches sterile medicine development — by starting early in the process. Launching a new company with sustainability as a core tenet gives ten23 distinct advantages over companies trying to work backwards and ‘retrofit’ sustainable practices into existing businesses.

“It was a clear opportunity for us to instill sustainability into the DNA of the organization — build it into every decision when people go on business trips, when thinking about sourcing procurement, when establishing checklists for our supplier evaluations, etc.,” says Mahler. “It gave us a total kickstart in defining our approach to sustainability and organizational culture.”

it comes to sterile drug development, a common mistake is looking at fill-finish as an afterthought. “Due to its complexity, the drug substance gets so much focus that the whole element of administration, stability and manufacturing of the drug product doesn’t receive a lot of attention.”

Ideally, says Mahler, products should be created with the end — the patient — in mind. Details such as how the drug will be administered, the choice of delivery device, the viscosity of the formulation and even the diameter of the needle, should be considered from the start.

“ten23’s focus is a lot about asking questions and thinking about the directions this product can take in the marketplace and in the hands of a patient or health care professional — and then helping the customer to conceptualize the product,” says Mahler.

Failing to look at the process holistically, and thus deprioritizing fill-finish, can cost pharma companies more in the long run.

“I sometimes hear people say ‘it’s just putting liquid into glass, how difficult can it be?’” says Mahler.

The fill-finish process is prone to issues, including bottlenecks, contamination and product loss. Aseptic fill-finish for complex products, such as high concentration formulations for intravitreal or subcutaneous delivery, is uniquely challenging due to high viscosities and stability issues in addition to specific regulatory requirements. Mahler cautions against bargain-hunting in an area that requires advanced technology and scientific and regulatory know-how.

“We’ve had customers approach us who basically said, ‘We had $3 million worth of drug substance and the CMO we previously utilized destroyed it in one fill — but the fill was very cheap!’”

In ten23’s first two years of existence, the company was already operating ‘carbon positive.’ It achieved an EcoVadis sustainability rating in 2023 and has a Pending B-Corp status, a certification which affirms a company’s commitment to using business as a force for good.

The company chose to locate its headquarters and development operations on the Rosental Mitte life sciences campus in Basel, taking over 4,000 square meters of existing building infrastructure, and then immediately adding sustainable upgrades. Features such as LED lights and motion controls, water-saving faucets, composting for organic waste and plastics recycling were incorporated into the facility. No detail was overlooked, right down to the type of toilet paper used in the restrooms.

But anyone in the pharma industry knows the biggest sustainability obstacle comes on the plant floor, especially when handling aseptic drugs. Using single-use, disposable plastics offers several pivotal advantages, including lessening the risk of cross-contamination, speeding

turnovers and eliminating the need for cleaning validation.

While employing single-use systems has become standard practice in aseptic environments, Mahler says the pharma industry tends to overuse materials in the name of caution.

“Companies sometimes sterilize three filters for a fill, just to be safe,” says Mahler. “The general idea is that we make sure that we are not using materials in excess quantities. Our ambition is that waste per batch will go down.”

And while Mahler concedes that there’s probably no near-term solution for getting rid of plastic disposables in manufacturing, that doesn’t mean ten23 won’t try. For example, the company is embarking on a research project with other players in the Swiss industry, exploring the use of biodegradable disposables. ten23 has also announced its collaboration with Elio, an AI-based tool that aims to evaluate pharmaceutical processes from a sustainability perspective.

Still, for all its efforts and success stories, ten23 must go up against a well-established stigma: sustainability is expensive. The belief is so ingrained that Mahler has had clients approach him asking what the cost savings would be if ten23 were to not operate sustainably.

“Our approach to sustainability is not optional for customers. It’s our way of operating,” asserts Mahler. “I think this impression that sustainability is costing us so much money is an absurd image. It’s actually helping us save money — we improved our energy efficiency by 30% compared to last year by prioritizing sustainable practices in our business development.”

It’s a battle being fought broadly across the pharma industry, but Mahler hopes that ten23, through its transparency, can showcase how pharma companies and CDMOs can

simultaneously save money and the planet.

Mahler credits much of ten23’s success to its nontraditional organizational structure. An individual driven by his own inherent motivation, Mahler wanted to build a company where employees had a deep sense of purpose and could work according to their personal strengths.

Inspired by management models in books like Frédéric Laloux’s “Reinventing Organizations” and Sebastian Klein and Ben Hughes’ “The Loop Approach,” Mahler designed ten23’s organizational culture to be adaptive, allowing employees to be their authentic selves in the workplace. ten23 also eliminated some of the more traditional hierarchical ways of operating, such as line managers and performance ratings, instead embracing a management framework based on holacratic principles that empowers every team member to make decisions for their given role(s).

Additionally, the approach has helped ten23 tackle an ongoing obstacle in the manufacturing space — workforce recruiting. The company’s progressive mindset has attracted a talented and diverse workforce, committed to the company’s culture and mission.

“I think there’s other modus operandi for organizations, where the employee can be more at the center,” says Mahler. “My equation is that happy employees equals great projects, equals satisfied customers, equals revenue.”

