SPIKED SODA

Behind the boozy soft-drink trend

THIRD SHIFT

How retailers make 24/7 operations work

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT).

AVT reduces the likelihood of selling tobacco products to underage individuals. It’s simpler for associates to execute rather than manually entering in date of birth.

Tobacco Product Scanned Prompt to Scan for Age Validation

The AVT system saves on transaction times.

AVT protects the future/viability of innovative products and harm reduction.

Verify and Scan I.D. POS System Validates Transaction Continues

46

More Than a Flavor

This article is brought to you by Kretek International

For many smokers, the taste of menthol is a unique multisensory experience that is an irreplaceable part of their tobacco ritual.

52 Flavor Forward

Food and beverages are being influenced by many taste preferences, creating bold, exciting and new profiles for every demographic.

63

Training’s Digital Era

C-store employees make gains when they learn via video bursts and mini games.

72

Exploring the Beer Cave

Walk in refrigerators expand selection, drive traffic and allow c-stores to compete with larger retailers.

89 No Nicotine: Novelty or New Segment?

Retailers, consumers and major manufacturers are looking at nicotine-free products.

98

Catering to the Next Generation

Distributors are focusing on the preferences of young adult shoppers.

106

The Second Front Door Bathroom standards are no joke today—expectations are high, and c-stores that don’t meet them will lose sales.

Mexican Beer’s ‘Fighting Spirit’ Unpacking the rise of imported beer as some brands surpass domestic labels.

STAY CONNECTED WITH NACS

@nacsonline facebook.com/nacsonline instragram.com/nacs_online linkedin.com/company/nacs

Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily

114

Putting Truck Parking on the Map

With a shortage of parking spaces for long-haul truck drivers, c-stores and travel stops aim to close the gap.

122 What’s Driving Food Packaging Innovation?

This Q&A is brought to you by Inline Plastics.

Inline Plastics shares how changing consumer expectations are leading to fresh takes on packaging.

124 Here Today, Gone Tomorrow

Limited-time-only beverages create excitement in the vault and spur incremental sales.

132

Own Your Online Presence

Three elements define your digital footprint: searchability, social media and reputation management.

140 Carding Better

Age verification goes digital and gets more discreet.

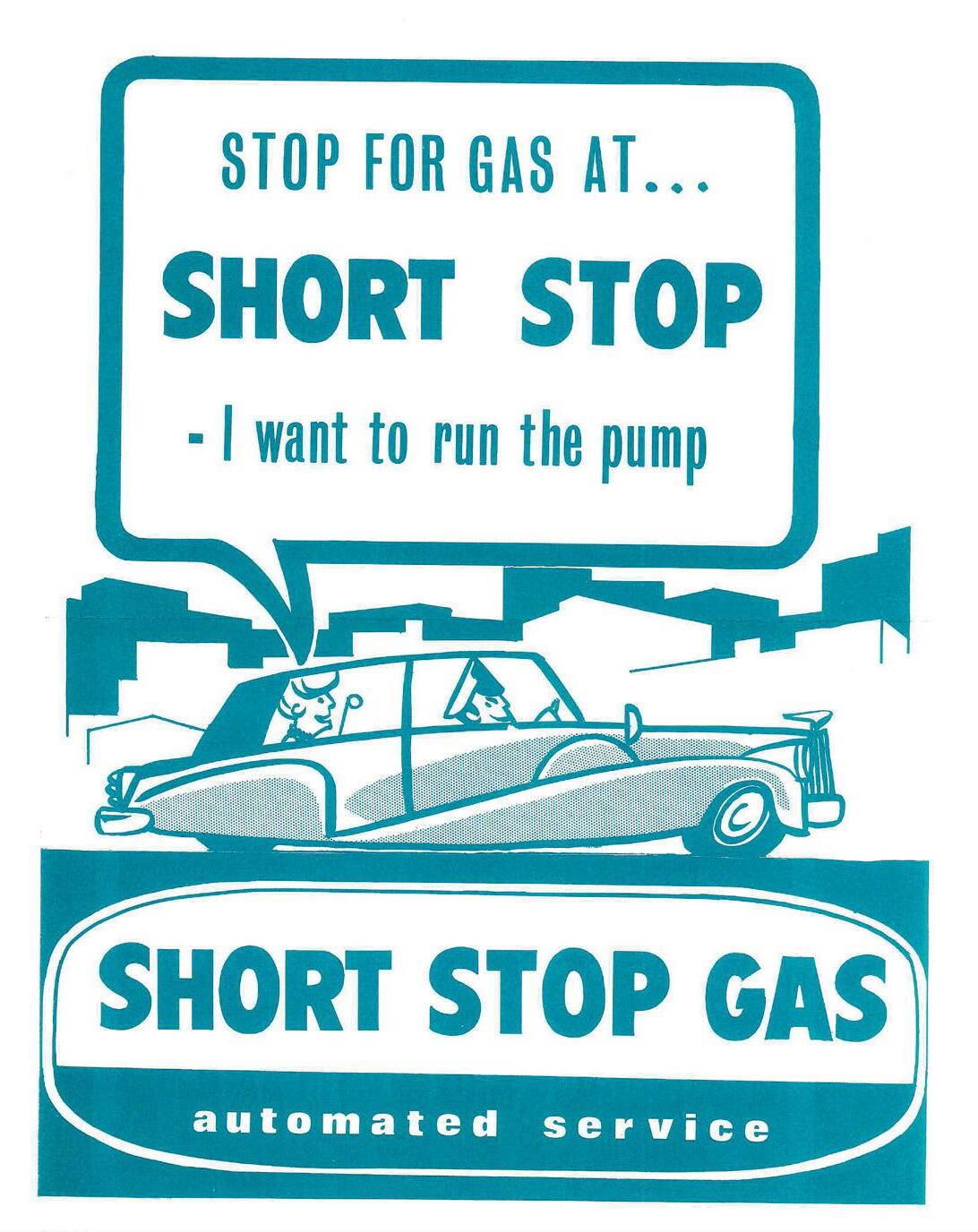

146 Self-Serve Turns 60

Industry icon John Roscoe popularized self-serve … now he ponders what’s next.

154 Keeping Up With the Consumer

Convenience Voices has started gathering 2024’s customer insights.

158 Five Foodservice Equipment Innovations

Smart technology, UI updates and automations can help improve offerings and reduce labor.

165 What’s Hot in Cold Storage

New products in refrigeration give retailers merchandising options.

172 Streamlining Maintenance

This article is brought to you by Vixxo.

Artificial intelligence can streamline technician workflow.

176 Revving Up With Retail Media Networks

C-stores are uniquely positioned to utilize retail media networks, which can drive sales and reinforce brand loyalty.

194

The Latest on Norway’s EV Explosion

What North American retailers can learn from the leading country’s prolific EV adoption.

202

Scanning the Horizon

This article is brought to you by GS1 US.

Retailers should start laying the groundwork now for Sunrise 2027’s transition to 2D barcodes.

48-ct.

Convenient cases with 8-ct. inner cartons

5-day refrigerated shelf life

PLEASE RECYCLE THIS

10 From the Editor

12 Faces of the Industry 14 NACS News

24 Convenience Cares

28 Inside Washington

The credit card industry keeps putting more money and muscle into stopping the CCCA—perhaps to its detriment.

38 Ideas 2 Go

206 Cool New Products

220 Gas Station Gourmet

Fastime stores highlight classic Southern food and an inviting atmosphere.

222 Category Close-Up

Customers continue to depend on c-stores for salty snacks, but they also seek new and exciting flavor innovations.

232 By the Numbers

The percentage of in-store sales accounted for by salty snacks in 2023.

CATEGORY CLOSE-UP PAGE 222

The presence of an article in our magazine should not be permitted to constitute an expression of the association’s view.

Premier Manufacturing is excited to introduce NIC-S®. Premium tobacco-free nicotine pouches backed by extensive scientific research, made with pharmaceutical grade nicotine, and is setting a higher standard for nicotine pouches.

PHARMACEUTICAL GRADE NICOTINE

6 FLAVOR PROFILES WITH 3 STRENGTHS (3MG, 6MG, AND 9MG)

EXTENDED NICOTINE RELEASE

LONG LASTING FLAVOR

PREMIUM SOFT POUCHES

EDITORIAL

Jeff Lenard V.P. Strategic Industry Initiatives (703) 518-4272 jlenard@convenience.org

Ben Nussbaum Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Leah Ash Editor/Writer lash@convenience.org

Noelle Riddle Editor/Writer nriddle@conveneince.org

Lauren Shanesy Editor/Writer lshanesy@convenience.org

CONTRIBUTING WRITERS

Angel Abcede, Terri Allan, Joe Beeton, Stephen Bennett, Jamie Grill Goodman, Sarah Hamaker, Al Hebert, Stephenie Overman, Pat Pape, Keith Reid, Emma Tainter

DESIGN MX

www.themxgroup.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

CHAIR: Jose Victor Pardo Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

TREASURER: Lisa Dell’Alba, Square One Markets Inc.

