4 minute read

Solape Akinpelu’s Sight Is Set On Financial Inclusion For Modern African Women

from DTNOW MAY 14TH

by dtnow.ng

BY OLAMIDE OLAREWAJU

You talk a lot about inclusive finance. What should the average African woman know about it?

Advertisement

I believe that by establishing the "what" of inclusive finance, the "why" becomes acceptable. And I encourage institutions and women, especially, to get on board. Because when one woman wins, every woman wins.

Inclusive finance refers to financial services or products that are designed to help low-income individuals. Finance becomes inclusive when a given beneficiary, such as a family, farmer, or young entrepreneur, is able to access a product or suite of services, sometimes personalized, that respond to a specific need.

Those products or services can be financial, for example, credit or insurance subscriptions. But they can also be non-financial: training or support in launching a business. Inclusive finance takes into account all the actors of a value chain, so not only the final beneficiary but also donors and even the environment are positively impacted.

This is our approach at HerVest; through our impact investment opportunities, everyone can participate in inclusive finance and contribute their quota in driving shared prosperity.

You are passionate about empowering women; at what exact moment did this become something that turned into a tangible product, HerVest? When did you have that aha moment?

Honestly, it wasn’t just an AHA moment. It was a series of lightbulb moments. It was urgent to step into a lingering assignment.

Having spent over a decade marketing financial brands, I was surprised and sad that women were not targeted recipients of wealth-building initiatives.

It wasn’t that women weren't interested, as months of surveys and personal inquiries revealed. If the financial messaging were simplified, with customized products and services, women would invest and explore various possibilities for economic growth. And this was the need that birthed HerVest. From the farmland to the boardroom, we are leaving no woman behind in our quest for gender financial empowerment.

What is HerVest about?

HerVest is an inclusive fintech that provides easy access to target savings, credit, and impact investment opportunities for women.

By connecting retail female investors who want to build wealth with female farmers and traders, HerVest reinforces its mission to be the inclusive financial services provider for the advancement of African women regardless of creed, economic status, or belief.

With a thriving community of over 30,000 women, HerVest is committed to improving women’s lives through greater access to and use of financial services. Learn more about HerVest at www.hervest. ng. HerVest is available on web, Android, and iOS devices.

You authored a book about finance recently. What inspired it?

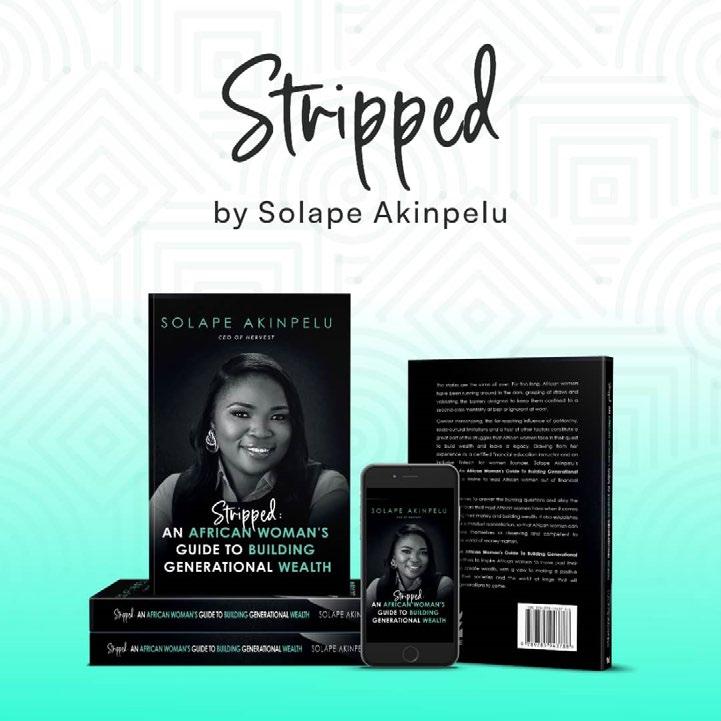

Yes, you are right! On December 1, 2022, "Stripped: An African Woman's Guide to Building Wealth" was unveiled to the world. It’s a volume of work that is dear to my heart, and thousands of women across the world have been impacted by the genuine insights and life lessons shared.

I was inspired to write this book to change misconceptions about women and wealth. I also wanted to give the next woman a road map and a support system as she walked this uphill journey toward financial independence. Stripped is an answer to the many questions and gaps that African women face on their journey to building financial stability. It tackles budgeting, investing, saving, estate planning, and even the money mindset because wealth starts with the mind.

Most of the financial books out there are either not tailored for the Nigerian financial system or provide generalized insights. Stripped does what it says. It strips away the quagmire and tackles the foundational issues of building wealth.

Women have always been wealthy. I did a historical sojourn in my book to show that we have always been money smart. Where did it go wrong, and how can we change the culture? Stripped encapsulates all these insights, so women never feel left out of the equation. It’s a kaleidoscope of my experiences working in wealth management and even as the CEO of HerVest.

I also wanted to project a balanced view of wealth. Wealth is relative. It is a unique journey to financial stability. Your wealth should not end with you as well. But some principles and structures must be in place.

How can we begin to close the gender finance gap in Africa?

I believe the first line of action should be determining the drivers of financial exclusion. By this, I mean eliminating the bottlenecks that hinder women from accessing affordable and relevant financial services. In Nigeria, for instance, gender financial exclusion is largely rural and agrarian. Most of these women lack the capital, the monetary wherewithal—to purchase land, labour or even basic farming inputs like quality seedlings and fertilizer. If they are not economically viable, how can we begin to talk about saving or insurance? Financial services are broad!

So the starting point is economic inclusionby meeting these women where they are. This is what we do at HerVest. We provide easy access to credit for smallholder women farmers and traders. But we don’t just stop at lending; we also connect these women to training and premium markets.

If we are to close the gender finance gap, economic inclusion should be prioritized. Other steps include providing financial education and training, as well as improving the availability and accessibility of banking services.

Additionally, governments and financial institutions can offer targeted financial products and services that address the unique needs and challenges faced by women entrepreneurs and business owners. By leveraging our mobile app technology and USSD code (*7213#), HerVest provides relevant financial information at low communication costs so that the rural farmer without access to a smartphone can also participate in financial services.

Finally, we should address cultural and societal norms that may limit women's access to finance. By working to remove these barriers and increase opportunities for women, we can help close the gender finance gap and promote greater economic equality and growth in Africa.

Share 5 smart financial tips for the modern African woman.

As a modern African woman, it's important to have a solid understanding of financial management. Here are five smart financial tips that can help you achieve financial stability

1. Budget wisely: Create a budget that takes into consideration your income, expenses, and savings goals. Stick to it as much as possible and adjust it when necessary.

2. Invest in yourself: Take advantage of learning opportunities that can advance your career or business. This can help you earn more money and increase your financial stability.

3. Save for emergencies: Life is unpredictable, so it's important to have a rainy-day fund. Aim to save enough to cover at least six months' worth of expenses.

4. Diversify your investments: Don't put all your eggs in one basket. Spread your investments across different asset classes to minimize risk.

5. Plan for retirement: Start thinking about retirement early and aim to save at least 10% of your income. Time is your greatest asset here, so the earliest you start, the better.

Please remember that financial management is a journey, so be patient and consistent. With the right mindset and habits, you can achieve your financial goals and live the life you want.