Mahler’s math appears to be working out for ten23.

Back in July 2023, the CDMO unveiled the launch of a new quality control division, with services at both its Visp and Basel sites. The division

will offer release and stability testing of clinical and commercial sterile drug products according to international CGMP standards.

With customer demand for sterile fill-finish services increasing, ten23 health announced this past fall that it is expanding the available capacity at its Visp sterile manufacturing facility by 50%, hiring more staff to accommodate an additional shift.

ten23’s new facility, also in Visp, will come online in late 2024/early 2025, with the first customer project and tech transfer already signed. The facility will offer two additional filling lines for sterile commercial supplies of ready-to-use syringes, cartridges and vials, and liquid or freeze-dried clinical and commercial vial supplies.

But even when it comes to growth, sustainability remains at the forefront for ten23.

“I believe in sustainability not only from a planet perspective, but also from a business perspective. While we are always thinking about other organic or inorganic opportunities for growth, growth needs to be well managed. As a company you want to grow sustainably,” says Mahler.

At a time when many pharma manufacturers are still looking at sustainable initiatives as a tickbox exercise, ten23 health, under Mahler’s passionate leadership, is proving sustainability’s true value to the industry.

“I wish there was a more focused thinking about sustainability from a right-to-operate perspective, but it doesn’t hold us back,” says Mahler.

1. Barth, G. et. al. How sterile pharma manufacturers can grow capacity without capital investment. McKinsey Life Sciences Practice. (January 2023).

Karen Langhauser Chief Content Director

Karen Langhauser Chief Content Director

Cellares’ differentiated technology will allow pharma companies to unlock massive productivity gains in cell therapy and save the lives of millions

T Today’s pharma industry has a scaling problem — and Cellares wants to solve it.

The industry is facing a formidable crisis in the cell therapy space: groundbreaking scientific advancements are vastly outpacing pharma’s ability to manufacture them. With each cell therapy approval, the addressable patient population expands and the waitlist for cell therapies grows longer.

And for many patients, wait times can be the difference between life and death — it’s estimated that 20% of patients eligible for FDA-approved CAR-T cell therapies die awaiting treatment.1

Recognizing that the traditional manual manufacturing model for cell therapies was ripe for disruption, Fabian Gerlinghaus and Omar Kurdi came up with an ambitious idea. In 2019, armed with a plan to build the sector’s first

end-to-end fully automated manufacturing platform, Gerlinghaus and Kurdi launched Cellares, a new breed of CDMO.

“We saw an opportunity to save the lives of millions of people because cell therapy manufacturing capacity and scalability is just not where it needs to be and as a result, patients who are eligible for approved CAR-T cell therapies are dying needlessly,” says Gerlinghaus.

Gerlinghaus, an aerospace engineer turned tech inventor turned entrepreneur, has long been motivated by impact, and he went big when it came to Cellares.

“We’re very confident that we will deliver on our goal, which is to meet the total demand for cell therapies globally,” says Gerlinghaus.

The San Francisco-based company is the first to brand itself as an IDMO — an integrated development and manufacturing organization — promising to deliver in an area where traditional CDMOs have fallen short by taking an Industry 4.0 approach to commercializing today’s most cutting-edge medicines. The company, which revealed a blockbuster $255 million Series C funding round this past August, is backed by a suite of investors including cell therapy leader, Bristol Myers Squibb.

With two smart factories in the U.S., including its new commercial-scale plant in New Jersey, and near-future plans to break ground on a commercial facility in Belgium followed by one in Asia, the promising IDMO has set itself up to make an impact on both pharma clients and patients.

According to Gerlinghaus, if you want to create disruptive technology, you need to begin by understanding why disruption is needed.

“I think every good invention starts with a really good understanding of the problem. The problem that

“What does it take to increase scalability and capacity? First and foremost, automation and really high throughput. So those were two key requirements,” says Gerlinghaus.

The company’s core technology, known as the Cell Shuttle, automates the entire manufacturing process from start to finish.

The heart of the Cell Shuttle platform is its single-use closed cartridge. Starting materials from patients are loaded into the cartridges, which contain modules that integrate all the technologies needed for the cell therapy processing steps.

What’s more is that the Cell Shuttle can handle 16 cartridges, which means therapies for 16 patients, simultaneously. This equates to 800 batches per year per Cell Shuttle (7-day process) or 2,800 batches per year per Cell Shuttle (2-day process).

we’re facing in cell therapy manufacturing today is focused on scale, cost, quality and speed,” says Gerlinghaus.

Current methods of manufacturing cell therapies typically consist of dozens of hands-on processes, where cells are manually moved from one benchtop instrument to another in cleanroom environments. These methods have proven to be cumbersome, expensive and plagued with errors.

Despite an eligible patient population of over 450,000, Cellares estimates that only 4,000 commercial doses of CAR-T cell therapy were manufactured in 2021. With new approvals and drugs being extended into earlier lines of treatment, market forecasts predict that the addressable patient population for CAR-T therapies will be 2 million patients per year from 2025-2030.2 This means there is a huge capacity gap that needs to be closed.