OFFICERS: Anne Gauthier, St. Romain Oil Company LLC; Varish Goyal, Loop Neighborhood Markets; Brian Hannasch, Alimentation Couche-Tard Inc.; Charles McIlvaine, Coen Markets Inc.; Lonnie McQuirter, 36 Lyn Refuel Station; Tony Miller, Retail Delek US

GENERAL COUNSEL: Doug Kantor, NACS

LIAISON: Joseph Sheetz, Sheetz Inc.

MEMBERS: Chris Bambury, Bambury Inc. dba BONNEAU; Tom Brennan, Casey’s General Stores Inc.; Andrew Clyde, Murphy USA; Terry Gallagher, Gasamat Oil Corp/Smoker Friendly; Raymond M. Huff,

NACS SUPPLIER BOARD

SUPPLIER BOARD CHAIR: David Charles, Cash Depot

CHAIR-ELECT: Vito Maurici, McLane Company Inc.

VICE CHAIRS: Josh Halpern JRS Hospitality / BCIP dba Big Chicken; Kevin M. LeMoyne, The Coca-Cola Company; Bryan Morrow, Chobani & La Colombe

MEMBERS: Tony Battaglia, Tropicana Brands Group; Patricia Coe, Advantage Solutions; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds American Inc.; Mark Falconi, Greenridge Naturals; Ramona Giderof, Diageo Beer Company USA; Mike Gilroy, Mars Wrigley; Danielle Keck Holloway, Altria Group Distribution Company; James Hughes, GALLO; Kevin Kraft,

HJB Convenience Corp. dba Russell’s Convenience; John D. Jackson, Jacksons Food Stores Inc.; Mark Jordan, Refuel Operating Company; Missy Matthews, Childers Oil Co. dba Double Kwik; Brian C. McCarthy, Blarney Castle Oil Co.; Natalie Morhous, RaceTrac Inc.; Jigar Patel, FASTIME; Robert Razowsky, Rmarts LLC; Stanley Reynolds, 7-Eleven Inc.; Kristin Seabrook, Pilot Travel Centers LLC; Babir Sultan, Fav Trip; Richard Wood, Wawa Inc.

PAST CHAIRS: Donald R. Rhoads, The Convenience Group LLC; Jared Scheeler The Hub Convenience Stores Inc.

SUPPLIER BOARD

REPRESENTATIVES: David Charles Sr., Cash Depot; Vito Maurici, McLane Company Inc.

STAFF LIAISON: Henry Armour, NACS

Q Mixers; Jay Nelson, Excel Tire Gauge, LLC; Nick Paich, GSTV; Sarah Vilim, Keurig Dr Pepper

PAST CHAIRS: Brent Cotten The Hershey Company; Kevin Farley W. Capra Consulting Group LLC (Axonet); Drew Mize, PDI Technologies

RETAIL BOARD

REPRESENTATIVES: Tom Brennan, Casey’s General Stores Inc.; Scott E. Hartman, Rutter’s; Kevin Smartt, TXB Stores

GENERAL COUNSEL: Doug Kantor, NACS

STAFF LIAISON: Bob Hughes, NACS

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

Night or day, we’re on call to help with 24/7/365 fuel availability. Because, we know, keeping pumps fueled means keeping business pumping and the community moving. Right Now.

It’s that time of year when everything in the industry is bigger and better.

The October issue of NACS Magazine is always our signature issue. Advertisers, understandably, want to put their products in front of the c-store community at the NACS Show and during the planning cycles that, for many retailers, come later in October. More ad pages means the NACS team can bring you more content, which in turn means more perspectives on this endlessly fascinating industry.

In 1964, self-serve came to convenience stores.

For example, this issue will take you back in time to 1964 when c-stores first added self-serve fuel. John Roscoe was instrumental in driving industry adoption. He shares his story in “Self-Serve Turns 60.” (Be sure to check out the vintage advertisements in that story.)

We also look at an interesting long-term opportunity: creating more parking spaces for semi-trucks. “Putting Truck Parking on the Map” is written by Lorrie Grant, who spent more than a decade covering the trucking industry.

Another highlight for me is our coverage of innovations in training. “Training’s Digital Era” helps retailers of all stripes find their own sweet spot for the most effective training tactics.

If you’re reading this while on-site at NACS Show, I hope you:

• Discover great new ideas to drive success for you and your business.

• Connect with peers you haven’t met yet and catch up with old friends.

• Have time to reach out and say hi … to me or anyone else on the NACS team. We’re easy to spot—just look for the NACS name tags.

Ben Nussbaum Editor-in-Chief

Correction:

In the August article “A Fresh Focus on Design,” we failed to properly credit King Retail Solutions for its work. King Retail Solutions is the company behind the Jacksons Food Stores and Power Market examples in that story. Check out kingrs.com to see the company’s full portfolio.

Guests visiting the Dash In store in Indian Head, Maryland, are greeted by plenty of friendly faces, but Joyce Kendall, the store’s dedicated concierge and guest experience member, stands out.

Joyce is there to make customers feel at home and help them find everything they need while in Dash In, the new concept store from the Wills Group, which is a food- and experience-forward spin on convenience retail.

As the concierge, Joyce is a key part of the store’s focus on hospitality and being a pillar of its neighborhood. At any given time, you can find her walking the floor with samples of the kitchen’s fresh food items to try, helping guests customize

their order at the kiosk, making personalized recommendations or just asking visitors how their day is going and getting to know them like a neighbor.

Joyce has been with Dash In for eight years and started as the Indian Head location’s concierge when the store opened in April. She’s always loved working with people, and spoke with NACS about:

My role is to welcome the guests—we call them guests, not customers. I am here to make sure everyone feels welcome and has the best possible experience in the store while shopping.

the people who make our industry great.

I have always enjoyed working with people, and I’ve always treated people like I’ve known them forever. And by doing that, I just get to know the guests well and they know me, and when they come into the store, we talk like we’ve been friends forever.

WHAT SHE FINDS FULFILLING ABOUT HER ROLE AS A CONCIERGE

The most fulfilling thing is that I get to talk to guests who really enjoy coming to the store. They’re not used to being waited on and so they’re often totally shocked by the level of service. They’re not used to someone saying ‘Welcome, how are you doing today?’ or ‘You look nice today’ at every store they visit. And so they really love that and it makes them want to come back.

WHAT SHE WOULD TELL OTHERS ABOUT WORKING IN A CONVENIENCE STORE

I love it because you get to meet all kinds of people from different walks of life. You experience and learn things by meeting customers that you normally might not have. You get to help people. If they’re sad, you lift them up and can really make their day. When you talk to someone who is having a bad day or maybe isn’t feeling great, and then they walk out the door with a smile, that makes you feel great and is rewarding.

In August, the NACS Research & Technology Committee was invited to tour the Kwik Trip facilities in La Crosse, Wisconsin.

The Kwik Trip campus, settled along the eastern bank of the Mississippi River, is home to the retailer’s bakery, kitchens, food protection laboratory, distribution center, ice plant, LP plant and blow mold facility. Kwik Trip is a vertically integrated company and makes and ships over 80% of its own branded products, which include Kitchen Cravings, the Kwikery and Cheese Mountain.

The Research & Technology Committee’s first stop was the blow mold facility. The facility can make over 130 bottles per minute, which are filled with Kwik Trip’s Nature’s Touch brand of dairy products, water and flavored drinks. Each bottle is stamped with Kwik Trip’s signature “smiley face.”

The morning of the tour, the Kwik Trip bakery was making bismarks. The bismarks (and other baked goods like muffins, cinnamon rolls, long johns and the retailer’s famous Glazers Donuts) are made in-house and the bakery can

make 328 bismarks per minute. The Committee also visited the kitchens, the bread and bun bakery and the Food Protection Laboratory.

“Even within the first stop of the tour, the self-sufficiency of Kwik Trip’s operations immediately became obvious and it was impressive to see how quickly they can produce so many private-label products and fresh food items with such quality,” said Emma Tainter, research analyst/writer at NACS.

Kwik Trip employs over 38,000 workers across six states and 876 stores. In addition to the production facility, Kwik Trip’s headquarters has an onsite childcare facility and a Center for Health available to all employees and their dependents.

In everything we do at NACS, we strive to be a best-in-class organization that supports our members and drives the industry forward—and this magazine reflects that.

Each month, NACS Magazine brings its members the content, stories and resources they need to make better business decisions and excel in the convenience retail industry.

NACS Magazine has been named the Best Association Publication by the Content Marketing Institute in the 2024 Content Marketing Awards. The Content Marketing Awards are the largest and longest-running international content marketing awards program recognizing the best in strategy, content creation and visual and audio storytelling.

NACS Magazine was also selected as a finalist in the Best Publication Design category.

NACS and our editorial team are proud of the issues we put together each month and hope you enjoy reading them as much as we enjoy producing them.