Quality is also a contributing issue. According to Gerlinghaus, process failure rates in the current CAR-T space range between 15-30%. Not only is that inefficient from a business perspective, it also can cost patients their lives.

“We are mostly talking about autologous cell therapies and if you have a manufacturing failure, that patient may die before you get another chance to collect high-quality cells,” says Gerlinghaus.

But perhaps the biggest threat looming over the future of cell therapies is manufacturing cost. “Cell therapy right now is not competitive with other drug modalities from a financial and economic perspective within pharma companies,” says Gerlinghaus. “So we need to bring down manufacturing costs to make these personalized therapeutics sustainable, and turn this into a sustainable business for pharma companies.”

Aware of the multitude of challenges plaguing the cell therapy sector, Cellares first set its sights on tackling scalability and capacity.

In addition to CAR-T, the platform can support therapies utilizing hematopoietic stem cells (HSC), T-cell receptors (TCR), natural killer (NK) cells, tumor-infiltrating lymphocyte (TIL) cells, regulatory T-cells (Tregs) and gamma-delta (γδ) T-cells.

Beyond solving scalability and capacity bottlenecks, the Cell Shuttle’s automated process all but eliminates two primary sources of process failure — contamination and operator error. In fact, Cellares says its technology offers 75% lower process failure rates when compared to conventional CDMOs using manual processes.

The assumption may be that utilizing cutting-edge technology like the Cell Shuttle comes at an exorbitant cost and that this cost will be absorbed by Cellares’ customers — but Gerlinghaus says the exact opposite is true. The Cell Shuttle drastically reduces the need for large facility footprints, as well as labor. And capturing these efficiencies allows Cellares to pass cost savings on to its customers.

“Normally when a pharma company outsources to a CDMO, their manufacturing costs go up. When they outsource to us, their manufacturing costs go down because of the efficiencies of the technology and our ability to offer a much lower price per batch,” says Gerlinghaus.

In fact, according to Gerlinghaus, Cellares charges customers 50% lower cost per batch than conventional CDMOs in the cell therapy space.

But the most impressive stat for Gerlinghaus comes in the form of productivity. The collective efficiencies of the Cell Shuttle mean that Cellares can offer unprecedented productivity levels in the cell therapy manufacturing space. And this, says Gerlinghaus, is what truly sets Cellares apart.

“What’s the key difference between an IDMO and a CDMO? To put it succinctly, it’s a 10x increase in productivity, meaning we can produce 10 times as many cell therapies with a facility of the same size and the same number of employees.”

It’s no secret that the pharma industry tends to be riskaverse when it comes to adopting new technology, so how does a young IDMO win the trust of pharma manufacturers? According to Gerlinghaus, the scope of the problem in cell therapies is so massive, that manufacturers are casting aside their circumspect ways and actively searching for solutions.

“Taking risks is usually not rewarded within large pharma companies,” says Gerlinghaus. “But the pain is tremendous. There are 1000s and 1000s of patients dying because pharma can’t produce enough drug products. At the same time, pharma companies are missing out on billions of dollars in revenue. It’s such a huge issue for both patients and pharma companies and it’s going to get worse with more and more cell therapy approvals, cell therapies getting approved for earlier lines of treatment, and cell therapies getting approved for indications with larger patient populations.”

But buy-in from other pharma companies hasn’t hurt either.

Cellares initially set up a low-risk, low-cost program to generate proof of concept for the Cell Shuttle. The Technology Adoption Partnership (TAP) program enabled companies to transfer their cell therapy processes onto the Cell Shuttle to evaluate potential benefits in capacity, process failure rates and manufacturing costs.

The program, which can be completed in six months or less, attracted companies like investor Bristol Myers Squibb, Cabaletta Bio and Lyell Immunopharma. The TAP program was so successful that Cellares is sunsetting it at the end of the quarter in favor of traditional CDMO supply agreements.

“We had a really strong influx of cell therapy companies wanting to work with us and that trend is not slowing down. We’re continuing to sign deals left and right,” says Gerlinghaus.

Gerlinghaus is all-in on the Cell Shuttle technology and the impact he foresees it will have on Cellares’ growth, the cell therapy industry as a whole and most importantly, patients.

“The way you build a $100 billion company is by making a big bet on cell therapies. Then you build strongly differentiated technologies and vertically integrate to operate them yourself. In this way, we’ll proceed to save the lives of millions of people over the next decade.”

1. ’How do you decide?’: The CAR-T cell shortage is forcing impossible decisions. Advisory Board. (Updated March 2023).

2. Nam, S., Smith, J. and Yang, G. Driving the next wave of innovation in CAR T-cell therapies. McKinsey & Company. (December 2019).

Andrea Corona Senior Editor

Andrea Corona Senior Editor

You could say that INCOG BioPharma Services is the result of an ultimatum.

The CDMO was conceived during a 34-mile cycling journey through Maui when Cory Lewis found himself at a crossroads in his career, uncertain about the path to pursue. Lewis’ wife had strongly requested that he come to a decision about what to do next by the time the trip was over. Somewhere along the scenic route between Paia and Mt. Haleakala, the revelation struck him.

Leveraging his years of experience in the contract manufacturing sector, along with his network of connections, Lewis embarked on his next journey — to establish INCOG. He was propelled by the idea that there must be better working philosophy in the CDMO industry, specifically by taking a flexible approach to

projects and putting excellent customer service at the forefront.

Lewis, partially inspired by his cycling journey, chose the name ‘INCOG’ to reflect the company’s values — ‘all in,’ ‘lean forward’ and ‘pull for the team.’ The name also signifies the company’s commitment to service.

“The ‘cog’ in our name not only reflects our connection to cycling but also symbolizes our role as a crucial component in a customer’s entire process of bringing therapies to the market,” says JR Humbert, INCOG’s vice president of quality.

Since its establishment in Fishers, Indiana in 2020, INCOG has begun to pull away from the pack. The company’s flexible approach is aimed at helping pharma clients quickly and safely bring modern sterile injectables to market. While the CDMO’s predominant focus is on biologics, it can also accommodate small molecules, peptides and mRNA products. Utilizing state-of-the-art technology and driven by a commitment to serve both clients and community, INCOG ultimately looks to offer better outcomes for patients.

While INCOG has lofty world-class aspirations, the foundation of the CDMO’s success lies in keeping its wheels grounded in its home state. INCOG’s role in Indiana extends beyond a mere presence. By deeply embedding itself in the community, the company has contributed to a growing life sciences presence in Fishers.

Located just 30 minutes north of Indianapolis, Fishers’ thriving community wasn’t built by chance but instead through INCOG’s hands-on influence.

“We had the opportunity to say, ‘Hey, we want to be all-in on Fishers. It’s a community with the potential to be the next great life sciences hub,” says Humbert.

According to Humbert, Fishers’ local government — who were transparent about not knowing much about biotech — worked hand-inhand with INCOG to outline what the industry needed. “In response, we adopted a proactive approach, and provided essential information about the biotech industry to the mayor and his business development team,” says Humbert.

This collaborative effort paved the way for INCOG’s commitment, leading to the mayor’s decision to acquire the 75 acres that became the Fishers Life Sciences and Innovation Park. The hub has since attracted notable players like viral vector CDMO Genezen Labs and Italian drug containment and delivery solutions provider, Stevanato Group. The development not only fosters a thriving business environment but also grants eligibility for city paid infrastructure upgrades and tax breaks.

Stevanato announced the start of construction on its new U.S. facility in Fishers in fall of 2021. With an investment of approximately $145 million, the 370,000-squarefoot plant focuses on expanding Stevanato’s pre-sterilized drug containment systems. The facility aims to employ over 230 local professionals in production, engineering, maintenance and corporate support roles by the end of 2025.

For INCOG, Stevanato’s investment is excellent news. “Stevanato built the machines that we’ve purchased for our facility. The fact that our service provider is going to be right around the corner gives us confidence that we will easily be able to address potential equipment issues and more easily prepare for expansion. Ultimately, this is important because it will enhance the level of service to our customers.” says Humbert.

With its specialization in aseptic fill-finish manufacturing, INCOG is tapping into a flourishing sterile injectables market, with recent forecasts projecting a rise from $518.49 billion in 2023 to an impressive $1.02 trillion by 2030.1

Ready to help meet this demand, INCOG’s 90,000-square-foot facility, scalable to accommodate up to three filling lines, is also designed with transparency in mind, with 95% of processes visible without gowning up.

“Our focus on transparency allows customers to actively participate and ensure their drug is produced as desired. It’s a unique approach with windows around most filling activities, providing an enhanced level of trust for customers to monitor the manufacturing process and contribute to the drug’s timely and accurate production,” says Humbert.

“This line ensures swift and precise filling, enhancing the product for both patients and medical providers. The shift from the current vial storage method to the multi-use line promises improved dosing accuracy, exceeding the capabilities of the existing process,” says Humbert.

INCOG has guided the client through the entire process — tech transfer, process validation and batch stability — and the filing is currently under review by the FDA.

“If that doesn’t validate the business model, I’m not quite sure what does,” Humbert. “We are helping customers take existing products and make them better for the patients that need these medications.”

INCOG’s multi-use filling line is designed to accommodate vials and prefilled syringes concurrently, enabling seamless transitions between the two. This adaptability, Humbert says, caters to a diverse customer base at various stages of the product life-cycle journey.

“If a customer has previously manufactured in a vial and now desires a prefilled syringe, our technology allows us to produce both on the same filling line. This means we can manufacture comparability material for the vial and demonstrate it in the syringe using the same equipment,” says Humbert.

Manufacturing on a single line offers cost-efficiency, time-savings and flexibility. With streamlined processes and consistent quality, companies can swiftly adapt to market demands while simplifying regulatory compliance.

When working with high-value biologics or small clinical trial batches, guaranteeing precise fill weight targets for every unit is crucial. In INCOG’s multiuse filling line, each component is taken out of the nest in the tub, allowing for in-process weight check.

“Thanks to the 100% in-process weight check and the re-dosing on request feature, our line ensures that the first unit off the line meets the fill weight target,” says Humbert.