2024 NOVEMBER

NACS Innovation Leadership Program at MIT

November 03-08 | MIT Sloan School of Management Cambridge, Massachusetts

NACS Women's Leadership Program at Yale

November 17-22 | Yale School of Management New Haven, Connecticut

2025 JANUARY

Conexxus Annual Conference

January 26-30 | Loews Ventana Canyon Tucson, Arizona

FEBRUARY

NACS Leadership Forum

February 11-13 | The Ritz-Carlton Amelia Island, Florida

NACS Convenience Summit Asia

February 25-27 | Conrad Tokyo Tokyo, Japan

MARCH

NACS Day on the Hill March 10-12 Washington, D.C.

NACS Human Resources Forum March 24-26 | Hutton Hotel Nashville, Tennessee

APRIL

NACS State of the Industry Summit

April 08-10 | Hyatt Regency DFW International Airport Dallas, Texas

For a full listing of events and information, visit www.convenience.org/events.

Maverik named Crystal Maggelet as its new CEO and chief adventure guide. Building upon Maverik’s former CEO Chuck Maggelet’s wins for the brand during his more than seven-year tenure, Crystal will bring a renewed focus on people, philanthropy and culture to her leadership of nearly 15,000 team members across the family-owned c-store network, now serving customers at over 830 stores in 20 states from the Midwest to the west coast and growing.

Crystal Maggelet’s professional background includes extensive experience with both the Maverik brand and with Maverik’s parent company, FJ Management Inc., where she remains the CEO and chairwoman. She founded Crystal Inn Hotel & Suites in 1993 prior to stepping into the CEO role at Flying J (later rebranded to FJ Management) in December 2008.

Colonial Group Inc., promoted Bob Kenyon to chief operations officer. Kenyon will also retain his position as president of Colonial Oil Industries Inc. Prior to joining Colonial in 2022, he served as senior vice president, sales and marketing for Renewable Energy Group Inc. He is also the former president of Atlas Oil Company, where he led the company’s nationwide sales, marketing, supply, operations and administrative resources spanning 20 terminals and more than 900 employees.

Ryan Chandler has been promoted to chief commercial officer of Colonial Group Inc., and will also retain his position as president of

Colonial Terminals Inc. Chandler joined Colonial Group Inc., as vice president of business development in 2011 and became president of Colonial Terminals Inc., in 2020.

Erica Fortune was named as Alimentation Couche-Tard’s new chief digital officer. Previously, Fortune served as chief product management officer and senior vice president of e-commerce at Advance Auto Parts. Prior to that, she was senior vice president of e-commerce for home discount retailer Big Lots, where she drove its omnichannel transformation and built its e-commerce platform.

Flexeserve, a hot-holding manufacturer and hot foodto-go specialist, hired Conrad Randell as sales manager for the United States and Canada. He will be responsible for all non-retail foodservice sectors throughout the United States and Canada, including c-stores, QSRs, express grab-and-go, colleges, stadiums, workplaces and more.

Flexeserve also hired Anthony Harris as sales manager for retail and Latin America. In Latin America, he is responsible for growing all business segments, including c-stores, QSRs, express graband-go, colleges, workplaces and more. Additionally, Harris is tasked with developing the retail business segment in the United States, focusing on supermarkets.

Michael Caldwell joined the Rovertown team as its new customer success manager— enterprise. At Rovertown, he’ll leverage his unique background to spearhead a new customer success program for enterprise-level retailers amidst rapid growth in that segment. Prior to joining Rovertown, Caldwell worked at Yesway, where he built and grew Yesway Rewards from 35 stores to 435 stores.

NACS welcomes the following companies that joined the Association in July 2024. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting convenience.org/ create-login. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership

NACS AFFILIATED ASSOCIATION

Greater Houston Retailers Cooperative Association Inc. – Kudos Stafford, TX www.ghraonline.com

NEW HUNTER CLUB MEMBERS

Bronze Freedom Electronics LLC Kennesaw, GA www.freedomelectronics.com

VitaminWell USA/Barebells Los Angeles, CA www.nocco.com

Silver Built Brands LLC American Fork, UT Built.com

RETAILERS

Drury Southwest Inc. Cape Girardeau, MO Drurysouthwest.com

DT Dietel Tank Grimma, Germany www.dietel-tank.de

First Class Vending Chandler, AZ www.firstclassvending.com

HCG Corporation Dededo, GU www.healthcitynutrition.com

Ira Phillips Inc. Gadsden, AL www.iraphillips.com

Lets Go Market LLC New Caney, TX

Merced Mall Chevron Merced, CA

Newbur Inc. dba Borchard Chevron Newbury Park, CA

Pats Travel Center La Porte, TX

Suduri Corporation NV, dba Palm Beach Service Station Oranjestad, Dutch Caribbean, Aruba

TMPEC LLC Mission Viejo, CA

Town Line Deli Inc. East Waterboro, ME www.waterboromarket.com

Yucaipa Auto Spa Yucaipa, CA

SUPPLIERS

AB Mauri Saint Louis, MO www.abmna.com

A-Game Beverages Ocoee, FL www.drinkagame.com

Bank of Hope NA

Benson’s Bakery

Berlin Packaging Chicago, IL www.berlinpackaging.com

Blake’s Beverage Co. Armada, MI Blakesbevco.com

Cadence OTC Oakland, CA www.cadenceOTC.com

E-Seek by Veridos San Diego, CA www.e-seek.com

Food Fair Magazine San Anselmo, CA www.thefoodshownetwork.com

GVH Distribution Lubbock, TX www.gvhdistribution.com

Happy Dad Santa Ana, CA

Ice-O-Matic Denver, CO www.iceomatic.com

KPS Commercial Construction Arcadia, IN www.kpsconstruction.com

Marwan’s Kitchen Baltimore, MD www.marwanskitchen.com

Multiplex Beverage New Albany, IN www.multiplexbeverage.com

NexRev Plano, TX www.nexrev.com

Protein Candy Inc. London, ON, Canada Proteincandy.com

Purple Frog Graphics Wilton, CT www.purplefroggraphics.com

Rustoleum Vernon Hills, IL www.rustoleum.com

S & O Wholesale Reno, NV www.sandowholesale.com

Spectrio Tampa, FL www.spectrio.com

Speed Data LLC Frisco, TX www.speeddatallc.com

Sterling BV Foods Inc. San Antonio, TX www.sterling-fd.com

Stuffed-Foods Wilmington, MA Stuffed-foods.com

The Water Street Collective Thewaterstreetcollective.com

Theoreon Services Inc. Las Vegas, NV Theoreon.com

TRU Brands Inc. Miami Beach, FL

Verkada San Mateo, CA www.verkada.com

Vulcan Spring & Manufacturing Telford, PA www.vulcanspring.com

WhiteHall Products LLC Tampa, FL www.whitehall-products.com

Take your Shot with 5-hour ENERGY® Gamer Shots and 5-hour ENERGY® Pre-Workout Sport shots

Sports Shots, featuring CitraPeak,® to maximize your workout.

Introducing exciting new flavors and ground breaking products to captivate new audiences don’t miss your shot.

The in-store Fuel the Cause campaign celebrated local heroes.

Nittany MinitMart raised $176,934.02 during its fifth annual Fuel the Cause campaign to support local volunteer fire companies across central and northern Pennsylvania. The amount beat last year’s record total by more than $25,000, and all of the proceeds from the fundraiser were donated to local volunteer fire companies across central and northern Pennsylvania.

From March 28 to June 2, Nittany MinitMart and Pennsylvania Skill games each contributed one cent for each gallon of gas sold. Customers could also round up their purchases, buy special fire company merchandise and order from Nittany MinitMart’s special Firehouse Foods menu, with a percentage of proceeds benefiting the campaign.

“The most important part of Fuel the Cause is our customers,” said Nittany MinitMart’s Nicole

Masullo. “We’re beyond grateful for the support from our customers, sponsors and community, who come together every year to make this event even bigger and better and who help us give back to the volunteer firefighters who keep us safe.”

According to the National Volunteer Fire Council, around 676,900 of the total estimated 1 million firefighters across the United States are volunteers.

The National Volunteer Fire Council also stated that the cost to train and equip a firefighter can exceed $20,000. With smaller communities (populations under 10,000) across the United States typically protected by all-volunteer departments, the costs can quickly add up.

Nittany MinitMart is based out of central Pennsylvania and has 28 locations across the state.

Crystal Seal Cravings round deli containers are made with our EcoStar® post-consumer recycled PET material and are recyclable with a #1 resin code to meet your sustainability goals. Most importantly, we added our patent pending tamper-evident feature on the lid, so you and your customers ensure the safety and security of the contained food. The round shape makes for easy stacking, optimizing shelf space while providing superior clarity. Available in 5 sizes. Satisfy your cravings, get your free sample kit today!

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America and to share these powerful stories.

Learn more at www.conveniencecares.org

1 OnCue donated $98,000 in nonperishable and personal care items to local food banks, including the Regional Food Bank of Oklahoma, Our Daily Bread and other food pantries to combat food insecurity in the towns where it operates. The donated products are collected from the retailer’s stores annually to update item selection while minimizing waste. Since 2020, the company has donated over $331,500 worth of products and donated more than $50,000 in monetary support to Oklahoma food resource centers. The Regional Food Bank of Oklahoma was OnCue’s biggest beneficiary, receiving more than $63,733 worth of items— equivalent to 4,615 pounds.