This de-nesting and re-nesting for syringes and cartridges also means the risk of losing units due to glass contact is minimized, which is crucial for maximizing the value of each batch.

INCOG’s first client immediately put the CDMO’s adaptability to the test. The client had an existing approved drug that necessitated a transition to an ophthalmic delivery method requiring a 0.5 ml syringe with specialized small fill volumes. INCOG was able to accommodate this with its multi-use filling line.

INCOG’s vision extends beyond its current offerings, with plans to increase capacity through the addition of a high-speed syringe filling and cartridge line. According to Humbert, there is an order in place and fabrication underway for the new line, and it will be GMP-ready by the second quarter of 2025.

INCOG also plans to continue expanding capacity, potentially launching a second building focused on inspection, labeling and packaging — providing a complete end-to-end solution for clients.

“Our goal is to build solid partnerships with our customers and take a full portfolio approach. We want to support multiple molecules in their pipeline, and become a trusted partner for them,” says Humbert. “Our vision is that they’re continually coming back to INCOG because they know we will support their products at every step of the manufacturing process and give them an experience they won’t find at other CDMOs.”

1. Research and Markets. Global sterile injectable drugs market by molecule forecast 2024-2030. (2023).

Andrea Corona Senior Editor

Andrea Corona Senior Editor

With a dedication to advanced technologies, Matica Biotechnology is helping quickly bring cell and gene therapies from idea to patient

Matica Biotechnology was conceived as the missing piece of a larger puzzle.

The CDMO’s origins are rooted in the CHA Medical Group, which was founded in South Korea in the 1960s with an initial focus on hospitals and women’s centers. Over the years, the CHA network continued to expand, adding various health care and research entities, but it lacked one essential piece — manufacturing capabilities.

Created to fill this crucial gap, Matica Biotechnology was spun out from CHA Biotech as a contract manufacturer in December 2019. The CDMO swiftly actualized its vision by breaking ground on a 25,000-square-foot GMP facility in College Station, Texas.

But Matica was created to bridge another formidable gap: the growing void between the global demand for cell and gene therapies and the industry’s capacity for GMP production.

By leveraging advanced technologies such as real-time monitoring and closed systems, as well as its expert workforce, Matica is helping clients quickly bring CGTs from clinic to patient without compromising on quality.

Matica’s manufacturing capabilities are centered around advanced technologies designed to enhance efficiency and productivity.

The company’s commitment to automation and real-time monitoring is highlighted by Brian Greven, senior director of operations, who explains, “One of the things that I’m very proud of is that we’re trying to put automation in at the front end.”

Real-time, in-line readouts provide immediate insights, allowing for reduced production volumes and tighter process control. Early issue detection helps prevent batch failures — as a major hurdle for cell and gene therapy developers — ensuring consistent high-quality outputs. While such failures are costly for all drugmakers, in the realm of cell and gene therapy, a single failed batch can entail financial losses in the millions and pose a risk to patient lives.

Another defining aspect of Matica’s manufacturing capabilities is the implementation of closed systems. Greven underscores the significance of a 100% closed systems, explaining that this approach de-risks processes, reduces adverse events, and enhances efficiency by engineering out potential human errorprone scenarios.

The emphasis on automation extends to the platforming of equipment, with Matica forging an equipment manufacturing collaboration with Sartorius. As Greven points out, “This collaboration extends beyond mere partnerships, as Matica positions itself as an alpha and beta site for Sartorius, actively contributing

to the development and testing of newer technologies.”

In its collaboration with Sartorius, Matica is actively engaged in the development and optimization of advanced viral vector manufacturing. Utilizing single-use platforms and automation, they aim to achieve faster, safer and higher-quality production.

In partnership with Texas A&M University’s Center for Innovation in Advanced Development and Manufacturing, Matica is also collaboratively working on the development of innovative manufacturing technology. The goal is to enhance the efficiency of virus-based therapeutics production.

Matica also streamlines operations by utilizing cell lines that yield increased vector outputs and DNA systems that reduce costs and

timelines. “Our MatiMax cell lines will support us in overcoming CG&T manufacturing challenges. Every element, encompassing cells, media, equipment, and analytical methodologies, undergoes meticulous fine-tuning to ensure superior performance,” says Greven.

Featuring four proprietary cell lines, the company supports an accelerated development process and heightened productivity for advanced therapies. According to Matica, its HEK293 and HEK293T lines have demonstrated faster doubling times, reduced transfection resource requirements, and shortened overall production timelines.

But developing your own cell lines is not just about making them better — it’s about ensuring availability to manufacture your products. “We’re

also developing our own media, which gives us confidence in the reliability of our products,” says Greven.

Matica believes that the true value of a CDMO is determined by the quality of its people.

Given the broad pharma industry’s persistent workforce shortages, the company takes a multi-pronged approach to nurturing a workforce capable of meeting the demands of the burgeoning CGT industry.

To begin with, Matica looks to foster a symbiotic relationship between leadership and floorlevel workers. “Here at Matica, we emphasize that we’re all in this together and that everyone has a crucial part to play in the overall collective success of the company,” says Greven.

The emphasis on worker success is implemented from the first day. At Matica, new employees are tasked with one responsibility during onboarding: getting comfortable. Instead of stressful training and a day full of meetings, employees are instead scheduled to have lunch with their recruiter, followed by a welcome reception by the immediate team. This way, Greven says, people have a chance to celebrate with whomever was responsible for them joining the company and discuss goals and expectations from day one.

Matica’s approach involves looking at the workforce environment in two parts: culture and climate. Climate, as Greven describes it, can be influenced by quickly deploying and demonstrating company values. Culture, on the other hand, becomes the natural result of having everyone

feel part of a larger success story. Take care of the climate, and the culture will follow, “By leading these initiatives, the culture is shaped –evident in town halls, communication methods, and project discussions, not just at executive levels but also on the ground floor,” Greven says.

As Matica charts its course for the future, the company is hoping for organic growth, leveraging its collaborations and cutting-edge technology to maintain its position as an industry leader.

“I foresee that our footprint here in College Station will at least double, if not triple in the next few years,” says Greven.

Partnerships play a pivotal role in Matica’s future plans. “I think that we have some partnerships that are really very fruitful, and we continue

to move forward and push the needle,” Greven acknowledges.

The company hopes to sow the seeds of what it has planted locally and use them to grow globally.

“Our approach ensures not only localized impact but also global adaptability. In the event a client decides to transition to another CDMO, though we anticipate they won’t, our methodology is transferable,” says Greven. “Guided by our motto of ‘act locally, but think globally,’ we are attuned to potential project destinations, be it in the U.S., Asia, or Europe, making adaptability and seamless transitions essential.”

is passionate about innovation, and we burn the midnight oil - just like you. Our proven team of industry experts understand how to transform your business by cutting time-to-market and increase your innovation throughput to drive growth and boost ROI.

Our track record of success built on the efforts of results-driven professionals bring extensive experience in delivering meaningful and lasting improvement to the organizations we work for.

We excel in navigating heavily regulated and R&D intensive industries, specializing in Innovation, Product Development, Lab of the future, Manufacturing, and Supply Chain Excellence.

See our feature article in this issue of Pharma Manufacturing on how the industry can leverage proven lean innovation principles to help navigate recent policy changes around drug costs.

Dantar Oosterwal Partner and Senior Vice President, ARGO-EFESO

Dantar Oosterwal Partner and Senior Vice President, ARGO-EFESO

In the dynamic realm of pharmaceuticals, where innovation intersects the challenges of rising drug costs, executives are presented with an opportune moment.

With recent policy changes, such as the executive order on lowering prescription drug costs which currently impacts Medicare and Medicaid, forward-thinking executives are rightfully contemplating the potential extension of these measures to all drugs. The question echoes: How can pharma leaders not only navigate these changes but proactively position their organizations for success?

Pharmaceutical executives now face a crossroads where the trajectory to success demands more than reaction; it requires anticipation. Executives are navigators of the future for their organizations. They must leverage insights into potential policy trajectories, aligning strategies with the evolving narrative of health care cost.

This is where the first to adopt proven lean innovation methods from other industries to their pharma organization create a distinct advantage. Navigating change is not merely a reaction to waves of transformation; it’s the proactive stance of a captain charting a course through uncharted waters.

Now is the time for leaders to challenge their organizations, not just for compliance but to retool for sustained success. It’s an acknowledgment that the pharma landscape is undergoing a metamorphosis, and those who anticipate and adapt will not just survive but thrive.

As executives respond to this pivotal moment, they aren’t just navigating change; they’re charting a course toward a future where their organizations stand as pillars of innovation, efficiency and societal impact. The journey begins with anticipation, strategizing, and a resolute commitment to the pharmaceutical future.

Compliance is not negotiable; it’s foundational. Yet, proactive compliance offers a strategic edge. Executives, poised at the helm, are pivotal in shaping robust compliance strategies that not only align with current policies but also position their organizations as trailblazers in an evolving regulatory landscape. This demands active engagement with policy developments, understanding their implications and reshaping organizational structures accordingly.

Navigating change transcends policy tweaks; it’s about charting a course and fostering a culture of continuous improvement. We must champion lean innovation practices not as a reaction but as a strategic choice, woven into the fabric of our organizations. This requires cultivating an environment where lean becomes intrinsic to how we operate.

Executives should view this transformation as a chance to optimize operations, fuel innovation and fortify organizations for lasting success. Embracing change isn’t just about survival; it’s about leading the charge in an industry poised for evolution.

In navigating change, proactive leadership is key. It demands foresight, strategic vision, and an understanding that compliance isn’t a destination — it’s an ongoing journey of adaptation and growth.

Consider this: the cost of a drug carries a substantial burden from the R&D process, constituting 10% to 30% of the total cost of the drug.