2 Citgo supported Florida communities affected by Hurricane Debby by donating $25,000 to Team Rubicon. The funds are set to be used for debris removal, chainsaw operations, roof tarping and mucking and gutting out homes.

“With our recent experience with Hurricane Beryl in the Houston area, we understand what our neighbors in Florida are experiencing right now and we want to help with the recovery,” said Chris Kiesling, Citgo assistant vice president of light oils operations and marketing. “We have a longstanding relationship with the people of Florida and the response efforts in Perry will help them restore their homes and businesses as soon as possible.”

3 To celebrate Love’s Travel Stops 60th anniversary, the retailer donated $408,000 to the United Way of Central Oklahoma (UWCO). The donation was split between UWCO’s 68 partner agencies, with a donation of $6,000 to each. Love’s has worked with the organization for 25 years.

The donation will “help address issues ranging from homelessness to food insecurities and crisis intervention,” the retailer said.

AFFORDABLE HEALTHCARE

4 Mirabito Convenience Stores raised $65,000 with its Mirabito Cares Round Up campaign. The money will benefit the UHS Foundation’s Journey Campaign for the Wilson Main Tower, which will provide enhanced healthcare services to the communities Mirabito serves and neighboring areas, helping them have access to affordable healthcare.

“At Mirabito, we believe in giving back to the community that supports us,” said Marissa Sweeney, marketing director at Mirabito. “The success of our round up campaign is a testament to the generosity of our customers and their commitment to improving local healthcare. We are proud to support the UHS Wilson Main Tower and look forward to seeing the positive impact it will have on our community’s health and well-being.”

5 Casey’s General Stores ran a Cash for Classrooms program throughout the month of August. The annual program encourages customers to round up their purchase to help fund grants for K-12 schools in Casey’s communities.

“Casey’s is here to make a positive impact in our communities and for guests who visit our stores every day. Our guests’ generosity helps us provide grants to local schools across Casey’s Country,” said Katie Petru, director of communications and community at Casey’s.

To date, Casey’s has raised more than $4 million for schools across its 17-state footprint.

The credit card industry keeps putting more money and muscle into stopping the CCCA—perhaps to its detriment.

BY LYLE BECKWITH

Since the Credit Card Competition Act (CCCA) was first introduced in 2022, the credit card industry has spent over $100 million in advertising and lobbying to defeat it, and that spend is still growing. That is certainly a daunting number, but it turns out money can’t overcome the contradictions that come from arguing for the wrong thing. On almost a weekly basis, opponents of CCCA say or do something that undermines their position.

NACS and the Merchant Payments Coalition (MPC) have been diligently gathering these gaffes and sending them to Capitol Hill offices to expose their duplicity and falsehoods. The following is by no means a complete list, but provides examples of how the CCCA’s opponents can be their own worst enemies, and why we as an industry need to continue to advocate for the passage of the CCCA.

As Oscar Wilde once wrote, “There is only one thing in the world worse than being talked about, and that is not being talked about.” Well, the credit card industry has made sure that everyone on Capitol Hill is talking about CCCA. Big banks and credit card companies have launched ads warning consumers about Congress trying to steal rewards, or “the Big Box Bailout.” And if you happen to be caught up in a geofencing area for such ads, you have been inundated with their online messaging. They have paid spokespeople on talk TV and radio, including “The Points Guy,” and even bought ads to run during last season’s NFL games in almost every market. There is no way that Main Street merchant groups could have paid to generate this much buzz around a piece of legislation—underscoring to Congress just how much money the credit card industry rakes in from swipe fees.

The claim that passage of the CCCA would cause consumers to lose their rewards points had been the credit card industry’s main argument against CCCA, but it has been thoroughly discredited by numerous independent fact-checking groups. One need merely to look around the world to countries that either have dual routing (like the CCCA would bring to the United States) or outright capped swipe fees (which CCCA doesn’t do) at a fraction of what the United States pays. All of these countries still have rewards programs attached to their payment cards.

Credit card rewards programs have already caught the attention of regulators and Congress. A recent Consumer Financial Protection Bureau (CFPB) report highlighted consumer frustrations with credit card rewards programs, including vague or hidden conditions to redeem rewards; the devaluation of rewards; a failure to reinstate rewards when consumers are unable to redeem them; and revocation of previously earned rewards. And according to a July 2024 report from The Capitol Forum, “Over the last five years, hundreds of Capital One customers have told the CFPB about problems with the rewards program. Many describe how the bank shut down their accounts without warning due to alleged concerns about fraud … then cancelled all their rewards.” Perhaps one of the biggest boons to the CCCA came from a recent poll of voter sentiment, which found that the “Lose Your Points” argument actually garnered more support for CCCA rather than less.

In February 2024, the Senate Judiciary Committee invited the CEOs of Visa, Mastercard, United Airlines and American Airlines to testify at a hearing on competition in the credit card market. All four CEOs refused to appear.

Why? They know that they will look bad when asked about how Visa and Mastercard centrally set prices for thousands of banks, or put those banks in a cartel-like structure to ensure that every bank’s card must be accepted by merchants. Nor can Visa defend its candid admissions on earnings calls that it profits from inflation.

The credit card industry has rolled out the same arguments about CCCA that they’ve used about pre-

vious policies that it didn’t like. It’s cited things like free checking going away, lower income consumers losing their ability to bank, consumers losing rewards or the fear that transactions won’t be secure.

All of this because CCCA would require a second routing option. The credit card industry is trying to play into the notion that competition is a bad idea. Enter JPMorganChase, which announced this summer that it would be offering an alternative network on its payment cards in France. This is exactly what CCCA would do in the United States … but for some reason in America it means disaster. In France, Chase even said it was doing this to “provide competitive transaction costs” to its clients. No kidding. We made sure Congress heard about this one.

Despite all the mistakes and falsehoods of the credit card industry, the bill’s passage is far from certain. You can’t win a vote unless you get a vote, and up

until now, Congressional leadership hasn’t given us one. We believe we can win, but not without the ongoing support of retailers—you and your fellow Main Street businesses.

NACS and the MPC will be scheduling several fly-ins to Washington D.C. this fall to insist on passage of the CCCA. Even if you have done this in the past … perhaps several times … we still need your help this fall. Calls to your Senators and letters and meetings with legislators in your home state are essential. If a vote does happen, it will likely be the most important vote for Main Street in decades. With your dedication and help, we can get this over the line.

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac. NACSPAC donors who made contributions in August 2024 are:

Doug Beech Casey’s General Stores Inc.

Tom Brennan Casey’s General Stores Inc.

Matt Durand EG America LLC

Darlene Hall Nittany Oil Company dba Minitmart

Cara Heiden Casey’s General Stores Inc.

Joe Juliano United Pacific

Katrina Lindsey Casey’s General Stores Inc.

Wolfgang Manz PWM Electronic Price Signs Inc.

Nicole Masullo Nittany Oil Company dba Minitmart

Vito Maurici McLane Company Inc.

Gil Moyle Moyle Petroleum Company

Doug New Nouria Energy Corp.

Charles Reesman Nittany Oil Company dba Minitmart

Greg Scriver Kwik Trip Inc.

Joseph Vonder Haar iSee Store Innovations

YOUR PREMIER PARTNER FOR GROWTH TALK ABOUT INNOVATION, OPPORTUNITY, AND

COME VISIT US AT NACS SHOW BOOTH N2347.

ITG, Your Premier Partner for Growth, is ready to collaborate with you to leverage our newest innovations and help create the volume and profitability to enhance your bottom line. We have the products and the support that can make all the difference!

COME SEE THE POWER OF ITG’S:

• Retail Excellence

• Leading Partnerships

• Superior Trade Solutions

CEO FKG Oil

What role in the community do you think convenience stores should play? Convenience stores serve as a community center. We provide fuel, food, convenience items, car washes and entertainment from gaming to our communities, and we serve our customers every day with the items and services they need the most.

What does NACS political engagement mean to you and what benefits have you experienced from being politically engaged?

It’s difficult to stay up to date with the seemingly unending list of regulations that affect our ability to survive and thrive in our communities. I’ve found that being politically engaged with NACS allows me to navigate those webs of regulations that often impact our industry. Having NACS advocate for our industry in our nation’s capital allows us to continue to operate our stores and serve our employees and customers.

What federal legislative or regulatory issues keep you up at night (with respect to the convenience store industry)? This is an easy one—taxes, regulations and electric vehicle mandates are always top of mind for me.

What c-store product could you not live without? Krispy Krunchy Chicken, coffee and beer!

Name of company: Four Corner Variety

Year founded: 1990

# of stores: 1

Website: www.facebook.com/ fourcornervariety

Being former shoppers gives the owners of Four Corner Variety a unique perspective on the other side of the counter.

BY SARAH HAMAKER

When Rich and Jenn Mazurek moved to Union, Maine, four years ago, Four Corner Variety became their go-to neighborhood store. “We live about a mile from the store and went by it every day on our way to work,” Rich said. “So we were familiar with the store and location for several years before we took over in 2022.”

Both Mazureks kept their day jobs—Rich works as a car sales manager and Jenn as a retail banker—but they take shifts whenever possible. “We’re the third owners, and the original owners lived in Union as well. When they opened the business in 1990, they wanted the store to be the hub of the town,” Rich said. “The community views it as their store and we’re trying to build off of that.”

Because the Mazureks had been regular customers before becoming the owners, they had a good idea of what merchandise sold well and what didn’t. “Our philosophy is really simple—keep the store super clean and full of merchandise all the time,” Rich said.

The store packs a lot of products into its 2,000 square feet. “I like to say it’s a nook-and-cranny store because we fill every little square inch to the maximum in order to best serve our customers,” Rich said.

To ensure a good selection of products, they partnered with Associated Grocers of New England, a wholesale grocery distributor, which helped them stock on-trend items and unusual snacks. “The uniqueness of our store is really that we listen to our customers and bring in what they want,” Jenn said.

So far, the store has added around 30 products that customers have requested. “Once people see that we take their requests seriously, they become more loyal to our store,” Rich said. For example, one regular customer asked for a particular beer, which they added to their inventory, and “now that customer comes in twice a day—once in the morning for his coffee and donut, and again in the afternoon or evening for his beer,” Rich said.

They also tweaked the fresh foodservice offer, and now serve breakfast sandwiches, pizza and other dinners. “We refined our menu to simplify items down to what’s quick to make,” Rich said. “That way, our customers are getting the same quality and consistency when it comes to the fresh food.”

Because it’s in a fairly rural area, Four Corner Variety has a little bit of everything, from fishing gear and automotive products to healthcare items, grocery items and beer, wine and

liquor. “Whatever we carry, we try to support as many Maine-based companies as we can,” Rich said.

The Mazureks connect with their community in a variety of ways. “We do most of our promotions through our Facebook page,” Jenn said. For those who come into the store, “we want them to feel like we care about them,” added Rich. “We’re in the store as much as we can be with our full-time jobs, so people know who we are and we know our regulars by name.”

The store also runs an annual deer hunting contest during the fall hunting season. “We tag and weigh probably 400 deer during the season, and for every pound, we donate 10 cents to a local charity,” Jenn said. Last year, the contest raised $1,500 for Habitat for Humanity.

The owners’ attention to people spills over to their staff. “We treat our staff as well as we can, making sure we give them time off and empowering them to help our customers without having to ask permission,” Rich said. “At the end of the day, they’re the face of the store for the customer,” Jenn added. “Our employees make us successful.”

To keep their employees engaged, the Mazureks have a monthly contest where each employee who doesn’t miss a shift has the chance to win a $100 store gift card. They also have a referral program for current employees who bring in new hires. “Instead of giving our new hires a bonus, we give the referring employee a $500 bonus,” Rich said. “We also give our workers differential pay to work Saturdays and Sundays.”

Overall, Rich and Jenn Mazurek want to concentrate on making Four Corner Variety the “best store possible. We’re

During the winter, customers stop by Four Corner Variety in Union, Maine, to pick up fresh bait for ice fishing. Owners Rich and Jenn Mazurek converted a former ice cream stand behind the store into a live bait shack for the duration of the ice fishing season.

“We work with a local bait company who sends someone out once a day to restock,” Rich said.

The shack is available 24 hours per day and relies on the honor system. “Ice fishermen can come to scoop out bait and put the money in a lockbox attached to the wall,” Rich said. The honor system form of payment has held up.

“Customer’s love that we put our trust in them and in return they put theirs in us. And it’s been a great addition to the store, as those who grab their bait during store hours come inside for supplies or food for their fishing trip,” he said.

not looking to branch out into other locations, as we enjoy running the store as it is,” Rich said.

Sarah Hamaker is a freelance writer, NACS Magazine contributor and award-winning romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2023 and earlier, go to www.convenience.org/Ideas2Go.

Name of company: Choctaw Landing Mercantile

Date founded: April 2024

# of stores: 1

Website: choctawlanding.com/ the-mercantile

Choctaw Landing Mercantile celebrates the Choctaw Nation’s history and culture with unique local gifts.

Choctaw Landing Mercantile stocks products you’ll find in most convenience stores—tobacco, drinks and snacks, among others—but that’s not what draws customers to the Hochatown, Oklahoma, store. The main attraction is its unusual assortment of gift items. “Our uniqueness is our selection of special items—it makes our store memorable,” said Misty Hendricks, executive director of retail operations for Choctaw Nation.

The new Choctaw Landing Mercantile is the Choctaw Nation’s 21st store location, but it’s the first with a focus on upscale gifts and souvenirs. “Because Choctaw Landing [a 100-room resort and casino] is a tourist destination in and of itself, as well as being situated near hundreds of rental cabins tucked into the woods close to Broken Bow Lake and Beavers Bend National Park, we knew we needed to create something really special for tourists and locals alike,” Hendricks said.

The Mercantile, along with the entire Choctaw Landing complex, honors its Choctaw and Oklahoma history.

“Throughout the resort, we have around 600 pieces of artwork by 20 Choctaw artists on display, which adds to the uniqueness and authenticity of Choctaw Landing,” Hendricks said.

Customers at the Mercantile are greeted with a large white buffalo statue made out of fine crystal. “It’s massive and stands right outside the store entrance and attracts a lot of attention,” Hendricks said.

Employees continue the reception by greeting customers with “halito,” a traditional Choctaw greeting. “We want everyone to feel welcome with halito and other Choctaw sayings,” Hendricks said.

Visitors can take a bit of the area’s rich heritage home by purchasing souvenirs made by Choctaw Nation members, such as medallions, beaded jewelry, stick balls and dream catchers. “We’ve begun to seek out Choctaw vendors for other items, such as firewood and freeze-dried candy to add to our merchandise,” Hendricks said. Choctaw Farms, for example, provides jams, jellies, spreads, pickled items, salsa and relish for the store.

The large gift section also offers Hochatown- and Oklahoma-themed shirts, as well as travel mugs and cowboy hats, Western-themed bags and other leather goods. “We also have upscale home décor,” Hendricks said.

In addition, a huge children’s selection offers plenty of outdoor items for hunting, hiking or digging in the dirt, as well as indoor pursuits, such as puzzles and LEGOs. “One of our more popular items is our big bear slippers, which the children love,” Hendricks said.

“A lot of [our] items are designed with the cabin renters in mind,” Hendricks added. Cabin guests can pick up s’mores fixings with heart-shaped marshmallows and gourmet graham crackers, as well as beverage mixes. A small grocery area provides essentials for a cabin stay, while the convenience store stocks the usual variety of snacks and packaged beverages, including a large beer cave. The wine section offers the local Girls Gone Wine brand in addition to other favorites.

The candy section’s one-of-a-kind assortment brings delight to tourists and locals alike. “We have candies you can’t find anywhere else—both upscale and old-fashioned candies,” Hendricks said. Popular candies include candy cigarettes, Pop Rocks, classic rock candy sticks, Razzles and Goo Goo Clusters, in addition to freeze-dried candy.

Fresh foodservice includes a Starbucks and Tuklo Deli, a full-service deli serving slow-smoked barbecue and freshly sliced deli meats, as well as southern fried chicken. “We offer grab-and-go meals, hand-crafted salads and made-to-order sandwiches,” Hendricks said.

Hendricks is looking forward to infrastructure improvements in the vicinity of the store. “Traffic gets really bogged down on the weekend because it’s a two-lane road to get here, but we’ve invested $7 million for road construction to allow for traffic lights and turn lanes,” she said.

Plus, they’re working with the Oklahoma Department of Transportation to make stormwater improvements, relocate utilities and widen Highway

To create a unique experience for customers at Choctaw Landing Mercantile, Misty Hendricks, executive director of retail operations, tapped an outside firm to bring the store vision to life. “We knew we wanted to have something that set us apart from other convenience retailers,” she said. By using an outside company, Hendricks said they were able to find the right merchandise mix for the new location. “We operate 18 travel plazas, so having this company do the legwork necessary to come up with the unique angle for the Landing Mercantile saved us time in the end.”

The Choctaw Nation is continuing its relationship with the firm to bring a similar experience to 10 additional locations. “We’re updating those plazas to match the aesthetic of the Mercantile,” she said.

259. “Those improvements will help ease some of the congestion,” Hendricks said. Overall, Hendricks said the store’s main aim is for “our visitors feel satisfied and eager to return to experience our culture and history in this special experience they can’t find anywhere else.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor and award-winning romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2023 and earlier, go to www.convenience.org/Ideas2Go.

For many smokers, the taste of menthol is a unique multisensory experience that is an irreplaceable part of their tobacco ritual.

BY LAUREN SHANESY

In 2023, menthol smokers accounted for 32.5% of all cigarette smokers, according to the Centers for Disease Control (CDC). That’s a core customer segment that c-stores might lose if the U.S. Food and Drug Administration (FDA) enacts its federal menthol cigarette and flavored cigar bans. The menthol ban has been looming on the horizon for more than a decade. While President Biden delayed the ban even further in April, retailers need to prepare now for this shakeup in the backbar even though enforcement could still be a year or more away.