Compared to traditional products, pharmaceutical products carry a burden two to 10 times greater for R&D as a percentage of total product cost. By optimizing and enhancing the innovation process through lean innovation practices, a transformative change will occur. A mere doubling of R&D efficiency repeatedly demonstrated in other industries, for instance, translates to a remarkable 5% to 15% reduction in overall drug costs. This isn’t just a cost-saving measure; it’s a strategic move to safeguard profit margins. This is direct savings to the bottom line.

In the pharma industry, where decisions affect the health and well-being of countless individuals as well as the bottom line, the adoption of lean innovation

The lean advantage isn’t just about achieving more with less; it’s about adopting new strategies to position pharma companies for long-term success.

isn’t just a business strategy; it’s a transformative proposition. For pharma executives, this goes beyond the realm of cost reduction — it’s about fortifying organizations for a future where efficiency, profitability and societal impact converge in the face of increasing pressures for reduced drug costs.

Beyond the immediate cost benefits, the beauty of lean innovation lies in its capacity to unlock valuable R&D resources. By improving efficiency, pharma companies not only save costs but free up additional R&D capacity. This liberated surplus resource should not be idle; it can be redirected towards developing new products. The ripple effect is an engine that powers a diversified product portfolio, generating additional revenue streams, and, importantly, boosting revenue and profits while delivering greater good to humanity.

R&D improvement is the gift that keeps giving with benefits that also include:

Not only does lean innovation reduce time-to-market, but as an outcome of being faster, it also introduces an element of agility into the traditionally rigorous and sequential drug development process.

Executives can steer their organizations towards a more responsive and adaptive approach, ensuring that they stay ahead in a rapidly evolving industry. Being nimble is not just about the speed of product development; it’s

EXHIBIT 2

Implementing LPD has led to:

$160

39%

Consistent

Consistent

a strategic asset in responding to emerging health care needs and staying competitive in a dynamic market.

Mitigating risk and increasing predictability

The lean development advantage extends well beyond cost reduction — it’s about mitigating risks inherent in drug development. By embracing an iterative learning processes and set-based experimentation, executives enhance the predictability of outcomes.

Identifying potential issues earlier in the development process reduces the likelihood of late-stage failures, ultimately lowering the financial risks associated with bringing a new drug to market and over time, the cost incurred from these dead ends.

Strategic positioning from changing regulations

In a landscape where drug pricing regulations are evolving, the lean advantage strategically positions pharma companies to excel. The ability to showcase proactive measures

Lean

towards efficiency and cost-effectiveness aligns seamlessly with the broader industry narrative. Pharma executives embracing lean methodologies aren’t just responding to change; they’re shaping a narrative of resilience and adaptability that resonates with regulators and stakeholders alike.

The lean advantage isn’t just about achieving more with less; it’s about adopting new strategies to position pharma companies for long-term success. For executives, this means more than immediate cost savings, as it’s a pathway to transforming their organizations into agile, innovative and resilient entities that can thrive amidst industry evolution.

The pharma industry is at a pivotal moment, navigating regulatory changes, evolving policies, and the

need for innovation. For executives, it’s not just about reacting to changes — it’s about forging a strategic vision that positions their organizations for enduring success. The impact on the R&D portfolio can be dramatic for a company that implements a lean development methodology approach (Exhibit 2).

The adoption of lean development methods isn’t merely a tactical response to policy changes; it’s a strategic vision to secure the future success of pharma companies (Exhibit 3). As the industry faces the possibility of broader cost reduction measures, those who proactively embrace lean innovation gain a dual advantage: compliance with evolving regulations and a fortified business model that is inherently more efficient and resilient.

Adopting lean development methods is a proactive assertion of leadership and forward-thinking,

instead of a mere reaction to external pressures. As demonstrated previously in the adoption of lean methods in manufacturing, a lean development approach puts organizations ahead of the curve and drives increased innovation, while ensuring efficient resource utilization to deliver maximum value to customers.

Pharma executives are presented with an unprecedented opportunity — to not only navigate policy changes but to proactively shape their organizations for a future where efficiency, profitability and societal impact converge. The initiative to lower drug costs for Americans serves as a resounding call to action — an action emphasizing the potential for transformative change that extends beyond compliance, offering strategic advantages. In embracing this proactive approach, all stakeholders stand to gain.

are using technology to meet the unique demands of today’s small scale era

Over the last several decades, there have been significant scientific discoveries in fields such as immunology, disease profiles (including various types of cancers), genetic sequencing, virology and more. The pharma industry has used these key scientific discoveries to develop novel therapeutics that target the specific nature of a disease to meet previously underserved or unserved patient populations. From mapping the first human genome in 2001 to delivering novel medical technologies based on gene modifications today, the industry has transformed at a pace never seen before in history.

Today’s new therapies are more sophisticated and more targeted in comparison to the blockbuster one-size-fits-all medications of the past. Whether a therapy is developed for a specific patient population, such as patients with a specific genetic marker, or a therapy is using cells captured from an individual patient (e.g., autologous cell therapy), smaller batch sizes are required to meet the scale of these targeted therapies.

Additionally, to circumvent the supply chain challenges felt worldwide starting in 2020, many governments and companies are adjusting their national policies and market strategies to ensure a secure supply by creating more regional or local manufacturing capabilities. This also means smaller batch sizes than the former blockbusters.