Menthol cigarettes and flavored cigars account for about 6% of c-store inside sales, or roughly $18 billion for the industry, according to Kretek International, an importer and distributor of premium tobacco products.

Retailers in California and Massachusetts have already seen revenue losses firsthand after the states instituted menthol bans, with users either driving across state lines to stock up on products or, even worse for everyone involved, buying illicit versions on the black

Brought to you by

Kretek International

market. This behavior shows that menthol smokers are loyal enough to the flavor that when menthol cigarettes are banned, many won’t just quit or switch to regular cigarettes or other tobacco options.

A looming ban and the significant loss of sales dollars that comes with it means retailers need to position themselves to retain this segment of customers.

But with consumers having distinct reasons to smoke menthols, a preference for the flavor’s experiential quality, and for many, a distaste for non-flavored cigarettes, it begs the question—where will menthol smokers turn in the absence of the product they’re loyal to?

Kretek commissioned two years of independent product research and focus group studies to learn what really makes menthol smokers tick—their habits, their needs and preferences and most importantly, what they’ll likely buy if they can’t smoke menthols.

Menthol smokers have distinct preferences from cigarette smokers and overall tobacco users. For example, in consumer surveys conducted by Kretek, 59% of menthol smokers ranked taste as their main motivating factor, compared to only 24% who said nicotine was most important.

“For menthol smokers, the word ‘taste’ is shorthand for everything about their enjoyment,” said John Geoghegan, a consultant for Kretek with over 30 years in the tobacco industry, noting that these consumers consider smoking a menthol cigarette a unique, multisensory experience. “It’s a deeper feeling of relaxation and calm that goes beyond words.”

“There is an expressed ritual to a menthol smoke that we didn’t hear from non-menthol smokers in our research,” he continued. “A dedicated moment set aside to just ‘be.’ They liken it to that first cup of coffee you have when you wake up.”

Around half of menthol smokers said they are so drawn to this multisensory experience that if menthols were banned, they would quit altogether. In reality, Geoghegan thinks not nearly that many will actually quit because nic-

otine dependency still influences their usage. However, the sentiment underscores the key motivator of menthol smokers for whom nothing can replace the feeling of a menthol smoke. Their strong taste loyalty is why Kretek has created a nicotine-free, non-tobacco version of filtered menthol that aims to fill the void.

The overall experience is influenced by the menthol agent itself, according to research and studies from the Duke University and University of Kentucky Schools of Public Health. Sven-Eric Jordt, a sensory neurobiologist, led the studies at Duke University.

“Menthol basically activates [your] cold receptor, and that’s why we feel cooling when we are exposed to menthol, when we inhale it or when we put it on our skin,” explained Jordt. “In turn, the receptor partially moderates how we perceive pain, which ultimately gives menthol the ability to dampen irritation or discomfort.”

But there’s another component to menthol cigarettes that is important—nicotine.

It’s common for menthol smokers to perceive the neurological effect of menthol as part of the nicotine buzz—they include this feeling in what they describe as their cigarette’s “taste.” Nicotine is part of the ritual and sense of calm experienced while smoking, but is perhaps less impactful for some smokers.

Despite many smokers’ self-noted dependence on nicotine, Kretek’s smoker research found that a nicotine-free menthol option would be a viable solution for a substantial

segment of smokers. Many are in fact trying to cut down on nicotine usage—Kretek’s research confirmed CDC studies that showed 62% of consumers said they had health concerns about nicotine.

Response to smoking trials inferred that around 20% likely have a low enough level of nicotine dependence to make the switch to a nicotine-free product as long as the menthol taste meets their expectations, explained Geoghegan.

When current menthol smokers in Kretek’s product trials tried nicotine-free alternatives, 51% said they “missed the nicotine a little,” and 18% said they were “glad it’s gone,” according to Kretek’s Benjamin Winokur, brand manager of emerging brands at Kretek, who oversaw the project and development of SPLASH nicotine-free menthol smokes. “Our view is that nicotine-free menthols can end

up with 8-12% of the current menthol population across several brands,” said Winokur. He noted that the moment of truth will be when customers walk into the store to buy their preferred brand and it’s no longer available.

Even as zero nicotine products begin to attract share in the backbar, Winokur said retailers should manage their expectations for replacements after a flavor ban. “Menthol smokers who opt for the nicotine-free smokes won’t make up the volume difference of what will be removed because of the ban, but even retaining 10% of those customers could easily create a billion-plus dollar business,” he explained.

A federal menthol ban won’t go into effect overnight, but it’s never too early for retailers to begin laying the groundwork to retain this customer base. While Kretek and a few other manufacturers are bringing non-tobacco menthol smokes to market, others are launching menthol-flavored vapor devices that offer nicotine, even if the smoking ritual is lost.

“There’s a larger potential loss of revenue without that menthol consumer—a large majority of these buyers visit the same store week after week and add other items to their basket,” said Winokur. “Having the right products in place for a menthol smoker after a ban helps to retain those consumers in your store, and offers additional revenue from the other basket items that they buy.”

To retain menthol smokers, retailers will need to offer them something to fill the void and provide the unique experience of a menthol smoke. Bringing together its years of research and consumer studies about menthol smoker preferences, Kretek and its manufacturing partner PT Djarum, an Indonesian maker of filtered clove cigars, collaborated on the development of SPLASH menthols, a nicotine-free, non-tobacco filtered menthol smoke. During focus groups and trials, 56% of trial users indicated they liked the taste of SPLASH enough to switch after the ban (“very likely or somewhat likely”). Kretek is launching SPLASH at the 2024 NACS Show and plans to roll out the product in trial markets in California (where menthol cigarettes are currently banned statewide) in early 2025.

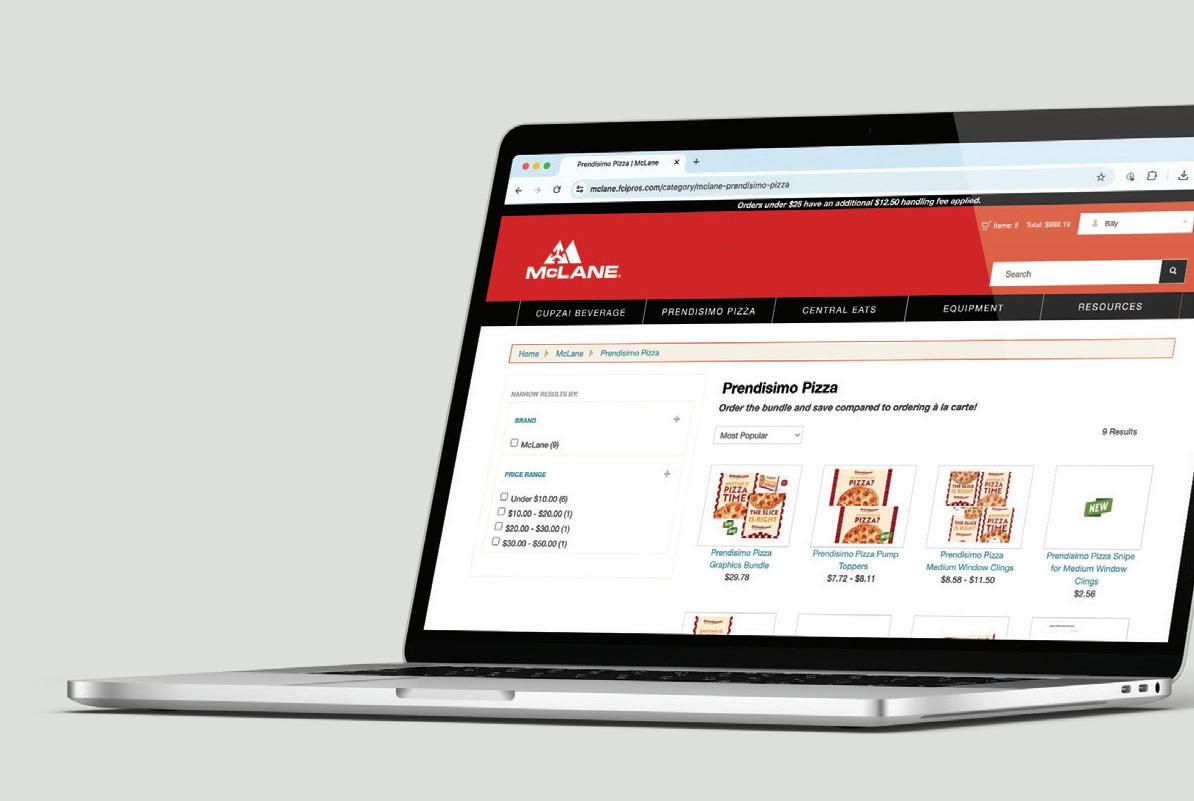

Our mission is to make it easy for you to provide the highquality, fresh food and beverage options your customers want while eliminating pain points and barriers to entry on your end. These McLane Fresh programs can increase foot traffic and profitability in your stores.

Optimized commissary network.

Order only what you need, meal by meal, with our wide range of product offerings.

Fresh, never frozen cold sandwiches with industry-leading 7-day shelf life.

Your first POP bundle is FREE when launching a branded program!

Central Eats puts fresh and exciting food in the center of your customer’s day, featuring plenty of grab-and-go products to satisfy every craving.

Central Eats is your go to destination for grab-andgo, in store solutions. We take high quality produce and ingredients and an operationally efficient, robust commissary kitchen network to allow timely deliveries that meet your shelf life needs. That means you’ll always have the freshest product to satisfy the tastes of the modern customer. Our chef-inspired line of snacks, parfaits, cut fruit, hot and cold sandwiches, wraps, and salads are all conveniently packaged, optimized for freshness, and ready to go.

Foodservice and snacking trends continue to outpace other categories.

C-Store foodservice programs average $677k sales/store/year.1

90% of consumers report snacking multiple times a day.2

Crafted coffees that cater to every coffee lover’s taste.

Ongoing training and marketing support.

Your first POP bundle is FREE when launching a branded program!

Introducing CupZa! — our reimagined line of beanto-cup coffees, teas, and lemonades that offer exciting new flavors and drink styles to bring real value and coffee shop quality to retailers of every size.

wow!

Our flavored syrup SHOTT program offers a tailored experience for your guests, letting them put the perfect finishing touch in their cups.

CupZa! sources the finest coffee beans and ingredients to bring a wide range of on trend items, from nitro cold brew and cold brew coffee options to bright and refreshing teas and lemonades. We also feature the latest in bean-to-cup technology, which replicates the experience of having a barista prepare the coffee, ensuring consistency and quality in every cup.

The cold, hard facts!

In fact, today, the $1.2 billion global cold brew coffee market is expected to almost quadruple by 2028.1

Retail-ready, easily sold from the freezer or cooler case or sold hot by the slice or as whole pies!

Eliminate the need for extensive training or skilled labor.

Your first POP bundle is FREE when launching a branded program!

Introducing Prendisimo, a new and improved proprietary freezer-to-oven pizza program that’s designed for any convenience store to implement efficiently and profitably.

There is no denying the appeal of pizza. It’s a 24-7 product that holds the power to drive consistent visits to any convenience store, anytime. Prendisimo brings a fresh baked and profitable pizza program to life in your store. Our turnkey solutions meet retailers where they are on their foodservice journey by providing marketing support, merchandising, quality competitively priced equipment bundles, and expert guidance.

91% of consumers Love or Like Pizza, making it America’s favorite food.1

Convenience and affordability are top drivers for purchasing frozen or takeand-bake pizzas.1

CupZa!:

• Bean-to-Cup Coffee Units

• Coffee Brewers (Hot & Iced)

• Nitro & Cold Brew Coffee Station

• Creamy Cold Brew Station

• Tea/Lemonade Brewer

• Creamer Station

Prendisimo & Central Eats:

• TurboChef Plexor Double Deck Combi Oven

• Single Deck Combi Ovens

• Rapid Cook Convection/ Microwave Ovens

• Warming / Holding Cabinets

• Open Air Coolers

Getting the right equipment for your space and customer needs is critical to foodservice success. That ’s why we’ve designed the entire McLane Fresh line of offerings to fit with a flexible and easy-tomanage array of equipment and packaging options.

Additional equipment available to fit your store footprint!

Branded To-Go

Packaging Available

We understand the power of a cohesive experience and believe that attractive merchandising paired with great food and drink is key to driving repeat visits. That ’s why we’ve created smart merchandising bundles that make your foodservice offerings stand out. Need more elements for LTOs or additional signage? We’ve made it easy to access them in our online marketplace.

If you are starting from scratch or adding to an existing foodservice platform, McLane Fresh can help you drive customer engagement while focusing on profitability. Our chef-inspired products combine great ingredients that are easyto-execute and are sure to delight customers and operators alike. Learn more at mclanefresh.com.

Food and beverages are being influenced by many taste preferences, creating bold, exciting and new profiles for every demographic.

BY AMANDA BALTAZAR

foodservice providers should be zeroing in on, it’s flavor. Today’s consumers, who eat out regularly and pay attention to social media, are always seeking new tastes and flavor profiles to delight their palate and provide a new experience.

“Consumers have a higher set point of fear after Covid,” said Suzy Badaracco, president of Culinary Tides, a trend foresights company in Fort Lauderdale, Florida. “They want to experience strong flavors, new flavors and global flavors. Exploration is a psychological driver. It offers optimism, control, learning, reward and distraction.”

And social media is fueling, inspiring and educating shoppers on bold and compelling options from around the world, said

As global influences continue, here are a few flavors that have big potential for the future:

• Chai: Datassential ranks chai in the 92nd percentile for future growth potential.

• Tropical fruits like guava, lychee, yuzu and dragon fruit.

• Turmeric.

• American flavors such as Southern BBQ and New England seafood.

• Mojo (garlic-herb sauce), checca (tomato sauce), Pickapeppa (a sweet, spicy and sour Jamaican branded sauce) and flavored vinegars.

• Complex heat made from combinations of different peppers.

• Pickles in unexpected items. C-store chain Casey’s has sold limited-edition dill pickle chips, and in recent years Sonic has brought back its pickle juice slush for a limited time. Pickle-topped pizza is also gaining traction, up 50% on menus over the past 12 months, according to Datassential’s Menu Trends platform.

• Black garlic, which 46% of consumers are now familiar with, according to Datassential’s Consumer Preferences platform.

• Tahini is moving beyond hummus to appear in protein bars, plant-based ice cream and desserts.

Chelsey Capps, director of thought leadership for Daymon, a private label consulting company in Stamford, Connecticut. In fact, 84% of consumers who actively seek out new flavors cited social media as their primary information source, according to data from Mintel.

According to Mintel’s Global Consumer Survey, 36% of consumers like trying flavors they’re unfamiliar with. And while most of us are up for trying something new, Gen Z and Millennials are the most experiential when it comes to trying new flavors, said Capps. “Over 90% of Gen Z and Millennials say they seek out new food and beverage flavors, with the majority citing ‘the wilder the better,’” she said.

“For younger consumers, bold flavors are the norm,” said Mike Kostyo, vice president, Menu Matters in Arlington, Vermont. “For any brand, the focus should be on leveraging the bold, interesting flavor trends that excite consumers and keep the brand relevant. Stop playing it safe.”

“Consumers’ love of spice and heat continues to grow and evolve,” said Kostyo. “When you see a national brand like Campbell’s adding ghost pepper to chicken noodle soup, you know American consumers’ capacity to embrace heat has reached a new level. With more wellknown brands offering spicier flavor profiles, it not only gives other brands permission to increase the heat levels in their own menu items or products, but it also means brands have to work harder to differentiate themselves.”

They can do this by using more complex peppers or pepper blends, he points out, or even inserting heat into new categories like desserts. Spicy garlic and spicy mustard are also popular spicy flavor combos.

Swicy flavors are also on the rise, and consumers can’t get enough of this blend of spicy and sweet food. Daymon research shows that of shoppers who enjoy spicy food, four in 10 specifically also like swicy flavor profiles. This could be something like hot chili pepper and lime; or sweet chili jalapeño, said Sally Lyons Wyatt, global executive vice president and chief advisor, consumer goods and foodservice insights at Chicago-based market research company Circana.

Hot honey is also booming. It’s a “unique yet accessible flavor,” said Capps, and is often found in products like pizza, sandwiches and roller grill items. Although this trend has been around since 2021, it’s now proliferating, said Jaclyn Marks, senior publications manager and trendologist with Datassential.

Hot honey is up 128% on menus over the past four years according to Datassential’s Menu Trends platform.

Along with swicy, there’s also swokey (sweet and smoky) and swalty (sweet and salty), pointed out Badaracco.

Fusion food is nothing new. Restaurants have been combining global cuisine for years, but some unusual combos are showing up as of late—dill pickle in desserts, or adding alcohol flavors, like Fireball whisky, to food are a few examples, said Lyons Wyatt.

“Fusing emerging flavors with mainstream flavors makes products more approachable by bridging the gap,” added Jillian Hermanowicz, spokesperson, Florida Food Products, a Eustis, Florida-based company that offers ingredient solutions. For example, fusing a classic flavor like French vanilla with lavender in a product like iced lattes “adds excitement, which drives trial.”

Maeve Webster, president of Menu Matters, is seeing fusion that’s based on a chef’s background rather than simply mashing different countries’ foods together, “so the fusions are going to be more organic and built from experience,” she said.

Badaracco expects to see food combinations that bring together flavors from different cuisines, such as tikka sauce wings, birria ramen and sashimi tostadas.

According to Mintel, 55% of consumers said they would purchase an LTO with nostalgic ingredients. But these don’t have to be old-fashioned creations. Capps is seeing

Consumers’ love of spice and heat continues to grow and evolve.

nostalgic flavors that are dynamically paired with new and exciting flavors.