To adjust to these smaller scale needs, companies are building more multi-product manufacturing facilities. This includes both traditional biopharmaceutical companies, as well as contract development and manufacturing organizations (CDMOs). As part of the transformation driven by these product markets, the needs in the process development and manufacturing areas have also been intensifying and changing. These and other developments are calling for smaller batches, necessitating new solutions.

While modern trends drive the industry toward smaller batches, especially for new products, many of the traditional facility requirements to develop and manufacture these types of products remain. However, there are some noteworthy challenges in this market space. With many batches of smaller sizes and multiple products in a facility come business requirements for managing more recipes, records, changeovers, technology transfers, equipment, batches, materials, logs, data with context, and other factors.

Today’s most successful small batch manufacturers are categorizing these needs into three key strategic areas — capturing process knowledge,

managing the transfer process and tracking the batches — while pairing the key needs in each of these areas with the associated enabling technologies to help them meet the increased demands of the small batch era.

Whether a facility is using experimental data from process development or data from a manufacturing process, making the contextualized data available at the right time for key decisions is critical. In the small batch world, the number of batches is significantly increased, which means that more data with context must be aggregated.

Capturing the knowledge about a product and defining the associated process is necessary for licensing. Yet, that same knowledge is also useful for developing new products with similar unit operations, or on the same platform, to share learnings from successes and failures, for transferring knowledge to support multiple manufacturing locations

EXHIBIT 1

EXHIBIT 1

Successful small batch manufacturers are categorizing needs into three strategic areas — capturing process knowledge, managing the transfer process and tracking the batches.

and for managing the life cycle of the product (e.g., continued process verification, assessing deviations, evaluating potential changes, etc.). In the small batch world, these needs are intensified.

Several core technologies can be used to address these needs. Data collection, contextualization and aggregation tools are useful to make data available to scientists, operators, quality personnel and others in near-real time, with the ability to view data from experiments and batches across the globe. Process knowledge management solutions can be used for capturing and maintaining a master platform for storing manufacturing process flows, along

with related data, such as critical process parameters (CPPs), critical quality attributes (CQAs) and other data sets (Exhibit 1).

Additionally, embedded in some of these solutions, or separately available, are quality risk management tools which are used to capture the relationships between CPPs and CQAs, along with the control strategies designated to manage potential risks.

In cases where a process needs to be transferred, whether to the next stage in the life cycle, to/from a CDMO or to another internal facility, managing the manufacturing process, quality control process and associated parameter details (up to thousands of parameters for an individual product) is typically an extremely cumbersome manual process fraught with opportunities for errors.

Additionally, when transferring a new product to an existing facility, certain characteristics of the available equipment must be confirmed. Also, the ability to change out equipment and update systems easily — often referred to as flexible manufacturing — is important. Finally, when changing from one

Digital tools help manage the complexity of small batch operation, while also eliminating the cleanroom contamination risk that comes with using paper records.product to another in manufacturing, structured processes and procedures need to be in place to ensure consistency and compliance.

Process knowledge management software provides these functions, along with the ability to export the pertinent manufacturing process and parameter details for use in the development of electronic and process automation recipes to enable faster technology transfer of the process and product. Additionally, this type of system can confirm that the equipment configured for a process meets the needs for a new product to be introduced in a facility, and it can highlight any areas where changes are needed.

Today’s most advanced small batch facilities are taking advantage of modern software to enable on-demand treatment without increasing complexity of operations.

Although some of the standards, such as NAMUR’s module type package, are yet to be finalized when it comes to flexibility or plug and play concepts, both suppliers (equipment and automation) and manufacturers have started to use the currently available technologies to make flexible manufacturing easier and faster. When it comes to ensuring that the process is properly connected and that the right equipment is in the right place for a specific product setup, electronic workflow tools can be used for confirmation.

In the smaller batch world, where many batches of different product types are produced in various manufacturing suites at the same time, it becomes even more critical to know details about the batches.

When an operator needs to perform an action on a batch, its location is important. Additionally,

understanding the timing for performing a task and the status of the batch is key. Ensuring consistency in controlling the critical process parameters is also pertinent. The equipment status for all these smaller pieces of equipment located throughout the facility must be tracked, with material location and status relevant.

In the cases where a specific batch is designated for an individual, such as in CAR-T cell therapy, it is important to ensure that the operator is working on the right batch and documenting actions in the corresponding record. In this case, the chain of identity tracking throughout the entire manufacturing process must be maintained. Also, with many small batches come many batch records to be managed. Finally, many of these processes are paperbased, yet paper is inherently a particle shedder, complicating cleanroom operations.

In the smaller batch world, it becomes even more critical to know details about the batches.

Several technologies are being used to address the challenges that are common across the industry yet amplified in a facility producing many small batches. Real-time dynamic scheduling software is used to track the status of every batch and to help operators to know what to do when. These tools can also be used to evaluate the full extent or ripple effect of a delayed process step, or to determine the best time to perform maintenance on equipment. Additionally, the models from real-time dynamic scheduling software can be used to evaluate and eliminate bottlenecks.