At Rutter’s, the retailer is offering products that reimagine “flavors reminiscent of childhood treats, such as cereal-flavored snacks,” said Philip Santini, senior director of advertising and foodservice.

Nostalgic flavors include dessert and breakfast flavors, such as maple and French toast— staples of childhood, said Hermanowicz.

Even the sports nutrition category has flavors that hearken back to childhood treats. 1440 Foods introduced two nostalgic flavors—brownie and caramel churro—to its Pure Protein line of protein bars.

Nostalgia is trending “because things are so anxiety-inducing for consumers right now as they think about the election, economy and global issues,” said Kostyo. For older consumers, this means remembering a more carefree time in their lives, he said, and for younger consumers, it’s era envy, “meaning consumers are envious of times they didn’t even experience because they associate them with simpler times and less stress.”

Convenience stores should keep up with relaunches to play to consumers’ desire for nostalgia, said Kostyo. “You can imagine a Dunkaroos-flavored coffee beverage or Viennetta individual dessert bar, to name just two brands that Millennials in particular have brought back from extinction. But that need to escape is a key need across all demographics. C-stores should lean into that escapist desire.”

Beverages are a great place to experiment with flavor because they’re inexpensive and are an area where consumers—especially younger ones—like to experiment. Look no further than Doritos x Empirical, a distilled spirit featuring Doritos Nacho Cheese.

How fresh is meeting fast—and how c-stores can satisfy every customer craving.

Continuing from last month’s Digital Forecourts Future article, the evolution of convenience shouldn’t stop at the pump— let it flourish inside with bites, beverages, and bespoke interactions.

John’s mornings have a rhythm, starting with the familiar chime of his alarm and the promise of that first cup of coffee. The world is just waking up as he pulls into the c-store parking lot, the early sunlight casting long shadows. There’s a comforting consistency in his routine, but today, something feels a little more alive.

Stepping inside, the warmth of the store and the scent of freshly brewed coffee mixed with sizzling bacon welcome him. The digital displays flicker to life, almost like they’re greeting him. Today’s breakfast burrito special catches his eye, a reminder of life’s simple pleasures. He grabs and goes.

Noon rolls around, and John’s back—this time focused on fueling the rest of his day. The sun is high, and the pace has quickened, but the c-store remains a welcoming oasis, just minutes from work. The digital screens now showcase a fresh array of lunch specials. His favorite wrap is waiting,

almost as if the store knew he’d return. It’s these moments of quiet ease, of knowing what to expect, that make his day flow a little smoother. By mid-afternoon, the demands of the day have caught up with him, and John craves a break. He pulls in again, seeking that perfect pick-me-up. The c-store is bathed in the warm afternoon glow, and the displays have shifted again, offering what he didn’t even know he needed— prepared bites and caffeinated sips. The choices feel endless, yet the experience remains effortless.

John’s day might be hectic, but these stops at his favorite c-store are more than just routine—they’re personal moments that ground him. The digital signs almost predict his needs, making each visit feel intentional… even delightful

As evening approaches, John realizes he’s stopped here three times today, each visit as effortless and satisfying as the last. To John, this c-store isn’t just a place to grab essentials—it’s his oasis, a natural part of his week that’s become woven into the fabric of his lifestyle. He’s a loyal lifer because of it.

Join others who’ve discovered the c-store secret—that your locations can be more than just a mindless pit stop. Experience the difference that digital panels, interactive kiosks, and dynamic menus can make.

Visit Us at Booth C6487 (Technology) at the NACS Show to Get a Free Future Guide for C-Stores. Scan the QR code to get a look into the future now.

Beverage is the perfect format for flavor innovation, and it continues to be where consumers push the boundaries and expectations on flavors, said Florida Food’s Hermanowicz. Mexican flavors are driving some beverage trends. Horchata has seen a 33% four-year increase on coffee menus in product formats such as iced lattes and frappes, she added.

Lyons Wyatt is seeing a lot of nostalgia in beverages, such as candy flavors added to soda or alcoholic drinks, but said she wouldn’t be shocked to see the reverse happen, especially with candy.

And dessert-inspired flavors are proliferating in cold and frozen coffee—according to Datassential, 69% of consumers eat or drink an indulgent treat weekly. “In cold and frozen coffee beverages we see dessert flavors ranging from the nostalgic birthday cake, red velvet and creme brûlée to globally inspired flavors such as churros and tres leches,” said Hermanowicz.

According to Datassential, Millennials have the strongest interest in frozen treats as a snack, followed closely by Gen Z consumers, who also visit c-stores more frequently than older generations. “They are an important demographic to appeal to,” said Florida Food’s Hermanowicz.

As consumers are exposed to more flavors through travel or social media, more global flavor profiles are making their way into products and onto foodservice menus. Asian food flavors are popping up in restaurants, such as the masala veggie burger at A&W, and in packaged snacks and drinks (like the mango tamarind White Claw or jalapeno-flavored evaporated milk from Carnation).

Vietnamese flavors in particular “have been making waves across QSRs,” said Erica Holland-Toll, culinary director at The Culinary Edge in San Francisco. She highlighted the banh mi fried chicken promotion from fast casual chain Starbird, as well as

Hannah’s Bretzel and TGI Fridays exploring banh mis as part of their LTOs. She’s also seeing a rise in Vietnamese pickles on grocery shelves.

At Rutter’s, classic Asian flavors such as Korean BBQ and Szechuan peppercorn are also gaining traction. Santini is seeing taste profiles from Asian countries, especially Korea and Japan, influencing the rise in spicy and umami profiles, while Latin American flavors, particularly from Mexico, “are popular for their sweet and spicy combinations,” he said.

Latin and Hispanic flavors are the norm, according to Kostyo, but “Asian-inspired flavors are what excite.” Consumers, particularly younger ones, simply expect Latin flavors because they eat them all the time, but from an innovation and excitement standpoint, “they get excited about the sweet and unique flavor profiles and concepts inspired by Asian markets, social media trends and street foods,” he explained.

Scandinavian cuisine “is finally poised for more significant growth and more innovation inspiration,” said Webster. She also expects to see increased awareness of, and engagement in, cuisines from the Middle East and Eastern Europe.

Fruit flavors are also seeing new combinations and fusions across the entire food and beverage segment.

Capps said tropical fruit flavors are “poised for success … particularly when dynamically paired to create desirable and interesting new flavors like watermelon mango.”

Convert more customers with appealing displays that spur sales. Anchor packaging keeps food fresh and ready to go. Win more meals and see for yourself – food out the door means profit through the roof.

INCREASE PROFIT BY REDUCING COSTS

Reduce shrink with packages that hold food quality longer – even hot & crispy favorites.

PROTECT TASTE AND TEMPERATURE LONGER

Patented cross-flow ventilation protects taste by protecting temperature and texture for hours in a hot case and 30 minutes on the go.

SERVE SUSTAINABLY

Microwave & dishwasher safe, reusable and recyclable after use. Protect food quality to reduce food waste.

Yuzu, a type of Japanese citrus, is up 43% on beverage menus, according to Datassential’s Menu Trends platform, and it’s appearing in everything from beverages (Shake Shack, for instance, has offered a yuzu honey lemonade) to salad dressings to baked goods. Unique fruit blends, like pineapple and habanero, are becoming more available in beverage options.

The sweet-savory pairing is cropping up in new pastries and desserts, said Webster, particularly combining Japanese and Asian flavor elements into more American or European formats. “It’s toning down the sweet elements and upping the savory to rethink what those pastries and desserts could be and the types of occasions they are best for,” she explained.

Expect to see more floral and botanical flavors like jasmine, rose, lavender, hibiscus and eucalyptus in 2025.

Starbucks recently featured an iced lavender cream oatmilk matcha, which “bridges the larger trend of food-meets-beauty,” said Marks. According to Datassential’s Menu Trends platform, lavender is up 41% on menus over the past four years, and Datassential’s AI-powered trend prediction platform Menucast estimates lavender will grow another 38% on menus over the next four years.

Floral flavors, including chamomile, honeysuckle and rose, are the fastest-growing botanical flavor trends in packaged foods, according to Innova Market Insights. The Arnhem, Netherlands-based company’s research shows many consumers perceive that products with these natural elements are good for their health.

New and unique flavors are most commonly appearing in snacks and beverages because these are low-commitment items for consumers to buy. They’re inexpensive and small, and so are lower risk, even if adventurous flavors have become the norm for younger generations.

Adding an unusual flavor like basil or rosemary to a snack “can feel unique but not overwhelming,” according to a survey by Kantar and Mintel.

“Flavor virtually has no bounds for application in convenience stores, but top category players most often include foodservice, nuts, chips, non-chocolate, bakery or pastry programs, and RTD beverages,” Capps added.

At Rutter’s, snacks such as potato chips, nuts and popcorn “are leading the way,” said Santini. “Beverages, including energy drinks, sparkling water and craft sodas are also incorporating these trends. We’re looking at ways to incorporate these items into our foodservice program.”

He expects to see new limited-edition flavors in snacks and beverages, cross-category products like spicy beverages or sweet-savory snacks, and enhanced flavor profiles in staple items such as chips and energy drinks.